www.teitimes.com

March 2023 • Volume 16 • No 1 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Carbon necessity

V2G decarbonisation

It is often forgotten that the

production of hydrogen-

based fuels requires

carbon. Page 13

Vehicle-to-grid technology is set to enter the

fray in the battle to decarbonise.

Page 14

News In Brief

EU seeks to boost

competitiveness through

Green Industrial Plan

The European Commission has out-

lined its Green Deal Industrial Plan

in a move to enhance the competi-

tiveness of Europe’s net zero indus-

try and support the fast transition to

climate neutrality.

Page 2

Small modular reactors

move towards deployment

Small modular nuclear reactors

(SMRs) are set for deployment at

two sites in Canada and the USA,

which could kick-off orders from

other customers.

Page 4

Renewables lose

competitive edge in Asia

Pacic

The levelised costs of electricity

(LCOE) for utility solar and onshore

wind in Asia Pacic have increased

since 2020 with the rise in equip-

ment and construction costs as well

as interest rates.

Page 6

Europe concerns over

maintaining offshore wind

momentum

The Danish government has

shocked the offshore wind industry

by announcing a hold on its so-

called ‘open door’ development

procedure.

Page 7

Days of windfall prots

could be numbered

Centrica, bp and Equinor are the lat-

est companies to follow Shell in

reporting extraordinary prots.

Some argue, however, that the good

times are unlikely to last.

Page 9

Technology Focus: New

carbon capture technology

can cut costs

A new process hailed as the next

generation in carbon capture tech-

nology has been demonstrated. The

novel process has the potential to

cut costs and extend the breadth of

applications for the technology.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

With most new electricity demand set to be met by renewables and nuclear, the International

Energy Agency says carbon emissions from the sector could be close to a tipping point. The

report comes, however, as bp warns that the transition away from fossil fuels also needs to

take account of the security and affordability of energy. Junior Isles

Ministers discuss coordinated actions to limit impact

of energy crisis on natural gas markets

THE ENERGY INDUSTRY

TIMES

Final Word

Don’t get mad;

get even, says

Junior Isles. Page 16

Signicant rises in future carbon emis-

sions from electricity generation are

unlikely, suggesting the world is close

to a tipping point for power sector emis-

sions, according to the International

Energy Agency (IEA).

In a new report, the Paris-based

agency said renewables are set to

dominate the growth of the world’s

electricity supply over the next three

years and, together with nuclear pow-

er, will meet the vast majority of the

increase in global demand through to

2025.

The IEA’s Electricity Market Report

2023 nds that the growth in world

electricity demand is expected to ac-

celerate to an average of 3 per cent

over the next three years, after slow-

ing slightly last year to 2 per cent amid

the turmoil of the global energy crisis

and exceptional weather conditions in

some regions. Renewables and nucle-

ar power, however, are expected to

meet more than 90 per cent of the ad-

ditional demand.

Electricity generation from the burn-

ing of fossil fuels is one of the most

signicant contributors to the green-

house gas emissions driving climate

change.

“The world’s growing demand for

electricity is set to accelerate, adding

more than double Japan’s current

electricity consumption over the next

three years,” said IEA Executive Di-

rector Fatih Birol. “The good news is

that renewables and nuclear power are

growing quickly enough to meet al-

most all this additional appetite, sug-

gesting we are close to a tipping point

for power sector emissions. Govern-

ments now need to enable low-emis-

sions sources to grow even faster and

drive down emissions so that the

world can ensure secure electricity

supplies while reaching climate

goals.”

Keisuke Sadamori, Director of the

Ofce for Energy Security at the IEA,

added: “CO

2

intensity of the world’s

power generation declined in 2022

and will continue to decrease as the

share of renewables increases and the

share of coal and gas red generation

falls.”

The IEA says strong growth of re-

newables means their share of the

global power generation mix is fore-

cast to rise from 29 per cent in 2022 to

35 per cent in 2025. Separately, a new

report from BloombergNEF nds that

global investment in the low-carbon

energy transition totalled $1.1 trillion

in 2022 – a new record and a huge ac-

celeration from the year before.

However, despite almost all new

generation coming from renewables,

forecasts show more still needs to be

done to accelerate emissions cuts.

Commenting on what more can be

done, Sadamori said: “To see a decline

in CO

2

emissions, we need to acceler-

ate the energy transition much faster.

This means stronger policy interven-

tions. First we need to accelerate in-

vestments in energy efciency

through government support, as this

will lead to smaller requirements for

new electricity capacity. We also need

to accelerate renewables; we need to

use all measures available to increase

low carbon energy, including sources

like nuclear and hydropower.”

The IEA report came shortly after bp

released its ‘Energy Outlook 2023’,

Continued on Page 2

Forty governments met last month at

a Special IEA Ministerial meeting on

natural gas markets and supply secu-

rity to discuss additional ways to

limit the impacts from the global en-

ergy crisis triggered by Russia’s inva-

sion of Ukraine and propose measures

to support affected countries.

The virtual meeting of countries

representing half of global gas de-

mand also reviewed how such mea-

sures can contribute to momentum

on clean energy transitions world-

wide in line with the goal of limiting

the rise in global temperatures to

1.5°C.

In a statement, ministers said they

reached an agreement on the need to

“coordinate response efforts” in order

to mitigate the risks of Russia using

energy “as a weapon of political co-

ercion”. There was acknowledgment

that short-term measures such as the

additional capacity in liqueed natu-

ral gas (LNG) had eased supply con-

cerns. But a range of factors mean

that uncertainty is likely to persist

into 2023.

Measures to strengthen energy se-

curity were therefore welcomed by

all the ministers. These include ef-

forts to improve energy efciency

rapidly, speed up the deployment of

renewables, and carry out targeted

upgrades to grid infrastructure. In

addition, coordinated actions are be-

ing prepared to support an orderly

gas storage lling season in the

Northern Hemisphere.

The meeting was held as the bench-

mark gas price in February fell below

€50/MWh for the rst time in almost

18 months, down to €48.90/MWh, as

traders report growing condence

that European countries will avoid

shortages this winter and next. The

gas benchmark peaked at more than

€300/MWh in August 2022.

According to Moody’s, companies’

resilience, mild weather and policy

effectiveness (to replace Russian

gas) have been key to keeping the

energy situation safe. It estimates

that policy effectiveness and compa-

nies’ resilience contributed to around

75 per cent of the improvement in the

energy situation in 2022. European

gas storage at the end of 2022 stood

at 82 per cent (around the highest

level since 2015).

Moody’s warned, however, that en-

ergy supply in the winter of 2023-24

will be tight since Russian gas ows

will be, at best, around 20 per cent of

2022 energy ows assuming no fur-

ther cuts.

A new report by energy and sus-

tainability consultancy Advantage

Utilities, said the UK and the rest of

Europe may never return to its reli-

ance on Russian gas and oil thanks to

increased global imports of LNG,

new LNG terminals as well as stor-

age coming online. Greener options

such as solar, wind and hydro have

also aided in this transition, it said.

Power sector set for

Power sector set for

2025 ‘tipping point’ on

2025 ‘tipping point’ on

emissions, says IEA

emissions, says IEA

The IEA’s Keisuke Sadamori says CO

The IEA’s Keisuke Sadamori says CO

2

2

intensity will continue to decrease

intensity will continue to decrease

THE ENERGY INDUSTRY TIMES - MARCH 2023

2

Junior Isles

The European Commission has out-

lined its Green Deal Industrial Plan in

a move to enhance the competitiveness

of Europe’s net zero industry and sup-

port the fast transition to climate neu-

trality. The move comes as pressure

mounts on the bloc to respond to the

US Ination Reduction Act (IRA)

launched by US President Joe Biden

in August last year.

The Plan aims to provide a more

supportive environment for the scal-

ing up of the EU’s manufacturing

capacity for the net zero technologies

and products required to meet Eu-

rope’s ambitious climate targets. It

builds on previous initiatives and re-

lies on the strengths of the EU Single

Market, complementing ongoing ef-

forts under the European Green Deal

and REPowerEU.

