www.teitimes.com

January 2023 • Volume 15 • No 11 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Grid operators can at least avoid

a potential blackout this winter

with the help of software to boost

transmission grid capacity. Page 14

Grids of the future

A softer approach

The short-term energy crisis

and the longer-term race to net

zero can both be solved through

implementing the grids of the

future now. Page 13

News In Brief

Fusion breakthrough brings

commercialisation closer

The demonstration of “energy gain”

for a fusion reaction is a big boost

to a private sector that is becoming

increasingly condent there will be

commercial reactors within the next

decade or two.

Page 2

California roadmap to cut

carbon allows for carbon

capture

California has approved a roadmap

for achieving carbon neutrality by

2045 that requires deep reforms in

energy, transport and agriculture.

Page 4

Wealthy nations support

Vietnam’s shift from coal

Vietnam has been offered a $15.5

billion package to help fund its

transition from coal to renewable

energy.|

Page 5

Europe struggles to manage

power prices

Europe’s governments are struggling

to manage rising energy costs,

driven by high and volatile gas

prices and low supply, while

continuing to boost a green energy

sector that will reduce reliance on

gas in the long term.

Page 7

Hyundai Electric to enter

offshore wind power

business

Hyundai Electric, a power

equipment and energy solution

subsidiary of Hyundai Heavy

Industries Group, is entering the

offshore wind power business in

partnership with GE Renewable

Energy of the United States.

Page 9

Technology Focus: Giving

biogas a boost

Biogas has an important role to play

in reducing fossil fuel dependence

but more needs to be done to ramp-

up production of this renewable gas.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

As Brussels continues to debate the rules around hydrogen production, individual countries

are pressing ahead with efforts to grow the nascent hydrogen economy. Junior Isles

Carbon emissions carving out international borders

THE ENERGY INDUSTRY

TIMES

Final Word

Hydrogen, in all its forms,

is on track and picking up

speed, says Junior Isles.

Page 16

The European Commission’s ongoing

delay of the release of ‘additionality’

rules that will set the requirements for

renewable hydrogen is seen as an ob-

stacle to the ramping-up of the bloc’s

nascent hydrogen market.

It was expected that a draft of the

rules would be released in mid-De-

cember but there was no further news

as the year drew to a close.

According to a draft document seen

and published by EURACTIV, addi-

tionality rules are needed to ensure

that renewable hydrogen is produced

at times and at places where renew-

able electricity is available. “Until 31

March 2028”, this approach will

largely be discarded, the draft shows.

According to the draft rules, there

should be a quarterly correlation be-

tween renewable generation and hy-

drogen production and a geographi-

cal correlation in terms of being

located in the same electricity bid-

ding zone. Think-tanks and activists

are more in favour of an hourly or

daily correlation.

Modelling shows that an hourly cor-

relation between renewable electricity

production and hydrogen production

from grid-drawn electricity will keep

related carbon emissions in check.

Rather than running 24/7, electrolys-

ers would run during hours that wind

and solar PV plants feed renewable

electricity into the grid.

The geographical correlation will

similarly be fullled if electrolyser

and renewable generation are in the

same electricity bidding zone. This

plan is far less ambitious than initial

expectations.

Commenting on the draft, an expert

told EURACTIV that the delegated act

is a “perfect compromise” that hurts

all sides “just enough.”

The EU Renewable Energy Direc-

tive obliges the European Commis-

sion to dene the term “renewable”

hydrogen through a Commission

“Delegated Act”. Until Europe’s pow-

er system is primarily decarbonised,

the EU must put safeguards to ensure

that hydrogen produced via electroly-

sis is in line with the Green Deal.

Brussels is also believed to be study-

ing the establishment of scenarios in

which hydrogen production from fos-

sil fuels can be considered “fully re-

newable” for the next four years in a

move aimed at increasing hydrogen

production in the near-term. The rules

would qualify the production of re-

newable liquid and gaseous fuels of

non-biological origin, as well as the

resulting fuel, as fully renewable until

December 31, 2026.

The energy sector, however, is press-

ing ahead with efforts to grow the

green hydrogen economy, with sev-

eral key projects being announced in

recent weeks.

Last month Germany’s National Hy-

drogen Council presented a roadmap

Continued on Page 2

Domestic laws on green energy and

carbon emissions, aimed at supporting

the global effort to address climate

change, are threatening to create trade

divisions between countries.

In December the United States and

European Union agreed to intensify

talks to resolve EU concerns over ma-

jor subsidies for American companies

contained in a US clean energy law.

Although no deal was reached at a

meeting of the bilateral Trade and

Technology Council (TTC) last

month, the two sides pledged to con-

tinue work on preliminary progress

and said they would push for a solu-

tion that benets both US and Euro-

pean rms, workers and consumers as

well as the climate.

“We acknowledge the EU’s con-

cerns and underline our commitment

to address them constructively,” the

two sides said in a joint statement af-

ter the meeting at the University of

Maryland in College Park, located

just outside Washington.

“We underline the TTC’s role in

achieving this and in supporting a

successful and mutually supportive

green transition with strong, secure,

and diverse supply chains that benet

businesses, workers, and consumers

on both sides of the Atlantic,” it said.

The dispute revolves around the US

Ination Reduction Act (IRA), which

offers about $375 billion in new and

extended tax credits to help the US

clean energy industry as well as buy-

ers of qualifying electric vehicles

made in North America.

But European leaders have ex-

pressed alarm that the subsidies

would be an enormous setback for

European companies. French Presi-

dent Emmanuel Macron raised the

issue directly with President Joe

Biden during his recent state visit to

Washington during which Biden and

other US ofcials said they were will-

ing to address the matter, including

“glitches” in the law.

Meanwhile, EU lawmakers have

agreed to introduce the world’s rst

carbon border tax with the aim of rais-

ing environmental standards globally

and protecting its domestic industry,

despite concerns that the plans could

breach WTO rules and spark trade

disputes.

Under the carbon border adjustment

mechanism (CBAM), importers will

have to buy permits for their carbon

emissions at the same price paid by

domestic producers under its emis-

sions trading system.

Mohammed Chahim, a socialist

MEP who led the negotiations for the

European Parliament, said the agree-

ment would be “a crucial pillar of

European climate policies”, adding,

“it is one of the only mechanisms we

have to incentivise our trading part-

ners to decarbonise their manufac-

turing industry.”

The CBAM is designed to protect

against “carbon leakage” – the risk

that EU industries could outsource

manufacture of goods for the domes-

tic market to regions with lower envi-

ronmental standards, ultimately lead-

ing to deindustrialisation in Europe.

Tax credits for green technologies

under the US’ IRA has added to those

concerns.

