www.teitimes.com

January 2022 • Volume 14 • No 11 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

The missing piece

Coal on a comeback?

Waste-to-energy is the

missing part of the EU

taxonomy puzzle.

Page 13

The International Energy Agency

examines the reasons behind

record coal use in 2021.

Page 14

News In Brief

Revised TEN-E rules will

boost hydrogen

Revised rules of the Trans-European

network for Energy (TEN-E)

Regulation have been introduced to

support the European Green Deal

and looks set to provide a much

needed boost for hydrogen.

Page 2

Canada ‘can reduce

unabated fossil use by 2050’

Canada can reduce its unabated

fossil fuel use by 62 per cent by

2050, even as electricity and oil

demand grows, according to a new

report from the Canada Energy

Regulator.

Page 4

Australia going major on

hydrogen

The Government of the Northern

Territory (NT) in Australia has

awarded ‘Major Project Status’ to

the A$15.0 billion Desert Bloom

green hydrogen project, to fast-track

the approval process as the country

strives to become a hydrogen

exporter.

Page 6

UK energy crisis highlights

renewables investment

The UK has opened its fourth

renewables tender, with Contracts

for Difference on offer for 12 GW

of capacity – more than the previous

three rounds combined.

Page 7

Middle East and Africa set

for solar PV capacity boost

Nearly 20 GW of solar power

is expected to be added over the

next ve years in the Middle East

& North Africa (MENA) region,

according to a report by the Arab

Petroleum Investments Corporation,

Page 8

Utilities gear-up for energy

transition

Several major European utilities

have recently made signicant

investments as they prepare to

operate in the changing energy

landscape.

Page 9

Technology Focus:

Hydrogen makes progress

with plastics

Peel NRE is progressing with plans

to roll-out plastics-to-hydrogen

technology.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

A rebounding economy and high gas prices have pushed coal red power generation to an

all-time, threatening net zero goals according to a recent report. Junior Isles

Climate change drives large-scale changes in energy and

utilities sector, says Capgemini report

THE ENERGY INDUSTRY

TIMES

Final Word

Coal looks like the

Mark Twain of energy,

says Junior Isles.

Page 16

The amount of electricity generated

worldwide from coal was surging to-

wards a new annual record in 2021,

undermining efforts to reduce green-

house gas emissions and potentially

putting global coal demand on course

for an all-time in 2022, says a new

report.

According to the International En-

ergy Agency’s (IEA) latest annual

market report, global power genera-

tion from coal is expected to jump by

9 per cent in 2021 to an all-time high

of 10 350 TWh, after falling in 2019

and 2020.

The IEA said record demand for coal

in power generation was driven by

the economic recovery from the pan-

demic. This caused electricity demand

to outstrip supply from renewable

energy and low carbon energy. The

record-breaking increase in natural

gas prices also added to consumption,

making it cheaper and more protable

for utility companies to burn coal in

their power stations.

Overall coal demand worldwide –

including uses beyond power genera-

tion, such as cement and steel produc-

tion – is forecast to grow by 6 per cent

in 2021. That increase will not take it

above the record levels it reached in

2013 and 2014. But, depending on

weather patterns and economic

growth, overall coal demand could

reach new all-time highs as soon as

2022 and remain at that level for the

following two years, underscoring the

need for fast and strong policy action.

In 2020, global coal demand fell by

4.4 per cent, the largest decline in de-

cades but much smaller than the an-

nual drop that was initially expected at

the height of the lockdowns early in

the pandemic, the report shows. Re-

gional disparities were large. Coal

demand grew by 1 per cent for the full

year in China, where the economy be-

gan recovering much earlier than else-

where, whereas it dropped by nearly

20 per cent in the US and the Euro-

pean Union, and by 8 per cent in India

and South Africa.

“Coal is the single largest source of

global carbon emissions, and this

year’s historically high level of coal

power generation is a worrying sign of

how far off track the world is in its

efforts to put emissions into decline

towards net zero,” said IEA Executive

Director Fatih Birol.

Keisuke Sadamori, Director of En-

ergy Markets and Security at the IEA,

added: “The pledges to reach net zero

emissions made by many countries,

including China and India, should

have very strong implications for coal

– but these are not yet visible in our

near-term forecast, reecting the ma-

jor gap between ambitions and action.

Asia dominates the global coal mar-

ket, with China and India accounting

for two-thirds of overall demand.

These two economies – dependent on

coal and with a combined population

of almost 3 billion people – hold the

key to future coal demand.”

In China, where more than half of

Continued on Page 2

Energy and utility organisations that

have implemented new energy models

are reporting multiple benets, accord-

ing to a new report from the Capgem-

ini Research Institute.

The report, titled ‘Remodeling the

future: How energy transition is driv-

ing new models in energy and utili-

ties’, says new energy models are

transforming the entire energy and

utilities sector, as mitigating the im-

pact of climate change has become its

raison d’être.

Climate change and investor de-

mand are principal drivers of change.

Almost 70 per cent of energy and util-

ity organisations (68 per cent) say that

mitigating the impact of climate

change is driving their shift towards

new ways of doing business, 63 per

cent cite investor demand as the impe-

tus for change. While just 44 per cent

of executives are guided by protabil-

ity as the leading driver for a shift to

new models, the potential benets for

the bottom line are clear.

According to Capgemini, however,

the sector remains in a state of transi-

tion and while the critical need to

transform is apparent, there are very

few organisations currently imple-

menting new energy models. For in-

stance, while 64 per cent of organisa-

tions plan to implement energy

storage solutions in the future, just 19

per cent are already doing so. Further,

just 18 per cent of those surveyed say

they have a global strategy with well

dened goals and target timelines.

In November research from CDP,

the World Benchmarking Alliance

and ADEME (the French Agency for

Ecological Transition) found almost

all companies across the electric utili-

ties sector are set to exceed their

1.5°C warming scenario budgets. It

says 98 per cent companies in the

electric utilities sector are set to ex-

ceed their carbon budgets.

Overall the companies assessed will

exceed their total carbon budget by 57

per cent up to 2035. Just three out of

50 companies (Ørsted, EDP and AES

Corporation) have emissions targets

that align with the IEA’s 1.5°C warm-

ing scenario. Only Ørsted is projected

to stay within its carbon budget be-

tween now and 2035.

Given their continued reliance on

fossil fuels, the climate performance

of 35 companies in this sector is ex-

pected to decline in the near term. To

be fully aligned with a 1.5°C pathway,

78 per cent of companies’ electricity

generating capacity needs to come

from renewables by 2030. Currently,

only eight companies are investing at

these levels. There are no companies

in the sample with a zero carbon port-

folio and for 34 companies, coal ac-

counts for more than 10 per cent of

their capacity.

The sector has performed well on

pursuing a Just Transition, with Euro-

pean headquartered companies dem-

onstrating the highest levels of best

practice on planning for and mitigat-

ing the social impacts of their low-

carbon transition on workers, com-

munities and affected stakeholders.

Coal power rebound

Coal power rebound

threatening net zero goals

threatening net zero goals

THE ENERGY INDUSTRY TIMES - JANUARY 2022

2

Junior Isles

Revised rules of the Trans-European

network for Energy (TEN-E) Regula-

tion have been introduced to support

the European Green Deal and look set

to provide a much needed boost for

hydrogen.

On December 14, 2021, the Euro-

pean Union’s Council, Parliament,

and Commission agreed in principle

on new EU rules for cross-border en-

ergy infrastructure and future Projects

of Common Interest (PCIs) under the

TEN-E framework. The agreement

comes after the European Commis-

sion tabled a proposal for renewing

the regulation in 2020, with an aim to

modernise the existing regulation and

fully align it with the objectives of the

Green Deal.

Key elements of the political agree-

ment include a strengthened frame-

work for the cross-border cooperation

to accelerate the implementation of

offshore grids as a key element of the

energy transition, a strengthened fo-

cus on infrastructure categories such

as smart electricity grids, a widened

scope to include hydrogen networks

as well as a mandatory sustainability

assessment for all eligible projects.

“Now is the time to invest in the

energy infrastructure of the future.

The revised TEN-E rules will allow

clean technologies to be plugged in to

our energy system – including off-

shore wind and hydrogen. We need to

update and upgrade now to achieve

the Green Deal’s goal of climate neu-

trality by 2050,” said Executive Vice-

President for the EU Green Deal,

Frans Timmermans.

The revised rules also bring new pro-

visions on support for projects con-

necting the EU with third countries,

Projects of Mutual Interest (PMIs), that

contribute to the EU’s energy and cli-

mate objectives in terms of security of

supply and decarbonisation.

