www.teitimes.com

June 2021 • Volume 14 • No 4 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Offshore hubs

China’s nuclear belief

European transmission grid operator,

TenneT, explains why offshore wind

hubs are a better way to full the North

Sea’s potential and deliver carbon

neutrality. Page 13

Nuclear is less publicised than wind

and solar but China sees it as key

to achieving its carbon emission

targets. Page 14

News In Brief

Shell ruling has

ramications for energy

majors

A court ruling ordering Royal Dutch

Shell to deepen planned greenhouse

gas emission cuts could trigger legal

action against energy companies

around the world.

Page 2

Mexico will fall short of

revised Paris targets

Mexico will fail to meet its

revised targets under the Paris

Agreement, the Federal Competition

Commission has admitted.

Page 4

South Korea to deepen

emissions cuts

South Korea’s climate envoy has

promised “bold” policy changes,

following pressure to do more to

tackle climate change.

Page 6

UK opening puts spotlight

on ETS

Carbon prices surged beyond £50

before slipping back to the £45 level

as the UK opened its own Emissions

Trading Scheme (ETS) after

deciding to leave the EU ETS when

it left the European Union.

Page 7

Renewables must grow

faster “to avoid fossil gas

trap”

Coal generation is falling to record

lows but fossil fuels continue to

satisfy most of Africa’s electricity

demand growth.

Page 8

Vestas eyes UK offshore

growth

Following its recent re-entry into

offshore wind, Vestas is planning to

further expand its UK wind turbine

production footprint.

Page9

Fuel Watch: Hydrogen

Climate pressure drives hydrogen

and ammonia developments.

Page 12

Technology Focus: Warming

up to hydrogen

A gas engine now operating on

green hydrogen at a CHP plant in

Hamburg is a signicant milestone

in the development of recip engines

for burning the carbon-free fuel.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

A landmark report launched by the IEA gives a detailed roadmap on how to reach net zero

emissions by 2050. But the pathway calls for unprecedented transformation. Junior Isles

G7 countries agree to end state nancing for coal power plants

THE ENERGY INDUSTRY

TIMES

Final Word

Is a roadmap any help

on a disappearing

pathway, asks

Junior Isles. Page 16

The world has a viable pathway to

building a global energy sector with

net zero emissions in 2050, but it is

narrow and requires an unprecedented

transformation of how energy is pro-

duced, transported and used globally,

according to a landmark report by the

International Energy Agency.

The new report, ‘Net Zero by 2050:

a Roadmap for the Global Energy

Sector’ comes at a crucial time, as

world leaders prepare for the COP26

climate talks in November this year.

Climate pledges by governments to

date – even if fully achieved – would

fall well short of what is required to

bring global energy-related carbon

dioxide (CO

2

) emissions to net zero

by 2050.

According to the IEA, the scale and

speed of the efforts needed to limit

global warming to 1.5°C and thus

avoid irreversible climate change,

make this “perhaps the greatest chal-

lenge humankind has ever faced”.

Launching the report, Dr Fatih Birol,

the IEA’s Executive Director said:

“More countries are coming up with

net zero commitments, which is very

good, but I see a huge and growing

gap between the rhetoric and the real-

ity. Our Roadmap shows the priority

actions that are needed today to ensure

the opportunity of net-zero emissions

by 2050 – narrow but still achievable

– is not lost… Moving the world onto

that pathway requires strong and cred-

ible policy actions from governments,

underpinned by much greater interna-

tional cooperation.”

The Roadmap sets out more than

400 milestones to reaching net zero by

2050. These include, “from today”, no

investment in new fossil fuel supply

projects, and no further nal invest-

ment decisions for new unabated coal

plants. By 2035, there are no sales of

new internal combustion engine pas-

senger cars, and by 2040 the global

electricity sector to have already

reached net zero emissions.

In the near term, the report de-

scribes a net zero pathway that re-

quires the immediate and massive

deployment of all available clean and

efcient energy technologies, com-

bined with a major global push to ac-

celerate innovation. The pathway

calls for annual additions of solar PV

to reach 630 GW by 2030, and those

of wind power to reach 390 GW. To-

gether, this is four times the record

level set in 2020. A major worldwide

push to increase energy efciency is

also essential, resulting in the global

rate of energy efciency improve-

ments averaging 4 per cent a year

through 2030 – about three times the

average over the last two decades.

Most of the global CO

2

reductions

between now and 2030 in the net zero

pathway come from technologies

readily available today. But in 2050,

almost half the reductions come from

technologies that are currently only at

the demonstration or prototype phase.

The special report is designed to in-

form the high-level negotiations that

will take place at COP26 in Glasgow

and was requested as input to the ne-

gotiations by the UK government’s

COP26 Presidency.

Continued on Page 2

A recent decision by the Group of

Seven (G7) wealthy nations to end

state nancing of coal red power

plants by the end of this year sends a

clear signal that world leaders are

treating the climate crisis with grow-

ing urgency.

Last month’s move followed a rec-

ommendation from the International

Energy Agency that all future fossil

fuel projects must be scrapped if the

world is to reach net zero carbon

emissions by 2050 and limit warming

to 1.5°C.

Reafrming their commitment to

keep temperature rises below 1.5°C

by 2050, climate and environment

ministers from the G7 (Canada,

France, Germany, Italy, Japan, US

and Britain) said fossil fuels should

be mostly phased out from G7 coun-

tries’ electricity supplies by the

2030s. The group also reiterated that

it aimed to eliminate “inefcient fos-

sil fuel subsidies” by 2025.

UK lawmaker Alok Sharma, who is

president-designate of the COP26

UN climate summit to be held in

Glasgow in November, said the con-

sensus was “a clear signal to the

world that coal is on the way out”.

Britain has also proposed that the G7

call for ending coal red power gen-

eration as soon as possible in a joint

statement when their leaders gather

in June.

