www.teitimes.com

September • Volume 17 • No 6• Published 10 times a year • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

The storage revolution A road to hydrogen?

As renewable energy capacity surges,

the demand for scalable long-duration

energy storage to provide reliability and

exibility has never been more critical.

Page 12

Can carbon capture, utilisation and

storage facilitate the production of low

carbon hydrogen from natural gas in the

near term – and at reasonable cost?

Page 13

News In Brief

Welcome boost for wind

energy manufacturers

The European Investment Bank

(EIB) has reached a €500 million

counter-guarantee deal with Ger-

many’s Deutsche Bank to boost

Europe’s wind turbine manufactur-

ing industry.

Page 2

Energy-hungry AI turns US

interest towards new nuclear

TerraPower has begun site prepara-

tion at its Wyoming site for a next-

generation nuclear power plant that

the company’s chair, Microsoft

co-founder Bill Gates, says will

“revolutionise” how electricity is

generated.

Page 4

China unveils massive

nuclear investment, as coal

plant expansion slows

China has approved a massive $31

billion investment to build 11 new

nuclear reactors across ve sites,

highlighting its commitment to

atomic energy as a key element in

its energy security and emissions

reduction efforts.

Page 5

Storage rolls out across

Europe at giga pace

Romania has announced plans to

have at least 2.5 GW of battery stor-

age in operation by next year and

to double capacity to 5 GW by 2026,

joining a push to install storage

across Europe.

Page 7

Private sector nance: the

linchpin of energy transition

investment

Private sector nance is crucial to

the energy transition. Joseph Jaco-

belli explains the ins and outs with

case studies illustrating the differ-

ence it can make in bringing proj-

ects to fruition.

Page 14

Technology Focus: Tapping

into untapped wind

A novel form of wind power gen-

eration that can harness untapped

wind resources through its unique

design has been developed by

Glasgow-based greentech innova-

tor, Katrick Technologies.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 1933 392987

The failure to include text referencing a transition away from fossil fuels in a draft document

ahead of an upcoming UN summit is causing concern, as world leaders gear up for COP29

later this year. Junior Isles

Europe’s energy crisis is “over”, says Shell boss

THE ENERGY INDUSTRY

TIMES

Final Word

It’s time to ease the

transmission gridlock,

says Junior Isles.

Page 16

A group of former world leaders and

Nobel prize winners have hit out at the

removal of a specic mention of fossil

fuels from the draft of a UN climate

pact at the centre of a summit in New

York later this month.

The 77-strong group published a let-

ter urging governments to address the

issue of fossil fuels at the summit,

scheduled for September 22-23. The

signatories of the letter are calling for

fair timelines for reducing reliance on

oil, gas and coal.

The letter was prompted by recent

changes to the draft outcome docu-

ment, dubbed ‘the Pact for the Fu-

ture’. The initial draft negotiating text

for the New York Summit included a

reference to “accelerating” a “transi-

tion away from fossil fuels”. This was

in line with the agreement already

struck between almost 200 countries

after negotiations at last November’s

UN COP28 conference in Dubai.

But revisions to the text to be put

forward in the separate pact in New

York have omitted any reference to

fossil fuels, instead calling for climate

action “on the basis of the best avail-

able science”.

The letter stated: “The extraction

and burning of fossil fuels is the pri-

mary cause of the climate crisis, fuel-

ling extreme weather, res, lethal

heat, droughts and ooding that are

threatening lives and livelihoods

around the planet.

“Yet this isn’t the end of the carnage

– the extraction and burning of fossil

fuels undermine all 17 Sustainable

Development Goals.”

The group raising the alarm includes

former President of Ireland Mary

Robinson – who clashed with the

COP28 president in the UAE over the

need to phase out fossil fuels to limit

global warming – as well as Bangla-

desh chief adviser Muhammad Yunus,

and former Swedish prime minister

Stefan Löfven. Most of the signatories

to the open letter came from science.

“We call on the United Nations to

ensure that the Pact for the Future in-

cludes robust commitments to man-

age and nance a fast and fair global

transition away from coal, oil and gas

extraction in line with the 1.5°C limit

agreed to by nations in the Paris

Agreement,” the letter stated.

The UN’s Summit of the Future will

see all the member states meet and

agree a text aimed at tackling a range

of global issues, including sustainable

development, technological co-opera-

tion and climate change.

It will also be the last formal oppor-

tunity for climate discussions ahead of

Continued on Page 2

The energy crisis in Europe is nally

over, according to the Chief Executive

of Shell, as market prices and volatil-

ity return to levels before Russia’s

invasion of Ukraine.

“We have seen that across the ener-

gy complex this quarter, maybe more

so than any of the previous ones in

recent times, that we are moving back

to a normalised price and margin lev-

el that is pre-2022,” said Wael Sawan

in an interview with the Financial

Times, adding that gas, crude and

power prices had all dropped back

and become more stable.

The fall in prices and volatility in

Europe saw Shell’s renewable and en-

ergy solutions business, which in-

cludes power trading, post a $187 mil-

lion loss, a 215 per cent drop from the

quarter before. The oil major also said

it had reduced its pipeline of renew-

able power projects under construc-

tion from 4.6 GW in the rst half of

last year to 3.8 GW.

Sawan said the loss was “not a mas-

sive surprise” because a lot of the

unit’s earnings had come from high

power prices. He added that the busi-

ness was in a “heavy investment

phase” and that while Shell pledged to

spend $10 billion to $15 billion be-

tween 2023 and 2025 on projects, it

would not start to make money until

the latter part of the decade.

Sawan’s prediction on Europe’s en-

ergy crisis came ahead of recent news

that the EU reached the 90 per cent

target for lling its subway natural gas

storage tanks 10 weeks before the

deadline set by Brussels.

According to the latest data from

Gas Infrastructure Europe (GIE), cor-

responding to August 19th, gas re-

serves were at 90.02 per cent of their

capacity. Spain leads the table, with

its tanks at maximum (100 per cent) in

the face of the cold season, when heat-

ing systems trigger consumption

across the continent.

The current level of tank lling is,

according to European Commission

projections, sufcient to cover one

third of total gas demand during the

winter.

This is a huge gure, given that,

even if there were to be a total shut-

down of gas pipelines from Russia,

the EU already has a large network of

regasication stations that allow the

import of liqueed natural gas (LNG)

from practically any corner of the

world where this fuel is extracted.

“This is the second year in a row in

which we managed to reach 90 per

cent full well before November 1,”

European Energy Commissioner

Kadri Simson said in a statement.

“This underlines the EU’s prepared-

ness for the coming winter, based on

our intensive work over the past two

and a half years.”

The EU Commission, she said,

“will continue to monitor the situa-

tion so that gas storage levels remain

sufciently high over the coming

months and so that we also maintain

our focus on improving energy ef-

ciency and boosting the deployment

of renewables”.

World “uncertain”

World “uncertain”

about need to phase

about need to phase

out fossil fuels

out fossil fuels

Raising the alarm: former

President of Ireland

Mary Robinson

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2024

2

Junior Isles

The European Investment Bank (EIB)

has reached a €500 million counter-

guarantee deal with Germany’s

Deutsche Bank to boost Europe’s wind

turbine manufacturing industry.

The announcement marks the rst

tranche activated under the EIB’s €5

billion counter-guarantee scheme

which constitutes the EIB’s key con-

tribution under the EU Wind Power

Package. The counter-guarantees will

improve access to nance for wind

turbine manufacturers, providing

them with the support they need to

help boost Europe’s energy security

and competitiveness.

The agreement to support the supply

chain forms part of a portfolio of up

to €1 billion of counter-guarantees for

the supply chain and investments in

wind farms that Deutsche Bank will

use to support the wind industry. The

EIB estimates that this will trigger

additional private investments of up

to €8 billion.

The initiative is part of a EU Wind

Power Package presented by the Euro-

pean Commission in October 2023 to

maintain a competitive wind energy

supply chain across the Union.

A quick build-up of wind power is

crucial for decarbonising the economy,

said EIB vice-president Nicola Beer.

