www.teitimes.com

July 2021 • Volume 14 • No 5 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Special Supplement

Land of the rising sun

Following its spin-off, Siemens Energy is

transferring its cyber security processes to

the new organisation. TEI Times discusses

the process and the growing cyber threat

to the energy sector. Page 10

In the second of our ‘Climate

Countdown’ series focused on

Asia, Joseph Jacobelli explores

the challenges facing Japan’s

decarbonisation effort. Page 14

News In Brief

Energy investments set to

recover but still far from net

zero pathway

Global investment in energy is set

to rebound by nearly 10 per cent in

2021 but spending on clean energy

needs to accelerate to meet climate

goals.

Page 2

First federal offshore wind

project sparks boom in

potential projects

Following approval of the rst large

offshore wind project in federal

waters, the US has stepped up plans

for offshore wind projects to meet

plans to install 30 GW by 2030

Page 4

Indonesia raises new and

renewables target

Indonesia’s energy and mineral

resources ministry has raised

the country’s target to generate

electricity from new and renewable

energy from 30 per cent to 48 per

cent, which includes co-ring coal

with biomass.

Page 5

UK set to see fusion

demonstration plant by 2025

General Fusion, a Canadian rm

backed by Amazon founder Jeff

Bezos, will build a demonstration

nuclear fusion power plant at

Culham in the UK, it has been

announced.

Page 6

OEMs move to boost

electrolyser credentials

Interest in supplying electrolysers

is gaining interest, with original

equipment manufacturers (OEMs)

moving to improve their position in

the hydrogen market.

Page 8

Fuel Watch: Hydrogen

An EBH study reports a large

potential for European green

hydrogen production.

Page 12

Technology Focus: Driving

the green electron revolution

Grid enhancing technologies are

key to the success of the energy

transition. Smart Wires has

developed a Modular Power Flow

Control technology that allows

power to ow where there is spare

capacity, thus maximising the use of

the grid.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

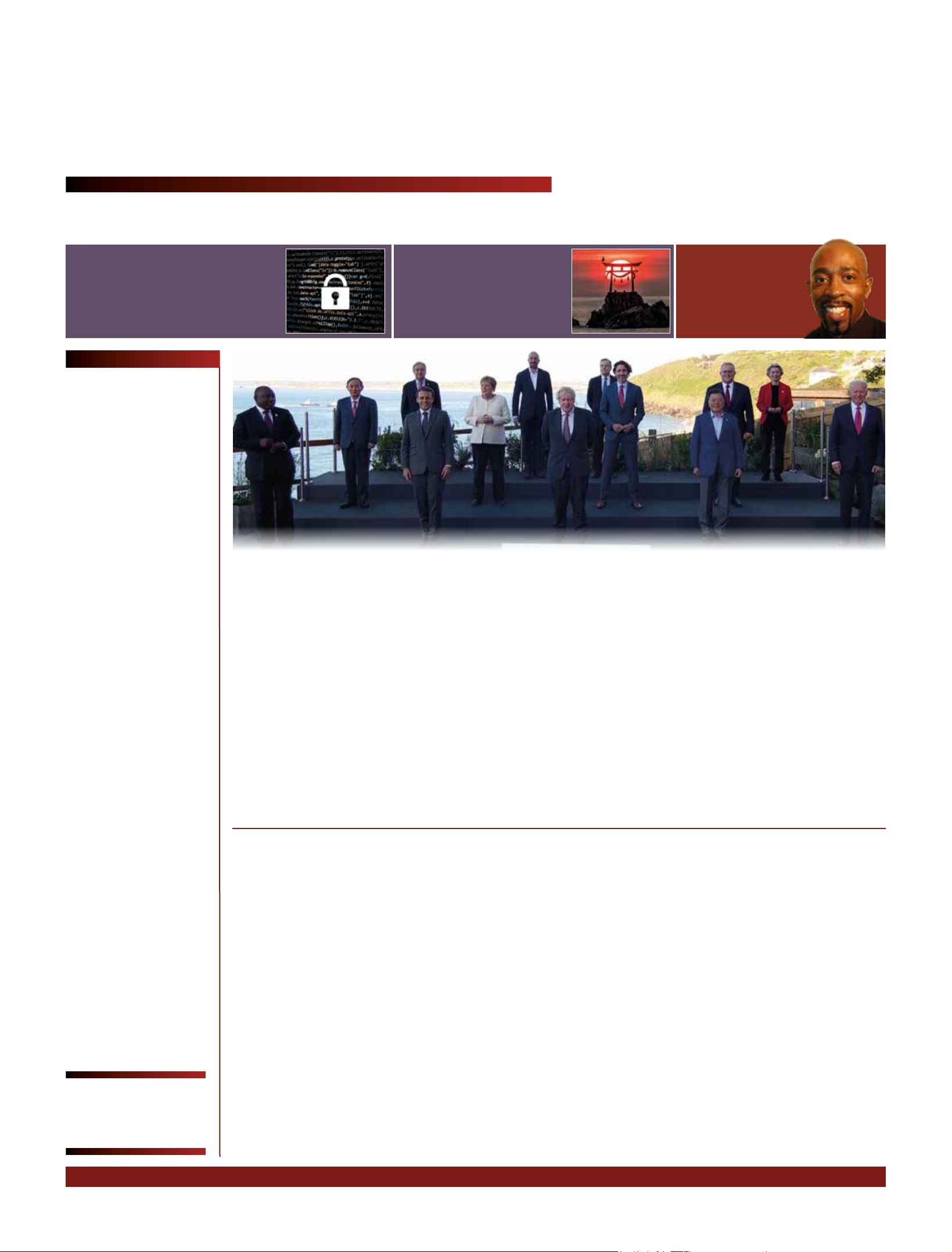

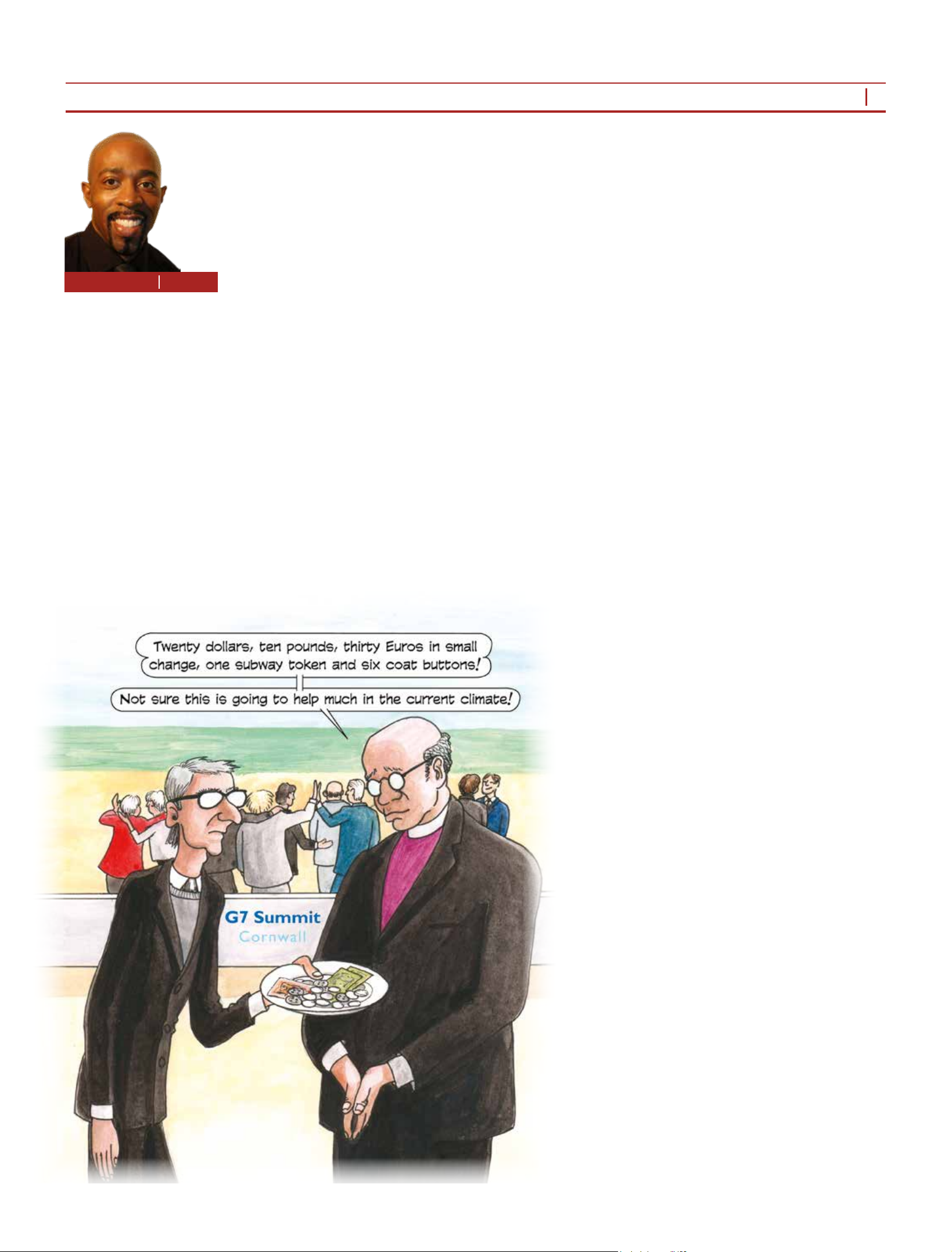

With climate nance potentially being a major stumbling block at the upcoming COP26

climate meeting, the G7’s failure to agree more ambitious concrete commitments to

help developing countries tackle the worst effects of climate change is seen as a missed

opportunity. Junior Isles

Time to invest in emerging economies, says IEA

THE ENERGY INDUSTRY

TIMES

Final Word

Junior Isles follows

The Pilgrim’s Progress

towards the G7 Summit.