The UK government has said it will

double its climate aid contribution

and Prime Minister Boris Johnson has

said he wants to secure a “substantial

pile of cash” from leaders of major

economies at the upcoming G7 meet-

ing for climate nance.

UN Secretary General Antonio

Guterres also urged members of the

Organization for Economic Cooper-

ation and Development to gradually

abolish coal red thermal generation

by 2030 and for G7 members to pres-

ent concrete plans for realising it by

the time leaders gather for the meet-

ing starting on June 11.

All G7 nations now have 2030 emis-

sions reduction targets, aligned with

2050 net zero aims.

German Environment Minister

Svenja Schulze called the agreement

“an important step forward” that gave

credibility to industrialised nations to

urge others to follow suit.

The German government recently

raised the ambition on its emissions

reduction targets after a landmark rul-

ing by the country’s top court declared

its existing climate protection law “in-

sufcient”, saying it placed too much

responsibility for cutting carbon

emissions on future generations.

Under the new targets, the govern-

ment expects to slash emissions by 65

per cent by 2030 compared to 1990

levels, going further than the current

55 per cent reduction target. Germany

is also aiming to be carbon neutral by

2045, ve years earlier than previ-

ously planned.

Notably, the original law said that

Germany’s power plants must reduce

emissions to 175 million tonnes of

CO

2

in 2030. That target has now been

cut to 108 million tonnes.

Commenting on the difculties in

meeting the new targets, Schulze

said: “The expansion of renewables

is now the bottleneck. We have to be

able to do that more quickly, because

that’s the condition for us getting out

of coal faster.”

Meanwhile, the Asian Develop-

ment Bank (ADB) is mulling over

helping wean developing countries

off coal while also supporting gas

red power generation as an insur-

ance against the intermittent supply

from renewables. The multilateral

lender is currently updating its ener-

gy policy, which is scheduled for

submission to the board of directors

in the fourth quarter this year.

Sumitomo Mitsui Financial Group

Inc. also said it will tighten its policy

on nancing coal red power plants,

halting new lending without excep-

tion from June 1st.

IEA net zero

IEA net zero

roadmap lays out

roadmap lays out

daunting pathway

daunting pathway

Dr Birol: says the

pathway to net zero

by 2050 is “narrow

but achievable”

THE ENERGY INDUSTRY TIMES - JUNE 2021

2

Junior Isles

A landmark court ruling ordering

Royal Dutch Shell (RDS) to drasti-

cally deepen its planned greenhouse

gas emission cuts could trigger legal

action against energy companies

around the world.

Last month a court in The Hague said

the oil and gas major must reduce car-

bon emissions by 45 per cent by 2030

from 2019 levels in absolute terms. The

ruling applies to emissions from op-

erations, suppliers and customers and

is to be implemented via a change in

Shell’s corporate policy, while Shell

has complete freedom in how it

achieves the target.

Earlier this year, Shell set out one of

the sector’s most ambitious climate

strategies – to cut the carbon intensity

of its products by at least 6 per cent by

2023, by 20 per cent by 2030, by 45

per cent by 2035 and by 100 per cent

by 2050 from 2016 levels. The court

said, however that Shell’s climate

policy was “not concrete and is full of

conditions... that’s not enough”.

Reading the ruling, Judge Larisa Al-

win said: “The conclusion of the court

is therefore that Shell is in danger of

violating its obligation to reduce. And

the court will therefore issue an order

upon RDS.”

Shell said that it would appeal the

court verdict and that it has set out its

plan to become a net zero emissions

energy company by 2050.

Commenting on the ruling, Dmitry

Loukashov, Equities Analyst at VTB

Capital said: “It is difcult for us to

understand the grounds on which the

ruling is based and how it might be

implemented. However, one thing is

certain for us: this event could have

far-reaching consequences. Since the

decision applies to emissions by cus-

tomers (so-called Scope 3), over which

Shell has little to no control, the chief

option for implementing it is to cut the

production of oil and oil products.”

The lawsuit, which was led by sev-

en groups including Greenpeace and

Friends of the Earth Netherlands, marks

a rst in which environmentalists have

turned to the courts to try to force a

major energy rm to change strategy.

The judgement is signicant in that

it emphasises that companies and not

just governments may be the target of

strategic litigation which seeks to drive

changes in behaviour.

Michael Burger, head of the Sabin

Center for Climate Change Law at

Columbia Law School said “there is

no question that this is a signicant

development in global climate litiga-

tion, and it could reverberate through

courtrooms around the world”.

It will certainly put the strategies of

other oil and gas majors to cut emis-

sions under the spotlight, and high-

lights the growing pressure on them to

change course.

In April Chevron investors voted in

favour of a proposal to cut its custom-

er emissions, while shareholders at

Exxon elected two climate activists to

its board after months of wrangling

over its business direction.

Total has begun to invest more in

solar and wind power, but it is under

pressure to do more as climate issues

rise closer to the top of investors’ agen-

das. Last month the group said it is

preparing to change its name to Total-

Energies to signal its diversication

towards cleaner energy sources.

“We think that these events are not

isolated and are likely to be followed

by further pressure on oil companies

(especially those incorporated in West-

ern countries and/or publicly traded)

to decarbonise (maybe at a quicker

pace), entailing a cut in their hydro-

carbon production and a ramp-up in

investments into new lines of business,

such as renewables, hydrogen produc-

tion and carbon capture. More broadly,

if such sentiment on oil consumption

persists, this might signify a bleak out-

look for global oil demand in the not-

so-distant future,” said Loukashov.

The ruling follows a landmark Unit-

ed Nations Methane Report that states

that drastically cutting emissions is

necessary to avoid the worst impacts

of global climate change.

Responding to the report, OGUK, the

body representing the UK’s offshore

oil and gas industry noted that last year,

aring from the offshore oil and gas

industry was down by 22 per cent but

acknowledged, “there is always more

work to be done”.

