www.teitimes.com

August 2022 • Volume 15 • No 6 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Collaboration is key to solving the

issues facing offshore wind expansion.

Page 13

Special Technology

Supplement

Offshore collaborations

Delivering a stable energy

transition.

News In Brief

Supreme Court sets new

limits on action of EPA

The US Supreme Court has limited

the Environmental Protection

Agency’s ability to regulate carbon

emissions from existing power

plants.

Page 4

ETS will support Australia’s

emissions reduction goals

Australia’s new Labor government

will launch an emissions trading

scheme in 2023.

Page 5

EU taxonomy opposed

as Ukraine invasion puts

pressure on gas

The EU’s attempt to classify

energy investments in a so-called

‘taxonomy’ that makes it clear

which are ‘climate-friendly’ for the

purposes of investment is set to face

a legal challenge.

Page 7

‘Quick and cheap’

renewables key to energy

and climate solutions

As the cost of renewables continued

to fall last year, solar and wind

power additions in 2021 are

estimated to save $55 billion from

global energy costs in 2022.

Page 8

EDF to be nationalised as

France bets on nuclear for

energy security

The French government is to buy-

out the remaining shares in EDF that

it does not already own for the sum

of €9.7 billion in a move to facilitate

huge investment in nuclear power.

Page 9

Nuclear could but won’t

solve Japan’s green energy

plight

Japan is looking to nuclear to tackle

the energy crisis and at the same

time decarbonise its economy. But

with public opinion likely to remain

sceptical post-Fukushima, it is

unlikely that nuclear will solve its

problems, says Joseph Jacobelli.

Page 14

Will the gas crisis plunge the

EU into recession?

A full stop to Russian gas could

plunge Europe into a full-blown

recession, according ING’s team of

macroeconomists. Therefore, trying

to avoid it by jointly coming up with

credible demand reduction plans is

crucial.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

With the real possibility of a complete halt in Russian gas, EU member countries have

struck a deal to reduce gas consumption. The agreement, however, comes as individual

governments plan a temporary but worrying return to coal and nuclear. Junior isles

High energy prices slow global electricity demand

THE ENERGY INDUSTRY

TIMES

Final Word

Letting them eat cake

is not an option,

says Junior Isles.

Page 16

EU ministers have agreed a deal to

reduce gas consumption in the face of

a looming energy crisis this winter but

there are concerns over several coun-

tries reverting to coal red power

generation as the fall-out from Rus-

sia’s war in Ukraine hits EU energy

supplies.

Late last month the EU’s 27 minis-

ters compromised on a deal, pledging

to reduce gas by 15 per cent on a vol-

untary basis but with a long list of opt-

outs should the target have to be made

binding. A week before the deal, the

European Commission faced broad

backlash after suggesting that it would

demand a blanket 15 per cent cut in

gas if need be.

Now exemptions are included for

island states such as Malta, Cyprus

and Ireland that are not directly con-

nected to the European grid, for

states that are heavily reliant on gas

for electricity and for countries that

are exporting gas at 90 per cent of

their total capacity to other member

states. The amount of gas in storage

and demand reductions already

achieved should also be taken into

account, drafts of the nal text said.

The International Energy Agency

(IEA) has been warning for many

months of what it is calling “the rst

truly global energy crisis” in history,

noting that the situation is especially

perilous in Europe.

Fatih Birol, Executive Director of

the IEA, recently wrote in an edito-

rial: “The gas crisis in Europe has

been building for a while, and Rus-

sia’s role in it has been clear from the

beginning. In September 2021 – ve

months before Russia’s invasion of

Ukraine – the IEA pointed out that

Russia was preventing a signicant

amount of gas from reaching Europe.

We raised the alarm further in Janu-

ary, highlighting how Russia’s large

and unjustied reductions in supplies

to Europe were creating articial

tightness in markets and driving up

prices at exactly the same time as ten-

sions were rising over Ukraine.”

Following the invasion on February

24, the IEA released its ‘10-Point Plan

to Reduce the European Union’s Reli-

ance on Russian Natural Gas’, setting

out the practical actions Europe could

take.

One of the IEA’s suggestions is to

minimise gas use in the power sector.

It said this could be done by temporar-

ily increasing coal and oil red

Continued on Page 2

The world’s electricity demand growth

is slowing sharply in 2022 from its

strong recovery the previous year as

economic growth weakens and energy

prices soar following Russia’s inva-

sion of Ukraine, according to the In-

ternational Energy Agency’s (IEA)

latest ‘Electricity Market Report’.

Global electricity demand is expect-

ed to grow by 2.4 per cent in 2022

after last year’s 6 per cent increase,

bringing it in line with its average

growth rate over the ve years prior to

the Covid-19 pandemic, the new re-

port says. While electricity demand is

currently expected to continue on a

similar growth path into 2023, the

outlook is clouded by economic tur-

bulence and uncertainty over how

fuel prices could impact the genera-

tion mix.

Encouragingly, the report noted that

renewable power generation is grow-

ing faster than overall demand in

2022, leading to a slight decline in

global power sector CO

2

emissions

despite rising coal use in Europe amid

the gas crisis. Strong capacity addi-

tions are set to push up global renew-

able power generation by more than

10 per cent in 2022, displacing some

fossil fuel generation.

Despite nuclear’s 3 per cent decline,

low-carbon generation is set to rise by

7 per cent overall, leading to a 1 per

cent drop in total fossil fuel-based

generation. As a result, carbon diox-

ide emissions from the global electric-

ity sector are set to decline this year

from the all-time high they reached in

2021, albeit by less than 1 per cent.

In the rst half of 2022, average

natural gas prices in Europe were four

times as high as in the same period in

2021 while coal prices were more

than three times as high, resulting in

wholesale electricity prices more than

tripling in many markets. The IEA’s

price index for major global electric-

ity wholesale markets reached levels

that were twice the rst-half average

of the 2016-2021 period.

Due to high gas prices and supply

constraints, coal is replacing natural

gas for power generation in markets

with spare coal plant capacity, par-

ticularly in European countries seek-

ing to end their reliance on Russian

gas imports.

In its latest ‘Gas Market Report’,

the IEA said high gas prices and sup-

ply disruptions following the inva-

sion of Ukraine have led to down-

ward revision of forecasts for gas use

and casts doubt on the fuel’s pros-

pects in energy transitions.

Prospects of a rapid energy transi-

tion have been called into question in

a recent report. The report from the

International Institute for Sustainable

Development (IISD), Oil Change In-

ternational (OCI), and Tearfund

warns of two major threats to imple-

menting the COP 26 Statement on

International Public Support for the

Clean Energy Transition on time.

The report says that some signato-

ries of the COP26 statement, known

as the Glasgow Statement, have sig-

nalled their intention to allow contin-

ued large-scale overseas support to

gas, despite their pledge. The report

added: “This risk has increased since

the war in Ukraine as countries look

to replace the Russian fossil fuel sup-

ply. Yet, this support is incompatible

with the agreed 1.5°C global warming

limit, and research shows that clean

alternatives are better suited to serve

energy security and clean develop-

ment pathways.”

If signatories’ development nance

institutions, export credit agencies,

and government departments fully re-

direct their $28 billion a year in over-

seas public nance for oil and gas,

they would more than double their

international clean energy nance,

from $18 billion a year to $46 billion,

the report nds.

EU moves to tackle looming gas crunch but

EU moves to tackle looming gas crunch but

concerns remain as countries shift back to coal

concerns remain as countries shift back to coal

EU ministers show solidarity in gas crisis

THE ENERGY INDUSTRY TIMES - AUGUST 2022

2

Junior Isles

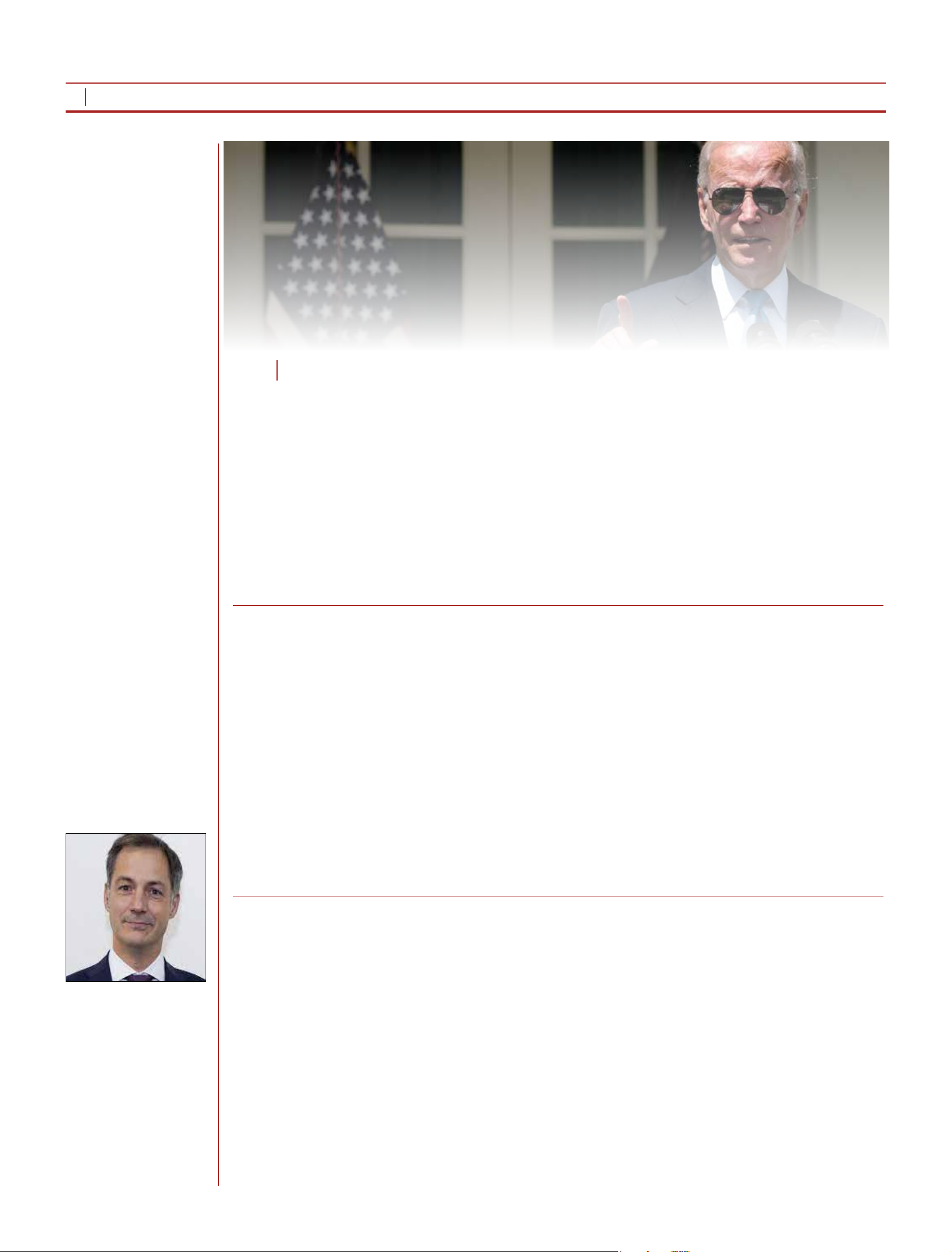

US President Joe Biden is said to be

close to declaring a climate emer-

gency in an effort to advance his clean

energy agenda. The idea comes as the

country experiences record tempera-

tures and follows a decision by the US

Supreme court that curbs the powers

of the Environmental Protection

Agency (EPA).

