www.teitimes.com

May 2022 • Volume 15 • No 3 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

The rise of renewables requires

sophisticated energy contracting

and trading transactions.

Page 14

Pivoting away from

Russian gas

Trading places

Utilities take centre stage as

Europe pivots away from

Russian gas. Page 13

News In Brief

Economists question efforts

to protect energy users from

high prices

Economists have warned that many

of the measures to protect consumers

and businesses from soaring energy

prices, made worse by Russia’s

invasion of Ukraine, could backre.

Page 2

Biden administration to

underwrite nuclear power

plants at risk of closure

The US President Biden’s

administration is launching a $6

billion programme to support

nuclear power plants.

Page 4

Philippines accelerates

decarbonisation but coal will

remain king

The Philippines power sector is

ramping up its decarbonisation

efforts with a fast-growing pipeline

of renewable energy but coal will

still remain the dominant generating

source for the next decade.

Page 5

European countries raise

renewables ambition further

European governments, industry

and networks have agreed to fast-

forward offshore wind as part of an

even faster expansion of renewables,

in response to the Ukraine invasion.

Page 7

Renewables dominate

new generating capacity

worldwide

New data released by the

International Renewable Energy

Agency (IRENA) shows that

renewable energy continued to grow

and gain momentum despite global

uncertainties.

Page 8

Technology Focus:

Developing a ‘Virtual Energy

System’

National Grid ESO has launched

an industry-wide programme to

develop a Virtual Energy System – a

digital twin of Great Britain’s entire

energy system. This centralised

tool offers the potential to create a

collective view of the UK’s entire

energy system.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

Russia has red its rst serious salvo of strikes against the European Union, as energy

becomes a weapon of war. Junior Isles

Germany’s Easter package sees profound changes to

wind energy policy

THE ENERGY INDUSTRY

TIMES

Final Word

Germany needed to pull a

rabbit out of a hat

this Easter, says

Junior Isles. Page 16

The unfolding energy war between

Europe and Russia escalated last

month, as the Europe Union began ef-

forts to ban Russian fossil fuel imports.

With relations worsening between the

two sides as a result of Russia’s ongo-

ing war in Ukraine, Moscow retaliated

by demanding payment for gas in

roubles and cutting gas supplies to Po-

land and Bulgaria.

In early April the EU proposed a ban

on Russian coal imports in what

would be the rst sanctions targeting

the country’s lucrative energy indus-

try. The Polish parliament had already

passed a ban on import and shipment

of coal from Russia and the Russia-

controlled Donetsk and Lugansk re-

gions in eastern Ukraine.

The EU-wide coal embargo is ex-

pected to come into effect from Au-

gust. After a wind-down of existing

contracts, new contracts will be

banned.

Ursula von der Leyen, European

Commission President, said the em-

bargo, worth around €4 billion, “will

cut another important revenue source

for Russia”.

In line with its climate ambitions,

the EU has been moving away from

coal. Coal use fell from 1.2 billion

tons a year to 427 million tons be-

tween 1990 and 2020, but imports

rose from 30 per cent to 60 per cent of

coal use.

Germany’s association of coal im-

porters said in March that Russian

coal could be replaced “in a few

months”. Indeed replacing Russian

coal would not be too difcult because

coal is transported by ship and there

are multiple global suppliers.

JPMorgan Chase & Co warned,

however, that banning Russian coal

imports will further hurt the conti-

nent’s energy markets, and countries

will have to pay more for supplies

elsewhere.

The bank said in a report that Russia

will be able to nd buyers for its coal,

but Europe will have to turn to sup-

plies from South Africa, Australia

and the US in an already tight coal

market. That will increase the price at

which it is more protable for power

companies to burn coal rather than

natural gas.

Europe is also trying to wean itself

off Russian gas, a move that will be

far more difcult. The EU gets about

40 per cent of its natural gas from

Russia, and many EU countries, in-

cluding Germany – the bloc’s largest

economy – are opposed to cutting off

gas imports.

The decision, however, may have

Continued on Page 2

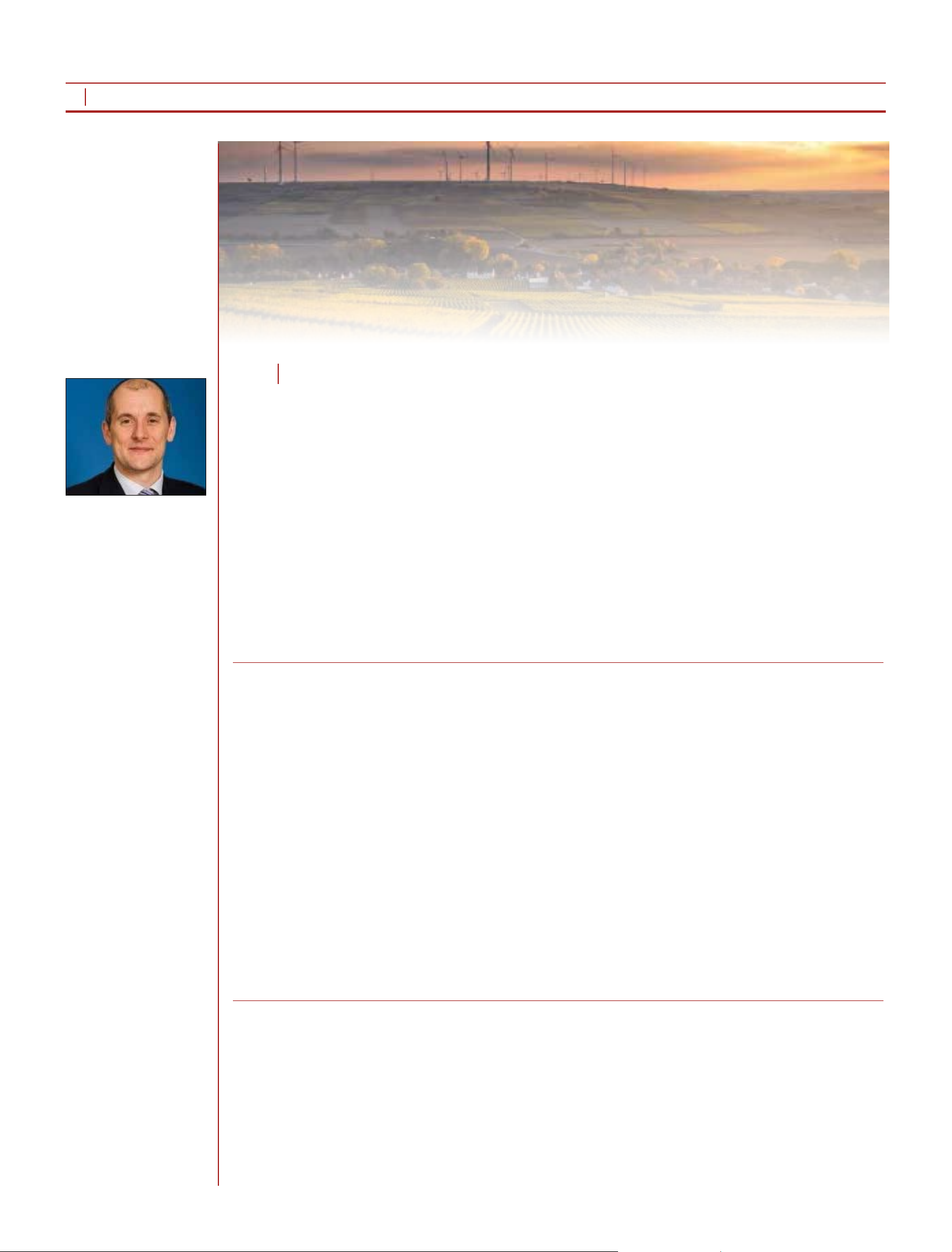

The German government has passed

the so-called “Easter Package”, setting

out the most profound changes to Ger-

man energy policy since the introduc-

tion of competitive auctions in 2017.

At the heart of the package are

changes to Germany’s Renewable

Energy Law (EEG) to enshrine a new

renewable energy target of 80 per cent

in total electricity consumption by

2030.

From 2025 onwards Germany wants

to install 10 GW of new onshore wind

energy every year. To deliver this ex-

pansion in onshore wind the govern-

ment proposal increases annual auc-

tion volumes to up to 12 GW. The

package also increases offshore wind

targets. This will see the country

achieve 30 GW of operational off-

shore wind by 2030, 40 GW by 2035,

and at least 70 GW by 2045.

To this end, the package adjusts an-

nual auction volumes as well as an-

nual wind energy installation targets.

Auction volumes will increase to up

to 12 GW per year. On this trajectory,

Germany would have 115 GW of

onshore wind by 2030.

Giles Dickson, WindEurope CEO,

called the Easter Package “an out-

standing package of measures” that

will drive the expansion of wind en-

ergy, both onshore and offshore. “Big

auction volumes. A clear long-term

auction schedule. And crucially, ma-

jor steps to simplify the permitting of

wind farms – without which the tar-

gets would be purely academic. It’s a

great example for the rest of Europe,”

he said.

