www.teitimes.com

September 2022 • Volume 15 • No 7 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Collaboration is key to unlocking clean

energy innovation Page 12

Special Technology

Supplement

Working with startups

Rapid grid evolution is crucial

to carbon neutrality.

News In Brief

No clear sign of extreme

prices abating

With gas prices continuing to climb

and low nuclear and hydropower

output, there is no sign that

electricity prices will fall any time

soon.

Page 2

Offshore wind opens for

business in Colombia

Colombia has launched its rst

offshore wind leasing round and is

scheduled to award rst permits in

the second half of 2023.

Page 4

Australia looks offshore,

as government passes new

climate legislation

Australia’s government is taking

the next steps in creating a new

renewable energy industry following

its decision to pass the country’s rst

climate change legislation in more

than a decade.

Page 5

UK urged to speed up

hydrogen infrastructure

plans

The UK government has been urged

to accelerate its plan for hydrogen

storage business models, soon after

it published a Hydrogen Sector

Development Action Plan.

Page 7

Russia-Ukraine fallout

impacts German companies

The ongoing war in Ukraine is

continuing to weigh heavy on

German companies that had ties

with Russia prior to its invasion of

its neighbour.

Page 9

New long-duration storage

technology is key to energy

security

Lithium-ion technology is currently

used for most energy storage

applications but as demand for

batteries grows, challenges to

adequate and reliable supply of this

technology are emerging.

Page 14

Power grids regain missing

inertia

Power grids are becoming more

decentralised while the penetration

of renewable resources is increasing.

These two factors are causing a

steady decrease in the level of

inertia essential to maintain stable

operation. Synchronous condensers

can restore this missing inertia in a

number of applications.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

The US has passed a bill into law that will drive clean energy and help it meet its climate

change commitments but some experts caution that there are potential challenges.

Junior isles

Energy companies’ prots under re as energy crisis deepens

THE ENERGY INDUSTRY

TIMES

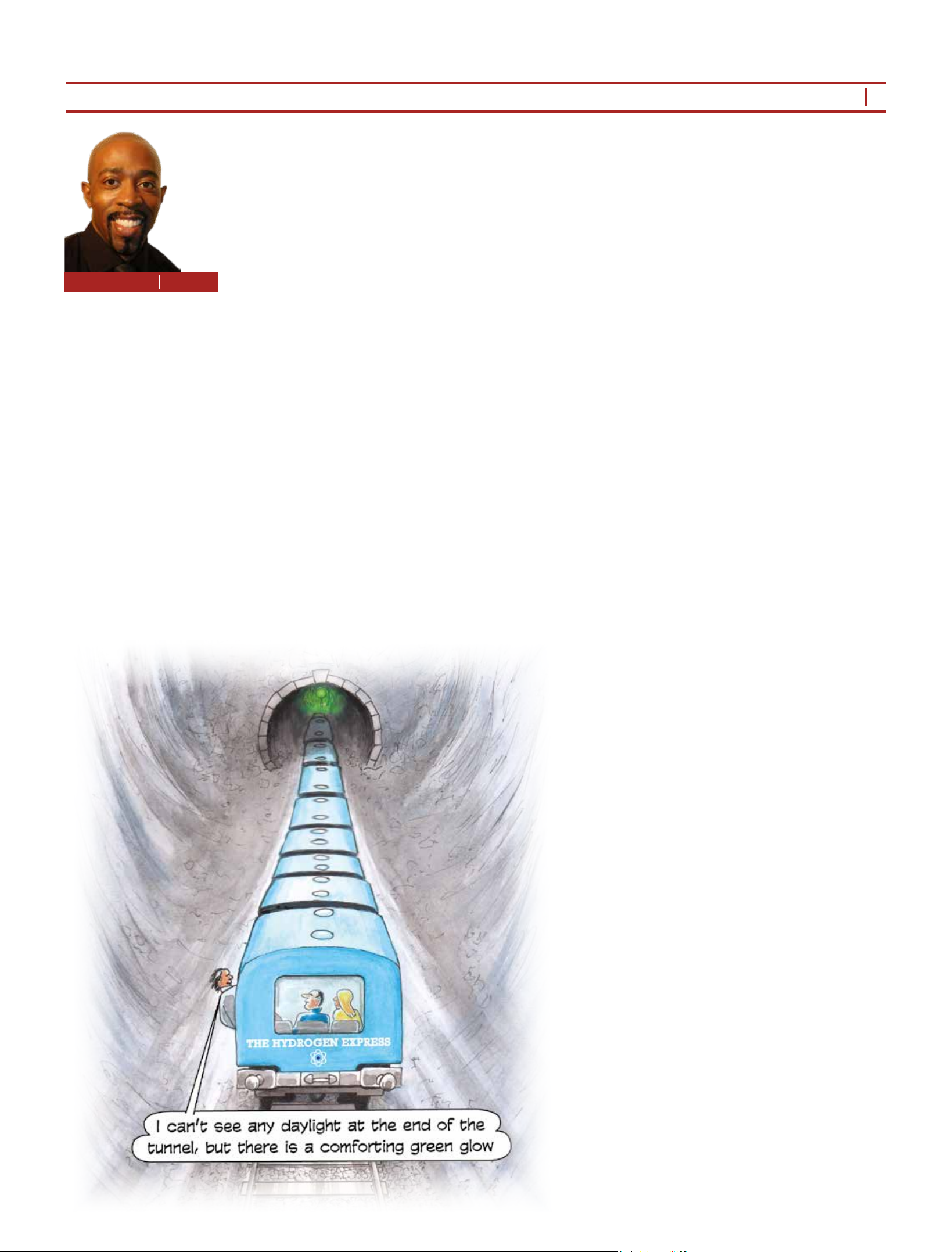

Final Word

There’s a glow at the

end of the tunnel,

says Junior Isles.

Page 16

The landmark Ination Reduction Act,

recently passed into law in the US will

pump a record $369 billion into clean

energy but experts caution that the

move to drive the country’s green en-

ergy transition will face obstacles.

Jos Shaver, Chief Investment Of-

cer at Electron Capital Partners, a re-

newables-focused asset manager said

the new law was “absolutely game

changing”, but warned: “It’s an ener-

gy transition, not an energy switch.

It’s not going to happen overnight and

there’s going to be a lot of bumps in

the road.”

The climate, tax and spending law

signed by President Joe Biden has the

potential to trigger a massive upsurge

of new renewable power that would,

according to the government, allow

the country to slash greenhouse gas

emissions by 40 per cent from 2005

levels by the end of the decade. This

would see it inch closer to its commit-

ment to cut emissions by 50-52 per

cent by 2030 under the Paris climate

accord.

Public investment in climate must be

paired with private investment to meet

ambition needed for Paris. The bill

therefore provides $27 billion in sup-

port for green banks in the US, which

will provide low-cost capital to accel-

erate private investment in climate

projects.

Heather Zichal, Chief Executive of

the American Clean Power Associa-

tion hailed the climate bill as a

“generational opportunity for clean

energy” after years of uncertainty and

delay. “This is the vote heard around

the world. It puts America on a path to

creating 550 000 new clean energy

jobs while reducing economy-wide

emissions 40 per cent by 2030.”

Tax credits to spur investment in and

production of renewable power form

the centrepiece of the new bill. Such

tax credits for wind and solar develop-

ments have been used for a number of

years to help drive renewable projects

but they have been short-term. This

has made planning difcult and devel-

opers have often struggled to attract

nancing.

The new bill reinstates and expands

production and investment tax cred-

its for wind, solar and energy storage

but with a 10-year time timeframe,

which allows long-term planning.

The 10-year credits will also feature

a “transferability” mechanism that

allows the credits to be bought and

sold, thereby expanding options for

nancing projects.

In anticipation of the bill passing,

Hanwha Solutions said it is

considering expanding investment in

its US photovoltaic plant construc-

tion plan, which was announced in

May this year.

Some project developers, however,

have expressed concern over the bill’s

goal of also promoting a home-grown

green industry.

Continued on Page 2

Energy companies have come under

re as prots soar while businesses and

households struggle under the burden

of record high energy prices.

Last month Saudi Arabia’s state-

owned energy corporation, Saudi Ar-

amco, highlighted the huge earnings

made by gas and oil-rich nations dur-

ing the energy crisis after making rev-

enues of $48.4 billion in the third

quarter, up 90 per cent from $25.5

billion a year earlier.

