www.teitimes.com

November 2021 • Volume 14 • No 9 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Special Supplement

Financing Asia’s

decarbonisation

TEI Times hears how data

centres can be an important

part of the move to a low

carbon energy economy.

There is plenty capital available for

decarbonising Asia but there will be bumps in

the road. Joseph Jacobelli explains. Page 14

News In Brief

China power crunch impacts

global energy markets

The impact of China’s power crunch

is being felt globally, as commodity

prices remained elevated in late

October, driven by high coal prices.

Page 5

UK publishes policies for

move towards Net Zero

The UK government has published

a suite of policy proposals for

decarbonisation, including a Net

Zero Strategy that would see all

electricity generated from low

carbon sources by 2035.

Page 7

Industry Perspective:

Partnering for a green

hydrogen future

Global collaboration can help

to manage and share the risk of

producing green hydrogen at scale.

Page 12

Energy Outlook: Placing

energy at the heart of

communities

How Spain can be a blueprint for

countries struggling with energy

prices.

Page 13

Technology Focus: A

battery design for a circular

economy

Clean-tech company Aceleron has

built a battery that is easy to take

apart, service or upgrade and put

back together as a fully renewed

product with an extended life.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

World leaders at the UN’s COP26 climate summit in Glasgow are under pressure to increase

ambition on climate change, as several reports reveal a huge emissions gap between national

pledges to cut global warming gases and what is needed to limit global temperature rise to

targets agreed in Paris. Junior Isles

THE ENERGY INDUSTRY

TIMES

Final Word

Change is never easy

but it’s often necessary,

says Junior Isles.

Page 16

As COP26 kicks off, clean energy

progress is still far too slow to put

global emissions into sustained de-

cline towards net zero, warn several

major reports issued ahead of this

year’s UN climate summit in

Glasgow, UK.

In its latest ‘World Energy Outlook

(WEO) 2021’, published as a hand-

book for the COP26 Climate Change

Conference, the International Energy

Agency (IEA) issues stark warnings

about the direction in which today’s

policy settings are taking the world.

Governments will be in the spotlight

at the COP26 over the next 10 days to

meet a deadline of this year to commit

to more ambitious climate pledges, in

what could be the last chance to put

the world on track to limiting global

warming to below 2°C above pre-in-

dustrial levels and ideally to 1.5°C as

agreed under the Paris Accord.

The IEA’s annual agship publica-

tion, shows that even as deployments

of solar and wind go from strength to

strength, the world’s consumption of

coal is growing strongly this year,

pushing carbon dioxide (CO

2

) emis-

sions towards their second largest an-

nual increase in history with poten-

tially disastrous effects.

In its ‘Announced Pledges’ scenario,

which maps-out a path in which the

net zero emissions pledges announced

by governments so far are implement-

ed in time and in full, demand for fos-

sil fuels peaks by 2025, and global

CO

2

emissions fall by 40 per cent by

2050. All sectors see a decline, with

the electricity sector delivering by far

the largest. However, the global aver-

age temperature rise in 2100 reaches

2.1°C, exceeding the 1.5°C ambition

agreed in Paris in 2015.

“Today’s climate pledges would

result in only 20 per cent of the emis-

sions reductions by 2030 that are nec-

essary to put the world on a path

towards net zero by 2050,” said Dr.

Fatih Birol, the IEA Executive Direc-

tor. “Reaching that path requires in-

vestment in clean energy projects and

infrastructure to more than triple over

the next decade. Some 70 per cent of

that additional spending needs to hap-

pen in emerging and developing econ-

omies, where nancing is scarce and

capital remains up to seven times

more expensive than in advanced

economies.”

Commenting on the IEA Outlook,

Dr Simon Cran-McGreehin, Head of

Analysis at the Energy and Climate

Intelligence Unit (ECIU) said: “By

showing that current policies fall well

short of getting global warming in

check by 2030 and providing a clear

checklist of commitments that the UK

– as host of COP26 – will need to se-

cure to keep 1.5°C of warming alive,

the IEA are laying down a clear gaunt-

let for action on climate.

Shortly after the report, the Global

Wind Energy Council released a man-

ifesto at the Bloomberg NEF London

summit calling on governments to

“get serious” about the energy transi-

tion and work with the private sector

to rapidly scale up wind and renew-

able energy installations.

The call came as the UN Environ-

ment Programme’s (UNEP) 12th an-

nual Emissions Gap report conrmed

country pledges will fail to keep the

global temperature rise under 1.5°C

this century. The UNEP analysis sug-

gests the world is on course to warm

by around 2.7°C with hugely destruc-

tive impacts.

Continued on Page 2

World leaders must bridge

World leaders must bridge

the gap at COP26

the gap at COP26

Advancing a sustainable

energy future for all

www.hitachienergy.com

THE ENERGY INDUSTRY TIMES - NOVEMBER 2021

2

Junior Isles

The world’s developed countries must

show leadership in tackling global cli-

mate change, says a new International

Energy Agency (IEA) report.

According to the report ‘Achieving

Net Zero Electricity Sectors in G7

Members’, G7 members are well

placed to fully decarbonise their elec-

tricity supply by 2035, which would

accelerate the technological advances

and infrastructure rollouts needed to

lead global energy markets towards net

zero emissions by 2050.

The pathway laid out in the report

underscores how the G7 can serve as

rst movers, jump-starting innovation

and lowering the cost of technologies

for other countries while maintaining

electricity security and placing people

at the centre of energy transitions.

“G7 leadership in this crucial en-

deavour would demonstrate that get-

ting to electricity sectors with net zero

emissions is both doable and advanta-

geous, and would also drive new in-

novations that can benet businesses

and consumers,” said Dr. Fatih Birol,

the IEA Executive Director. “G7

members have the nancial and tech-

nological means to bring their elec-

tricity sector emissions to net zero in

the 2030s, and doing so will create

numerous spill-over benets for other

countries’ clean energy transitions

and add momentum to global efforts

to reach net zero emissions by 2050.

The new report builds on the IEA’s

landmark Roadmap to Net Zero by

2050, which identies key milestones,

challenges and opportunities for G7

members. It was requested by the

United Kingdom, which holds the G7

Presidency this year.

The G7 accounts for nearly 40 per

cent of the global economy, 36 per cent

of global power generation capacity,

30 per cent of global energy demand

and 25 per cent of global energy-relat-

ed carbon dioxide (CO

2

) emissions.

According to the IEA’s pathway to

net zero by 2050, renewables need to

provide 60 per cent of the G7’s elec-

tricity supply by 2030, whereas under

current policies they are on track to

reach 48 per cent.

It says the G7 has an opportunity to

demonstrate that electricity systems

with 100 per cent renewables during

specic periods of the year and in cer-

tain locations can be secure and af-

fordable. “At the same time, increased

reliance on renewables does require

the G7 to lead the way in nding solu-

tions to maintain electricity security,

including seasonal storage and more

exible and robust grids,” the report

states.

The IEA’s ndings came as the Or-

ganisation for Economic Cooperation

and Development (OECD) agreed to

end support for unabated coal red

power plants. Specically, the ban will

apply to ofcially supported export

credits and tied aid for:

n new coal red power plants without

operational carbon capture, utilisation

and storage (CCUS) facilities; and

n existing coal red power plants, un-

less the purpose of the equipment sup-

plied is pollution or CO

2

abatement

and such equipment does not extend

the useful lifetime or capacity of the

plant, or unless it is for retrotting to

install CCUS.

Participants to the arrangement are

Australia, Canada, the European

Union, Japan, Korea, New Zealand,

Norway, Switzerland, Turkey, the

United Kingdom, and the United

States.

At the end of September United Na-

tions (UN) Secretary-General Antonio

Guterres called on countries to rapidly

shift towards decarbonised energy sys-

tems, redirect their fossil fuel subsidies

to renewables and place a price on

carbon.

“Investing in renewable energy – in-

stead of spending billions on propping

up fossil fuels – can create tens of mil-

lions of good jobs and empower the

most vulnerable,” Guterres said.

“Every country, city, nancial institu-

tion, company and civil society organ-

isation has a role to play in building a

sustainable and equitable energy fu-

ture,” he said.

Companies continued to demon-

strate their commitment to tackling

climate change, as analysis from

BNEF revealed that through August,

111 of the 167 Climate Action100+

“focus companies” set a net zero or

equivalent target, pledging to fully

reduce and/or offset their emissions

at a level equivalent to what they emit

annually.

BNEF says these companies will

reduce greenhouse gas emissions by

3.7 billion metric tons of carbon di-

oxide equivalent (GtCO

2

e) annually.

This increases to 9.8 billion metric

tons by 2050 – equivalent to over a

quarter of global greenhouse gas

house emissions today.