The Plan is based on four pillars. The

rst pillar of the plan is about a simpler

regulatory framework. The Commis-

sion will propose a Net Zero Industry

Act to identify goals for net zero in-

dustrial capacity and provide a regula-

tory framework suited for its quick

deployment, ensuring simplied and

fast-track permitting, promoting Euro-

pean strategic projects, and developing

standards to support the scale-up of

technologies across the Single Market.

The second pillar will speed up in-

vestment and nancing for clean tech

production in Europe. Public nanc-

ing, in conjunction with further prog-

ress on the European Capital Markets

Union, can unlock the huge amounts

of private nancing required for the

green transition.

Under competition policy, the Com-

mission aims to guarantee a level play-

ing eld within the Single Market

while making it easier for the Member

States to grant necessary aid to fast-

track the green transition.

As between 35 per cent and 40 per

cent of all jobs could be affected by the

green transition, developing the skills

needed for well-paid quality jobs will

be a priority for the European Year of

Skills, and the third pillar of the plan

will focus on it.

The fourth pillar will be about global

cooperation and making trade work for

the green transition, under the princi-

ples of fair competition and open trade,

building on the engagements with the

EU’s partners and the work of the

World Trade Organization. To that end,

the Commission will continue to de-

velop the EU’s network of Free Trade

Agreements and other forms of coop-

eration with partners to support the

green transition.

The draft proposal stated Brussels

would aim to set up a European sover-

eignty fund by the middle of this year

to allow all 27 governments to fund

state aid.

The proposed measures, which have

yet to be nalised are part of a compre-

hensive Brussels plan to respond to the

US’ IRA legislation, which many Eu-

ropean leader say will lead to Euro-

pean companies shifting clean sector

investment from Europe to the US.

The Commission’s Executive Vice-

President for Competition Margrethe

Vestager said when combined with

stable, cheap energy prices in the US,

the IRA could have a “toxic” effect on

some European industries. Thierry

Breton, the EU commissioner for the

internal market accused the US of start-

ing a “subsidy race”.

More than $90 billion in green invest-

ment has poured into the US since last

year’s passage of the IRA, which pro-

vides $369 billion worth of tax credits,

grants and loans to boost renewable

energy and slash emissions.

In an interview with the Financial

Times, John Podesta, President

Biden’s senior clean energy adviser,

pushed back at criticism that the IRA

would divert investment and under-

mine the EU economy. He said Europe

must take responsibility for develop-

ing its own clean energy sector.

“We hope that the European indus-

trial base will succeed, but it’s up to

Europe to do some of the work,” he

said. “We’re not going to do that all for

them.”

which explores key trends and un-

certainties surrounding the energy

transition out to 2050.

The three main scenarios consid-

ered in the Outlook – Net Zero, Ac-

celerated, and New Momentum –

have been updated to take account

of two major developments over the

past year: the Russia-Ukraine war

and the passing of the Ination Re-

duction Act (IRA) in the US.

bp’s chief economist, Spencer

Dale, said: “Global energy polices

and discussions in recent years have

been focused on the importance of

decarbonising the energy system

and the transition to net zero. The

events of the past year have served

as a reminder to us all that the tran-

sition also needs to take account of

the security and affordability of

energy. Any successful and endur-

ing energy transition needs to ad-

dress all three elements of the so-

called energy trilemma: secure,

affordable and lower carbon.”

The Outlook stressed that “the

carbon budget is running out”, not-

ing that despite the marked increase

in government ambitions, CO

2

emissions have increased in every

year since the Paris COP in 2015

(with the exception of 2020). “The

longer the delay in taking decisive

action to reduce GHG emissions on

a sustained basis, the greater are the

likely resulting economic and social

costs,” it stated.

It also said government support

for the energy transition has in-

creased further in a number of coun-

tries, including the passing of the

IRA in the US. The scale of the

decarbonisation challenge, how-

ever, suggests greater support is

required, said the Outlook, includ-

ing policies to facilitate quicker

permitting and approval of low-

carbon energy and infrastructure.

The Outlook for natural gas going

forward appears uncertain. Accord-

ing to bp, its prospects depend on

the speed of the energy transition,

with increasing demand in emerg-

ing economies as they grow and

industrialise offset by the transition

to lower-carbon energy sources led

by the developed world.

“The recent energy shortages and

higher prices highlight the impor-

tance of the transition away from

hydrocarbons being orderly, such

that the demand for hydrocarbons

falls in line with available supplies.

Natural declines in existing produc-

tion sources means there needs to

be continuing upstream investment

in oil and natural gas over the next

30 years, including in Net Zero,” bp

stated.The IEA, meanwhile, noted

that sharp spikes in natural gas

prices amid the energy crisis have

fuelled soaring electricity prices in

some markets, particularly in Eu-

rope, prompting debate in policy

circles over reforms to power mar-

ket design.

According to the IEA, the Iberian

model has succeeded in lowering

electricity prices in Spain but, at

the same time, it has increased gas

consumption.

Continued from Page 1

The EU’s proposal for a Green Indus-

trial Plan has reinforced that hydrogen

is now a strategic technology for reach-

ing the EU’s net zero target by 2050.

Under the Plan, the Net Zero Industry

Act will establish concrete shared EU

objectives for hydrogen technology by

2030 and speed up permitting

processes,which will be vital for meet-

ing its targets.

According to Hydrogen Europe The

Temporary State Aid Crisis and Transi-

tion Framework are also “headed in the

right direction”, providing direct sup-

port for renewable hydrogen produc-

tion and storage, the use of renewable

hydrogen in industry, and the produc-

tion of electrolysers and related critical

raw materials.

Jorgo Chatzimarkakis, CEO of Hy-

drogen Europe, the European asso-

ciation representing the interest of the

hydrogen industry, said: “We very

much welcome President Ursula von

der Leyen’s announcement, which

reafrms what she said in Davos con-

rming hydrogen as a key strategic

technology in the energy transition.

We hope this type of support will be

extended to the entire hydrogen eco-

system.”

The proposal for the Green Indus-

trial Plan came as the European Com-

mission nally published the long-

awaited delegated act on additionality.

The denition is key for determining

compliance with the proposed targets

in the Renewable Energy Directive,

targets that would see the industry and

transport sectors progressively re-

place grey hydrogen with green hy-

drogen as well as creating new mar-

kets for the commodity.

It has taken over three years for the

European Commission to provide a

framework that denes renewable-

based hydrogen and hydrogen-based

fuels. Hydrogen Europe said the pro-

cess has been “lengthy and bumpy,

but the announcement is welcomed by

the hydrogen sector”, which has been

eagerly waiting for the rules to be set

so that companies can nalise invest-

ment decisions and business models.

Chatzimarkakis said: “A far-from-

perfect regulation is better than no

regulation at all. At last, there is clar-

ity for industry and investors and Eu-

rope can kick-start the renewable

hydrogen market.

“This comes at a critical time, with

the USA setting a very high bench-

mark with their Production Tax Cred-

its, offered under the Ination Reduc-

tion Act, attracting more and more

investments towards their clean hy-

drogen market’’.

This new regulation mandates that

renewable hydrogen be produced ex-

clusively with additional renewable

power plants, and that the hydrogen

only be produced during the hours that

the renewable energy asset is produc-

ing electricity (hourly temporal cor-

relation), and only in the area where

the renewable electricity asset is lo-

cated (geographical correlation).

These strict rules can be met but will

inevitably make green hydrogen proj-

ects more expensive and will limit its

expansion potential, reducing the

positive effects of economies of scale

and affecting Europe’s capacity to

achieve the goals set in REPowerEU.

The role of governments will be cru-

cial in supporting this sector and clos-

ing the price gap between renewable

and conventional hydrogen.

Early last month the EU also an-

nounced plans for a pilot EU auction

this autumn. The EU Innovation Fund

has committed an initial €800 million,

with the precise terms and conditions

of the auction expected to be an-

nounced in June.

The pilot is part of the bloc’s broader

Hydrogen Strategy – under which

green hydrogen has been cited as a key

priority for the EU to achieve the Eu-

ropean Green Deal.

Europe’s largest electricity and gas

companies have come together to

make proposals in relation to the up-

coming reform of the EU Electricity

Market Design.

The European Commission is ex-

pected to publish its proposal, which

comes in response to the energy crisis,

by March 14.

