www.teitimes.com

November 2022 • Volume 15 • No 9 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Black & Veatch shares key ndings on

decarbonising Asia.

Page 13

Special Project

Supplement

Asian emissions:

what executives think

Schwarzheide opens its heart to

carbon neutrality.

News In Brief

Europe prepares for winter

energy crunch

Europe is preparing for what

could be a difcult winter with

preparations to secure energy

supplies and curb high electricity

prices.

Page 2

Canada’s provinces release

power plans

The province of Nova Scotia is

set to hold Canada’s rst offshore

wind auction, as Ontario province

announces plans for at least 1.5 GW

of energy storage.

Page 4

Australia drives clean

energy developments

The Australian government has

signed several key agreements that

will accelerate the development of

its clean energy sector.

Page 5

Winter could see demand

response to alleviate system

stresses

European homes and businesses

will be helped to switch their usage

away from peak times this winter,

reducing costs and alleviating strain

on the grid.

Page 7

BP accelerates bioenergy

expansion, as energy majors

show big prots

In a move that will expand and

accelerate the growth of its strategic

bioenergy business, BP has agreed

to acquire Archaea Energy Inc.,

in the US. The deal came just

ahead of Q3 results, which were

expected to show another quarter of

extraordinary prots

Page 9

Energy Outlook: Global

shocks will not alter the

direction of travel

DNV’s latest ‘Energy Transition

Outlook’ assesses the short- and

long-term effects of the shocks

caused by the pandemic and

Russia’s invasion of Ukraine.

Page 14

Technology Focus:

Demonstrating the value of

hydrogen

With pressure on carbon emissions

and high gas prices, there has

been much debate on whether gas

turbines have a future. Some believe

the answer lies in hydrogen.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

Global carbon emissions are set to show minimal growth this year due to the ongoing

deployment of renewables in the power sector, but more still needs to be done. Junior Isles

COP27 Presidency urges developed world to implement commitments

THE ENERGY INDUSTRY

TIMES

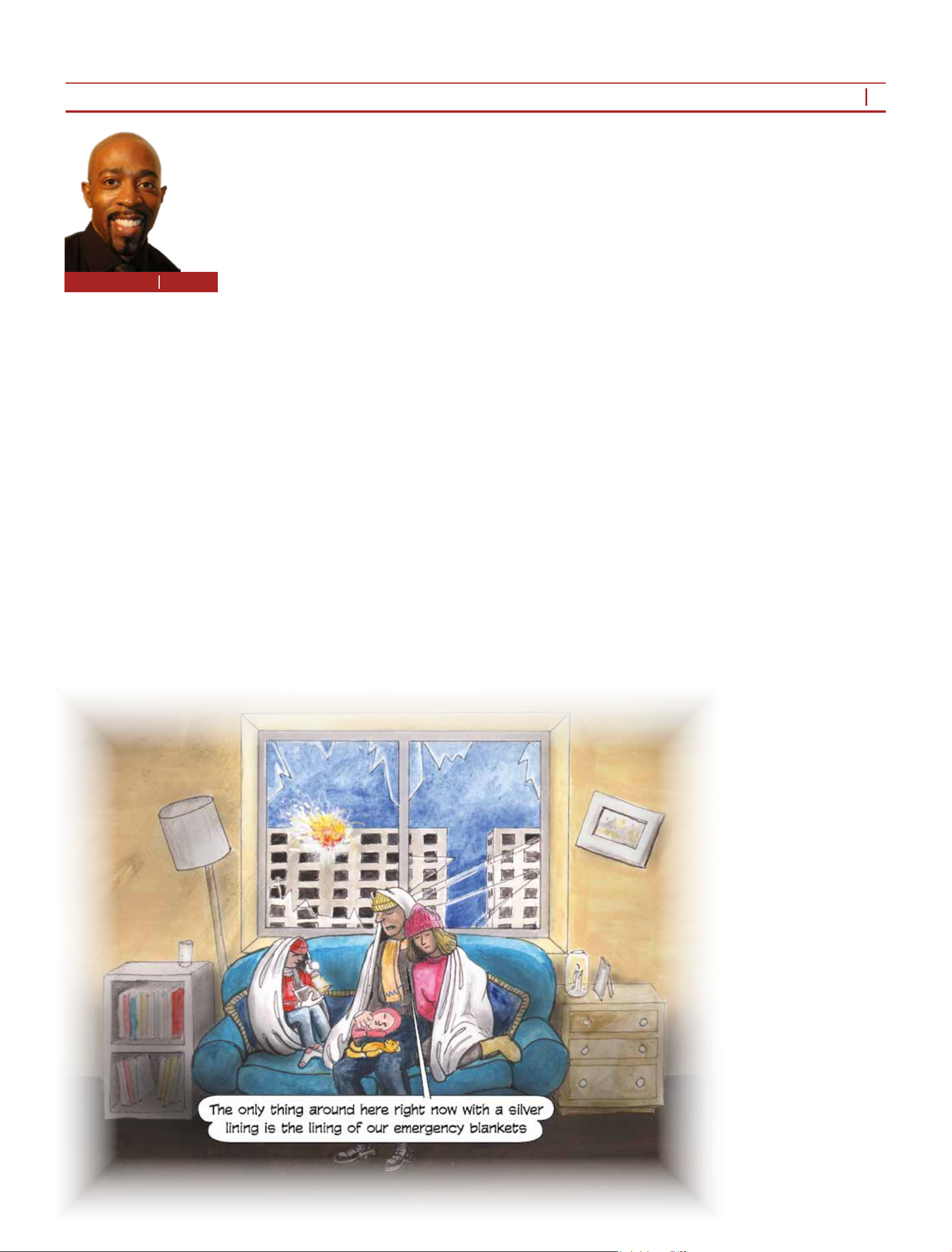

Final Word

Perhaps good can

come from bad,

says Junior Isles.

Page 16

Global carbon dioxide (CO

2

) emis-

sions in 2022 are set to grow by only

a fraction of last year’s big increase due

to a strong expansion of renewables in

the power sector, according to several

recent industry reports.

In a press note released just ahead of

its ‘World Energy Outlook 2022’ pub-

lication, the International Energy

Agency (IEA) said that despite con-

cerns about the effects of the current

energy crisis, global CO

2

emissions

from fossil fuel combustion are ex-

pected to grow by just under 1 per cent

this year, as a strong expansion of re-

newables and electric vehicles prevent

a much sharper rise.

New IEA analysis of latest data

from around the world shows that

these CO

2

emissions are on course to

increase by close to 300 million

tonnes in 2022 to 33.8 billion tonnes

– a far smaller rise than their jump of

nearly 2 billion tonnes in 2021 caused

by the economic recovery after the

pandemic.

Even though the energy crisis

sparked by Russia’s invasion of

Ukraine has propped up global coal

demand in 2022 by making natural

gas far more expensive, the relatively

small increase in coal emissions has

been considerably outweighed by the

expansion of renewables, said the

IEA. Notably, it says the European

Union’s CO

2

emissions are on course

to decline this year despite an increase

in coal emissions.

“The global energy crisis triggered

by Russia’s invasion of Ukraine has

prompted a scramble by many coun-

tries to use other energy sources to

replace the natural gas supplies that

Russia has withheld from the market.

The encouraging news is that solar

and wind are lling much of the gap,

with the uptick in coal appearing to

be relatively small and temporary,”

said IEA Executive Director Fatih

Birol. “This means that CO

2

emis-

sions are growing far less quickly this

year than some people feared – and

that policy actions by governments

are driving real structural changes in

the energy economy.”

Energy think-tank Ember found that

renewables met all of the rise in glob-

al electricity demand in the rst half of

2022, preventing any growth in coal

and gas generation.

Global electricity demand was

found to have grown by 389 TWh in

the rst half of 2022. Renewables –

wind, solar and hydro – increased by

416 TWh, slightly exceeding the rise

in electricity demand.

The rise in wind and solar generation

met over three-quarters of the demand

growth in the rst half of 2022, while

hydro met the remainder, preventing a

Continued on Page 2

Egypt’s COP27 Presidency has spelled

out the importance that the developed

world keep its climate pledges to avoid

a “crisis of trust” in the COP process

whilst holding out hope for progress

at COP27 in Sharm El Sheikh starting

on November 7th.

Speaking to 60 ministers from

around the world at the pre-COP27

meeting in Kinshasa, Democratic Re-

public of Congo, H.E. Sameh

Shoukry, Egyptian Minister of For-

eign Affairs and COP27 President-

Designate, said: “We have not yet

delivered on the $100 billion pledge,

which in itself is more a symbol of

trust and reassurance than a remedy to

actual climate needs.”

Commenting on the current levels of

support to protect people’s lives and

livelihoods in the developing world

he highlighted that “mitigation -

nance is receiving more attention than

adaptation” and that “instruments of

nance are still mostly non-conces-

sional loans rather than concessional

loans and grants which account for

only six per cent of climate nance.

“We must nd a way to address this

challenge. Without appropriate and

fair nance serving as a catalyst, we

will all continue to struggle in deliver-

ing impactful climate action,” he said.

Setting out his vision in a press we-

binar at the end of September,

Shoukry said: “We must accelerate

climate action on all fronts including

mitigation, adaptation and nance in

addition to adopting more ambitious

mitigation measures to keep the

1.5°C within reach. There can be no

room for delay in the fullment of

climate pledges or backtracking on

hard-earned gains in the global ght

against climate change. We must

work together for implementation.”

The urgent need to act now was

highlighted in the recently published

UN Environment Programme

(UNEP) ‘Emissions Gap Report

2022’.

The report nds that, despite a deci-

sion by all countries at the 2021 cli-

mate summit in Glasgow, UK

(COP26) to strengthen Nationally

Determined Contributions (NDCs)

and some updates from nations, prog-

ress has been “woefully inadequate”.