Kyle Harrison, head of sustainability

research at BNEF, said: “Companies

will be under the microscope for the

path they take to achieving net zero

emissions. The winners will be the ones

that will – and already do – address

their entire value chain, focus on tan-

gible emission reductions and turn a

net zero strategy into a new business

opportunity.”

In late September funds managing

nearly $30 trillion in assets called on

1600 of the world’s most polluting

companies to “urgently” set science-

based emissions reduction targets.

n The Court of Justice of the EU

(CJEU) has ruled that the international

treaty used by energy companies to

claim compensation from member

states that frustrate their investments

is incompatible with EU law.

The UN World Meteorological

Organization (WMO) also said that

greenhouse gas concentrations hit a

record last year and the world is

“way off track” in capping rising

temperatures.

The Emissions Gap report takes

into account nationally determined

contributions (NDCs) or carbon-

cutting pledges submitted by 120

countries for the run-up to 2030, as

well as other commitments not yet

formally submitted in an NDC. It

nds that when added together, the

plans cut greenhouse gas emissions

in 2030 by around 7.5 per cent com-

pared to the previous pledges made

ve years ago.

“If there is no meaningful reduc-

tion of emissions in the next decade,

we will have lost forever the pos-

sibility to reach 1.5°C,” said UN

Secretary General Antonio

Guterres.

In early October, global consult-

ing rm Capgemini also revealed

energy consumption and green-

house gas emissions are on the rise

again and called for realistic, afford-

able, plans to accelerate energy

transition.

In the 23rd edition of its annual

report, the World Energy Markets

Observatory (WEMO), created in

partnership with De Pardieu Brocas

Maffei, Vaasa ETT and Enerdata,

Capgemini makes several recom-

mendations to meet climate change

goals whilst ensuring energy secu-

rity of supply, and affordability for

citizens.

These include setting ambitious

but realistic energy transition plans;

accelerating research in low carbon

technologies; measuring the effect

of actions taken; and paying special

attention to cyber security.

The WEMO report followed a

report published at the end of Sep-

tember by the Energy Transitions

Commission (ETC), which set out

the actions nations and companies

could take during the 2020s to de-

liver the Paris agreement and limit

global warming to 1.5°C.

The ETC’s report ‘Keeping 1.5°C

Alive: Closing the Gap in the

2020s’, describes technologically

feasible actions that could close that

gap to a 1.5°C pathway and could

be catalyzed by agreements in

Glasgow.

It said many of the actions entail

minimal cost and would spur further

innovation and support green eco-

nomic development; and all of them

could be given impetus at COP26

via commitments from leading

countries and companies, without

the need for comprehensive inter-

national agreement. It stressed,

however, that two high priority ac-

tions – ending deforestation and

reducing emissions from existing

coal plants – will need to be sup-

ported by climate nance ows

from rich developed countries.

Continued from Page 1

The spiralling cost of electricity has

forced Brussels to take more time in

considering how to classify nuclear

power and natural gas under the EU’s

landmark labelling system for green

nance.

As EU member states call for slack-

er rules to help counteract the conti-

nent’s energy crisis, EU nancial

services commissioner Mairead Mc-

Guinness told the Financial Times

that Brussels would delay its decision

on how to deal with the energy sourc-

es under the so-called “taxonomy on

sustainable nance”. The decision

had been due this autumn.

Amid the ongoing debate on how to

classify low carbon natural gas and

nuclear energy, which produces no

CO

2

but creates nuclear waste, Mc-

Guinness said: “As we come to the end

of the year there will be more pressure

to resolve this. We don’t have a ready-

made solution because this is, both

technically and politically... one of

those issues where you have very di-

vided views.”

Environmental groups want the sys-

tem to abide by scientic criteria to

ensure the rules stamp out, rather than

encourage, ‘green washing’ in the in-

vestment industry. Meanwhile pro-

nuclear countries and pro-gas member

states are demanding the taxonomy

rules do not penalise technologies they

say are vital in securing the transition

to net zero emissions.

McGuinness added: “We’re hearing

from citizens and businesses about

higher energy costs and keeping the

lights on. We must make sure we don’t

create fears that this transition is a

problem because the transition is the

solution.”

Speaking at Russian Energy Week

last month, HE Yury Sentyurin, Sec-

retary General of the Gas Exporting

Countries Forum (GECF) said the

current global energy crunch and the

intensifying climate change debate

highlight the serious need to embed

natural gas as part of a long-term solu-

tion to energy market stability and

transition.

“One of the most sensible, econom-

ically-viable ways to achieve sustained

energy market stability, inclusive eco-

nomic growth and Sustainable Devel-

opment Goals is to consider natural gas

as a destination fuel.”

Russia’s President Vladimir Putin,

noted: “According to experts fore-

casts looking at a 25-year horizon, the

share of hydrocarbons in the world

energy balance may decrease from the

current 80-85 per cent to 60-65 per

cent. At the same time, the role of oil

and coal will decrease. But the role of

natural gas as the most environmen-

tally friendly clean, transitional fuel

will grow, including the development

of the production of liqueed gas.”

The European Parliament has issued

updated rules to select which energy

projects should be supported in a

move to make cross-border energy

infrastructure sustainable and in line

with the EU Green Deal.

The Industry, Research and Energy

Committee approved its position on

the criteria and methodology for se-

lecting energy projects of common

interest (PCIs), such as high voltage

transmission lines, pipelines, energy

storage facilities or smart grids, which

would benet from fast-track admin-

istrative procedures and be eligible to

receive EU funds.

Members of the European Parlia-

ment supported funding the develop-

ment of hydrogen infrastructure, in-

cluding the construction of elec-

trolysers, as well as carbon capture

and storage (CCS). They also propose

to fund projects that repurpose exist-

ing natural gas infrastructure for hy-

drogen transport or storage.

Projects based on natural gas will no

longer be eligible for EU funding un

-

der the updated rules. However, a

temporary derogation will allow, un-

der strict conditions, natural gas proj-

ects from the fourth or fth list of PCIs

to be eligible for a fast-track authori-

sation procedure.

Despite making little progress in the

power sector, CCS appears to be gain-

ing momentum in hard-to-abate sec-

tors. Last month a new climate report

released by the Global CCS Institute

said that in 2021, the total capacity of

the CCS project-pipeline increased

for the fourth year in a row – by almost

one third over the previous year.

CEO of the Global CCS Institute,

Jarad Daniels, said: “As we accelerate

toward net zero emissions by mid-

century and establish clearer interim

targets, CCS will be integral to the

decarbonisation of energy, industrial

sectors such as cement, fertilisers, and

chemicals, and will open new oppor-

tunities in areas including clean hy-

drogen and carbon dioxide removal.

Headline News

Green nance labelling uncertainty still

Green nance labelling uncertainty still

surrounds gas and nuclear

surrounds gas and nuclear

Hydrogen and CCS are winners under Brussels ruling

Hydrogen and CCS are winners under Brussels ruling

Industrial nations can lead

Industrial nations can lead

decarbonisation effort

decarbonisation effort

Guterres: the possibility of

limiting warming to 1.5°C could

be “lost forever”

n G7 can serve as rst movers

n OECD to end support for unabated coal red power plants

THE ENERGY INDUSTRY TIMES - NOVEMBER 2021

3

Advancing a sustainable

energy future for all

We are advancing the world’s energy system to be more

sustainable, flexible and secure.

As the pioneering technology leader, we collaborate with

customers and partners to enable a sustainable energy

future – for today’s generations and those to come.

www.hitachienergy.com

THE ENERGY INDUSTRY TIMES - NOVEMBER 2021

5

Asia News

Syed Ali

The impact of China’s power crunch

is being felt globally, as commodity

prices remained elevated in late Oc-

tober, driven by high coal prices.

The country experienced power out-

ages in September and a mandate to

energy companies from government

to secure power at all costs pushed

coal and gas prices even higher. With

winter on its way for much of the world

and natural gas prices at record levels,

economies are competing for a lim-

ited supply of coal.

Europe’s coal use is expected to in-

crease over the winter amid lower

renewable energy production, record

natural gas prices and planned nucle-

ar reactor closures.

Meanwhile India is being hard hit

and warned of possible power short-

ages. India is facing possible energy

supply problems in the coming

months due to coal shortages and a

post-pandemic surge in demand, the

power minister said in a report.

“Normally the demand starts com-

ing down in the second half of Octo-

ber... when (the weather) starts cool-

ing,” R. K. Singh told the Indian

Express in an interview.

“But it’s going to be touch and go,”

Singh said, calling demand for elec-

tricity “tremendous”.

India’s coal red power stations had

on average four days’ stock at the end

of September, the lowest in years.

More than half the plants were on alert

for outages.

In late October coal prices fell some-

what on news that China’s National

Development and Reform Commis-

sion (NDRC) would “study specic

measures to intervene in coal prices”

if they kept rising.

