www.teitimes.com

December 2022 • Volume 15 • No 10 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

The ramications of China and

India’s carbon-cutting strategies go

far beyond their borders. Page 14

Cementing the case

for WHR

Net zero game

changers

Waste heat recovery is an under-

utilised solution for decarbonising

hard-to-abate industrial processes

such as cement-making. Page 13

News In Brief

High power prices threaten

EU shift away from fossil

fuels

Europe’s plans to reduce dependence

on imported fossil fuels by

increasing installed renewable

energy capacity and using electric

vehicles could be frustrated, if

power prices do not come down.

Page 2

Mexico plans low-carbon

additions as US offers

support

Mexico has announced plans to

add 30 GW of new wind, solar,

geothermal, and hydroelectricity

capacity by 2030, as part of a new

ambition to raise its greenhouse gas

emissions reduction target.

Page 4

Indonesia’s coal retirement

plan takes shape

Indonesia’s plan to reduce its

dependence on coal red generation

is taking shape as the country signed

signicant deals to nance its

transition to clean energy.

Page 5

Europe ‘must invest to shift

to LNG instead of Russian

gas’

Europe has to pivot to liqueed

natural gas (LNG) if it wants

to wean itself off Russian gas,

according to a new report from S&P

Global Ratings.

Page 7

GE sells Steam Power

nuclear activities to focus on

gas and renewables

GE has signed a binding agreement

to sell GE Steam Power’s nuclear

activities to French state-owned

power company EDF as part of a

plan to focus on its gas turbine and

renewable energy businesses.

Page 9

Technology Focus: Evolving

energy storage for time-

shifting

Battery energy storage systems

can help operators cut dependence

on traditional energy sources by

avoiding curtailments of wind and

solar farms.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

Last month’s COP27 climate conference secured a “historic” deal on nancial support for

countries affected by extreme weather events but failed to act on calls to accelerate much-

needed cuts in carbon emissions. Junior Isles

Developing countries raise clean power policy ambitions

THE ENERGY INDUSTRY

TIMES

Final Word

Junior Isles commentates

on this year’s World COP.

Page 16

World climate change ministers and

negotiators struck a “historic” deal at

this year’s UN COP27 climate summit

in Egypt to support countries most af-

fected by climate change but failed to

make progress on how to cut green-

house gas emissions faster.

Almost 200 countries attending the

conference in Sharm El-Sheikh agreed

to set up a “loss and damage” fund to

rescue and rebuild the physical and

social infrastructure of countries dev-

astated by extreme weather events.

There is still no agreement on how

the nance should be provided, where

it will come from, or the criteria to

trigger a payout. There are also ques-

tions on the size of the funding. The

EU has contributed €60 million to

Pakistan against the $30 billion costs

resulting from the oods that devas-

tated the country in September.

Nevertheless the deal has been wel-

comed by developing countries that

have been seeking nancial assistance

for loss and damage for nearly 30

years.

Sherry Rehman, Climate Change

Minister of Pakistan, hailed the deal as

“historic”. She said: “This is not about

accepting charity. This is a down pay-

ment on investment in our futures, and

in climate justice.”

The deal however, has to some ex-

tent been overshadowed by the sum-

mit’s failure to accelerate cuts in car-

bon emissions.

Simon Stiell, the UN climate chief

warned that time was short to take ac-

tion on the targets agreed, and there

was “no room for backsliding”. He

said the national plans that countries

had submitted on cutting greenhouse

gas emissions by 2030 were not

enough to meet the vital goal of limit-

ing global temperature rises to 1.5°C

above pre-industrial levels, in line

with scientic advice. “The [national

plans] just don’t add up,” he said.

There had been calls for an agree-

ment to peak emissions by 2025 but

this was removed from the nal text

following strong lobbying from a

group of oil and gas producing

countries emboldened by the global

energy crisis.

One person involved in the eleventh

hour discussions said Saudi Arabia

had been “playing hardest” in its resis-

tance to faster progress in cutting

emissions. China also held back prog-

ress but was less vocal than the Arab

Continued on Page 2

Policymakers in emerging markets

and developing economies are raising

their sights when it comes to renewable

energy, research company Bloom-

bergNEF (BNEF) nds in the latest

edition of its annual Climatescope

survey.

More than nine in 10 (92 per cent)

developing countries have made pub-

lic commitments to install and con-

sume certain volumes of renewable

power with specic deadlines. That is

up from 82 per cent a year earlier and

67 per cent in 2019, according to

BNEF.

Possible reasons for the change,

says BNEF, could include a desire to

demonstrate progress ahead of the

COP27 global climate talks, anxiety

over energy security amid rising fos-

sil fuel prices, fears about climate

change, or simply the appeal of

building renewables because they

are affordable.

According to the report, emerging

markets’ long-term clean energy

goals can only be met if policymakers

adopt accompanying implementation

policies. These markets, are, however,

making progress.

Climatescope nds that 56 per cent

of emerging markets now have poli-

cies to hold reverse auctions for clean

power delivery contracts, up from 49

per cent last year. The popularity of

net metering has also grown, with

such policies in place in 53 per cent of

emerging markets in 2022 compared

with 49 per cent last year. Further, 30

per cent of emerging markets have

established feed-in tariffs, increasing

from 27 per cent in 2021.

The gap between the long-term tar-

gets and the shorter-term implementa-

tion policies suggests policymakers

have substantial work ahead. Even in

countries that have promised to adopt

renewables auctions, net metering or

feed-in tariffs, follow-through can be

lacking.

“Without supporting regulations,

policy implementation alone cannot

guarantee that a country attracts the

amount of investment needed to kick

off its energy transition,” said Soa

Maia, Climatescope’s Project Man-

ager. “Among the 15 developed and

emerging nations that nished at the

bottom of the Climatescope power

policy scoring table, only one man-

aged to secure more than $2 billion

in clean power investment from 2017

to 2021.”

The report was released during the

COP27 climate summit in Sharm El-

Sheikh, where nancing climate

change efforts in emerging economies

was high on the agenda.

Nordic pension funds announced

that despite nancial challenges and a

volatile economic environment, they

are on course to reach their target of

$130 billion towards climate invest-

ments by 2030. The initial reporting

follows the landmark announcement

made at COP26 last year. This is also

the case for new investments in

emerging markets and developing

economies, which are proving to be

on track. The total, collective report-

ing of annual investments from Cli-

mate Investment Coalition pension

funds is expected to be announced in

the rst quarter of 2023.

Separately, the Emerging Market

Climate Action Fund (“EMCAF”)

announced a $25 million investment

into Alcazar Energy Partners II, a

fund providing early-stage equity -

nancing to develop, construct and

operate renewable energy projects in

the Middle East, North Africa, East-

ern Europe and Central Asia. This

commitment is in parallel to EIB

Global, the dedicated arm for outside

the EU of the European Investment

Bank (EIB) Group, which provides

$75 million to the fund.

COP27 also saw publication of the

‘Sharm El-Sheikh Guidebook for Just

Financing’. The Guidebook aims to

translate commitments into imple-

mentable projects, while capturing

opportunities to leverage and catalyse

needed nance and investments to

support climate action.

The Guidebook denes “Just Fi-

nancing”, as nancing that accounts

for historical responsibility for cli-

mate change while ensuring equita-

ble access to quality and quantity

climate nancing that supports resil-

ient development pathways leaving

no one behind.

It sets forth 12 core principles that

serve as a framework to guide stake-

holders to adopt innovative climate

nance modalities and instruments.

These will enable unlocking of need-

ed nancing from public and private

capital providers to scale up and

drive the transition required to ad-

dress climate adaptation and mitiga-

tion goals.

COP27 makes progress

COP27 makes progress

on climate nancing but

on climate nancing but

falls short on emissions

falls short on emissions

ambition

ambition

Sherry Rehman, Pakistan’s Climate Change Minister, hailed the deal as “historic”

THE ENERGY INDUSTRY TIMES - DECEMBER 2022

2

Junior Isles

The world must move quickly to re-

duce carbon dioxide emissions from

coal signicantly in order to avoid se-

vere impacts from climate change, a

new International Energy Agency

(IEA) report says. There must also be

immediate policy action to rapidly mo-

bilise massive nancing for clean en-

ergy alternatives to coal and to ensure

secure, affordable and fair transitions,

especially in emerging and developing

economies.

The new IEA special report – ‘Coal

in Net Zero Transitions: Strategies for

Rapid, Secure and People-Centred

Change’ – which is part of the IEA’s

‘World Energy Outlook series, says

replacing the use of coal to generate

electricity will cost $6 trillion and “will

not be easy”.

According to the report, the over-

whelming majority of current global

coal consumption occurs in countries

that have pledged to achieve net zero

emissions. However, far from declin-

ing, global coal demand has been stable

at near record highs for the past decade.

If nothing is done, emissions from ex-

isting coal assets would, by them-

selves, tip the world across the 1.5°C

limit.