An open letter, published by Swe-

den’s Vattenfall AB and signed by

many of its European peers, states that

the planned reform of the market is a

“great opportunity” to foster invest-

ments in renewables and low-carbon

power, but warned that it should be

handled with caution in order to avoid

fragmentation of the internal energy

market.

The companies therefore say in the

letter that “certain elements should be

considered”, such as the need to prop-

erly assess a reform with a future-

proof design rather than “urging struc-

tural corrective measures that would

not deliver the expected outcomes”.

With regard to renewables and low-

carbon power generation, the compa-

nies believe that “long-term commit-

ments should be incentivised to

de-risk the investments and hedge

nal customers against price volatil-

ity”. They also pointed out regulatory

stability and long-term price signals

are essential.

Another area of concern is the need

for improved short-term markets.

Some initiatives given as examples

include ow-based day-ahead market

coupling, maximising cross-border

trade, and demand response participa-

tion in markets. The establishment of

grids to enable the green transition is

also crucial, they said.

Several of these recommendations

were echoed by Dutch-German grid

operator TenneT, which added in a

separate statement that market design

also needs to properly reect grid con-

straints and operational challenges to

ensure system resilience and efcient

use of infrastructure.

The energy companies’ letter also

warned that the exceptional emer-

gency measures adopted some months

ago by the European Council should

not be confused with structural market

reform.

Germany, Denmark, the Nether-

lands, Luxembourg, Finland, Lithu-

ania and Slovenia also distributed a

joint letter in which they position

themselves in favour of a mild reform

of the wholesale electricity market as

opposed to approaches such as that by

Spain. The countries said they believe

such approaches are much more ambi-

tious and interventionist.

Headline News

Hydrogen central to Green Deal Industrial Plan,

Hydrogen central to Green Deal Industrial Plan,

as EU adopts delegated act on additionality

as EU adopts delegated act on additionality

Industry players weigh-in ahead of EU proposal for electricity market reform

Industry players weigh-in ahead of EU proposal for electricity market reform

EU seeks to boost competitiveness

EU seeks to boost competitiveness

through Green Industrial Plan

through Green Industrial Plan

Dale says the transition needs

to address all three elements of

the energy trilemma

In an attempt to maintain competitiveness in the burgeoning clean energy sector, the EU

is proposing an industrial plan that will boost domestic manufacturing and stave-off the

growing shift of investment to the US. Junior Isles

THE ENERGY INDUSTRY TIMES - MARCH 2023

3

www.teitimes.com

THE ENERGY INDUSTRY

TIMES

subscribe today

The Energy Industry Times is the only publication that

covers global news related to the power and energy

sector in a newspaper style and format whose

uniqueness is recognised by our readers.

As a paid subsciber you will gain full access to our online

news desk.

You will also no longer have to wait for the printed edi-

tion; receive it by PDF “hot off the press” or download it

online.

To subscribe, email subscriptions@teitimes.com or visit

www.teitimes.com

To guarantee receiving your monthly copy of the award

winning newspaper, you need to subscribe today

www.investinginhydrogen.com

14-15 September 2023

QEII Centre, London, UK

A LEADING GLOBAL

PLATFORM UNITES THE FULL

HYDROGEN VALUE CHAIN.

Co-located with:

Brought To You by:

#RUKGOW23

The largest dedicated oshore

wind event in the UK is returning

to London. Don’t miss 6 streams

of content, 250+ expert speakers,

180+ exhibitors and so much more!

250+

SPEAKERS

GOW23 Advert 120x160mm.indd 1GOW23 Advert 120x160mm.indd 1 12/01/2023 08:5512/01/2023 08:55

THE ENERGY INDUSTRY TIMES - MARCH 2023

5

MED ENERGY

CONFERENCE & EXHIBITION

Reshaping the Energy Industry:

Action for Transition

23-25 May 2023

Ravenna, Italy

www.omc.it

FOUNDERS ASSOCIATED COMPANIES

ORGANISED BY

16.000

OMC ATTENDEES

1.000

DELEGATES

30

SPONSORS

25

SUPPORTING

ASSOCIATIONS

350

EXHIBITING

COMPANIES

SPACE REQUESTS exhibition@omc.it CONFERENCE ENQUIRIES conference@omc.it

formerly Powergen & Renewable Energyformerly Powergen & Renewable Energy

JIExpo Kemayoran,Jakarta-Indonesia

Indonesia’s Most Comprehensive International Trade Show forIndonesia’s Most Comprehensive International Trade Show for

SMART GRID & RENEWABLE ENERGYSMART GRID & RENEWABLE ENERGY

www.smartenergy-indonesia.comwww.smartenergy-indonesia.com

The 8

th

Indonesia International

Solar Power & PV Technologies

Exhibition 2023

REGISTER NOW

Renewable Origination &

Development Conference

17 May - 18 May 2023 | Chicago, IL

More Information:

Contact Ayis Panayi at

ayisp@marcusevanscy.com

9th

Power Plant Decommissioning

Operational Excellence

10-11 May 2023 | Atlanta (GA)

Novel techniques and strategies used

to overcome regulatory hurdles,

mitigate costs, find funding, earn

revenue and decommission a plant

safely

REGISTER NOW

W

ith the discussion about

green hydrogen (H

2

) gain-

ing momentum over the

past couple of years, the question

also arises as to how we can cover

the huge amounts of hydrogen need-

ed to decarbonise various industrial

sectors in the future. This question

is posed too in the context of the

IEA’s prediction that, already by

2030, worldwide hydrogen demand

will reach around 180 million tons.

To cover this huge hunger for

green hydrogen, an increasing num-

ber of proposals suggest producing

hydrogen in sunny regions such as

the Saharan countries or Australia.

Similarly, regions blessed with con-

sistent wind conditions, such as the

Patagonian region in the South of

Chile and Argentina, come into

play. In these areas, the conditions

for renewable energy production –

the inevitable prerequisite for green

hydrogen – are eminently favour-

able in that they deliver affordable

green energy and, consequently, sig-

nicantly reduce the cost of green

hydrogen.

But how to bring this economical-

ly-produced green hydrogen to

those world regions where the ener-

gy need is greatest? The remoteness

of these potential, new hydrogen

hubs make pipelines impracticable,

while transporting hydrogen by ship

is technically complicated owing to

both its low volumetric energy-den-

sity and high fugacity. A much easi-

er solution would be to further con-

vert the hydrogen, with the help of

power-to-X technology, into syn-

thetic fuels such as synthetic natural

gas (SNG) or methanol with both

fuels then easily transportable using

current infrastructure. As an exam-

ple, SNG is more or less pure meth-

ane and, thus, existing LNG infra-

structure can be used for its

transportation. The same situation

applies to methanol, which is al-

ready traded worldwide as a stan-

dard chemical. Of course, other

transport media like ammonia and

LOHC (Liquid Organic Hydrogen

Carrier) are available as well, and

we expect to see a broad mix of me-

dia being established over the next

decade.

Upon transportation to Europe,

such fuels could then either be con-

verted back to green hydrogen or

used directly as climate-neutral fu-

els. For example, SNG can already

power today’s gas-engine power

plants and ‘green’ them without sig-

nicant technical adjustment. Simi-

larly, methanol-running engines for

power plants are also a viable pros-

pect. Additionally, such synthetic

fuels are also urgently required to

decarbonise sectors such as ship-

ping, aviation and the chemical in-

dustry where new markets with new

off-takers are imminent.

But what is often left out of the

hydrogen discussion, is that the pro-

duction of these fuels requires an-

other raw material, namely carbon.

An example: to produce 4 kg of

SNG requires 1 kg of green hydro-

gen and nearly 11 kg of carbon di-

oxide (CO

2)

.

This makes the discussion ambig-

uous: on the one hand, we need to

reduce carbon emissions as much as

possible to prevent global warming,

but on the other hand carbon is

needed as a raw material to produce

the synthetic fuels urgently required

to reduce emissions from sectors

that cannot be directly electried,

including the aforementioned ship-

ping, aviation and chemical industry

sectors.

Therefore, the discussion must be

broadened. Besides green-hydrogen

strategies – which are currently ad-

opted by many governments world-

wide – there has to be discussion

around carbon management and

both views must be reconciled. The

main question then becomes how to

supply enough carbon for synthetic-

fuel production in the future without

causing harmful emissions to the

atmosphere.