The power outages in China were a

consequence of a head-on collision

between strong electricity demand

growth and China’s policies to reduce

both energy demand and emissions

intensity.

China’s power crunch has struck at

a time when the country is stepping

up climate change mitigation targets.

Earlier this year it said it is aiming to

reach a peak in its CO

2

emissions be-

fore 2030 and achieve carbon neutral-

ity before 2060 – a target likely to be

questioned at the UN COP26 climate

change summit currently ongoing in

Glasgow, UK.

In a weekly blog, Gavin Thompson,

Wood Mackenzie Asia Pacic Vice

Chair, wrote: “… the short-term real-

ity is that China and many others have

little choice but to increase coal con-

sumption to meet power demand.

Looking further out, China’s econom-

ic and strategic push towards decar-

bonisation must support a greater role

for gas, accelerate investments in re-

newables and increase the rate of

nuclear build.”

In its recently released report, ‘An

Energy Sector Roadmap to Carbon

Neutrality in China’, the International

Energy Agency said China has made

notable progress in its clean energy

transition, but still faces some sig-

nicant challenges.

Coal accounts for over 60 per cent

of electricity generation, and the coun-

try continues to build new coal power

plants domestically. At the same time,

China has added more solar power

capacity than any other country year

after year. It is the second largest oil

consumer in the world, but it is also

home to 70 per cent of global manu-

facturing capacity for electric vehicle

batteries.

The China Roadmap sets out a path-

way consistent with the enhanced

ambitions that China announced last

year in which CO

2

emissions reach a

peak before 2030 and carbon neutral-

ity is achieved before 2060.

The main drivers of emissions reduc-

tions between now and 2030 in this

pathway are energy efciency im-

provements, expansion of renewables

and a reduction in coal use. Electricity

generation from renewables, mainly

wind and solar PV, increases seven-

fold between 2020 and 2060, account-

ing for almost 80 per cent of China’s

power mix by then. Industrial CO

2

emissions decline by nearly 95 per cent

by 2060, with the role of emerging in-

novative technologies, such as hydro-

gen and carbon capture, growing

strongly after 2030.

n China has started construction on

the rst 100 GW phase of a solar and

wind build-out that is likely to see

hundreds of gigawatts deployed in the

country’s desert regions. The an-

nouncement was made by President

Xi Jinping via video link at a United

Nations Biodiversity Conference last

month. While the location and con-

struction timeline of the projects, or

the total expected capacity or the num-

ber of subsequent phases, were not

revealed, the scheme will represent a

notable chunk of China’s ambition of

reaching more than 1200 GW of in-

stalled solar and wind capacity by

2030.

According to a new report by the Cen-

tre for Research on Energy and Clean

Air (CREA) and TransitionZero, close

to 75 GW of excess fossil fuel capac-

ity can be retired immediately without

compromising reliable supply of elec-

tricity in four key countries – India,

Bangladesh, Pakistan, and Sri Lanka.

The study found that 27 per cent of

the total excess fossil fuel capacity

(coal, oil and gas) in the modelled

countries in 2021, can be considered

overcapacity in South Asia. The high

amount of overcapacity found in the

study is a result of excessive invest-

ment in coal development, as construc-

tion has far outpaced actual demand

growth within countries.

The report, ‘Ripe for Closure’, high-

lights how retiring excess fossil fuel

capacity can result in immediate cost

savings worth billions of dollars while

improving system efciency.

“Our analysis nds that South Asia

has over 75 GW of excess fossil fuel

capacity. This excess capacity can be

phased out resulting in improved util-

isation of other power assets as well as

annual savings of over $2.3 billion,”

CREA analyst Sunil Dahiya said.

Together, India, Bangladesh and

Pakistan commissioned over 30 GW

of coal, oil, and gas capacity between

March 2018 and 2021. The report nds

close to 29 per cent of excess installed

fossil capacity.

“Our analysis nds that India has the

largest overcapacity of fossil fuel in

South Asia. Over 67 GW of coal red

capacity in India is found to be in ex-

cess. This is costing Indian rate payers

over $2.1 billion (Rs 15,780 crore) an-

nually. Retiring 67 GW of excess coal-

red capacity will not only save bil-

lions of dollars but also help India

improve its air quality,” Dahiya told

IANS.

In regulated electricity markets like

those in South Asia, investments are

made through power purchase agree-

ments (PPAs). Conventional fossil fuel

generators are often shielded from

market forces and receive xed capac-

ity charges and payments regardless of

whether plants are utilised. Such pay-

ment policies make overcapacity a cost

borne by consumers and can raise the

overall cost of electricity.

An estimated $2.3 billion in xed

operating and maintenance costs is

spent despite no longer being neces-

sary to meet peak demand.

Given the enormous potential sav-

ings in maintenance costs and benets

to human and planetary health, phasing

out excess fossil fuel capacity and en-

suring that future demand is met by

renewable energy by halting addition-

al fossil fuel projects is a crucial rst

step in the energy transition.

In August, the Asian Development

Bank said it planned to work with pri-

vate sector nancial rms to buy and

close coal red power plants across

Asia in a bid to help countries meet

their climate targets. The plan was ex-

pected to be ready for the COP26 cli-

mate conference.

Last month the ADB approved a new

energy policy to support universal ac-

cess to reliable and affordable energy

services, while promoting the low-

carbon transition in Asia and the Pa-

cic. ADB President Masatsugu

Asakawa said energy is central to in-

clusive socio-economic development,

but the expansion of energy systems

has come at the cost of harmful impacts

on the climate and environment.

“This new policy locks in our strong

commitment that ADB will not fund

new coal power production. Together

with our elevated ambition to deliver

$100 billion in climate nancing to our

developing member countries in 2019-

2030, it provides a clear path for ADB’s

contribution to an environmentally

sustainable energy future.”

China power crunch impacts

China power crunch impacts

global energy markets

global energy markets

Asian countries can

reduce reliance on coal

n Power crunch comes as country stepping up climate change mitigation

n India facing possible power outages

Working alongside you to move

your performance forward

Valmet Field Services

Trust is earned every day. On site and remotely.

Our field services cover everything from fast, on-call troubleshooting to

planned, practical, and strategic maintenance carried out on a continuous

basis at your production site. We plan, execute, manage and develop

maintenance activities according to your needs.

Valmet’s field services professionals are on the front line working at

customer sites daily both locally and remotely. Safety, communication

and trust are our top priorities when delivering our field services solutions.

Explore valmet.com/fieldservices

6

THE ENERGY INDUSTRY TIMES - NOVEMBER 2021

Asia News

Syed Ali

The Indonesian government is work-

ing on an energy transition plan to re-

place coal red power plants with

sustainable and green electric power

plants, according to Deputy Minister

of Finance Suahasil Nazara.

Under the energy transition plan, the

government can request coal red

power plant operators to cease power

plant operations whilst adhering to

contract terms normally inked for a

long-term period between the opera-

tors and state electricity company PT

PLN, he afrmed. PLN earlier pledged

to stop building coal plants by 2023

after nishing the 35 GW worth of

projects it had in the pipeline.

After fullling its obligation to com-

pensate the coal red power plant op-

erators affected by the scheme, the

government will continue with the next

stage to construct renewables-based

power plants, he noted.

“We need to allocate a budget to com-

pensate for the replacement of existing

coal red power plants and construct

new sustainable power plants under the

energy transition mechanism scheme,”

Nazara said during a webinar in Ja-

karta last month. The minister said the

move was “an indispensable step” to

achieve zero carbon emissions by 2060

or sooner, whilst preventing losses to

related parties.

Meanwhile, Director General of

Electricity at the Energy and Mineral

Resources Ministry Rida Mulyana

conrmed that the government would

no longer accept proposals for new coal

red power plant, as the future nation-

al energy policy will focus on renew-

able energy and a green economy.

“After 2030, no fossil fuel-red

power plant construction will take

place, and all power plants will be new

and renewable energy-based, Mulyana

said.

A new Power Procurement Plan

(RUPTL), approved by the Indonesian

government in October for state-

owned electricity company Perusa-

haan Listrik Negara (PLN) for 2021-

30, is expected to deliver 51.6 per cent

share of renewable generating capac-

ity in PLN’s generating mix.

Under the RUPTL, 40.6 GW of new

capacity will be installed in the next 10

years, including 21 GW of renewables

generating capacity and 19.6 GW of

fossil-based generating capacity. The

country will allow more private power

companies or independent power pro-

ducers (IPPs) to be involved in the

development of new plants.

The planned additions could bring

the share of renewable power in the

national mix to 25 per cent by 2030. At

the end of 2020, it stood at 14 per cent

and the country is aiming at 23 per cent

by the middle of the decade.

“With the cost of building solar

power systems becoming increas-

ingly lower and construction time

faster, to full the 23 per cent target

of renewables mix by 2025, the share

of solar power systems is made bigger

than in the previous RUPTL,” said

Energy Minister Arin Tasrif.