OGUK Energy Policy Manager Will

Webster said: “We’re committed to tak-

ing action and driving change in this

area – working with members on a

progressive Methane Action Plan, a

key deliverable of the recently agreed

North Sea Transition Deal, that will

drive industry efforts and reduce rou-

tine aring and venting across the basin.

“We look forward to publishing this

plan as another important milestone

for our changing sector in the coming

months.”

“I welcome this report, which sets

out a clear roadmap to net zero emis-

sions and shares many of the pri-

orities we have set as the incoming

COP Presidency – that we must act

now to scale-up clean technologies

in all sectors and phase-out both

coal power and polluting vehicles

in the coming decade,” said COP26

President-Designate Alok Sharma.

Financing the net zero pathway

will call for total annual energy in-

vestment to reach $5 trillion by

2030, adding an extra 0.4 percent-

age points a year to global GDP

growth, based on a joint analysis

with the International Monetary

Fund, said the report.

The investment will, however,

deliver economic benets. The

jump in private and government

spending creates millions of jobs in

clean energy, including energy ef-

ciency, as well as in the engineer-

ing, manufacturing and construc-

tion industries. All of this puts

global GDP 4 per cent higher in

2030 than it would reach based on

current trends, said the report.

A growing number of businesses

are also making an increasingly im-

portant contribution to the drive

towards net zero.

Last month more than 100 com-

panies, governments and NGOs,

including some of the world’s big-

gest energy consumers, technolo-

gy rms and utilities, publicly

backed a world-rst programme to

improve transparency around re-

newable energy. The programme is

being spearheaded by EnergyTag,

the independent industry-led ini-

tiative to accelerate the shift to 24/7

clean power.

Although many organisations

and individuals already buy ener-

gy, which is classied as renew-

able through current certication

schemes, the consumption of this

energy is only matched to produc-

tion on an annual basis. The prob-

lem is that as more renewable

power plants are built, the avail-

ability of clean energy becomes

increasingly volatile, meaning over-

production at certain times of day

and scarcity at others.

A report published by EnergyTag

sets out how energy consumers and

producers can use hourly certi-

cates to verify that the energy they

consume is green hour-by-hour.

EnergyTag also announced six

projects to demonstrate how these

more granular certicates can re-

ward those that can provide renew-

able power at times of short supply,

including storage and exibility

providers.

The projects, the rst of up to ten

planned this year, are in the US,

Denmark, Netherlands, Sweden,

Norway and Australia, and involve

industry leaders Google, Microsoft,

Vattenfall, Centrica, Energinet, Stat-

kraft and Eneco. Initial results will

be published by the end of 2021.

Continued from Page 1

Spain’s Congress has approved the

country’s Climate Change and Energy

Transition Law, after almost a year in

parliament.

Spain has now set itself an obligation

to reach certain intermediate targets

that are to help it fully decarbonise its

economy by no later than 2050. The

main targets include:

n Cutting the total GHG emissions by

at least 23 per cent compared to 1990

levels by 2030

n Increasing the share of renewables

in the nal energy consumption to at

least 42 per cent by 2030

n The electricity system should pro-

duce at least 74 per cent of power using

renewable sources by 2030,

n Energy efciency should be im-

proved by at least 39.5 per cent.

The law leaves room for these targets

to be revised up in line with scientic

knowledge and the Paris Agreement

obligations. The rst such revision is

due in 2023, according to the text of

the bill.

Commenting on the bill, David How-

ell, SEO/BirdLife Climate and Energy

Lead said: “SEO/BirdLife welcomes

this law as an important milestone in

Spain. It comes late and its content is

insufcient in some respects, but it

seems the best possible outcome given

the current political situation in Spain

and the inertias of its economy.

“Among many priority tasks now, it

should ensure that the deployment of

renewable energy is focused on the

least environmentally sensitive areas:

it is still too rare to see solar panels in

cities and industrial areas and shop-

ping centres.”

He added: “The law establishes a

new expert committee, a gure that

has played a key role in other coun-

tries’ announcements to accelerate

decarbonisation, such as Germany

and the UK. The Spanish government

should not be afraid of a similar ‘crit-

ical friend’, with a strong independent

role and the necessary resources to do

its job. The government should clari-

fy these two urgent issues with a

royal decree and the expert committee

should be up and running before the

end of the year.”

A new report by Aurora Energy Re-

search highlights just how quickly

companies are responding to the po-

tential of low carbon hydrogen.

Drawing on its global electrolyser

database, Aurora nds that companies

are planning electrolyser projects total-

ling 213.5 GW for delivery by 2040

– of which 85 per cent of projects are

in Europe.

Within Europe, there is a pipeline of

over 9 GW in Germany, 6 GW in the

Netherlands, and 4 GW in the UK, all

scheduled to be operational by 2040.

Current global electrolyser capacity

is just 0.2 GW, mainly in Europe,

meaning that if planned projects de-

liver by 2040, capacity will grow by

a factor of 1000.

The success of green hydrogen from

electrolysis will be driven by two key

factors: the cost of the power – which

makes up most of the cost, and the car-

bon footprint. For grid-connected elec-

trolysers, France is expected to have

the lowest grid power prices to 2040,

followed by Germany. The countries

with the lowest grid carbon intensity

will be Norway, Sweden and France.

To achieve the lowest carbon footprint,

electrolysers can bypass the grid and

connect directly with renewable pow-

er sources such as wind, solar and

hydro. The European Union is starting

to determine carbon footprint thresh-

olds within their laws and policies,

which will increasingly reserve the

label of ‘sustainable’ hydrogen to re-

newable-connected electrolysers only.

A separate study conducted by Re-

search partners IFP Énergies Nou-

velles, SINTEF and Deloitte on

behalf of the funding partners of Hy-

drogen4EU, found that total demand

in 2030 could increase up to three

times higher than the EU’s Hydrogen

Strategy projections.

