www.teitimes.com

October 2022 • Volume 15 • No 8 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Climate action in Asia is making

progress in the run-up to COP27,

despite a cloud of gloom and doom.

Page 14

Fuelling utility risk

Asia decarbonisation

Finding resources to replace

Russian gas is fuelling risks for

European utilities.

Page 13

News In Brief

European gas storage levels

on target for winter but high

prices will persist

Europe is ahead of its target to

replenish gas storage levels to 80

per cent by October 1, but gas prices

will likely remain high this winter,

according to Wood Mackenzie.

Page 2

USA opens way to large-

scale solar rollout

US President Joe Biden will allow

solar panel parts to be imported free

of tariffs from four southeast Asian

nations, boosting ambitious plans to

expand solar generation in the US.

Page 4

Indonesia bans coal in pivot

to renewables

Indonesia has issued a new

presidential regulation that stops the

issuing of licenses for new coal red

power plants as it transitions to new

and renewable energy sources.

Page 5

UK to boost domestic

resources in response to

energy crisis

The UK wind industry hopes to see

a resurgence in onshore projects

after the government announced a

package of measures to address the

crisis in energy costs and increase

domestic energy supply.

Page 7

Grid expansion “essential”

to achieving climate targets

There is an urgent need for greater

investment in power grids to better

connect regions, secure reliable

distribution of resources and meet

climate targets, according to new

analysis.

Page 8

European utilities struggle

as crisis deepens

Major European energy companies

are being supported by their

governments to protect them from

default or failure as they struggle

with soaring gas prices.

Page 9

Technology Focus: Floating

new ideas

A new hybrid platform has been

developed that will signicantly

reduce the cost of installations and

accelerate the deployment of oating

offshore wind generation.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

The EU has proposed a set of emergency measures in response to the urgent priority of

shielding EU consumers from higher energy prices this winter. But EU-wide measures must

avoid a patchwork of rules between member states. Junior Isles

Move for electricity market reform gains traction

THE ENERGY INDUSTRY

TIMES

Final Word

It’s the end of an era,

says Junior Isles.

Page 16

The European Commission has pro-

posed a set of emergency measures in

an effort to combat spiralling energy

prices but the move comes as indi-

vidual EU states are already taking

approaches that could create national

market discrepancies and uncertainty

across the bloc.

Commenting on the emergency in-

tervention Commission President

Ursula von der Leyen said the pro-

posals will raise more than €140 bil-

lion for member states to “cushion”

the impact of high energy prices on

consumers.

A key part of the package is a pro-

posed tax on excess prots from en-

ergy companies that governments

could use to protect businesses and

citizens from sky-high energy bills

this winter.

The Commission has therefore pro-

posed a cap of €180/MWh for ‘infra-

marginal’ sources, i.e. those with the

cheapest operating costs, including

wind, solar and nuclear power plants,

because those plants could prot most

from a surge in electricity prices.

“These companies are making reve-

nues they never accounted for, they

never even dreamt of,” von der Leyen

said. “In these times, it is wrong to re-

ceive extraordinary record revenues

and prots benetting from war and

on the back of consumers.”

The Commission has estimated that

Member States would be able to col-

lect up to €117 billion from the pro-

posed temporary revenue cap on in-

fra-marginal electricity producers, on

an annual basis. The surplus revenues

collected will have to be channelled

by the member states to nal electric-

ity consumers, be it private or com-

mercial ones, who are exposed to high

prices. These revenues can be used to

provide income support, rebates, in-

vestments in renewables, energy ef-

ciency or decarbonisation technolo-

gies. The support provided should

keep an incentive for demand reduc-

tion. Decisions on the precise distribu-

tion will be taken at national level.

WindEurope, however, warned of

the uncertainty that could be created

by decisions also being taken at na-

tional level. “A patchwork of different

price caps, unilaterally introduced by

individual member states, creates in-

vestment uncertainty, said WindEu-

rope’s CEO Giles Dickson.

Ahead of the Commission’s propos-

al, Czech Prime Minister Petr Fiala

introduced a price cap of approxi-

mately €200/MWh (without VAT).

Due to the so-called ‘Iberian deroga-

tion’ prices in Spain and Portugal are

already capped at well below the EU

average.

In a message to national govern-

ments, WindEurope stated: “More re-

newables require huge investments.

Investors need clear rules around their

likely revenues. A new EU-wide rev-

enue cap of €180/MWh for all forms

of infra-marginal generation gives

them that.

“But if governments are free to devi-

ate from that, clarity goes out of the

window – especially if you decide to

set different caps for different types of

electricity generation. Investors don’t

Continued on Page 2

Brussels will work on a comprehen-

sive reform of its energy markets to

break the “dominant inuence” of the

price of gas on electricity prices.

The move is one of several emer-

gency measures proposed by the Eu-

ropean Commission in an effort to

tackle high energy prices and ensur-

ing consumers benet from the low

cost of renewables and nuclear.

Speaking to MEPs in September,

European Commission President Ur-

sula von der Leyen told MEPs that

the design of energy markets was not

“t for purpose” and that it needed to

be redesigned.

“The skyrocketing electricity pric-

es are now exposing, for different

reasons, the limitations of our cur-

rent electricity market design,” she

said. “We need a new market model

for electricity that really functions

and brings us back into balance.”

Under the current EU wholesale

electricity market system, all electric-

ity producers – from fossil fuels to

solar and wind – bid into the market

and offer power according to their

production costs. Dispatching starts

with the cheapest resources, the re-

newables, and nishes with the most

expensive ones, usually natural gas.

The last source to be dispatched sets

the system marginal price. But since

most EU members still depend on fos-

sil fuels for their energy demands, the

nal price of electricity is often set by

the price of natural gas.

Several EU governments, including

Germany, Austria, and Belgium, have

recently called for reform in the pric-

ing mechanism of the European en-

ergy market and to decouple gas and

electricity markets.

Spain, Greece, Italy, France, and

Portugal have been calling for similar

reforms for over a year to protect con-

sumers from rising energy prices.

The UK is also looking to decouple

gas and electricity prices. In two pa-

pers published last month by UCL,

researchers outlined reasons why,

despite the advance of relatively

cheap renewable energy, electricity

prices have rapidly risen across Eu-

rope alongside the increased cost of

natural gas. They identify the struc-

ture of the wholesale electricity mar-

ket as the main driver of excessive

prices, and are developing solutions

to change this.

According to the research, the ongo-

ing energy crisis has pushed retail

prices up by over 80 per cent this year,

and quadrupled wholesale prices, fu-

elling the ‘cost of living’ crisis and

ination. Yet the UK already gener-

ates half of its electricity from non-

fossil sources, with 25 per cent from

wind and solar power, whose costs

have fallen hugely to around a quarter

of the costs now seen in the wholesale

electricity market. But the structure of

the UK’s power market means that

these falling costs are not reected in

bills.

Professor Michael Grubb (UCL In-

stitute for Sustainable Resources),

who is leading the research, said:

“While renewables are providing

more and more electricity, we still

need natural gas to meet the demand.

The most expensive natural gas pro-

ducers are still needed to cope with

uctuations in renewable energy pro-

duction, so they are setting what’s

called the marginal cost, at the edge of

what’s needed. Because natural gas

generation is expensive, those pro-

ducers charge the highest prices –

which means that other producers are

also able to charge similar prices.”

However, Kristian Ruby, Secretary

General of Eurelectric, the organisa-

tion representing Europe’s electricity

producers, said: “The root cause of

the problem is a shortage of gas sup-

ply and our addiction to imported fos-

sil fuels. Governments should seek to

tackle this rather than resorting to dis-

tortive, ad-hoc interventions in the

electricity market. In parallel, we also

encourage sobriety measures to save

energy this coming winter.”

Europe eyes options

Europe eyes options

on tackling energy

on tackling energy

prices

prices

THE ENERGY INDUSTRY TIMES - OCTOBER 2022

2

Junior Isles

Europe is ahead of its target to replen-

ish gas storage levels to 80 per cent

by October 1, but gas prices will like-

ly remain high this winter, according

to Wood Mackenzie.

Wood Mackenzie’s ‘European Gas

Q3 Short Term Outlook’ report found

that Strong LNG and non-Russian

pipeline imports have helped get Eu-

rope gas storage levels to its target at

the end of August, beating expecta-

tions. A more recent gure from Re-

uters put the level at nearly 88 per cent

on September 25th.

According to the Outlook, high natu-

ral gas prices will continue to drive

down European demand to seven per

cent below the ve-year average

through March, leaving a best-case

scenario of storage levels at 31 per cent

at winter’s end, in line with the ve-

year average.

Commenting on the impact on pric-

es Penny Leake, Wood Mackenzie

research analyst for European gas,

said: “In addition to uncertainty over

gas supply from Russia, power market

tightness – due to low nuclear, hydro

and wind output – and the risk of elec-

tricity disruption are putting addi-

tional stress to gas prices futures this

winter.” The biggest risk will be win-

ter. Leake said: “Under normal weath-

er conditions we anticipate a rebalance

of the power market after winter,

which, combined with an improved gas

market balance, might see gas prices

dropping by more than 35 per cent trad-

ing closer to levels Europe had in late

July 2022.”