“In addition, the renewables mix

target will be met by co-ring biomass

at coal red power plants with due

consideration of the environment

when providing feedstock,” he added.

Australia is planning to issue carbon

credits to ‘carbon capture and storage’

(CCS) projects.

In what it says is a world’s rst, the

government will award large-scale

CCS projects with tradeable carbon

credits, known as Australian Carbon

Credit Units (ACCUs). Each ACCU

will represent one tonne of carbon

emissions avoided, and projects will

be able to sell ACCUs to the Australian

government at bi-annual auctions or

on the private voluntary market.

Commenting on the move in its Out-

Law newsletter Toby Evans of law rm

Pinsent Masons, said: “CCS technol-

ogy has the potential to assist in decar-

bonising some of Australia’s most

carbon-intensive industries and should

be supported in that aim. To that end,

during our transition from fossil fuels

to more carbon-neutral alternatives

such as hydrogen and biofuel, we see

the potential benets of awarding car-

bon credits to appropriate large-scale

projects in the interest of promoting

the incorporation of CCS in fossil fuel

projects which otherwise would have

proceeded without such harm mini-

mising technology.”

The Clean Energy Regulator, an Aus-

tralian statutory authority responsible

for administering legislation to reduce

carbon emissions in the country, is also

entering a public consultation phase to

further expand the range of activities

eligible for incentives under the Emis-

sions Reduction Fund, including hy-

drogen and ‘carbon capture use and

storage’ (CCUS).

Australian is already at the forefront

of hydrogen developments, with new

projects regularly reported.

Last month Queensland’s state-

owned CS Energy and its joint venture

partner Japanese engineering rm IHI

announced they will build a pilot re-

newable hydrogen plant with capacity

of 50 000 kg per year from 2023.

Meanwhile, the Government of New

South Wales (NSW) also announced

the launch of the NSW Hydrogen Strat-

egy – a plan to support its decarbonisa-

tion efforts and drive investments of

more than A$80 billion ($58.8 billion)

in the region.

The NSW government will offer in-

centives for hydrogen production and

establish a network of hydrogen refu-

elling stations across NSW. NSW has

already committed to offering A$70

million for the development of hydro-

gen hubs in the Illawarra and Hunter

regions.

Meanwhile, the Northern Territory

Government also in October released

its Renewable Hydrogen Masterplan,

which will support the development of

a local and export renewable hydrogen

industry.

The Territory is looking to make use

of its advantages such as high solar

resources, vast land areas and an es-

tablished energy production and ex-

port industry to drive the hydrogen

industry, which could help both cut

emissions and create economic

growth.

The local government says the hy-

drogen sector in the Northern Terri-

tory could be similar to the existing

export liqueed natural gas (LNG)

market.

Japan has adopted a new energy policy.

The new basic energy plan, adopted by

the Cabinet, calls for drastically in-

creasing use of renewable energy to

cut fossil fuel consumption over the

next decade as Japan pushes to achieve

its pledge of reaching carbon neutral-

ity in 2050.

The plan compiled by the Ministry

of Economy, Trade and Industry says

Japan should set ambitious targets for

hydrogen and ammonia energy, carbon

recycling and nuclear energy. It also

calls for promoting offshore wind

power and use of rechargeable batter-

ies that have potential for growth.

“We will mobilise all options” to

achieve the emissions target, the plan

states, adding that the “supply of stable

and low-cost energy is a prerequisite”.

Since the 2011 Fukushima disaster,

Japan has been undecided on the future

of nuclear. It now says reactor restarts

are key to meeting its emissions targets.

Japan has pledged to reduce its emis-

sions by 46 per cent from 2013 levels,

up from an earlier target of 26 per cent,

to achieve carbon neutrality by 2050.

It says it will try to push the reduction

as high as 50 per cent to be in line with

the European Union’s commitment.

The energy plan says renewables

should account for 36-38 per cent of

the power supply in 2030, up from the

current target of 22-24 per cent, and

that newly introduced fuels such as

hydrogen and ammonia should com-

prise 1 per cent. The target for fossil

fuel use was slashed to 41 per cent in

2030 from 56 per cent. The plan said

Japan will reduce dependence on fossil

fuel but did not set a timeline.

n UK company SSE Renewables is to

enter Japan’s offshore wind farm mar-

ket through a $208 million joint ven-

ture with local renewables company

Pacico Energy. The alliance will see

the energy rms develop offshore wind

projects in the country as it seeks to

become net zero by 2050.

Indonesia eyes transition

Indonesia eyes transition

away from coal

away from coal

Japan OKs plan to push clean energy, nuclear to cut carbon

Australia to issue carbon

Australia to issue carbon

credits for CCS projects

credits for CCS projects

n Coal operators will be compensated

n PLN to build over 21 GW of new renewable capacity

community.e- world-essen.com

Find new projects, ideas and the

right contact persons of the

European energy sector.

ONE SECTOR.

ONE NETWORK.

THE ENERGY INDUSTRY TIMES - NOVEMBER 2021

Special Technology Supplement

Transitioning beyond data

The growing number

of data centres and

their high energy

consumption

presents a

conundrum for a

world that has to cut

carbon emissions

while satisfying

the need to handle

increasing amounts

of data. Siemens

Energy argues

that data centres

can do more than

just handle data;

they can also be

an important part

of the move to a

low carbon energy

economy.

Junior Isles

work if the data centre is in a location

where there is a high latency of data

required, which is usually in metro-

politan areas where limited space is

available.”

Building and operating a 25-400

MW power plant to serve a data centre

is usually not the business of a big

tech company. Nevertheless, securing

rm power contracts from utilities is

often a challenge.

“Ireland’s EirGrid has published a

data centre connection policy, which

says that a data centre connection

customer can get a connection and

receive power, but only on a exible

basis. So you don’t know when or

how much power you will get,” said

Schuenemann. “However, they have

said that if you want a rm contract,

you need to install reliable and dis-

patchable gas-based power genera-

tion at your data centre.”

This, he says, is an “interesting

move” by EirGrid in terms of how

the power sector is developing in

Ireland “because the data centre now

becomes part of the solution and not

the problem”.

Offshore wind will play a signicant

role in Ireland’s decarbonisation. Ac-

cording to its National Energy &

Climate Plan, Ireland aims to develop

5 GW of offshore wind by 2030. And

with its newly published climate bill,

the Irish government aims to reduce

total carbon emissions by more than

50 per cent by 2030 compared to

2018. It also commits Ireland to cli-

mate neutrality by 2050.

According to Schuenemann, every

data centre will help this push for

more green power. “Green power

uctuates – the wind is not always

blowing and the sun is not always

shining. So with this policy that the

data centre will have its own genera-

tion, it will not only provide power

for the data centre to operate but also

support stabilisation of the grid. So

essentially the data centre can be

A

s the world’s demand for

increasing amounts of data

processing grows, so too does

the need for data centres. In recent

years, the energy consumption and

corresponding carbon footprint of

these facilities has come to the

attention of the public. Yet, the

explosive growth in data centres need

not be a problem. Instead, data centres

can play a positive role in the global

energy transition.

The International Energy Agency

(IEA) estimates that electricity de-

mand for global data centres in 2019

was around 200 TWh, or about 0.8

per cent of global nal electricity

demand.

The IEA predicts an electricity de-

mand for hyperscale and colocation

data centres (where a company rents

space within a data centre) to grow

from 70 TWh in 2019 to 93 TWh in

2022 globally. This translates to ap-

proximately 3 GW additional demand

on a yearly basis.

Today that growth, which is partly

due to increasing digitalisation and

cloud-based services, is being intensi-

ed by the Covid-19 pandemic’s ac-

celeration of the transition to working

from home, teleconferencing, online

shopping, video streaming, and other

data-intensive activities.

Other potential geopolitical moves

could also have an impact. For ex-

ample, the EU believes that its data

should be stored within the bloc in-

stead of in the US. This will drive

growth in Europe. Asia is also think-

ing along the same lines and the region

is expected to see the most growth

globally.

According to a report released this

year by French think-tank, The Shift

Project, the annual electricity usage

of just ve tech groups – Amazon,

Google, Microsoft, Facebook and

Apple – is about as much as New

Zealand’s, at more than 45 TWh. As

demand continues, so too does the

potential for generating carbon emis-

sions. According to the report, carbon

emissions from tech infrastructure

and the data servers that enable cloud

computing now exceed those of pre-

Covid air travel.

Estimates suggest tech-related

emissions are rising by 6 per cent

annually, and public pressure is

prompting some companies to act.

Big tech companies are investing in

renewable power like solar panels on

their roofs and solar elds nearby or

even wind farms mostly connected

via virtual Power Purchase Agree-

ments (PPAs).

