www.teitimes.com

February 2023 • Volume 15 • No 12 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Special Technology

Supplement

Corporate

Decarbonisation

Looking through the

industrial cyber security

portal.

Corporations in the Asia-Pacic region lag

behind their European counterparts when it

comes to sustainability and climate strategies.

But this is changing fast. Page 14

News In Brief

World “at the dawn” of new

industrial age, says IEA

The energy world is at the dawn of

a new industrial age – the age of

clean energy technology manufac-

turing – that is creating major new

markets and millions of jobs but is

also raising new risks.

Page 2

US turns to wind and solar

as gas and nuclear additions

barely balance retirements

New solar installations will account

for nearly two-thirds of ‘high prob-

ability’ additions to utility-scale

power generating capacity in the US

over the next three years, according

to the Federal Energy Regulatory

Commission.

Page 3

Philippines power

companies ramp up

renewables

The Philippines is ramping up its

renewable generating capacity as

several power companies announce

plans for major new additions this

year.

Page 4

France takes up challenge

to speed up renewables

deployment

The lower house of the French Par-

liament has approved a draft bill that

would speed up deployment of solar

PV and offshore wind, cutting red

tape and offering tax incentives.

Page 5

Businesses prioritising

commercial success over

sustainability

A survey has found that 8 in 10 or-

ganisations would accept regulatory

penalties to avoid taking on sustain-

ability initiatives.

Page 7

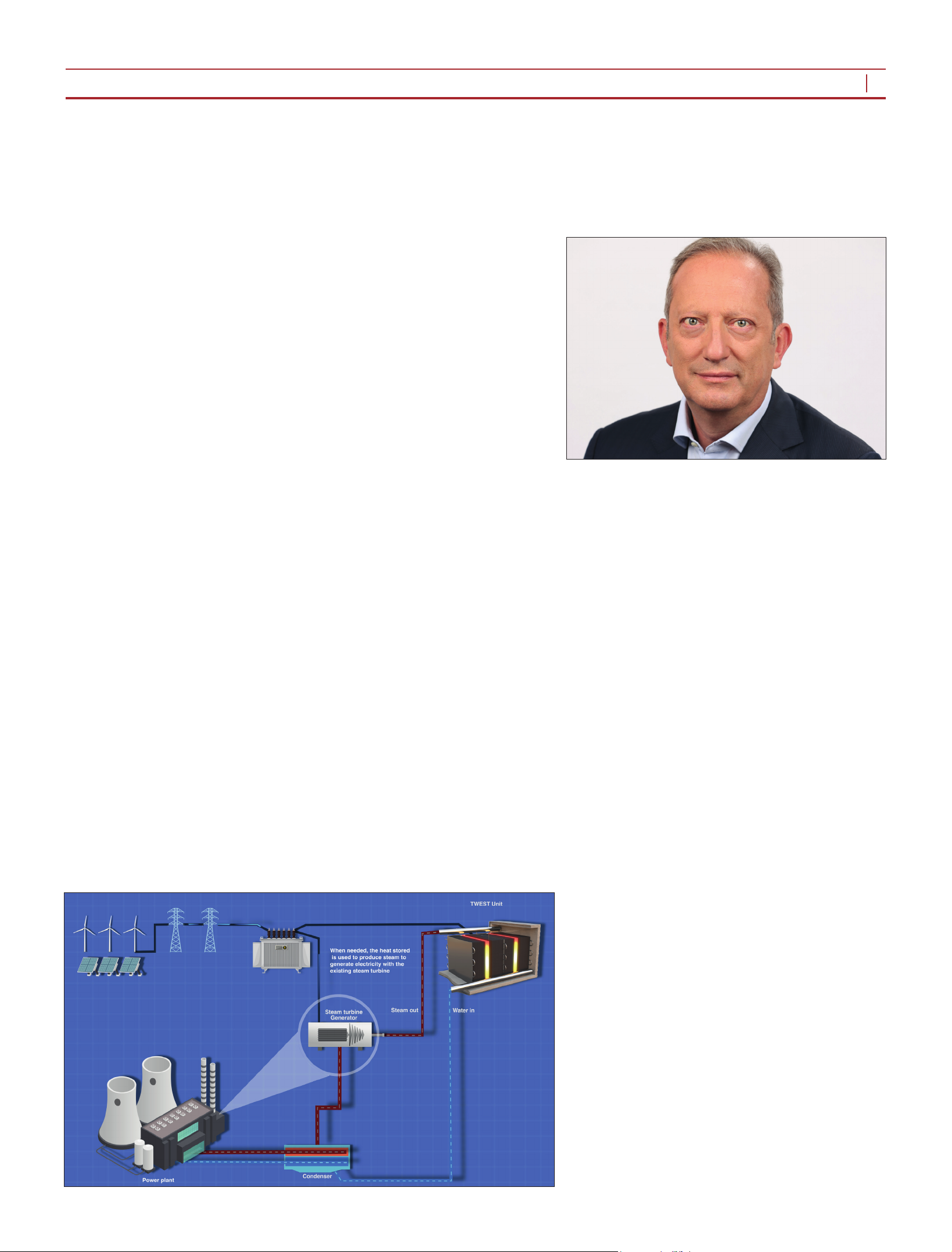

Technology Focus: Avoiding

stranded assets with thermal

energy storage

A new thermal energy storage tech-

nology is soon to be delivered to a

site in India. The system has the

potential to accelerate the move to

renewables, while addressing the

issue of stranded fossil fuel assets.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

In an effort to tackle high electricity prices, the European Commission is under pressure to act

quickly on reforming the market. Junior Isles

Energy crisis must be addressed by long-term

transition goals, says WEF

THE ENERGY INDUSTRY

TIMES

Final Word

It’s time for the EU to

put its best foot forward,

says Junior Isles..

Page 16

European Commissioner for Energy,

Kadri Simson has said the European

Commission is under “very strong

political pressure” to redesign the

electricity market to cut bills for con-

sumers. As the EU faces an energy

crisis, largely brought on by a huge

rise in gas prices, the Commission is

looking to reform the market so that

electricity prices are no longer dic-

tated by gas prices.

Simson said the Commission was

looking at how to bring the “benets

of a larger share of renewables” to

consumers. She told the Financial

Times: “We will also need gas red

power plants, but we don’t want to

create a system where they will be in

operation 24/7.”

With the low cost of renewables

and their increasingly signicant

share in electricity production, the

Commission suggests making re-

newable power more reective of its

“true production costs”. Renewables

accounted for about 40 per cent of

European electricity production in

2020, according to European Com-

mission data, and once the infrastruc-

ture is built, power from wind and

solar is essentially free.

In a draft document outlining pos-

sible reforms, seen by the FT, the

Commission also proposes extending

a windfall tax on renewable power

companies, the proceeds of which are

passed to consumers and which is

due to expire in 2023.

Under the current market model,

renewable and nuclear power are dis-

patched rst, followed by gas and

coal, with prices being set by the last

generator called on to meet demand.

This means renewable power prices

are often tied to the cost of fossil fu-

els, mainly gas.

While this has promoted investment

in renewables, which have beneted

from the higher cost of gas, it means

consumers pay high prices for renew-

able electricity despite its lower pro-

duction costs.

As countries across the bloc strug-

gle with the high prices, Brussels has

come under pressure from, most no-

tably, Spain and France to rapidly

reform the market.

Renewables provides almost half of

Spain’s electricity but prices in the

wholesale market soared during 2022.

On average, prices were 88.3 per cent

more expensive than in 2021 –

€209.69/MWh compared to €111.93/

MWh the previous year, according to

OMIE data. However, a cap on gas

price has softened the impact of the

energy crisis in the country, as prices

remained well below the average of

the major European economies.

The government wants to protect it-

self against large increases in the price

of electricity for as long as the energy

crisis lasts. And it says the easiest way,

until the European Union agrees to

reform the current regulation of the

wholesale electricity market, is to

maintain the current gas cap mecha-

nism applied in the Spanish market for

the next few years.

The validity of the so-called ‘Iberian

exception’ – the limit on the price of

gas used to produce electricity that ap-

plies in Spain and Portugal – expires

on May 31, but the Spanish govern-

ment wants to extend it at least until

the end of 2024 and plans to ask the

European Commission for permission

to extend it.

Brussels has said it will launch a

consultation on the possible reforms,

and publish a full proposal by the end

of March.

