www.teitimes.com

October 2021 • Volume 14 • No 8 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Special Supplement

Coal: an obstacle and a

driver

TEI Times discusses why

the grid is central the global

decarbonisation effort.

China’s approach to the coal

power sector might actually drive

decarbonisation. Joseph Jacobelli

explains. Page 14

News In Brief

China’s retreat from coal

plant seen as boost for

climate talks

China’s recent promise to stop

nancing new coal power

plants overseas has been hailed

as “signicant” in light of the

upcoming COP26 climate summit.

Page 2

Brazil’s drought boosts

expansion of wind and solar

President Jair Bolsonaro has called

on Brazilians to save energy to

prevent hydroelectric plants from

shutting down.

Page 4

Australia’s Offshore

Electricity Infrastructure Bill

“not up to scratch”

Australia has introduced its rst

offshore electricity legislation in

parliament but the bill is not up to

scratch, according to some experts.

Page 5

Denmark ready to support

energy island and green

hydrogen

A tender will be launched next year

for Denmark’s planned 10 GW

North Sea energy island hub, after

terms for the project were conrmed

by legislators.

Page 7

EDF eyes GE French nuclear

steam turbine ops

EDF is holding exploratory

negotiations over the possible

acquisition of General Electric’s

nuclear steam power unit.

Page 9

Industry Perspective:

harnessing hydrogen’s full

potential

With the ability to develop hydrogen

at scale and storage now part of

the equation, some argue the hype

around hydrogen is justied.

Page 13

Technology Focus: Injecting

inertia into the energy

transition

A service to accurately measure

system inertia in real-time will

give grid operators better visibility

of network conditions as growing

renewables penetration threatens

system stability.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

Soaring gas prices and the knock-on effect on electricity prices, is causing some European

governments to intervene in the market and re-assess a proposal to extend the Emissions

Trading Scheme. Junior Isles

Gas price takes toll on UK suppliers

THE ENERGY INDUSTRY

TIMES

Final Word

Now is the time to hold

your nerve,

says Junior Isles.

Page 16

The huge rise in European gas prices

is driving a number of governments to

re-assess some of the proposals that

underpin Europe’s Green Deal.

The Green Deal comprises 13 poli-

cies designed to reduce EU emissions

by 55 per cent by 2030 compared with

1990 levels, and falling to net zero in

2050. One of those proposals is an ex-

tension of the Emissions Trading

Scheme (ETS) to consumer sectors

such as cars and heating for buildings,

including homes. Such a move would

increase the price of petrol and energy

for already hard-pressed households.

With the recent rise in prices, some

legislators in the European parliament

are now considering scrapping the

plan and replacing it with alternative

measures such as tougher regulation.

One EU ofcial told the Financial

Times: “If the ETS extension is gone,

it leaves a big hole that will need to be

lled,” said the EU ofcial. “You

can’t simply replace an instrument

like the ETS with a new target.”

Discussions on modications to the

ETS are set to continue for months as

ministers debate plans that include

emissions targets for cars, an EU car-

bon border tax and nationally binding

greenhouse gas targets.

In September, several global fac-

tors, including weather conditions

and strong gas demand in Asia fol-

lowing the pandemic, sent coal and

gas prices soaring. This sent Euro-

pean electricity costs to record highs

and saw coal demand rise as power

generators looked to avoid sky-high

gas prices. With coal plants emitting

double the amount of carbon dioxide

as gas plants, this has in turn led to

more demand and higher prices of

carbon permits.

Ministers were due to meet at the

end of September to discuss national

responses to the surge in wholesale

gas prices. A major concern is that

high gas prices, which are predicted to

continue, will jeopardise Europe’s

post-pandemic economic recovery

and undermine Brussels’ plans for

green reforms.

In a controversial move, the Spanish

government says it will recoup £3 bil-

lion over the next six months from the

prots of energy companies to fund a

nancial package to subsidise house-

hold energy bills. Energy companies

are expected to mount a legal chal-

lenge to the move.

In Spain, protests mounted against

energy companies after electricity

prices rose more than 200 per cent in

the past year and the issue has become

politically sensitive. Madrid said it

was targeting €2.6 billion in “excess

prots” from utilities that do not use

gas but have benetted from how ris-

ing gas prices have driven electricity

prices higher. This follows a similar

initiative, announced in July, to claw

back about €650 million from energy

companies whose income has in-

creased because of the rising cost of

carbon.

The Association of Electric Power

Companies, Aelec, which represents

major utility companies including

Iberdrola, Endesa, Viesgo and EDP,

said in a statement that the Spanish

Continued on Page 2

Soaring gas prices has led to the fail-

ure of a number of UK energy compa-

nies.

As of late September seven small

suppliers had gone bust in a little over

six weeks. Citizens Advice, the con-

sumer charity, said 1.5 million house-

holds had been affected by the sup-

plier failures. Avro Energy, which had

2 per cent of the British energy supply

market with 580 000 domestic cus-

tomers, was notably the largest sup-

plier to have failed in at least the last

decade.

The increase in gas price has been

replicated across Europe due to low

storage stocks, competition with Asia

for LNG cargoes, and Russian supply

concerns. In the UK, the shutdown of

a key power cable between Britain

and France due to a re has caused

energy prices to soar even further,

heaping even more pressure on ener-

gy suppliers.

Kwasi Kwarteng the UK’s Business

and Energy Industry Secretary, said

he expected the nal number of failed

retail suppliers to be fewer than the 40

or so predicted by industry consul-

tants, a level that would leave the UK

with only 10 providers. “I’d be very

surprised if we got to that gure,”

Kwarteng said.

With wholesale gas prices in the UK

having risen by 250 per cent since

January, some green groups are call-

ing on the government to commit to

ending gas-red electricity generation

and give more detail on plans for re-

ducing the nation’s dependence on

gas for heating.

Energy and climate think-tank Em-

ber, said it is cheaper to generate elec-

tricity from new wind and solar than

existing gas plants.

“Generating electricity from exist-

ing UK fossil gas power plants is

three times more expensive than from

new onshore wind and almost twice

that from new solar. Even the lev-

elised cost of electricity (LCOE) from

new offshore wind is cheaper than

generating electricity from fossil

gas,” it said in a statement.

“Continued reliance on fossil gas for

power generation has caused substan-

tial increases in electricity bills when

people can least afford it. UK fossil

gas prices have skyrocketed since the

start of 2021, with the average day-

ahead price more than doubling from

45 pence per therm in December 2020

to 109 pence per therm in August

2021.”

It added that fossil gas costs account

for 86 per cent of UK electricity price

increases – UK power prices have

tripled year-on-year from August

2020 (£36/MWh) to August 2021

(£107/MWh) – a jump of £71/MWh.

Noting that the escalation in gas

prices looks set to continue as winter

approaches, it said the need to switch

from imported fossil gas to domestic

wind and solar generation has never

been more apparent or urgent.

It says that with US President Joe

Biden setting the path for clean elec-

tricity generation by 2035, Canada’s

Prime Minister, Justin Trudeau mak-

ing it a manifesto pledge, and a change

in the German government, gas

phase-out could become a big issue at

the COP26 climate summit in

Glasgow next month.

“The soaring cost of imported fossil

gas is driving up electricity prices in

the UK. A more rapid and committed

transition to clean electricity is the

only way to avoid the volatility of fos-

sil fuels,” said Sarah Brown, Senior

Electricity Analyst at Ember.

European governments

European governments

struggle with surge in energy prices

struggle with surge in energy prices

THE ENERGY INDUSTRY TIMES - OCTOBER 2021

2

Junior Isles

China’s recent promise to end the -

nancing of new coal power plants over-

seas has been hailed as “signicant” in

light of the upcoming COP26 climate

summit.

The pledge made by President Xi

Jinping last month in a speech to the

United Nations General Assembly was

welcomed by global leaders, who

stressed that China needed to also

phase-out the use of coal domestically.

“China will step up support for other

developing countries in developing

green and low carbon energy, and will

not build new coal red power projects

abroad,” Xi said, but he stopped short

of ending coal red projects at home.