Hyperscale (bigger than 5000 serv-

ers and 10 000 ft

2

) data centre opera-

tors in particular are leaders in cor-

porate renewables procurement,

particularly through PPAs. The top

four corporate off-takers of renew-

ables in 2019 were all ICT compa-

nies, led by Google.

Christoph Schuenemann, who leads

Siemens Energy’s Competence Cen-

tre for data centres in the Generation

Division, has been working with a

growing number of companies on

how to decarbonise the power supply

of their data centres.

He commented: “This [data centre]

sector is very interesting from two

aspects. Firstly, almost every day we

are seeing new megawatt-scale data

centres – typically between 25 MW

and 400 MW – either being planned

or erected somewhere. The IEA has

forecast this will call for an addi-

tional 3 GW per year but we think it

could be more, based on the drivers.

“In addition to these hyperscale

and colocation data centres, there’s

another trend that will come in the

future – edge data centres. These will

be smaller, in the kW range, setup so

data is close to the users, for example

in urban situations and industrial

locations.

“Secondly, we are seeing those big

tech companies like Google, Apple

and Microsoft, sign up for renewable

PPAs to help meet their zero carbon

targets – most have targets for 2030.

So on one hand, there is this boom in

data centres and power demand, and

on the other there is this need for de-

carbonisation via low and better zero

carbon power supply solutions for

existing and future projects.

“This decarbonisation plan is now

becoming even more concrete, so to

speak. Instead of buying green certi-

cates on an annual basis, companies

are really analysing what part of their

energy is really green and what is grey

by monitoring their consumption

hour-by-hour.”

Earlier this year more than 100

global companies, including PwC,

Microsoft and Google, announced

they are taking part in a new world-

wide initiative led by the independent

non-prot EnergyTag, aimed at veri-

fying clean energy sourcing on an

hourly basis.

Typically data centres are built in

locations based on internet nodes,

where there is a high latency of data,

so cities such as Frankfurt, London,

Amsterdam, Paris Dublin (FLAPD

markets) are the most popular with

increasing growth in the Asia Pacic

region. The data centre owner also

has to look at how it will be powered,

so the electricity connection – con-

nection point, generation, voltage

level, etc., – has to be assessed before

power is purchased from the supplier.

At the same time backup power solu-

tions are installed, e.g. small diesel or

gas engines along with fuel tanks

supported by signed contracts to en-

sure fuel supply is always available.

If the data centre is in a more remote

area, it may be that the owners build

their own decarbonised hybrid gener-

ating facility. “In the US, for example,

a company is planning data centres in

areas where there is space to locate

solar PV, with batteries for backup,”

noted Schuenemann. “But this can’t

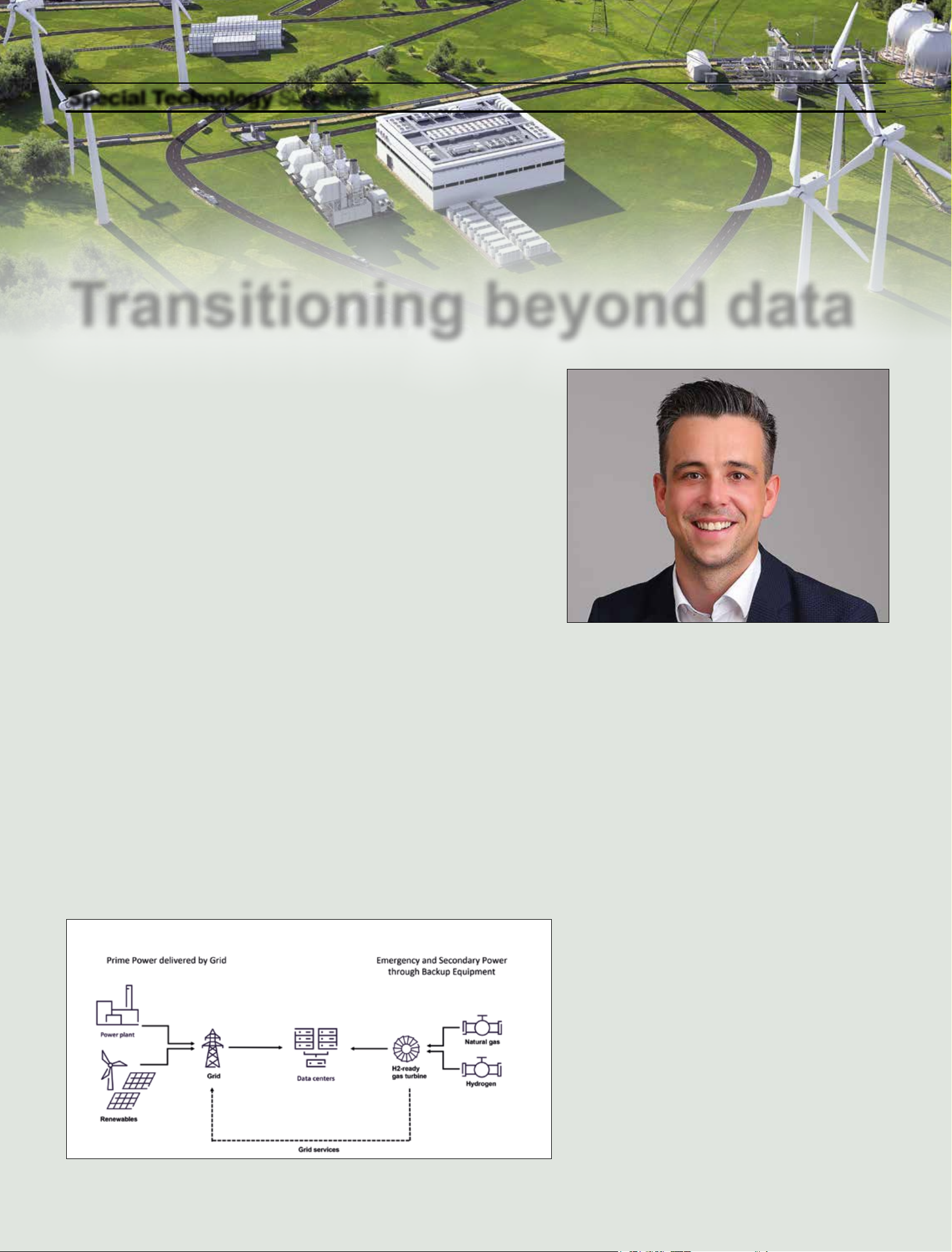

Backup power solutions such as gas turbines can be installed to ensure power is always

available

Schuenemann says there is a boom in data centres and power

demand, at the same time as a need for decarbonisation

countries,” Schuenemann added.

The use of hydrogen as an energy

vector is gaining momentum as the

amount of renewables on the grid

rises and sustainable hydrogen and its

derivatives (e-ammonia, e-fuels) are

being introduced in several other sec-

tors such as industry and mobility.

Eventually, hydrogen is also expected

to play a role as a fuel for gas turbines

– replacing fossil fuels for the residu-

al load to enable large-scale, long-

term seasonal storage of renewable

energy and deep decarbonisation of

the power sector.

“Even if re-electrication of hydro-

gen is not cost-economical today,

with green hydrogen likely being

used in other sectors of the economy

rst, we expect new gas turbine plants

being built today to switch gradually

to hydrogen over their life time. This

requires provisions for a later retrot

to hydrogen as a fuel, a concept called

H2 readiness”, said Schuenemann.

Siemens Energy has been working

on adapting its gas turbines to run on

hydrogen for a number of years now,

and has released a hydrogen blending

capability with natural gas in DLE

(dry low emissions) mode between 30

and 75 per cent by volume, depending

on the gas turbine model. The com-

pany has set out a roadmap for

achieving a 100 per cent hydrogen

capability in DLE mode by 2030 at

the latest.

Notably, Siemens Energy has a

demonstration project under execu-

tion in France known as HYFLEX-

POWER that will play a key role in

demonstrating full decarbonisation of

its gas turbines. The project, which is

being hailed as the world’s very rst

industrial-scale power-to-X-to-power

demonstrator with an advanced 13

MW SGT-400 hydrogen turbine, will

demonstrate the importance of using

hydrogen as a long-term energy stor-

age technology for a grid that has a

high renewables penetration.

Where provision and storage of

sustainable hydrogen is not possible,

other decarbonised fuels like syn-

thetic e-fuels or biofuels may – al-

beit more expensive or less sustain-

able – also become an option for gas

turbines.

The high cost of green fuels can be

mitigated by conguring these tur-

bines as high efciency combined

cycle plants. But with such fuels not

yet widely commercially on viable,

part of the solution in a decentral-

ised electricity grid on the way to

decarbonisation.”

According to the Sustainable Digital

Infrastructure Alliance, by the begin-

ning of 2030, data centres are esti-

mated to account for up to 13 per cent

of global electricity consumption,

noting that the inefcient use of

equipment is creating unnecessary

waste and costs. On a global average,

eight out of ten servers are idling

while still consuming energy, it says.