Saudi Aramco is just the latest in a

long line of oil giants to announce

bumper prots this year. Exxon-

Mobil’s prot, for example, came to

$17.6 billion in the second quarter,

excluding special items. The compa-

ny nearly doubled what it made in its

very protable rst quarter as oil and

gas prices started to soar driven by

Russia’s invasion of Ukraine.

Tradingplatforms’ Edith Reads

commented: “It is clear that the ener-

gy crisis is beneting the oil-rich na-

tions and those companies involved in

extracting and selling fossil fuels. The

high prices may be a cause for con-

cern for consumers, but for now, it

seems that the energy producers are

reaping the rewards.”

Record oil and gas prices have also

contributed to a bumper year for oil

giant bp, with half-year underlying

prots almost tripling from $5.4 bil-

lion in 2021 to $14.6 billion in 2022.

The company plans to boost dividend

payments by 10 per cent and will also

initiate a new share buyback pro-

gramme, totalling $3.5 billion.

In response to bp reporting huge

prots while household energy bills

soar, Doug Parr, Chief Scientist for

Greenpeace UK, said: “While house-

holds are being plunged into poverty

with knock-on-impacts for the whole

economy, fossil fuel companies are

laughing all the way to the bank. The

government is failing the UK and the

climate in its hour of need.

“Government must bring in a proper

windfall tax on these monster prots

and stop giving companies massive

tax breaks on destructive new fossil

fuel investments.”

Following the UK’s windfall tax

already imposed on oil and gas com-

panies, Britain’s electricity genera-

tors are facing pressure from minis-

ters to invest their “extraordinary

prots” in new green energy proj-

ects, rather than paying out the wind-

fall to shareholders.

Although many UK energy suppliers

have gone bust since the energy crisis,

some electricity generators have made

huge prots from surging electricity

prices that have risen in line with the

soaring cost of gas. Both Shell and

Centrica smashed earning results, with

Shell’s prot reaching a record of

$11.5 billion in the second quarter.

Pressure is now likely to increase on

generators with the announcement

that the UK will again raise its energy

price cap for households by 80 per

cent from October. This will see the

average household energy bill jump to

over £3500. The price cap was raised

by 54 per cent in April pushing the

average bill to just over £1900. Ex-

perts are predicting a further increase

in January, which could see average

annual bills reach in the region £5000,

with another increase likely in April.

Earlier last month UK Chancellor

Nadhim Zahawi and Business Energy

and Industry Secretary Kwasi Kwart-

eng met generators including Centri-

ca, Drax and RWE to discuss the en-

ergy crisis, including the sharp jump

in household bills.

US landmark clean

US landmark clean

energy bill will face

energy bill will face

obstacles

obstacles

The American Clean Power Association’s

Heather Zichal hailed the climate bill as a

“generational opportunity”

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2022

2

Junior Isles

European power prices hit new highs

last month and show no signs of abat-

ing as natural gas extended gains, says

independent energy research consul-

tancy Rystad Energy AS.

According to the company, next-year

electricity rates in Germany advanced

as much as 3.7 per cent to €477.50/

MWh ($487/MWh) on the European

Energy Exchange AG. This was almost

six times as much as this time last year,

with the price doubling in the past two

months alone.

Commenting on the latest numbers

Rystad Energy analyst Fabian Ronnin-

gen said: “There’s no clear sign of the

extreme price rally abating soon. The

continent’s low nuclear, hydropower

and coal capacities aren’t enough to

help ease that pressure.”

The market price is being driven by

concerns over whether Europe’s tight

gas supplies will be able to generate

enough electricity this winter. France’s

nuclear capacity is extremely low,

denting the possibility of power ex-

ports in the months ahead.

According to the forecast, European

electricity prices are expected to peak

during the winter of 2022-2023.

Day-ahead prices in Germany and the

UK also set records last month, an in-

dicator of high demand for cooling,

with heat waves and drought on the

continent straining infrastructure in the

short-term.

According to the International En-

ergy Agency (IEA), wholesale power

prices in the rst half of 2022 were

three to more than four times as high

as the average in the rst half of 2016

to 2021, primarily due to gas prices

climbing to more than ve times the

value of the reference period.

The IEA price index, representing the

moving average of weighted prices in

the main electricity markets for four

quarters, reached almost 300 points in

the second quarter of 2022, indicating

three times higher average wholesale

prices than in the reporting period of

2016, and 60 per cent higher prices than

over the same quarter of 2021. The IEA

also forecasts that European electricity

prices are expected to peak during the

coming winter.

With energy driving ination across

Europe, the deepening energy crunch

is threatening to plunge the region into

a recession.

In the UK, it was recently announced

that the household energy price cap

will increase by 80 per cent at the start

of October on the back of rising

wholesale costs. The wholesale price

of UK electricity for that month has

jumped about sevenfold in the past

year to roughly £591/MWh ($713/

MWh) on the Intercontinental Ex-

change AG.

In March the US Department of

Commerce agreed to investigate al-

leged circumvention of anti-dump-

ing and countervailing duties by

solar manufacturers in Southeast

Asia. The move has proven to be

damaging to the US solar sector as

it essentially froze the import of PV

cells and modules to the country.

The potential for retroactive tar-

iffs along with supply chain snags

drove down solar installations in

the last quarter to their lowest

level since the start of the corona-

virus pandemic, according to en-

ergy and commodities consultancy

Wood Mackenzie.

Speaking to the Financial Times,

Tom Buttgenbach, Chief Executive

at 8Minute Solar, one of the biggest

utility-scale developers, comment-

ed: “I need to know what my supply

chain looks like in four to ve

years.”

Meanwhile, offshore wind power

developers are anxiously eyeing a

separate piece of legislation that

would require them to use only

American vessels and crews when

installing turbines. Pedro Azagra,

Chief Executive of Avangrid,

which owns utilities and is one of

the biggest US wind developers,

said: “It’s something that is not

realistic. You do not have them and

it will take some time to build them,

some time to train the crews.”

The IRA makes hundreds of mil-

lions of US dollars available to gov-

ernmental bodies to optimise and

accelerate the processes behind

bringing projects onto the grid. It

calls for comprehensive permitting

reform legislation to be passed be-

fore the end of the scal year, to

unlock domestic energy and trans-

mission projects, which will lower

costs for consumers and help the US

meet its long-term emissions goals.

This includes offshore wind de-

velopment and transmission proj-

ects related to this energy infrastruc-

ture, including interconnections.

The Act puts $100 million on dis-

posal for the Secretary of Energy

until September 30, 2031 to carry

out activities related to the develop-

ment of interregional electricity

transmission and transmission of

electricity generated by offshore

wind.

Notably, the bill seeks to kick-start

hydrogen by also offering tax cred-

its for hydrogen production proj-

ects, with the of tax credit for proj-

ects based on the amount of carbon

equivalent emissions for each kilo-

gramme produced, starting at a ba-

sic rate of $0.60/kg of hydrogen

produced.

This scale means that clean hydro-

gen producers can receive tax cred-

its of up to $3/kg. Experts say the

measures will make the US one of

the lowest cost hydrogen producers

in the world.

Continued from Page 1

Renewable energy sources, which ac-

count for the bulk of annual invest-

ments in power generation, are set to

provide the majority of Europe’s

power by the end of the decade despite

global supply chain challenges.

According to a recent report by S&P

Global Ratings Renewables are fore-

cast to increase to 60 per cent of pow-

er generation in Europe by 2030, and

could approach 40 per cent in the US

and China, according to S&P Global

Commodity Insights (Platts).

BloombergNEF recently calculated

that global investment in renewable

energy totalled $226 billion in the rst

half of 2022, setting a new record for

the rst six months of a year. It said the

uptick in investment reects an accel-

eration in demand for clean energy

supplies to tackle the ongoing global

energy and climate crises.

Its Renewable Energy Investment

Tracker 2H 2022 report says invest-

ment in new large- and small-scale

solar projects rose to a record-breaking

$120 billion, up 33 per cent from the

rst half of 2021. Wind project nanc-

ing was up 16 per cent from 1H 2021,

at $84 billion.

“Both sectors have been challenged

recently by rising input costs for key

materials such as steel and polysilicon,

as well as supply chain disruptions and

rising nancing costs,” it said. “Yet,

today’s gures indicate that investor

appetite is stronger than ever, in part

due to the very high energy prices cur-

rently being seen in many markets

around the world.”