Since the war in Ukraine the govern-

ment has repeatedly stressed the es-

sential role of renewables for Germa-

ny’s energy security. Finance Minister

Christian Lindner had described re-

newables as “freedom energies”.

The Easter Package is not the last

legislative change for wind energy in

this political term. To reduce Ger-

many’s dependence on Russian fos-

sil fuel imports, Germany’s Econo-

my and Energy Minister Robert

Habeck has pledged to move forward

the announced “Summer Package”

to May.

This package will include a national

repowering strategy, new measures to

ensure sufcient sites for wind ener-

gy, improvements to permitting, and a

new strategy to harmonise the expan-

sion of wind energy with biodiversity

and nature protection.

Minister Habeck identied supply

chain disruptions, rising international

prices for raw materials and compo-

nents as well as a potential shortage in

sufciently skilled workers as the

main challenges to the expansion

ahead. He pledged to collaborate

closely with the German wind indus-

try to overcome these challenges and

to ensure the delivery of the ambitious

new volumes.

Tim Holt, Member of the Managing

Board of Siemens Energy, and Ten-

neT’s COO, Tim Meyerjürgens, both

commented on the challenges during

a recent press a tour of the DolWin

kappa offshore platform, being built

by Siemens as part of TenneT’s Dol-

Win6 grid connection project.

Holt said: “Currently we are really

ramping up our engineering capacity.

In terms of manufacturing capacity

we can handle the volume… what

Ukraine is now triggering is a focus

on the supply chain. How do we now

meet increased demand with a resil-

ient supply chain? We need to sit

down and ask: do we continue the

strategy of global, compact, intercon-

nected supply chains or do we also

build-in additional resilience? These

are the discussions we are having be-

cause it will mean a fundamental shift

in supply chain strategy.”

Meyerjürgens added: “The targets

are very ambitious, some say overly-

ambitious if we look at the 2030 tar-

gets, since these projects take 6-7

years to construct. What is still lack-

ing, is the decisions we need to ac-

celerate. Licensing is one of the bot-

tlenecks. Another is caused by

changing the scope of ongoing proj-

ects. We were asked by the govern-

ment to come with a proposal on how

the 30 GW can be connected by

2030. We have done a proposal with

the other two German TSOs on how

it’s feasible.”

Energy war escalates as

Energy war escalates as

EU bans coal imports and

EU bans coal imports and

Russia imposes rst

Russia imposes rst

blocks on gas

blocks on gas

Putin: “unfriendly”

countries must pay for gas in roubles

THE ENERGY INDUSTRY TIMES - MAY 2022

2

Junior Isles

The Intergovernmental Panel on Cli-

mate Change (IPCC) has issued a re-

port saying the world has the tools and

know-how required to limit warming

and halve emissions by 2030, but the

world must act now.

The report notes that major transi-

tions in the energy sector will be re-

quired to reach this target. This will

involve a substantial reduction in fossil

fuel use, widespread electrication,

improved energy efciency, and use of

alternative fuels (such as hydrogen).

Without this, the IPCC warns that

limiting global warming to 1.5°C is

beyond reach.

“We are at a crossroads. The deci-

sions we make now can secure a live-

able future. We have the tools and

know-how required to limit warming,”

said IPCC Chair Hoesung Lee.

“I am encouraged by climate action

being taken in many countries. There

are policies, regulations and market

instruments that are proving effective.

If these are scaled up and applied more

widely and equitably, they can support

deep emissions reductions and stimu-

late innovation.”

The report also demonstrates that

while nancial ows are a factor of

three to six times lower than levels

needed by 2030 to limit warming to

below 2°C, there is already sufcient

global capital and liquidity to close

investment gaps.

However, it relies on clear signalling

from governments and the interna-

tional community, including a stronger

alignment of public sector nance and

policy.

Without taking into account the eco-

nomic benets of reduced adaptation

costs or avoided climate impacts,

global Gross Domestic Product (GDP)

would be just a few percentage points

lower in 2050 if we take the actions

necessary to limit warming to 2°C or

below, compared to maintaining cur-

rent policies, said the IPCC.

According to the report, having the

right policies, infrastructure and

technology in place to enable changes

to lifestyles and behaviour can result

in a 40-70 per cent reduction in green-

house gas emissions by 2050.

The IPCC says the next few years are

“critical”.

“It’s now or never, if we want to

limit global warming to 1.5°C,” said

IPCC Working Group III Co-Chair Jim

Skea. “Without immediate and deep

emissions reductions across all sectors,

it will be impossible.”

In the scenarios assessed, limiting

warming to around 1.5°C requires

global greenhouse gas emissions to

peak before 2025 at the latest, and be

reduced by 43 per cent by 2030; at the

same time, methane would also need

to be reduced by about a third. It says,

however, that even if this is achieved,

it is “almost inevitable” that the tem-

perature threshold will be exceeded

temporarily but could return to below

it by the end of the century.

It noted that the industrial sector ac-

counts for about a quarter of global

emissions. The reports stresses that

achieving net zero will be challenging

and will require new production pro-

cesses, low and zero emissions elec-

tricity, hydrogen, and, where neces-

sary, carbon capture and storage.

Notably, at the end of March the Eu-

ropean Commission allocated €1.1bil-

lion to seven large-scale climate proj-

ects, including a “CCS value chain”

scheme based in Belgium to capture,

liquefy, ship, and permanently store

carbon.

Sushil Purohit, President of Wärtsilä

Energy said the IPCC report would

give the carbon removal industry a “bit

of a boost”. Wärtsilä Energy has in-

vested in one so-called direct air cap-

ture start-up, Soletair Power. “We will

keep looking at this space with some

interest,” he said.

Meanwhile, following the release of

the IPCC report, Swiss-based Clime-

works, which builds direct air capture

systems said it had raised $600 million

from investors including the Singapor-

ean fund GIC, and Edinburgh-based

Baillie Gifford.

been taken out of EU hands when

Russian President Vladimir Putin

signed a decree demanding that na-

tions deemed “unfriendly” must

pay for gas deliveries in roubles

from April, using an account in the

Russian currency at Gazprombank,

or face a halt in supplies.

Poland and Bulgaria became the

rst victims of the decree when Rus-

sia halted gas supplies to the coun-

tries following their refusal to pay

in roubles. Supplies from Gazprom

cover about 50 per cent of Poland’s

consumption and about 90 per cent

of Bulgaria’s.

Commenting on the Kremlin’s

decision, von der Leyen said Russia

was using gas “as an instrument of

blackmail”.

Nathan Piper, head of oil and gas

research at Investec, told the BBC

the halting of supplies to Poland and

Bulgaria was the “start of Russia

exerting economic pressure on Eu-

rope”, and a move which could

“escalate” with other EU nations.

Poland’s Deputy Foreign Minis-

ter said the country could cope

without Gazprom’s gas and had

“taken some decisions many years

ago to prepare for such a situation”.

Its climate ministry said the coun-

try’s energy supplies were secure.

Climate Minister Anna Moskwa

said there was no need to draw gas

from reserves, and gas to custom-

ers would not be cut.

Poland was already planning to

stop importing Russian gas by the

end of the year, when its long-term

supply contract with Gazprom

expires.

Marcin Przydacz, Poland’s Un-

dersecretary of State for Security,

the Americas, Asia and Eastern

Policy, told the BBC there were “op-

tions to get the gas from other part-

ners”, including the US and gulf

nations. “I’m pretty sure that we will

manage to handle this,” he said.

Elsewhere, other countries have

been taking steps in preparation for

suspension of gas from Russia.

At the beginning of April Lithu-

ania became the rst EU country to

cut off Russian gas supplies com-

pletely, with the two other Baltic

states also temporarily stopping

their ow in response to Moscow’s

invasion of Ukraine. Russian gas

also stopped owing into Estonia

and Latvia on April 1.

The three Baltic states have been

among the loudest voices urging the

EU to end its members’ dependence

on Russian oil and gas.

Meanwhile, in late April the Dan-

ish government made a new pro-

posal to accelerate and expand the

development of new energy is-

lands. Denmark already plans to

build the world’s rst energy island

in the North Sea, with a maximum

capacity of 10 GW. Another energy

hub will be established on the is-

land of Bornholm in the Baltic Sea

with a capacity of 2 GW. A provi-

sional estimate shows an initial

demand for at least 35 GW of off-

shore wind from the Danish parts

of the North Sea.

Continued from Page 1

Economists have warned that many of

the measures to protect consumers and

businesses from soaring energy prices,

made worse by Russia’s invasion of

Ukraine, could backre.

Germany, France, Italy and Spain –

the EU’s four largest countries – plan

to cut taxes or fund rebates on fuel,

electricity or natural gas, in an attempt

to shield their economies from spiral-

ling costs.

However, some economists argue

that the series of measures, amounting

to €80 billion, may exacerbate the

problem by reducing the incentive for

households and businesses to reduce

their consumption of electricity and

fuel, thus making it harder to reduce

dependence on Russian fossil fuels.

Rüdiger Bachmann, Economics Pro-

fessor at the University of Notre-

Dame, said: “You want the price

mechanism to have its effect, by signal-

ling that a good is scarce, so people

decide if they want to change their

behaviour.”