Page 16

The recent agreement reached by the

G7 to “raise” contributions to help

developing countries address the cli-

mate crisis has been met with erce

criticism.

At a summit held in Cornwall, UK,

last month by the Group of Seven

wealthy countries, leaders from the

United States, Britain, Canada,

France, Germany, Italy and Japan re-

afrmed their commitment to “joint-

ly mobilise $100 billion per year

from public and private sources,

through to 2025”.

The communiqué said the seven na-

tions would “commit to each increase”

and improve “overall international

public climate nance contributions

for this period”. It also said the G7

would “call on other developed coun-

tries to join and enhance their contri-

butions to this effort”.

Green campaigners, however, were

unimpressed noting that the commu-

niqué issued at the end of the summit

lacked detail and the developed na-

tions should be more ambitious in

their nancial commitments.

Catherine Pettengell, Director at Cli-

mate Action Network, said the G7 had

failed to rise to the challenge of agree-

ing on concrete commitments on cli-

mate nance. “We had hoped that the

leaders of the world’s richest nations

would come away from this week

having put their money where their

mouth is,” she said.

The G7 agreement essentially just

reiterates an existing pledge. Devel-

oped countries agreed at the United

Nations in 2009 to achieve a com-

bined contribution of $100 billion

each year by 2020 in climate nance

to poorer countries, many of which

are faced with rising seas, storms and

droughts made worse by climate

change. That pledge was re-afrmed

in Paris in 2015, where rich nations

promised to extend the $100 billion a

year nancing by ve years through

to 2025.

The target, however, has not been

met, partly due to the coronavirus pan-

demic. According to OECD gures

climate nance provided and mobil-

ised by developed countries for cli-

mate action in developing countries

reached $78.9 billion in 2018 (the

most recent year covered by the data).

After the summit concluded, Canada

said it would double its climate -

nance pledge to C$5.3 billion ($4.4

billion) over the next ve years, while

Germany will increase its pledge by

€2 billion, to €6 billion ($7.26 billion)

a year by 2025 at the latest.

Professor Kevin Haines, Director of

Sustainable Capital PLC, a UK-based

issuer which offers green and sustain-

able bonds, said: “If we are to succeed

Continued on Page 2

The world’s energy and climate future

increasingly hinges on whether emerg-

ing and developing economies are able

to transition to cleaner energy systems,

calling for a step-change in global ef-

forts to mobilise and channel the huge

surge in investment that is required,

says a new report by the International

Energy Agency (IEA).

Annual clean energy investment in

emerging and developing economies

needs to increase by more than seven

times – from less than $150 billion

last year to over $1 trillion by 2030

to put the world on track to reach net-

zero emissions by 2050, according to

the report, ‘Financing Clean Energy

Transitions in Emerging and Devel-

oping Economies’. Unless much

stronger action is taken, energy-re-

lated carbon dioxide emissions from

these economies – which are mostly

in Asia, Africa and Latin America –

are set to grow by 5 billion tonnes

over the next two decades.

“In many emerging and developing

economies, emissions are heading up-

wards while clean energy investments

are faltering, creating a dangerous

fault line in global efforts to reach

climate and sustainable energy

goals,’’ said Dr Fatih Birol, the IEA

Executive Director. “Countries are

not starting on this journey from the

same place – many do not have ac-

cess to the funds they need to rapidly

transition to a healthier and more

prosperous energy future.

“There is no shortage of money

worldwide, but it is not nding its way

to the countries, sectors and projects

where it is most needed. Governments

need to give international public -

nance institutions a strong strategic

mandate to nance clean energy tran-

sitions in the developing world.”

Recent trends in clean energy

spending point to a widening gap be-

tween advanced economies and the

developing world even though emis-

sions reductions are far more cost-ef-

fective in the latter. Emerging and

developing economies currently ac-

count for two-thirds of the world’s

population, but only one-fth of glob-

al investment in clean energy, and

one-tenth of global nancial wealth.

Annual investments across all parts of

the energy sector in emerging and de-

veloping markets have fallen by

around 20 per cent since 2016, and

they face debt and equity costs that are

up to seven times higher than in the

United States or Europe.

Avoiding one tonne of CO

2

emis-

sions in emerging and developing

economies costs about half as much

on average as in advanced econo-

mies, according to the report. That is

partly because developing econo-

mies can often jump straight to

cleaner and more efcient technolo-

gies without having to phase-out or

ret polluting energy projects that

are already underway.

“A major catalyst is needed to make

the 2020s the decade of transforma-

tive clean energy investment,” said Dr

Birol. “The international system lacks

a clear and unied focus on nancing

emissions reductions and clean ener-

gy – particularly in emerging and de-

veloping economies. Today’s strate-

gies, capabilities and funding levels

are well short of where they need to

be.”

The special report, which was car-

ried out in collaboration with the

World Bank and the World Econom-

ic Forum, sets out a series of priority

actions to enable emerging and de-

veloping countries to overcome the

major hurdles they face in attracting

the nancing that is needed to build

the clean, modern and resilient ener-

gy systems that can power their

growing economies for decades to

come.

These priority actions – for gov-

ernments, nancial institutions, in-

vestors and companies – cover the

period between now and 2030, draw-

ing on detailed analysis of successful

projects and initiatives across clean

power, efciency and electrication,

as well as transitions for fuels and

emissions-intensive sectors. These

include almost 50 real-world case

studies spanning across different

sectors in countries ranging from

Brazil to Indonesia, and from Sene-

gal to Bangladesh.

Finance tops climate agenda but

Finance tops climate agenda but

G7 falling short

G7 falling short

THE ENERGY INDUSTRY TIMES - JULY 2021

2

Junior Isles

Global investment in energy is set to

rebound by nearly 10 per cent in 2021

to $1.9 trillion, reversing most of last

year’s drop caused by the Covid-19

pandemic, but spending on clean en-

ergy transitions needs to accelerate

much more rapidly to meet climate

goals, according to a recent report

from the International Energy Agency

(IEA).

With energy investment returning to

pre-crisis levels, its composition is

continuing to shift towards electricity:

2021 is on course to be the sixth year

in a row that investment in the power

sector exceeds that in traditional oil and

gas supply, according to the ‘World

Energy Investment 2021’ report.

Global power sector investment is set

to increase by around 5 per cent in 2021

to more than $820 billion, its highest

ever level, after staying at in 2020.

Renewables are dominating invest-

ment in new power generation capac-

ity and are expected to account for 70

per cent of the total this year. And that

money now goes further than ever in

nancing clean electricity, with a dollar

spent on solar PV deployment today

resulting in four times more electricity

than ten years ago, thanks to greatly

improved technology and falling costs.

“The rebound in energy investment

is a welcome sign, and I’m encouraged

to see more of it owing towards re-

newables,” said Fatih Birol, the IEA’s

Executive Director. “But much greater

resources have to be mobilised and

directed to clean energy technologies

to put the world on track to reach net-

zero emissions by 2050. Based on our

new Net Zero Roadmap, clean energy

investment will need to triple by 2030.”

While renewables dominate new

power investment, and approvals for

coal red plants are some 80 per cent

below where they were ve years ago,

coal is not out of the picture. There

was even a slight increase in go-

aheads for coal red plants in 2020,

driven by China and some other Asian

economies.

There are signs in the latest data that

spending by some global oil and gas

companies is starting to diversify. IEA

analysis last year highlighted that only

around 1 per cent of capital spending

by the industry was going to clean en-

ergy investments. But project tracking

to date in 2021 suggests that this could

rise to 4 per cent this year for the in-

dustry as a whole, and well above 10

per cent for some of the leading Euro-

pean companies.

The anticipated $750 billion to be

spent on clean energy technologies and

efciency in 2021 is encouraging but

remains far below what the IEA says

is required to put the energy system on

a sustainable path. Clean energy in-

vestment would need to triple in the

2020s to put the world on track to reach

net zero emissions by 2050, thereby

keeping the door open for a 1.5 °C sta-

bilisation of the rise in global tem-

peratures, said the Paris-based agency.

Just ahead of the G7 Summit last

month, 57 investors managing more

than $41 trillion in assets released a

joint statement to all world govern-

ments urging a global race-to-the-top

on climate policy and warning that lag-

gards will miss out on trillions of dol-

lars in investment if they aim too low

and move too slow.

This represents the largest collective

assets under management to sign a

global investor statement to govern-

ments on climate change since the rst

statement in 2009.

in keeping temperatures below the

agreed target of 1.5°C above pre-

industrial levels, we must mas-

sively accelerate investment in

clean and renewable energy proj-

ects, particularly in developing

countries.”