NDCs submitted this year take only

0.5 Gt of CO

2

equivalent, less than 1

per cent, off projected global emis-

sions in 2030.

This lack of progress “leaves the

world hurtling” towards a tempera-

ture rise far above the Paris Agree-

ment goal of well below 2°C, prefer-

ably 1.5°C, it said.

Unconditional NDCs are estimated

to give a 66 per cent chance of limit-

ing global warming to about 2.6°C

over the century. For conditional

NDCs, those that are dependent on

external support, this gure is re-

duced to 2.4°C. Current policies

alone would lead to a 2.8°C hike,

highlighting the temperature impli-

cations of the gap between promises

and action.

“In the best-case scenario, full im-

plementation of unconditional NDCs

and additional net zero emissions

commitments point to only a 1.8°C

increase, so there is hope. However,

this scenario is not currently credible

based on the discrepancy between

current emissions, short-term NDC

targets and long-term net zero tar-

gets,” the report stated.

To meet the Paris Agreement goals,

UNEP says the world needs to reduce

greenhouse gases by unprecedented

levels over the next eight years.

Unconditional and conditional

NDCs are estimated to reduce global

emissions in 2030 by 5 and 10 per

cent, respectively, compared with

emissions based on policies current-

ly in place. To get on a least-cost

pathway to holding global warming

to 1.5°C, emissions must fall by as

much as 45 per cent over those envis-

aged under current policies by 2030.

For the 2°C target, a 30 per cent cut

is needed.

Growth in carbon

Growth in carbon

emissions slows as

emissions slows as

power sector embraces

power sector embraces

renewables

renewables

THE ENERGY INDUSTRY TIMES - NOVEMBER 2022

2

Junior Isles

Europe is preparing for what could be

a difcult winter with preparations to

secure energy supplies and curb high

electricity prices exacerbated by Rus-

sia’s invasion of Ukraine.

At the end of September EU member

states agreed to: reduce electricity

demand by 5 per cent during peak

hours; establish a “solidarity” levy on

fossil fuel intermediaries, such as oil

companies; and redistribute to the

most vulnerable the extraordinary

prots of ‘infra-marginal’ technolo-

gies – i.e. those with the cheapest

operating costs, including wind, solar

and nuclear power plants – that sell

electricity above €180/MWh.

The EU Commission also presented

its proposal for an “autumn package”

in the gas sector. The package is in-

tended to include temporary measures

against the high gas prices and for

greater gas supply security. In early

October the Commission told EU

countries that they must make even

deeper cuts to gas demand to get

through winter at the same time as

outlining several measures to slash the

price of gas.

Germany’s Federal Minister Robert

Habeck commented: “ With the emer-

gency measures jointly decided by the

Energy Council, we have agreed on

good and effective instruments to curb

the rise in electricity prices.

“To do this, we siphon off random

prots from the electricity market and

also put a solidarity tax on energy

producers, such as companies in the

oil, natural gas, coal and renery sec-

tors. It is only fair because some of

companies earn a lot of money in the

crisis and it is right to use this income

for a solidarity contribution used for

the common good.”

He added: “It is, and will remain,

just as important to save energy. We

are in a serious situation and winter is

yet to come. That is why the binding

energy saving targets are necessary.”

Habeck went on to explain: “Of

course we also have to curb the high

wholesale gas prices. We support the

proposal of the European Commis-

sion and are committed to using our

European strength wisely and lower-

ing the gas price across Europe

through joint purchasing strategies.”

The EU agreement came as the Eu-

ropean Commission approved a €450

million temporary German measure

under EU State aid rules, to enable

ve lignite red power stations to be

on stand-by and ready to be activated

in the event of gas shortages.

Germany also warned, however, that

Russia’s war in Ukraine must not lead

to a “worldwide renaissance” for coal.

Germany also decreed that all three

of the country’s remaining nuclear

power plants will continue operating

till mid-April 2023, as the country

battles to avert an energy crunch this

winter.

Elsewhere, Switzerland said it is

well prepared for the winter crunch

thanks to its hydropower reserves,

support for the electricity sector, a

national energy-savings campaign

and efforts by the government and gas

sector to secure additional gas storage

capacities abroad.

Meanwhile, Türkiye’s Karpower-

ship, one of the world’s largest opera-

tors of oating power plants, said it is

in talks with four European countries

for the supply of oating power barg-

es with a combined capacity of 2 GW.

The barges, which can generate elec-

tricity from liqueed natural gas

(LNG) or liquid fuels, can be con-

nected to a country’s electricity grid

in about 30 days. The most powerful

of the barges is said to be 500 MW.

possible 4 per cent increase in fossil

generation and avoiding $40 billion

in fuel costs and 230 Mt CO

2

in

emissions.

Consequently, global CO

2

power

sector emissions were unchanged in

the rst half of 2022 compared to

the same period last year, despite

the rise in electricity demand.

The report analysed electricity

data from 75 countries representing

90 per cent of global electricity de-

mand. It compares the rst six

months of 2022 to the same period

in 2021 to show how the electricity

transition has progressed.

But despite the halt in fossil gen-

eration in the rst half of 2022, coal

and gas generation increased in July

and August. This leaves open the

possibility that power sector CO

2

emissions in 2022 may yet rise, fol-

lowing last year’s all-time high.

“We can’t be sure if we’ve reached

peak coal and gas in the power sec-

tor,” said Malgorzata Wiatros-Mo-

tyka, senior analyst at Ember. “The

rst step to ending the grip of ex-

pensive and polluting fossil fuels is

to build enough clean power to meet

the world’s growing appetite for

electricity.”

In its ‘Energy Transition Outlook’

published last month, DNV warned

that while greening of electricity

production remains the driving

force of the transition, emissions are

not on track to meet climate change

targets. It forecasts that the planet is

on course to warm by 2.2°C by

2100, stressing that global CO

2

emissions reduction of 8 per cent

every year is needed to reach net

zero by 2050.

Alongside the ‘best estimate’ fore-

cast for the energy transition the

Outlook this year also includes the

Pathway to Net Zero, which is

DNV’s most feasible route to

achieving net zero emissions by

2050 and limiting global warming

to 1.5°C.

It says reaching net zero globally

in 2050 will require certain regions

and sectors to go to net zero much

faster. OECD regions must be net

zero by 2043 and net negative

thereafter; with carbon capture and

removal enabling negative emis-

sions. China needs to reduce emis-

sions to zero by 2050 rather than

the current goal of 2060. Some

sectors like electricity production

will need to reach net zero before

2050, while other sectors like ce-

ment and aviation will still have

remaining emissions.

“According to our Pathway to Net

Zero, no new oil and gas will be

needed after 2024 in high income

countries and after 2028 in middle-

and low-income countries. Invest-

ments in renewables and grid need

to scale much faster; renewables

investment needs to triple and grid

investment must grow by more than

50 per cent over the next 10 years,”

stated the report.

Continued from Page 1

Global demand for low carbon hydro-

gen is expected to increase from less

than 1 Mt to 200 Mt by 2050, accord-

ing to global research and consultancy

group Wood Mackenzie. The group

also forecasts that capital costs for hy-

drogen production technologies will

fall signicantly in the next 5-10 years.

The EU’s REPowerEU plan, which

has set an ambitious low carbon hy-

drogen production target of 10 Mt,

with an additional 10 Mt of imports

by 2030, and the US with its Ination

Reduction Act (IRA), which intro-

duces a production tax credit (PTC)

for clean hydrogen, will support the

industry’s broader commitment to

achieving net zero targets by 2030 and

2050 and drive growth of hydrogen

production, the research said.

The ndings came as the European

Commission approved state aid worth

€5.2 billion for a second wave of

hydrogen-related ‘Important Projects

of Common European Interest (IP-

CEI)’, helping to reduce dependence

on natural gas and accelerate the hy-

drogen economy.

The IPCEI wave, called Hy2Use,

supports projects in two main areas.

First, it supports hydrogen-related

infrastructure, namely large-scale

electrolysers – totalling 3.5 GW for

an annual output of 340 000 tons of

hydrogen – and infrastructure for the

production, storage, and transport of

renewable and low-carbon hydrogen.

Second, it supports innovative tech-

nologies for the integration of hydro-

gen into industrial processes, in sec-

tors such as steel, cement and glass.

Hy2Use was prepared and notied

by 13 European Member States: Aus-

tria, Belgium, Denmark, Finland,

France, Greece, Italy, Netherlands,

Poland, Portugal, Slovakia, Spain and

Sweden. It also includes two Norwe-

gian projects. These countries will

provide up to €5.2 billion in public

funding, which is expected to unlock

an additional €7 billion in private in-

vestment, for the development of 35

schemes across Europe.

Hydrogen Europe said it “welcomed

this decision and the fact it aligns”

with the objectives of key EU policy

initiatives such as the European Green

Deal, the EU Hydrogen Strategy and

the REPowerEU Plan.

It stated: “The large-scale roll-out of

impactful hydrogen schemes will lay

the path for future projects to be de-

veloped faster and at lower costs.

Hydrogen Europe underlines the im-

portance of IPCEIs in the roll-out of

the hydrogen economy and encour-

ages Member States to notify subse-

quent IPCEI waves under preparation

as soon as possible.”

A recent report by the International

Energy Agency (IEA) said that mo-

mentum continues to build behind

low-emissions hydrogen amid the

global energy crisis, with electrolyser

manufacturing expected to grow

strongly and pilot projects proliferat-

ing in new applications such as steel

and transport. It said, however, that

these areas remain a small part of the

overall hydrogen landscape, high-

lighting the need for greater policy

support.

According to the IEA, the encourag-

ing developments in hydrogen tech-

nologies that can support the clean

energy transition include an expected

six-fold increase by 2025 in global

manufacturing capacity of electrolys-

ers, which are needed to produce low-

emissions hydrogen from renewable

electricity.