The answer mainly lies in carbon-

capture technology. This facilitates

the capture of inevitable carbon

emissions, for example those from

industrial processes, preventing

them from entering the atmosphere.

A look at the cement industry, re-

sponsible for 8 per cent of world-

wide CO

2

emissions, shows that

two-thirds of these emissions are

caused by the process and thus can-

not be reduced by using a climate-

neutral energy source. Accordingly,

such ‘hard-to-abate’ industries ur-

gently need carbon-capture technol-

ogy to reduce their harmful atmo-

spheric emissions.

What happens to the captured car-

bon afterwards? Certain countries,

such as Norway, the Netherlands

and Canada, send it underground –

mostly to exploited gas elds – for

storage, a process called Carbon

Capture and Storage (CCS). But

you can also take the idea further

and bring this captured carbon back

into the cycle for use in synthetic-

fuel production, called Carbon Cap-

ture and Utilisation (CCU). The vi-

sion is to create a circular system

where carbon is captured, transport-

ed, stored and re-used – for example

in synthetic-fuel production.

For some, this may seem like a

bold vision but the carbon-capture

technology is already proven and in

use in various projects globally. As

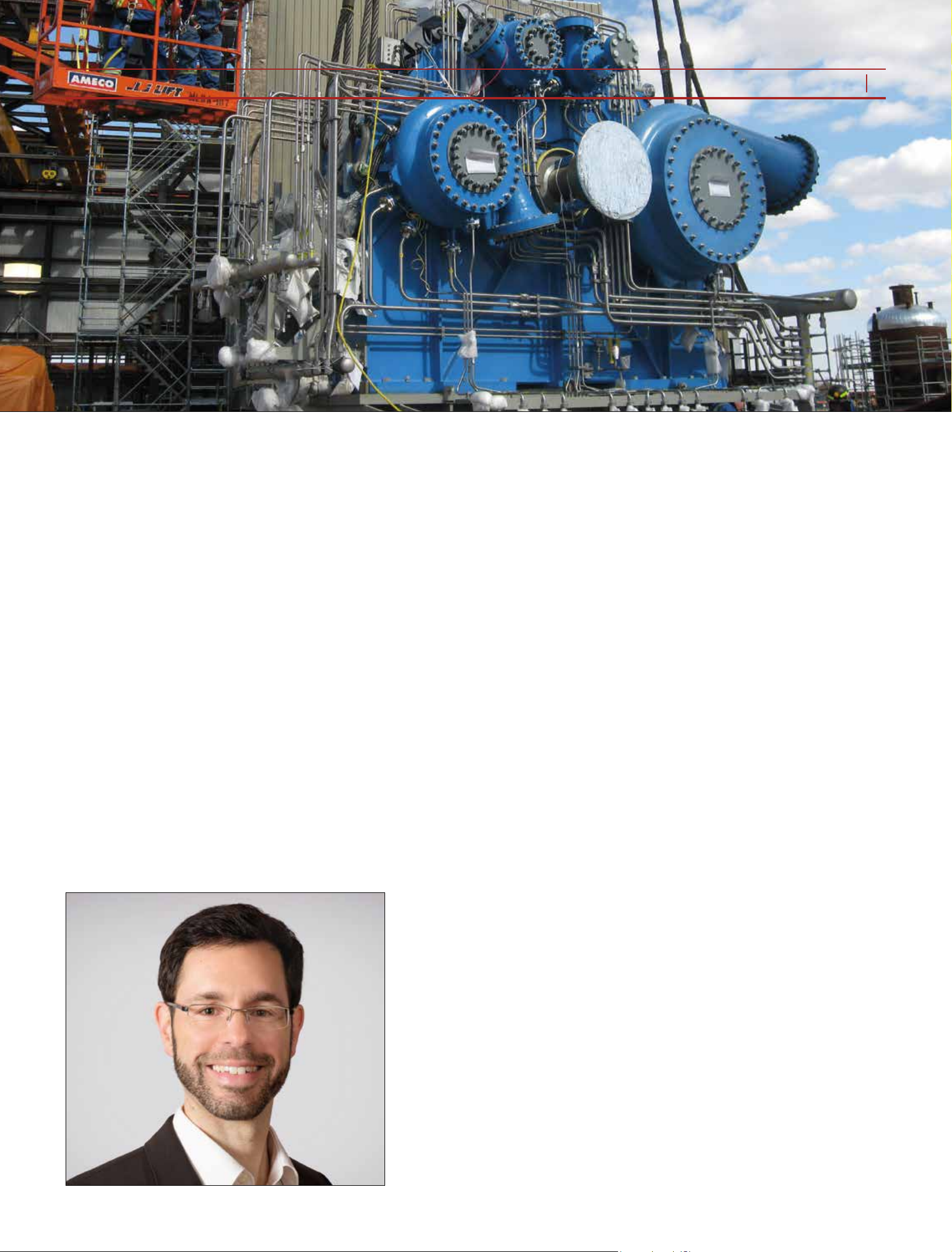

an example, MAN Energy Solutions

compressors are already used in

more than 20 carbon capture projects

worldwide. Currently, the world’s

rst large-scale carbon capture plant

for the cement industry is under con-

struction for Heidelberg Materials in

Brevik, Norway, which will help re-

duce emissions from the cement

plant by around 50 per cent or 400

000 t CO

2

annually.

While the current projects in Nor-

way, the Netherlands and Canada –

and, following the US Ination Re-

duction Act, carbon capture

technologies are also building mo-

mentum there – show that the tech-

nology is already available and ma-

ture, unfortunately carbon capture is

often viewed as just standalone

technology and not connected to a

broader picture. However, there is

no doubt that carbon capture has not

only the potential to reduce inevita-

ble emissions from hard-to-abate in-

dustries, but also has the ability to

supply enough carbon as a raw ma-

terial to produce the huge amounts

of synthetic fuels that will be need-

ed in the future. Furthermore, car-

bon can easily be compressed,

stored and shipped to remote hydro-

gen hubs the world over.

Accordingly, hydrogen, power-to-

X and carbon capture are not com-

peting technologies, rather they are

all part of a bigger picture and we

need them all to prevent climate

change. But what’s needed to make

sure that carbon-capture technolo-

gies support a hydrogen economy?

Ideally, some kind of worldwide

deposit system for carbon needs to

be created which enables its cap-

ture, storage, transport and re-use to

create a circular economy. The basic

idea begins with hydrogen produc-

tion at a remote location, its subse-

quent shipping as synthetic fuel –

for example to Europe – and its use

or conversion back to hydrogen.

During this process, any emitted

carbon is captured and shipped back

to the remote hydrogen hub, and the

circle begins again.

Of course, this requires the build-

ing up of a dedicated, worldwide in-

frastructure to transport, handle,

store and trade carbon that comple-

ments the hydrogen and synthetic

fuels infrastructure. In the mid-term,

a CO

2

pipeline network is needed to

transport the captured carbon from

industrial emitters to either a nearby

power-to-X or storage facility, or a

port from where it can be shipped

overseas. Such ports will also re-

quire the infrastructure to store and

handle compressed CO

2

as well as a

worldwide eet with CO

2

-transport-

tankers.

The capture and re-use of carbon

also needs to be incentivised to

make it economically viable to in-

vest in such technologies. One ap-

proach to this could be to introduce

certicates of origin to create trans-

parency around the origin of the

used carbon: is it carbon that has al-

ready circled round? Thus, synthetic

fuels produced with ‘recycled’ car-

bon would be labelled as such and

its use incentivised. Ideally, users

would be further rewarded for re-

capturing the carbon and bringing it

back to the cycle.

Finally, it needs to be emphasised

in this discussion that carbon-cap-

ture technology does not interfere

with the much needed ramping-up

of renewable energies, rather it is a

complementary technology that is

necessary to supply carbon as the

raw material needed in the power-

to-x process to produce synthetic fu-

els. Carbon-capture technology

should not be used to ‘greenwash’

oil or coal red power plants, and

prolong their life-span when they

could just as easily be replaced by

renewable or lower-emission energy

sources. Also, even if such carbon

cycles can take up large volumes of

CO

2

, they cannot replace the strong

need to decarbonise processes emit-

ting CO

2

wherever possible.