Dozens of new coal red power and

steel plants in China announced during

the rst half of 2021, if built, would

alone add 150 million tonnes in an-

nual carbon dioxide emissions, accord-

ing to research group Global Energy

Monitor (GEM).

Ending all support for coal has be-

come a prime goal of the UN COP26

global climate summit scheduled for

Glasgow, UK, in November.

“This is an important development,

as China has been one of the biggest

nanciers of coal infrastructure in de-

veloping countries, particularly in

Asia,” said Alden Meyer, senior asso-

ciate at E3G, a climate think-tank. But

he said it was also “essential” that

China stopped building new coal red

power stations at home and moved

away from the fuel to meet its climate

goals.

Globally, emissions are still rising, at

a time when scientists warn that they

need to fall almost 50 per cent by 2030

to avoid more extreme storms, heat

waves and drought.

China was the nancial backbone for

about half of the coal projects being

planned worldwide, in countries such

as South Africa, Vietnam, Indonesia

and Bangladesh, according to a report

by E3G.

Analysts at GEM said China’s over-

seas coal power retreat could wipe out

$50 billion of investment, affecting

44 coal plants earmarked for Chinese

state nancing. The country, however,

is isolated as the last major provider of

public nance for overseas coal plants,

with over 40 GW of plant in 20 coun-

tries in the pre-construction pipeline.

The Asian Infrastructure Investment

Bank also welcomed China’s an-

nouncement, calling it “a bold and

consequential step for China, and for

the rest of the world”.

The news followed New research

published by Sustainable Energy for

All (SEforALL) and Climate Policy

Initiative (CPI) that despite environ-

mental, economic and many other

challenges facing coal, pockets of

funders continue to nance additional

coal red generation capacity in South

Asia and Sub-Saharan Africa.

From 2013 to 2019, $42 billion was

committed to grid-connected coal

power plants in the 18 countries stud-

ied. Among them, Bangladesh, India

and Pakistan received the majority of

nance commitments to new coal

plants, while in Africa, Madagascar,

Mozambique, Malawi, Niger and

Tanzania all host active coal plant

development.

With many economies, including

South Korea, having pledged to stop

investing in coal projects, activists are

now turning their attention to oil and

gas.

At the end of August environmental

group Solutions For Our Climate

(SFOC) said South Korea’s public

nancial institutions have provided

more than $127 billion for global fos-

sil fuel projects over the past decade.

South Korea is the second-biggest

public nancier of oil and gas projects

worldwide, after China, according to

SFOC.

government’s measures go against

the efciency of the market, Euro-

pean orthodoxy and create a climate

of legal uncertainty.

Iberdrola, the Spanish renewable

energy group, said the plan would

create more problems for custom-

ers. “It will also undermine investor

condence in the country, at a criti-

cal time when Spain needs billions

of euros of private investment to

deliver the projects behind ambi-

tious climate change targets,” Iber-

drola said.

Italy was expected to follow suit,

as Energy Transition Minister Ro-

berto Cingolani said retail power

prices in Italy were set to rise by 40

per cent in the next quarter.

Discussing the surge in gas prices,

Claudio Descalzi, Chief Executive

of Italy’s Eni – one of the world’s

largest oil and gas companies – said

that while governments were right

to try to accelerate the adoption of

renewable energy, they had chosen

to tackle supply of fossil fuels be-

fore demand, contributing to tight-

ness in the market.

“This is not something that is for

a limited time; it’s structural,” Des-

calzi told the FT. “You cannot cut

supply without also reducing de-

mand,” he said, warning that grow-

ing pressure from governments,

activists and investors had made it

very difcult for energy companies

to invest in gas supplies.

The IEA stressed that the recent

increases in global natural gas pric-

es are the result of multiple factors.

“It is inaccurate and misleading to

lay the responsibility at the door of

the clean energy transition,” said

IEA Executive Director Fatih Birol.

“Today’s situation is a reminder to

governments, especially as we seek

to accelerate clean energy transi-

tions, of the importance of secure

and affordable energy supplies –

particularly for the most vulnerable

people in our societies. Well-man-

aged clean energy transitions are a

solution to the issues that we are

seeing in gas and electricity markets

today – not the cause of them.”

Kadri Simson, EU Energy Com-

missioner, commented: “The cur-

rent situation makes the case for the

Green Deal policies even stronger.

We need more change, not less, and

faster. The only real, long-term, so-

lution here is to increase the share

of renewable energy, which is al-

ready generally the cheapest energy

on the market.”

Going forward, the European gas

market could well face further stress

tests from unplanned outages and

sharp cold spells, especially if they

occur late in the winter, noted the

IEA. Gas storage levels in Europe

are well below their ve-year aver-

age but not markedly below their

previous ve-year lows, which

were reached in 2017, it said.

Continued from Page 1

Panama’s National Energy Secretary

Dr. Jorge Rivera Staff has called for a

regional approach to tackling climate

change on the road to the UN’s COP26

climate summit in November.

In the leadup to the High-Level Dia-

logue on Climate Action in the Amer-

icas, co-hosted by Panama, last month,

Dr. Rivera Staff, said Latin America

was one of the most vulnerable areas

to climate change but is one of the low-

est contributors to greenhouse gas

emissions. He explained that it was

important to voice this as a unied re-

gional message at COP26.

“The countries that contribute the

most greenhouse gases have different

responsibilities to those that are low

emitters, like us. At COP26 we want

to stress the different responsibilities

and commitments. Right now, we are

taking a regional approach to align the

strategies of the stakeholders in each

[Latin American] country in order to

put climate change at the top of our

agenda as we drive a green recovery.

The high level dialogue is seen as a

milestone in this regional approach that

we are working on,” he told TEI Times.

According to Dr. Rivera Staff, one of

the most pressing issues at COP26 will

be how to get promised nancing ow-

ing to developing countries. In the

meantime, he said Panama was ensur-

ing it has a “comprehensive and well

structured plan” for utilising those re-

sources when they are unlocked.

“We have to use those resources in

the most efcient way, so we are align-

ing our climate initiatives with the

economic recovery so we will be ready

to invest once we receive the money.

We are also exchanging best practices

with other countries.”

He added: “We are very condent

about a positive outcome at COP26.

We are seeing lot of specic steps being

taken in the run-up that we’ve not seen

in the last three or four years.”

As one of only three carbon negative

countries in the world, Panama sets a

standard for other developed nations

to layer over their economic growth

with a commitment to sustainability.

The country has established a system

of incentives to foster the production

of energy from renewable sources, all

while creating jobs, protecting natural

resources and improving the electric-

ity matrix.

Panama has an ambitious but practi-

cal plan to move its economy away

from fossil fuels and into clean energy,

which will generate 70 per cent of the

nation’s energy needs by 2050.

To achieve its 2050 goals, last year

the country approved its Energy Tran-

sition Agenda 2030 with more specic

nearer-term targets. The agenda, ap-

proved in November has ve specic

strategies for the electricity sector and

two for the hydrocarbon sector. The

inputs used for the agenda formed the

basis of Panama’s Nationally Deter-

mined Contributions submitted in

December last year.

The world will still fall “a long way

short” of achieving the 2050 net zero

emissions ambitions of the COP21

Paris Agreement even if all electricity

was ‘green’ from this day forward, says

a recent report.

According to DNV’s Energy Transi-

tion Outlook (ETO) 2021, electrica-

tion is on course to double in size

within a generation and renewables are

already the most competitive source of

new power. However, the forecast

shows global emissions will reduce

only 9 per cent by 2030, with the 1.5˚C

carbon budget agreed by global econ-

omies exhausted by then.

Remi Eriksen, Group President and

CEO of DNV, said: “We’ve seen

governments around the world take

extraordinary steps to manage the ef-

fects of the pandemic and stimulate a

recovery. However, I am deeply con-

cerned about what it will take for gov-

ernments to apply the resolution and

urgency they have shown in the face

of the pandemic to our climate. We

must now see the same sense of ur-

gency to avoid a climate catastrophe.”