Leaders from developing coun-

tries also voiced concern over the

outcome of the G7 summit. Malik

Amin Aslam, Climate Minister of

Pakistan, said: “The G7 announce-

ment on climate nance is really

peanuts in the face of an existential

catastrophe. It really comes as a

huge disappointment for impacted

and vulnerable countries like Paki-

stan – already compelled to ramp

up their climate expenditures to

cope with forced adaptation needs.”

He also warned of the impact on

the COP26 talks scheduled for No-

vember. “At the least, countries

responsible for this inescapable

crisis need to live up to their stated

commitments, otherwise the up-

coming climate negotiations could

well become an exercise in futility,”

he said.

While some said it was encourag-

ing that leaders were recognising

the importance of climate change,

they argued it was not enough.

Pettengell said that their “words

had to be backed up by specic ac-

tion” on cutting subsidies for fossil

fuel development and ending in-

vestment in projects such as new

oil and gas elds, as well as on

climate nance.

At the summit, European Com-

mission President Ursula von der

Leyen said the G7 leaders had

agreed to phase-out coal. The G7

said it will end the funding of new

coal generation in developing coun-

tries and offer up to £2 billion ($2.8

billion) to stop using the fuel. But

despite committing to an end to -

nancing coal overseas, and phasing

out fossil fuel subsidies by 2025, the

group stopped short of calling a halt

to the exploitation of new fossil fuel

resources.

“We have committed to rapidly

scale-up technologies and policies

that further accelerate the transition

away from unabated coal capacity,

consistent with our 2030 NDCs

[Nationally Determined Contribu-

tions] and net zero commitment,”

stated the communiqué.

Laurie van der Burg, senior cam-

paigner at the pressure group Oil

Change International, said: “The

G7 has failed to commit to what

leading economists, energy ana-

lysts, and global civil society have

shown is required: an end to public

nance for all fossil fuels. Our cli-

mate cannot afford further delay,

and the failure of the G7 to heed

these demands means more people

impacted by the ravages of our cli-

mate chaos.”

Continued from Page 1

Green infrastructure developer Ceru-

lean Winds has revealed an ambitious

plan to accelerate decarbonisation of

oil and gas assets through an inte-

grated oating wind turbine and hy-

drogen development that would shift

the dial on emissions targets and cre-

ate signicant jobs.

The £10 billion proposed green in-

frastructure plan would have the ca-

pacity to abate 20 million tonnes of

CO

2

through simultaneous North Sea

projects West of Shetland and in the

Central North Sea.

The venture is now calling on UK

and Scottish governments to make an

“exceptional” case to deliver an

“extraordinary” outcome for the

economy and the environment. A for-

mal request for seabed leases has been

submitted to Marine Scotland.

The proposed development involves

over 200 of the largest oating tur-

bines at sites West of Shetland and in

the Central North Sea with 3 GW,

feeding power to the offshore facili-

ties and an excess of up to 1.5 GW to

onshore green hydrogen plants.

Cerulean says the project will need

no subsidies or contract for difference

(CfD) and will provide green power

to offshore platforms at a price below

current gas turbine generation.

The company says it has carried out

the necessary infrastructure planning

for the required level of project read-

iness and aims to achieve nancial

close in the rst quarter of 2022. Con-

struction would start shortly after-

wards and operation could begin in

2024.

Such projects could be crucial to the

oil and gas sector. Speaking ahead of

a debate in Holyrood, Scotland, in

June OGUK, the leading representa-

tive body for the UK’s offshore oil and

gas industry, said that there is a clear

plan for the future of oil and gas.

Commenting on the the North Sea

Transition Deal, announced in March,

OGUK said it recognises the climate

crisis as a priority and “provides a clear

plan for the industry” as it works to

transform the UK’s energy system. It

said the deal sets out key milestones

for the oil and gas industry to cut its

emissions by 10 per cent by 2025, 25

per cent by 2027 before 50 per cent by

2030 while producing the “healthy,

domestic oil and gas the UK will need

with ever reducing emissions”.

OGUK External Relations Director

Jenny Stanning said: “The North Sea

Transition Deal was recognised by

many parties during the election cam-

paign and provides a clear plan for the

transformation of our energy, resourc-

es, people and skills.”

A tax on fossil carbon is more effective

for a carbon border adjustment mech-

anism (CBAM) than a tax on CO

2

emis-

sions, say experts from Germany’s

nova-Institute GmbH.

According to a recent paper from the

institute, a tax on fossil carbon is “an

effective and elegant tool” to achieve

the goals of the CBAM, noting that it

is in line with the ambitious climate

goals of the EU and supports both the

decarbonisation of the energy sector as

well as the transformation of the chem-

icals and derived materials sector from

fossil to renewable carbon.

With the introduction of the Euro-

pean Green Deal in 2019, the Euro-

pean Union committed to achieving

climate neutrality by 2050. As a step

towards this goal, the rst European

Climate Law – agreed in April 2021

– strengthened the emission reduction

targets. In 2030, emissions are to be

at least 55 per cent lower than in 1990.

There has been growing support for

a CBAM to create a level playing eld

for competitors producing goods in

countries that have set their sights

lower than the European Union and

importing into the internal European

market. In other words, goods pro-

duced outside the EU would have to

bear the same costs for carbon emis-

sions as those produced in Europe.

The most frequently suggested op-

tion is to tax imported goods according

to the greenhouse gases emitted during

their production, most often referred

to as a CO

2

tax.

In the new nova-Paper #15, experts

argue that a tax on fossil carbon at the

feedstock level (called a “fossil carbon

tax”) provides several advantages over

a CO

2

tax as an end-of-pipe measure.

Carbon enters the economic cycle

through the use of coal, oil and natural

gas and is usually emitted as CO

2

(after

incineration) but can also be released

into the atmosphere in other forms, e.g.

CH

4

(methane).

“With levying a price on fossil car-

bon, the cause of global warming could

be priced elegantly, fairly, and univer-

sally,” said the paper.

The idea follows discussions on the

topic at the G7 Summit hosted in June

by British Prime Minister Boris John-

son. At the meeting the G7 pledged to

work together to tackle so-called car-

bon leakage – the risk that tough cli-

mate policies could cause companies

to relocate to regions where they can

continue to pollute cheaply.

In May, Johnson came under pressure

from senior members of his Conserva-

tive party to introduce a UK carbon

border tax to protect British industry

from cheap competition from polluting

countries.

Chancellor Rishi Sunak has ordered

work to be done on the tax, which Trea-

sury insiders said would address “real

issues”. They told the FT that Sunak

was interested in the proposal, but ad-

mitted that there were serious technical

hurdles to be overcome.

Headline News

Floating wind and hydrogen could

Floating wind and hydrogen could

decarbonise North Sea oil and gas

decarbonise North Sea oil and gas

Study suggests tax on fossil carbon more effective than CO

Study suggests tax on fossil carbon more effective than CO

2

2

tax

tax

Energy investments set to

Energy investments set to

recover but still far from

recover but still far from

net zero pathway

net zero pathway

Aslam called the G7 climate

nance “peanuts”

n Energy investment to hit $1.9 trillion

n Power sector spending set to grow 5 per cent

THE ENERGY INDUSTRY TIMES - JULY 2021

3

The 26th International Conference and Exhibition on

Electricity Distribution

Join the electricity distribution community for three days of

technical presentations and discussions covering the very

latest challenges facing the industry today and in the future.

IET = The Institution of Engineering and Technology. IET Services Limited is registered in England. Registered Oce: The Institution of Engineering and Technology, Savoy Place, London WC2R 0BL, United Kingdom.

Registration Number 909719. IET Services Limited is trading as a subsidiary of The Institution of Engineering and Technology, which is registered as a Charity in England and Wales (No. 211014) and Scotland (No. SC03869).

cired2021.org

20-23 September 2021 | Online

www.teitimes.com

THE ENERGY INDUSTRY

TIMES

subscribe today

The Energy Industry Times is the only publication that

covers global news related to the power and energy sector

in a newspaper style and format whose

uniqueness is recognised by our readers.

As a paid subsciber you will gain full access

to our online news desk.

You will also no longer have to wait for the printed edition;

receive it by PDF “hot off the press” or download it online.

To subscribe, email subscriptions@teitimes.com or visit

www.teitimes.com

To guarantee receiving your

monthly copy of the award

winning newspaper, you need to

subscribe today

GTW full page.indd 1 17/11/16 12:22:16

enquiry@africaninfex.com | +27 (0) 81 777 0028

www.africaninfex.com

• Industry overview

• Unbundling the electricity act

• Access to funding and project finance

• Government grants and subsidies

• Licence distribution, tariffs and distributor registration

• Mitigating and managing operational and technical risks

• Technology advances in the industry

• Project showcase session

TANZANIA

RENEWABLE ENERGY

Bringing together the various role players and stakeholders in the

Renewable Energy industry in Tanzania to discuss and brainstorm

the latest developments, strategies, legislation, challenges and

opportunities facing this expanding industry.

3 AUGUST 2021 // DAR ES SALAAM // ONLINE OPTION

AGENDA AT A GLANCE:

Junior Isles

Interest in supplying electrolysers is

gaining traction, with original equip-

ment manufacturers (OEMs) recently

making moves to improve their posi-

tion in the hydrogen market.