Together with Deutsche Bank, we are

promoting the expansion of renewable

energy in Europe and in that way bring-

ing the price of sustainable energy

down. The respective project will also

help to safeguard and create jobs in a

sustainable and competitive European

industry.”

The news was welcomed by Euro-

pean wind industry association, Wind-

Europe, Phil Cole, Director of Indus-

trial Affairs at WindEurope, said:

“Today’s announcement is warmly

welcomed. It is an important step in

delivering the EU Wind Power Pack-

age. There is rapidly growing demand

for wind turbines that are “made in

Europe”. Improved access to nance

and de-risking instruments are central

to ensuring Europe’s wind turbine

manufacturers can keep up with this

demand and ramp up their manufactur-

ing output in line with the EU’s 2030

targets.”

Wind turbines and solar panels gener-

ated 30 per cent of the EU’s electricity

in the rst half of the year.

According to Ember, the independent

global energy think tank, wind turbines

and solar panels generated 385.6 TWh

of electricity in the EU during the rst

half of the year, surpassing the 343.5

TWh produced from fossil fuels for the

rst time.

The transformation of the EU’s elec-

tricity system has been swift over re-

cent years. The rst half of 2024 in

particular has seen almost unprece-

dented falls in fossil generation despite

demand growing. Renewables have

played a vital role in alleviating high

power prices in the bloc, but sustaining

the pace of this transition will not be

an easy feat, said Ember. It will require

dedicated policy action and implemen-

tation to ease barriers to future wind

and solar deployment.

The EU’s wind capacity additions

are expected to ramp up only from

2025 onwards, as longer project lead

times mean that the increased auction

volumes and investment decisions in

2023 will take longer to deliver larger

deployment. However, under current

policy conditions, the EU is still fore-

cast to fall 30 GW short of the mini-

mum 425 GW required to meet its

2030 target, and further short of the

500 GW stipulated in the REPowerEU

plan.

“As power prices return to pre-crisis

levels, Europe cannot rely on the mar-

ket alone to drive the necessary ac-

celeration of renewables deployment.

Well-designed and implemented in-

centive schemes will remain impor-

tant to sustaining momentum,” said

Ember.

the UN COP29 summit to be held

in Baku in November.

The failure to refer to fossil fuels

in the pact in New York would risk

“sending a signal that the world is

uncertain about the need to phase

out fossil fuels”, said Alex Rafalo-

wicz, Director of the Fossil Fuel

Non-Proliferation Treaty campaign

group.

“It’s extremely concerning that

the text doesn’t even contain the

language agreed in Dubai last

year,” he added, referring to last

November’s COP28 agreement,

known as the UAE Consensus.

The signatories of the letter are

calling for fair timelines for reduc-

ing reliance on oil, gas, and coal,

while stressing the importance of

nancial support to help lower-in-

come countries transition to sustain-

able energy.

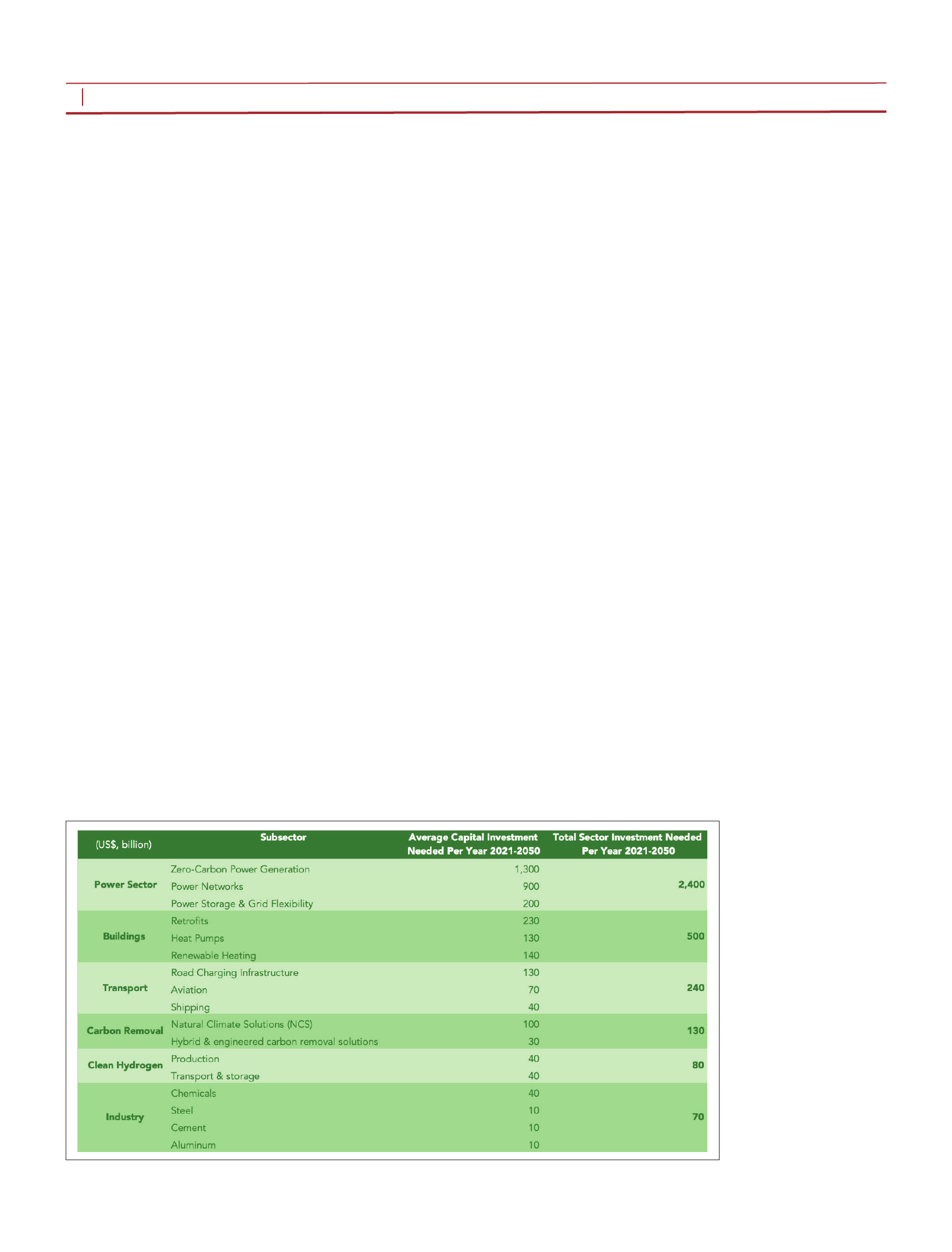

According to the International

Energy Agency (IEA), putting the

global energy system on track to net

zero by 2050 this decade would re-

quire just 1 per cent of the money

currently poured into the energy

sector annually.

The IEA’s net zero by 2050 path-

way advises against any expansion

of global oil and gas extraction ca-

pacity beyond projects that were

approved before the end of 2021. It

also recommends no new coal

mines, mine expansions, or the con-

struction of new unabated coal red

power plants.

In its latest update on coal market

trends worldwide, published in late

July, the IEA said global coal de-

mand is set to remain broadly un-

changed in both 2024 and 2025 as

surging electricity demand in some

major economies offsets the im-

pacts of a gradual recovery in hy-

dropower and the rapid expansion

of solar and wind.

The world’s use of coal rose by

2.6 per cent in 2023 to reach an all-

time high, driven by strong growth

in China and India, the two largest

coal consumers globally, the IEA’s

‘Coal Mid-Year Update’ nds.

While coal demand grew in both the

electricity and industrial sectors, the

main driver was the use of coal to

ll the gap created by low hydro-

power output and rapidly rising

electricity demand.

“Our analysis shows that global

coal demand is likely to remain

broadly at through 2025, based on

today’s policy settings and market

trends,” said Keisuke Sadamori,

IEA Director of Energy Markets and

Security. “The continued rapid de-

ployment of solar and wind, com-

bined with the recovery of hydro-

power in China, is putting signi-

cant pressure on coal use. But the

electricity sector is the main driver

of global coal demand, and electric-

ity consumption is growing very

strongly in several major econo-

mies. Without such rapid growth in

electricity demand, we would be

seeing a decline in global coal use

this year. And the structural trends

at work mean that global coal de-

mand is set to reach a turning point

and start declining soon.”

