www.teitimes.com

September 2021 • Volume 14 • No 7 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Special Supplement

Decarbonisation of

two cities

TEI Times hears why

industrial gas turbines will

be crucial in complementing

renewables-plus-storage in an

optimised system.

With just two months to COP26, Asia

energy expert and author, Joseph Jacobelli,

compares the decarbonisation efforts of

Hong Kong and Singapore. Page 14

News In Brief

IPCC report is stark warning

in run-up to climate talks

The Intergovernmental Panel on

Climate Change’s (IPCC) recent

assessment report has been hailed

as a stark reminder of the need for a

successful outcome at the upcoming

COP26 climate summit.

Page 2

China and India unveil big

plans for hydrogen

China and India have both set out

bold strategies for the development

of hydrogen production.

Page 5

Germany under pressure to

grow renewables faster

Germany has added 240 new

onshore wind turbines with a

potential output of 971 MW

during the rst six months but that

deployment is not fast enough to

meet its renewable targets.

Page 7

Industry Perspective: A

model for nuclear new build

in Europe?

Hanhikivi 1 in Finland could offer

some clues on how nuclear plants,

including small modular reactors,

could be successfully developed in

the future.

Page 13

Technology Focus: An

imaginative approach to

long duration storage

US-based 247Solar has developed

an innovative thermal battery that

looks set to facilitate around-the-

clock wind and solar energy.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

Conscious of its role to show leadership on climate action, the UK government has set out its

Hydrogen Strategy. But the announcement has met a mixed reaction. Junior Isles

THE ENERGY INDUSTRY

TIMES

Final Word

Budding rock stars need to

wear the right colour, says

Junior Isles.

Page 16

The UK government’s recently pub-

lished hydrogen strategy has come

under scrutiny as the country prepares

to host the crucial COP26 climate sum-

mit later this year.

As part of its ‘Ten Point Plan’ for a

green revolution announced earlier

this year, the government has outlined

how it will cooperate with industry to

achieve 5 GW of low carbon hydro-

gen production capacity by 2030.

Government analysis estimates that

up to 30 per cent of the UK’s energy

consumption could be hydrogen-

based by 2050, making it a key tech-

nology in achieving net zero emis-

sions by 2050 and meeting the

country’s target of cutting emissions

by 78 per cent by 2035.

It could also play an important role

in rebuilding an economy driven by

clean energy technology.

According to the government, the

UK’s rst-ever Hydrogen Strategy

will unlock over £4 billion ($5.5 bil-

lion) in investment and create thou-

sands of jobs in the move to establish

a low carbon hydrogen sector by

2030. It said a thriving, UK-wide hy-

drogen economy could be worth over

£900 million and create over 9000

high-quality jobs, which may rise to

100 000 jobs and be worth up to £13

billion by 2050.

“With the potential to provide a

third of the UK’s energy in the future,

our strategy positions the UK as rst

in the global race to ramp up hydrogen

technology and seize the thousands of

jobs and private investment that come

with it,” said Business and Energy

Secretary Kwasi Kwarteng.

The government wants to mimic its

success with offshore wind, where

early government action and Con-

tracts for Difference (CfD) support

have helped secure the country a lead-

ing position. It said it is publishing a

consultation on a preferred hydrogen

business model, shaped on a similar

premise to the offshore wind CfDs.

A consultation is also being initiated

on the design of the £240 million Net

Zero Hydrogen Fund, intended to

back new plants for low-carbon hy-

drogen production in the UK.

The government says it will take a

“twin track” approach, developing

both blue and green hydrogen simul-

taneously. Green hydrogen is pro-

duced via electrolysis, using electric-

ity from renewable electricity and is

therefore zero emissions. Blue hy-

drogen is generated from steam

methane reformation combined with

carbon capture and storage (CCS). It

has lower emissions than current pro-

duction, but is not zero emissions.

The decision to pursue blue hydro-

gen alongside green has drawn criti-

cism from some quarters.

Dr Doug Parr, Chief Scientist for

Greenpeace UK, said: “Hydrogen

produced from renewable energy is

genuinely low carbon, and genuinely

useful in some areas of the economy

where electrication is difcult. But

producing large quantities of hydro-

gen from fossil gas locks us into cost-

ly infrastructure that is expensive and

may be higher carbon than just burn-

ing the gas. So the emphasis put on

that part of the government’s plan

looks like a bad idea both environ-

mentally and economically.”

A recent study conducted by Cornell

University and Stanford University

found that blue hydrogen could be 20

per cent worse for the climate than

burning natural gas. The study, pub-

Continued on Page 2

UK Hydrogen Strategy

UK Hydrogen Strategy

questioned ahead of COP26

questioned ahead of COP26

www.hitachiabb-powergrids.com

From this October we are evolving

to become

Hitachi Energy!

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2021

2

Junior Isles

The Intergovernmental Panel on Cli-

mate Change’s (IPCC) recent assess-

ment report has been cited as a stark

reminder of the need for a successful

outcome at the upcoming COP26 cli-

mate summit scheduled for November

in Glasgow, UK.

Britain’s Prime Minister Boris John-

son called the IPCC Report “sobering

reading” and a “wake-up call”, while

COP26 President Alok Sharma said it

“shows all too clearly… the deciency

of our response [to the climate crisis]

to date”.

The Working Group I report is the

rst instalment of the IPCC’s Sixth As-

sessment Report (AR6), which will be

completed in 2022. Prepared by 234

scientists from 66 countries, it high-

lights that human inuence has warmed

the climate at a rate that is unprecedent-

ed in at least the last 2000 years. It also

states that many changes due to past

and future greenhouse gas emissions

are irreversible over hundreds to thou-

sands of years, especially changes in

the ocean, ice sheets and global sea

level.

The report shows that emissions of

greenhouse gases from human ac-

tivities are responsible for approxi-

mately 1.1°C of warming since 1850-

1900, and nds that averaged over the

next 20 years, global temperature is

expected to reach or exceed 1.5°C of

warming. This assessment is based on

improved observational datasets to

assess historical warming, as well as

progress in scientic understanding

of the response of the climate system

to human-caused greenhouse gas

emissions.

The IPCC projects that in the coming

decades, climate changes will increase

in all regions. For 1.5°C of global

warming, there will be increasing heat

waves, longer warm seasons and short-

er cold seasons. At 2°C of global warm-

ing, heat extremes would more often

reach critical tolerance thresholds for

agriculture and health, the report

shows.

The report has huge implications for

policymakers in terms of tackling

greenhouse gas emissions and adapt-

ing to the levels of climate change the

world is already locked into. To keep

the 1.5°C target alive and adapt to a

changing climate, governments around

the world must provide unequivocally

clear policy signals to signicantly ac-

celerate the investment needed for a

zero carbon future.

Nick Molho, Executive Director at

the Aldersgate Group, said: “The UK

government has a critical role to play

in the coming months. On the global

stage, it needs to gather maximum mo-

mentum to bring emission reduction

pledges from all key emitting nations

in line with the 1.5°C target and look

to underpin this with tangible global

collaboration and initiatives in areas

where cutting emissions is particularly

complex.”

Christiana Figueres Founding Partner,

Global Optimism & former Executive

Secretary, UN Climate Change Con-

vention, said the report is yet another

reminder of the need to accelerate

global efforts to “ditch fossil fuels”

and shift to a cleaner, greener growth

model.

“We have a plan – it’s called the

Paris Agreement,” she said. “Every-

thing we need to avoid the exponential

impacts of climate change is doable.

But it depends on solutions moving

exponentially faster than impacts, and

getting on track to halving global emis-

sions by 2030. COP26 will be the mo-

ment of truth.”

COP26 presents a clear opportunity

to implement credible policies in areas

that will cut emissions quickly but

countries are failing to deliver on the

ambitions agreed at the COP meeting

in Paris in 2015.

At the start of August, it was revealed

that only just over half of countries

signed up to the Paris Agreement had

submitted their nationally determined

contributions (NDCs) before the

deadline.

By the cut-off date, the UNFCCC

revealed that it received new or up-

dated NDCs from 110 Parties. This

means that only 58 per cent of the Par-

ties have met the cut-off date.

A landmark report, aimed at inform-

ing policy and business on the task of

reaching net zero, has revealed the

huge task of achieving net zero by

2050. Providing a globally applicable

framework, with the US utilised as the

core case study, the report says that

without an unprecedented restructure

to energy project delivery, the world

may not make it even halfway to net

zero by mid-century.

Produced by Worley, a global pro-

vider of engineering, procurement, and

construction services to the energy,

chemicals and resources industries, in

collaboration with Princeton Univer-

sity’s Andlinger Center for Energy and

the Environment, the study uses path-

ways developed in the Net-Zero Amer-

ica study by Princeton in 2020.

This further examination says the US

will have to drastically exceed its cur-

rent low-emissions project build rate.