She added: “Europe’s hope to get

through this and next winter is predi-

cated upon record LNG imports – ex-

pected to reach a 40 per cent market

share in Europe next year, while Rus-

sia reduces below 10 per cent – requir-

ing high gas prices and Europe re-

maining the LNG premium market

globally.”

With Europe pivoting towards the

consumption of high-cost LNG, the

direction of LNG on the spot market

has also shifted from markets in Asia

to European markets.

According to the data collated by

Anadolu Agency from nancial mar-

ket statistics and infrastructure pro-

vider Renitiv, Europe’s LNG imports

increased 86 per cent from June to

August this year compared to the same

period last year.

European countries imported about

21 billion m

3

(bcm) of LNG in the June

to August period of last year, but this

surged to 39.14 bcm during the same

period this year.

There has been a marked fall in LNG

imports to Asia this summer relative to

last year, dropping from 90 bcm to ap-

proximately 83 bcm.

know what the rules will be. The

rules could change at any moment.

This makes investing in your coun-

try too risky. And you won’t get the

investments you want.”

“The message is simple: stick to

the single EU-wide cap the Com-

mission has proposed; apply the

same cap to all forms of ‘infra-

marginal’ electricity; and only apply

the cap to actual revenues earned.

Most wind farms in Europe earn

xed income far lower than today’s

wholesale electricity prices: from

government contracts, PPAs or be-

cause they’ve hedged against lower

and higher prices. Ignore this and

you turn away investments in re-

newables. You cement Europe’s

dependency on fossil fuel imports.

You worsen the energy crisis.”

The proposed package includes a

“solidarity contribution” from fos-

sil fuel companies that have made

signicant windfall prots. These

oil and gas producers will be asked

to contribute at least 33 per cent of

their surplus prots generated in

2022. Member States can apply

higher rates. These solidarity con-

tributions should be used to support

households, to help energy-inten-

sive industries transitioning to re-

newables and to fund cross-border

projects.

The Commission previously

mooted a price cap solely on Rus-

sian gas but the idea has been strong-

ly opposed by states such as Austria,

which still receives 50 per cent of

its gas from Russia and fears retalia-

tory cut-offs.

The Czech Republic, which holds

the rotating European Council pres-

idency, tasked the Commission with

coming up with mechanisms to cap

gas prices and extend liquidity sup-

port for energy companies facing

steep collateral demands.

A draft of the countries’ latest ne-

gotiating document, seen by Re-

uters, would also allow countries to

subject coal red power plants to

the planned revenue cap on electric-

ity producers.

According to the Commission the

proposed measures are “extraordi-

nary in nature” and should there-

fore be limited in time. At the time

of writing, EU diplomats were

discussing the proposals and trying

to nd deals that EU energy min-

isters would be ready to approve at

a September 30th meeting.

The electricity emergency tool

should apply no later than Decem-

ber 1, 2022 and until March 31,

2023. The Commission has com-

mitted to carrying out a review of

the electricity emergency tool by

February 28, 2023, taking into ac-

count the electricity supply situa-

tion and electricity prices across

the EU, and present a report on the

main ndings of that review to the

Council.

Continued from Page 1

Nadia Weekes

Offshore wind has enormous untapped

potential to drive the global energy

transition and tackle the climate and

energy crises, according to the multi-

stakeholder Global Offshore Wind Al-

liance (GOWA), which aims to see

installed global offshore wind capac-

ity rise 670 per cent from 57 GW in

2021 to 380 GW in 2030.

Representatives from the Interna-

tional Renewable Energy Agency

(IRENA), the Global Wind Energy

Council (GWEC) and governments

including Denmark and the US met at

a public event in New York on Septem-

ber 19th to discuss how to unleash the

potential of offshore wind.

GOWA was founded by Denmark,

IRENA, and GWEC with the ambi-

tion to create a global driving force

for the uptake of offshore wind

through political mobilisation and the

creation of a global community of

practice. The aim of GOWA is for

global offshore wind capacity to reach

a minimum of 380 GW by 2030, with

35 GW on average each year across

the 2020s and a minimum of 70 GW

each year from 2030, culminating in

2000 GW by 2050.

According to forecasts by the Inter-

national Energy Agency (IEA) and

IRENA, 2000 GW of installed offshore

wind capacity will be needed in order

to limit the rise in global temperatures

to 1.5°C and achieve net zero by 2050.

Yet, global installed offshore wind ca-

pacity only totalled 57 GW in 2021.

Danish Minister for Climate, Energy

and Utilities, Dan Jørgensen said at the

launch event: “A massive increase in

energy from offshore wind is key to

ght climate change, phase out fossil

fuels and strengthen energy security.

We cannot do it alone but must work

together across the public and private

sectors as well as across countries and

regions.”

As a pioneer in offshore wind, having

installed its rst turbines in waters off

Copenhagen in 1991, Denmark has

“extensive experience in the eld and

a long history of sharing it with the rest

of the world”, he added.

Francesco La Camera, IRENA’s

Director-General said that offshore

wind farms built at gigawatt scale

would make “an important addition to

the world’s technology portfolio”. He

said that a “blue economy” driven by

renewables would bring socio-eco-

nomic benets to coastal communities

globally.

GWEC’s CEO, Ben Backwell said

this was a crucial time for this type of

alliance, with energy security and cost

of living crises compounding runaway

global heating. “With offshore wind,

the world has an effective solution for

adding large amounts of zero carbon

power at affordable costs, while creat-

ing jobs and new investments in indus-

try and infrastructure all around the

world,” he said.

Germany’s hopes of keeping two of its

three remaining operating nuclear

plants on standby in in order to stave

off potential power shortages this win-

ter have been thrown a lifeline by E.On.

In late September, the German en-

ergy giant’s wholly-owned subsidiary

PreussenElektra GmbH reached an

agreement with the Federal Ministry

of Economics and Climate Action

(BMWK) and the Federal Ministry for

the Environment, Nature Conserva-

tion, Nuclear Safety and Consumer

Protection (BMUV) on the corner-

stones of a potential continued opera-

tion of the Isar 2 nuclear power plant

beyond December 31, 2022.

The news will come as a relief to the

government, which had been told just

weeks earlier by E.On that keeping the

plant on standby was not an option.

At the beginning of September, the

government said it was rethinking its

plan to close the last of its nuclear plants

in December, with German Economic

Minister Robert Habeck pushing to

keep the plants online for longer.

The ministry told Bloomberg it was

looking at a potential draft law to fa-

cilitate the extension, and had also

changed the parameters for stress tests

on the country’s energy security which

would make prolonging the reactors a

viable option.

Habeck said that two reactors – Isar

2 in Bavaria and Neckarwestheim

north of Stuttgart – will be kept on

standby until mid-April next year. A

third plant, Emsland near the Dutch

border, will be powered down as

planned in December. No new fuel

rods will be purchased for the two

plants, he said.

Shortly after Habeck’s announce-

ment, however, E.On told the govern-

ment that nuclear power plants in their

technical design were not reserve

power plants that can be variably

switched on and off.

Following weeks of “close exchange”

with the German economy ministry “to

nd an implementable solution”, the

two sides have reached an agreement.

E.On CEO Leonhard Birnbaum,

said: “E.On has always declared that

it supports the German government’s

efforts to ensure a secure energy sup-

ply within the scope of our possibili-

ties. That is why we have always been

willing to discuss the potential con-

tinued operation of the Isar 2 nuclear

power plant, if the German govern-

ment requested it.”

The company says that, after the cor-

responding preparations, the plant will

go into a short shutdown in order to

carry out an overhaul of the pressuris-

er pilot valves. After the restart, the

plant can continue to operate with the

existing reactor core until probably

March 2023.

The federal government will decide

on the actual call-up by the beginning

of December at the latest. Should the

plant be called up, PreussenElektra

would earn electricity market revenues

for approximately 2 TWh of electricity

production with Isar 2 next year. These

potential revenues must be set against

the additional costs arising from the

extension and the legal regulations that

would then potentially apply to the

treatment of electricity market reve-

nues. E.On plans to use any possible

revenues from continued operation to

support the Energiewende, or energy

transition. If there is no call, the fed-

eral government will reimburse all

costs incurred in preparing continued

operation.

A legislative procedure will be initi-

ated in the short-term, and work is be-

ing done in parallel on a contractual

safeguard.

n The newest nuclear reactor in Eu-

rope, the Olkiluoto 3 plant unit (OL3),

exceeded the landmark 1000 MW

power mark last month, easing the

strain on Finland’s electricity grid.

The plant unit was connected to the

national grid in March 2022. After the

test production phase, regular elec-

tricity production is expected to start

in December.