Continued from Page 1

UK energy regulator Ofgem has ap-

proved a £3.4 billion ($4.47 billion)

electricity high voltage transmission

link between Scotland and England in

the biggest single investment for elec-

tricity transmission infrastructure in

Britain.

The 500 km Eastern Green Link 2

(EGL2) project will stretch from Ab-

erdeenshire to North Yorkshire and will

transport huge amounts of renewable

energy between Scotland and England.

The joint venture between Scottish

and Southern Electricity Networks and

National Grid is part of a push to mod-

ernise the electricity grid to deal with

greater demands placed on it by the

green transition.

The new network capacity from the

power line will carry enough renew-

able electricity to power two million

homes, Ofgem said, describing it as a

“superhighway”.

Chief Executive Jonathan Brearley

said: “Ofgem is fully committed to

supporting the government to meet its

aims of getting clean power by 2030.

Today’s announcement is a further step

in putting the regulatory systems and

processes in place to speed up network

regulation to achieve its aim

The new interconnector cable will be

able to move 2 GW of electricity be-

tween Scotland and England, partly

enabling England to benet from off-

shore wind energy generated by off-

shore wind farms in the North Sea.

Ofgem said it is pushing to fast-track

the approvals process for power proj-

ects to help the UK meet its 2030 net

zero carbon emissions target.

The regulator also provisionally gave

the green light to a £295 million fund-

ing package for a set of upgrades to the

electricity grid in Yorkshire.

The project, which is run by Nation-

al Grid, will involve building new sub-

stations and overhead lines to improve

networks in the North East of England.

Separately, the Electricity System

Operator unveiled plans to connect up

to 4.5 GW of oating offshore wind

power from the Celtic Sea to south

Wales’ and southwest England’s grids.

The recommended design connects

up to 3 GW into two locations in south

Wales and up to 1.5 GW into the south-

west of England, with each of the three

proposed offshore wind farms (also

known as Project Development Areas,

or PDAs) having its own connection

to the onshore electricity network. The

proposals are for one high voltage di-

rect current (HVDC) connection into

a potential new south Wales connection

node, and two connections utilising

high voltage alternating current

(HVAC) technology into Carmarthen-

shire and North Devon.

ESO’s chief engineer Julian Leslie

said: “Offshore wind is vital to achiev-

ing the government’s target for clean

power by 2030, sustaining energy se-

curity and achieving net zero by 2050,

so it is a really positive development

that this is the rst time an offshore

wind leasing round will have been

launched with a recommended high

level network design in place.”

In July, the new Labour government

increased the budget for the next wave

of schemes to a record £1.56 billion a

year. About £1.1 billion of the total will

be allocated for offshore wind projects,

as the government tries to make up for

a opped auction round last year when

no offshore wind developers bid.

The UK energy secretary has there-

fore raised by 50 per cent the budget

for this year’s subsidy contract auction,

in which developers bid for 15-year

state guarantees on their electricity

price.

Labour wants to quadruple offshore

wind capacity, double onshore wind

capacity and triple solar power capac-

ity in order to meet its target of cutting

emissions from electricity generation

to net zero by 2030.

The target is ve years faster than the

goal set out by the former Conservative

government, and experts say it would

require radical change to the way proj-

ects are built in the UK.

The US Department of Energy (DOE)

has announced $2.2 billion of grid in-

vestments across eight projects in 18

states, which are expected to add al-

most 13 GW of grid capacity, including

4.8 GW of offshore wind.

The projects, representing a com-

bined public and private investment

of almost $10 billion, will deploy new

transmission infrastructure and tech-

nology upgrades with the aim of pro-

tecting against extreme weather, low-

ering costs for communities and

preparing for growing demand from

an increase in manufacturing and data

centres.

The funds come from the Bipartisan

Infrastructure Law’s $10.5 billion Grid

Resilience and Innovation Partner-

ships (GRIP) Programme; project

sponsors will provide about $7.8 bil-

lion in matching funding.

The grants from the GRIP pro-

gramme – funded by the bipartisan

infrastructure law – mark the second

funding round under the programme.

In October, DOE awarded nearly $3.5

billion in grants to support 58 projects

in 44 states.

The funding announced last month is

from GRIP’s $5 billion grid innovation

programme, which focuses on projects

that use new approaches to transmis-

sion, storage and distribution infra-

structure to improve grid resilience and

reliability.

The selected projects also include

two projects for the deployment of new

transmission lines – Clean Path New

York, led by New York Power Author

-

ity, and North Plains Connector, led by

Montana Department of Commerce.

The two lines will boost grid capacity

by about 4.3 GW.

“The Biden-Harris Administration is

investing in the most crucial compo-

nent of the nation’s infrastructure, ex-

panding and hardening the grid to al-

low more resilient, clean power to

reach more households, and support

the ongoing manufacturing boom – all

while creating thousands of local jobs,”

commented US Secretary of Energy

Jennifer Granholm.

The DOE expects to issue the second

round of funding selections for

GRIP’s Grid Resilience Utility and

Industry Grants programme and its

Smart Grid Grants programme later

this year.

Headline News

Biden-Harris Administration to invest in “crucial” grid infrastructure

Welcome boost for wind

Welcome boost for wind

energy manufacturers

energy manufacturers

Sadamori: coal demand likely

to remain at through 2025

n First tranche activated under EIB’s €5 billion counter-guarantee scheme

n Wind and solar generate 30 per cent of EU’s electricity in rst half of 2024

UK ‘superhighway’ gives boost to

UK offshore wind

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2024

3

We’re scaling up production

Producing enough green hydrogen is the key

to decarbonizing businesses that can’t be

directly electried. Our power-to-X processes

convert renewable electricity and water into

green hydrogen and its derivate net-zero fuels.

Together with our subsidiary H-TEC SYSTEMS

we are mass-producing PEM electrolyzers and

scaling up production of green hydrogen –

moving big things to zero in the energy, heavy

industry, and transport sectors.

www.man-es.com

with green hydrogen

from PEM electrolyzers

2403_26526_MAN_ES_MBTTZ_Anz_PEM_reSe_ENG_290x380mm_ISO_V2.indd 12403_26526_MAN_ES_MBTTZ_Anz_PEM_reSe_ENG_290x380mm_ISO_V2.indd 1 23.05.24 16:2023.05.24 16:20

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2024

5

Asia News

The Philippines government is target-

ing 2028 as the year to begin construc-

tion of nuclear power capacity to begin

in 2028 with commissioning to start by

2032, according to the draft Philippine

Nuclear Energy Program (PNEP) for

2024-2050.

The PNEP outlined the key targets

that must be achieved for the success-

ful commercial operations of a nuclear

power plant in the country. The target

minimum nuclear power capacity is

1200 MW by 2032, 2400 MW by 2035,

and 4800 MW by 2050.

The key targets cited under the proj-

ect development activities of Mile-

stone 2 (2024-2028) include regula-

tory compliance of the country’s

Nuclear Power Plant (NPP) (2025-

2028) and construction of the nuclear

power plant (2028-2032).

“Power supply arrangements for the

power produced by the NPP pro-

ject will be executed in 2027 while

construction will commence by 2028.

After ve years, commissioning and

grid synchronisation of the NPP is

expected,” the PNEP stated.

The legal and regulatory framework

for available domestic nuclear materi-

als and reliable and responsible foreign

suppliers is expected to be nalised by

2025 while the selection of processing

technology, especially for waste dis-

posal, will be completed in 2026.

Milestone 3, meanwhile, is the start

of commercial operation. The commer-

cial operation of these NPPs will con-

tribute to at least 1200 MW capacity

using conventional, SMR (small mod-

ular reactors) or MMR (micro modular

reactor) technology across multiple

sites in the country.

The country’s transition to cleaner,

more sustainable energy, received a

boost last month when Aboitiz Power

awarded LONGi a contract to supply

solar PV modules for a 600 MW plant.