Under one pathway, to reach net zero,

individual solar projects with an area

equivalent to 260 Tokyo Olympic sta-

diums need to be built every week from

now until 2050. In another, more than

250 large nuclear power stations will

be needed – under current processes,

one such nuclear plant can take upto

20 years to get operational.

The report explores ve key shifts in

the approach to energy infrastructure

that can deliver a transition to net zero.

Dr. Paul Ebert, Group Director En-

ergy Transition at Worley said: “We

hope our work with Princeton Univer-

sity will help to equip key players in

the industry with strategic guidance for

the path ahead, using breakthrough

thinking, and shifting the focus from

what technologies we need, to how to

get them built, working to deliver a

more sustainable world for us all.”

found that blue hydrogen could be

20 per cent worse for the climate

than burning natural gas. The study,

published in Energy Science & En-

gineering, is claimed to be the rst

in a peer-reviewed journal to layout

the lifecycle emissions intensity of

blue hydrogen

Concluding that there is “no role

for blue hydrogen” in a carbon-free

future, the authors suggested that

“blue hydrogen is best viewed as a

distraction, something that may de-

lay needed action to truly decarbon-

ize the global energy economy”.

Robert Howarth, co-author of the

study and Professor of Ecology and

Environmental Biology at Cornell

University noted: “Politicians

around the world, from the UK and

Canada to Australia and Japan, are

placing expensive bets on blue hy-

drogen as a leading solution in the

energy transition.”

Others, however, see the strategy

as a welcome development for both

the energy industry and communi-

ties alike, as it creates a road map

for future power generation from

both blue and green hydrogen.

Stuart Carter at Keystone Law,

commented: “This also plays into

the government’s model for carbon

capture and storage, which is fo-

cused on the UK’s industrial hubs

such as Teesside and Humber-

side… if the government aims to

achieve its net-zero targets, the

blue hydrogen model and the

CCUS [carbon capture usage and

storage] model will need to be

fully integrated. This may mean

that blue hydrogen solely becomes

the fuel for power generation at

industrial hubs where CCUS will

be highly developed, and leaving

carbon-free green hydrogen, to be

produced, possibly at a more re-

gional level, to be used by domes-

tic consumers for transport, heat-

ing and cooking.”

David Parkin, Project Director

from Progressive Energy and Proj-

ect Director of HyNet North West,

a project to capture and store car-

bon from industry in the North

West of England and North Wales,

said: “Industry across the UK’s

North West industrial heartland is

crying out for low carbon hydrogen

so we welcome the promise of

more support.

“With initial engineering nearly

completed on HyNet’s rst hydro-

gen production plant at Essar’s

Stanlow Manufacturing Complex,

hydrogen production will begin as

soon as 2025 and deliver up to 4

GW of low carbon hydrogen by

2030. The key now is for the govern-

ment to build momentum by pri-

oritising projects that are ready for

development today.”

Continued from Page 1

The UK’s plans for a new eet of large

nuclear power plants could be under

threat, as the government is report-

edly reconsidering China’s involve-

ment in the development of projects

amid cooling diplomatic relations and

concerns over potential security

threats.

According to the Financial Times,

the British government is exploring

ways to remove China General Nu-

clear (CGN) from the consortium

planning to build the Sizewell C nu-

clear power station in Suffolk. It said

ministers are also going cold on plans

by CGN to build a plant at Bradwell-

on-Sea in Essex using its own reactor

technology. CGN is already a minor-

ity investor in the 3.2 GW Hinkley

Point C nuclear power station, which

France’s EDF is currently building.

One nuclear industry executive told

the FT that CGN might now reassess

its involvement with Hinkley Point.

They pointed out there were four in-

terlinked agreements between CGN,

EDF and the government dating to

2015: Hinkley Point, Sizewell,

Bradwell and the pursuit of regula-

tory approval for China’s own reactor

design.

CGN is eager to get UK regulatory

approval at Bradwell for its own Hua-

long One HPR1000 reactor in order

to help market it in other countries.

The reactor design is going through

the UK’s rigorous approval process,

with a decision expected in the second

quarter of next year.

According to the Daily Telegraph, a

“cross-party” group of “China hawks”

in the House of Commons is putting

pressure on the government to impose

an “outright” ban on a Chinese state-

owned rm’s involvement in all UK

nuclear power plants.

The group – led by Tory MPs Iain

Duncan Smith and Chairman of the

Foreign Affairs Committee, Tom Tu-

gendhat – reportedly has the full back-

ing of the Inter-Parliamentary Alli-

ance on China (IPAC), which claims

to be an international body working

to “reform how democratic countries”

engage with the Asian giant.

The Daily Telegraph quoted IPAC

as warning that the UK is “danger-

ously exposed” by its “overreliance”

on Chinese investment and technol-

ogy in the “critical national infrastruc-

ture” sector.

UK Foreign Secretary Dominic

Raab observed last year that Britain

could no longer conduct “business as

usual with China”. The UK’s highest-

prole action so far has been to force

the Chinese telecoms supplier, Hua-

wei, out of Britain’s 5G network.

British ministers are now said to be

“looking for ways” to enable EDF

energy to develop the £20 billion Size-

well C project without any input from

CGN, which has a 20 per cent stake

in the project.

The Times said the government is

mulling options for funding the plant,

including buying a multi-billion

pound stake in the project or nding

new investors to replace CGN.

Tim Yeo, a former Tory energy min-

ister who chairs the New Nuclear

Watch Institute, an industry-support-

ed think-tank, said concerns about

Chinese involvement in the UK nu-

clear power sector had been over-

stated. Any disruption or interference

in its operations would close down all

export opportunities elsewhere for

CGN, he argued.

“The notion that China would arbi-

trarily close down a plant which they

had built in UK for some geopolitical

reason is absurd,” he said. “They have

nothing to gain and everything to lose

by disrupting the supply of electricity

from a nuclear plant which they had

built here.”

A spokesperson for the UK govern-

ment did not comment directly on the

claims that ministers would seek to

forge a nuclear programme without

CGN, instead only saying that “all

nuclear projects” must comply with

“robust and independent regulation”

in order to meet the UK’s “rigorous

legal, regulatory and national security

requirements, ensuring our interests

are protected”.

Headline News

UK nuclear programme could be

UK nuclear programme could be

under threat

under threat

IPCC report is stark warning

IPCC report is stark warning

in run-up to climate talks

in run-up to climate talks

Howarth says countries are

“placing expensive bets” on

blue hydrogen

n Human inuence has warmed climate at unprecedented rate

n Only just over half of countries submit climate targets

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2021

3

TOWARDS A CARBON-NEUTRAL

ENERGY FUTURE.

Together with customers and partners, we are co-creating pioneering technologies that are

making energy systems more sustainable, resilient, safe and secure. We contribute innovative

solutions that are advancing societal progress towards a carbon-neutral energy future for all.

From this October we are evolving to become Hitachi Energy!

www.hitachiabb-powergrids.com

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2021

5

Asia News

Syed Ali

China and India have both set out bold

strategies for the development of hy-

drogen production.

In mid-August, Beijing authorities

released a blueprint for the develop-

ment of its hydrogen energy industry

from 2021 to 2025. According to the

plan released by the Municipal Bureau

of Economy and Information Technol-

ogy, by 2025 the Beijing-Tianjin-He-

bei region will achieve a hydrogen

energy industry chain valued at more

than Yuan100 billion ($15.4 billion)

and reduce carbon emissions by 2 mil-

lion tonnes.

Before 2023, ve to eight leading

enterprises with international inu-

ence in the hydrogen energy industry

chain will be setup, and the scale of the

industrial chain in Beijing-Tianjin-

Hebei region will exceed Yuan50 bil-

lion to reduce carbon emissions by 1

million tonnes.

Ahead of 2025, 10-15 leading indus-

trial chain enterprises with interna-

tional inuence will be established, and

three to four world-class industrial

R&D and innovation platforms will be

built.

At the same time China’s Inner Mon-

golia region was given the green light

for a massive hydrogen production

plan that will utilise roughly 2.2 GW

of wind and solar power capacity. The

project envisages the installation of

1850 MW of solar photovoltaic (PV)

and 370 MW of wind farms to power

the production of 66 900 tonnes of re-

newable hydrogen annually, according

to Bloomberg, citing a report by the

Hydrogen Energy Industry Promotion

Association.

These clean energy plans, however,

came as it was revealed that state-

owned rms proposed 43 new coal-

red generators and 18 new blast fur-

naces in the rst half of 2021. If all are

approved and built, they would emit

about 150 million tonnes of carbon

dioxide per year. According to the Cen-

tre for Research on Energy and Clean

Air (CREA) China limited emissions

growth in the second quarter to a 5 per

cent increase from 2019 levels, after a

9 per cent rise in the rst quarter.

India, Asia’s other major global emit-

ter, also unveiled its plans for hydrogen

last month, as Prime Minister Narendra

Modi formally announced the formal

establishment of its National Hydro-

gen Mission.