Last month MAN Energy Solutions

announced that it is increasing its

share in H-TEC Systems to almost 99

per cent. The acquisition of the shares,

which will remain held in free oat,

has been agreed.

MAN Energy Solutions already

gained a 40 per cent stake in the com-

pany in 2019. The now completed

acquisition of the shares from the pre-

vious majority shareholder, GP

JOULE, was already agreed in the past

year. The parties have agreed not to

disclose the price of the acquisition.

The now complete transaction was,

until now, subject to approval by the

competition authorities.

GP JOULE, the Schleswig-Hol-

stein-based group, which operates in

the renewable energies sector, ac-

quired H-TEC Systems in 2010.

With the acquisition, MAN Energy

Solutions is completing its range

across the hydrogen value chain and

will now drive the industrialisation of

electrolysis forwards with H-TEC.

“Today, H-TEC Systems offers elec-

trolysers in the megawatt range,” said

Dr. Uwe Lauber, Chief Executive Of-

cer at MAN Energy Solutions. “The

objective now is to prepare the com-

pany for serial production because

green hydrogen is going to become a

mass market.”

H-TEC Systems was founded in

1997 and has over 20 years of experi-

ence in hydrogen development and

research. The specialists in locations

such as Bavaria and Schleswig-Hol-

stein produce stacks and megawatt

electrolysers based on the polymer-

electrolyte membrane process (PEM)

to cover the hydrogen demand for

industry as well as for energy reners.

MAN Energy Solutions is also a

forerunner in Power-to-X technology,

which enables green hydrogen to be

converted into climate-neutral fuels.

The announcement follows news

that Haldor Topsoe, a Danish supplier

of catalysts and proprietary technolo-

gies, has established a focused green

hydrogen organisation to accelerate

its electrolysis business.

Haldor Topsoe has appointed clean-

tech entrepreneur Chokri Mousaoui as

head of the new organisation.

The new green hydrogen organisa-

tion aims to accelerate all aspects of

Haldor Topsoe’s business within elec-

trolysis, including development of

high-performance electrolysis tech-

nology, sales, and partnerships.

Haldor Topsoe announced in March

2021 that it will build a large-scale

SOEC (solid oxide electrolysis cells)

electrolyser manufacturing facility to

meet customer needs for green hydro-

gen production. The manufacturing

facility is scheduled to be operational

in 2023, and will produce electrolysis

stacks with a capacity of 500 MW per

year, expandable to 5 GW.

Siemens Energy and Mitsubishi Elec-

tric have become the latest companies

to cooperate on eliminating the use of

sulphur hexauoride (SF

6

) in gas insu-

lated switchgear.

In June the two industrial giants

signed a Memorandum of Understand-

ing (MoU) to conduct a feasibility

study on the joint development of high-

voltage switching solutions with zero

global warming potential (GWP).

Both companies will research meth-

ods for scaling up the application of

clean gas insulation technology to

higher voltages. They will start with a

245 kV dead-tank circuit breaker that

will speed up the availability of cli-

mate-neutral high-voltage switching

solutions for customers around the

globe. Both partners will continue to

manufacture, sell, and service switch-

gear solutions independently.

In most of the world’s gas insulated

substations, SF

6

– a greenhouse gas

with a potential for global-warming

roughly 23 500 times greater than CO

2

,

– is still the insulating gas of choice.

Even with very low leakages, the im-

pact on global warming is notable. In

light of the drive toward global decar-

bonisation, the demand for alternatives

is growing as operators seek future-

proof technologies that signicantly

reduce the carbon footprint of their

systems. At the same time, regulations

to reduce or prohibit the use of uori-

nated gases in the electricity industry

are being reviewed and implemented

in various parts of the world.

The agreement between Siemens

Energy and Mitsubishi Electric fol-

lows a similar agreement between GE

Renewable Energy’s Grid Solutions

business and Hitachi ABB Power

Grids in April. The non-exclusive,

cross-licensing agreement is related to

the use of a uoronitrile-based gas

mixture as an alternative to SF

6

.

The two companies will keep the

product development, manufacturing,

sales, marketing and service activities

of their gas solutions fully indepen-

dent. Each company will continue to

independently grant and set terms of

licenses to its respective intellectual

property, hence preserving supplier

base diversity for the industry and fair

competition.

Commenting on the reasoning be-

hind the collaboration Dr Markus

Heimbach, Executive Vice President,

Managing Director, High Voltage

Products, Hitachi ABB Power Grids,

said: “As part of our commitment to-

wards a carbon-neutral future and ac-

celerating the energy transition, we

have chosen to work towards a stan-

dard solution to address the needs of

our customers through this cross-li-

censing agreement.”

Spanish group Acciona SA expects its

renewables subsidiary, Corporacion

Acciona Energias Renovables SA (Ac-

ciona Energia), to be valued between

€8.8 billion ($10.5 billion) and €9.8

billion in its upcoming initial public

offering (IPO).

The group has decided to oat 15-25

per cent of the share capital of Acciona

Energia on Spain’s stock exchanges,

corresponding to roughly 49.4 million

and up to 82.3 million shares to be of-

fered to qualied investors.

The Spanish Securities and Ex-

change Commission approved the

registration document for the IPO last

month and it is expected that manage-

ment bodies will approve the IPO

subject to market conditions and in-

vestor interest.

“The announcement of Acciona En-

ergia’s IPO is an important milestone

in our mission to build a world-lead-

ing renewable energy company and

to play a central role in the global

energy transition,” said Acciona En-

ergia Chief Executive Rafael Mateo.

Acciona’s renewables business op-

erates in 16 countries and boasts about

11 GW of installed capacity across a

diverse range of clean energy tech-

nologies, as of March 31, 2021. It

plans to reach a total installed capac-

ity of 20 GW by the end of 2025 and

has identied 28 GW in opportunities

beyond 2025 with the goal of reaching

an installed capacity of 30 GW by

2030.

In 2020, Acciona Energia was the

largest supplier of 100 per cent renew-

able energy in Spain. The company

was also one of the top four develop-

ers in the world by volume of private

power purchase agreements (PPAs)

signed.

Mitsubishi Power is gearing up for an

electricity sector that will have an in-

creasing dependence on renewables.

The company has agreed to collabo-

rate with Spanish energy company

Iberdrola to drive the development of

green hydrogen projects, battery stor-

age systems and heat electrication

solutions in different regions around

the world.

Commenting on the tie-up, Mitsubi-

shi Power President and CEO Ken

Kawai said: “Iberdrola and Mitsubishi

Power have been collaborating in sup-

porting decarbonisation in the power

generation sector by providing high

efciency GTCC [gas turbine com-

bined cycle] projects. Using this col-

laborating experience in GTCC proj-

ects, we will jointly develop and deploy

the necessary hydrogen infrastructure,

battery energy storage systems, and

electried heat production systems to

decarbonise the power and industrial

sectors.

“This joint development with Iber-

drola fullls our mission to create a

future that works for people and the

planet by developing innovative pow-

er and storage solutions to realise a

carbon neutral future.”

The announcement came as the

company conrmed the expansion of

its operational footprint in Europe

with the establishment of the GTCC

EMEA Business Unit, effective April

1, 2021.

The new business unit will focus on

the sale of its J-Series air-cooled gas

turbines – which boast world-class

reliability of 99.6 per cent and ef-

ciency of greater than 64 per cent.

Capable of operating on a mixture

of up to 30 per cent hydrogen and 70

per cent natural gas, the turbines will

be able to run on 100 per cent hydro-

gen in the future. This highly efcient

energy generation technology can

play a crucial role in helping countries

across Europe meet ambitious net

zero carbon emissions targets.

As a demonstration of the company’s

continued commitment to EMEA’s

power industry, the business unit will

be located in Dubai. The new business

unit will be supported by Mitsubishi

Power’s dynamic services centres

across the region.

Taking up the position of Vice Pres-

ident GTCC Sales EMEA, Jose Aguas

– based in Valencia, Spain – will report

to Business Unit Head, Khalid Salem,

who takes on a new role as GTCC Busi-

ness Unit Leader EMEA in addition to

his role as President, Mitsubishi Pow-

er Middle East and North Africa.

Mitsubishi Power

Mitsubishi Power

ramps up cleantech

ramps up cleantech

activity

activity

Siemens and

Siemens and

Mitsubishi are

Mitsubishi are

latest to

latest to

cooperate on

cooperate on

eliminating SF

eliminating SF

6

6

Acciona renewables otation could fetch $10 billion

OEMs move to boost electrolyser

credentials

n MAN Energy Solutions acquires 99 per cent of H-TEC Systems

n Haldor Topsoe establishes green hydrogen organisation

8

THE ENERGY INDUSTRY TIMES - JULY 2021

Companies News

These processes address more than

data transfer and data privacy; they

also look at specic products.

“When we produce a piece of hard-

ware that includes electronics and

software, and the hardware has to be

transported to a customer site, you

have to test the equipment in the fac-

tory and again on-site after deploy-

ment. It’s important to secure the en-

tire supply chain before installation

on the site in such a way that the sys-

tem itself cannot be manipulated,”

said Dr. Wunschik. “Almost all sys-

tems in the energy industry have a

physical attack surface, which can

affect IT security, and vice versa

where IT vulnerability can take a

physical dimension at a customer

site.”