As well as seeing booming project

investments, the rst half also saw an

all-time record for venture capital and

private equity investments into renew-

ables and energy storage, with $9.6

billion raised – up 63 per cent on the

previous year.

Albert Cheung, Head of Analysis at

BloombergNEF, said: “Policy makers

are increasingly recognising that renew-

able energy is the key to unlocking en-

ergy security goals and reducing depen-

dence on volatile energy commodities.

Despite the headwinds presented by

ongoing cost ination and supply chain

challenges, demand for clean energy

sources has never been higher, and we

expect that the global energy crisis will

continue to act as an accelerant for the

clean energy transition.”

Global cumulative energy storage de-

ployments are expected to reach 500

GW by 2031 but demand in Europe

lags behind China and the US despite

the region’s need for exible power

solutions.

According to Wood Mackenzie’s

‘Global Energy Storage Outlook’ Eu-

rope’s demand lags behind as its grid-

scale market struggles to stabilise,

with only 159 GWh forecasted for the

region by 2031, compared to 422

GWh for China and 600 GWh for the

US.

Commenting on the forecasts, Dan

Shreve, Global Head of Energy Stor-

age at Wood Mackenzie, said:

“Growth has stalled in Europe as

regulatory barriers fail to improve

storage project economics. In addi-

tion, limited access to power markets

and a lack of revenue stacking oppor-

tunities, combined with a lack of ca-

pacity market auctions, has lowered

investment for grid-scale storage as-

sets in Europe.”

Despite this, Germany’s energy stor-

age market continues to grow and is

set to become the third biggest energy

storage market by 2030, following the

US and China. With 32 GWh fore-

casted for the country, 61 per cent from

the residential segment.

The European Commission’s RE-

PowerEU plan, launched as a means

of the EU weaning itself off Russian

fossil fuels, will boost the EU energy

storage market further as it pushes for

a higher share of renewable supply in

EU Member States. Europe has al-

ready seen a 12 GWh increase since

the plan was launched in May 2022,

which set out a 600 GW target for the

solar PV market and pledged to ease

permitting processes for both storage

and PV systems.

“While REPowerEU does not set out

a specic target for energy storage,

higher renewable supply targets will

drive demand for exible power solu-

tions, including energy storage as-

sets,” Shreve said.

The report was followed shortly af-

ter by an announcement by the Euro-

pean Commission that it wants to

boost output of its own raw materials

needed for green energy. The plans,

still at an early stage, would lower

regulatory barriers to mining and pro-

duction of critical materials such as

lithium, cobalt and graphite, needed

for batteries, wind farms, solar panels

and electric vehicles.

“Demand is increasing dramatically

due to the digital and green transition

of our society [but] we are too often

almost entirely dependent on imports,

while the geopolitics of supply chains

are increasingly unstable,” said the

EU’s internal market Commissioner

Thierry Breton.

Europe produces less than 1 per cent

of the world’s lithium ion cells com-

pared with China’s 66 per cent, ac-

cording to a report issued by JRC last

year. Mining lithium, however, has

challenges as demonstrated by Portu-

gal’s efforts to unearth large reserves.

A potential cornerstone of Europe’s

green energy transition, the Barroso

mine in northeastern Portugal was

expected to start producing lithium for

electric vehicle batteries in 2020. But

the mine’s owner, Savannah Resourc-

es, has been forced to push the start

date back several times due to delays

in environmental approval. In July

Portugal’s regulator added a phase to

the process, causing Savannah to reset

its rst production date again to 2026.

Meanwhile, demand continues to

grow. The EU target is for renewables

to produce 32 per cent of the bloc’s

energy by 2030, potentially increas-

ing to 45 per cent.

Dries Acke, Policy Director at So-

larPower Europe, said the industry

body expected EU installations of

photovoltaic cells to reach an all-time

high of 34 GW this year, up from 28

GW in 2021. But he said supply of

raw and processed materials would

determine the availability of solar

products.

Headline News

Renewable energy sector dees supply chain

Renewable energy sector dees supply chain

challenges

challenges

EU needs energy storage but market lags behind

EU needs energy storage but market lags behind

US and China

US and China

No clear sign of extreme

No clear sign of extreme

prices abating soon

prices abating soon

Buttgenbach called for

long-term policy certainty

With gas prices continuing to climb and low nuclear and hydropower output in Europe, there

is no sign that electricity prices will fall any time soon.

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2022

3

HYDROGEN

Enabling your

transition to a

green future

We’re ready for H

2

!

Get ready, too!

At INNIO*, we are continuously innovating exible,

scalable, and resilient energy solutions to help

you generate and manage energy efciently

and

sustainably.

Our Jenbacher* engine technology is an

investment in the future. It can be converted

to run on traditional gas-hydrogen mixtures

and up to 100% hydrogen when hydrogen

becomes available. Installing our “Ready for

H

2

” **-designed

gas power plant now will enable

you

to convert it to 100% hydrogen operation

later, deli

vering a sustainable energy solution

that works for

you today and accelerates a

cleaner tomorrow!

Let us support your transition journey.

innio.com

* Indicates a trademark.

** Optional scope on demand.

ENERGY SOLUTIONS.

EVERYWHERE, EVERY TIME.

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2022

5

Asia News

Japan has announced plans to return

to nuclear power in a move to halt

soaring energy costs and secure pow-

er supply. Late last month Prime min-

ister Fumio Kishida threw his support

behind accelerating the restart of reac-

tors which have been closed since the

Fukushima Daiichi nuclear plant di-

saster in 2011, and signalled the con-

struction of new plants.

“As a result of Russia’s invasion of

Ukraine, the global energy situation

has drastically changed,” Kishida said.

“Whatever happens globally, we need

to prepare every possible measure in

advance to minimise the impact on

people’s lives,” adding that the govern-

ment would aim to come up with con-

crete plans for the nuclear sector by

year-end.

The plan to research the construction

of new nuclear reactors, which experts

say could be safer than those using

existing technologies, marks a U-turn

in government policy since the Fuku-

shima crisis.

Earlier in August, new Minister of

Economy, Trade and Industry, Yasu-

toshi Nishimura, had said he had no

intention or plan to allow power com-

panies to build new nuclear power

plants or replace existing ones. Never-

theless, Kishida had expressed hope

that his new industry minister would

nd a way to secure stable energy sup-

plies at reasonable prices.

Japan had already announced the

restart of some nuclear plants after

Tokyo came close to suffering a pow-

er blackout this year. With the accel-

eration, it will aim to bring back 17 out

of a total 33 operable reactors by sum-

mer next year and also to extend the

life of existing plants.

Asia is becoming the focus of oil and

gas majors looking for clean energy

opportunities.

Last month a unit of US oil super-

major Chevron Corporation said it

plans to explore hydrogen, carbon

capture and other more environmen-

tally friendly energy operations in

Central Asia with a local partner.

Chevron Munaigas and KazMunay-

Gas (KMG) said they would evaluate

the potential for carbon capture, utili-

sation, and storage as well as hydrogen

production and methane management.

The news came as French energy gi-

ant TotalEnergies and Eneos received

clearance to form a joint venture (JV)

for developing 2 GW of business-to-

business solar projects in Asia over the

next ve years.

The deal to create the TotalEnergies

ENEOS Renewables Distributed

Generation Asia JV was rst an-

nounced in April this year.

TotalEnergies Renewables Distrib-

uted Generation Asia Head, Gavin

Adda, said: “Together with our partner,

we will mobilise our know-how and

expertise for more projects in the com-

ing months which puts us rmly on

track to achieve the goal of 2 GW

within the next ve years.”

TotalEnergies also said it plans to

produce and commercialise green hy-

drogen across India and beyond with

its purchase of a 25 per cent stake in

Adani New Industries Ltd. (ANIL)

from its parent, Adani Enterprises Ltd.

Japan accelerates nuclear to

secure energy supply

Oil majors target Asian clean

energy opportunities

Fast forward to a

clean future

An optimal air emission control solution provides the highest

environmental performance and ability to meet set emission limits.

Additionally, it significantly improves energy and process efficiency of

your production.

To control emissions in the best possible way, both technically and

economically, we at Valmet offer you an unrivaled combination of

innovative technology, automation and lifecycle services to improve

your performance every step of the way.

