www.teitimes.com

June 2023 • Volume 16 • No 4 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Special Technology

Supplement

Different strokes for

different folks

Recyclable blades and

HVDC technology are crucial

to Europe’s offshore wind

programme. Page 8

Offshore wind is one of the fastest growing

forms of clean energy globally but different

regions are on different paths. Page 14

News In Brief

Challenges ahead for US

proposals to limit power

plant emissions

A new proposal to cut greenhouse

gas emissions from fossil fuelled

power plants looks set for legal chal-

lenges, as fossil fuel lobbyists argue

that carbon capture and storage has

not been adequately demonstrated.

Page 2

Colombia announces plans

for offshore wind auction

Colombia has announced that its

rst auction for offshore wind en-

ergy generation projects will be

ready in August.

Page 3

Wind to play major role in

Vietnam Power Development

Plan

Vietnam has approved its National

Power Development Plan VIII

(PDP8), notably including big plans

for wind power generation.

Page 4

EU states cut both demand

and fossil fuel use last

winter

Nearly every EU state reduced en-

ergy demand last winter and renew-

ables generated more than fossil

fuels for the rst time ever, accord-

ing to energy think-tank Ember.

Page 5

Green shoots for wind

turbine manufacturers?

Wind turbine manufacturers are be-

ginning to see improved nancial

results, as the impact of global head-

winds appears to be easing.

Page 7

Industry Perspective: Energy

security vs decarbonisation

Medium and longer-term solutions

are emerging for the converging and

conicting challenges of energy se-

curity and decarbonisation.

Page 13

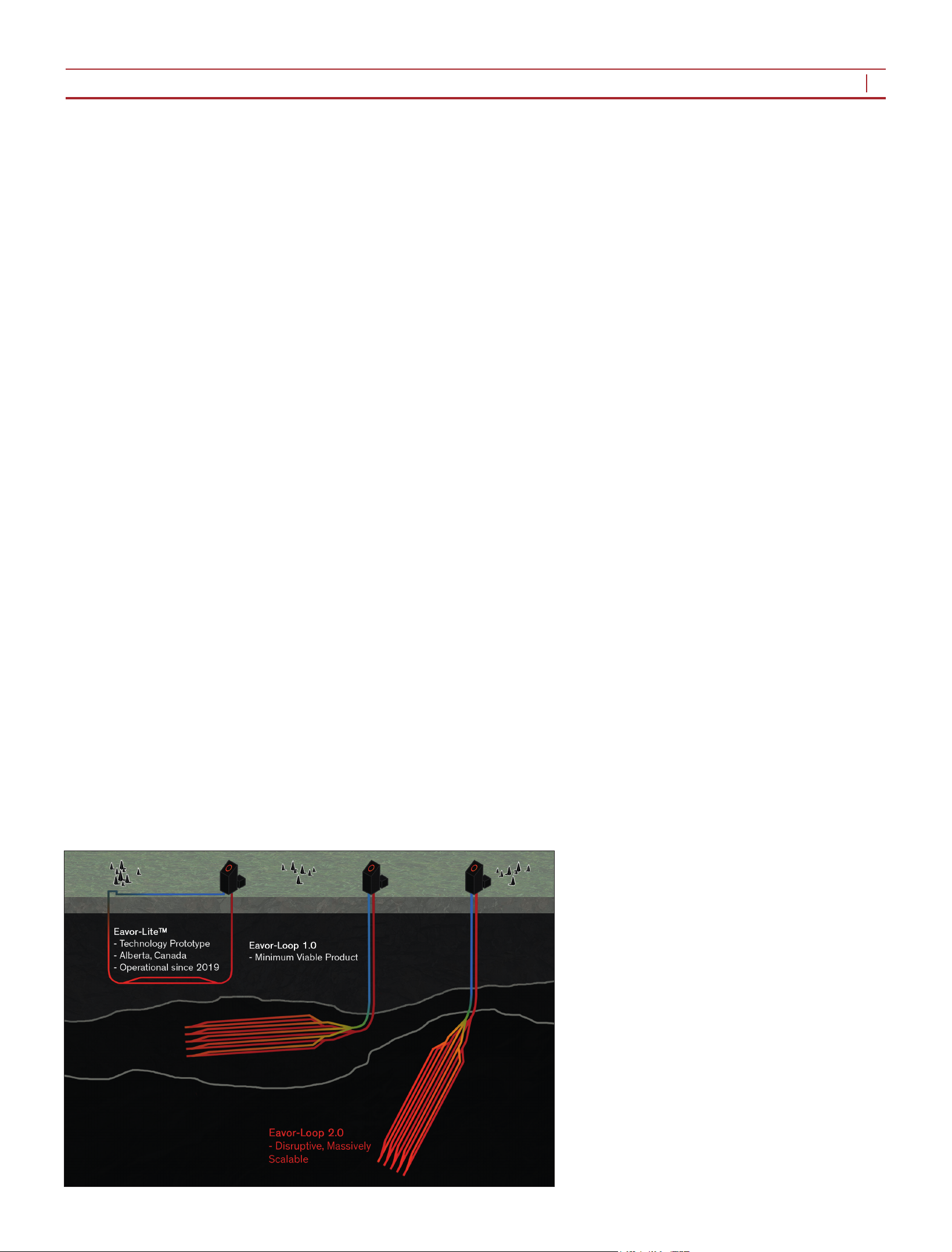

Technology Focus: Saving

geothermal from being an

afterthought

Deep-well, closed-loop energy trans-

fer could drive renewed interest in

geothermal energy.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

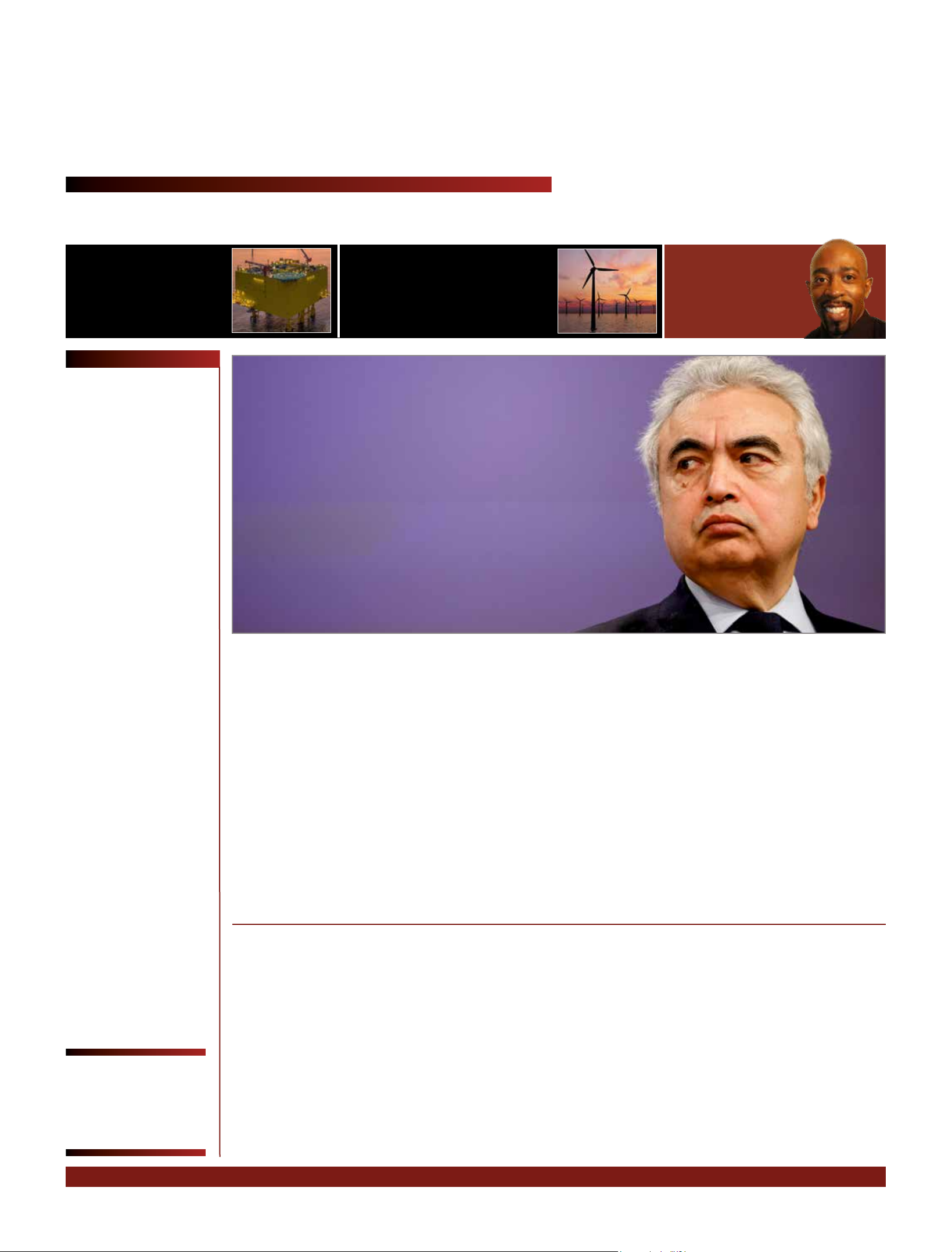

Investment in clean energy is outstripping that in fossil fuels at an increasing pace, according

to the International Energy Agency’s latest World Energy Investment report. The agency

notes, however, that oil and gas companies could do more. Junior Isles

Prospect of deal on fossil fuel phase-out under threat

THE ENERGY INDUSTRY

TIMES

Final Word

We need more than

beautiful words,

says Junior Isles. Page 16

The clean energy economy is emerging

faster than expected, with investment

in clean technology now almost double

current spending on fossil fuels, ac-

cording to a new report from the Inter-

national Energy Agency (IEA).