The report also says the pandemic

was a “lost opportunity”, noting that

many of the pandemic recovery pack-

ages have largely focused on protect-

ing, rather than transforming, existing

industries.

“[There has been] A lot of ‘building

back’ as opposed to ‘building better’

and although this is a lost oppor-

tunity, it is not the last we have for

transitioning faster to a deeply decar-

bonised energy system,” said Eriksen.

Energy efciency remains the big-

gest opportunity to tackling climate

change as the world drifts further away

from achieving Paris. Securing sig-

nicant improvement in this area is

viewed as the most signicant lever for

the transition, according to DNV. This,

it says, will see global energy demand

level off, even as the global population

and economy grows.

Reductions in the use of fossil fuels

have been remarkably quick, says the

report. These sources, however, espe-

cially gas, will still constitute 50 per

cent of the global energy mix by 2050

– making the need to invest in and scale

hydrogen, and carbon capture and

storage all the more important. Oil de-

mand looks set to halve, with coal use

reduced to a third by mid-century.

ETO 2021 also reveals that while 69

per cent of grid-connected power will

be generated by wind and solar in 2050,

and indirect electrication (hydrogen

and e-fuels) and biofuels remain criti-

cal, although none of these sources are

scaling rapidly enough.

In a separate report, Arcadis, the

global design and consultancy organ-

isation for natural and built assets, said

the global energy sector needs to halve

emissions this decade to reach net zero

and limit warming to 1.5˚C.

It said €6 trillion – approximately 7

per cent of global GDP – in investments

will be required to realise the transition.

Headline News

Panama calls for regional approach on road to COP26

Panama calls for regional approach on road to COP26

Electrication not enough to meet net zero target

Electrication not enough to meet net zero target

China’s retreat from coal seen

China’s retreat from coal seen

as boost for climate talks

as boost for climate talks

Cingolani says Italy’s retail

power prices set to rise 40 per

cent in the next quarter

Dr. Jorge Rivera Staff: “we

are aligning the strategies of

stakeholders”

n China’s coal retreat could wipe $50 billion from global coal plant investment

n “Essential” that China stops building new domestic coal red power stations

THE ENERGY INDUSTRY TIMES - OCTOBER 2021

5

Asia News

Syed Ali

A Memorandum of Understanding

(MoU) has been signed between Ma-

laysia’s Petronas, through its subsid-

iary Petronas Gas & New Energy Sdn

Bhd (PGNESB), and Japan’s Eneos

Corporation, which will help the two

companies reach their net zero goals

through the use of hydrogen.

The MoU will see the companies

launch a technical-commercial joint-

study of a hydrogen supply chain which

includes hydrogen production and its

transportation in methylcyclohexane

(MCH) form, where hydrogen is con-

verted from its original gaseous state

into a liquid form to enable large vol-

ume deliveries.

Petronas and Eneos will also explore

low carbon hydrogen production from

Petronas’ petrochemical facilities and

in the future, green hydrogen produced

by renewable energy.

The development of liquid organic

hydrogen carrier (LOHC) technology

such as MCH is gaining momentum

due to its chemically stable nature that

allows for long-term storage and long-

distance transport. Moreover, the use

of LOHC leverages on existing con-

ventional oil and petrochemicals infra-

structure, thus heavily reducing the

need to develop new assets. This makes

it a viable option for established energy

players to implement.

“With emerging clean energy sourc-

es like hydrogen, innovation and col-

laboration with partners in techno-

logical development are key, as they

contribute towards achieving cost

competitiveness and scalability for

wider use across businesses and in-

dustries,” said Petronas Gas + New

Energy Executive Vice President and

Chief Executive Ofcer, Adnan Zain-

al Abidin.

In Malaysia, the development of a

hydrogen-based economy is set to

complement future growth as the coun-

try prepares to transition towards a low

carbon economy. Petronas already pro-

duces low carbon hydrogen from its

facilities and will soon explore the

commercial production of green hy-

drogen. Petronas is well-poised to be a

competitive hydrogen solutions pro-

vider due to its existing operations and

expanding renewables portfolio.

Eneos has applied for funding from

the Japanese government’s Green In-

novation Fund, which sponsors decar-

bonisation projects and initiatives. The

company is working towards achiev-

ing its carbon neutral ambition via its

Environmental Vision 2040.

Australia has introduced its rst off-

shore electricity legislation in parlia-

ment but the bill falls short in several

areas, according to some experts.

The bill is designed to establish a

regulatory framework for the offshore

wind industry, paving the way for more

than ten proposed projects. Academics

from Macquarie University, however,

have said “upon rst reading one is left

a little wanting”.

In a written paper, Madeline Taylor,

Senior Lecturer, Macquarie University

and Tina Soliman Hunter, Professor of

Energy and Natural Resources Law,

Macquarie University claim the bill

falls short due to several reasons.

“We nd four reasons the bill isn’t

up to scratch yet, from its inadequate

safety provisions to vague wording

around Native Title rights and inter-

ests,” they wrote.

Offshore wind is essential to help

Australia cut its greenhouse gas emis-

sions and create a sustainable and af-

fordable electricity market.

The explanatory memorandum that

accompanies the bill claims that if

passed, the legislation will establish

certainty that investors crave, poten-

tially leading to billions of dollars

worth of investment. Taylor and Hunt-

er argue, however, that the bill as it

stands does not go far enough.

“Upon closer examination of the bill,

we nd critical omissions compared to

best practice in North Sea jurisdic-

tions,” they wrote. “To protect the

environment, projects need to create a

management plan that complies with

requirements under the federal envi-

ronment law. But this won’t ensure

marine life is unharmed by enormous,

noisy turbines. The law is far too broad

to deal with the unique requirements

of offshore wind turbines, which Aus-

tralian waters have never experienced

before.”

Secondly, the paper says that offshore

energy project developers are prohib-

ited from interfering with Native Title

rights and interests. But the bill allows

interference if it’s “necessary” for the

“reasonable exercise” of project rights

and obligations.

Taylor and Hunter also pointed out

that safety provisions under the bill are

vague.

Finally, the academics say the bill

contains no explicit community ben-

et schemes, unlike in Denmark where

developers are obliged to offer at least

20 per cent of ownership shares to lo-

cal citizens.

Australia’s wind resources are

among the world but a lack of legal

framework has meant it is yet to com-

mission its rst offshore wind farm.

n The Australian Energy Market Op-

erator (AEMO) said in a recent report

that Australia’s mainland National

Electricity Market (NEM) states could

have sufcient renewable energy re-

sources available in 2025 to meet the

cumulative power demand of consum-

ers in certain periods.

Malaysia and Japan

Malaysia and Japan

sign hydrogen MoU

sign hydrogen MoU

Australia Offshore

Electricity Infrastructure

Bill “not up to scratch”

n Petronas and Eneos to launch hydrogen supply chain study

n Companies will explore hydrogen production from petrochemical

facilities initially

Energy & Storage

solutions expertise

Securing energy supplies

Ensuring a reliable power supply is one

of the key factors for progress and

prosperity around the world. Building

on decades of MAN innovation, we can

help secure clean and effi cient energy

supplies for your customers. Our expertise

covers solutions for hybrid power, LNG

to power, energy storage, power-to-X,

thermal power plants, and CHP.

www.man-es.com

Your reliability

shines

1912_14870_MAN_ES_Anzeige_SC_KV_Power_YourReliabilityShines_reSe_ENG_249x160mm_ISO_V2.indd 1 01.10.19 13:36

6

THE ENERGY INDUSTRY TIMES - OCTOBER 2021

Asia News

Syed Ali

South Korea is set to more than double

its solar and wind energy production

facilities within four years as part of

the government’s new carbon neutral-

ity policy.

In early September President Moon

Jae-in reiterated the government’s plan

to increase the country’s combined

capacity of solar and wind energy pro-

duction facilities, which reached 17.6

GW in 2020, to 42.7 GW by 2025.

President Moon underlined the need

to achieve a big transition in the South

Korea’s economic structure and ex-

plained that achieving carbon neutral-

ity is the goal of its Green New Deal

initiative. He also said that driving

carbon neutrality could provide growth

opportunities for companies in the

elds of batteries and hydrogen.