He said the aim is to make India the

new global hub of green hydrogen,

and also its largest exporter. Last year

in October, Modi outlined a new en-

ergy map for India with seven key

drivers – one of them being the devel-

opment of emerging fuels, particu-

larly hydrogen.

Announcing the Mission in his Inde-

pendence Day speech, Modi said: “Of

every effort being made by India today

the thing that is going to help India with

a quantum leap in terms of climate is

the eld of green hydrogen… We have

to make India a global hub for Green

Hydrogen production and export…

India has to make a resolution to make

India energy independent before the

completion of 100 years of indepen-

dence and our roadmap is very clear

for the same. It should be a gas-based

economy.

“There should be a network of

CNG [compressed natural gas] and

PNG [pipeline natural gas] across the

country. There should be a target of

20 per cent ethanol blending. India is

moving ahead with a set goal. India

has also made a move towards Electric

Mobility.”

The announcement comes ahead of

COP26 in Glasgow, UK, where nations

will be under pressure to pledge more

ambitious climate action and substan-

tial nancing, especially regarding

energy requirements.

In a meeting with Union Minister of

Power and Renewable Energy, Shri

RK Singh, Alok Sharma, COP 26

President, expressed the UK’s willing-

ness to collaborate with India on green

hydrogen. Both sides discussed the

possibility of establishing a World

Bank for Green Energy, which could

realise the proposal for $100 billion in

climate nance pledged by developed

countries under the Paris Agreement.

China and India unveil big

China and India unveil big

plans for hydrogen

plans for hydrogen

n China to setup 10-15 leading industrial chain enterprises by 2025

n India formally establishes National Hydrogen Mission

Energy & Storage

solutions expertise

Securing energy supplies

Ensuring a reliable power supply is one

of the key factors for progress and

prosperity around the world. Building

on decades of MAN innovation, we can

help secure clean and effi cient energy

supplies for your customers. Our expertise

covers solutions for hybrid power, LNG

to power, energy storage, power-to-X,

thermal power plants, and CHP.

www.man-es.com

Your reliability

shines

1912_14870_MAN_ES_Anzeige_SC_KV_Power_YourReliabilityShines_reSe_ENG_249x160mm_ISO_V2.indd 1 01.10.19 13:36

6

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2021

Asia News

Syed Ali

Japan is inching forward with plans to

boost its offshore wind capacity, which

will help accelerate the country’s pro-

duction of green hydrogen.

Last month Aker Offshore Wind and

global wind and solar company, Main-

stream Renewable Power (“Main-

stream”) were together selected as the

preferred bidder to acquire an initial

50 per cent stake in Progression En-

ergy’s 800 MW oating offshore

wind project in Japan. The project is

a well-formed early-stage develop-

ment asset.

The two companies will now enter

into exclusive negotiations with Pro-

gression Energy with a view to estab-

lishing a special purpose vehicle

(“SPV”) to continue collectively de-

veloping the project.

“In 2015, Progression recognized

that oating offshore wind would be-

come a major segment of the offshore

wind industry. Since that time, Pro-

gression has originated oating proj-

ects in four markets globally,” said

Chris Swartley, CEO of Progression

Energy. “Japan has set a goal of zero

emissions by 2050 with a strong focus

on offshore wind.

Japan aims to expand offshore wind

energy capacity to 10 GW by 2030

and 30-45 GW by 2040, according to

the Ministry of Economy, Trade and

Industry (METI). Project areas for

offshore oating wind will be put to

auction for interested companies to

submit their proposals.

Projects like Progression Energy’s

will be integral to Japan’s plans to

increase the production of green

hydrogen.

In late July Nikkei Asia reported that

four Japanese companies intend to

build Japan’s largest hydrogen plant

powered by offshore wind energy on

the northern island of Hokkaido as

part of a national effort to slash carbon

dioxide emissions.

Participating in the project are Hok-

kaido Electric Power, renewable en-

ergy developer Green Power Invest-

ment, Nippon Steel Engineering and

industrial gas supplier Air Water.

Scheduled to begin operation as

early as the year ending March 2024,

the plant will produce up to roughly

550 tons of hydrogen a year – enough

to fuel more than 10 000 hydrogen

vehicles, according to plans.

The Japanese government aims to

attain net-zero greenhouse gas emis-

sions by the middle of the century.

Hydrogen is to play a big part of that

goal. The government’s Green Growth

Strategy announced last year calls for

up to 3 million tons of hydrogen pro-

duction capacity to be introduced in

2030, rising to about 20 million tons

in 2050. This plan requires Japan to

develop its own hydrogen industry

without relying on imports.

n Chiyoda Corporation (Chiyoda)

and GridBeyond have signed a Mem-

orandum of Understanding (MoU) to

collaborate in providing exibility

solutions for the Japanese electricity

markets. Such solutions help grid op-

erators to balance demand and supply

on the electricity network and enables

greater integration of intermittent re-

newable generation sources into the

energy mix.

Wind power farms in Vietnam’s cen-

tral province of Quang Tri are scram-

bling to complete construction of proj-

ects to benet from the 20-year

incentive feed-in tariff available until

31 October 2021.

Quang Tri has 29 wind farms under

construction with a total capacity of

1117 MW and costing over VND30

trillion ($1.32 billion).

At two projects – Phong Huy and

Phong Nguyen – the foundations are

complete but only four out of 24 tow-

ers have been built. Nguyen Ngoc

Tien, CEO of the projects, said he has

increased the number of workers and

even transports materials at night to

nish the projects before the deadline.

Developers are also calling for a

change in quarantine restrictions to al-

low foreign experts to quarantine on-

site upon arrival and start working

immediately.

Wind power is becoming an increas-

ingly important part of Vietnam’s en-

ergy mix. Vietnam is striving to pro-

duce about 3000-5000 MW of offshore

wind power by 2030 and 21 000 MW

by 2045.

Addressing a webinar last month,

Chairman of the Vietnam Union of

Science and Technology Associations

(VUSTA) Phan Xuan Dung said the

country will benet from the develop-

ment of offshore wind power, whose

cost will gradually decrease in the

future.

Experts say, however, that the coun-

try still lacks legal regulations and

technical standards for the production,

installation, operation, and mainte-

nance of offshore wind power. A

mechanism for offshore wind power

purchase is also necessary to stimulate

this market, they said.

State-owned electricity company PT

PLN Persero has said it will increase

investment directed at renewable-

energy power plant construction in

anticipation of a ve-fold jump in

Indonesia’s electricity demand by

2060.

PT PLN said it will ensure several

old plants that are still operational are

included in the biomass co-ring

programme, and will also convert fos-

sil fuel power stations into green en-

ergy power plants to reduce the use of

polluting oil and coal.

According to PT PLN’s General

Vice Director Darmawan Prasodjo,

the company will start to phase out

the rst generation of conventional

steam plant by 2030. He said all of

these oil and coal red stations will

be replaced by renewable energy

power plants by 2060.

The announcement is timely. It co-

incides with the news in early August

that some of the world’s biggest nan-

cial institutions are working on a plan

to speed up the closure of coal red

power plants in Asia.

According to a recent BBC report,

the initiative created by UK insurer

Prudential, which includes major

banks HSBC and Citi, is being driven

by the Asian Development Bank

(ADB). The ADB hopes the plan will

be ready for the COP26 climate con-

ference in Glasgow, UK.

Under the proposal, public-private

partnerships will buy coal red plants

and shut them far sooner than their

usual operating lifespan. The ADB

hopes to launch a pilot programme in

a developing South East Asian nation

– potentially Indonesia, the Philip-

pines or Vietnam – in time for the

COP26 event in November.

The International Energy Agency

has forecast that global demand for

coal will grow by 4.5 per cent this

year, with Asia making up 80 per cent

of that rise.

Japan steps up offshore

Japan steps up offshore

wind activity

wind activity

Indonesia to increase renewable investment, as coal nancing dries up

Vietnam wind developers

scramble for tariff incentive

n Preferred bidder selected for stake in oating offshore wind project

n Largest offshore wind powered hydrogen project takes shape

28-29 SEPTEMBER 2021

Formerly

Officially Supported by: In Partnership with:

Your gateway to the ASEAN power & energy market

Connecting businesses to energy

leaders from ASEAN Utilities & IPPs –

digitally!

e n l i t - a s i a . c o m / l i v e - e v e n t

Enlit Asia Enlit Asia Enlit Asia@Enlit_Asia

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2021

Special Technology Supplement

Industrial gas turbines:

the perfect complement for

renewables-plus-storage

With the growth in

variable renewables,

energy storage is

expected to be the

key technology

for providing grid

support and shifting

renewable power to

when it’s needed.

Siemens Energy’s

Anders Stuxberg

explains to

TEI Times why

industrial gas

turbines will

be crucial in

complementing

renewables-plus-

storage in an

optimised system.