Headline News

Global alliance to tap into offshore wind’s

Global alliance to tap into offshore wind’s

potential

potential

Germany still looking at nuclear to stave off energy crisis

Germany still looking at nuclear to stave off energy crisis

European gas storage levels

European gas storage levels

on target for winter but high

on target for winter but high

prices will persist

prices will persist

Dickson: stick to the single

EU-wide cap

n Storage levels over 85 per cent

n Additional stress to gas prices futures this winter

n Installed capacity to grow seven-fold in a decade

n Zero-carbon solution to energy security and jobs concerns

THE ENERGY INDUSTRY TIMES - OCTOBER 2022

3

LONDON

Our Clients:

Our Partners:

weber media solutions

YOUR CREATIVE MEDIA AGENCY FOR

DESIGN AND MARKETING SOLUTIONS

We are a creative media agency which provide a bespoke

service to meet your media and marketing requirements

and much more

DESIGN / VIDEO / WEB / EXHIBITION STAND DESIGN

MAGAZINES / PRINT MANAGEMENT / MAILING

For more information please contact:

Karl Weber / Director

T: +44 7734 942 385 / E: karlw@webermediasolutions.com

www.webermediasolutions.com

some of our exhibition signage projects, for more information please visit our website:

karlweber@hotmail.co.uk

www.teitimes.com

THE ENERGY INDUSTRY

TIMES

subscribe today

The Energy Industry Times is the only publication that

covers global news related to the power and energy

sector in a newspaper style and format whose

uniqueness is recognised by our readers.

As a paid subsciber you will gain full access to our online

news desk.

You will also no longer have to wait for the printed edi-

tion; receive it by PDF “hot off the press” or download it

online.

To subscribe, email subscriptions@teitimes.com or visit

www.teitimes.com

To guarantee receiving your monthly copy of the award

winning newspaper, you need to subscribe today

THE ENERGY INDUSTRY TIMES - OCTOBER 2022

5

Asia News

Hydropower, when developed sustainably, has brought

major advancements in human development by spurring

economic growth, creating millions of jobs and improving

standards of living.

Whether by providing aordable green energy, a means

of water supply, irrigation services, ood and drought

protection, or bringing social investment, hydropower

has brought many positive impacts to communities

worldwide.

On 11 October 2022, we invite you to share your stories

about how hydropower has been a part of your life using

the hashtag #GlobalHydropowerDay.

Find out more at hydropower.org/globalday

GL BAL

HYDROPOWER

DAY

11 OCTOBER

2022

Syed Ali

Indonesia’s President Joko “Jokowi”

Widodo has issued a new presidential

regulation that stops the issuing of li-

censes for new coal red power plants

as part of a move to transition to new

and renewable energy sources in the

country.

The 2022 Presidential Regulation

about Acceleration of Renewable En-

ergy Developments unveiled on Sep-

tember 14, 2022, also requires the

energy minister to draw up a roadmap

to accelerate the closure of all coal

red power plants before 2050.

The regulation, however, leaves

some loopholes that still allow com-

panies to build new coal red power

plants over the next few years. Those

that have secured their permits before

the presidential regulation will be al-

lowed to continue. Also, coal red

plants integrated with any projects

listed in the government’s National

Strategic Projects list will be allowed

to proceed.

The regulation said that to achieve

the emission reduction target, the ex-

empted coal red power plants could

develop new technology, buy carbon

offsets, or mix their power generation

with renewable energy. The power

plants also have to agree to cease op-

eration by 2050.

At the end of August state-owned

electricity provider PT PLN (Persero)

said it has taken several measures to

help mitigate climate change, includ-

ing optimising the operation of exist-

ing power plants and using more en-

vironmentally friendly fuel for the

plants.

“Indonesia has committed to reduc-

ing carbon emissions to achieve the

17th sustainable development goal

(SDG) and achieve net zero emissions

by 2060,” Director of Corporate Plan-

ning at PT PLN Evy Haryadi said in

a statement.

Haryadi said that to achieve carbon

neutrality, PLN is trying to implement

75 per cent of the new and renewable

energy mix of the installed electricity

capacity of 413 GW, which will also

be supported by 19 GW of electricity

interconnections from Sumatra, Kali-

mantan, and Nusa Tenggara regions

to Java region.

The company is also planning to

implement carbon capture and stor-

age (CCS) technology for thermal

power plants (PLTUs), cut off the use

of PLTUs early, as well as apply new

technologies such as biomass and hy-

drogen, he added.

The state-owned enterprise will re-

quire $614 billion in investment to

achieve the carbon neutral target by

2060, of which around $596 billion

would be used to improve electricity

capacity, while the remaining invest-

ment would be utilised to strengthen

electricity interconnection.

Transitioning to clean energy is a

key opportunity for Indonesia to di-

versify its economy while making its

energy supplies more secure and af-

fordable. A recent report from the

International Energy Agency (IEA)

noted Indonesia has a viable path to

reaching its target of net zero emis-

sions by 2060 but key policy reforms

and international support will be cru-

cial to its success.

“Indonesia has the opportunity to

show the world that even for a coun-

try that relies heavily on fossil fuel

exports, a pathway to net zero emis-

sions is not only feasible but also

benecial,” said IEA Executive Di-

rector Fatih Birol. “We must be clear-

eyed about the challenges, especially

in areas that depend on the coal indus-

try, but the economic opportunities

more than compensate for the costs.”

Pakistan’s government is embarking

on an ambitious plan to replace elec-

tricity generated by expensive fossil

fuel with clean, low-cost hydropower

and solar.

In September the government out-

lined plans for 9000 MW of hydro-

power that would help replace ther-

mal-based electricity, which currently

represents around 70 per cent of the

total energy mix.

The government has announced sev-

eral projects, including the 4500 MW

Diamer Basha dam, the Dasu project

(4200 MW), the Tarbela 5th Extension

(1530 MW), as well as the Mohmand

dam and Keyal Khwar hydropower

projects.

These projects are mostly ‘multi-

purposed’– in addition to generating

low cost hydropower, they would also

store water thereby helping to mitigate

ash oods, which wreaked havoc

across the entire country during the

current monsoon season.

Asian Infrastructure Investment

Bank (AIIB) has shown keen interest

in nancing Pakistan’s Water and

Power Development Authority (Wap-

da) projects and says it will remain

closely associated with the authority.

“AIIB will look into possibilities of

nancial assistance for Wapda proj-

ects,” said AIIB Director General

(Investments) Supee Teravaninthorn.

At the start of September Prime Min-

ister Shehbaz Sharif also gave the go-

ahead for the execution of 10 000 MW

of solar energy projects to reduce the

import bill of costly diesel and furnace

oil.

“Our National Solar Energy Initia-

tive is aimed at substituting costly

energy with cheap solar power, which

will provide massive relief to people

and save precious foreign exchange,”

said Sharif.

In the rst phase, the solar energy

would be supplied to government

buildings, tube wells that currently

operate on electricity and diesel for

pumping drinking water, and domes-

tic electricity consumers with low

power consumption.

Indonesia bans coal in

pivot to renewables

Pakistan decarbonisation

plan banks on hydro and

solar

n Licenses stopped for new coal plants

n PLN adopts measures to help mitigate climate change

6

THE ENERGY INDUSTRY TIMES - OCTOBER 2022

Asia News

South Korea is to reduce its renew-

ables target and put greater focus on

nuclear energy in the revised version

of its national green taxonomy, known

as ‘K-Taxonomy’.

The country established the K-Tax-

onomy guideline last year to provide

principles and standards on environ-

mentally sustainable economic ac-

tivities, but the Ministry of Environ-

ment has now revised the guideline to

include nuclear energy in the green

economic activities that are com-

posed of the ‘green’ and the ‘transi-

tion’ sectors.

The green sector refers to the truly

green economic activities essential

for carbon neutrality, including re-

search and development on nuclear

energy such as small modular reactor

(SMR) and accident-tolerant fuel

(ATF).

The transition sector refers to ac-

tivities temporarily included in the

green taxonomy as an intermediary

step toward carbon neutrality, includ-

ing the construction of new nuclear

power plants.

The inclusion of nuclear activities

will be dependent on specic condi-

tions and requirements, such as legis-

lation on the ATF use and the safe

storage and treatment of high-level

radioactive waste, the ministry said.

The revision reects the decision in

late August to reverse the previous

government’s policy to gradually re-

duce dependence on nuclear power.

The change in approach was outlined

in a new draft of the 10th Basic Plan

for Long-term Electricity (BPLE).

This will see the share of nuclear

power generation increase to 32.8 per

cent by 2030, up from the 23.9 per

cent target announced a year earlier.

The government says it plans to con-

tinue operating nuclear power plants

whose operating licenses have ex-

pired, and to increase power genera-

tion through six new nuclear power

plants, including the newly built Units

1 and 2 of the Shin Hanul nuclear

power plant.

Conversely, the share of renewable

energy will be greatly reduced. The

BPLE subcommittee has decided to

reduce the share of renewable energy

generation from 30.2 per cent to 21.5

per cent by 2036.