The Bruegel think-tank found that 17

countries were also cutting taxes or

duties on energy, while 10 countries

were regulating retail energy prices and

three were regulating wholesale prices.

The French government has capped

the increase in household electricity

bills, a move expected to slash French

state-owned energy group, EDF’s

earnings by €10 billion when com-

bined with a requirement to sell its

nuclear power below wholesale rates.

Klaus Adam, Economics Professor at

the University of Mannheim, stated in

the Financial Times: “The subsidy on

household energy is crazy – it reduces

the incentive to reduce energy con-

sumption. Give everyone an amount

each month and let them decide if they

want to use it to pay the higher gas

prices or if they want to save energy

consumption and spend it on some-

thing else.”

Veronika Grimm, a member of the

council of economic experts, which

advises the German government, crit-

icised the latest package of measures

announced last month to help busi-

nesses with high energy prices.

The package will include a time-

limited and “narrowly dened cost

subsidy” for companies whose elec-

tricity costs have at least doubled since

last year. “It is very unfortunate to

subsidise the use of fossil fuels by di-

rectly subsidising energy consump-

tion,” Grimm told Die Welt newspaper.

“Ultimately, this keeps the gas price

high on the exchanges.”

At the end of March Spain and Por-

tugal submitted a proposal to the Eu-

ropean Commission requesting per-

mission to set a maximum reference

price for gas of €30/MWh and thus

force a sharp reduction in the price of

electricity. If accepted, experts esti-

mate that the price of electricity would

fall from over €200/MWh at present to

around €100/MWh. The proposal has

been met with concern by the Euro-

pean Commission, which believes

such a low ceiling could distort the

market beyond what is acceptable.

The President of the European Com-

mission, Ursula Von der Leyen, has

committed to “special treatment” for

Spain and Portugal due to the Iberian

peninsula energy island status.

Short-term interventions addressing

the current energy crisis must be ac-

companied by a steadfast focus on

mid- and long-term goals of the en-

ergy transition, according to the World

Energy Transitions Outlook (WTO)

2022.

Launched by the International Re-

newable Energy Agency (IRENA),

the WTO sets out priority areas and

actions based on available technolo-

gies that must be realised by 2030 to

achieve net zero emissions by mid-

century. It also takes stock of progress

across all energy uses to date, clearly

showing that the current pace and

scale of the renewables-based transi-

tion is inadequate.

“The energy transition is far from

being on track and anything short of

radical action in the coming years will

diminish, even eliminate chances to

meet our climate goals,” said Fran-

cesco La Camera, Director-General of

IRENA.

The Outlook sees investment needs

of $5.7 trillion per year until 2030

including the imperative to redirect

$0.7 trillion annually away from fos-

sil fuels to avoid stranded assets. But

investing in the transition would bring

concrete socioeconomic and welfare

benets, adding 85 million jobs

worldwide, it said.

Meanwhile, a new rst-of-its-kind

modelling commissioned by Carbon-

Free Europe claims that the optimal

energy mix for Europe to achieve its

net zero goals at lowest cost would be

to generate 20 per cent of its electric-

ity from nuclear, 18 per cent from

offshore wind, 27 per cent from

onshore wind, 27 per cent from solar,

and 8 per cent other resources like

biomass, geothermal, and hydropow-

er by 2050.

Pursuing a 100 per cent renewable

energy strategy would cost the EU at

least €80 billion ($84.3 billion) more

a year by 2050, it says, and require the

bloc to quadruple its electricity gen-

eration compared to a tripling in

other net zero pathways.

The modelling also calculates the

EU needs to add over 2000 GW of

clean energy by 2050.

Headline News

Economists question efforts to protect

Economists question efforts to protect

energy users from high prices

energy users from high prices

Energy transition is key to tackling global energy and climate crisis

Energy transition is key to tackling global energy and climate crisis

IPCC urges immediate action

IPCC urges immediate action

to halve emissions by 2030

to halve emissions by 2030

Piper: halting gas supplies is

“the start of exerting economic

pressure on Europe”

n “Almost inevitable” the temperature threshold will be exceeded temporarily

n Right policies, infrastructure and technology can result in a 40-70 per cent reduction in

emissions by 2050.

THE ENERGY INDUSTRY TIMES - MAY 2022

3

INNIO* is among the world’s

leaders in CCHP solutions.

INNIO’s exible, innovative trigeneration plants offer

combined cooling, heat and power

(

CCHP

)

systems

that can cut your data center’s CO

2

footprint by up to

50 %** while saving more than 20 % of the primary

energy used. A modular CCHP plant provides you with

the security and independence you need to power

your data center. INNIO’s CCHP systems run on a wide

range of gases with the option of converting to

CO

2

-free H

2

*** operation once that fuel is more

readily available.

Join us on our path for a sustainable future!

innio.com

* Indicates a trademark.

** Depending on the energy mix.

*** Optional scope on demand.

DATA CENTER

POWER

SOLUTIONS

Secure and efcient

ENERGY SOLUTIONS.

EVERYWHERE, EVERY TIME.

A22001_05_INNIO_Data_Center_250x328mm.indd 1A22001_05_INNIO_Data_Center_250x328mm.indd 1 07.04.22 17:3207.04.22 17:32

CONFERENCE & EXHIBITION

#RUKGOW212

Programme live

Exhibition sold-out

Book now!

Event partners

Events.RenewableUK.com/GOW22

THE NEXT

GENERATION

4000

Attendees

200

Speakers

170

Exhibitors

42

Countries

A GLOBAL PLATFORM FOR THE ENTIRE

POWER & WATER UTILITIES VALUE CHAIN

Supported By

9 - 11 MAY 2022 | ABU DHABI, UNITED ARAB EMIRATES

DELIVERING INTEGRATED TRANSFORMATION

FOR POWER AND WATER UTILITIES

UNDER THE PATRONAGE OF HH. SHEIKH KHALID BIN MOHAMMED BIN ZAYED AL NAHYAN

نﺎﻴﻬﻧ لآ ﺪﻳاز ﻦﺑ ﺪﻤﺤﻣ ﻦﺑ ﺪﻟﺎﺧ ﺦﻴﺸﻟا ﻮﻤﺴﻟا ﺐﺣﺎﺻ ﺔﻳﺎﻋر ﺖﺤﺗ

120+

210+

EXHIBITING COMPANIES

EXPERT SPEAKERS

20,000+

50+

GROSS SQM

CONFERENCE SESSIONS

10,000+

1,000+

UTILITIES PROFESSIONALS

CONFERENCE DELEGATES

REGISTER AS

A VISITOR

REGISTER AS

A DELEGATE

BOOK YOUR

STAND SPACE

3 WAYS YOU CAN PARTICIPATE AND JOIN THE CONVERSATION

www.worldutilitiescongress.com

+971 4 445 3693

wuc.enquiries@dmgevents.com

#WUC #WUCCongress

#worldutilitiescongress

Organised

By

Strategic Insights

Partner

Knowledge

Partner

Partner Hydrogen Theatre

Sponsor

Associate

Sponsor

Venue

Partner

Host

City

Look towards a brighter energy future

at Gastech Milan 2022

Be a part of the conversation to enable a low-carbon and aff ordable energy

future for all at Gastech’s 50th anniversary. Showcase your technologies to

the world and exhibit at the leading natural gas, LNG, hydrogen and low-

carbon solutions event, Gastech Milan, 2022.

Book your stand today by visiting gastechevent.com/exhibit,

call +44 (0) 20 4551 1602 or email sales@gastechevent.com

40,000+

Attendees

1,0 0

0+

Exhibitors

600+

Speakers

4,000+

Delegates

24

International

country pavilions

Co-host

Host Region Host City Host Venue Organised byUnder the patronage of Supported by

GT22 Exprom adv 12x16.indd 1GT22 Exprom adv 12x16.indd 1 29/03/2022 11:4029/03/2022 11:40

For a renewable, decentralized and digital energy industry

Cross-sector solutions for electricity, heat and mobility

From the latest insights to current best practice examples

Meet 1,450 exhibitors and 50,000+ energy experts at four parallel exhibitions

Be Part of the Leading Energy Exhibitions and Conferences at The smarter E Europe

