www.teitimes.com

May 2023 • Volume 16 • No 3 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Green grids

Building the next terawatt

Ideally situated between Europe

and Asia, the Gulf region could

act as a bridge linking a global

network of green grids.

Page 13

Despite the current challenging conditions,

the wind power sector will add as much

capacity in the next decade as it has

over the last 40 years.

Page 14

News In Brief

TenneT deal is boost

for global offshore wind

ambition

The signing of a contract between

TenneT and four cooperation part-

ners to develop the North Sea as a

hub for sustainable and independent

European energy production will go

a signicant way to the EU realising

its ambition for offshore wind.

Page 2

Brazil prepares for inaugural

offshore wind auction

Brazil is expected to launch its rst

offshore wind auction this year with

the aim of bringing winning projects

into operation in 2027.

Page 4

Green shift will be tall order

for India

Making the transition from coal to

clean energy will be a tall order for

India, with the scale of transition

being described as “massive” by a

US-based think tank.

Page 5

Offshore wind investor

interest moving to oating

wind farms

Europe invested just €17 billion in

new offshore wind farms in 2022,

down from €41 billion in 2021 and

the lowest since 2009, according to

WindEurope’s Annual Financing

and Investment Trends report.

Page 8

Analysts fear clean energy

U-turn following Enel

shake-up

Analysts are concerned over a po-

tential change in Enel’s clean energy

transition strategy following up-

coming changes to the state-owned

Italian energy giant’s management

board.

Page 9

Technology Focus:

Modelling weather impact for

renewable energy

The Institute for Environmental

Analytics describes how data-driv-

en energy modelling helps with

planning effective nancial and op-

erational strategies for renewable

power production.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

Although emissions from the power sector appear to be ofcially in decline due to the

increasing deployment of renewables, more needs to be done to accelerate the phase-out of

coal. Yet it is an area in which the G7 remains unable to reach a consensus. Junior Isles

US and EU move to reduce dependency on Russia for nuclear materials

THE ENERGY INDUSTRY

TIMES

Final Word

The G7 will need to be a

bit more magnicent in the

climate change battle, says

Junior Isles. Page 16

Carbon emissions from global electric-

ity generation may have peaked in

2022, but the use of coal for power

generation is not decreasing fast

enough to avoid the Paris Agreement’s

target of a maximum of 2°C of warm-

ing, according to new research from

Chalmers University of Technology

and Lund University, Sweden.

In a study by the research pro-

gramme Mistra Electrication, a

group of researchers analysed 72

countries’ pledged commitments to

phase out their coal use by 2022–

2050. It found that the Paris Agree-

ment’s target of a maximum of 2°C of

warming appears to be missed, and

the world is moving towards a

temperature increase of 2.5–3°C.

In the best-case scenario, the re-

searchers show that it is possible that

the temperature increase will stay at

2°C. But that assumes, among other

things, that both China and India be-

gin phasing out their coal use within

ve years. Furthermore, their phase-

out needs to be as rapid as it has been

in the UK, which is the fastest to ever

happen in a large country, and faster

than Germany has promised. This

may create inequities, which will

need to be addressed by international

policies.

The study came just ahead of a G7

climate, energy and environment

meeting in Japan where ministers

from Canada, Germany, Italy, Japan,

UK and the US pledged to accelerate

a gradual phase-out of fossil fuels

and the shift towards renewable en-

ergy but failed to set a rm timeline

for phasing out coal red power

plants amid continuing opposition

from Japan.

A 36-page document issued at the

meeting’s conclusion reafrmed the

G7’s commitment “to achieving a

fully or predominantly decarbonised

power sector by 2035”, but the phras-

ing leaves open the possibility for

continued use of fossil fuel-red pow-

er. Last year, the G7 added a loophole

to a previous pledge to end invest-

ments in overseas fossil fuel projects

by the end of this year and said invest-

ment in liqueed natural gas was a

“necessary response to the current

crisis”.

At last month’s meeting in Sapporo,

ministers instead directed there efforts

towards growing renewables as a way

of tackling both climate change and

the energy crisis fuelled by Russia’s

war on Ukraine.

In their communiqué, the members

pledged to collectively increase off-

shore wind capacity by 150 GW by

2030 and solar capacity to more than

1 TW.

“The solar and wind commitments

are huge statements to the importance

Continued on Page 2

The United States and the European

Union have outlined a programme to

reduce their dependency on Russia for

nuclear materials and to diversify

nuclear fuel supplies.

The EU-US Energy Council said it

intended “to intensify cooperation to

reduce dependency on Russia for

nuclear materials and fuel cycle ser-

vices” and that it supported efforts by

EU member states to diversify their

nuclear fuel supplies.

There have been calls for EU sanc-

tions on the Russian nuclear industry,

but these could not be implemented

on account of the dependency of

countries like Hungary, Bulgaria,

Slovakia and the Czech Republic on

Russian fuel elements.

The news followed an announce-

ment by the Czech Republic that it

would cease sourcing fuel elements

for its nuclear power stations from

Russia from next year. In mid-April,

Westinghouse, a US-based nuclear

fuel supplier, said it will replace

Russia’s TVEL as the supplier for

CEZ’s Dukovany nuclear power

plant beginning in 2024.

Explaining the switch, CEZ’s Chief

Executive, Daniel Benes, said: “Se-

curing a western supplier of fuel as-

semblies for Dukovany is an impor-

tant step not only for the Czech

energy industry, but also for the en-

tire Czech Republic. There is a fur-

ther signicant strengthening of en-

ergy safety.”

The rst assemblies for Dukovany

with fuel supplies are set to arrive

next year. The Czech Republic’s two

nuclear power stations will fully

switch from Russian to US fuel as of

2024, covering about one-third of the

country’s total power production.

Last year, CEZ selected Westing-

house and French company Frama-

tome as its suppliers of nuclear fuel

assemblies at its second nuclear pow-

er station, Temelin. This decision

came as part of CEZ’s efforts to diver-

sify suppliers and increase security

after the Ukrainian crisis.

At a meeting of G7 energy, climate

and environment ministers last

month, the member states – Canada,

France, Germany, Italy, Japan, UK

and the US – reached an agreement

aimed at “pushing” Russian Presi-

dent Vladimir Putin out of the nucle-

ar fuel market “as quickly as possi-

ble”.

The G7 said it would collaborate on

exploring “strategic opportunities in

uranium extraction, conversion, en-

richment and fabrication”.

“This multilateral co-operation

would enable us to strengthen our

domestic sectors and establish a level

playing eld to compete more effec-

tively against predatory suppliers,” it

added in a statement.

Russia is one of the world’s largest

suppliers of enriched uranium for ci-

vilian nuclear programmes, with

more than 40 per cent of enrichment

capacity globally.

Several former Soviet bloc coun-

tries in Europe remain reliant on Rus-

sian nuclear fuel and have resisted

pressure to ban it from the EU until

they have an alternative, with many

working with US company Westing-

house to convert to its fuel.

Reducing dependence on Russia is

crucial in countering the Kremlin’s

ongoing use of energy as a weapon

against the west.

Last month the EU reported that it

is storing record levels of natural gas

after a milder than anticipated win-

ter, bolstering hopes that the bloc can

wean itself off imports from Russia.

The bloc’s storage totalled 55.7 per

cent of capacity at the start of April

according to the industry body Gas

Infrastructure Europe – the highest

level for early April since at least

2011.

Moody’s says, however, the EU

will probably still face a supply-de-

mand gap of around 12 per cent of its

gas storage capacity by March 2024,

based on its current estimates.

Emissions may have peaked but

Emissions may have peaked but

coal phase-out still too slow

coal phase-out still too slow

G7 ministers are still grappling with

coal phase-out timelines

THE ENERGY INDUSTRY TIMES - MAY 2023

2

Junior Isles

The signing of a contract between

TenneT and four cooperation partners

to develop the North Sea as a hub for

sustainable and independent Euro-

pean energy production will go a sig-

nicant way to the EU realising its

ambition for offshore wind and bring

the world closer to reaching increased

targets.