According to a report compiled by

the ofce of Rep. Kim Yong-min of

the main opposition Democratic Par-

ty, six afliates of the state-run Korea

Electric Power Corp. (KEPCO) plan

to cut their investment in renewable

energy over the next ve years as they

are under pressure to improve their

worsening nancial health.

The EU is proposing a deeper partner-

ship with India on hydrogen and solar

power as it attempts to present India

with viable energy alternatives to Rus-

sian fuel.

Visiting New Delhi last month,

President of the European Commis-

sion Ursula von der Leyen offered

Indian an alliance that would allow

both to work for the conguration of

the “new world”.

Addressing the First EU-India

Green Hydrogen Forum, European

Commissioner for Energy Kadri Sim-

son said the energy system had been

“impacted” by the Russian invasion

of Ukraine. She said: “Whether we

like it or not, the game - and our glob-

al energy system – has changed.”

India has been neutral toward Rus-

sia’s military intervention in Ukraine

despite calls by western powers to

oppose it. New Delhi has also in-

creased fuel purchases from Moscow

in recent months.

As a result of the invasion, the EU,

which is heavily dependent on fossil

fuels from Russian, has stepped up its

green energy ambitions.

Kadri told the forum that the EU had

ramped up its efforts on hydrogen,

noting that “solar and hydrogen en-

ergy are both game changers for the

energy transition”.

Under its REPowerEU package,

aimed at allowing the bloc to become

fully independent from Russian fossil

fuels, the EU has included an addi-

tional 10 million tonnes of renewable

hydrogen, bringing the goal to 20 mil-

lion by 2030.

“We don’t just see this as a reaction

to what is going on in the world or the

environment, it’s also an investment

agenda. At the EU level, we are ex-

pecting investments in the range of

€320-460 billion.”

Indian Power Minister RK Singh,

meanwhile, highlighted the Indian

growth story. Noting that the coun-

try’s “demand for energy is increas-

ing,” he said India has emerged as a

place for foreign investment.

The EU-India hydrogen forum came

as Reliance Industries’ Chairman,

Mukesh Ambani. unveiled his plan to

shift to green hydrogen, with the aim

of starting the transition by 2025.

“We aim to progressively com-

mence [the] transition from grey hy-

drogen to green hydrogen by 2025,

after proving our cost and perfor-

mance targets,” Ambani said.

He also informed that the company

has partnered with Stiesdal, a climate

technology company, to speed up cost

reduction and commercialisation of

their Pressurised Alkaline Electroly-

ser technology.”

n Amidst western sanctions against

Moscow following its invasion of

Ukraine, China’s coal purchases from

Russia hit a ve-year high in July,

surging 14 per cent from last year.

After the European Union banned

Russian coal on 11th August, in a bid

to reduce the revenue gained by Mos-

cow following its invasion on 24th

February, Russia has targeted other

buyers, such as China and India, sell-

ing at major discounts.

Nuclear will be key to

carbon reduction as South

Korea revises green energy

taxonomy

EU seeks to reduce India’s

dependence on Russia

Hydrogen plans are on the drawing

board but ‘deployment is lagging’

Russia pivots from EU to Chinese

market for hydrocarbon exports

Gary Lakes

There is a growing pipeline of hydro-

gen projects being proposed, but most

have yet to reach the stage of a nal

investment decision (FID), according

to a new report released by the Hy-

drogen Council (HC). “Actual de-

ployment is lagging,” the HC says in

the report, produced in collaboration

with McKinsey and Company.

According to the report published in

September, 680 large-scale project

proposals worth $240 billion have

been put forward but only about 10

per cent ($22 billion) have reached a

nal investment decision (FID).

Europe leads in proposals – about 30

per cent of the total – but China is lead-

ing the global effort with the actual

deployment of about 200 MW of elec-

trolysers. Japan and Korea are leading

in the production of fuel cells with an

11 GW manufacturing capacity.

Urgent and urgently are two words

used in the report, which says that

investment in mature hydrogen proj-

ects is needed greater than ever. “For

the world to be on track for net zero

emissions by 2050, investments of

some $700 billion in hydrogen are

needed through 2030 – only 3 per cent

of this capital is committed today,” the

report said, adding: “Ambition and

proposals by themselves do not trans-

late into positive impact on climate

change; investment and implementa-

tion on the ground is needed.”

The public and private sectors must

move through joint action from project

proposals to FIDs, the report states,

calling for “policy ambition and project

proposals to materialise into actual

investments and start delivering envi-

ronmental and socio-economic bene-

ts, enabling conditions are necessary

today,” the HC argued.

It states that a key barrier that project

developers face is a lack in “demand

visibility”. Many developers are await-

ing decisions on the regulatory frame-

works and funding to incentivise off-

takers to enter long-term hydrogen

supply contracts, which is key to un-

locking project nance and support

from investors, the report says.

The report identies several priority

actions for policy and industry during

the 2022-2023 period. On policy it

wants governments to enable demand

visibility and regulatory certainty by

adopting legally binding measures; it

urges fast-tracking access to public

funding for hydrogen projects; and it

recommends that policies ensure inter-

national coordination and [to] support

credible common standards and robust

tradeable certication systems.

For industry it calls for actions to be

taken by advancing project proposals

to FID by committing to funding and

resource deployment; a scaling up for

hydrogen supply chain capability and

capacity; and the building of infrastruc-

ture for cross-border trade.

As stated in the report, Europe is lead-

ing with proposals with some 30 per

cent of the total. Last month the Euro-

pean Commission took steps to make

€5.2 billion in funding available for the

hydrogen value chain through its sec-

ond Important Project of Common

European Interest (IPCEI) program,

which is supported by 13 EU members.

Austria, Belgium, Denmark, Finland,

France, Greece, Italy, Netherlands,

Poland, Portugal, Slovakia, Spain and

Sweden are participating in IPCEI Hy-

2Use, as the program is known, and

will provide the funding, which is ex-

pected to unlock a further €7 billion in

private investments.

It is reported by H2 View that 29

companies in the participating states

will use the funding to develop 35 proj-

ects. The funding is expected to go

towards supporting construction of

infrastructure and the development of

technologies for the integration of hy-

drogen into industrial processes inside

the EU.

IPCEI was established to encourage

the supply of renewable and low car-

bon hydrogen for the sake of cutting

Europe’s dependence on gas. It com-

pliments the REPowerEU pro-

gramme, which targets production of

10 million tons of renewable hydro-

gen by 2030.

Meanwhile, a report entitled ‘Re-

newable Energy and Jobs: Annual

Review 2022’ prepared by the Inter-

national Renewable Energy Agency

(IRENA) and the International La-

bour Organization said that during

2021, solar energy showed to be the

fastest growing in the renewable jobs

sector, adding 4.3 million jobs, equiv-

alent to a third of the current renew-

able workforce globally.

According to a press release an-

nouncing the report, the continuing

expansion of renewable energy needs

can create many millions of new jobs

if it is supported with “holistic policy

packages, including training for work-

ers to ensure jobs are decent, high qual-

ity, well paid and diverse in pursuit of

a just transition”.

Announcing the report, Francesco La

Camera, IRENA’s Director-General,

said: “In the face of numerous chal-

lenges, renewable energy jobs remain

resilient, and have been proven to be a

reliable job creation engine. My advice

to governments around the world is to

pursue industrial policies that encour-

age the expansion of decent renew-

ables jobs at home. Spurring a domes-

tic value chain will not only create

business opportunities and new jobs

for people and local communities. It

also bolsters supply chain reliability

and contributes to more energy secu-

rity overall.”

Gary Lakes

The meeting last month in Uzbekistan

during a summit of the Shanghai Co-

operation Organization (SCO) be-

tween Russian President Vladimir

Putin and China’s Xi Jinping had to

be a disappointing experience for Pu-

tin, who was certainly looking for

economic as well as moral support

from Peking for his war in Ukraine.

Putin and Xi have met numerous

times during the last decade and are

reported to share a number of opin-

ions, particularly about the West. Un-

fortunately for Putin, the meeting in

Samarkand came at a time when Rus-

sian forces were being pushed back

by the Ukrainian army.

Prior to the war in Ukraine, Peking

said there were “no limits” to the

friendship between China and Russia,

but since the start of the war last Feb-

ruary, China has taken a “balanced”

stance and called for negotiations with

the intention of doing nothing to

arouse the concern in America and the

West that China was supporting Rus-

sia’s war effort. Putin told President

Xi that Moscow “understands” Chi-

na’s concerns.

In Samarkand Putin and Xi held a

tripartite meeting with Mongolian

President Ukhnaagiin Khurelsukh,

who engaged in a discussion on future

energy infrastructure in Central Asia

and a role for Mongolia in the planned

Power of Siberia 2 pipeline which was

proposed in 2019, following the open-

ing of the rst Power of Siberia gas

pipeline that carries Russian gas into

eastern China.