Brussels delays rules on green

Brussels delays rules on green

hydrogen but countries still

hydrogen but countries still

press ahead

press ahead

THE ENERGY INDUSTRY TIMES - JANUARY 2023

2

Junior Isles

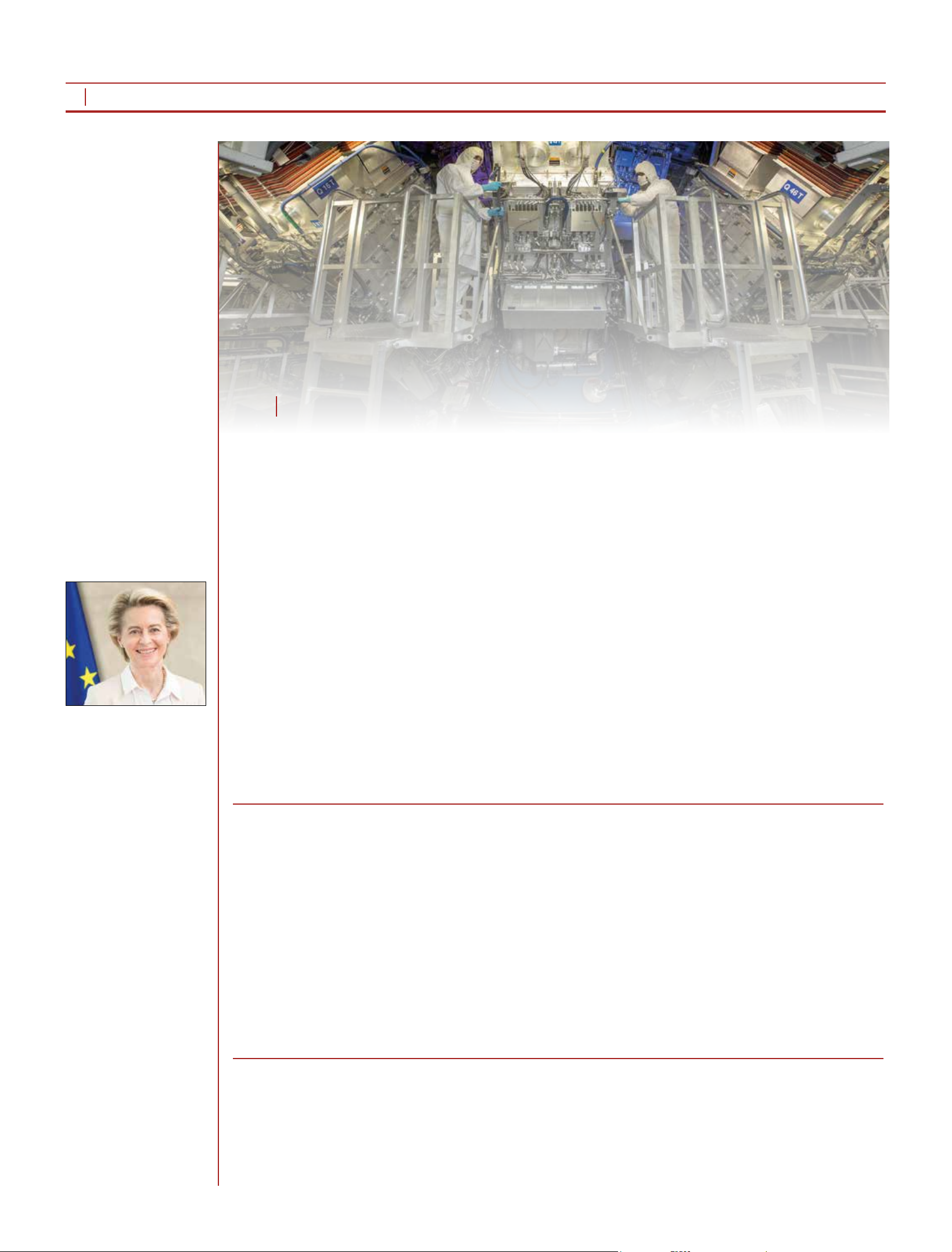

The promise of near limitless, zero-

carbon power is beginning to look less

like science ction, as private investors

gain condence following news of a

breakthrough that has seen scientists

achieve energy gain in a fusion reaction

for the rst time in history.

Last month, scientists at the Law-

rence Livermore National Laboratory

in California, USA, revealed that they

achieved the gain using inertial con-

nement laser-based fusion. The test

involved bombarding a pellet of hy-

drogen plasma with the world’s largest

laser to trigger a nuclear fusion reaction

– the same process that powers the sun.

The gain occurred for a split second

and the energy produced was only

greater than that in the lasers used to

trigger the reaction, and not the total

electrical energy use to power the sys-

tem. Researchers were able to produce

2.5 MJ of energy, 120 per cent of the

2.1 MJ used to power the experiment.

Many commentators, however, cel-

ebrated the breakthrough.

“Scientists have struggled to show

that fusion can release more energy out

than is put in since the 1950s, and the

researchers at Lawrence Livermore

seem to have nally and absolutely

smashed this decades-old goal,” Ar-

thur Turrell, Deputy Director of the UK

Ofce for National Statistics, wrote on

Twitter. “This experimental result will

electrify efforts to eventually power the

planet with nuclear fusion – at a time

when we’ve never needed a plentiful

source of carbon-free energy more!”

The announcement is good news for

a technology that has received growing

interest from the private sector, which

is now expected to play a huge role in

bringing it to market.

“We see this as a passing of the torch

moment,” said Andrew Holland, Ex-

ecutive Director of the Fusion Industry

Association, which was set up in 2018

to represent the nascent sector. “This

is where it goes from the lab to the

market place.”

The oldest private company in the

eld, according to the association’s

most recent report, is Princeton Fusion

Systems, founded in 1992. California-

based TAE Technologies came next in

1998, followed by Canada’s General

Fusion in 2002. But most of the private

sector growth has come in the past ve

years after the 2016 Paris climate

agreement committed countries to

limit global warming to well below 2°C

The breakthrough adds impetus to

this growing momentum.

Zoltan Tompa, a board member of

General Fusion, said: “It’s a huge shot

in the arm and I think it’s a psycho-

logical signal to society at large, to

investors, to policymakers, that fusion

is no longer in the realm of science

ction. We believe it has a real shot at

putting a commercial power plant on

the grid within about a decade from

now.”

The company says it is on track to

demonstrate the real-world possibili-

ties of the clean energy technology at

the power plant level by the year 2027

and have its rst commercial power

plant online in the early 2030s.

Some public-sector scientists sug-

gest that such timeframes are too opti-

mistic. But Philippe Larochelle at Bill

Gates’s Breakthrough Energy Ven-

tures, which rst backed Common-

wealth Fusion Systems (CFS) when it

was founded in 2018, said the fund’s

fusion investments should no longer

be seen as speculative.

“The reason we’ve invested in CFS

and our other fusion companies is that

we apply the same standard to them

that we do to all of our other electric-

ity investments, which is: do we think

that this is a scalable way of getting

carbon free dispatchable power at less

than $50/MWh,” he said. “It seems like

there’s a very plausible pathway here

that this could be a dominant source of

energy on Earth, sometime this cen-

tury, and I think maybe even in the next

decade or two.”

Although energy gain is a huge step,

a similarly signicant leap is still need-

ed to get to commercialisation, notably

in developing materials and compo-

nents that can operate reliably over

long periods. But encouraged by the

breakthrough, the race is now on to

build the rst nuclear fusion reactor.

The US Department of Energy

(DOE) believes fusion energy should

be feeding the nation’s power grid by

2040 and has called for applications

for entrepreneurial projects under the

US Energy 2020 Act, allocating a bud-

get of $50 million.

If the companies selected for these

initial grants succeed in meeting a se-

ries of increasingly rigorous scientic

and engineering milestones, they could

be eligible for up to $415 million more

in research grants. To remain in the

programme, fusion teams will have to

reach a progressive series of technical

milestones, demonstrating that they

can solve outstanding engineering

challenges.

Meanwhile, in Europe, in early De-

cember Swedish company Novatron

Fusion Group AB secured investment

from EIT InnoEnergy – the innovation

engine for sustainable energy sup-

ported by the European Institute of

Innovation and Technology (EIT) – to

build a new test facility to validate No-

vatron’s unique approach to plasma

connement.

In late November, UK-based First

Light Fusion announced a technical

partnership to rapidly advance towards

a 60 MW pilot plant based on its unique

fusion technology – a form of inertial

connement fusion using a projectile

instead of a laser – while addressing

the need for tritium harvesting.

with actions that need to be taken in

order to ensure enough storage ca-

pacity for hydrogen and support the

transition from natural gas to a hy-

drogen economy.

The paper was published as Ger-

many’s economy ministry com-

pleted a draft strategy paper that

reveals plans to develop an 1800 km

hydrogen energy pipeline network

by 2027 with state participation.

The paper, seen by Reuters also en-

visages Germany fostering the use

of blue hydrogen and importing it

during a transition period towards

green hydrogen.