The new rules came as the Interna-

tional Energy Agency (IEA) called for

more ambitious and concrete hydro-

gen policy efforts from governments

across Europe and beyond to bridge a

wide gap between the current market

trajectory and the projects needed to

meet net zero targets.

Speaking at the S&P Global Platts

Hydrogen Markets Europe Confer-

ence in late November, Jose Bermu-

dez, the IEA’s energy technology

analyst for hydrogen and alternative

fuels, said that under the IEA’s net zero

scenario, hydrogen demand of around

90 million mt/year in 2020 would

roughly double by 2030, with a six-

fold increase by 2050. However, un-

der current trends, the IEA expects the

market to reach just 105 million mt/

year by 2030, with most growth lim-

ited to traditional sectors, or to rise to

120 million mt/year by that date if

existing government pledges are met.

The EU has a target to produce 10

million tonnes of renewable hydro-

gen by 2030, though vast quantities

of new renewable power capacity will

be required.

Bermudez said carbon auctions and

contracts for differences could play a

potential role in developing the hy-

drogen market, but almost no such

schemes have come into force yet.

global coal red electricity genera-

tion takes place, coal power is ex-

pected to grow by 9 per cent in 2021

despite a deceleration at the end of

the year. In India, it is forecast to

grow by 12 per cent. This would set

new all-time highs in both countries,

even as they roll-out impressive

amounts of solar and wind capacity.

While coal power generation is set

to increase by almost 20 per cent

this year in the United States and

the European Union, that is not

enough to take it above 2019 levels.

Coal use in those two markets is

expected to go back into decline

next year amid slow electricity

demand growth and rapid expan-

sion of renewable power.

Last month Greece became the

latest country in Europe to an-

nounce a timeline for ending coal

red power generation.

Greece is to introduce its rst cli-

mate law, pledging to cut its reliance

on coal within six years as part of a

move to a carbon net zero economy

by 2050.

The law comes after the country

suffered devastating wildres this

year when summer heat soared that

was attributed partly to global

warming.

“The national climate law is of

historic importance . . . in order to

deal with the climate crisis and

achieve climate neutrality by 2050,”

said Kostas Skrekas, Environment

and Energy Minister.

The law foresees an intermediate

target of reducing greenhouse gas

emissions by 55 per cent by 2030.

As part of its plans Greece will

phase-out production of lignite, a

particularly polluting form of coal,

within the next six years. The deci-

sion will be reconsidered by 2023

with an eye to accelerating an exit.

Greece is one of the EU countries

that relies most heavily on coal for

energy and has been a laggard with-

in the EU in cutting emissions. Ger-

many has cut its emissions 38 per

cent from 1990 levels, according to

UN data, while Greece has cut its

emissions by less than 19 per cent

over the same period.

n Last year (2021) will surpass the

2020 record, with 290 GW of new

renewables capacity installed, de-

spite rising prices for some com-

ponents and transport, highlights

the IEA’s ‘Renewables’ report. Ac-

cording to the IEA, which revised

and raised its projections, 4800

GW of installations will be avail-

able by 2026, which means 60 per

cent more than in comparison with

2020 and the equivalent of the cur-

rent power capacity from nuclear

and fossil energies together. Pho-

tovoltaics will account for more

than 50 per cent of this increase,

and offshore wind will triple its

capacities.

Continued from Page 1

Gas and nuclear were likely to have

“amber” status, meaning they would

not be in the “green” category with

wind and solar power, but would fea-

ture in the EU taxonomy, the EU’s

ambitious labelling system for green

investment, according to a EU ofcial.

At the time of writing, the European

Commission was expected to publish

the draft taxonomy – the second del-

egated act – on 31 December, allowing

a few weeks of consultation with ex-

perts and governments. The nal pro-

posals may be published on 12 Janu-

ary and could only be blocked by a

super-majority of 15 EU member

states.

It will describe the sustainable cri-

teria for renewable energy, car manu-

facturing, shipping, forestry and bio-

energy and more, and include a

“technology-neutral” benchmark at

100 grams of CO

2

/kWh for any invest-

ments in energy production.

The EU taxonomy is a green clas-

sication system that is intended to

guide investors to projects that are in

line with Europe’s goal of net zero

emissions by 2050 and better protec-

tion of the environment.

Both gas and nuclear were expected

to feature in the next part of the EU’s

“taxonomy for sustainable activities”,

following a period of intense political

bargaining between the Commission

President, Ursula von der Leyen; the

French president, Emmanuel Macron;

and Germany’s new chancellor, Olaf

Scholz.

The rst two chapters of the sustain-

able taxonomy, the so-called ‘rst del-

egated act’, were passed on 9 Decem-

ber and came into force on 1 January

2022. But in a meeting of member

states on 29 November the project

nearly faltered.

The EU described nuclear as “a stable

energy source” needed “during the

transition to gas”. EU climate chief

Frans Timmermans also acknowl-

edged “nuclear and transition gas play

a role in the energy transition”, but

stressed that this “does not make them

green”.

An EU diplomat, speaking anony-

mously, explained to EUobserver that

a French-led group of 13 member states

tried to block the rst list “out of prin-

ciple” because the commission had not

agreed to include nuclear and gas in

the green taxonomy.

France and Finland pushed for nucle-

ar to be “fully part of the taxonomy”.

Ten other mainly eastern European

countries want gas included. Sweden

joined the group because the new rules

endanger its forestry sector.

Sebastien Godinot, a senior econo-

mist at WWF and member of the EU’s

Sustainable Finance Platform, said:

“The commission must deliver a sci-

ence-based taxonomy regulation that

excludes fossil gas, nuclear, and fac-

tory farming. Otherwise, the credibil-

ity of the taxonomy is ruined.”

Some argue the Commission may

have no choice but to compromise

with regards gas and nuclear – sup-

porting member states on one side,

and countries opposing these on the

other – while also being mindful that

investors and experts from its Sustain-

able Finance Platform will reject a

system containing contradictory po-

litical concessions.

Institutional investors have already

signalled they want a taxonomy based

on science, not political compromise.

Finland’s long-delayed Olkiluoto 3

(OL3) nuclear reactor has started pow-

ering up and will start producing elec-

tricity at the end of this month, some

12 years later than originally sched-

uled. Regular electricity production is

scheduled to begin in June.

The Nordic country’s nuclear safety

authority, STUK, gave permission last

month “for making the reactor critical

and conducting low power tests,” Finn-

ish electricity producer TVO said in a

statement. Construction of the 1600

MWe EPR began in 2005. Completion

of the reactor was originally scheduled

for 2009 but the project has had various

delays and setbacks.

Other EPR builds in France and the

UK have also been beset with delays,

with Hinkley Point in southwest

England pushing back its planned

electricity production by half a year

to mid-2026.

OL3 was built under a xed-price

turnkey contract by a consortium of

Areva and Siemens who have joint li-

ability for the contractual obligations

until the end of the guarantee period of

the unit.

Once low-power tests are completed,

the reactor’s power will be gradually

increased and further commissioning

tests conducted. STUK will oversee the

most signicant tests on site and check

the results of the commissioning tests.

During the power tests, permits issued

by STUK are required for power levels

of 5 per cent, 30 per cent and 60 per

cent. Electricity production starts at a

power level of 30 per cent.

Olkiluoto 3, which will run alongside

two existing reactors at Eurajoki on the

west coast, was the rst nuclear power

station to be procured in Europe after

the 1986 Chernobyl disaster.

“We are now moving step-by-step

with a safety-rst attitude towards the

moment we have waited for a long

time,” said TVO Senior Vice President

for Electricity Production Marjo Mus-

tonen. “The preconditions for the start-

up of the reactor have been fullled,

and soon we will be able to realise our

promises on Finland’s greatest act for

the climate.”

STUK said the preconditions for

criticality and low-power tests have

been met and the commissioning tests

performed before rst criticality show

that the plant operates as planned. It

noted the commissioning tests also

included re-tests carried out after mod-

ications were made to certain plant

systems.

The nal go-ahead came as the Min-

istry of Economic Affairs and Employ-

ment (TEM) announced it is launching

legislative preparations aimed at a

comprehensive reform of the country’s

Nuclear Energy Act. It said the future

use of nuclear energy – including new

technologies such as small modular

reactors – requires “appropriate and

up-to-date legislation”.

The revised draft legislation is ex-

pected to be submitted for consultation

during 2024. The government’s pro

-

posal to Parliament is due at the end of

the next parliamentary term, with the

law entering into force in 2028.