The Innovation Hub

for New Energy Solutions

MESSE MÜNCHEN, GERMANY

6

THE ENERGY INDUSTRY TIMES - MAY 2022

T

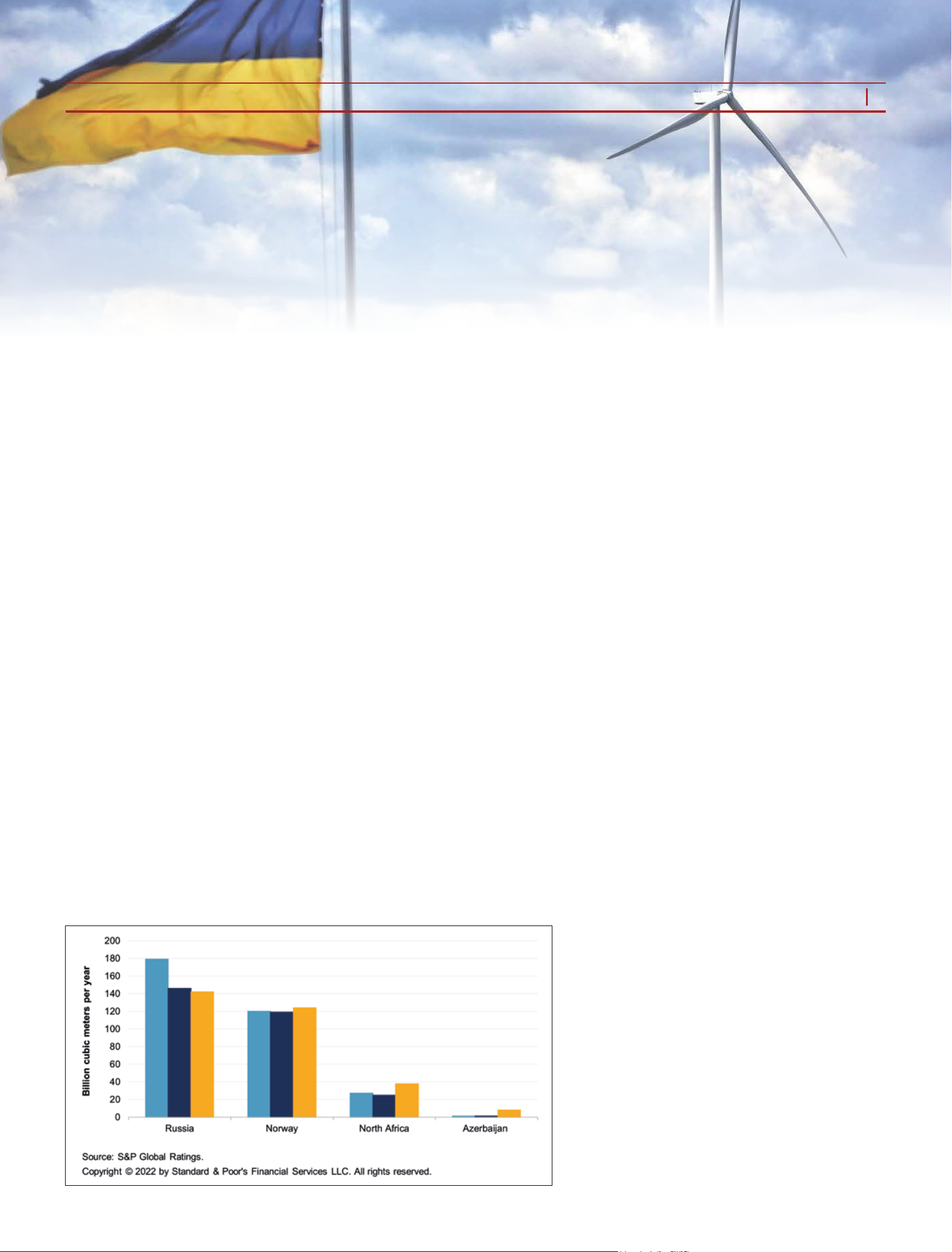

he ongoing conict in Ukraine

has prompted the European

Commission to make a major

shift in its energy policy. The RE-

PowerEU plan – unveiled in March

2022 – aims to diversify Europe’s

gas supplies, replace gas in heating

and power generation, and overall

reduce the EU’s demand for Russian

gas by two-thirds by 2023.

The EU currently imports 90 per

cent of the gas it consumes and, on

average, 40 per cent comes from

Russia. Given the lack of adequate

supply on offer from alternative

sources, replacing the 140 billion cu-

bic metres (bcm) per year currently

imported from Russia will be chal-

lenging. Indeed, gas storage levels

are running well lower than the tar-

geted 80 per cent, and Europe’s own

gas production has long been in

structural decline. Furthermore, most

of the world’s liqueed natural gas

(LNG) production is currently

locked into long-term contracts with

pre-agreed destination clauses and

large supply increments are unlikely

before 2026.

Under the most optimistic scenar-

io, Europe could source up to 50

bcm of gas from alternative sources

before winter 2022. According to

S&P Global Platts Analytics, this

would most likely come from inter-

national imports of LNG (25 bcm),

Italy’s strategic reserve (4.6 bcm), a

potential increase in Norwegian pro-

duction (10 bcm), additional ows

to Italy from Algeria and Libya (10

bcm and 4 bcm, respectively), and

increased production in the Nether-

lands (2 bcm).

This leaves a considerable short-

fall, leading to some demand de-

struction. This tension on gas supply

is likely to prompt a surge in gas

prices – and with gas remaining the

primary price-setter for European

power prices, a hike in spot and for-

ward power prices will mechanically

follow.

The price hike has wider implica-

tions. S&P Global Ratings had al-

ready anticipated an increase in pow-

er prices precipitated by the ongoing

energy transition, owing to the clo-

sure of coal and lignite plants and the

decommissioning of nuclear power

plants. The ongoing drive towards

decarbonisation therefore places an

even greater importance on gas –

further accentuating its role in deter-

mining European power prices.

Indeed, the TTF, Europe’s main gas

index, is currently trading 10x higher

than its 2020 average and above its

previous peak in December 2021 –

something that, at the time, led to

heavy margin calls by main market

players.

Rising prices will inevitably have

wider economic fallout, and some

energy-intensive industrial sectors

like fertilisers, steel, and paper could

face temporary plant closures – with

repercussions for the Eurozone’s

GDP growth. Indeed, in light of the

ongoing Russia-Ukraine conict,

S&P forecasts a GDP decline of

about 1.2 per cent in Europe for

2022. The potential escalation of the

military conict in Ukraine, its ex-

pansion across a wider geographic

area, or the broadening of sanctions

on Russia’s energy exports would

also bring further macroeconomic

risks.

Looking ahead to 2023 and 2024,

S&P anticipates that the rate of eco-

nomic growth will be largely un-

changed, while ination will jump 2

per cent. And while the high volatili-

ty makes predictions difcult, for-

ward gas prices could be up to three

times higher in 2023 and 2024 than

previously assumed.

Such high power prices place an

unsustainable burden on the Europe-

an economy, which the EU plans to

mitigate by introducing measures to

protect households and businesses.

Possible options being explored by

the European Commission include

imposing temporary price limits, of-

fering energy subsidies and vouchers

and tax reductions.

Considering the current exceptional

circumstances, individual member

states can set regulated prices for

vulnerable consumers, households,

and micro-enterprises to help protect

consumers and the economy. They

can also impose temporary tax mea-

sures on utility companies’ windfall

prots. As such, with most of their

operations hedged for 2022, utilities

do not stand to benet signicantly

from elevated prices. Furthermore,

government measures mean that

higher prices might not be forthcom-

ing next year either.

Utilities companies therefore face a

variety of considerations as they

adapt to the new environment. Large

European utilities generally manage

supply and trading risk by securing

prices on both the procurement and

sale of commodities. This hedging

policy allows them to make a margin

without being signicantly exposed

to volume or price risk. However, in

the event of disruption to gas deliv-

ery, hedging contracts will leave

companies exposed to market risks.

As the energy transition progress-

es and the geopolitical situation

continues to present risks, market

volatility will likely persist. Of

course, some key commodity mar-

ket players have adapted rapidly in

2022, supporting their credit quality

by renegotiating contracts, limiting

margin calls with key counterpar-

ties, using letters of credit (LCs) to

manage related cash risk with key

core banks, and securing additional

credit lines to manage liquidity.

Nevertheless, large working capital

swings are likely to continue.

Despite the turmoil, decarbonisa-

tion remains a key priority. Beyond

the diversication of gas sources,

the goal of reducing dependence on

Russian gas necessitates the acceler-

ated expansion of Europe’s renew-

able energy capacity. The Commis-

sion’s plans for renewables are

positive for utilities’ growth pros-

pects, even though they may require

companies to increase capital expen-

diture beyond what is planned.

Europe’s targets – which require

adding between 45 and 55 GW of

renewable capacity a year this de-

cade – are ambitious. Indeed, S&P

Global Ratings maintains that the

national targets envisaged by the

EU’s ‘Fit for 55’ package will be

difcult to achieve by 2030. Eu-

rope’s renewables roll-out faces

a number of obstacles, including bu-

reaucratic processes to obtain per-

mits and supply chain disruptions,

with a large proportion of necessary

components coming from China.

Of more immediate concern, how-

ever, is that, in light of the Russia-

Ukraine conict, Europe will likely

prioritise the security of its energy

supply over decarbonisation. This

implies greater use of carbon-inten-

sive energy sources to make up for

the shortfall in gas supply – with

Germany already considering re-

opening some coal red power

plants. This move will likely support

earnings for the generation compa-

nies involved, even if the possibility

of earnings claw-backs remains due

to the current environment.

Furthermore, in light of these sup-

ply concerns, Europe seems to be

changing its attitude towards nuclear

energy. Few new nuclear plants have

been constructed in recent decades,

and questions have been raised as to

whether Europe has sufcient access

to skilled technical personnel. But

with power prices surging across the

continent, nuclear generation offers a

viable, low-carbon supply of energy

that supports Europe’s drive towards

energy independence.