The creation of a hydrogen net-

work company with state participa-

tion was needed to build a system

that was both t for purpose and

affordable, the paper said. The gov-

ernment is expected to present its

plans to industry shortly. The gov-

ernment also envisages Germany

doubling its electrolysis capacity to

10 GW by 2030, the paper said.

Spain has also recently announced

plans that will accelerate green hy-

drogen production and prepare for

transport of this future energy sourc-

es across the EU.

Following a meeting in December

with the leaders of France and Por-

tugal and European Commission

President, Ursula Von der Leyen,

Spain’s President, Pedro Sánchez

revealed the cost of plans for a green

hydrogen corridor between Spain

and France.

The new submarine hydrogen

pipeline between Barcelona and

Marseille (BarMar) will cost an es-

timated €2.5 billion and link the

Iberian Peninsula with France.

The new pipeline will form a sig-

nicant part of the €2.85 billion

H2Med project. Hailed as the rst

“great hydrogen corridor of the Eu-

ropean Union”, the project will in-

terconnect the hydrogen networks

of Portugal and Spain with France.

The plan is for H2Med to be “com-

pleted and operational” in 2030 to

allow Spain to export 10 per cent

– some 2 million tons per year – of

the total renewable hydrogen con-

sumption target estimated by the

European Union.

Von der Leyen expressed the Eu-

ropean Union’s full support for a

project based on hydrogen. She said

the project will “change the history

of Europe” and will be “a crucial

part” of the EU’s energy system.

“The project is clearly going in the

right direction, and I welcome it to

apply for EU funds. This is only the

beginning, but it is a very promising

beginning. The Iberian Peninsula

will be one of the great energy hubs

of the European Union,” she said.

The rst section between Celorico

(Portugal) and Zamora (Spain),

which will cost some €350 million,

is expected to be completed in about

four years, including 26 months to

obtain the relevant authorisations.

The estimated execution time for

BarMar is 56 months, including 26

months to obtain the permits. Con-

struction is expected to start in 2025.

Continued from Page 1

The global energy crisis is driving a

sharp acceleration in installations of

renewable power, with total generating

capacity worldwide set to almost dou-

ble in the next ve years, the Interna-

tional Energy Agency (IEA) says in a

new report.

Energy security concerns caused by

Russia’s invasion of Ukraine have

motivated countries to increasingly

turn to renewables such as solar and

wind to reduce reliance on imported

fossil fuels, whose prices have spiked

dramatically. Global renewable pow-

er capacity is now expected to grow

by 2400 GW over the 2022-2027 pe-

riod – an amount equal to the entire

power capacity of China today – ac-

cording to ‘Renewables 2022’, the

latest edition of the IEA’s annual re-

port on the sector.

This massive expected increase is

30 per cent higher than the amount of

growth that was forecast just a year

ago, highlighting how quickly gov-

ernments have thrown additional

policy weight behind renewables.

The report nds that renewables are

set to account for over 90 per cent of

global electricity expansion over the

next ve years, overtaking coal to

become the largest source of global

electricity by early 2025.

The amount of renewable power

capacity added in Europe in the 2022-

27 period is forecast to be twice as

high as in the previous ve-year pe-

riod, driven by a combination of en-

ergy security concerns and climate

ambitions.

An even faster deployment of wind

and solar PV could be achieved if EU

member states were to rapidly imple-

ment a number of policies, including

streamlining and reducing permitting

timelines, improving auction designs

and providing better visibility on auc-

tion schedules, as well as improving

incentive schemes to support rooftop

solar.

The report came as EU energy min-

isters agreed in principle emergency

regulations that aim to speed up wind

and solar permitting. Delays in envi-

ronmental permitting and grid con-

nections have slowed wind and solar

growth. Permitting can take several

years due to complex administrative

processes and a lack of resources at

approval authorities.

The transition to a net zero emissions

world opens up an investment oppor-

tunity that totals almost $200 trillion

by 2050 – or nearly $7 trillion a year,

according to BloombergNEF.

The research and analysis rm mod-

elled a path to global net zero by 2050

and found the world can limit warm-

ing to 1.77°C. For that, “clean power

deployment needs to quadruple by

2030, in addition to a major invest-

ment in carbon capture and storage,

advanced nuclear technologies, and

hydrogen,” said David Hostert, glob-

al head of economics and modelling

at BNEF and lead author of the report.

There are two scenarios highlighted

in the report: an Economic Transition

Scenario, that assumes no new policy

action; and a Net Zero Scenario, that

assumes global net zero emissions by

2050. The economic transition sce-

nario requires annual investment to

double from the 2021 level of $2 tril-

lion per year to $4 trillion, while the

net zero scenario requires annual in-

vestment to more than triple to $6.7

trillion per year.

Headline News

Energy security is driving renewables growth,

Energy security is driving renewables growth,

says IEA

says IEA

Net zero emissions is $7 trillion opportunity

Net zero emissions is $7 trillion opportunity

Fusion breakthrough brings

Fusion breakthrough brings

commercialisation closer

commercialisation closer

Von der Leyen expressed

full support for hydrogen

The demonstration of “energy gain” for a fusion reaction is a big boost to a private sector

that is becoming increasingly condent there will be commercial reactors within the next

decade or two.

THE ENERGY INDUSTRY TIMES - JANUARY 2023

5

weber media solutions

www.webermediasolutions.com

YOUR CREATIVE MEDIA AGENCY FOR

DESIGN AND MARKETING SOLUTIONS

We are a creative media agency providing a bespoke

service to meet your media and marketing requirements

DESIGN / VIDEO / WEB / EXHIBITION STAND DESIGN

MAGAZINES / PRINT MANAGEMENT / MAILING

weber media solutions

samples of our

exhibition stand design

Our Clients:

Our Partners:

For more information please contact:

Karl Weber / Director

T: +44 7734 942 385 / E: karlw@webermediasolutions.com

karlweber@hotmail.co.uk

Foresight

HYDROGEN

LIVE - 2023

TWO-DAY INTERNATIONAL CONFERENCE,

EXHIBITION AND NETWORKING EVENT

ACCLERATING THE FULL HYDROGEN

ECONOMY

IN LIVERPOOL ON FEB 8+9

WWW.FORESIGHT.EVENTS/HYDROGEN-LIVE

thermalpowercentralasia.com

+ 4 4 2 0 7 3 9 4 3 0 9 0 ( L o n d o n )

events@vostockcapital.com

FORUM HIGHLIGHTS

200+ TOP MANAGEMENT

REPRESENTATIVES

20+ REPORTS

20+ LARGEST INVESTMENT

PROJECTS OF INDUSTRY LEADERS

THE REPUBLIC

OF UZBEKISTAN THERMAL

POWER DEVELOPMENT

DYNAMICS

OPENING SESSION

OF INDUSTRY LEADERS

INVESTMENT PROGRAMME

OF CENTRAL ASIA

TIMELY MODERNISATION

IS THE KEY TO LONG-TERM

AND SAFE OPERATION

OF THERMAL POWER PLANTS

IMPORTANT!

ENVIRONMENTAL SAFETY

EXCLUSIVE EXHIBITION AND

TECHNOLOGICAL PRESENTATIONS

30+ HOURS OF BUSINESS AND

INFORMAL NETWORKING!

ELIZAVETA SMIRNOVA

Programme Director

+44 207 394 30 90 (London)

ESmirnova@vostockcapital.com

FOR PROGRAMME AND SPEAKER ENQUIRIES,

PLEASE CONTACT:

15-16 FEBRUARY 2023

UZBEKISTAN, TASHKENT

INTERNATIONAL FORUM AND EXHIBITION

Organised by:

Australian LNG industry fumes at

hint of gas export, price controls

Europe moves ahead with hydrogen

infrastructure projects

Gary Lakes

“Marxist power grab!” “Soviet-era

policy.” “Hasty.” Such are some the

words that the Australian LNG indus-

try has hurled at the centre-left govern-

ment of Prime Minister Anthony Alba-

nese for its decision to introduce laws

that could direct the gas giants to sell

uncontracted natural gas to the domes-

tic market at A$12/GJ (around $8.50/

million Btu) during the next year.