Accordingly, in the future, CO

2

must not only be viewed as the

source of harmful emissions but

also as a raw material that can play

a pivotal role in the hydrogen and

synthetic-fuel production chain. Ul-

timately, we will need both a world-

wide hydrogen and carbon economy

that are closely connected.

Sebastian Schnurrer is Business De-

velopment Manager Power at MAN

Energy Solutions.

While hydrogen-

based fuels are

urgently needed for

decarbonisation, it

is often forgotten

that their production

requires carbon.

MAN Energy

Solutions’

Sebastian Schnurrer

explains why it must

also be viewed as a

raw material.

Carbon: a forgotten factor in

Carbon: a forgotten factor in

the hydrogen discussion?

the hydrogen discussion?

THE ENERGY INDUSTRY TIMES - MARCH 2023

13

Industry Perspective

Schnurrer: We need to reduce

carbon emissions as much

as possible to prevent global

warming, but on the other

hand carbon is needed as a

raw material to produce the

synthetic fuels

MAN Energy Solutions

compressors are already used

in more than 20 carbon-capture

projects worldwide

home and monitoring the customer

day-to-day experience.

In a series of initial tests run in Au-

gust 2022, Octopus charged and dis-

charged the batteries of up to 20

electric cars from participating cus-

tomers at times of grid imbalance.

The trial saw customers use an app to

set the time they want the vehicle to

charge in the morning and how much

charge they would like in the vehicle.

In addition to covering the whole

customer experience, the trial

achieved its other key aim of integrat-

ing with the National Grid grid bal-

ancing mechanism.

“We were the rst to dispatch V2G

into the balancing mechanism,” said

Miller. “This meant working really

closely with their and our tech teams

to enable the control centre to accept a

bid from our V2G cohort and for that

signal then to be translated into activ-

ity in the real world to get those vehicles

to export. It’s a very important mile-

stone because if you look at National

Grid’s future scenarios, each talks

about V2G. We look forward to ex-

panding that by proving it out with

National Grid.”

Although the technology worked as

expected in the trial, being able to de-

pend on consumers in the real world to

deliver electricity when needed is a

question that still needs to be an-

swered. To this end, Octopus Energy

is also working on an innovation it

calls CrowdFlex.

CrowdFlex has three main objec-

tives. The rst is to think about domes-

tic exibility services and how com-

mercial frameworks need to be

developed around those offerings. The

second is to address the technology

that is needed and the required cus-

tomer behaviour. The third objective

is to learn about the statistical nature

of exibility – developing models

around domestic demand exibility

across the range of domestic exibility

technologies.

“We need CrowdFlex to understand

these things broadly at scale, to give

us that condence,” said Miller. “We

saw an incredibly high rate of plug-

ging in compliance – partly because

our customers were very engaged in it

but also because it was very easy.

A

ccording to the International

Energy Agency’s (IEA) track-

ing report, published in Sep-

tember last year, the global electric

vehicle (EV) eet will reach 300 mil-

lion in sales in 2050 in its Net Zero

2050 Scenario. This accounts for 60

per cent of all new car sales. With that

share expected to hit 13 per cent in

2022, it appears there is every likeli-

hood the IEA’s long-term prediction

will be realised.

The role of EVs in decarbonising

transport is well understood but using

them – through vehicle-to-grid (V2G)

technology – as a tool to decarbonis-

ing power grids by supporting grid

balancing and exibility, is an area

that is also seen as important in tack-

ling climate change.

“From a decarbonisation perspec-

tive, V2G is one of the key technolo-

gies, which will allow the grid to

move to wholly renewables in the

future,” said Claire Miller, Head of

Technology and Innovation at UK-

based energy supplier Octopus Ener-

gy. “Storage is crucial for this renew-

ables grid of the future and V2G is

one of those really important storage

technologies – one that customers can

engage with. In terms of that storage

element, we’re already using over 20

000 EV batteries every night on our

Intelligent Octopus [platform] to

store energy at times that help the

grid. And with V2G, when we have

V2G-enabled cars at scale, customers

will be able to export energy in the

evening when there is a peak demand.

This will increasingly eliminate the

need to use gas red peaking plants,

which is a really important part of

grid decarbonisation.”

In August last year, Octopus Energy

Group and National Grid Electricity

System Operator successfully demon-

strated the viability of V2G technol-

ogy for the rst time in Great Britain.

The project is one of the most signi-

cant of the various demonstrations

conducted around the world in recent

years in terms of showing how con-

sumers could play a direct role in

balancing the national transmission

system through their electric vehicles.

With several demonstrations con-

ducted in countries such as Japan and

the US, for example, the question of

when the technology will start to play

a part in decarbonisation still remains.

Miller commented: “It seems like

the technology has been a year or two

away for the last ten years almost. But

now we’re actually seeing vehicles

about to come to market – mass pro-

duction EVs that are V2G-ready. This

year will be a very important year for

the technology.”

One challenge is the lack of a stan-

dard charging system. Currently the

Nissan Leaf is capable of V2G with

the CHAdeMO charging system de-

veloped in Japan. But although it is

relatively mature technology, it has

not seen universal adoption.

“CHAdeMO charging technology –

the connector, and the computer

communications that go behind it –

has been around for 8-10 years but

unfortunately has not been adopted

globally as a prevailing standard.

There’s a kind of VHS [vs] Betamax

situation, where CCS, the Combined

Charging Standard has won-out.

“The CCS is quite new, so it’s taking

a bit of time for vehicle manufacturers

to t it into their vehicles and for the

charge-point manufacturers to devel-

op chargers that are interoperable.

There is an international standard

called ISO 15118-20, which governs

standardisation of communications

but the new car development cycle

can be pretty long. So actually we’re

at the very early days of this new V2G

enabling technology. While our plat-

form is sound and ready to go, we are

waiting for this new technology to

come to market. This year and next

year are important years because this

is when all of the interoperability test-

ing, etc., is happening for bringing it

to market.”

Octopus Energy is among the front-

runners of players experimenting

with V2G-enabled cars. The compa-

ny’s Powerloop V2G trial is born out

of a UK government-funded initiative

that began in 2017. It brought to-

gether several organisations, to form

a consortium that would “think about

the whole customer experience” –

from leasing the vehicle, installing

the bi-directional charger, getting

permission to export power from the

They saw it as part of their day-to-day

[routine]. I think this will be an inter-

esting outcome of CrowdFlex… there

is always that basic motivation of

charging the vehicle, overnight when

it’s cheapest and easiest, in order to

get around.”

There is also the nancial motiva-

tion, which is often the overarching

driver for customer uptake.

As a customer coming from a xed

rate tariff to a V2G tariff, there are

signicant savings to be made. Here

EV owners are rewarded for exporting

to the grid while having access to im-

port cheaper energy. Octopus’ analysis

shows customers could realise a po-

tential saving of up to £840 per year,

compared to unscheduled charging on

a at rate tariff. This is based on

analysis from the original Powerloop

V2G trial, scaled up for a driver travel-

ling 10 000 miles a year. It would be a

welcome saving during times of re-

cord high energy costs.

Despite such a lucrative saving

there is the question as to whether it is

sufcient to compensate for any po-

tential impact of cycling on battery

life. Miller stresses, however, that

concerns over degradation are largely

unfounded.

“On the face of it, it’s natural to

think along those lines but actually

there are a couple of important things

to point out,” she said. “Firstly, we see

leasing as a really important way of

accessing vehicles… with the various

incentives and schemes that provide

low access cost to leasing EVs, cus-

tomers are less and less likely to own

vehicles going forward. With technol-

ogy moving fast, whether it’s around

V2G or battery technology, leasing is

a great option.

“Secondly, with regards to the bat-

tery itself, there’s emerging evidence

from around the world that V2G does

not have a negative impact on the

battery. Most manufacturers are offer-

ing 8-year or 100 000 miles warranties

[on batteries]. Also, it’s a much nicer

life for a car battery to be gently

charged and discharged while sitting

on a driveway than actually being

driven, which puts a varying load on

the battery in terms of discharging.