Besides the Power of Siberia 2 pipe-

line, Moscow is also proposing that it

build an oil pipeline to China via Mon-

golia. It already delivers 1.6 million

b/d to China through the Eastern Si-

beria-Pacic Ocean (EPSO) pipeline

and clearly has more for sale as Euro-

pean and other customers purchase

crude elsewhere. Neither the oil or gas

pipeline projects can proceed without

being underwritten by contracts, but

as the European Union takes steps to

halt its purchases of Russian oil and

gas, the proposals for new export

routes from Russia are clearly out

there.

Khurelsukh said he supports the idea

of Russian oil and gas pipelines pass-

ing through Mongolia and suggested

they undergo a study. The country

would benet nancially through em-

ployment and transit fees, plus access

to oil and gas supplies. However, it

would likely take several years before

these pipelines come into use, and

where might the Russian energy in-

dustry be then?

It’s clear that Putin was very mis-

taken about Europe and its reliance on

Russian energy supplies when he

launched his invasion against Ukraine.

He had on several occasions used

natural gas as a weapon against

Ukraine, the consequences of which

manifested themselves in Europe.

And for that reason, the EU had al-

ready begun to implement projects

that would reduce its members’ de-

pendence on Russian gas. But the at-

tack on Ukraine forced the issue for

Europe, which continues to take steps

to halt Russian imports and prevent

Moscow from benetting nancially

from oil, gas and coal exports.

In this regard, Moscow has in the

last seven months shifted its market

focus to Asia, and China in particular.

For China, the Western sanctions

against Russian energy has worked in

its favour to some degree. It has en-

abled it to buy oil at discounted prices

and to re-export LNG imports from

non-Russian suppliers at higher spot

prices.

Russia is putting a pretty face on the

situation. Last month, Energy Minis-

ter Alexander Novak said that Power

of Siberia 2 would take the place of

Nord Stream 2, Russia’s second gas

pipeline through the Baltic Sea to

Germany. The 55 bcm/year capacity

pipeline, a twin to Nord Stream 1, was

completed last year, but Germany

stopped certication of it once the war

in Ukraine began. Russia, has mean-

while, halted its shipments of gas

through Nord Stream 1 in retaliation

to EU sanctions.

Novak said Power of Siberia 2,

which will have a design capacity of

50 bcm/year, will replace Nord Stream

2, and that Russia and China would

soon sign a contract for the delivery

of that volume. But it will take time

for volumes to reach the levels that

Russia is talking of delivering to

China.

Construction of the Power of Siberia

2 pipeline is tentatively scheduled to

begin in 2024, and experts say it is

unlikely that China will need more gas

than it is already importing until after

2030.

Russia is expected to deliver about

16 bcm of gas via the Power of Sibe-

ria 1 pipeline this year and it will be

2025 before the pipeline reaches full

capacity of 38 bcm/year.

Hydrogen

Gas

The world is ready – even anxious – for an energy transition that is promised to put the global climate

back on a pre-crisis course. But it seems to be taking a very long time to get started on all the projects

that have been proposed, as a new report from the Hydrogen Council points out.

Western sanctions against Russia’s energy industry are apparently beginning to impact Moscow as it increasingly

turns to Asia, particularly China, as a viable alternative market for its natural gas and oil exports. Russia’s predicament

has worked to China’s advantage to some degree, but whether it can be a substitute for Europe and other customers

is not at all certain.

12

THE ENERGY INDUSTRY TIMES - OCTOBER 2022

Fuel Watch

G

as plays a crucial role in

bridging Europe’s diverse

power mix, providing reli-

able backup generation as intermit-

tent renewable capacity ramps up.

For decades now, Russia has been

Europe’s largest supplier. Indeed, the

155 billion cubic metres (bcm) of

gas imported from Russia in 2021–

140 bcm of which was delivered by

Gazprom, Russia’s monopoly ex-

porter – represented nearly one-third

of total demand.

Yet the ongoing conict in Ukraine

has seen Europe pivot away from

Russian gas, with the European

Union’s ambitious REPowerEU plan

seeking to cut all Russian gas im-

ports by 2027. The conict has led to

a considerable shortfall in gas avail-

ability for Europe given Russian

supply cuts. Indeed, a complete shut-

off of Gazprom exports remains a

possibility after the susepnsion of

Nordstream 1 ows, further jeop-

ardising security of supply. As such,

a considerable energy gap has

emerged that must be lled ahead of

the crucial 2022-23 winter.

In order to meet demand, Europe

has turned to various alternative en-

ergy sources to bridge this gap. Liq-

ueed natural gas (LNG), for in-

stance, has now become Europe’s

single largest source of gas supply,

and could rise to about 30 per cent of

total market supplies should the

steep year-on-year increase seen

over the January to July 2022 period

continue until the end of the year.

In addition, alongside growing con-

cerns regarding security of supply,

several countries aim at increasing

coal based generation, which may

temporarily slow the pace of the en-

ergy transition – though we expect

this to be temporary. Coal and lig-

nite-based generation, for instance,

now represents 30 per cent of the

German power mix. The German

government is also considering a

coal red capacity reserve of 10 GW,

with Austria, France, Italy and the

Netherlands considering similar

measures.

Another signicant change in the

power mix is the comeback of nucle-

ar energy. Earlier this year, the Euro-

pean Parliament voted to include nu-

clear in the EU’s green taxonomy,

and for some countries, it will form a

crucial temporary bridge. Belgium,

for example, has extended two GW

of existing capacity from 2025 to

2035. Nuclear capacity will be more

permanent in other countries, but

new builds will require signicant

government or regulatory support.

Since the outbreak of the conict in

Ukraine, such policies have solidi-

ed, and France has afrmed plans

to build six to 14 European pres-

surised reactors (EPRs), the UK has

decided to build up to eight EPRs,

and Poland is proceeding with plans

for an additional six reactors.

What do these changes mean for

Europe’s utilities? To date, credit rat-

ings for the sector have remained

largely resistant to challenges. In-

deed, while the temporary gas price

spike in early March provoked con-

siderable margin calls, utility compa-

nies have been able to weather initial

shocks and importers have taken ac-

tions to somewhat mitigate the im-

pact of future price swings.

In addition, government measures

have been largely supportive of cred-

it quality and demonstrate a willing-

ness to support the reliability of en-

ergy market functioning until next

winter. Indeed, 10 governments have

triggered various mitigation plans

supportive of both supply and the

utility sector. From this autumn, Ger-

many, for instance, will allow utili-

ties to pass on higher supply costs to

their customers and the government

has also set up a €15 billion facility

for Trading Hub Europe GmbH to

secure 90 per cent storage by No-

vember 1st, despite elevated prices.

Another crucial form of interven-

tion is the establishment of gas ra-

tioning plans. In light of a tight sup-

ply-demand equation, most Euro-

pean governments have put in place

legally binding staged intervention

protocols to ration gas by govern-

ment decision if supplies are insuf-

cient to meet demand in case of a

gas shortage, and in June, some

started to activate the early stages of

these protocols.

Alongside measures protective of

utilities creditworthiness, some gov-

ernments – including France, Italy,

Spain and the UK – have also imple-

mented measures supportive of af-

fordability for consumers, with some

credit negative implications for utili-

ties. In France, for instance, regula-

tory measures will contribute to

EDF’s mid-single-digit EUR billion

EBITDA loss in 2022, while its 2022

tariff freeze on household gas repre-

sents a negative working capital

movement for Engie – though this

will be manageable if the freeze is

temporary.

What’s more, key producers have

hedged much of their 2022 produc-

tion, which should limit the impact

of Italy’s windfall taxes and Spain’s

price caps. In the UK, meanwhile,

utilities were spared from windfall

taxes in June, and despite adverse in-

terventions in recent years, new

measures have been geared towards

easing the burden on households

rather than shifting it onto suppliers.

As such, despite declining global

gas demand – triggered by high pric-

es, notably in Europe and APAC,

and slower GDP growth – S&P

Global Ratings has conducted no up-

grade or downgrade exceeding one

notch, with most ratings clustered in

the BBB to low A range.

Looking ahead, however, interna-

tional markets face ongoing disrup-

tion. Replacing Russian gas comes at

a high cost, and energy prices are ex-

pected to remain volatile as the sec-

tor becomes riskier with reduced vis-

ibility. In addition, the ongoing

conict in Ukraine is aggravating

pre-existing imbalances in European

gas markets, and utilities’ credit

paths are likely to become increas-

ingly divergent. Where some have

enjoyed increased earnings – low-

cost generators with high availabili-

ty, for instance, have been able to

capitalise on high power prices –

government action on affordability,

higher debt costs, interest rates, and

ination could tighten ratings head-

room across much of the sector.

Furthermore, supply difculties

could emerge in the latter part of the

2022-2023 winter which may impact

liquidity. A complete shutoff of Gaz-

prom exports is no longer a remote

scenario and could lead to supply

difculties in Q1 2023, with Novem-

ber to April typically representing

two-thirds of annual requirements.

