www.teitimes.com

August 2021 • Volume 14 • No 6 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Special Supplement

Time to lead

There is an urgent need to move to a

carbon-neutral energy future. TEI Times

discusses why this transition has to

be done sustainably, and in a way that

improves system resilience.

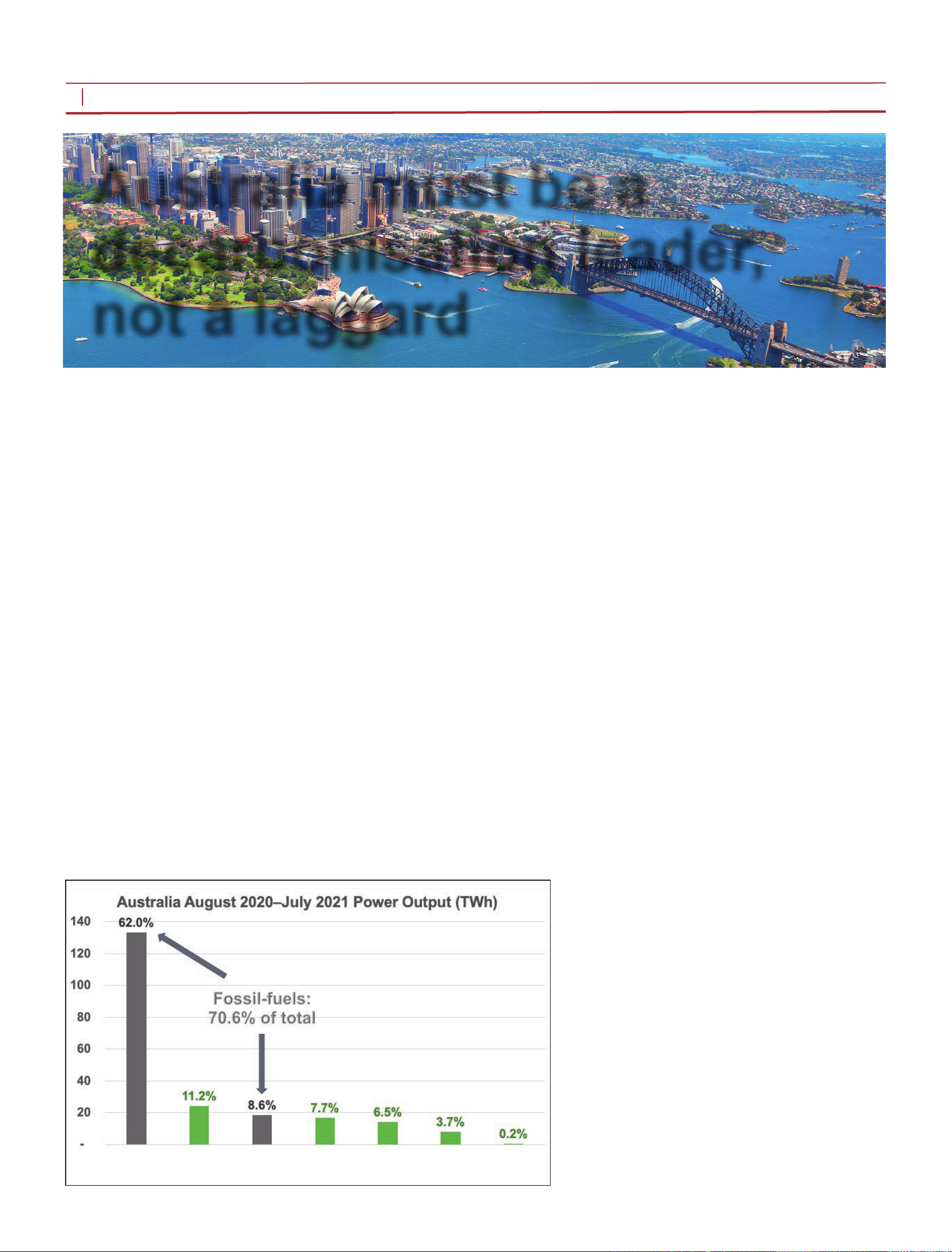

In the countdown to COP26, Asia

energy expert and author, Joseph

Jacobelli, argues that Australia

must be a decarbonisation leader,

not a laggard. Page 14

News In Brief

Continued fossil fuel

support will put Paris goal

beyond reach

Fossil fuel subsidies and continued

exploration by oil and gas majors are

at levels that put the Paris climate

goal beyond reach.

Page 2

US infrastructure operators

must update risk mitigation

strategies

US infrastructure operators are

being hit by changing risks that

require them to re-evaluate their risk

management and mitigation regimes.

Page 4

UK, France, Spain vie for

pole position in oating wind

The ‘Scotwind’ seabed auction has

included bids for oating offshore

wind but the UK’s leading position

in the technology is under pressure

from its European neighbours.

Page 7

Iraq needs electricity sector

overhaul, says IEA

Iraq’s electricity sector must bring in

long-term reforms and solutions to

x its power crisis, an International

Energy Agency ofcial has said.

Page 8

Oil and gas majors explore

hydrogen alliances

Both Chevron and Shell have

announced alliances that will see the

two oil and gas majors speed their

transition to cleaner energy.

Page 9

Industry Perspective: Digital

infrastructure is key to a

renewable future

Digital infrastructure will play a

vital part in helping renewables form

the backbone of the grid by reliably

transmitting the data renewable

providers need to keep the lights on.

Page 13

Energy Outlook: Biomass

use must be sustainable

While bio-resources are in principle

renewable, there is growing concern

over the sustainability of biomass

for applications such as power

generation.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

The EU’s ‘Fit for 55’ package revises more than 10 pieces of legislation to bring them in line

with the new ambitions of the European Union’s Green Deal, the increased targets for 2030,

and a climate-neutral Europe by 2050. But although broadly welcomed, some still have

concerns about the package. Junior Isles

Rapid scaling of clean energy investment needed

THE ENERGY INDUSTRY

TIMES

Final Word

Being t for 55 needs

holistic thinking,

says Junior Isles

Page 16

The European Union’s raft of propos-

als detailing how it will cut the bloc’s

emissions by 55 per cent compared to

1990 levels by 2030 has been broadly

welcomed but may still require further

policy and regulation changes.

In its ‘Fit for 55 package’, the Eu-

ropean Commission last month laid

out 13 legislative proposals aimed at

cutting carbon emissions across all

the major energy consuming sectors

on the road to reaching net zero by

2050. By targeting a 55 per cent

emissions reduction the EU could

save as much as 8 billion t CO

2

cu-

mulative emissions.

Notably, the proposals include a re-

vised Renewable Energy Directive

(RED III); an extended Emissions

Trading Scheme (ETS) that now also

covers aviation and maritime; a re-

vised Energy Taxation Directive; sup-

port for biofuels, hydrogen and carbon

capture and storage; as well as a Car-

bon Border Adjustment Mechanism

(CBAM).

According to Wood Mackenzie data,

the EU would need 472 GW of addi-

tional wind and solar by 2030 to se-

cure its new renewables target. The

global energy and commodities con-

sultancy said, however, the task of

installing the required amounts of

wind and solar would be “unnecessar-

ily challenging” unless further policy

and regulation changes are made.

In a press statement, it said the plan-

ning, connection and permitting pro-

cess will need to be streamlined, dis-

tribution network investment will

need to be in place, and regulators will

need to adopt a new net zero mindset.

“On top of this, system exibility

build-out will need to be supported,

and market reforms will need to be in

place to ensure it is t for operating in

a zero marginal cost producers’ envi-

ronment,” it added.

The lack of adequate provision for

system exibility in an energy land-

scape that is being increasingly dom-

inated by intermittent renewables

was also a concern to energy storage

proponents.

The European Association for Stor-

age of Energy (EASE) said that the

revised RED III does not offer suf-

cient support for the energy storage

that will be needed to integrate renew-

ables into the energy system.

EASE Secretary General Patrick

Clerens noted: “EASE supports that

the revised directive increases the

overall Union target for renewable en-

ergy in 2030 to 40 per cent, which is a

positive step. The RED III proposals,

however, fall short in terms of sup-

porting energy storage deployment to

facilitate renewable energy sources

(RES) integration. This is a mistake

because focusing only on deploying

more RES is insufcient… Energy

storage is a key enabler of a RES-

dominated system, as it can ensure

security of supply, efcient energy

system operation, and the competi-

tiveness of EU industries.”

The proposals to strengthen carbon

pricing have also been welcomed, as

Continued on Page 2

Achieving net zero carbon emissions

by 2050 will require as much as $173

trillion in investments in the energy

transition, according to Bloomberg-

NEF’s (BNEF) ‘New Energy Outlook

2021’ (NEO), the latest edition of its

annual long-term scenario analysis on

the future of the energy economy.

With the route to net zero being un-

certain, BNEF’s NEO outlines three

distinct scenarios (Green, Red and

Gray) that each achieve net zero

while relying on a different mix of

technologies.