Low-emissions hydrogen produc-

tion worldwide in 2021 was less than

1 million tonnes – with practically all

of it coming from plants using fossil

fuels with carbon capture, utilisation

and storage – according to the latest

edition of the IEA’s annual ‘Global

Hydrogen Review’.

Meanwhile, overall hydrogen de-

mand worldwide reached 94 million

tonnes in 2021, exceeding the previ-

ous annual high of 91 million tonnes

reached in 2019. Almost all of the

increase last year was met by hydro-

gen produced from fossil fuels with-

out carbon capture. And while de-

mand for new applications of

hydrogen jumped by 60 per cent in

2021, the growth was from such a low

base that it rose to just 40 000 tons,

the report nds.

Several underwater blasts in late Sep-

tember that hit both stems of the Nord

Stream gas pipeline linking Russia and

Germany, emitting record levels of

methane for the oil and gas sector, have

redrawn the global gas trading map,

according to climate data company

Kayrros.

According to Kayrros, the damage

inicted on the pipeline may “durably

redraw” the global gas trading map by

structurally reducing Russia’s gas ex-

port capacity to the west.

“One of the less commented upon

effects of the Nord Stream blasts will

be to make the recent European thirst

for US LNG more permanent,” said

the company.

European imports of US LNG

surged in early 2022, spurred by tight

European gas balances and reduced

Russian shipments, and have since

remained elevated as Russia has

steadily deepened its export cuts, cul-

minating with the full Nord Stream

closure since late August.

With Russia’s gas export capacity to

Europe having been badly hit, US gas

exporters can expect Europe to remain

“a US gas magnet” for a lot longer

said Karryos.

Russia’s continued curtailment of

natural gas ows to Europe has pushed

international prices to painful new

highs, disrupted trade ows and led

to acute fuel shortages in some emerg-

ing and developing economies, with

the market tightness expected to con-

tinue well into 2023, according to the

International Energy Agency’s latest

quarterly ‘Gas Market Report’.

“Natural gas markets worldwide

have been tightening since 2021, and

global gas consumption is expected

to decline by 0.8 per cent in 2022 as

result of a record 10 per cent contrac-

tion in Europe and unchanged demand

in the Asia Pacic region,” said the

report.

It added: “Global gas consumption

is forecast to grow by only 0.4 per cent

next year, but the outlook is subject

to a high level of uncertainty, particu-

larly in terms of Russia’s future ac-

tions and the economic impacts of

sustained high energy prices.”

Headline News

Global demand for low carbon hydrogen

Global demand for low carbon hydrogen

to surge

to surge

Nord Stream blasts redraw the global gas trading map

Nord Stream blasts redraw the global gas trading map

Europe prepares

Europe prepares

for winter energy crunch

for winter energy crunch

Wiatros-Motyka: unsure if

fossil fuelled power has peaked

n Consumption to be cut 5 per cent, renewable generators taxed

n Germany agrees temporary generation measures, as others eye power barges

THE ENERGY INDUSTRY TIMES - NOVEMBER 2022

3

www.teitimes.com

THE ENERGY INDUSTRY

TIMES

subscribe today

The Energy Industry Times is the only publication that

covers global news related to the power and energy

sector in a newspaper style and format whose

uniqueness is recognised by our readers.

As a paid subsciber you will gain full access to our online

news desk.

You will also no longer have to wait for the printed edi-

tion; receive it by PDF “hot off the press” or download it

online.

To subscribe, email subscriptions@teitimes.com or visit

www.teitimes.com

To guarantee receiving your monthly copy of the award

winning newspaper, you need to subscribe today

weber media solutions

www.webermediasolutions.com

YOUR CREATIVE MEDIA AGENCY FOR

DESIGN AND MARKETING SOLUTIONS

We are a creative media agency providing a bespoke

service to meet your media and marketing requirements

DESIGN / VIDEO / WEB / EXHIBITION STAND DESIGN

MAGAZINES / PRINT MANAGEMENT / MAILING

weber media solutions

samples of our

exhibition stand design

Our Clients:

Our Partners:

For more information please contact:

Karl Weber / Director

T: +44 7734 942 385 / E: karlw@webermediasolutions.com

karlweber@hotmail.co.uk

THE ENERGY INDUSTRY TIMES - NOVEMBER 2022

5

Asia News

The Department of Energy (DOE) has

said foreign ownership restrictions that

hamper the ow of investments in the

renewable energy sector may now be

relaxed following a legal opinion pro-

vided by the Department of Justice

(DOJ).

There is currently a 40 per cent eq-

uity limit for foreign investors, who

have been asking the government to

lift the foreign ownership limit in re-

newable energy projects to attract

more investments into the sector. The

DOE is now looking to amend this

rule following the legal opinion.

“The good news is there is strong

interest from foreign investors to

enter and invest in renewable ener-

gy projects here in the Philippines,

provided that we are able to increase

the equity or ownership for foreign-

ers,” Energy Secretary, Raphael Lo-

tilla said.

To further entice foreign investors,

Lotilla said the government must en-

sure the availability of adequate trans-

mission lines to bring the renewable

energy from where it is plentiful to

areas where it is needed.

“We are listening to the needs of the

investors because we don’t want re-

newable energy projects to be built

and then, as what happened in Negros,

they cannot be used at all. It is wasted

because there are no transmission

lines to transmit the power out of Ne-

gros Island,” Lotilla said.

To reach net zero emissions by 2060,

a World Bank report estimates China

needs between $14-17 trillion in ad-

ditional investments for green infra-

structure and technology in the power

and transport sectors alone.

China’s current decarbonisation plan

would need to decouple economic

growth and emissions at a faster pace

and at a lower income level than in

advanced economies, the bank warned,

as it made the “signicant investments

in a massive green infrastructure and

technology scale-up”.

The International Finance Corpora-

tions’s Regional Vice President for

Asia and the Pacic, Ruth Horowitz,

said: “Given the immense price tag,

public investments won’t be sufcient

to meet these needs, so China needs

policy and regulatory reforms to spur

the private sector and fully tap the po-

tential for investment and innovation.”

China could also leverage some

advantages, said the World Bank,

such as its position at the forefront of

advancing low carbon technologies.

The World Bank Group’s ‘Country

Climate and Development Report’

(CCDR) for China contains a compre-

hensive set of economy-wide and sec-

tor level policy recommendations,

including for the energy, industry,

building, agriculture, transport and

other sectors.

These include accelerating the pow-

er sector transition by increasing solar

and wind power generation capacity

by 2030 to 1700 GW from the current

target of 1200 GW, and enhancing the

integration of renewables by invest-

ing in energy storage.

It also recommends expanding the

current Emissions Trading System in

the power sector to other high-carbon

sectors such as steel, iron, and cement,

and gradually transitioning to abso-

lute emissions caps.

Philippines urged to lift foreign equity

limit in renewable energy sector

China’s energy transition needs

shifts in resources and technologies

Moving forward

together in changing

energy markets

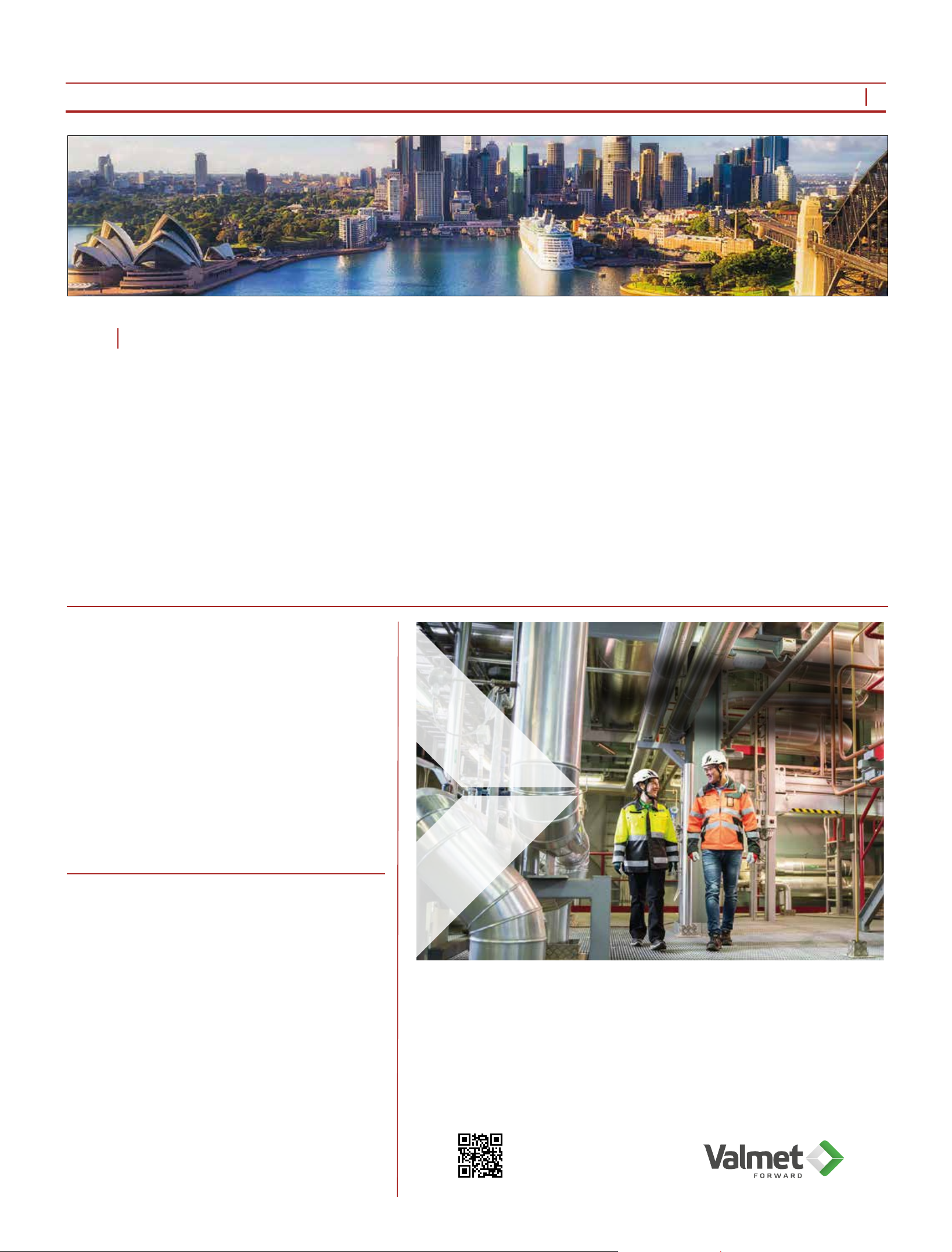

Resource efficiency, flexibility and clean solutions are the key for

success in changing energy markets. Based on our decades-long

experience, we have the know-how to deliver the best solutions

based on biomass, waste or on a mixture of different fuels.

