L

ike a number of developed

countries across the globe, the

UK has set a target to elimi-

nate carbon emissions from its power

sector by 2035. With little over a de-

cade to get there, it is clear that ur-

gent action is needed now.

Early last month GE Vernova Con-

sulting Services launched a new

study, ‘Reaching Net Zero Carbon in

Great Britain’, that analyses genera-

tion and transmission investment

pathways for the economic build-out

of the renewables, nuclear, storage

and lower carbon thermal generation

that would be needed for the UK to

achieve its target.

Commenting on the rationale for

focusing on the UK and the need for

the study now, Martin O’Neill, Vice

President, Strategy, at GE Vernova’s

Gas Power business, said: “The UK

is the most catalytic region in geo-

graphical Europe in the energy tran-

sition… [but] what differentiates it

from many of its continental and Eu-

ropean peers is a belief system that is

quite anchored in common sense.

That is: in the energy transition,

there’s no silver bullet – there isn’t

one technology that solves [all] for a

net zero future. You need to embrace

nuclear, as much as you do existing

gas turbine plants, as much as you

wish to grow wind and solar assets.

“The study aims to bring some real

hard facts to the table about what it

will actually take in a world where a

new power plant can take, in the case

of wind, several years to get the per-

mit application approved and several

years to bid, construct and commis-

sion new gigawatts of power. For

new gas power plants it can take six

or seven years from inception to

commissioning. And for nuclear it’s

even longer. Investment in transmis-

sion and grid infrastructure often

takes six to eight years to be sited

and permitted, and then the actual

upgrade programmes can last several

years.

“So if we’re talking about zero car-

bon generation in 2035, it’s time we

move away from a very high level

narrative where we talk about large

handfuls of things that we would like

to see happen, to a more anchored

discussion about: where we need to

invest in the UK in the grid and in

power generation assets; what size of

investments are necessary; and what

is the market design that will actually

support the ow of capital that will

allow nanciers and banking institu-

tions to stand behind these projects.

If it takes, 5, 10, 15 years for proj-

ects, we need real solutions on the ta-

ble now.”

The study looks at several different

pathways to net zero. It started by

examining a very detailed depiction,

or digital twin, of the power grid.

Beth Larose, Energy Transforma-

tion Leader, GE Vernova, comment-

ed: “We studied the physical con-

straints of the grid and how they play

into the power system as it evolves to

net zero.”

The model covers 17 different grid

zones in GB, keeping transmission

constraints in mind to help depict the

ow of power across GB. Inputs to

the model come from publicly avail-

able data, such as the Centre for Cli-

mate Change. One of those inputs as-

sumes that GB electricity demand

will double from about 300 TWh in

2025 to 660 TWh in 2050, mainly

driven by electrication of transport,

industry and heating.

It assumes new generation to meet

this demand will be sited in very spe-

cic areas. “Offshore wind, for ex-

ample, is highly sited towards the

northern part of GB, Scotland, and

some in the Midlands as well; where-

as solar is much more towards the

southwest and southeast. That leaves

the very big load centre of London

needing a lot of support from more

conventional generation such as

combined cycle, nuclear and open

cycle power plants,” noted Larose.

The study shows that an additional

244-282 GW of renewable and de-

carbonised generation, approximate-

ly 2.5-3 times that of the existing

capacity, will need to be added to

the power system by 2050 across

Great Britain. About two-thirds of

the new capacity is expected to be

wind and solar, with nuclear, abated

gas and battery storage all playing

an important role to accommodate

for the intermittency of renewables

and grid congestion.

Capacity build projections are split

into three main scenarios: a ‘Base

Case’ scenario with 244 GW based

on the least cost economic build-out;

a ‘High Nuclear Small Modular Re-

actor (SMR)’ scenario; and a ‘High

Wind’ scenario.

“These scenarios do result in meet-

ing a net zero plan by 2035, or very

close to net zero, based on the Centre

for Climate Change’s targets,” noted

Larose.

The study shows 70-100 GW of

offshore wind is expected, along

with: 70 GW of solar; 60 GW of bat-

tery storage; up to 27 GW of CCGTs

with carbon capture and storage and

23 GW of hydrogen-capable open

cycle gas turbines; 10-30 GW of on-

shore wind in addition to repowering

of existing sites; and 10-18 GW of

new nuclear.

It is a signicant amount of new ca-

pacity in a relatively short time.

“To add a 1 GW gas turbine plant

takes about ve years… When some-

one puts a chart in front of me that

says we need 244+ GW, as an indus-

try expert, I panic,” said O’Neill.

“That’s a huge number. We are talk-

ing about multiplying the existing

UK grid by more than by 2.5 times.”

According to Larose, “the big key

takeaway is that “we can achieve the

climate goals with a very aggressive,

and forward-leaning plan towards net

zero generation sources”.

GE Vernova was keen to examine

the physical constraints of the grid to

gain information around siting new

generation and how that in turn im-

pacts wholesale electricity prices. It

observes that in general, wholesale

electricity prices are expected to in-

crease post-2040 due to the greater

need to balance variable renewable

energy sources with exible hydro-

gen-based generation.