Junior Isles

prices for nal consumers, and the use

of smart meters.

“When you look at the demand for

balancing power, storage solutions

are efcient systems, with up to 80

per cent of the energy coming back

[from the storage]. But it is not eco-

nomical to design an energy storage

system for all possible situations. And

when you empty the storage, you

have to ll-in with something else,”

said Stuxberg.

That “something else”, he says, will

typically be (fuel red) thermal

plants, i.e. the backup power capacity

that must exist in the grid anyway to

ensure reliable supply when there is

no wind or solar for a long period.

There are several options as to

which technology, or group of tech-

nologies, can support renewables-

plus-storage depending on the sce-

nario. For example, arguments are

sometimes made for fuel cells while

other experts present compelling

cases for fast-start generating assets

such as gas turbines and reciprocating

engines.

Stuxberg believes industrial gas

turbines are currently the best all-

round option. He commented: “In a

deeply decarbonised energy system,

gas turbines will play a key role both

for mid-merit power supply and as

backup power. Although some argue

that fuel cells will take that role, that

can only happen if fuel cells for a

fully functional and installed power

generation plant become cheaper than

gas turbines. We are not there today

and I believe that if it happens, it will

take many decades. Fuel cells,

though, are already a good option for

microgrids and mobility applications.

The requirement that backup power

also should be fuel exible, e.g. use

both hydrogen and liquid renewable

W

ith the urgent need to combat

climate change, wind and

solar power are growing at a

phenomenal rate. According to the

International Energy Agency, renew-

ables will meet 80 per cent of global

electricity demand growth during the

next decade. Solar PV, for example,

dubbed by the IEA as “the new king”

of electricity supply, grows by an

average of 13 per cent per year between

2020 and 2030, meeting almost one-

third of electricity demand growth

over the period.

The variable nature of wind and

solar, however, presents challenges in

terms of grid stability and how best to

provide backup power for when the

wind is not blowing or the sun is not

shining.

With targets set for reaching zero

carbon emissions in the electricity

sector, clearly the goal must be to

support renewables as far as possible

with energy storage – a zero carbon

source of grid exibility. The ques-

tion, however, is what generating as-

sets to deploy alongside storage, and

how to achieve the best mix of storage

and those assets in terms of cost and

operability.

Anders Stuxberg, Specialist in

Power Plant Process Integration at

Siemens Energy AB said: “Gas tur-

bines (GTs) will be the technology of

choice to be dispatched when storage

power capacities are insufcient for

the demand and also when the storage

becomes emptied. If you look at bal-

ancing supply and demand through

the grid in general, you have to look

at it over a number of different time-

frames. The system has to be man-

aged, second-by-second, minute-by-

minute, hour-by-hour, using different

technologies. You also have to look at

balancing over longer timeframes…

The question is how to optimise these

storage and generating resources.

Storage will handle the bulk of energy

for balancing, but there will not be a

business case to try to cover every-

thing with storage alone, you will

need to complement it with GTs.

“By implementing storage, the op-

erating prole for GT-based plants

will be signicantly changed. GTs

will be a cornerstone of the grid infra-

structure but with a new role in future

compared to what we have been used

to seeing. You will see a shift to

backup power instead of peaking

units and exible mid-merit com-

bined cycle plants instead of baseload

plants; this will favour industrial GTs

for new installations. Industrial gas

turbines are also suited to use hydro-

gen as fuel and fuels produced

through power-to-X schemes,” said

Stuxberg.

With storage expected to take cen-

tre-stage in maximising the integra-

tion of renewables and distributed

generating sources, the market for

the technology is forecasted to grow

exponentially over the next decade

(see box).

Regardless of which of the various

storage solutions is selected, however,

they are all generally limited by two

parameters: power capacity and en-

ergy capacity, i.e. duration of storage

at full power. Stuxberg noted that

when optimising storage solutions,

power plant owners will size for the

most frequent instances that give the

most energy trade volume and then

leave the residual load to some other

technology.

He said: “There will be many days

the energy in the storage is insufcient

for the demand and many days when

storage systems have less power ca-

pacity than needed, at least during

part of the dispatch duration. So other

technologies will be called for both at

surge of power and of energy, there

will be a play between different types

of storage solutions and capacity

backup.”

He also noted: “Storage technolo-

gies that can shift operating mode af-

ter the storage is emptied – continuing

power production by ring a supple-

mentary fuel – will also play a role in

backup supply, i.e. double benets to

the system. Examples are: power-to-

hydrogen-to-power where the hydro-

gen-to power unit (gas turbine) oper-

ates on e-methanol when the gas

storage is emptied, or a thermal stor-

age plant that also can run by ring of

e-ammonia when the thermal storage

is emptied.”

Stuxberg says there will also be

competition between storage and

demand response (DR). If altering

the time of energy use (e.g. smart

charging electric cars) does not dam-

age business, then DR will be more

efcient and cost competitive than

storage.

Many types of DR will, however, be

limited in much the same way as stor-

age. For example, duration – mainly

limited by the nature of the demand

that has been put on hold – will nor-

mally be limited to a number of hours.

The amount of DR that will be avail-

able naturally depends on the price

incentive, the volatility of energy

Power plant owners will optimise storage solutions size for the most frequent instances that give

the most energy trade volume and leave the residual load to another technology

Don’t let balancing power capacity get out of balance

Storage will handle the bulk of energy for balancing but it will

need to be complemented with GTs

slightly more expensive power than

the storage system. If the dispatch is

just based on a commercial energy

trade, then hybrid plants comprising a

combination of e.g. renewable power,

storage and GT may be a good busi-

ness as smarter dispatch can be

achieved.”

Typically, many gas turbines will be

installed in an electric grid to provide

the necessary backup power. The

dispatch order for these will be based

on cost or environmental footprint.

Since the requirement will be for a

fairly low dispatch rate, Stuxberg

says a large portion of dispatch may

be based on capacity auctions where

a xed compensation for just existing

as available backup is paid out.

If efciency is also credited, e.g. by

dispatch order, then a fair portion of

these cycling GTs will be congured

as combined cycle. However, the

bottoming steam cycle must then be

suited to frequent starts, i.e. fast and

with low start-up cost. Stuxberg notes

that in a future where these mid-merit

plants need to operate on renewable

fuel, which will be expensive, a bot-

toming cycle will be required for

many of these plants for the sake of

opex. The remaining plants, which

will have a low dispatch rate of, say,

less than 500 hours per year, will not

be so sensitive to efciency but will

need to have low capex and xed

standstill cost.

“So, for the power generation busi-

ness, we will see two typical types of

GT plants for the future: combined

cycle plants for cycling operation,

dispatching in a mid-merit pattern of

somewhere between 1000 and 3000

hours per year; and simple cycle

plants, with dispatch often less than

500 hours per year. The traditional

base load plant is thus replaced by a

very exible mid-merit plant, while

the traditional peaking plant is re-

placed by demand response and stor-

age solutions plus a large quantity of

backup power.”

His absolute conviction is that in-

dustrial gas turbines present the best

suitability to this type of future duty

for both these plant types. “They have

very high reliability due to simplicity

in design concept, high combined

cycle efciency, low price, low main-

tenance cost, good fuel exibility and

much better grid stabilisation charac-

teristics (by high inertia and strong

control response) than aeroderivative

GTs or recip engines,” he said.

For both these plant types, his ex-

pectation is that there will be an aver-

age of one start every one to four

days, most frequent for the mid-merit

type. Stuxberg predicts a wide operat-

ing regime for such gas turbine plants.

For demand response (DR) and for

energy storage systems, he noted that

they will dominate dispatch of bal-

ancing power for short duration and

during periods of low demand for re-

sidual power.

He noted, however: “When looking

at capacity it is hard to rule out rare

events with low probability, thus in-

stalled GT power capacity in the grid

will need to be large. The scale of

backup capacity needed depends

predominantly on the capacity factor

fuel is also a cost issue, if not a prob-

lem, for fuel cell plants.

“Reciprocating engines compared

with gas turbines have pros and cons.

In short, they are less efcient than

combined cycles and are more expen-

sive per capacity than simple cycle

GTs, with the exception of emergency

diesels gensets, which have a shorter

lifespan. For mid-merit operation,

maintenance cost is an important

factor to consider – industrial GTs

have lower maintenance cost than,

e.g. recip engines or fuel cells.”

He also notes that conventional

boilers with steam plants are too in-

exible to handle the frequent starts

and stops to balance residual power

demand. Further, their efciency is

low, especially if designed for renew-

able fuels such as biomass.

Based on the shortcomings of these

technologies, Stuxberg believes the

focus for grid balancing should there-

fore be on a blend of industrial gas

turbines (IGTs) and storage solutions

and a probable future dispatch prole

for those assets.