According to the Paris-based agen-

cy’s latest ‘World Energy Investment’

report, $2.8 trillion is set to be invest-

ed globally in energy in 2023, of

which more than $1.7 trillion is ex-

pected to go to clean technologies –

including renewables, electric vehi-

cles, nuclear power, grids, storage,

low-emissions fuels, efciency im-

provements and heat pumps. The re-

mainder, slightly more than $1 tril-

lion, is going to coal, gas and oil.

Commenting on this trend, IEA

Executive Director, Fatih Birol said:

“I had the opportunity to address the

G7 leaders in Hiroshima, Japan, with

regards to energy and climate issues.

We shared many things but the main

idea was that a new clean energy

economy is emerging, and emerging

must faster than many realise. Five

years ago, the investment in all energy

sources was about 2 trillion – $1 tril-

lion for fossil fuels and $1 trillion to

clean energy. Five years ago the ratio

of fossil fuels [investment] to clean

energy was 1:1, this year it is 1:1.7 in

favour of clean energy. In my view,

this is a dramatic shift.”

Driven by factors such as the falling

cost wind and solar; government poli-

cies adopted as a result of the energy

crisis brought on by the war in

Ukraine; and industrial strategies

around the world designed to boost

home-grown manufacturing of clean

equipment, the IEA expects clean en-

ergy investment to rise by 24 per cent

between 2021 and 2023. Spending on

fossil fuels is expected to increase by

15 per cent.

Low-emissions electricity technolo-

gies are expected to account for al-

most 90 per cent of investment in

power generation. Consumers are also

investing in more electried end-uses.

Global heat pump sales have seen

double-digit annual growth since

2021. Electric vehicle sales are ex-

pected to leap by a third this year after

already surging in 2022.

Solar was hailed by the IEA as the

“shining star” of the global energy in-

vestment landscape. According to IEA

forecasts, solar power investment is

set to outstrip spending on oil produc-

tion this year for the rst time.

Spending on upstream oil and gas is

expected to rise by 7 per cent in 2023,

taking it back to 2019 levels. The few

oil companies that are investing more

than before the Covid-19 pandemic

are mostly large national oil compa-

nies in the Middle East.

Birol expressed disappointment at

the level of re-investment into clean

energy by the oil and gas sector, de-

spite them seeing record revenues last

year as a result of high energy prices

Continued on Page 2

Talks aimed at setting a deadline to

phase out fossil fuels at this year’s UN

COP28 climate change summit in

Dubai in December look set to face

serious headwinds under the UAE

presidency.

Speaking at the recent Petersberg

Climate Dialogue in Berlin, incom-

ing COP28 President Sultan al-Jaber,

who is also the head of the Abu Dha-

bi National Oil Company, said fossil

fuels would “continue to play a role

in the foreseeable future”. He said

the world should use all sources of

energy while reducing emissions

from power plants and other fossil

fuel-reliant sectors by using carbon

capture and storage (CCS).

“If we’re serious about mitigating

climate change and reducing in a

practical manner emissions we must

scale-up carbon capture technolo-

gies,” he said, adding that in the

United Arab Emirates “we have em-

braced a comprehensive, holistic ap-

proach to the energy transition.”

His view on the continued use of oil

and gas, however, differed from that

of several other ministers.

During a press brieng at the event

in Berlin, German Foreign Minister

Annalena Baerbock, said: “We have

to get out of fossil fuels, we have to

dramatically reduce emissions.”

The Danish Minister for Global

Climate Policy, Dan Jørgensen, also

told the Financial Times there were

concerns “about making sure [CCS]

does not become an excuse for not

making the [energy] transformation

we need”.

“I don’t think we should dismiss

[CCS]. There are emissions that we

are not able to phase out,” he said,

pointing to industry examples such

as cement making. However, he add-

ed: “This should not be seen as some-

thing we do instead of replacing fos-

sils with renewables”.

The diverging views make for dif-

cult talks later this year in Dubai.

Also speaking in Berlin, Tina Stege,

the climate envoy for the vulnerable

Marshall Islands, and Maisa Rojas,

Chile’s Environment Minister, called

for “honesty” at COP28 about the

end of fossil fuel use.

“We . . . want the phase out. We

want to make sure if we add new en-

ergy, we are taking the old dirty en-

ergy out of the system,” said Rojas,

while Stege added: “We need to re-

ally honestly look at where we are,

what we haven’t done and what we

need to do. The fossil fuel era has to

come to an end.”

Last year at the UN COP27 climate

change sunmit in Egypt, efforts to

reach an agreement to phase out fos-

sil agreement failed, despite the sup-

port of dozens of countries including

the US and EU.

Clean energy

Clean energy

economy emerging

economy emerging

“faster than

“faster than

imagined”

imagined”

IEA Executive Director, Fatih Birol hailed solar as

the “shining star”

THE ENERGY INDUSTRY TIMES - JUNE 2023

2

Junior Isles

New proposals to limit greenhouse gas

emissions from US power plants look

set to face legal challenges from fossil

fuel companies.

After being struck down almost a year

ago by the Supreme Court, the Biden

Administration has unveiled a plan to

cut emissions from gas and coal plants

through what would be the rst-ever

large-scale use of carbon capture and

green hydrogen over the next decade.

According to the White House, the

new plan, if successful, would put the

US on track to reach net zero emissions

from the power sector by 2035. Power

plants are currently responsible for a

quarter of the nation’s greenhouse

gases.

The new carbon pollution standards

avoid up to 617 million metric tonnes

of total carbon dioxide between 2028

and 2042.

The plan, however, could be open to

legal challenges as fossil fuel compa-

nies and their representatives explore

challenging it in court on the basis the

technologies are unproven. A similar

effort to clean up the power industry

by the Obama White House in 2015

was hung up by legal challenges and

ultimately repealed.

Michelle Bloodworth, President and

CEO of America’s Power, which rep-

resents utilities that burn coal, said:

“The proposal raises a number of

critical legal questions, including

whether the EPA has the authority to

force the use of technologies that are

not economically or technically fea-

sible for widespread use.”

Jeff Holmstead, a lobbyist at

Houston-based Bracewell LLC who

formerly ran the EPA’s air and radiation

ofce during the Bush administration,

said betting on carbon capture is risky.

“There isn’t a single commercial-

scale gas-red power plant anywhere

in the US – or as far as I know, anywhere

in the world – that uses CCS to control

its emissions,” he said. “This fact alone

could make it hard for EPA to convince

the courts that CCS has been adequate-

ly demonstrated.”

EPA ofcials and some environmen-

tal groups say the rule was designed to

withstand legal challenges because it

focuses on available technologies that

can be applied directly at power plants,

and because Congress afrmed the

agency’s authority to impose technol-

ogy-based carbon standards.

They add that the Ination Reduction

Act, Biden’s centrepiece climate leg-

islation, offers billions in tax credits

and incentives that make CCS and

clean hydrogen economically feasible.

In its 651-page proposal, the EPA also

cited SaskPower’s Boundary Dam

project in Canada as one that has dem-

onstrated CO

2

capture rates of 90 per

cent on an existing coal steam generat-

ing unit.

n Lured by President Joe Biden’s green

energy tax incentives under the Ina-

tion Reduction Act, UK power genera-

tion business Drax said it plans to spend

$4 billion building two biomass power

plants in the southern US. The plants

are part of Drax’s strategy to become

a leader in “negative emissions”, which

can be sold in the form of credits to

other companies looking to offset their

emissions. The company’s biomass

power plants burn pellets made from

organic matter such as wood chips to

generate electricity.

brought about by the crisis. He

noted that the majority of the $4

trillion generated by oil and gas

companies has gone to dividends,

share buybacks and debt repay-

ment – rather than back into tradi-

tional supply.

“The oil and gas industry’s capital

spending on low-emissions alter-

natives such as clean electricity,

clean fuels and carbon capture tech-

nologies was less than 5 per cent of

its upstream spending in 2022,” the

IEA stated.

According to the report, the big-

gest shortfalls in clean energy in-

vestment are in emerging and de-

veloping economies.

“There are some bright spots, such

as dynamic investments in solar in

India and in renewables in Brazil

and parts of the Middle East. How-

ever, investment in many countries

is being held back by factors includ-

ing higher interest rates, unclear

policy frameworks and market de-

signs, weak grid infrastructure, -

nancially strained utilities, and a

high cost of capital,” it stated.

The IEA said “much more needs

to be done” by the international

community, especially to drive in-

vestment in lower-income econo-

mies, where the private sector “has

been reluctant” to venture.

To help address this, the IEA and

the IFC will on 22 June release a

new special report on ‘Scaling Up

Private Finance for Clean Energy

in Emerging and Developing

Economies’.

The IEA report came just 10 days

after another report by Bloomberg-

NEF (BNEF) estimated that Europe

needs to invest more than €29 tril-

lion ($32 trillion) in energy and

related technologies between now

and 2050 to transition to a net zero

economy.

In 2022, the region’s investment

in low-carbon energy transition was

$227 billion. To achieve the report’s

Net Zero Scenario, Europe has to

increase its annual investments in

clean energy supply, electric vehi-

cles (EVs), heat pumps and sustain-

able materials to more than three

times this level throughout the re-

mainder of the decade and more

than four times in the 2030s.

According to BNEF’s ‘New En-

ergy Outlook: Europe’ report, more

than two-thirds of the required in-

vestment is on the demand side,

with EVs accounting for the big-

gest single portion – $21 trillion

over 2022-2050, and heat pumps

for another $1.4 trillion.

By 2050, Europe should also

spend around $3.8 trillion on devel-

oping an expanded and digitalised

grid that supports the integration of

more renewables, EVs and heat

pumps. A similar amount, more

than $3.8 trillion, is invested in new

clean power assets by 2050 under

the Net Zero Scenario, a large part

of which must be before 2030.

In that scenario, onshore and off-

shore wind capacity grows to 675

GW by 2030, up from 234 GW in

2022, while solar expands to 774

GW from 226 GW.