The study nds that zones with

high levels of wind and solar will

have the lowest price, while London

will observe the highest prices due to

its demand and limitation on siting

new capacity.

Notably, GE Vernova warns that

zones with signicant wind genera-

tion and lower demand could experi-

ence up to 50 per cent curtailment.

Certainly the geographic distribu-

tion of certain types of generation,

combined with the need to support

variable renewables, will result in an

urgent need for grid investment over

and above that already outlined out

to 2040 by National Grid.

In total, around 22 GW of addition-

al transmission line capacity across

the Scottish boundaries and 57 GW

in the English boundaries is required

to alleviate congestion and avoid cur-

tailment of renewable electricity, to

save system costs of around £80 bil-

lion by 2050.

GE Vernova stresses that a combi-

nation of various electricity genera-

tion, transmission and system con-

trol/management technologies with

underlying supportive policy and

regulatory measures coupled with

reformed markets will be essential.

Its key recommendations are there-

fore to:

n Enable and accelerate investments

at the required scale and pace in all

lower carbon generation technolo-

gies (renewables, nuclear, carbon

capture and storage and hydrogen)

and grid solutions with enhanced

digitalisation of the energy system

including facilitation of active partic-

ipation by consumers. The study esti-

mates that over £50 billion of invest-

ment is required in generation and

storage capacity alone by 2030 in or-

der to meet the 2035 target

n Expedite the implementation of

market reforms that are technology

agnostic, remunerate all system ser-

vices (energy, capacity, exibility

and stability) and provide adequate

signals for investment in generation

and grid assets “when and where”

needed

n Adapt energy policy and regula-

tion that bring clarity to the uptake of

lower carbon generation (in particu-

lar for SMR, CCS and hydrogen) as

well as grid technologies. These

should ensure:

- Rapid permitting and deployment

of required exible resource (circ. 10

GW of storage and gas with hydro-

gen readiness) necessary to integrate

over 30 GW of new wind and solar

capacity by 2030 to ensure system

security.

- Build-out and commitment of

over 100 GW of new generation ca-

pacity by 2030

- Step up of the required grid rein-

forcement (transmission lines and

operational solutions) that is compul-

sory for the delivery of lower carbon

energy to consumers.

Overall, GE Vernova warns that it

is essential the UK makes tangible

progress within the next 1-3 years re-

garding the stated recommendations

to mitigate the risk of falling short of

achieving a net zero 2035 power sys-

tem and the 2050 net zero target.

“The general conclusion of this

piece of work is the net zero trajecto-

ry in the UK is achievable through

physics and technology but the eco-

nomic stimulus and sense of urgency

is lacking entirely… the energy mar-

ket design reform has to be imple-

mented and it needs to be sharper,”

said O’Neill. “If we’re still having

this conversation in 2026, whatever

the stated objective is in 2035 is not

going to be achieved.”

A number of

countries around

the world have

committed to fully

decarbonising

electricity production

in a little over a

decade. GE Vernova

recently published

a study of Great

Britain’s power

sector that shows

the tangible progress

that is needed within

the next 1-3 years

for the UK to avoid

missing its promised

2035 net zero carbon

emissions target.

Junior Isles

Net zero targets:

Net zero targets:

the time to act is now

the time to act is now

THE ENERGY INDUSTRY TIMES - AUGUST 2023

13

Energy Outlook

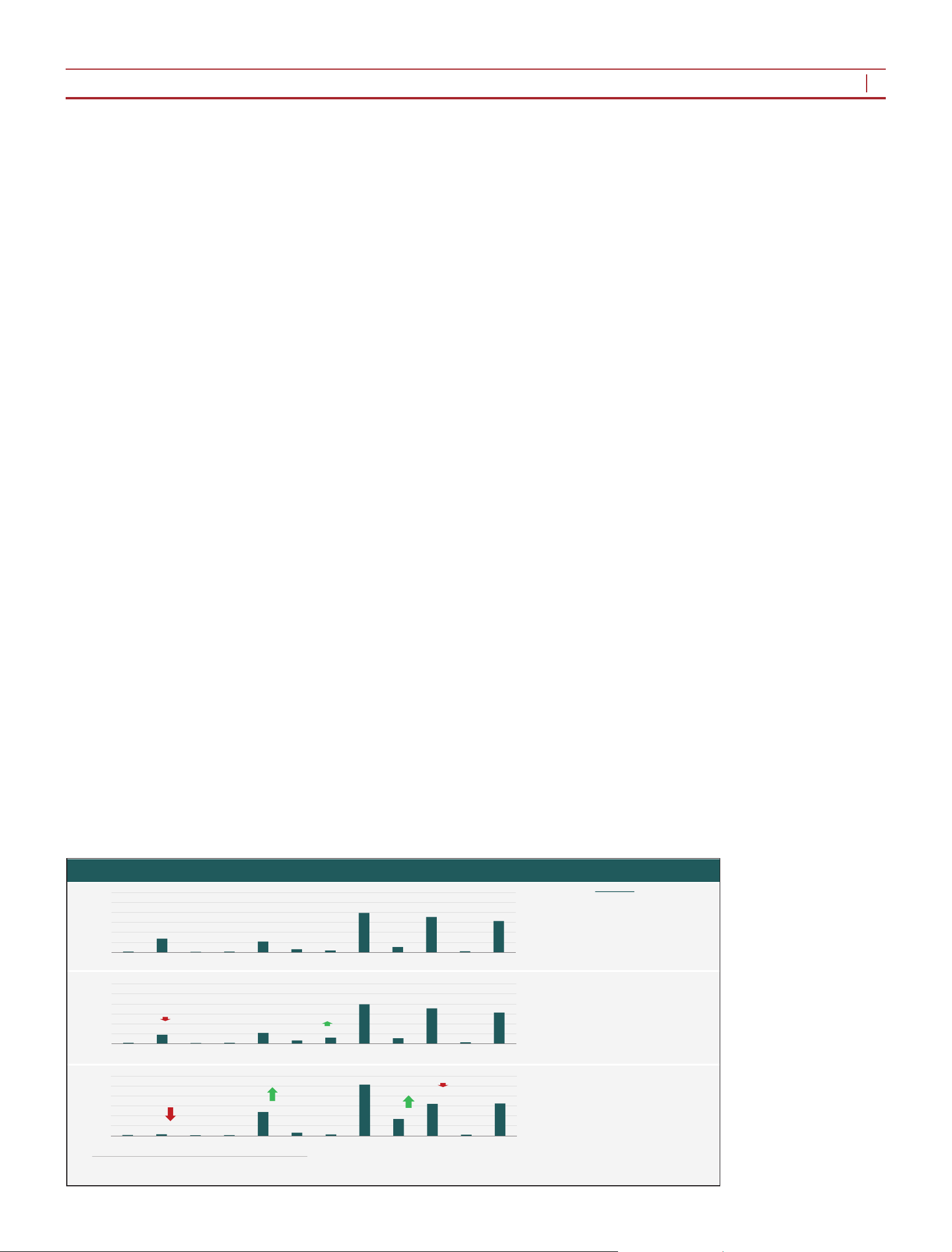

Capacity build projections

244-282 GW new capacity - 2.5 X current capacity

Capacity Build Projections

8

2GW

28GW

1GW

1GW

22GW

6GW

4GW

79GW

11GW

71GW

2GW

63GW

0

20

40

60

80

100

120

CCGT

unabated

CCGT with

CCS

OCGT OCGT Refit to

H2

H2 capable

OCGT

Nuclear EPR Nuclear SMR Offshore Wind Onshore Wind Solar Biomass retrofit

w/ CCS

Battery

Capacity Additions (GW)

2025 - 2050

2GW

18GW

1GW

1GW

22GW

6GW

12GW

79GW

11GW

71GW

2GW

63GW

0

20

40

60

80

100

120

CCGT

unabated

CCGT with

CCS

OCGT OCGT Refit to

H2

H2 capable

OCGT

Nuclear EPR Nuclear SMR Offshore Wind Onshore Wind Solar Biomass

retrofit w/ CCS

Battery

Capacity Additions (GW)

2025 - 2050

2GW

3GW

1GW

1GW

48GW

6GW

3GW

103GW

34GW

64GW

2GW

65GW

0

20

40

60

80

100

120

CCGT

unabated

CCGT with

CCS

OCGT OCGT Refit to

H2

H2 capable

OCGT

Nuclear EPR Nuclear SMR Offshore Wind Onshore Wind Solar Biomass

retrofit w/ CCS

Battery

Capacity Additions (GW)

2025 - 2050

-2 GW

-1 GW

-10 GW

+8 GW

-25 GW

+26 GW

-7 GW

+23 GW

+24 GW

1

https://www.gov.uk/government/publications/british-energy-security-strategy/british-energy-security-strategy

2

OffShore capacity corresponds to a midpoint between the Balanced and High Ambition scenarios by Arup et al. https://www.futureoffshorewindscenarios.co.uk/

Base Case

• Total capacity additions are 244 GW by

2050, increasing the installed capacity in GB

by 2.5 times

• The expansion plan is based on overall least-

cost build to meet emission targets

High Nuclear SMR

• Higher level of nuclear SMR capacity driven

by additional incentives in line with UK

government Energy Security Strategy

1

plan

• Additional 10 GW of SMRs are compensated

by a lower build of CCGTs with CCS

High Wind

• To understand the implications of very high

penetration of wind (47 GW of additional

Offshore and Onshore wind compared to the

Base Case)

2

• Assumed that CCGTs with CCS will not be

installed post-2030 and the system flexibility

is provided by H

2

OCGTs

© 2023 GE VERNOVA and/or its affiliates. All rights reserved.

Scenarios