In April, top representatives of the

transmission system operator TenneT,

the Hitachi Energy/Petrofac coopera-

tion and the three consortium partner-

ships GE/Sembcorp (SMOP), GE/

McDermott and Siemens Energy/

Dragados ofcially signed the con-

tracts in Berlin to seal Europe’s larg-

est-ever tender award for energy tran-

sition infrastructure.

The total volume of the contracts for

the components of the 14 systems

amounts to around €30 billion. The

result will be a transmission capacity

of offshore wind energy in the German

and Dutch North Sea that will gener-

ate as much electricity as 28 large-

scale power plants.

With the signing, TenneT has now

completed the process of awarding

contracts for the sea- and land-based

converter stations for a total of 14

offshore grid connection systems,

which was launched in August 2022.

TenneT had already awarded 11 of

these systems at the end of March,

eight of them in the Netherlands and

three in Germany. Three more sys-

tems in Germany were added last

month. These 14 systems are to be

realised by 2031.

Their “core components”, i.e. the

innovative 2 GW HVDC technology

for converting alternating current into

direct current and back, will be man-

ufactured exclusively at European

production sites of the consortiums’

members in all projects.

The company stated in a press re-

lease: “With a contract of this magni-

tude, Europe will be taking a global

lead – in terms of both technology and

production – in a key sector of tomor-

row’s energy supply.”

Tim Meyerjürgens, COO of TenneT,

said: “As the leading offshore trans-

mission system operator in the EU, we

have the know-how needed to make

Europe’s goal of securing an indepen-

dent supply of renewable energies a

reality. To achieve this, the North Sea

must be developed as Europe’s green

powerhouse and quickly connected to

the electricity grids on land. We are

acting and investing accordingly. Our

2 GW Program will help make green

wind energy from the North Sea scal-

able and more cost-efcient – while

continuing to minimise any impacts on

the environment.”

All agreements apply to both the

offshore and onshore converter sta-

tions and the associated HVDC tech-

nology. The contracted suppliers will

start the preparatory work for the

projects immediately.

The deal was signed as Amprion

GmbH, one of the four transmission

system operators (TSOs) in Germany

said it intends to spend about €22 bil-

lion ($24.23 billion) in the next ve

years to expand and upgrade the coun-

try’s power grid with the aim to enable

the integration of more renewable

energy.

The focus of the investment strategy

is on the expansion of the north-south

direct current corridors on land, which

will allow the distribution of wind

energy from Germany’s north to the

south and the construction of four

offshore grid connections that will

transport power from offshore wind

farms to the mainland.

Germany, along with the UK, is

among the leaders in the global charge

to accelerate offshore wind. Accord-

ing to the latest market outlook from

Wood Mackenzie, the next ten years

will see an intensied focus on off-

shore wind as the sector matures and

technology innovation and supply

chain development help make off-

shore development more accessible in

different regions.

The company’s ten-year outlook

forecasts a seven-fold increase in

global offshore wind capacity in 30

countries, with European countries

and China accounting for 81 per cent

of capacity additions.

that they will rely on the energy

superpowers of solar and wind in

order to phase-out fossil fuels,” said

Dave Jones, head of data insights at

energy think-tank Ember.

In a study issued just ahead of the

G7 meeting, the think-tank said the

power sector could have reached a

tipping point in its transition to clean

power. It said electricity emissions

grew by 1.3 per cent last year to hit

a record high, fuelled by a small

increase in coal use to meet growing

electricity demand after the end of

the Covid-19 lockdowns, but 2022

will probably be the last year the

global power sector will see growth

in greenhouse gas emissions.

Green power met 80 per cent of

the increase in electricity demand

as economies opened up after the

lockdowns, with coal generation

increasing by just 1.1 per cent dur-

ing 2022.

In a new report that draws on 2022

data from 78 countries covering 93

per cent of global electricity de-

mand, Ember says record deploy-

ments of renewable power last year

pushed wind and solar to a new high

of 12 per cent of electricity genera-

tion, up from 10 per cent in 2021.

Ember’s ‘Global Electricity Re-

view 2023’ suggests that clean

sources of energy, which include

hydro, nuclear and bioenergy as

well as wind and solar, now account

for nearly 40 per cent of the world’s

electricity supply.

The report also noted that the EU

increased its solar power generation

by 24 per cent in 2022 in line with

the global average, whereas EU

wind power generation grew 9 per

cent year-on-year, just over half the

average global growth of 17 per

cent.

The pace of growth in clean pow-

er will accelerate in 2023 and be-

yond, according to the Ember re-

port, as developers take advantage

of falling technology costs and fa-

vourable government policies to

roll-out more cheap green electric-

ity generation.

But despite the accelerating

growth the global energy transition

remains off-track. At the end of

March, IRENA’s ‘World Energy

Transitions Outlook 2023 Preview’

called for a “fundamental course

correction” in the energy transition.

To keep 1.5°C alive, it said deploy-

ment levels must grow from some

3000 GW today to over 10 000 GW

in 2030, an average of 1000 GW

annually. Deployment is also lim-

ited to certain parts of the world.

China, the EU and the US account-

ed for two-thirds of all additions last

year, leaving developing nations

further behind.

IRENA’s Director-General Fran-

cesco La Camera said, “The stakes

could not be higher. A profound and

systemic transformation of the

global energy system must occur in

under 30 years, underscoring the

need for a new approach to acceler-

ate the energy transition. Pursuing

fossil fuel and sectoral mitigation

measures is necessary but insuf-

cient to shift to an energy system t

for the dominance of renewables.”

Continued from Page 1

According to S&P Global Ratings, the

European Commission’s proposals to

reform Europe’s power market should

accelerate investment in renewable

energy by supporting the extension of

contracts for difference (CfD) schemes

and market-based power purchase

agreements (PPAs).

Indeed, S&P now expects that the

majority (50 -55 per cent, or 63 per cent

including hydro) of Western Europe’s

electricity will stem from wind and

solar generation in 2030, up from about

26 per cent this year and 20 per cent in

2019.

The ratings agency said the extension

of two-sided CfD schemes to the entire

EU strengthens price visibility for de-

velopers. These offtake agreements

take away both the uncertainty of long-

term market prices and, in the case of

renewables, the risk of intraday price

uctuations.

It also noted that the Commission’s

proposal for PPAs requires EU mem-

bers to ensure availability of counter-

party risk guarantees. Such a guaran-

tee-mechanism, it said, could allow

more corporates to enter into PPAs

and extend their tenors, as well as sup-

port more stable remuneration for

renewable energy source (RES) proj-

ect assets.

Power market reform will be central

to the EU achieving its increased re-

newables ambition.

In late March, the European Union

countries and negotiators from the

EU’s parliament reached a provisional

deal to raise the share of renewables in

the bloc’s energy mix.

The European Council, which repre-

sents the 27 member nations, said the

agreement reached after all-night ne-

gotiations would raise the renewable

energy target to 42.5 per cent of total

consumption by 2030. The current goal

is 32 per cent.

To meet the EU’s goal of becoming

climate neutral by 2050, the EU’s ex-

ecutive commission supported a tar-

get of 45 per cent. The council and the

European Parliament left a door open

for such an increase, agreeing on “an

additional 2.5 per cent indicative top

up” that would allow it to reach 45 per

cent.

European Commission President Ur-

sula von der Leyen said the agreement

would allow “for more ambition and

faster roll-out” of renewables. “This

will help us progress towards climate

neutrality, strengthen our energy secu-

rity and boost our competitiveness, all

at once,” von der Leyen said.

The Commission has since proposed

to revise elements of the Clean Energy

Package to support development of

offshore wind. A Proposal for a Regu-

lation would amend the Internal Mar-

ket in Electricity Regulation

((EU/2019/943) and Directive ((EU)

2019/944).

Recitals state that to reduce invest-

ment risk for offshore project develop-

ers and ensure projects have full access

to surrounding markets, TSOs should

guarantee access of the offshore project

to the capacity of any hybrid intercon-

nectors for all market time units.

Under the IME Regulation, when al-

locating congestion income, priority

currently is given to guaranteeing

availability of the allocated capacity

and to maintaining or increasing cross-

zonal capacity.