Johannes Trüby, Director for Energy

and Regulation at Deloitte Economic

Advisory, explained: “Based on a

comprehensive analysis of the Euro-

pean energy system, our models have

shown that hydrogen will be essential

for steel, chemicals and heavy-duty

transportation, and that a mix of re-

newable and low-carbon hydrogen is

best placed to deliver on the Climate

Law’s net zero target.”

According to the Energy Transitions

Commission, about $2.4 trillion ($80

billion per annum) will be required

between now and 2050 for hydrogen

production facilities and transportation

and storage.

n German chemicals producer BASF

SE says it will be partnering with en-

ergy major RWE AG to realise a mas-

sive industrial plan that relies on off-

shore wind power generation and

green hydrogen production. The plan

calls for RWE to develop, build and

operate a 2 GW, zero-subsidy offshore

wind farm in the North Sea that will

produce some 7500 GWh of electric-

ity annually.

About 80 per cent of the generated

electricity is expected to power innova-

tive CO

2

reduction technologies, in-

cluding electrically heated steam

cracker furnaces, at BASF facilities in

Germany. The remaining 20 per cent

will be used to run a 300 MW elec-

trolyser plant for green hydrogen pro-

duction in northwestern Germany.

Headline News

Spain passes climate change and energy transition bill

Spain passes climate change and energy transition bill

Electrolyser projects to pass 200 GW by 2040

Electrolyser projects to pass 200 GW by 2040

Shell ruling has

Shell ruling has

ramications for

ramications for

energy majors

energy majors

Sharma: We must act now to

scale-up clean technologies

A ruling ordering Shell to bolster its plans for cutting carbon emissions could have a huge

impact on the oil and gas sector.

THE ENERGY INDUSTRY TIMES - JUNE 2021

5

The Citizens Energy Congress, taking place virtually 15–16 June 2021, will bring together a

broad spectrum of energy industry professionals, policy makers, investors, and civil society.

Together, these groups will challenge the concepts and constraints of the existing energy

models and foster consensus-driven foundations for a low carbon energy system.

Join us as we help reset the energy system.

Securing a sustainable future

energy system through strategy,

collaboration and innovation

#CEC2021

#citizensenergycongress

Organised byStrategic Insights Partner

Book your delegate pass today

Visit citizensenergycongress.com/register

Call +44 (0) 203 239 0515

Email info@citizensenergycongress.com

CEC21 Energy Global 120x160 advert v1.indd 1CEC21 Energy Global 120x160 advert v1.indd 1 21/05/2021 14:5621/05/2021 14:56

EU PVSEC 2021

online

Connect. Engage. Evolve.

Enlit Africa, formerly African Utility Week and POWERGEN Africa, invites you

to learn, connect and engage with industry leaders and Africa’s power and

energy community across our 3-day, not-to-be-missed digital event on

8 – 10 June 2021. Register for your front-row seat to highly topical webinars,

roundtables, tech showcases and the world’s leading suppliers and their latest

solutions and so much more.

Why you should attend:

• Understand the role and opportunities of the energy transition in Africa

• Gain insight into the implications of climate change for the energy sector

• Access the world’s leading suppliers forwarding the progress of the energy

sector

• Engage with participants in real-time via our Enlit Africa-Connect platform

• Take advantage of AI powered matchmaking to meet like-minded

professionals and industry experts.

DIGITAL EVENT

8 - 10 June 2021

Formerly

Your inclusive guide to the energy transition.

enlit-africa.com

Brought to you by In partnership with

REGISTER NOW at www.enlit-africa.com/digital

THE ENERGY INDUSTRY TIMES - JUNE 2021

7

Europe News

Janet Wood

Carbon prices surged beyond £50 be-

fore quickly slipping back to the £45

level as the UK opened its own Emis-

sions Trading Scheme (ETS) after de-

ciding to leave the EU’s scheme when

it left the European Union.

The EU’s scheme has also seen emis-

sions prices exceed €55 – a new record

– and then fall to below €49.

Jonathan Marshall, head of analysis

at the Energy and Climate Intelligence

Unit, said the similarity between the

two price levels “is going to make a lot

of people pretty happy”. Some had

feared prices could diverge, creating

the potential for arbitrage between the

UK and EU systems. Since the UK

market is smaller it is potentially more

volatile than its European equivalent.

The UK government has said that if the

carbon price is consistently above

£44.74 it will cool prices through a so-

called Cost Containment Mechanism.

Ingvild Sorhus, Lead Analyst at Re-

nitiv Carbon Research, said that the

early high prices had showed con-

dence in UK carbon allowances as “an

attractive asset”. Sebastian Rilling, EU

Power & Carbon Markets Analyst at

ICIS, said he expected UK prices to

trade in line with EU prices following

“an initial period of volatility”.

Carbon prices have been rising as

governments have been tightening

emissions targets, with the EU ETS up

from the €30 level in December. That

has raised concerns in some sectors –

EU steel producers, for example,

warned that carbon price increases

have put them at a competitive disad-

vantage against companies outside the

scheme. The EU is considering wheth-

er to deal with concerns over ‘carbon

leakage’ – when imports have a price

advantage because they do not have to

pay a cost for carbon emissions – with

a carbon border tax. The UK is also

mulling over a similar border tax.

Meanwhile a Taskforce on Scaling

Voluntary Carbon Markets, set up last

year by Mark Carney, UN Special En-

voy on Climate Action and Finance,

recently launched a consultation on a

market governance body, legal prin-

ciples of the market, and the denition

of high-quality carbon credits, in a bid

to ensure a high-integrity market for

carbon trading.

Bill Winters, Chair of the Taskforce

and Group Chief Executive, Standard

Chartered commented: “A high-integ-

rity carbon market, combined with

emissions reduction and high stan-

dards of reporting, holds the key to

accelerating progress.