In the meantime, the Spanish gov-

ernment has submitted a proposal to

the European Commission to serve as

Continued on Page 2

The current energy crisis is driving

ination and slowing economic

growth, yet short-term backward

steps like increasing electricity output

from coal and broad-based consump-

tion subsidies are risky, according to

a new report from the World Eco-

nomic Forum (WEF).

The report, titled ‘Securing the En-

ergy Transition’, proposes a strategic

plan to make energy security and re-

silience the backbone of a transition-

ing energy system. It suggests align-

ing current interventions to address

the energy crisis with long-term en-

ergy transition goals.

“The energy crisis has brought en-

ergy security to the forefront of po-

litical and corporate agendas and

prompted the need to develop re-

sponses that are adapted to how the

energy system has evolved and to

where it needs to transition,” said

Roberto Bocca, who heads a WEF

section on shaping the future of en-

ergy and infrastructure.

“What is now a global crisis is a

real opportunity to steer a more di-

rect course towards a secure, sustain-

able, and affordable energy future for

everyone,” he added.

The report proposes a broad frame-

work for a secure energy system to

guide countries and policymakers to

plan strategic actions, policies, and

regulations.

Solutions include prioritising re-

newable energy investments, plug-

ging methane leaks, maximising

electrication, driving consumption

efciencies, and taking advantage of

excess prots made by energy com-

panies in 2022.

One immediate action proposed is

to prioritise supply from renewable

energy and constrain fossil fuel rein-

forcements to committed emission

reduction targets.

The International Energy Agency

recommends $5 of investment in re-

newables for every $1 spent on new

fossil fuel production.

According to the WEF report, the

climate benets of natural gas are no

better than coal if more than 3.4 per

cent of it escapes before combustion,

but some gas elds have fugitive

emission rates of 6 per cent or more.

Through a separate report launched

at the WEF in Davos, Switzerland,

Spanish utility Iberdrola issued a call

to action for global policymakers,

companies in the energy and indus-

trial sectors and other stakeholders

on the steps that need to be taken in

2023 to break the cycle of crises

driven by oil and gas, and to shift the

balance to delivering green energy

security as quickly as possible. Iber-

drola is investing a total of €47 bil-

lion for the three years to 2025.

In a ve-point manifesto titled

‘Electric, Together’, Iberdrola un-

picks the key challenges that remain

unsolved in the energy transition,

setting out the best ways to move for-

ward at speed.

The ve points for action listed by

the company are: accelerating plan-

ning and ambition for electricity grid

infrastructure to deliver the transi-

tion to a green economy; turbocharg-

ing the deployment of renewable

generation projects; scaling up green

hydrogen; increasing ambition on in-

novation to drive climate solutions;

and “keeping our eyes on the long-

term prize” of decarbonisation.

Brussels under

Brussels under

“political pressure”

“political pressure”

to redesign electricity market

to redesign electricity market

THE ENERGY INDUSTRY TIMES - FEBRUARY 2023

2

Junior Isles

The energy world is at the dawn of a

new industrial age – the age of clean

energy technology manufacturing –

that is creating major new markets and

millions of jobs but also raising new

risks, prompting countries across the

globe to devise industrial strategies to

secure their place in the new global

energy economy, according to a major

new report by the International Energy

Agency (IEA).

The Paris-based agency’s ‘Energy

Technology Perspectives 2023’ shows

that although the global market for key

mass-manufactured clean energy tech-

nologies will be worth around $650

billion a year by 2030 – more than three

times today’s level – current supply

chains of clean energy technologies

present risks in the form of high geo-

graphic concentrations of resource

mining and processing as well as tech-

nology manufacturing.

For technologies like solar panels,

wind, EV batteries, electrolysers and

heat pumps, the three largest producer

countries account for at least 70 per

cent of manufacturing capacity for

each technology – with China domi-

nant in all of them.

Commenting on whether Europe

and the US should be concerned about

the dominance of China, IEA Execu-

tive Director Fatih Birol, said: “Yes it

is true that today China has a dominant

role in both the manufacturing of clean

energy technologies and processing

critical minerals. But you can look at

this in two ways. On the one hand it

has a huge role and concentration but

on the other you can see that as a result

of China’s learning by doing, it was

able to bring the cost of these clean

energy technologies down to make

them more affordable.

“Now I see that countries like the US,

Europe, India and Japan are also com-

ing with their clean energy manufactur-

ing strategies. This will help with di-

versication, which is always good to

reduce risks. But we should not forget

that the efforts the Chinese are making

is having a positive global impact.”

The report notes that major econo-

mies are acting to combine their cli-

mate, energy security and industrial

policies into broader strategies for their

economies.

The Ination Reduction Act in the

United States is a clear example of

this, but there is also the Fit for 55

package and REPowerEU plan in the

European Union, Japan’s Green

Transformation programme, and the

Production Linked Incentive scheme

in India that encourages manufactur-

ing of solar PV and batteries – and

China is working to meet and even

exceed the goals of its latest Five-Year

Plan.

Meanwhile, clean energy project

developers and investors are watching

closely for the policies that can give

them a competitive edge. Relatively

short lead times of around 1-3 years

on average to bring manufacturing

facilities online mean that the project

pipeline can expand rapidly in an en-

vironment that is conducive to invest-

ment. Only 25 per cent of the an-

nounced manufacturing projects

globally for solar PV are under con-

struction or beginning construction

imminently, according to the report.

The number is around 35 per cent for

EV batteries and less than 10 per cent

for electrolysers. Government poli-

cies and market developments can

have a signicant effect on where the

rest of these projects end up.

Amid the regional ambitions for

scaling up manufacturing, ETP-2023

underscores the important role of in-

ternational trade in clean energy tech-

nology supply chains. It shows that

nearly 60 per cent of solar PV modules

produced worldwide are traded across

borders. Trade is also important for

EV batteries and wind turbine com-

ponents, despite their bulkiness, with

China being the main net exporter

today.

basis for reforming an European

electricity market that was designed

in 1998.

It is proposing a dual market with

a short-term market (daily and in-

traday) “that is very liquid and

transparent” like the current mar-

ginal market, that would be com-

bined with another long-term mar-

ket adapted to the particularities of

each national market. It would

separate the most expensive energy

source in Europe’s power mix –

natural gas – from clean electricity

producers, such as renewables,

hydro and nuclear energy, and pro-

mote forward contracts.

Another option in the proposed

reform includes segregating power

generators by technology. Renew-

ables, nuclear and hydro would be

on one side, paid based on forward

contracts for producing electricity.

Combined cycle gas plants, energy

storage and demand-side manage-

ment would form the capacity mar-

ket and be paid for rm capacity and

availability, according to the Span-

ish proposal.

In this scenario, contracts for dif-

ference (CFDs) for renewables

would incorporate a xed price for

the lifetime of the power plant,

while prices for nuclear and hydro-

power would be regulated under

their CFDs.

The upside of this design is that

power generators would not be able

to earn windfall prots, while the

capacity market would facilitate

investments in energy storage, the

government said.

Spain believes the new regulation

will give states room to adapt their

energy mix and that, in the case of

Spain, it may allow the remunera-

tion of hydro and nuclear energy to

be removed from the daily mar-

ginal market in order to reduce the

weight of the daily price inuenced

by volatility and give more room

for long-term contracts.

France, meanwhile, is committed

to maintaining the existing mar-

ginal pricing system and rules out

any type of market price interven-

tion, as proposed by the Spanish

government for nuclear and hydro-

electric energy.

Instead the French government

advocates the creation of a fund to

serve as a counterpart mechanism.

This vehicle could be managed by

the system operators to guarantee

neutrality in its application.

Eurelectric, the organisation rep-

resenting Europe’s electricity com-

panies has already tabled a pro-

posal that will focus on the

implementation of a capacity mech-

anism. This would allow the devel-

opment of back-up technologies,

with CFDs and long-term PPAs to

guarantee the protability of infra-

marginal technologies (renewables

and nuclear).

Meanwhile, the EU faces continu-

ing difculties in 2023. The Inter-

national Energy Agency has warned

that the reduction in pipeline gas

from Russia risks leaving the bloc

with a shortfall of 30 billion m

3

.

Continued from Page 1

Offshore wind installations are up,

inspite of challenges such as a lack of

trained personnel and supply chain

issues.

According to WindEurope, the EU

installed 15 GW of new wind farms in

2022 – one third more than 2021. The

organisation noted that this increase in

new installations “is an encouraging

result” given the overlapping chal-

lenges the industry faced in 2022.