IGTs in the range up to 70 MW are

typically used in a number of applica-

tions. CHP applications are common

across the whole range due to their

ability to meet heat demand. The

smaller machines may be deployed in

settings like hospitals, universities,

small industries and O&G, to provide

power in areas where the grid is not

completely stable or onsite generation

is required. Medium-sized machines

in the upper range of 30-70 MW may

be used by, independent power pro-

ducers (IPPs), industrial CHP asset

owners, the O&G industry, munici-

palities producing electrical power

for the grid and heat for district heat-

ing networks, as well as utilities.

Stuxberg believes the operating

prole of IGTs in the future will not

be same as the peaking units of today.

Units in the future he says might start-

up and shut down once a day during

parts of the year, be in standby other

periods and also occasionally run for

a longer period, as opposed to cycling

several times per day.

With storage expected to be the rst

option for supplying multiple daily

power peaks, operators must then

decide how gas turbines will operate

to complement this storage.

Stuxberg foresees gas turbines be-

ing dispatched when the energy re-

quired exceeds what is available in

the storage. This will likely be after

the large afternoon/early night peak

or possibly in the morning. Gas tur-

bines will also be called for when all

storage solutions are already provid-

ing near full power capacity, i.e. typi-

cally during the evening peak.

He explained: “If GTs are being

called on every day for one of the two

reasons, power surge or energy surge,

then that’s a signal to storage inves-

tors that here you have an attractive

business opportunity – just buy some

more capacity. It’s low-hanging fruit.

So my conclusion is that GTs will

typically start once every 2-4 days on

average; some days they might be

called on twice and many other days

not at all.

“Traditional peaking plants and

base load plants will no longer be

suitable for this kind of market. So if

we have a GT on the system to ensure

backup anyway, the question is:

should you operate it for more hours,

which means more fuel consumption,

or should you make the storage

slightly bigger?”

According to Stuxberg, that optimi-

sation determines how the gas turbine

is operated, the type of turbine se-

lected and whether the plant should

be simple cycle or combined cycle.

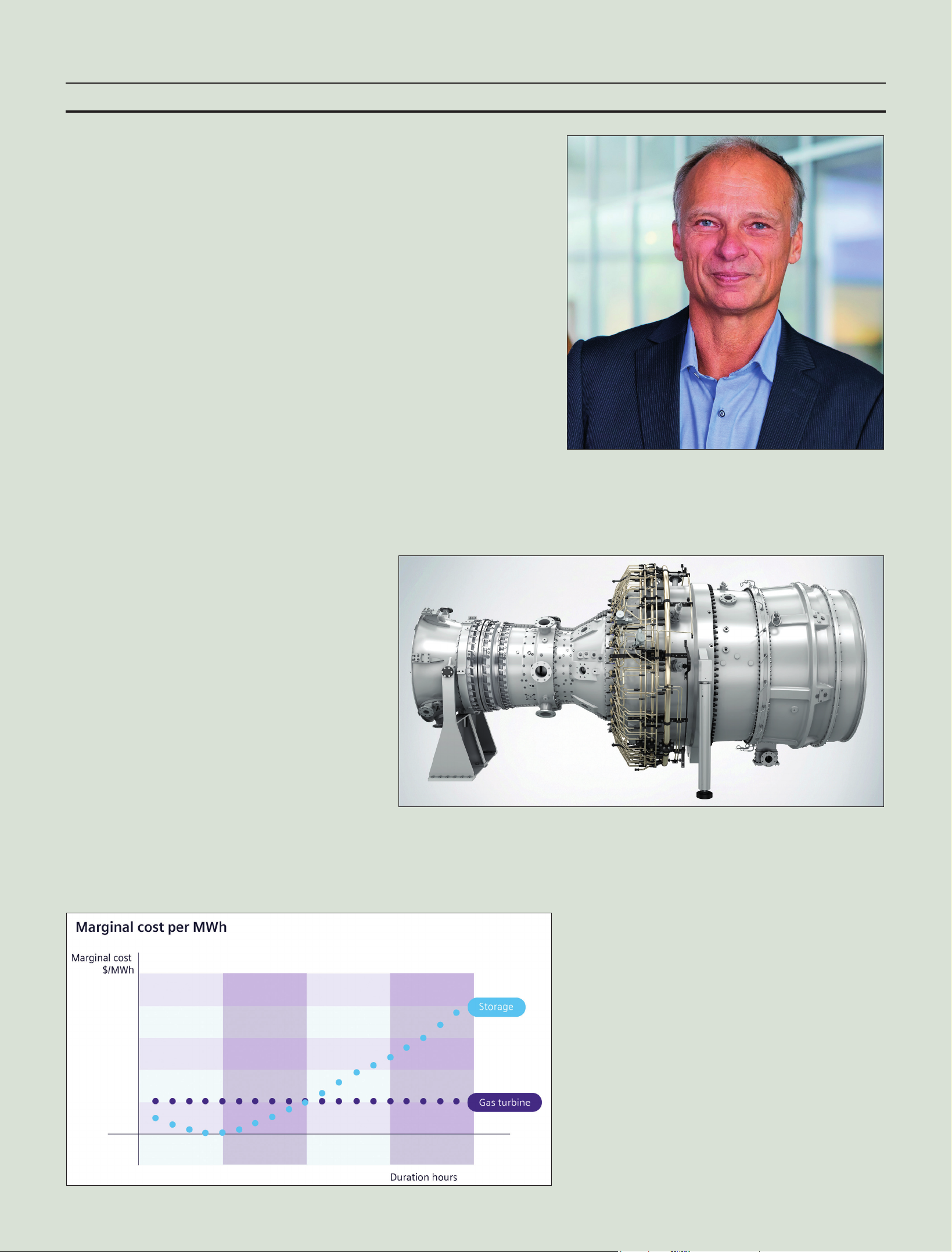

He explained: “Generally, each ad-

dition of duration for a storage tech-

nology comes at an added investment,

which needs to be paid for by less and

less events since long duration events

are less frequent than shorter events.

The marginal cost of longer operation

for a GT plant ring renewable fuel

on the other hand is constant as it just

adds fuel consumption (fuel storage is

relatively cheap). The duration at the

cross-over point between technolo-

gies depends on event probability, a

number of economic factors and

choice of technology. The decreasing

probability of long events explains

why even pumped hydro plants, at

present, often are sized to t just one

day cycles.”

He added: “Grid balancing of up to

a couple hundred megawatts would

be fairly common. This could be di-

vided across a number of machines so

you can follow demand better without

running machines at part-load.”

Such an installation would have to

be capable of meeting several require-

ments. Firstly, it should be capable of

starting “reasonably” fast.

“If there is some kind of communi-

cation protocol (using new IT solu-

tions and advanced forecasting tools)

in the market telling GT operators to

start in fair time before stored energy

runs out, then very fast GT start is not

required, 20 minutes should sufce,”