“Today we are calling for the estab-

lishment of a new governance body,

responsible for setting the Core Car-

bon Principles (a threshold standard

for high quality credits), clear legal

standards and uniting existing, frag-

mented carbon credit markets in one

impactful, well-run system.”

Anglo-American joint venture com-

pany Hecate Independent Power Lim-

ited (HIP) has set out plans to install

10 GW of xed and oating wind

turbines in the North Atlantic, which

would connect to the GB market via

high voltage direct current (HVDC )

submarine cables. The total project

cost is estimated at GBP £21 billion

($30 billion).

The capacity is targeted entirely at

the GB market. Each 1 GW tranche

would have its own connection, sited

in meteorological ‘catchment areas’

that differ from each other and current

wind sites, with the aim of covering

periods of low wind in those areas.

HIP said it has lodged connection ap-

plications for an initial 4 GW of grid

connections at four sites and the rst

2 GW off the southern and eastern

coasts of Iceland, could be commis-

sioned in early 2025.

HIP chair Sir Tony Baldry, who

served as UK energy minister in a

previous government, noted: “HIP

Atlantic fulls the Prime Minister’s

vision of attracting investment and job

creation in the North of England as

part of this country’s ambitious policy

to make Britain the world leader in

offshore wind energy.

“We will stretch the zone of British-

operated wind generation outside of

our traditional territorial waters, push-

ing the boundaries of existing cable

technology to generate over 1000 km

from our grid landfall points through-

out England.”

Germany is planning to set new strict-

er climate change targets for cutting

emissions after a recent court ruling

that said its current goals contravene

the rights of children and young

adults.

Federal lawmakers now want to

bring forward the country’s switch to

net zero carbon emissions by ve

years to 2045. “We want to make our

goals more precise,” Finance Minister

Olaf Scholz said.

The announcement, after the coun-

try’s constitutional court described a

agship climate protection law as

“insufcient”, comes as the growing

popularity of Germany’s Green Party

has increased pressure on the CDU

party and its centre-left coalition part-

ner the SPD.

With the general election imminent,

in September, the government is un-

der pressure to show it takes environ-

mental issues seriously.

The court said that Germany’s time-

line for emissions reductions beyond

2030 did not have enough clarity and

current measures could “irreversibly

ofoad major emission reduction bur-

dens” on to the period after 2030. It

said that impeded the freedom of fu-

ture generations.

The government now aims to reduce

emissions to 65 per cent of 1990 lev-

els by 2030 and 88 per cent by 2040.

It will have to set annual emission

targets for the period after 2030 in an

improved plan to be put forward by

December next year to comply with

the court order.

Sweden-based Zephyr Vind, a wholly

owned subsidiary of the Norwegian

company Zephyr, has announced plans

to build a large-scale offshore wind

farm in Sweden, which would use both

oating and xed foundations.

The offshore wind farm, named

Poseidon, would consist of two sites

– Poseidon North and Poseidon South

– built some 40 km northwest of Go-

thenburg, within an area in the waters

between Sweden and Denmark.

The location of the Poseidon project

has been chosen based on the assess-

ment of the most suitable grid connec-

tion area and good wind conditions,

according to Zephyr Vind. Because of

the water depth, the developer has

opted for oating turbines for Poseidon

North, while wind turbines at the Pose-

idon South site would be installed on

xed-bottom foundations.

The company has proposed two pre-

liminary project designs: one with 61

wind turbines, each with a capacity of

over 20 MW each, and one with 94

turbines each with a rated power out-

put of 15 MW.

Zephyr Vind recently launched a

public consultation, which runs until

late June. It said it expects to submit

permit applications in 2022, after fur-

ther investigations and studies are car-

ried out, and to have the project op-

erational around 2031, subject to

receiving all necessary permits.

A milestone was reached recently

when the European Commission ap-

proved Poland’s plans for a Contracts

for Difference (CfD) support scheme

for offshore wind. Poland plans to

implement it to bring forward offshore

wind projects worth €22.5 billion.

During the rst phase, offshore wind

projects will not have to full a re-

quirement to auction the CfDs, be-

cause the number of projects will be

very limited.

Instead they will have a reference

price xed based on their costs, with

a maximum set at €71.82/MWh. But

each project will have to be cleared

by the Commission. CfDs for 5.9 GW

of capacity may be offered by the end

of June 2021 for projects that will

come into operation from 2025.

From 2025, in the scheme’s second

phase, the reference price of projects

will be xed based on auctions, which

will run in 2025 and 2027, each for

2.5 GW of additional capacity.

The scheme will run until 2030 and

is also supported by an Offshore Act,

recently signed into law, which regu-

lates the development of offshore wind

farms in the Polish Baltic Sea and al-

lows for 10.9 GW of offshore wind

capacity to be either operational or

under development by 2027.

The Polish Energy Regulatory Of-

ce (ERO) has already awarded CfDs

to the 1GW Baltica 3 and 1.5 GW

Baltica 2 offshore wind power proj-

ects, developed by Ørsted and PGE,

and to the 350 MW FEW Baltic II

offshore wind project, developed by

Baltic Trade and Invest Sp. z o. o., a

subsidiary of the German energy com-

pany RWE.

The Polish government has allocated

more than €4 billion for offshore wind,

port development, and hydrogen pro-

duction and distribution in its Nation-

al Reconstruction Plan.

The plan has been submitted to the

European Commission and Poland

hopes to tap into the EU’s €58 billion

Reconstruction Fund.

Meanwhile the closure of Poland’s

coal industry also took a step forward

recently as the Treasury announced

plans to take over hard coal and lignite

red generation assets as well as lig-

nite mines from power groups PGE,

Tauron and Enea. All the assets will

be held in a single entity, to be named

National Agency for Energy Security,

according to a statement from the

State Assets Ministry.