Although it hailed the progress, the

organisation noted that the 15 GW still

falls signicantly short of what Eu-

rope needs to build to deliver on its

climate and energy security targets.

The shortfall is largely due to permit-

ting bottlenecks, it said, noting that 80

GW of wind energy projects across

Europe are currently stuck in permit-

ting procedures.

WindEurope CEO Giles Dickson

said: “15 GW of new wind in 2022 is

not too bad given the challenges faced

last year by Europe’s wind industry.

It’s not enough for the EU’s energy

targets, but governments know the

latter can only be achieved if they

simplify the permitting rules and pro-

cedures – and there are now signs of

progress on this. Less encouraging is

the slowdown in investments in new

wind farms. Confusion about electric-

ity market rules is turning investors

away. The EU must make Europe an

attractive place for renewables invest-

ments again.”

A combination of ination and un-

helpful government interventions in

electricity markets is undermining in-

vestments in new wind farms, said

WindEurope. In the rst 11 months of

2022 the total new investments in wind

farms in the EU covered only 12 GW

of new capacity. This is signicantly

less than the rate of new investments

needed to deliver the EU’s 2030 cli-

mate and energy targets.

The organisation also said the forth-

coming reform of electricity markets

must give investors greater clarity

about what rules apply. “The freedom

given to Member States in last year’s

emergency measures to set their own

national rules is turning investors

away. They’re investing instead in the

US, Australia and elsewhere. The EU

is not attractive for major renewables

investors right now,” it said.

Meanwhile, the International Energy

Agency said in a report that the lack of

trained personnel in the offshore wind

energy sector could delay installation

in the coming years.

“Installing a wind turbine requires

fewer workers per unit of capacity than

solar PV, but more material inputs,

notably cement and cabling, as well as

specialised machinery to transport and

position the turbine. In the case of off-

shore wind farms, specialised vessels

are required, which increasingly need

to be capable of handling taller and

larger wind turbines,” the agency said.

At the same time, offshore wind en-

ergy projects require more trained

workers and more labour per megawatt

than land-based projects throughout

their life cycle.

“For instance, installing an offshore

wind farm takes six or more years. For

large-scale solar PV farms, installers

can spend 8-14 months on a project,

while distributed rooftop PV systems

can typically be installed in just a few

days,” said the report.

n The UK government has signed an

agreement with a group of European

partners to develop offshore renewable

projects in the North Sea. The projects

will link electricity interconnectors

and wind farms. Players include Bel-

gium, Denmark, France, Germany,

Ireland, Luxembourg, Netherlands,

Sweden, Norway and the European

Commission.

The UK needs a ve-fold increase in

solar power, an earlier ban on new gas

boilers by 2033 and curbs on the export

of plastic waste by 2027, according to

a recent report.

In the 340-page ‘Net Zero Review’,

Chris Skidmore, the Tory MP and for-

mer science and universities minister,

commissioned to conduct the review,

said the transition to a low-carbon

economy is “the industrial revolution

of our time” with opportunities for

companies. He stressed, however, that

opportunities are being missed today

because of weaknesses in the UK’s

investment environment.

Grant Shapps, Business and Energy

Secretary, commented: “The UK is

well placed to ensure that tackling cli-

mate change also brings new jobs and

investment for businesses and com-

munities. I am grateful to Chris Skid-

more for his detailed report, which

offers a range of ideas and innovations

for us to consider as we work to grasp

the opportunities from green growth.”

Energy UK welcomed the indepen-

dent review. Deputy Director of Policy,

Charles Wood said: “We welcome the

ndings of the Net Zero Review which

underline in comprehensive fashion,

the economic benets, in addition to

the environmental ones, that meeting

net zero will bring – as well as making

it clear quite how far we have to go.”

He called the review a “wide-ranging

assessment”, noting there are 129 spe-

cic recommendations and actions that

the government should adopt in full.

The report recommends reforms to

local and national planning systems to

“unleash” cheaper forms of electricity

generation – onshore wind and solar

– albeit with the caveat “where [such

technologies are] locally supported”.

The review called for the government

to set an ofcial target for solar power

for the rst time – proposing that the

UK develops 70 GW of solar genera-

tion by 2035 compared to the current

gure of 14 GW.

It also urged the Treasury to give

greater “longer-term certainty” to nu-

clear power stations, hydrogen tech-

nology and carbon capture and storage

projects.

Headline News

Wind installations advance despite challenges

Wind installations advance despite challenges

UK is missing net zero opportunities

UK is missing net zero opportunities

World “at the dawn” of new

World “at the dawn” of new

industrial age, says IEA

industrial age, says IEA

The Spanish government

has submitted a proposal to

the European Commission

n Clean-tech manufacturing market worth $650 billion per year

n Geographic concentration presents supply chain risks

Syed Ali

Australia’s energy transition effort is

continuing to make progress, with the

announcement that Azuli Internation-

al (Azuli) has signed an extension to

its Memorandum of Understanding

with Australian Gas Infrastructure

Group (AGIG), under which the two

companies will work together to iden-

tify, evaluate and progress carbon

capture and storage (CCS) project op-

portunities in the country. CCS is a

core strand of the energy transition to

net zero targets, with onshore pipe-

lines being a key component of any

project.

Azuli is an independent CCS special-

ist company based in the UK, with a

portfolio of global CCS opportunities,

while AGIG is one of Australia’s larg-

est gas infrastructure businesses with

operations across every mainland state

and the Northern Territory.

CEO of Azuli, Hamish Wilson, ex-

plained: “This move allows us to put

real impetus into a new phase of

growth, looking to leverage the range

of opportunities on offer in Australia,

where the government has set emis-

sions targets and regulations for carbon

sequestration either in place or being

rapidly developed.”

The move will be an important piece

of Australia’s plan to achieve net zero

by 2050. To reach its goal, the Austra-

lian government will invest A$20 bil-

lion ($14.4 billion) in low emissions

technologies over the next decade (un-

der the Technology Investment Road-

map), hoping to unlock A$80 billion

of private and public investment on

green technologies.

Notably, the state of New South

Wales (NSW) is well on the way to

the 2050 target, having said in Decem-

ber that it will slash greenhouse emis-

sions by 70 per cent by 2035. It is

already on track to meet its current

target of halving emissions by 2030,

based on 2005 levels. NSW Treasurer

Matt Kean said the new 2035 target

would also attract more than $39 bil-

lion in private investment.

In January Italy’s Enel Green Power

secured grid-connection approval for

a project that is planned to incorporate

96 MW of solar and 20 MW battery

storage capacity. It will be the com-

pany’s “very rst” hybrid solar-plus-

storage project in the country.

The complex will be installed in the

state’s Central West and Orana Re-

gion, with its construction set to begin

in the middle of this year. Enel said

the point of connection to the electric-

ity grid will be shared under single

Generator Performance Standards

(GPS), instead of two separate con-

nection points in close proximity.

South Korea will raise its dependence

on nuclear power generating sources

to over 30 per cent, while sharply re-

ducing its reliance on coal by 2036,

as it accelerates its push to reach car-

bon neutrality.

Last month the Ministry of Trade,

Industry and Energy said it will raise

the share of nuclear energy in the gen-

erating mix to 34.6 per cent by 2036

from 23.4 per cent in 2018, while re-

newable sources will be responsible

for 30.6 per cent, up from 6.2 per cent

in 2018. At the same time, South Ko-

rea will cut its reliance on coal red

power generation to 14.4 per cent by

2036 from 41.9 per cent in 2018.

South Korea’s President Yoon Suk

Yeol has pledged to reverse the nucle-

ar phase-out policy of the previous

administration.

The move comes as South Korea has

been pushing to reduce its greenhouse

gas emissions by 40 per cent from the

2018 levels by 2030 and reach carbon

neutrality by 2050.

“South Korea will actively use re-

newable energy sources and nuclear

power plants and come up with a fea-

sible and balanced energy mix amid

the country’s efforts to reach carbon

neutrality,” the ministry said.

South Korea will also reduce the

proportion of power generation from

liqueed natural gas to 9.3 per cent in

2036 from 26.8 per cent in 2018, the

ministry said. A total of 28 aging coal

power plants will be converted to

LNG power plants by 2036.

In terms of renewable energy, the

ministry plans to add more wind gen-

erators by 2036 to reduce its heavy

reliance on solar power generators.