Meanwhile in July Hydrogène de

France (HDF Energy), a leading play-

er in large-scale green hydrogen infra-

structure and high-power fuel cell

manufacturing, signed a joint Memo-

randum of Understanding (MoU) with

the Department of Energy and Mind-

anao Development Authority.

The partnership will drive research

and development in efcient technolo-

gies for harnessing renewable energy

sources and locally produced green

hydrogen for sustainable application

across targeted regions throughout the

Philippines.

Raphael P.M. Lotilla, Secretary of

DoE, commented: “The signing of this

MoU marks a signicant milestone in

our journey toward a sustainable and

resilient energy future. It underscores

our collective commitment to harness-

ing the power of hydrogen technolo-

gies, which is a pivotal step in achiev-

ing our national energy goals.”

Pakistan’s federal cabinet has ap-

proved a ve-year privatisation pro-

gramme, which will be executed in

three phases. The decision was made

during a cabinet meeting held in Islam-

abad last month.

According to sources, in the rst

phase, key entities slated for privatisa-

tion include Pakistan International

Airlines (PIA), the House Building

Finance Corporation (HBFC), Faisala-

bad Electric Supply Company (FES-

CO), Islamabad Electric Supply

Company (IESCO), and Gujranwala

Electric Power Company (GEPCO).

Subsequent phases will see the pri-

vatisation of Lahore Electric Supply

Company (LESCO), Multan Electric

Power Company (MEPCO), Peshawar

Electric Supply Company (PESCO),

Hyderabad Electric Supply Company

(HESCO), Sukkur Electric Power

Company (SEPCO), Utility Stores

Corporation, State Life Insurance Cor-

poration, and Pakistan Re-Insurance

Company.

Earlier, the cabinet had given the go-

ahead for the privatisation of 13 entities

under Pakistan’s Power Division, in-

cluding nine power distribution com-

panies. Notably, the Quetta Electric

Supply Company (QESCO) and Trib-

al Electric Supply Company (TESCO)

were excluded from the list.

In addition to the distribution com-

panies, power generation companies

(GENCOs) were also approved for

privatisation as part of the programme.

Philippines eyes nuclear construction

Philippines eyes nuclear construction

as part of sustainable energy

as part of sustainable energy

portfolio

portfolio

Pakistan approves privatisation programme

China has approved a massive $31

billion investment to build 11 new

nuclear reactors across ve sites, high-

lighting the country’s commitment to

atomic energy as a key element in its

energy security and emissions reduc-

tion efforts.

CGN Power Co, the listed unit of

state-owned China General Nuclear

Power Corp, is the biggest beneciary

of the nuclear push, receiving approv-

als for six reactors. China National

Nuclear Corp has received approval for

three reactors, while State Power In-

vestment Corp said it had received ap-

proval for two units.

The new reactors will include ad-

vanced domestic designs like the Hua-

long One and a fourth-generation high-

temperature gas-cooled reactor.

George Borovas, Partner at Hunton

Andrews Kurth, and lead at the rm’s

Nuclear practice, said: “China’s ap-

proval of new nuclear reactors further

demonstrates the country’s reliance

on atomic energy for energy security

and its commitment to reducing emis-

sions. The reactors will feature vari-

ous designs, including the latest Chi-

nese Gen III+ and Gen IV models.

With China poised to surpass the US

and France in nuclear power capacity

by the end of the decade, the Chinese

government’s commitment to nuclear

power is undeniable.”

Already a world leader in wind and

solar, China has turned to nuclear as a

zero carbon energy source to replace

the large baseload capacity predomi-

nantly provided by coal.

Coal still accounted for nearly 60 per

cent of the country’s electricity supply

last year, according to industrial asso-

ciation China Electricity Council. The

country’s existing nuclear power ca-

pacity, from 56 reactors, accounted for

about 5 per cent of total electricity

demand.

According to an analysis by the Cen-

tre for Research on Energy and Clean

Air (CREA) and the Global Energy

Monitor.

The analysis, published last month,

revealed a signicant decrease in the

approval of new coal red power proj-

ects in the rst half of 2024 compared

to the same period last year.

A review of project documents by

Greenpeace East Asia found that 14

new coal plants were approved from

January to June with a total capacity of

10.3 GW, down 80 per cent from 50.4

GW in the rst half of last year. In 2023

and 2022, China had approved new

coal red power projects that were set

to generate more than 100 GW of

power, according to the report.

Environmental group Greenpeace

recently reached similar conclusions.

It reported that 10.34 GW of coal red

power projects had been approved in

the rst half of the year, marking a 79.5

per cent decrease.

“We may now be seeing a turning

point,” Greenpeace East Asia project

lead Gao Yuhe said.

The government has issued a slew of

documents in recent months on reduc-

ing carbon emissions and accelerating

the shift to renewable energy.

The National Energy Administra-

tion unveiled a three-year plan in June

to retrot existing coal power units

and equip newly built ones with low-

carbon technologies. Another govern-

ment plan released last month to “ac-

celerate the construction of a new

power system” took aim at bottle-

necks and other challenges, including

how to expand transmission of renew-

able energy.

Gao said that China should focus its

resources on better connecting wind

and solar power to the grid rather than

building more coal power plants.

China unveils massive nuclear

China unveils massive nuclear

investment, as coal plant

investment, as coal plant

expansion slows

expansion slows

China’s massive investment in nuclear demonstrates the country’s determination to wean itself off coal and cut carbon

emissions. Junior Isles

Taiwan allocates offshore wind capacity

Taiwan’s Ministry of Economic Affairs

has announced the results for the coun-

try’s Round 3.2 offshore wind tender,

awarding 2.7 GW of capacity across

ve projects.

The results follow the release of ap-

plicant rankings in July, which featured

six developers. The ministry then said

that due to the overlapping scope of

some project sites, it was yet to notify

each developer of the exact capacity it

will be awarded.

The largest of the projects is Synera

Renewable Energy’s (SRE) Formosa

6 offshore wind project. The 800 MW

project, with a maximum potential

capacity of 1 GW, will be situated ap-

proximately 35 km off the coast of

Xianxi Township, Changhua County,

spanning an area of around 84 km

2

.

Based on the allocated capacity of

800 MW, the project can install up to

57 wind turbines, each with a capac-

ity of 14 MW.

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2024

6

Are you getting ready for Net Zero? The Thought Leaders’ Summit,

is where you will hear asset managers, think tanks and investors

discuss strategies and case studies on how to best achieve net zero

Our expert panels will be discussing the merits of investing in;

SOLAR PV, ONSHORE & OFFSHORE WIND, BATTERY STORAGE,

BEHIND-THE-METER, CARBON CAPTURE & STORAGE, ELECTRIC

VEHICLES, HYBRID, HYDROGEN & eFUELS.

Lightsource BP

PwC

Hive Energy

For event agenda & tickets click the link here

Lotus Cars

True Green Capital

Who should attend; LP’s, asset & fund managers, family oices,

heads of sustainability, corporates, CEOs. cleantech start-ups

9thOctober

London

John Dashwood, Head of Renewables PwC, Mike Evans MD Cambridge Carbon

Capture, Jim Totty, Partner, Viridis Capital Will Morgan MD UK True Green Capital

https://www.eventbrite.co.uk/e/936320368427?aff=oddtdtcreator

Early bird oer ends 15.9.24

Pre-register now:

www.enlit-europe.com/thinktank

Want to be part of the

next industry report?

Join us in Milan

22-24 October 2024

15k Attendees

700 Exhibitors

500 Speakers

80 EU Projects

400 Future Energy Leaders

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2024

7

Europe News

Janet Wood

Romania has announced plans to have

at least 2.5 GW of battery storage in

operation by next year and to double

capacity to 5 GW by 2026.

The new goals were announced by

Energy Minister Sebastian Burduja

and follow recommendations by trans-

mission system operator Transelectri-

ca that the country needs at least 4 GW

of storage. Last year Romania allo-

cated €80 million in grants for storage

and this is expected to support 1.8 GW

of new capacity.