Furthermore, extending the lifes-

pan of existing nuclear plants could

buy valuable time for the expansion

of renewables.

The EU’s Green Taxonomy, which

seeks to encourage sustainable in-

vestment, has recently been updated

to encompass nuclear energy under

certain conditions. At the same time,

concerns about the safety of nuclear

plants remain prevalent – particular-

ly in view of the potential risks

posed to the nuclear facilities in

Ukraine including Zaporizhzhia –

Europe’s largest plant – and Cher-

nobyl, which is now non-operational.

In light of current events, the pow-

er market has to adapt to a new reali-

ty. The pivot away from Russian gas

could have long-term implications

for utilities and for the structure of

the power market. In accordance

with the energy transition’s acceler-

ated trajectory, gas and power utili-

ties will be expected to advance their

shift towards renewables. The EU is

also planning to invest in increasing

its capacity for decarbonised gas,

such as biomethane and hydrogen,

which will encourage investments in

new infrastructure faster than cur-

rently anticipated.

Additionally, the European Com-

mission is considering options such

as alternative pricing mechanisms to

optimise the electricity market’s de-

sign to promote renewable energy

generation and fostering green in-

vestments. This could well amount

to a move away from the merit order

mechanism, and reshape the Europe-

an energy market.

Claire Mauduit-Le Clercq is Direc-

tor, EMEA Utilities at S&P Global

Ratings

THE ENERGY INDUSTRY TIMES - MAY 2022

13

Energy Outlook

In the midst of

an ambitious

decarbonisation

drive, Europe is

now making energy

security its rst

priority. This shift has

clear implications

for utilities, explains

S&P Global Ratings’

Claire Mauduit-Le

Clercq.

Utilities take centre stage

Utilities take centre stage

as Europe pivots away

as Europe pivots away

from Russian gas

from Russian gas

Europe pipeline gas imports by

source. Source: S&P Global Power

Ratings

This results in market participants

losing out on revenue because they

cannot respond to the new market.

However, by bringing technology

into the mix, we are beginning to see

energy market participants get ahead

of this trend and increase their

revenue.

Volatility, and shorter-term and in-

traday trading will certainly provide

traders increased opportunities but

will, at the same time, give rise to

greater risk exposure. Market par-

ticipants need to be able to track po-

sitions and risk exposures in real-

time – not only to monitor risk but

also to trade opportunistically. The

market participants engaging in so-

phisticated energy contracting and

trading transactions to serve their

load efciently, protably, and in a

balanced fashion on a real-time basis

are using a robust digital commodity/

energy trading and risk management

(C/ETRM) solution.

A real-time integrated C/ETRM

system automates bid-to-bill business

processes that support the forecasting

and optimisation of trade cycles from

deal capture and contract manage-

ment to market integration. Market

participants can use these digital solu-

tions to tackle everything from pric-

ing and complex fees to trade conr-

mations to portfolio management and

valuations to environmental product

optimisation and more.

The advancement of renewable

energy has also brought about the

need to capture, track and redeem

tradable certicates related to emis-

sion allowances and energy attri-

butes. While the recording of a pur-

chase or sale of these certicates is

straight forward, the inventory man-

agement, expiration and cancellation

are more complex.

Nevertheless, there is a new revenue

opportunity with renewable energy.

As noted, energy attribute certicates

(EACs) – known as Guarantees of

Origin (GOO) in Europe, Renewable

Energy Certicates (REC) in North

America, and International RECs (I-

REC) in other geographies – are

growing in importance and volume as

renewable energy becomes a domi-

nant source of the energy mix.

Markets for EACs exist to encour-

age the supply of, and demand for,

certied renewable energy. These

markets for certied renewable en-

ergy are not only about providing

income to producers that can be in-

vested into new generation capacity

or create another revenue stream;

they are also about giving informa-

tion that allows consumers to decide

what kind of electricity (or green

gas) they want to use.

An EAC, such as a GOO, is one that

guarantees that 1 MWh of electricity

has been produced from renewable

energy sources. EACs are tradable

products with an expiration period of

one year from the date of certication.

Additionally, when the energy is de-

livered, the EAC is cancelled. If you

T

he past year has been marked by

some of the most extreme en-

ergy supply and demand shocks

ever seen. Events such as global lock-

downs caused by the Covid-19 pan-

demic, weather extremes and more

recently, the conict in Ukraine have

posed challenges for energy rms

around the world. For energy market

participants, these challenges come

against the already complex backdrop

of new market designs created to fa-

cilitate the integration of renewables

and the global move toward carbon

neutrality.

Last year, for the rst time, renew-

ables generated more electricity than

fossil fuels in the European Union – a

trend noted around the world. While

increased renewables pose signicant

challenges to grid operators, they also

leave energy traders facing a new

landscape as well. Renewable genera-

tion is less predictable, which intro-

duces volatility, price uctuations and

rapidly changing market positions. It

requires power companies to make

decisions based on more information

sources than ever before.

This dynamic environment brings a

shift towards more frequent trading,

and market participants need to be

able to track positions and risk expo-

sures in real-time.

Ten years ago, the energy market

was based around the conventional,

centralised generation of oil and coal

plants. It was predictable and formu-

laic. Participants were able to suc-

cessfully navigate this relatively

simple market environment with a

basic strategy and manual processes

to track market transactions.

The fossil fuel staples of yesterday’s

energy market are no longer the future

of energy generation, however, and

outputs from wind and solar, are less

predictable than thermal generators.

This not only brings about changes in

how electricity is produced and con-

sumed, but also in the way energy is

traded. These renewable sources can

lead to either an abundance of gener-

ated power at low prices (even nega-

tive when the grid can’t absorb the

excess) or exactly the opposite, when

there is less wind or sunshine than

forecasted. Then thermal generators

are challenged to ll the gap.

Add to this the impact of localised

generation on transmission networks

and it’s clear how market positions

become more uncertain as renewable

energy supply increases. The volatile

and intermittent nature of renewable

resources introduces rapidly chang-

ing market positions, which requires

a market based on more short-term,

intraday trading.

In addition, decarbonisation efforts

have created a growing market in

green certicates – receiving a boost

by the European Union’s ‘Fit for 55’

programme as well as the recent re-

port from the Intergovernmental

Panel on Climate Change (IPCC) –

driving demand for tradable certi-

cates to offset CO

2

emissions to prove

electricity was generated by a renew-

able source. Managing this increased

volume requires new solutions to

manage risk, nancial and compli-

ance reporting.

Moreover, new consumer and busi-

ness demands, are calling for support

of business scenarios to serve their

needs for trade-to-trade matching and

peer-to-peer matching of electricity

deals (B2B and B2C) with a desired

set of certicates. As a result, whole-

sale market participants are facing

increased complexity – necessitating

automation and market integration.

This new landscape also requires

that market participants develop a

sound and multi-faceted energy port-

folio management strategy informed

by digital technology in order for

planners, portfolio managers, traders

and investors to make better eco-

nomic and strategic decisions that

support effective, successful opera-

tions. Many companies however,

continue to rely on manual processes

and spreadsheets to track their mar-

ket access activities. Yet manual and

un-integrated system processes can

no longer handle the complex and

varied nature of all of the compo-

nents. Un-integrated systems lack

the visibility and risk controls neces-

sary for effective portfolio manage-

ment and optimisation.

own the EACs associated with your

renewable energy project’s electricity

output, you can sell these EACs to

another party. In doing so, you forfeit

the ability to make any claims about

“using” renewable energy, but gener-

ate a new revenue stream.

The revenue is a function of the

system’s kWh output and the market

price of EACs. Voluntary demand

continues to grow, partly because of

the growing realisation that EACs

are the evidence behind renewable

energy Power Purchase Agreements.

In addition, regulatory changes, such

as the growing adoption of full dis-

closure is driving the voluntary mar-

ket. In the next 10 years, the EAC

volume is projected to continue its

current growth rate (accumulated

volume between 2020 and 2030 12

000TWh), while prices are forecasted

to more than double.

Businesses that focus on this ex-

panding market will have more op-

portunities down the line.

Businesses around the globe are

making urgent and signicant com-

mitments to save the planet, and in

fact, environmental stewardship is

now necessary for future competi-

tiveness. In recent years, potential

employees and other corporate

stakeholders have become more fo-

cused on a company’s purpose and

core values as well as its sustainabil-

ity record. They even use it as a pri-

mary factor in their decision to join or

invest. They have increasing expecta-

tions about the origin of the power

consumed. They expect companies to

document, report and track electricity

consumed from renewable sources.

Market-based instruments such as

GOOs are an effective way to increase

the market momentum for renewable

energy. Buying GOOs sends a signal

to the market that the company prefers

to consume renewable energy and it

shows the organisation’s commitment

to changing energy behaviour. This

presents a growing opportunity to sell

to more companies seeking to do

good for the planet.

The carbon-neutral world is electric.