Also manufacturers are actually

bringing EVs to market with batteries

designed for V2G.”

Developing technology and market

evolution will no doubt see V2G be-

come popular among consumers and

an increasingly important tool for

utilities in the tackling decarbonisa-

tion and grid exibility.

“We’re excited about the way the

market is starting to move and develop.

There will be more regional and loca-

tional pricing, and the evolution of

more ancillary markets as well,” said

Miller.

With several vehicle manufacturers

talking about V2G and making vehi-

cles interoperable, 2023/24 will be an

“exciting year”.

Miller summed up: “This year you

will hear more and more about it.

We’ve learned a lot about how cus-

tomers interact with V2G and we

understand how it will work in a re-

newables-heavy grid. There’s a lot of

interest and a lot of demand for it. So

we’re really pleased that we are

ready for when those vehicle manu-

facturers bring vehicles to market

THE ENERGY INDUSTRY TIMES - MARCH 2023

Energy Outlook

14

Vehicle-to-grid (V2G) technology is not only capable of providing grid balancing, but could also be a key tool in

decarbonising power grids. Junior Isles discusses the technology and the current state of commercialisation with

Octopus Energy’s Claire Miller.

V2G is coming of age

Claire Miller, Head of

Technology and Innovation at

Octopus Energy, took part in

the Powerloop V2G trial

T

he Intergovernmental Panel

on Climate Change has iden-

tied carbon capture as a key

means of reducing the climate im-

pacts of man-made carbon emis-

sions. The scale and speed of emis-

sion reduction necessary to avoid

irreversible climate change means

that there is no option to simply

“turn off” conventional energy

sources. Instead, cleaning up their

emissions is an essential component

in the ght to limit global tempera-

ture rises while giving time for the

transition to zero carbon energy

sources. Indeed, many studies indi-

cate that without carbon capture the

cost of reducing carbon emissions

will be much higher.

Many important industrial pro-

cesses such as steel, cement and

glassmaking emit carbon dioxide

both from heating processes and

from chemical reactions fundamen-

tal to production. While there are

other options for heating, carbon

capture is essential to reduce emis-

sions from the fundamental reac-

tions. However even this change

may only be feasible for new pro-

cesses and existing plant and energy

systems, such as CHP (Combined

Heat and Power), will need a viable

transition path towards a zero car-

bon future.

In the transport sector shipping

faces a different problem as alterna-

tive zero emission energy sources

are not compatible with existing

vessels. Rapid replacement of the

global eet of over 50 000 ships is

impractical, uneconomic and would

be environmentally damaging, giv-

en the large emissions generated by

a premature replacement pro-

gramme. Carbon capture offers a

means of delivering a controlled

transition to a zero-carbon future.

The legacy carbon capture tech-

nologies were developed for chemi-

cal processes rather than for clean-

ing exhaust gases and are not well

suited to handling variable and of-

ten dirty gas streams. Conventional

processes use a solution of a mix-

ture of different amines to wash the

carbon dioxide out of a gas stream.

These amine solutions are toxic and

environmentally damaging. The

amine process needs to use an ab-

sorber column typically 10-20 m

high to reduce the carbon dioxide

content of the gas stream by 90-95

per cent. The washing solution is

then heated to regenerate it and re-

cover the carbon dioxide.

The heat requirement is substan-

tial, resulting in signicant addi-

tional fuel burn and hence further

carbon emissions that also need to

be captured. The result is high CA-

PEX, high OPEX and large plant,

which often is difcult to t into a

congested production site or on

board a ship.

PMW Technology has worked

with the Department of Physical,

Mathematics and Engineering Sci-

ences (PMES) at the University of

Chester since 2017 to develop its

radically different carbon capture

process. Initial work was a success-

ful doctoral project at laboratory

scale by Dr David Cann, which was

followed by the construction of a

large pilot rig to demonstrate the

novel process.

The initial studies were funded by

Innovate UK and the Eco-Innova-

tion project at the University, sup-

ported by the European Regional

Development Fund. Subsequent

work has been funded by the com-

pany, with support from the Depart-

ment of Transport and the HEIF

through the University. PMW Tech-

nology, has had excellent support

from the University to reach this

point and will continue its relation-

ship as the technology progresses

towards commercialisation.

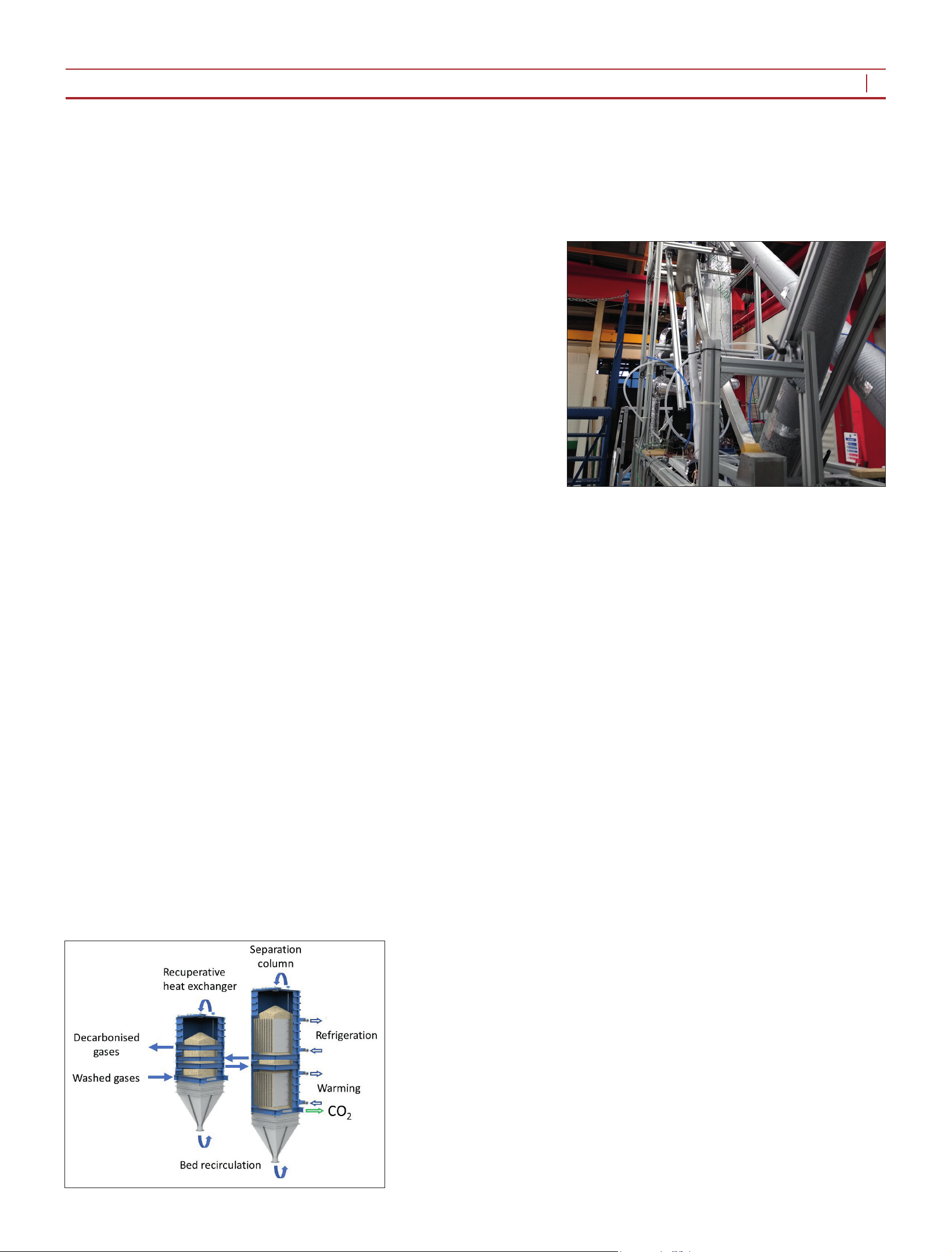

The A3C cryogenic carbon diox-

ide separation process has two stag-

es, each with a circulating packed

bed of metallic or ceramic beads.

The rst step cools and removes all

traces of water from the gases,

while the second cools the gases

further to separate the carbon diox-

ide as a coating of frost on the slow-

ly moving cold bed material.