The statement was followed by news

that Danish wind turbine manufac-

turer Vestas Wind Systems will invest

$300 million in South Korea and

move its Asia-Pacic headquarters to

the country.

The investment will be made toward

a large-scale turbine parts plant that

will produce key equipment for wind

turbines for export to the entire Asia-

Pacic region.

Vestas’ decision to move its Asia-

Pacic headquarters to South Korea

shows that multinational companies

are recognising the country as an in-

vestment hub, the presidential ofce

said.

Indonesia says it will stop importing

fossil fuels from 2045, under a pro-

gramme that aims to cut imports of

fossil fuels, increase the use of renew-

able energy, as well as minimise emis-

sions from the use of fossil fuels.

Coordinating Minister for Maritime

Affairs and Investment, Luhut Binsar

Pandjaitan, said the increased produc-

tion of palm oil will be central to the

abandonment of fossil fuel imports.

According to Pandjaitan, the transi-

tion from fossil fuelled energy to re-

newable energy would enable net zero

emissions by 2060.

Pandjaitan said the development of

alternative fuels is one of the ve

green economic pillars being imple-

mented, the other four being: decar-

bonisation of the electricity sector; the

utilisation of low-carbon transporta-

tion; the development of green indus-

try; and the strengthening of carbon

sinks.

Speaking at the World Energy Fo-

rum which took place in Davos, Swit-

zerland last month, Pandjaitan said:

“We are currently researching (the

potential of) palm oil because we be-

lieve that we will be able to produce

around 100 million tons of palm oil

by 2045.”

At least 30 percent of palm oil pro-

duction will be used for the food in-

dustry, while the remaining 70 per cent

will be used to manufacture ethanol,

the coordinating minister said.

The Indonesian government will

now allow productivity of the planta-

tions to be increased from 2.3 tons per

hectare to 8-10 tons per hectare in the

next 10-15 years.

The Philippines is ramping up its re-

newable generating capacity as sev-

eral power companies announce plans

for major new additions this year.

Meralco PowerGen Corp. (MGen),

the power generating arm of Manila

Electric Co., is targeting to commence

this year the construction of “hundreds

of megawatts” of new renewable en-

ergy projects, as two solar plants are

set for commissioning this quarter.

MGen President and CEO Jaime

Azurin said the company was looking

to commission projects this quarter

that would add around 150 MW to its

renewable energy capacity.

The two projects that will start com-

mercial operations shortly are the 75

MWac solar plant in Baras, Rizal and

a 68 MWac solar plant in Ilocos Norte.

The news came as Solar Philippines

New Energy Corp. announced its plan

to convert land located in Nueva Ecija

and Bulacan for solar energy projects

in its pipeline.

In a disclosure sent to the Philippine

Stock Exchange in early January, Solar

Philippines said that over 3000 ha (30

km

2

) will be prepped by the rst quar-

ter of this year. Conversion of these

lands will commence by the nal quar-

ter of 2023.

Meanwhile, Aboitiz Power Corp.

said it has secured a P20 billion ($1.65

billion) loan from state-run Land Bank

of the Philippines to fund the expansion

of its renewable energy projects.

The long-term debt nancing is set

to nance AboitizPower’s ongoing

expansion and development projects,

according to the company’s Chief Re-

newables Ofcer Jimmy Villaroman.

“This loan will allow us to continue

providing clean and sustainable energy

to help meet the growing demand in

the country,” he said.

Villaroman said the loan facility is

aligned with AboitizPower’s 10-year

strategy of growing its renewable en-

ergy portfolio to 4600 MW, or half of

the total 9200 MW capacity, alongside

its thermal assets, which the company

targets to generate by 2030.

AboitizPower is looking to spend

P190 billion this decade for an addi-

tional 3700 MW of clean energy. It has

over 1000 MW of disclosed and ongo-

ing renewable projects, which include

solar, oating solar, hydro, and onshore

wind, as of end November 2022.

S. Korea raises nuclear ambitions in net zero drive

S. Korea raises nuclear ambitions in net zero drive

Indonesia to halt fossil fuel imports by 2045

Indonesia to halt fossil fuel imports by 2045

Philippines power companies ramp up renewables

Philippines power companies ramp up renewables

Australia advances low carbon

Australia advances low carbon

projects

projects

n Azuli and AGIG extend carbon capture agreement

n Enel Green Power secures solar-plus-storage grid connection

4

THE ENERGY INDUSTRY TIMES - FEBRUARY 2023

Asia News

United Arab Emirates’ Masdar has

signed deals for renewable energy

projects with a combined generation

capacity of 6 GW in Central Asia and

5 GW in Africa.

Masdar agreed to jointly develop

with the State Oil Company of the

Republic of Azerbaijan (SOCAR) a

total capacity of 4 GW of onshore

wind and solar projects, and integrat-

ed offshore wind and green hydrogen

projects.

The UAE company has also signed

an agreement to develop a 1 GW pipe-

line of renewable projects in Kyrgyz-

stan, starting with a 200 MW solar

photovoltaic plant, and another deal

for an up to 1 GW wind power plant,

its rst investment in Kazakhstan.

Under the Etihad 7 initiative, a glob-

al development fund launched by the

UAE to provide 100 million people

across Africa with clean electricity by

2035, Masdar has agreed to develop

projects with a combined 5 GW of

capacity across Angola, Uganda and

Zambia.

Speaking at the Abu Dhabi Sustain-

ability Week (ADSW) 2023 in Janu-

ary, Sheikh Shakhboot Nahyan Al

Nahyan, Minister of State in the UAE

Ministry of Foreign Affairs and Inter-

national Cooperation, said that his

country and African nations share “a

rm belief in the tremendous potential

[of clean energy] to unlock economic

and climate action progress”.

Following a 2 GW agreement last

year for renewable energy projects in

Tanzania, this year’s 5 GW pledge

includes agreements with:

n Angola’s Ministry of Energy and

Water for the development of 2 GW

of renewable energy capacity;

n Uganda’s Ministry of Energy and

Mineral Development for the devel-

opment of 1 GW of greeneld renew-

able capacity;

n and Zambia’s Ministry of Energy

and Zambian national utility ZESCO

Limited for the joint development of

solar, wind and hydroelectricity proj-

ects with a total capacity of 2 GW.

Angola’s Minister of Energy and

Water, Joao Baptista Borges, said the

agreement would boost power gen-

eration capacity, create jobs and

improve access to electricity for the

Angolan people. Victor Benjamin

Mapani, ZESCO Managing Director,

said his company – and Zambia over-

all – viewed the development of clean

energy as complementary to hydro-

power and a matter of urgency for

energy security.

According to the International Re-

newable Energy Agency (IRENA),

less than half of the sub-Saharan

population has access to electricity.

Africa generates just 20 per cent of its

electricity from renewable sources but

has a theoretical potential capacity of

approximately 850 TW of solar and

wind.

Masdar has already established a con-

siderable presence in Africa, having

formed its Innity Power Holding joint

venture with Egypt’s Innity to target

opportunities on the continent. In No-

vember, Masdar, Innity Power and

Hassan Allam Utilities signed an

agreement with the government of

Egypt to develop a 10 GW onshore

wind project – one of the largest wind

farms in the world.

The three companies are also coop-

erating on the development of green

hydrogen projects in Egypt, targeting

a combined electrolyser capacity of

4 GW by 2030, and an output of up to

480 000 tonnes of green hydrogen per

year.

The deals are part of Masdar’s ef-

forts to deliver 100 GW of clean en-

ergy worldwide by 2030.

Lebanon’s caretaker government has

approved credit lines totalling $116

million to x the country’s electricity

transmission grid. Prime Minister Na-

jib Mikati said an advance of $62 mil-

lion had been approved, with $54

million being allocated to mainte-

nance works.

Energy Minister Walid Fayad has

announced a $600 million, ve-

month initiative to solve the country’s

chronic power outages and increase

electricity supplies to ten hours a day.

Since 2019, Lebanon has been

plagued by a crippling economic cri-

sis. The country’s two main power

plants have suffered outages and re-

quire heavy maintenance.

Nadia Weekes

Türkiye has revealed how it plans to

achieve 29.6 GW of installed wind

capacity by 2035, with 5 GW to be

deployed offshore. Under projections

included in the country’s latest Na-

tional Energy Plan, which is aligned

with Türkiye’s goal to achieve net zero

emissions in 2053, nearly 100 GW of

electricity capacity is to be commis-

sioned in the 2020-2035 period.