Romania is joining a push to install

storage across Europe. In Germany,

TotalEnergies said it has taken the nal

investment decision on a 100 MW/200

MWh battery in Dahlem, North Rhine-

Westphalia. It is the rst in a pipeline

of projects arising from TotalEnergies’

acquisition, in February, of German

battery developer Kyon Energy which

brought together the developer with

TotalEnergies battery maker Saft.

“This investment decision reects

the acceleration of our integrated de-

velopment in the German electricity

market, the largest in Europe. For the

battery system design, we will lever-

age synergies between our electricity

teams: Saft will supply the batteries,

Kyon Energy will manage develop-

ment, and Quadra Energy will market

this new capacity,” said Stéphane Mi-

chel, SVP, Gas, Renewables & Power

at TotalEnergies.

Meanwhile in Spain, Masdar plans

to join with Endesa to add 0.5 GW of

battery storage to 48 operational solar

plants totalling 2 GW, if Masdar’s ac-

quisition plans (see separate story)

come to fruition.

The UK has already seen a boom in

battery construction – most recently

developer RES was granted permis-

sion to add a 49.9 MW battery in Scot-

land to its 700 MW portfolio of batter-

ies across the UK and Ireland. RES

currently manages over 600 MW of

battery storage systems from its control

centre in Glasgow.

Now interest in the UK has moved

towards longer-duration storage and

with an order of magnitude increase

in energy stored. SSE Renewables has

partnered with a group led by Gilkes

Energy to build one of the largest

pumped-storage hydropower stations

in the UK. The project in Scotland has

a planned capacity of 1.8 GW/37GWh.

The scheme includes the development

of tunnels and a new power station at

Loch Fearna, near SSE Renewables’

existing Loch Quoich reservoir in the

Great Glen hydro scheme.

Under a development services

agreement with SSE Renewables,

Gilkes Energy will lead the develop-

ment of the Fearna project, which

already has a grid connection offer.

Subject to a nal investment decision,

the facility could become operational

in the mid-2030s.

Two energy consultancies have

warned that Northern Ireland and the

Republic of Ireland will miss their

2030 renewable energy target of 80

per cent energy from renewables.

Cornwall Insight said delays in plan-

ning and a shortage in grid connec-

tions will play a part in slowing down

the renewables transition. They have

been “signicant barriers” to the Re-

public’s Renewable Energy Support

Scheme (RESS), which resulted in

just three successful onshore wind

projects last year. Aurora warned that

the next RESS auction is unlikely to

achieve its procurement target.

Steph Unsworth, Senior Associate,

Aurora Energy Research, said: “Proj-

ects in Ireland remain higher cost than

in other European markets due to tight

supply chains on the island system and

nancing difculties given the ardu-

ous planning and grid connection

processes.”

Kitty Nolan, Energy Modeller at

Cornwall Insight, said: “While some

may argue that the delay won’t have

a signicant impact, Ireland’s contin-

ued reliance on insecure imports ex-

poses us to global market disruptions,

which could drive up prices, while our

dependence on fossil fuel generated

power is delaying our progress toward

achieving net zero. It’s crucial that we

streamline these planning processes

and invest in grid infrastructure to

meet our climate commitments.”

Northern Ireland is currently de-

signing its own renewable support

scheme, but much of the procured

capacity is expected to come online

after 2030.

Masdar (the UAE’s Abu Dhabi Future

Energy Company) is set to join forces

with Endesa in a €1.7 billion renewable

energy venture in Spain. The transac-

tion would see the two companies

partner on 2.5 GW of renewable en-

ergy assets in Spain. Masdar will invest

€817 million to acquire a 49.99 per cent

stake in 2 GW of solar energy plants,

potentially adding 500 MW of battery

storage to sites, and the two companies

will also explore jointly developing

new projects.

Masdar has ambitious expansion

plans in Europe. It recently announced

an agreement to acquire 67 per cent of

Greece’s Terna Energy, which is target-

ing renewable energy operational ca-

pacity of 6 GW by 2030 and earlier this

year it reached nancial close, in com-

bination with Iberdrola, on the 476

MW Baltic Eagle offshore wind proj-

ect in the Baltic Sea off the coast of

Germany.

The Endesa agreement cements Mas-

dar’s position in Spain, one of EU’s

largest solar markets. Most recently a

€50 million loan from the European

Investment Bank (EIB) and Matrix

Renewables will support ve new solar

photovoltaic plants with an installed

capacity of 240 MW.

“With this operation, the EIB contin-

ues to accelerate the energy transition

in Spain by increasing renewable en-

ergy generation capacity,” said Ales-

sandro Izzo, EIB Director of Equity,

Growth Capital and Project Finance.

Shell Deutschland GmbH has taken a

nal investment decision on Re-

fhyne II, a 100 MW renewable pro-

ton-exchange membrane (PEM) hy-

drogen electrolyser at the Shell

Energy and Chemicals Park Rhein-

land in Germany.

Refhyne II is expected to produce up

to 44 000 kg per day of renewable, also

known as green, hydrogen to partially

decarbonise site operations. The elec-

trolyser is scheduled to begin operating

in 2027.

“Today’s announcement marks an

important milestone in delivering our

strategy of more value with less emis-

sions. Investing in Refhyne II is a vis-

ible demonstration of our commit-

ment to the hydrogen economy, which

will play an important role in helping

to decarbonise Shell’s operations and

customer products,” commented

Shell’s Downstream, Renewables and

Energy Solutions Director, Huibert

Vigeveno.

Meanwhile, German utility EnBW

has announced plans to invest some

€1 billion to create a national hydrogen

core network. The network is expected

to be built by 2032 and will play a cru-

cial role in the future European Hydro-

gen Backbone, according to German

government plans. It will deliver hy-

drogen to industrial centres and power

plants, and will establish routes for

importing hydrogen from abroad.

EnBW subsidiaries Terranets and

VNG/ONTRAS Gastransport have

led pipeline project commitments

with the Federal Network Agency as

part of a joint application by German

transmission system operators. Ter-

ranets has also conrmed that a south

German gas pipeline will connect to

the hydrogen core network.

Janet Wood

It will cost Sweden around $38 billion

to carry out its plans to construct 2.5

GW of new nuclear capacity by 2035

and ten new reactors by 2045, which

will require government loans and

price guarantees, according to a gov-

ernment-appointed commission.

The private sector has yet to invest,

citing lack of a guaranteed return. In

response, the government said it would

look at taking on a greater share of the

costs of nancing and appoint a com-

mission to study the cost-effectiveness

of such projects.

The commission now says the state

should offer loans that cover 75 per

cent of the cost of building power

plants. It should also guarantee a set

price for electricity for 40 years. The

commission’s report said that a eet of

four or ve new plants totalling 4-6

GW would be most cost-effective.

“The challenge for those who want

to build new nuclear power is that the

risks are seen as multiple and very

large,” said Mats Dillen, head of the

commission.

Meanwhile in central Europe, Czech

energy company CEZ has said nal

proposals for nancing two new nu-

clear units at Dukovany should be

completed by the end of this year. CEZ

spokesman Ladislav Kriz said con-

tracts should be exchanged with the

contractor, Korea’s KHNP, by the be-

ginning of March. Construction is ex-

pected to start in 2029, with the rst

unit due to start producing electricity

in 2036.

The Czech government continues to

negotiate with KHNP over two more

units at a second site, Temelin in south-

ern Bohemia.

The Polish government has also

published legislation that would allow

it to provide nancing for a nuclear

power plant, which would be Poland’s

rst, at the Lubiatowo-Kopalino site

in Pomerania.

A government statement said: “The

rst of the government’s legislative

initiatives is aimed at providing

nancing for the project to build Po-

land’s rst nuclear power plant, being

implemented at the Lubiatowo-Ko-

palino site in Pomerania”. It is ex-

pected to receive around €14.05 bil-

lion ($15.57 billion) in state support

in the period 2025-2030 and Poland

has announced the rst €1.2 billion

investment from its 2025 budget.