A third priority would be added: com-

pensating offshore generators if access

to interconnected markets has been

reduced in such a way that one or more

TSOs have not made enough capacity

available on the interconnector or the

critical network elements affecting the

capacity of the interconnector, result-

ing in the offshore plant operator not

being able to export its generation ca-

pability to the market.

Investment in grid infrastructure and

an economically efcient risk alloca-

tion as between project developers and

TSOs is critical to delivering offshore

renewable energy at scale.

The Commission invites feedback

until 23 May 2023.

Low-carbon hydrogen – electrolysis

hydrogen emitting no or marginal car-

bon – is emerging as one of the most

promising routes to accelerating the

decarbonisation of high-emission

sectors and a crucial facilitator in

achieving a greener future, says a new

report from the Capgemini Research

Institute.

The report: ‘Low-Carbon Hydrogen

– A Path to a Greener Future’ nds

that 62 per cent of heavy industry

companies across sectors are looking

at low-carbon hydrogen to replace

carbon-intensive systems. On aver-

age, Energy and Utilities (E&U) com-

panies expect low-carbon hydrogen to

meet 18 per cent of total energy con-

sumption by 2050. They are unlock-

ing investment across the hydrogen

value chain, notably to develop hy-

drogen infrastructure, cost-effective

electrolysers and fuel cells.

The report nds that most organisa-

tions believe low-carbon hydrogen

(3.38 kg CO

2

-equivalent per kg of

hydrogen) will be a long-term con-

tributor to achieving emissions and

sustainability goals. Some 63 per cent

of E&U organisations view low-car-

bon hydrogen as critical for decarbon-

ising economies, and 62 per cent be-

lieve it can help nations reduce

dependence on fossil fuels and pro-

mote energy independence.

According to those surveyed, low-

carbon hydrogen could meet up to 55

per cent of hydrogen mix totals by

2050. On average, 0.4 per cent of total

annual revenue is earmarked for low-

carbon hydrogen by E&U organisa-

tions by 2030, in particular for hydro-

gen energy transport and distribution

(53 per cent), production (52 per cent)

and R&D (45 per cent).

n RES and Octopus Energy Genera-

tion’s green hydrogen joint venture

HYRO has signed a deal to develop

electrolysers that will be used to pro-

duce green hydrogen for use in place

of gas at two Kimberly-Clark UK

manufacturing facilities.

Headline News

EU electricity market reform should accelerate renewables

EU electricity market reform should accelerate renewables

investment, says S&P Global Ratings

investment, says S&P Global Ratings

Heavy industries to leverage low-carbon hydrogen to achieve

Heavy industries to leverage low-carbon hydrogen to achieve

sustainability targets

sustainability targets

TenneT deal is boost for

TenneT deal is boost for

global offshore wind ambition

global offshore wind ambition

La Camera says “the stakes

could not be higher”

n Deals signed worth €30 billion

n Global offshore wind to increase seven-fold

community.e-world-essen.com

ONE SECTOR. ONE NETWORK.

Exchange and network with the

energy sector 365 days a year.

6

THE ENERGY INDUSTRY TIMES - MAY 2023

www.teitimes.com

THE ENERGY INDUSTRY

TIMES

subscribe today

The Energy Industry Times is the only publication that

covers global news related to the power and energy

sector in a newspaper style and format whose

uniqueness is recognised by our readers.

As a paid subsciber you will gain full access to our online

news desk.

You will also no longer have to wait for the printed edi-

tion; receive it by PDF “hot off the press” or download it

online.

To subscribe, email subscriptions@teitimes.com or visit

www.teitimes.com

To guarantee receiving your monthly copy of the award

winning newspaper, you need to subscribe today

T

he 1.5°C limit is achievable.

But it will take a quantum leap

in climate action,” said UN

secretary-general Antonio Guterres,

in response to the latest report pub-

lished by the UN Intergovernmental

Panel on Climate Change (IPCC).

The report, signed-off by govern-

ments worldwide, found that the

risks of global warming were greater

than was thought at the time of the

last assessment in 2014, with some

regions already having reached the

limit of what they can adapt to.

To avoid climate catastrophe, hu-

manity must stay within a safe car-

bon budget. However, between the

slow pace of government action, a

lack of funding, and an unwilling-

ness to divest from fossil fuels at the

pace required, current climate

change initiatives are caught be-

tween a rock and a hard place, with

millions of ordinary people paying

the price.

As it stands, fossil fuels – coal, oil,

and natural gas – supply around 80

per cent of the world’s energy, pro-

pelling the world quickly towards

what are described as irreversible

climate ‘tipping points’, the points at

which various changes to the climate

would become permanent (or at the

very least, long-term). In order to

avoid this reality, greenhouse gas

emissions would need to peak before

2025 and fall by 60 per cent by

2035. However, governments’ na-

tional emissions reduction plans are

already falling short, and at our cur-

rent rate we are on track for warm-

ing of about 2.8°C by 2100. To

avoid global disaster, governments

need to make drastic changes in fa-

vour of reducing our global carbon

output.

Challenges to what has been the

global modus operandi for the past

150 years will undoubtedly be dis-

ruptive. However, solutions do exist.

Harnessing the huge potential of

renewable energy sources in order to

meet global needs will require both

signicant political will and resourc-

es to build the necessary large-scale

infrastructure. Practically, there

needs to be a collective adoption of

renewable power globally, from

small-scale projects such as rooftop

solar and mini-grids for rural com-

munities, to a massive expansion of

large-scale solar and wind power

projects in prime locations.

The best locations for huge solar

power stations are, obviously, des-

erts, where strong sunshine is com-

bined with cheap land, and where

covering large areas with solar pan-

els or mirrors does not displace food

production. Alongside this, the best

locations for wind infrastructure are

often equally remote, such as Pata-

gonia, the south coast of Morocco,

or indeed offshore.

However, solar and wind produc-

tion in a single location is variable.

Wind comes and goes. The sun rises

and sets.

For renewable energy to provide a

reliable source of affordable energy

365 days a year, energy-rich loca-

tions need to be linked to popula-

tions, cities, and industry by grids in

order to combine different energy

sources in different time zones into a

reliable 24/7 supply of clean energy

for all.

Whilst energy storage and other

energy sources will have a key role

to play in this, large-scale continen-

tal ‘green grids’ will be essential for

this transition.

A key geographical area that could

benet from this infrastructure is the

Gulf region.

As it stands, the Gulf region in-

cludes ve of the top ten oil-produc-

ing countries and is responsible for

27 per cent of world production.

However, what if instead of centring

their economic output on fossil fu-

els, these countries reinvested their

resources in clean energy? The Gulf

region, with its vast deserts and

year-round sunshine, is a prime loca-

tion for the extensive solar farms

necessary for humanity’s growing

energy needs.

Ideally situated between Europe

and Asia, the region could act as a

bridge linking the global network of

green grids; desert solar could be de-

livered to Europe by day, with Euro-

pean and North African wind energy

transmitted eastwards during the

night. This mutually benecial ex-

change of energy could be replicated

around the world. Namibian coastal

wind and desert solar could be deliv-

ered to the big cities of Southern Af-

rica, Australian desert solar trans-

ported to Southeast Asia, and

Patagonian wind brought to South

America’s metropolitan hubs.