Headline News

Nuclear and gas still not seen as

Nuclear and gas still not seen as

“green” by EU climate chief

“green” by EU climate chief

Finland’s OL3 prepares to start-up, 12 years late

Finland’s OL3 prepares to start-up, 12 years late

Revised TEN-E rules

Revised TEN-E rules

will boost hydrogen

will boost hydrogen

Skrekas says the national

climate law is of “historical

importance”

n New EU rules for cross-border energy infrastructure

n IEA calls for more ambitious and concrete hydrogen policy efforts

THE ENERGY INDUSTRY TIMES - JANUARY 2022

3

Middle East & North Africa

ﺎـــــــــــــــــــﻴﻘﻳﺮﻓﺍ ﻝﺎـــــــــــــــــــﻤﺷﻭ ﻂــــــــــــــــــــﺳﻭﻷﺍ ﻕﺮــــــــــــــــــــﺸﻟﺍ

M

ﺔﻴﺴﻤﺸﻟا ﺔﻗﺎﻄﻟا تﺎﻋﺎﻨﺼﻟ ﻂﺳوﻻا قﺮﺸﻟا ﺔﻴﻌﻤﺟ

Middle East Solar Industry Association

Empowering Solar across the Middle East

MIB Media.pdf 2 11/11/21 9:12 AM

21

st

-23

rd

JUNE

LANDMARK CENTRE, LAGOS

Conneccng the Nigerian Uclices Industry

Digiczacon. Sustainability. Opcmizacon.

POWER & WATER

NIGERIA 2022

THE ENERGY INDUSTRY TIMES - JANUARY 2022

7

Europe News

Janet Wood

The European Bank for Reconstruc-

tion and Development (EBRD) is to

lend Poland €38.9 million to build two

wind farms, Grajewo and Sulmierzyce,

totalling 63.1 MW. The other funder is

DNB ASA, Norway’s largest nancial

services group. Denmark’s export

credit fund is providing guarantees.

Poland’s transition to low-carbon

generation is gaining momentum, as it

aims to increase the renewable propor-

tion of its nal energy consumption

from 12.2 per cent at the end of 2019

to 23 per cent by 2030.

The next six months are expected to

see major contracts signed for the 1.2

GW Baltic Power offshore wind farm,

which is due to be completed in 2026,

according to its owner, a joint venture

between Poland’s PKN ORLEN and

Canadian Northland Power. “Key con-

tracts for the project will be signed

within the next six months, and the key

contractors will begin selecting and

working with new partners, including

local suppliers,” said Jarosław Broda,

President of the Baltic Power Manage-

ment Board. Almost 600 representa-

tives of 369 companies and institutions

attended a supply chain meeting at the

start of December, the developers said.

The European Commission has al-

ready given Poland State Aid clearance

to continue an existing scheme to sup-

port electricity production from renew-

able sources, who receive a variable

premium on top of the market price.

The measure will continue for the pe-

riod 2022-2027, and the European

Commission said, “the aid is necessary

to further develop energy generation

from renewable sources and to help

Poland meet its environmental targets,

set at European and national level”.

New companies in the market include

Eni SPA, which signed an agreement

with Copenhagen Infrastructure Part-

ners to extend their existing offshore

wind partnership to the Polish seas.

The Polish Energy Regulatory Ofce

(ERO) has also offered Contracts for

Difference to 5.9 GW of wind capac-

ity, some of which could be opera-

tional by 2025. They include the 1 GW

Baltica 3 and 1.5 GW Baltica 2 offshore

projects, developed by Ørsted and

PGE, and to the 350 MW FEW Baltic

II offshore project, developed by Baltic

Trade and RWE subsidiary Invest Sp.

z o. o., the 370 MW B&C-Wind proj-

ect developed by Ocean Winds, Equi-

nor and Polenergia’s Bałtyk II and

Bałtyk III projects with a combined

capacity of 1440 MW, and the 1.2 GW

Baltic Power project developed by

PKN Orlen and Northland Power.

Two more CfD auctions, each for 2.5

GW, are planned in 2025 and 2027.

Vattenfall AB has taken the nal in-

vestment decision on Denmark’s 344

MW Vesterhav Syd and Vesterhav

Nord offshore wind farms. Now the

Danish government wants to add up

to 3 GW of new offshore wind capac-

ity to be developed before 2030. The

plans were published in the Finance

Act 2022, with the rst tender for 2

GW of offshore wind capacity before

2030.

Currently, Denmark plans to add up

to 7.2 GW of offshore wind capacity

by 2030. It wants to develop an ‘en-

ergy island’ in the North Sea to host

more offshore wind connections by

2040.Recently the Danish Minister of

Climate, Energy and Utilities, Dan

Jørgensen, and the Belgian Minister

of Energy, Tinne van der Straeten,

signed a Memorandum of Agreement

to establish an offshore grid connec-

tion between Denmark and Germany,

including the planned energy island.

Meanwhile, the CO

2

storage project

known as Project Greensand has won

€26 million from the Danish Energy

Agency. “Carbon capture storage is

one of the steps needed to reach the

ambitious climate goals in Denmark,

and we as a consortium are very proud

to be allowed to contribute to that

through this project,” said David

Bucknall, Chief Executive of Project

Greensand consortium leader INEOS

Energy.

The European Commission’s newly

published Hydrogen and Decar-

bonised Gas Package aims for an EU

market for hydrogen by 2030.

Executive Vice-President for the Eu-

ropean Green Deal, Frans Timmer-

mans, said: “Europe needs to turn the

page on fossil fuels and move to clean-

er energy sources. This includes re-

placing fossil gas with renewable and

low carbon gases, like hydrogen. To-

day, we are proposing the rules to en-

able this transition and build the nec-

essary markets, networks and

infrastructure.”

The new rules will ease tariffs and

allow low-carbon gases to access the

existing gas grid. They also create a

certication system.

The EU sees an important role for

hydrogen in decarbonisation. To help

deliver its Hydrogen Strategy it set up

a European Clean Hydrogen Alliance,

which has now announced a pipeline

of over 750 European industrial hydro-

gen projects.

Among them, BP is planning a new

production facility in the UK, HyGreen

Teesside, which could deliver up to 500

MW of hydrogen production by 2030.

The UK also plans a £9.4 million

($12.7 million) hydrogen storage and

production facility at Whitelee, its larg-

est onshore windfarm.

In Belgium, Engie and Equinor have

announced the H2BE project to pro-

duce hydrogen from natural gas, with

gas transmission system operator

Fluxys.

In Spain, a joint-venture between

Iberdrola and H2 Green Steel plans to

build a €2.3 billion 1 GW electrolyser.

The Republic of Ireland is ready to

bring forward several new gas red

power plants over the next decade.

Minister for the Environment Eamon

Ryan will layout a policy to build

2 GW of gas generation to supplement

and act as backup for wind energy.

The policy would likely see between

four and seven new gas red plants.

The new gas plant would be in ad-

dition to about 15 GW in the form of

offshore and onshore wind farms and

solar farms. With the closure of the

coal red Moneypoint station and

other fossil fuel plants, the overall

volume of gas being used will remain

almost at current levels.

The Republic of Ireland expects to

see electricity demand increase over

the next decade, including for major

new data centres. In addition, it is plan-

ning on electrication of the transport

eet as well as more reliance on elec-

tricity for home heating.

The Commission for the Regulation

of Utilities said that “additional gas

red generation is vital for the success-

ful delivery of Ireland’s 2030 renew-

able electricity and climate targets”.

The Republic will also invest in in-

terconnection to connect it directly to

the EU’s internal electricity market

(IEM), of which it remains a member

although it is currently only linked via

the UK, which departed the IEM when

it left the European Union.

Janet Wood

The UK has opened its fourth renew-

ables tender, with Contracts for Differ-

ence (CfD) on offer for 12 GW of ca-

pacity – more than the previous three

rounds combined. UK energy regula-

tor Ofgem is also set to hold a third

investment round for interconnectors

next year, aiming to bring connections

between Great Britain and its neigh-

bours to at least 18 GW. But the major

investment in new capacity for the next

decade is being made as the UK’s con-

sumers face an energy crisis, with

sharply rising energy bills this winter.

The CfD auction will support major

offshore wind development including

oating offshore wind, along with

tidal stream projects and other emerg-

ing technologies. The allocation round

will close on 14 January 2022 and the

results are expected in late spring. It is

a major step towards delivering the

government’s plan for 40 GW of off-

shore wind by 2030.