Valmet’s proven automation solutions help you to optimize your

energy production and our network of service professionals is ready

to recharge your competitiveness both on-site and remotely.

Explore valmet.com/energy

Syed Ali

The Australian government has signed

several key agreements that will ac-

celerate the development of its clean

energy sector.

In mid-October the federal govern-

ment announced the rst investments

of its Rewiring the Nation plan, which

will drive renewable energy develop-

ment in Victoria and Tasmania.

Australia’s federal government and

Victoria signed an agreement to joint-

ly fund Victorian offshore wind proj-

ects, renewable energy zones (REZs)

and the Victoria-New South Wales

Interconnector (VNI West) Kerang-

Link.

The agreement includes A$1.5 bil-

lion ($948 million) of concessional

nancing for REZ projects in the state,

including offshore wind, a A$750 mil-

lion concessional loan to support VNI

West’s completion by 2028 and plans

to coordinate regulatory processes to

aid the development of the offshore

wind industry in Victoria. The VNI-

West KerangLink is expected to un-

lock 4 GW of new power generation.

“Rewiring the Nation has always

been about jobs in new energy indus-

tries, delivering cleaner, cheaper and

more secure energy, and bringing

down emissions – today it begins do-

ing just that,” said Labour Prime Min-

ister Anthony Albanese.

The Albanese government said that

key transmission projects stalled un-

der the former federal government at

a time when the country’s electricity

system is changing rapidly.

In addition, the Australian govern-

ment, Victoria and Tasmania will

equally fund a 20 per cent equity invest-

ment in the Marinus Link interconnec-

tor between Tasmania and Victoria.

Under a letter of intent between the

federal government and Tasmania, the

remaining 80 per cent of the project

costs will be funded by a concessional

loan from Rewiring the Nation,

through the Clean Energy Finance

Corporation.

The partnership also includes up to

A$1 billion of low-cost debt for Tas-

mania’s Battery of the Nation projects,

as well as low-cost debt to link Cressy,

Burnie, Shefeld, Staverton and

Hampshire in Tasmania, known as the

North West Transmission Develop-

ments (NWTD), to enable Tasmania

and the mainland to take advantage of

the wind energy resources in North-

West Tasmania.

The news follows an announcement

in September that Australia expects to

receive up to $2.8 billion of clean en-

ergy infrastructure investment from

major US corporations.

Australia’s Climate Change and En-

ergy Minister Chris Bowen signed a

Letter of Intent with his US counter-

part Special Climate Envoy John

Kerry and a group of nine US con-

glomerates, seeking to support the

clean energy transition. The pact

makes Australia a member of the

Clean Energy Demand Initiative

(CEDI), a global platform that con-

nects countries with corporations

seeking to rapidly deploy clean en-

ergy to offset electricity demand in

their sectors.

Australia’s participation in the

CEDI is seen to showcase the govern-

ment’s active engagement on region-

al energy security.

“Australia’s policy actions – includ-

ing large-scale generation credits,

corporate power purchase agreements

(PPAs), and renewable retail contracts

– may serve as a model for other coun-

tries working to expand corporate

procurement of renewable energy,”

the US Department of State said.

Australia has made some signicant

announcements in renewables devel-

opment in recent weeks.

In early October the Australian Re-

newable Energy Agency (ARENA)

said it is providing funding to support

Alinta Energy Ltd in the early-stage

development of a 1 GW offshore wind

project that could power the Portland

Aluminium Smelter.

Meanwhile the state of Queensland

said it will be the host of a green en-

ergy hub that will produce green am-

monia for export to South Korea.

The project is being proposed by the

Han-Ho Hydrogen consortium, made

up of Korea Zinc and its Australian

unit Ark Energy, and Korean rms

Hanwha Impact and SK Gas.

The project will focus on the devel-

opment of Ark Energy’s new Collins-

ville Green Energy Hub project lo-

cated south west of Bowen, Queensland

which, once complete, will potentially

be able to generate up to 3 GW of re-

newable electricity. By 2032, the hub

is expected to export over 1 Mt of green

ammonia, a byproduct of green hy-

drogen production, from Australia to

South Korea each year.

Australia drives clean energy

Australia drives clean energy

developments

developments

n First investments in ‘Rewiring the Nation’ plan n Up to $2.8 billion of energy investment from major US corporations

6

THE ENERGY INDUSTRY TIMES - NOVEMBER 2022

Asia News

Malaysia has published its national

energy policy (NEP) 2022-2040, set-

ting out details of the government’s

priorities for the energy sector over the

next 20 years.

The policy is aimed at streamlining

various existing policies, creating a

long-term vision coordinated across

various stakeholders, and providing

updated direction for the country’s

energy sector.

Speaking in its Out-Law News pub-

lication, climate change expert John

Yeap of Pinsent Masons, commented:

“With Malaysia’s commitment to net

zero emissions, the increasing focus

on decarbonising the generation sec-

tor across southeast Asia is to be ex-

pected. Delivering on the ambitions

of the plan will, however, require the

support of both public and private sec-

tor stakeholders in enabling not just a

just transition away from fossil inten-

sive generation but also in champion-

ing regulatory progress on commer-

cialising economically marginal

technologies.”

The NEP has a series of new targets

to help Malaysia become low carbon

by 2040. These include increasing the

total installed capacity of renewable

energy from 7.6 GW in 2018 to 18.4

GW in 2040 and the overall percent-

age of renewable energy in the total

primary energy supply from 7.2 per

cent to 17 per cent. The policy also

targets reducing the percentage of

coal in installed capacity from 31.4

per cent to 18.6 per cent.

By 2040, the NEP aims to reach an

energy mix of 4 per cent bioenergy, 4

per cent solar, 9 per cent hydropower,

27 per cent oil products, 39 per cent

natural gas and 17 per cent coal com-

pared to 2018 numbers of 1 per cent

bioenergy, 0 per cent solar, 6 per cent

hydropower, 30 per cent oil products,

41 per cent natural gas and 22 per cent

coal.

Natural gas looks set to remain an

important part of the country’s elec-

tricity mix with the recent announce-

ment of plans for a new gas red

combined cycle power (CCGT) plant

in Kapar, Selangor.

Last month state-owned electricity

utility Tenaga Nasional Berhad

(TNB), through its wholly owned

subsidiary, TNB Power Generation

Sdn (TPGSB) received a Letter of

Intent (LoI) from the Ministry of En-

ergy and Natural Resources for the

new 2100 MW project, which would

be developed on land located to the

north of the existing Sultan Salahud-

din Abdul Aziz power station.

The project is aligned with TNB’s

Net Zero Emissions Aspiration by

2050 which also forms part of TP-

GSB’s initiative in supporting the

government’s Low Carbon Aspira-

tion 2040 under the NEP.

Singapore and Japan are both looking

at the use of ammonia as a green fuel

for power generation.

Keppel New Energy, a wholly-

owned subsidiary of Keppel Infra-

structure, recently said it will explore

the use of 100 per cent ammonia as a

fuel for gas red generation alongside

Mitsubishi Heavy Industries (MHI)

and global independent energy expert,

DNV.

Under the memorandum of under-

standing (MoU), Keppel New Energy

will study the feasibility of an ammo-

nia-fuelled power plant, whilst MHI

will develop an ammonia-red gas

turbine that produces carbon-neutral

power. DNV will bring its quality as-

surance and risk management exper-

tise to the project.

Through the MoU, Keppel, MHI,

and DNV aim to draw-up robust as-

sessment guidelines to ensure the

safety and sustainability of ammonia

as a clean fuel, while maintaining high

efciency and low NOx emissions for

use in a gas turbine system for power

generation.

Meanwhile, Japanese utilities are

exploring the case for retrotting their

existing coal power plants to enable

co-ring ammonia to reduce CO

2

emissions. However, ammonia-coal

co-ring is unlikely to be economi-

cally viable for Japan to reduce pow-

er sector emissions, according to a

new report published by research rm

BloombergNEF (BNEF).

BNEF estimates the levelised cost

of electricity (LCOE) for a retrotted

coal power plant in Japan using a 50

per cent clean ammonia co-ring ratio

would be at least $136/MWh in 2030

By 2050, the LCOE of a retrotted

plant running 100 per cent on clean

ammonia is expected to be at least

$168/MWh.

This is more expensive than the

LCOE of renewable alternatives such

as offshore wind, onshore wind or

solar with co-located batteries.

BNEF says ammonia co-ring

would therefore require a signicant

rise in Japan’s carbon tax to be eco-

nomically viable. Its analysis shows

that at least $300 per ton of CO

2

would

be needed to make the technology

economically viable at a 20 per cent

blend rate in 2030. By 2050, the car-

bon price needed to make 100 per cent

ammonia-fuelled retrotted coal

plants economically viable could be

reduced to around $159/t of CO

2

.

These values are far higher than Ja-

pan’s current “tax for climate change

mitigation”, which is set at below $3/t

of CO

2

.

n Mitsubishi Heavy Industries Ltd.

has said it will develop a next-gener-

ation nuclear reactor with Kansai

Electric Power Co. and three other

major Japanese utilities in what could

be the rst project in the government’s

recent policy shift to push nuclear

energy.