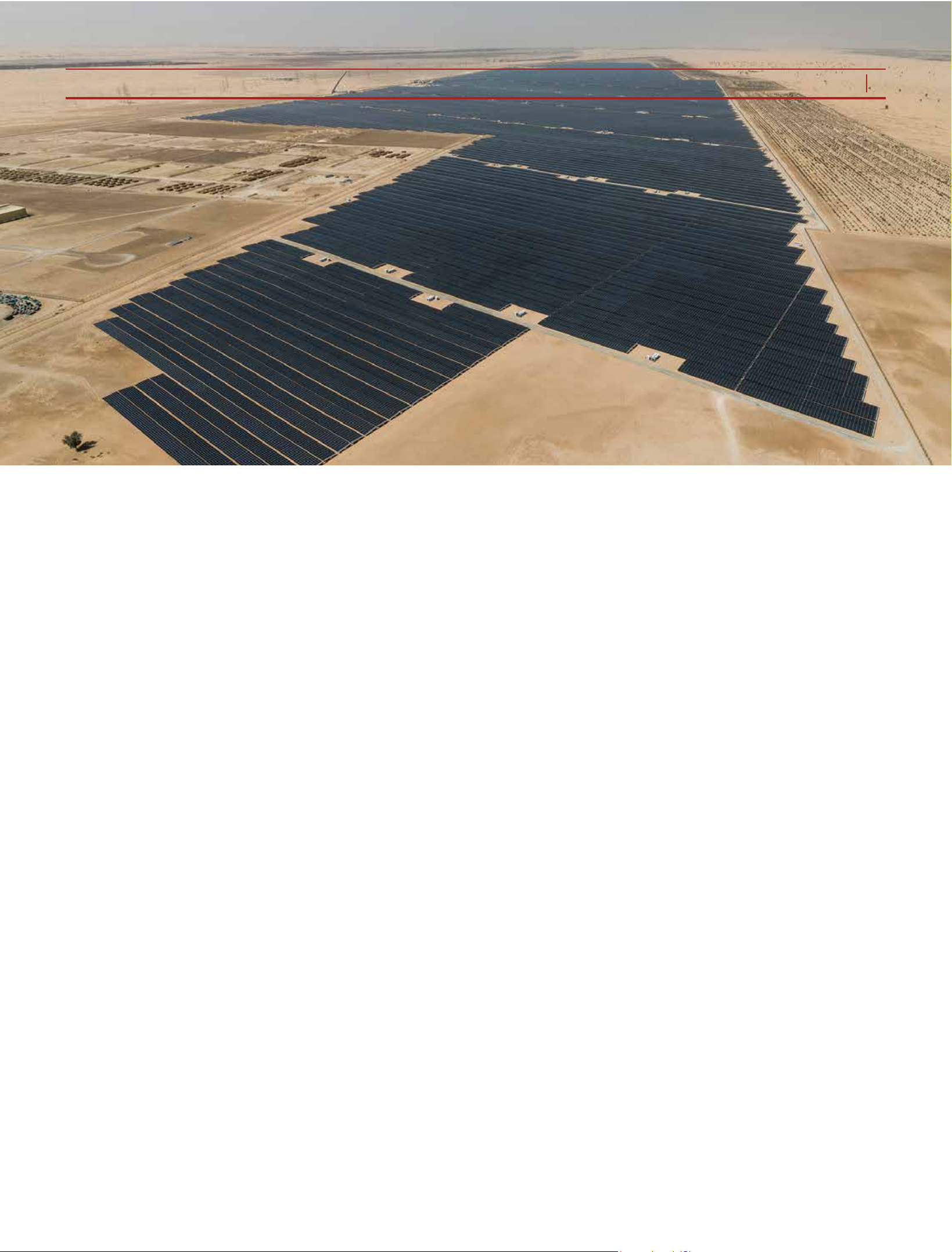

Deserts, such as those found in the

Gulf, are home to almost innite so-

lar resources that have remained rel-

atively untapped. The world’s largest

single site solar farm is already lo-

cated in Abu Dhabi, but this is still a

largely domestic facility which can

be replicated at real transformative

scale.

All the energy humanity uses in a

year is equal to the energy that

reaches the earth from the sun in a

single hour. We can tap into this en-

ergy cost effectively. Solar and wind

power are already the cheapest ener-

gy sources in the world, and as tech-

nology improves, prices will de-

crease further. But despite the

enormous potential lying dormant in

solar, we are yet to see any meaning-

ful action towards fully realising its

potential. To do so, we will need to

establish the grids and technology

that would make this resource avail-

able to all.

In order to achieve this, we need

new transmission lines crossing

frontiers and connecting different

time zones, creating a global ecosys-

tem of interconnected renewables

and a new energy market built to op-

erationalise, and seize the opportuni-

ty in, a net zero future. This must be

combined with expanded and mod-

ernised national and regional grids

and complemented with the rapid

scale-up of mini-grids and off-grid

solar solutions.

The open secret is this technology

does exist and is already widely

used. High voltage direct current

(HVDC) transmission lines can

transport energy over long distances

– overhead, underground, or under-

water – with little energy loss. Clean

energy highways can be built rapidly

using undersea cables to help avoid

delays and the public opposition that

overhead lines often encounter.

Fundamentally, the grids of tomor-

row will also have to be designed to

handle a signicant increase in the

electrication of an energy system

powered by renewables, and will

therefore need to be ‘smart’, decen-

tralised, and digital. Integrating bil-

lions of rooftop solar panels, wind

turbines and storage systems into the

grid will require cutting edge tech-

nology and techniques, the likes of

which will only be deployed with

appropriate political and nancial

backing.

Organisations like the Climate Par-

liament are ghting to make this a

reality. At COP26 in 2021, the Prime

Ministers of India, Samoa and the

United Kingdom, and Ministers

from Australia, France, Nigeria, and

the United States launched the

Green Grids Initiative – One Sun

One World One Grid. The Green

Grids Initiative was rst conceived

by the Climate Parliament as a glob-

al coalition seeking to accelerate the

establishment of renewable grids.

As an international network of

legislators, the Climate Parliament

works to enact a functioning solu-

tion to the world’s dependence on

fossil fuels, centred on rapidly in-

creasing political support for, and

the development and use of, renew-

able energy sources such as solar

and wind.

Despite positive steps being taken

in this space, the pace at which work

is being carried out is not as fast as it

could, or should, be to avoid a cli-

mate catastrophe. If these projects

are to succeed, there will need to be

a lot more dynamism on the part of

governments to really champion the

cause.

As a result, the Climate Parliament

has now established a series of green

grids ‘accelerators’ focused on fos-

tering close collaboration between

business leaders, investors, govern-

ments, and legislators to create

‘project pipelines’ of green grid con-

struction projects which can move

rapidly from concept to completion.

These groups function to (literally)

accelerate particular clean energy

projects. They will open channels

for governments, investors, industry

leaders, legislators, and NGOs to be-

come involved in green grid build-

ing, increasing the speed at which

they can be built by enabling dy-

namic collaboration.

Furthermore, as an international

network, the Climate Parliament is

also working to increase cooperation

with non-state actors such as univer-

sities and research institutions, who

will be key players in the success of

the establishment of these grids, as

their ability to act independently en-

dows them with a dynamism that na-

tional governments can often lack.

Combining the resources and sta-

bility of state actors with the speed

and technical expertise of research

bodies and private sector operators,

who bring both skills, capital and

existing adaptive infrastructure, will

be key to making the energy transi-

tion a reality.

Climate change is a global prob-

lem, and as such, will require global

solutions. Green grids present us

with a viable way to drastically re-

duce our carbon emissions, increase

global interconnectivity, and create a

thriving green economy. It is now up

to us, and our governments, to be

bold, decisive and make it a reality.

Nicholas Dunlop and Dr. Sergio

Missana are, respectively, Secretary

General and Executive Director, of

the Climate Parliament.

Green grids offer

a viable way to

drastically reduce

carbon emissions.

Ideally situated

between Europe

and Asia, the Gulf

region could act as a

bridge linking a global

network of green

grids – desert solar

could be delivered

to Europe by day,

with European and

North African wind

energy transmitted

eastwards during

the night. The

Climate Parliament’s

Nicholas Dunlop

and Dr. Sergio

Missana, explain.

Green grids, global warming

Green grids, global warming

and the Gulf: a hot solution to

and the Gulf: a hot solution to

a hot issue

a hot issue

THE ENERGY INDUSTRY TIMES - MAY 2023

13

Industry Perspective

Norway commissioned 60 MW of

oating wind capacity last year,

bringing the region’s total installa-

tions to 171 MW, equal to 91 per cent

of global installations.