Launching the auction, Kwasi

Kwarteng, Secretary of State at the

Department for Business, Energy and

Industrial Strategy, said: “Our biggest

ever renewables auction opening today

will solidify the UK’s role as a world-

leader in renewable electricity, while

backing new, future-proof industries

across the country to create new jobs.”

RenewableUK CEO Dan McGrail

said: “More than 16 GW of wind could

be ready to compete and over 23 GW

of renewables overall. We could see

investment of over £ 20 billion in this

round”.

Britain currently has 7.4 GW of elec-

tricity interconnectors with Ireland,

France, Belgium, the Netherlands and

Norway. A new investment round in

the middle of 2022 will target intercon-

nectors that can connect by 2030. “Our

next investment round for interconnec-

tors will bring forward the investment

we need, creating green jobs and un-

leashing the full potential of the UK’s

world leading offshore wind industry,

while also protecting customers by

capping costs,” said Ofgem’s Net-

works Director Akshay Kaul.

The major investment plans came as

rising gas prices and balancing costs

have caught out two dozen energy sup-

pliers, which have gone out of busi-

ness. Ofgem has been blamed for al-

lowing often thinly capitalised and

poorly hedged companies to operate in

a bid to boost competition.

Energy UK Chief Executive Emma

Pinchbeck said: “The industry has long

been calling for a more sustainable

regulatory and policy environment –

not only to avoid situations like the

present one, but because suppliers need

to drive the innovation in products and

services to help customers get the best

of the green energy transition.”

Kwasi Kwarteng said: “By generat-

ing more renewable energy in the UK,

we can ensure greater energy indepen-

dence by moving away from volatile

global fossil fuel prices, all while driv-

ing down the cost of new energy.”

Poland funds

Poland funds

green ambitions

green ambitions

UK energy crisis highlights

UK energy crisis highlights

renewables investment

renewables investment

EU’s hydrogen

EU’s hydrogen

industry hits 750

industry hits 750

projects

projects

Ireland to build gas power to

“cover transition”

Denmark invests in wind, carbon capture

n Financing in place for major onshore site n Two contracts for difference auctions by 2027

n Contracts for Difference for renewables, open door for new

interconnectors

n Gas and system costs raise prices

Gas market dynamics put future of

East Mediterranean gas in question

Snam commits to hydrogen future, US

sets up clean energy ofce

Gary Lakes

The future of East Mediterranean gas

is under debate. The surge in gas pric-

es has brought speculation about the

future demand for gas in a world that

is planning to make an energy transi-

tion that will phase out fossil fuels by

2050. But what if this transition does

not go smoothly and the world nds

that it needs more gas and needs it for

a longer period of time than currently

envisaged?

Questions surrounding the future

global gas markets have been bandied

about since the coronavirus pandemic

brought deep cuts in demand for hy-

drocarbons, and they have been hang-

ing over the East Mediterranean like a

Sword of Damocles. The known gas

resources in the East Med have yet to

be developed fully and most of the re-

sources believed to exist in the region

have yet to be discovered.

For now, its appears that gas will be

in demand for at least the next three

decades after which the world is meant

to be operating at net zero carbon emis-

sions. The recent price increases in gas

and especially the situation between

the EU and Russia over gas supplies is

an example of a situation that could

repeatedly pop-up during the course of

the switch to renewable energies.

Egypt, which several years ago had

basically shut down its LNG exports

because of low prices, is now exporting

at full capacity – around 12 million

tons/year – in order to take advantage

of current high prices. Egypt’s gas in-

dustry is well developed and over the

last six years has received a signicant

production boost after the discovery of

the Zohr eld in 2015. Current gas

production in Egypt is between 6.5 and

7.0 billion ft

3

per day.

Since Zohr, Egypt has been promot-

ing itself as a regional energy hub, the

idea being that it would import gas

produced in Israel and Cyprus, and re-

export it as LNG or, as Cyprus, Israel

and Greece have been suggesting, ex-

port East Med gas through a 2000 km

subsea pipeline that would land in

Greece and carry on to Southeast and

Central Europe. Egyptian President

Abdel Fattah el Sisi has proposed that

this pipeline run across northern Egypt

as far as the Libyan border and cross

to Crete and then Greece from there.

The pipeline projects are viewed by

many as unlikely, especially in a cli-

mate where long-term gas projects,

especially pipelines, are being ques-

tioned as being worthy of investment.

Funding for hydrocarbon projects is

under close scrutiny and it is doubtful

that more gas pipeline projects will be

added to the existing list.

For the time being, it looks like fu-

ture East Med gas production that is

not distributed regionally will be ex-

ported through Egypt’s LNG facili-

ties. And, it remains to be seen if

global gas markets will warrant the

investment in exploration and devel-

opment of the gas resource targets

offshore Cyprus and Lebanon.

Israel already has gas resources esti-

mated at around 1 trillion m

3

. Produc-

tion from the Tamar eld is going to

meet domestic needs, as is some of the

gas from the giant Leviathan eld. But

Leviathan is also exporting to Egypt

for re-export. Further development of

Leviathan will depend on decisions yet

to be made by operator Chevron, the

US giant. Greece’s Energean is also

developing the Karish and Tanin elds

and that gas will be available for the

Israel market next year.

Meanwhile, the Israeli government

announced last month that it will halt

further offshore gas exploration and

shift attention to developing renewable

energies, with Energy Minister Karine

Elharrar saying: “Gas can wait.”

In Cyprus, gas has been waiting for

a long time. ExxonMobil launched

during Christmas week an appraisal

well for its January 2019 Glavcos-1

discovery well. Glavcos-2 is expected

to conrm the estimated 5-8 tcf gas

resource and lead to further explora-

tion. This is the rst well drilled off-

shore Cyprus by licensed companies

since the start of the coronavirus pan-

demic. Cyprus’ Aphrodite eld, with

a 4.5 tcf resource, was discovered in

December 2011 and still lies undevel-

oped. Prior to the pandemic, there had

been talk of plans to ship the gas to

Egypt via a subsea pipeline for re-

export as LNG. Chevron, which is also

operator for Aphrodite, has yet to de-

cide on that eld’s future.

What will become of Lebanon’s en-

ergy sector is anyone’s guess. One

obstacle after another has appeared

that has held the country back.

One licensing round has been com-

pleted and two blocks awarded, but a

well drilled by the Total/Eni/Novatek

group proved un-commercial and an-

other planned well was cancelled due

to the pandemic. In November, the

Lebanese Petroleum Authority an-

nounced a closing date of June 15,

2022, for its second licensing round.

This might prove successful, but the

nancial crisis, the internal politics,

and an ongoing maritime border dis-

pute with Israel might not allow the

round to be as successful as it could be

under different circumstances.

Gary Lakes

Keen to take a leading role in Europe’s

transition to clean energy, Italy’s Snam,

the largest gas pipeline operator in Eu-

rope, has committed some €23 billion

to investments in hydrogen infrastruc-

ture from now until 2030, the company

said in November.

The company has expressed its plan

to transport entirely decarbonised gas

– hydrogen and biomethane – through-

out Italy and to the rest of Europe by

2050, making Italy an important hub

for the transition away from fossil fu-

els. Snam has allocated 50 per cent of

its 2020-2024 budget of €7.4 billion to

replace and develop infrastructure that

is compatible with the movement and

storage of hydrogen. The company

already asserts that 70 per cent of its

pipeline network is capable of trans-

porting hydrogen.

In a talk unveiling the company’s plan

for the next decade, CEO Marco Al-

vera, who has written several books on

hydrogen, said in November that Snam

would “play a key role in a decisive

decade for the energy transition” with

the aim to seize new growth opportuni-

ties in Italy as well as internationally.

Alvera’s comments followed the pur-

chase of a 49.9 per cent stake in Eni’s

gas pipelines that carry Algerian gas

from North Africa to Italy. The pur-

chase was made for the purpose of

eventually transporting hydrogen and

green ammonia produced in Algeria to

Italy and other countries in Europe.

Snam will pay Eni €385 million for

nearly half ownership in the 2700 km

pipeline system that currently trans-

ports gas to Italy. Algeria supplies Ita-

ly with about 30 per cent of its annual

gas demand.

A vast solar power generation system

has been envisaged for North Africa

with the plan calling for electricity gen-

erated by the solar stations to be trans-

mitted to Europe. Current thinking

calls for solar power to be used to run

electrolysers that would create hydro-

gen gas and then possibly green am-

monia for export. Snam plans to invest

€3 billion to repurpose the pipeline.