Speaking to The New York Times in

late July, John Kerry, the US special

envoy for climate, said the President

was “very close” declaring a national

climate emergency and that “it’s a mat-

ter of timing”.

Secretary Kerry said that within the

administration, discussions were about

when the declaration should be an-

nounced, “rather than if it should be

done”, The New York Times reported.

The remarks came while wildres

raged through California, and as

Biden announced more climate-relat-

ed measures including offshore wind

development in the Gulf of Mexico

and $2.3 billion to help vulnerable

communities deal with extreme heat.

Texas saw record high temperatures

in June and has been experiencing

searing temperatures throughout the

summer.

The $2.3 billion formula grant pro-

gramme is designed to strengthen and

modernise America’s power grid

against wildres, extreme weather,

and other natural disasters exacer-

bated by the climate crisis. Power

outages from severe weather have

doubled over the past two decades

across the US and the frequency and

length of time for power failures has

reached their highest levels since reli-

ability tracking began in 2013.

Speaking in Somerset, Massachu-

setts, at the site of a defunct coal red

power plant being transformed into a

manufacturing hub for New England’s

offshore wind industry, Biden prom-

ised that more aggressive climate ac-

tion was coming.

“This is an emergency and I will look

at it that way,” Biden said but he

stopped short of declaring a national

emergency. Addressing the question

why he stopped short of describing the

situation as a climate emergency,

Biden said: “Because I’m running into

traps on the totality of the authority I

have. I will make that decision soon.”

A national emergency declaration

would give the President power to stop

fossil fuel projects at the federal level,

and rapidly shift to clean energy in

order to carbon emissions without

input from Congress. But the move

would also likely face a raft of legal

challenges from Republican-led

states.

At the end of June the US Supreme

Court limited the ability of the EPA to

limit greenhouse gas emissions from

power plants in a landmark ruling that

dealt a blow to the Biden administra-

tion’s ght against climate change.

The ruling leaves the Biden adminis-

tration dependent on passing congres-

sional legislation if it wants to imple-

ment sweeping regulations to curb

emissions.

More than 1200 environmental and

climate groups have reiterated calls for

greater action on climate change – not-

ing that none of the plans announced

by Biden would do much to cut the

fossil fuel use that is largely respon-

sible for global warming.

generation while accelerating de-

ployment of low-carbon sources,

including nuclear power where it is

politically acceptable and techni-

cally feasible.

It is a move that several countries

have made, but one that had ini-

tially been met with caution by the

Commission. The risk of a total gas

supply cut-off by Russia has since,

however, led the Commission to

draw up a contingency plan recom-

mending that nuclear and coal red

plants be kept in operation.

“We have to make sure that we use

this crisis to move forward and not

to have a backsliding on the dirty

fossil fuels,” European Commis-

sion chief Ursula von der Leyen said

in late June. “It’s a ne line and it is

not determined whether we are go-

ing to take the right turn.”

Neil Makaroff, of Climate Action

Network, an umbrella organisation

for environmental groups, called

turning back to coal “a bad choice”

with structural consequences.

France, the Netherlands, Austria

and Germany have all announced

plans to keep coal plants running or

re-open previously mothballed

plants.

Notably, last month Germany’s

government passed emergency leg-

islation to keep its 10 000 MW of

coal red power plants operational

but says it still aimed to close its

coal plants by 2030. The country

will also accelerate its so-called

Easter package, in which it planned

to speed up the installation of renew-

able energies and self-consumption.

Germany is also reconsidering its

position of just a couple months

ago when it concluded it was not

possible to delay the phase-out of

its nuclear plants. It is now prepar-

ing a stress test for its electricity

system in order to nd out whether

it will be necessary to resort to the

three remaining nuclear power

plants it had planned to shut down

this autumn.

Similarly, Belgium is also plan-

ning to keep its reactors running. In

late July, the Belgian federal gov-

ernment and the French group Engie

reached an agreement in principle

to extend the operation of two nu-

clear reactors in Belgium for a pe-

riod of 10 years in order to guaran-

tee energy supply.

“A rst agreement in principle has

been reached between the Belgian

state and Engie on the extension of

the Doel 4 and Tihange 3 nuclear

power plants. The Belgian govern-

ment assumes its responsibilities so

that our country can control its en-

ergy supply,” Belgian Prime Minis-

ter Alexander De Croo announced

on his ofcial Twitter account.

n The Ukrainian government an-

nounced that it has ofcially com-

pleted its synchronisation with the

continental energy grid of the Eu-

ropean Union – well ahead of the

original 2023 schedule.

Continued from Page 1

Energy demand and emissions

bounced back to around pre-pandem-

ic levels in 2021, reversing the tem-

porary reduction in 2020 resulting

from the Covid-19 pandemic, accord-

ing to the latest bp ‘Statistical Review

of World Energy’.

Data from the 71st edition of the Re-

view showed that global primary en-

ergy in 2021 increased by almost 6 per

cent, more than reversing the sharp fall

in energy consumption in 2020 as

much of the world locked down. Pri-

mary energy use in 2021 is estimated

to be more than 1 per cent above its

2019 level.

Commenting on the Review, Spen-

cer Dale, bp’s Chief Economist, said:

“In many ways, this sharp rebound in

energy demand is a sign of global suc-

cess, driven by a rapid recovery in

economic activity as the widespread

distribution of effective vaccines al-

lowed for an easing in Covid-19 re-

strictions in many parts of the world

and a return to our everyday lives.”

He noted, however that it also high-

lights that the pronounced dip in carbon

emissions in 2020 was only temporary:

carbon equivalent emissions from en-

ergy (including methane), industrial

processes, and aring increased by 5.7

per cent last year. Smoothing through

the impact of the pandemic, it said

emissions were broadly unchanged

over the past two years.

Encouragingly, the report found re-

newable energy, led by wind and solar

power, continued to grow strongly and

now accounts for 13 per cent of total

power generation. Renewable genera-

tion increased by almost 17 per cent in

2021 and accounted for over half of the

increase in global power generation

over the past two years.

Solar and wind capacity continued to

grow rapidly in 2021, increasing by

226 GW, close to the record increase

of 236 GW seen in 2020. China re-

mained the main driver of solar and

wind capacity growth last year, ac-

counting for about 36 per cent and 40

per cent of the global capacity addi-

tions, respectively.

Meanwhile, hydropower generation

decreased by around 1.4 per cent in

2021, the rst fall since 2015. In con-

trast, nuclear generation increased by

4.2 per cent – the strongest increase

since 2004 – led by China.

Coal remained the dominant fuel for

power generation in 2021, with its

share increasing to 36 per cent, up

from 35.1 per cent in 2020.

Natural gas in power generation in-

creased by 2.6 per cent in 2021, al-

though its share decreased from 23.7

per cent in 2020 to 22.9 per cent in

2021.

The report also noted that global en-

ergy prices increased sharply in 2021,

with the most pronounced increase be-

ing in the price of natural gas. It said

natural gas prices quadrupled in Eu-

rope, tripled in Asia, and doubled in

the US.

The UK’s exposure to volatile global

gas markets and energy costs for con-

sumers could be radically reduced in

the long term, if a recently launched

review leads to a transformation of

Britain’s electricity market design.

In July the government launched the

Review of Electricity Market Ar-

rangements (REMA) in a move to

tackle higher global energy costs,

boost energy security and transition

to a cleaner energy system.

With electricity demand set to at

least double over the next 13 years,

REMA will focus on establishing a

t-for-purpose market design, identi-

fying and implementing the reforms

needed to GB electricity markets.

The consultation, which will run

until October 10, will fundamentally

explore ways of updating the existing

pricing system to further reect the

rise in cheaper renewable electricity.

This could have a direct impact on

reducing energy costs, ensuring con-

sumers reap the full benets of the

UK’s abundant wind energy resourc-

es.

Some of the changes being consult-

ed on include:

n introducing incentives for consum-

ers to draw energy from the grid at

cheaper rates when demand is low or

it is particularly sunny and windy, sav-

ing households money with cheaper

rates

n reforming the capacity market so

that it increases the participation of

low carbon exibility technologies,

such as electricity storage, that enable

a cleaner, lower cost system

n de-coupling costly global fossil fuel

prices from electricity produced by

cheaper renewables, a step to help

ensure consumers are seeing cheaper

prices as a result of lower-cost clean

energy sources

n varying prices according to location

and proximity to power generation

assets, such as wind farms.

Through this initial consultation, the

UK government will engage exten-

sively with the sector to develop and

assess options for reform. Following

this consultation, the department will

further develop, rene and narrow

down options for reform during 2022-

2023 before delivering proposed mar-

ket reforms.

It is understood that some potential

changes within the review could be

implemented as soon as the middle of

next year.

Business and Energy Secretary

Kwasi Kwarteng said: “In what could

be the biggest electricity market shake

up in decades, I am condent that this

review will signicantly enhance

GB’s energy security and supply for

generations to come.”