Malaysia sets out

national energy

policy

Countries eye ammonia in

decarbonisation drive

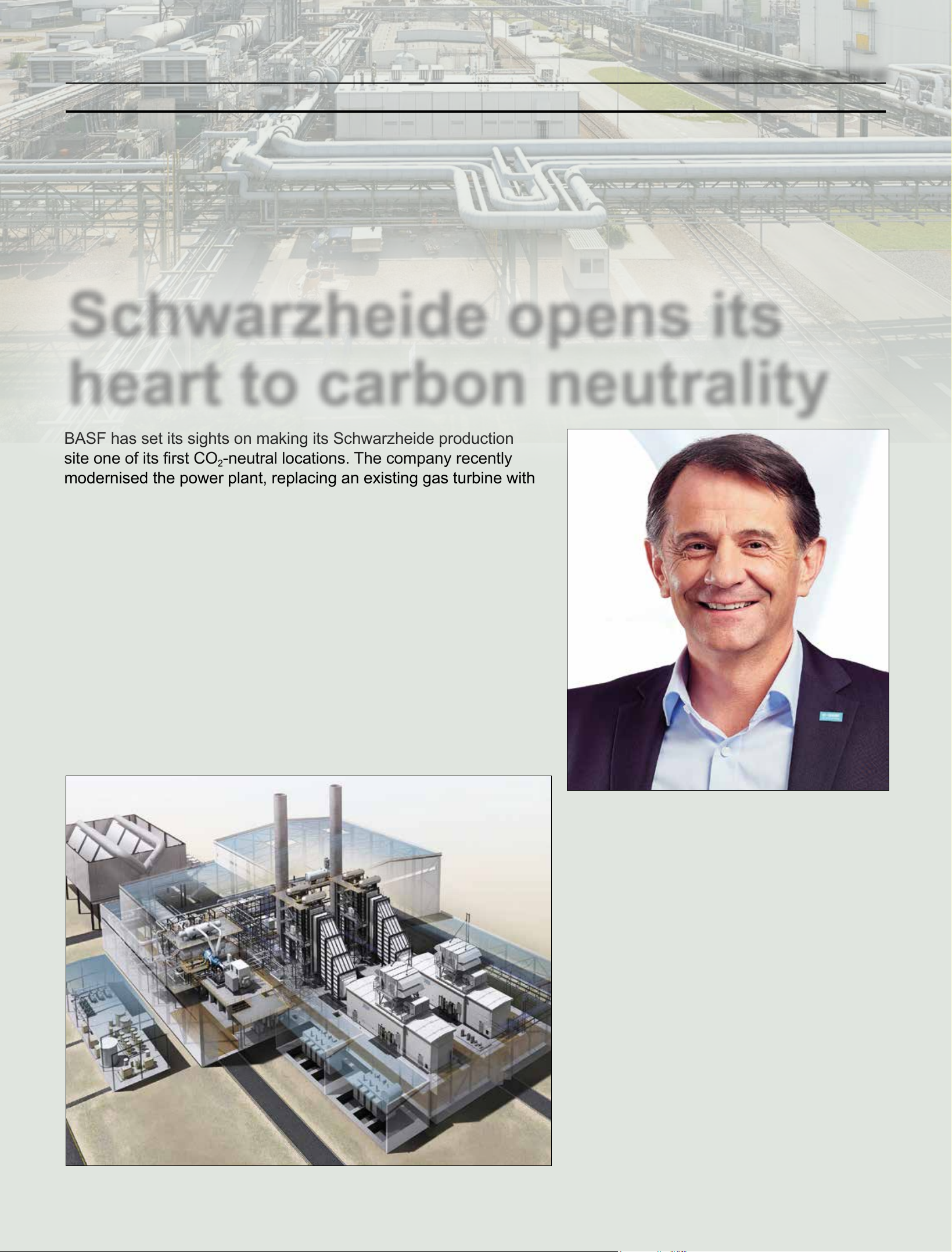

BASF has set its sights on making its Schwarzheide production

site one of its rst CO

2

-neutral locations. The company recently

modernised the power plant, replacing an existing gas turbine with

a Siemens Energy SGT-800 and also installing a battery system

for black-start capabilities. Junior Isles hears how carrying out the

upgrade was somewhat akin to open-heart surgery.

one hand, our steam consumption had

decreased, but we knew that in the

next two or three years we would

have an increasing need for electricity.

So we wanted to prepare for this by

modernising the power plant.”

But this would be no regular mod-

ernisation. With closing the plant

temporarily not an option, Siemens

Energy would have to work closely

with BASF to carry out the exchange

on the live power plant – keeping one

power train in operation while carry-

ing out extensive alterations to the

other line. It would be sort of an “open

heart surgery”, as the teams called it.

“Working while the plant is in op-

eration presents certain challenges.

Any vibration during assembly might

cause our gas turbine to stop mid-op-

eration,” said DeKeyser.

Commenting on the project’s ori-

gins, Bernd Künstler, Key Account

Manager at Siemens Energy said:

“The contract for the project was

signed in 2019. But we were engaged

in initial talks in late 2017 when they

said they would like to replace one of

the turbines at the Schwarzheide

plant. We gured out that it was a re-

ally difcult task, as it would require

a lot of changes. It would have been a

lot easier to replace the existing tur-

bine with a successor engine from

project at the combined cycle plant

powering its Schwarzheide facility in

order to increase power output while

cutting emissions.

Commenting on the rationale be-

hind the project, Jürgen Fuchs, Head

of the Management Board of BASF

Schwarzheide GmbH, said: “We

must keep our site competitive in or-

der to grow the business and attract

investments. We’ve already achieved

a lot here in the last few months and

years.

“When it comes to sustainability,

we always talk about the triad of the

environment, economy and society.

Going forward we can use the op-

portunities provided by the need to

change as a driver for our site’s

growth. We will use eco-efcient

technologies such as modernisation;

integrate renewable energies and

drive forward the circular economy.

We want to do this to become one of

the rst BASF CO

2

-neutral produc-

tion sites.”

As a growing location that is install-

ing new production systems and

technologies, BASF Schwarzheide

will need a very exible energy sup-

ply at the site in the coming years.

Julie DeKeyser, Head of Site Ser-

vices and Infrastructure at BASF

Schwarzheide, explained: “On the

Artist’s cutaway of an SGT-800 plant with batteries

Fuchs: We want to become one of the rst BASF CO

2

-neutral

production sites

Schwarzheide opens its

heart to carbon neutrality

Special Project Supplement

A

s the world’s largest chemical

producer, BASF has long been

taking measures to minimise

the impact of its operations on the

environment. It is no surprise then that

the company has set itself ambitious

climate goals, striving to achieve net

zero CO

2

emissions by 2050.

In addition, the company wants to

reduce its greenhouse gas emissions

worldwide by 25 per cent by 2030

compared with 2018. Excluding the

effects of the planned growth – which

includes the construction of a large

Verbund site (a chemical production

site with highly interlinked product

ows) in South China – this means

cutting CO

2

emissions by around a

half in the current business by the end

of this decade.

In 2021, BASF Group’s worldwide

carbon emissions amounted to

20.2 million tonnes of CO

2

equiva-

lent. In 1990, this gure was roughly

twice as high. The new 2030 emis-

sions goal represents a reduction of

approximately 60 per cent compared

to 1990 levels, and exceeds the

European Union’s target of a 55 per

cent reduction.

In a move that is signicant in

achieving those targets, in 2019 the

company engaged Siemens Energy to

carry out a browneld exchange

THE ENERGY INDUSTRY TIMES - NOVEMBER 2022

support high maintainability.