It notes that the energy transition

requires substantial investments in

infrastructure, with capital owing

away from fossil fuels and toward

clean power and other climate solu-

tions. Despite uncertainty around

the overall cost of each NEO sce-

nario set out, BNEF estimates in-

vestment in energy supply and infra-

structure amounts to between $92

trillion and $173 trillion over the

next 30 years. Annual investment

will need to more than double to

achieve this, rising from around $1.7

trillion per year today, to somewhere

between $3.1 trillion and $5.8 tril-

lion per year on average over the

next three decades.

A core part of the BNEF analysis is

constructing sector-by-sector emis-

sions budgets to achieve net zero in

2050 with an orderly transition. To-

gether these show that global energy-

related emissions need to drop 30 per

cent below 2019 levels by 2030, and

75 per cent by 2040, to reach net zero

in 2050. This is a 1.75°C equivalent

budget that implies a 3.2 per cent re-

duction each year to 2030 and a swift

reversal of recent trends: emissions

rose 0.9 per cent a year from 2015 to

2020.

The power sector needs to make the

greatest progress over the next de-

cade, reducing emissions by 57 per

cent from 2019 levels by 2030, and

then 89 per cent by 2040.

“There is no time to waste. If the

world is to achieve or get close to

meeting net zero by mid-century,

then we need to accelerate deploy-

ment of the low-carbon solutions we

have this decade – that means even

more wind, solar, batteries, and elec-

tric vehicles, as well as heat pumps

for buildings, recycling and greater

electricity use in industry, and redi-

recting biofuels to shipping and avia-

tion,” said BNEF Chief Economist

Seb Henbest.

Last month the International Energy

Agency also said the sums of money,

both public and private, being mobil-

ised worldwide by recovery plans fall

well short of what is needed to reach

international climate goals.

New analysis from the Paris-based

agency said that governments world-

wide are deploying an unprecedent-

ed amount of scal support aimed at

stabilising and rebuilding their econ-

omies, but only about 2 per cent of

this spending has been allocated to

clean energy measures. It noted that

shortfalls are particularly pro-

nounced in emerging and develop-

ing economies, many of which face

particular nancing challenges.

Under governments’ current recov-

ery spending plans, global carbon di-

oxide emissions are set to climb to

record levels in 2023 and continue

rising in the following years. This

would leave the world far from the

pathway to net zero emissions by

2050 that the IEA set out in its Global

Roadmap to Net Zero.

These ndings come from the new

Sustainable Recovery Tracker that

the IEA launched in July to help

policy makers assess how far recov-

ery plans are moving the needle on

climate.

“Since the Covid-19 crisis erupted,

many governments may have talked

about the importance of building back

better for a cleaner future, but many of

them are yet to put their money where

their mouth is. Despite increased cli-

mate ambitions, the amount of eco-

nomic recovery funds being spent on

clean energy is just a small sliver of

the total,” said Fatih Birol, the IEA

Executive Director.

EU moves to align legislation

EU moves to align legislation

with 2030 emissions target

with 2030 emissions target

THE ENERGY INDUSTRY TIMES - AUGUST 2021

2

Junior Isles

Fossil fuel subsidies and continued

exploration by oil and gas majors are

at levels that put the Paris climate goal

beyond reach.

In July a report by BloombergNEF

(BNEF) and Bloomberg Philanthro-

pies revealed that governments of all

19 individual country members of the

G20 have given more than $3.3 trillion

in subsidies for coal, oil, gas, and fos-

sil fuel production and consumption

from 2015-2019. At today’s prices,

that sum could fund 4232 GW in new

solar power plants – over 3.5 times the

size of the current US electricity grid,

said the report.

Phasing out support for fossil fuels,

particularly coal, and shifting funding

to renewables is a crucial step to ac-

celerating the clean energy transition

and is core to the upcoming Glasgow

COP26 climate conference goals.

The ‘Climate Policy Factbook’ high-

lights three concrete areas in which

immediate government action is need-

ed to limit global warming to 1.5 °C:

rst, phasing out support for fossil

fuels; second, putting a price on emis-

sions; and third, encouraging climate

risk disclosure. In each of these areas,

the report found that the policies of

many G20 countries were signicantly

off course.

G20 nations collectively cut fossil

fuel funding by 10 per cent from 2015

to 2019, with eight member nations

making notable progress in reducing

their fossil fuel subsidies by 10 per cent

or more (Argentina, Germany, Italy,

Saudi Arabia, South Africa, South Ko-

rea, Turkey, and the UK).

However, to remain in line with the

Paris Agreement goals in the lead-up

to COP26, the G20 cannot rely on the

actions of a few nations, said the report.

“Every G20 country must take imme-

diate action to end support of fossil fuel

projects and accelerate their coal

phase-outs,” it said.

During the same timeframe (2015-

19), eight members increased their

support – notably Australia, Canada,

and the US – encouraging the use and

production of fossil fuels, distorting

prices, and risking carbon ‘lock-in’ –

where assets funded today continue to

emit high levels of emissions for de-

cades ahead.

According to BNEF, to effectively

lead the phase-out of coal and other

fossil fuels ahead of COP26, G20

countries must also implement emis-

sion pricing mechanisms to hold pol-

luters accountable for the true social

cost of their actions.

In a separate study, the oil and gas

sectors came under scrutiny. A com-

prehensive benchmarking analysis of

the oil and gas industry’s performance

against the Paris climate goals today

shows that, without immediate and

decisive action, the sector would pre-

vent the world from meeting the

IPCC’s 1.5°C global warming sce-

nario by 2050.

The benchmark created by the

World Benchmarking Alliance

(WBA), alongside partners CDP and

ADEME, scores private, state-owned

and publicly listed companies using

CDP’s and ADEME’s Assessing low

Carbon Transmission (ACT) meth-

odology. This is the rst time the in-

dustry has been judged against a

1.5°C scenario – the most ambitious

emissions reduction plan proposed by

the Paris Agreement – and the rst

study to assess oil and gas companies

using the International Energy Agen-

cy’s (IEA) ‘Net Zero Emissions by

2050’ scenario.

Assessing 100 of the world’s biggest

oil and gas rms against this scenario,

it shows that based on current rates of

production these companies are set to

consume the sector’s allocated carbon

budget (from 2019 to 2050) by 2037

– 13 years too early. Despite this trajec-

tory, researchers found that none of the

100 companies have committed to

stopping exploration.

Other key ndings include: from

2014-2019 the majors and National

Oil Companies (NOCs) all increased

either their oil or gas production; only

13 companies have low carbon tran-

sition plans that extend at least 20

years into the future.

“Opaque, unambitious or non-exis-

tent targets and strategies from the

greatest contributors to climate change

show that the oil and gas sector is not

accepting its share of responsibility for

global emissions,” said the report.

they should begin to incentivise in-

dustrial decarbonisation through

the use of technologies like high

temperature heat pumps or carbon

capture.

“Reforming the carbon market

will be critical, especially for the

hard-to-decarbonise industrial sec-

tors, such as cement and steel,” said

the Wood Mackenzie statement.

“Though the EU ETS covers sectors

that generate half of the bloc’s emis-

sions – power, industry and aviation

– these sectors will only deliver a

third of the cuts needed by 2030.”

With the ETS, the EU has tried to

push companies to gradually reduce

their emissions to minimise their

cost of emissions allowances,

which have risen from €8/t of emis-

sions at the start of 2018 to over

€50/t in early May.

In the absence of any changes to

the proposed package, ICIS (Inde-

pendent Commodity Intelligence

Services) expects EU ETS prices to

reach around €90/tCO

2

by 2030,

with a price increase expected in

particular in the second half of the

decade when the proposed reforms

to free allocation would take effect.

The EU is also acting to ensure its

efforts to increase carbon prices do

not put its economy at a disadvan-

tage. The CBAM aims to prevent

carbon leakage and ultimately en-

courage the rest of the world to re-

duce emissions. The mechanism

will create a level playing eld on

emissions costs for companies ex-

porting goods to the EU and EU

producers already subject to the

ETS.

The CBAM proposed in Fit for 55

will cover the steel, aluminium, ce-

ment, electricity, and fertilisers sec-

tors. ICIS estimates that around 200

million t of embedded emissions

would initially be covered by the

measure.

Commenting on the proposal, Se-

bastian Rilling, Analyst EU Power

& Carbon Markets, ICIS, said: “It

remains to be seen, however, to what

extent domestic carbon pricing

schemes in the countries of origin

as well as a potential resource shuf-

ing will limit the impact for im-

porters on the ground especially in

the rst years of operation.”

James Whiteside, Global Head of

multi-commodity research at

Wood Mackenzie, warned that

implementation “could prove to be

a logistical nightmare”. He said:

“There is little transparency around

carbon emissions associated with

products. Determining the country

of origin of products can also be

problematic. Robust certication

schemes must be adopted – and

adhered to – to effectively admin-

ister border taxes.”