South Korea has been gradually ac-

celerating its domestic renewables

programme, while at the same time

exploring overseas opportunities.

At the start of September a new joint

venture called MunmuBaram was set

up by Shell Overseas Investment (80

per cent) and CoensHexicon (20 per

cent) to develop and operate a 1.4 GW

oating wind project off the South

Korean coast. The facility, which will

cover an area of around 240 km

2

, is

currently at feasibility study stage.

The multi-phase project is expected

to generate up to 4.65TWh of electric-

ity annually.

Meanwhile ODE, an international

renewables engineering and project

management company, part of the

DORIS Group, announced that it has

entered into a Memorandum of Un-

derstanding with Korean engineering

company DongYang Engineering

(DYE) to pursue offshore wind and

other prospects across Korea and the

global market.

ODE and DYE will collaborate

across business development activities

and the execution of engineering ser-

vices including the joint-development

of an offshore substation design spe-

cically targeted to Korean offshore

wind farms.

Jinho Paik, ODE’s Korea Country

Manager, commented: “This is a sig-

nicant step in ODE’s development in

Korea. DYE has an established and

respected presence in the Korean en-

ergy market; this memorandum will

bring important opportunities to both

companies.”

David Robertson, Head of Renew-

ables for ODE, added: “From our Seoul

ofce, we are looking forward to draw-

ing on our global technical expertise in

offshore wind and energy transition

whilst further expanding our experi-

ence in the wider APAC region.”

Syed Ali

The United Kingdom will invest $1.2

billion through public and private in-

vestments to support India’s target of

450 GW of renewable energy by 2030.

Union Finance Minister Nirmala

Sitharaman and UK Chancellor of the

Exchequer Rishi Sunak also launched

the Climate Finance Leader Initiative

(CFLI) India Partnership to mobilise

private capital into sustainable infra-

structure in India, including solar,

wind, and other green technologies.

The UN Special Envoy on Climate

Ambition and Solutions, Michael

Bloomberg, will chair the CFLI India

Partnership, and several leading glob-

al nancial institutions will lead the

partnership.

As a part of the package, CDC Group,

the UK’s development nance institu-

tion and impact investor, will invest $1

billion in Indian green projects be-

tween 2022-2026. With this, CDC’s

existing investment portfolio in the

Indian private sector stands at $1.99

billion.

Both governments will make a joint

investment to support companies pro-

viding innovative green tech solutions

and a $200 million private and multi-

lateral investment into the joint UK-

India Green Growth Equity Fund,

which invests in the Indian renewable

energy sector.

The announcement came as a new

report warned that proposals for new

coal plant in India amounting to 27

GW could potentially become super-

uous to the overall country electric-

ity requirements by 2030.

The report published by UK-based

renewable think-tank Ember and Cli-

mate Risk Horizons said the current

proposals could jeopardise the pros-

pect of the country’s ambitious

renewable energy target of achieving

450 GW by 2030.

These surplus “zombie” plants are

projected to lie idle or operate at un-

economic capacity factors due to sur-

plus generation capacity in the system.

Signicantly, they require $33 billion

of investment.

Even with a 5 per cent annual growth

in power demand projection, the anal-

ysis shows that coal red generation in

FY 2030 will be lower than in FY 2020,

as India achieves its renewable and

other non-coal targets.

Furthermore, it says India can meet

peak demand in FY 2030 even if it

retires its old coal plants and stops

building new coal beyond those under

construction. By FY 2030, India will

have a total rm capacity of about 346

GW in addition to 420 GW of variable

renewables capacity to meet an esti-

mated peak demand of 301 GW.

South Korea to scale-up

South Korea to scale-up

wind and solar

wind and solar

India taps UK in effort to grow renewables

n Wind and solar production set to more than double

n New joint venture to build 1.4 GW oating wind project

GAS TURBINES IN

A CARBON-NEUTRAL

SOCIETY

Virtual conference with high-level

keynote sessions, panel discussions,

technical papers, virtual expo

and networking platform

ETN’s 10

th

International Gas Turbine Conference

11-15 October 2021

www.etn.global/events/igtc-21

ETN IGTC AD 120x160mm.indd 1ETN IGTC AD 120x160mm.indd 1 24/09/2021 16:2924/09/2021 16:29

INTERNATIONAL CONFERENCE & EXHIBITION

20—21 OCTOBER, MOSCOW

ORGANISED BY:

WWW.HYDROGENRU.COM

JOIN US!

AMONG THE REGULAR PARTICIPANTS OF OUR EVENTS

200+

PARTICIPANTS

20+

INVESTMENT

PROJECTS

40+

SPEAKERS &

PANELLISTS

BRONZE SPONSOR:

THE ENERGY INDUSTRY TIMES - OCTOBER 2021

Special Technology Supplement

Paving the way towards a

decarbonised grid

The power grid is

central to the energy

transition and cutting

global greenhouse

gas emissions.

Siemens Energy

discusses how the

use of technologies

such as HVDC

transmission

enables the

integration of

renewables on a

large scale, and

outlines its plans

to develop a high

voltage equipment

portfolio that emits

zero greenhouse

gases. Junior Isles

power from the west to the south.

Such developments will see Sie-

mens Energy also work on “multi-

vendor approaches”. Jürgensen said:

“At the moment systems from differ-

ent manufacturers don’t have to talk

to each other because we only have

point-to-point connections but in the

future with multi-terminal connec-

tions with, say, three or more con-

verter stations connected to each other,

you will have to connect systems

from different suppliers. This will re-

quire new elements in the grid code,

new software solutions, new control

and protection solutions, etc. We are

currently working with the various

partners on these, together with insti-

tutions such as Cigré.”

He adds that TSOs are also looking

to use “multi-purpose” interconnec-

tions to not only trade energy, but to

also increase efciency and use cases.

“This would mean that an intercon-

nector between the UK and France

could, for example, trade wind power

in both directions and therefore in-

crease the possibilities for energy

trading,” said Jürgensen.

The planned energy hubs in the

North Sea and the Baltic are a good

example, where islands that integrate

wind energy with hydrogen produc-

tion will be made possible with multi-

terminal, multi-purpose connectors.

Looking at challenges and trends

elsewhere, Jürgensen notes that in

Asia in countries with ample coast-

lines, such as Vietnam, China, Japan

and India, offshore wind could be a

driver.

While some of these markets will

largely use domestic suppliers, Jür-

gensen believes India offers oppor-

tunities for international players like

Siemens Energy. The country has set

an ambitious target of 5 GW of

offshore wind by 2022 and 30 GW

by 2030 and will need HVDC con-

nections as these wind projects

materialise.

T

he recent report on climate

change published by the

Intergovernmental Panel on

Climate Change (IPCC) gives cause

for great concern. Prepared by 234

scientists from 66 countries, the

report highlights that human in-

uence has warmed the climate at a

rate that is unprecedented in at least

the last 2000 years.

Worryingly, it shows that emissions

of greenhouse gases from human

activities are responsible for ap-

proximately 1.1°C of warming since

1850-1900 and nds that, averaged

over the next 20 years, global tem-

perature is expected to reach or ex-

ceed 1.5°C of warming.

As the COP26 climate talks ap-

proach, the report is a stark reminder

of the need to accelerate global efforts

to shift to a cleaner, greener economy.

But while much of the public focus

is often on generation and the uptake

of wind and solar, the grid that under-

pins the entire electricity system is

equally important – a fact that is being

increasingly recognised, partly due to

the often remote location of renew-

able generating sources from the

point of consumption.

Commenting on the importance of

the grid in combatting climate change,

Hauke Jürgensen, Senior Vice Presi-

dent High Voltage Grids, Siemens

Energy, said: “It’s one thing to build

wind and solar plants but they are

typically in remote locations – e.g.

solar in a desert, wind power offshore

at sea. You need the grid to connect

those plants; it goes hand-in-hand. So

increasing just the generation from

renewables alone will not solve the

problem. The exact same focus has to

be on the transmission grid.”