Uniper’s earnings and liquidity

squeeze has, to date, been unique in

its suddenness and extent: as Germa-

ny’s key importer of Russian gas, its

rating was stabilised only thanks to

considerable government support.

Other gas importers could face simi-

lar challenges. Indeed, in the event

of a further drop in Gazprom ows,

importers could be required to pur-

chase much costlier volumes on the

market in order to meet their deliv-

ery contracts.

Gas will continue to play an impor-

tant role in bridging Europe’s diverse

power mix, presenting a reliable

backup to intermittent power supply

from renewables. However, the high

cost of LNG has challenged appe-

tites for gas in general, and its role is

only temporary.

Pressing social-environmental di-

lemmas – including energy afford-

ability and local acceptance of re-

newables versus the need to

accelerate the energy transition –

stand in the way of a consolidation

of creditworthiness. Many utilities,

for instance, face bottlenecks stem-

ming from local decisions regarding

the wider acceptance of renewables

generation installations. To address

this, national policies may rebalance

– favouring security of supply over

maximum environmental protec-

tions. In addition, public authorities,

in collaboration with the industry,

will need to establish the acceptable

economic cost of security of supply,

energy affordability, and indeed a

customer pecking order in order to

navigate potential supply cuts.

Looking ahead, as the energy in-

dustry moves to stabilise itself, it is

renewable sources that will present

the greatest opportunities – and chal-

lenges – for the industry. Indeed, the

energy transition offers a route to

strengthen utilities’ business models

and could transform the sector. How-

ever, despite the considerable fund-

ing available through REPowerEU,

in the immediate term, severe indus-

trial bottlenecks will likely persist

and some of the EU’s ambitious de-

carbonisation targets may not be

met. In the longer term, policy sup-

port and the rate at which technology

can be developed will determine the

pace at which transformation will be

achieved.

The ongoing conict in Ukraine has forced Europe to distance itself from Russian gas supplies. But nding the

resources to bridge the resultant gap is fuelling risks for the European energy sector. Emmanuel Dubois-Pelerin,

Sector Lead, EMEA Utilities at S&P Global Ratings, explains.

Gas shortfall fuels

Gas shortfall fuels

European utility sector risks

European utility sector risks

THE ENERGY INDUSTRY TIMES - OCTOBER 2022

13

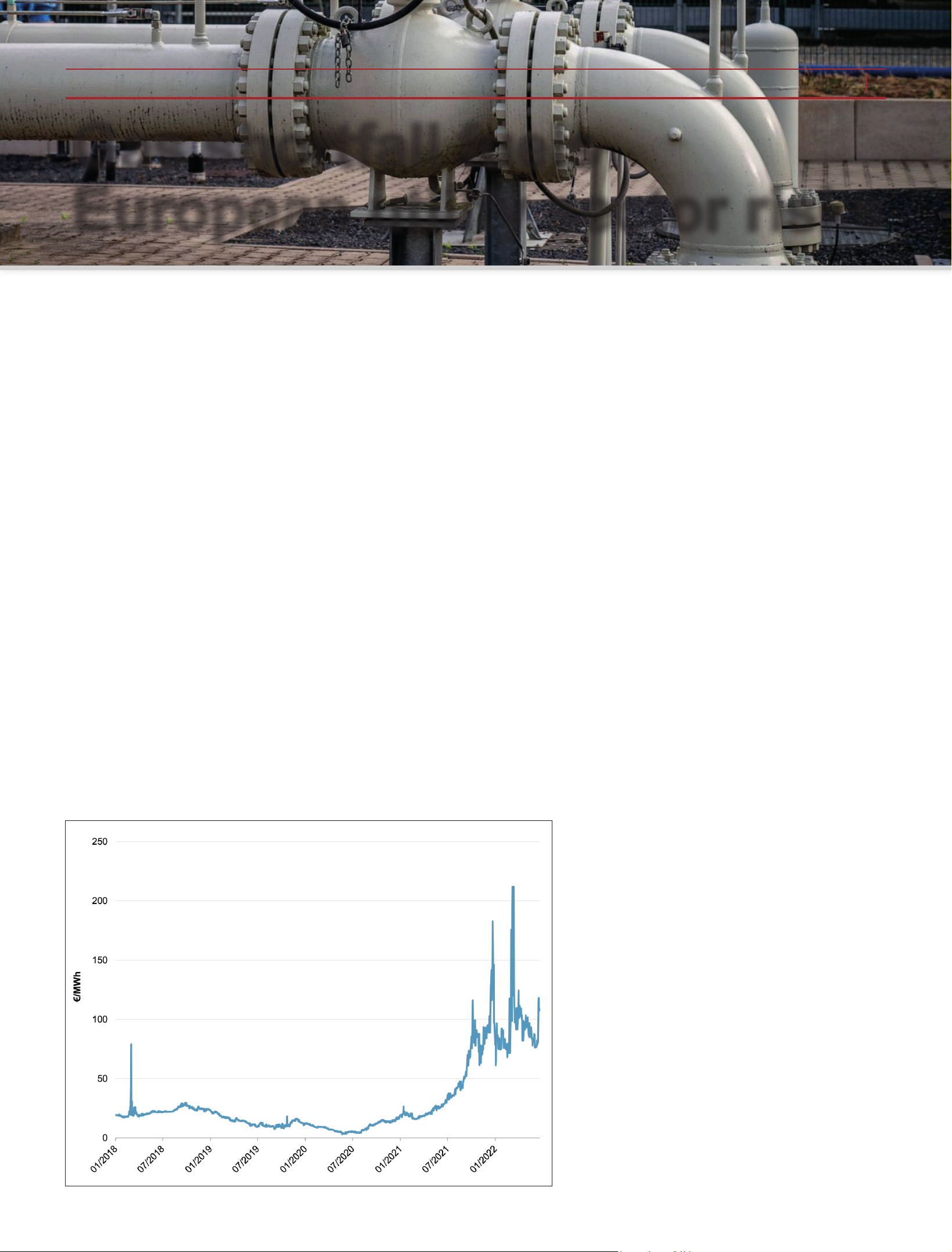

Energy Outlook

European day-ahead TTF gas

prices stay very high

Energy Industry Times, April 2022).

Have we seen real evidence of cli-

mate action accelerating since COP26

ended? The answer is unequivocally

“yes”. An example is real climate ac-

tion from Australia, China, and India.

Since Australia elected a new ad-

ministration (see ‘Elections will ac-

celerate Asia’s path to net zero’, The

Energy Industry Times, June 2022) it

has nally taken the path to wanting

to be a climate action leader as op-

posed to the laggard it was. The new

government led by Prime Minister

Anthony Albanese was sworn in at

the end of May 2022. It managed to

swiftly introduce the Climate Change

Bill 2022 which was approved by the

country’s parliament, 86 to 50, on

September 8th. The Bill calls for

“greenhouse gas emissions reduction

targets of a 43 per cent reduction from

2005 levels by 2030 and net zero by

2050”. It also mandates for better

transparency by requiring govern-

ment to provide an annual climate

change assessment.

China has done well in reducing its

over reliance on coal. In January to

August 2022, thermal power (mostly

coal red generation) accounted for

53 per cent of total output compared

to 81 per cent for the same period ten

years earlier. This could have been

even lower if it were not for lower

output from its hydro plants.

The key action point since COP26

has been the release of its Renewable

Energy 14th Five Year Plan (2021-

2025). It was an aggressive yet more

measured plan. The more aggressive

target is chiey for non-fossil fuel

power generation to reach 20 per cent

of the total by 2025 and 33 per cent by

2030; the 2030 target had been only

20 per cent in the 13th Five Year Plan.

The more measured approach con-

sists of not focusing on hard renew-

able energy generation capacity tar-

gets, as the focus is on the

gigawatt-hours (GWh) and not the

gigawatts (GW); this together with a

T

he next UN global climate talks

take place against a backdrop of

many macro gloom and doom

factors. One bright spot is the climate

action progress made by several key

economies in Asia, the world’s big-

gest energy consumer. Steps taken by

these economies have positive busi-

ness and investment opportunities

implications. There is empirical evi-

dence that shows this.

The last iteration of the Conference

of the Parties (COP26) attended by

nations that had signed the United

Nations Framework Convention on

Climate Change (UNFCCC) was in

November 2021 in Glasgow, United

Kingdom. This annual UN climate

change conference produced several

positive outcomes. For example, im-

portant progress was made on green

nance, corporate transparency and

disclosure, and the implementation of

the Paris Climate Agreement; a legally

binding international treaty on climate

change where countries state their net

zero emissions, or NZE, targets.

The hope was that at COP27, to be

held in November 2022 in the Egyp-

tian resort town of Sharm el-Sheikh,

climate change action would make

even more progress, especially on the

execution side. Unfortunately, the

world right now faces many macro

gloom and doom problems.