The industry warns that any attempt

to cap prots could interfere with con-

tracted export volumes (most of which

go to Japan, Korea and China) and

harm investments which they argue are

crucial to sustain sufcient resources

to maintain the export industry – and

the domestic market as well.

Australian gas producers sell only

about 20 per cent of their product on

the domestic market and the A$12/GJ

price is above the historic gas price and

the cost of production, according to

media reports emanating from Austra-

lia. But exporters are earning ve times

and more than that price on the inter-

national market, where LNG cargoes

are hard to nd, leading Japanese ana-

lysts several weeks ago to declare the

market is booked solid for the next

couple years.

The steps taken by the Albanese gov-

ernment are designed to protect con-

sumers in an era when domestic scar-

city and price rises have been

predicted by a government agency.

The Australian Competition and Con-

sumer Commission (ACCC) issued a

report last summer saying the country

could face gas shortages and steep

price hikes in 2023 and 2024. The

agency suggested that the government

invoke the 2017 Australian Domestic

Gas Supply Mechanism (ADGSM),

which allows the government to direct

gas originally meant for LNG export

to be diverted for domestic supply.

With domestic prices predicted to rise

by 40 per cent by 2024, energy minis-

ters in Australian states urged energy

policy reform and that gas output to be

directed to the domestic market at

competitive prices in order to avoid the

predicted high prices and shortages.

When the government passed the new

laws, it triggered the gas industry to

warn of dire consequences, although

an 80 per cent majority of Australians

are reported by the media to support

the government’s moves.

Analysts backing the government said

the industry’s reaction was “hyperbole”,

and Industry Minister Ed Husic said the

government is taking action in the na-

tional interest and that gas executives

wanted to “hold on to every single dol-

lar of their Putin prots”.

The crisis in the gas market exploded

when Russian President Vladimir Pu-

tin invaded Ukraine in February 2022

causing a global disruption in hydro-

carbon supplies and an eruption in

energy prices.

Along with Qatar and the US, Aus-

tralia stands in that group of largest

exporters, and considerable prots

have been made. A report by Bloom-

berg last month said the country’s LNG

sector is an increasingly important part

of the Australian economy. It said ex-

ports of LNG more than doubled to

A$70.5 billion in 2021-22 and are fore-

cast to rise to A$90 billion in 2022-23.

With LNG accounting for 3 per cent

of GDP, it is unlikely that the prime

minister’s government would take any

step that would negatively impact the

sector’s investment or revenue.

There are three key LNG exporters

on Australia’s northeastern Queens-

land coast, and those companies would

likely be the most affected by the new

legislation since they are nearest to the

population centres. The price cap

would keep all of Australia’s producers

on an even keel with contracts, but it

is unclear what impact this could have

on any Australian cargoes appearing

on the spot market. This could very

well be the cause of the industry’s ire.

The Queensland located companies:

Gladstone LNG facility (owned by

Santos, Petronas, TotalEnergies and

Kogas); Australia Pacic LNG (owned

by Origin Energy); and Queensland

Curtis LNG (owned by Shell) exported

some 13.24 million tons of LNG dur-

ing the rst half of 2022. Those com-

panies are expected to be producing

and processing more natural gas than

they require to fulll their contracts.

The three facilities have been in talks

since September with Federal Re-

sources Minister Madeleine King on

an agreement that will secure energy

supplies for the domestic market. How

that proceeds will be determined in the

new year.

Gary Lakes

Global warming, climate change and

the need to develop and expand the

use of renewable energies continue to

occupy the minds of world govern-

ments, scientists and businesses even

though current events have prompted

the energy sector to remain focused

on hydrocarbon production and pro-

curement. However, climate condi-

tions demand that the switch to renew-

ables be made and to that end Europe

is moving forward with projects

meant for a new energy era.

In the UK, Scotland-based SSE an-

nounced last month that it has begun

developing an underground cavern for

the storage of hydrogen in east York-

shire. The cavern will stockpile hy-

drogen for use when freezing and

windless conditions make wind-gen-

erated electricity unavailable.

The new storage facility will pro-

duce hydrogen through renewable

energy driving a 35 MW electrolyser

(green hydrogen). The storage cavern

is a mile deep into the ground along

the coast of Aldbrough and hydrogen

stored there will power a turbine con-

nected to the power grid. The system

will be used during periods of high

demand.

The project is scheduled to be com-

pleted by 2025. By 2028, SSE and

Norwegian partner Equinor are to start

work on a larger hydrogen storage

facility near the same site. The Scot-

tish and Norwegian power companies

are co-owners of the Aldbrough Gas

Storage facility, which came into use

in 2011. That facility has nine under-

ground storage caverns, each the size

of London’s St. Paul’s Cathedral.

SSE, which operates a large renew-

able energy division, maintains that

hydrogen storage will be vital in cre-

ating a large-scale hydrogen economy

in the UK and Ireland by balancing

the overall energy system by provid-

ing backup where large proportions of

energy are produced from renewable

power.

Meanwhile, a recent report prepared

by the trade association Hydrogen

UK says that unlocking infrastructure

investment for 3.4 TWh of large-scale

hydrogen storage is urgently required.

The report – ‘Hydrogen Storage: De-

livery to the UK’s Energy Needs’ –

recommends that a long-term regu-

lated business model for large-scale

storage be designed by 2025.

Noting that the UK government’s

Energy Security Strategy targets hy-

drogen reaching domestic production

targets of up to 10 GW by 2030, the

trade association’s report stresses that

building storage infrastructure simul-

taneously with production capacity is

key to ensuring that hydrogen can

deliver affordable low-carbon energy

and economic growth.

Hydrogen UK CEO Clare Jackson

said: “This report highlights the im-

portance of policy and investment in

hydrogen infrastructure to ensure the

UK is on track to meet both its Net

Zero target and energy security

needs.”

In the report, Hydrogen UK urges

the government to design a long-term

regulated business model for large-

scale storage no later than 2025;

launch interim measures as soon as

possible to unlock nal investment

decisions before the nalisation of the

business model, as well as a short-term

business model; and create a strategic

planning body to facilitate coordina-

tion between production, network and

storage infrastructure.

Further east, Nordic, Scandinavian

and Baltic companies have signed on

to a project to develop and operate a

5000 km hydrogen pipeline transmis-

sion system that would connect the

region by 2030, Euractiv reported.

Last month, Gasgrid Finland, the

state-owned transmission system op-

erator, the Swedish gas TSO Nordion

Energi and Danish companies OX2

and Copenhagen Infrastructure Part-

ners launched the Baltic Sea Hydro-

gen Collector (BHC).

This followed the signing of a coop-

eration agreement on the Nordic-

Baltic Hydrogen Corridor, a hydrogen

infrastructure system extending from

Finland through the Baltics and Po-

land to Germany. Gasgrid Finland,

Estonia’s Elering, Latvia’s Conexus

Baltic Grid, Lithuania’s Amber Grid,

Poland’s GAZ-SYSTEM, and Ger-

many’s ONTRAS are all parties to the

agreement.

The Euractiv report said the BHC is

meant to use offshore wind potential

in the region and create an efcient,

harmonised and integrated hydrogen

market in Europe. The project should

boost investments in the hydrogen

value chains and enhance decarboni-

sation and green industrialisation in

the Nordic, Baltic and Central Euro-

pean states. Once complete, the hy-

drogen transport system would supply

industries and consumption areas

throughout the region and reduce the

use of hydrocarbons. A feasibility

study on the plans will be carried out

next year.

By 2030, it is expected that the BHC

and the Nordic-Baltic Hydrogen Cor-

ridor will be connected along with the

Finnish-Swedish Nordic Hydrogen

Route, a project established earlier

this year in Bothian Bay. Combined,

the projects are seen as moving north-

ern Europe towards a net-zero era.