Continued from Page 1

bp’s ‘Statistical Review of World En-

ergy 2021’ has captured the “dramatic

impact” the global pandemic had on

energy markets and how the “year of

Covid” may shape future global energy

trends.

The data collected in this year’s edi-

tion includes energy data for 2020 – one

of the most turbulent years the world

has ever seen. The report showed pri-

mary energy consumption fell by 4.5

per cent in 2020 – the largest annual

decline since 1945 – largely driven by

a 75 per cent decline in oil consump-

tion. Even electricity generation fell by

0.9 per cent – more than the decline in

2009 (-0.5 per cent), the only previous

year in bp’s data series (which starts in

1985) that had seen a decline in elec-

tricity demand.

Wind, solar and hydroelectricity

generation, however, all grew despite

the fall in overall energy demand.

Wind and solar capacity increased by

238 GW in 2020 – 50 per cent larger

than at any time in history.

US, India and Russia saw the largest

declines in energy consumption. China

saw the largest increase (2.1 per cent),

one of only a handful of countries

where energy demand grew last year.

Spencer Dale, bp’s Chief Economist,

said: “For the Review – as for so many

of us – 2020 will go down as one of

the most surprising and challenging

years in its life. The global lockdowns

had a dramatic impact on energy mar-

kets, particularly on oil, whose trans-

port-related demand was crushed.

“Encouragingly, 2020 was also the

year the share of renewables in global

power generation recorded its fastest

ever increase – a growth that came

largely at the expense of coal red gen-

eration. These trends are exactly what

the world needs to see as it transitions

to net zero – strong growth in renew-

ables crowding out coal.”

Additional highlights from the pub-

lication showed the share of gas in

primary energy continued to rise,

reaching a record high of 24.7 per cent,

as gas prices fell to multi-year lows.

Coal consumption fell by 6.2 EJ, or

4.2 per cent, led by declines in the US

(-2.1 EJ) and India (-1.1 EJ). OECD

coal consumption fell to its lowest

level in bp’s data series back to 1965.

China and Malaysia were notable ex-

ceptions, with consumption by 0.5 EJ

and 0.2 EJ, respectively.

Renewable energy (including biofu-

els but excluding hydro) rose by 9.7

per cent, slower than the 10-year aver-

age (13.4 per cent p.a.) but the absolute

increment in energy terms (2.9 EJ) was

similar to increases seen in 2017, 2018

and 2019.

Solar electricity rose by a record 1.3

EJ (20 per cent) but wind (1.5 EJ)

provided the largest contribution to

renewables growth. Solar capacity

expanded by 127 GW, while installed

wind capacity grew 111 GW – almost

double its previous highest annual

increase.

China was the largest contributor to

renewables growth (1.0 EJ), followed

by the US (0.4 EJ). Europe, as a region,

contributed 0.7 EJ to the rise.

The British government together with

energy regulator Ofgem, has published

its Smart Systems and Flexibility Plan

and Energy Digitalisation Strategy in

an effort to deliver on the commitments

made by the government in the Energy

White Paper. The plan updates the pre-

vious plan launched in 2017 and rep-

resents a signicant step forward on

the path to providing exibility for the

country’s energy network.

According to the government, full

deployment of smart systems and ex-

ibility in the energy sector could create

up to 24 000 UK jobs and boost exports

while enabling the UK to create a net

zero energy system by 2050.

Jonathan Brearley, Chief Executive

of Ofgem, commented: “This plan is

essential to hitting the UK’s net zero

climate goal while keeping energy bills

affordable for everyone. It requires a

revolution in how and when we use

electricity and will allow millions of

electric cars, smart appliances and

other new green technologies to digi-

tally connect to the energy system.”

The government also published a call

for evidence on the deployment of

technologies that allow electric vehi-

cles to export electricity from their

batteries back on to the grid or to homes

during times of higher demand. A

separate call for evidence will look at

enabling large-scale and long-duration

electricity storage so that availability

can be maintained during periods when

renewables generate less energy.

Two government consultations were

also launched on proposed reforms to

the energy system that will ensure

frameworks are in place to drive the

UK’s decarbonisation plans, while

minimising costs to consumers and

industry and maintaining resilience in

the system.

The Future System Operator consul-

tation is on proposals to create a new

energy system operator separate from

National Grid plc, with roles in both

the electricity and gas systems. Ac-

cording to the government, the chal-

lenges of meeting commitments to

tackle climate change are creating the

need for new technical roles and re-

sponsibilities in electricity and gas

systems

The other consultation assesses pro-

posals to reform the codes that govern

gas and electricity markets. This con-

sultation will ensure that governance

of the energy system is t for purpose

in a low-carbon future and builds on a

previous consultation from 2019.

Headline News

bp Statistical Review highlights “dramatic

bp Statistical Review highlights “dramatic

impact” of pandemic on energy markets

impact” of pandemic on energy markets

UK gets smart on delivering a exible energy network

UK gets smart on delivering a exible energy network

Continued fossil fuel support

Continued fossil fuel support

will put Paris goal beyond reach

will put Paris goal beyond reach

Whiteside: implementation

of the CBAM could be a

“logistical nightmare”

n G20 gives more than $3.3 trillion to fossil sector over four-year period

n Oil and gas companies to consume sector’s carbon budget by 2037

THE ENERGY INDUSTRY TIMES - AUGUST 2021

3

Our Clients:

Our Partners:

weber media solutions

YOUR CREATIVE MEDIA AGENCY FOR

DESIGN AND MARKETING SOLUTIONS

We are a creative media agency which provide a bespoke

service to meet your media and marketing requirements

DESIGN / VIDEO / WEB / EXHIBITION STAND DESIGN

MAGAZINES / PRINT MANAGEMENT / MAILING

For more information please contact:

Karl Weber / Director / T: +44 7734 942 385

E: karlweber@hotmail.co.uk

28-29 SEPTEMBER 2021

Formerly

Officially Supported by: In Partnership with:

Your gateway to the ASEAN power & energy market

Connecting businesses to energy

leaders from ASEAN Utilities & IPPs –

digitally!

e n l i t - a s i a . c o m / l i v e - e v e n t

Enlit Asia Enlit Asia Enlit Asia@Enlit_Asia

INTERNATIONAL CONFERENCE & EXHIBITION

20—21 OCTOBER, MOSCOW

ORGANISED BY:

WWW.HYDROGENRU.COM

JOIN US!

AMONG THE REGULAR PARTICIPANTS OF OUR EVENTS

200+

PARTICIPANTS

15+

INVESTMENT

PROJECTS

40+

SPEAKERS &

PANELLISTS

EU PVSEC 2021

online

THE ENERGY INDUSTRY TIMES - AUGUST 2021

9

Companies News

Both Chevron and Shell have an-

nounced alliances that will see the two

oil and gas majors speed their transition

to cleaner energy.

In the most recent tie-up, Chevron

U.S.A. Inc. and global power equip-

ment company Cummins Inc., an-

nounced a memorandum of under-

standing to explore a strategic alliance

to develop commercially viable busi-

ness opportunities in hydrogen and

other alternative energy sources.

The memorandum provides the

framework for Chevron and Cummins

to initially collaborate on four main

objectives: advancing public policy

that promotes hydrogen as a decarbon-

ising solution for transportation and

industry; building market demand for

commercial vehicles and industrial ap-

plications powered by hydrogen; de-

veloping infrastructure to support the

use of hydrogen for industry and fuel

cell vehicles; and exploring opportuni-

ties to leverage Cummins’ electrolys-

ers and fuel cell technologies at one or

more of Chevron’s domestic reneries.

“Chevron is committed to develop-

ing and delivering affordable, reliable,

ever-cleaner energy, and collaborating

with Cummins is a positive step toward

our goal of building a large-scale busi-

ness in a lower-carbon area that is

complementary to our current offer-

ings,” said Andy Walz, President of

Chevron’s Americas Fuels & Lubri-

cants. “Hydrogen is just one lower-

carbon solution we are investing in that

will position our customers to reduce

the carbon intensity of their businesses

and everyday lives. We’ve also in-

vested in developing and supplying

renewable natural gas, blending re-

newables into our fuels, co-processing

biofeedstocks in our reneries, and

abatement projects that will reduce the

carbon intensity of our operations.”

Amy Davis, Vice President and Pres-

ident of New Power at Cummins,

added: “The energy transition is hap-

pening, and we recognise the critical

role hydrogen will play in our energy

mix. We’ve deployed more than 2000

fuel cells and 600 electrolysers around

the world and are exploring other hy-

drogen alternatives including a hydro-

gen-fuelled internal combustion engine

as we continue to accelerate and har-

ness hydrogen’s powerful potential.”

Earlier in July, Dutch energy giant

Shell also moved to increase hydrogen

use, when Shell Gas & Power Develop-

ments B.V. and Uniper Hydrogen

GmbH signed a memorandum of un-

derstanding to explore accelerating the

development of a hydrogen economy

in Europe.