A war initiated by Russian President

Vladimir Putin, sky-high fossil fuel

costs and ination in many key

economies, a rise in interest rates,

slowing GDP growth and a looming

economic recession, are just some of

the factors. Countering these, are ex-

treme natural weather events, which

have highlighted a variety of climate

risks. The world in 2022 has wit-

nessed unseasonably high tempera-

tures, record-breaking heatwaves,

massive droughts, enormous wild-

res, and severe ooding. These

manifestations of climate change will

force the focus to remain on climate

action.

Looking at the track record so far,

the pace of climate action in key

Asian economies has been slow.

Their scorecards do not look impres-

sive at all. The Carbon Action Tracker,

a not-for-prot think-tank producing

independent scientic analysis from

two research organisations, tracks the

NZE progress of some of the world’s

most important economies. Looking

at a sample of ten important Asian

countries, the overall scorecard is that

their climate action is largely insuf-

cient. Australia and Japan are rated

“Insufcient”. Singapore, Thailand,

and Vietnam are rated “Critically In-

sufcient”. The climate action of the

remaining ve are rated “Highly In-

sufcient”; these comprise China,

India, Indonesia, New Zealand, and

South Korea.

Yet, with the exception of Thailand

all the governments have set NZE

targets. The NZE objective for ve is

2050, China’s and Singapore’s are

2060, and India’s is 2070. Importantly

the momentum is building up. Partly

because of extreme weather, as na-

tions in Asia have been far from im-

mune from these events. This is espe-

cially true for the most populated

regions, China and South Asia which

comprise over 3.2 billion people. In

China, heat waves produced the high-

est temperatures in 60 years and

drought caused all sorts of havoc, in-

cluding shortages of power from hy-

dropower plants. The drought and

ensuing high rainfall – the highest in

Southern China in recorded history –

affected rice and other food crops.

Bangladesh, India and Pakistan

witnessed shocking heat waves fol-

lowed by horrendous pre-monsoon

rains causing ash oods and gen-

eral ooding. Another reason for

more aggressive climate action is

energy security concerns and the

high fossil fuels price volatility ensu-

ing from Russia’s invasion of

Ukraine (see ‘Putin’s War: the short-

and long-term impacts on Asia’, The

mountain of measures to improve

clean energy adoption. Emissions are

now more likely to peak by 2025 or so

versus the planned 2030, according to

one observer.

India had 152 GW in non-fossil fuel

generation capacity at the end of

2020. Since COP26, it has announced

that it targets the amount to reach 500

GW by 2030. Another action point

was nally submitting its Nationally

Determined Contribution or NDC to

the UNFCCC in August. An impor-

tant step given that India is the third

largest polluter in the world and is one

of the last major emitters to meet its

Paris Agreement obligation. Like

China, it also introduced a bunch of

climate action measures it will push

to promote through tax and nancial

benets investments in electric mo-

bility, including electric vehicles and

battery manufacturing. Also, the cabi-

net announced an incentive scheme

directed to the production of high ef-

ciency solar PV modules domesti-

cally. It is hoped that the country will

change its NZE 2070 target to 2050

like many other nations.

All of these steps undertaken by

various key Asian countries have

positive implications in terms of busi-

ness and investment opportunities.

Business-wise there are a variety of

incentives for clean energy business-

es. The business opportunity is mas-

sive, including the domestic manu-

facturing of renewable energy

equipment such as solar PV modules

and energy storage – batteries or other.

The opportunity is also great for in-

vestors such as private equity funds or

energy corporations.

Let’s take Southeast Asia as an ex-

ample. The total population is about

690 million, according to the latest

United Nations estimate. Primary

energy demand almost doubled be-

tween 2000 and 2020, calculated the

International Energy Agency (IEA).

Renewables rose 143 per cent to ac-

count for 18 per cent of the total but at

the same time coal jumped over 470

per cent to account for 26 per cent of

the total. In terms of investments, as

the IEA points out, spending on en-

ergy will be very high because con-

sumption is expanding, and the share

of clean energy is rising. Numbers-

wise, in the ve years through 2020,

the annual average energy sector in-

vestment was about $70 billion, in-

cluding 40 per cent related to clean

energy. For the ten years through

2030, it will be $130-190 billion an-

nually, with clean energy taking in an

even bigger share.

Giuseppe ‘Joseph’ Jacobelli is Man-

aging Partner at Asia Clean Energy

Investments a single-family ofce and

direct investments advisor. He is an

Asian energy markets expert, author

of ‘Asia’s Energy Revolution’ (De

Gruyter, 2021) and host of The Asia

Climate Capital Podcast.

THE ENERGY INDUSTRY TIMES - OCTOBER 2022

Asia decarbonisation

14

The upcoming

COP27 climate

change meeting

is taking place

in a world facing

unprecedented

challenges.

Asia’s progress in

decarbonising its

economies, however,

remains a bright spot.

Joseph Jacobelli.

Climate action

Climate action

progresses despite

progresses despite

cloud of gloom and doom

cloud of gloom and doom

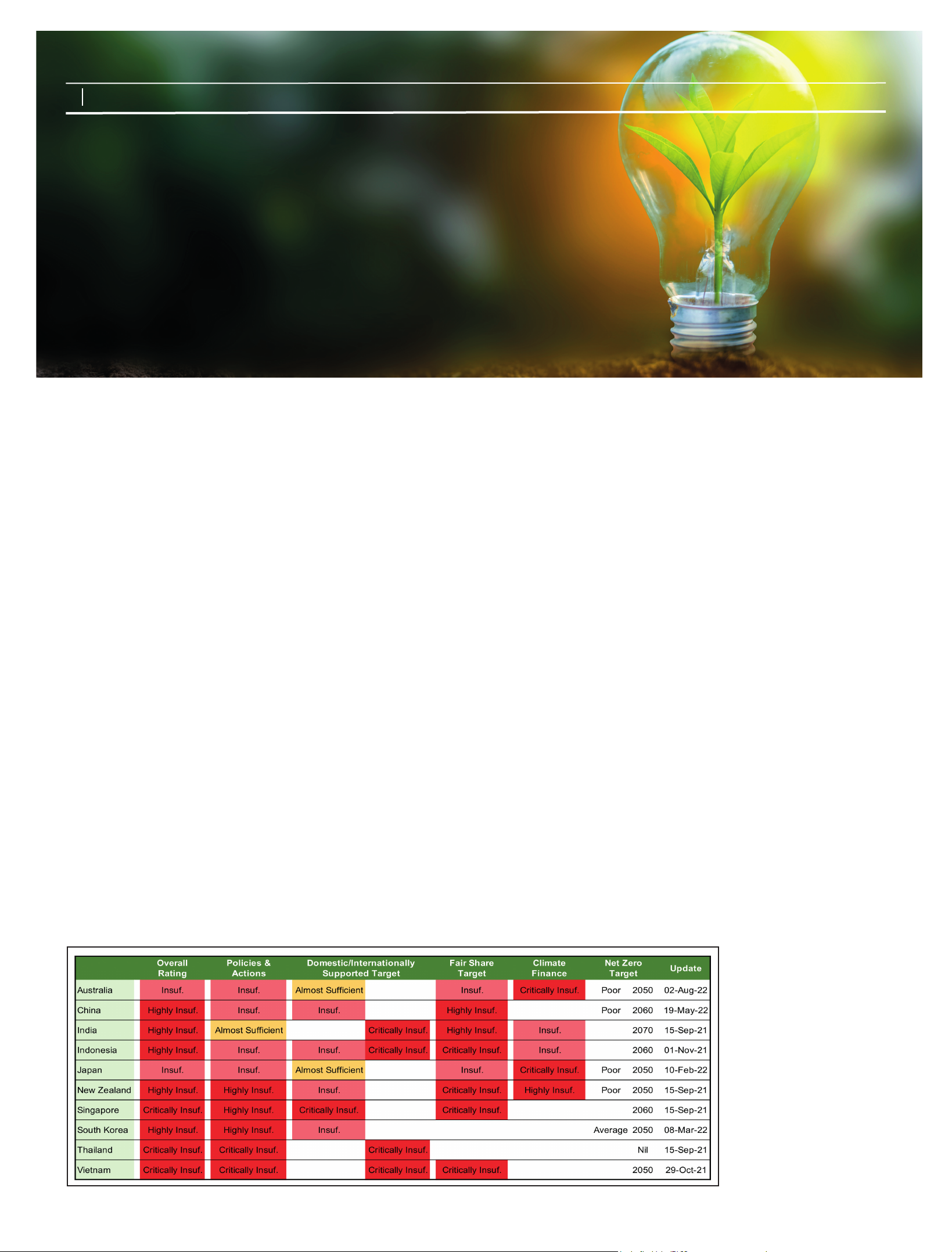

Key Asian Economies Climate

Action Scorecard

Note: Insuf. = Insufcient; Update =

latest update undertaken by Climate

Action Tracker. Chart compiled by

the author using data from Climate

Action Tracker, ‘Home | Climate Ac-

tion Tracker’ (Climateactiontracker.

