Post - Blog

Capacity Markets: a fresh look at the 10-year old energy initiative delivering revenue for businesses

- 1 year, 1 month ago (2025-01-08)

- Junior Isles

Wayne Davies , Head of Flexibility, UK & Ireland, Enel X

Solar and Storage Live Philippines 2026

It’s a market that is open to participation from businesses that consume energy, not just those who generate it. That said, a decade on many businesses simply aren’t aware of what the Capacity Market is and how they can participate.

The Capacity Market works by providing payments to make sure there is enough reliable capacity to meet peak electricity demands. It acts as an ‘insurance policy’ against possible power outages, which may become more common if grid upgrades do not match growth in renewable power generation.

Capacity Market Participation as an Energy Management Strategy

Participation in the Capacity Market is aimed at businesses with energy intensive processes often involving heating, electrochemical reactions, and large-scale machinery. Processes such as aluminium smelting, steel production, electrolysis in chemical manufacturing, cement grinding and clinker production, paper milling and pulping, and chilling for food processing all demand substantial electricity for thermal or mechanical operations. These businesses have the potential to unlock significant revenue from the capacity market for being on standby to either reduce consumption or generate electricity at times of stress on the grid.

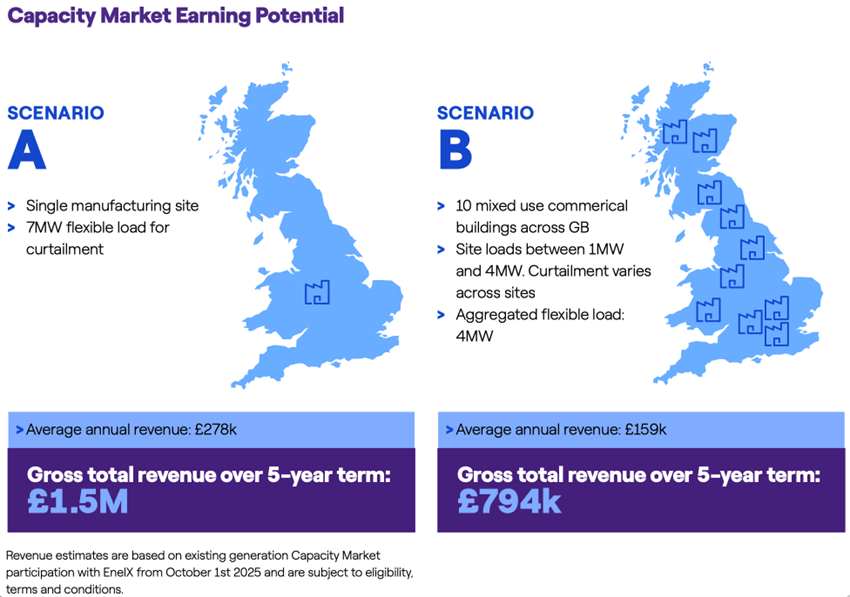

By participating in the Capacity Market, businesses can secure significant revenue by being ready to reduce energy use or generate electricity when the grid needs it most. For example, National Grid will pay businesses up to £65,000 for every megawatt (MW) that they enrol in the Capacity Market for future years. However, as many businesses don’t know where to find those spare MWs, payments are going unclaimed.

Energy Research specialists, Aurora Energy [1] expect the market prices to remain high as traditional gas turbine and nuclear plants are retired from production, and are being replaced by more intermittent renewable energy sources like solar, wind and tidal. This makes participation in the Capacity Market attractive as an opportunity to maximise revenue while helping decarbonise the UK’s energy grid by enabling more renewable energy sources to be incorporated into the energy mix.

Understanding how to participate in this market to access the benefits can appear daunting, but it needn’t be. Much of what is required to participate is already in place in the form of energy consuming plant and equipment.

Turning Energy Assets into Revenue Generation

Soaring energy costs have driven commercial and industrial consumers to find ways to reduce consumption in a bid to reduce operating expenses. Industries that are heavy users of electricity have already invested in innovative energy-saving technology across their operations. These range from variable speed drives on production equipment, to energy-efficient LED lighting to smart Heating Ventilation and Air Conditioning (HVAC) systems. Businesses have invested in uninterruptible power supply (UPS) systems and energy storage systems, including batteries, for operational purposes. And a growing number have invested in behind-the-meter energy production, such as cogeneration Combined Heat and Power (CHP) units and PV solar arrays, to protect their energy supply and offset rising prices.

While investing in energy-efficient, carbon-reducing practices and corporate energy generation is an important step towards an efficient energy management strategy, why stop there?

A Natural Next Step

Many large businesses are unaware of the opportunities available through Capacity Market participation. Commercial and industrial energy users already own energy assets and equipment that can provide essential capacity for the UK’s power system simply by being turned down or off at times of need. They can get paid significant amounts for making that capacity available. However, people are holding off taking part for a number of reasons: perceived complexity, operational disruption, uncertainty about the rewards and the risk of penalties. These barriers can be overcome by working with experienced energy aggregators whose job is to minimise the complexity and reduce risk, while securing market access through the Capacity Market auctions.

Understanding is Key to Overcoming Barriers

Participating in the Capacity Market can take up a lot of resource for a business trying to go it alone. The application process is complex and there are stringent rules of engagement with financial penalties for not meeting commitments. These are off-putting enough without the rewards appearing uncertain, as they do with many markets.

In fact, the Capacity Market delivers a highly stable return compared to other energy flexibility programs that are open to businesses. In these, returns can be volatile as they are subject to natural fluctuations in prices. The Capacity Market gives participants visibility of their rewards for the next four years.

When referring to ‘markets’, people often assume they are hugely complicated. While this is sometimes the case, the Capacity Market is the least complicated option to begin with, especially when someone can oversee its management for you. Once businesses experience its simplicity and benefits, they often see it as a gateway into other energy flexibility markets.

As an example, Enel X removed the complexity entirely for a food manufacturer that entered the Capacity Market in 2020, managing their entry to the scheme – including compliance, data analysis and testing and submissions to the Electricity Market Reform Settlement body. The customer has gone on to generate over £1.25 million in revenue and unlock a consistent stream of new income every year.

Minimising Operational Disruption

Operational disruption, often seen as a barrier to participation, is not an option for some businesses. While the Capacity Market presents the most stable, lowest risk demand-side response program, it still requires careful planning and forecasting to give organisations greater control over their response to events. Expert participation management helps firms maintain focus on their core business, without being sidetracked into time-consuming energy management activities.

The CEO of a regional agricultural feeds company says, “The ease of taking part is a significant benefit for us, allowing us to focus on farming and production. Demand response offers us an additional revenue stream and reduces our overall energy costs. It’s also a way for us to encourage the use of renewable energy and reduce emissions.”

You Are Not Alone

Participating in the Capacity Market is highly lucrative, tried and tested, and surprisingly low effort. The market itself may be ten years old, but it is reliable, and the risks are low. Most businesses already have the tools and infrastructure to participate in the Capacity Market but may not be aware of the opportunities or find the process daunting. In reality, participating can be easy when you work with an experienced aggregator like Enel X. If the Capacity Market is not part of your energy strategy, ask yourself why not.

To find out how you could benefit from the Capacity Market and other flexibility schemes, please visit https://www.enelx.com/uk/en/contact-us

[1] https://auroraer.com/insight/gb-market-summary-september-2024/