Under the MoU, the companies in-

tend to nd joint opportunities to

couple industrial and mobility demand

with hydrogen supply, production, and

storage.

Shell and Uniper will begin by as-

sessing the opportunity to develop

potential synergies to accelerate exist-

ing projects in Germany, the Nether-

lands, and potentially other European

countries. Taking a full value chain

approach, Shell and Uniper will work

backwards from customer demand to

identify key opportunities to develop

the foundation of a new hydrogen

economy in Europe.

Exploring future options including

the necessary infrastructure for large-

scale transport of hydrogen and CO

2

from the ports of Rotterdam and Wil-

helmshaven to North Rhine Westpha-

lia (NRW) – the industrial heartland

of Germany – will be at the centre of

the collaboration.

Among the projects considered will

be Shell’s Rheinland transformation

where Shell recently opened a 10 MW

PEM electrolyser, the largest of its kind

in Europe, and is working with partners

to expand the capacity to 100 MW.

Uniper will further explore the sup-

ply of hydrogen from the existing

Uniper production sites at Rotterdam

and Wilhelmshaven to the Shell En-

ergy and Chemicals Park Rheinland

locations at Wesseling and Godorf. In

addition, Uniper intends to connect its

power plant in Gelsenkirchen Schol-

ven as well as some large-scale cus-

tomers with its coastal hydrogen pro-

duction plants.

”Our mission is to connect Uniper’s

large-scale hydrogen projects – e.g. in

the Netherlands and in Northern Ger-

many – with industrial customers to

enable a decarbonisation of our econ-

omy,” said Dr. Axel Wietfeld, CEO,

Uniper Hydrogen.

Recent agreements signed by Rolls-

Royce in the UK and Doosan Heavy

Industries & Construction in the US

are demonstrating the growing belief

that small modular reactors (SMRs)

will play a signicant role in the future

of nuclear power.

In July Rolls-Royce and Cavendish

Nuclear signed a Memorandum of Un-

derstanding (MoU) to explore oppor-

tunities to deepen the relationship be-

tween the parties through cooperation

on the Rolls-Royce SMR programme.

Rolls-Royce is leading a consortium

that has been working on the design of

a SMR power station for the last two

years with support from the UK gov-

ernment through UK Research and

Innovation.

Under this latest agreement Rolls-

Royce and Cavendish Nuclear commit

to working together to develop the

roles that Cavendish Nuclear can per-

form in the design, licensing, manu-

facturing and delivery aspects of the

Rolls-Royce factory-fabricated SMR

power plant.

Commenting on the agreement, Tom

Samson, CEO of the Rolls-Royce

SMR Consortium, said: “Our SMR

programme has been designed to de-

liver clean affordable energy for all

and does so with a revolutionary new

approach aimed at commoditising

the delivery of nuclear power through

a factory build modularisation

programme.

“Cavendish Nuclear, and its parent

Babcock International Group, have

unique capabilities within the UK in-

dustry with their world-class manufac-

turing and modularisation capabilities

at their facilities at Rosyth, as well as

their wider nuclear skill set delivering

engineering and manufacturing solu-

tions across the new-build and decom-

missioning landscape.”

SMR power plants are also being

developed in the US. In a more recent

move South Korea’s power plant

builder Doosan Heavy Industries &

Construction Co. said it will invest

$60 million to expand its stake in US-

based SMR developer NuScale Pow-

er LLC.

Doosan Heavy already invested $44

million in the unlisted SMR devel-

oper in 2019, along with other local

investors, and signed a deal to provide

core parts to be used for the construc-

tion of SMRs.

The two companies also agreed to

join forces for the hydrogen and fresh-

water production business using

SMRs.

NuScale Power plans to provide its

SMRs to Utah Associated Municipal

Power Systems (UAMPS), a US elec-

tricity provider that has been pushing

ahead with a project to build a power

plant in Idaho, with 2029 eyed for

commercial operation.

Finnish companies Valmet and Neles

are to merge in a move aimed at

strengthening their position in the pro-

cess and energy industries.

The proposed combination will be

implemented as a statutory absorption

merger whereby Neles will be merged

into Valmet.

The combined company, which will

have combined net sales for 2020 of

approximately €4.3 billion and about

17 000 employees, says it stands to

benet from megatrends such as the

energy transition and increasing de-

mand for renewables.

Valmet President and CEO Pasi

Laine will continue to act as the Pres-

ident and CEO of the combined com-

pany after the completion of the

merger. Completion is expected to

occur on or about January 1, 2022,

subject to all conditions for comple-

tion being fullled.

n Valmet also recently completed the

acquisition of EWK Umwelttechnik

GmbH and ECP Group Oy following

the agreements originally announced

on June 10. EWK Umwelttechnik is

a German company manufacturing

and supplying air emission control

systems and after-installation ser-

vices. ECP Group is a manufacturer

and maintainer of electrostatic pre-

cipitators (ESPs), focusing on power

plants and pulp and paper industry, in

Finland.

Hitachi ABB Power Power Grids has

announced that it will be evolving to

become Hitachi Energy from October

2021, in a move that reects the rap-

idly evolving energy landscape.

The decision coincides with the busi-

ness’ rst-year anniversary since it

started operations on July 1, 2020. Hi-

tachi Ltd. has an 80.1 per-cent stake in

the joint venture and ABB Ltd. holds

the remainder.

Explaining the name change, Toshia-

ki Higashihara, Executive Chairman

and CEO of Hitachi, said: “With cli-

mate change and increasing natural

disasters, there is a need to solve three

social issues worldwide: environment,

resilience, and security and safety.” He

continued: “Hitachi ABB Power Grids

provides a variety of solutions that

solve these social issues, and by chang-

ing the company name to Hitachi En-

ergy, we are further strengthening our

commitment to the realisation of a

sustainable society.”

Claudio Facchin, CEO of Hitachi

ABB Power Grids, added: “The energy

landscape continues to evolve and so

do we.”

On changing its name, the company

says it will at the same time change its

corporate brand to the Hitachi brand.

The business formally registered Hita-

chi Energy Ltd. on June 30, 2021 and

is now undertaking the formal process

for the change of names globally.

The news came as the company an-

nounced that it was extending its

global base of engineering and service

centres through the opening of Col-

laborative Operations Centres (COC)

for grid automation solutions at key

regional centres around the world. In

addition, Hitachi ABB Power Grids

announced its new lifecycle manage-

ment programme, which enables cus-

tomers to map and track their installed

assets.

Hitachi ABB

Hitachi ABB

Power Grids is

Power Grids is

evolving

evolving

OEMs step-up

OEMs step-up

SMR involvement

SMR involvement

Valmet and Neles to merge

Oil and gas majors explore

hydrogen alliances

n Chevron signs MoU with Cummins n Shell and Uniper to grow hydrogen use across Europe