Heat transfer within the moving

beds of ne beads is intense, en-

abling a very compact separation to

be achieved, with a comparable sep-

aration to a column 15 m high for

the conventional amine process be-

ing delivered by a bed less than 100

mm deep.

The advanced recuperative refrig-

eration cycle exploits the low tem-

perature heating required to recover

the carbon dioxide from the frosted

bed to offer a very low refrigeration

energy consumption for a cryogenic

system. A reverse Brayton cycle re-

frigeration cycle is used with air as

the refrigerant gas, minimising the

cost of refrigerant make-up and

avoiding the hazards of combustible

or toxic refrigerants that would oth-

erwise be required.

The main challenge for the new

process is achieving a uniform mass

ow of bed material through the

stages so that uniform conditions

are maintained at each level in the

bed. This is managed by careful de-

sign and renement using physical

models, thereafter giving reliable

behaviour through life.

The pilot rig is designed to cap-

ture 50 kg of carbon dioxide per

day. The rig stands 4.5 m high,

close to the height expected for full-

scale units, with a column a few cm

square. The rig is designed to clean

and decarbonise the exhaust gas

from a test diesel engine, so it in-

cludes quench columns as well as

the recuperative heat exchanger and

separation column. Refrigeration is

provided by a compressed air circu-

lation cooled with liquid nitrogen,

as small-scale refrigerators for the

temperatures required are not com-

mercially available.

The objective of the pilot rig was

to demonstrate the process and

evaluate performance of its main el-

ements. An important secondary ob-

jective was to learn how to design

components working with a moving

packed bed since this is an unusual

process medium with less well-

known characteristics.

Despite its unusual arrangement

and low operating temperature the

rig has performed very well. The re-

frigeration system has proved capa-

ble of delivering temperatures of

-160°C and cooling the bed to

-120°C. The heat exchangers have

behaved well with initial estimates

of heat transfer coefcient proving

reasonably accurate. The initial tri-

als have indicated an effectiveness

of over 70 per cent removal of car-

bon dioxide from a test stream of 6

per cent concentration. Unfortunate-

ly further tests have been deferred

due to the need to relocate the rig.

PMW Technology plans to follow

the pilot rig with a prototype unit.

This will have a much larger capac-

ity since the only scale-up of signif-

icance is the cross-sectional area of

the bed rather than the path length

of the process.

The prototype is sized to handle

the exhaust gas ow of a 1MW die-

sel engine, capturing 12-30 tonnes

of carbon dioxide per day. This pro-

totype will be capable of treating in-

dustrial exhaust gas streams or be-

ing marinised for installation on

board a ship. The prototype will be

designed as a base module allowing

rapid scale-up for application to en-

gines up to 10 MW and up to 300

tonnes per day capture.

It is planned for the prototype to

be operational in 2025/6 leading to

commercial deployment in 2027.

The development of the A3C pro-

cess has the potential to have a ma-

jor impact on the application of car-

bon capture. A key differentiator for

the process is its low energy con-

sumption, which is typically less

than a third of that for the conven-

tional amine process. Its compact

design and ease of application with-

out large additional heat require-

ments and freedom from chemical

hazards makes the process easy to

deploy and operate. Another impor-

tant benet is the direct production

of pure carbon dioxide.

One challenge for carbon capture

is its perception as a “landll” solu-

tion, with the only destination for

carbon dioxide being mass geologi-

cal sequestration. A better alterna-

tive would be to create closed envi-

ronmental loops, which see the

reuse of the captured carbon diox-

ide. A signicant opportunity for

such reuse exists in shipping which

currently contributes around 3 per

cent of global carbon emissions,

comparable to the carbon emissions

of Germany.

One of the key future fuels in

shipping is green methanol. The

current focus in the challenge to

produce green methanol is the

availability of hydrogen produced

from zero carbon energy. Ironically

a less discussed challenge is the

availability of climate neutral car-

bon dioxide to combine with that

hydrogen to create methanol. The

efciency of the A3C process and

the purity of its product offers a

clear pathway to a closed loop to

produce green methanol using recy-

cled carbon dioxide from methanol

fuelled shipping. This methanol cy-

cle is more efcient, safer and has

smaller impacts on vessel capacity

than alternative zero carbon fuels.

PMW Technology is currently re-

cruiting partners for the develop-

ment and manufacture of its com-

mercial scale prototype.

This project has accelerated since

2022 within the Department of

Physical, Mathematics and Engi-

neering Sciences (PMES) at the

University of Chester. The A3C pi-

lot rig has real potential to capture

carbon dioxide, and clean and de-

carbonise the exhaust gases at a

lower energy consumption than

similar processes. This application

may be economically viable and

provide the decarbonisation oppor-

tunity that is needed as we move to-

wards science-based targets on

emissions reduction.

It is anticipated that this research

will contribute to the decarbonisa-

tion agenda, as the research moves

towards prototyping.

Paul Willson is Managing Director

at PMW Technology; and Professor

Julieanna Powell-Turner is Associ-

ate Dean and Head of PMES at the

University of Chester.

A new process

hailed as the next

generation in

carbon capture

technology has

been demonstrated.

The novel process

has the potential

to cut costs and

extend the breadth

of applications for

the technology.

Paul Willson and

Professor Julieanna

Powell-Turner.