Continued from Page 1

The wind power industry has outlined

key tasks for EU members if the bloc

is to realise its offshore wind ambitions.

An Industry Declaration of more than

100 companies, representing the whole

value chain of offshore wind and re-

newable hydrogen in Europe, recently

outlined the urgent need for new invest-

ments in wind energy manufacturing

capacity and supporting infrastructure.

The Declaration also warns that cur-

rent policies do not underpin Europe’s

ambitions with adequate nancing and

funding mechanisms. In 2022 not a

single offshore wind farm reached nal

investment decision. Uncoordinated

market interventions, price caps and

national claw-back measures deterred

investments, it said.

Investment to get Europe where it

wants to be is massive: the EU has

calculated the cost of getting to 300

GW in offshore energy production by

2050 at €800 billion ($900 billion).

The Declaration came as nine Heads

of State & Government – from Bel-

gium, Demark, Germany, Nether-

lands, France, Ireland, Luxembourg,

Norway and the UK – and the Presi-

dent of the EU Commission met at the

North Sea Summit in Ostend, Bel-

gium, to agree new commitments on

the build-out of offshore wind in the

North Seas.

The Declaration said expanding the

offshore wind value chain is now pri-

marily a volume game. Today Europe

can manufacture 7 GW of offshore

wind turbines a year. To meet the ex-

pansion path outlined in the Ostend

Declaration Europe needs to manufac-

ture 20 GW a year by the second half

of this decade.

Importantly, it stressed that the ex-

pansion of offshore wind must be un-

derpinned by investments in grids and

ports. Europe needs to double its an-

nual grid investments and channel €9

billion into the modernisation and ex-

pansion of its port infrastructure be-

tween now and 2030. It noted that if

the UK is to meet its 50 GW target for

2030, signicant acceleration is need-

ed in grid development and supply

chain investment.

Major European Transmission Sys-

tem Operator (TSO), TenneT, has al-

ready been making signicant invest-

ments in developing a North Sea grid

to handle the massive amount of wind

power that is coming on line.

Early last month it concluded an-

other framework cooperation agree-

ment with NKT, Nexans and a con-

sortium of Jan De Nul, LS Cable and

Denys, for at least ten 525 kV HVDC

cable systems with delivery until

2031.

In a separate move, offshore wind

developers Cerulean Winds and Fron-

tier Power International have unveiled

plans for a £20 billion ($25 billion)

oating wind-powered transmission

network that will electrify North Sea

oil and gas platforms.

The North Sea Renewables Grid

(NSRG) project is touted as one of the

UK’s largest infrastructure develop-

ments backing the oil and gas sector’s

decarbonisation, Cerulean Winds said.

The offshore wind sector must act to

address increasing mechanical break-

down issues, component failures and

serial defects resulting from the de-

ployment of ever-larger offshore wind

turbines, according to renewable

energy projects underwriter GCube

Insurance.

GCube’s new report, entitled ‘Ver-

tical Limit: When is bigger not better

in offshore wind’s race to scale?’, is

compiled from 10 years of the com-

pany’s claims data and draws on evi-

dence from experts across the offshore

wind sector to demonstrate how off-

shore wind’s risk landscape has sig-

nicantly shifted, as manufacturers

push to develop bigger machines,

faster.

Over the past ve years, the race to

scale turbine technologies has seen

the leap from 8 MW to 18 MW tur-

bines occurring in a fraction of the

time it took to go from 3 MW to 8

MW. While this is an impressive tech-

nological achievement, GCube says

such rapid commercialisation of ‘pro-

totypical’ technologies is now leading

to a concerning number of losses, and

subsequently piling nancial pressure

on manufacturers, the supply chain

and the insurance market.

Amongst the ndings of the report,

underwriters are concerned that 55 per

cent of all claims by frequency come

from component failures during con-

struction from 8 MW+ machines,

which now represent a larger share of

Total Insured Values (TIVs).

This, combined with an increase in

average offshore wind losses, up from

£1million ($1.24 million) in 2012 to

over £7 million in 2021, is creating

unsustainable nancial risk, right

when scaling is needed to bring about

the energy transition.

Another major nding is that 8

MW+ machines are suffering from

component failures within the rst

two years of operation. This is juxta-

posed against the signicantly shorter

timeframe (ve years) for component

failures during operation in the 4-8

MW category of turbines and points

to the urgent need to address product

quality and reliability – a key recom-

mendation of the report.

Fraser McLachlan, CEO, GCube

Insurance, commented: “The push to

rapidly develop more powerful ma-

chines is piling pressure on manufac-

turers, the supply chain, and the insur-

ance market.

“Scaling up is an essential part of

driving forward the energy transition,

but it is now creating growing nan-

cial risks that pose a fundamental

threat to the sector.” He added: “We

advise manufacturers to focus on im

-

proving the quality and reliability of

a reduced number of products to put

themselves back on a sustainable path

of development.

“At the same time, developers must

support manufacturers by sharing the

risk of larger machines more equitably

and open their lending books to supply

chain companies.

“Vessels are going to be one of the

biggest bottlenecks in building off-

shore projects, and developers are in

a powerful position to invest in supply

chain companies at the benet of the

entire sector.”

Headline News

Industry outlines urgent needs as Europe moves to scale-up

Industry outlines urgent needs as Europe moves to scale-up

offshore wind

offshore wind

Offshore wind turbine scaling is creating unsustainable

Offshore wind turbine scaling is creating unsustainable

market risks

market risks

Challenges ahead for US

Challenges ahead for US

proposals to limit power plant

proposals to limit power plant

emissions

emissions

The IEA said the O&G sector

re-invested less than 5 per cent

of revenues in clean energy

A new proposal to cut greenhouse gas emissions from fossil fuelled power plants looks set

to face legal challenges as fossil fuel lobbyists argue that carbon capture and storage has

not been adequately demonstrated.

THE ENERGY INDUSTRY TIMES - JUNE 2023

5

Europe News

Janet Wood

The European Union has granted €252

000 ($270 000) of funding, as part of

its Connecting Europe Facility (CEF),

for feasibility studies for a 300 MW

offshore wind farm in the Northern

Adriatic coastal zone near Croatia and

Italy.

The initiative is one of many offshore

wind projects being progressed across

Europe, despite pressure on the indus-

try’s supply chain, concerns over scal-

ing up of offshore wind turbines and a

wish list for government support.

The EU’s current targets for offshore

wind – which call for 60 GW by 2030

and 300 GW by 2050 – are in addition

to those set by countries outside the EU

such as the UK and Norway. The con-

tinent could have up to 450 GW of

offshore wind in operation by 2050.

As projects continue to be delivered

in the southern North Sea, attention has

also turned to other offshore areas. The

CEF funding for Croatia’s initial off-

shore wind farm will tap just a small

part of the potential resource in the area.

Croatia’s offshore wind potential is

seen at up to 25 GW, according to a

new report funded by the European

Bank for Reconstruction and Develop-

ment (EBRD).

“The identied potential of up to 25

GW of offshore wind capacity in low-

impact areas alone could turn Croatia

into a major European player in the

renewable energy sector over the next

decade,” said Victoria Zinchuk, EBRD

Director for Central Europe. The study

identied more than 29 000 km

2

of

offshore area available for renewables,

including offshore wind, both bottom-

xed and oating.

Elsewhere, Greece has recently se-

lected ve areas to accommodate 2.1

GW of offshore wind turbines in the

north and central Aegean, according

to recent reports, in what will be the

rst phase of its offshore wind deploy-

ment programme.

In the north, a site off Alexandroup-

oli has been designated as suitable to

become home to pilot projects totalling

600 MW. Three areas in the central

Aegean could each accommodate a

300 MW wind farm while a location

off eastern Crete could host a 600 MW

complex.

Greece is targeting at least 2 GW of

offshore wind by the end of the decade,

most of it oating wind.

In the Baltic Sea European Energy

and Vårgrønn have announced a long-

term strategic partnership to pursue

opportunities off Lithuania, Estonia

and Latvia. The three states are consid-

ered to have 15.4 GW of possible ca-

pacity and tenders are expected in

Lithuania and Estonia this year.

Wind and wave energy projects can

reduce their levelised cost of energy

(LCOE) if they share infrastructure,

services and a supply chain, according

to a new report produced for Wave

Energy Scotland.

‘Wave and Floating Wind Energy

– Opportunities for Sharing Infra-

structure, Services and Supply Chain’,

investigated a range of sharing oppor-

tunities. It found LCOE savings of up

to 7 per cent for wind power and up

to 40 per cent for wave energy, while

the combined LCOE of a shared

project can be up to 12 per cent lower

than in separate developments.

Cost reductions are shown to be

available to both wind and wave tech-

nologies without needing to consider

fully hybrid wind/wave platforms – an

option considered to be too high-risk

at this stage.

Wave energy can be integrated by

placing individual megawatt-scale

devices in clusters between oating

wind turbines or by mounting numer-

ous wave devices on oating wind

substructures, sharing their supply

chain and manufacturing processes.

WES Managing Director Tim Hurst

said: “The conclusions from this report

provide a promising starting point for

cross-sector discussions, supporting

the launch of a more detailed optimisa-

tion and feasibility study, and WES

looks forward to progressing this de-

velopment for the sector.”

Scotland is already creating a huge

supply chain and services network to

satisfy the massive offshore wind ca-

pacity leased through the ScotWind

programme.

Nearly every EU state reduced energy

demand last winter and renewables

generated more than fossil fuels for the

rst time ever, according to energy

think-tank Ember – despite extended

outages in France’s nuclear power

plants.

Overall energy demand fell by seven

per cent. But fossil fuel generation

dropped by 12 per cent compared to

2021 – coal power was down 11 per

cent and gas was down 13 per cent.

Fifteen of the 18 coal-using EU coun-

tries reduced coal use, with the biggest

users – Poland and Germany – making

up 70 per cent of the reduction.