Snam also plans to invest €12 billion

to upgrade its 33 000 km pipeline in

Italy. Furthermore, the company has

entered a partnership with Italian rm

De Nora that will build an electroly-

ser factory with a capacity to produce

1 GW for hydrogen conversion.

Another €5 billion will be invested

in energy storage by 2030 and develop-

ing an international green energy stor-

age platform. According to company

information, Snam’s storage facilities

are already capable of storing 100 per

cent hydrogen. Snam operates nine

storage sites across Italy and more than

41 000 km of pipelines in Italy, Greece,

France, Austria, the UK and the UAE.

Besides De Nora, Snam has entered

into a number of partnerships designed

to share expertise that will move the

hydrogen agenda forward. The com-

pany is working with railway operators

FS Italiane and Ferrovie Nord, traction

suppliers Alstom, energy and utility

suppliers Eni, A2A and Hera in order

to develop refuelling infrastructure

that will make hydrogen mobility by

rail possible in Italy. Snam is also work-

ing with industrial rms and power

generation companies like Tenaris and

Edison.

Meanwhile, the US has established

the New Ofce of Clean Energy Dem-

onstrations with funding amounting to

more than $20 billion. The ofce is

mandated to help deliver on US Presi-

dent Joe Biden’s climate agenda and

set up numerous clean energy pro-

grams across the US. Those projects

include clean hydrogen, carbon cap-

ture, grid-scale energy storage, small

modular reactors and other innovative

forms of clean energy production.

“Demonstration projects prove the

effectiveness of innovative technolo-

gies in real-world conditions at scale

in order to pave the way towards wide-

spread adoption and deployment,” the

Department of Energy said in a De-

cember 21 statement announcing the

establishment of the ofce, which was

made possible by Congress passing

the Bipartisan Infrastructure Law.

“The Ofce of Clean Energy Dem-

onstrations will move clean energy

technologies out of the lab and into

local and regional economies across

the country, proving the value of tech-

nologies that can deliver for communi-

ties, businesses and markets,” Jennifer

Granholm, Secretary of Energy, said in

the statement.

A large portion of the funding will

go towards project developing green

hydrogen. Some $9.5 billion is allo-

cated for establishing four regional

green hydrogen hubs plus manufac-

turing and recycling programmes, all

of which are meant to demonstrate and

commercialise the new technology.

The demonstrations are intended to

unlock millions and billions of dollars

in follow-on investment.

Many of the projects will be located

in rural and low-income regions that

have been targeted by Biden’s Justice

40 initiative which aims to deliver 40

per cent of clean energy investment

benets to disadvantaged communities

and those hardest hit by climate change.

According to the statement, the ofce

will “consistently engage environmen-

tal justice groups, labour, and commu-

nities to help shape program develop-

ment and execution.”

Hydrogen

Gas

The future of East Mediterranean gas is under debate as questions continue to cloud the future of

global gas markets.

n

Europe’s largest gas pipeline operator plans to transport decarbonised gas by 2050

n New US ofce commits $20 billion to fund clean energy demonstration projects

THE ENERGY INDUSTRY TIMES - JANUARY 2022

11

Fuel Watch

I

n 2018, the European Commis-

sion published its action plan on

nancing sustainable growth. It

set a strategy to attract investment in

sustainable activities, including

through the creation of a European

framework evaluating the sustain-

ability of various economic activi-

ties. Such a framework is known as a

‘taxonomy’.

On June 22, 2020, the Regulation

on the establishment of a framework

to facilitate sustainable investment

was published in the EU Ofcial

Journal. This regulation creates the

EU taxonomy, basing its sustainabil-

ity assessment on six objectives:

1. Climate change mitigation

2. Climate change adaptation

3. The sustainable use and protection

of water and marine resources

4. The transition to a circular

economy

5. Pollution prevention and control

6. The protection and restoration of

biodiversity and ecosystems.

To be labelled as sustainable, an

activity should substantially contrib-

ute to at least one of these objectives,

without doing signicant harm to

any of the ve others (“Do No Sig-

nicant Harm” principle, DNSH).

The activity also needs to full

technical screening criteria that are

developed by the Platform on Sus-

tainable Finance – an expert group

composed of representatives from

the nancial sector, various indus-

tries, and NGOs – and adopted in

delegated acts. Without these dele-

gated acts, the framework is an emp-

ty shell: to assess the sustainability

of their portfolios, investors and

companies need to assess the activi-

ties they nance, insure or conduct

against the technical criteria pub-

lished in the delegated acts.

A rst delegated act, covering the

two climate objectives and encom-

passing around 70 activities, was

published in the Ofcial Journal of

the EU on 9th December 2021. A

draft complementary delegated act

covering gas and nuclear energy was

scheduled for December 22, 2021,

and a delegated act covering objec-

tives 3 to 6 is expected in 2022.

But waste management is one

piece missing in the taxonomy. The

waste management sector can con-

tribute to at least three of these ob-

jectives (climate change mitigation,

circular economy and pollution pre-

vention) and has therefore been par-

tially covered by the rst delegated

act and by the rst draft of activities

proposed by the Platform for the sec-

ond delegated act.

The rst delegated act acknowl-

edges the contributions to climate

change mitigation that can be

achieved in the higher steps of the

waste hierarchy: material recovery

of non-hazardous waste, anaerobic

digestion of biowaste, composting.

At the lower end of the hierarchy, it

recognises the positive contribution

of landll gas capture in closed land-

lls. As for the activities to be cov-

ered in the next delegated act, the

Platform proposed to note the contri-

bution of material recovery (both

non-hazardous and hazardous waste)

and of phosphorus recovery from

sewage sludge to the transition to the

circular economy, and of hazardous

waste treatment to pollution preven-

tion and control. The lower end of

the waste hierarchy was also cov-

ered, with the inclusion of the reme-

diation of legally non-conforming

landlls and abandoned or illegal

dumps as contributing to pollution

prevention and control.

So far, the work accomplished on

the taxonomy has however over-

looked a cornerstone of sustainable

waste management: dealing with re-

sidual waste, the waste that despite

all efforts cannot be prevented, re-

used or recycled. Large disparities in

waste management systems still ex-

ist between EU Member States:

while some Member States like Ger-

many recycle 67 per cent of their

municipal waste and landll virtual-

ly none of it, others like Romania

landll 76 per cent and recycle 11

per cent of their municipal waste. In

2019 in Spain, 12 million tonnes of

municipal waste were landlled.

The EU’s best performers in waste

management combine a high level of

recycling with an appropriate level

of waste-to-energy (WtE) so that

non-sorted waste and residues from

sorting and recycling processes can

be safely treated and their energy re-

covered. In order to reach the 2035

targets of minimum 65 per cent recy-

cling and maximum 10 per cent

landlling of municipal waste, many

Member States that still rely heavily

on landlls will need investments in

all of the other levels of the waste hi-

erarchy. The taxonomy would be an

ideal framework to provide investors

and public authorities with clear cri-

teria for sustainable residual waste

treatment activities. The move to-

wards more high quality recycling is

also leading to an increase in residu-

al, non-recyclable waste streams.

This waste must be treated in dedi-

cated installations, to avoid waste

transports to third countries where

environmentally sound management

is not guaranteed. This is the role of

waste-to-energy.

As acknowledged in the European

Commission’s Communication on

the role of Waste-to-Energy in the

Circular Economy, the WtE sector is

a key element of an integrated waste

management system and fully be-

longs in a circular economy as it

treats residual, non-recyclable waste.

It is therefore disappointing that nei-

ther the Commission nor the Plat-

form on Sustainable Finance have

proposed any guidance for the treat-

ment of the unrecyclable residual

waste to the countries that will need

to develop this aspect of their waste

management system.

The legal feasibility of including

WtE activities in the taxonomy has

been demonstrated by a legal analy-

sis from PwC (provided technical

criteria are developed and adopted).

In practice, the sector contributes to

the three objectives highlighted ear-

lier (1, 4 and 5).

With regard to climate change miti-

gation, WtE substitutes fossil fuel by

producing energy from non-recycla-

ble waste which would otherwise

have been landlled (emitting cli-

mate potent methane). As a signi-

cant part of the waste treated is bio-

genic, around half of the energy

produced is renewable. The combus-

tion process also allows the recovery

of metals embedded in the waste,

which leads to further greenhouse

gas emission savings. The mineral

part of bottom ash can be recovered

and used as aggregates, leading to

further emission savings.

Waste-to-Energy also helps to en-

able the transition to a circular econ-

omy, by treating non-recyclable

waste in the most sustainable way

possible, in line with the waste hier-

archy and best available techniques.