Speaking at the launch of the plan,

Energy and Natural Resources Min-

ister Fatih Donmez said it will both

support economic growth and take the

country’s green energy transforma-

tion to the next level.

The combined share of solar and

wind power will increase to 43.5 per

cent, while the share of all renewable

energy sources is expected to reach

64.7 per cent. To date, Türkiye has

installed 11 GW of onshore wind ca-

pacity and no offshore wind.

Veli Bilgihan Yaşacan, vice-chair of

the board of the Offshore Wind En-

ergy Association (DURED), said the

5 GW target was an important mile-

stone for the sector. Yaşacan also em-

phasised the role that offshore wind

power can play in the production of

green hydrogen.

Türkiye’s energy consumption was

147.2 million tons of oil equivalent in

2020. It is projected to increase 39.5

per cent to reach 205.3 million tons

of oil equivalent in 2035.

The country’s installed electricity

capacity will reach 190 GW by 2035,

up from 96 GW in 2020. Three-quar-

ters of the increase is expected to come

from renewable energy sources, pri-

marily solar and wind. In 2035, solar

capacity will reach 53 GW, followed

by hydro at 35 GW and wind at 30 GW,

well ahead of nuclear, geothermal and

biomass. Battery storage capacity is to

rise to 7.5 GW.

Türkiye’s new Hydrogen Technolo-

gies Strategy and Roadmap outlines

the important role that green hydrogen

can play in achieving the country’s

net zero emissions target. From 2030

to 2053, the share of hydrogen blend-

ed into natural gas will be 12 per cent,

and synthetic methane 30 per cent.

The expected cost of hydrogen pro-

duction is $2.4/kg in 2035, halving to

$1.2/kg by the 2050s.

Under the plan, installed electroly-

ser capacity will reach 2 GW in 2030,

5 GW in 2035 and 70 GW in 2053.

Africa can harness its strong solar en-

ergy resources to produce 50 million

tonnes of green hydrogen a year by

2035 to meet local demand and for

export, according to a study by the

European Investment Bank (EIB).

The study nds that producing green

hydrogen from solar power is eco-

nomically viable at a cost below €2/

kg ($2.1), equivalent to an oil price of

$60 a barrel.

Unlocking Africa’s green hydrogen

potential will help decarbonise local

heavy industry while creating jobs,

securing global energy supplies and

improving access to clean water and

sustainable energy.

The Africa’s Extraordinary Green

Hydrogen Potential report focuses on

three hubs: Egypt, southern Africa, and

Mauritania – Morocco. It estimates

that tapping the sun’s energy for hy-

drogen production would require 1230

GWp of new solar energy generation

and €1 trillion of investment in green

hydrogen production and transmis-

sion.

The study outlines three prerequi-

sites to reach the contemplated scale

of hydrogen development:

n national planning, regulation and

incentive schemes;

n partnerships to cooperate on infra-

structure and enable mass-scale off-

take;

n and pilot projects.

Meanwhile, a report by the Interna-

tional Renewable Energy Agency

(IRENA) nds that nearly 60 per cent

of Nigeria’s energy demand in 2050

can be met with renewable energy

sources, saving 40 per cent of natural

gas and 65 per cent of oil use.

‘Renewable Energy Roadmap for

Nigeria’, developed in collaboration

with the Energy Commission of Ni-

geria, nds renewable energy tech-

nologies are key to achieving a sus-

tainable energy mix and meeting the

country’s growing needs. “By using

its abundant, untapped renewables,”

said IRENA’s Director-General Fran-

cesco La Camera, “Nigeria can pro-

vide sustainable energy for all its

citizens in a cost-effective manner.”

Coordinated policies will be essen-

tial for a successful energy transition,

said Dr. Adeleke Olorunimbe Ma-

mora, Nigeria’s Minister of Science,

Technology and Innovation. “A cross-

cutting agency or body tasked with

doing so would be helpful in building

consensus and developing a coherent

plan which in turn would allow for the

scaling up of renewable energy to

meet the needs across the Nigerian

energy sector,” he added.

The share of primary energy require-

ments met with renewable energy can

reach 47 per cent by 2030 and 57 per

cent by 2050, according to IRENA’s

report. Electrication will play a key

role in achieving higher renewable

energy shares with electricity in nal

energy use nearly doubling by 2050.

Türkiye unveils roadmap to 30 GW

Türkiye unveils roadmap to 30 GW

of wind energy by 2035

of wind energy by 2035

Solar-powered hydrogen ‘viable’ in Africa

Solar-powered hydrogen ‘viable’ in Africa

Lebanon opens credit

Lebanon opens credit

lines to x electricity

lines to x electricity

grid

grid

Masdar signs multi-megawatt

Masdar signs multi-megawatt

clean power deals

clean power deals

Agreements in Central Asia and Africa pave the way for global rollout of 100 GW of renewable energy projects by

2030. Nadia Weekes reports

n First 5 GW of offshore wind “an important milestone”

n Renewables will be three-quarters of capacity growth

6

THE ENERGY INDUSTRY TIMES - FEBRUARY 2023

International News

National Host Organised by:

Driving Clean,

Reliable Solutions to

European Energy Demand

BOOK YOUR

STAND

Under the patronage of

For information:

exhibition@emc-cyprus.com

+39 30803030

+39 340 3377803

28-30 November 2023

Limassol - Cyprus

www.emc-cyprus.com

EASTERN

MEDITERRANEAN

ENERGY

CONFERENCE &

EXHIBITION

MINISTRY OF ENERGY

COMMERCE AND INDUSTRY

OF CYPRUS

THE ENERGY INDUSTRY TIMES - FEBRUARY 2023

7

Companies News

Junior Isles

As businesses were called on during

the World Economic Forum in Davos,

Switzerland, to follow credible net

zero pledges or risk greenwashing, a

survey has found that 8 in 10 organisa-

tions would accept regulatory penal-

ties to avoid taking on sustainability

initiatives.

In a survey of 2000 senior IT deci-

sion-makers from the US, Canada,

UK, Germany and France, Germany-

based Software AG found that the

majority (84 per cent) of organisations

will prioritise commercial objectives

over sustainability in the face of eco-

nomic challenges. This is despite the

fact that almost all (95 per cent) lead-

ers agree sustainability is either a top

or high priority and a similar number

(97 per cent) agree that other rms’

sustainability credentials are either

essential or important in their own

buying decisions.

Despite the difculties of delivering

sustainability initiatives, 87 per cent of

companies believe that they will lose

investors if they do not have a clear

strategy and many lack the technology

to deliver one. In almost a third (32 per

cent) of cases the necessary technology

is simply not in place. And even when

it is available, it is poorly implemented

or used by almost half (47 per cent) of

companies. In particular, 36 per cent

say that they are unable to effectively

track the progress of sustainability ini-

tiatives to determine whether they are

effective.

The majority (87 per cent) of organ-

isations tackle sustainability and digi-

tal transformation separately. The Re-

ality Check report, which seeks to

investigate how technology initiatives

can benet both sustainability and

commercial objectives, shows how an

integrated approach can address mul-

tiple challenges at once.

Sanjay Brahmawar, CEO, Software

AG commented: “In the current cli-

mate, it’s no surprise that commercial

objectives are a top priority – they

have to be, otherwise organisations

cannot continue to operate. We are

keen to help organisations to nd so-

lutions using the ‘Genius of AND’,

where they don’t have to be torn be-

tween commercial and sustainability

objectives.”

Promisingly, a third (33 per cent) of

organisations have already integrated

sustainability plans into their technol-

ogy roadmap.

Earlier ENGIE Impact launched its

2023 Net Zero Report, titled ‘Six Ac-

tions to Accelerate Decarbonisation’.

It revealed that nearly two-thirds (62

per cent) of the 500 senior executives

surveyed said they have now made

some form of public commitment or

target to address carbon emissions

reduction but only 12 per cent rate

their sustainability efforts as “ex-

tremely successful”.

GE Gas Power has signed of a Mem-

orandum of Understanding (MoU)

with Japan’s IHI Corporation (IHI) to

jointly develop ammonia combustion

technologies for heavy duty gas tur-

bines to generate electricity with re-

duced or near zero CO

2

emissions.