THE ENERGY INDUSTRY TIMES - AUGUST 2021

Special Technology Supplement

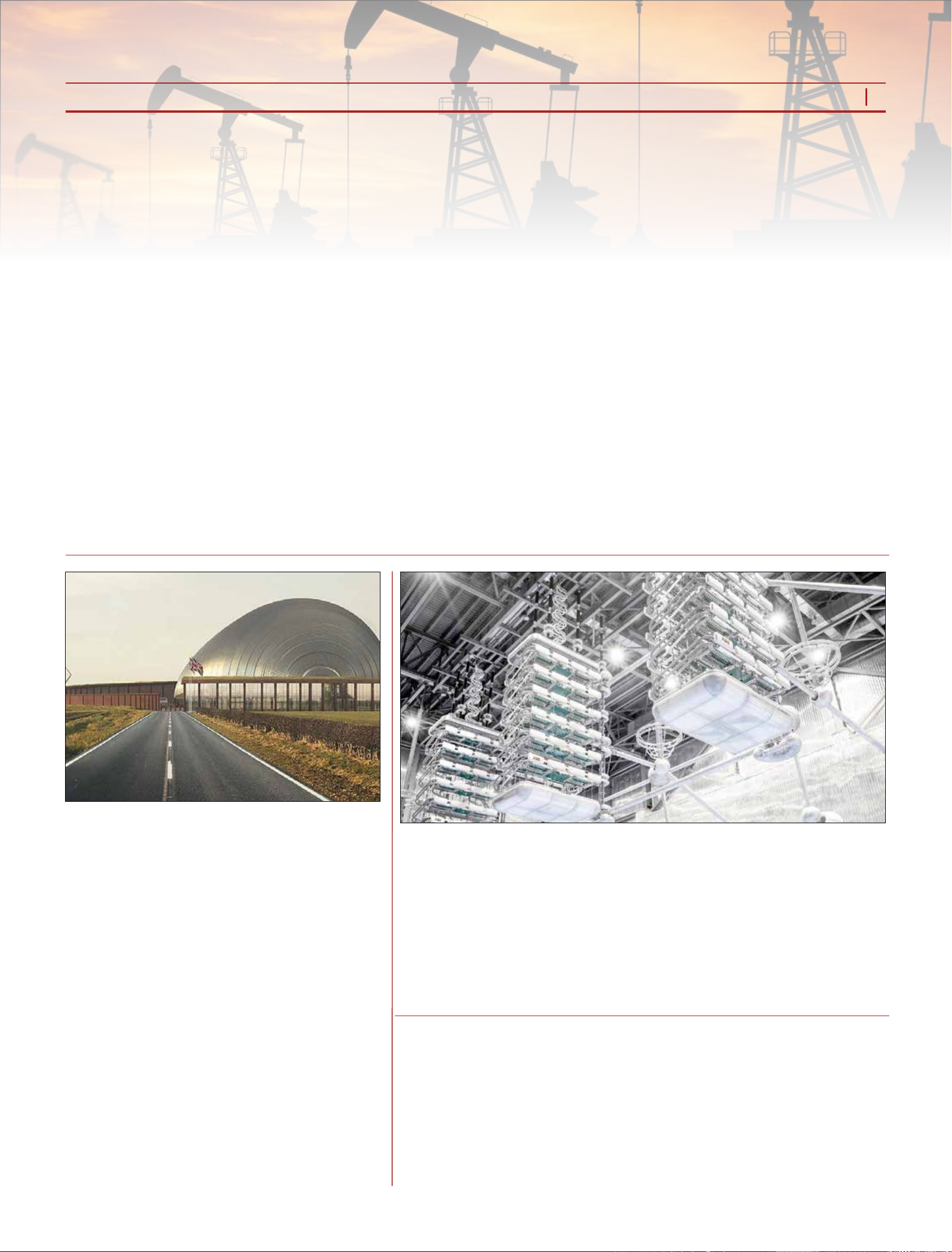

The need to speed

towards a resilient,

carbon-neutral future

The urgent need to make the transition towards a carbon-neutral energy future is becoming increasingly clear.

Hitachi ABB Power Grids’ Dr. Gerhard Salge, explains why this transition has to be done sustainably, and in a way that

improves system resilience. Junior Isles

storage, batteries and other energy

carriers for mid-term, and other carri-

ers like green hydrogen, for long-term

storage. Especially on long-term, or

so-called seasonal storage technolo-

gies, there is still a lot of research to

be done towards cost-effective and

energy efcient solutions.”

He stresses, however, that storage

and electrical interconnections need

to go hand-in-hand in order to opti-

mise system efciency with respect to

excess fuels and generation capacity,

while improving resilience. “We need

a different kind of thinking,” he said.

One element that needs to be re-in-

vented is how to drive energy system

resilience. And this is a key element

of the transition. The new power/en-

ergy landscape must not compromise

reliability and availability.

“We need to move towards a more

resilient power system,” said Dr. Sal-

ge. “There has to be a certain change

in philosophy in how to build and

operate a power system. In the past, a

power system was typically built to

be as robust as possible to avoid out-

ages by making things robust and in-

cluding safety buffers. But a resilient

system is one that is so exible it can

handle foreseen and unforeseen situa-

tions so that the impact on the end

customer is minimal.”

Handling unforeseen circumstances

such as the outages caused by extreme

weather in Texas, USA, a few months

ago, is a case in point. Designing re-

silience concepts for such events

C

limate change is one of the

greatest challenges of our time.

The rise in extreme weather

conditions such as the recent oods in

Europe and China, the blizzards and

heatwaves in the US, and the growing

frequency of hurricanes around the

world are all signs that the climate

emergency is clear and present.

With the urgency now obvious,

country and company strategies to

drive the energy transition in order to

achieve a carbon-neutral economy

are a top priority.

Last year’s formation of Hitachi

ABB Power Grids was a highly pub-

licised example of how companies

are positioning themselves to help

address the challenges facing the en-

ergy sector. Carbon-neutral energy

and sustainability are at the core of the

new company’s strategy and will

continue to be so as it prepares to

change its name to Hitachi Energy

from this October. As part of its re-

cently released Sustainability 2030

Strategy, the company is pioneering

digital and energy platforms, which

help its customers to overcome com-

plexity, increase efciency and ac-

celerate the shift towards a carbon-

neutral energy future.

Commenting on how he sees the

evolving energy sector and the role

his company will play in its transfor-

mation, Dr. Gerhard Salge, Chief

Technology Ofcer, Hitachi ABB

Power Grids, said: “With all the com-

mitments and pledges made by

countries and regions within the last

12 months, it’s clear that the urgency

is becoming much more prominent.

This is highlighted in the Interna-

tional Energy Agency’s ‘Net Zero by

2050’ report; there really is a need for

speed. The rst key milestone on the

way to 2050, is 2030 and there are

only about 3000 days to reach this

target. This is not that far off for infra-

structure build-up, so all efforts are

needed from everyone to accelerate

– and starting today.”

Dr. Salge reinforces Hitachi ABB

Power Grids’ perspective, “that elec-

tricity will be the backbone of the

entire energy system”. He emphasizes

that three key building blocks are

stacking up to deliver this carbon-

neutral electric future: connecting

larger volumes of wind, solar and

hydro to the grids; electrifying the

world’s transportation, buildings and

industry sectors; and where direct

electrication is either not efcient or

impossible, introducing complemen-

tary and sustainable energy carriers,

such as green hydrogen.

Basing the entire energy system as

much as possible on electricity gener-

ated from renewables not only mini-

mises carbon emissions, it also im-

proves the total energy efciency of

the energy system. Dr. Salge ex-

plained: “For example, when you go

from a solar panel or a wind turbine to

an electric vehicle, you have average

losses across the chain of about 30 per

cent. By comparison, there are about

80 per cent losses in going from an oil

source to a combustion engine.”

Increased electrication, however,

not only means largely increasing

power system capacity. It will also

require greater power system com-

plexity due to more complex in-feeds

from uctuating renewable sources,

as well as more complex consump-

tion patterns.

Renewables should be installed in

the best locations. For wind, this

means installing in regions that have

the best wind conditions; this some-

times means offshore or on land far

away from load centres. These wind

farms then have to be connected to the

load centres and to the existing grids.

It is a similar story for solar. It is also

important that all of these distributed

energy resources are aligned and

work together.

“Harvesting these renewables

means that we have to exibly ex-

change energy across time zones and

different climates, achieved electri-

cally by interconnection and also

through storage, which is another key

element – batteries for short-term

Battery energy storage is a key element for integrating renewables

Carbon-neutral energy and sustainability are at the core of the

Sustainability 2030 Strategy

“When you dream what’s possible

in the future, it’s not the technology

that is the limitation but more your

imagination,” said Dr. Salge.

Technologies such as articial intel-

ligence could, for example, enable

systems to become more autonomous.

Today, it is needed to make sense of

the ood of information coming from

sensors in the eld, but Dr. Salge says

it will go way beyond that, again

pointing out the need to drive exibil-

ity and resilience.

“In the background you will have

algorithms that are always running

and learning in order to simulate

‘what if?’ scenarios for what could

happen in the power system. They

will also enable the system to under-

stand what is happening and react by

automatically changing some set-

tings, for example. We call it adaptive

protection. It learns from a particular

fault situation. It may have been that

the system protection logic reacted in

a certain way to a storm but the re-

sponse was not optimised. AI would

see that, simulate a better response

and automatically change the protec-

tion schemes of the protection devices.

“Further in the future, it may be that

the system gives the operator propos-

als on what devices to invest in next

in order to be more exible and resil-

ient in the future. It’s identifying the

next step for improvement.”

Dr. Salge, stressed that such a sce-

nario requires the buy-in of stake-

holders across different technical

disciplines to collaborate and co-cre-

ate. “You need the customer to pro-

vide all the data for the learning cycle

of the AI and machine learning tech-

nologies. This has to be done in dif-

ferent congurations; so you have to

look at various networks across the

world, under different boundary con-

ditions and translate that from one

region to the other.”

Looking at the main technologies

the company will be working on over

the next years, Dr. Salge summarises

the focus areas with three keywords:

sustainability, digitalisation and

power electronics.

“It’s about providing exibility by

means of products, systems and solu-

tions which are optimised to enable

sustainable systems,” said Dr. Salge.

“When looking at power electronics,

it’s about having exible, energy ef-

cient converters across all the power

ranges. You need them at small scale

to e.g. integrate battery storage. You

need lter functionality at low and

medium voltage to ensure power

quality. We need to be able to up-

grade the large, older HVDC con-

verters, which are typically based on

thyristor technology, with today’s

IGBTs [insulated-gate bipolar tran-

sistors] or our BIGTs [bi-mode insu-

lated-gate bipolar transistors]. Ex-

panding and upgrading these large

congurations and substations will

allow more power transmission and

greater exibility. And behind that

are the control systems, which would

then be based on the most modern

software architectures.”