High-quality recycling can only be

achieved if there is an outlet for re-

jects from sorting and recycling fa-

cilities. This has been highlighted by

the recycling industry.

While the Platform proposal in-

cludes treatment of hazardous waste

for pollution prevention, there are

also contaminated wastes that are not

classied as hazardous but still need

thermal treatment to destroy the pol-

lutants and pathogens (e.g. POP-con-

taining wastes, some healthcare

waste). For these wastes, WtE plants

contribute to pollution prevention

and control: they allow the material

cycle to remain free of pollutants.

To be included in the taxonomy, an

activity must do no signicant harm.

With regards to WtE, this means that

installations are planned, designed

and operated so that they are in line

with the waste hierarchy, hence con-

sidering waste prevention and recy-

cling efforts. The Taxonomy Regula-

tion (Art. 17(1)(d)(i)) indicates that

an activity is signicantly harmful to

the transition to a circular economy

if this activity leads to a “signicant

increase in the generation, incinera-

tion or disposal of waste”. The Reg-

ulation does not dene further what

a “signicant increase” means and

on which level this should be inter-

preted (local, national, European).

As for additional capacities, the

WtE sector explicitly stated that new

investments should only happen in

well justied cases, in line with local

and national waste management

plans taking into account the EU

waste targets and potential waste

prevention and recycling measures.

The ongoing discussions on taxon-

omy are an ideal opportunity to de-

velop guidelines for the treatment of

non-recyclable waste in the most

sustainable way possible, in line

with the waste hierarchy and best

available techniques, while ensuring

that proper safeguards are in place.

Missing this opportunity will delay

investments in WtE when they are

needed, which will lead to incom-

plete waste management systems.

Many countries will lack outlets for

the rejects from their sorting and re-

cycling facilities and rely instead on

treatments lower in the hierarchy, or

send non-recyclable waste to regions

with lower environmental standards.

This will hamper the achievement of

the European waste management tar-

gets and, more importantly, be detri-

mental for both the circular economy

and the environment.

This is why CEWEP, together with

European associations representing

the whole waste management value

chain, calls on the European Com-

mission and the Platform on sustain-

able nance to develop technical

screening criteria for the inclusion of

WtE in the taxonomy.

Dr. Ella Stengler, is the Managing

Director at the Confederation of Eu-

ropean Waste-to-Energy Plants (CE-

WEP); Maxime Pernal is Policy Of-

cer, CEWEP.

The waste

management sector

can contribute to at

least three of the

six objectives of

the EU taxonomy

but the current

plan overlooks

a cornerstone of

sustainable waste

management:

dealing with residual

waste. Waste-to-

energy has a vital

role to play here,

say CEWEP’s

(Confederation of

European Waste-to-

Energy Plants)

Dr. Ella Stengler

and Maxime Pernal.

Waste-to-energy: the missing

Waste-to-energy: the missing

piece of the taxonomy puzzle

piece of the taxonomy puzzle

THE ENERGY INDUSTRY TIMES - JANUARY 2022

13

Industry Perspective

Pernal: the WtE sector is a key

element of an integrated waste

management system and fully

belongs in a circular economy

Dr Stengler: So far, the work accomplished on the taxonomy has

overlooked a cornerstone of sustainable waste management

E

liminating non-recyclable

plastic is one of the biggest

challenges facing the waste

management sector. According to

government data, in the UK alone in

2016 (the latest government data

available) the amount of plastic

waste going to landll was 53 400

tonnes. But although this remains a

signicant problem, technology

could soon be demonstrated that

would address the issue, while sup-

porting the UK’s plans to grow the

hydrogen economy.

Just over six months ago Peel

NRE, part of Peel L&P, announced

that it is planning to develop a waste

plastic-to-hydrogen facility at Rothe-

say Dock on the north bank of the

River Clyde, West Dunbartonshire.

The facility will be the second in the

UK to use pioneering technology de-

veloped by Powerhouse Energy

Group plc, after plans for a similar

facility at Peel NRE’s Protos site in

Cheshire were approved in 2019.

Like Protos, the latest £20 million

facility will take non-recyclable plas-

tics, destined for landll, incineration

or export overseas, and use them to

create a local source of sustainable

hydrogen. The hydrogen will be used

as a clean fuel for buses, cars and

HGVs, with plans for a linked hy-

drogen refuelling station on the site.

The project is one of a number of

low carbon “waste-to value projects”

the company is developing as part of

a clean energy portfolio that includes

renewables, i.e. wind, solar projects.

Peel NRE’s plastics-to-hydrogen

projects will play a signicant role in

the UK’s Hydrogen Strategy an-

nounced in August last year, when

the government said it will work

with industry to meet its ambition for

5 GW of low carbon hydrogen pro-

duction capacity by 2030. This is the

equivalent of replacing natural gas in

powering around 3 million UK

homes each year as well as powering

transport and businesses, particularly

heavy industry.

Richard Barker, Development Di-

rector at Peel NRE, said: “Plastic is

often demonised, but we have seen

how essential it is in industries like

healthcare. We do need to recycle as

much of this plastic as possible and

also get as much value from unrecy-

clable, end-of-life plastic.”

While the company is working on

the disposal of several residual

waste projects, Barker says the key

focus is bringing forward the plastics

facility development at Protos. “It

has been a couple of years in gesta-

tion but we’ve rolled out a concept

that brings together various forms

of technology – some established,

some emerging such as the plastics-

to-hydrogen.”

Barker notes that the idea is to have

a grouping of technologies, that are

“symbiotic and co-located to benet

from each others’ presence. He ex-

plained: “The plastics park compris-

es two plastics recycling facilities

[PRFs] – one (PRF1) is a purely sort-

ing facility that will separate out var-

ious polymer types and at the end

produce recyclers that are suitable

for the next recycling stage (PRF2)

or to go off-site. PRF2 does some

additional sorting to improve the

quality of the recyclers that are cap-

tured. These then go through a series

of washing lines… so they are recov-

ered into their base polymer type to

eventually go back into plastics pro-

duction. The idea is then to use the

poorer quality feedstock that cannot

be recycled in the plastics-to-hydro-

gen facility.”