Ember’s analysis found that between

October 2022 and March 2023 renew-

ables provided 40 per cent of the EU’s

electricity compared to 37 per cent

from fossil fuels.

Although most EU states reduced

electricity demand over the winter,

only Romania, Slovakia and Greece

achieved a voluntary target of 10 per

cent. On average, demand fell by 6.2

per cent between November and

March.

“Europe faced a crisis winter, with

spiralling energy costs and supply con-

cerns triggered by Russia’s invasion of

Ukraine,” said Ember analyst, Dr Chris

Rosslowe. “The EU got through those

difcult months, but it can’t rely on

emergency demand cuts and mild

weather for future years.”

Janet Wood

Germany is about to accelerate the de-

ployment of solar energy across the

country.

It recently proposed a new strategy

after consultations in March and April.

It promised: faster approval proce-

dures for ground-mounted solar farms;

a boost for rooftop commercial and

industrial solar installations; measures

to speed up and simplify grid connec-

tion; actions to build industrial produc-

tion capacity; skills investment; and

removal of tax hurdles.

Economy Minister Robert Habeck

said that Germany is well on track to

meet its 2023 target of 9 GW of new

solar capacity. The country’s Federal

Network Agency also recently opened

a new rooftop solar tender looking for

190 MW of capacity. It hopes to reach

650 MW in three calls this year.

European countries have redoubled

their efforts to install solar PV on roof-

tops and co-locate it with other ac-

tivities as the solar industry encoun-

ters push-back over large-scale use of

agricultural lands.

A recent report from McKinsey &

Company highlighted land availability

as a major constraint in expanding both

wind and solar capacity. The report,

‘Land: A crucial resource for the en-

ergy transition’ said new renewable

installations in France, Germany and

Italy alone would affect an area the size

of Belgium (up to 35 000 km

2

) by 2040.

McKinsey notes that technical and en-

vironmental constraints place limita-

tions on the land available.

Raffael Winter, Partner at McKinsey

said: “Land availability is crucial to

other societal and environmental ob-

jectives, such as agriculture and biodi-

versity conservation. This creates in-

creased competition for what are all

extremely important issues. It’s vital

for businesses and regulators across

Europe to act hand-in-hand to ensure

that RES development is land-efcient

and biodiversity-enhancing by har-

nessing deployment strategies that can

ensure sustainability and promote a

comprehensive approach.”

The pressure on land has prompted

research into solutions like Agri-PV, a

multi-functional agricultural system

that combines crop production with

solar energy production. The Danish

government-funded project will be

developed in collaboration with Euro-

pean Energy, Aarhus University, Co-

penhagen University, and Slagelse

Municipality.

The project will explore intensive use

of eld robots, increased biodiversity,

the technical and economic viability of

the system, and the acceptance of farm-

ers and the surrounding community.

“We are excited to participate in this

project to develop and mature the po-

tential of agricultural and energy pro-

duction, thus establishing a solid

foundation for future larger projects,”

said Mads Lykke Andersen, Head of

Solar Energy Innovation at European

Energy.

Other options are also under investi-

gation. The Netherlands recently an-

nounced a €28 billion ($30 billion)

package to achieve its climate goals in

2030 that included building 3 GW of

offshore solar by 2030.

Lithuanian grid operator Litgrid says

successful test operations in which it

cut connections with the Russian

power grid have paved the way for

plans to synchronise Lithuania’s grid

with Western Europe.

Lithuania halted energy imports

from Russia last year but it is still part

of a common synchronised electricity

grid with Russia and Belarus dating

back to the Soviet era.

Lithuania’s electricity needs were

fully secured by its own generation

and imports from Poland and Sweden.

“Another and extremely signicant

step closer to the day when we will be

where we belong – in the European

grid!” wrote head of government In-

grid Simonyte on Facebook after the

successful test, while Energy Minister

Dainius Kreivys spoke of a “big step

towards energy independence”. Lith-

uania is also set to be further con-

nected to Estonia and Latvia via off-

shore wind connections.

Estonia and Latvia have also halted

imports from Russia, but are not tech-

nically ready to synchronise with the

Western European grid. Meanwhile,

Ukraine has increased exports to

Western Europe after a six-month gap.

The country’s electricity network was

synchronised with Western Europe

immediately after Russia invaded,

after plans to switch it away from the

Russian grid were brought forward. It

is currently able to export power via

a 400 MW link.

Sharing ‘cuts costs for wind and wave’

EU cuts both demand and fossil fuel use last winter

Solar expansion seeks new options

Offshore wind tenders continue to

roll out across Europe

n Multiple areas of Adriatic and Aegean seas set aside n Baltic Sea tenders expected this year

n

Major push on rooftop PV in Germany

n Offshore solar and co-location with agriculture under investigation

Lithuania follows Ukraine

to synchronise with Western

Europe grid

Nadia Weekes

Global nuclear capacity is projected to

increase by 280 GW by 2050 as coun-

tries look to boost decarbonised sourc-

es of electricity, according to a report

by consultants Wood Mackenzie, pro-

vided costs are reduced.

David Brown, Director of the Energy

Transition Practice at Wood Macken-

zie and lead author of the report, said

the nuclear industry must address the

cost challenge urgently if it wants to

capitalise on the signicant growth

potential offered by low-carbon power.

The high cost of new nuclear and

small modular reactors (SMRs) is

likely to remain a major obstacle to

their adoption, despite policy support

and market growth. Currently, the cost

gap between nuclear and other forms

of low-carbon power generation is too

substantial for nuclear to experience

rapid growth.

SMRs are designed to be modular,

assembled in factories and scalable.

They are expected to reach the market

faster, with a target construction time

of three to ve years compared with

the ten years needed for a large pres-

surised water reactor (PWR).

Wood Mackenzie’s modelling indi-

cates that if costs can drop to $120/

MWh by 2030, SMRs will be com-

petitive with nuclear PWRs, gas and

coal (both abated and unabated) in

certain regions around the world. Fur-

ther price reductions are anticipated

between 2040 and 2050 as SMRs ben-

et from economies of scale and im-

proved market economics.

The rate of expansion for SMRs will

depend on how quickly costs can be

reduced. Wood Mackenzie estimates

that conventional nuclear power cur-

rently has an electricity cost that is at

least four times higher than wind and

solar power when considering the lev-

elised cost of electricity (LCOE).

Up until 2030, SMRs are projected

to have a limited presence in the pow-

er market due to high costs impeding

their rapid deployment. With the de-

cade already progressing and the time

required for construction, it is now

evident that only a few plants can be

built at best.

According to industry estimates, the

cost of a rst-of-a-kind (FOAK) SMR

could range from $6000/kW to $8000/

kW, with Wood Mackenzie analysts

expecting FOAK costs to be on the

higher end or even above, as develop-

ers undertake early-stage projects.

Wood Mackenzie’s tracking of the

SMR sector indicates that there are

only six potential FOAK SMR projects

in the pipeline between 2023 and 2030,

with the capacity of each facility rang-

ing from 80 MW to about 450 MW.

The amount of investment in FOAK

SMRs remains uncertain and will be

inuenced by factors such as nancing

terms, commodity costs, uranium

availability and political support.

Wood Mackenzie estimates that, be-

tween 2030 and 2040, it will be neces-

sary to have 10-15 projects with a

combined capacity of 3000- 4500 MW

to support reduced SMR costs.

Nuclear must compete with a number

of electricity decarbonising technolo-

gies including hydrogen-red power,

gas or coal with carbon capture and

storage, geothermal and long-duration

energy storage. All of them are expen-

sive and require technological ad-

vancements to establish a strong foot-

hold in the market, the report nds.

n Korea Hydro & Nuclear Power,

Samsung Heavy Industries and Sea-

borg Technologies have formed a con-

sortium to develop oating nuclear

plants with Seaborg’s innovative mol-

ten salt reactor technology.

Israel has launched a comprehensive

national plan to integrate hydrogen into

the country’s energy landscape as part

of the Ministry of Energy’s efforts to

decarbonise the economy.

The ministry estimates that hydro-

gen demand for electricity, heavy

transport, industry, aviation and ship-

ping could reach 5.2 million tonnes in

Israel in 2050.

The multi-year plan includes the pro-

motion of research and development

(R&D), regional hydrogen valleys

and other infrastructure. It also pro-

poses the introduction of exible regu-

lation for integrating hydrogen into the

energy sector.

R&D and demonstration projects

are intended to provide solutions to

major challenges such as high costs,

logistical and safety issues, and the

efciency of hydrogen production,

storage and use.

The hydrogen valleys will cover the

entire value chain, from production

technologies, through storage and

transport to nal use in industry, trans-

port and energy.

The promotion of the necessary in-

frastructure will include the setup of

dedicated fuelling stations, under-

ground hydrogen storage, and testing

the feasibility of transporting hydro-

gen in natural gas pipelines.

The ministry also intends to promote

international collaboration to help de-

velop technologies, reduce costs, cre-

ate new trade relations and diversify

available energy sources.

Kazakhstan’s Prime Minister, Alikhan

Smailov and the European Commis-

sion’s Executive Vice-President, Val-

dis Dombrovskis, approved a roadmap

for the secure and sustainable supply

of raw and rened materials and the

development of renewable hydrogen

and battery value chains, with the aim

of promoting the green and digital

transformation of both economies.

The document addresses crucial top-

ics such as the modernisation and de-

carbonisation of the Kazakh mining

industry, while foreseeing closer coop-

eration on geological exploration, re-

search and innovation.

In a separate development, Kazakh

government ofcials and representa-

tives from Chinese companies State

Energy Investment Corporation of

China (CPIH) and SANY Renewable

Energy signed a memorandum of un-

derstanding on the building of a 1 GW

wind farm complex in the Jambul re-

gion of Kazakhstan.

An energy storage facility will be

built next to the wind farm to smooth

out uctuations in wind generation.