Dr. Wunschik explained: “Take a

simple switch to be used at a data

centre, for example. You order the

switch from anywhere in the world,

install it and expect it to work cor-

rectly. But during maintenance, the

engineer might notice additional

chips on the switch. Were they put on

the motherboard after the initial pro-

duction process? I have seen this

happen whereby a manufacturer

added components to block some

functionality on the switch in order to

sell it at a lower price. But do you re-

ally know what these chips are doing

without having tested?”

It is therefore imperative that the

entire chain is secure – that includes

vendors like Siemens Energy, its sup-

pliers, as well as the customer site. As

Dr. Wunschik put it: “Cyber security

is a team sport. You cannot do it only

from your own point of view; you

need partners with the same security

level or at least the same awareness of

the topic.”

Siemens Energy has a dedicated

“ProductCERT” team in place that

manages all security-related issues in

Siemens Energy products, solutions,

and services. ProductCERT coordi-

nates and maintains communication

with all involved internal and exter-

nal parties to quickly and effectively

respond to security issues. Security

Advisories are issued to inform cus-

tomers about measures that must be

taken to securely operate Siemens

Energy products and solutions.

The company has offered power

plant operators in the UK penetration

testing – not as a typical IT vendor

but as an energy company for IT and

OT issues at the site. Here, Siemens

Energy experts act as external hack-

ers to test systems and products for

vulnerabilities.

While a number of energy compa-

nies are quite mature in terms of cyber

security strategy, Dr. Wunschik be-

lieves some need to leverage the

community effort to deploy technolo-

gies and processes and apply similar

approaches from the IT side to the

energy grid. She says this is where

Siemens Energy can help but noted

that the level of what is needed varies

from place to place.

“There are specic regions in the

world where the government is very

active in monitoring the energy grid

and they are looking at how trans-

mission and distribution operators

are working together to look for

anomalies in the system to assess

A

s digitalisation spreads through

the electricity sector and a

growing number of companies

move data into the cloud, cyber-

attacks are on the rise. For critical

infrastructure like electricity, water

and gas, the consequences of a

successful cyber-attack can be

disastrous. The attack on the Colonial

Pipeline in May was a very public

reminder.

Fortunately, regulators are becom-

ing increasingly active in tackling

the problem. Following the Colonial

Pipeline incident, US lawmakers

joined forces in a bipartisan bill that

would direct the Cyber security and

Infrastructure Security Agency

(CISA) to create a special cyber

programme to test the nation’s criti-

cal infrastructure defences.

It is a step in the right direction but

the scale of the problem cannot be

underestimated.

Dr. Judith Wunschik, Global Cyber

Security Chief at Siemens Energy,

outlined how Siemens Energy is pre-

paring itself for the challenges ahead.

Having grown her cyber security ex-

pertise in the banking sector, she was

able to offer an interesting perspective

on the threat facing the energy sector.

“I have a physics background but

switched over to cyber security in

2013 for ING Bank. Joining what was

then Siemens Gas and Power in 2019

was a challenge and opportunity to

see cyber security from a different

viewpoint. Banks have been doing

this for a long time, and a lot of the

cyber principles from the banking

sector can be transferred [to the

power industry]. At the end of the day,

an IT system is an IT system, and if

someone tries to attack a weak point

on a chip, it makes little difference if

the computer is in the data centre of a

bank or in the data centre of a utility

operator, or on the site of the utility

itself.”

She noted that when considering the

IT/OT (operational technology) con-

vergence in the energy sector,

whether at in-house manufacturing

sites or utility installations, processes

have to be modied but core principles

remain the same. “Processes [in the

energy sector] have to be adapted to

more locally managed, non-redundant

systems and there are a lot more lay-

ers to the operation. But it’s still asset

management. Also, crisis manage-

ment and communication is a core

process for any cyber security ofcer

regardless of the business itself.”

She also said the adversaries in the

two sectors are comparable: they

could be hackers looking to extort

money; ‘hacktivists’, looking to

cause reputational damage; or nation-

state actors that are politically moti-

vated to compromise systems.

Essentially, years of experience

have taught Dr. Wunschik that regard-

less of the sector, every connected

product or solution can be attacked.

Coming into the energy sector, her

rst task was to secure the solutions

and processes of Siemens Energy.

“When you look at the digital envi-

ronment from a Siemens Energy

point of view, there are the internal

assets – all the IT for our daily busi-

ness, laptops, mobiles, applications,

servers, etc. – the data and informa-

tion assets of the company and its

customers, all the product specics

and the intellectual property as well as

the digital components of the products

itself; and last but not least the solu-

tions and services we supply as a

full-service offering to the customer.

As a cyber security ofcer in energy,

your universe is much broader com-

pared to a digital product realm.”

During her rst year as global cyber

security ofcer, Dr. Wunschik’s main

task was to ensure the security of the

newly spun-off Siemens Energy –

keeping the licences to operate exist-

ing processes within Siemens and

transferring them to the independent

company. Now it is a case of ramping

up the cyber security capabilities

across the new organisation.

“With more than 90 000 employees

around the globe, we always joke that

we are the largest global start-up ever.

This year we are now looking at the

processes to see what can be done

leaner with a higher degree on auto-

mation,” said Dr. Wunschik. “The

product departments within Siemens

Energy are quite mature already and

there are a lot of principles in place.

We are currently looking at more

standardised working from an over-

sight perspective to bring the same

standards to all departments. That

also helps our customers from an in-

dustry perspective.

“But the biggest focus is to build our

energy business of tomorrow with

products and solutions that evolve

with changing threat landscapes to

continuously meet the highest cyber

security standards.”

As an example, she cites the com-

pany’s recent receipt of ‘Cyber Es-

sentials Plus’ certication across

Great Britain and Ireland (see box).

This certication is essential for bid-

ding for critical national infrastructure

projects but will also support Siemens

Energy’s R&D, lifecycle and supply

chain processes.

Dr. Wunschik: “It is

imperative that the entire

chain is secure – that

includes vendors like

Siemens Energy, its

suppliers, as well as the

customer site”

Energising cyber security

Following its spin-off almost a year ago, Siemens Energy is transferring its cyber security processes to the new

organisation. Junior Isles hears what this has meant for the company and its customers, and discusses the growing

cyber threat to the energy sector.

Special Technology Supplement

THE ENERGY INDUSTRY TIMES - JULY 2021

10

where rst attacks might come from.

But there is a huge difference in ma-

turity around the globe.

“As a global vendor, you have to be

able to tackle the needs of the region. If

you look at mobile IT devices, for ex-

ample, there are regions in which you

can use the device itself as a trusted

factor; but there are others where you

can’t. When you are looking to re-

motely monitor plants or grids you

have to consider whether you send out

a eld engineer with their own device.

The industry needs to mature much

more from the perspective of trusted

identities and processes.”

Certainly, the energy industry has

challenges ahead in the world of cy-

ber, with perhaps the main one being

the increasing number of threats and

attacks on old vulnerabilities.

“There are growing attacks on IT

infrastructure. If you look at the attack

on the Colonial Pipeline in the US, it

was not an attack on the OT [infra-

structure] of the pipeline, i.e. the op-

erational technology. It was an attack

on the nancial systems of the enter-

prise, which caused Colonial to take

the decision to shut down the pipeline.

So the reputational and nancial dam-

age was caused by attacking a classi-

cal IT system,” said Dr. Wunschik.

“This is why you have to look at the

entire digital landscape and ask where

an attacker can come in – he will al-

ways step in at the weakest link in the

chain.”

Similar vulnerabilities can arise

from eld service engineers using old

systems or unchecked devices such as

USB sticks.

“The pandemic has increased the

distribution of your end-points, from

an ofce point of view, across the in-

ternet,” said Dr. Wunschik. “Compa-

nies that were not ready, having previ-

ously worked only in closed ofce

networks without a transparent asset

and identity management concept,

failed immediately,” said Dr. Wun-

schik. “From an energy company/

utility view, although direct attacks on

the generation and transmission busi-

ness did not change, adversaries found

there was a growing environment to

hack connections via the internet. At

Siemens Energy, we have seen the

level of attacks grow signicantly. But

we were prepared, supported by ma-

ture technologies and processes that

we could scale up to securely meet the

increased demands. All ofce em-

ployees were equipped with laptops,

and IT infrastructure performance was

available on broad scale.”

Unfortunately, small and medium-

sized enterprises are often not so pre-

pared and social engineering, i.e.

changing social behaviour around cy-

ber security, remains a key issue as

more employees work from home.

Looking past the pandemic, in the

immediate future Siemens Energy

will continue to support utilities in

securing the entire ecosystem – not

just specic parts, such as nancial

systems or scada systems but to secure

and create protection concepts from a

threat perspective. This requires more

than equipment and software; it also

requires people.

One of the main challenges that Dr.

Wunschik sees for the next 5-10 years

is talent. “We need to nd the people

that are ready to step into these cyber

security positions. A lot of enterprises

are relying on software vendor prom-

ises. Energy utilities have to adapt the

secure solutions they are offering, so

you still need knowledge. So the ques-

tion for the next ve or ten years from

a cyber management perspective

should be how to share resources

across the industry.”

Summing up, she said: “I’m always

asked who will pay for all of this? But

cyber has to become a USP for the

vendors as well as the [energy] com-

panies. It is fundamental to securing

our society overall.”