Deputy Director at Energy UK,

Adam Berman, said: “With the cost

of energy reaching unprecedented

levels, it’s right and timely that the

government reviews how to provide

the most efcient market arrange-

ments to support decarbonisation – so

that it reduces bills in the long term.”

The current market design, wherein

gas sets electricity price has seen en-

ergy prices soar due to spiralling

global gas prices, and resulted in doz-

ens of energy suppliers going out of

business.

Headline News

Energy demand and emissions bounce back, says

Energy demand and emissions bounce back, says

bp Statistical Review

bp Statistical Review

UK eyes biggest market reform in a generation as

UK eyes biggest market reform in a generation as

energy costs bite

energy costs bite

Biden mulls declaring

Biden mulls declaring

climate emergency

climate emergency

following EPA court ruling

following EPA court ruling

De Croo has moved to extend

nuclear plant life in Belgium

n Biden announces offshore wind and grid strengthening plans

n Stops short of declaring national emergency as temperatures soar

THE ENERGY INDUSTRY TIMES - AUGUST 2022

3

13 & 14 SEPTEMBER

THE EGG BRUSSELS AND ONLINE

Register now!

Benet from a 10% discount on the 3-Day onsite ticket:

EITIMES10

discount code

Registration is now open!

Co-Hosts

The global energy landscape is changing.

Join 38,000+ energy professionals and 750+

international exhibitors in Milan from 5-8

September at Gastech 2022, the world’s largest

meeting place for the global natural gas, LNG,

hydrogen, and low-carbon solutions industries.

Activate your complimentary visitor pass today

or register as a delegate to attend the Gastech

Strategic, Technical & Commercial, and Hydrogen

Conferences.

gastechevent.com

@gastechevent #Gastech

Host VenueHost Association Organised byUnder the patronage of

MINISTERO DELLA

TRANSIZIONE ECOLOGICA

Supported by

Ministry of Foreign Affairs

and International Cooperation

VISITOR PASS DELEGATE PASS

Visit register.gastechevent.com

Even Led advert 120x160.indd 2Even Led advert 120x160.indd 2 22/07/2022 12:3222/07/2022 12:32

co-located with :

FORMERLY:

Accelerating ASEAN’s Energy Transition to Achieve Carbon Neutrality

Key Topics Include:

Power

Generation

Digital

Transformation

Energy

Transformation

Energy

Storage

Solar Smart

Energy

Transmission &

Distribution

Renewables Hydrogen

20-22

September

2022

BITEC, Bangkok, Thailand

Your free Exhibition Visitor Pass

consists of:

• Access the exhibition halls

• Access all technical sessions at the

Knowledge Hubs

• Access to Initiate! in the exhibition

Meet-up with...

+300

Expert

Speakers

Knowledge Hubs located

in the exhibition floor

Free for all attendees

5

+350

Leading

Exhibitors

+70

Countries

Worldwide

+15,

000

Attendees

enlitasia

enlit-asia @Enlit_Asia

enlit-asia.com

info@enlit-asia.com

Janet Wood

The UK government has granted de-

velopment consent for the Sizewell

C 3.2 GW, twin-reactor nuclear pow-

er plant on the east coast. Although

the Sizewell C plant remains subject

to a nal investment decision, ex-

pected next year, the government it-

self has taken an option on part-own-

ership of the plant.

Sizewell C is expected to cost around

£20 billion in 2015 prices and would

be paid for through a surcharge on

customer energy bills as well as £1.7

billion of taxpayers’ money.

Tom Greatrex, Chief Executive of the

Nuclear Industry Association, said:

“This is a huge step forward for Brit-

ain’s energy security and net zero am-

bitions.” He added: “Sizewell C will

be one of the UK’s largest ever green

energy projects, and this decision sig-

nicantly strengthens the pipeline of

new nuclear capacity in Britain.” The

Sizewell C plant is a key part of the

UK government’s ambitious plans to

start work on eight nuclear reactors by

the end of the decade.

But the project still faces local op-

position. “Not only will we be looking

closely at appealing this decision, we’ll

continue to challenge every aspect of

Sizewell C because… it remains a bad

project and a very bad risk,” argued

Alison Downes of the Stop Sizewell C

campaign.

Meanwhile the government has

provided further nancial support for

nuclear, in the form of a new £75 mil-

lion fund to support domestic produc-

tion of nuclear fuel. The Nuclear Fuel

Fund will award grants to projects

that can increase the UK’s domestic

nuclear fuel sector.

The decision came as the UK un-

veiled the results of its latest auction

of so-called ‘contracts for difference’,

which offer 11 GW of green energy

projects a stable price for 15 years.

The contracts included 7 GW of off-

shore wind, which bid at lower prices

(£45/MWh) than solar and onshore

wind and ten onshore wind contracts

totalling 900 MW.

Ørsted, Vattenfall, and Scottish Pow-

er were among the winners of the off-

shore wind contracts. Kwasi Kwart-

eng, Business and Energy Secretary,

said: “The more cheap, clean power

we generated within our own borders,

the better protected we will be from

volatile gas prices that are pushing up

bills.”

The contracts for wind and solar proj-

ects would save £7 billion on electric-

ity costs under wholesale prices seen

during the current gas crisis, equivalent

to over £100 per home, analysis by the

Energy and Climate Intelligence Unit

found. Dr Simon Cran-McGreehin,

Head of Analysis at ECIU said: “To

keep bills low, these new wind farms

can’t come online soon enough.”

Work to build the NeuConnect inter-

connector will start this year, after a

consortium of more than 20 banks and

other investors reached nancial close

on the €2.8 billion investment.

The European Investment Bank

(EIB) will contribute up to €400 mil-

lion for the nancing of the European

part and will be joined by the UK In-

frastructure Bank and the Japan Bank

for International Cooperation.

The project will be the rst intercon-

nector between Germany and the

United Kingdom, facilitating electric-

ity trade between the European Union

and the GB markets. It is expected to

go into commercial operation in 2028.

The 750 km cable for the high-volt-

age direct current link will pass through

German, Dutch and British waters. It

will have a rated capacity of 1400 MW

and DC voltage of 525 kV. It will con-

nect to Tennet’s electricity network

near Fedderwarden and at the Isle of

Grain in the United Kingdom. Siemens

has been appointed as the contractor

for the converter stations, and Prys-

mian will manufacture and install the

cable.

EIB Vice-President Ambroise Fay-

olle, said: “This project is ground-

breaking for the energy transition, as

it makes it possible to use offshore

wind energy more efciently.”

EDP has installed a 5 MW oating

solar farm on a reservoir in Alqueva,

expected to provide 7.5 GWh annu-

ally – the second oating plant built in

Portugal, after EDP’s pilot project in

Alto Rabagão. It has 12 000 PV panels

occupying 4 hectares. It will be com-

bined with power from the hydroelec-

tric energy from the Alqueva dam and

a planned 1 MW battery.

Furthermore, EDP plans to install up

to 70 MW of oating PV.

“Floating solar technology, in which

EDP is a global pioneer, is a remark-

able leap forward in the expansion of

renewables and in accelerating the

decarbonisation process. And our hy-

bridisation strategy, by combining

water, sun, wind and storage, is clear-

ly a logical path,” commented Miguel

Stilwell d’Andrade, Chief Executive

of EDP.

Meanwhile RWE has commis-

sioned its rst oating project, with

over 13 000 solar panels totalling 6.1

MW at the Amer power plant in

Geertruidenberg, Netherlands on a

lake whose waters were once used as

cooling water. The power plant al-

ready has 0.5 MW of roof-mounted

PV and 2 MW of ground-mounted PV.

Roger Miesen, Chief Executive of

RWE Generation and Country Chair

for the Netherlands said: “With Solar

Park Amer we demonstrate that it is

possible to turn conventional asset sites

into landmark projects that promote

innovative solutions for a sustainable

electricity system.”

The EU has to act now if it is to meet

its 100 MW ocean energy deployment

target by 2025, according to a new

report by Ocean Energy Europe

(OEE).

The organisation highlighted new

developments being made in ocean

energy outside the bloc, such as rev-

enue support in the UK and Canada,

a €500 million package in the US, and

deployment in China’s Five-Year

Plan. The UK granted contracts for

difference to four tidal stream projects

in its auction earlier this year, having

‘ring-fenced’ a portion of funding for

ocean technologies.

OEE said Europe has not matched

the pace of other countries and risks

losing its competitive advantage. It

suggested an action plan focused on

improving the funding available to

ocean energy, making it easier to ac-

cess and improving coordination with

Member States, as promised in ear-

lier EU strategies.

That included leveraging pro-

grammes such as Horizon Europe to

get pilot farms in the water and EU

requirements for ocean energy proj-

ects in new National Energy & Cli-

mate Plans.

Remi Gruet, Chief Executive of

OEE, said: “Ocean energy targets in

the Offshore Strategy are exactly what

Europe needs right now – it’s clean and

home-grown, and can create hundreds

of thousands of jobs. But implementa-

tion is just as important. If Europe

wants to stay out in front, it needs to

act now.”

Janet Wood

The EU’s attempt to classify energy

investments in a so-called ‘taxonomy’

that makes it clear which are ‘climate-

friendly’ for the purposes of investment

are set to face legal challenge.

At issue is the inclusion of gas red

generation and nuclear as ‘green’ op-

tions, which have attracted opposi-

tion, for different reasons. The two

sources had already been the subject

of a year of debate within the EU over

their status, until the European Parlia-

ment passed the law establishing the

taxonomy.

The EU taxonomy does not ban in-

vestments in fuels that are not labelled

as green, but it incentivises investors

to choose projects within the taxono-

my, to ensure they would be classied

as ‘climate friendly’ to meet environ-

mental standards.

Now Austria is seeking support from

other European Union countries for a

legal challenge to the taxonomy. Aus-

trian climate minister Leonore Gew-

essler said: “We have several other

states who’ve been very critical of, and

very vocal also in their criticism, on

the delegated act. And so we will also

look for further allies in the lawsuit.”

It has already won backing for the chal-

lenge from Luxembourg.

Austria’s lawsuit will argue that nei-

ther fuel deserves a green label and also

question whether Brussels used the

correct law-making process.