For more information valmet.com/emissions

Syed Ali

Australia’s recently elected govern-

ment is taking the next steps in creat-

ing a new renewable energy industry

following its decision to pass the

country’s rst climate change legisla-

tion in more than a decade.

In early August the Albanese gov-

ernment announced six proposed re-

gions for offshore wind development.

It also began consultation on one of

the regions – an area in the Bass Strait

off Gippsland.

The government has invited the pub-

lic to comment on the notice for the

proposed Gippsland zone, with sub-

missions to be received by October 7,

2022 in order to be considered.

The other regions for offshore wind

energy projects include: the Pacic

Ocean region off the Hunter in New

South Wales (NSW); the Pacic

Ocean region off the Illawarra in

NSW; the Southern Ocean region off

Portland in Victoria; the Bass Strait

region off Northern Tasmania; and the

Indian Ocean region off Perth/Bun-

bury, WA.

The Department of Climate Change,

Energy, the Environment and Water

will facilitate the consultation process

in the proposed regions.

Unlocking the offshore wind indus-

try is seen as “an exciting new chapter

for Australia”. Climate Change and

Energy Minister Chris Bowen has

been ghting to unlock Australia’s

offshore wind capacity for years.

He said many other countries have

been successfully harvesting offshore

wind energy for years, and “now is the

time for Australia to start the journey

to rmly establish this reliable and

signicant form of renewable energy”.

“We have some of the best wind re-

sources in the world,” said Bowen.

“The world’s climate emergency is

Australia’s regional jobs opportunity

and offshore wind is just one example.

Australia’s stance on tackling cli-

mate change has been a political

touchpaper for some time but in early

August the House of Representatives

passed a new climate bill that is ex-

pected to become law. The main part

of the previous bill – an emissions

trading scheme, introduced by the Gil-

lard government with the support of

Greens and independents – was re-

pealed by the Coalition under Tony

Abbott in 2014.

The new bill sets two national green-

house gas emissions targets: a 43 per

cent cut below 2005 levels by 2030,

and a reduction to “net zero” by 2050.

The bill emphasises that the 2030

target is a oor not a ceiling, which

means it is the minimum cut that can

happen but there is nothing to legally

prevent deeper cuts. The legislation

requires several government agencies

to consider the targets – that is, factor

in climate change – when making in-

vestment decisions.

The legislation strengthens the role

of the Climate Change Authority, a

decade-old agency responsible for

giving policy advice. The authority

was cut back and largely ignored un-

der the previous Coalition but will

now be expected to give annual advice

on progress towards meeting Austra-

lia’s climate targets and to advise

later this parliamentary term on a new

target for 2035.

The government will have to release

the advice and publicly explain why

if it does not follow it.

The climate change minister is re-

quired to give an annual statement to

parliament on progress towards the

targets. Bowen has likened it to the

annual Closing the Gap statement.

The new legislation, however, does

not include a mechanism or funding

to cut emissions from electricity, in-

dustry, transport, agriculture or other

parts of the economy.

There are still several details to be

eshed out and the bill still has to clear

the Senate when parliament next sits

in September, but this is now seen as

a formality.

n Copenhagen Energy has led a pro-

posal with the Federal Department of

Water and the Environment for initial

review of a 3 GW offshore wind farm

off the coast of the state of Western

Australia.

Australia looks offshore, as

Australia looks offshore, as

government passes new climate

government passes new climate

legislation

legislation

n Six offshore wind zones proposed n New climate legislation sets tougher emissions targets

6

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2022

Asia News

China’s worst heat wave since records

began 60 years ago has caused drought

in the parts of the country, forcing a

switch from hydropower to coal in an

effort to keep the lights on.

Extreme temperature, which has

lasted more than two months, and a lack

of rain have starved dams of water in

Sichuan Province forcing authorities

there and in the neighbouring munici-

pality of Chongqing to ask companies

to temporarily shut factories.

In an effort to secure electricity sup-

plies, Vice-Premier, Han Zheng said

Beijing would provide support for the

coal sector.

“[We need to] guarantee safe elec-

tricity supply for the people… and

key sectors,” he said during a visit to

the State Grid Corporation of China.

The government will “enhance poli-

cy support [and] take multiple mea-

sures to help coal plants ease actual

difculties”.

David Fishman, an analyst who cov-

ers Chinese energy at The Lantau

Group, told the Financial Times that

the province would inevitably turn to

coal, which has become more expen-

sive due to high demand. Government

support could include a price cap, he

added.

“[Provinces where] coal capacity [is]

deployed to support hydropower in the

dry season will be looking to maximise

usage of their coal capacity as hydro

production drops,” said Fishman. “Un-

der these conditions, there’s no choice

but to run the coal plants at maximum

capacity.”

Although necessary, the move will

slow China’s effort to combat climate

change. Nevertheless, the country’s

clean energy sector will continue to see

expansion this year, according to ex-

perts. The clean energy sector will con-

tinue fast expansion in the second half,

said Su Xinyi, an analyst with China

Electric Power Planning & Engineer-

ing Institute.

China’s installed capacity of wind

and solar PV added 12.94 GW and

30.88 GW, accounting for 18.7 per cent

and 44.7 per cent of total new capacity,

respectively, in the rst half of 2022,

according to data from the National

Energy Administration.

China’s newly installed capacity of

wind and solar PV for the entire year

is expected to exceed 100 GW, while

the consumption of power produced by

the two energy sources is estimated to

reach over 12.2 per cent of total power

consumption, Su said.

The Malaysian government will stop

building coal power plants starting in

2040, and shift its focus toward clean

and renewable energy, according to

Mustapa Mohamed, the minister in

charge of economy in the Prime Min-

ister’s department.

Speaking at a question and answer

session of the Malaysian Parliament’s

second meeting, Mustapa said the on-

going global energy crisis will acceler-

ate the transition to cleaner energy,

adding that Malaysia will improve its

renewable energy capacity to fulll the

set targets.

A number of renewable energy sourc-

es identied for development include

hydroelectricity, solar energy, biogas

and biomass, he said, noting that bat-

tery energy storage technology will

also be introduced to ensure quality and

guaranteed power supply.

The government will also expand the

use of hydrogen, and develop technol-

ogy related to carbon capture and stor-

age, he went on.

According to Mustapa, the Econom-

ic Planning Unit is nalising a nation-

al energy policy, which is in line with

Malaysia’s commitment to Sustain-

able Development Goal 7 (SDG7) of

the UN to ensure access to affordable,

reliable, sustainable and modern en-

ergy for all. The policy is expected to

be released this year.

State-owned utility Tenaga Nasional

Bhd (TNB) via its New Energy Divi-

sion (NED) is focused on exploring

new markets to grow its renewable

energy (RE) portfolio in Southeast

Asia, as well as Europe.

TNB President and CEO Datuk Ba-

harin Din said its NED aims to in-

crease participation in solar, offshore

and onshore wind to potentially cap-

ture 14 GW of RE capacity by 2050.

TNB Renewables Sdn Bhd will focus

on Southeast Asia – exploring new

markets that include Thailand, the Phil-

ippines, Vietnam, Taiwan, South Ko-

rea and Australia.

In a separate development TNB also

said it plans to begin the process next

year for a potential listing of its power

generation business. In what would be

the country’s largest initial public of-

fering (IPO) in a decade, TNB Power

Generation Sdn Bhd, known as TNB

Genco, could be valued at about $4

billion.

Sources close to the matter told Re-

uters Proceeds from the offering will

be used to grow TNB Genco’s renew-

able energy portfolio.

The clean energy market is estimat-

ed to be worth MYR65-80 billion

($14.54-17.9 billion) in Malaysia by

2050, and Tenaga aims to have TNB

Genco take MYR40 billion of it.

Cost of renewables

rise but still gains on

fossil fuelled power

Malaysia speeds up shift

to clean energy

Energy & Storage

solutions expertise

Securing energy supplies

Ensuring a reliable power supply is one

of the key factors for progress and

prosperity around the world. Building

on decades of MAN innovation, we can

help secure clean and effi cient energy

supplies for your customers. Our expertise

covers solutions for hybrid power, LNG

to power, energy storage, power-to-X,

thermal power plants, and CHP.

www.man-es.com

Your reliability

shines

1912_14870_MAN_ES_Anzeige_SC_KV_Power_YourReliabilityShines_reSe_ENG_249x160mm_ISO_V2.indd 1 01.10.19 13:36

An enhanced, resilient, electricity network is the key to delivering the massive amounts of renewables planned

around the world. Hitachi Energy’s Niklas Persson discusses the key power grid technologies and project

development strategies that are urgently needed to accelerate the transition to a carbon-neutral energy system.