Yet it sees digital technology as one of

the keys to solving the world’s most

pressing problems, be it the distribu-

tion of resources, social mobility or

climate change.

Certainly cooperation between data

centre owners, governments, utilities

and power plant technology suppliers

could help optimise the overall energy

system and address climate change.

To ensure data centres are an integral

part of the sustainable future of Eu-

rope, the European Data Centre As-

sociation (EDCA), an organisation

comprised of data centre operators

and trade associations, have agreed to

make data centres climate neutral by

2030. Their aim is to leverage tech-

nology and digitalisation in support

of the European Green Deal’s goal of

making Europe climate neutral by

2050.

This self-regulatory initiative fo-

cuses on, among other things, energy

efciency and clean energy.

Under its ‘Climate Neutral Data

Center’ pact, the EDCA says data

centres and server rooms in Europe

shall meet a high standard for energy

efciency, which will be demonstrat-

ed through aggressive power use ef-

fectiveness (PUE) targets. PUE de-

scribes the ratio of IT power vs. total

power including cooling power.

By January 1, 2025 new data centres

operating at full capacity in cool cli-

mates will meet an annual PUE target

of 1.3, and 1.4 for new data centres

operating at full capacity in warm

climates. Existing data centres will

achieve these same targets by January

1, 2030. These targets apply to all data

centres larger than 50 kW of maxi-

mum IT power demand.

In recognition of the European

Commission’s interest in creating a

new efciency metric, trade associa-

tions will work with the appropriate

agencies or organisations toward the

creation of a new data centre ef-

ciency metric. Once dened, trade

associations will consider setting a

2030 goal based on this metric.

“There are various ways to increase

PUE, including avoiding transmis-

sion losses by, for example, direct

current to direct current connections

from the power source to the servers”

Schuenemann mentioned.

On clean energy, data centres will

match their electricity supply through

the purchase of clean energy. Data

centre electricity demand will be

matched by 75 per cent renewable

energy or hourly carbon-free energy

by December 31, 2025 and 100 per

cent by December 31, 2030.

Although data centres are making

serious steps to power their opera-

tions by green energy, typically they

often still have diesel gensets for

backup power if the grid fails. How-

ever, in many parts of the world these

engines are not permitted to run for

more than 300 hours per year due to

their high emissions. This means

diesel gensets are not a suitable tech-

nology to rm up uctuating renew-

able power.

In terms of reliable, self-generation

alternatives, large lithium-ion batter-

ies may become the default in the fu-

ture but there will still be situations

when battery storage is insufcient –

Li-ion batteries cannot be relled

with fuel and therefore can only cover

power supply for periods of hours to

a day. Schuenemann says there are

several alternatives in such scenarios.

“We are applying existing technolo-

gies such as gas turbines and also

looking to work with customers on

new technologies in our focus area,

for example, storage and hybrid

power plants, and other forward look-

ing technologies like hydrogen red

gas turbines or fuel cells,” he said.

Schuenemann notes, that the natural

gas option is attractive because not

only is it lower carbon than diesel, but

it also offers the possibility of being

easily converted to a carbon-free fuel

in the future. Gas turbines have a

higher power density than reciprocat-

ing engines and are also fuel exible;

they can run on liquid fuels including

bio diesel as well as gaseous fuels

such as natural gas and hydrogen.

This ability to run on hydrogen brings

a big opportunity to decarbonise gas.

“Natural gas is a fossil fuel but with

lower carbon dioxide emissions than

diesel. Also, gas turbines compared

to gas engines have lower methane

slip and so release less methane into

the atmosphere,” he explained. “Gas

turbines can start quickly without

major pre-warming, are dense in

power and have high availability and

reliability and also have the versatil-

ity to switch fuels online. This makes

them attractive.