Hydrogen

Gas

Australia is one of the largest LNG exporters in the world, but the bulk of its resources are off its

northwestern coast, far from the population centres of the eastern central and southeastern coasts

where energy demand is greatest. With the international gas market in disarray and prices going

through the roof, a plan by the country’s government to make Australian gas producers deliver gas to

the domestic market at an affordable price has set off something of a bruhaha within the industry.

While many European countries are scrambling to secure sufcient gas supplies to see them through the

winter, European companies and organised bodies have not forgotten that there is another problem out

there demanding that they look further ahead. Numerous efforts on how to produce hydrogen effectively and

cheaply are widespread, but so are projects on how to move it and store it.

THE ENERGY INDUSTRY TIMES - JANUARY 2023

11

Fuel Watch

T

he grids of tomorrow must be

designed to enable global am-

bitions for a net zero emis-

sions (NZE) energy system. Such a

grid will not only need to handle a

signicant increase in the electri-

cation of the energy system driven

by renewables, but will also need to

be much more exible to integrate

those renewables, as well as han-

dling power inows from the de-

mand side.

Realising such systems calls for

greater effort in terms of both tech-

nology implementation and policy.

Some argue, however, the tools are

already there to enable these grids

to be implemented today, thereby

signicantly accelerating progress

to NZE.

Explaining what a grid of the fu-

ture looks like, Frédéric Godemel,

EVP of Schneider Electric’s Power

Systems & Services Division, not-

ed: “Achieving NZE requires much

greater use of electricity compared

to fossil fuels. What we see going

forward is twice as much electricity

ow as we have today. At the same

time there will be much more re-

newable generation, which is more

intermittent, as well as more pro-

sumers – users that can both pro-

duce and consume electricity. The

grid of the future will need to be

like a [orchestra] conductor that can

permanently manage demand and

supply in a way that favours the

maximum use of renewable energy

produced from both centralised and

decentralised sources. To achieve

this exibility grids have to be mod-

ernised, digitised and much more

automated than they are today.”

A recent report from the European

Commission states that the Europe-

an Green Deal and REPowerEU re-

quire a deep digital and sustainable

transformation of the energy sys-

tem. According to the EC, the bloc

needs to install solar photovoltaic

(PV) panels on roofs of all commer-

cial and public buildings by 2027

and on all new residential buildings

by 2029, install 10 million heat

pumps over the next ve years and

replace 30 million cars with zero-

emission vehicles on the road by

2030.

To achieve these objectives, Eu-

rope needs to build an energy sys-

tem that is much smarter and more

interactive than it is today. Energy

and resource efciency, decarboni-

sation, electrication, sector integra-

tion and decentralisation of the en-

ergy system all require a

tremendous effort in digitalisation.

The Commission estimates that

about €584 billion of investment in

the electricity grid will be required,

between 2020 and 2030, in particu-

lar in the distribution grid. A sub-

stantial part of these investments,

about €170 billion, will need to be

in digitalisation.

According to Godemel, exible

digitised grid systems could allow

carbon emissions to be reduced

three-fold. While he says the growth

in renewables – for example,

through utility offshore wind in the

UK, solar in Spain and growing

rooftop solar in Denmark and Ger-

many – is impressive, it is still not

enough.

“Local production [of renewables]

at the demand side must be multi-

plied by ten,” said Godemel.

He added: “There must also be in-

credible investment in batteries to

store unused renewable production.

This must be increased by a factor

of 100. And to connect centralised

generation with the demand side,

you also need to increase invest-

ment in digitalisation by a factor of

ve – mostly in the distribution net-

work.” This is the area of digitalisa-

tion that he believes can deliver the

fastest gains.

According to Godemel, most utili-

ties have an old generation of con-

trollers, offering zero visibility on

many parts of the network, especial-

ly at the distribution level. “This

means they cannot manage balanc-

ing and load shedding at the de-

mand side level,” he noted. “The

rst big step in improving visibility

is through the use of smart meters.

They can now start to aggregate

data and optimise but it’s not

enough; we need more investment

in digitalisation.”

According to Godemel, in 10-15

years much more of the grid balanc-

ing will be handled at the regional

or even local level by the DSOs.

Digitalisation will enable this to be

done automatically.

“In the future, you can imagine a

municipality in Germany balancing

the local grid and simply interfacing

with the transmission grid. For ex-

ample, typically you are out during

the day when solar is produced. So

the rst thing you have to do is store

it for use in the evening, comple-

menting what you need from the

grid. So for zero [emissions], there

is a total disconnect between the lo-

cal production and the usage. To

move to net zero, you probably need

to equip 30 per cent of homes with

solar or wind generation, which you

need to store.

“But then the grid needs to be able

to give the signal to the user to let

them know when to use the power

they have accumulated. So if, for

example, there is a peak in produc-

tion at the grid scale level the grid

operator may want to shave this

peak because it may not have

enough capacity to supply at, say, 6

pm. So the grid operator will want

to discharge the batteries to shave

the peaks and needs to be able to

give this signal to the user without

any manual intervention.”

Grid operators that have invested

in advanced distribution manage-

ment and control systems have, ac-

cording to Godemel, managed to

defer investment in centralised gen-

eration. And with this deferment or

cancellation of what is usually gas

red generation, they have also

made a positive impact in cutting

carbon emissions.

He added: “They have also recog-

nised 1 per cent less losses in their

network. And when this is trans-

ferred into CO

2

savings, especially

when the power is produced with

gas or coal, the saving is huge.”

Godemel also pointed out that the

use of technologies, which enable

net zero ofce buildings that are au-

tomatically connected to the local

the grid, can have a return on in-

vestment of less than ve years. He

noted that industries are also invest-

ing in local generation and digital

automation systems to provide 10-

15 per cent of their energy needs,

thereby cutting CO

2

emissions and

costs.

Importantly, Godemel, stresses

that all of these grid balancing and

automation technologies exist today.

What is missing, he says, is legisla-

tion on the demand side that incen-

tivises prosumers.

“Part of this is to do with how we

price energy; it’s about policy and

nancial incentives,” he said.

“Since the Ukraine war, the price of

energy has skyrocketed. The price

of energy in Europe is simply linked

to the price of gas with no consider-

ation of renewables. Legislation

needs to inject an incentive for pro-

sumers to use [renewable] energy at

the time when it is abundant. If I

charge my car at night it is a bit

cheaper but it is completely inde-

pendent of the abundant production

of renewables during the day. It

should not be. So prosumers should

be given nancial incentives in their

energy bill.

“There also needs to be a mecha-

nism at grid level that drives invest-

ment in digitalisation. Digital in-

vestments need to be taken more

seriously and must be more central

to the equation.”

Godemel says that to make all of

this happen calls for tripartite col-

laboration between utilities, groups

of users, and technology vendors.

“Of the utilities, DSOs are the cen-

trepiece,” he noted. “You don’t nec-

essary need all three parties at the

same time to implement solutions.

For example if you want to imple-

ment load shaving, you need the in-

volvement of the demand side. For

load balancing, it’s between tech-

nology vendors and utilities. And

reection of what are the best solu-

tions often come from working

groups and the experience from all

three parties.”

In terms of what needs to happen

next, Godemel believes that ideally

there should be a big boom in pro-

sumers. “It would help the entire sit-

uation very quickly because these

are typically multiple companies so

the burden is not placed on one or

two companies and it would be at

large scale.” He stresses, however,

that any near-term boom in prosum-

ers is unlikely, as policies and in-

centives must rst be changed. “It

takes time to convince people;

we’ve seen this with EVs.”

He therefore argues that while pro-

sumers would have the biggest im-

pact, the most implementable solu-

tion today is investment in

digitalisation at the distribution grid

level.

Godemel concluded: “We need

distribution management systems

connected to the data of smart me-

ters in all countries, as well as auto-

mation at the secondary distribution

layer, i.e. between the medium- and

low-voltage. Today there is very lit-

tle automation here. And of course

we need to put green products into

our substations. For example we can

get rid of SF

6

gas in switchgear.