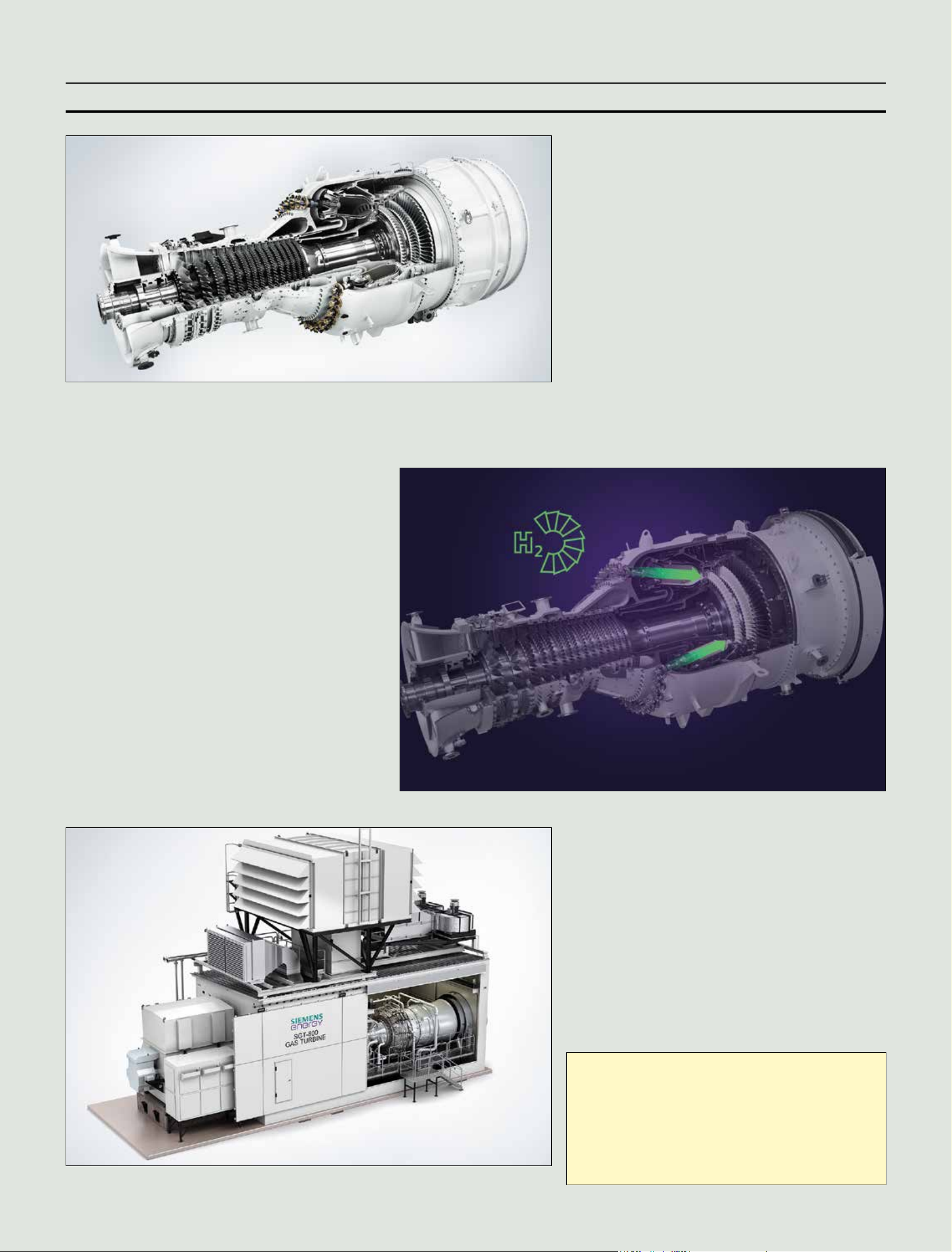

The SGT-800’s 15-stage axial

compressor has a pressure ratio of

21.8 and has ve compressor extrac-

tions at stages 3, 5, 8, 10 and 15. The

machine’s compressor casing has a

vertical-split plane to provide good

access to the compressor compo-

nents for inspection.

Notably, the engine is cold-end

driven – unlike the previously exist-

ing turbine, which was hot-end driven

– and due to certain conditions, BASF

stipulated that the existing turbine

generator had to remain intact. This

meant substantial changes to the

generator to accommodate the SGT-

800, which consequently called for a

new baseplate for the whole train.

“This wasn’t part of Siemens Ener-

gy’s work, noted Künstler. “But they

had to dig out the old massive con-

crete baseplate, do a forming structure

onsite for the new one and lift it in

place with a big crane. Doing it this

way saved them time, since it allowed

other work to be done in parallel.”

This was just one of several tricky

changes that were needed. Künstler

added: “With our machine being a

cold-end drive, as opposed to hot-end,

the generator had to be moved from

one end of the drive train to the other.

This resulted in a change in direction

of rotation of the generator rotor.

“Another change that was needed,

was that the exhaust pipe of the gas

turbine also had to be modied as the

original machine had a vertical ex-

haust, while the SGT-800 has an axial

exhaust.”

As the old generator was from an-

other OEM, manufacturing drawings

had to be scanned and understood by

the engineering department, said

Künstler. “It was an engineering task

but they were up for the challenge.

The risk is that you have some over-

view drawings and ideas of what it

might look like inside but you don’t

know the truth until the patient is ly-

ing on the table. That was what we

discovered when we disassembled

the generator.”

Once the generator was opened up,

engineers were able to perform re-

verse engineering so that the neces-

sary modications could be made.

According to Siemens Energy, the

generator is now in better condition

than before and can now be taken to

its performance limits.

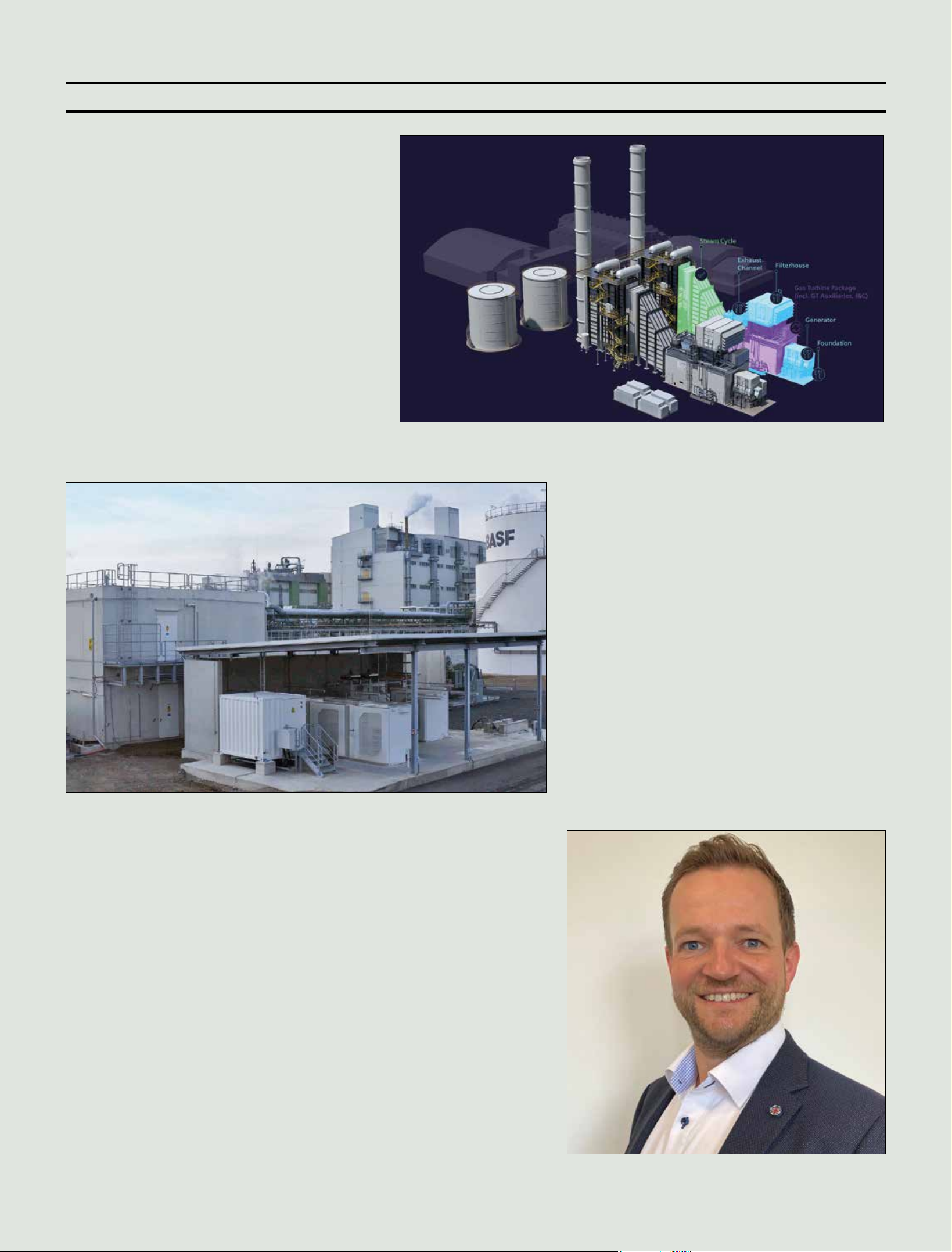

Following dismantling of the old

gas turbine and generator around the

end of October/beginning of No-

vember 2020, construction of the

gas turbine was carried out in the

Special Project Supplement

THE ENERGY INDUSTRY TIMES - NOVEMBER 2022

Model of the BASF

Schwarzheide plant

that manufacturer but they were still

very interested in replacing the tur-

bine despite the huge effort that was

needed.”

Siemens Energy therefore began

developing the project with BASF

and found that despite the level of

difculty, the resulting higher output

and greater efciency still made the

project worthwhile in terms of the

business case. For a company like

BASF, operational expenditure

(Opex) over the plant’s lifetime is as

much of a consideration as capital

cost.

“Opex was certainly one of the

major selection criteria for choosing

Siemens Energy turbine,” noted

Künstler.

The Schwarzheide combined cycle

plant has a ‘2+2’ conguration,

meaning there are two power trains,

each consisting of a gas turbine and

steam turbine. The gas turbines were

originally GE Frame 6Bs, while the

steam turbines are Siemens Energy

machines.

Although BASF considered other

congurations for the modernisation,

the decreasing steam consumption of

the chemicals production facility was

the main driver in how the modernised

plant would be congured. BASF

therefore decided the best option was

to replace one of the gas turbines to

increase power output, while lower-

ing fuel consumption.

Künstler added: “They also worked

on the boiler; wherein the exhaust

boiler behind the gas turbine was

modied along with the plant distrib-

uted control system. These tasks were

carried out by BASF.”

Due to key differences in design, the

biggest undertaking in the project was

the replacement of the existing gas

turbine with a Siemens Energy SGT-

800 industrial gas turbine.

The new turbine has a maximum

power output of 57 MW, although

BASF will operate the unit at 52 MW.

This compares to 40 MW from the old

machine. The SGT-800 has a gross

efciency of 40.1 per cent, which ac-

cording to Künstler is currently the

best-in-class in the 50-60 MW range.

According to Siemens Energy, its

design efciency is up to 10 per cent

higher than its nearest competitor.

The single-shaft engine is composed

of a 2-bearing rotor with a 15-stage

compressor and a 3-stage turbine.

First- and second-stage blades and

vanes are cooled, third-stage blades

and vanes are uncooled, all three tur-

bine disks are cooled. The turbine

section is designed as a module to

Finspång, Sweden, plant from No-

vember 2020 to January 2021. After

customer acceptance tests were

completed, installation work for the

gas turbine was carried out between

April and October 2021. This was

followed by hot commissioning and

rst re in November.