“Over 95 per cent of the world’s coal

consumption is taking place in coun-

tries that have committed to reducing

their emissions to net zero,” said IEA

Executive Director Fatih Birol. “But

while there is encouraging momentum

towards expanding clean energy in

many governments’ policy responses

to the current energy crisis, a major

unresolved problem is how to deal with

the massive amount of existing coal

assets worldwide.”

The IEA highlights the countries

where coal dependency is high and

transition likely to be most challeng-

ing: Indonesia, Mongolia, China, Viet

Nam, India and South Africa stand out.

In developed countries, the use of coal

to generate electricity will fall by 75

per cent by 2030, while in developing

nations there will be a peak in 2025

and thereafter it will start to decline.

In total, countries have announced

commitments to reduce coal use for

power generation by 20 per cent by

2030, which is a “signicant step for-

ward”, according to the IEA.

The report came as the Global Carbon

Project, a coalition of international

climate science bodies, issued a sepa-

rate report that said global carbon di-

oxide emissions from energy are on

track to rise 1 per cent to reach 37.5

billion tonnes in 2022, with the biggest

increases coming from India and the

United States.

Today, there are around 9000 coal

red power plants around the world,

representing 2185 GW of capacity.

Their age varies by region, from an

average of over 40 years in the US to

less than 15 years in developing econ-

omies in Asia.

A massive scale up of clean sources

of power generation, accompanied by

system-wide improvements in energy

efciency, is key to unlocking reduc-

tions in coal use for power and to

reduce emissions from existing assets.

In a scenario in which current na-

tional climate pledges are met on time

and in full, output from existing glob-

al unabated coal red plants falls by

about one-third between 2021 and

2030, with 75 per cent of it replaced

by solar and wind. This decline in coal

output is even sharper in a scenario

consistent with reaching net zero

emissions by 2050 and limiting glob-

al warming to 1.5°C. In the Net Zero

by 2050 Scenario, coal use falls by 90

per cent by mid-century.

An important condition to reduce

coal emissions is to stop adding new

unabated coal red assets into power

systems.

New project approvals have slowed

dramatically over the last decade, but

there is a risk that today’s energy cri-

sis fosters a new readiness to approve

coal red power plants, especially

given the IEA report’s nding that

around half of the 100 nancial insti-

tutions that have supported coal-relat-

ed power projects since 2010 have not

made any commitments to restrict

such nancing, and a further 20 per

cent have made only relatively weak

pledges.

League countries in the negotia-

tions, those familiar with the talks

said.

The Arab group of nations and

Russia resisted wording that em-

phasised the need for renewable

power. Saudi Arabia pushed for

the UN agreement to allow for car-

bon capture and storage technolo-

gy, which would limit emissions

and enable continued oil and gas

production.

UN climate summit observer Al-

den Meyer, a senior associate at the

E3G think-tank, said the playbook

was familiar. “They [the oil states]

traditionally play hard ball in the end

stages,” he said. “Clearly they have

more inuence with this presidency

than they have with some others.”

Last year’s COP26 President Alok

Sharma expressed his disappoint-

ment in the text, seeing it as a missed

opportunity.

“I’m incredibly disappointed that

we weren’t able to go further,” he

said. “Emissions peaking before

2025, as the science tells us is nec-

essary. Not in this text,” he said.

“Clear follow-through on the phase

down of coal. Not in this text.”

The failure to agree on the phase-

down of all fossil fuel use was cause

for particular frustration.

“I wish we got fossil fuel phase

out,” said Kathy Jetnil-Kijiner, the

Climate Envoy of the Marshall Is-

lands, who along with other island

states fear annihilation if tempera-

tures rise above 1.5˚C.

“The current text is not enough.

But we’ve shown with the loss and

damage fund that we can do the

impossible. So we know we can

come back next year and get rid of

fossil fuels once and for all.”

There were other signicant an-

nouncements on the sidelines of the

summit aimed at accelerating the

energy transition. Notably, global

industry organisations representing

wind, solar, hydropower, green hy-

drogen, long duration energy stor-

age and geothermal energy indus-

tries ofcially joined forces under

one Global Renewables Alliance,

with the signing of a Memorandum

of Understanding.

The Global Renewables Alliance

will use the collective weight of its

member technologies to overcome

the challenges affecting the global

energy transition and increase the

share of voice for renewables where

fossil fuels are still disproportion-

ately present.

Ben Backwell, Global Wind En-

ergy Council CEO, said: “Massive

deployment of renewable energy

is the critical element in the battle

against climate change and coun-

tries will need all of the key tech-

nologies represented by this alli-

ance in order to be successful, and

it is important that we take a col-

laborative approach and work to-

gether as technologies to help

governments and communities

achieve the just energy transition

to ensure a sustainable and pros-

perous future.”

Continued from Page 1

Europe’s plans to reduce dependence

on imported fossil fuels by increasing

installed renewable energy capacity

and using electric vehicles could be

frustrated, if power prices do not come

down, says Rystad Energy.

According to the Norway-based en-

ergy research and business intelli-

gence company 35 GW of solar PV

manufacturing and more than 2000

GWh of battery cell manufacturing

capacity could be mothballed “unless

power prices quickly return to normal

levels”. Some 25 per cent of the Eu-

ropean solar and battery manufactur-

ing capacity remains at risk today it

said.

The research noted that recent

months had seen European power

prices hit €1500/MWh during peak

hours. “Although prices have retreated

signicantly since these record highs

in August, rates remain in the €300-400

range, many multiples above pre-en-

ergy crisis norms,” it said.

High gas prices, exacerbated by the

virtual cut-off of Russian gas to Eu-

rope, have had a knock-on effect on

power prices and seen Europe launch

a desperate scramble to secure alterna-

tive gas supplies. Some argue this

could threaten the bloc’s ambition to

achieve its climate goals.

New analysis from the Climate Ac-

tion Tracker claims the world has

“overreached” in its bid to respond to

the energy crisis, to the extent that

emissions from new gas capacity now

threaten the 1.5˚C warming limit.

In its COP27 update, the Climate

Action Tracker has calculated the

CO

2

emissions from all the under-

construction, approved and proposed

liqueed natural gas (LNG) produc-

tion projects between 2021 and 2050,

nding they could add up to around

10 per cent of the remaining global

carbon budget for 1.5˚C warming by

mid-century.

In 2030, oversupply of LNG could

reach 500 Mt of LNG, equivalent to

almost ve times the EU’s 2021 Rus-

sian gas imports, and double total

global Russian exports. This oversup-

ply of fossil gas could lead to excess

emissions of just under 2 Gt of CO

2

per year in 2030, well above emission

levels consistent with the IEA Net

Zero by 2050 scenario (2022).

“The energy crisis has taken over the

climate crisis, and our analysis shows

proposed, approved and under con-

struction LNG far exceeds what’s

needed to replace Russian gas,” said

Bill Hare, CEO of CAT partner organ-

isation Climate Analytics.

Meanwhile, a new report released

by Bloomberg Philanthropies and

BloombergNEF (BNEF) said that

G20 member countries provided $693

billion in fossil fuel support in 2021,

thereby slowing down progress on

reaching the goals of the Paris Agree-

ment. The Climate Policy Factbook

noted that coal still attracted $20 bil-

lion of government support in 2021.

While policymakers and commenta-

tors continue to debate whether hy-

drogen is the “silver bullet” we need

to achieve Net Zero, developers’ com-

mitments have ballooned over the past

six months.

According to Aurora Energy Re-

search’s latest global electrolyser da-

tabase, published with the bi-annual

Hydrogen Market Attractiveness Re-

port, the current pipeline of electroly-

ser projects totals 957 GW worldwide

– up by 592 GW since April 2022 and

dwarng the 270 MW of electrolyser

capacity operational today.

The report notes, however, that only

a handful, just 11 per cent, of these

projects have advanced beyond the

early planning stage. The Spirit of

Scotia project in Canada has added

500 GW to the global electrolyser

pipeline since April 2022, but does not

yet have a targeted commissioning

date.

Electrolyser manufacturing capaci-

ty is set to surpass 30 GW/year by

2025, Aurora’s database shows, with

70 per cent of planned capacity to be

located in Europe.

Global electrolyser manufacturing

capacity will rise to over 30 GW/year

by 2025, up from 8 GW/year opera-

tional capacity today, Aurora nds.

Europe is again the dominant region,

with 70 per cent of planned manufac-

turing capacity to be located there.

Belgian engineering rm John Cock-

erill is positioning itself to be the larg-

est global electrolyser manufacturer

by 2030, followed by German indus-

trial group ThyssenKrupp. If all man-

ufacturers were to operate at their

maximum capacity, 231 GW of elec-

trolysers could be manufactured be-

tween today and 2030.