Analysis comparing and contrasting

multiple recent studies of the evolu-

tion of the total world energy system

shows that global electricity con-

sumption will more than double from

20 per cent today to over 40 per cent

of total energy demand by 2050. For

this to happen, increasingly larger

volumes of renewables will need to

be connected to the world’s grids and

incorporated into energy markets.

With the right technology and digital

tools, market participants will be

ready and able to assess the opportu-

nities and risks that come along with

this new landscape. Moreover, they

will be positioned to play a dominant

role in a truly sustainable energy sys-

tem for today’s generations and those

to come.

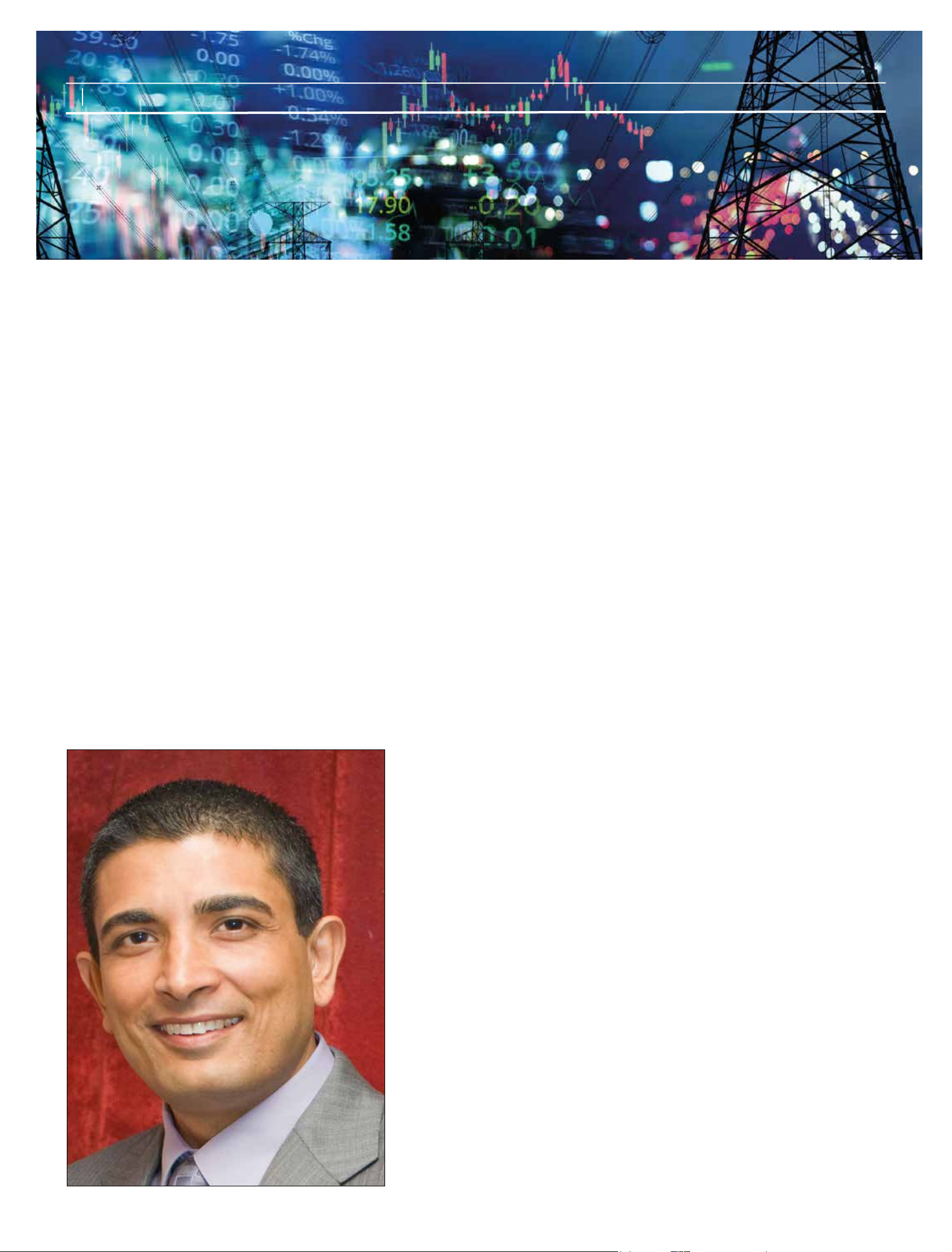

Uday Baral is Head of Energy Plan-

ning & Trading, Hitachi Energy.

THE ENERGY INDUSTRY TIMES - MAY 2022

Industry Perspective

14

The global drive to net zero and the consequent increase in renewables, introduces challenges for grid operators and

new responsibilities for utilities. Hitachi Energy’s Uday Baral explores the need for utilities and other energy market

participants to engage in sophisticated energy contracting and trading transactions to serve their load efciently and

protably, while meeting sustainability goals within this new, dynamic context, and looks at the technology needed to

make that happen.

Real-time trading creates new,

Real-time trading creates new,

sustainable opportunities

sustainable opportunities

Baral: Volatility, and shorter-

term and intraday trading

will certainly provide traders

increased opportunities

W

ith the countdown to the

UK’s target for a decar-

bonised power system by

2035 in motion, the entire energy in-

dustry must combine efforts to reach

a sustainable future.

Already, the energy industry has

made impressive strides along the

path to decarbonisation while under-

going the transition to digitisation.

These two important transitions

working in parallel have been instru-

mental in helping to plan for the

changing demands on the energy

sector as other industries also under-

go changes as part of their own ef-

forts to reach net zero.

The next shared step is to capitalise

on the potential of a more dynamic,

joined-up and intelligent view of the

entire energy system. One that will

create something incalculably more

powerful, and one which offers the

potential to advance our progress on

net zero while driving benets to

consumers and suppliers alike.

That’s why last year National Grid

ESO launched an industry-wide pro-

gramme to develop the ‘Virtual En-

ergy System’ – a digital twin of

Great Britain’s entire energy system.

This centralised tool offers the po-

tential to create a collective view of

the energy system: supporting fore-

casting, decision-making and inno-

vation while informing improve-

ments to the physical system.

The Virtual Energy System begins

with an open framework, with

agreed access, operations and securi-

ty protocols. Over time, this is popu-

lated by existing and new digital

twins – replicas of physical compo-

nents of our energy system. Each

digital twin will contribute to and ac-

cess real-time data on the status and

operation of other elements of the

system. This layered data then gen-

erates insight, and a virtual environ-

ment with the potential to transform

the system and support the transition

to net zero.

Digital twins are already at the

forefront of delivering benets

across an array of sectors. From

helping F1 teams model driving pat-

terns, to developing strategies to

build smarter cities, digital twins are

revolutionising the way we perform

simulations and improve operations.

To leverage the opportunity that an

integrated network provides, howev-

er, we must consistently feed digital

twins with relevant and accurate

contextualised data. As such, foster-

ing collaboration is vital to meeting

net zero goals.

Consumers are also in line to bene-

t when the industry embraces mod-

elling scenarios that aid decarbonisa-

tion. With more accurate projections

of how the network functions, it will

be easier to share data with custom-

ers to help them to reduce emissions

and usage costs.

With planning and development

well under way, the next steps in

bringing the Virtual Energy System

to life involve exploring use cases to

illustrate the efcacy of the system

and to highlight specic process-ori-

ented benets for businesses. As

with all transformative tech projects,

there are commercial considerations

and technical risks to consider to en-

sure the system is safe, secure, and

t for purpose.

The project is ambitious in its

aims, and success will depend on

participation at every level of the in-

dustry. And the challenges extend

beyond the practical implementation

of the digital replica. The socio-tech-

nical concerns of the project are far-

reaching. The need to establish how

this cross-industry collaboration will

look in areas such as regulatory and

legal issues, cyber security, and data

usage is therefore crucial.

It is vital that different elements of

the digital twin are compatible and

adhere to a Common Framework.

Earlier this year, National Grid ESO

announced it had appointed profes-

sional services rm, Arup, supported

by Energy Systems Catapult and Ice-

breaker One, to articulate the princi-

ples and framework needed for par-

ties to develop digital twins which

are interoperable and can interact

with the Virtual Energy System, us-

ing open data.

Development of the framework

provides an opportunity to bench-

mark how to connect digital twins

against international best practice

and standards. When it is under-

stood how the Virtual Energy Sys-

tem measures up on a global level,

it is then possible to harness the po-

tential for wider industry participa-

tion in making the grid greener and

more sustainable.

The Benchmarking Report detail-

ing key considerations for the cre-

ation of the Virtual Energy System

has recently been published.

The Virtual Energy System is an

important next step in helping the

energy industry achieve its goal of

reaching net zero. For those putting

it together, however, the rst chal-

lenge to overcome is that the push

for decarbonisation across the UK’s

energy system has already generated

so many strands and areas of work.

Across the energy industry and cen-

tral government there is debate about

which technologies should be used,

how we adapt to the changing re-

quirements of consumers and, ulti-

mately, about what the right choices

are to help us both decarbonise and

improve our energy offer.