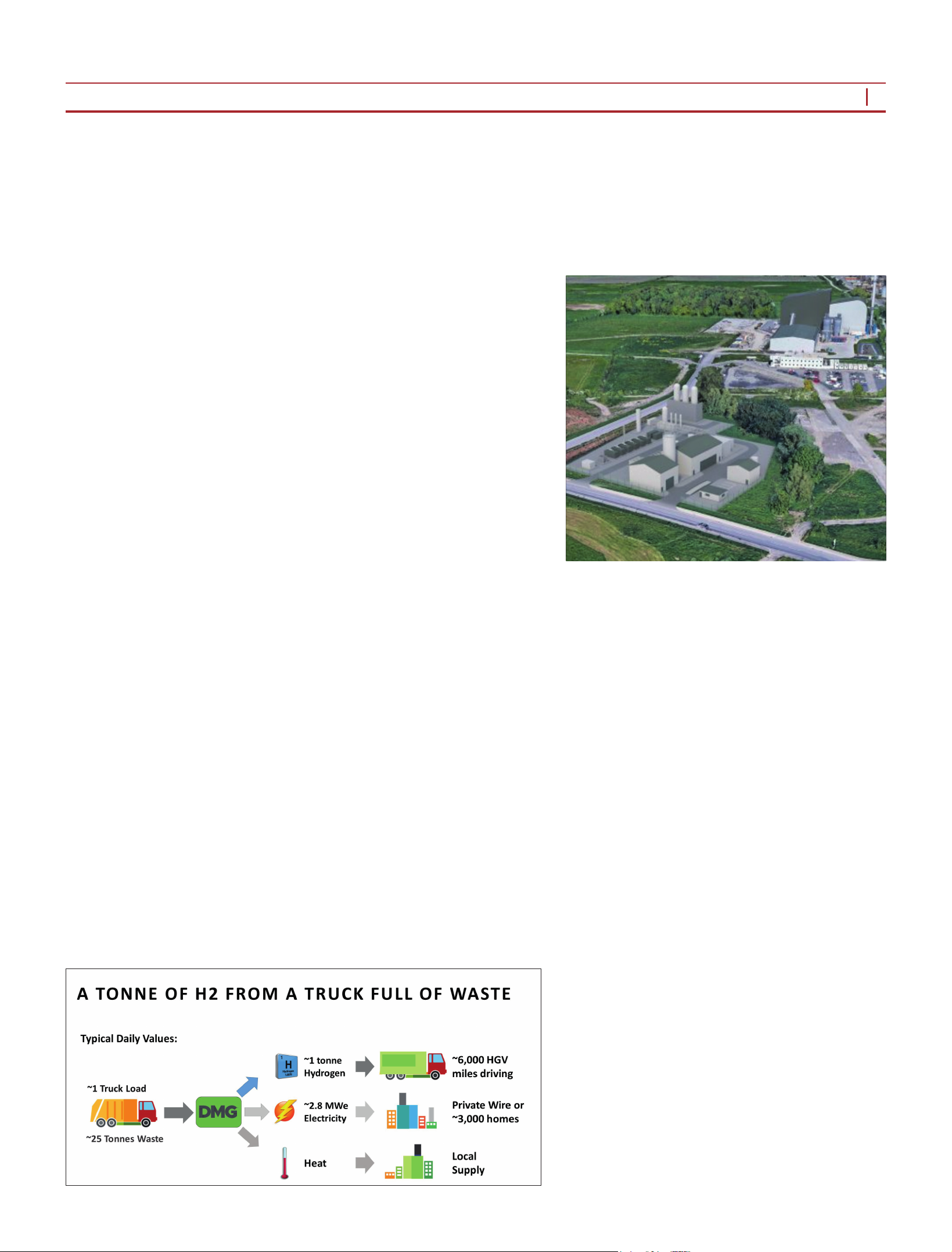

The plastics-to-hydrogen facility at

Protos can process around 13 500 t/

annum of plastics to produce about 2

t/day of hydrogen. It uses Power-

House Energy’s DMG (distributed

Modular Gasication) technology,

which is essentially a pyrolysis pro-

cess where the material is melted and

boiled so it becomes vapour. Gasi-

cation is carried out at around

1000°C with the help of an oxidising

agent but without introducing any

oxygen or air into the process. The

operation takes place in a slight vac-

uum but although there is a little air

in the chamber, the product is not be-

ing burned.

The temperature, oxidising agent

and the residence time of the gases in

the chamber are controlled to pro-

duce either hydrogen gas or a meth-

ane-rich gas. When looking to pro-

duce electricity, the methane content

would be increased so it can be

burned in a reciprocating gas engine.

According to PowerHouse Energy

the technique is a far cheaper way of

producing hydrogen than steam

methane reformation (SMR), which

is currently the only industrial scale

technique for hydrogen production.

The company says that its DMG has

a smaller footprint and is more ef-

cient than electrolysers, noting that

DMG vessels could be loaded on to

a lorry. It also noted that their small

size would make them easier and

faster to permit – taking in the order

of months as opposed to years.

The Protos site, which sits on about

1.8 acres (approx. 7300 m

2

), also

hosts a hydrogen fuelling station, so

arriving trucks could potentially be

refuelled with hydrogen. It is big

enough to refuel about 80 vehicles

and about 1 MW of electricity. This

is sufcient electricity to power the

facility and the plastics park, with

the surplus going to the local grid.

“By co-locating a refuelling sta-

tion, we can help to kick-start the in-

frastructure needed to support the

rollout of hydrogen vehicles which

will be an important part of our jour-

ney to net zero,” said Barker

The Dunbartonshire site will be

slightly bigger, sitting on a roughly

3 acres site due to a larger plastics

processing facility. “It’s more of a

standalone; it doesn’t have the bene-

t of a plastics park wrapped around

it, so will have to process more of its

own,” noted Barker. “But the [plas-

tics-to-hydrogen] units are the same

size.”

Hydrogen from the facility will be

shared between the refuelling station

and the local market. Barker noted:

“Glasgow city council is looking to

convert its diesel eet to hydrogen,

and has already gone some way to

doing that. So we would be com-

pressing the hydrogen and tankering

it out on trailers.”

The planning application for the

Dunbartonshire project has been sub-

mitted and is expected to be deter-

mined some time this year. “Beyond

that,” said Barker, “we’re unlikely to

be doing anything substantive until

we’re sure of the outcome of the rst

[Protos] project.”

Commenting on the schedule for

Protos, PowerHouse Energy stated:

“As a rst-of-a-kind project, Protos

is being designed to allow it to be

commissioned in stages. This mea-

sured approach will place the plant

gradually into full test, and subse-

quently, full operation. One of the

initial tests will be the thermal con-

version chamber (TCC) and syngas

production. Earlier in our delivery

schedule, this test will provide Pow-

erHouse Energy and investors alike,

great condence that a high quality

and consistent syngas product is able

to be produced.

“Following TCC and syngas pro-

duction we then test power genera-

tion, and nally hydrogen produc-

tion, before we declare that we are

complete and operational. This nal

announcement is forecast for 2023.”

Construction of front-end facilities

and site infrastructure is already un-

derway and the project is, as Barkers

puts it “top of everyone’s priority”.

Although still a work in progress,

Barker says lessons have already

been learned from Protos. “You’re

always learning with these projects.

For example, we’ve learned about

the front-end processing capacity but

once the [Protos] project is fully con-

structed and up and running, we’ll be

undertaking a review of the project.

So that’s why we wouldn’t want to

start too soon on the second project.”

These rst two projects are the start

of what is likely to be a long-term re-

lationship between Peel NRE and

PowerHouse Energy. The two com-

panies have signed a collaboration

agreement to develop 11 waste plas-

tic-to-hydrogen facilities across the

UK over the next few years, with the

option of exclusive rights for a total

of 70 facilities.

Commenting on where the addi-

tional facilities might be, Barker

said: “The locations depend on the

nature of the land surrounding the

various sites. What we’re looking for

is sites that are located either close to

the source of the feedstock or close

to the [hydrogen] end-user. Although

the economics will still work, there

are commercial benets from being

in those two areas. We will be using

some of our land but equally they

could be built on third-party land –

most likely close to industrial areas

and large cities, where people are.”

Barker says the aim is to roll-out

these projects “as rapidly as possible

after the rst one; hence the reason

for going into planning on the sec-

ond”. He concluded: “We have a

number of other sites that could po-

tentially be utilised, where we’ve got

existing waste management consent

in place, so we could just re-purpose

the site.”

THE ENERGY INDUSTRY TIMES - JANUARY 2022

15

Technology Focus

Making use of hard

to recycle plastics

could be one

way of reducing

plastic waste, while

supporting the UK’s

hydrogen strategy.

Junior Isles looks

at how Peel NRE

is progressing with

plans to roll-out

plastics-to-hydrogen

technology.