European hydrogen demand would

total 1885 TWh by 2050, under a sce-

nario in which Europe achieves net

zero by 2050, Aurora’s modelling

shows. This is up from just 300 TWh

today.

n The World Bank Group has an-

nounced the creation of the Hydrogen

for Development Partnership (H4D),

a new global initiative to boost the

deployment of low-carbon hydrogen

in developing countries. The main

activities of the H4D partnership, to

be hosted in the Energy Sector Man-

agement Assistance Program (ES-

MAP) of the World Bank, will in-

clude: convening international

cooperation to increase the knowl-

edge base in low-carbon hydrogen

technologies for developing coun-

tries; and fostering collaboration with

private sector partners for clean hy-

drogen projects.

Headline News

High power prices threaten EU shift away from

High power prices threaten EU shift away from

fossil fuels

fossil fuels

Hydrogen commitments balloon

Hydrogen commitments balloon

Swift cut in coal emissions central to

Swift cut in coal emissions central to

reaching climate targets, says IEA

reaching climate targets, says IEA

Jetnil-Kijiner: hoped for

fossil fuel phase-out

n Emissions from existing coal assets will tip world across the 1.5°C limit

n Replacing coal plant will cost $6 trillion

THE ENERGY INDUSTRY TIMES - DECEMBER 2022

5

weber media solutions

www.webermediasolutions.com

YOUR CREATIVE MEDIA AGENCY FOR

DESIGN AND MARKETING SOLUTIONS

We are a creative media agency providing a bespoke

service to meet your media and marketing requirements

DESIGN / VIDEO / WEB / EXHIBITION STAND DESIGN

MAGAZINES / PRINT MANAGEMENT / MAILING

weber media solutions

samples of our

exhibition stand design

Our Clients:

Our Partners:

For more information please contact:

Karl Weber / Director

T: +44 7734 942 385 / E: karlw@webermediasolutions.com

karlweber@hotmail.co.uk

thermalpowercentralasia.com

+ 4 4 2 0 7 3 9 4 3 0 9 0 ( L o n d o n )

events@vostockcapital.com

FORUM HIGHLIGHTS

200+ TOP MANAGEMENT

REPRESENTATIVES

20+ REPORTS

20+ LARGEST INVESTMENT

PROJECTS OF INDUSTRY LEADERS

THE REPUBLIC

OF UZBEKISTAN THERMAL

POWER DEVELOPMENT

DYNAMICS

OPENING SESSION

OF INDUSTRY LEADERS

INVESTMENT PROGRAMME

OF CENTRAL ASIA

TIMELY MODERNISATION

IS THE KEY TO LONG-TERM

AND SAFE OPERATION

OF THERMAL POWER PLANTS

IMPORTANT!

ENVIRONMENTAL SAFETY

EXCLUSIVE EXHIBITION AND

TECHNOLOGICAL PRESENTATIONS

30+ HOURS OF BUSINESS AND

INFORMAL NETWORKING!

ELIZAVETA SMIRNOVA

Programme Director

+44 207 394 30 90 (London)

ESmirnova@vostockcapital.com

FOR PROGRAMME AND SPEAKER ENQUIRIES,

PLEASE CONTACT:

15-16 FEBRUARY 2023

UZBEKISTAN, TASHKENT

INTERNATIONAL FORUM AND EXHIBITION

Organised by:

Qatar, China sign 27-year LNG

contract as market tightens

Japanese companies move ahead with

ammonia transport project

Gary Lakes

Qatar and China last month signed an

agreement destined to go down in LNG

history. It is the rst time that a sup-

plier, that being state-owned Qatar

Energy, and China’s Sinopec, another

state-owned entity, negotiated a long-

term contract covering 27 years. The

length of the Supply and Purchase

Agreement (SPA) will bring LNG to

China up to 2053, three years after the

date that most of the world has tar-

geted for net zero in accordance with

the Paris Climate Accord.

Media reports put the value of the

contract at $60 billion for the delivery

of 4 million tons annually of Qatari

LNG beginning in 2026 when the

North Field East (NFE) expansion

project is due to start producing LNG.

The LNG will be delivered to Sino-

pec’s regasication terminals in China

via a eet of new tankers.

This latest deal follows a 10-year

contract signed in 2021 between Qatar

Energy and Guangdong Energy Group

Natural Gas Company for 2 million

tons annually, and China is reported to

be busy pursuing other long-term con-

tracts with Qatar and in a global market

that is becoming increasingly tight as

LNG consumers vie for what LNG

might be oating about on the spot

market.

Case in point: Japan, which until

Chinese demand soared, was the

world’s largest LNG importer, said in

late November that long-term con-

tracted LNG is “sold out” until 2026,

a situation that if true sets the scene

for erce competition in the spot mar-

ket among LNG importers not only

for this winter but probably the next

and possibly the one after that. For its

part, Japan is reported to have suc-

cessfully lined up sufcient supply for

this winter, and taken special mea-

sures to provide nancing if Japanese

companies are forced to turn to the

spot market, where prices have be-

come exorbitant.

The thing about long-term contracts

is that a buyer can count on a steady

supply at an expected price, while sup-

pliers know that their product is al-

ready sold.

Saad Sherida Al-Kaabi, who is Qa-

tar’s Minister of State for Energy Af-

fairs and the President and CEO of

Qatar Energy said the SPA will “fur-

ther solidify the excellent bilateral

relations” between China and Qatar

and “help meet China’s growing en-

ergy needs”.

Qatar has been the world’s largest

exporter of LNG, despite being chal-

lenged for that position rst by Austra-

lia and now from the US. China, mean-

while, has claimed to be the largest

importer of LNG during 2021 and will

overtake Japan in imports this year or

next, but the country’s battle with Co-

vid-19 has had a drastic impact on

energy demand and continues to do so.

However, energy demand is expected

to continue to grow once China man-

ages to get the virus under control.

Al-Kaabi mentioned that the SPA

with Sinopec was the rst committing

gas/LNG from the NFE expansion

project, which began in 2020 with the

intention to expand Qatar’s LNG pro-

duction from 77 million tons/year to

110 million tons/year by 2026. The

North Field South (NFS) expansion

project will boost Qatar’s production

capacity to 126 million tons/year by

2027.

Qatar Energy has signed partnership

agreements with eight international

oil companies for the two projects that

include the involvement of Exxon-

Mobil, Shell, TotalEnergies, Eni and

ConocoPhillips.

Qatar Energy has also lined up con-

struction contracts and long-term

charters agreements for 60 LNG car-

riers to support the NFE and NFS

projects. The number of tankers

linked to the projects is expected to

reach around 100 over time.

Qatar has had talks with potential

European customers, but no long-

term deals have been reached, as the

Europeans have not abandoned their

plans to move resolutely towards re-

newable energy systems even though

for now, they themselves are lining up

LNG deliveries.

American LNG companies are ex-

panding production capacity and cur-

rently shipping large volumes to Eu-

rope, which has had to a scramble for

gas supplies since western sanctions

against Russia for invading Ukraine

have led to Russia cutting off pipeline

supplies to Europe.

The Ukraine war calls much specu-

lation into play when considering the

gas market. The war’s outcome will

likely determine Russia’s future role

as a gas supplier and whether western

economies will ever revert to Russia

for energy supplies or push ahead with

their renewable targets. Asian buyers

would now like to see more Russian

LNG available, but will Moscow hold

onto its status as new LNG projects

come on-stream later this decade?

Gary Lakes

Japan’s JERA, the country’s largest

power generation company, has

signed a memorandum of understand-

ing with shipping companies Nippon

Yusen Kabushiki (NYK) and Mitsui

OSK Lines (MOL) regarding the

transportation of ‘fuel ammonia’ to

JERA’s Hekinan Thermal Power Plant

for a project proposing to mix ammo-

nia with coal. The project, which has

provoked questions about the envi-

ronmental safety and cost of an am-

monia/coal mix, is set to come into

operation by the end of the decade or

early 2030s.

The three companies will together

examine how large-scale ammonia

carriers might be developed and safely

transported. The transport vessels are

to be designed to carry the ammonia to

Japan’s domestic thermal power plants

and deliver the fuel to receiving sta-

tions. The group will look at “building

a fuel ammonia transportation and re-

ceiving system, as well as installing and

operating propulsion engines that use

ammonia as ship fuel”, a statement

released by JERA said. The partners

are also to work with related parties to

foster a set of rules for the reception of

fuel ammonia, the statement added.

JERA intends to start the commer-

cial operation of large-volume co-

ring – a 20 per cent mix of fuel am-

monia with coal – at its Hekinan

Thermal Unit 4 by the end of the

2020s. The project is part of JERA’s

green fuels production and promotion

scheme under the JERA Zero CO

2

Emission 2050 programme, which is

designed to cut emissions at its do-

mestic and overseas facilities.

The programme led to the signing

of a deal in August this year between

JERA, Singapore’s Jurong Port, and

Mitsubishi Heavy Industries Asia Pa-

cic on the production of ammonia.

The group plans to set up a direct 100

per cent ammonia combustion power

plant on Jurong Island, where Singa-

pore’s chemical and energy industries

are based. JERA said in its statement

that a 60 MW class gas turbine com-

bined cycle power plant fuelled by

100 per cent ammonia is planned for

the location that will produce carbon-

neutral electricity and stimulate am-

monia demand.