Including gas in the taxonomy also

met opposition over the use of gas sup-

plies from Russia. Sandrine Dixson-

Declève, member of the Platform for

Sustainable Finance, said: “In light of

Russia’s invasion of Ukraine, it is lu-

dicrous that the EU continues to le-

gitimise gas as green as planned at the

start of the year. No credible institution

can sanction the Russian invasion of

Ukraine with one hand, and push ahead

with plans to incentivise investments

which include Russian fossil gas sup-

plies with the other.”

EU nancial services chief Mairead

McGuinness said the law would ensure

that investments in gas and nuclear met

“strict criteria”.

Meanwhile, the EU has tried to speed

up a reduction in gas use across the

bloc, recently gaining agreement to cut

gas use across the bloc by 15 per cent

this winter.

The EU Energy Council recently

agreed a revised Renewable Energy

Directive (RED) and Energy Ef-

ciency Directive which stress the need

to accelerate the deployment of home-

grown renewables in order to strength-

en EU’s energy security.

They agreed the expansion of renew-

ables and the linked expansion of on-

and offshore grid infrastructure in

Europe should be considered a matter

of “overarching public interest” and

“public safety”.

‘Climate friendly’

‘Climate friendly’

taxonomy opposed as

taxonomy opposed as

Ukraine invasion puts

Ukraine invasion puts

pressure on gas

pressure on gas

Work set to start

on GB-Germany

interconnector

EU must act to support

ocean renewables

Floating PV for Portugal and the Netherlands

UK set to invest in massive new

generation capacity

n Development consent for Sizewell C n Contracts for difference for 11 GW of renewables

n Austria plans to lead legal challenge

n

Bloc agrees short and long term measures to reduce gas use

THE ENERGY INDUSTRY TIMES - AUGUST 2022

7

Europe News

THE ENERGY INDUSTRY TIMES - AUGUST 2022

Special Technology Supplement

Delivering a stable energy

transition

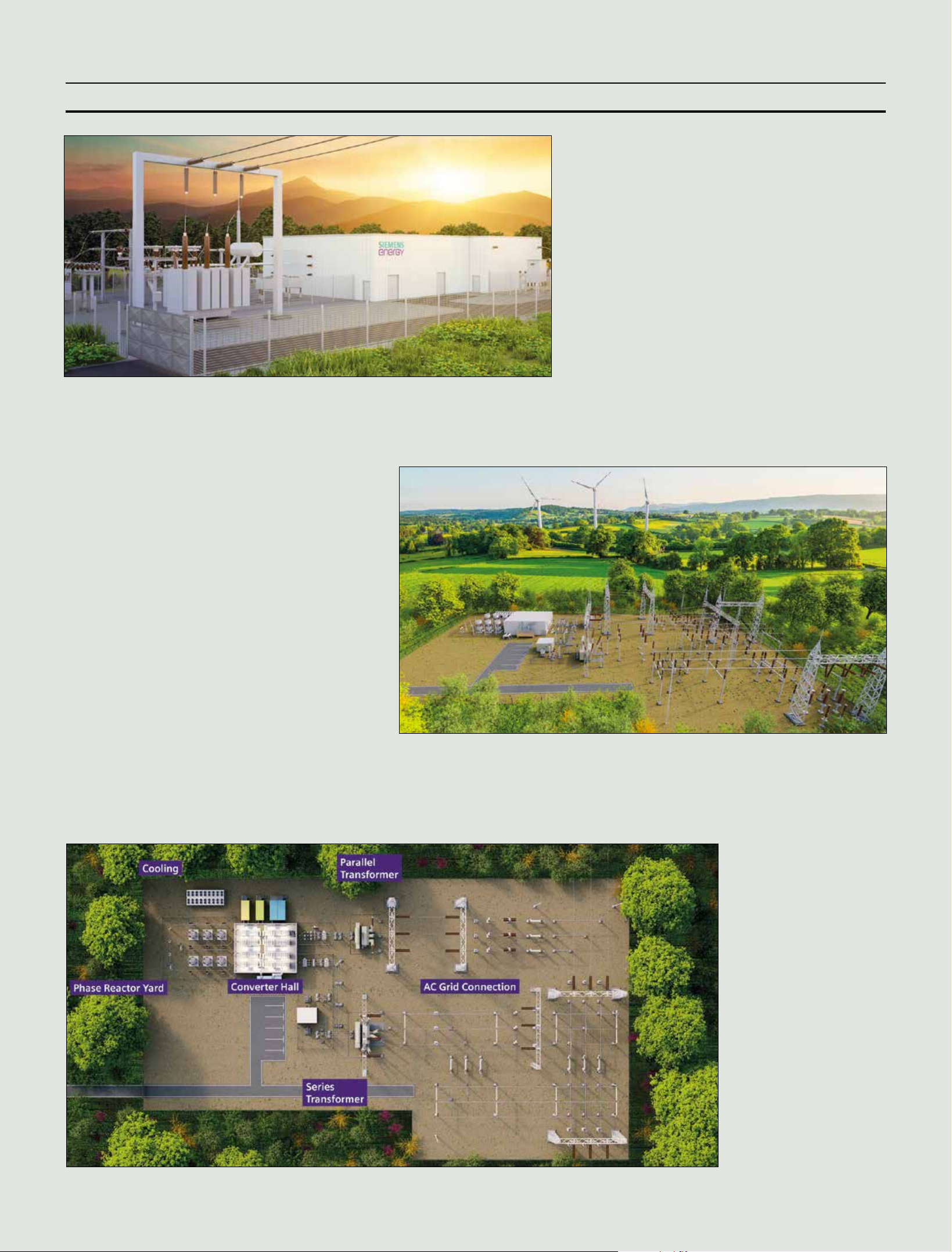

The retirement of large coal, gas and nuclear power plants, combined with the rapid rise of variable renewable

energy is making the operation of a stable transmission network increasingly difcult. Siemens Energy describes the

solutions that are available to network operators and offers a glimpse of some of the more advanced technologies it is

developing. Junior Isles

Flexible AC transmission system

(FACTS) devices.

Typical applications are in electric

power transmission, electric power

distribution, electrical networks of

heavy industrial plants, arc furnaces,

high-speed railway systems and other

electric systems, where voltage sta-

bility and power quality are of the

utmost importance. STATCOMs

have been deployed in hundreds of

applications around the world and

according to Siemens Energy, de-

mand is increasing every year.

The technology is based on voltage

source converters (VSCs) with

semiconductor valves in a modular

multi-level conguration. The

STATCOM design and fast response

makes the technology very conve-

nient for maintaining voltage during

network faults (as STATCOMs are

capable of providing fast fault cur-

rent injection limited to the rated

current), enhancing short-term volt-

age stability. In addition, STAT-

COMs can provide power factor

correction, reactive power control,

damping of low-frequency power

oscillations (usually by means of re-

active power modulation), active

harmonic ltering, icker mitigation

and power quality improvements.

Like STATCOMS, the need for

synchronous condensers (sometimes

called a rotating phase shifter) has

also increased signicantly over the

E

urope, and indeed many parts of

the world, is at a crossroads. As

the electricity sector works its

way through the energy transition, grid

operators are faced with one

overarching challenge: how to keep

power grids stable as it shifts from a

centralised, fossil fuel-based market to

one that is increasingly underpinned

by variable renewable generation in a

more distributed network.

As Europe faces searing tempera-

tures and the crisis in Ukraine deep-

ens, never has it been clearer that

there is a need to accelerate the de-

ployment of wind and solar to address

the twin threats of climate change and

the need for energy independence. Yet

without an adequate electricity net-

work to deliver renewable energy to

homes, businesses, and EV (electric

vehicle) charging stations, the green

transition will be ineffective.

Speaking at a conference co-organ-

ised by E.DSO and ENTSO-E – the

organisations representing Europe’s

distribution system operators (DSOs)

and transmission system operators

(TSOs) – Sonya Twohig, ENTSO-E

Secretary General, said: “Innovation

in power system distribution and

transmission and its fast uptake is key

to Europe’s energy transition. The

needs for exibility will ramp up to

ensure the stability and security of a

power system with an increasing

share of variable renewable energy

sources.”

It is an area that Siemens Energy

also agrees is crucial. The company

noted that while grid expansion must

be accelerated in order to meet future

electricity demand, strengthen resil-

ience and ensure security of supply,

the ever-growing amount of decen-

tralised and uctuating renewables

poses new challenges for grid stability.

It said that the expansion not only

calls for new high voltage direct cur-

rent (HVDC) lines, but also requires

investment in grid stabilisation.

Hauke Jürgensen, Senior Vice

President High-Voltage Grids at Sie-

mens Energy, explained: “Looking at

it from the transmission side, it’s clear

that less fossil-based generation, i.e.

rotating equipment in the form of

turbines on the grid, and more volatile

wind and solar leads to grid instability.

This means you need solutions to re-

place the missing rotating equipment

that provides inertia and ensures fre-

quency stability.”

Volker Hild, Siemens Energy’s

Vice President Grid Stabilisation,

added: “More and more power plants

are being retired – coal obviously, as

well as nuclear in parts of Europe

and maybe gas later on. With all

these retired power plants in Europe,

as well as North America, this means

inertia is missing and therefore

short-circuit power is missing. Solar

and wind farms can hardly, if at all,

provide this inertia and short-circuit

power. It’s a problem for the overall

stability of the network, and this is

why we are seeing a big demand for

grid stabilising solutions.”

Grid operators are seeing these in-

stabilities in the form of voltage uc-

tuations, frequency deviations and

situations where they are operating in

contingency or emergency modes for

much longer periods of time.

To counter these problems, which

can manifest at various voltage levels

in the network, Siemens Energy rec-

ommends a top-down approach in

terms of where to target stabilisation.

Hild explains that, if the necessary

stability and interconnection can be

provided at the high voltage level, it

will also help stabilise the network at

the lower voltage levels.

“If you try to provide stabilisation

at the lower voltage level, it will

have less of an effect at the higher

voltage level. So it is more or less a

top-down approach. There are needs

on the distribution side but because it

can be done easier and with less in-

vestment, there is less public focus

on it,” he said.

Transmission grid stabilisation

technologies are essentially split into

two main categories: Static Synchro-

nous Compensator (STATCOM) de-

vices and synchronous condensers.

STATCOM devices are essentially

based on power electronics, which

allow voltage to be adjusted in the

network within milliseconds by in-

jecting or absorbing reactive power.