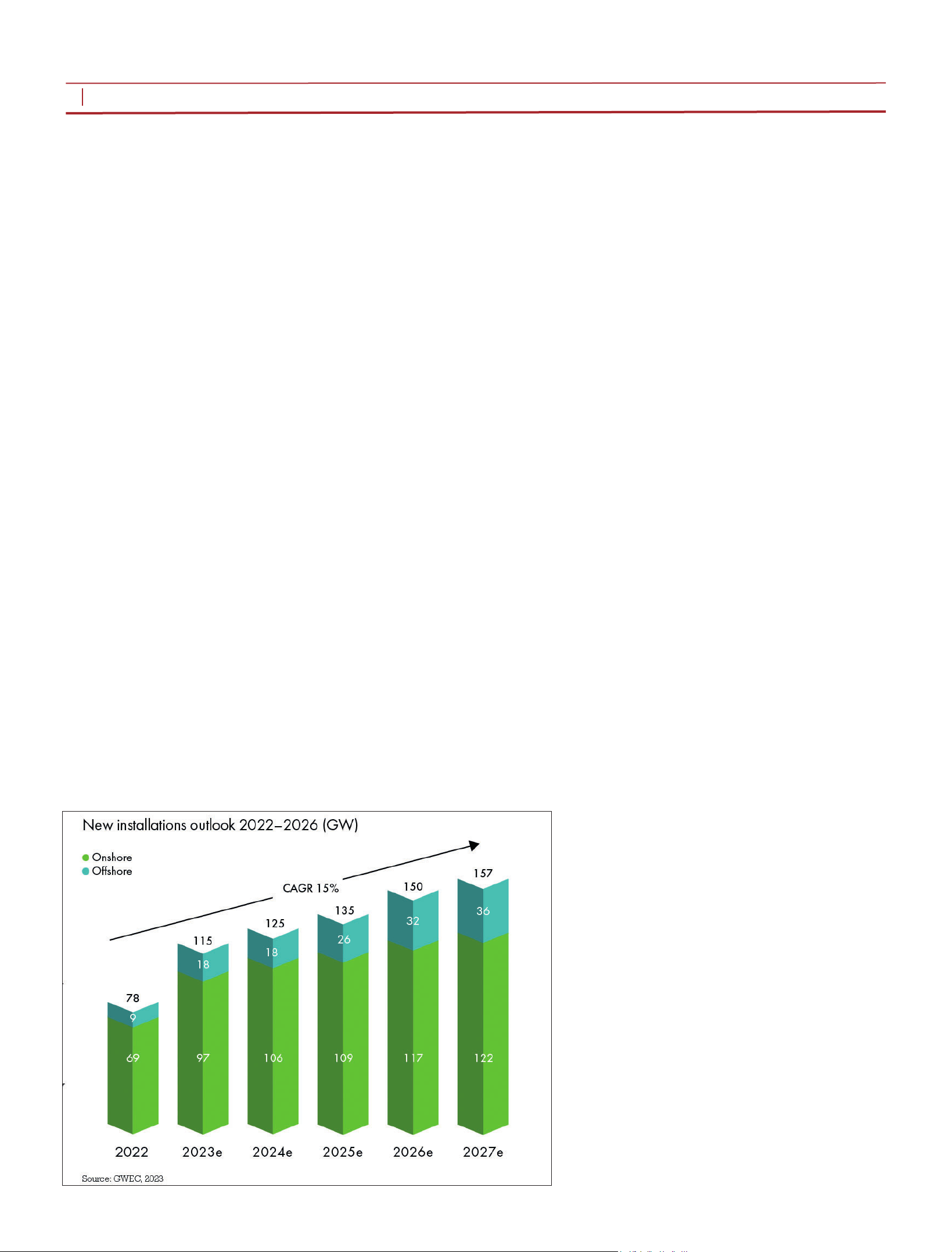

Looking forward, GWEC Market

Intelligence expects that total new

onshore and offshore wind power

installations will exceed 100 GW in

2023 and that 680 GW of new capac-

ity will be added in the next ve

years under current policies. This

equals more than 136 GW of new

installations per year until 2027. This

represents a compound annual

growth rate (CAGR) for the next ve

years of 15 per cent.

The GWEC lists ve pillars that

will underpin this level of growth in

the next ve years:

n Europe’s renewed urgency to re-

place fossil fuels with renewables to

achieve energy security in the after-

math of the Russian invasion of

Ukraine;

n A strong uplift for renewable en-

ergy in the US over the next ten years,

primarily driven by the Ination Re-

duction Act (IRA)

n China’s commitment to further ex-

panding the role of renewables in its

energy mix, aiming for renewable

energy to contribute more than 80 per

cent of total new electricity consump-

tion by the end of the 14th Five-Year

Period (2021–2025);

n Governments fully waking up to

the opportunities that offshore wind

can provide, making offshore wind

truly global and increasing ambition

in mature and developing markets;

n Strong growth in large emerging

markets both onshore and offshore

from the middle of this decade.

In terms of the global onshore out-

look, the CAGR for onshore wind in

the next ve years is 12 per cent.

Expected average annual installa-

tions are 110 GW, with a total of 550

GW likely to be built in 2023–2027.

Growth in China, Europe and the

US will be the backbone of global

onshore wind development in the

next ve years. Altogether they are

expected to make up more than 80

per cent of total additional capacity

in 2023–2027. GWEC Market Intel-

ligence believes that China will be

the engine of near-term growth, ac-

counting for 62 per cent of new in-

stallations in 2023.

But installations will accelerate in

Europe, the US and emerging mar-

kets in Southeast Asia and Africa &

ME from 2025. Global onshore wind

markets will become more diversi-

ed by 2027 with half of the annual

growth coming from markets outside

of China.

Assessing the global offshore out-

look. GWEC nds that after a Y-o-Y

fall of 58 per cent in 2022, annual

offshore wind installations are ex-

pected to bounce back reaching 18

GW in 2023. The CAGR for offshore

wind in the next ve years is 32 per

cent. With such a promising growth

rate, new installations are likely to

double by 2027 from 2023 levels.

China and Europe will continue to

be the two key contributors to near-

term growth, making up more than

80 per cent of new additions in 2023

and 2024.

The US and emerging markets in

APAC will start gaining sizeable

market share from 2025 with 7-8

GW of new offshore wind expected

N

early 78 GW of wind power

capacity was added world-

wide last year, the lowest

level in the past three years but still

the third highest year in history, ac-

cording to the Global Wind Energy

Council’s (GWEC) latest report on

the sector. This was achieved despite

a challenging economic environment

and a disrupted global supply chain,

compounded by global health and

energy crises.

Commenting on the latest instal-

ment of the annual report, titled

‘Global Wind Report 2023’, Ben

Backwell, GWEC’s CEO said: “The

coming years will mark a crucial

transition period for the global wind

industry. Later this year, wind energy

will reach the historic milestone of 1

TW of installed capacity. It has taken

us around 40 years to get here. How-

ever, the next TW will take less than

a decade.”

Globally, 77.6 GW of new wind

power capacity was connected to

power grids in 2022, bringing total

installed wind generating capacity to

906 GW, a year-on-year (YoY)

growth of 9 per cent.

The onshore wind market added

68.8 GW worldwide last year, with

China contributing 52 per cent. Ad-

ditions were 5 per cent lower than

the previous year. The slowdown in

Latin America, Africa & the Middle

East is partly responsible for the de-

cline, but the primary reason, says

GWEC, was falling installations in

the US.

Despite nishing the year with a

strong nal quarter, the US wind in-

dustry commissioned only 8.6 GW

of onshore wind capacity in 2022,

due in part to supply chain constraints

and grid interconnection issues.

Thanks to record installations in

Sweden, Finland and Poland – and

recovering installations in Germany

– Europe performed well in a volatile

2022, said the report. The bloc added

a record 16.7 GW of onshore wind

capacity, bringing its market share

up to 24 per cent. Onshore wind ad-

ditions in North America last year

fell by 28 per cent while new addi-

tions in Asia-Pacic (APAC) re-

mained constant, but the three re-

gions combined still made up 92 per

cent of global onshore wind installa-

tions in 2022.

GWEC noted that 8.8 GW of new

offshore wind was fed into the grid

last year, bringing total global off-

shore wind capacity to 64.3 GW by

the end of 2022. New additions were

58 per cent lower than the “bumper”

year of 2021 but still made 2022 the

second highest year in history for

offshore wind installations.