Novel compact carbon capture

technology can cut costs

THE ENERGY INDUSTRY TIMES - MARCH 2023

15

Technology Focus

Outline of A3C separation

process: The carbon dioxide

separation process has two

stages, each with a circulating

packed bed of metallic or

ceramic beads

View of the pilot rig. The rig stands 4.5 m high, close to the

height expected for full-scale units

THE ENERGY INDUSTRY TIMES - MARCH 2023

16

Final Word

I

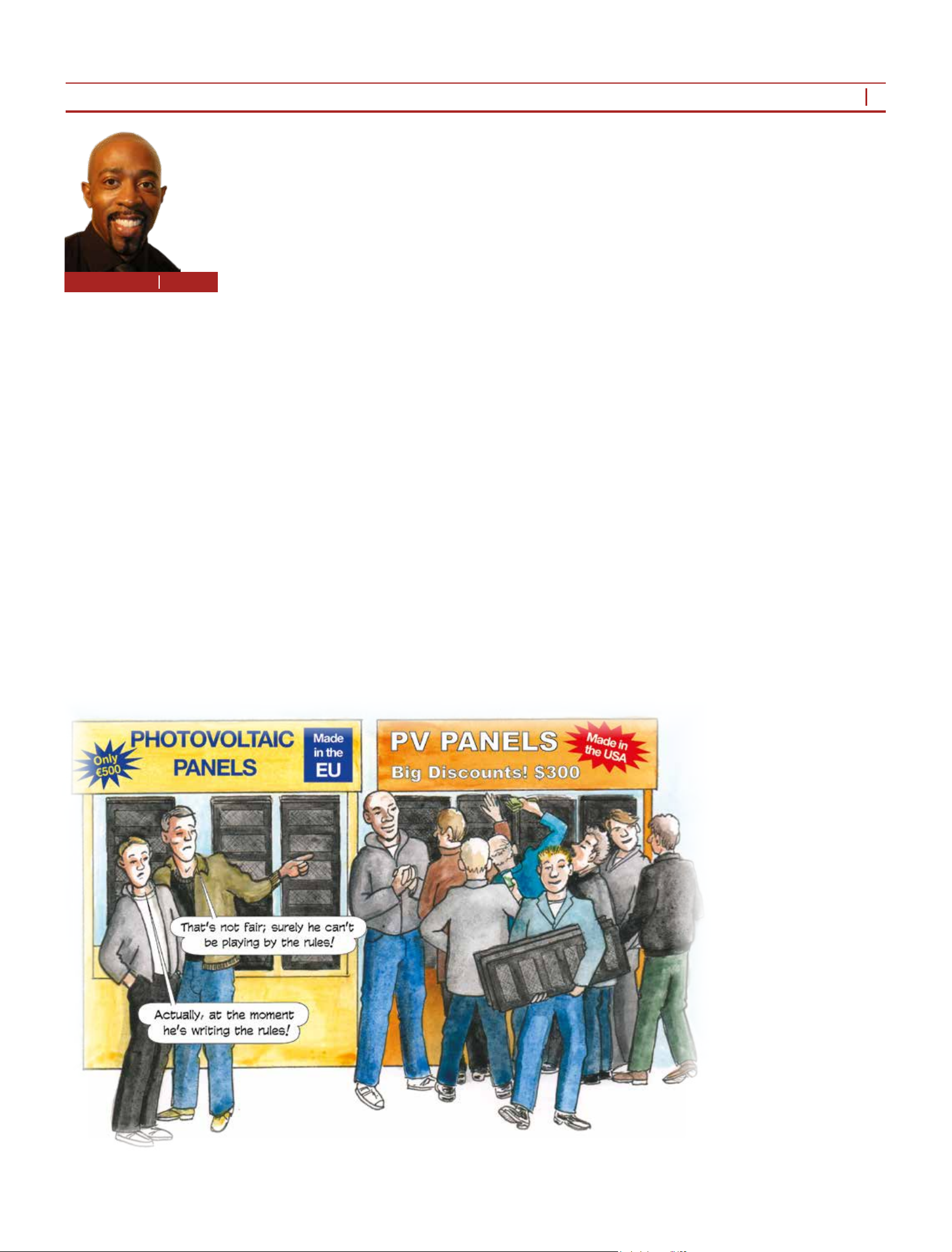

n a competitive world it doesn’t

pay to just shout from the sidelines,

green with envy when the game is

not going your way. It’s far better to

rise to the challenge. Get yourself into

the game. In response to the US upping

the ante on driving clean energy invest-

ment, at last we nally get a glimpse

of how the EU plans to keep its position

in the lucrative clean energy technol-

ogy-manufacturing sector.

When US President Joe Biden

launched the Ination Reduction Act

(IRA) last August, its European trad-

ing partners expressed alarm that the

move would disadvantage European

companies. EU countries were par-

ticularly concerned that the IRA,

which gives tax credits for each eli-

gible component produced in a US

factory, would take away potential

clean sector investment from the

continent.

The IRA earmarked $369 billion for

clean energy and climate-related

projects, notably providing a tax

credit of 30 per cent of the cost of new

or upgraded factories that build renew-

able energy components in the US.

Unhappy with the move, Thierry

Breton, the EU Commissioner for the

internal market said in November that

the US was starting a “subsidy race”

through the investment incentives the

IRA offers for companies.

“It is really unfortunate that our so-

called like-minded partners resort to

such means,” Breton was quoted as

saying by German newspaper

Handelsblatt.

At the time, German Economy

Minister Robert Habeck told a confer-

ence: “We are in talks with the

Americans so we do not start a kind

of trade war now, but we see what

competition there is and we have to

nd European answers to that.”

Breton’s fear that the bill could push

European companies to move signi-

cant parts of their supply chains to the

US has not proved unfounded. In

November Enel, Italy’s largest utility

company, said it plans to construct a

factory in the US to manufacture PV

cells and solar panels. When it

reaches its full 6 GW capacity in 2025,

it is expected to employ 1500 workers.

Meanwhile, last month Spanish re-

newables developer-operator Uriel

Renovables said it had started devel-

oping 675 MW of battery energy

storage system projects in Texas and

Massachusetts. Uriel Renovables said

all of the Texas projects are eligible to

benet from the tax incentives pro-

vided by the IRA.

In an attempt to stave off a trade war,

leaders from both France and Ger-

many held talks with Washington.

But business leaders and US climate

envoy John Kerry argue that instead

of expecting major concessions from

the US, the EU and other partners

need to take urgent steps to make their

own green investment conditions

more attractive.

John Podesta, Senior Clean Energy

Adviser in the Biden Administration

went further. He told the Financial

Times: “We make no apologies for the

fact that American taxpayer dollars

ought to go to American investments

and American jobs,” calling on Europe

to take responsibility for developing

its own clean energy sector.

Fortunately the EU is taking heed.

While cooperation with partners is

important, it makes little sense to wait

for changes from the US. This would

not only result in lost business, but

would also likely slow EU efforts to

address climate change within its own

borders.

At the start of February, European

Commission President Ursula von der

Leyen presented plans to “make Eu-

rope the home of clean tech and indus-

trial innovation on the road to net

zero”. To achieve that, the Commission

proposed a new EU Green Deal Indus-

trial Plan based on four pillars, with

global competitiveness in mind. The

plan is aimed at simplifying the regu-

latory environment, providing faster

access to funding, upping skills and

taking an open approach to trade to

create resilient supply chains.

Explaining the plan, von der Leyen

said: “To grow, our net zero industries

need a legislative framework. This has

to be faster, and predictable […] We

want this industry to stay here and

prosper here. We listened to the indus-

tries; we need to match with US solu-

tions, through state aid and tax breaks.”

Speaking during a recent webinar:

‘Green Deal Industrial plan – future-

proong Europe’s industry’, Domien

Vangenechten, Senior Policy Advisor

at E3G, commented: “The impetus for

the EU to respond to the IRA, which

had some very clear climate dynamics

to it, is an opportunity to get new and

increased ambition on the table.

There’s an opportunity here to tell a

story of economic growth across Eu-

rope, not just in some of the richer

western parts, but throughout the

continent. The EU needs to keep its

eye on the prize. We’re doing all this

for green growth and decarbonisation.

Let’s focus on that, and not only on

grabbing market share.”

Bernice Lee, Chair, Sustainability

Accelerator Advisory Council at

Chatham House, added: “What we are

already seeing is a reconguration of

the landscape. Some call it the ice

bucket moment, some call it the

Sputnik moment, but it is indeed a

moment where we are really looking

at strategic competition, whether we

need to harness competitive versus

cooperative dynamics. The race is

beginning properly, and we will prob-

ably have to see a combination of

cooperation and competition. Believe

it or not, not only in the domestic

support system, but also in the trade

arena.”

Niclas Poitiers, Research fellow,

Bruegel, however, questioned

whether the EU has the tools to do

industrial policy. “The question that

we in the EU have to answer, is how

do we want to do industry policy? Do

we do subsidies in the right way for

the right purposes? Do we have the

right instruments? I’m happy that we

have the discussion, because this is a

trend that we’ve had for some time,

and I think the tools are not really up

to speed and not really made for pur-

pose in the EU.”

It is certainly more difcult for a bloc

like the EU to agree and implement a

cohesive policy than it is in the US. It

will require revision of the state aid

framework for net zero technologies

and need broad support from 27

member states. Revising state aid rules

could be controversial, as it will be

easier for richer states to provide scal

incentives for their companies than it

would for poorer member states.

The Commission’s draft proposal

reportedly proposes the redirection of

some of the $869.8 billion in Covid-19

recovery funding to green tax credits.

It states: “The provisions on tax ben-

ets would enable member states to

align their national scal incentives on

a common scheme, and thereby offer

greater transparency and predictabil-

ity to businesses across the EU.”

The Solar Heating & Cooling sector

also called on the Commission and

member states to ensure a level playing

eld among all renewables in line with

the principle of fair competition.

“As the global race to subsidise clean

technologies is pressuring the EU to

intervene, policymakers cannot give

up fair competition, the founding

principle of the Single Market,” said

Costas Travasaros, President of Solar

Heat Europe, in a press statement.

During the webinar, Nils Redeker,

Deputy Director of the Jacques De-

lors Centre also voiced concern over

the need for a policy that works for the

Single Market. “It’s quite clear the EU

needs an industrial policy and needs

to be targeted for certain industries. At

the same time, the EU needs its Single

Market. So it needs an industrial pol-

icy that works for the single market.

What we really need is to use the US’

IRA as a wake up call; to really get

industrial policy at EU level to join

nancing and governance. If the EU

can leverage this, this would be huge.”

It would be huge indeed. As von der

Leyen said, this is “a once in a gen-

eration opportunity to show the way

with speed, ambition and a sense of

purpose to secure the EU’s industrial

lead in the fast-growing net zero

technology sector”.

Let us hope the EU can agree on its

proposed Green Industrial Plan

quickly, as shouting foul from the

sidelines will get it nowhere fast.

Don’t be green with envy

Junior Isles

Cartoon: jemsoar.com