The technology is categorised under

In a rapidly changing energy world, grid operators need a quick solution to respond to

uctuations when power plants are shut down and renewables are added

Jürgensen: You need solutions to replace the missing rotating

equipment that provides inertia and ensures frequency stability

Essentially, it is a STATCOM that

includes a large number of super-ca-

pacitors. A super-capacitor is a high-

density energy storage device that

typically stores 10 to 100 times more

energy per unit volume or mass than

electrolytic capacitors. It can accept

and deliver charge much faster than

batteries, and tolerates many more

charge and discharge cycles than re-

chargeable batteries.

The frequency stabiliser will allow

operators to absorb or inject reactive

power for voltage stabilisation like a

STATCOM. In addition, however, if

the network frequency is dropping

due to high loads or large uctuations

due to a solar or wind farm dropping

out, the SVC PLUS FS recognises the

frequency deviation. In the case of a

frequency drop, it injects the active

power stored in the super-capacitors

within seconds. Such an injection of

active power will have a stabilising

effect on the frequency.

Hild added: “The reason we are

doing this with super-capacitors and

not with batteries is because frequency

support needs a high amount of active

power in a very short, limited time.

Unlike batteries, super-capacitors can

charge or discharge within seconds.

Batteries are used for storing energy,

which is then delivered in minutes or

hours. So, if it’s an imminent network

contingency case where there is a

major problem, you need very fast

reacting devices. The utility we have

sold this to in Germany has a strong

need for that frequency support and

other TSOs in Germany have already

identied a large number of installa-

tions that will be needed over the next

few years.”

Looking further down the line, there

are a few other important technolo-

gies that are under development. The

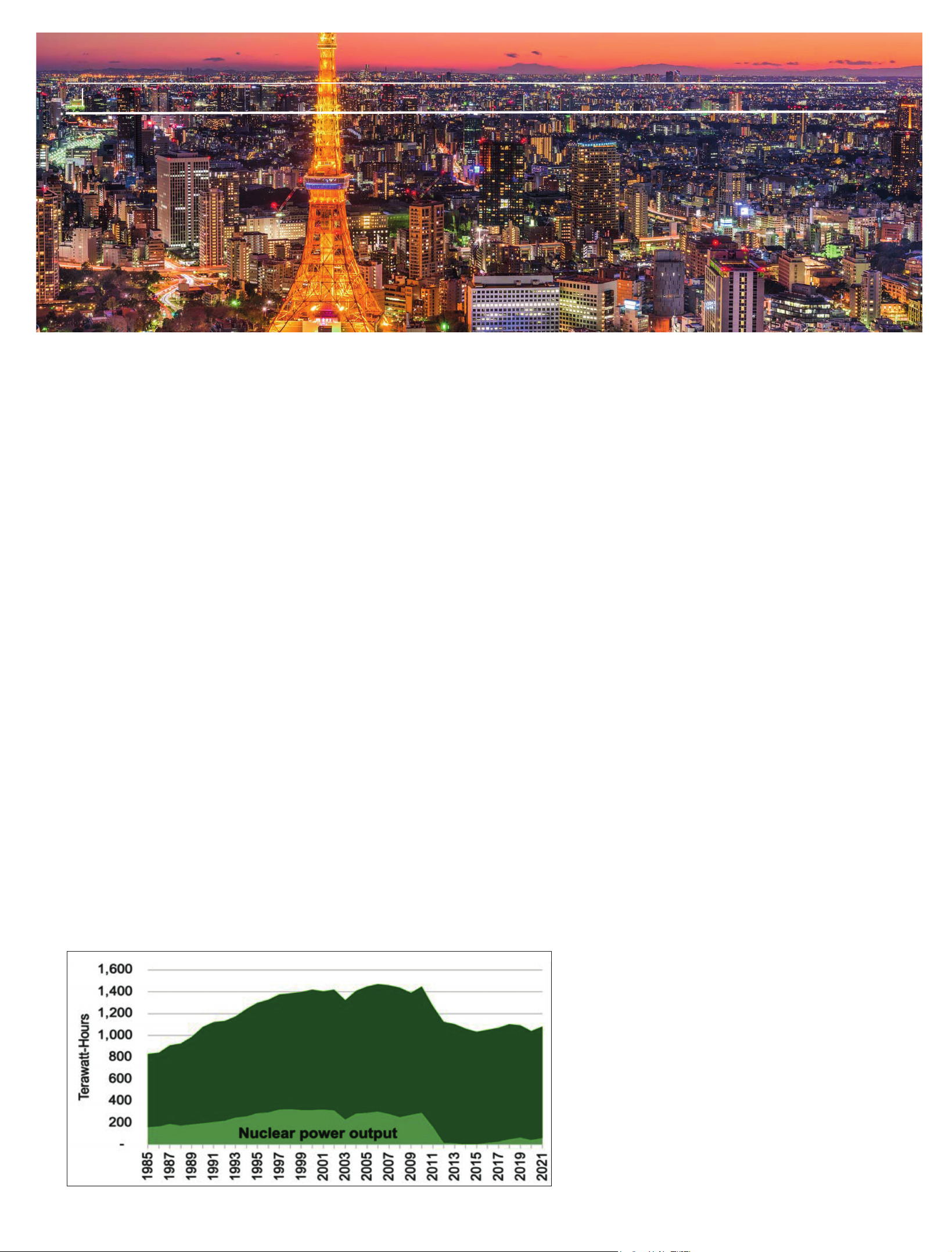

UPFC (Unied Power Flow Control-

ler) PLUS is one such technology that

is already part of the Siemens Energy

portfolio. The technology is based on

power electronics, which actively

adjusts the power ow in an AC net-

work within milliseconds.

It can rapidly bypass overloaded

line sections, provide reactive power

and dynamic voltage control, and

utilise assets to physical limits with-

out the need for safety margins.

“An existing AC network is like a

highway where there are multiple

lanes. In a high-voltage transmission

line there are several circuits that are

interconnected and there are different

loads on it. Depending on where the

generation feeds in and where the

demand is, it can lead to an over-util-

isation of one line. This means you

can exceed the load that one line can

safely carry, while another line in the

other circuit might be under-utilised.”

According to Siemens Energy, there

are limited options in the market for

managing such scenarios, apart from

physically switching lines on and off

or switching loads from one circuit to

another. This, however, is not fast and

requires manual intervention.

“The UPFC PLUS is a fully auto-

mated system that will actively adjust

the impedance of the transmission

line and therefore make the load ow

differently, since current always ows

in the path of least resistance,” said

Hild.

When managing a fully loaded net-

work during a fault, the line loading

will be at 100 per cent, which will

cause a voltage drop. Because of this,

reactive power will need to be pro-

vided to ensure stability. Also, when

managing or changing the load ow

during a network fault it is possible

that there will be some stability

problems in the transmission line or

network that will require insertion of

active damping. The UPFC PLUS

provides active damping by injecting

a voltage with a controlled magnitude

and angle to ensure that the line and

voltage are in phase.

With a UPFC PLUS the load can be

balanced across numerous lines in

milliseconds. When the network is

healthy there is no time pressure to

balance the ow, this can often be in

the range of several minutes, but

when a fault occurs you must act in

milliseconds. The rst requirement

for any active or dynamic load ow

management is to perform the load

ow management in two time zones,

both for slow control and fast control.

This is where UPFC PLUS outper-

forms other ow management com-

ponents. In the eld of dynamic load

ow management, it supplies fast

last few years. This piece of equip-

ment is essentially a generator weigh-

ing several hundred tonnes, which

spins purely to provide a rotating

mass and therefore inertia. It does not

produce energy but is driven up to the

network frequency using a motor,

leaving the rotor to spin at the network

frequency. This rotating mass essen-

tially provides the inertia that would

have come from the turbines of the

retired conventional power plants.

Again, Siemens Energy says it sees a

growing demand for such equipment

across Europe, the US and other parts

of the world.

Choosing between the two technolo-

gies depends on the network’s needs.

“It always depends on the electro-

technical aspect that is missing,” ex-

plained Hild. “If it is voltage support

or reactive power, then you use

STATCOM; if it’s missing inertia or

short-circuit power due to power

plant retirements, then it’s most likely

a synchronous condenser.”

While it is easier to identify things

such as voltage deviations through

ickering lights, for example, as-

sessing whether inertia or short-cir-

cuit power is needed in the grid, is

something only a grid operator can

identify through measurements and

calculations. “It’s a matter of how

easily failures in the network could

lead to blackout,” noted Hild. “If the

network is weak because rotating

mass is missing, then short-circuit

power is low. This means that even a

small variation in voltage or power

ow could cause load shedding and

potential blackouts in regions. This

is why network operators always

check the strength of the network in

terms of inertia and short-circuit

power and how stable voltage and

frequency are.”