He notes that there is already a

global move away from large, mono-

lithic software blocks to more exi-

ble software architectures based on

micro-services and related technolo-

gies. Explaining the trend Dr. Salge

noted: “Here you ‘exibilize’ and

standardise the interfaces in the

software modules, and then you

build large software solutions out of

many of those connected and inter-

acting modules. This can for example

bring technologies such as machine

learning and articial intelligence

into the system in a exible way; as

well as to ensure cyber-secure

might include connecting to more

systems so energy can be imported

from across longer distances and time

zones.

Dr. Salge adds that whatever equip-

ment is installed, it should be the most

modern and most exible. “You have

to think differently when creating a

new system or adding new equipment

to an existing one, so you get the ex-

ibility that creates resilience in the

total system.

“If for example, you install a num-

ber of houses with electrical heating

on a long unidirectional feeder, you

are creating a critical situation for this

feeder. Here the resilience strategy

would not just mean installing a

larger overhead line or cable into that

feeder, or even a second one into the

same route. It might be that you

change to e.g. exible ring structures

where you can alternatively feed

those houses from another geographi-

cal site. Another option is to insert

controllable DC connections in be-

tween AC-feeders or ring structures

to optimize the energy ows. This

means you can feed from another di-

rection if something happens to a

portion of that supply of the feed. This

creates more redundancy and back-up

options.”

Efcient load management should

also be part of the resilience equa-

tion, as there may be situations

where spare generating capacity is

not available.

Dr. Salge explained: “Here a utility

could switch specic loads on and off

exibly in a way that does not affect

the customers required functionality.

For example, if customers use elec-

tricity for heating water, they don’t

need permanent access to electricity

for that application; it’s good enough

if they do that every few hours. If

utilities have more information on

their loads, they can have a exible

demand response so the impact [on

their customers] is minimised and

you therefore have more degrees of

freedom for a very resilient system. In

the future it might be that a utility

could use the energy from a fully

charged EV in an extreme thunder-

storm, for example, and then charge

the EV the next day.”

This is all possible if a system is

resilient enough and smart enough to

consider and factor in these degrees

of freedom.

Notably, much can be done with

today’s infrastructure by, for exam-

ple, introducing intelligence, storage

and new types of upgraded network

devices.

Hitachi ABB Power Grids says it is

therefore building much more intelli-

gent, exible systems that are safer

and more secure – also in terms of

cyber security. This is being achieved

through a combination of digitalisa-

tion and power electronics.

“With a lot of projects being brown-

eld, it’s often about embedding new

DC and HVDC technology into exist-

ing AC grids and controlling it digi-

tally,” said Dr. Salge. “For example

HVDC interconnectors can provide

really exible energy exchange across

short, mid and long distances – up to

a world record of more than 3000 km

and 12 GW.

“At the same time HVDC technol-

ogy can also improve power quality,

which is needed in grids that have less

inertia. Converters can provide syn-

thetic inertia. Or you can provide real

inertia when you connect, for exam-

ple, synchronous generators next to

the power electronic valves. You

could also put storage next to the

converters to inject energy into the

system. In our HVDC valve controls,

there’s also the option to have black-

start capabilities.”

While driving resilience is key, Dr.

Salge also stresses the importance of

making equipment sustainable with

low environmental impact. This is a

central part of the Sustainability 2030

strategy. “We have looked at the total

lifecycle, and re-use of materials,” he

said.

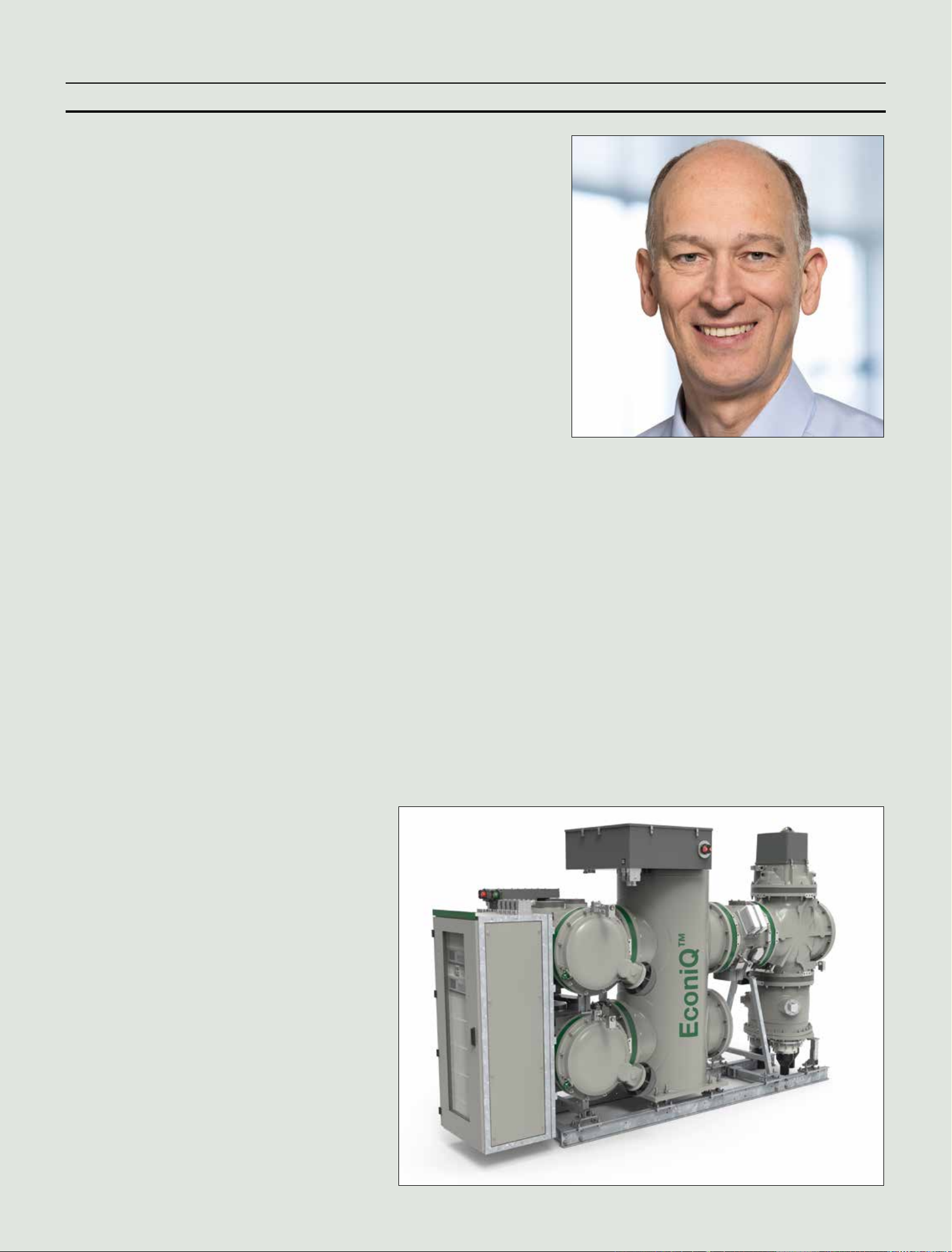

Notably, in April Hitachi ABB

Power Grids launched EconiQ™ – its

eco-efcient portfolio of products,

services and solutions which are sus-

tainability-oriented in design to de-

liver superior environmental perfor-

mance compared to conventional

solutions.

It kicked off with a new range of

high voltage switchgear, which uses a

uoronitrile-based gas mixture in

place of sulphur hexauoride (SF

6

) –

state of the art today but with a very

high global warming potential if re-

leased – as insulation and current in-

terruption medium, optimising the

total switchgear on its total life-cycle

impact.

This focus on reducing environ-

mental impact while increasing sus-

tainability is now embedded in every-

thing the company does. “We have

also launched a range of semiconduc-

tors that are enabling signicantly

lower losses in HVDC valves,” said

Dr. Salge. “Together with the intro-

duction of renewables, this all con-

tributes to a system that is overall

more sustainable.”

In fact the move to a more sustain-

able, interconnected energy system,

where electricity will be the back-

bone, is seen as the reasoning behind

the adoption of the new company

name.

Dr. Salge explained: “The power

system is expanding its role in the

total energy system. We also see new

digital capabilities, with improved

control through machine learning,

articial intelligence, prognostics and

predictive maintenance; sector cou-

pling with the gas networks; energy

trading and forecasting; etc. It’s about

taking a more holistic view of the

energy system. The logical conse-

quence of this is that we are no longer

just thinking ‘Power Grids’ but also

beyond; so we are now making it

clear in our name. That’s why we are

becoming Hitachi Energy.”

Becoming part of the Hitachi com-

pany brings signicant opportunities.

In January Hitachi ABB Power Grids

and Hitachi Vantara announced the

integration of Hitachi ABB Power

Grids’ Digital Enterprise solutions

within the Lumada portfolio of ad-

vanced digital solutions and services

for turning data into insights. This

saw the launch of the Lumada Asset

Performance Management, Lumada

Enterprise Asset Management and

Lumada Field Service Management

solutions.

