Post - Blog

The impact of the Inflation Reduction Act on the global solar market

- 2 years ago (2024-02-05)

- Junior Isles

Brian Crotty , Executive Vice President and General Manager, Dow Jones Energy

World Utilities Congress 2026

We are fast approaching a tipping point for solar energy, which is set to surpass coal as the biggest power source within the next five years, according to the International Energy Agency. While China has traditionally been the world leader for solar production, President Biden’s Inflation Reduction Act (IRA) marked a significant step forward for the US solar market. In its first year, the Act saw more than $270+ billion invested in domestic clean energy projects, including over 60 new US-based solar manufacturing facilities.

However, regulatory and supply issues continue to affect polysilicon prices, with the risk that this could hinder market growth. The ripple effects of this price volatility and the introduction of the IRA extend globally. Let’s examine the opportunities and challenges for solar as the world moves towards net zero.

The US and China: the innovators behind solar’s rise

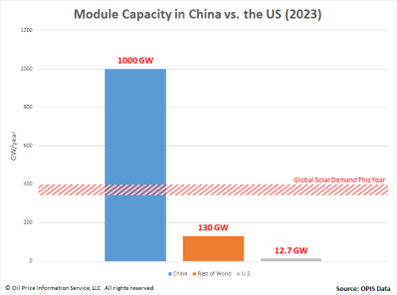

China has long been the undisputed solar “superpower”, dominating the world sevenfold according to OPIS analysis. However, after decades of planning and investment in the solar value chain, China is currently facing a severe oversupply. Washington’s growing package of trade restrictions is designed to insulate its domestic renewables market from Chinese exports, which is bringing about changes in the solar supply chain as companies recalibrate so that they can operate within the new rules.

As a result of US trade policy, solar panels made with polysilicon from China are effectively banned from entering the US, creating a growing global glut of polysilicon. With other key markets, such as the European Union, also cautious in their approach to allowing Chinese polysilicon into their markets, manufacturers in China are having to adapt, moving some of their production elsewhere to allow them to meet new trade requirements.

On the other side of the coin, the US solar sector is struggling to keep pace with surging demand. Although the introduction of the IRA has granted generous incentives supporting domestic solar manufacturing, local production capacity is currently only around 13 GW, according to OPIS data. This falls far short of US government ambitions, and pales in comparison to the 1000 GW that China could produce if its factories were running at full capacity. These figures reflect just how serious the oversupply situation is for the Chinese market, while the US faces mounting pressure to translate planned projects into reality.

Polysilicon price dynamics

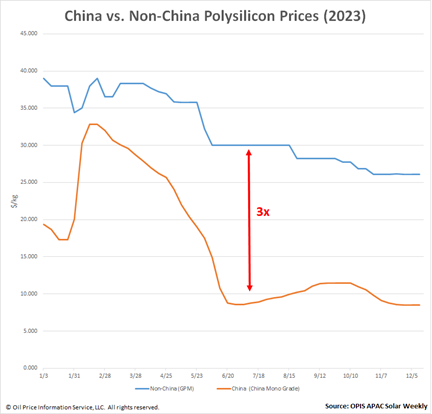

This bifurcation of the global solar market – oversupply in China and scarcity in the US – is having a significant impact on the price of polysilicon, an essential raw material required for manufacturing solar panels. Since trade restrictions came into play in 2021, the price of polysilicon has increasingly diverged to the extent that non-China polysilicon has been trading at around triple the price of its Chinese counterpart since June 2023. It might be easy to assume that with recent legislation boosting the US solar sector, the situation will stabilise – but our forecasts suggest this may not be as soon as conventional wisdom might indicate.

OPIS analysis indicates that this price disparity is set to continue through 2024, which could influence buying decisions and the growth trajectory of the entire sector in the foreseeable future. Without the US market to sell to, oversupply will continue to keep the prices of solar panels that China sells to the rest of the world extremely low; meanwhile the volume of non-China polysilicon available to the market will remain more or less static, and will continue to sell at a premium.

Against this backdrop, Europe finds itself in a precarious position. The low prices at which Chinese manufacturers are selling solar panels has undermined European efforts to localise and develop solar production, potentially increasing rather than decreasing the bloc’s dependence on Chinese solar. This past year has seen multiple European solar manufacturers shutter operations, with a number citing their inability to compete with the price of Chinese modules. There are also potentially broader implications for European players, who could find themselves excluded from US investment due to the “buy American” conditions of the IRA.

To reach solar’s full potential globally, it will be critical for governments on all sides to work together to ensure the free trade paradigm does not break down. If we are to meet our 2050 climate goals, we need to chart a path that fosters opportunities and innovation for the US and Europe, while lowering the cost of clean energy on both sides of the Atlantic.

Looking ahead

The Inflation Reduction Act is widely applauded as a landmark climate bill that could re-establish the US as a global climate leader, while simultaneously creating jobs and turbocharging the economy. This simple yet creative approach is set to inject billions of dollars of funding into climate and clean energy over the next decade, offering the US a credible pathway to meet its emission reduction target under the Paris Agreement.

The solar market has been one of its biggest beneficiaries of the Act to date. But as solar demand continues its upward trajectory, fundamental challenges remain. Despite a surge in investment, our projections show that the US still faces a significant shortfall in solar capacity over the next few years. With supply from China all but certain to remain closed off to US manufacturers, and a limited volume of non-China polysilicon available to purchase on the global market, the US needs to quickly ramp up homegrown production if it is to achieve its objective of supply chain independence and reach its full solar potential. The upcoming presidential election creates further pressure – with Republicans proposing to scrap the IRA, the current administration needs to act fast if it is to deliver a long-lasting impact on the global green tech industry and create a brighter future for solar energy.

As the complexities of the global solar industry play out, market participants need to be prepared for a period of volatility alongside rapid growth. In this environment, access to trusted data, insights and forecasts has never been so important if we are to achieve a sustainable, ethical and affordable supply chain for the solar sector as part of a broader global commitment to decarbonisation.