said Stuxberg. “Also when power

capacity becomes the issue, it should

on most occasions be possible to

predict when to dispatch GTs. How-

ever, power peaks come faster than

drainage of energy, so here dispatch

centres can reserve some power in the

storage by starting the GTs a bit in

advance when a demand ramp-up is

expected. Here a fast GT start pays off

a little as there is less need to reserve

power from storage dispatch and thus

there is a bit less operation of the GTs,

which could be assumed to produce

Special Technology Supplement

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2021

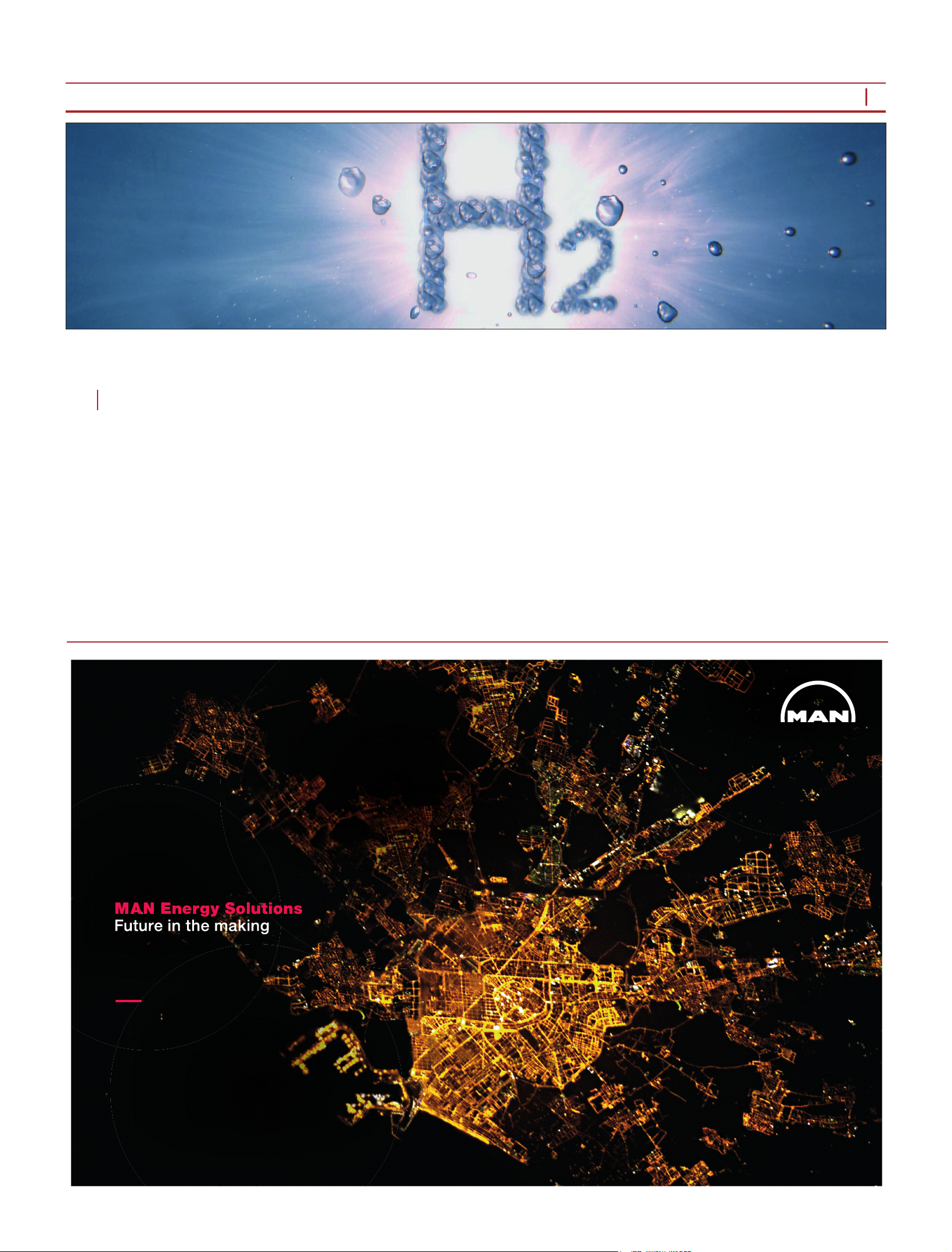

IGTs such as the SGT-800 are

typically used in a number of

applications

The dispatch order for

GTs in the grid for backup

will be based on cost or

environmental footprint

Stuxberg: in a deeply decar-

bonised energy system, gas

turbines will play a key role

both for mid-merit power sup-

ply and as backup power

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2021

through to morning and for the bal-

ancing duty that storage solutions

would otherwise provide, as there is

no surplus renewable power during

the day for charging the storage.

Here, high efciency storage is

charged from high efciency mid-

merit GT plants during the day, as

this limits the need of thermal plant

capacity during the peaks. The result

is that the required thermal plant ca-

pacity is about twice the capacity of

installed storage.

If DR is added, it would reduce the

required amount of storage as well as

the power capacity for storage charg-

ing/discharging during an average

wind day. In the low wind scenario, it

would also reduce the need for in-

stalled thermal capacity, as it attens

the thermal power supply.

“Naturally reality is more complex

than these simple scenarios, with sea-

sonal variations on both demand and

supply, effects of clouding, fast uc-

tuations, grid disturbances etc.,” noted

Stuxberg.

Fuel exibility also has to be a key

consideration. If a machine is oper-

ated for less than 1000 hours/year,

the impact of fuel consumption on

environment and economics is rela-

tively small. However, the goal is to

of wind and solar and level of long

distance power transmission. Up to

about 50 per cent of grid capacity may

be expected; in isolated grids or grids

with weak connection to other grids

one may even argue for 100 per cent.

When you also look at resilience and

tolerance for grid failures most of the

GT installations should be distributed

in the grid, this favours mid-sized gas

turbines as well as exible CHP. In

large, high capacity grids, large GTs

will also be attractive for backup

power capacity due to low specic

investment.

“When looking at energy supply

rather than the installed capacity, de-

mand response and storage will dis-

patch maybe 80 per cent of all energy

needed for grid balancing and GTs

only the remaining 20 per cent. Those

GTs should preferably operate on re-

newable fuel.” he added.

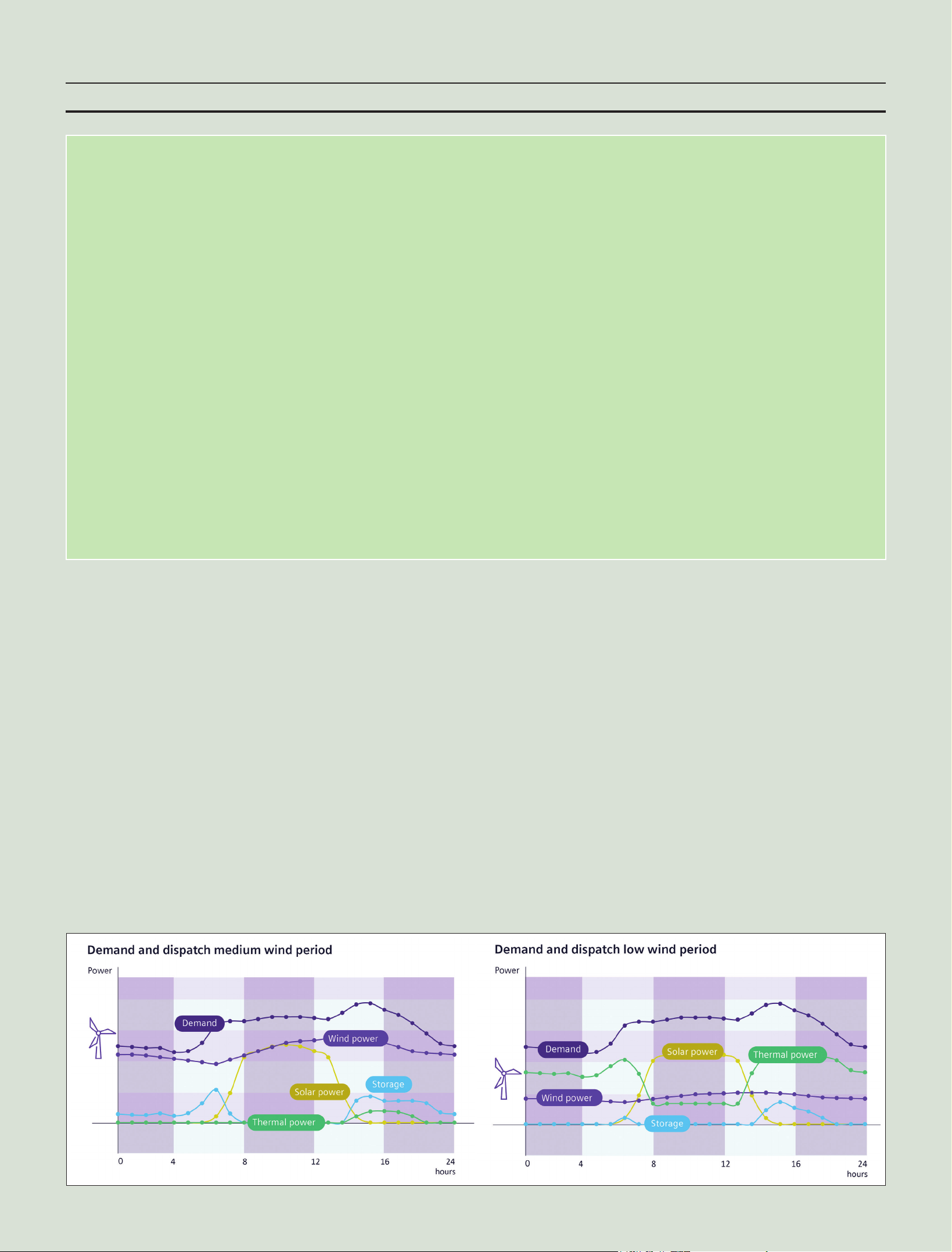

The gure below shows demand as

well as solar and wind supply in a

simplied ctitious medium size

grid. On the left, wind supply during

an average day, where energy fed into

storage covers about 85 per cent of

the balancing need. On the right,

where wind supply is low, thermal

power generation is needed to replace

lower wind supply during the evening

run turbines on renewable fuels, and

uncertain policy in the long-term out-

look in this area is a challenge.

Stuxberg said: “There are a number

of optional renewable fuels for use in

GTs, hydrogen being one of the top

candidates, but today we don’t know

which of these will be economical or

available in the future and obviously

it will always depend on the site loca-

tion and operating prole. But the

point is, industrial gas turbines are

exible”

The market for IGT-based grid

balancing assets is huge – anywhere

in the world where there is renew-

ables growth calling for day-to-day

renewables support, while offering

emergency backup for the grid.

There is also room for large frame

gas turbines, where countries have

large robust grids.