“We are already leveraging the one

year of experience, i.e. the excellent

know-how and competence of Hita-

chi, in the IT space,” said Dr. Salge.

“The Hitachi Lumada platform has,

for many years, been among the top

IoT platforms in the Gartner Magic

Quadrant. That complements our

competence when it comes to OT

[operational technology], compo-

nents, and our large installed base. We

are now able to combine our compe-

tence across all technologies within

the energy domain, from the physical

component via the OT to the world-

class IoT/IT competence of Hitachi in

order to offer something unique. Ap-

plying this competence scope in our

domain is really exciting.”

He notes that digitalisation is en-

abling companies to achieve much

more, providing deeper collaboration

with customers when planning, de-

signing, operating and maintaining

components and systems through the

use of technologies such as digital

twins and virtual reality. Such ad-

vances enable the evaluation of

equipment and systems that may not

even yet exist, for example; or for

personnel to be trained remotely

anywhere in the world.

Special Technology Supplement

THE ENERGY INDUSTRY TIMES - AUGUST 2021

The EconiQ 145 kV gas

insulated switchgear is

part of a new portfolio

designed to deliver superior

environmental performance

compared to conventional

solutions

Dr. Salge: a resilient system

is one that is so exible it

can handle foreseen and

unforeseen situations

THE ENERGY INDUSTRY TIMES - AUGUST 2021

through in power capacity and is seen

as a milestone in the potential capacity

of future grids to integrate massive

amounts of renewable power. “The

same technology will be extended to

offshore grids and possibly onshore

applications,” said Dr. Salge. “These

are the next steps that need to be done.

“There are also good discussions in

Europe for improving interoperability

between systems. It is not just about

achieving the highest power and volt-

ages, or the longest distances. It is

very important that we make short

connections between grids that are not

interconnected today.”

This is crucial for neighbouring

countries that might have grids operat-

ing at different frequencies or do not

want to fully synchronise their grids.

“Short back-to-back interconnections

could bring grid partners together to

start to develop their collaborations in

a step-wise approach,” said Dr. Salge.

“It is key that we start to do this as

much as possible and as quickly as

possible. Building such trustful col-

laborations is key for the energy tran-

sition to happen.”

Indeed, partnerships is one of the

four pillars of Hitachi ABB Power

communication.”

Existing HVDC technologies are

also expected to become more wide-

spread. For example, point-to-point

HVDC connections will evolve to

multi-terminal connections. “We

have done this in India but it is not

state-of-the-art, in so far as it’s not

used frequently. We can do it but it’s

not used everywhere,” said Dr. Salge.

“It should be done in many more

places.”

Overlaying DC grids is another

technology that is expected to gain

prominence. It has already been dem-

onstrated in China at the Zhangbei

project. The Zhangbei DC-grid de-

signed by State Grid Corporation of

China (SGCC), is the world’s rst

four-station meshed HVDC voltage

sourced converter grid, operating at

500 kV and up to 4500 MW. Hitachi

ABB Power Grids has supplied sev-

eral critical elements including an

HVDC Light valve, wall bushings,

transformer components, high-voltage

capacitors and power semiconductor

devices.

The system, set up to meet higher

demand during the Beijing 2022

Winter Olympics, represents a break-

Grid’s Sustainability 2030 Strategy.

Dr. Salge stresses that the urgency

needed in addressing the energy

transition is something that requires

action from all stakeholders – govern-

ments, regulators, investors, opera-

tors, etc.

Governments need to create the

right framework and incentives,

which are needed to attract invest-

ment and promote collaboration.

“You can see in regions of the world

such as Europe, that there is a good

level of trust between partners across

countries. Our recently installed in-

terconnector between Norway and

Germany is a good example of how

much these TSOs trust each other; it

goes far beyond nancial incentives.

It’s about setting the rules and build-

ing the trust,” said Dr. Salge.

Regulators have to build the exibil-

ity into the grid code requirements to

enable TSOs to work together, while

setting the boundary conditions to

also enable investors and operators to

work together.

“All of this would stimulate electri-

cation of the applications in the

various sectors and accelerate the

transition,” noted Dr. Salge. “But the

industries need to re-invent them-

selves as leaders of the energy transi-

tion; they need to look at their pro-

cesses – especially when they are

energy intensive – and re-invent

them so they electrify and also

change processes to eliminate the

carbon emissions.

“Oil and gas companies are also key

players, and are already starting to

convert. One of our partners, Equinor,

for example, is using its competence,

know-how and nancial power to go

offshore. We are working with them

to help make their transition happen

in their specic way – it’s not a one

size ts all approach. Each company,

country or region is different; indus-

tries are different.”

He summed up: “As the energy

system evolves, we are looking at

how we can contribute with our

scope, global reach and the value

proposition we can bring with our

technologies, to work with our part-

ners in building a sustainable, resilient

and affordable energy system. Being

able to anticipate future needs and

then contribute to social, environ-

mental and economic value creation

is something that makes me proud.”

HVDC Light valve of the type

for the world’s rst four-

station meshed HVDC voltage

sourced converter grid in

China

Case study of a 50 MW x 8

hour energy storage plant

showing levelised cost of

storage for liquid air versus

Li-ion.

Note: Plants allowed to fully

discharge each day and capture

$50/MWh energy price differential

Special Technology Supplement

TOWARDS A CARBON-NEUTRAL

ENERGY FUTURE.

Together with customers and partners, we are co-creating pioneering technologies that are

making energy systems more sustainable, resilient, safe and secure. We contribute innovative

solutions that are advancing societal progress towards a carbon-neutral energy future for all.

From this October we are evolving to become Hitachi Energy!

www.hitachiabb-powergrids.com

Gas deal will help Iraq meet summer

power demand

US DOE funds Hydrogen Energy

Earthshot projects

Gary Lakes

Soaring summer temperatures in Mes-

opotamia are again forcing the Iraqi

government to confront its serious lack

of power generation capacity, the direct

result of its failure to capture its associ-

ated gas production, which it normally

ares at a rate of 18 billion cubic metres

(bcm) annually – an amount second

only to Russia.

With work to harness ared gas ex-

pected to take years, for now the coun-

try is using what gas of its own that it

can direct to power stations and import-

ing gas from neighbouring Iran.

In its latest attempt to reduce aring,

the Iraqi government last month ap-

proved a deal with French company

Total, which has recently changed its

name to TotalEnergies, to capture and

process some 600 million cubic feet

per day from the Ratawi eld, which

would amount to around 7.7 bcm/year.

TotalEnergies will also begin work

on a seawater injection project de-

signed to pump water into the oil elds

of southern Iraq in order to boost pres-

sure and increase oil and gas produc-

tion. Iraq has a current capacity to

produce some 4.5 million b/d oil but

Baghdad is looking to increase this to

at least 6 million b/d in the coming

years. The French major will also pro-

ceed to build a 1000 MW solar power

plant. Details of the agreement were

not released.

Since the mid-2000s, following the

invasion of Iraq by US forces in 2003,

the Iraqi government and internation-

al partners have been planning to get

the country’s energy sector better or-

ganised and make it efcient. How-

ever, continual ghting with Al Qaeda

and Islamic State (ISIS), internal po-

litical disputes, differences over con-

tracts, money and budget problems

and a seemingly continuous state of

crisis has prevented Iraq from making

real advances in building energy

infrastructure that could make a dif-

ference. Flaring is a particular prob-

lem in that burning the gas contributes

to global warming and climate change,

it is also impacting the health of Iraq-

is living in the regions where gas is

ared.

The situation is further complicated

by acts of sabotage being carried out

by ISIS militants against power lines

and pylons.

Furthermore, Iraqis are forced to deal

with power shortages, leaving them to

cope with temperatures that can reach

50°C. Rioting in southern Iraq has

erupted in previous years when Iraqis

were left without power during sum-

mer temperature extremes.

In late June, the Basrah Gas Consor-

tium, comprised of Shell, Mitsubishi

and state-owned South Gas, announced

it would receive a loan of $360 million

from the World Bank’s International

Finance Corporation (IFC) that will be

used to harness gas that is normally

ared and channel it to a new gas-

processing station, the Basrah Natural

Gas Liquid Extraction Plant. BGC is

already gathering gas from the Ru-

maila, West Qurna1 and Zubair oil

elds and using it to produce some 3.4

GW of power. The rm also produces

about 80 per cent of the country’s liquid

petroleum gas (LPG).

The BGC project calls for gas pro-

cessing capacity to be increased by 40

per cent to 1.4 billion cubic feet per

day, around 14 bcm/year.

It is estimated that Iraq is consuming

around 12 bcm/year but supplies only

about 4.6 bcm/year of that. Real de-

mand is estimated at close to 16 bcm/

year.

Iraq is planning to reach 90 per cent

self-sufciency in natural gas produc-

tion by 2025. Recently the government

called for investment of $3 billion over

the next ve years and as much as $15

billion in investment may be needed to

reach self-sufciency. It hopes to end

aring by 2025.