China continued to lead global

offshore wind development, al-

though its new installations dropped

to 5 GW from 21 GW in 2021 – a

record year driven by the end of the

feed-in tariff (FiT). Two other mar-

kets reported new offshore wind in-

stallations in APAC last year: Taiwan

(1175 MW) and Japan (84 MW). No

intertidal (nearshore) wind projects

achieved commercial operation in

Vietnam in 2022, due to the ceiling

price to be used by Vietnam Electric-

ity (EVN) to negotiate power pur-

chase agreements (PPAs) with inves-

tors for their renewable projects

missing until January 2023.

Europe connected the remaining

2.5 GW of capacity in 2022, with

France and Italy each commission-

ing their rst commercial offshore

wind projects. Despite the rate of

installations last year being the low-

est since 2016, Europe’s total off-

shore wind capacity reached 30 GW,

46 per cent of which is from the UK.

With its total installed offshore

wind capacity reaching 34 GW in

APAC, in 2022 Europe lost its top

position as the world’s largest off-

shore wind market but continues to

lead the way with oating wind.

to be added every year over the rest

of the forecast period.

In total, 130 GW of offshore wind

is expected to be added worldwide in

2023–2027, with expected average

annual installations of nearly 26 GW.

Beyond 2027, GWEC expects the

growth momentum to continue.

Global commitments to net zero,

coupled with growing energy secu-

rity concerns, have already brought

the urgency of deploying renewables

to the top of the political agenda.

“The energy and climate policies

now being pursued by the world’s

largest economies in both the ‘West’

and the ‘Global South’ point to a

whole new level of ambition and

support for wind energy and renew-

ables, said Backwell. “These policies

are likely to take us to 2 TW of in-

stalled wind energy by the end of

2030.”

He added: “These policies are the

consequence of growing urgency in

the ght against dangerous global

heating; prolonged high fossil fuel

prices and the impact of fossil fuel

dependence on security; and the suc-

cess of our industry in scaling up and

establishing wind as one of the most

cost-competitive and reliable power

sources in the world.”

While the industry pushed through

the new level of 100 GW of annual

installations in 2021, the last few

years have not been without their

challenges. Many of the manufactur-

ers at the heart of the industry have

seen mounting nancial losses

caused by ‘race to the bottom’ pric-

ing, as a result of what GWEC de-

scribes as “misguided government

policies” around procurement and

off-take arrangements, exacerbated

by higher ination and logistics

costs.

Meanwhile, wind projects have

been delayed or stalled by inadequate

and inefcient permitting and licens-

ing rules, from Denmark to India to

Japan and beyond.

“This,” said GWEC, “has created

the bizarre paradox of energy mar-

kets rewarding fossil fuel companies

with record prots, while renewable

energy companies have struggled to

break-even.

“As this report shows, while com-

panies have regrouped to adapt to the

new inationary pressures, the mar-

ket has stalled, and the industry in-

stalled only 77.6 GW in 2022,” it

stated.

All this has come at a time when

policymakers are racing to address

the energy and climate crises by

dramatically increasing their targets

for wind energy across the world.

Backwell believes, however that

the situation is about to change and

2023 will mark the start of a decisive

turnaround. He noted that govern-

ments of all the major industrialised

nations have enacted policies that

will result in a signicant accelera-

tion of deployment.

Nevertheless, he says much more is

needed, and fast. He concluded:

“The wind industry will need to

forge new partnerships with govern-

ments, cities, communities, investors

and customers in order to enable the

next era of growth. Working together,

we can put into place the right poli-

cies, which will allow trillions of

dollars in investments to ow and the

creation of millions of jobs.”

THE ENERGY INDUSTRY TIMES - MAY 2023

Energy Outlook

14

The Global Wind

Energy Council’s

recent ‘Global

Wind Report 2023’

revealed that new

capacity additions

last year were the

lowest for three

years. But despite

the challenging

conditions, the sector

will add as much

capacity in the next

decade as it has over

the last 40 years.

TEI Times presents

a summary of the

report.

Wind power: building the

next terawatt

New installations outlook

2022-2026 (GW).

Source: GWEC, 2023

P

rogress towards the complete

decarbonisation of our energy

systems – the ultimate goal of

the energy transition – has seen a

whole new infrastructure to gener-

ate renewable energy gradually

spread out across the globe, with

developments faster in some places

than others.

A fundamental principle for elec-

tricity systems is that generation

must balance with demand across

all time periods, from micro-sec-

onds to hours and throughout sea-

sons. This doesn’t change when re-

newable energy sources are

integrated, but increasing the pro-

portion of variable renewable ener-

gy (VRE) in the mix introduces

some major new challenges.

As the proportion of renewables in

the energy mix increases, the impli-

cations for energy systems become

more acute. Their intermittent na-

ture increases the need for addition-

al power system exibility to avoid

blackouts, brownouts and other

power quality issues as more VRE

is introduced. Understanding how

the weather might behave, and how

this impacts generation potential is

a key part of almost all decisions

about renewable energy. Modelling

these impacts is not easy and be-

comes more signicant when you

factor in climate change. It follows

that the need to de-risk energy sup-

ply and climate investments, and in-

centivise funding requires informed,

persuasive, scenario-based and data-

driven modelling and insights.

As energy systems evolve, the pri-

mary challenge lies in managing the

differences between load and resid-

ual load, i.e., the difference between

forecasted load and the expected

electricity production from variable

renewable generation assets. In its

Status of Power System Transfor-

mation report the International En-

ergy Agency describes the various

levels of VRE penetration within

the energy transition, and the key

challenges associated with each.

In Phase 1, the percentage of VRE

is typically less than three per cent

of grid capacity. At such a low lev-

el, the availability, or unavailability,

of power generated from wind or

solar has no noticeable impact on

the system.

As the proportion of VRE in the

energy mix increases, the system

operator needs to react to changing

variability on multiple levels.

In Phase 2, where VRE typically

accounts for between three per cent

and 13 per cent of grid capacity and

has a minor to moderate impact on

system operation, challenges begin

to emerge as differences between

load and residual load become no-

ticeable at certain times. The oper-

ating patterns of legacy, fossil-fu-

elled generators start to be affected

by the input of VRE. The introduc-

tion of short-term forecasting (1-3

days ahead) for VRE generation

may be considered and transmission

system congestion constraints may

be encountered.

By Phase 3, the balance has shift-

ed and VRE now determines the op-

erational patterns of the overall

power system. Typically, this is ex-

pected when the proportion of VRE

reaches between 13 per cent and 25

per cent of total production. Dis-

patchable generators must now be

deployed more dynamically, and

system operators have to manage

new power ow patterns. There

may be a need to implement sub-

minute responses and increase fore-

casting capabilities from daily to

hourly, or even 10-minute intervals,

to maintain balance between de-

mand and supply and prevent out-

ages or power quality issues.

Given the intermittent nature of

renewables, a common concern is

ensuring sufcient backup genera-

tion to meet demand when weather

conditions are unfavourable. But by

Phase 3, and beyond, the opposite

challenge emerges when more pow-

er is produced than is required at

certain times. This also needs to be

managed, and so additional levers

such as curtailment, demand re-

sponse and energy storage must be

considered.

By Phase 4, VRE provides the

majority of electricity generation

during sustained periods. This typi-

cally requires advanced technical

solutions to ensure system stability.

Other changes will also be required

in operational and regulatory ap-

proaches e.g., to allow VRE to pro-

vide system services.

By Phase 5 there are sustained pe-

riods of excess generation from

VRE. Excess output will need to be

curtailed, stored or used in areas

that are not currently electried

such as transport or heating.

Once an energy system reaches

Phase 6, seasonal imbalances can

occur that will exceed the scale of

response available from demand

side and electricity storage mea-

sures. Phase 6 is therefore likely to

require measures such as the con-

version of electricity into chemical

form, such as hydrogen.

While the principles for operating

coal or diesel red generation plants

are pretty much the same all over

the globe, the availability and char-

acteristics of VRE resources vary

widely, as will the energy systems

that rely on them. The need to prop-

erly account for weather variability

and seasonality is crucial for plan-

ning, whether that’s for an individu-

al site, a portfolio of installations or

a complete system. This calls for

suitable datasets, models and tools.