The MoU marks a signicant mile-

stone following the announcement in

June 2021 of the rst MoU between

GE and IHI to carry out an economic

assessment for the use of ammonia as

a carbon-free fuel for both existing

and new gas turbines. As part of the

MoU, both parties will further dene

a technology roadmap to develop gas

turbine technologies by 2030 that will

enable GE’s 6F.03, 7F and 9F gas tur-

bines to re up to 100 per cent am-

monia in a safe and commercially

competitive manner, with potential

implementation across additional gas

turbines in the future.

The collaboration aligns with the

companies’ commitment to support

the global transition. GE will bring its

extensive experience and expertise in

engineering and manufacturing gas

turbine combustors and balance of

plant systems, while IHI Corporation

will bring its experience in developing

ammonia combustion technologies

and global value chain development.

Scott Strazik, CEO of GE Vernova,

said: “We hope that this collaboration

will pave the way for power plant op-

erators to pursue the adoption of

carbon-free fuels such as ammonia for

power generation in their GE gas tur-

bines and signicantly contribute to-

wards lowering carbon emissions in

the power sector globally.”

UK energy company Centrica has

forecast an almost eight-fold increase

in full-year earnings after it benetted

from soaring energy prices. The fore-

cast is in spite of the impact of the

windfall taxes on energy companies.

The energy group, which owns Brit-

ish Gas, said that it expected to report

adjusted earnings per share of more

than 30p when it publishes its 2022

results this month. The update repre-

sents a signicant upgrade on the com-

pany’s previous guidance in Novem-

ber when it said earnings would come

in at the top end of analysts’ expecta-

tions, which at the time ranged be-

tween 15.1p and 26p per share.

SSE also increased its full-year

prot forecast after higher than ex-

pected output from its gas red plants.

The company said that output from its

gas power plants was 27 per cent

higher in the nine months to the end

of December compared to the previ-

ous year.The power generator said last

month that adjusted earnings were

expected to rise to more than 150p a

share for the 12 months to the end of

March, up from its earlier forecast of

at least 120p. In November, SSE re-

ported a four-fold increase in prots

in the six months to September.

Power companies have benetted

from the high electricity and gas en-

ergy prices exacerbated by Russia’s

war on Ukraine, which has led the UK

government to impose windfall taxes

on power companies and oil and gas

majors.

Alistair Phillips-Davies, SSE’s

Chief Executive, had warned that the

tax could harm investment in the UK.

But the company says it remains on

track to deliver record investment of

more than £2.5 billion this year, “with

clear visibility” for further investment

opportunities that support the transi-

tion to net zero.

Phillips-Davies maintains, however,

that Britain is not moving fast enough

on green economy and says planning

and consent times for renewables de-

velopment must be improved.

n The UK government is set to recoup

hundreds of millions of pounds from

the sale of the collapsed power sup-

plier Bulb to Octopus Energy, as long

as wholesale gas prices do not rise

again in the coming months. The po-

tential payback from the Octopus deal

will raise hopes that the cost to taxpay-

ers and households of Bulb’s tempo-

rary nationalisation will be well below

expectations. The recent drop in en-

ergy prices – if it continues – would

shave up to £840 million from the

eventual losses, government ofcials

have estimated.

Wind turbine manufacturer Siemens

Gamesa Renewable Energy SA has

revealed a €472 million ($511.4 mil-

lion) charge to operating prot in the

rst quarter ended December, after

discovering faulty components in its

installed eet that increased its war-

ranty and maintenance costs.

The charge will lead to approximate-

ly a €760 million loss of EBIT before

purchase price allocation (PPA) and

integration and restructuring (I&R)

costs for the rst three months, the wind

turbine maker said in its preliminary

earnings report.

“These charges reect the outcome

of the evaluation of the installed eet,

during which the company detected a

negative development of failure rates

in specic components resulting in

expected higher warranty and service

maintenance costs than previously es-

timated,” the company stated.

The news comes as some developers

are predicting difcult times for the

wind industry.

In January, Denmark’s Orsted A/S,

one of the world’s largest renewable

energy developers, said it fears that the

energy transition will slow as increased

competition and interest rates reduce

protability and challenge the case for

investment.

Some argue that the sector is becom-

ing a victim of its own success. Until

recently, wind power was increas-

ingly affordable. As turbine sizes in-

creased, costs plummeted. This trajec-

tory was expected to continue and

tenders for new projects began to fa-

vour applicants who could promise

lower power prices. In recent years,

however, ination and rising interest

rates have put an end to the downward

trend in costs and now threaten con-

tinued growth.

Mads Nipper, CEO of Orsted, told

Bloomberg Green in a podcast: “If

states around the world say energy

prices can only go down, it will be a

race to the bottom. In the end, capital

will dry up.”

He added: “There’s not much room

to absorb higher costs. A typical off-

shore wind farm generates a return of

about 1 per cent above the cost of

capital. A really good project can get

as much as 3 per cent. Rising interest

rates are eroding that return, and if the

price of electricity from wind farms

doesn’t go up, companies won’t be able

to invest at the rate needed to meet cli-

mate targets.”

GE and IHI eye ammonia-red gas turbines by 2030

Energy company prots surge as prices soar

Siemens Gamesa takes hit on operating prot

Businesses prioritising commercial

success over sustainability

A corporate survey nds that although almost all IT decision makers rank sustainability as their top priority, 84 per cent

still prioritise commercial objectives over sustainability.

MED ENERGY

CONFERENCE & EXHIBITION

Reshaping the Energy Industry:

Action for Transition

23-25 May 2023

Ravenna, Italy

www.omc.it

FOUNDERS ASSOCIATED COMPANIES

ORGANISED BY

16.000

OMC ATTENDEES

1.000

DELEGATES

30

SPONSORS

25

SUPPORTING

ASSOCIATIONS

350

EXHIBITING

COMPANIES

SPACE REQUESTS exhibition@omc.it CONFERENCE ENQUIRIES conference@omc.it

Looking through the

industrial cyber portal

Every power project has different requirements and components

that change the prerequisites for cyber security. At the same time,

cyber security needs to change over the lifetime of a project, making

it tricky to maintain a holistic overview of projects around the world.

Siemens Energy has therefore developed an industrial cyber

security portal that simplies the integration of cyber security into

each of its projects, with the aim of delivering products and solutions

that are inherently cyber secure. Junior Isles

denition in alignment with business

units’ offerings and manufacturing, it

also enables understandable and opti-

mised implementation of cyber secu-

rity in processes, technology and

guidelines.

To address these issues, the company

recently launched what it calls its In-

dustrial Cybersecurity Portal (ICS

Portal).

The portal is designed to simplify

security by providing specic func-

tion modules within a central reposi-

tory. Tasks and outcomes are stored

centrally so they can be evaluated and

documented. This will help provide

transparency for the central ICS team

and the business units themselves.

Stensletten said: “It is designed to

serve as a ‘one-stop-shop’ for ad-

dressing all cyber security needs of

any given project. Helping all our

Siemens Energy business units work-

ing with our portfolio, the ICS portal

provides transparency, for example,

on relevant security requirements for

their assets as well as guidance on

related vulnerabilities and their miti-

gation. Featuring automation capa-

bilities, and the ability to contextual-

ise, visualise, and structure the

project data, it has never been easier

to integrate and maintain cyber secu-

rity in the design of our products and

solutions.”

The types of risks that a project

might face could range from a vul-

nerability in an individual compo-

nent delivered to a customer, to a

solution from a sub-supplier that

does not meet the security require-

ments of the customer.

“To remain a trusted partner for our

customers, our portfolio must become

secure by design to protect adequately

against cyber threats, meeting global

regulatory requirements and stan-

dards. To achieve this goal broadly

and holistically can be a huge chal-

lenge. It requires a simplication of

security and the ability to integrate

cyber security into existing business

W

hile digitalisation is seen as

a key pillar of the energy

transition, the growth of

devices connected to the industrial

internet poses a real threat. Certainly,

it is a major concern for executives.

According to PwC’s 25th Annual

Global CEO Survey, 44 per cent of

energy, utilities and resources CEOs

ranked cyber threats as a “top three”

concern. And of all sectors, energy is

among the most targeted.

According to the X-Force Threat

Intelligence Index 2022, the energy

sector ranked as the fourth most af-

fected sector in 2021, with 8.2 per

cent of all observed attacks, behind

the manufacturing industry, the nan-

cial sector, and the professional ser-

vices sector. The war in Ukraine has

no doubt heightened that threat. In

April, for instance, Ukraine’s Com-

puter Emergency Response Team

announced that it had successfully

repelled a series of cyber attacks on

the country’s power grid.