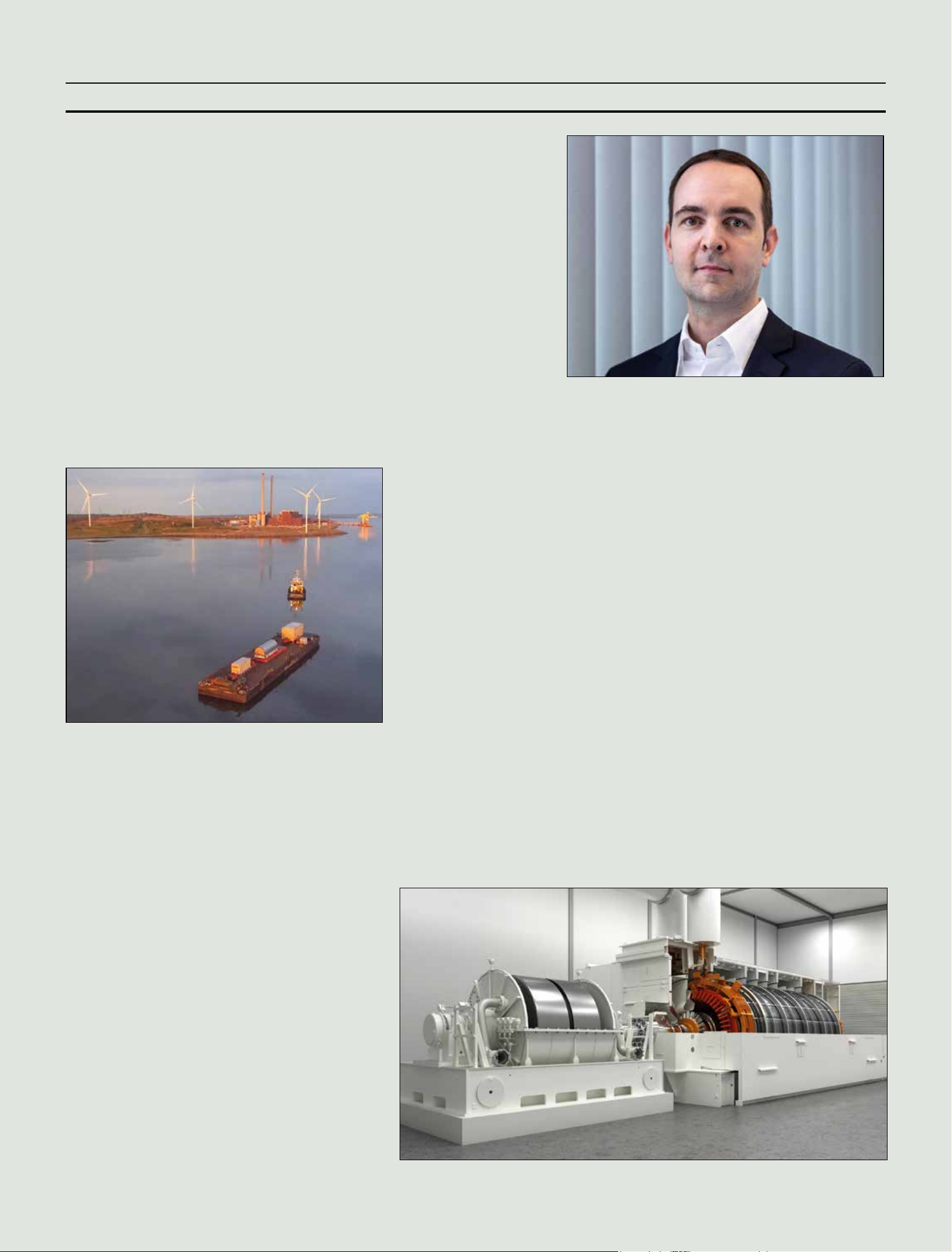

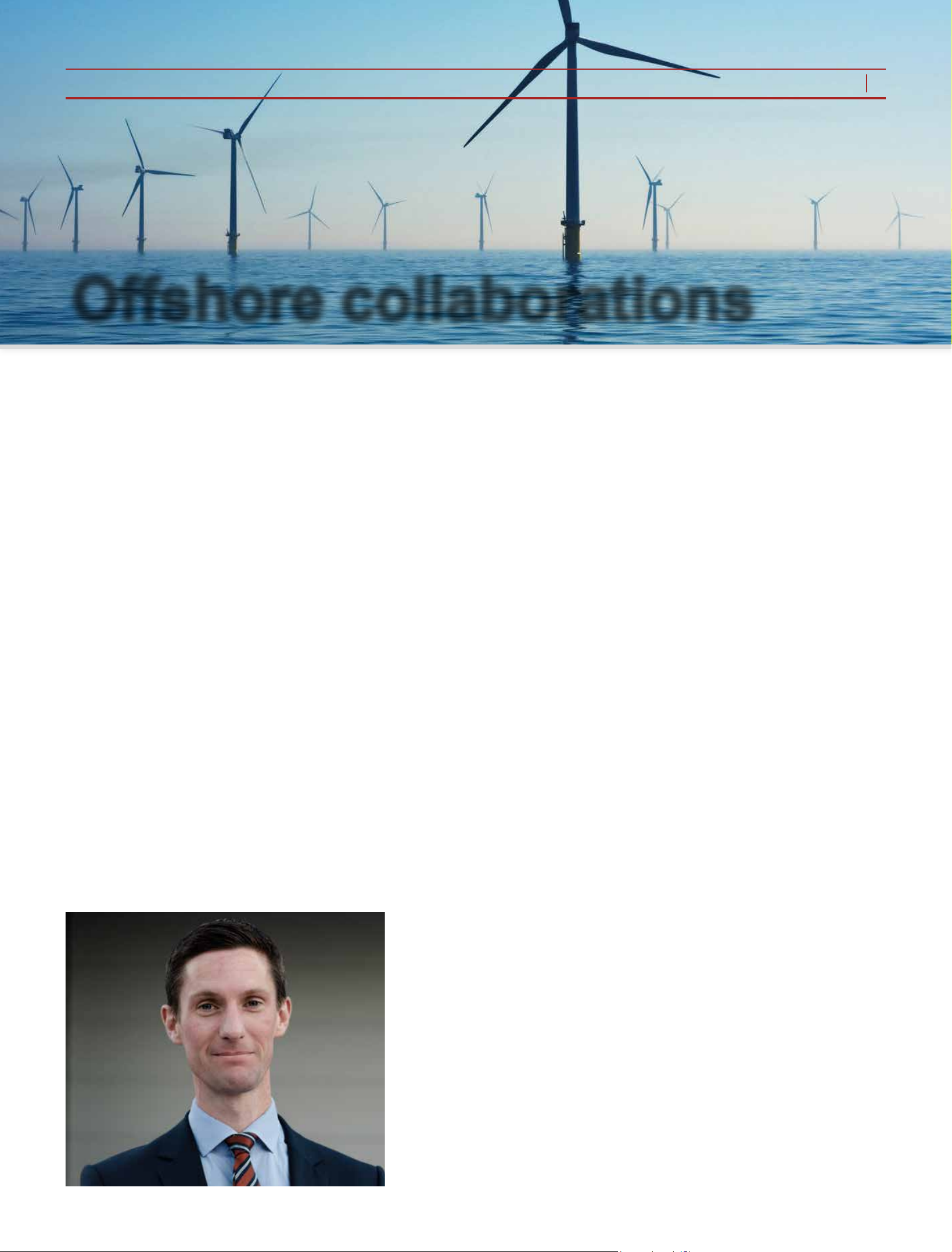

The Moneypoint project, which

Siemens Energy is working on in

Ireland, is a good example of how

grid operators are providing grid iner-

tia using synchronous condensers.

At the end of April last year the

company secured a €50 million con-

tract to supply a synchronous con-

denser system to the Electricity Sup-

ply Board (ESB), Ireland’s leading

energy company. The grid stabilising

system will be developed at the

Moneypoint power station located in

southwest Ireland near Kilrush,

County Clare.

ESB recently announced the launch

of Green Atlantic @ Moneypoint, an

ambitious plan to transform the

County Clare site into a green energy

hub, where renewable technologies

will be deployed over the next decade

with the capacity to power 1.6 million

homes. The synchronous condenser, a

key component of ESB’s Green At-

lantic @ Moneypoint project, will be

the rst in the country and incorporate

the world’s largest ywheel used for

grid stability.

The facility will enable an increased

integration of wind power into the

Irish grid by providing sufcient iner-

tia for frequency support, short-circuit

power for system strength and reac-

tive power for voltage control. The

project is expected to enter operation

this summer.

Commenting on the project, Hild

said: “The site has existing coal red

power plants that ESB want to retire

in the near future. At the same time,

a number of wind farms are being

built in the western part of Ireland,

which need to be connected to the

Irish and then subsequently the Eu-

ropean grid. So here we have the

dual effect: a lot of wind power is

being injected into the network,

which we know will soon become

much weaker because the large coal

red power plant will retire. This is

why ESB identied the need for a

large synchronous condenser in the

Moneypoint area so that the grid can

handle the inux of wind power.”

He added: “Since the mass of the

generator cannot provide enough

inertia, a ywheel, which is simply a

rotating mass, is placed on the exten-

sion of the rotor shaft. The size of the

ywheel is determined by the required

electrical features – the amount of

inertia, short-circuit power and maybe

reactive power. Depending on the re-

quirements, we determine whether a

larger generator with a smaller y-

wheel, or a smaller generator with a

larger ywheel, or a large generator

without a ywheel is the best and

most economic choice.”

Just last month, a similar project

began operation in the UK with the

commissioning of two synchronous

condenser units at the Killingholme

power station in Lincoln. The project

included the re-purposing of two

steam turbine generators and install-

ing ywheels at the site. The technol-

ogy will allow Uniper to deliver es-

sential grid stabilising services to

National Grid ESO without the need

to generate power.

Siemens Energy was appointed to

provide the solution after Uniper was

awarded four six-year contracts by

National Grid ESO in 2020 to provide

inertia services and voltage control to

the grid under phase 1 of its Stability

Pathnder at its Killingholme and

Grain sites.

Another important more recent

technology in the eld of grid stabili-

sation is what Siemens Energy calls a

frequency stabiliser. Currently in the

nalisation stage, the company has

secured its rst order for its ‘SVC

PLUS FS’ (Frequency Stabiliser) for

a project in Germany.

Special Technology Supplement

THE ENERGY INDUSTRY TIMES - AUGUST 2022

Hild: We are seeing a big

demand for grid stabilising

solutions

To provide maximum inertia, synchronous condensers solution can be extended with additional

rotating mass from a ywheel

Siemens Energy’s synchronous condenser and ywheel at their

arrival at Moneypoint power station in Ireland

THE ENERGY INDUSTRY TIMES - AUGUST 2022

Hild explained: “Just think of a

branch on a small tree; if it’s a very

tiny branch, i.e. a weak branch, it

doesn’t take much force to move it

away but if it’s a large branch, it would

take much more force to move it. It’s

the same on a network. If a network is

weak, a small injection of voltage or

reactive power could lead to a signi-

cant impact. “This is why you always

need a good mixture of power elec-

tronics which controls voltage and

response in terms of active power

management, coordinated reactive

power control and can insert active

damping to ensure stability. For effec-

tive dynamic load ow management,

a response time in milliseconds is re-

quired to balance the load during the

fault condition and manage the net-

work integrity in terms of stability

and thermal limits. This is achieved

by the voltage source converter,

which is one of the main components

of the UPFC PLUS system.