However, a study carried out by

Bloomberg New Energy Finance

(BNEF) examining Japanese utility

companies’ plans to retrot their exist-

ing coal red power plants to enable

co-ring of coal with ammonia might

not be a good idea. Japan is keen to

reduce its carbon dioxide emissions by

46 per cent by 2030 from 2013 levels

and hit net zero by 2050, but according

to the BNEF analysis of the proposal,

it appears that ammonia and coal might

not mix well.

The plan could be an attempt by

JERA and other companies with coal-

red generation facilities to save their

coal red plants in the face of what

will in future be growing pressure to

close them as usage and development

of renewables expands. The cost of

phasing out these plants or converting

them to a no-emissions fuel could be

ruining for the coal sector of the en-

ergy industry. Coal provides Japan

with some 30 per cent of the electric-

ity it requires drawn from 49 GW

worth of coal red capacity.

Japanese utilities are reported to have

invested heavily in retrotting for am-

monia, and have received hundreds of

millions of dollars in support from the

government, but it could prove to be

an uneconomic pursuit.

According to the BNEF analysis:

“The CO

2

emissions from a coal pow-

er plant burning ammonia at a co-

ring ratio of below 50 per cent will

still emit as much CO

2

as a natural gas

fuelled combined cycle gas turbine.

Coal power plants co-ring ammonia

may also emit more nitrous oxide, a

greenhouse gas with global warming

potential 273 times larger than that of

CO

2

for a 100-year timescale. Addi-

tionally, handling ammonia requires

more care than coal due to its volatil-

ity and toxicity.”

Furthermore, co-ring ammonia

and coal may prove to be an expensive

route for Japan to take. According to

the report: “The levelised cost of elec-

tricity (LCOE) for a typical Japanese

coal plant retrotted for ammonia co-

ring at 50 per cent or higher energy

content is signicantly higher than

zero-emission sources such as off-

shore wind. Ammonia co-ring is

unlikely to become an economically

viable path for Japan to reduce power

sector emissions.”

The report calculates that the LCOE

using a 50 per cent clean ammonia co-

ring ration could be $136/MWh in

2030, while using 100 per cent clean

ammonia could be $168/MWh in 2050.

“These values are costlier than the

LCOE of renewable alternatives such

as offshore wind, onshore wind or so-

lar with co-located batteries. Clean

ammonia is better suited for decar-

bonisation of applications such as fer-

tiliser production than power,” the

BNEF study said.

The words ‘ammonia’ and ‘hydro-

gen’ generate considerable attention in

the energy sectors, but it may turn out

that they are not miracle molecules and

may not t all applications in econom-

ic and environmental ways that are best

met with other renewables.

Hydrogen

Gas

Qatar has plenty of renewable energy potential, but its main resource is natural gas. The country’s

latest contract to supply LNG to China and its North Field expansion projects are testament to the fact

that Doha plans to be in the gas business well into the future.

Japan relies almost entirely on imports of natural gas and coal to meet its energy needs. But its desire to cut

carbon emissions is pushing it to test innovative methods to meet its huge energy demand and contribute to

the battle against global warming. Many advances are being made in alternatives and renewables, but is an

ammonia/coal mix one of them?

THE ENERGY INDUSTRY TIMES - DECEMBER 2022

11

Fuel Watch

G

rowing population, increas-

ing urbanisation and industri-

alisation are three factors

driving growth in the construction

and cement industries. Forecasts ex-

pect the cement industry to grow at a

compound annual growth rate of 3.4

per cent until 2030.

Cement plants are the backbone of

economic activity and prosperity and

an integral part of our everyday lives

– it is the second-most consumed

product worldwide after potable wa-

ter. While a crucial part of our lives,

its environmental impact has become

an even bigger issue. The cement in-

dustry alone is responsible for about

a quarter of all industries’ CO

2

emis-

sions, according to McKinsey.

With governments and industries

aiming to reach full carbon neutrali-

ty, the cement industry needs to

adapt and reinvent itself. To keep on

track with a net zero emissions by

2050 scenario, cement production

needs to decline by 3 per cent annu-

ally until 2030. Some players have

started to act, but overall, the indus-

try is nowhere near achieving this

target. CO

2

intensity derived from

cement production has increased by

about 1.5 per cent annually between

2015 and 2021, according to an In-

ternational Energy Agency (IEA)

report.

In addition, governments are in-

creasingly requiring environmental

impact assessments prior to commit-

ting funding for projects. And ESG

investments are booming: they are

expected to account for a third of

global Assets Under Management by

2025, exceeding $53 billion, says

Bloomberg Intelligence. This means

that funding is more likely to go to

companies able to demonstrate tan-

gible sustainability credits.

Currently, the silver-bullet road-

map towards cement decarbonisation

does not exist and the eventual route

remains uncertain. Cement players

need to identify a clear roadmap to-

ward decarbonisation by assessing

digital and technological advance-

ments to invest in and rethinking

their products, portfolios and con-

struction methodologies. Strategis-

ing and investing now will provide

forward-thinking players with an op-

portunity to become the industry

front-runners.

Key strategies to drastically reduce

carbon emissions in cement produc-

tion involve improving energy ef-

ciency, switching to low-carbon fu-

els, promoting material efciency,

and advancing innovative zero-emis-

sions production routes. While the

latter two will impact direct emis-

sions reduction most, according to

the IEA, they require deploying

technologies that are not yet avail-

able. Even if they eventually manage

to be deployed at scale, building

low-emission cement production ca-

pacity with carbon capture utilisation

and storage (CCUS) equipment pos-

es the risk of making the average

metric tonne of cement about 45 per

cent more expensive by 2050.

Electrical efciency can be im-

proved by changing preheater de-

signs on the kilns and by improving

grinding. In addition, unused and re-

stored lands near cement sites can be

used for renewable energy genera-

tion. However, the challenges that

come with betting on renewable en-

ergy sources are two-fold. First, re-

newable energy is uctuant, and ce-

ment plants need constant reliable

electricity production. Secondly, they

require a vast amount of land. Few

plants have the ability to produce

their own renewable energy on-site.

While a transition towards a grid

powered by renewable energy is in-

evitable, another solution can be im-

plemented by cement players today:

waste heat recovery (WHR). By in-

tegrating WHR facilities in plants,

manufacturers can increase electrical

efciency and alleviate emissions.

Waste heat is the largest unused en-

ergy resource in the world. WHR has

been commercially deployed in

many sectors – such as marine, steel,

geothermal, power generation and

also cement – but remains an un-

tapped resource for many players.

Tapping currently wasted energy

could, for example, satisfy the bulk

of UK households’ electricity de-

mand (109 000 GWh in 2021).

Given the gigantic waste heat po-

tential in the cement industry world-

wide, corresponding waste heat solu-

tions could generate a total of 82 000

GWh of electricity worldwide. At

the same time, WHR in the cement

industry could save 36 million tons

of CO

2

– a double advantage.

Cement players can choose be-

tween two routes to integrate WHR

facilities in their plants. They can: a)

opt for large tailor-made WHR

plants dependent on high tempera-

tures, integrated heat sources and

high conversion efciency; or b) go

for a more modular approach that al-

lows them to tap into individual low,

medium or high-temperate sources

exibly. The rst option comes with

a lower conversion efciency and re-

quires an unchanged heat source

over many years, while the second

allows exible modication of the

plant. These novel modular WHR

solutions full all the required crite-

ria for a successful and prosperous

cement industry: exible, fast, low

capex, and impactful. In short: a no-

regret option.

Just like there is no silver bullet so-

lution to decarbonising the cement

industry, opting for modular WHR

solutions over large ones will depend

on what producers value. The most

common approach to WHR is

through expensive steam turbines

that are complex to plan, require a

manned operation, and prevent any

exibility in operation. Even the

classic organic rankine cycle (ORC)

plant gives only little operational

exibility, plus requires long deliv-

ery time and complex planning. To

exploit the higher power output of

these rather sophisticated installa-

tions, a stable plant operation with-

out setup changes such as CCUS in-

tegration is required.

We believe that most cement play-

ers urgently need autonomous, exi-

ble and easy-to-use solutions. Orcan

Energy’s modular approach with

plug-and-play solutions is tailored to

answer those individual needs. The

technology is highly exible regard-

ing the waste heat source: the mod-

ules can be installed wherever waste

heat is generated, for example in en-

gines or in industrial processes. The

novel ORC modules are smaller than

conventional solutions and allow re-

installation in different places. In

times of uncertainty and rapid

changes, this solution allows great

exibility.

From a technical point of view, the

novel ORC modules work similarly

to a steam power plant: organic liq-

uids are evaporated at a lower tem-

perature than water. In this way,

waste heat can be used even at com-

paratively low temperatures starting

at under 100°C. The modules allow

clean electricity to be generated from

waste heat at a very low price. The

electricity can be fed into the grid or

consumed immediately, improving

energy reliability and exibility.