According to a recent report by global data

protection company Veritas Technologies,

just over half of UK utilities have fallen victim

to a cyber-attack in the last year. But despite

the sector’s vulnerability to cyber-attacks, it

is pressing ahead with its move to the cloud.

The research found that, on average, utility

companies have 48 per cent of their business

data stored in the cloud. In the next ve years,

this is set to grow to 60 per cent.

It is a trend that will keep John Cornelius

busy for the foreseeable future. As Siemens

Energy’s Senior Cyber Security Ofcer (CSO)

UK&I and “the face” of cyber for the company

in the UK and Ireland, Cornelius is the rst

point of contact in supporting Siemens Energy

business units and their customers in their

efforts to keep their organisations and the na-

tion’s energy infrastructure safe and secure.

“Attacks on energy infrastructure and indus-

trial facilities unfortunately happen every day.

The differences are not specic to regions but

depend on the nature of the different threat

actors and their individual motivation – which

might be publicity, monetary interests, political

revenge or blackmailing,” he said. “The indus-

try is shifting away from on-premise solutions

to cloud-hosting solutions. The risks that go

with that are an increased potential for attacks

aimed at manipulating or stealing data. A big

part of my role is to understand the potential

impact of someone getting hold of Siemens

Energy data, and protecting it in line with cor-

porate requirements to the best of everyone’s

ability.”

According to Cornelius, activities to provide

this protection include:

n Critical Asset identication – what is the

most important data for Siemens Energy and

how to protect it

n ‘Exception management’ – mitigating risks

if a business is unable to comply with policy

and making sure everything is transparent

n Vulnerability management – taking care of

internal IT vulnerability management aspects

and supporting the company’s “Product and

Solution Security team” in detecting vulner-

abilities in the lifecycle management

n Training and awareness, e.g. as part

of the Siemens Energy-wide Cyber security

Ambassador community that helps local man-

agement to apply cyber-secure work practices

and improve the company’s overall resilience.

This last point is of particular importance in

an environment where more staff are working

from home. But the training and awareness

programme has paid off.

“When everyone started working from home

at around the end of February last year, I was

very concerned the amount of cyber security

issues would go through the roof,” said Corne-

lius. “I thought there would be compromised

credentials, people clicking on links in emails,

etc., but every single employee stepped up

their game. We’ve had less cyber security

incidents in the last year than we’ve had in

previous years.”

During his rst 12 months, Cornelius’ main

task has been to secure Siemens Energy

internally and demonstrate this to custom-

ers. The rst real proof-point to customers of

that undertaking was achieved in May when

the company received Cyber Essentials

Plus (CE+) certication for Great Britain and

Ireland.

The government-backed certication, which

is a pre-requisite for national critical infrastruc-

ture projects, shows Siemens Energy provides

reliable products, solutions and services, and

also demonstrates the resilience of its policies

and procedures.

CE+ requires independent verication by

an external auditor who conducts a series of

technical assessments to ensure the company is

protected against various attack scenarios. The

evaluation, completed remotely in view of the

Covid-19 restrictions, assessed:

n Boundary rewalls

n Secure asset conguration

n Patch management

n User access controls

n Malware protection

n Mobile assets

The certication was awarded by ECSC, an

independent certifying body for the Cyber Es-

sentials programme, and must be re-certied

every 12 months. In total, around 5500 digital

assets were in the scope of the evaluation.

Steve Scrimshaw, Vice President, Siemens

Energy UK&I, commented: “Cyber-attacks

have become more sophisticated and com-

mon in today’s digital world. It is therefore

crucial for us as Siemens Energy to have

robust procedures and protections in place to

reduce cyber threats. Our customers want to

see that we provide reliable products, solu-

tions and services and also take the security

of their information seriously. Cyber security

is therefore mandatory for every reliable busi-

ness partner as well as being a prerequisite

for critical national infrastructure projects.”

Cornelius added: “We [the cyber team]

haven’t delivered CE+, Siemens Energy

employees have delivered it for themselves by

doing what’s been asked – following the guid-

ance and training, and doing what matters at

the right time. We are very proud of them.”

Receiving CE+ certication is, however,

only seen as the starting point and Siemens

Energy says it will continue to evolve and im-

prove its processes and procedures. Looking

forward, Siemens Energy has already identi-

ed some areas for further work. In addition to

re-certifying CE+ annually, it is continuing to

roll-out ISO 27001 compliance across its loca-

tions and businesses.

Over the next 12 months Cornelius says the

company will continue to identify, assess and

protect what he calls “critical assets”. This is

key data within the Siemens Energy business,

its suppliers, or that of customers. “This is a

continual cycle, we never just set and forget

– it’s discover, understand, protect and review

all the time.”

Cyber security: the experience of a UK CSO

Cornelius says Siemens Energy will

continue to evolve and improve its

processes

THE ENERGY INDUSTRY TIMES - JULY 2021

Special Technology Supplement

11

siemens-energy.com

The energy sector has become a primary

target for cyber attacks.

Siemens Energy helps its customers confront

the growing cyber threat with our protection,

detection, and monitoring solutions.

Perpetual

vigilance

for what’s mission critical

Siemens Energy is a registered trademark licensed by Siemens AG.

LET’S MAKE TOMORROW DIFFERENT TODAY.

recently announced Green Growth

Strategy. It admirably calls for more

rapid adoption of innovative technol-

ogies and spells out the focus areas.

Unfortunately, the strategy is very

lightweight, lacks detail, and does not

offer clear incentives to the private

sector to accelerate their energy

transformation. In fact, Japanese cor-

porations in general are far behind

those of other developed markets in

terms of the energy transition or dis-

closing (and probably understand-

ing), for example, climate risk factors.

There are, however, a few optimistic

voices such as the Japanese indepen-

dent think-tank, the Renewable En-

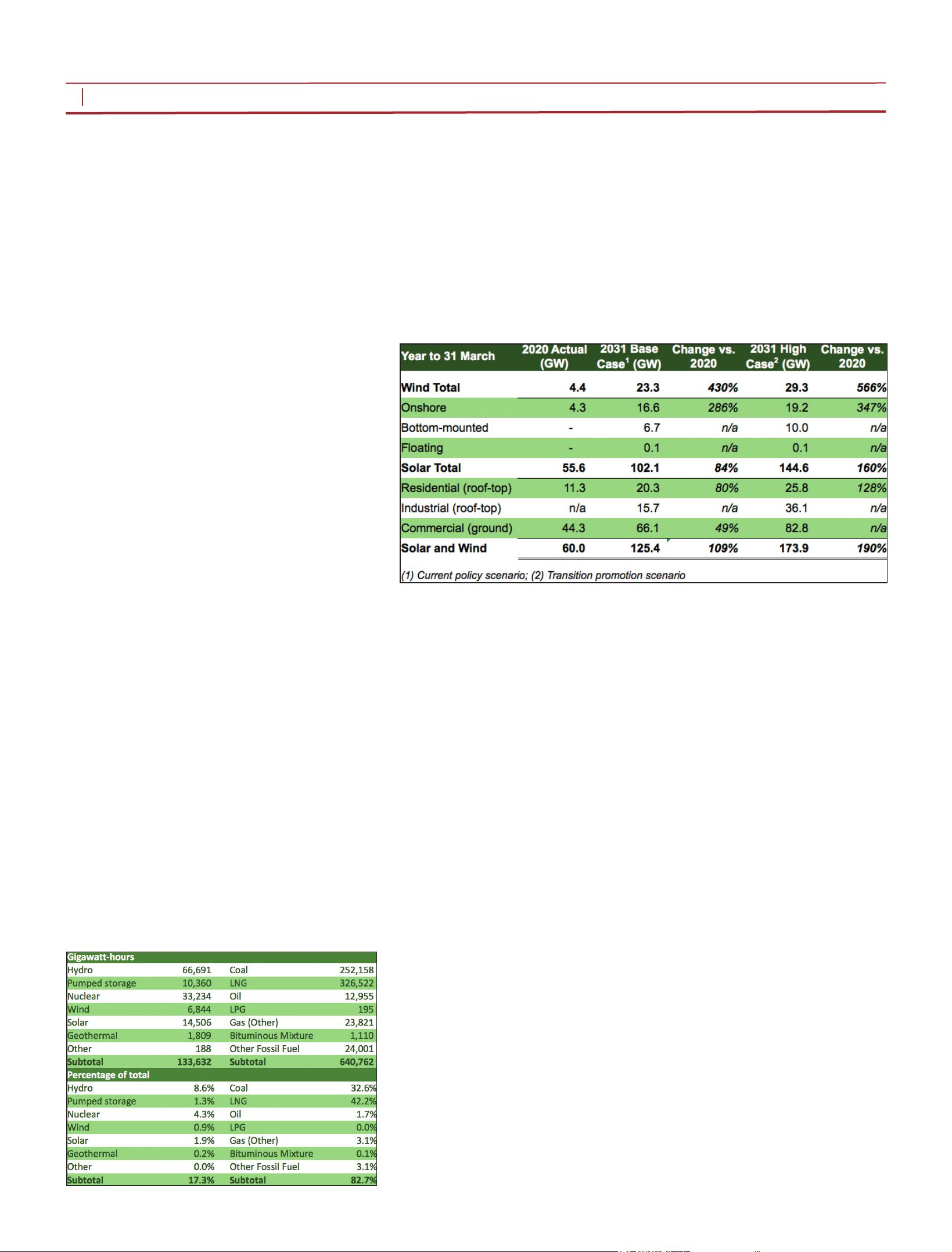

ergy Institute (REI). In REI’s Transi-

tion Promotion Scenario (i.e., its

more bullish scenario), it estimates

that solar and wind capacity could

almost double to about 174 GW by

March 2031 from 60 GW in March

2020. While these are realistic fore-

casts, to reach these levels quite a few

hurdles must be surmounted.