Deputy Assets Minister Artur Sobon

said: “… we decided to put on the gov-

ernment agenda the programme of

spinning off coal assets to a separate

entity… If the Council of Ministers

makes a decision, we will launch the

actual consolidation process; we

would like to complete it towards the

end of the next year.”

UK opening puts spotlight on

UK opening puts spotlight on

emissions trading schemes

emissions trading schemes

Offshore wind to lead

Offshore wind to lead

Poland’s energy

Poland’s energy

transformation

transformation

Germany to speed

Germany to speed

path to net zero

path to net zero

after court ruling

after court ruling

Poseidon split between xed

and oating sites

‘Far offshore’ wind farm proposed for GB

n EU considering carbon ‘border tax’

n International initiative would assure integrity of carbon markets

n EC clears offshore wind regime

n Treasury set to take on coal assets

THE ENERGY INDUSTRY TIMES - OCTOBER 2020

11

Energy Industry Data

Source: IEA Net Zero by 2050: A Roadmap for the Global Energy Sector (Table 3.2, page 117). All rights reserved.

Key milestones in transforming global electricity generation

Chapter 3 | Sectoral pathways to net-zero emissions by 2050 117

3

3.4.2 Keymilestonesanddecisionpoints

Table 3.2 ⊳⊳ Key milestones in transforming global electricity generation

Category

Decarbonisationof

electricitysector

Advancedeconomiesinaggregate:2035.

Emergingmarketanddevelopingeconomies:2040.

Hydrogen‐based

fuels

Startretrofittingcoal‐firedpowerplantstoco‐firewithammoniaandgasturbines

toco‐firewithhydrogenby2025.

Unabated

fossilfuel

Phaseoutallsubcriticalcoal‐firedpowerplantsby2030(870GWexistingplants

and14GWunderconstruction).

Phaseoutallunabatedcoal‐firedplantsby2040.

Phaseoutlargeoil‐firedpowerplantsinthe2030s.

Unabatednaturalgas‐firedgenerationpeaksby2030andis90%lowerby2040.

Category 2020 2030 2050

Totalelectricitygeneration(TWh) 26800 37300 71200

Renewables

Installedcapacity(GW) 2990 10300 26600

Shareintotalgeneration 29% 61% 88%

ShareofsolarPVandwindintotalgeneration 9% 40% 68%

Carboncapture,utilisationandstorage(CCUS)generation(TWh)

CoalandgasplantsequippedwithCCUS 4 460 1330

BioenergyplantswithCCUS 0 130 840

Hydrogenandammonia

Averageblendinginglobalcoal‐firedgeneration(withoutCCUS) 0% 3% 100%

Averageblendinginglobalgas‐firedgeneration(withoutCCUS) 0% 9% 85%

Unabatedfossilfuels

Shareofunabatedcoalintotalelectricitygeneration 35% 8% 0.0%

Shareofunabatednaturalgasintotalelectricitygeneration 23% 17% 0.4%

Nuclearpower 2016‐20 2021‐30 2031‐50

Averageannualcapacityadditions(GW) 7 17 24

Infrastructure

ElectricitynetworksinvestmentinUSDbillion(2019) 260 820 800

Substationscapacity(GVA) 55900 113000 290400

Batterystorage(GW) 18 590 3100

PublicEVcharging(GW) 46 1780 12400

Note:GW=gigawatts;GVA=gigavoltamperes.

TransformingtheelectricitysectorinthewayenvisionedintheNZEinvolveslargecapacity

additionsforalllow‐emissionsfuelsandtechnologies.Globalrenewablescapacitymorethan

triplesto2030andincreasesninefoldto2050.From2030to2050,thismeansaddingmore

than600GWofsolarPVcapacityperyearonaverageand340GWofwindcapacityperyear

includingreplacements(Figure3.11),whileoffshorewindbecomesincreasinglyimportant

IEA. All rights reserved.

For more information, please contact:

International Energy Agency

9, rue de la Fédération

75739 Paris Cedex 15

France

.