The benets of these plug-and-play

modules have already been demon-

strated at several sites. Pioneered by

the Miebach family and its cement

company Wittenkind, cement giant

Cemex also decided to take this no-

regret step. Orcan Energy supplied

Cemex, which runs Germany’s larg-

est cement plant, with six modules.

While producing 2 million tons of

cement on-site yearly, the modules

generate savings on the existing

cooler and convert previously un-

used waste heat from production into

a total of up to 8150 MWh of elec-

tricity per year. At the same time,

they reduce the plant’s CO

2

emis-

sions by around 3500 tons annually.

This example shows WHR solutions

can have a real impact.

Waste heat recovery is not limited

to the cement industry: it can also

produce clean electricity wherever

waste heat is generated. Having

made headway into the decarbonisa-

tion of the cement industry Orcan

Energy’s is also focusing on the oil

and gas sector. Being responsible for

42 per cent of all global emissions,

directly and indirectly (according to

McKinsey), decarbonising this in-

dustry is incredibly important. Fortu-

nately, the industry has great poten-

tial for heat-to-power solutions. Just

this year, Orcan Energy implement-

ed its novel geothermal solution in

the US, paving the way for more

projects utilising waste heat around

the globe.

There is a wide range of use cases

for heat-to-power in oil and gas: up-

stream, midstream and downstream.

Upstream, energy conversion tech-

nology can leverage further geother-

mal and waste heat potential of ex-

isting oil and gas sites. The

heat-to-power modules can, for in-

stance, be installed at generators or

compressors in the eld or tap geo-

thermal potential of existing wells.

Midstream, we can utilise waste heat

at gas-compressor stations. And

downstream, we tap another huge

energy potential as there is an “invis-

ible wind park” hiding under every

renery.

Decarbonising industries like ce-

ment and oil and gas is a task requir-

ing fast and urgent action. It can only

be achieved with solutions that can

deliver benets now without block-

ing any future investments. With a

simple solution, businesses and en-

tire industries can lower their energy

costs signicantly, relying on stable

prices in unstable times. Waste heat

recovery makes a real impact on

global emissions – now and even

more so in the future.

Dr Andreas Sichert is co-founder

and CEO of Orcan Energy AG.

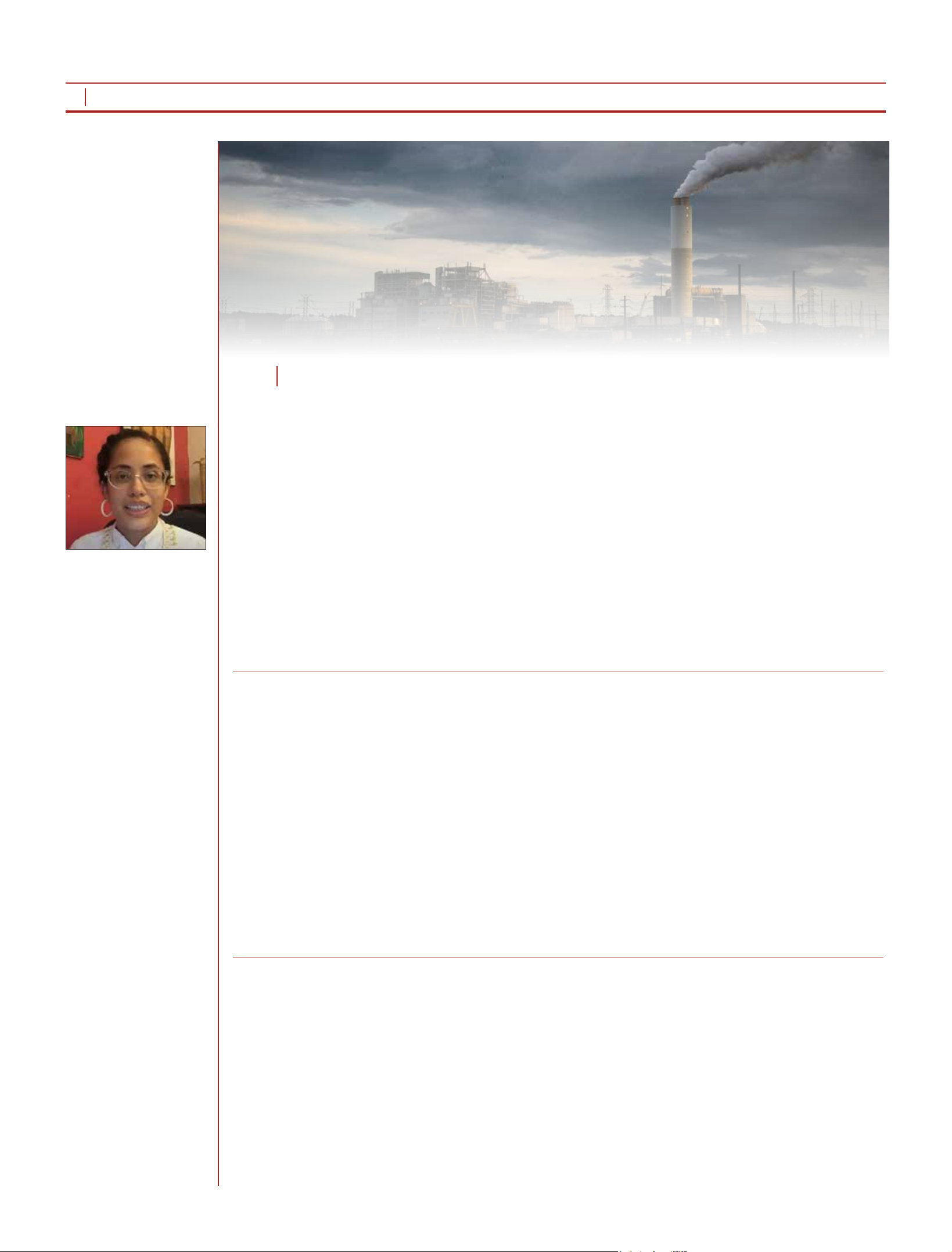

Decarbonising the hard-to-abate industrial sector is crucial in the ght against climate change. Luckily, there are many

different use cases for turning unused heat into clean, affordable and reliable electricity – modules can be installed

wherever waste heat is generated. Orcan Energy’s Dr Andreas Sichert says waste heat recovery modules offer a

key solution to achieving climate neutrality, while saving on energy costs.

Cementing the case for

Cementing the case for

waste heat recovery

waste heat recovery

THE ENERGY INDUSTRY TIMES - DECEMBER 2022

13

Decarbonising Industry

Dr. Sichert: Waste heat recovery

in the cement industry could

save 36 million tons of CO

2

capacity. The share of coal power in

India, however, is likely to still rise

for some time unless major curbs are

urgently adopted.

The two nations ofcially have

NZE objectives that lag behind many

of their peers. China’s NZE goal is

“by/before” 2060 based on current

policies. However, it is most likely to

reach its objective well before 2060.

Probably in the early 2050s. India is

targeting 2070 though there is scope

for an earlier date.

Some of the global narrative is that

China’s decarbonisation plans are

weak or unclear. This may not be

completely accurate. The nation aims

at creating new decarbonisation pa-

rameters or “base” for the whole

economy by 2025. It will introduce,

for example, more green guidelines

for key industries, including improv-

ing their energy efciency. Energy

consumption per unit of GDP in 2025

will fall 13.5 per cent versus 2020.

This includes cutting CO

2

emissions

per unit of GDP 18 per cent. It will

also raise the share of non-fossil en-

ergy consumption to 20 per cent by

2025 and to 25 per cent by 2030, with

wind and power installed capacity

reaching 1200 GW.

Its ambitions could be somewhat

thwarted in the short term by its net

zero Covid policies and slower eco-

nomic growth. However, capacity

additions and policy trends remain

positive. In the rst nine months

through September 2022, electric

power sector generation capacity rose

25.1 per cent to Yuan392.6 billion

(about $55 billion). Almost 87 per

cent of the total expenditure was to-

wards non-fossil fuel generation ac-

cording to the China Electric Power

Council. Policy-wise, the central

government’s strong climate action

motivation witnessed in the 2010s do

not seem to have changed. As Presi-

dent Xi entered his third term in

power, he actually reiterated the na-

tion’s green and low-carbon develop-

ment goals, including peak CO

2

emissions within the next ve years.

Unlike China, India’s decarbonisa-

tion plans have indeed been weak and

lack some clarity. While climate ac-

tion policy and related regulations are

slowly but surely improving, such as

the recent release of its decarbonisa-

tion strategy, policy and regulatory

execution have been inconsistent.

Arguably, the country is at a different

stage of development versus China.

This is both a challenge and an op-

portunity. It must increase a gigantic

amount of installed capacity in the

I

n light of Russia’s invasion of

Ukraine and the resulting Euro-

pean and global energy crisis, it

was no surprise that energy and the

transition toward a global green and

sustainable future featured promi-

nently at both the UN COP27 climate

change conference and the G20 Lead-

ers Summit.