“Ireland, for example has a vision to

have 50 per cent of its gas demand

carbon-free by 2050,” noted Schuen-

emann. Part of the plan for achieving

this is by investing in new technolo-

gies to facilitate substitution with a

sustainable gas (e.g. hydrogen), into

the gas network. “This approach by

Ireland may also be valid for other

Special Technology Supplement

THE ENERGY INDUSTRY TIMES - NOVEMBER 2021

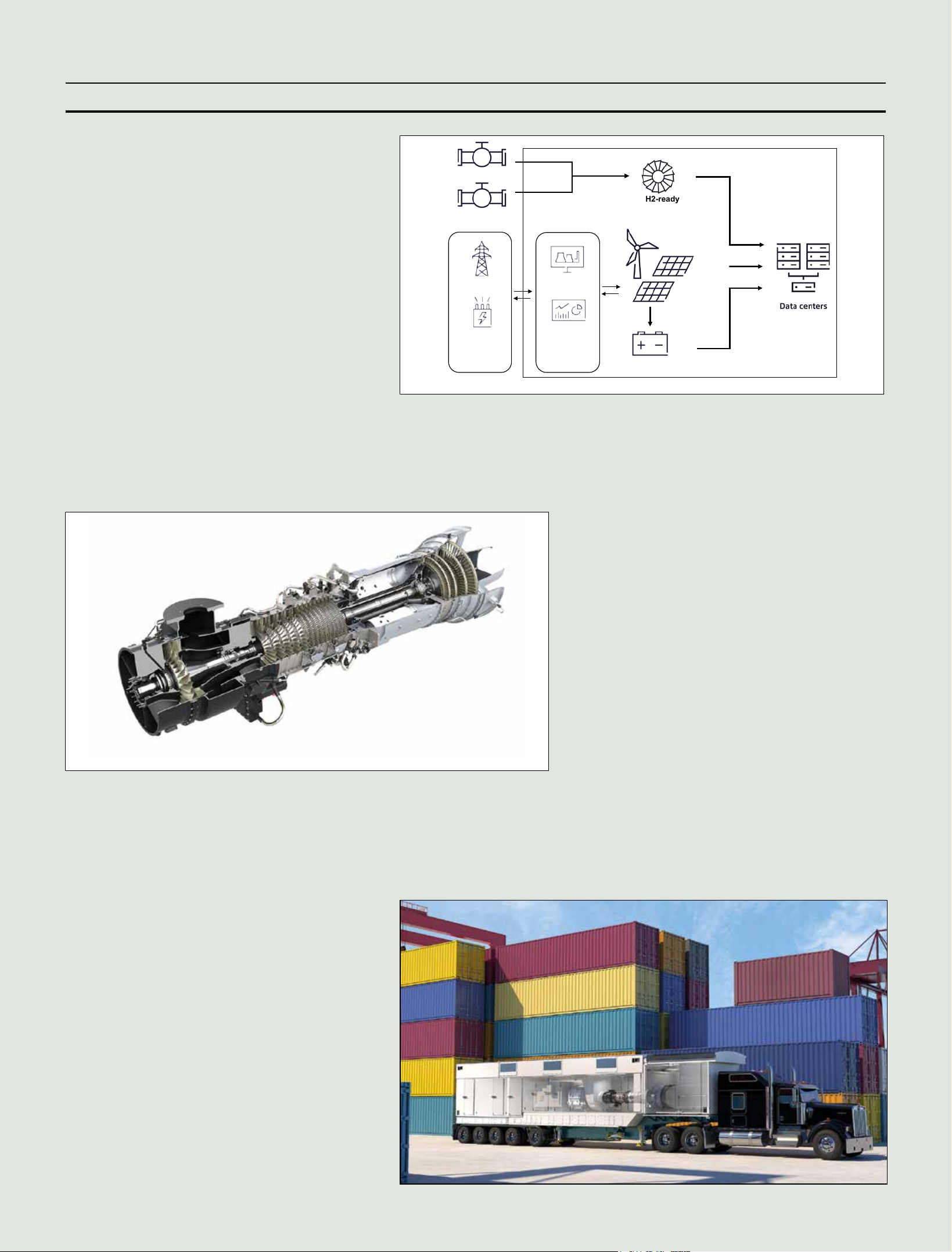

!"#$%&#'(&$)*

Renewables

Storage solution

Power

management and

hybrid controls

Grid connection

System Border

H2-ready

gas turbine

Natural gas

Hydrogen

Transmission

Transformer

Data visualization

Power plant 4.0

Siemens Energy is applying

existing technologies such as

gas turbines and also looking

to work with customers on

new technologies in its focus

areas, for example, storage

and hybrid power plants

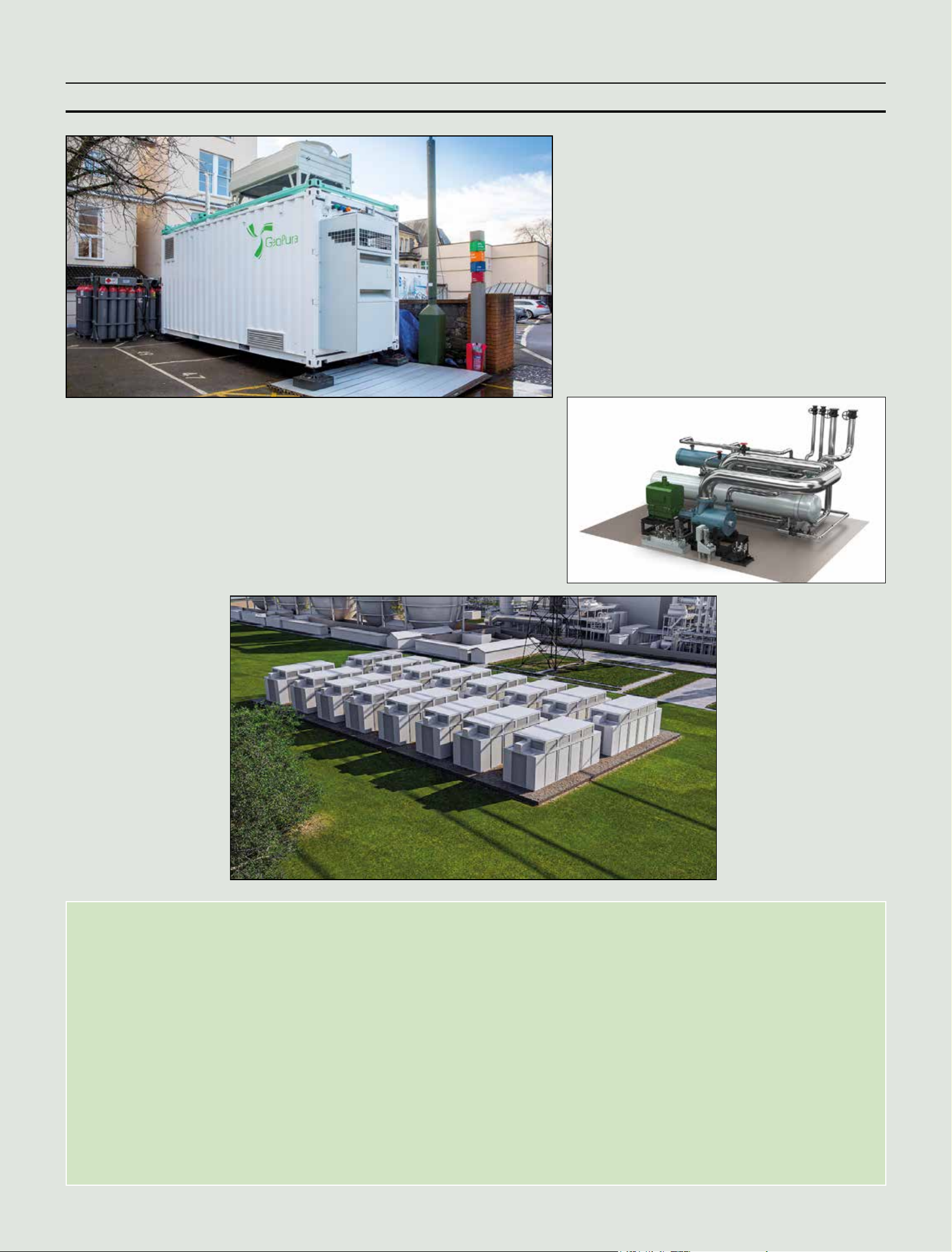

Aeroderivative SGT-A05: Gas turbines have a higher power density than reciprocating engines

The SGT-A05 is compact and

easily transported

THE ENERGY INDUSTRY TIMES - NOVEMBER 2021

September last year, the partners de-

livered a hydrogen-powered fuel cell

to provide off-grid power and heat to

National Grid’s UK Viking Link con-

struction site in Lincolnshire. The

installation served the site for eight

months when the remote site was

without a grid connection. Also BBC

Studios Natural History Unit have

used a GeoPura solution in place of

diesel gensets for critical and back-up

power whilst lming on location.

“With improving economies of

scale, this is becoming an interesting

solution, especially when considering

its high efciency, modularity and

potential high power density,” said

Siemens Energy says natural gas

would be today’s fuel to allow low

emissions per electricity unit generat-

ed, with the e-fuel being mixed in as it

becomes available. With waste heat

utilisation overall energy conversion

efciency can be in the order of 80-90

per cent. Such solutions, however, are

complex and may only be suited to

very specic requirements of a data

centre.

Siemens Energy says fuel cells are

another clean option for data centres.

Through its partnership with GeoPura,

the company can deliver such systems

for events and other situations where

green onsite power is needed. In

Schuenemann. “Its modularity

means you can size the installation to

better match the power needs at high

efciency.”

The other interesting technology for

data centres, is waste heat utilisation.

Data centres generate signicant

amounts of heat and therefore require

cooling systems.

Schuenemann explained: “It may be

there is air conditioning and cooling

of the servers. If you have a 100 MW

data centre, depending on the loca-

tion, you will need to add 40 per cent

for the air conditioning and cooling.

The waste heat released to the atmo-

sphere from the cooling system out-

side of the building should be better

re-used via heat pumps, which can

boost the heat to a higher temperature

level so it can be sold to an industrial

customer or fed to a district heating

network.”

He noted that waste heat is cur-

rently not subject to carbon taxes in

most countries where it is produced

by fossil power plants and is a more

sustainable form of producing heat

than just burning fossil fuels. This

can provide a business opportunity

in the future for facilities like data

centres, which together with local

partners such as municipalities, can

sell otherwise wasted heat to further

drive decarbonisation.

As the world goes through the en-

ergy transition, it is clear data centres

have a role to play. Looking at tech-

nologies to support the power needed

for their burgeoning growth, com-

bined with the business opportunities

presented by the implementation of

those technologies, data centres no

longer need to be seen as part of the

climate challenge. On the contrary,

they could be integral to helping the

world meet those challenging cli-

mate targets.

Special Technology Supplement

Fuel cells are another clean

option for data centres. BBC

Studios Natural History Unit

has used a GeoPura solution

in place of diesel gensets for

critical and back-up power

Satisfying the thirst for data

According to an International Energy Agency (IEA) report, global internet trafc

surged by almost 40 per cent between February and mid-April 2020, driven by

growth in video streaming, video conferencing, online gaming, and social net-

working. This growth comes on top of rising demand for digital services over the

past decade: since 2010, the number of internet users worldwide has doubled

while global internet trafc has grown 12-fold or around 30 per cent per year.

Demand for data and digital services is expected to continue its exponential

growth over the coming years, driving massive growth in demand for data centre

and network services. Global data centre electricity demand in 2019 was around

200 TWh, or around 0.8 per cent of global nal electricity demand.

The report, ‘IEA (2020), Data Centres and Data Transmission Networks’,

notes, however, that rapid improvements in energy efciency have helped to

limit energy demand growth from data centres and data transmission networks,

which each accounted for around 1 per cent of global electricity use in 2019.

Strong government and industry efforts on energy efciency, renewables

As the world goes through the

energy transition, it is clear

data centres have a role to

play

Waste heat released to

the atmosphere from the

cooling system outside of

the building should be better

re-used via heat pumps, says

Schuenemann

procurement, and RD&D are necessary to limit growth in energy demand and

emissions over the next decade, it said.

If current trends in the efciency of hardware and data centre infrastructure

can be maintained, global data centre energy demand can remain nearly at

through 2022, despite a 60 per cent increase in service demand, according to

the IEA.

Strong growth in demand for data centre services continues to be offset by

ongoing efciency improvements for servers, storage devices, network switches

and data centre infrastructure, as well as a shift to much greater shares of cloud

and hyperscale data centres.

Hyperscale data centres are very efcient large-scale cloud data centres that

run at high capacity. They enable data centre operators to deliver greater work

output with fewer servers. According to Statista hyperscale data centres have

doubled their energy demand between 2015 and 2021.

siemens-energy.com

LET’S MAKE TOMORROW DIFFERENT TODAY.

The solution to power availability and quality lies

within the reach: flexible distributed generation

and storage technologies with carbon emissions

cut to zero.

Siemens Energy is a trademark licensed by Siemens AG.

How can we

provide power

for the data of the future?

solar-driven green hydrogen plant in

the MENA region in collaboration

with DEWA, Expo 2020 Dubai and

Siemens Energy. The project takes

advantage of the Emirates’ geo-

graphical strengths in reliable weather

conditions for generating solar energy

to produce hydrogen.

The facility will provide clean fuel

to power all transportation during

Expo 2020 Dubai, an early demon-

stration of the real-world applications

for green hydrogen, including re-

electrication, transportation, and

other industrial uses. This is a clear

example where multiple partners

have pooled resources, expertise, and

technologies to pioneer new clean

energy assets in the Middle East.