Siemens Energy has certainly been

playing its part in developing and

deploying transmission system equip-

ment to enable the green transition,

while reducing the global warming

impact of that equipment.

Jürgensen added: “Replacing fossil

fuelled power plants and rotating

mass in the grid with renewables also

means you lose a lot of inertia and

therefore grid stability. This means

we have also been installing, and will

continue to provide, equipment such

as FACTS (Flexible AC Transmission

System) products, synchronous con-

densers, Statcoms, SVCs, etc. to

maintain stability.”

The growth in renewables genera-

tion is clearly being reected in terms

of transmission system market growth

and investment.

“In the past decades there were only

a handful – maybe six to eight large

HVDC connections planned to be

awarded per year. Today, that’s prob-

ably more like the number we see in

Europe alone, so the market is really

expanding,” said Jürgensen. “If you

look at UK offshore wind and the

ambitious growth plans of all Euro-

pean TSOs (Transmission System

Operators), including future articial

power islands, it’s quite signicant.

And some of these projects have been

brought forward from 2033/35 to

2030. The EU plans to spend about

€80 billion by 2030 on the transmis-

sion grid; the funds are available so

it’s just a question of how fast we can

implement the projects. Meanwhile in

the US, the new Administration has

ambitious plans to build-out renew-

ables, especially offshore wind on the

east coast as well.”

Building new networks and upgrad-

ing existing circuits to demanding

deadlines is, however, not without its

challenges – the main one being ap-

proval processes.

“There are constraints around re-

sources – particularly engineering

resources – but this is solvable. There

are a lot of young people wanting to

work in the eld and do something for

climate change,” noted Jürgensen.

“But when we talk to the TSOs, their

biggest challenge is political approval

processes.”

He cited Germany as an example,

where the company is currently

building its seventh offshore HVDC

connection platform for TenneT in

the North Sea and high voltage

connectors to transport wind power

from the North Sea to the industrial

south of the country.

“To make it all possible, we need

HV connectors or corridors to trans-

mit the power from the north to the

load centres in the south. Siemens

Energy recently won awards for the

converter stations for two of these

connectors in the SuedOstLink and

SuedLink electricity highway.

“The locations for the converter

stations that we will build are nal-

ised, but there are still uncertainties

regarding the detailed cable routes.

Everyone wants to have electricity…

but ‘not in my backyard’. And it’s

not just Germany; it’s the same

across Europe and places like North

America, where there is limited

space on the east coast, for example,

for AC connections.”

According to Jürgensen, the chal-

lenges facing transmission grids de-

pend on the region or country, and this

is driving technology trends. Cur-

rently projects take the form of point-

to-point HVDC interconnectors be-

tween countries, or national high

voltage corridors that could be DC or

AC links. But this is changing.

Jürgensen explained: “These con-

nectors are great; they enable energy

trading, improve network stability

and better load management but

there’s a trend towards meshed DC

grids. So we will work on multi-ter-

minal solutions, more than we have

done in the past.”

Siemens Energy is currently build-

ing Ultranet, the rst multi-terminal

application in Germany – a new 2

GW, 340 km, HVDC link between

North Rhine-Westphalia and Baden-

Württemberg that is targeted for

completion in 2024. The project,

which is being built for Amprion and

TransnetBW, allows the transmission

of wind power from the north to the

south, solar power from the south to

the west and conventionally generated

Borwin 3: Siemens Energy is currently building its seventh offshore HVDC connection platform

for TenneT in the North Sea

Jürgensen: The focus is often on generation from renewables

but the exact same focus has to be on the transmission grid

insulation function and vacuum in-

terrupters for the arc extinguishing.

So there will be no F-gases at all in

our grid equipment.”

The move to eliminate SF

6

is

spreading among a number of major

equipment manufacturers, with some

using clean air with zero global

warming potential (GWP) and others

opting for different F-gas mixtures

with a GWP still above zero. Siemens

Energy believes, however, that when

taking the serious climate situation

into consideration, zero greenhouse

gas emissions has to be the goal to

ensure CO

2

neutrality.

“Some are replacing SF

6

with other

uorinated gases that are better than

SF

6

in terms of global warming po-

tential but are still worse than natural

clean air,” Katschinski noted. “Our

approach is zero global warming po-

tential; we believe this is the only

long-term alternative. It is essential to

save our planet. Clean air as a natural

gas and vacuum switching technology

has zero toxicity, zero impact on

health and the environment. It offers

highest switching capability without

degradation and is completely main-

tenance free. Another advantage is

that it can be used in places that expe-

rience very low temperatures in win-

ter. In places like Canada and Russia

where you can get temperatures of

-60°C, you can use SF

6

or clean air,

but other F-gases are not suitable.”

Clean air is a form of processed or

puried air, where the humidity is

removed along with some noble

gases. “Humidity and the presence

of noble gases reduce voltage with-

stand capability,” noted Katschinski.

“Since the voltage withstand capa-

bility is not as good as SF

6

, you need

a larger volume of clean air to handle

the same voltage levels.

He said, however that it is possible to

compensate for the size increase. With

innovative technologies like digital

low-power instrument transformers,

the switchgear can be similar to the F-

gas-insulated version with conven-

tional instrument transformers.

“By replacing some of the conven-

tional switchgear components with

new digital technology, we can even

reduce the size of the switchgear

compared to conventional switch-

gear. The overall functionality of the

switchgear is the same but some of

the functions, i.e. current and voltage

measurements are performed by

digital devices instead of inductive

transformers.”

Siemens Energy has been working

on its Blue technology for a number

of years, initially focusing on low

voltage levels, i.e. 72.5 kV. “The basic

research on the vacuum interrupters

took a pretty long time. They have

been used for decades in the medium

voltages,” said Katschinski. “Within

the last few years we introduced

products with vacuum interrupters

for voltage levels of 72.5 kV and

higher. The technology is now mature

up to 170 kV.”

The technology is currently being

rolled out across Siemens Energy’s

entire HV switching equipment port-

folio up to the highest transmission

level of 420 kV. “In urban areas,

where distances are shorter, say 10-

100 km, voltages of about 110 kV are

used but longer distances need higher

voltage to transmit the energy. For

long distance transmission, voltages

of up to 420 kV or 550 kV are typi-

cally used,” said Katschinski.

“This means we have to develop

products for different applications,

voltage levels and according to differ-

ent product standards. For example,

in Europe all equipment is designed

according to IEC standards, while in

some other regions such as North

America, the standard is IEEE. This

means we have to replace a family of

products.”

SF

6

-based equipment operating at

lower voltage is being replaced rst,

as products are already available up to

145 kV for different standards and

various applications. Such applica-

tions include indoor gas insulated

switchgear (GIS) and outdoor air in-

sulated switchgear (AIS) equipment.

“We already have more than 6 mil-

lion operating hours for this equip-

ment. Air insulated substations using

clean air at 145 kV have been in the

eld since December 2017 and the

rst Blue GIS for 145 kV was ener-

gised already in April 2020,” said

Katschinski.

The company also emphasized that

switchgear with Blue technology are

already being installed in wind tow-

ers. Siemens Energy sees it as a great

opportunity to make a signicant

More notably, however, India has

now begun using the technology to

help improve power quality and grid

stability. In March this year, it con-

nected its rst HVDC link featuring

voltage-sourced converter (VSC) and

DC-XLPE cable technology.

The 2 GW transmission system

consists of two converter stations

supplied by Siemens Energy for the

±320 kV HVDC system, which are

connected via two links comprising a

DC-XLPE cable and overhead trans-

mission line. The link enables power

exchange between Pugalur in the

southern state of Tamil Nadu and

Trichur in Kerala State in southwest

India and supports transmission op-

erator Power Grid Corporation of In-

dia (PGCIL) to counter power de-

cits in India’s southern region and

improve grid stability.

Not so far east, power from shore is

expected to drive the call for HVDC

technology in the Middle East for

companies like ADNOC and Scandi-

navian players such as Equinor.