China and India featured in a major

way at both summits. With their huge

population, rising share of global

GDP and carbon emissions, what

these countries do in terms of climate

action has a huge impact on the rest of

the world. Importantly, each of the

giant nations renewed their pledges to

achieve net zero emissions (NZE).

Yet the two countries have adopted

dissimilar paths and are transforming

their respective energy systems at

different speeds. Although China is

ahead of India, India does have the

capacity and resources to accelerate

the transition over the next few years

Both China’s President Xi Jinping

and India’s Prime Minister Narendra

Modi attended the G20 in Bali, Indo-

nesia. Notably, the meeting put China

and the US back on climate action

talking terms and placed China back

in the spotlight as a key (or “the” key)

climate action participant. Also, there

seemingly is a prospect that India

may accelerate its decarbonisation

path with Prime Minister Modi say-

ing that “India is committed” to clean

energy and environment and stressing

that half of its electricity will be gen-

erated from renewable sources by

2030.

Meanwhile, at COP27 in Sharm

El-Sheikh, Egypt, hopes on climate

action were high but realistic expecta-

tions were low – only senior

representatives from the two countries

were present.

China and India’s differing paths in

terms of the level and speed of their

energy transition can be explained by

several factors. One reason is the

level of development of their power

systems. Another is their reliance on

thermal coal. The two have similar

population sizes but China has a

larger GDP, almost six times greater.

The nation accelerated its electric

power capacity expansion in the past

three decades or so. It now consumes

about ve times as much as India. Yet,

both continue to be highly reliant on

fossil fuel generation.

The brown to green ratio in China is

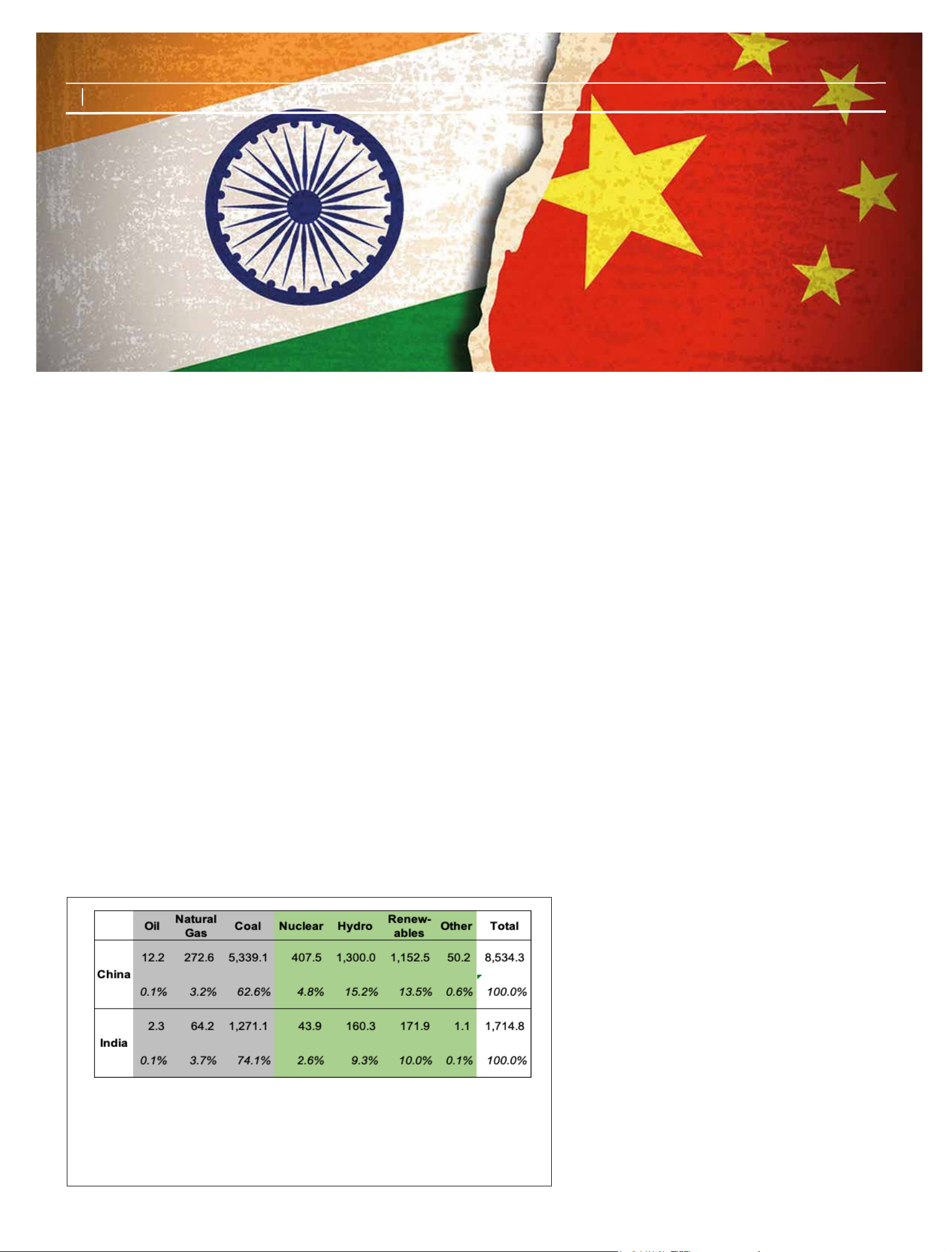

66:34 and that of India is 78:22. Chi-

na’s coal power has a share of 63 per

cent of total output, versus 74 per cent

for India. China’s coal power share

has most certainly peaked and will be

declining from the current level as it

continues to massively expand its

conventional renewable energy

sources, namely solar energy as well

as onshore and offshore wind power.

This will conrm its status as today’s

global clean energy leader in terms of

output and equipment manufacturing

coming decades – ve times the

amount to reach China’s level today.

But if it adds more clean energy than

fossil fuel baseload plants, it can eas-

ily beat its 2070 NZE aim. And maybe

even bring the date forward.

India issued its Long-Term Low

Emission Development Strategy (LT-

LEDS) in mid-November – the last of

the ve largest economies in the

world to do so. Its environment min-

ister proudly told Reuters that the re-

lease of the strategy was “an important

milestone”, and that “once again India

has demonstrated that it walks the talk

on climate change”. The initiatives

the strategy highlights are not vastly

different from those China is imple-

menting. India wants to add clean

energy generation, upgrade technolo-

gies (including those for carbon cap-

ture, use and storage or CCUS), push

for a domestically driven electric ve-

hicles sector and cut household energy

consumption. The major variation

from China is that it still wants to add

a signicant amount of fossil fuel-

based generation.

Over the next few decades China

and India will continue to be the key

players in global decarbonisation, the

main forwards to use a soccer analogy.

China will continue to lead in terms

of clean energy output, adding clean

technologies such as energy storage,

and further develop electric systems-

related digital technologies and solu-

tions to optimise the clean energy

sources. It will continue to drive clean

energy asset investments and research

and development as it has done for the

past decade or so.

India has enormous scope to upsize

its decarbonisation strategy. It also

has the capability and the capacity to

follow China’s path. It does need,

however, to greatly expand climate

nance resources.

Importantly, collaboration and co-

operation between China and India on

decarbonisation would be hugely

benecial to both, and the world,

given their bulk manufacturing and

technological capacity and know-

how. Unfortunately, they must rst be

able to break through their existing

political or diplomatic barriers.

Giuseppe ‘Joseph’ Jacobelli is Man-

aging Partner at Asia Clean Energy

Investments, a direct investments advi-

sor, and at Bougie Impact Capital, a

single-family ofce. He is an Asia en-

ergy markets expert, author of ‘Asia’s

Energy Revolution’ (De Gruyter,

2021) and host of ‘The Asia Climate

Finance’ Podcast.

THE ENERGY INDUSTRY TIMES - DECEMBER 2022

Asia Decarbonisation

14

CHINA VS INDIA

• Output 8,534 TWh vs 1,715 TWh

• Coal power 63% of total vs 74%

• Fossil fuels 66% of total vs 78%

• Clean energy 34% vs 22%

• Clean energy ex-nuclear power 29% vs 19%

The importance of China and India to the world’s net zero emissions ambition cannot be understated, as was evident

at two major global diplomatic events held in mid-November. The size of their populations, rising share of global GDP,

energy markets, and emissions, mean their action on climate change has a signicance that reaches far beyond their

borders. Joseph Jacobelli explains.

China and India: the net

China and India: the net

zero game changers

zero game changers

China and India 2021 power

generation by fuel (TWh).