Junior Isles

same concept to connect the Nordic

and British power markets. Commis-

sioned in October last year, the 1400

MW capacity NSL (North Sea Link),

720 km interconnector, built for

Statnett and National Grid, is the

longest subsea link in the world. It is

also the rst interconnection between

the UK and Norway.

The link will help evacuate power

from the UK when, for instance,

wind power generation is high there

and electricity demand low, thereby

conserving water in Norway’s hydro-

power reservoirs. When demand is

high in the UK and wind power gen-

eration is low, low-carbon energy can

ow from Norway, helping to secure

the UK’s electricity supply. The link

will also facilitate power trading and

electricity price arbitrage between

the countries.

“The EU has a clear vision that in-

terconnection is the key to make use

of the new energy system,” noted

Persson, adding that HVDC is mov-

ing from what used to be a technol-

ogy for very specic applications to

one that will be the basis of a future

meshed DC grid.

“Our rst HVDC technology,

HVDC Classic, was seen as a very

niche solution used for point-to-

point bulk power transmission to

load centres over very long distances,

because it has lower losses and a

much smaller footprint [than AC

link that will transmit up to 2 GW of

wind power from the north to the

industrial south, or alternatively solar

power from the south to the north

when needed.

At the same time, the EU has made

great strides in expanding its inter-

connected electricity system. Pers-

son cited examples such as the Nord-

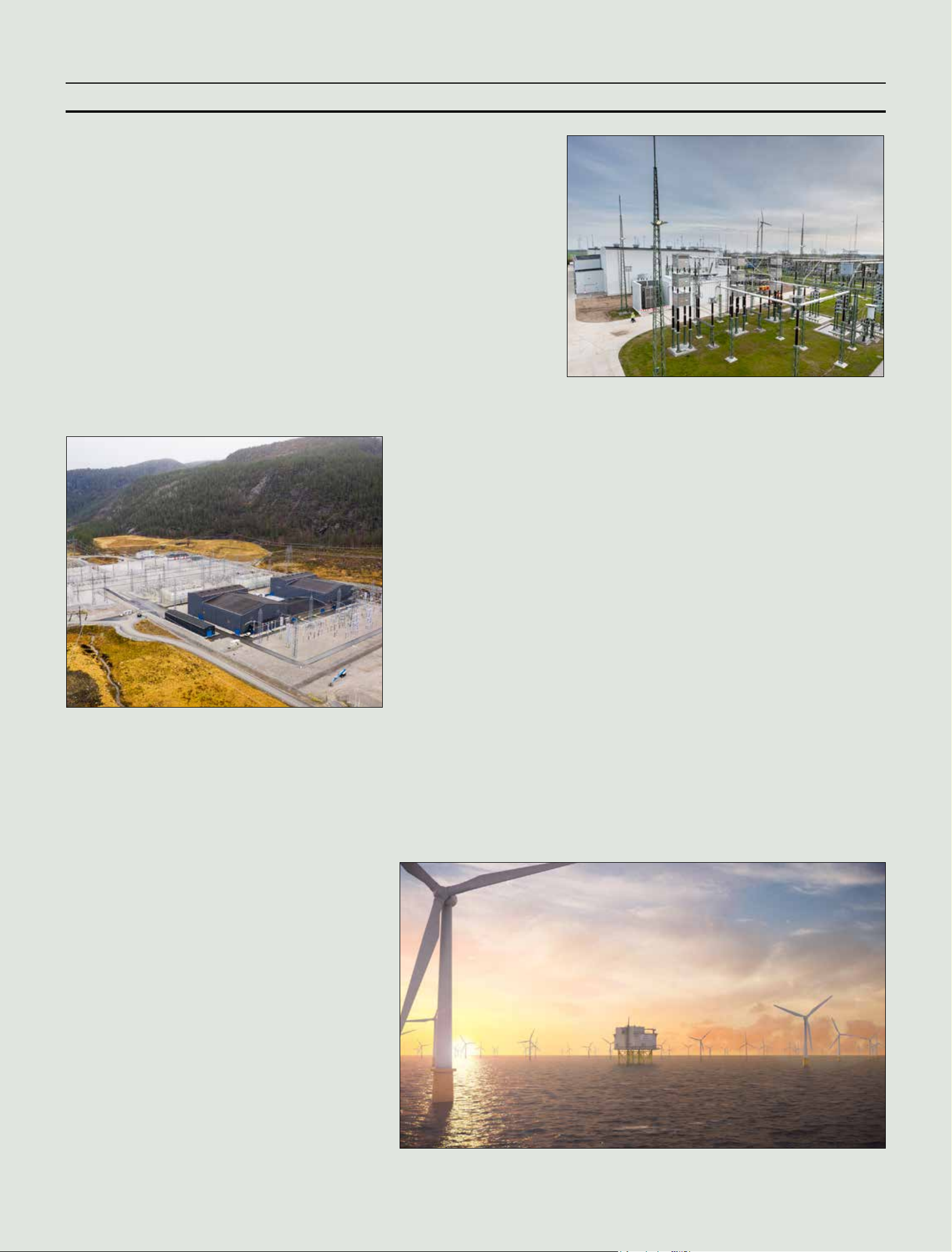

Link interconnector linking the

power grids of Norway and Ger-

many. Commissioned in 2020, it

enables the integration and exchange

of wind, solar and hydro power be-

tween the two countries. NordLink

was not only the world’s longest

voltage source converter (VSC) cable

connector at 623 km, but was also

Europe’s longest HVDC power grid

interconnection, and the rst inter-

connection to link the Norwegian

and German power grids.

Hitachi Energy’s delivery included

the design, engineering, supply and

commissioning of two 1400 MW

±525 kV converter stations, using

Hitachi Energy’s VSC technology,

known as HVDC Light

®

. The project

is signicant since it is the world’s

rst HVDC Light

®

bipole installa-

tion to perform at 525 kV and 1400

MW, nearly doubling the power

transmission capacity compared

with earlier systems, while improv-

ing overall reliability and availability

in the grid.

Hitachi Energy has since used the

Wilster HVDC converter station. SuedLink DC4 will transmit electricity between Wilster in the

north and Bergrheinfeld in the south

Persson says the industry is “coming together and pushing the

transition” forward

Rapid grid evolution is

crucial to carbon neutrality

Special Technology Supplement

S

ince setting global ambitions for

climate change through the Paris

Agreement in 2015, many would

argue that the speed and level of

action needed to combat global

warming has been insufcient. But in

the last couple of years, there has been

a real feeling that the pace of change

is gathering momentum. The EU has

been at the vanguard of accelerating

that change with its European Green

Deal, which encompasses the ‘Fit for

55’ proposals, as well as the more

recent REPowerEU plan aimed at

reducing dependence on Russian

fossil fuels.

Much of those plans are under-

pinned by a massive rollout of wind

– offshore wind in particular – and

solar, as well as energy efciency

and green hydrogen. But the key fa-

cilitator will be the power grid and

how it will evolve to enable the en-

ergy transition.

Niklas Persson is Managing Direc-

tor of Hitachi Energy’s Grid Integra-

tion business. Having worked in the

sector for the best part of 25 years,

he has no doubt that the grid is central

to accelerating the energy transition.

“Until fairly recently, the pace of

change has not been what we hoped

for and expected. But now we see the

industry is coming together and

pushing the transition forward – even

if political decisions are lagging in

some areas such as a regulatory

framework for a future offshore grid,

for example.” he said. “Certainly,

in the last two or three years, inde-

pendent of the Ukraine situation,

there has been increased awareness

and momentum. This was clear

at COP26.

“As a technology leader, we are

seeing much more demand from

customers looking at how to manage

the network through digitalisation,

greater efciency, more sustainable

and even more innovative technolo-

gies and solutions. They have to

manage a network that is much more

complex in terms of both consump-

tion and generation. On the genera-

tion side, new capacity is being

added but without inertia when that

capacity is wind or solar.”