Connecting these strands, and more

generally ensuring the sector is pull-

ing in the same direction, is the only

way forward, and the development

of the Virtual Energy System can

play a key role in helping to deliver

this connectivity. Arup, was tasked

with building the common frame-

work for the system, and necessarily

put connectivity and collaboration at

its heart.

This need for collaboration with

the sector has been a common thread

across its work at every stage. Arup

worked closely with industry stake-

holders from the outset in the devel-

opment of this common framework.

The key is to “collaborate on the

rules, compete on the game” – den-

ing the rules for all to use to feed

into the Virtual Energy System,

whilst acknowledging that these

stakeholders will undoubtedly end

up competing for business during

and after the creation of a decar-

bonised energy system.

Stakeholder engagement also has

to continue throughout the develop-

ment of the common framework.

Stakeholders must be engaged in or-

der to raise awareness of the Virtual

Energy System, to encourage their

involvement, and to ensure they

know how it will work with existing

programmes in the digital energy

sphere.

Creating this common framework

began by developing an understand-

ing of current examples, carrying out

a benchmarking assessment of case

studies which existed across differ-

ent industries. These proved to be

few and far between – while the con-

cept of “digital twins” has been

around for years, creating connected

ecosystems of digital twins is a rela-

tively new space. The other sectors

in the UK and international energy

industries that have attempted it have

faced challenges. However, it is im-

portant to note that the benchmark-

ing assessment will prove to be an it-

erative activity, as more case studies

will appear in this developing mar-

ket over the coming months and

years which we can then apply learn-

ings from.

While the problems faced by others

creating similar systems highlighted

a range of technical challenges, they

also showed the clear emphasis on

the social challenges, and the socio-

technical nature of the common

framework – linked also to data,

people, and process. These ranged

from legal challenges over data shar-

ing, to difculties with interoperabil-

ity brought about by a lack of meta-

data standards, and to a general clear

need to focus our attention on educa-

tion, skills, and change management.

Identifying these socio-technical

factors became the top priority once

the benchmarking was completed,

with 14 identied across the areas of

people, process, data, and technolo-

gy. As well as tackling each of the

socio-technical areas that needed to

be addressed, each of them had to be

aligned with the recommendations

and ndings of the Energy Digitali-

sation Taskforce, which was pub-

lished in January. They also drew

from the practical experience gained

through the National Digital Twin

programme and its CReDo demon-

strator, and other industry-wide proj-

ects such as Open Banking and

Open Energy.

The development of this frame-

work has been no mean feat. The

team, including non-prot organisa-

tion Icebreaker One and leading en-

ergy system innovation centre Ener-

gy Systems Catapult, has a huge

amount of experience working in

the energy sector – providing

knowledge and expertise which has

been crucial.

This is a digital-rst system both

to aid the UK’s decarbonisation

transition and to adapt with the

times. It is National Grid ESO’s aim

to create harmonisation, using this

common framework to bring align-

ment and collaboration and thereby

create a more efcient, streamlined

system. For decarbonisation, for the

growth of technologies, and for data

and knowledge sharing – the Virtual

Energy System’s purpose is to help

the UK build an energy network for

the future.

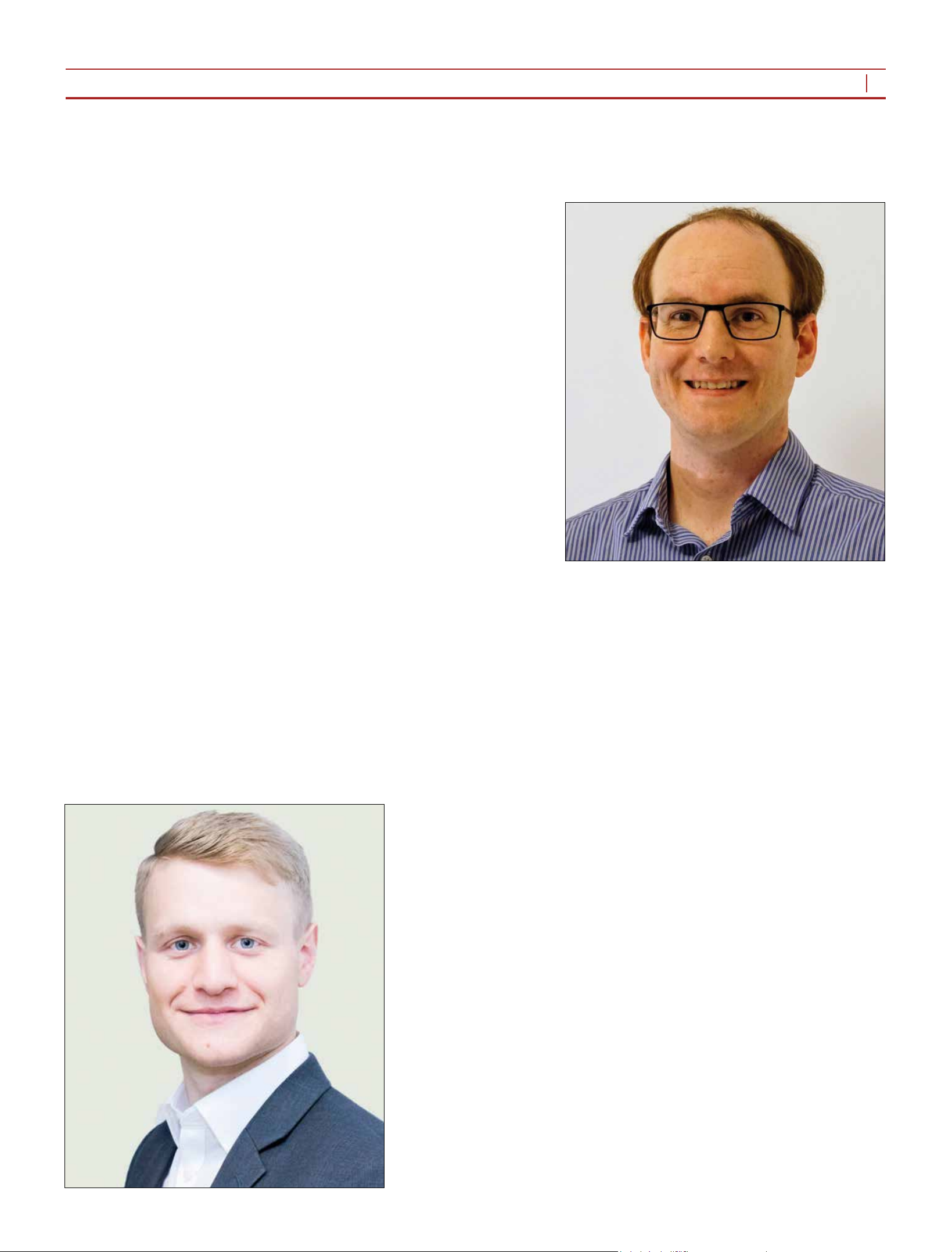

Jonathan Barcroft is Common

Framework Workstream Lead at

National Grid ESO. Simon Evans is

Global Digital Energy Leader at

Arup.

National Grid ESO

has launched

an industry-wide

programme to

develop a Virtual

Energy System – a

digital twin of Great

Britain’s entire

energy system.

This centralised

tool offers the

potential to create

a collective view

of the UK’s energy

system: supporting

forecasting,

decision-making

and innovation

while informing

improvements to

the physical system.

Jonathan Barcroft

and Simon Evans

explain.