Source: Author using data from

the ‘bp Statistical Review of World

Energy June 2022’

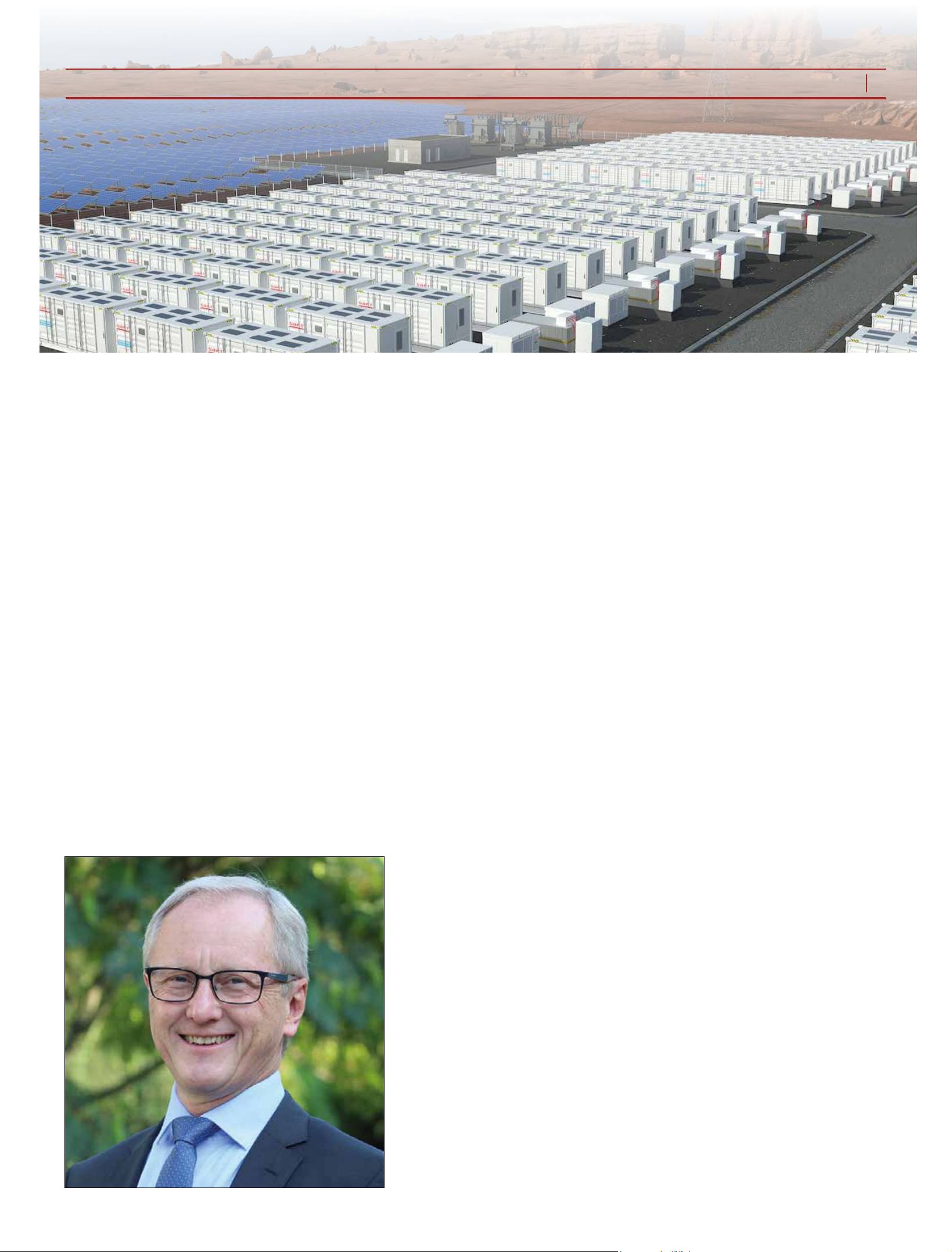

L

ooking back 10 years, there

was no need to use a battery

system for time-shifting. The

relatively small scale of solar and

wind farms meant that their energy

could generally be absorbed by the

grid. Meanwhile, the relatively high

cost of battery capacity per kilo-

watt-hour meant that energy storage

was not economically viable for ar-

bitrage. This is where energy is

stored at times of peak production

when its price is low and sold sev-

eral hours later when demand and

price have picked up.

However, we now need this level

of storage – and energy storage sys-

tems (ESS) can provide it. Today’s

market is evolving. Whereas energy

storage used to be dominated by

high-power applications such as fre-

quency regulation or wind/solar

smoothing, it is now feasible to use

batteries in more energy-oriented,

longer-duration applications that

enable operators to integrate more

renewable energy onto the grid.

In practical terms, this uses ESS in

“energy-shifting”, which is also

known as time-shifting. Although

renewable energy sources such as

solar and wind power cannot be

turned on or off, they can be cur-

tailed. A wind turbine might pro-

duce a high volume of energy, but if

congestion on the grid means that it

is not able to handle all this power

at once, the grid operator will not

accept it.

Therefore, energy storage has the

role of absorbing renewable energy

when it exceeds either the demand

or the grid’s transmission capacity.

And as we are currently seeing a

steady growth of renewable power

capacity, we are also seeing a

growth in curtailment. Not only is

this energy lost to the operator of

the wind or solar farm, it is also lost

to the community. In addition, when

demand is high, alternative sources

must be used as a substitute at rela-

tively high economic and environ-

mental costs.

Another important consideration

is the exibility and capacity that

are essential for power grids. Flexi-

bility enables operators to overcome

variability in supply and demand.

This is becoming more important

with the growing penetration of re-

newable sources that are variable

and non-dispatchable.

Secondly, investing in grid capaci-

ty enables them to cope with peak

demand and guarantee security of

supply, even in extreme cases. For

example, they need capacity to meet

high demand on the coldest winter

evenings or to overcome a sudden

outage of a major generation plant.

Having sufcient capacity tends to

overcome the lower predictability

of renewable generators.

Typically, fast-reacting generation

plants, such as simple cycle or com-

bined cycle gas turbines (CCGT),

are used to provide both exibility

and capacity reserves. However, the

drive towards net zero by 2050 and

the energy crisis have shown that

we need alternatives.

Batteries have the capability to

capture precious zero-carbon elec-

tricity that could otherwise be lost

to curtailment, and to provide exi-

bility and capacity resources that

have until now relied on fossil fuel-

powered generators.

Today’s battery energy storage is

increasingly competitive and can

deliver peak power at a similar cost

to gas peaking generation plant. We

have already seen US operators

award tenders to energy storage

rather than gas peaking. It is a ven-

ture that is becoming more prot-

able in Europe in light of current

prices on the energy market.

The question asked by investors is

whether the situation will last and

whether electricity prices will still

be as expensive in the next ve

years. It is likely that energy and

other resources will continue to be

scarce. As a result, policymakers

and industry leaders will view elec-

tricity as a valuable commodity and

its storage will provide a commer-

cial advantage.

Looking at the economic side of

energy storage itself, the overall

cost of lithium-ion (Li-ion) battery

systems has signicantly reduced

over the past decade. However, re-

cent increases in raw material costs

have caused a 15 per cent price in-

crease over the last year. The good

news is that the underlying reason

for this is a short-term reduction in

capacity for processing battery ma-

terials. Therefore, the outlook is for

continuation of the long-term reduc-

tion in ESS costs driven by a well-

known learning curve of cost reduc-

tion as a function of cumulated

volume produced.

As with any other area of technol-

ogy, there have been technological

advances in ESS and particularly in

digitalisation, energy density and

scale.

Digitalisation provides enhanced

management and control of ESS in

real-time. This improves availabili-

ty, reduces downtime and cuts

maintenance requirements. Opera-

tors can manage ESS more ef-

ciently with modern digital plat-

forms by automating key functions.

In addition, an interface with the

cloud provides remote monitoring

of key performance indicators

(KPIs) and control over the bat-

tery’s operating parameters.

In practice, this enables the opera-

tor to measure the ESS provider

against contractual performance tar-

gets. A contract might specify a

minimum available energy storage

capacity of X megawatt-hours

(MWh) with availability of 98 per

cent or more. A digital platform like

Saft’s I-Sight will monitor perfor-

mance of the system in real-time. If

performance drops below 98 per

cent availability or below X MWh,

the platform will alert the operator,

as well as Saft. As a result, they can

take corrective action immediately.

Digital monitoring and control

also pre-empt major issues before

they can develop. Before the advent

of such systems, operators were not

able to access real-time perfor-

mance data. Therefore, they could

not easily observe performance

trends and might not be able to spot

issues early to take remedial action.

Moreover, as the cost per kWh has

dropped, the overall size of systems

has grown. A 5 MW system was

considered big only a few years

ago, but today we are starting to see

gigawatt-scale systems.

This creates a challenge for the

physical size of systems. It is con-

ceivable that we will see the devel-

opment of ESS of 50, 60 or even

100 MW. This will require greater

energy density. Packing more stor-

age capacity into the same space

will require less civil engineering,

less cabling and less installation

time.

Anticipating this, Saft has in-

creased the energy capacity per

container from 2.3 MWh to 2.9

MWh by improving the system de-

sign and using higher-capacity

modules. Other aspects of system

design also help to control system

costs. For example, factory installa-

tion of heating, ventilation and air

conditioning (HVAC) and safety

features ensure that containers ar-

rive on site ready to plug and play.