Meanwhile, Romanian nuclear en-

ergy company Nuclearelectrica has

announced plans to take forward a

project to develop small modular reac-

tors (SMRs). The project in Romania

is being developed by a joint venture,

RoPower Nuclear, with Nova

Power&Gas. Nova is part of the private

group E-INFRA group, which owns a

site in Doicești where a 462 MW SMR

may replace a coal red thermal pow-

er plant.

Nuclearelectrica has agreed con-

tracts related to Phase 2 of the FEED

(Front-End Engineering Design) study

for the project, which will be carried

out by Fluor, with the US company

NuScale as a subcontractor.

Countries start to

Countries start to

allocate funding for new

allocate funding for new

nuclear plants

nuclear plants

Irish markets set to miss 2030

renewable energy targets

Spain attracts Abu Dhabi

investor and EIB loan for solar

Hydrogen production and transmission moves forward in Germany

n Romania plans to reach 5 GW by 2026

n Long duration storage in sight in the UK

n Sweden assesses needed investment in new units

n Czechia, Poland, Romania move towards delivery

Storage rolls out across Europe at giga pace

Ukraine seizes vital Russian gas transit point

in Sudzha

Africa looks to potential as green hydrogen

producing continent

Gary Lakes

A bold move taken by Ukraine’s mil-

itary has led to the capture of an im-

portant gas metering station inside

Russia as well as the town of Sudzha

and more than 1000 km

2

of surround-

ing countryside. Launching a military

operation in early August, Ukrainian

forces had by mid-August seized con-

trol of a large chunk of the Kursk

Oblast and were ghting to secure a

small portion of Russia lying north of

the border with Ukraine with the

stated intention of establishing a ‘buf-

fer zone’ within Russia.

Within that area is a key transit point

for Russian natural gas through which

gas continues to ow to European

countries despite a variety of sanctions

imposed by the European Union. The

gas is produced in western Siberia and

is routed through Sudzha and through

the Ukrainian gas network to a crossing

point on the Slovakia border. From

there the gas is transported to Austria,

Slovakia and Hungary.

A pre-war agreement between Rus-

sia and Ukraine allows for the transit

of gas through this route. However,

that agreement is due to expire by the

end of the year and it is not expected

to be extended due to the war. Ukrai-

nian Energy Minister, German Ga-

lushchenko, has said Kiev does not

intend to extend or replace the transit

agreement.

Before Russia decided to invade

Ukraine in February 2022, the EU was

Gazprom’s single largest market, rep-

resenting 40 per cent of the group’s

gas demand. Since then, Russian ship-

ments to Europe have fallen signi-

cantly with only the gas through

Ukraine arriving by pipeline. Russia

continues to export gas to Europe in

the form of LNG, but that may not

continue for much longer as US LNG

exports and those from other suppliers

ll Europe’s energy gap.

Gazprom operated four pipelines to

Europe, Nord Stream though the Bal-

tic Sea to Germany, but it was de-

stroyed through an act of underwater

sabotage, a pipeline system through

Belarus and Poland, but that stopped

when Europeans objected to Russia’s

invasion of Ukraine and Moscow de-

manded that the gas be paid for in

rubles. There exists the TurkStream

gas pipeline across the Black Sea to

Turkey, and the pipeline through

Ukraine.

While the lack of gas sales to Europe

has had an impact on Russia’s econ-

omy, Moscow has also found clever

ways to continue exporting gas and

oil, most to Asian customers.

The situation is not a good one for

Ukraine either. The pipeline systems

through Ukraine and Eastern Europe

were constructed during the time of

the Soviet Union. In post-Soviet Eu-

rope many Eastern countries contin-

ued to depend on Russian gas, but

following stoppages in Russian gas

ow in 2006 and 2009, and their

integration into the EU, Eastern EU

members opted to seek a new supply

of gas. Since the fall of the Soviet

Union, Ukraine relied on Russian gas,

but it was often in dispute with Gaz-

prom over supplies that unaccounted

for or payments that were not made.

Those circumstances created a series

of disagreements between the two

countries and control of the gas net-

work through Ukraine might be con-

sidered one of the reasons why Mos-

cow wishes to control the country.

Russian gas owing through

Ukraine generated substantial transit

fees for Kiev and became an important

part of the Ukrainian budget. The

country also depended heavily on

Russian gas supplies that also gave

Kiev a strategic advantage as a go-

between from Europe and Russia, as

its role always needed to be taken into

consideration when gas agreements

were made.

Furthermore, Ukraine was able to

secure investment in the pipelines and

other infrastructure that contributed to

economic growth.

The post-war situation may contrib-

ute to a new dynamic. If Ukraine and

Russia reach an amicable end to the

ghting it could mean that Gazprom

might continue to ship gas through

Ukraine. It could mean that EU coun-

tries other than Austria, Slovakia and

Hungary may renew their purchases

of Russian gas. If not, it means that

Ukraine will likely continue with its

current programme to establish new

sources and routes for gas supply as

well as further develop its own gas

resources, energy infrastructure and

gas storage facilities. Ukraine is al-

ready drawing gas supplies from pipe-

line connections with neighbouring

European states, a step that would

likely be strongly encouraged by the

EU as it considers Ukraine’s eventual

membership in the organisation. And

if Ukraine is admitted as a member of

NATO, it will surely seek gas supplies

that are not Russian.

Gary Lakes

As the energy transition gets underway

in most parts of the world, African lead-

ers are keen to have the entire continent

of Africa get involved in green hydro-

gen production. Africa’s abundant re-

newable energy resources of wind,

solar and hydro power gives it prime

potential to be a major global producer

of green hydrogen, which is viewed as

a sustainable solution for the conti-

nent’s growing energy demand in the

midst of addressing climate change.

Some organisations believe that Africa

has the potential to produce as much

as 5000 megatons of hydrogen annu-

ally. That is as much as the current

total world energy supply.

As it looks now, Africa has the great-

est potential to produce solar electric-

ity, as much as 40 per cent of the world’s

total. This is due to the fact that produc-

tion of solar energy in Africa would be

stable and would not vary due to weath-

er conditions. The continent is also

believed to have the wind potential to

produce electricity that could meet its

demand by over 250 times. It also has

a capacity to produce the largest

amount of hydroelectricity. Currently

more than 90 per cent of this capacity

is untapped.

These reasons make Africa a prime

candidate for green hydrogen produc-

tion. The conferences in Namibia and

the Hydrogen Africa conference in

South Africa in October both seek to

accelerate the hydrogen economy

throughout the continent. The confer-

ences look to not only establish a de-

gree of energy autonomy for African

countries, but also address the issues

of reaching net zero and pushing eco-

nomic growth. There are also efforts

being made to encourage the active

participation in renewables and green

hydrogen within segments of society

that are usually marginalized.

Hydrogen promoters are looking for

government assistance and foreign in-

vestment to move the sector forward.

Experts on the subject agree that the

continent’s green hydrogen economy

will require substantial investment.

Estimates range from $450 billion to

$900 billion by 2050. But according to

the European Investment Bank, Africa

could produce 50 million tons per year

by 2035 at a cost competitive with

global oil prices, according to a recent

report in the UAE’s Zawya. According

to the report, those investment gures

would require an injection of $6 billion

until 2030 to meet net zero goals, and

of that, $200 million would go annu-

ally to infrastructure alone.

But, with green hydrogen currently

costing between €2.50/kg and €5.50/

kg to produce, it remains higher than

fossil fuels.

“Only through partnerships and col-

laboration will the hydrogen ecosys-

tem in Africa be able to take off,”

Tiago Marques, head of content at the

Namibia summit and Vice President of

Production at the Sustainable Energy

Council, was quoted by Zawya as say-

ing. He added that African countries

are working to attract as much funding

as possible.

However, Africa is already seeing the

development of a number of green hy-

drogen projects that are using renew-

able energy as power sources, among

them:

■ Egypt’s Green Hydrogen Plant – This

is a pioneering project aimed at lever-

aging the country’s abundant renew-

able energy resources, particularly

solar and wind, to produce green hy-

drogen. This plant is part of Egypt’s

broader strategy to become a leader in

the green hydrogen sector and to con-

tribute to global efforts in reducing

carbon emissions. A number of inter-

national organisations have become

involved in the project, which is de-

signed to produce enough hydrogen to

meet Egypt’s needs and export to

neighbouring countries.