The expansion of the BASF

Schwarzheide power plant will see

the chemical facility produce more

materials for use in batteries for e-

mobility. This was one of the drivers

behind the decision to install a Sie-

mens Energy SIESTART battery

system for black-start of the power

plant. The battery system has been

designed for an output power of 2.4

MW and an installed battery capacity

of 1.7 MWh.

“There is a huge installation cur-

rently going on to build a production

plant for battery materials at the site,”

said Künstler. “As they are expanding

in this direction, the plant is going to

get a perfect reference for an entire

battery value chain from end-to-end

– battery materials, battery technology

and even battery recycling. So it’s not

just talk, BASF lives it”

Black-start capability was a require-

ment for the power plant, and the

battery system will be used to perform

the duty of what would typically be

handled by a diesel generator. As an

innovative company, BASF was open

to the idea.

“This is not completely new but it’s

also not standard [practice]; it’s a

development that BASF saw as in-

novative. So this is another opportu-

nity for us to demonstrate and prove

the technology,” said Künstler. “Also

CO

2

emissions are a lot lower [than

from a diesel genset].”

The SIESTART system is designed

to provide the maximum loads of the

turbine start motor and of the auxil-

iary equipment (1.8 MW for the

starter motor and 0.4-0.5 MW for

auxiliary equipment) to perform at

least three sequential black-starts. It is

designed to operate for ten years but a

capacity extension at the end of its

designed lifetime is possible to com-

pensate for the ageing and capacity

degradation.

In addition to ticking the environ-

mental box, battery systems have

several advantages over diesel en-

gines. According to Siemens Energy,

battery storage black-start systems

require less maintenance than diesel

gensets and are more reliable when

needed. A diesel generator requires

fuel feed lines; space for fuel stor-

age; it has to be started monthly; and

fuel needs to be changed annually if

not used.

Künstler noted: “Diesel engines of-

ten have starting problems when they

are needed, so they gured that batter-

ies could be a good option. They also

realised that there is the potential to

increase their use in the future beyond

black-start.”

Künstler: We gured out that it was a really difcult task, as it

would require a lot of changes

Battery energy storage at the BASF plant will provide black-start capability

THE ENERGY INDUSTRY TIMES - NOVEMBER 2022

Special Project Supplement

The SGT-800 has a maximum

power output of 57 MW

plant while it is operating is not un-

heard of, it was the rst time that

Siemens Energy would carry out such

an operation with this kind of turbine

and technology.

Künstler said: “Currently we are

working on another project with

BASF, which will be similar but it’s

not a gas turbine project. Projects like

Schwarzheide are becoming more

frequent. In the future we will have to

work much more on existing power

plants and modify them to meet future

needs.”

Having successfully handed the gas

turbine over for commercial opera-

tion earlier this year, Siemens Energy

believes the browneld exchange

could become a blueprint and key

reference not only for BASF but also

for other industrial customers looking

at tackling similar issues.

“What we did at Schwarzheide is

perfect proof that it’s possible to do it

like this; and that we can use the tur-

bine in this way,” said Künstler. “The

project was executed within the

timeframe and is running as planned.

It’s also a perfect reference for the

market – for the chemical industry

and the power plant industry. There

are other engines of the same type as

at Schwarzheide that we can exchange

successfully.”

As pressure increases to cut emis-

sions, Siemens Energy anticipates

there are plenty of opportunities for

the SGT-800 at industrial sites.

The SGT-800 operates on natural

gas with low emissions. The NO

x

emission levels will be 15 ppm for the

gas turbine while operating in the

range of 60-100 per cent load. This

will see nitrogen oxides from the

plant reduce by 50 per cent.

Most, notably, however, in line with

BASF’s drive to cut carbon emis-

sions, the new installation will sub-

stantially reduce CO

2

. At the operating

load at Schwarzheide, power plant

efciency is 4 per cent higher, thus

reducing CO

2

by 16 per cent.

And as gas turbine operators look to

zero CO

2

, Siemens Energy is already

looking ahead with a programme to

allow its units to run on hydrogen.

The company has been working on

adapting its gas turbines to run on

hydrogen for a number of years now,

and has released a hydrogen blending

capability with natural gas in DLE

(dry low emissions) mode between 30

and 75 per cent by volume, depending

on the gas turbine model. The com-

pany has set out a roadmap for

achieving a 100 per cent hydrogen

capability in DLE mode by 2030 at

the latest.

This could be a consideration for

BASF in the future as it moves to-

wards its net zero goal.

“Although it’s currently not fore-

seen that the turbine will run on hy-

drogen due to still outstanding avail-

ability, we are investing in the

technology already so that we are

prepared for the future,” said Kün-

stler. “But of course BASF were inter-

ested in what hydrogen capabilities

we have, and it was investigated as an

option for future use.”

DeKeyser added: “We are very

pleased. For this kind of project, you

really need a partner that is capable to

keep coming up with their own ideas

and keep re-thinking things.”

Summing up the project, Künstler

said: “The collaboration with BASF

Schwarzheide was really excellent; it

was always a real partnership. The

project was challenging but working at

an experienced level with the customer

was really benecial – the profession-

alism we had in exchanging informa-

tion. It’s always a pleasure when

technical discussions could be held on

a high level due to the knowledge of all

related engineers. BASF’s Center of

Expertise departments are a perfect

example – their engineers understand

the discussions at a high level.

“There was always open communi-

cation even during the challenges,

which you get with projects of this

size. We always found a good solu-

tion; there was always great teamwork

and team spirit throughout the execu-

tion period.”

The SGT-800 package is at the heart of the modernised plant

Batteries are certainly more versa-

tile. Wherein a diesel genset is “bound

capital” in terms of fuel, the electric-

ity from a battery storage system can

also be used to generate revenue. The

battery could in future be used along-

side the gas turbine to cover load

variations, provide fast frequency

control, and potentially gain revenues

from participating in the ancillary

service markets.

With the SIESTART system, the gas

turbine would operate at a specic,

optimised output level, i.e. in load

following mode. When the required

level of plant output is below the

output of the gas turbine, the extra

output could be used to charge the

batteries. When the required level of

plant output is above the output of the

gas turbine, the batteries would pro-

vide the additional output required.

This improves the overall efciency

of the power plant and therefore low-

ers emissions, while improving oper-

ational exibility.

“When thinking about using it in

future for ramp-up for load changes,

it might get interesting but it depends

on the operating value: how often you

will need it; how big is the battery

capacity, etc.,” said Künstler. “Of

course the battery [at the site] is too

small for this at the moment. But if a

battery is already installed and con-

nected to the grid, it’s easier to enlarge

the system to provide more capacity

for this type of operation. So it offers

exibility for the future.”

Although modernising a power

Siemens Energy is already looking ahead with a programme to allow its units to

run on hydrogen

SCC-800: Performance data for 1x1 combined

cycle power plant

62 MW rating 57 MW rating

Gross plant output (MWe) 89 81.5

Gross plant efciency (%) 95.6 58.5

Gross plant heat rate (kJ/kWh) 6040 6154

Number of gas turbines 1 1

LET’S MAKE TOMORROW DIFFERENT TODAY

Transforming the entire energy system requires

all of us to change how we do business, invest,

govern, consume, and even live.

we can’t do it alone

Honestly,

siemens-energy.com

Siemens Energy is a trademark licensed by Siemens AG.

Anzeige_Honestly_ENG_290x380mm_220921.indd 1Anzeige_Honestly_ENG_290x380mm_220921.indd 1 21.09.22 10:3221.09.22 10:32

A

s Asia races to expand its

variable renewable energy

generation, more integration

of generation, transmission and dis-

tribution technologies will be re-

quired to balance electric grids, en-

hance energy security and reach

decarbonisation goals.

Integration of renewable energy

into grid systems was viewed by se-

nior industry executives in the

‘Black & Veatch 2022 Asia Electric

Report’ as the biggest challenge fac-

ing Asia’s electric industry.

With the rising threats and impacts

of severe weather events on Asia’s

grids, alongside the increasing de-

ployment of more variable solar and

wind power, the need to focus in-

vestments beyond generation into

transmission and distribution is un-

derlined throughout the report.

For example, one in four industry

respondents revealed they were not

condent in the performance and re-

silience of their transmission and

distribution systems. Additionally,

under-investment in transmission

and insufcient energy storage were

highlighted as top threats to provid-

ing reliable service to customers.

Advancing the energy transition is

complex, particularly in regions, like

Asia, where the coal power plant

eet is young and there is signicant

dependence on fossil fuels to meet

its base load energy demand.

What’s more, the survey was con-

ducted before the current energy cri-

sis, which is tightening global sup-

plies of natural gas. These

constraints have restricted the ability

of the region’s power sector to de-

velop gas red generation facilities

as an energy transition solution that

lowers emissions and continues to

provide stable, base load power.

Prior to the crisis, approximately

half of survey respondents believed

that over the next ve years there

would be “more investment” in gas or

liqueed natural gas (LNG)-to-pow-

er facilities combined with carbon

capture, while, separately, 46 per

cent of respondents believed gas

red generation would remain an

important part of the grid beyond

2035. Today, the price of gas, driven

up by the current energy crisis, has

led to uncertainties of expanding gas

capacity in Asia in the mid-term.

It is within this global context that

the United Nations Climate Change

Conference 2022 (COP27) will urge

an acceleration of renewable energy

and other new technologies that will

reduce greenhouse gas emissions. In

his welcome message to COP27,

Abdel Fattah El-Sisi, President of

host nation Egypt, anticipates a

“stronger will and higher ambition”,

for mitigation measures.

The current challenges with devel-

opment of LNG-to-power facilities

offer a huge opportunity for Asia to

adopt an even higher percentage of

renewables in the energy mix, pro-

vided the transmission infrastructure

is planned and developed in tandem

with the new renewable generation

being added to the grid.

This points to a continued focus on

integrating renewables successfully

while global gas markets stabilise

and enable more certain investment

in gas red generation assets.