In the past, hacking energy infra-

structure would usually require cyber

criminals to have an on-site deploy-

ment to successfully hack the opera-

tional technology needed to run a

network or plant. With increasing

digitalisation, and as information

technology (IT) and operational

technology (OT) converge, this is no

longer the case.

Today, utilities, factories, etc., typi-

cally use IT systems connected to OT

networks to operate their digital

equipment. This makes it easier than

ever for cyber criminals – whether

nations (cyber warfare) or individuals

– to not only inltrate the IT of a

company, but also the attached OT

operated via those IT systems. To

keep the critical infrastructure secure,

providers of energy technology

equipment nowadays have to provide

state-of-the-art cybersecurity solu-

tions including secure products that

meet all legal requirements.

Commenting on the challenges its

customers are facing and what it can

do as a company, Bernhard Mehlig,

Industrial Cybersecurity Consultant,

Siemens Energy, said: “Companies

that provide us with electricity, natu-

ral gas for heating or oil for transport,

operate complex manufacturing and

production sites that use digital solu-

tions to make their operations more

efcient and protable. These are at

risk from various types of hackers.

The companies that we provide solu-

tions to are becoming more and more

aware of this. So it is important for us

to focus on what we can do to ensure

our customers achieve a secure opera-

tion of the products and solutions we

provide.”

Rune Stensletten, Head of Industrial

Cybersecurity Ofce (ICS Ofce),

Siemens Energy, added: “The indus-

trial products and solutions we pro-

vide to our customers cannot be pro-

tected in the same way as IT

infrastructure. Trying to secure these

systems is a highly complex task. So

what we are doing is trying to collect

and dene best practice and guidance

centrally and provide it to our internal

business partners. The purpose of our

industrial cyber security team is to

support our businesses involved in

the execution of customer projects

and product development.”

Although each business unit of Sie-

mens Energy has its own industrial

cyber security community, which

oversees cyber security for products

and solutions coming out of the spe-

cic business unit, the central ICS

Ofce coordinates all the various ef-

forts. This includes cyber resilience

of Siemens Energy’s various manu-

facturing and production sites as well

as the security of products and solu-

tions provided to its customers.

Such an approach enables each

business unit’s ICS community to

bring their expertise to customer

projects, answering all questions and

meeting the needs of the customer.

But in an environment that is changing

quickly there has to be a coordinated

way of managing this community of

ICS experts and bringing them up to

speed with the latest requirements for

each product and solution. This is

where the central ICS team comes in.

A good example is the differing and

evolving cyber legislation in the re-

gions Siemens Energy is operating in.

In the EU, the recently introduced

Cyber Resilience Act (CRA) requires

each project in the energy industry to

meet certain criteria. Cyber security

therefore is a business enabler and

market access requirement in many

countries, as technology providers are

not able in some parts of the world to

conduct business without complying

with existing legislation. Further,

customers themselves might have

specic requirements that can be a

deciding factor in selecting an equip-

ment supplier.

Executing projects worldwide is al-

ready a complex task; and cyber secu-

rity adds yet another layer of com-

plexity that has to be addressed. As

Mehlig put it: “There are already a lot

of moving parts and a lot of resources

and deliverables have to be aligned.

Cyber security adds to that. And if

you look at the specic cyber security

task there is a sequence that has to be

followed and tasks have to be execut-

ed iteratively. You have to have all

your ducks in a row.

“This presents challenges for tech-

nology companies, from both a cen-

tral point of view and in a customer

project context to keep track of risks

originating from cyber security is-

sues, e.g. non-compliance to cyber

requirements or security vulnerabili-

ties in products or solutions. Essen-

tially, one needs enough transparency

when it comes to cyber risk to act

appropriately.”

According to Siemens Energy, hav-

ing the tools to keep track throughout

its cyber community is therefore key.

Having this ability not only drives

horizontal cyber security portfolio

Mehlig: “Essentially, one needs enough transparency when it

comes to cyber risk to act appropriately.”

THE ENERGY INDUSTRY TIMES - FEBRUARY 2023

8

Special Supplement: Cyber security

Stensletten says the portal is designed to serve as a ‘one-stop-

shop’ to address all cyber security needs of any given project

tasks and workow. The supplier

module says that when you are buying

things from 3rd parties, you want to

make sure that these vendors are se-

cure and know how to develop secure

products and solutions that meet our

customer requirements.”

“There are certain activities that

should be best practice, depending on

the state, or the time in the lifecycle of

the project,” added Mehlig. “So, we

want to create a module for every ac-

tivity; i.e. specic modules for certain

activities that occur during a particular

timeframe in the project lifecycle.

“This simplies security. A person

that is focused on a specic activity

can feed in the data to the portal,

which stores it in the context of the

project. This makes it easier for the

project team to assess certain out-

comes and react accordingly.”

Stensletten noted: “Bernhard and I

have worked in cyber security in the

business units for many years and

we’ve been talking about having this

tool for at least ve or six years. Now

as part of this central team, we nally

have the means to be able to do this.

By doing this we are not only helping

the business unit we came from but

the entire company, when it comes to

dealing with cyber security.”

In developing the portal, the central

ICS team has collaborated closely

with cyber security communities

working on projects. “This is impor-

tant to build the functionalities that

are relevant to them in their business

area,” said Stensletten. “But we are

also thinking long term because we

know that if we do all of our cyber

security due diligence as part of our

project execution, it also makes it

possible to use these services for our

end customers.

“By doing vulnerability manage-

ment in-house, we ensure the elimi-

nation of all vulnerabilities before

handing over to customers, and we

are also monitoring solutions during

the warranty phase. Further, we can

provide this as an end service to

customers after the warranty. ”

This, he says, not only provides

them with information on upcoming

vulnerabilities but also gives them

access to experts that actually devel-

oped the product or solution, who can

advise on how to address the issue.

Stensletten added: “Going into the

project phase, there are a number of

different roles. There are engineers,

technical project managers, etc., and

we are introducing a role that is re-

sponsible for cyber security in proj-

ects to ensure that the activities that

have been dened are actually being

followed – kind of like a quality

[control] function. There is also an

ICS expert, who will help with the

technical implementation and veri-

cation of requirements, etc.

“The idea is that the tool will guide

you through all the cyber security

activities, allow you to customise ac-

cording to the project’s cyber security

risks and introduce cyber security

activities for different roles in the

project.”

Siemens Energy also plans to create

a dashboard where it can collect key

performance indicators (KPIs), gen-

erate queries and create reports on, for

example, projects that have reached a

certain stage.

Mehlig explained: “This is impor-

tant for us centrally and for the port-

folio. We can, for example, look at all

projects in a certain area and see how

many components have been sold

there, what their current status or risk

assessment score is, etc. This would

allow us to make detailed evaluation

reports based on data entered, and try

to gure the risks or hotspots in terms

of cyber security risks.”

“It could also show where the or-

ganisation is lagging. For example,

we can nd out where, say, vulnerabil-

ity mitigation is taking very long. The

portal will allow the organisation to

monitor itself in order to learn and

improve.”

In addition to further developing

the tool, the ICS team’s next steps

will be to reap the rewards of its

work by raising awareness of the

portal internally and making its use

inside the company more wide-

spread. The overall goal is to sim-

plify the integration of projects, ulti-

mately beneting Siemens Energy

customers, who can rely on a unied

process that ensures implementation

of cyber security before the solution

is handed over.

Stensletten summed up: “We have

been a small group, currently working

on the development of the portal’s

functionality and verifying that the

technology is working. Now we will

introduce it to the whole company by

implementing the module for the ini-

tial risk assessment, and will build the

core functionality as we get more

people to start using this tool.”

THE ENERGY INDUSTRY TIMES - FEBRUARY 2023

9

Special Supplement: Cyber security

processes. The ICS portal is a tool that

covers the whole lifecycle of cyber

security for our customers’ projects,”

said Mehlig.

The portal will have a number of

modules to support both Siemens

Energy and its customers. With the

rst release of the ICS Portal it is al-

ready possible to:

n Dene the ‘project context’ by add-

ing project information, (security)

zone hierarchy; asset denitions; soft-

ware/hardware components;

n Evaluate standards and require-

ments by the mapping of requirements

between different standards;

n Perform vulnerability monitoring.