“To reduce emissions, it can make

much more sense to transmit electric-

ity from onshore power stations to

power the oil platforms rather than

using diesel engines on the platform,”

said Jürgensen.

Just last month [September], Sie-

mens Energy received a contract from

Aker Solutions to supply the complete

packages for the electrical transmis-

sion, distribution, and power manage-

ment system for Equinor’s Troll West

electrication project in the North

Sea. A key objective of the project is

to reduce NO

x

and CO

2

emissions by

replacing existing gas turbine-driven

generators and compressors on the

Troll B and C facilities with power

from shore.

According to Equinor, reducing the

power from the gas turbines on the

Troll facilities will reduce annual

carbon emissions by approximately

500 000 tonnes – an amount equiva-

lent to about 1 per cent of all emis-

sions from Norway. In addition, NO

x

emissions from the eld will be re-

duced by an estimated 1700 tonnes

per year.

Looking at future developments

and needs for HVDC technology,

Jürgensen cited recent near blackouts

and issues in the European grid, not-

ing that interconnectors also play a

role in achieving grid stability.

“We are still working on shortening

the fault clearance time, so they can

contribute to avoiding blackouts. And

with the possibility to exibly and

quickly adjust the transmitted power

in either direction, which you can

only do with DC, they can play a big

role in securing grid stability when

there’s a danger of a blackout. So we

are also working to improve the con-

trol and protection to avoid blackouts.

On the DC side, these are the main

things in addition to the multi-terminal

applications and DC meshed grids.”

Using HVDC to facilitate the inte-

gration of wind and solar, while

maintaining grid reliability and stabil-

ity is crucial. But with the increasing

pressure to achieve zero emissions,

Siemens Energy is determined to

eliminate greenhouse gas emissions

right across its high voltage transmis-

sion equipment portfolio.

Ulf Katschinski, Senior Vice Presi-

dent, High Voltage Switching Prod-

ucts & Systems, Siemens Energy,

explained: “There is a growing focus

on the transmission grid because for

switchgear in high voltage transmis-

sion grids, the whole industry is based

on the use of a special insulation gas.

Gas insulated circuit breakers, instru-

ment transformers and, for more

compact applications, complete gas

insulated switchgear including dis-

connector and earthing switches, all

use sulphur hexauoride (SF

6

). But

although this is the ideal gas for insu-

lating high voltages and interrupting

fault currents, it’s an extremely potent

greenhouse gas. It has 23 500 times

the global warming potential of CO

2

.”

Indeed uorinated, or F-gases, such

as SF

6

, have come under the micro-

scope of the EU. Under the current

F-gas Regulation, in force since 2014,

the EU is limiting the total amount of

the most potent F-gases that can be

sold in the EU from 2014 onwards

and steadily phasing them out with

each revision. Currently the next revi-

sion is in progress.

The EU’s objective was clearly

communicated in a stakeholder meet-

ing May 2021 to meet the ambition of

the EU Green Deal. The main objec-

tive is “prohibiting F-gases in prod-

ucts or equipment, where these gases

are no longer needed” and more

comprehensive monitoring for all F-

gases.

In line with this EU drive and its

own commitment to tackling climate

change, Siemens Energy has launched

what it calls its ‘Blue portfolio’. The

technology is available for gas-insu-

lated switchgear (GIS), circuit break-

ers and instrument transformers all

with absolutely zero CO

2

equivalent

emissions over the lifetime of the

equipment.

Explaining the technology, Katsch-

inski said: “Unfortunately, there is

no gas that insulates high voltages

and interrupts fault currents as ef-

ciently as SF

6

. So our solution is to

replace SF

6

in the switchgear tanks

with clean air for the [high voltage]

Special Technology Supplement

THE ENERGY INDUSTRY TIMES - OCTOBER 2021

Katschinski: Our solution is to replace SF

6

in the switchgear

tanks with clean air

NemoLink converter station:

HVDC is crucial to facilitate

the integration of wind while

maintaining grid reliability and

stability

With innovative technologies

like digital low-power

instrument transformers, the

switchgear can be built even

smaller than F-gas-insulated

with conventional instrument

transformers

THE ENERGY INDUSTRY TIMES - OCTOBER 2021

decomposition products occur for

humans or the environment. On the

other hand, there are other challenges

compared to SF

6

technology. The

dielectric strength between the con-

tacts does not increase proportionally

to a larger contact distance and is

determined not only by the design but

also by the production processes. On

one hand, from today’s point of view,

for voltages above 245 kV, two vacu-

um tubes have to be connected in

series for economical operation. On

the other hand, the production pro-

cesses for higher voltages have to be

realised with corresponding manu-

facturing and testing equipment for

larger designs.”

Looking at the voltage roadmap,

Siemens Energy says it is working on

switchgear with a rated voltage of 245

kV. The task is to develop active

components such as circuit breakers

and vacuum interrupters.

“But as an interim solution the pas-

sive components – those that are not

active in interrupting the current –

contribution to reducing CO

2

emis-

sions not only in terms of power

generation but also transmission.

“Big offshore wind farms currently

use 72.5 kV. So we developed switch-

gear especially for wind tower appli-

cation, and rst installation started in

2017. This has a lot of advantages

when operating offshore. Special

equipment is required on the towers to

prepare SF

6

and other F-gases for the

switchgear. But with clean air it is

quite simple. We have already sold

more than 900 of such switchgear for

wind towers,” said Katschinski.

But going to higher voltages has a

few challenges.

Katschinski explained: “It is known

that the dielectric strength of the vac-

uum medium is considerably higher

than that of SF

6

. Vacuum switches

have a very high mechanical reliabil-

ity and compared to SF

6

switchgear, a

longer electrical life and therefore al-

low signicantly higher switching

operations.

“Another advantage is that no toxic

such as bus ducts that only carry cur-

rent, are already available at up to 420

kV,” said Katschinski. “Some cus-

tomers are already asking for clean air

to be used in place of SF

6

for passive

components. By doing this, they can

reduce the use of harmful SF

6

already

by about 60 per cent.”