Similarly, Emirati waste manage-

ment leader Bee’ah and UK-based

Chinook Sciences’ partnership to

build the rst waste-to-hydrogen fa-

cility in the UAE represents the po-

tential that can be achieved from le-

veraging long-standing partnerships.

The project is particularly impressive

for its dual-purpose approach. The

new facility includes a plant that

generates green hydrogen from waste

– and a station to fuel large vehicles

with hydrogen power, helping to de-

carbonise transportation.

An additional partnership with am-

bitious plans to decarbonise transpor-

tation includes an electrolysis facility

launched by Masdar, Siemens Energy,

the Abu Dhabi Department of Energy,

Etihad Airways, Lufthansa, Marubeni

Corporation and Khalifa University.

While this will initially test green

hydrogen for road transport, the

planned kerosene synthesis plant will

convert most of it into sustainable

aviation fuel, with plans to explore

maritime fuel also.

Formal agreements on hydrogen

co-operation between countries are

also crucial. Two such agreements –

with Japan and Germany – have

spurred cooperation to increase hy-

drogen production and create interna-

tional supply chains. The agreement

with Japan aims to increase annual

hydrogen demand in Japan by a mil-

lion tonnes by 2030, and to 20 million

tonnes by 2050, along with boosting

hydrogen production in the Emirates.

The Energy Partnership with Germa-

ny has not only increased our dialogue

on the energy transition but has led to

a framework for collaboration be-

tween the public and private sectors

across both countries, including a

technical hydrogen committee in the

UAE to align all existing work.

But this isn’t all just happening in

the Emirates. There are many other

countries that are also forming hydro-

gen partnerships. Germany and Aus-

tralia announced a Hydrogen Accord

to increase technological innovation

G

reen hydrogen is becoming

increasingly prominent in in-

ternational dialogue on the

energy transition. As countries across

the world look to meet the global goal

of net zero emissions by 2050, green

hydrogen is emerging as a potential

solution to decarbonise a range of in-

dustries. Although in its early stages,

it is being backed by many govern-

ments around the world, including in

the UK, as evidenced by the recently

released National Hydrogen Strategy.

Green hydrogen is also on the

agenda in the Emirates, where we

have undertaken a Dh600 billion

($163.4 billion) investment into our

energy transition to a cleaner and

more sustainable energy mix. The

UAE Energy Strategy 2050 aims to

meet the growing energy demand and

ensure sustainable economic devel-

opment. Our stated strategic initiative

of net zero by 2050 is an evolution of

that strategy, with a focus on achiev-

ing climate neutrality. This invest-

ment by the UAE government will be

joined by private sector investments

and projects as we realise the substan-

tial economic and commercial op-

portunities this move opens up.

As COP26 opens, we are seeing an

unprecedented movement from na-

tions and organisations across the

world to reach net zero. For these to

be effective, and to truly create a

competitive global market for green

hydrogen, we need to reach across

borders and cement international

partnerships to reap the full potential

of new hydrogen technologies.

So why green hydrogen? An in-

creasing proportion of the world’s

energy is produced by renewables.

However, carbon emissions are not

reducing at the rate required to meet

the current net zero targets. Decar-

bonising with renewables remains

difcult for many industries – such as

metal, steel, chemicals, heating,

manufacturing, and even transporta-

tion. Electrication may be possible

for the likes of cars and buses, but still

presents a signicant challenge for

heavy freight shipping or aviation.

This is where the earth’s most

abundant element, hydrogen, comes

into play. Techniques that harness

hydrogen to generate energy have

been around for a long time, such as

hydrogen produced from fossil fuels

(otherwise known as grey hydrogen)

or natural gas (referred to as blue hy-

drogen). However, innovation in its

cleanest form, green hydrogen, has

the potential to revolutionise energy

production. Generated using electric-

ity from renewable sources, green

hydrogen can be used to decarbonise

industries that are traditionally dif-

cult-to-abate. In addition, hydrogen’s

greater storage capacity enables it to

provide a more stable energy supply

by offsetting the intermittency of re-

newables such as wind and solar.

It’s no surprise, therefore, that green

hydrogen is a staple of most countries’

energy strategies. With green hydro-

gen a key aspect of the Emirates’ fu-

ture clean energy mix, we’re aiming

to reduce the carbon footprint of

power generation by 70 per cent and

increase the consumption efciency

of individuals and corporates by 40

per cent. But currently, green hydro-

gen only accounts for 0.1 per cent of

the world’s hydrogen production.

For a developed green hydrogen

market to take shape, we need lower

electricity prices, incentives to sup-

port production, energy system inte-

gration and infrastructure develop-

ment. This will require extensive

collaboration between multiple par-

ties and cannot happen overnight.

However, this is the route we must

take to enable clean, hydrogen-based

fuels, produced in zero-carbon pro-

cesses, to decarbonise the hardest-to-

abate sectors of the economy.

Developing an effective and com-

petitive hydrogen market will require

building networks between govern-

ments, policymakers, the private sec-

tor, and academic institutions alike.

With the supporting technologies be-

hind green hydrogen still in the early

phases of widespread implementa-

tion, global collaboration can help to

manage and share the risk of produc-

ing green hydrogen at scale.

In Dubai, we have launched the rst

and R&D between the two nations

and boost sustainable hydrogen pro-

duction. Not to mention, Portugal and

Morocco earlier this year signed an

agreement announcing a joint work-

ing group to implement a roadmap for

green hydrogen production.

The UK is also making signicant

strides with the launch of its National

Hydrogen Strategy. When it comes to

producing green hydrogen, there are

similarities between the UK and the

UAE: both are geographically blessed

with abundant sources for producing

renewable energy – the UK with

wind, the UAE with solar.

There is signicant potential in the

UK’s plan to invest in offshore wind

infrastructure to generate green hy-

drogen by the 2030s and increased

funding to help businesses decarbo-

nise. This potential is being recog-

nised by international private sector

rms, with Ørsted bidding for off-

shore wind projects in Scotland, Ineos

investing signicantly in its UK fa-

cilities to progress decarbonisation

efforts, and the OYSTER Consortium

developing plans for a marinised

electrolyser project in Grimsby.

The progress that the UK and UAE

have made in advancing towards a

hydrogen-based economy can be

amplied with further collaboration:

both with each other and with other

nations. These partnerships allow us

to share knowledge, bring together

engineering talent and technologies,

and more closely align policy and

regulatory activity between markets,

stimulating a boost in supply. Col-

laborating will also allow us to man-

age the risks of early adoption and

create a larger shared market for initial

implementation of green hydrogen.

Together, we can use green hydrogen

to not only meet our own domestic net

zero targets but create a competitive

market in which other countries can

benet as well.

The imperative to act is now. Green

hydrogen has the potential to be the

fuel of the future – but it will require

urgent efforts between stakeholders

across the world. We have so much to

learn from each other in engineering,

policy and regulation, energy system

integration and infrastructure devel-

opment. But we cannot afford to miss

the opportunity of hydrogen’s grow-

ing place at the forefront of interna-

tional agendas. We must unite – and

act now – if we wish to reap the

maximum benets of green hydrogen

to swiftly reduce carbon emissions.

His Excellency Suhail Mohamed Al

Mazrouei is UAE Minister of Energy

and Industry, and a board member of

the Abu Dhabi National Oil Company

ADNOC and Mubadala Investment

Company.

THE ENERGY INDUSTRY TIMES - NOVEMBER 2021

Industry Perspective

12

His Excellency Suhail

Mohamed Al Mazrouei: We

must unite, and act now, if we

wish to reap the maximum

benets of green hydrogen

With the supporting

technologies behind

green hydrogen still

in the early phases

of widespread

implementation, global

collaboration can help

to manage and share

the risk of producing

green hydrogen at

scale.His Excellency

Suhail Mohamed

Al Mazrouei, UAE

Minister of Energy and

Industry.

A green hydrogen future

depends on global

partnerships

E

nergy markets across Europe

are at the centre of public at-

tention once more. Rising

electricity and gas prices are putting

pressure on energy suppliers, policy

makers, businesses and not least the

consumers. The current crisis is a

concerning example of how the con-

tinued heavy dependency on gas and

other non-renewable fuels can lead

to sharp price increases.

A fully renewable energy system

with distributed production and

smart, connected consumption

would be more resilient, decreasing

the reliance on gas imports and the

goodwill of certain foreign actors.

Energy communities are a meaning-

ful way of contributing to such a

system, creating more exibility to

balance production and consump-

tion. The current developments are

an opportunity to learn and adapt

lessons and model from other coun-

tries, with the Spanish market being

a prime example of progress in the

right direction.

Since 2018, Spain has signicant-

ly progressed the mass deployment

of renewable energy generation.

Until then, the controversial “sun

tax” in the country taxed the self-

consumption of renewable energy

generation, mostly photovoltaics

(PV). Spain accelerated digitalisa-