CPIH intends to build factories in

Kazakhstan for the production of

wind turbine towers, blades and other

components.

Nadia Weekes

Finnish AW-Energy, a player in near-

shore wave energy technology, has

signed a memorandum of understand-

ing with Namibian company Kaoko

Green Energy Solutions for the devel-

opment of renewable energy and the

production of green hydrogen from

renewable sources including wave

energy.

AW-Energy is behind WaveRoller, a

commercial-scale wave energy con-

verter unit that is submerged near-

shore and generates electricity from

the movement of the waves through

the surge phenomenon.

Christopher Ridgewell, CEO of AW-

Energy, said: “With an energetic and

consistent wave resource Namibia is

very well positioned to utilise the ben-

ets of wave energy to enable sustain-

able industries and jobs.”

Sacky Nalusha, a director for Kaoko

Green Energy Solutions, said that cre-

ating opportunities for innovative solu-

tions and partnerships could grow the

energy sector, which is currently un-

derdeveloped in southern Africa.

“Ocean waves have the potential to

provide a sustainable solution to our

energy needs and demands,” he added.

Phase 1 of the collaboration will in-

clude a detailed site design and the

fabrication and deployment of a Wa-

veRoller wave farm on the coast of

Swakopmund to deliver renewable

power to the area. Phase 2 will assess

the capacity for wave farms in other

Namibian locations. Finally, Phase 3

will expand wave energy plants to de-

liver power to the grid and explore

options to support desalination and

green hydrogen projects.

Namibia’s Green Hydrogen Council

launched its green hydrogen strategy

at COP27 in Sharm El-Sheikh, Egypt.

The strategy sees Namibia become a

net exporter of hydrogen.

“Combined with other renewable

energy sources such as solar, Wa-

veRoller enables signicant cost re-

ductions in green hydrogen produc-

tion and represents a viable solution

in the drive to execute the world’s

clean energy hydrogen roadmap,” ac-

cording to Ridgewell.

Israel launches national hydrogen

Israel launches national hydrogen

integration plan

integration plan

Kazakhstan forges international

Kazakhstan forges international

hydrogen and renewables partnerships

hydrogen and renewables partnerships

Wave energy technology

Wave energy technology

could support Namibia’s

could support Namibia’s

decarbonisation

decarbonisation

High cost ‘main hurdle’ for nuclear

High cost ‘main hurdle’ for nuclear

in growth trajectory to 2050

in growth trajectory to 2050

n Cost of new nuclear and SMRs principal obstacle to adoption

n Next decade will be critical to long-term success

6

THE ENERGY INDUSTRY TIMES - JUNE 2023

International News

National Host Organised by:

Driving Clean, Reliable

Solutions to European

Energy Demand

BOOK YOUR

STAND

Under the patronage of

For information:

exhibition@emc-cyprus.com

+39 30803030

+39 340 3377803

28-30 November 2023

Limassol - Cyprus

www.emc-cyprus.com

MINISTRY OF ENERGY

COMMERCE AND INDUSTRY

OF CYPRUS

EASTERN

MEDITERRANEAN

ENERGY

CONFERENCE &

EXHIBITION

n Strong wave resource makes of Namibia an ideal location

n Ambition to become a leading green hydrogen exporter

the RecyclableBlade at this project,

further signicant CO

2

reduction will

be achieved using the recycled blade

materials in new products.

The blades are the result of a devel-

opment process that has lasted about

ve years. Explaining the thinking

behind it, Mænnchen said: “Because

wind turbine blades are very strong

composite materials, they are hard to

breakdown; it requires a lot of energy

or costly applications to dispose of

them afterwards. That’s why they are

disposed to landll. Some ask why

there hasn’t been a solution until now

but you must remember that we are

still quite a young industry.”

He added: “But because Siemens

Gamesa is a company that wants to

create green, sustainable solutions, it

was very important for us to look into

this. So we decided to develop this

new composite blade with a more

circular approach.”

Siemens Gamesa developed a

multi-generation plan that contained

its ideas for materials to be used in the

blade. This laid down a path to begin

discussion on what the technical

properties and sustainability require-

ments were for its development in the

short-, mid- and long-term. While the

company shared its proposal with all

its resin suppliers, it was Indian-based

“Of course targets have shifted a bit

over the last few years, so I imagine

it could be more. But regardless, the

sheer size of the number is abso-

lutely huge. There are some energy

intensive and costly ways of getting

rid of the blades; and other things

have been tried, such as mixing them

in cement kilns. But normally, blades

are sent to landll at the end of their

life. But because the materials they

are made from are quite stable, they

just remain there. This doesn’t send

the right message.”

Not to mention that the disposal of

such quantities of blade material

would likely call for the creation of

new landll sites.

To address the problem, Siemens

Gamesa launched its Recyclable-

Blade product in September 2021.

Just ten months later, the world’s rst

commercial recyclable blades entered

operation at the Kaskasi offshore

wind farm in German waters.

The wind farm will operate at a

nominal output of 327 MW and, in

boost mode, at a maximum capacity

of 342 MW – generating enough

clean energy for up to 400 000 homes

across Germany. Kaskasi features 38

SG 8.0-167 DD offshore wind tur-

bines, with each blade measuring

81 m in length. Thanks to the use of

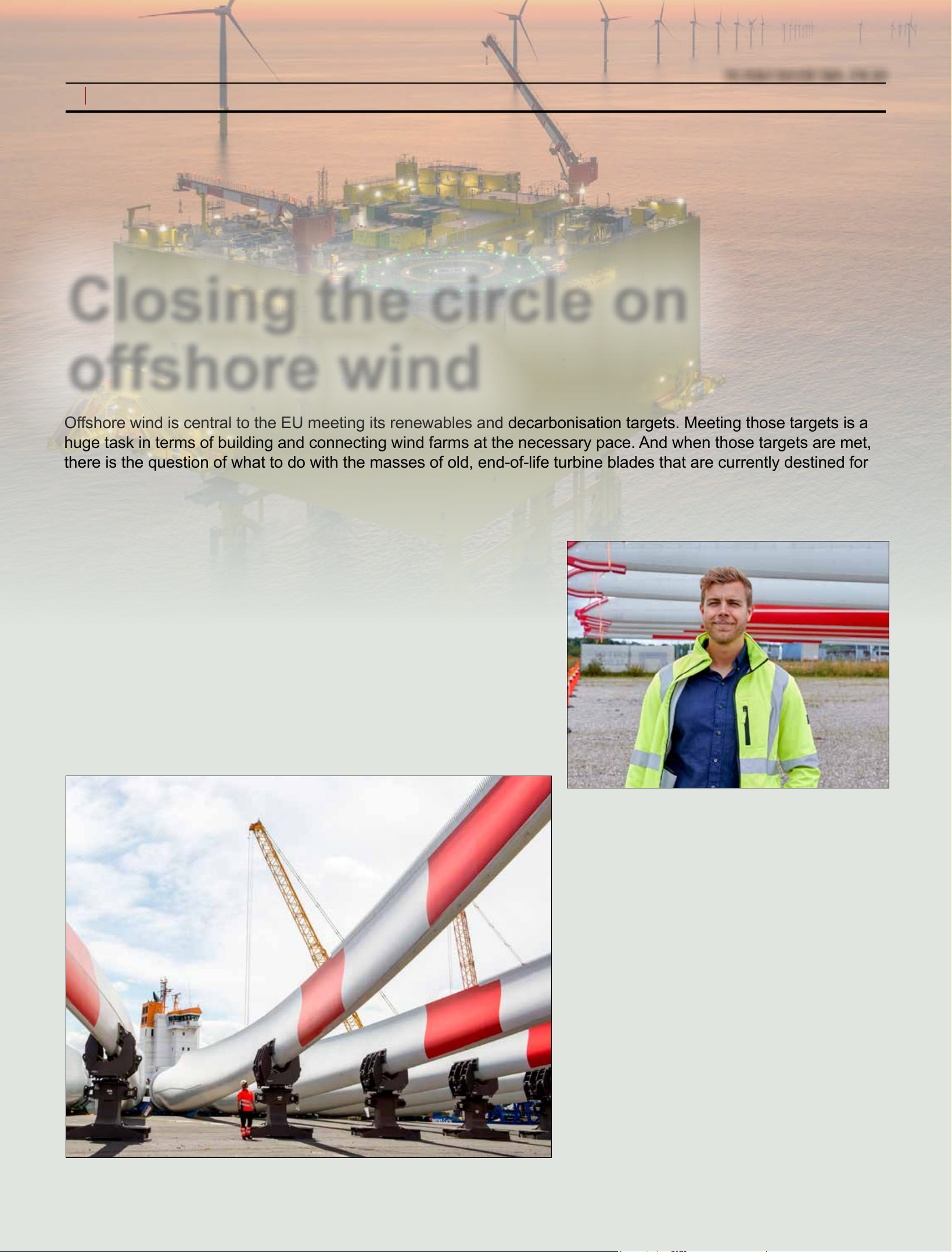

Siemens Gamesa RecyclableBlades leaving the blade factory in Hull (UK) for the Kaskasi

offshore development (Germany)

Mænnchen was part of a multi-disciplined team that developed

the RecyclableBlade

Special Technology Supplement

I

n January this year, the EU agreed

on new, ambitious long-term goals

for the deployment of offshore

renewable energy up to 2050, with

intermediate objectives to be achieved

by 2030 and 2040.