Email: bookshop@iea.org

website: www.iea.org

THE ENERGY INDUSTRY TIMES - JUNE 2021

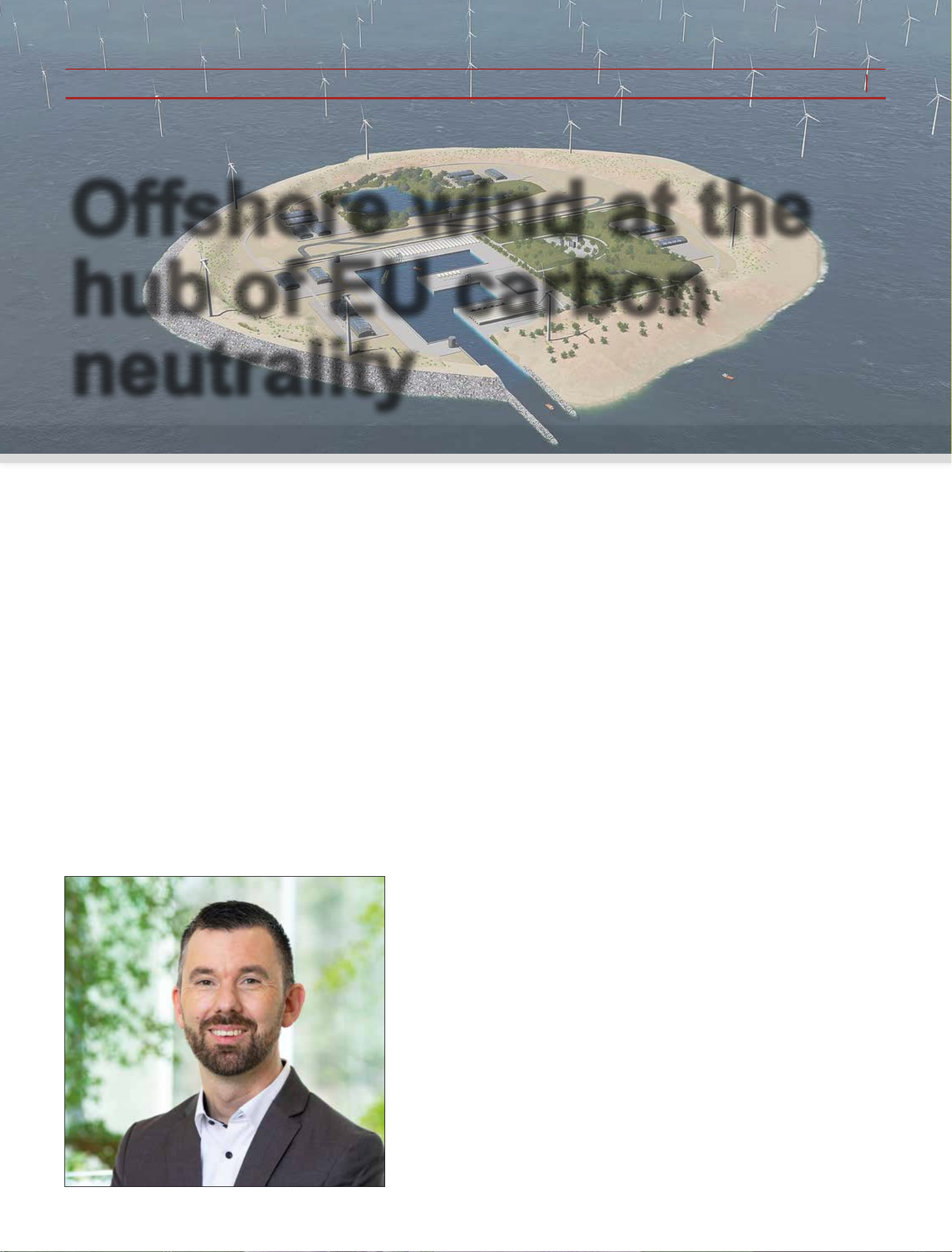

E

urope’s offshore wind power

potential is large enough to

meet its growing electricity

demand and is central to helping the

bloc achieve its carbon reduction tar-

gets. In its ‘Our Energy, our future’

report, WindEurope concluded that

to reach carbon neutrality by 2050,

212 GW should be deployed in the

North Sea, 85 GW in the Atlantic

(including the Irish Sea), 83 GW in

the Baltic, and 70 GW in the Medi-

terranean and other Southern Euro-

pean waters.

Today the EU’s offshore wind ca-

pacity, however, stands at just over

25 GW. This is a long way short of

the 111 GW that European countries

plan to deliver by 2030 under their

National Energy and Climate Plans,

and even further from the EU’s am-

bition of building 300 GW of off-

shore wind by 2050.

It is clear that plugging the gap

will call for a different approach to

what has been used thus far. As one

of Europe’s major investors in na-

tional and cross-border grid connec-

tions on land and at sea, electricity

transmission system operator (TSO)

TenneT has a key role to play in Eu-

rope’s effort to realise its offshore

wind ambition.

Commenting on the task at hand,

Tim Meyerjürgens, TenneT’s Chief

Operations Ofcer, said: “It’s clear

that the North Sea will be the power-

house of Europe in the future –

something that is increasingly being

recognised by politicians. But we

saw very early on, when the Paris

Climate Agreement was made, that

the way offshore wind is being add-

ed will not be sufcient to meet the

target. So we looked at what was

needed at the end and then analysed

what was necessary to get there.”

Together with Energinet and Gas-

unie, TenneT looked at the potential

of the southern part of the North Sea

to see what was needed in terms of

meeting climate goals for the energy

sector. They calculated that 180 GW

was necessary and feasible in the

southern area.

Meyerjürgens noted: “It was clear

from the very beginning that the

point-to-point connection approach

that is being used – because we are

mainly building DC (direct current)

connections – will not be sufcient

and will also not be efcient.”

TenneT, Energinet and Gasunie, to-

gether with Port of Rotterdam, under

a consortium known as the North

Sea Wind Power Hub (NSWPH),

therefore came up with what they

call the ‘hub-and-spoke’ concept,

which takes a more integrated and

long term approach to the energy

transition.

The idea is to shift focus from us-

ing the point-to-point offshore con-

verter platforms commonly used at

the moment and instead build modu-

lar, connected, hubs in the North

Sea. The hub-and-spoke concept

connects offshore wind farms to one

or several hub islands via alternating

current cables (AC). Power is then

converted to DC electricity by con-

verters on the hub islands, before be-

ing exported by a series of intercon-

nectors (the spokes) to the linked

North Sea countries.

Projects may also utilise power-to-

gas technologies on the hub islands

to convert offshore wind-generated

power into hydrogen, which would

then be exported via new and exist-

ing gas pipelines.

The consortium believes interna-

tionally coordinated roll-out of off-

shore wind energy, supported by

one or more hub-and-spoke proj-

ects, is technically feasible, reduces

system cost and provides long term

security of supply. Further, the co-

ordinated development of wind

farm connections and interconnec-

tions reduces the need for onshore

grid reinforcements.

“We will start with a rst island in

the North Sea connected to Den-

mark, the Netherlands and Germany,

and later, when further hubs are

built, we connect them to all the

countries around the North Sea. We

think the optimum size of such hubs

is around 12-15 GW,” said Meyer-

jürgens. “Our studies show that this

concept, compared to the point-to-

point networks being built at the na-

tional level, is about 30 per cent

more efcient since combining off-

shore wind connections with inter-

connections makes much better use

of the cables. The average full load

[of a cable] in the North Sea is

around 4500 hours, so the cable is

not used half of the time.