■ South Africa’s Hydrogen Valley –

This initiative focuses on creating a

hydrogen corridor that will support

various industries, including mining,

manufacturing, and transportation.

The Hydrogen Valley stretches from

Mokopane in Limpopo, where plati-

num group metals (PGMs) are mined,

through Johannesburg, and ends in

Durban. The project aims to establish,

accelerate, and embed hydrogen in-

novations, leveraging South Africa’s

rich renewable energy resources and

expertise in the Fischer-Tropsch pro-

cess. It is expected to create signicant

economic opportunities, including

job creation and the development of

new industries. South Africa is look-

ing to secure 4 per cent of the global

green hydrogen market share by 2050.

■ Namibia’s SCDI (Southern Corridor

Development Initiative) Green Hydro-

gen Project – Located in the Tsau

Khaeb National Park, this project is a

groundbreaking initiative for Namibia

requiring an investment of $10 billion.

It is a gigawatt-scale green hydrogen

plant that will be capable of producing

300 000 tons of green hydrogen annu-

ally by 2030. It is being developed in

collaboration with Hyphen Hydrogen

Energy, a German consortium. First

production is targeted at 125 000 tons

in 2026. The project is expected to off-

set CO

2

emissions by 5-6 million tons

annually.

■ Mauritania’s Project Nour – The

project is located in northern Mauri-

tania covering two onshore areas to-

talling 5000 km

2

with the aim of de-

veloping up to 10 GW of electrolysis

capacity, which would make it one of

the largest green hydrogen facilities

in the world. The rst phase is to have

a renewable generation capacity of

3 GW that will power up to 1.6 GW

of electrolysis to produce 150 000 tons

annually. The project is a 50/50 part-

nership between Chariot Green Hy-

drogen and TE H2, a company co-

owned by TotalEnergies and EREN

Group.

Kenya, Morocco, Ethiopia, Djibouti,

Angola and Nigeria are other African

countries working to get green hydro-

gen projects rolling, as are the North

African states of Algeria, Tunisia and

Libya.

Hydrogen

Gas

The war in Ukraine has taken a surprising turn with the invasion by Ukrainian forces into Russian territory and the

capture of the town of Sudzha and the gas metering station there.

Namibia is gearing up to host the rst Global African Hydrogen Summit in early September. Organisers are keen to

have all elements of African society included in hydrogen projects that could energise Africa and make it an important

producer of renewable energy and hydrogen in the energy transition. Meanwhile, another conference will take place in

South Africa in October.

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2024

11

Fuel Watch

storage. By 2030, around half of Eu-

ropean coal power plants are expected

to be retired with most European

countries planning to fully phase out

coal before 2040. Fortunately, these

legacy coal red plants leave behind

assets which are good candidates for

conversion to clean energy hubs and

can be adapted by developers. The

large tracts of land and existing grid

connections can rapidly connect re-

newable capacity without the need for

new transmission infrastructure. In

addition, these regions are frequently

already home to a strong energy-fo-

cused workforce that can be readily

retrained on new technologies.

Once clean energy hubs are de-

ployed, new LDES technologies can

store and discharge larger quantities

of energy over longer periods than

earlier battery types, making it possi-

ble to store clean energy when avail-

able to use when needed. This means

that the lights still come on, and EVs

still charge, even when the sun is not

shining, and the wind is not blowing.

Today, short duration storage, pri-

marily using lithium-ion (Li-ion)

technology, is already being deployed,

but current solutions cannot meet the

demands of an increasingly renew-

ables grid alone. These installations

are mostly able to discharge for 2-4

hours, which provides adequate ca-

pacity to mitigate demand peaks and

provide short-term grid stabilisation

but falls short of enabling intermittent

energy resources to truly power the

grid. Recent questions around sus-

tainability of critical minerals used in

Li-ion batteries, such cobalt and

nickel have also caused concerns.

Fortunately, new long duration

technologies are now available which

provide up to 12 hours of energy stor-

age and offer advantages over exist-

ing battery systems.

The technology is commercially

available; now, the focus must shift to

ramping up manufacturing, deploy-

ing new solutions at scale, and ad-

vancing clean energy projects. This

approach is essential for meeting in-

creasing demand while reducing

costs. However, many planned re-

newable energy projects are being

hampered by persistent problems

I

n April, G7 nations set a new glob-

al energy storage target of 1500

GW by 2030, a six-fold increase in

electricity storage.

This marks a new wave of interna-

tional climate action, with leaders

recognising that we not only need

aspirational carbon targets, but con-

crete technology goals to achieve de-

carbonisation. If met, this target will

result in energy storage deployed at

scale to transform the availability of

renewable resources and strengthen

energy security.

The necessity for increased storage

has become clear following the rapid

deployment of renewable energy

globally. At COP28 almost 200 coun-

tries agreed to “transition away” from

fossil fuels, and triple renewable en-

ergy capacity to 11 TW by 2030. This

signicant stride was welcomed but

raised major questions about energy

supplies at times when the wind is not

blowing, and the sun is not shining.

The issue was summarised recently

by the International Energy Agency

(IEA), which concluded that the

“rapid expansion” of batteries would

be critical to meeting the energy goals

set at COP28.

Long-duration energy storage

(LDES) specically will form the

linchpin of the energy transition

by providing adequate capacity to

ensure 24/7 availability of clean en-

ergy. To achieve a net zero energy

system while managing uctuations

in demand and supply, electricity

grids around the world will need to

deploy 8 TW of LDES by 2040. For-

tunately, there are commercially

available LDES technologies which

can meet this need. The challenge

now is to scale these clean energy

technologies and reduce barriers to

their deployment . The UK’s House

of Lords Science and Technology

Committee released a report in

March, ‘Long-duration energy stor-

age: get on with it’, highlighting that

the government must “act fast” to

ensure LDES technologies can scale

up and contribute to the decarbonisa-

tion of the electricity system.

Once these obstacles are overcome,

the energy industry is positioned to

reach the bold net zero and storage

goals established on the global stage.

These deployments are not happen-

ing in a vacuum. Demand for clean

electricity is surging as large com-

mercial customers that require grow-

ing amounts of energy, such as data

centres operators, have made public

commitments to cut their net emis-

sions to zero. For example, tech gi-

ants like Amazon, Microsoft and

Meta have emerged as the dominant

force in corporate green power pro-

curement, as they seek to match the

skyrocketing electricity demands of

their Articial Intelligence (AI)-

driven data centres with their looming

sustainability targets.

These forward-looking companies

are also demanding 24/7 clean power

purchase agreements (PPAs) where

zero carbon energy supply is matched

with demand on an hourly basis.

While this may be challenging for

wind or solar to meet alone given

their inherently intermittent nature,

when LDES is deployed alongside

clean energy generation, it becomes

possible to exibly meet the needs of

energy users without relying on re-

serve fossil fuel generation to ll the

gap when the wind doesn’t blow, or

the sun doesn’t shine.

Similarly, as renewables are rolled

out on a larger scale, LDES can

combat imbalances in supply and de-

mand and changes in transmission

ow patterns across the entire grid to

replace fossil fuels and ensure system

stability. For example, in Australia,

the Queensland government’s Stan-

well Power Station will be replaced

with a multi-phase clean energy de-

velopment including renewable gen-

eration and LDES. The project aims

to bring a large battery installation

online later this decade.

This project demonstrates how sites

once occupied by coal red power

stations can be ideal locations for

renewable generation and energy

accessing the electricity grid, for ex-

ample, limited capacity and outdated

planning regulations. In the UK, the

Environmental Audit Committee

found that the current queue to access

the grid has over twice the amount of

generation required to meet the gov-

ernment’s target of decarbonising the

energy system by 2035.