“There are a few things that we

can do fairly quickly, and the Euro-

pean Commission is working to

support solutions like these that can

quickly help accelerate the transi-

tion. I believe the energy crisis will

accelerate all the drivers behind a

decarbonised electricity system,

and hope this gas crisis can be

somehow translated into an energy

revolution.”

Running a reliable

grid, largely based on

renewable electricity

is not a pipe dream,

but it is only possible

with a smart, digital

and decentralised

bi-directional grid.

Schneider Electric’s

Frédéric Godemel

explains to

Junior Isles how the

short-term energy

crisis, and the longer-

term race to net zero

can both be solved

through implementing

these grids of the

future today.

Grid digitalisation holds the

Grid digitalisation holds the

key to a faster transition

key to a faster transition

THE ENERGY INDUSTRY TIMES - JANUARY 2023

13

Industry Perspective

Godemel: the most

implementable solution today

is investment in digitalisation

at the distribution grid level

worst-case weather assumptions, e.g.

when it is hot or there is no wind.

Connecting grid operation with

weather data would allow these limits

to be changed for certain network ar-

eas or sections of the overhead line,

where there is a cooler climate or

temperature, or where there is greater

wind chill. Then we can temporarily

increase transmission capacity dy-

namically – up to 30 per cent.”

German TSO TransnetBW recently

introduced such a system, which it

says enables overhead lines to trans-

port up to 50 per cent more electricity

when it is windy and in cooler ambient

temperatures.

Grunert noted: “This is done just

through software. This is why soft-

ware is such a big enabler of the en-

ergy transition, because it limits capital

expenditure. You can increase the ca-

pacity of grids without installing more

copper.”

Another important area where soft-

ware comes into play is for protection

concepts in substations. Protection

devices in networks are set to default

values for voltage and current. If there

is an overcurrent, for example, this is

recognised by the protection device,

which then trips the respective net-

work or grid section. Grunert ex-

plained that these default values can

be “manipulated” to increase power

throughput.

He said: “We can use exible values

depending on the actual situation in

the specic grid area. This also allows

us to increase the available capacity of

the grid.”

The dynamic stability of the grid can

also be improved using software solu-

tions. Trend analysis programmes can

make forward-looking assessments of

the dynamic stability of the grid and

offer grid operators options on how to

keep the grid stable.

Grunert also stresses the importance

of changing human behaviour in re-

lieving pressure on the grid and noted

the increasing use of apps.

“It’s important to help the popula-

tion recognise when there is a tense

situation for grid stability so they can

change their behaviour. For example,

not everyone needs to switch on their

washing machine or charge their EVs

at the same time. For the rst time,

Germany recently rolled out an app

that will help balance supply and

consumption.”

The “StromGedacht” app from

TransnetBW allows private house-

holds in Baden-Württemberg to ac-

tively contribute to system stability by

making suggestions as to how the user

can effectively relieve the grid by

shifting electricity consumption over

time.

Such software tools are important

for the immediate challenges but go-

ing forward, grid operators are looking

at how to better plan the grids of the

future in order to accelerate the energy

transition. And again, software has a

huge part to play in the form of creat-

ing digital twins of networks.

“Digital twins are really important,”

said Grunert. “If you want to better

plan your grid and make better use of

investment, it helps to have a digital

A

rguably, there has been insuf-

cient progress in enabling

Europe’s electricity grids to

cope with the challenges presented by

the energy transition. Germany is a

classic case in point. Having taken the

decision to phase-out nuclear in reac-

tion to the Fukushima disaster, the

country has embarked on replacing this

lost generating capacity by installing

huge amounts of offshore wind tur-

bines in the North Sea.

While these turbines have been suc-

cessfully connected to the onshore

grid via DC links, progress has been

slow in building the onshore lines

needed to transmit this power to the

industrial south. The reasons behind

Germany’s plight are several, the most

notable being the difculty in obtain-

ing permits to build overhead lines

and converter stations. But while leg-

islation is crucial here, the increasing

amount of renewables also means that

millions of new assets must be con-

nected to the grid, as the government

incentivises technologies such as

rooftop solar and batteries and the

purchase of electric vehicles (EVs).

All of this, combined with the im-

pacts of Russia’s war in Ukraine, has

raised concerns over the security of

electricity supply across the country.

Siemens AG believes that the only

way to match the hosting capacity of

the power grid with the growth in

distributed energy resources is by in-

creasingly utilising current and future

software solutions in addition to

hardware enhancements.

Explaining the challenges, Frank

Grunert, Head of Grid Control, Sie-

mens AG, said: “There is a lot of

generation coming onto the low volt-

age grid. There has been a massive

increase in renewables, which is being

accelerated as we try to move away

from fossil fuels due to the war in

Ukraine. Gas prices have, for example,

driven the growth of heat pumps – if

you look at heat pump manufacturers,

their order books are full. But if there

are a lot of consumers using heat

pumps and EVs, this puts a lot of

stress on the grid. This bi-directional

power ow has to be managed.”

Grunert believes software can help

address many of the problems facing

transmission system operators (TSOs)

and distribution system operators

(DSOs). He noted: “When grids are

not balanced correctly, there’s a risk of

an unplanned outage. To avoid this, a

grid operator needs to have transpar-

ency on the grid early enough to see

when grid stability is at risk so they

can take measures to prevent that

blackout or in the worst case do con-

trolled load-shedding and warn con-

sumers well in advance.”

Greater transparency is particularly

needed on the low voltage grid, to

address problems “at the root”. Ac-

cording to Grunert if simulations can

be carried out at this level, grid en-

forcement measures can be undertaken

in specic areas of the network to

avoid incidents at the medium and

high voltage level. He notes that here,

software can play a major role in pro-

viding grid operators with the neces-

sary transparency.

Hardware, he adds, can also play a

major role. For example, several

countries have either completed or are

well advanced in their smart meter

rollout programmes. Grunert noted,

however, that smart meter deployment

has been disappointing in Germany. In

October Economy Minister Robert

Habeck said that installations will be

accelerated, with the government

pledging to remove legal uncertainties

and bureaucratic hurdles through a

package of measures that would ac-

celerate and simplify their installation.

“Germany is currently still lagging

behind when it comes to rolling out

smart meters, which would help to

get the data for better transparency

on the low voltage grid,” Grunert

commented.

Software can also increase security

on high voltage transmission lines.

One such solution is dynamic line

rating (DLR), where software is used

to temporarily increase transmission

line capacity when needed.

Grunert explained: “Transmission

lines are designed to have thermal

limits, which limit transmission ca-

pacity. These limits are based on

representation of your grid. We are at

the start of the curve here… but it will

allow you to simulate and analyse a lot

of situations on the grid and what it

means to all stakeholders connected to

it. They could also help you to recog-

nise any reinforcement you might

want to undertake to strengthen the

grid.”

While some utilities and grid opera-

tors make better use of these technolo-

gies than others, Grunert notes that the

speed of change has increased dra-

matically in recent years. “Apps that

inform the public about the grid status

are a good example that shows they

are truly changing and accelerating

their efforts signicantly,” he said.

“Deploying new software requires a

more agile mindset. And I see that our

customers are becoming more agile in

their approaches and processes.”

Grunert said, however, that while

utilities and vendors are becoming

more agile, the same is required of

regulators to respond to not only the

needs of today but also those of tomor-

row. “They need to support the grid

operators in their agile approach.”

“Today’s modern software has

changed. We are not looking at mono-

lithic systems anymore, which are

highly customised to manage grids.

Today’s systems are more modular,

open and exible, allowing utilities to

create their own software solution

landscape from various vendors to

deal with the huge amount of assets

and data that is coming. This software

is usually cloud-native so it can be

easily scaled up.