Having a clear sense of how exist-

ing and emerging technologies will

work together will be critical in

achieving lower emissions grids in

Asia and will underpin the power

market’s efforts to decouple fossil

fuels from the provision of afford-

able, reliable and resilient power

supply over the mid- to long-term.

Adopting a 360-degree view of the

entire grid system is key. Notably,

systems integration surpasses last

year’s top concern around invest-

ment uncertainties.

The nding indicates an accep-

tance of the electric grid’s ongoing

shift from a centralised model with

a few large base load facilities to a

more distributed, digitalised array

of generation sources equipped to

accommodate the electrication of

everything.

What remains constant is the goal

of any electricity provider — reliable

and resilient grid operations and ser-

vice. The survey shows this core

business is threatened most by gov-

ernment policies that continue to

evolve and, in the wake of 2021’s

COP26, have pushed decarbonisa-

tion goals sharply over the past 12

months.

These policy challenges are com-

pounded by an under-investment in

transmission systems and insuf-

cient energy storage capacity, sys-

tems that help in mitigating renew-

able intermittency while traditional

conventional generation capacity is

reduced.

Alongside critical grid manage-

ment and technical issues, where the

sun shines and the wind blows are

also key integration factors. The lo-

cation of new solar and wind facili-

ties often is distant from existing

base load plants, transmission lines

and, indeed, from where major de-

mand centres exist.

Such practicalities have coincided

with increased interest in and debate

about the use of hydrogen as an en-

ergy carrier. Hydrogen can be used

as seasonal energy storage to re-

spond to the variable generation of

wind and solar energy, and as a fuel

for existing gas turbine facilities.

Such a solution could underpin na-

tions’ energy security planning.

While the production of hydrogen

via electrolysis scales – and corre-

sponding cost barriers decrease –

adoption can be encouraged through

gateway approaches that combine

hydrogen production from fossil fu-

els with carbon capture. In parallel

with incentivised investment in

green hydrogen production as part of

nations’ new and emerging energy

security plans, these two commer-

cialisation pathways can bring scale

to a hydrogen economy and help

lower the cost per kilogram of green

hydrogen over time.

Asia’s energy industry is optimistic,

with three out of four respondents

believing that, beyond 10 years, hy-

drogen will help meet emissions re-

duction and clean energy goals. This

is signicantly more than any other

technology over the mid-term and

also reects ndings conducted be-

fore the current energy crisis in Eu-

rope. Only 8 per cent of respondents

believe there is no future for hydro-

gen as a feasible, clean and afford-

able alternative to natural gas.

Vietnam is a frontrunner in Asia

with respect to decarbonisation.

Vietnam’s The Green Solutions

(TGS) has appointed Black & Ve-

atch to study the production and

storage of green hydrogen in the

country utilising solar or wind pow-

er supplied through the grid. The

study also includes development of

a green ammonia production plant

as well as plant conguration and

technology review; technology evo-

lution risk and tentative mitigation;

conceptual design; order of magni-

tude cost estimates; and levelised

cost calculations.

Despite these and other emerging

challenges, industry respondents rec-

ognise the importance of the region’s

energy transition. A mere 2 per cent

of respondents disagree that invest-

ments are being channelled to clean

energy.

The energy transition will require

the development of prioritised decar-

bonisation roadmaps, essentially the

detailed, yet exible plans that elec-

tricity providers will use to maxi-

mise returns on their asset invest-

ments and realise their sustainability

goals.

The survey ndings show that one

in three respondents do not have

decarbonisation roadmaps in place

today, highlighting a signicant -

nancial risk. Such technology and in-

vestment blueprints help electricity

providers plan-out capital invest-

ment over 10 years or longer hori-

zons. Only 15 per cent of respon-

dents claim to have such robust

investment roadmaps in place, indi-

cating there is much room to priori-

tise and optimise ongoing clean en-

ergy investments in the years ahead.

So where to start? Rising demands

from intensive power users like data

centers and the electrication of

transportation is increasing the load

burden and proles on Asia’s grid.

At the same time, the region is

looking to balance the increasing

price of energy with its decarboni-

sation efforts.

Taking the long view when it

comes to decarbonisation is critical.

Natural gas remains a critical transi-

tion fuel as it is a highly exible, dis-

patchable generation source that can

stabilise and enhance the resilience

of regional grids with high renew-

able energy generation.

At today’s price point, gas will not

be able to replace coal red genera-

tion yet. However, in the longer run,

gas prices are anticipated to stabilise

as additional capacities are being

built across the globe. When that

happens, Asia will be able to contin-

ue expanding its gas capacity to sup-

port decarbonisation efforts.

In addition to the availability of

gas, realising an affordable and suc-

cessful energy transition also re-

quires all stakeholders in Asia’s elec-

tric industry to be aligned and to

embrace holistic planning and design

of generation, transmission and dis-

tribution systems.

Governments can assist to further

adapt policy and regulations to en-

courage the scale-up of commit-

ments around rm power renewable

energy developments and required

grid augmentation. Technology pro-

viders, like Black & Veatch, can

contribute existing and emerging de-

carbonisation, hydrogen, renewable

and energy storage solutions to help

power infrastructure developers gain

the competitive edge that they need

to remain protable.

Narsingh Chaudhary is Executive

Vice President & Managing Direc-

tor, Asia Pacic at Black & Veatch.

Curbing carbon

emissions in Asia

is key to achieving

global climate goals.

Black & Veatch’s

Narsingh Chaudhary,

outlines the key

ndings of a report

that reveals what

industry executives

see as the main

issues surrounding

decarbonisation in the

region.

Renewable integration is key

to decarbonising Asia

THE ENERGY INDUSTRY TIMES - NOVEMBER 2022

13

Industry Perspective

Chaudhary: an affordable and

successful energy transition

requires all stakeholders in

Asia’s electric industry to be

aligned

From your perspective, what are the most challenging

issues facing the electric industry in your region today?

(Select the top three). Source: Black & Veatch

Challenging issue %

Renewable integration 35.1

Economic regulation (i.e. rates) 24.6

Uncertainty of investment 24.6

Market uncertainty due to the pandemic (i.e. Covid 19) 24.6

Energy storage 21.1

Planning/forecasting uncertainty 21.1

Environmental regulations 17.5

Aging infrastructure 14.0

Distributed energy resources (DERs) integration 14.0

Distribution system upgrades and modernisation 14.0

Access to capital investment 14.0

Market structure 12.3

Lack of skilled workforce 8.8

D

oes the gas turbine have a

future? “It’s a big debate,”

said Karim Amin, Member

of the Executive Board and Execu-

tive Vice President of the Genera-

tion Division at Siemens Energy.

During a press visit to the compa-

ny’s Zero Emission Hydrogen Tur-

bine Centre (ZEHTC) in Finspång,

Sweden, Siemens Energy set out its

views on the market and gave jour-

nalists a rst-hand view of what it is

doing in hydrogen – the technology

that it believes could be key to the

continued use of gas turbines in the

future.

Setting out how he sees the gas

turbine market going forward, Amin

noted that “it’s a matter of perspec-

tive and timeline”. Citing data from

IHS Markit and its own “bottom-

up” numbers, he showed that in

2020 there was an average addition

of 44 GW/a of new gas turbine ca-

pacity worldwide. Its latest data for

2021 put the average at 61 GW/a.

This number stays steady through

2025 and increases to 65 GW/a in

2030.

The growth is largely attributed

to: a growth in distributed genera-

tion; an accelerated switch from

coal to gas in markets such as the

US and Asia; as well as the need for

back-up generation for the growing

amount of renewables. Looking

longer term, Amin said: “The ques-

tion is how to make the impact of

gas on the environment and climate

change as least as possible.”

To this end, Siemens Energy has

been developing hydrogen-burning

capabilities across its portfolio of

gas turbines – from its small indus-

trial machines, right up to its large

Frame HL-class units. According to

the company, its popular SGT-800

industrial turbine can already han-

dle natural fuel mixtures with up to

75 per cent H

2

, and will be ready for

100 per cent H

2

by 2025.

At the upper power range of the

portfolio, its large 600 MW-scale

HL machine can run on 50 per cent

hydrogen today, says Amin, with a

development schedule in place to

enable 100 per cent H

2

operation by

2030. “This programme could be

accelerated so we are 100 per cent

ready by 2025, but we don’t believe

the hydrogen infrastructure will be

ready by then to provide the amount

of hydrogen needed.”

Siemens Energy’s experience with

testing fossil-free fuels started more

than 15 years ago but it was not un-

til 2016 with the introduction of 3D

printing of the combustion parts,

i.e. the burners, that “things really

took-off”.

Hans Hölmstrom, Vice President,

Generation , Industrial Gas Tur-

bines and Managing Director of

Siemens Energy Sweden, ex-

plained: “If you burn hydrogen, it

burns so quickly, that it heats up the

metallic parts that are close to the

ame. With 3D printing, we can

make cooling holes inside the metal

that allow us to manage this process

of burning 100 per cent hydrogen.”

Commenting on the roadmap, he

said: “It’s important to reach 100 per

cent [hydrogen burning] capability

as soon as possible because although

some customers may not need to

burn it now, it’s important for them

to show their investors that they are

future-proof and that the plant will

not become a stranded asset.”

Much of Siemens Energy’s ongo-

ing development and testing of its

H

2

-burning capabilities is being un-

dertaken at its ZEHTC.

Åsa Lyckström, Sustainability

Strategist and Product Positioning

Expert and Member of the Execu-

tive Leadership Team of Siemens

Energy AB, Sweden, was part of the

launch of this demonstration facility

in 2018.

“We wanted to show the role of

the gas turbine in the future energy

system and make it visible for ev-

erybody,” she said. “We formed a

consortium including two universi-

ties – one in Italy and one in Swe-

den – along with Linde and the Fin-

spång municipality. With funding

from the EU, the idea was to use

available technology to make peo-

ple aware of how the various tech-

nologies t together.”

The ZEHTC is used to run H

2