Large-scale ESS also requires

more sophisticated controllers. It is

important for an electrical power

conversion system (PCS) to oversee

multiple containers as a single enti-

ty but this is complex. Without ade-

quate control in place, the system

might experience a drift between

the real and perceived state-of-

charge (SOC). This may affect sys-

tem capacity and performance – and

to overcome it, it’s important to use

a system that can handle real-time

data from many battery strings in

multiple containers. This enables

systems to scale up to hundreds of

megawatts.

Another factor that inuences en-

ergy density is the safety gap be-

tween containers. This can be mini-

mised with good mechanical design

and choice of electrochemistry.

In the US, more than 30 per cent

of solar farms have an ESS under a

solar-plus storage model, which has

been driven by tax incentives. The

new Ination Reduction Act (IRA)

is likely to increase the trend for

ESS and for time-shifting.

In contrast, the European ESS

market has traditionally focused on

grid services, such as primary and

secondary frequency regulation,

with storage durations of up to an

hour.

This is creating an opportunity in

Europe. As there is greater penetra-

tion of renewables on the grid, it’s

likely that we will see deployment

of large-scale ESS to give operators

the ability to time-shift renewable

energy for consumption during peak

time. This will make the most of

precious energy as we continue to

adapt to the energy transition.

As the energy crisis rumbles on, electricity is set to become a precious commodity. Operators need to nd ways to

reduce their dependence on traditional sources of energy such as natural gas and fossil fuels. Saft’s Michael Lippert

explains how battery energy storage systems can help them to achieve this by avoiding curtailments of wind and solar

farms to maximise the integration of renewables.

Evolving energy storage

for time-shifting

THE ENERGY INDUSTRY TIMES - DECEMBER 2022

15

Technology Focus

Lippert: “It’s likely that we will

see deployment of large-scale

ESS to give operators the

ability to time-shift renewable

energy for consumption

during peak time”

THE ENERGY INDUSTRY TIMES - DECEMBER 2022

16

Final Word

T

he recently concluded COP27

climate change meeting in

Egypt really was a mixed bag.

While there were some signicant

agreements, overall the nal outcome

left much to be desired. In some ways,

you could say it was a game of two

halves.

For much of the two-week summit

held in Sharm El-Sheik, there was

little to write home about. COP27 was

meant to be an “action” summit that

implemented agreements made last

year. Yet expectations that it would

achieve anything new were low. That

proved to be the case in terms of

reaching an agreement on how to

accelerate much-needed cuts in car-

bon emissions.

Tuvalu’s Finance Minister Seve

Paeniu, said it was “regrettable” not

to have an agreement about emissions

peaking in 2025 to prevent a rise in

temperatures beyond 1.5°C.

More than 80 countries had, report-

edly, supported a proposal to phase-

down the use of all fossil fuels but in

the end there was no movement on

the weakened Glasgow COP26

pledge to phase-down polluting coal

power and phase-out inefcient fossil

fuel subsidies. Moves to phase-down

fossil fuel use were largely blocked

by a group of countries with a vested

interest in the production of oil and

gas – the most vocal among them

being Saudi Arabia.

COP26 President Alok Sharma said

he was “incredibly disappointed” that

countries were unable to go further.

“Emissions peaking before 2025, as

the science tells us is necessary. Not

in this text,” he said. “Clear follow-

through on the phase down of coal.

Not in this text.”

Negotiations on coal use remained

locked even as the International En-

ergy Agency (IEA) released a special

report on what it would take to cut

global coal emissions rapidly enough

to meet international climate goals

while supporting energy security and

economic growth.

According to the report, if nothing

is done, emissions from existing coal

assets would, by themselves, tip the

world over the 1.5°C limit. IEA Ex-

ecutive Director Dr. Fatih Birol said

a major unresolved problem is how

to deal with the “massive amount of

existing coal assets” worldwide.

“Coal is both the single biggest

source of CO

2

emissions from energy

and the single biggest source of

electricity generation worldwide,

which highlights the harm it is doing

to our climate and the huge challenge

of replacing it rapidly while ensuring

energy security,” Dr Birol said. “Our

new report sets out the feasible op-

tions open to governments to over-

come this critical challenge afford-

ably and fairly.”

The report notes that moving more

quickly to signicantly reduce carbon

dioxide emissions from coal would

require “massive nancing for clean

energy alternatives to coal and to

ensure secure, affordable and fair

transitions, especially in emerging

and developing economies”.

Replacing coal in electricity gen-

eration would cost $6 trillion and

“will not be easy”, as it will require

a “rapid nancial mobilisation” to

close old plants and implement alter-

native energies, said the IEA. Much

of that money will be needed to bring

renewables (90 per cent) and nuclear

(8 per cent) on line.

During COP27, a coalition of coun-

tries led by the US and Japan promised

to deliver $20 billion in public and

private nance to help Indonesia shut

coal power plants and bring forward

its peak emissions date by seven years

to 2030. The money, pledged under

the Just Energy Transition Partnership

(JETP), was hailed by the IEA and

others as one of the concrete suc-

cesses of the summit and came off the

back of a roadmap set out by the IEA

last year that would enable Indonesia

to achieve net zero by 2050.

“This JETP programme will help

Indonesia, a country that relies heav-

ily on coal, to move away from coal

to a cleaner energy future in a just and

secure way. It’s a real testament to

international cooperation,” said Dr.

Birol.

The Indonesian deal follows a

similar $8.5 billion package for South

Africa, and arrangements with India

and Vietnam have been mooted.

“Next year we hope we can work

with India, and after with Brazil, to

provide some insights to help them to

reach their climate commitments,”

said Dr. Birol.

The IEA stresses that the entire coal

sector must shift to net zero emissions

by 2050 in order to “give the world

an even chance” of limiting global

warming to the critical threshold of

1.5°C.

While COP27 kept in place the

COP26 pledge to accelerate the

phase-down of polluting coal power

and invest in renewable energy, there

was a sharp U-turn on the language

around fossil fuels in an effort to reach

a compromise between opposing

camps.

On one side, the Arab group of na-

tions and Russia resisted wording that

emphasised the need for renewable

power. Saudi Arabia pushed for the

UN agreement to allow for carbon

capture and storage technology,

which would limit emissions and

enable continued oil and gas produc-

tion. At the other end of the eld, a

growing number of countries, includ-

ing the US and Australia, said they

would support a commitment to

phase-down all fossil fuels.

The text now includes a reference

to “low emission and renewable en-

ergy”. This could cover anything

from wind and solar farms to nuclear

reactors, and coal red power stations

tted with carbon capture and stor-

age. Notably, it is also seen by some

as a signicant loophole that could

allow for the development of further

gas resources, as gas produces less

emissions than coal.

“The world will not thank us when

they hear only excuses tomorrow,”

said European Commission Execu-

tive Vice-President and EU green

chief Frans Timmermans. “This is the

make or break decade but what we

have in front of us is not enough of a

step forward.” And in fairness, such

general disappointment is not mis-

placed.

As the summit drew to a close

Brian O’Callaghan, Lead Researcher

and Project Manager, Oxford Eco-

nomic Recovery Project, said: “If

COP were a football rivalry, it would

be amongst the most lopsided; Fossil

Fuel Interests: 27, Humankind: 0.

“We are now at 27 years of COPs.

There have been successes, but

mostly, it’s been 27 years of obstruc-

tionism, delay, and greenwashing.

The world is already moving faster

than the COP processes – we need to

double down on that trend.”

But despite the disappointments,

the summit ended on what was seen

as a “historic moment”.

Financial support for helping devel-

oping countries address climate is-

sues and those affected by climate

change has long been a contentious

issue at these talks and was expected

to be a central factor in the eld of

play. Money has long been available

to cut carbon or help countries adapt

to rising temperatures – but until now

there was nothing for those who had

lost everything.

“For someone who has seen his

home disappear in the oods in

Pakistan, a solar panel or a sea wall

isn’t much use,” said Harjeet Singh

from the Climate Action Network.

The devastating oods in Pakistan

this summer, which killed about 1700

people with estimated damages of

$40 billion, set a powerful backdrop

to the summit.

As the talks went into extra-time,

countries agreed a new funding ar-

rangement on “loss and damage” – a

pooled fund that will see rich nations

pay poorer countries for the damage

and economic losses caused by cli-

mate change.

It is seen as the most important

climate advance since the Paris

Agreement at COP 2015.

Pakistan’s Climate Minister Sherry

Rehman, who negotiated for the bloc

of developing countries plus China,

was very happy with the agreement.

She told journalists: “I am condent

we have turned a corner in how we

work together to achieve climate

goals.”

Minister Molwyn Joseph, Antigua

and Barbuda Environment and chair

of the Alliance of Small Island States,

said the deal was a “win for the entire

world” and “restored global faith in

this critical process dedicated to en-