org, September 2022) <https://

climateactiontracker.org/> accessed

20 September 2022

A

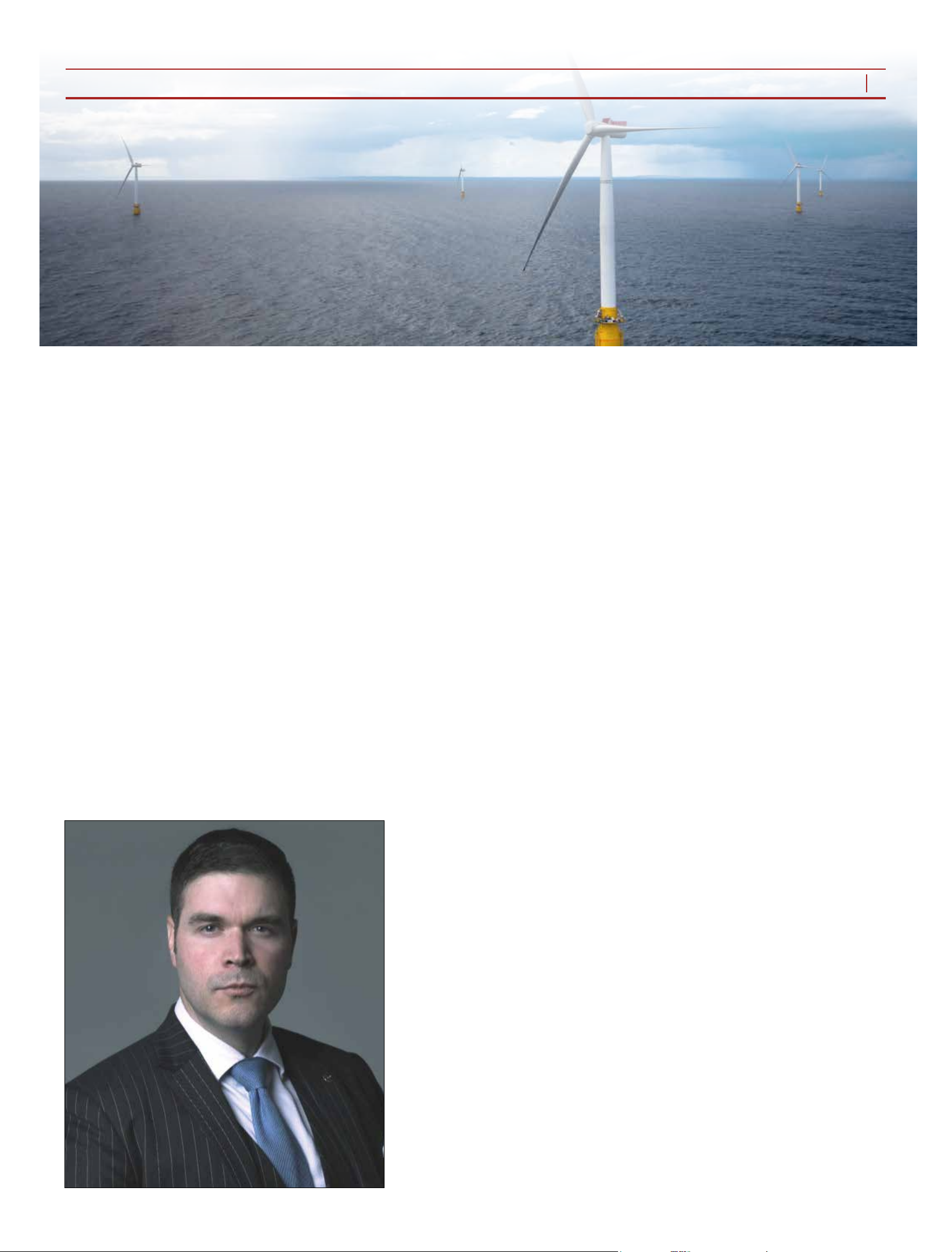

ccording to the Global Wind

Energy Council (GWEC),

more than 315 GW of new

offshore wind capacity will be add-

ed over the next decade (2022-

2031), bringing total global off-

shore wind capacity to 370 GW by

the end of 2031.

As the market matures, wind tur-

bines will be increasingly installed

in deeper waters further offshore re-

sulting in a massive growth in oat-

ing offshore wind installations.

GWEC predicts this edgling mar-

ket will grow from just over 121

MW at the end of 2021 to 18.9 GW

by 2030, with the vast majority

coming online after 2027.

With the share of oating wind

forecasted to grow signicantly and

governments implementing clean

energy policies, investments are

owing into technology advances in

the area that will lower costs and in-

crease turbine capacities – as they

have done and continue to do for

xed bottom installations.

Gazelle Wind Power is one com-

pany looking to unlock the massive

deep-water offshore wind market

through technology that it says sig-

nicantly reduces the cost of oat-

ing wind turbines and increases

speed to market.

Commenting on the market, Ga-

zelle Wind Power’s CEO, Jon Sala-

zar, said: “If we want to keep to the

targets for global warming, we need

these forecasts for offshore wind to

be accomplished.”

Being at the start of its maturity

curve, for oating offshore wind to

hit these predictions calls for a huge

ramp-up and some signicant chal-

lenges to be overcome.

“We can see three main challeng-

es,” said Salazar. “One is at the

technology level; another is the sup-

ply chain – how to move from pi-

lots to mass-produced solutions;

and lastly, the certainty that’s need-

ed to drive investment.”

He added: “The primary issue for

oating wind, today, is primarily

capex [capital expenditure] price.

This is impacting the LCOE [lev-

elised cost of energy].”

According to Salazar, the capex

forecast in 2025 is €3870/kW giv-

ing an LCOE of €90/MWh. This

compares to 2031/kW for xed bot-

tom and an LCOE of €50/MWh. By

2030, he says, the LCOE for oat-

ing wind is predicted to fall to 50

MWh, compared to 43/MWh for

xed bottom installations.

To achieve this, he says the indus-

try needs to reduce the capex of

current designs as well as increase

the availability of wind turbines for

the technology – especially for

oating substructures that require

wind turbine generator re-design.

“The large wind turbine manufac-

turers are not that eager to re-design

their wind turbines,” noted Salazar.

“If you need a slightly different re-

conguration, it’s not there. And -

nally, the market needs solutions

that are easy to assemble and easy

to manufacture.” This, he says, is

necessary to deliver installations at

the rate that is necessary to meet

forecasts.

Gazelle Wind Power aims to ad-

dress these issues through what it

calls a hybrid oating platform. Ac-

cording to the company, the new

platform signicantly reduces the

cost of the oating substructure,

which accounts for the main capex

of the installation, and increases

speed to market. According to the

company, the new platform design

dramatically reduces capex, which

translates into a lower LCOE.

Explaining the design, Salazar

said: “A oating wind installation

requires a oating foundation since

we are going into sea waters that

are 60 m deep or more. Most oat-

ing substructures are adaptations

from oil and gas. They are either

variations of semi-submersibles,

tension-leg platforms or spars. All

of these have one thing in common:

they require a signicant amount of

steel or concrete in order to provide

the buoyancy and stability. If the

wind turbine sways too much, say

more than 10 degrees, the turbine

operation will cease.”

Gazelle Wind Power says its solu-

tion is lighter than conventional

platforms – it uses signicantly less

steel and is substantially lower in

weight than other oating plat-

forms. It has a tilt of less than 5 de-

grees, and has 50 per cent less

mooring tension load than tension

leg platforms.

“On tension leg platforms, the

mooring loads are very high be-

cause of the type of mooring con-

nected to the seabed,” said Salazar.

“In our case, we can move up and

down because we have a dynamic

mooring system. As far we know,

this is the rst dynamic mooring

system in the world to be patented

for oating offshore wind. This al-

lows us to use vertical moorings, al-

though at the same time not being

limited vertically.”

He added: “What we are doing is

radically different. Our technology

doesn’t come from oil and gas; it

has been specically designed to

solve the oating offshore problem.

This is why we have had such com-

mercial technical traction and se-

cured record funding in such a short

time.

“We are taking a wind turbine that

can be almost the height of the Ei-

ffel Tower, of the latest 14-15 MW

design, and have separated the oat-

ability from the stability, allowing

us to achieve a lightweight design.

The hull of our platform is like a

boat; it follows shipbuilding tech-

niques. The mooring system is quite

novel; it also provides the stability.”

The unique platform design re-

sponds to waves through the action

of a central counterbalance connect-

ed via the platform to anchors on

the seabed. The geometric design

makes the platform move horizon-

tally and vertically with wind and

waves, with almost zero pitch an-

gle. Although most offshore wind

turbines are designed to support

pitch angles of up to 10 degrees,

this creates additional wear and tear

on components. Near null pitch

means less wear, less maintenance,

and longer life of the wind turbine

generator (WTG), which translates

into more energy production and

greater return on investment. While