“There are different models for pay-

ing for the software but we need

opex-based remuneration models for

software licences. It’s about capex

versus opex. Most of the remuneration

models today are capex-based and do

not support modern cloud-native

software. The [German] regulator

needs to allow opex-based remunera-

tion at least for software because it is

the biggest enabler for the energy

transition.”

He concluded: “There is a gap be-

tween what we can do, with conven-

tional hardware, and what we need to

do in order to achieve net zero. The

only way to close the gap is with

software.”

THE ENERGY INDUSTRY TIMES - JANUARY 2023

Energy Outlook

14

The ongoing energy crisis is affecting transmission system operators (TSOs) across Europe and particularly Germany,

which faces the challenge of transmitting power from North to South. Junior Isles hears how grid operators can at

least avoid a potential blackout this winter with the help of software to boost grid capacity.

A softer approach to tackling

the energy crisis

The only way to close the gap

is with software

Grunert: Software can also

increase security on high

voltage transmission lines

This chart takes into account that 1) conventional investments in grid hardware are limited, eg. by resource availability, coordination eort,

space or acceptance and that 2) mobility, heating/cooling and industry are going to be widely electried by 2050

T

he world’s consumption of

energy has seen a signicant

upshot since the 1980s, owing

to a rapid wave of industrialisations.

Fossil fuels have largely been sup-

plied to satisfy this growing de-

mand for energy. As recent as 2018,

about 88 per cent of the world’s to-

tal energy demand was being met

by fossil fuels. With carbon emis-

sions growing and the nite supply

of fossil fuels decreasing, viable re-

newable alternatives are needed

more than ever.

In this quest for energy security

and push towards low emission en-

ergy, renewable natural gas (RNG),

in the form of biogas/biomethane

(CH

4

), is an efcient, clean and cost

effective solution to help the world

wean itself off fossil fuels for ener-

gy supplies.

According to the European Biogas

Association, biogas or biomethane

form the bedrock to achieve carbon

neutrality by 2050 and achieve en-

ergy security. However, further in-

vestments in biogas innovations are

imperative to make biogas produc-

tion faster and increase yields.

Biogas or biomethane is produced

through the process of anaerobic di-

gestion (AD), where biodegradable

material is broken down by micro-

organisms in the absence of oxygen.

This creates RNG, which through

technological advancement, has the

potential to generate renewable en-

ergy on a global scale.

There are four stages to produce

biogas within the anaerobic diges-

tion tank:

1. Hydrolosis: organic polymers like

carbohydrates are broken down into

simple sugars

2. Acidogensis: bacteria called ac-

idogenic bacteria convert the simple

sugars and amino acids into carbon

dioxide, hydrogen, ammonia, and or-

ganic acids

3. Acetogenisis: bacteria called ace-

togenic bacteria convert the organic

acids into acetic acid, carbon dioxide

(CO

2)

, and hydrogen

4. Methanogensis: single-celled or-

ganisms called methanogens convert

the intermediate products produced

in the preceding stages into biogas

(primarily biomethane and CO

2

).

Using biogas has a number of

benets. The production process of

biogas means that it offers an en-

tirely practical solution to dispose

of farm and livestock waste. Using

biodigesters to control the rate of

decomposition of agricultural by-

products can produce a viable

amount of RNG to realistically re-

place fossil fuel energy. The process

uses emissions that would have oc-

curred naturally in the environment

due to decomposition of organic

matter – albeit there is a need for

the production process to be made

more efcient.

Another advantage is the low cost

of producing biogas. Investment in

biogas is relatively cost effective, as

anaerobic digesters can be easily t-

ted in farms and plants on an indus-

trial scale. This contrasts with other

renewable sources being explored,

such as hydrogen, the implementa-

tion of which is expensive when

considering the cost of distribution,

production, and storage. Moreover,

biogas (once upgraded into bio-

methane) is a direct replacement for

fossil fuels and can be used in the

existing energy pipes, so adoption

can be quicker as well as cheaper.

Many westernised countries like

the UK and US have the infrastruc-

ture already in place to support

greater adoption of renewable ener-

gy sources – they are steps ahead of

other markets. In Europe alone,

there are 24 300 biogas plants, 10

000 of which are just in Germany.

However, there are some key fac-

tors standing in the way of large-

scale adoption.

There are various hurdles to wide-

spread implementation and adop-

tion of biogas technology, which are

region-specic and unique to the

economy and its propensity towards

renewable energy.

Differences in government regula-

tion, energy policy, attitudes towards

climate change, and economics can

each present signicant barriers to

widespread adoption of biogas as a

transition fuel. The journey to defos-

silisation is paved with collaborative

effort in policy making and invest-

ment in shared technological re-

sources, since anaerobic digestion

and biogas production requires an

immense amount of support.

With respect to attitudes towards

climate change and renewable ener-

gy, Uruguay, for instance, is leaps

and bounds ahead with nearly 98

per cent of its energy requirements

being fullled by renewable sources

– a feat that is not easily achieved

or replicated in other parts of the

world.

The European Union Commis-

sion’s attempt to strive for a pan-

European agreement to invest in

biogas and biomethane technology

is an example of steps being taken

towards collaboration in policy and

governments. This can be further

bolstered by governing institutions

well-versed in the adoption of re-

newables, such as Germany, offer-

ing support to countries that would

benet from this insight.

For biogas to be an all-encom-

passing and attractive offering, it is

imperative that we show investment

in RNG to be protable as well as

sustainable. Ramping up biogas

production consists of a combina-

tion of factors ranging from funding

to government support. Careful at-

tention and collaboration amongst

all stakeholders is necessary for

wide scale implementation. Recent

funding by BP into biogas technolo-

gy is testament to the role different

actors can play.

Further investments in biogas in-

novations are imperative to make

biogas production faster and in-

crease yields. To this end, Vertus

Energy has developed technology

that allows AD plants to process

waste three times faster in the same

sized tank while delivering 60 per

cent more energy, using a retrotted

bio-catalytic platform. BRIO is a

small but powerful unit that is

placed inside the anaerobic digester.

The unit provides electrical stimula-

tion to the bacteria in the tank, ac-

celerating molecular activity that

breaks down waste and converts the

resulting gases into biomethane.

This enhanced environment en-

ables additional molecular path-

ways to activate, meaning more

CO

2

can convert into methane, in-

creasing the Methane Production

Rate and the Methane Conversion

Rate. This makes use of existing but

unutilised molecular pathways

within AD tanks by electrically

spurring the bacteria into action,

which accelerates the process.

Biogas can be further turned into

biomethane (a purer and more ef-

fective form of biogas) – by remov-

ing carbon dioxide or in some cas-

es, hydrogen sulphide – which is

very valuable as a direct replace-

ment of fossil natural gas. Since

biomethane is derived from the bio-

logical process of breaking down

waste, it is renewable, as opposed to

fossil derived methane, which is the

result of fossil and organic matter

undergoing years of compression

and degradation. This means more

RNG in the form of biomethane is

available for energy rms to pur-

chase and the result is a greener en-

ergy mix. Using biomethane de-

creases the reliance on fossil fuels

to plug energy gaps in the national

grid.

So does biogas technology set us

up for the future? Climate technolo-

gy that champions renewable ener-

gy has never been riper with interest

and investment than in the past few

years. There is a sense of urgency

for biogas penetration to increase

from 40 to 60 per cent, which is

possible only through cultural and

political shifts by governments and

investors alike. In developing coun-

tries, biogas can help full the ener-

gy demand, owing to the relatively

low implementation costs and hav-

ing the potential for yields matching

fossil fuels.

To bring about this shift and en-

sure that the potential of biogas en-

ergy is being recognised, we must

make use of the technology that is

already available to us. A way to do

this is to increase the productivity

of smaller scale units that can be

engineered offsite and brought in

when the need arises. Vertus’ BRIO

solution is a great example of this;

it is a compact unit about the size of

a shipping container, which can be

retrotted into existing ADs.