He noted that in the past, grids have

been “very rigid and stable”, existing

as islands within each country, un-

connected to neighbouring countries,

or sometimes as regions within a

country. With the inux of renew-

ables, however, grid operators now

have to mitigate load ows through

enhanced grid performance, and in

many areas start to use power elec-

tronics that provide more dynamic

solutions for a more complex grid.

Just last month, Hitachi Energy

secured the contract for SuedLink

DC4 in Germany, a ±525 kV HVDC

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2022

link completes the rst multi-termi-

nal HVDC system in Europe.

The Shetland interconnector will

connect to the existing 320 kV/1200

MW Caithness-Moray Link to form

a three-terminal HVDC network.

Caithness-Moray is a subsea link

connecting the electricity grid on ei-

ther side of the Moray Firth in

Northern Scotland. This link has two

land-based 320 kV HVDC Light

®

converter stations, one rated 1200

MW at Blackhillock in Moray and

another rated 800 MW at Spittal in

Caithness.

Persson noted: “This is a signicant

step in showing you can connect

several converters instead of just

having point-to-point. This could be

developed into a multi-purpose con-

nector scheme, where the energy

systems of one, two, three, or four

countries are connected. This would

form a ring and suddenly you have a

DC grid.”

From a technology aspect, Persson

says there is no issue in implement-

ing DC grids, noting that the key

component – the HVDC breaker –

has been type-tested. He says Hitachi

Energy has also engineered a control

function that can handle inputs from

various OEM systems.

“This has all been proven as part of

a European programme,” he said. “It

has not been proven at a large scale

yet, so some project development is

still needed. But we are very con-

dent that technically, it is not a big

issue.”

The main challenge, says Persson,

is the regulatory framework. “If, for

example, you look at this cluster be-

tween the Netherlands and the UK,

where there are three wind farms, if

the wind is blowing who will get

what energy and why? And at what

price? And if all the wind farms are

generating, will the price be zero

because there is an over-capacity?

The regulatory framework is not yet

in place.”

It is a challenge, however, that will

no doubt be overcome as transmis-

sion system operators (TSOs) start to

collaborate and set up pilot projects

such as the energy island being built

off the coast of Denmark, which is

being designed to transmit wind

power to various countries, as well

as hydrogen produced by electrolys-

ers powered by wind.

“Denmark will build it and then

make the energy available to maybe

Germany, Norway, the UK, etc., since

they won’t use all the energy them-

selves. This is how I see it. So we will

go from radial interconnectors, to

multi-purpose interconnectors, and

Special Technology Supplement

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2022

Kriegers Flak Combined Grid

Solution in Denmark. The

multi-purpose connection

demonstrates how new

HVDC hybrid solutions can

optimise power grids

transmission]. This made it suitable

for transporting power over thou-

sands of kilometres in countries like

China, India and Brazil. We later

developed HVDC Light

®

based on

VSC [Voltage Sourced Converter]

technology to transmit power under-

ground and underwater, as well as

over long distances. We now have

more than 25 years of development of

HVDC Light

®

, and stepwise devel-

opment has seen the transmission

levels go from 80 kV and about 50

MW, to 640 kV and 3 GW, with the

proven capabilities for managing fre-

quency uctuations, voltage dips, and

transients. But now there is a need for

multi-purpose and multi-terminal

connections.”

He used Kriegers Flak Combined

Grid Solution (KF CGS) as an ex-

ample of what he describes as “a

kind of rst multi-purpose” connec-

tion that demonstrates how new

HVDC hybrid solutions can optimise

power grids and make new and

larger applications of offshore wind

possible to further support EU targets

for achieving climate neutrality

by 2050.

Commissioned in 2019, the HVDC

system helps secure the energy sup-

ply in both countries and supports

cross-border energy trading while

reliably integrating the Baltic 1,

Baltic 2 and Kriegers Flak offshore

wind farms.

The innovative hybrid HVDC

Light

®

system digital master control-

ler manages the complex task of

controlling the entire KF CGS. By

adjusting power ows in real-time,

the system integrates and supports

the wind farms and the two asyn-

chronous AC power grids in Den-

mark and Germany, ensuring sus-

tainable and reliable energy to

consumers.

The 410 MW/150 kV converter

station is located in Bentwisch,

northern Germany where it connects

the Kriegers Flak offshore grid, part

of the Danish electricity network,

to the German network. The eco-

nomic back-to-back set-up minimis-

es the environmental footprint of the

installation.

More recently, in 2020 Hitachi

Energy won an order from Scottish

and Southern Networks Transmis-

sion (SSEN) for the Shetland link,

which is seen as signicant for the

industry. The link will allow SSEN

to efciently combine wind and

hydro power to meet user needs

while also increasing the reliability

and capacity of the power grids in

Scotland and on Shetland. Accord-

ing to Hitachi Energy, the 600 MW

Erstmyra converter station in Norway: the NordLink

interconnector links the power grids of Norway and Germany

then eventually it will be a grid,” said

Persson. “This type of scheme will

harvest all the energy that is the vi-

sion for Europe’s offshore wind

sector. Many have learned that for

this to happen, you need a DC grid

structure.”

While Persson believes this will

happen, he acknowledges that it will

take some time. “Permitting and -

nancing, etc., has to be in place, but

10 years is a short time in this indus-

try. Multi-terminal is already here

and we are starting to see multi-pur-

pose projects such as in Denmark but

you are looking at about 10+ years

before we really see the DC grid.”

Other countries outside of Europe

are also embracing HVDC technol-

ogy to help integrate renewables. In

December last year Hitachi Energy

secured a contract for what it says is

the world’s most powerful ‘power

from shore’ solution. Here, Hitachi

Energy will supply the enabling

technology – its HVDC Light

®

con-

verter stations and MACH digital

control platform – to connect two

large offshore oil and gas production

hubs to the mainland grid for the Abu

Dhabi Oil Company (ADNOC). The

project will reduce CO

2

emissions

from ADNOC’s production opera-

tions by up to 30 per cent by replac-

ing gas turbines at the hubs with

electricity generated onshore by

emission-free solar and nuclear

power.

The contract follows an earlier

contract in October last year that will

see Hitachi Energy lead a consortium

that will deliver the rst HVDC link

between the Middle East and Africa.

The link will allow Saudi Arabia and

Egypt to exchange up to 3 GW of

electricity – much of which is ex-

pected to be generated from renew-

able energy sources in the future.

More recently, in Mumbai, India, a

contract was awarded to Hitachi

Energy for what is called a “city

centre in-feed application” where an

HVDC Light

®

transmission system

will help bring 1000 MW of power

into the city.

“In mega cities like Mumbai, it’s

not easy to build new stations to get

power into the city. With this project

we are able to connect solar power

from outside Mumbai, with a very

small footprint inside the city. This is

the rst of its kind,” said Persson.

The massive worldwide deploy-

ment of renewables, however, comes

at a price in terms of grid stability,

since wind and solar are intermittent

and cause uctuations in terms of

voltage and frequency.

As the grid is forced to accommo-

date more distributed energy sources

and loads such as electric vehicles

(EVs), this also creates transients

and uctuations. According to Pers-

son this means that the grid will in-

creasingly need to be based on power

electronics and digitalisation.

“In the future, you will not only see

HVDC links and STATCOM devices

here and there; there will be power

electronics solutions in wind genera-

tion, with digitalisation for manag-

ing the load ows and stability,

which vary according to how the

wind is blowing or the sun is shining.

This will be the grid of the future.”

Power quality will also be an issue

in AC grids since there is less short-

circuit capability due to a lack of the

system inertia that comes from con-

ventional power plants.

Persson explained: “One of the

concerns we have is that there is a lot

of focus on wind generation, HVDC

and meshed grids, which is good, but

then you need to receive all of this

energy and transmit it to the load

centres. This means you also need to

invest in the AC grid. And this is

where many countries have been

taken by surprise on the needed in-

vestments to get an efcient grid in

place, in time.”

He says, there is therefore a grow-

ing need for what is known as ‘grid

forming’ capability, where the con-

trol function in a STATCOM is used

to rapidly control swings in the grid.

Like synchronous machine technolo-

gies, this enables the provision of

grid services such as inertia and grid

strength in the fastest timeframes.