In terms of business and investment

opportunities, they could come from

at least two sources. A government

net zero goal ‘crisis’ and faster insti-

tutional adoption of energy transfor-

mation paths.

Given the relatively poor track re-

cord of Japan’s energy policy makers,

it would not be far-fetched to assume

that in the next three to ve years the

government realises that it is far from

attaining its net zero ambitions. This

will lead to an accelerated push espe-

cially for renewable energy. Under

this scenario, the REI forecast could

be easily met or even surpassed.

Another likely transformation may

be from domestic corporates as they

react too slowly to the energy transi-

tion. It includes companies in the

seven priority areas – cement, chemi-

cals, gas, oil, power, paper pulp,

steel – and others. Push factors, be-

sides the government, include share-

holders, stakeholders, and, especially,

J

apan’s faces huge challenges in

meeting its net zero emissions goal

by 2050. The land of the rising sun

may nd the decarbonisation climb a

desperately steep one. Governmental,

institutional, and socio-political im-

pediments are just some of the multi-

faceted challenges. Still, many busi-

ness and investment opportunities for

new market entrants and companies

from abroad will be created as the

country tries to reach its targets.

To gain a better understanding, it is

necessary to look at Japan’s heavy

fossil fuel-consumption, government

policies and ambitions as well as in-

stitutional and socio-political barriers,

and assess potential opportunities.

To better evaluate the massive chal-

lenge in achieving net zero, some of

Japan’s energy market tenets must

rst be examined.

The country has positive cultural

and geopolitical factors to drive its

energy transition. Culturally, the

population does not need a hard sell

or massive education campaign to be

convinced of the benets of clean

energy. Nature and the environment

are an integral part of life in the

country. They are a cornerstone of

Japanese culture.

The nation has almost no indigenous

energy resources. So, prioritising do-

mestic zero carbon energy makes

great sense geopolitically. In fact,

about 87 per cent of its primary energy

is from polluting fuels, including coal

(26 per cent), gas (21 per cent), and

oil (40 per cent). Planners had counted

on nuclear power to meet at least a

quarter of output. However, that aim

fell through after the country shut

down all of its nuclear power eet

following the Tohoku earthquake and

tsunami that caused the Fukushima

Daiichi Nuclear Power Plant melt-

down on 11 March 2011.

Of note, the average output for nu-

clear energy was about 290 TWh per

year out of an average of 1130 TWh

in total, in the ten years through De-

cember 2010. Nuclear now contrib-

utes about 4 per cent of the electricity

mix and the overall contribution from

zero carbon generation is a low 17 per

cent. Standard coal and gas plants

occupy a massive 75 per cent of the

mix. In terms of electricity sector de-

carbonisation, this poses a challenge

even greater than the one China faces,

albeit China’s power consumption is

7.5 times the size of Japan (see TEI

Times, June 2021, page 14).

There are at least another two major

hurdles to the nation’s net zero ambi-

tions. One is that while its population

is ageing and declining, electricity

consumption is not expected to fall

but should instead continue to rise

due to drivers such as rising electric

mobility. Another is that the land re-

source for solar and wind farms is

very limited given the country’s land

mass is small, very mountainous, and

it is a densely populated country.

In terms of government policies and

ambitions, the various Japanese gov-

ernments in the past few decades have

a poor energy policy record. Much of

the running of the sector was left to

the major corporates involved, i.e.,

the large, traditionally vertically inte-

grated electric power companies,

such as Tokyo Electric Power and

Kansai Electric Power.

An example of poor policy is the

energy mix targeted by March 2031 in

a plan released in the late 2010s. It

specied that between March 2019

and March 2031 power generation

from fossil fuels would be cut to 56

per cent from 77 per cent, nuclear

power’s contribution raised to 20-22

per cent from 6 per cent, and renew-

able energy output to 22-24 per cent

from 17 per cent.

Research at the time showed that

these targets were clearly unrealistic.

Few of the nuclear reactors shut down

post-Fukushima have restarted. The

operators have struggled to bring

them back online in part because they

must meet signicantly higher safety

standards and also because of a sig-

nicant lack of support from the

population.

Another example lies with the

nancial institutions. A recent exam-

ple is Kansai Electric Power, facing a

call from its shareholders to stop

building new coal red plants last

April. Another is the country’s big-

gest commercial bank, Mitsubishi

UFJ Financial Group, formally an-

nouncing last May that it is targeting

a net zero nance portfolio by 2050.

This makes it hard for the bank to lend

to polluting power plants for example

and allow for more capacity to lend to

clean energy projects.

Business and investment opportuni-

ties will come about in several ways.

The country may not have sufcient

domestic production capacity to sup-

ply its market and it could open the

door for more imports. A lack of ex-

perience or expertise in some areas

may also mean government promot-

ing and incentivising foreign invest-

ments into some of the green growth

strategy priority. These areas include,

but are not limited to, offshore wind

power, electric mobility, digital tech-

nologies and solutions revolving

around the management of the deliv-

ery of the energy.

Often the perception abroad is that

it is hard for overseas companies to

participate in the Japanese and elec-

tric power sector. But this has been

far from the truth in recent years.

Some examples are Denmark’s

Ørsted in offshore wind projects,

France’s Engie in electricity trading,

the UK’s Centrica in Demand Side

Response, Italy’s Enel X in advanced

energy services, and Australia’s

Power Ledger in blockchain-based

energy trading.

Giuseppe (Joseph) Jacobelli is a busi-

ness executive, analyst, and author

with over 30 years’ experience in en-

ergy and sustainability in Asia. He is

author of ‘Asia’s Energy Revolution:

China’s Role and New Opportunities

as Markets Transform and Digitalise’,

De Gruyter, 2021.

THE ENERGY INDUSTRY TIMES - JULY 2021

Climate Countdown

14

Japan’s solar and wind capacity forecast by the Renewable Energy Institute.

Source: Renewable Energy Institute (2020). Proposal for 2030 Energy Mix in Japan. [online] Renewable Energy Insti-

tute, Tokyo, Japan: Renewable Energy Institute, pp. 7–8,11. Available at: https://www.renewable-ei.org/pdfdownload/

activities/REI_Summary_2030Proposal_EN.pdf [Accessed 30 September 2020]. Calculations by the author.

Asia has a huge role

to play in meeting

global carbon

emissions targets.

With the COP26

climate change

conference just over

four months away,

through a series of

articles TEI Times

will look at several

countries in the region

and their plans for

decarbonisation.

This month Asian

energy expert,

Joseph Jacobelli,

explores Japan.

Japan is not the land of the

rising decarbonisation

Japan power generation

11 months through February

2021

Source: Author’s calculations. Data

from: Agency for Natural Resources

and Energy, “Electric Power Survey

Statistics, Agency for Natural Re-

sources and Energy” (www.enecho.

meti.go.jp, May 31, 2021) <https://

www.enecho.meti.go.jp/statistics/

electric_power/ep002/> accessed

June 22, 2021.

I

n ten short years, the global en-

ergy landscape has changed pro-

foundly. Continued international

focus on climate change and its im-

pacts has seen the march towards

the energy transition intensify. Cou-

ple this with positive regulation and

policy changes across the world,

growth in renewables, and further

development of innovative technol-

ogy, and thankfully we are now on

an unstoppable trajectory which will

see several major nations reach net

zero by 2050. As the energy transi-

tion gathers pace, the question has

changed from “when” will it be

achieved, to “how”.

The increased adoption of innova-

tive, grid enhancing technologies

(GETs) will be key to meeting the

commitments and targets laid out by

the Paris Agreement in 2015.

Generating ‘green electrons’, or re-

newable energy, is of course a core

component of the energy transition,

but so is the ability to move clean

energy effectively and efciently

from source to demand – meaning

the grid, or electricity network, must

be an enabler rather than a barrier.

The current grid was designed for

large-scale, centralised fossil fuel

power generation, not intermittent

renewable generation of varying-size

and distribution. Energy generation

and demand patterns are shifting,

and so too must the grid. In order to

unlock the energy transition, the grid

must operate differently. The good

news is that there is actually a fair bit

of exibility and capacity that can be

extracted from today’s grid.

Grid enhancing technologies, such

as power ow control, dynamic line

rating, topology optimisation and

others, are poised to be absolutely

critical in transforming the existing

grid, and in doing so, unlocking and

maximising its capacity.

A recent Brattle Group report

found that grid enhancing technolo-

gies can allow more than double the

volume of renewable generators to

connect to the grid – compared to the

status quo approach – over the next

ve years. These investments could

be implemented in less than one year

and would pay for themselves in six

months.