Hydrogen makes progress

Hydrogen makes progress

with plastics

with plastics

A tonne of hydrogen from a

truck full of waste

Computer generated image of the

Protos plastics-to-hydrogen facility

THE ENERGY INDUSTRY TIMES - JANUARY 2022

16

Final Word

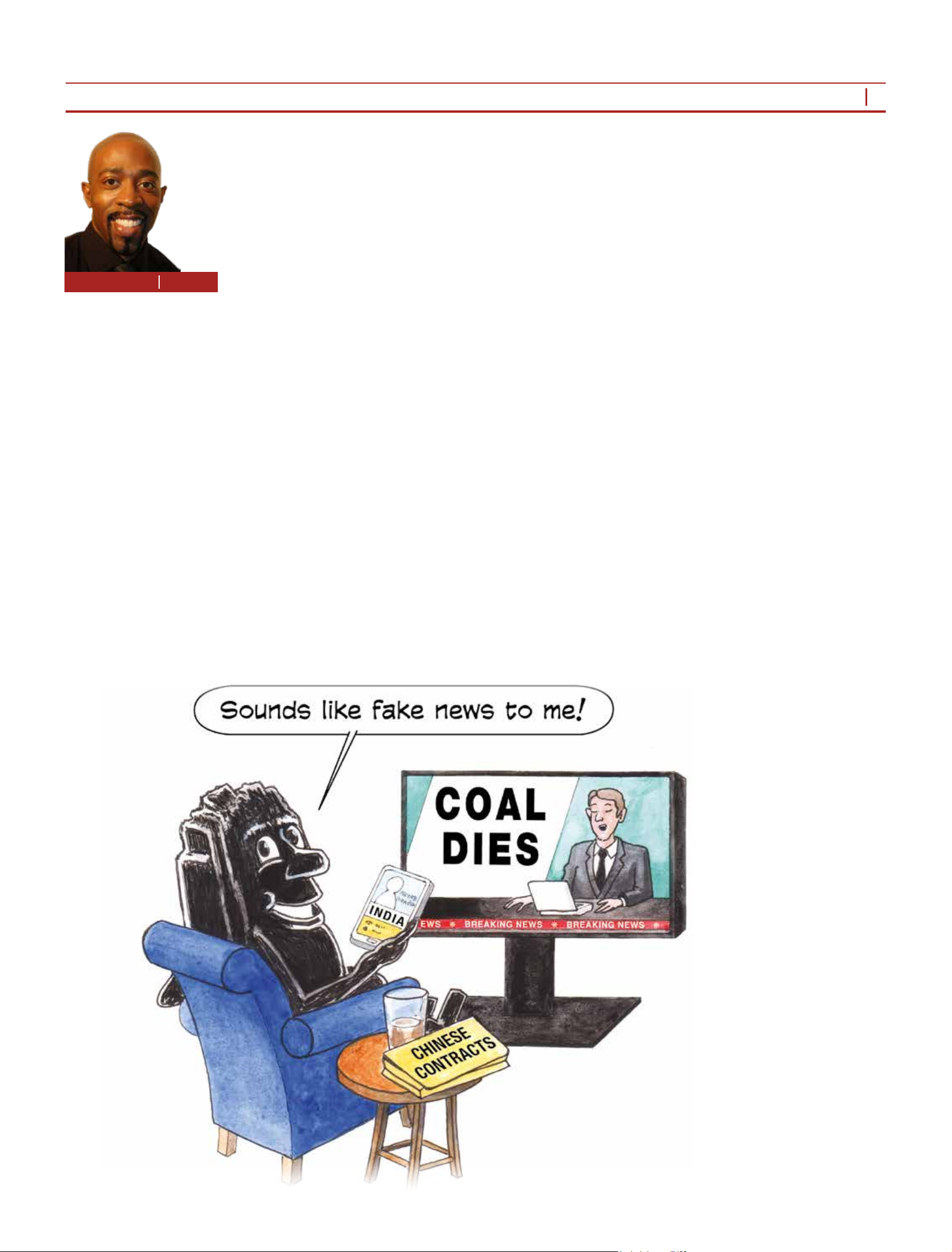

D

espite the war on coal in the

drive to net zero, the end days

of the black stuff are still some

way off. Borrowing from Mark Twain

one might quip: ‘reports of its death

have been greatly exaggerated’.

Certainly, the recent annual coal re-

port from the International Energy

Agency (IEA) made sobering reading.

The Paris-based organisation said

global power generation from coal was

set to jump by 9 per cent in 2021 to an

all-time high of 10 350 TWh, after

falling in 2019 and 2020.

According to the IEA, rapid eco-

nomic recovery is driving global coal

power generation to a record high in

2021 and overall coal demand to a

potential all-time high as soon as

2022. It says the economic rebound

in 2021 has pushed up electricity

demand much faster than low-carbon

supplies can keep up. The steep rise

in natural gas prices also increased

demand for coal power by making it

more cost-competitive.

The IEA warned that the level of

coal use could remain at the historical

high for the next two years. As we

move into a new year, such unsettling

news underlines the urgent need for

policy action.

Commenting on the ndings, the

IEA’s Executive Director Fatih Birol,

said: “Coal is the single largest source

of global carbon emissions, and this

year’s [2021] historically high level of

coal power generation is a worrying

sign of how far off track the world is

in its efforts to put emissions into de-

cline towards net zero. Without strong

and immediate actions by govern-

ments to tackle coal emissions – in a

way that is fair, affordable and secure

for those affected – we will have little

chance, if any at all, of limiting global

warming to 1.5°C.”

Coal’s comeback underlines the

challenge world leaders face in mak-

ing the transition to clean energy,

especially in countries like India and

China, which, according to the report,

account for two thirds of global coal

consumption. Notably, China and

India led calls that resulted in weak-

ened ambition to end coal red

power at the COP26 climate summit

in Glasgow. But although coal was

granted a stay of execution at the

summit, it is clear that it is living on

borrowed time.

“The climb-down on a global agree-

ment to phase-out coal made head-

lines, but the COP26 messaging was

clear enough: coal’s days are num-

bered. As a result, nance and insur-

ance costs for coal will climb even

higher. Alternatives to coal-based

power and industrial applications that

are both scalable and affordable will

take time to roll out. But a global

carbon market will eventually accel-

erate the competitiveness of low-

carbon solutions in both the power and

steel sectors. The consequences for

coal are clear,” said Wood Mackenzie

Research Director, Robin Grifn.

Meanwhile, nancial institutions

continue to pull back. Just last month

HSBC Holdings plc set out its policy

to phase-out the nancing of coal red

power and thermal coal mining by

2030 in EU and OECD markets, and

worldwide by 2040.

In recognition of the rapid decline

in coal emissions required for any

viable pathway to 1.5°C, the policy

will mean HSBC phasing out nance

to clients whose transition plans are

not compatible with the bank’s net

zero by 2050 target.

The thermal coal phase-out policy,

which will be reviewed annually based

on evolving science and internation-

ally recognised guidance, is a key part

of executing on HSBC’s October 2020

ambition to align its nanced emis-

sions – the greenhouse gas emissions

of its portfolio of clients – to net zero

by 2050 or sooner.

The policy includes short-term

targets to help drive measureable

results in advance of the phase-out

dates. A science-based nanced emis-

sions target will be published in 2022

to reduce emissions from coal red

power in line with a 1.5°C pathway.

HSBC stressed that given the nine-

year timetable to phase-out coal in EU/

OECD markets, new nance to clients

in these markets will be declined

where thermal coal makes up more

than 40 per cent of a client’s total

revenues (or more than 30 per cent of

total revenues by 2025), unless the

nance is explicitly for the purpose of

clean technology and infrastructure.

It noted, however: “HSBC is not

applying these criteria in non-EU/

OECD markets today, as we will

evaluate client transition plans accord-

ing to their alignment to HSBC’s net

zero by 2050 target and worldwide

coal phase-out date of 2040.”

Given the bank’s substantial foot-

print across Asia, with the region’s

heavy reliance on coal today and its

rapidly growing energy demand,

HSBC says it recognises it has a criti-

cal role to play in helping to nance

the region’s energy transition from

coal to clean energy. HSBC will expect

its clients to lay out credible transition

plans for the next two decades to di-

versify away from coal red power

production to clean energy, and from

coal mining to other raw materials,

including those vital to clean energy

technologies.

Group Chief Executive, Noel

Quinn, said: “We want to be at the

heart of nancing the energy transi-

tion, particularly in Asia. This is

where we can have the biggest impact

to help the world achieve its target of

limiting global warming to 1.5°C. We

have a long history and strong pres-

ence in many emerging markets that

are heavily reliant on coal for power

generation. We are committed to us-

ing our deep relationships to partner

with clients in those markets to help

them transition to cleaner, safer and

cheaper energy alternatives in the

coming decades.

“Tackling climate change is a stra-

tegic priority for HSBC, our investors

and our stakeholders.”

While Asia’s transition from coal is

essential if the world is to have any

hope of reversing climate change,

there are still fears that the climate

benets of record coal plant cancel-

lations in Asia will be lost if a planned

$358 billion expansion of Asian gas

infrastructure goes forward. Accord-

ing to a recent brieng from Global

Energy Monitor (GEM), there are

plans in the region for 285 GW of new

gas red power plants, 452 million

tonnes per annum (mtpa) of liqueed

natural gas (LNG) import capacity,

and 63 000 km of gas pipelines. This

expansion would double the region’s

gas power capacity and triple its

pipeline capacity, while increasing

the world’s 910 mtpa of LNG import

capacity by 50 per cent.

There is little doubt such gas expan-

sion undermines Asian countries’

pledges to achieve net zero emissions

by mid-century. According to GEM,

even if just half of the proposed gas

plants in Asia are built (143 of 285

GW) with an operating lifetime of 30

years, it will postpone the net zero

power system by decades.

“The coal bust is at a risk of becom-

ing a gas boom in Asia,” said Robert

Rozansky, GEM’s LNG research ana-

lyst. “Asia’s gas build-out would be a

$358 billion bet on assets that are – or

soon will be – uncompetitive against

ever cheaper renewable power.”

This may well be the case but there

will always be those willing to take

such risks – the countries that will

address their needs today and worry

about tomorrow when it comes. For

now, rumours of any imminent end to

coal power and fossil fuel may well be

premature but one thing is certain:

fossil fuel generation and net zero

targets are incompatible and ‘never the

twain shall meet’.

Never the twain shall meet

Junior Isles

Cartoon: jemsoar.com