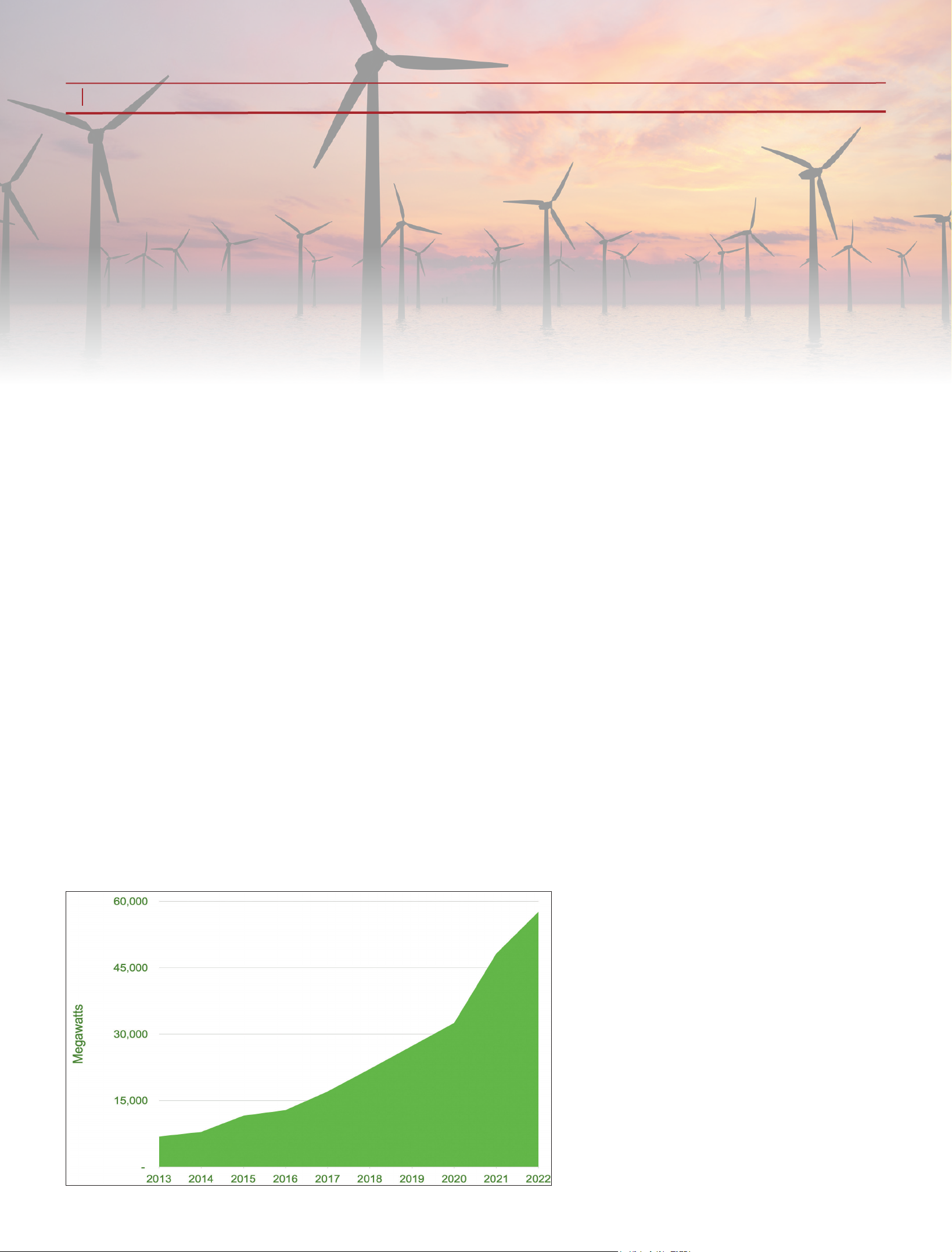

According to the European Com-

mission’s calculations, the region will

need to install about 111 GW of off-

shore renewable generation capacity

by the end of this decade – nearly

twice as much as the objective of at

least 60 GW set out in the EU Off-

shore Renewable Energy Strategy in

November 2020. And beyond 2030,

the sector must add 215-248 GW by

2040, and 281-354 GW by 2050.

Starting from an installed base of

16.4 GW in 2021, it is a huge task.

Connecting thousands of turbines

each year to meet climate change

targets will be a monumental chal-

lenge but looking further ahead, there

is also the question of tackling the

impact of these turbines on the envi-

ronment at the end of their life. What

to do with wind turbine blades from

decommissioned wind farms is now

increasingly being recognised as a

looming environmental problem.

According to Siemens Gamesa esti-

mates made in 2021, there could be as

much as 200 000 offshore wind tur-

bine blades in Europe that will be in-

stalled for offshore use by 2050. This

means there could be more than 10

million tonnes of recyclable material

that could be reclaimed.

Commenting on the scale of the

problem, Jakob Mænnchen, Head of

Casting at leading offshore wind tur-

bine supplier, Siemens Gamesa, said:

THE ENERGY INDUSTRY TIMES - JUNE 2023

8

Offshore wind is central to the EU meeting its renewables and decarbonisation targets. Meeting those targets is a

huge task in terms of building and connecting wind farms at the necessary pace. And when those targets are met,

there is the question of what to do with the masses of old, end-of-life turbine blades that are currently destined for

landll or other processes that emit CO

2

and jeopardise the circular economy. Junior Isles speaks to experts from

Siemens Energy and Siemens Gamesa about these pressing issues.

Closing the circle on

offshore wind

total composite waste, European

project developers were quick to em-

brace and drive the technology.

“Talks and initial development be-

gan about ve years ago. As soon as

we actually started producing the

blades and doing the initial testing of

the recycling, things moved very

quickly. Taking just a few years for

development is a very short time in

our industry. We were the rst to go

out with a solution like this”, noted

Mænnchen.

“When we announced the blades

and went to project developers, they

were very eager to learn about this

solution. It’s really about having the

same mindset across the board – from

OEM to developer – to foster an in-

novation like this.”

With the Kaskasi project already up

and running, it was not long before

RWE again opted for Siemens

Gamesa’s RecyclableBlades for 44 of

100 SG 14-222 DD offshore wind

turbines to be installed at the Soa

offshore wind power project off the

east coast of the UK. This project will

utilise RecyclableBlades measuring

108 m long, representing the rst de-

ployment of this variant.

When these blades do eventually

reach the end of their life, Siemens

Gamesa says it will advise on the re-

cycling process.

“Although we produce and service

the products, after they are in place,

we do not own them and are not

Special Technology Supplement

THE ENERGY INDUSTRY TIMES - JUNE 2023

The RecyclableBlades

being transported from Hull

to the Kaskasi offshore

development

Aditya Birla Advanced Materials, an

expert in epoxy resins, that was able

to come up with an idea that met the

requirements.

The research and development

team at Aditya Birla worked in close

co-ordination with Siemens Game-

sa’s technology team to develop a

novel recyclable epoxy resin system,

leveraging the company’s proprie-

tary Recyclamine technology.

Essentially, the blades use a recy-

clable resin system that enables re-

covered blade materials – the resin,

berglass, and wood, among others

– to be reused and repurposed, bring-

ing them back into the system and

closing the loop. The resin has been

designed for extra slow reactivity to

enable improved processability and

to cure faster than conventional ma-

terials, thereby contributing towards

lowering cycle time in wind turbine

blade manufacturing.

Importantly, the blade is also pro-

duced the same way as a standard

blade and is based on Siemens

Gamesa’s existing IntegralBlade

manufacturing process. This means

there is no increased implementation

risk associated with the new resin

system.

Mænnchen was part of a multi-dis-

ciplined team that worked on the

technology in the early stages. Ex-

plaining how it works, he said:

“Composite blades consist of a 3D

matrix chemical structure, where ev-

erything is bound together to make it

incredibly strong. The technology we

use introduces a new linkage in the

chemistry of this backbone that can

only be separated under certain spe-

cic conditions. But they are condi-

tions that are quite easy to achieve.”

By using a common acetic acid and

raising the temperature to 80°C, this

link can be activated in order to

separate the composite’s base mate-

rials. “It is an innovation in adapting

common products and well-known

chemistry to break this small link-

age,” said Mænnchen. “Basically,

you take down the blade, cut it into

pieces, place it in a tub of acid and

boil it for 3-4 hours.

“It’s one of those things that sounds

really simple once you’ve done it,

but getting to that point takes a lot of

research and development..”

Although the wind industry repre-

sents only about 10 per cent of the

responsible for decommissioning

them and doing the recycling; that’s

down to the project owner and which-

ever recycling companies that will be

handling it,” said Mænnchen. “But of

course we have a vested interest in

ensuring it’s done right. It can of

course be done in different ways, de-

pending on what you want out of it,

but we will advise on how to do it

when we deliver products.”

Mænnchen conrmed the process

and RecyclableBlades have been

tested to ensure they are not affected

over their lifetime by environmental

conditions such as acid rain, and that

when the blades are decommissioned,

the reinforcements, core materials,

plastics and metal parts can be easily

recovered in good quality and value.

He noted, however, that the “process

design” of the recycling facility,

needs to be rened. “After the recy-

cling process is complete, you will

have a mix of your bres, core mate-

rial, and thermoplastic material. The

core material and bres can be re-

moved, cleaned and used for other

purposes. The thermoplastic material

then has to be ltered out from the

acidic solution. This can be done by

centrifuge or neutralisation of the

solvent; it can be done in different

ways. It just depends on what is the

most efcient path, and the expertise

of the recycling facility.”

One notable point, he adds, is that

there will be a big industry using

materials from the RecyclableBlade

for other things such as printed cir-

cuit boards, and consumer electronic

devices.

Mænnchen noted: “This means

there will be recycling techniques and

facilities that are accustomed to using

materials like this. We can draw on

existing experience.”

Although there is a slight premium

on the price of the RecyclableBlade

compared to conventional blades,

Siemens Gamesa notes that this is

mitigated by the fact that project own-

ers can use and sell recycled materials

and also avoid paying for landll.