The Institute for Environmental

Analytics, for example, has devel-

oped customised methods to merge

numerical weather models with sat-

ellite observations that make it pos-

sible to downscale wind, tempera-

ture and irradiance estimates to a

1km spatial resolution and 10-min-

ute time-step.

Once the expected resource has

been quantied, power yields and

levelised costs can be estimated.

This can be done at varying levels

of detail, using standard formulae

and manufacturers’ specications.

As a renewable energy project pro-

gresses from pre-feasibility into fea-

sibility and eventually to detailed

design, increasingly specic details

are required to reduce uncertainties,

prove viability and make the nan-

cial case. Again, this needs the ap-

propriate data, modelling tech-

niques and technology to

accomplish successfully.

Increasing the proportion of VRE

in the energy mix makes accurately

forecasting expected production

even more important. Current best

practice involves running a combi-

nation of forecasting techniques up

to the event. For example, if you are

forecasting power production at

10:00 am on a given day, numerical

weather prediction models provide

sufcient forecasting skill up to 24

hours ahead.

From 24 hours up to one hour be-

fore the event, the best forecasting

skill for solar comes from using sat-

ellite observations to predict the

movement of cloud using a technique

known as Cloud Motion Vectors.

From one hour before, and up to

the event, the best forecasting skill

comes from statistical models com-

bining forecasting methods with on-

site observations from sky cameras,

anemometers, and on-site power

production.

Combining these prediction meth-

ods can give valuable data to the

system operator and help the site

owner schedule planned mainte-

nance at times of low- or no-genera-

tion, to minimise costs, optimise

revenues and maximise CO

2

emis-

sion reduction.

As with all VRE estimates, the ac-

curacy of the forecast is likely to be

localised, dependent on weather re-

gimes, and potentially variable. In

stable conditions forecasting accu-

racy could be very close to 100 per

cent, but in intermittent conditions

accuracy can drop signicantly.

Modelling future mixes of energy

generation across a range of times-

cales helps produce effective gener-

ation proles. This level of model-

ling involves navigating through

large, high-resolution time-series

data to nd typical and extreme

conditions and calls for signicant

modelling power.

Understanding variability across

multiple timescales provides the

key to understanding likely weather

behaviour and the potential for, and

impact on, renewable energy gener-

ation. Variability between years and

months is important for feasibility

analysis, planning and design activ-

ities. Understanding variation on a

daily, hourly, minute or even sec-

ond-by-second basis is crucial for

making operational decisions to

manage the grid.

For a solar plant, overcast condi-

tions will maximise the need for

dispatchable generation to compen-

sate for the lack of VRE. Highly in-

termittent generation must be bal-

anced either by storage or exible

dispatchable generation. Clear sky

conditions will minimise the need

for dispatchable generation.

At times of excess generation

from wind or solar, the system oper-

ator may need to curtail energy pro-

duction, store energy in batteries,

increase demand – for example, en-

courage EV charging or industrial

consumption – or convert it into a

fuel such as hydrogen.

A tool that enables generation pro-

les to be visualised with increasing

granularity shows how signicant

short-term variability can be on any

given day. At an individual site, up

to 80 per cent of solar generation

can be lost in as little as 30 seconds

as clouds obscure the sun. Manag-

ing the power system at all levels is

critical.

Robust weather behaviour model-

ling shows the impact on power

generation of different weather con-

ditions – both typical and extreme.

It is this modelling that informs the

strategies that governments, opera-

tors, generators and investors will

need to adopt to ensure a stable, ef-

cient and economically sound re-

newable energy system.

It is important to appreciate that

every case is different. From sce-

nario analysis to project design

through to operational energy gen-

eration, models must be customised

to the relevant specics to highlight

and quantify the uncertainty and

limitations.

Effective decision-making around

renewable energy production calls

for a tool that enables quick evalua-

tion of multiple different generation

scenarios to plan effectively for a

successful energy transition.

The Institute for Environmental

Analytics has developed Energy-

Metric, a web-based application to

enable efcient development of

modelled scenarios to inform deci-

sion-making for prospecting, pre-

feasibility and feasibility analyses.

The application is designed to help

planners and investors create and

explore potential future VRE gener-

ation scenarios as power systems

evolve through transition phases.

Alan Yates is Head of Energy

Applications at the Institute for

Environmental Analytics.

Assessing the

nancial and

operational viability

of renewable energy

developments calls

for data-driven

decisions that are

based on robust,

reliable modelling.

The Institute for

Environmental

Analytics’

Alan Yates

describes how

data-driven energy

modelling helps with

planning effective

strategies for

renewable power

production.

Modelling weather impact

Modelling weather impact

for renewable energy

for renewable energy

generation

generation

THE ENERGY INDUSTRY TIMES - MAY 2023

15

Technology Focus

Yates: Robust weather

behaviour modelling

shows the impact on power

generation of different weather

conditions – both typical and

extreme

THE ENERGY INDUSTRY TIMES - MAY 2023

16

Final Word

W

ith the condemnation of

Russia’s “illegal, unjusti-

able, and unprovoked war

of aggression against Ukraine” out of

the way, it was time for the G7 Minis-

ters of Climate, Energy and the Envi-

ronment to get down to the business

of tackling the unprecedented twin

challenge of climate change and en-

ergy security. Yet after two days of

difcult talks in Japan last month,

which led to some signicant agree-

ments, questions remain as to whether

the Group of Seven wealthy nations

achieved the level of consensus need-

ed to address the task at hand.

In its communiqué issued after the

meeting in Sapporo, the G7 (consist-

ing of Canada, France, Germany, Ita-

ly, Japan, the UK and the US) set big

new collective targets for solar power

and offshore wind capacity. The

members pledged to collectively in-

crease offshore wind capacity by 150

GW by 2030, based on each country’s

existing targets, and solar capacity to

more than 1 TW.

The G7 ministers also committed to

promoting improvement in innovative

technologies such as oating wind and

stated that the G7 would ask the Inter-

national Renewable Energy Agency

(IRENA) to prepare an analysis on

innovation and sustainability of oat-

ing offshore wind.

“We will accelerate the deployment

of renewable energies such as solar,

onshore/offshore wind, hydropower,

geothermal, sustainable biomass,

biomethane, tidal using modern

technologies, as well as investing in

the development and deployment of

next-generation technologies and de-

veloping secure, sustainable and resil-

ient supply chains,” the communiqué

stated.

US Secretary of Energy Jennifer M.

Granholm, who served as the Head of

Delegation for the Energy Track of the

meeting, said it delivered “a strong

message that the G7 remains in lock

step” on the most pressing global en-

ergy and climate challenges.

“This document sends an important

signal to the rest of the world – from

other governments, to industry, to

civil society – that G7 nations are

mobilising to accelerate the decar-

bonisation and diversication of our

energy sources.”

The hope is that the agreements will

pave the way for similar commitments

from other major economies in forums

like the G20 and the UNFCC’s COP28

Climate Change summit, and form a

basis for agreements on environment

and energy at the upcoming G7 Lead-

ers’ Summit to be held in Hiroshima

from May 19-21.

Yet paving the way will be difcult

when there is already disagreement

within the ranks on how to get to the

nal destination. As the host country,

Japan was expected to lead in the

discussion on accelerating climate

change measures, yet was reluctant to

specify a date for the phase-out of coal

red power generation.

In addition to speeding up renew-

able energy development, the G7 also

pledged to move toward a quicker

phase-out of fossil fuels, commit-

ting “to accelerate the phase-out of

unabated fossil fuels in order to

achieve net zero in energy systems by

2050”.

However, it stopped short of endors-

ing a 2030 deadline for phasing out

coal, which Canada and other mem-

bers had pushed for, and left the door

open for continued investment in gas,

saying that sector could help address

potential energy shortfalls.

Canada was clear that unabated coal

red power should be phased out by

2030, and other members, including

the UK and France committed to that

date, Canada’s minister of natural re-

sources, Jonathan Wilkinson, told

Reuters.

“Others are still trying to gure out

how they could get there within their

relevant timeframe,” Wilkinson said.