“In Sweden, we have a lot of hy-

dropower but when we close down

nuclear capacity and replace with

wind farms, there isn’t enough ca-

pacity to handle the residual power

peaks. There we will see a large de-

mand for [GT] backup power. Those

machines would probably operate

for less than 10 per cent of the time.

In many markets today, there is no

compensation for having capacity in

place and that is an issue.

“Grid integrity and resilience via

sufcient backup should mainly be

seen as part of the grid infrastructure

rather than energy trade. Solving

backup power supply with existing

coal red plants is a route that has

already proven a failure as it counter-

acts the greenhouse gas savings from

renewable power, i.e. incentives for

investment in more suitable backup

technology is needed” said Stuxberg.

He concluded: “Renewables and

storage systems will play the major

future role for energy supply but that

requires a lot of exible backup and

for that gas turbines are the most cost

effective today – if you need to build

capacity today; it’s gas turbines.

“We can only speculate on what

will happen in the future through

development of other technologies.

But we need to change the energy

system now. With the environmental

challenge, we cannot wait 30 years;

so we have to base it on the technol-

ogy we have today and industrial gas

turbines is an available technology

well t for the purpose. Backup

power also needs to be installed

ahead of renewable implementation

to ensure grid resilience, so the need

is urgent.”

Demand, solar and wind

supply in a simplied

ctitious medium size grid

Special Technology Supplement

The energy storage market is forecasted to grow exponentially

All storage technologies can store surplus renewable energy and return it to the

grid later, thus avoiding curtailment and increasing the use of renewable power.

According to analysis from IHS Markit, annual installations of energy storage

capacity globally will exceed 10 GW in 2021, more than doubling the 4.5 GW in-

crease in 2020. The existing capacity in stationary energy storage is dominated

by pumped-storage hydropower (PSH), but because of decreasing prices, new

projects are generally lithium-ion (Li-ion) batteries.

PSH capacity additions are predicted to remain constant at 5-10 GW per year,

while battery capacity is expected to grow from 2.3 GW/year in 2018 to above

30 GW/year in 2050. Total installed storage capacity was around 170 GW in

2019, a gure that is expected to reach 950 GW by 2050, according to IHS

Markit.

Another report – ‘The Energy Storage Grand Challenge Energy Storage Mar-

ket Report 2020’ – published by the US Department of Energy forecasts a 27

per cent compound annual growth rate (CAGR) for grid-related storage through

to 2030. It projects annual grid-related global employment to increase about 15

times from around 10 GWh in 2019 to almost 160 GWh in 2030.

The type of storage deployed will depend on grid design and the distribution

of generating plants and loads unique to each grid. The technology selected

depends on which offers the best economic and operational capability according

to the services, range of capacity and energy discharge duration needed.

Super-capacitors and rotating grid stabilisers (ywheels and synchronous

condensers) provide instantaneous system responses and grid control. Both

technologies are aimed at applications in the range of approximately 1-100 MW.

Pumped storage hydro is the most dominant energy storage solution in terms

of globally installed megawatt capacity, representing some 93 per cent of the

operating system. It is a gigawatt-scale technology mostly used for energy shifting

and high-capacity rming with storage durations of around days or weeks with mini-

mal energy losses.

Further, capacity and operating reserve is provided when the asset is connected to

the grid. But although a mature and widespread technology, its main drawback is the

required topology of the site (large height differences are needed) and its physical

impact on the environment.

Thermal energy storage (TES) can improve utilisation of waste heat, assist in the

electrication of process heat supply, or store renewable energy for re-electrication

using a steam turbine. TES can also be integrated with thermal generation plants,

e.g. a combined cycle plant. A wide variety of heat storage media are available,

including liquids such as molten salt and pressurised water, or solids such as stone,

steel, concrete, or sand.

Liquid air energy storage (LAES) and compressed air energy storage (CAES) are

further technologies aimed at gigawatt-scale applications. LAES is based on the

cryogenic liquefaction of air when it is compressed with the use of (preferably)

renewable electricity. The liquid and the produced heat can be easily stored and

discharged when needed for re-electrication. CAES works similar but stores com-

pressed air. By adding a thermal storage to this technology, the overall efciency is

improved.

Li-Ion batteries are currently the technology of choice driven by their cost-effective-

ness and speed characteristics. They offer several applications, such as frequency

response, exibility enhancements of conventional power generation assets, black

start capabilities or energy arbitrage. Their sweet spot is up to around 250 MW and 5

hours of duration.

siemens-energy.com/ decarbonization

LET’S MAKE TOMORROW DIFFERENT TODAY.

Improving efficiency of our energy systems. Replacing

conventional fuels with cleaner options. Building

highly flexible hybrid systems. This is how we lead the

way to mitigate the impact of climate change.

Decarbonizing

our energy systems

is a journey of many steps.

Siemens Energy is a trademark licensed by Siemens AG.

Anzeige Decarbonization_Englisch_290x386mm_210825.indd 1Anzeige Decarbonization_Englisch_290x386mm_210825.indd 1 26.08.21 12:0226.08.21 12:02

Junior Isles

Already affected by the Covid-19 pan-

demic, wind turbine manufacturers are

now bracing for the impact of higher

wind turbine prices.

Danish wind turbine manufacturer

Vestas has lowered its full-year guid-

ance citing supply chain constraints,

cost ination, and restrictions in key

markets caused by Covid-19.

The company now expects full-year

revenue in 2021 of between €15.5 bil-

lion and €16.5 billion, including Ser-

vice. The previous expectation was

€6-17 billion.

It was a similar story for Siemens

Gamesa. The company adjusted its

guidance for nancial year 2021 with

an EBIT margin pre-PPA and before

Integration and Restructuring (I&R)

costs in the range of between -1 per cent

and 0 per cent. It said group revenue is

expected to be at the low end of the range

announced during the presentation of

results for the second quarter (April 30,

2021), i.e. €10.2-10.5 billion.

“We are operating in what is cur-

rently a very difcult environment and

have taken additional steps to balance

our risk prole as we focus on deliver-

ing long-term sustainable protabili-

ty,” said Andreas Nauen, Siemens

Gamesa’s Chief Executive Ofcer.

‘Despite current challenges, the com-

pany is soundly placed to take advan-

tage of the huge potential of wind en-

ergy, which is reected in our strong

order backlog.

Meanwhile, the Nordex Group is

maintaining its guidance for the cur-

rent nancial year of achieving con-

solidated sales of €4.7-5.2 billion and

an EBITDA margin of 4.0-5.5 per

cent. The group said the impact of the

pandemic on the operating business

only had a limited inuence on its

positive performance in the second

quarter but noted its indirect effects

were still clearly evident in the up-

heaval in the raw materials and logis-

tics markets.

According to Wood Mackenzie, wind

turbine prices are set to continue their

upward trend, rising by up to 10 per

cent over the next 12 to 18 months on

higher commodity prices and logistics

cost, as well as challenges linked to the

coronavirus.

Turbine prices have increased over

the last six months, pushed up by rises

in steel, copper, aluminium and bre

prices and a four-fold surge in logistics

costs. According to the research and

consultancy group, they will likely re-

turn to normal levels by end-2022.

“Turbine OEMs and component sup-

pliers face a double whammy of cost

increases and demand softening over

the coming two years due to the US

PTC (Production Tax Credit) and Chi-

na feed-in-tariff (FiT) phase-outs,”

said Wood Mackenzie principal ana-

lyst Shashi Barla.

Further cost pressures in relation to

the US-China trade tussle have caused

the likes of Vestas, Siemens Gamesa

Renewable Energy and Nordex to ex-

plore alternative supply hubs such as

India, the rm said.

Wood Mackenzie also warned of sup-

ply chain bottlenecks for key materials

over the next four to ve years and

advised OEMs and turbine suppliers to

adopt next-generation technologies

and materials.

Last month Siemens Gamesa said it

will expand its offshore blade factory

in Hull, England by 41 600 m

2

, more

than doubling the size of the manu-

facturing facilities. The expansion

represents an investment of £186 mil-

lion and is planned for completion in

2023.

Earlier, the company said it aims to

manufacture fully recyclable blades by

2030, and redesign the rest of the wind

turbine components to put a 100 per

cent recyclable generator on the market

by 2040.

A growing number of companies are

ramping up plans to build battery

manufacturing plants around the

world, as the world accelerates its

transition to low carbon economy.

In mid-August Reliance led a $144

million fundraising by US energy stor-

age start-up Ambri, as part of the In-

dian group’s plans to manufacture

batteries in its home market.

Reliance New Energy Solar said it

would invest $50 million in Ambri and

that the two were in talks “to set up a

large-scale battery manufacturing fa-

cility in India, which could add scale

and further bring down costs for Reli-

ance’s green energy initiative”.

The deal, which follows an an-

nouncement in July that ArcelorMittal

had invested in Massachusetts-based

start-up Form Energy, is the latest in a

series of tie-ups between large indus-

trial groups and start-ups seeking to

develop energy storage technology.