Arguably, these considerations

should be rewarded in the auction

process if the industry is to continue

developing innovations that protect

the environment. The circular econo-

my is vital to a sustainable future and,

argues Siemens Gamesa, when mak-

ing the decision on a project-winning

developer, it should not come down

Converter platform of the BorWin3 grid connection in the German North Sea. The grid

connection system BorWin3, which can bring 900 MW of wind energy onshore, began

operation in August 2019

9

THE ENERGY INDUSTRY TIMES - JUNE 2023

Special Technology Supplement

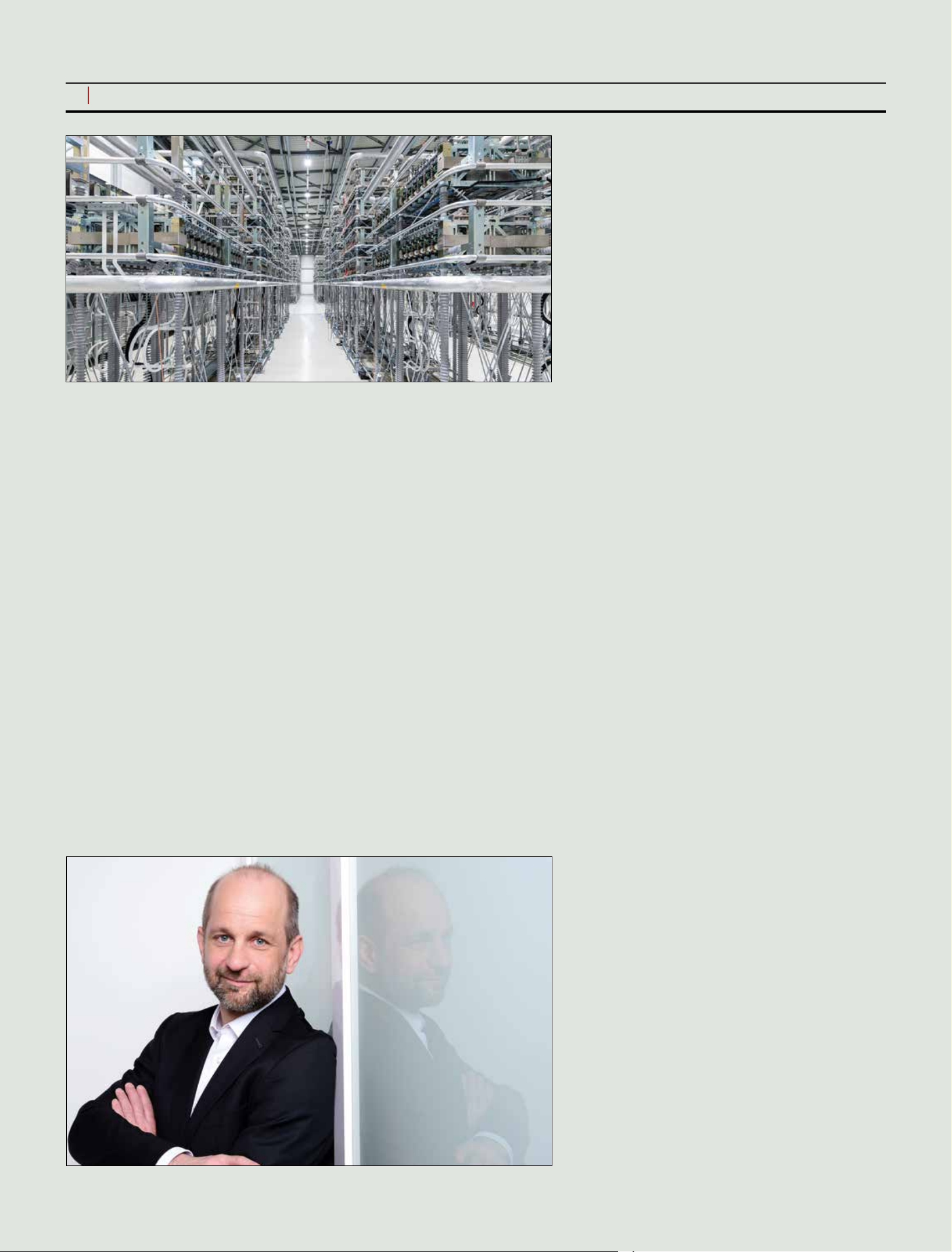

Inside a high-voltage direct

current converter hall

level Converter (MMC) for, voltage

source converter (VSC) applications.

Outside of Germany the same tech-

nology is used to provide higher

power capacity, depending on the

voltage. In the UK, where the voltage

is 420 kV, the power capacity is just

over 1.3 GW.

For the EU to reach its ambitious

targets for offshore wind, a new stan-

dard for connecting wind farms to

shore is being adopted. Going for-

ward, there will be more and more

bipole systems that also operate at a

higher voltage.

The new standard, which has al-

ready been adopted by transmission

system operators (TSOs), TenneT

and Amprion, will see HVDC off-

shore platforms operate at 525 kV for

a capacity of 2 GW.

Andreas Barth, Vice President

Tender and Projects Grid Solutions at

Siemens Energy, noted: “We will be

able to supply more power via a single

HVDC connection. The big advan-

tage of a bipole system is that you

can even operate the system with half

the power in case there is a failure in

one of the poles. This gives a much

higher availability of the system,

since the operator does not run the

risk of fully dropping the wind farm

from the grid.”

One challenge with the higher volt-

age is the requirement of a larger

platform but rather than only optimis-

ing the design to reduce platform size,

the focus is also shifting to building

identical platforms in an effort to

speed up the build-out programme.

In April the TSO, in a move that will

go a signicant way to helping the EU

realise its ambition for offshore wind,

signed contracts worth €30 billion

with four cooperation partners to de-

velop the North Sea as a hub for sus-

tainable and independent European

energy production.

With the signing, TenneT has now

completed the process of awarding

contracts for the sea- and land-based

converter stations for a total of 14

offshore grid connection systems,

which was launched in August 2022.

TenneT had already awarded 11 of

these systems at the end of March,

eight of them in the Netherlands and

three in Germany. Three more sys-

tems in Germany were added with the

April deal. These 14 systems, each of

2 GW, are to be connected by 2031.

One of the deals will see Siemens

Energy in a consortium with Draga-

dos Offshore execute the German

projects BalWin3, LanWin4 (both

with a connection to the onshore grid

in Wilhelmshaven) and LanWin2

(with a connection near Heide). In

December 2022, the same consor-

tium was awarded acontract by Am-

prion to build the converter stations

for the German projects BalWin1

and BalWin2 offshore grid connec-

tion systems.

Commenting on the German TSO’s

approach to allow consortiums to

employ repeat designs for their plat-

forms, Barth said: “The question of

faster implementation and the secur-

ing of production capacities has

gained in signicance in the award

decisions. The focus is on being able

to connect to the grid on schedule

with the expansion targets.

He says that standardisation is key

to building and connecting the plat-

forms within what is a relatively

short timeframe. “The fact that we

have identical designs for all our

platforms is a big step forward. We

are using identical equipment for all

our platforms and therefore only

have to design the platforms only

once for all 2 GW standard projects.

Additionally, we will use the same

platform partner, Dragados Offshore,

for all our ve 2 GW projects in the

German North Sea and will build

them one after another. This well es-

tablished partnership allows for faster

implementation of the projects.”

Work is already well underway on

the new platform standard. Based on

TenneT’s standard design for the

platform, Siemens Energy started the

detailed design at the beginning of the

year and is also optimising it to meet

Amprion’s requirements.

Platform design work started with

system design – the basic design of

the electrical grid connection. This

involves a study of the offshore grid

and which turbines will be used; and

onshore network studies to identify

where the grid will be connected to

the different onshore locations. These

network studies provide the basis to

the design of high-voltage equipment.

Barth added: “Once the design of

transformers, converters, reactors,

switchgear, etc., is complete, this is

then incorporated into a platform and

civil design – a platform design for

the offshore and a civil design for the

onshore side. This is the moment

when we really partner, working

with Dragados Offshore on the nal

design for the offshore platform. The

rst platform will take more time

since the platform design has to be

well-thought-out. Subsequent plat-

forms are considerably faster to

build since they are based on the

same design. We have more time to

begin the civil design since this is not

on the critical path; and will only

take about two years to build.”

Siemens Energy is very condent it

will meet the necessary schedule.

“We have substantial experience.

We’ve already built ve HVDC plat-

forms and another 11 are in progress,

with DolWin6 soon to be nished,”

said Barth. “Once that rst 2 GW

project is complete, the next question

is how much more speed can we gain

by working with the TSOs. We are

now designing the platform, which

will take 18-24 months to nalise.

However, as implementation contin-

ues, there will certainly be more opti-

misations in the new standard, and as

our partner gains experience with

manufacturing, logistics, supply

chain, manufacturing methodology,

etc., these can also be optimised.”

The type of framework agreement

that TenneT has signed with the con-

sortiums not only helps accelerate the

offshore build programme but also

provides certainty for equipment sup-

pliers in what has been a volatile

market.

“If we need to build four or ve

platforms, each time we have to book

resources in terms of materials as well

as people and probably partner with

yards to increase our capacity. We

also have to think about partnering

with civil contractors, installers and

staff that can do the commissioning,”

said Barth. “More certainty through

this type of framework agreement al-

lows us to book what we need for the

next ve platforms. For example, it

makes it much easier to go to market

to book a jack-up barge and make

sure we have the necessary resources

when needed.”

He stressed that eventually, building

HVDC networks will have to be

handled similar to how AC grids have

been built for decades. “For AC grids,

it is straightforward because grid

codes are available and control and

protection mechanisms are all already

dened, etc. For DC, this is not the

case because at the moment we just

transmit from one point to another.

But this will have to change as we are

just starting a new type of grid.”

The goal is to build DC grids – both

onshore and offshore. Although the

2 GW standard is for point-to-point

connections, they will also be ‘hub-

ready’ so that at a later stage they can

be connected to a meshed grid. This

will call for multi-terminal operation.

Barth said: “In the next step the

offshore platforms, and even the on-

shore side, will be connected to each

other. This will give the operators

even more exibility, as it will allow

them to route energy not only from

point-to-point, but also to different

locations in the grid.”