Iraq is gradually turning to renew-

ables as a source of energy and re-

cently signed a deal with Abu Dhabi’s

state-owned Masdar for the develop-

ment of a solar generation facility that

will produce up to 2 GW of power from

locations in central and southern Iraq.

Currently Iraq depends on Iran to

supply it with the bulk of its gas re-

quirements, but in recent weeks Iran

has reduced the gas and electricity that

it is sending to Iraq because of a

drought and heightened demand from

Iranian consumers. Iraq continues to

be pressured by the US to reduce its

reliance on Iranian gas and power, as

Iran remains under strict sanctions

imposed by the US in late 2018. Iraq’s

nancial problems have stopped it

from paying Tehran billions of dollars

in areas for gas and electricity deliv-

ered over the last couple years. Still,

to maintain its inuence in Iraq, Iran

continues to supply.

Gary Lakes

The US Department of Energy last

month announced that it would pro-

vide $52.5 million in funding for 31

projects designed to advance next-

generation clean hydrogen technolo-

gies and support the DOE’s Hydrogen

Energy Earthshot initiative. The funds

are meant to reduce costs and acceler-

ate breakthroughs in the burgeoning

clean hydrogen sector.

“Part of our path to a net zero future

means investing in innovation to make

clean energy sources like hydrogen

more affordable and widely adopted so

we can reach our goal of net zero emis-

sions by 2050,” Secretary of Energy

Jennifer Granholm said in a statement.

“These projects will put us one step

closer to unlocking the scientic ad-

vancements needed to create a strong

domestic supply chain and good-pay-

ing jobs in the emerging clean hydro-

gen industry,” she said.

Several members of the Senate and

House of Representatives endorsed the

funding, $36 million of which will go

to the DOE’s Ofce of Energy Ef-

ciency and Renewable Energy (EERE)

and $16.5 million for the Ofce of Fos-

sil Energy and Carbon Management

(FECM). At EERE, 19 projects will

receive support, including those re-

searching electrolysis, clean hydrogen

production, fuel cell subsystems and

components, a domestic hydrogen sup-

ply chain, and analysis on cost and

performance of fuel cell systems, hy-

drogen production pathways, and hy-

drogen storage technologies. Funding

for FECM will test a number of techni-

cal systems and cover engineering

design for carbon capture, utilisation

and storage (CCUS) and the develop-

ment of a gas turbine combustion sys-

tem for 100 per cent hydrogen-red and

mixtures of hydrogen and natural gas.

But a much greater investment in

alternative energies is going to be

needed before the world will be able

to end its dependence on fossil fuels.

Up to $1 trillion will need to be in-

vested globally in renewable energy

systems if the world is to reach the

Paris Accord’s net zero targets by

2050, according to a Sustainable Re-

covery Plan proposed by the Interna-

tional Energy Agency (IEA).

Earlier this year, as the world health

and the global economy began to show

signs of improvement, the organisation

released its Global Roadmap to Net

Zero – its advisory on how the world

can reach net zero emissions by 2050.

That plan received criticism from those

immersed in the oil and gas industry,

due to its strident support for invest-

ment in renewables.

Economic improvement prompted

an increase in demand for oil and sub-

sequently a rise in oil prices, giving

Opec and its allies reason to believe

that the oil and gas industry will even-

tually return to its pre-Covid norm.

This they demonstrated with an agree-

ment to end production cuts beginning

in September 2022.

The economic pick-up has seen gov-

ernments boost spending to aid eco-

nomic recovery. But the IEA in late

July said not enough government

spending is going towards clean en-

ergy transitions.

Yet advances in the hydrogen sector

are reported every day and many pri-

vate companies clearly see it as a way

forward for sustainable energy.

For example, the global industrial gas

and engineering company Linde an-

nounced in mid-July that its fth liquid

hydrogen plant in the US had come into

operation in La Porte, Texas. It already

operates such facilities in California,

Indiana, Alabama and New York.

The liquefying plant will produce

more than 30 tons per day of hydrogen

to Linde’s customers. It receives hy-

drogen from Linde’s 600 km US Gulf

Coast pipeline, which has over 15 in-

dependent hydrogen production sourc-

es, giving it the most reliable feed sup-

ply of any hydrogen liqueer in the US

today.

The plant will purify and liquefy the

hydrogen before supplying it to end

markets including material handling,

mobility, aerospace, manufacturing,

metals, energy and electronics.

“This plant will not only boost the

reliability of our existing network but

will also make the supply chain more

efcient and increase our ability to

serve the rising demand from existing

and new customers, for both conven-

tional and clean hydrogen,” Jeff Barn-

hard, Vice President South Region,

said in a statement.

Meanwhile, the New York Power

Authority announced last month that it

would introduce a green hydrogen

demonstration project at its Brentwood

power plant on Long Island. The proj-

ect will begin construction in the au-

tumn and cost $8.5 million. It will re-

place up to 30 per cent of the power

produced by the gas red turbine op-

erating there since 2001. The green

hydrogen will be produced from a

hydroelectric plant in Canada.

In line with global targets, the State

of New York is implementing plans to

decarbonise its power sector, aiming to

cut carbon emissions 85 per cent below

1990 levels by 2050.

Hydrogen

Gas

Efforts to assist Iraq with harnessing its ared gas are being made by international companies and

institutions, but the job is expected to take several more years. With the summer peak power demand

looming, the country has therefore signed a deal with TotalEnergies to use gas from the Ratawi eld to

fuel its power stations.

n

Next-generation hydrogen projects to receive $52.5 million

n La Porte liquid hydrogen plant begins operation

THE ENERGY INDUSTRY TIMES - AUGUST 2021

Fuel Watch

12

P

owered by public demand and

government targets striving for

net zero, the rise of renewable

energy is irresistible. Nations around

the world are working towards ambi-

tious green energy targets and the

UK’s own objectives include gener-

ating enough wind energy to run ev-

ery home in the country by 2030,

just nine years away.

Of course, a driving factor behind

the rise of green energy is its rela-

tively new viability as the cost of

production steadily falls. As the sec-

tor grows, we must ensure the infra-

structure behind it not only keeps

pace, but also offers the support re-

quired while ensuring costs are kept

in check. In today’s interconnected

world, robust digital infrastructure is

critical.

Green energy providers obviously

need reliable network connections to

manage output and monitor demand.

But beyond this, the possibilities for

digital infrastructure and renewable

energy working together are huge.

For instance, sensors on wind tur-

bines and solar arrays can capture

performance data, informing energy

providers where best to position

them for the greatest returns. In the

future, 5G-connected drones and ro-

bots might be used not just to inspect

wind turbines, but also to repair

them. And the spread of internet of

things (IoT) technology will also

open up opportunities to conduct

more operations remotely.

As the renewables sector gains

more and more of the energy market

share, its reliance upon data centres

will also grow. Responsible for emit-

ting as much CO

2

as the commercial

airline industry, many data centres

are now making greater efforts to de-

carbonise. Therefore they’ll generate

a considerable amount of renewable

energy demand themselves, becom-

ing consumers as well as suppliers.

With the expansion of the sector,

intersections between digital infra-

structure and renewables will be-

come more common.

So what does the current landscape

look like? Right now, the energy sec-

tor is full of talk about the three Ds:

decarbonisation, digitisation and de-

centralisation.

There’s a very natural synergy be-

tween the digital infrastructure and

the renewable energy industries do-

ing the decarbonising. Both are reli-

ant upon emerging technologies be-

cause they’re both concerned with

improving upon the status quo and

shaping a different future.

Even so, some green energy com-

panies are more attuned to the im-

portance of sound digital infrastruc-

ture than others. In a 2019 ORE

Catapult survey, 94 per cent of re-

spondents (comprising wind farm

owners or operators, wind-related

consultancies and digital service pro-

viders) said the offshore wind indus-

try was not getting the most from

data and digital technologies.

By contrast, the Seagreen offshore

wind farm (due for completion in

2022/23) will be underpinned by an

advanced communications infrastruc-

ture and use data extensively. A wide

area network (WAN) will directly

connect engineers at its operations

centre with the supervisory control

and data acquisition (SCADA)

equipment required to manage the

distribution of power to the substa-

tion. The ow of data between sites

will maximise operational efciency

and provide vital insights into power,

temperature and energy patterns.

Once completed, Seagreen will be-

come Scotland’s largest offshore

wind farm, capable of producing

enough energy for 40 per cent of all

Scottish homes.

It’s just one example of the crucial

role now played by renewables in

the UK’s energy mix. The sector rep-

resented 45 per cent of power gener-

ation in the second quarter of 2020.

Remarkably, this gure stood at 35

per cent a year previously, meaning a

10 per cent gain of the energy mix in

just 12 months.

On mainland Europe too, there is

great emphasis on making the move

to renewables. Take the example of

the Clean Energy Transition sub-pro-

gramme, which has a budget of just

under €1 billion for the period 2021-

2027 and devotes signicant funds