“We are trying to nd ways (for) some

who are more coal-dependent than

others to nd technical pathways how

to do that,” he said.

Japanese Industry Minister Yasu-

toshi Nishimura told a news confer-

ence: “In the midst of an unprecedent-

ed energy crisis, it’s important to come

up with measures to tackle climate

change and promote energy security

at the same time.

“While acknowledging that there are

diverse pathways to achieve carbon

neutral, we agreed on the importance

of aiming for a common goal toward

2050.”

Japan’s pushback on fossil fuels is

understandable, even if its desired path

forward is questionable. The country

depends on fossil fuel imports for

nearly all its energy needs.

Having experienced oil crises in the

1970s, it reduced its dependency on

fossil fuels to a certain extent but since

the Great East Japan Earthquake in

2011, thermal power generation has

increased, with dependency on fossil

fuels in FY2019 being 84.8 per cent,

according to METI (Ministry of

Economy, Trade and Industry). Inter-

national Energy Agency (IEA) gures

show that in 2019, fossil fuels ac-

counted for 88 per cent of total pri-

mary energy supply – the sixth

highest share among IEA countries.

The country is therefore looking at

ways to keep its coal red plants

running by co-ring hydrogen and

ammonia for power generation – a

strategy not endorsed by the G7 in the

agreement, as it has little impact on

emission reductions and is not con-

sistent with a 1.5°C pathway. The

government also wants to keep lique-

ed natural gas (LNG) as a transition

fuel for at least 10 to 15 years.

With the recent IPCC report reiterat-

ing the critical climate situation, envi-

ronmental groups were understand-

ably less than impressed with Japan’s

stance.

Climate Action Network Japan

(CAN-Japan) said: “As the host

country, Japan should not be focusing

on building consensus around reliance

on new technologies to prolong the life

of fossil fuels. We expect Japan to lead

the discussion on what should be done

in this critically important decade to

achieve the 1.5°C target of the Paris

Agreement, and to provide a concrete

roadmap for a phase-out of fossil fuels

and a just transition to renewable en-

ergy, including setting a date for the

phase-out of coal red power genera-

tion in line with the Paris 1.5°C target.”

Masayoshi Iyoda, Interim Team

Lead, 350.org Japan, added: “The G7

Sapporo Ministerial Meeting agree-

ment on numerical targets for the in-

troduction of solar and wind power as

a means to achieve the Paris 1.5°C

goal, is a step forward. However, it is

not a sufcient response to the ur-

gency of the climate crisis. The list of

unsettled technologies such as green-

washed ammonia/hydrogen co-ring

with fossil fuels, CCS (carbon capture

and storage)/CCUS (carbon capture,

utilisation and storage)/DACCS (Di-

rect Air Capture with Carbon Storage),

as well as risky nuclear power, obscure

the top priority for maximising energy

efciency and a just transition to 100

per cent renewable energy solutions.”

These are valid criticisms and hope-

fully will help stimulate Japan’s

edgling offshore wind programme.

Despite having 34 000 km of coastline

and being among the rst markets in

Asia to examine the sector’s potential,

the country’s rst offshore wind

project only began operating in Janu-

ary. According to Wood Mackenzie,

its second offshore wind tender is

expected to close in June.

Commenting on the communiqué,

Dave Jones, head of data insights at

energy think-tank Ember, said:

“Hopefully this will provide a chal-

lenge to Japan, for which offshore

wind is the missing part of the jigsaw

that could see its power sector decar-

bonise much quicker than it thought

possible.”

So perhaps one of the most important

outcomes of the meeting is that there

is clear consensus that climate change

and energy security go hand-in-hand.

“Initially people thought that climate

action and action on energy security

potentially were in conict. But dis-

cussions which we had and which are

reected in the communiqué are that

they actually work together,” said

Wilkinson

Stressing this message is key, as

Japan and other G7 members respond

to criticism that they are backtracking

on climate targets following the

Ukraine crisis.

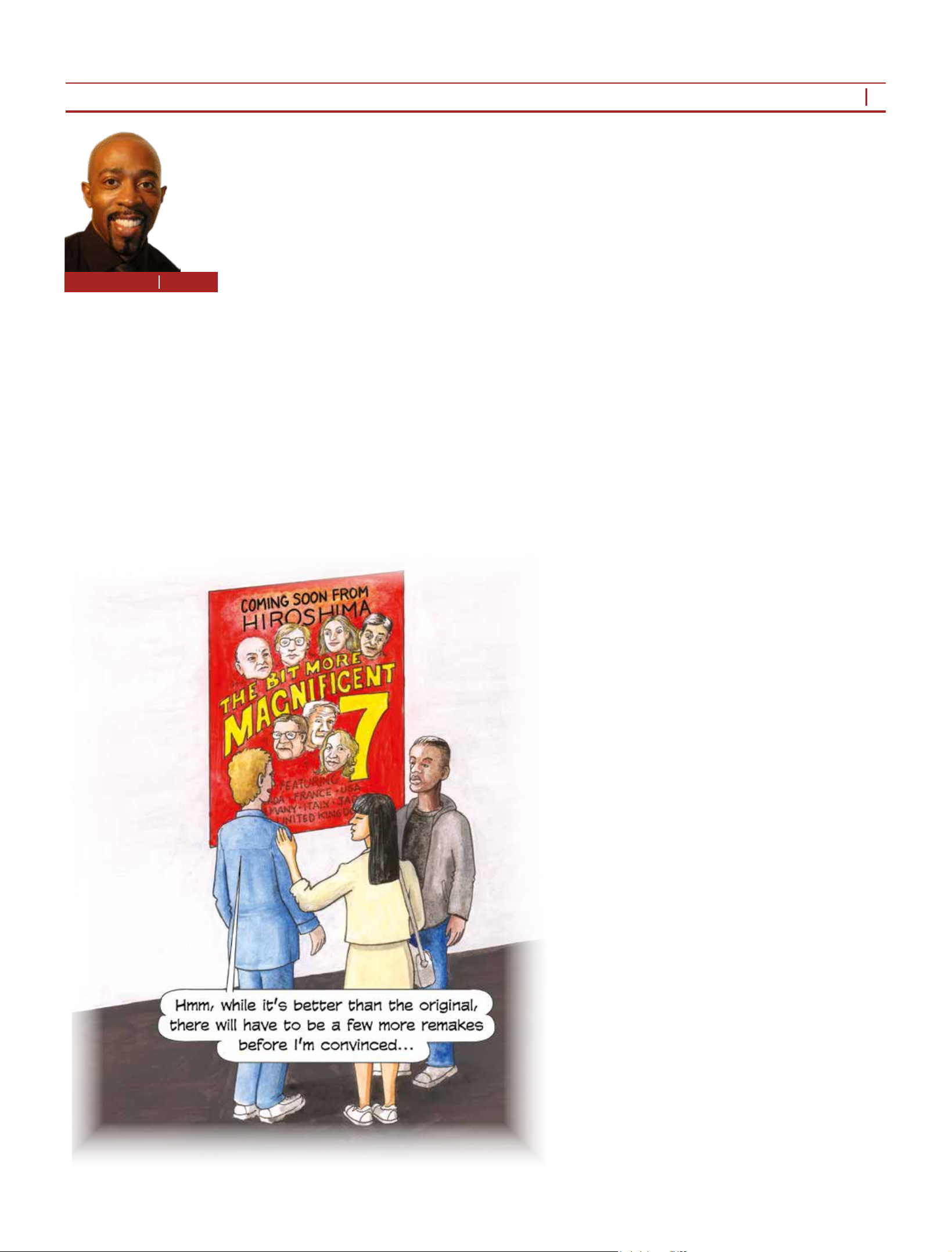

At the upcoming G7 Hiroshima

Summit, a more ambitious agreement

is required for the G7 to lead the

global effort to achieve the 1.5°C

target of the Paris Agreement. But to

have any chance of instilling con-

dence in that small ‘Mexican village’

called planet Earth that they can lead

the ght on climate change, the G7

will have to be a bit more magnicent.

The not so

Magnicent Seven?

Junior Isles

Cartoon: jemsoar.com