According to Siemens Energy,

UPFC PLUS can easily be imple-

mented in an existing grid and allows

fast reaction times for an efcient

load ow management. With this op-

tion and the high dynamic control,

transmission assets can be operated

closer to their physical limits. UPFC

PLUS is therefore seen as an innova-

tive solution to meet with the growing

requirements of the grid through dy-

namic load ow management that

adapts easily to changing in-feed from

renewable sources.

Nevertheless, the choice between

the array of technologies that can be

used to strengthen grids and provide

grid stability and how the various

technologies should be deployed is

largely down to the planning of the

TSO and its network analysis. This

gives a clear indication of what is re-

quired, where, and when. At the same

time STATCOM after STATCOM

cannot be indenitely placed on a

network. As a network becomes

weaker, small adjustments of reactive

power or voltage can lead to quite a

signicant impact on the network.

power regulation fast, and inertia and

short-circuit power, which comes

from either power plants or synchro-

nous condensers. You cannot ignore

one or the other.”

Looking further to the future and the

need for this mixture, Siemens Energy

is now developing a technology that

is kind of a combination of both

STATCOM and synchronous con-

denser – capable of meeting many of

the requirements at the same time.

Known as an Asynchronous Rotating

Energy System Stabiliser (ARESS), it

consists of a rotating machine similar

to a synchronous condenser but is a

different type of electrical machine in

that it is asynchronous and uses

power electronics to adjust the ma-

chine’s performance.

Hild noted: “With this technology,

we are able to provide much stronger

support in the network with the re-

gards to inertia and reactive power.

It’s kind of like a Swiss Army knife of

different solutions we have combined

in one technical offering.”

Siemens Energy is developing the

technology with Amprion for the 50

Hz market, as well as with Dominion

Energy in the US for the 60 Hz

market. “Both utilities have identied

the clear advantage of having such a

multi-tool solution, and were willing

to collaborate closely with us on the

development of this technology,” said

Hild.

Currently R&D activities are pro-

ceeding “at full speed”, with execu-

tion of the rst project set to begin in

2023 and commissioned in 2025.

Commenting on the project, Hild

said: “Since we are doing the project

in collaboration with TSOs, we give

them certain results and they simulate

the performance and give us feedback

for us to incorporate back into our

design.”

Although ARESS can perform the

task of STATCOMs and synchronous

condensers, Hild does not see it re-

placing them. “With any multi-use

offering, like a Swiss Army knife, it

can do quite a lot but it cannot perform

specic functions as well as a tool

specically designed for a purpose.

Also, if you only have a voltage

problem, why go for a solution that

has many more features that you

don’t require? You end up paying for

something you don’t need.

“The use cases [for ARESS] are in

situations where many individual

challenges for grid stabilisation come

together but none of the challenges

are unusual enough to require a

uniquely designed solution.”

No doubt there will likely be other

challenges in the future, as the net-

work topology changes with increas-

ing renewables. For example, Hild

believes that while the addition of

more battery storage will help the

integration of renewables by provid-

ing energy when the sun is not shin-

ing or the wind is not blowing, it will

make regulation of the network more

complicated.

“In the future you will be injecting

or absorbing energy at many more

multiple points in the network, unlike

today where there are a smaller num-

ber of power plants or large in-feeds

to the grid,” noted Hild.

Siemens Energy believes that with

all of its technologies, it has a power-

ful portfolio that targets various sta-

bilisation problems in the network

and can combine these solutions ac-

cording to the specic AC network

requirements.

But its message is clear. Jürgensen

summed up: “TSOs really underesti-

mated the scale of the challenge that

closing all of these large power plants

would present to the grid. What is

actually needed to stabilise the fre-

quency of the grid is quite tremen-

dous. In addition to all the transmis-

sion projects that we have, we are

seeing a similarly high demand for

grid stabilisation; and urgently. We

cannot wait 10 years to do it, other-

wise you really jeopardise the stabil-

ity of the grid.

“Grid planners need to plan ahead

– carefully consider this effect and

plan the investment that is needed.”

Recently, Siemens Energy has

secured its rst order for its

‘SVC PLUS FS’ (Frequency

Stabiliser) for a project in

Germany

Special Technology Supplement

Aerial view of various components in a typical UPFC PLUS system

Compared to traditional power ow controllers, UPFC PLUS controls power ow in just

milliseconds

T

he EU’s target of 300 GW of

offshore wind by 2050 is

daunting – it calls for just un-

der 285 GW of new capacity, or

roughly 10 GW every year for the

next near 30 years. And it is an even

taller mountain climb in a world

still suffering from the impacts of a

global pandemic and geopolitical

turmoil on a scale not seen since the

Second World War. Yet with the

need to combat climate change and

rapidly cut its dependency on Rus-

sian fossil fuels, the EU offshore

wind sector must nevertheless nd a

way to scale its Everest.

With electrication of the broader

society seen by many as one of the

best ways to cut carbon emissions

and the falling cost of wind power

produced from gigawatt scale wind

farms out at sea, it is no wonder that

offshore wind is central to the EU’s

strategy.

“Offshore wind is becoming an in-

creasingly attractive power genera-

tion source in more and more mar-

kets,” said Martin Kjäll-Ohlsson,

Vice President for Offshore Power,

ABB Energy Industries. “Those

markets already open to offshore

wind are increasing their ambitions

and more markets are coming on

stream. We are seeing a lot of activi-

ty in the Baltic Sea, with countries

like Poland for example, coming a

long way in just a few years.

“But there are challenges. Where

do you nd all the components that

go into the turbines? All the bumps

in the road and rough seas in terms

of the geopolitical situations are a

challenge for everybody. Generally,

we are seeing price appreciation on

many commodities and special piec-

es of kit needed for projects – this

might be anything from circuit

boards to high steel prices, and ev-

erything in between.”

Although no company can solve

these global problems, there are a

few things he says ABB is doing.

“The key, he says, “is openness

about the environment we are in –

with our suppliers and customers.”

One example he gives in the off-

shore oil and gas space, is its long-

time collaboration with Aker BP.

Instead of working together on a

project-by-project basis and push-

ing the supply chain from one proj-

ect to the next, ABB has what Kjäll-

Ohlsson calls a project alliance with

Aker BP.

This means that for certain disci-

plines or scopes of supply, there are

pre-dened partners that are quali-

ed to enter the project alliance for a

specic project.

“The aim,” he said, “is to nurture

a sound culture between those par-

ties inside of the alliance. This

means that, from the outset, you ex-

ecute with trust at not only the com-

pany level but at the personal level.

Then as you enter a project you ma-

ture towards investment decisions

together. Time, costs and risks are

set in stone, targets are set and then

everyone is incentivised to perform

better. You are all in the same boat,

and much more willing to solve

problems together when they come.

And since you know each other bet-

ter, you don’t add risk on top of

each other’s scope.”

Kjäll-Ohlsson notes that strong

global teams are required for such an

approach and may result in develop-

ers losing some exibility in terms

of sourcing freely from around the

world but says it is still benecial.

ABB has not yet engaged in any

offshore wind projects using this

project alliance type of scheme buts

says it would welcome them. Kjäll-

Ohlsson said: “The evidence is there

that it works very well in offshore oil

and gas. There is no evidence yet in

offshore wind but building projects

in the North Sea, in principle it’s not

all that different.”

A second example of collaboration,

directly related to the wind sector, is

ABB’s recent Memorandum of Un-

derstanding (MOU) with Ramboll.

In April this year ABB and Ramboll

signed an MOU to work together in

pursuing new prospects for offshore

substations.

Under the agreement, ABB will

bring its expertise in design and sup-

ply of electrical, SCADA (Supervi-

sory Control and Data Acquisition),

automation, and telecommunications

equipment, including engineering,

products, installation, commission-

ing, and operational maintenance of

such equipment.

Ramboll will contribute its exper-

tise in engineering services in devel-

opment, design and specication,

construction, maintenance, and oper-

ation, including disciplines of struc-

tural, piping, mechanical & layout,

process, and technical safety, electri-

cal, SCADA, automation, and tele-

communication systems.

The initial agreement is valid up to

ve years and facilitates collabora-

tion on a case-by-case basis.

Explaining the workings of the

MoU, Kjäll-Ohlsson said: “We go to

market together with a joint design,

with Ramboll being responsible for

the structural and mechanical ele-

ments and ABB of the electrical sys-

tem and associated disciplines. It’s

not excusive but if you are going to

make a cake it makes sense to go to

guys that have been making cakes

for decades; you can be sure that if

you follow that recipe, the cake will

be great. That’s what we are doing in

the offshore substation market; pro-

vide an attractive recipe.”

ABB has a similar strategic part-

nership in place with Norwegian oil

and gas services player Aibel to de-

liver voltage connections for off-

shore wind integration. Here ABB is

providing its proven high voltage

technology, while Aibel is responsi-

ble for turnkey engineering, procure-

ment and construction (EPC) respon-

sibility for the design, construction,

installation and commissioning of

the offshore platforms.

Kjäll-Ohlsson says the partnership

is working well. In March it signed a

deal for part-electrication of the

Oseberg oil and gas eld on the Nor-

wegian Continental Shelf. According

to ABB, the part-electrication with

105 MW of largely renewable power

will enable phasing out gas turbines

and installation of two new 10 MW

pre-compressors for gas production.

ABB is also cooperating with Aibel

in system design and engineering

and will deliver the complete power

and control systems onshore and off-

shore. ABB says that the connection

is designed for 180 MW high volt-

age alternating current at 132 kV.

It is also working with Aibel on the

massive Dogger Bank offshore wind

farm, having secured major contracts

for the HVDC link for the third

phase of the 3.6 GW project.

Yet meeting the massive amount of

offshore wind that is needed will re-

quire more than cross-company col-

laborations. It will also call for

cross-sector cooperation in the sup-

ply chain.

“It’s not possible to build the 100s

of GW with the supply chain to-

day,” said Kjäll-Ohlsson. “You have

to enable more players to grow the

supply chain. Specically, you have

to enable the supply chain to off-

shore oil and gas. There are whole

yards around the world that build

things, such as steel structures for

oil and gas. These fabricators need

to be enabled for the green energy

sector too; they have the capacity to

weld steel but only need guidance

from ABB and Ramboll, for exam-

ple, to understand what to make.

This would bring more capacity

into the supply chain.”