Developing a virtual energy system

THE ENERGY INDUSTRY TIMES - MAY 2022

15

Technology Focus

Evans: This is a digital-rst

system, both to aid the UK’s

decarbonisation transition and

to adapt with the times

Barcroft: With planning and development well under way, the

next step is bringing the Virtual Energy System to life

THE ENERGY INDUSTRY TIMES - MAY 2022

16

Final Word

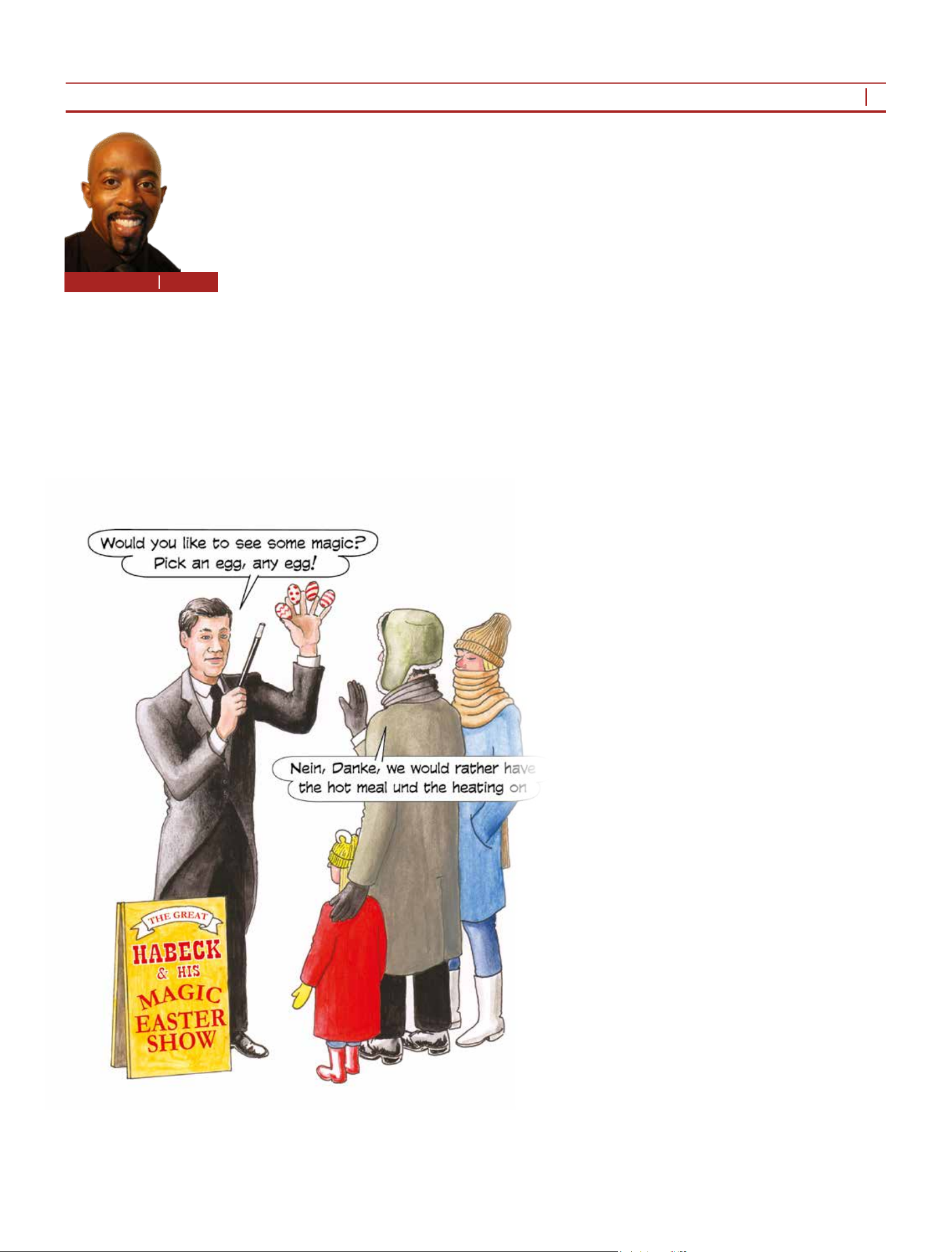

E

aster may have come and gone

but some of those Easter eggs

and bunnies will remain un-

wrapped for some time yet. If anyone

was expecting Germany’s “Easter

Package” for energy to sweeten the

bitter effects of Russia’s war on

Ukraine, they will no doubt be feeling

no more encouraged than prior to its

announcement. But in truth, it is hard

to fathom what more could have been

done.

Like the UK’s Energy Security

Strategy, which was unveiled at

around the same time last month, the

centrepiece of the Easter Package is

legislation aimed at doubling-down

on renewables in reaction to the en-

ergy crisis.

By amending the Renewable Energy

Sources Act (EEG), the German

Federal Government now plans to

generate almost all power from renew-

able energy sources by 2035. Under

the 500-page package announced by

Germany’s Economy and Energy

Minister Robert Habeck, the share of

renewable energy sources in gross

electricity consumption is to increase

to at least 80 per cent by 2030, up from

the previous target of more than 42 per

cent. It is one of the most comprehen-

sive amendments to the EEG since its

inception in 2000.

In addition, the government is to

provide relief for electricity consum-

ers. As of July 1, 2022, electricity

consumers will no longer have to pay

the Renewable Energy Sources Act

levy (“green power surcharge”) as part

of their electricity bill. Power suppli-

ers will pass on the resulting price

relief to end-consumers in full.

Overall it is an ambitious plan – one

that came as the EU prepared to ban

imports of Russian coal – but Russia

soon responded in what has now

become an energy war between Putin

and EU countries.

In late April Germany said it was

hoping to stop importing Russian oil

“within days”. And in what could be

seen as a warning shot to Germany

and others, Russia halted gas supplies

to Bulgaria and Poland for rejecting

its demand for payment in roubles.

The rm said services will not be

restored until payments are made in

the Russian currency.

Gazprom, the Russian gas export

monopoly, said in a statement it had

“completely suspended gas supplies

to Bulgargaz and PGNiG due to ab-

sence of payments in roubles”, refer-

ring to the Polish and Bulgarian gas

companies.

Vyacheslav Volodin, the speaker of

Russia’s lower house of parliament,

the Duma, said Gazprom had made

the right decision in suspending gas

supplies to Bulgaria and Poland and

said Moscow should do the same with

other “unfriendly” countries.

It is the toughest retaliation so far

against international sanctions over

the war on Ukraine; and although

hardly unexpected, has no doubt

struck fear and outrage in equal

measures across EU member states.

While Europe may be able to elimi-

nate oil and coal imports from Russia

fairly quickly, weaning itself off cheap

and abundant Russian natural gas,

which heats its houses, fuels its facto-

ries and drives its electric power

plants, is a much harder task.

With the decision on Poland and

Bulgaria, Russia seems to be rst

taking aim at its former Soviet-era

satellites – essentially, those easier to

bully. But the real question is how long

will it be before its tactics extend to

one of the big EU powerhouses like

Germany? It may not happen, as Putin

has much to lose. But so does the EU,

which is deeply concerned.

European Commission President

Ursula von der Leyen branded Gaz-

prom’s move as “blackmail” saying it

is “unjustied and unacceptable”.

With economic sanctions beginning to

bite, Gazprom and Putin would prob-

ably beg to differ.

In preparation for what might be on

the cards, in March the European

Commission proposed its outline of a

plan to make Europe independent from

Russian fossil fuels well before 2030,

starting with gas. Its REPowerEU

strategy will seek to diversify gas

supplies, speed up the roll-out of re-

newable gases and replace gas in

heating and power generation. This, it

believes, can reduce EU demand for

Russian gas by two thirds before the

end of the year.

Germany’s Easter Package aligns

with this strategy. The government has

put wind front and centre of its new

renewable goals. It is changing off-

shore wind legislation to reach the

new targets of 30 GW of operational

offshore wind by 2030, 40 GW by

2035, and at least 70 GW by 2045.

Offshore wind will be prioritised in

maritime spatial planning, permitting

procedures shortened and additional

staff hired in the permitting authorities.

On top of that the package plans to

auction sites that are not pre-devel-

oped. In the future, the expansion of

offshore wind in Germany would be

based on two equally important pil-

lars: auctions of sites that have already

been pre-surveyed by state authori-

ties on the one hand and auctions of

sites that have not yet been pre-devel-

oped on the other hand. Centrally

pre-developed areas would be auc-

tioned based on price, awarding 20-

year Contracts for Difference (CfDs)

to successful bidders. Not centrally

pre-developed areas would be auc-

tioned according to a catalogue of

criteria, which would also include

qualitative criteria.

The German government is also

looking into options of auctioning

wind energy in combination with re-

newable hydrogen production.

Central to the Easter Package is the

denition of renewable energies as an

“overriding matter of public interest

and public security”. This will speed

up the permitting of new renewables

projects and reduce delays caused by

legal appeals. Importantly, grid plan-

ning will be aligned with the acceler-

ated expansion of renewables – 36 new

grid expansion and optimisation

projects have been added.

It is a laudable package but will not

be easy to achieve. Commenting on

the challenges during a recent press

visit to update journalists on progress

at its DolWin kappa offshore con-

verter platform, which is part of the

DolWin6 grid connection, Tim

Meyerjürgens, Chief Operating Of-

cer at Tennet, the Dutch-German

transmission system Operator (TSO)

said: “We see very ambitious targets,

especially when looking to 2030. As

these projects take 6-7 years they have

to be existing projects or we will not

be able to complete them. But it is

positive that the government is so

ambitious because it now gives us the

opportunity to speed up and build-out

capacities to be able to deliver, espe-

cially after 2030.

“But we have to speed up licensing

procedures, and not just offshore. It’s

also the connections with the onshore

grid and transporting the energy from

the north to the load centres in the

south. And if you look at the offshore

grid, you still see licensing procedures

lasting on average, 10 years… the

Easter package offers some good rst

steps but they are just rst steps. Li-

censing [times] should be in the range

of what we need for [project] realisa-

tion, For AC lines, that time is about

two years. For the large DC corridors,

we have a construction time of about

four years, so four years of licensing

should be feasible and sufcient. Cur-

rently we see a lot of announcements

from politicians but not real decisions

to accelerate it.”

Having ruled out the possibility of

reversing its decision to close its nu-

clear plant, Germany is truly staring

down the barrel. It is difcult to see

what options it has if Russia decides

to take aim. But with such a move,

Russia would also be committing slow

suicide. The trick is to see who blinks

rst.

Germany’s proposal of an Easter

bunny to be enjoyed in just over a

decade from now is welcome. Unfor-

tunately, it is not enough. Nothing

short of pulling a rabbit out of a hat

will avert the impending emergency.

A not so magical Easter

Junior Isles

Cartoon: jemsoar.com