In the next iteration, the ICS team

plans to introduce other functions like

risk assessment to give an indication

of the type of cyber security that

should be planned for project execu-

tion; vulnerability management in

assets and components; secure sup-

plier cyber security evaluation; and

project security activities guidance.

Stensletten explained: “The vulner-

ability management module, for ex-

ample, will contain a full list of all

assets and components involved in

the project and will allow tracking of

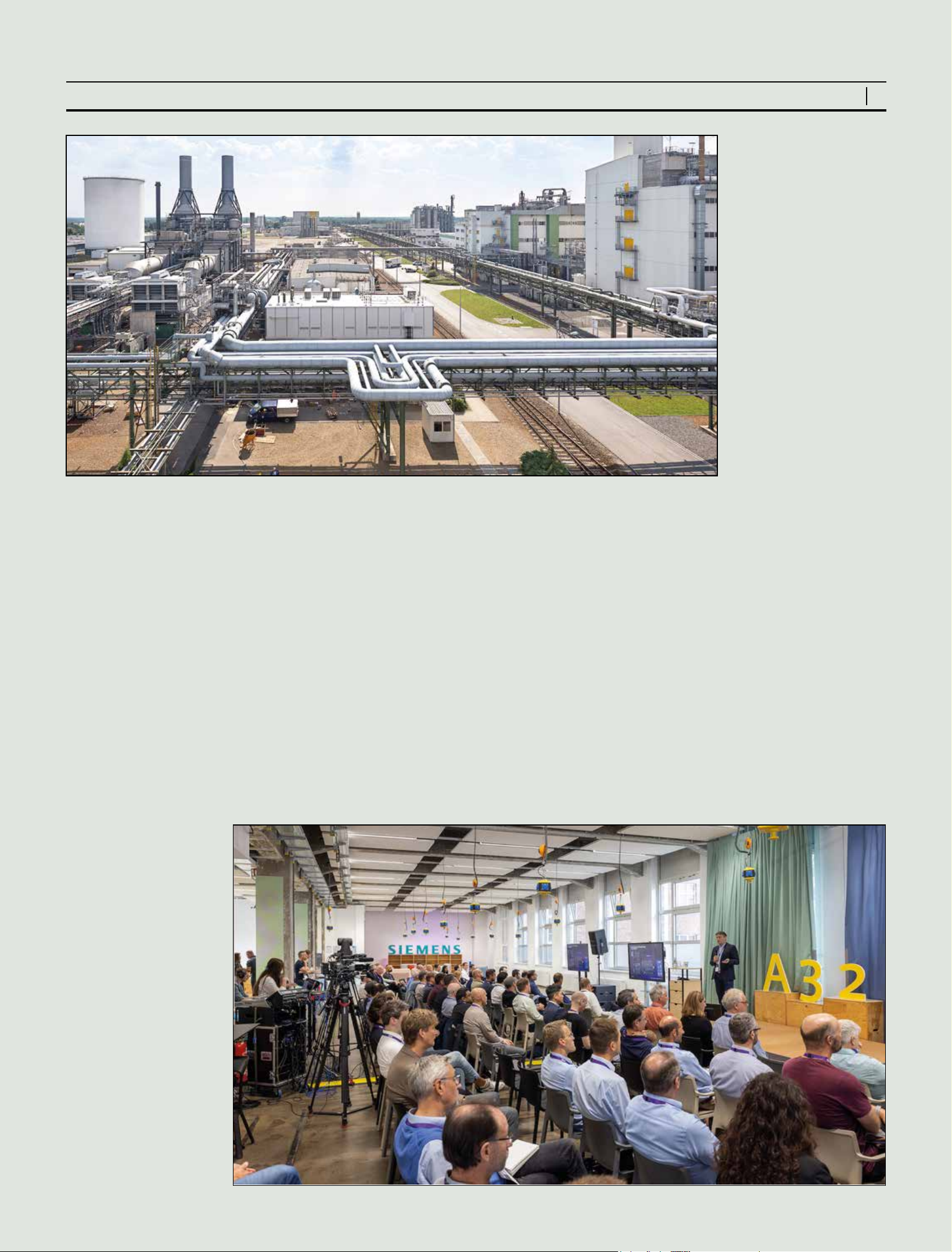

Cyber security in industrial

projects is a key concern

Siemens Energy’s industrial

cyber security experts came

together for an on-site event

in Berlin during September

last year

LET’S MAKE TOMORROW DIFFERENT TODAY

Transforming the entire energy system requires

all of us to change how we do business, invest,

govern, consume, and even live.

we can’t do it alone

Honestly,

siemens-energy.com

Siemens Energy is a trademark licensed by Siemens AG.

Anzeige_Honestly_ENG_290x380mm_220921.indd 1Anzeige_Honestly_ENG_290x380mm_220921.indd 1 21.09.22 10:3221.09.22 10:32

India launches $2.4 billion

programme to go big on hydrogen

Italy, Eni seek to boost Africa gas

exports to Europe with Mattei Plan

Gary Lakes

Coal and hydrocarbons provide India

with the energy it needs to keep its

industries and businesses growing and

its automobiles moving. But carbon

dioxide emissions must be drastically

curtailed if the country is serious about

reducing its contribution to the dam-

age being done to the global climate

as well as its own environment.

India’s air pollution problem alone

became starkly obvious when during

the early days of the Covid-19 global

lockdown, before and after photo-

graphs were published where the be-

fore photo showed the smog-lled

skies over New Delhi, while the after

photo taken from the same location

showed a clear view of the Himalaya

Mountains in the distance – the conse-

quence of reduced carbon emissions.

In early January, the Indian authori-

ties announced a $2.4 billion pack-

age designed to encourage its indus-

tries and businesses to produce, use,

and export green hydrogen, as many

governments in the developed world

are doing already.

An important factor weighing upon

India and encouraging an energy tran-

sition is the rising cost of hydrocarbon

imports.

Cutting the cost of energy will be

vital if India is to pull its masses out

of poverty. The country’s solar and

wind resources are sufcient enough

to enable India to reach its 2045 goal

of being energy independent and

reaching net zero emissions by 2070.

While the country has its own well-

developed coal, oil and gas industries,

it is highly dependent on imports of

gas and oil from the Middle East and

Russia. But as global energy prices

rise, the money owing out of India to

cover energy costs is a big incentive

to transition to renewables. India’s

reliance on hydrocarbon imports is

such that despite international sanc-

tions against Russia for invading

Ukraine, India has taken Moscow’s

offer to buy Russian oil at a discount.

Along with China, the two countries

are the best customers for discounted

Russian crude.

Funding under the programme is

meant to push India to building the

capacity to produce 5 million metric

tons of green hydrogen by the end of

this decade through the development

of electrolysers, which use water and

renewable energy to produce green

hydrogen. No greenhouse gas mole-

cules are emitted during this process.

What hydrogen there is in the world is

produced as blue, grey or even black,

which uses natural gas or even coal to

produce it.

Some major Indian heavy industrial

conglomerates are already making the

switch to hydrogen in the form of a

clean fuel. The Adani Group, part-

nered with France’s TotalEnergies, is

planning to invest $50 billion to create

what it describes as the “world’s larg-

est green hydrogen ecosystem” over

the next 10 years. And India’s multi-

industrial Reliance Industries is plan-

ning a $75 billion clean energy restruc-

turing that includes switching from

grey hydrogen to green by 2025.

In recent public remarks, Indian

Prime Minister Narendra Modi said

India would by 2030 develop a further

125 GW of renewable energy sources

to be used for green hydrogen produc-

tion. He said the new green hydrogen

programme would support research

and development as well as pilot proj-

ects that would increase decarbonisa-

tion in big energy users such as steel,

oil reneries and fertiliser companies.

He said regions of India capable of

large-scale production and utilisation

of green hydrogen would be identied

and developed as green hydrogen

hubs.

Under the recently-released Nation-

al Green Hydrogen Mission, India will

establish a green hydrogen ecosystem

in which these hubs will be located

near existing industrial centres where

oil rening and steel plants are located.

The hydrogen mission calls for at

least two large scale production and/

or utilisation hubs to be established

by 2025-26. It calls for pilot projects

in emerging applications such as steel

manufacture, mobility, port develop-

ment to be promoted in these hubs,

and that these hubs be connected by

mobility corridors that include suf-

cient refuelling infrastructure and