In Europe, Norway-based Freyr Bat-

tery recently said it remains committed

to plans to build ve gigafactories in

northern Norway, despite potential

complications caused by Brexit. There

are fears that a clause in the Brexit

agreement between the UK and EU

could mean that any cars built in the

EU containing Norwegian batteries

would face tariffs of 10 per cent to en-

ter the UK from 2027 and vice versa.

Tom Jensen, the Chief Executive of

Freyr Battery, said: “It has not caused

us to change our plans whatsoever. But

it doesn’t mean we’re not paying at-

tention to it.” The rst gigafactory is

due to produce batteries from next year.

Jensen said the rst two gigafactories

would be used for energy storage

rather than electric vehicles.

Iselin Nybo, Norway’s Minister of

Trade and Industry, said the country

has “initiated dialogue” with the Euro-

pean Commission and the UK “in an

attempt to nd solutions to the issue”.

Norway has high hopes for its battery

industry as it looks to use its extensive

renewable energy from hydroelectric

power to attract green businesses.

Freyr, whose shareholders include

Koch Industries and commodity giant

Glencore as well as institutional inves-

tors Fidelity and Franklin Templeton,

is aiming to have 43 GWh of battery

production capacity by 2025 and 100-

150 GWh by 2030.

Meanwhile, Glencore last month ac-

quired a stake in Britishvolt, the battery

start-up behind ambitious plans for

Britain’s electric battery gigafactory.

The £2.6 billion ($3.56 billion) project,

designed to equip the UK’s car indus-

try for an electric future, will be im-

portant in helping the government meet

its carbon reduction targets.

As part of the agreement, Glencore

will also supply the gigafactory, which

is under construction in Northumber-

land, with cobalt, a raw material used

in electric batteries.

CYE, a specialist in cyber security op-

timisation platforms is partnering with

Otorio, a provider of next-generation

OT cyber and digital risk management

solutions, to provide an integrated so-

lution to companies with converged IT/

OT/IOT environments looking for

proactive ransomware protection.

The partnership aims to help custom-

ers convert the new rigorous US gov-

ernment regulations for critical pipe-

line owners and operators into practical

cyber security plans, and to develop

actionable steps to improve their cyber

hygiene and overall security.

In recent months, there has been a

signicant increase in ransomware

attacks on industrial companies and

critical infrastructure, including the

Colonial Pipeline attack, which

caused fuel shortages across the East

Coast of the US for over a month and

led to the payment of a $4.4 million

ransom.

CYE and Otorio provide cyber

visibility across all IT, OT and IOT

environments, quantifying risks,

identifying exposures, and building

long-term cyber security best prac-

tices. The companies claim the solu-

tion is fully automated and simplies

compliance processes and ongoing

risk monitoring. Furthermore, by pro-

actively identifying exposure and

potential attack vectors, and address-

ing them before they become breach-

es, it enables companies to signi-

cantly reduce risks, while minimising

cost.

Two signicant deals in late July look

set to accelerate the growing hydrogen

market.

MAN Energy Solutions and Andritz

Hydro announced they have completed

a strategic framework agreement to

jointly develop international projects

for the production of green hydrogen

from hydropower.

A pilot project in Europe will mark

the start of the collaboration. Subse-

quently, the companies want to jointly

identify further projects and imple-

ment them in the context of the German

federal government’s H2 Global initia-

tive. H2 Global is a market-based fund-

ing platform, which aims to efciently

promote the market launch of green

hydrogen and hydrogen-based power-

to-X products. For this purpose, hydro-

gen energy partnerships are to be es-

tablished with countries with a

correspondingly high potential to pro-

vide a long-term, cost-effective and

reliable green hydrogen supply to Ger-

many and the EU.

Frank Mette, CEO of Andritz Hydro

in Germany, commented: “Hydro-

power is one of the few completely

climate-neutral forms of energy,

which is capable of providing base

load power. We therefore see excellent

potential for worldwide expansion –

in new construction projects just as

much as in repowering. By adding the

possibility of producing hydrogen to

hydropower plants, we are taking the

next step and also making the energy

generated there ready for export and

storage without restriction. Together

with MAN Energy Solutions, we can

open up new markets and opportuni-

ties for the operators.”

The companies are aiming to launch

an initial joint pilot project before the

end of this year to provide about 650

tons of green hydrogen by using an

electrolysis output of up to 4 MW, ini-

tially for local use. In follow-up proj-

ects, designed for the export of hydro-

gen, the installed electrolysis output is

expected to increase to up to 100 MW

in the coming years.

In another move, Johnson Matthey

(JM), a global leader in sustainable

technologies, announced its acquisi-

tion of the assets and intellectual prop-

erty of UK-based Oxis Energy Limit-

ed. Oxis Energy was a lithium-sulphur

battery developer with assets, which

can be adapted for the manufacture of

components for green hydrogen pro-

duction. The company entered admin-

istration on 19 May 2021.

With moderate additional invest-

ment in upgrades, this transaction will

signicantly accelerate the scale-up of

JM’s growing green hydrogen busi-

ness. The facility will further expand

JM’s ability to develop, test, and

manufacture catalyst coated mem-

branes and advanced materials for

electrolysers.

The site will enable the production

of tens of thousands of catalyst coated

membrane parts per year – enough to

equip hundreds of megawatts of elec-

trolyser capacity.

MAN Energy and Andritz

agree on hydrogen,

as Johnson Matthey

accelerates scale-up

Companies

Companies

charge up

charge up

battery

battery

manufacturing

manufacturing

CYE partners with Otorio to combat

ransomware attacks

Changing winds for OEMs

n Vestas and Siemens Gamesa lower full-year guidance

n Turbine prices to continue upward trend

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2021

9

Companies News

T

he challenges facing the devel-

opment of large nuclear power

plants, especially in Europe,

have been well documented over the

last 15 years or so. Finland’s Olkil-

uoto 3 is nearly 13 years behind

schedule and about three times over

the original €3.2 billion budget. It is

a similar story at Flamanville 3 in

France and Hinkley Point C in the

UK. Even across the pond in the US,

delays and costs at Vogtle 3 & 4 con-

tinue to head north.

Yet despite the poor track record

of the industry, Philippe Bordarier,

Chief Operating Ofcer at Fenno-

voima, believes the 1200 MW

Hanhikivi 1 project, currently under

development in Finland, can pro-

vide some valuable lessons for

plants going forward.

Fennovoima is owned by a number

of shareholders, which include doz-

ens of major Finnish industry corpo-

rations such as Outokumpu and For-

tum, and local energy utilities. These

shares, representing a 66 per cent

stake in Fennovoima, are held by

Voimaosakeyhtiö SF, a Finnish hold-

ing company. As these shareholders

require a large amount of energy for

their operations, a reliable and stable

priced power supply is crucial for

their businesses.

RAOS Voima, a 100 per cent

Finnish subsidiary of Rosatom,

owns the remaining 34 per cent of

the shares in Fennovoima. RAOS

Voima plans to sell its share of the

electricity from the plant on the

NordPool market.

Fennovoima operates under the

“mankala principle”, i.e. it will sell

all the electricity generated by the

plant to the owners at cost price in

proportion to their ownership. This

price includes operating and nanc-

ing costs, as well as the organisation-

al costs of the company. The manka-

la principle has been widely used in

Finland’s energy sector for decades –

about 40 per cent of the electricity in

Finland is produced by the mankala

companies.

Commenting on Fennovoima’s ap-

proach, Bordarier said: “We could be

paving the way; maybe what we are

doing here could be replicated else-

where. If you look at other opportu-

nities in the nuclear sector, like de-

veloping small modular reactors

[SMRs] for example, this could be a

useful model for future companies.

We are proving that it is possible to

develop, build and commission a nu-

clear power station design and be a

safe operator starting from the com-

mercial decision.”

Bordarier, who joined Fennovoima

from EDF in April, sees the compa-

ny as somewhat “unique” – doing

three things at the same time.

“Firstly we are building a nuclear

power plant, which is a massive in-

frastructure project. Secondly, we

are building the operator of the sta-

tion, which means we develop the

skills – the people, the processes – to

operate the station. This is quite

unique in itself because the nuclear

industry is very specic. And be-

cause Fennovoima is a brand new

company, we are building that com-

pany. All of this makes the project

very different and that’s part of what

attracted me.”

Bordarier calls Fennovoima “the

rst 21st century nuclear energy

company in the world”.

He explained: “The vast majority

of today’s nuclear new build projects

are controlled by either a large share-

holder that is usually an existing util-

ity company or state agency, or by

an EPC company. Fennovoima is a

commercial project that started al-

most from scratch – we don’t have a

massive utility or EPC company as

our main shareholder. Rosatom is the

EPC contractor but does not control

the company; it’s a kind of unique

model.”