A recent poll conducted by Opinium

Research and commissioned by Re-

newable UK reveals strong public

support for new renewable energy

projects and grid infrastructure. The

survey of 10 021 UK adults found that

59 per cent of respondents support the

construction of new electricity grid

infrastructure to facilitate the rollout

of renewable energy, with only 6 per

cent opposing.

Today’s grid was designed for large,

centralised generating stations and

relatively predictable residential and

light commercial energy loads. How-

ever, as the energy mix shifts to de-

centralised renewable generation and

EV charging increases, outdated grid

infrastructure will need to adapt and

overcome impediments if net zero

targets are to be achieved.

The G7 nations’ ambitious energy

storage target demonstrates global

action is needed to meet renewable

goals established at COP28. As re-

newable energy capacity surges, the

demand for scalable LDES to provide

reliability and exibility has never

been more critical. Fortunately, the

battery industry is ready to respond to

ambitious global goals through in-

creased manufacturing capacity and

the rapid advancements in sustain-

able, exible, and cost-effective

LDES technology.

To meet these bold targets and en-

sure a resilient energy future, it’s es-

sential to overcome grid interconnect

obstacles, scale up clean energy proj-

ects quickly and effectively and de-

ploy innovative storage solutions.

Once this has been achieved, the full

potential of renewables can be un-

locked to secure a sustainable future

for all.

Sergey Buchin is Founder and CEO

of Irbisio Cleantech Infrastructure

Fund.

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2024

Industry Perspective

12

The G7 nations’

ambitious energy

storage target

demonstrates global

action is needed to

meet the renewable

goals established

at COP28. As

renewable energy

capacity surges, the

demand for scalable

long-duration energy

storage to provide

reliability and

exibility has never

been more critical.

Irbisio Cleantech

Infrastructure Fund’s

Sergey Buchin

explains.

The energy storage

revolution goes global

LDES is needed when the

wind doesn’t blow

Buchin: long duration energy storage technologies are now

available, which provide up to 12 hours of storage and offer

advantages over existing battery systems

W

hile its relevance in help-

ing to reach climate goals

has long been recognised,

deployment of carbon capture, util-

isation and storage (CCUS) has

been slow and consistently ac-

counting for less than 0.5 per cent

of global investment in clean ener-

gy technologies.

Although CCUS is not a new tech-

nology and there are currently

around 41 operational facilities glob-

ally, it has typically been deployed at

a small scale – mainly for R&D proj-

ects and for enhanced oil recovery. In

order for CCUS to meaningfully

contribute to climate change goals,

the amount of CO

2

captured would

need to grow four-fold from current

levels by 2030, according to the In-

ternational Energy Agency (IEA) re-

port: ‘Accelerating deployment –

CCUS in Clean Energy Transitions

– Analysis’. However, stronger cli-

mate targets and investment incen-

tives are now starting to drive in-

creased momentum into CCUS – and

one of the key strategies to provide a

boost to the technology is the ef-

cient production of hydrogen.

Hydrogen is a versatile energy car-

rier that can help support the decar-

bonisation of a range of hard-to-

abate sectors where electrication

from renewable sources cannot de-

liver the level of energy output re-

quired. These include iron, steel,

chemicals and cement production –

as well as hydrogen-based fuels for

aviation, shipping and long distance

haulage.

CCUS can facilitate the production

of low carbon hydrogen (sometimes

referred to as ‘blue’ hydrogen) from

natural gas and provide an opportu-

nity to bring it into new markets in

the near term – and at reasonable

cost.

It can help alleviate pressure on al-

ready constrained electricity grids,

allowing renewable electricity gener-

ation and electrolytic hydrogen pro-

duction to scale at a more manage-

able pace. This benet of

CCUS-enabled hydrogen over the

next decade has been recognised in

the Committee on Climate Change’s

recently published Climate Change

Committee’s 2023 Progress Report

to Parliament.

Today, the cost of CCUS-enabled

hydrogen production is likely to be

around 50 per cent of hydrogen pro-

duction via electrolysis powered by

renewables-based electricity. While

the cost of electrolytic hydrogen is

anticipated to reduce over time with

the onset of increasingly cheaper elec-

trolysers and renewable electricity,

CCUS-equipped hydrogen will most

likely remain a competitive option

across regions typically associated

with low-cost fossil fuels.

Recently there has been a signi-

cant increase in the appetite to devel-

op CCUS projects, with a 50 per cent

increase in CO

2

capture in the 12

months between 2022 to 2023, ac-

cording to the CCUS Institute’s

‘Global Status of CCUS Report

2023’. This has been driven by gov-

ernments internationally coming un-

der increasing pressure to meet glob-

al climate targets, implementing

robust legislation and providing clear

pricing signals in order to make

CCUS commercially viable.

Despite this positive news, there re-

main three signicant issues. From

the many announced CCUS projects,

only around 5 per cent have taken

rm investment decisions due to the

uncertainty of demand, a lack of clar-

ity around certication and regula-

tion – and critically important – the

lack of infrastructure available to ac-

tually deliver the hydrogen to cus-

tomer sites. And, according to the

IEA, to help deliver a much-decar-

bonised heavy industry by 2030, a

third of all hydrogen production will

need to be dedicated to those hard to

abate sectors – and currently these

applications only account for around

0.1 per cent today. So, there is con-

siderably more work to do.

The fact that CCUS is far from a

mature industry, a single stakehold-

er is typically unable to take on all

the expertise, risk and capital ex-

penditure needed across the whole

value chain. As such, the most sig-

nicant challenges with deploying

CCUS at scale are the multiple dif-

ferent, distinct stakeholders that

need to be coordinated including:

the industrial plants which are the

CO

2

emitters themselves; the vari-

ous CCUS technology suppliers

which separate and capture the CO

2

;

providers of processing, compres-

sion solutions transportation solu-

tions – and, nally, experienced

storage providers who can inject

and store the CO

2

underground.

It is evident that urgent policy ac-

tion is needed to create demand for

low carbon hydrogen and unlocking

the necessary investment to acceler-

ate the scale-up of production and

building of delivery infrastructure.

Currently, different policy ap-

proaches are being undertaken by

governments to encourage the de-

ployment of CCUS at scale. In par-

ticular, the US has provided a much-

needed shot in the arm for the

infrastructure required to scale up

technologies. Incentives under the

Ination Reduction Act (IRA) pro-

vide project developers with a $50

per metric tonne of CO

2

tax reduc-

tion where CO

2

is stored in dedicat-

ed storage sites. And the Infrastruc-

ture Investment and Jobs Act

passed in November 2021 provided

a combined $15 billion to support

CCUS and low-carbon hydrogen

production.

The IRA has had a considerable

positive impact on hydrogen, en-

abling the US to have the largest hy-

drogen project pipeline of any coun-

try. It currently accounts for 18 per

cent of total announced capacity, al-

locating Australia to second place at

14 per cent. And while the percent-

age of hydrogen projects in the EU

surpass both of those (at 29 per cent),

it should be remembered that this g-

ure accounts for the whole of the EU

(consisting of 27 countries) and the

UK – which ultimately results in rel-

atively minor pipelines per country.

While Europe may be advancing

the highest number of projects over-

all, the US is considerably closer to

offering early scale-up, with the gen-

erous IRA tax credits, eventually

helping a strong ow of US projects

towards nal investment decision

(FID).

The majority of announced projects

are for green hydrogen, which is pro-

duced using renewable energy and

electrolysis and is the cleanest form

of hydrogen production. However, it

is also expensive, making access to

cheaper clean power necessary to

achieve the desired economics.

While most of the recently an-

nounced projects are for carbon-free

hydrogen, the projects that are most

advanced are dominated by blue hy-

drogen, especially in the US. Blue

hydrogen is mainly produced from

natural gas and creates carbon diox-

ide as a by-product, so it’s a low car-

bon solution, but not strictly a ‘clean’

one. However, it enjoys a signicant

cost advantage over green hydrogen,

particularly where natural gas is

cheap, as in the US and Canada.

Today, the cost of CCUS-enabled

hydrogen production remains around

half that of producing hydrogen

through electrolysis powered by re-

newables-based electricity. And

while the cost of electrolytic hydro-

gen will decline over time, with