An HVDC platform at the Dogger Bank wind farm. HVDC systems support cross-border energy

trading while reliably integrating offshore wind farms. (Photo courtesy of Aibel)

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2022

Special Technology Supplement

In January this year,

Hitachi Energy achieved the

rst-step target set out in

its Sustainability 2030 plan

way, you would build and assemble

the grid connection on-site. Our

concept is modularised, contain-

erised, pre-tested from a functional-

ity perspective in a controlled envi-

ronment and sent to the site, ready for

energisation. This allows us to reduce

both equipment size and commis-

sioning time.”

One recent example of the efcacy

of Grid-eXpand

TM

is a 170 kV contai-

nerised gas-insulated (GIS) grid

connection for a combined sh farm

and 312 MW solar photovoltaic

power plant in South East Asia.

Owned by Sunny Rich Group, the

site uses solar power and advanced

technologies to farm sh sustainably.

According to Hitachi Energy, com-

pared to a conventional GIS grid

connection, the Grid-eXpand

TM

solu-

tion has a 25 per cent smaller foot-

print, was delivered and energised 15

per cent faster, and reduced the cost

of civil works by 50 per cent.

Such developments are essential in

order for grid infrastructure to facili-

tate the energy transition. But tech-

nology will also have to be combined

with a more coordinated approach to

grid design and development, all

underpinned by the right regulatory

framework.

The UK is a good example of how

the grid of the future could be de-

signed and developed. In July the

National Grid ESO published its

Pathway to 2030 Holistic Network

Design (HND) to accelerate the con-

nection of 23 GW of wind to help

deliver the government’s ambition

for 50 GW of connected offshore

wind by 2030. The HND, which will

call for £54 billion ($65 billion) in-

vestment, is seen as a rst step to-

wards more centralised, strategic

network planning.

At the same time, regulation will

have to keep up with technology, if

the world is to realise the smart, re-

silient grids of the future that also

allow consumers to play their part in

the energy transition. Persson noted

that Hitachi Energy has the digital

technologies to provide smart grid

solutions but stresses that there is

still much to do for the industry and

government as a whole.

He said: “You can have houses

with solar panels, for example,

where households can buy and sell

energy, etc. I believe this will hap-

pen. But if a transmission system

operator has to respond to an issue, it

needs to know when and how energy

is available. There would need to be

a commercial agreement between

the TSO or DSO [distribution system

operator] and every household to

ensure energy is available when it’s

needed. There is still a lot of work to

be done from the regulatory and

policy perspective for this to happen,

so it will be quite a long time before

houses are really participating in

stabilising the grid.”

Such commercial and regulatory

issues, which include standardisa-

tion and grid compliance, calls for

collaboration in the market, Persson

says.

“There is ongoing collaboration

between TSOs, DSOs, politicians,

OEMs, etc., to understand how we

can standardise and do this as a com-

munity,” he said, adding that there

will also need to be collaboration

in how projects are executed, as the

sector continues to inch closer to

its vision.

“This market is very interesting

and there is a huge demand. I really

see movement from the TSOs, DSOs

and the industry. Project developers

including oil giants like BP, Equinor

and Shell are investing, so money is

available,” said Persson. “But you

still have to look at the industry’s

capacity to respond to this demand.”

He believes the need to meet this

massive demand requires a shift

away from the traditional turnkey

EPC approach, where OEMs also

take on the civil work for a project.

“At Hitachi Energy we believe

each partner should do what it is

good at. So we work with our cus-

tomers to dene who should deliver

what in order to speed up the whole

process. We deliver what is in our

DNA, i.e. the technology – manu-

facturing, system engineering and

project execution. For project exe-

cution, we form partnerships and

get customers to be more involved

in dening the scope.”

Hitachi Energy is keen to lead the

transition by example. “Industry

and technology providers really

want to support the momentum.

This manifests itself in our Sustain-

ability 2030 strategic plan, where

we have committed to achieving

carbon neutrality in our own opera-

tions and only using fossil-free

electricity,” said Persson.

In January this year, the company

announced that it had achieved the

rst-step target set out in its Sus-

tainability 2030 plan – the use of

100 per cent fossil-free electricity in

its own operations.

Work in helping its customers re-

duce carbon emissions is also pro-

gressing well. Hitachi Energy has

launched the rst SF

6

-free high-

voltage products, under the name

EconiQ

TM

, which will make a “sig-

nicant contribution” to its custom-

ers’ sustainability journey.

Persson summarised: “With proj-

ects all over the world – in Europe,

the Middle East, Asia and the US, I

really feel there is momentum in the

market to make this [energy transi-

tion] happen.

“Our vision 2030 is to signi-

cantly contribute to the green energy

transition. And we will be doing

that by being more sustainable our-

selves, providing technology solu-

tions and continuing to invest in

innovation and people, as well as

innovating together with customers

and partners. Given our global

footprint, we believe we are well

positioned to do this.”

The Grid-eXpand

TM

range of modular and prefabricated grid connection solutions will make it

faster, simpler and more efcient to expand renewables power grid capacity

Though grid-forming control con-

cepts are not new to the industry,

they have received renewed attention

with the proliferation of inverter-

based resources such as wind and

solar in recent years. While the in-

dustry has made tremendous prog-

ress in the space and many vendors

are offering and have installed grid-

forming inverters, there is a lot more

work to be done around the develop-

ment of the technology, applications,

and the impact on operations and

transmission planning.

“A network with a high degree of

power electronics interfacing renew-

able generation will face problems

with low inertia. This requires a new

type of solution for stabilisation,”

said Persson. “We have SVC Light

®

,

which is an enhanced STATCOM

with built-in super-capacitors, that

has active power capability for syn-

thetic inertia, and fast frequency

regulation to support the grid in

terms of stability. This is the technol-

ogy of the future and we are now

offering this technology.”

He also said there is a need to de-

ploy more standard network solu-

tions on the AC side (the onshore

network) to upgrade old substations,

etc. Accordingly, the company has

introduced its Grid-eXpand

TM

range

of modular and prefabricated grid

connection solutions that make it

faster, simpler and more efcient to

expand power grid capacity.

Grid-eXpand

TM

comprises a com-

prehensive range of air-insulated and

gas-insulated grid connections that

cover the most frequently used grid

voltages worldwide. Grid-eXpand

TM

solutions are engineered, assembled

and factory-tested by Hitachi Energy

before delivery, ready for speedy and

easy energisation on-site while re-

ducing site-based construction risks.

The modules are available in con-

tainers, on skids or trailers for perma-

nent or mobile deployment, in kits for

gas-insulated solutions, and with

complete power collection and grid

connection packages for offshore

wind farms and solar parks. Site in-

stallation is up to 40 per cent faster,

the footprint up to 60 per cent smaller

and civil work up to 70 per cent lower

in costs than for conventionally built

grid connections, which require ex-

tensive construction work and equip-

ment assembly on-site.

Crucially for many of its custom-

ers, Hitachi Energy says the solutions

can be tailored to meet specic needs

and grid code requirements.

“It’s an important innovation,” ex-

plained Persson. “In the traditional

hitachienergy.com

Visit us at the

CIGRE Paris Session 2022

Level 2, Booth 232

Palais des Congres de Paris,

Paris, France, from August 28

to September 2, 2022

Advancing a sustainable

energy future for all

We are advancing the world’s energy system to be more

sustainable, flexible and secure.

As the pioneering technology leader, we collaborate with

customers and partners to enable a sustainable energy

future – for today’s generations and those to come.

data-driven skills. Building the net

zero workforce and skills can provide

opportunities for both public and pri-

vate sectors, some of which could

come from bringing in external skill-

sets coming from startups

The AWS Clean Energy Accelerator

2.0 programme was set up to boost

growth of clean energy innovators

and encourage collaboration between

startups and global energy companies,

to co-create solutions to tackle climate

change, while building skills for the

future. It encourages open innovation,

an entrepreneurial culture, and fresh

thinking – helping both startups and

traditional companies realise the value

in learning from each other. It’s about

having a broader perspective and

thinking outside of your everyday

bubbles to really champion change.

By providing mentorship and a co-

innovation opportunity for mature

startups, the accelerator programme

is part of AWS’s efforts to help ad-

dress the innovation gap. Lyft, Stripe,

Slack, Klarna, Grab, Netix, Airbnb

and DoorDash are among the suc-

cessful companies who have built

their businesses on AWS, and then

gone on to help dene their industries.