In November Vertus announced

that it is partnering with Biogest to

demonstrate the BRIO solution at a

commercial scale in Europe. The

aim is to retrot BRIO technology

into every anaerobic digester to

help Europe maximise its existing

plant production, which when

achieved could meet 66 per cent of

the region’s 2030 targets.

The pilot will begin in 2023 with-

in the testing facility and move to

the demonstration unit in 2024. This

demonstration unit is the start of the

BRIO commercialisation, showing

investors and other potential part-

ners that BRIO can be implemented

at commercial scale.

Such developments are the rst

step in achieving the transition to

permanent renewable energy. Once

commercially enabled, Europe will

have an energy option that is do-

mestically sourced and less vulnera-

ble to price changes based on inter-

national politics and environmental

change. For households, this could

mean cheaper energy bills that are

less likely to uctuate. With the on-

going energy crisis in Europe, this

is a signicant step forward for the

implementation of more renewables

in the energy mix and the decarbon-

isation of our energy matrix.

The scale of change needed, how-

ever, requires the participation of

governments and the private sector.

Governing institutions can step in to

deal with regulatory issues and col-

laborate on policy that encourages

the move towards defossilisation,

starting with existing AD and bio-

gas technology. The role of private

actors is to make this not only sus-

tainable, but commercially attrac-

tive through investing in technolo-

gies that help scale biogas

production. The key to unlocking

biogas’ role in the reduction of fos-

sil fuel reliance is an exercise in

collaboration, propelled by the need

to achieve secure, clean and sustain-

able energy for the future.

Benjamin Howard is co-founder of

Vertus Energy.

Biogas has an

important role to play

in reducing fossil fuel

dependence but more

needs to be done to

ramp-up production

of this renewable

gas. Vertus Energy’s

Benjamin Howard

shares his view on

the potential of biogas

and describes a

technology that can

improve production

efciency.

Giving biogas a boost

THE ENERGY INDUSTRY TIMES - JANUARY 2023

15

Technology Focus

In Europe alone, there are

24 300 biogas plants, 10 000 of

which are in Germany

Howard’s aim is to retrot

BRIO units into every

anaerobic digester

THE ENERGY INDUSTRY TIMES - JANUARY 2023

16

Final Word

L

ast year proved to be a memo-

rable one for that magic mole-

cule, hydrogen. More speci-

cally, last month marked some

milestone moments in the long, ardu-

ous journey that might one day see

hydrogen become the single most

important element in the global energy

system.

In mid-December scientists at

Lawrence Livermore National Labo-

ratory in California, USA, achieved

‘ignition’, a fusion reaction that pro-

duced more energy than it took to

create.

Nuclear fusion, the process that

powers the sun, has long been the holy

grail of energy. Replicating fusion on

Earth would allow the near limitless

generation of zero carbon energy but

has been deemed by some as the stuff

of science ction. For decades scien-

tists have conducted numerous ex-

periments, successfully heating hy-

drogen isotopes – normally deuterium

and tritium – to such extreme tem-

peratures that the atomic nuclei fuse,

releasing helium and energy in the

form of neutrons. But such experi-

ments have consumed far more energy

than released – until last month’s

breakthrough.

It is a hugely signicant milestone

and proponents argue it paves the way

for commercial scale power plants

within the next couple of decades or

sooner. But there is still a long way to

go, with signicant challenges to

overcome.

For now, using hydrogen in its ele-

mental form as an energy vector is a

lot less sci- than fusion. Hydrogen is

seen as essential to decarbonise sec-

tors that cannot be electried, e.g.

aviation, maritime, and high-heat

manufacturing.

To meet decarbonisation targets of

the Paris Agreement, hydrogen uptake

would need to triple to meet 15 per

cent of energy demand by mid-centu-

ry. In a report issued last summer,

DNV predicted the amount of hydro-

gen in the energy mix will be only 0.5

per cent in 2030 and 5 per cent in 2050.

It seems a very small share but with

the pace of development it would be

no surprise if such predictions are

surpassed, at least in Europe where

DNV predicts hydrogen is set to take

11 per cent of the energy mix by 2050.

Last month saw several noteworthy

announcements, which certainly indi-

cate there is every likelihood that

Europe’s hydrogen train may well

reach its destination ahead of schedule.

In early December, Spain, Portugal

and France said they want to complete

a €2.5 billion underwater green hydro-

gen pipeline from Barcelona to Mar-

seille by 2030. It will be part of the

wider H2Med project – the rst green

corridor to connect the Iberian Penin-

sula with the rest of Europe – which

will interconnect Portugal and Spain

with France and have a total cost of

around €2850 million. H2Med will

comprise two routes: one that will

interconnect Portugal with Spain

(Celorico-Zamora) and the new sub-

marine hydrogen pipeline between

Barcelona and Marseille (BarMar) to

link the Iberian Peninsula with France.

Around the same time, Cepsa an-

nounced plans to build Europe’s

largest green hydrogen project in

Andalusia with an investment of €3

billion. Known as the Andalusian

Green Hydrogen Valley, it will involve

the start-up of two new electrolyser

plants, with a capacity of 2 GW and a

production of up to 300 000 tons of

green hydrogen. These will be located

at Cepsa’s energy parks in Campo de

Gibraltar (Cadiz) and Palos de la

Frontera (Huelva). In addition, the

project will be accompanied by an

additional investment of €2 billion for

the development of a 3 GW wind and

solar energy project portfolio to gener-

ate renewable electricity.

Meanwhile, Repsol is leading the

Shyne project, in which it plans to

invest more than €2.2 billion, with

targets to install 500 MW by 2025 and

2 GW by 2030. The project will also

connect major regional hydrogen ini-

tiatives that are already underway,

such as the Basque Hydrogen Corridor

(BH2C), the Hydrogen Valley of

Catalonia and the Hydrogen Valley of

the Region of Murcia.

Spain has a total of 80 projects –

mainly focused on the southern,

Cantabrian and Mediterranean coasts.

These areas are more industrialised

and therefore have more possibilities

for using hydrogen. Most of the

projects are aimed at industrial appli-

cations for renewable hydrogen.

It is a portfolio of projects that

calls for the development of more

than 15 GW of installed capacity of

electrolysers, demonstrating the

country’s strong interest in green hy-

drogen. The government’s push for

renewable hydrogen is part of a

roadmap that foresees 4 GW of in-

stalled electrolyser capacity by 2030.

According to the Ministry for Eco-

logical Transition and the Demo-

graphic Challenge, this appetite gives

“a clear vision that the objective of 4

GW at the end of this decade will be

reached and surpassed”. The govern-

ment is therefore working towards

revising the National Integrated En-

ergy and Climate Plan to raise the re-

newable hydrogen target to 2030.

The other big news last month was

Germany’s plan to develop an 1800

km hydrogen energy pipeline network

by 2027 with state participation. Ac-

cording to an economy ministry draft

strategy paper seen by Reuters, the

creation of a hydrogen network com-

pany was needed to build a system that

was both t for purpose and affordable.

The government also envisages Ger-

many doubling its electrolyser capac-

ity to 10 GW by 2030, the paper said.

In a separate paper, Germany’s Na-

tional Hydrogen Council presented a

roadmap with actions that need to be

taken in order to ensure enough storage

capacity for hydrogen and support the

transition from natural gas to a hydro-

gen economy. In the paper, the

Council underscores the need for po-

litical support to promote investments

in hydrogen storage as demand in

Europe’s largest economy is expected

to exceed 5 TWh by 2030 and then

increase signicantly.

These announcements all came just

ahead of a statement that was ex-

pected from the European Commis-

sion, which will set the rules around

the requirements for green hydrogen.

‘Additionality’ rules were expected

to be published last month in a move

aimed at avoiding “the cannibalisa-

tion” of existing wind and solar

generation, ensuring that renewable

hydrogen is produced at times and at

places where renewable electricity is

available. According to a draft docu-

ment published by EURACTIVE,