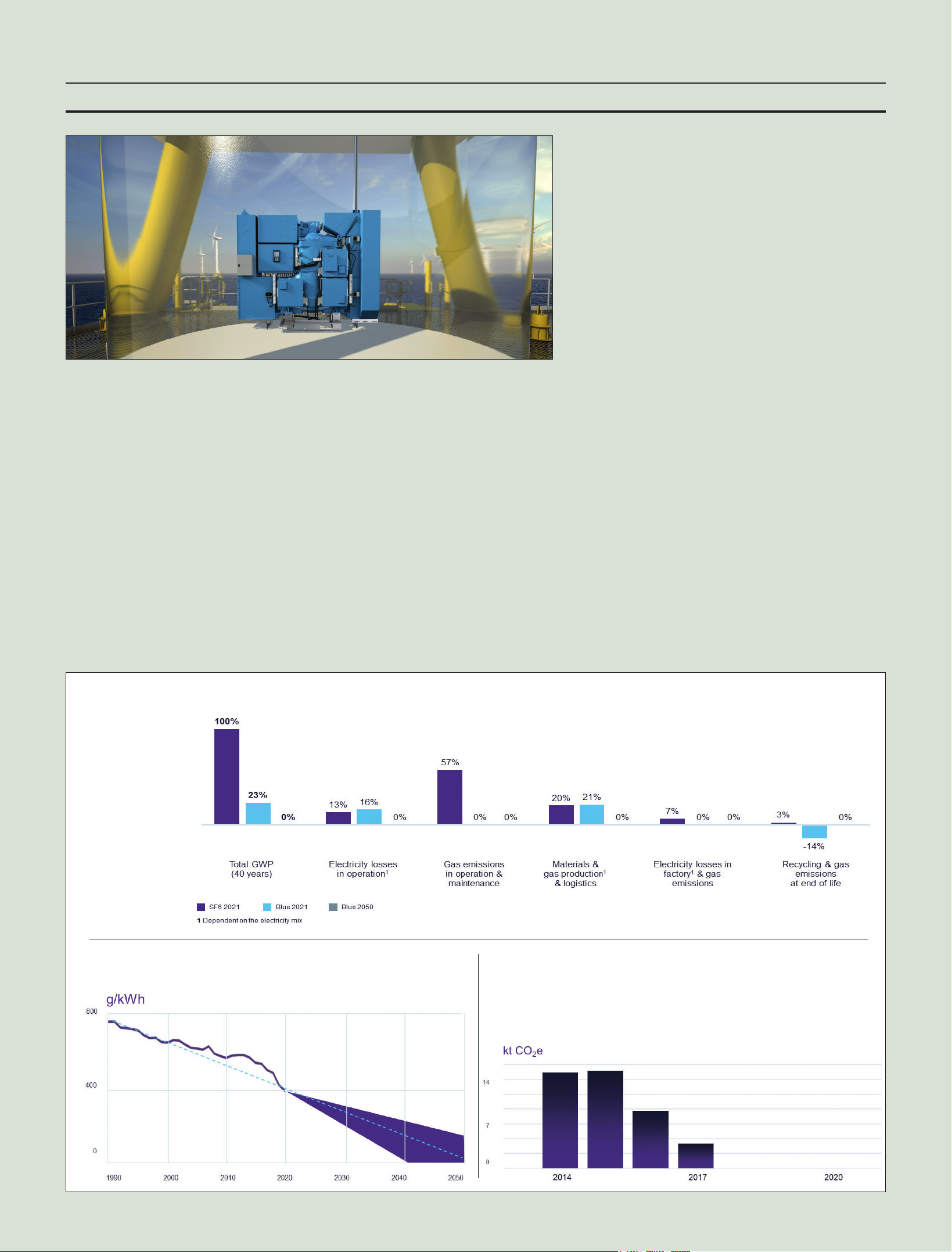

Siemens Energy notes that when

aiming for a zero emissions grid, it is

important to take a look at the prod-

ucts’ effects on the climate over its

complete life cycle taking the impacts

of electricity losses in the factory,

transportation, material and gas pro-

duction, recycling at the products

end-of-life and many other factors

into consideration.

“In the end, the global warming

potential of the products over the

complete life cycle strongly depend

on the electricity mix. In a completely

CO

2

-neutral economy, the global

warming potential of Siemens Ener-

gy’s Blue switchgear will be zero

over its complete life cycle,” said

Katschinski.

In Berlin, where Siemens Energy

switchgear factory is powered 100

per cent by renewable energy, the

company produces its 145 kV F-gas-

free switchgear, with a life cycle

global warming potential reduced by

more than three-quarters in compari-

son with the F-gas-insulated version.

Apart from the number one priority

of bringing the global warming po-

tential of their operations to zero, the

other key concern for its customers

going forward is reducing life cycle

costs.

Katschinski said: “This was always

a focus of our development because

clean air is really easy to handle,

with no preparation needed as with

F-gases. Our customers have to re-

port on F-gas because it is harmful to

the environment. They have to report

how much they consume to the au-

thorities, the leakage, etc. Equipment

with F-gases has to be checked fre-

quently, so there is a lot of work that

has to be done over its lifetime. All

of this is not necessary with our

clean air equipment. Therefore, the

life cycle costs is much lower than

with SF

6

and other F-gas solutions.

“Further, whereas gas mixtures de-

grade over time, vacuum switching

technology enables a large number of

switching processes with no wear to

the contacts, making it almost main-

tenance-free.”

Although Siemens Energy’s cus-

tomers continue to push for low cost,

zero emissions products, it will be

some time before equipment is avail-

able at all voltage levels.

“Customers are asking for solu-

tions,” said Katschinski. “The big

transmission system operators in Eu-

rope, especially, are all approaching

us for equipment that has zero global

warming potential, is environmentally

friendly and has reasonable life cycle

costs. But they recognise it will take

time, as do EU regulators. The ongo-

ing discussion by the regulators will

see the restriction in the use of SF

6

and maybe even its ban after 2028. So

everyone has to get prepared, and

transmission system operators are

therefore pushing for solutions for all

voltage levels.”

With work in progress on 245 kV, he

believes products will be available in

2-3 years, and estimates it will take

6-8 years to have the complete portfo-

lio of products for all applications and

standards at all the necessary voltage

levels.

The path to zero emissions is a long

and challenging road but Siemens

Energy believes that it has the tech-

nology to help asset owners on their

journey to what it calls “Day Zero” –

where transmission systems not only

have zero global warming impact, but

are central to an energy system that is

dominated by renewables.

Special Technology Supplement

Blue technology is well suited

for offshore wind towers.

Unlike SF

6

and other F-gases

no special equipment is

required on the towers to

prepare clean air for use in

switchgear

Life cycle assessment (LCA) according to ISO 14040

Electricity CO

2

impact, Germany example.

Reduction by use of more renewables

Electricity impact for

switchgear factory, Berlin

LCA carbon

footprint for a

145 kV GIS

example

(conventional IT)

It’s Day Zero

for Bergen Port

Cruise ships used to power up in the harbour using their diesel engines.

Now, thanks to BKK Nett and Blue switchgear technology from Siemens

Energy, they use only clean power. Zero greenhouse gas emissions,

zero F-gases and zero health impact. It’s their Day Zero. Let’s plan yours.

LET’S MAKE TOMORROW DIFFERENT TODAY

siemens-energy.com/blue

Siemens Energy is a trademark licensed by Siemens AG.

The Karapinar solar power plant is

part of the rst Turkish solar YEKA

tender launched in 2017 by the

Ministry of Energy. It will help Tur-

key commission 10 GW of solar ca-

pacity between 2017-27.

Wärtsilä and Gabon Power Company

(GPC) have signed an agreement with

the government of Gabon for the de-

velopment, supply, construction, op-

eration and maintenance of a 120 MW

gas red power plant. Wärtsilä will

build the plant under a full EPC con-

tract and will then operate and main-

tain the plant under a 15-year O&M

agreement.

The plant will be located at the in-

dustrial site of Owendo, close to Li-

breville, the capital of Gabon.

When commissioned, the plant will

supply electricity to Société

d’Energie et d’Eau du Gabon

(SEEG) under a 15-year PPA.

The project is being developed un-

der a Public Private Partnership

framework, with the asset to be

transferred to the Gabonese authori-

ties at the end of the concession

agreement.

The government of Uzbekistan has

announced that Saudi Arabia’s ACWA

Power has won a contract to develop

a 100 MW wind farm in the Karakal-

pakstan region of Uzbekistan. It is

expected that the wind farm will gen-

erate around 350 GWh per year.

The wind farm is scheduled to be

operating commercially within two

years.

Sherzod Khodjaev, Uzbekistan’s

Deputy Minister of Energy, said:

“Uzbekistan is making huge strides

towards producing and providing

green energy for its economy, de-

creasing the country’s dependence

on fossil fuels and reducing overall

CO

2

emissions. This project is a key

component of our ambitious, wider

energy strategy to develop environ-

mentally friendly renewable sources

of energy to meet growing electrici-

ty demand.”

Contractors have submitted bids for a

900 km 500 kV overhead transmission

line (OHTL) connecting Saudi Arabia

and Egypt. The OHTL will pass

through Medina and Tabuk to the Gulf

of Aqaba.

The project is valued at $1.6 bil-

lion, with Egypt set to fund $600

million of the total cost. The inter-

connection is expected to be able to

deliver up to 3000 MW daily.

The lowest bid of $446.8 million

was submitted by South Korea’s

Hyundai E&C. The local National

Contracting Company submitted the

second lowest bid of $449.4 mil-

lion, with Saudi Services for Elec-

tromechanical Works submitting a

bid of $463.5 million, the only oth-

er bid of under $500 million.

China-based Sungrow has secured a

contract from juwi to supply equip-

ment for a 36 MW off-grid solar-plus-

storage project in Egypt. Under the

contract, Sungrow will provide a 1.5

kV, 6.25 MW photovoltaic inverter

and a 7.5 MW battery energy storage

system for the facility, which will be

located at the Centamin-operated Su-

kari Gold mine.