Similarly, the aspiration is to em-

power the clean energy technology

startups of today so that they can

shape the evolution of the wider en-

ergy sector. In much the same way

that technologies such as quantum

computing and articial intelligence

that were previously only accessible

to academics and researchers, but are

now household terms, clean energy

technology development is now

within reach for almost anyone with a

passion for making energy cleaner,

more affordable and crucially, more

accessible. Cloud computing has

played a key role in this, owing in part

to its impact on speeding up experi-

mentation and democratising machine

learning. Just like the unicorn startups

before them, the AWS Clean Energy

Accelerator is helping the innovators

of today dene the clean energy in-

dustry of the future.

The startups from AWS’s inaugural

accelerator are already making an

impact in their respective elds. No-

tably, e-Zinc, which is advancing

long-duration battery storage by

storing electrical energy within zinc

metal, creating hundreds of hours of

energy capacity. Another startup,

Persefoni, is furthering intelligent

carbon footprint management and

sustainability reporting with their

dedicated reporting platform. The

second cohort of selected startups,

announced in May 2022, are well on

T

he greatest promise of startups

has conventionally been the

promise of innovation – the

capacity to invent and reinvent, chip-

ping away the status quo incremen-

tally or sometimes through sheer

disruption. However, there is a reali-

sation amongst the more traditional

energy players today that innovation

is only part of the equation and that

even greater collaboration with start-

ups may hold the key to bridging the

CO

2

emission reductions gap to meet

global net zero 2050 targets.

According to the International En-

ergy Agency (IEA), to meet 2050

ambitions, a 40-50 per cent reduction

in carbon emissions will need to come

from technologies not yet commer-

cially deployed, especially in sectors

where emissions are particularly

challenging to reduce, such as ship-

ping, aviation, chemicals and heavy

industry. With the energy transition

advancing, the new landscape emerg-

ing is one where energy systems of

the future will be more decentralised,

more complex, and rely on greater

interactions with partners in the sys-

tem. Fresh thinking is a key output of

clean energy partnerships, in addition

to a freer ow of data.

Energy players are starting to look

to startups more than ever as one way

to overcome this challenge, realising

that co-innovation and collaboration

will be key. An example of this shift

in behaviour towards the impact of

clean energy startups is the signicant

increase in investment over the last

year alone. In Europe, more early and

mid-stage venture capital funding

owed to clean energy startups in the

rst half of 2021 than in 2019 and

2020 combined. Public spending also

ramped up, with markets for clean

technology innovation receiving a

global boost, triggered by t for 2050

ambitions, COP26 commitments, and

climate agenda of the US Ination

Reduction Act.

The digital tness of these startups

has also been a sought after core ca-

pability for energy companies. Most

clean energy startups are cloud-native

from inception, understanding the

benets from a cost perspective but

also how the cloud helps achieve

scalability, speed, agility, security and

automation. Fostering innovation

with startups that have digital hard-

wired into their DNA provides an

opportunity for bigger energy compa-

nies to make greater strides forward,

faster. As the landscape shifts, a new

ecosystem develops and an explosion

of data continues, the ability to re-

spond to this and be digitally smart is

more important than ever.

There is also a realisation of the

economic value these partnerships

can bring. It’s estimated that success-

ful partnerships in the pursuit of net

zero could create a market for clean

energy technologies worth over $1

trillion a year by 2050 with the devel-

opment of hydrogen electrolysers and

fuelling, wind turbines, solar panels,

long duration energy storage, carbon

tracking tech, and advanced materi-

als. Exposure to innovating startups

in these spaces is crucial to competi-

tively participating in this market.

Some startups already making an

impact include Ionomr and E-zinc

(Canada), Ethosgen, Persefoni, Utility

Global, Power to Hydrogen, Shifted

Energy, Urban Electric Power, Cem-

vita Factory, Uprise and WindESCO

(USA), SmartPulse (Turkey), Flexid-

ao, Barbara ioT and Rated Power

(Spain),SmartHelio (Switzerland),

Hybrid Greentech (Denmark) Sunai

(Chile), SwitchDin and UPowr (Aus-

tralia), and Hydro Wind Energy

(UAE), to name a few.

Advancing clean energy will also

require re-skilling along two dimen-

sions: what needs to be learned; and

who is learning. There is a skills gap

to sustain the rate of growth and in-

novation by 2030 and beyond – par-

ticularly when it comes to digital and

their way to leveraging the AWS

Clean Energy Accelerator for greater

collaboration and industry-shaping

innovation.

The competitiveness of startups is

also a draw. This is not just down to

how they manage to creatively ad-

dress key industry topics and chal-

lenges, it’s also embedded in how

these young rms subvert traditional

organisational structures. Tackling a

problem with a willingness to experi-

ment and taking risks lies at the core

of innovation.

One example is Octopus Energy, a

‘digital-rst company’ that provides

millions of households in the UK with

clean, green energy. Octopus Energy

uses the breadth and depth of AWS

services, including data storage, to

build insights on its customer service

platform, Kraken. These insights are

helping the organisation to understand

energy consumption rates across the

business, down to individual house-

holds. To do this, Octopus Energy

trains neural networks on billions of

rows of smart meter data, looking at

energy consumption at different times

of the day. These insights can then be

used to predict energy use across

Octopus Energy’s network and in-

form when it buys energy from the

wholesale market.

Achieving net zero carbon goals is

simply not a journey that can be taken

alone. This journey will require work-

ing effectively with innovators from

outside bigger organisations to bring

both an unbiased perspective and

fresh ideas.

Another output of collaboration is

building strategic organisational ca-

pabilities. While mentoring and sup-

porting startups to scale their com-

mercial models, bigger organisations’

partnership with startups will require

working effectively with innovators

from within to bring the startups’ new

skills into the organisation. It’s crucial

to understand startups’ procurement

frameworks and their pace of work,

and to learn from them along the way.

No matter the framework, gaining

competitive advantage in this new era

of energy is unquestionably going to

be a tall order for organisations.

Strategically partnering with startups,

supporting their growth while learn-

ing how to work with them and from

them, will continue to be a promising

way of gaining access to, and expedit-

ing, the game-changing clean energy

solutions the world needs to achieve

net zero emissions.

Hassane Kassouf is Head of Innova-

tion Programs at AWS Energy.

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2022

Industry Perspective

12

Strategic collaboration and co-innovation between energy companies and emerging startups is key to the energy

sector’s future and achieving net zero goals. AWS Energy’s Hassane Kassouf explains why.

Startup support is key to

Startup support is key to

unlocking clean energy

unlocking clean energy

innovation

innovation

Kassouf: there is also a

realisation of the economic

value these partnerships can

bring

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2022

13

Benet from a 10% discount on the 3-Day onsite ticket:

EITIMES10

discount code

Access to all Summit Conference sessions

Access to all networking sessions

Access to approved speaker presentations post event

Interact & Schedule meetings with pass holders via Jublia

* Free for Utilities & IPPs only

Your Conference Delegate Pass*

will give you premium access to:

enlitasia

enlit-asia @Enlit_Asia

enlit-asia.com

info@enlit-asia.com

co-located with :

FORMERLY:

Accelerating ASEAN’s Energy Transition to Achieve Carbon Neutrality

REGISTER HERE

20-22

September

2022

BITEC, Bangkok, Thailand

Power

Generation

Digital

Transformation

Energy

Transformation

Energy

Storage

Solar Smart

Energy

Transmission &

Distribution

Renewables Hydrogen

KEY TOPICS INCLUDE:

Meet our Summit Speakers

Jimmy Khoo

CEO,

Powergrid, Singapore Power

Aqil Jamal

Chief Technologist Carbon

Management,

Saudi Aramco

Frank Thiel

Managing Director,

Quezon Power (Philippines),

Limited Co.

Dato' Indera Ir.

Baharin Bin Din

President and Chief

Executive Officer,

TNB Malaysia

Mochamad Soleh

Head of Research, Innovation

& Knowledge Management,

PT. Indonesia Power Head

Office

Celso Caballero

Coal Business Unit President

and COO,

Aboitiz Power

13 & 14 SEPTEMBER

THE EGG BRUSSELS AND ONLINE

Register now!

12 - 13 OCT | ABERDEEN

EVENT PARTNERS

HEADLINE SPONSOR |

REGISTER

NOW

2022

2.29x104 TWh. Meanwhile, deployed