The cooperation seen for the 2 GW

standard will be important in realising

the ultimate DC meshed grid.

“It will need alignment between

different transmission system opera-

tors as well as between the different

HVDC suppliers; if they each have

their own standard, the DC meshed

grid will never work. Aligning on the

2 GW standard was a good rst step

towards the DC meshed grid. It gives

all involved parties more planning

certainty so everyone can be aligned

for the next step. The alignment must

be approached internationally, i.e. it

must not only take place within Ger-

many, but also, for example, Germany

with UK, France Norway and Swe-

den. This will allow energy to be ex-

changed between locations and be

used more efciently.”

The ability to shift wind energy to

any country at any time is crucial for

the proper utilisation of the region’s

wind resources.

Barth explained: “For example,

there is a one hour time difference

between Germany and the UK. You

may need the energy at 6 pm in Ger-

many but one hour later, it might be

better used in the UK. So you would

need to exibly transport the energy

from one point to another.”

He concluded: “Building this DC

grid will be the big challenge for the

next ten years and it will require

standardisation, certainty, the right

regulatory schemes and innovation.”

just to price. Additional qualitative

criteria can include but are not limited

to recyclability.

The company stated: “Today, most

auction processes in Europe and

across the world are only focused on

price. This makes it difcult for new

products – which are more expensive

because they are new – to penetrate

the market as fast as we’d like to see

them. If we want the world to have

sustainable products, the system has

to appreciate the effort needed to

develop and manufacture them.”

As the number of offshore wind

farms grows in European waters,

policies that reward such innovation

and encourage technology that makes

turbines sustainable, is not the only

challenge.

With the need for around 90 proj-

ects to meet 2030 targets, Siemens

Energy stresses that developments in

technology to connect offshore

projects like Kaskasi to the onshore

grid will be key.

The three-phase current generated

by the Kaskasi wind farm is trans-

ported to the HelWin Beta high-volt-

age direct current (HVDC) platform,

which is at the heart of the HelWin2

HVDC offshore grid connection in

the German North Sea.

HelWin2 uses symmetrical mono-

pole technology, operating at 320 kV

direct current for a capacity of 690

MW. It uses Siemens Energy’s

HVDC PLUS technology to convert

power from AC to DC for transport

to shore. An onshore HVDC station

converts the power back into AC to

feed it into the grid. The technology

is based around the Modular Multi-

Barth says in the next step the offshore platforms will be connected to each other

10

EU taking steps to building hydrogen

infrastructure

New gas infrastructure shapes energy

security for southeast Europe

Gary Lakes

Ministers from EU members Ger-

many, Italy and Austria and their trans-

mission system operators (TSOs) last

month petitioned the European Com-

mission to provide special status to

hydrogen transport projects designed

to deliver hydrogen produced by re-

newable sources (green hydrogen) in

North Africa among those countries.

The countries are calling for the

SoutH2Corridor to be placed on the

list of Projects of Common Interest

(PCI), which provides special funding

and enables faster permitting. The

group is backing other hydrogen in-

frastructure projects such as Austria’s

proposed link between it and Ger-

many and Slovenia. Another proposal

calls for a gas pipeline owned by Ita-

ly’s Snam to be converted to carry

hydrogen to Austria and Slovenia.

The infrastructure links are designed

to transport hydrogen to industrial

regions that will be the focus of tran-

sitioning away from heavy fossil fuel

usage.

SoutH2Corridor would have a capac-

ity to transport 4 million tons/year, the

equivalent of 133.2 TWh/year and en-

sure access to green hydrogen at a time

when the market is expected to be

tightening as demand expands.

According to a forecast for 2030

made by ICIS, Germany, Italy and

Austria could see a combined domes-

tic demand for hydrogen amount by

that time to the equivalent of 124

TWh/year. Those states could pro-

duce 80 TWh domestically, while the

SoutH2Corridor would be able to ll

the gap.

ICIS data suggests that by 2050, the

North African states of Morocco, Al-

geria and Tunisia will be producing

hydrogen for export to the equivalent

of 363 TWh/year that will go by pipe-

line to Italy and Spain, of which 213

TWh would be transported to Italy.

In their letter to the EC, the ministers

said “the development of the project

candidates will contribute to security

of supply and greater diversication of

import sources, while at the same time

reducing fossil dependencies.”

Earlier this year, the TSOs of Spain,

Portugal and France launched an initia-

tive called Green2TSO that will guide

the conversion of their gas infrastruc-

ture network into a hydrogen system.

Through ‘open innovation’ the plan

calls for the incorporation of new tech-

nologies that will allow for hydrogen

development in the transport grids.

Priority will go to technologies for

the development of hydrogen detection

and measurement systems, compres-

sion and above-ground storage and

alternatives for coating and cleaning

pipelines. The EC has already agreed

to provide funding for a technology

called Green2TSO OPHTYCs, which

detects and measures hydrogen.

The Green2TSO partnership is

aligned with programmes backed by

the EC including the Green Deal, Fit

for 55 and REPowerEU, which set safe,

efcient and clean guidelines for the

future carriers of hydrogen.

All measures undertaken by EU

members for the hydrogen conversion

are guided by the Hydrogen Backbone

Initiative, which was launched a year

ago with the aim to accelerate Europe’s

decarbonisation by dening the critical

role of hydrogen infrastructure based

on existing and new pipelines. The

initiative seeks to enable the develop-

ment of a competitive, liquid, pan-

European renewable and low-carbon

hydrogen.

The TSOs of Spain (Enegas), Portu-

gal (REN) and France (GRTgaz and

Terega) are partnered in Green2TSO

and are behind the H2Med subsea hy-

drogen pipeline that will connect Bar-

celona with Marseille (known as the

Bar-Mar Pipeline), which was rst

proposed in October last year. It too is

part of the Hydrogen Backbone Initia-

tive. Earlier this year, Germany an-

nounced that it would join H2Med.

Also during April, TSOs in the Nor-

dic and Baltic countries launched a

feasibility study for the Nordic-Baltic

Hydrogen Corridor. Six EU member

states are involved in the study for a

pipeline system that will connect the

green energy production regions in

northern Europe with the major hydro-

gen consumption regions of the EU.

Finland, Estonia, Latvia, Lithuania,

Poland and Germany are participating

in the study, which is led by Latvia’s

Amber Grid TSO. The initial results

are due to be complete by the end of

this year and the project could be com-

pleted and in operation by 2030.

Meanwhile in May, Australia’s Pr-

ovaris and Norway’s Hydrogen AS

completed a pre-feasibility study on

exporting hydrogen from Norway to

Europe by 2027. The study is reported

to demonstrate the potential for low-

cost delivery of green hydrogen.

Provaris said the scope of the study

includes the selection of a preferred

coastal site in Norway, renewable

power supply, production of hydrogen,

compression facilities, and infrastruc-

ture requirements for jetty loading. The

project would employ Provaris’ H2Leo

storage technology and two H2Neo

carriers.

Gary Lakes

Energy security in Southeast Europe

has been an issue for decades. One

question in the late 1990s was how to

get the oil and gas resources in the

newly independent republics of the

Caspian region to the European mar-

ket. Another issue was linking the

existing gas grids throughout the en-

tire region.

In 2006 and again in 2009, the point

of European energy security was

driven home when disputes between

Russia and Ukraine led to temporary

stoppages in Russian gas deliveries to

Europe.

Years of legislation within the Eu-

ropean Union and its members, infra-

structure construction, and big invest-

ment has now placed eastern and

southeastern European countries in a

vastly improved situation as new in-

frastructure is completed and gas sup-

plies are moving at a time when the

EU is clearly cutting its energy con-

nections with Russia.

The Caspian oil question was settled

in 2006, when the BP-led Baku-

Tbilisi-Ceyhan (BTC) opened and

delivered Azeri crude to the Mediter-

ranean Sea, but Caspian gas took lon-

ger to arrive. The Southern Gas Cor-

ridor (SGC), stretching from Baku to

southern Italy, came into operation in

2020 with its rst delivery of Azeri

natural gas to southern Europe.

Azerbaijan supplies gas to the EU

members from its Shah Deniz gas eld

in the Caspian Sea. The gas is trans-

ported through Azerbaijan and Geor-

gia via the South Caucasus Pipeline

(SCP) to Turkey where it links to the

Trans-Anatolian Natural Gas Pipeline

(TANAP) that stretches to northern

Greece and connects to the Trans-

Adriatic Pipeline (TAP), which runs

across Greece to Albania and to Italy.

The Interconnector-Greece-Bulgar-

ia (IGB), which became operational

in October 2022, intersects TAP in

northeastern Greece and delivers gas

from the DESFA system to Bulgaria,

from where it is transported to other

countries.

“Do you remember the state Bul-

garia and the Bulgarian energy indus-

try was in until August of last year?”

Bulgarian President Rumen Radev

asked delegates at the Delphin

Economic Forum in Greece in April.

“No supplies, no gas, no contracts, no

auctions, no slots, no terminals, no

interconnector and with fuel and

prices in the sky?”

Greece’s LNG terminal at Re-

vithoussa in southern Greece is con-

nected to the DESFA system as will

be the Alexandroupolis terminal. Both

terminals will send gas into Bulgaria

and beyond through the IGB. Pipeline

connections are now being estab-

lished throughout the region. Mol-

dova has been receiving gas through

the vertical corridor since December.

Interconnecting pipelines are being

built between Bulgaria and Serbia and

Greece and Macedonia. Albania will

serve as a hub that will send Azeri gas

north along the Adriatic coast to Cro-

atia, where there exists the Krk LNG

terminal, which has recently signed

an agreement to increase its capacity.

Meanwhile, TAP is moving ahead

with plans to expand its capacity from

10 bcm/year to 20 bcm/year.

The developments will lead to not

only Bulgaria and Greece being gas