The project is scheduled to be op-

eration in the rst half of 2022.

benets during the three-year con-

struction period. We look forward

to working with Siemens Energy

and Sumitomo Electric towards

successful commissioning in 2024.”

Siemens Energy will be responsi-

ble for the overall system design

and construction of two converter

stations located in County Wexford

(Ireland) and the Pembroke trans-

mission substation in Pem-

brokeshire (Wales). Both converter

stations will use Siemens Energy’s

HVDC Plus technology with modu-

lar multi-level arrangement (VSC-

MMC) to convert AC to DC and

vice versa. Linked via an HVDC

XLPE (crosslinked polyethylene)

cable system by Sumitomo, the sta-

tions will enable transport of energy

at 320 kV. Siemens Energy’s scope

of supply also includes a Service

and Maintenance Agreement with

an initial duration of seven years.

Under a supply deal, Green Hydrogen

Systems (GHS) will provide three Hy-

Provide A90 alkaline electrolysers for

a green hydrogen manufacturing plant

in Bremerhaven, Germany. This proj-

ect is led by Wenger Engineering and

will be powered by onsite wind tur-

bines. The electrolysers have a total

capacity of around 1.3 MW.

GHS will provide remote monitor-

ing and support, as well as on-site

maintenance under a three-year ser-

vice deal.

The complete test eld will con-

sist of GHS’ pressurised alkaline

electrolysis equipment, compres-

sion unit, a PEM electrolyser, fuel

cells and storage system for system-

atic comparison of PEM and alka-

line electrolysis.

A consortium of Prysmian Group and

Asso.subsea has signed a contract with

RTE, Réseau de Transport d’Électricité

for the development of an export sub-

marine power cable system for the

Gruissan oating offshore wind farm

located in Southern France.

Under the terms of the €30 million

contract, Prysmian will design, sup-

ply, test and commission a 66 kV

three-core 25 km export submarine

cable with EPR insulation, and an-

other 66 kV submarine dynamic ca-

ble to connect a oating substation

to the shore.

Asso.subsea will undertake the in-

stallation services of the project.

The company will design and per-

form all marine works required for

the project, such as cable loading,

route preparatory works, cable in-

stallation and protection and HDD

works at landfall.

Kalyon has selected GE Renewable

Energy to deliver its FlexInverter solar

power station technology for the 270

MW Karapinar phase II-A and the 810

MW Karapinar phase II-B solar plant

in Turkey. The scope of work includes

design, engineering, project manage-

ment, site management, and commis-

sioning. The project is located in Tur-

key’s Konya Karapinar province and

is scheduled to start commercial op-

eration by December 2022.

GE Renewable Energy has already

completed the commissioning of

the FlexInverter solar power station

technology for the 267 MW Karapi-

nar phase I solar plant.

Vitol Wind has awarded Vestas Wind

Systems a contract to repower the

240 MW Big Sky wind farm in Illi-

nois, USA. Vestas will supply and

commission 104 units of V120-2.2

MW turbines and ve units of V110-

2.0 MW turbines in 2.2 MW operating

mode for the project.

The turbines will replace 109 Su-

zlon turbines.

Turbine delivery is due to begin in

Q1 2021, with commissioning

scheduled for Q2 2022.

MAN Energy Solutions will provide

six 18V51/60G engines, along with

the major balance of plant equipment,

to the City of Lakeland, Florida, USA,

for its municipal utility Lakeland Elec-

tric. Lakeland Electric and MAN En-

ergy Solutions will build a new 120

MW RICE (Reciprocating Internal

Combustion Engine) plant on a brown-

eld site in the city.

The new facility will run on natu-

ral gas and replace a recently re-

tired, coal red plant.

All equipment is scheduled to be

delivered to site by July 2022.

MAN Energy Solutions will main-

tain the plant for 10 years.

Doosan Heavy Industries and Con-

struction has signed a deal with US

SMR maker X-energy to design a

small modular reactor (SMR) based

on high-temperature gas-cooled reac-

tor (HTGR) technology.

Under the terms of the deal, Doo-

san Heavy will design an 80 MW

SMR known as the Xe-100, and

construct a prototype of it, for X-

energy.

X-energy said it plans to build a

320 MW nuclear power plant con-

sisting of four Xe-100s.

Vestas has secured a 50 MW order with

the German developer and operator of

renewable energy projects, wpd, for

three projects, Chuangwei 2, Leadway

2 and Hsinyuan wind farms in Taiwan.

The Hsinyuan wind farm includes

six V136-4.2MW wind turbines with

112 m towers, featuring the largest

onshore turbine rotors in Taiwan.

Chuangwei 2 and Leadway 2 wind

farms will be installed with four

and two V117-4.2MW turbines with

91.5 m towers, respectively.

The order includes a long-term

Active Output Management 4000

(AOM 4000) service agreement for

the wind farms.

Deliveries are expected to begin in

the second quarter of 2022, while

commissioning is planned for the

fourth quarter of the same year.

Toshiba Hydro Power (Hangzhou), a

Chinese subsidiary of Toshiba Energy

Systems and Solutions, and PT Toshi-

ba Asia Pacic Indonesia (TAPI), an

Indonesian subsidiary of Toshiba En-

ergy Systems and Solutions, have won

an order to manufacture four 105 MW

hydro turbines for the Kerinci Meran-

gin Hydro Electroc Power Plant on

Sumatra Island, Indonesia.

Delivery of the equipment will

start from September 2023.

The Kerinci hydropower plant has

a head greater than 400 m, therefore

requiring special technology to

meet the high head and rotating

speed for the turbines.

Siemens Energy has announced that it

has won a contract for the region’s rst

HL-class gas turbine. In conjunction

with its consortium partner CTCI Cor-

poration, which will build the Sun Ba

Power Phase II combined cycle pow-

er plant for the IPP Sun Ba Power

Corporation. The 1100 MW Sun Ba II

project will be built in Tainan, south-

western Taiwan, and will be red with

regasied LNG. Siemens Energy will

also provide long-term service for the

plant’s core components.

Sun Ba II will be a multi-shaft

combined cycle power plant, with

two gas turbines and one steam tur-

bine each driving its own electrical

generator. Siemens Energy’s scope

of supply includes the plant’s power

island, consisting of two SGT6-

9000HL gas turbines, one SST-5000

steam turbine, three SGen6-2000P

generators, two HRSGs, and the

SPPA-T3000 control system.

The contract includes long-term

service over 25 years for both gas

turbines, the steam turbine, the gen-

erators, and the HRSGs. It also in-

cludes an option for digital service

solutions. CTCI is responsible for

construction and installation, and

the EPC work for the balance of

plant.

Rewa Ultra Mega Solar has awarded

a contract to Tata Power’s unit TP

Saurya for the construction of a 330

MW solar project in the Indian state

of Madhya Pradesh.

The facility will be constructed in

Neemuch Solar Park, and will con-

sist of two units, one of 160 MW

and one of 170 MW. Output from

the facility will be supplied to the

Indian Railways and the Madhya

Pradesh Power Management Com-

pany under a 25-year PPA. The

project is scheduled to be commis-

sioned within 19 months from the

date of execution of the PPA.

The Nordex Group has received an

order from KGAL Investment Man-

agement for nine N131/3000 wind

turbines for the 27 MW Rywald wind

farm in Poland. The 3 MW units will

be mounted on 134 m tall towers. In

addition to installation and commis-

sioning, the order also includes a 15-

year service and maintenance con-

tract with a double extension option

for a further ve years.

The Rywald wind farm will be

built around 200 km northwest of

Warsaw. Construction is scheduled

to start in mid-2022.

Siemens Energy and Sumitomo Elec-

tric have signed a contract with Green-

link Interconnector Limited to deliver

HVDC converter technology for the

190 km Greenlink interconnector. The

500 MW HVDC link will connect the

power grids of Ireland and Great Brit-

ain. Work will begin at the start of

2022 following nancial close.

James O’Reilly, CEO of Green-

link, commented: “We will be look-

ing to maximise local supply chain

Americas

Asia-Pacic

Vestas wins 240 MW

repowering project