He compared it to the automotive

industry, where factories that manu-

facture internal combustion engine-

based cars will be transformed to

produce electric vehicles.

Kjäll-Ohlsson believes that as a

global leader in telecoms systems in-

tegration with extensive experience

in oil and gas, it is well placed to

succeed in the offshore wind sector.

He said: “Offshore wind is much

more asset intensive than oil and gas.

If you look at Dogger Bank, it will

have three huge substations sur-

rounded by 285 wind turbines. Mak-

ing sure all the assets are online, cy-

ber secure and can be controlled at

all times, is not an easy task. But it is

one that we can undertake with the

experience of doing similar work in

very harsh waters over the last three

or four decades.”

To this end, ABB and Aker Solu-

tions are focusing their attention on

seabed solutions for oil and gas in

an effort to accelerate technology

development for offshore wind

power.

“We are seeing whether we build

offshore [wind] infrastructure more

simply than it is done today,” said

Kjäll-Ohlsson. At the moment, huge

platforms are used for the power

transformers and switchgear. These

are costly. Our proposition is, as we

have done in oil and gas, is to place

the transformer and switchgear on

the seabed. Nobody has done this in

offshore wind but we are ready to

do it. I’m 100 per cent sure it will

come; it has the potential to save a

lot of costs.”

An offshore grid on the seabed is

an exciting idea, and one that would

not only further cut the cost of off-

shore wind but would enable wind

farms to be connected faster. But, as

Kjäll-Ohlsson summed up, “it’s a

case of who dares to be rst”. He

said: “It’s never easy. We are talk-

ing to some players and our mes-

sage is clear: we are ready to do it

and we welcome a developer to be

the rst to do it seriously.”

Expanding offshore wind at the necessary speed to meet climate change goals and stave off the energy security crisis

is a huge task in itself. Supply chain issues caused by global events make that task even more challenging.

Junior Isles hears why ABB Energy Industries believes greater collaboration is key.

Offshore collaborations

Offshore collaborations

THE ENERGY INDUSTRY TIMES - AUGUST 2022

13

Industry Perspective

Kjäll-Ohlsson: providing an

“attractive recipe” in the

offshore substation market

prices exceeded Yen30-40. Corpo-

rates have been paying less than

Yen20, while household electricity

rate plans are generally Yen20-30.

This has caused signicant nancial

turmoil for Japan’s electricity retail-

ers. Just like in Australia, the UK and

some other jurisdictions, the energy

crisis has forced some retailers to exit

the market for the rst time since the

country’s electricity markets were

fully liberalised in April 2016; 14 had

led for bankruptcy as at the end of

the last Japanese scal year, through

March 2022.

The energy crisis has resulted in re-

newed calls to boost domestic energy

security including raising the amount

of non-fossil fuels for electric power

generation.

The cabinet afrmed its commit-

ment to reach NZE by 2050 and also

approved the nation’s latest renew-

able energy plan in October 2021, just

ahead of COP26 (the 26th United

Nations Climate Change conference)

in Glasgow in November. The objec-

tive is for non-fossil fuel resources to

account for 56-60 per cent of power

supply. Renewable energy is to ac-

count for 36-38 per cent of the total

electricity generation, twice as much

as 2019 and up from the previous

22-24 per cent target. The breakdown

is between 14 and 16 per cent from

solar PV, 11 per cent from hydro-

power, 5 per cent from wind power, 5

per cent from biomass, and 1 per cent

from geothermal energy. Authorities

still hope for nuclear energy to gener-

ate 20-22 per cent of the total.

Between the release of the draft of

the plan in July and the Cabinet’s ap-

proval in October, media reported that

the government had received 6400

public submissions which included

negative comments around coal and

nuclear generation, Reuters and other

media reported.

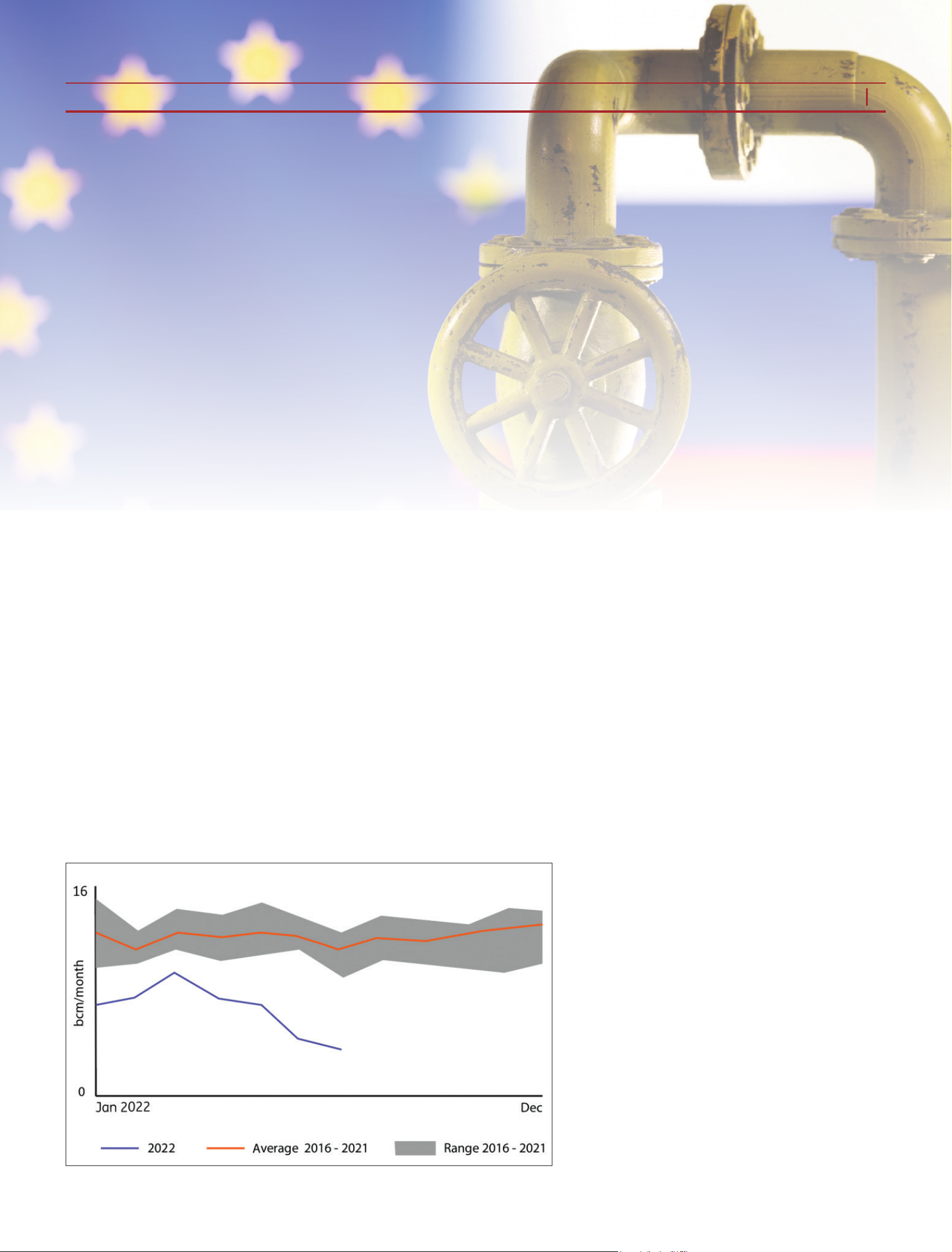

Nuclear power generation had con-

tributed to about 25 per cent, or 285

TWh, of the total on average in the 10

years through 2010. The amount was

just 6 per cent, or 61 TWh, in 2021, as

the majority of the country’s nuclear

eet was shut. Just eight reactors, out

of the previous 54, were operating

when the Cabinet approved the latest

renewables plan. The closures oc-

curred following the Fukushima nu-

clear disaster on March 11, 2011

when an earthquake-caused tsunami

triggered the meltdown of the Fuku-

shima Daiichi nuclear power plant,

owned, and operated by the nation’s

largest electric power utility, Tokyo

Electric Power (Tepco).

Various reports have indicated that

the dreadful tragedy which caused

human, environmental, and economic

disasters could have been prevented

by government, the regulator, and the

company. In fact, the scandal has

J

apan is currently facing an energy

crisis; just like many countries

around the world. Its challenges,

however, are more acute than the aver-

age country. With an economy that is

almost solely dependent on imported

fossil fuels, it wants to achieve net zero

emissions (NZE) by 2050 but lacks the

resources to do so. The government

may want nuclear energy to resolve

two massive energy hurdles – the en-

ergy crisis and energy decarbonisation

– yet this may turn out to be just wish-

ful thinking given the domestic scan-

dal-ridden nuclear power industry.

Japan is one of the many victims of

a global energy crisis – a fossil fuel

supply and pricing crisis. It is one that

experts, including the head of the In-

ternational Energy Agency (IEA) and

the Indian power minister, believe is

likely to worsen in the coming

months.

The crisis is massive, and the dy-

namics are highly complex. The rea-

sons lie well beyond underinvestment

in fossil fuel resources in recent years,

the Covid pandemic affecting de-

mand, and the Ukraine invasion by

Russia’s President Vladimir Putin af-

fecting supply of oil and gas from the

Russian Federation. The prices of

thermal coal, oil, and natural gas have

hit or are nearing historical highs.

Examples include South African coal,

whose Index was up to 328 points as

of June 1, 2022 using January 1, 2021

as a base (i.e., 100) or US or European

natural gas prices up to 473 and 288,

respectively, according to the World

Bank. This has caused tremendous

increases in gasoline or electricity

prices in the majority of countries

around the world. The outlook for

prices for the rest of 2022 and for

2023, unfortunately remains bullish.

Japan is important in the Asian and

global energy context. At 17.74 EJ,

the country was the fth largest

consumer in the world of primary

energy in 2021, and the second largest

in Asia, after China. In terms of elec-

tric power generation, at a little over

1000 TWh per year, it is also the fth

largest electricity generator in the

world. This is predominantly from

fossil fuels, albeit the share from coal,

gas and oil is declining; 64.7 per cent

in 2021 versus 69 per cent in 2020.

A previous commentary (‘Japan is

not the land of the rising decarboni-

sation’, The Energy Industry Times,