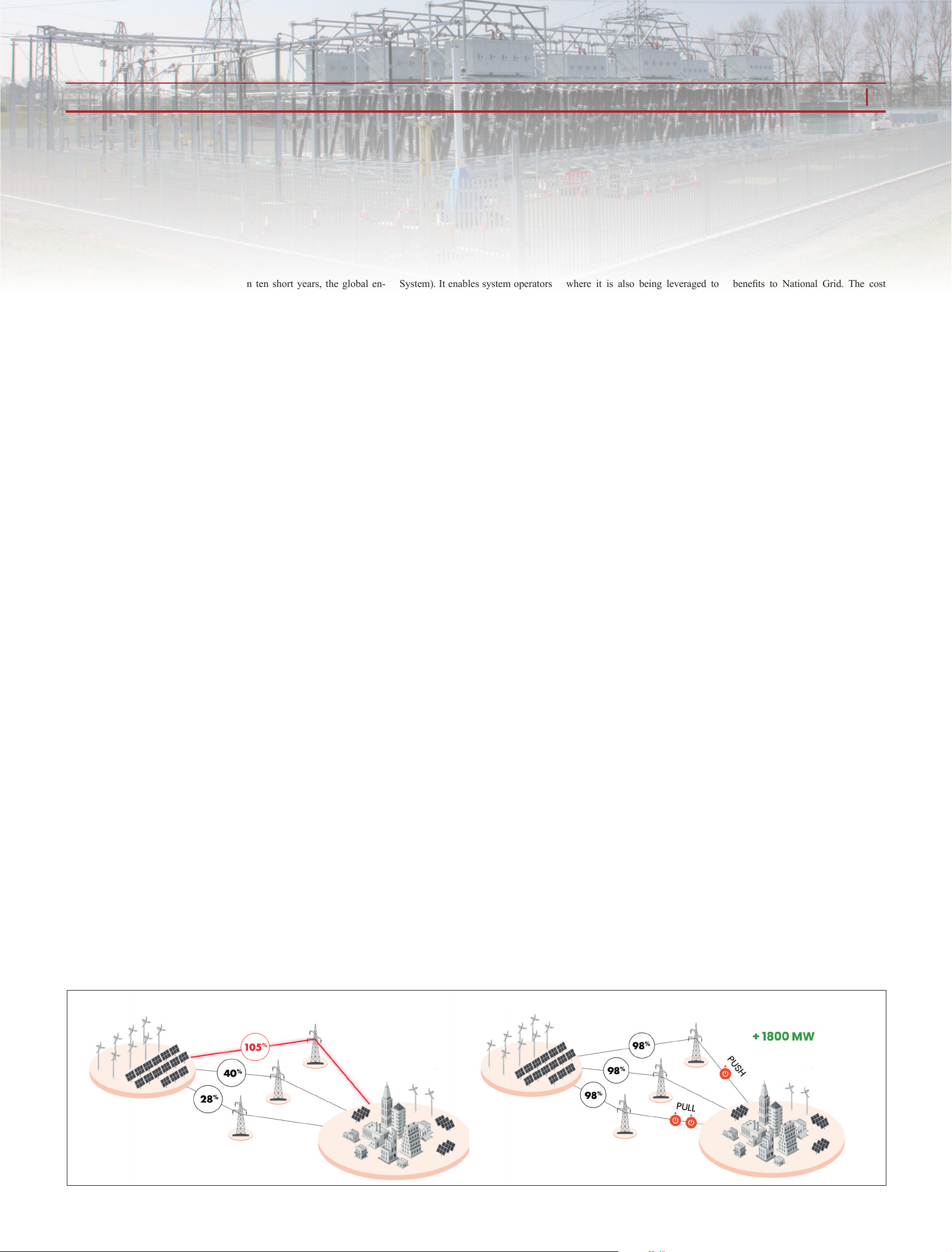

Modular Power Flow Control

(MPFC) is one such technology that

is gaining huge global traction.

Smart Wires has developed a MPFC

technology, known as SmartValve,

which is the next logical step in the

progression of FACTS (Flexible

Alternating Current Transmission

System). It enables system operators

to control power ows in the net-

work by adjusting transmission line

reactance in real-time. Essentially,

this intelligent hardware causes

power to be pushed off overloaded

lines or pulled onto under-utilised

lines – causing power to ow where

there is spare capacity, and maximis-

ing the full use of the grid.

As the ow of renewable energy

increases, the MPFC technology can

automatically activate to balance

power ows, boosting the amount of

energy the grid can transfer.

This is essential to enabling signi-

cantly larger amounts of renewable

energy to enter the system, and im-

portantly reduces the need for new

transmission lines – maximising the

use of what is already there.

As distinct from legacy forms of

power ow control, SmartValve is a

modular, digital solution which

means it is quick and exible to in-

stall and easy to scale or relocate.

This exibility and adaptability is in-

credibly valuable when generation,

load, and the evolution of the grid it-

self are highly uncertain.

Greece’s Independent Power Trans-

mission Operator (IPTO) deployed

MPFC in a containerised mobile unit

parked inside a substation, to accel-

erate renewable integration in a rela-

tively constrained portion of the grid.

IPTO installed the mobile MPFC

technology on one of two 150 kV

parallel single-circuit overhead lines,

to increase the lines impedance – re-

ducing loading on this particular line

by 17 per cent.

A key benet of the mobile MPFC

is to resolve short-term or near-term

issues. In this case, the mobile

MPFC provided a short-term solu-

tion until a new line came into ser-

vice. This rapidly deployable and re-

deployable solution is also often

used for managing operational con-

straints, such as enabling outage

windows for critical construction and

maintenance works.

Historically, it takes years to get

transmission projects completed,

even simple ones. The mobile MPFC

solution can be delivered in a few

months and installed within a matter

of days, allowing utilities to respond

much faster to the needs of genera-

tors, customers and communities. As

it is mobile, it is fully re-deployable

and can be reused many times at dif-

ferent voltage levels across the grid.

After several months on the Greek

system, the unit was moved to the

Bulgarian transmission system,

where it is also being leveraged to

improve renewable integration and

cross-border electricity ows. Instal-

lation of the technology, which took

just 2.5 days, was a joint project be-

tween the Bulgarian Transmission

System Operator (TSO), Electricity

System Operator (ESO), and Smart

Wires, as part of FLEXITRANS-

TORE – a European Union Horizon

2020 consortium. The mobile power

ow control solution was installed in

northeast Bulgaria, where 750 MW

of wind generation is installed.

In the UK, a substation-based de-

ployment of Smart Wires’ MPFC

freed up 95 MW of additional net-

work capacity by installing the tech-

nology on two lines within the UK

Power Networks distribution system.

This work resolved a critical pinch

point near the Essex/Suffolk border

and allowed more electricity generat-

ed from renewable sources to feed

into the system – without building

costly and disruptive new electrical

cabling and substations.

In just a year, UK Power Networks

saved customers £8 million, and en-

abled enough renewable power to

run 45 000 homes to safely connect

to a previously constrained point in

the local electricity network.

Further north in the UK, National

Grid (NGET) recently deployed the

world’s rst large-scale use of the

technology, enabling an extra 1.5

GW extra capacity on its existing

network.

NGET is installing SmartValve on

ve circuits at three of its substations

in the North of England, which

makes 500 MW of new network ca-

pacity available in each region. The

sites, at Harker in Carlisle, Pen-

wortham in Preston and Saltholme in

Stockton-on-Tees near Middles-

brough, were identied as needing a

solution to solve bottlenecks of

north-to-south renewable power

ows. Installing modular power ow

controllers at these sites allows

NGET to provide National Grid’s

Electricity System Operator with the

tools to quickly reduce the conges-

tion that limits renewable generation,

with minimal impact on communi-

ties and the environment.

Following these initial installations

at the three sites, National Grid is

looking to extend the capability at

Harker and Penwortham in the Euro-

pean autumn. This could mean free-

ing up an additional 500 MW of ca-

pacity, enough to power more than

300 000 homes. The scale of this

project is unprecedented, as are the

benets to National Grid. The cost

and environmental savings involved

are immense: 1.5 GW of extra ca-

pacity is enough renewable energy to

power 1 000 000 homes, clearly sup-

porting the UK’s net zero ambitions.

Elsewhere, Slovenian Transmission

System Operator ELES and Smart

Wires are collaborating on a project

that will see ELES’ dynamic line rat-

ing (DLR) technology combine with

Smart Wires’ MPFC. The two tech-

nologies offer compelling synergies.

DLR can identify which lines have

available capacity and power ow

controllers can then intelligently

route power to those lines.

The companies anticipate a series

of collaborative ventures on different

sites. ELES’ part of the collaboration

will be managed by its recently

launched member company Operato,

focused solely on the implementa-

tion of SUMO DTR (dynamic ther-

mal rating) technology.

SUMO DTR technology cost-ef-

ciently monitors and predicts weath-

er conditions along the whole line to

calculate a transmission line’s real-

time rating. By using SUMO DTR’s

real-time ratings, transmission opera-

tors can use higher line ratings with-

out endangering safety or reliability.

Since some circuits reach their

maximum rating while others are

well below their limits, balancing

power ows can eliminate con-

straints and improve network trans-

fers, which is where Smart Wires’

MPFC comes in to push power off

lines that are overloaded or pull

power onto lines with spare capacity.

Combining these rapidly installed

and low environmental impact tech-

nologies is the next logical step in

grid innovation as our industry facili-