“Also, the more renewables that

come on the grid, the more impor-

tant it is to connect larger areas in

Europe together. When there’s a lot

of wind in the UK, it does not mean

there is a lot of wind in Germany

at the same time. So connecting

markets together gives you more

exibility and ultimately greater

resilience.”

A few national hubs are already be-

ing planned. The Danish Energy Is-

land project, which was given the

go-ahead by the Danish government

in February, is planned to be up and

running by 2033, and there are dis-

cussions for a similar project in the

Netherlands.

Meyerjürgens says the NSWPH is

preparing its 12 GW international

hub with a view to being operational

around 2035. He notes, however,

that the concept is “not feasible

without hydrogen” and says some

innovations are still needed to make

it cost efcient.

TenneT is developing a new 2 GW

standard for greater transmission ca-

pacity for point-to-point connec-

tions, and says this standard will also

be used for the North Sea hubs. The

new standard will be based on a

voltage level of 525 kV to achieve

the increased power.

“This will be the new voltage stan-

dard for a number of years… and

will be now used for all our future

offshore connections. We are design-

ing them to be ‘hub-ready’, so that at

a later stage we are able to connect

them to a meshed grid. This is not

completely feasible yet since DC cir-

cuit breakers are still an issue. How-

ever, today you can already connect

an offshore connection with an on-

shore corridor by using technology

that allows you to connect three con-

verters to one cable without a circuit

breaker. So we are making decisions

today that keep a lot of options open

for the future.”

Siemens Energy, which is a key

technology partner of TSOs such as

TenneT, says a multi-terminal con-

cept operating at 525 kV requires

some development work in the sys-

tem’s protection and controls.

Siemens Head of Grid Access, An-

dreas Barth, said: “Today we have a

point-to-point connection; tomorrow

in the hub-and-spoke we need to be

able to feed-in from all directions

and export to all directions. That will

require developments in the control

and protection system so we can en-

sure the system integrity of the net-

work is secure. We are working on

this in a preferred partnership ar-

rangement with TenneT… multi-ter-

minal and 525 kV is the future; that’s

the storyline for the next 5-7 years.”

Nexans has also been playing an

instrumental role in developing the

new 525 kV system for offshore

wind. Having already qualied 525

kV HVDC onshore cables with a

power rating of 2 GW for Germa-

ny’s TSOs, the company is now in

the process of qualifying a cable

system at this voltage to meet off-

shore requirements.

Maxime Toulotte, Head of Techni-

cal Marketing for the Subsea & Land

Systems (SLS) business unit in Nex-

ans, said: “For the future connection

of offshore wind farms in Germany

and the Netherlands, TenneT is ask-

ing a number of cable manufactur-

ers, including Nexans, to qualify 525

kV HVDC technology according to

their requirements. This will nish

approximately by the middle of next

year. While 525 kV cables have been

used for interconnectors, TenneT has

requested a complete cable system

be developed with cables that use

XLPE insulation. The rst project

with the new technology is expected

to be in the Ijmuiden Ver wind ener-

gy area in the Netherlands by 2030.”

While these developments show

there are no insurmountable technol-

ogy obstacles, Meyerjürgens be-

lieves there has to be a change in po-

litical approach and planning if

Europe is to meet its offshore wind

target.

“The regulation and market models

always take a national approach,

which is limiting us in speed. It

would be better to have one [Europe-

an] regulatory framework or market

model. It’s a European task and we

need to collaborate much more

closely because we only get there

when we all get there.”

The North Sea is

seen by many as

the powerhouse of

Europe, but realising

its potential is not

without its challenges.

Junior Isles hears

how the region might

achieve its goals for

offshore wind.

Offshore wind at the

Offshore wind at the

hub of EU carbon

hub of EU carbon

neutrality

neutrality

THE ENERGY INDUSTRY TIMES - JUNE 2021

13

Industry Perspective

Meyerjürgens said “it was

clear from the very beginning”

that the point-to-point

connection approach “would

not be sufcient or efcient”

The hub-and-spoke concept

connects offshore wind farms to

one or several hub islands

Nuclear and Radiological Event

Scale Level Two or above. INES

Levels 1-3 are considered incidents,

Levels 4 -7 are classied as accidents.

The Chinese leadership has for now

declared that it targets for CO

2

emis-

sions to peak by 2030 and for the na-

tion to reach carbon neutrality by

2060 – its “30-60 Goal”.

These targets are likely to be ad-

justed and we will see CO

2

peaking

and a net-zero economy much earlier.

This is, in part, because of pollu-

tion’s high cost to the environment,

economy and population, the strong

commitment to decarbonisation in

the past decade, the track growing

record in cutting emissions in the

electricity and transportation sectors,

the economic value-add (i.e., the

jobs and industry creation prospects),

and the aspiration to be a global

leader in decarbonisation.

The country missed its 58 GW target

of operational nuclear capacity by

2020 by 16 per cent. Post Fukushima,

authorities became extremely cau-

tious in the approval of new nuclear

generation units, especially of units

using new technologies. Going for-

ward, approvals should become more

regular and the nation’s ofcial ca-

pacity targets for 2025 and 2030

should be easily achieved.

It aims at raising capacity by 40 per

cent during the 14th FYP to 70 GW

in operational capacity and 40 GW

under construction by 2025. It also

aims at further increasing by 187 per

cent in the 15th and 16th FYPs

(through 2035) to a total of about

200 GW. By that time the nation’s

total should reach about 4000 GW,

with nuclear accounting for 5 per

cent of capacity and 10 per cent of

generation, according to Tingke

Zhang, Vice President and Secretary

General of CNEIA.

There are a great variety of forecasts

as to how much upside there will be

to the nuclear power capacity after

2035. Most estimates range between

300 and 600 GW.

The key variable revolves around

technology. If the domestic manufac-

turers’ next generation nuclear tech-

nology can ensure that even in the

unlikely event of an accident higher

M

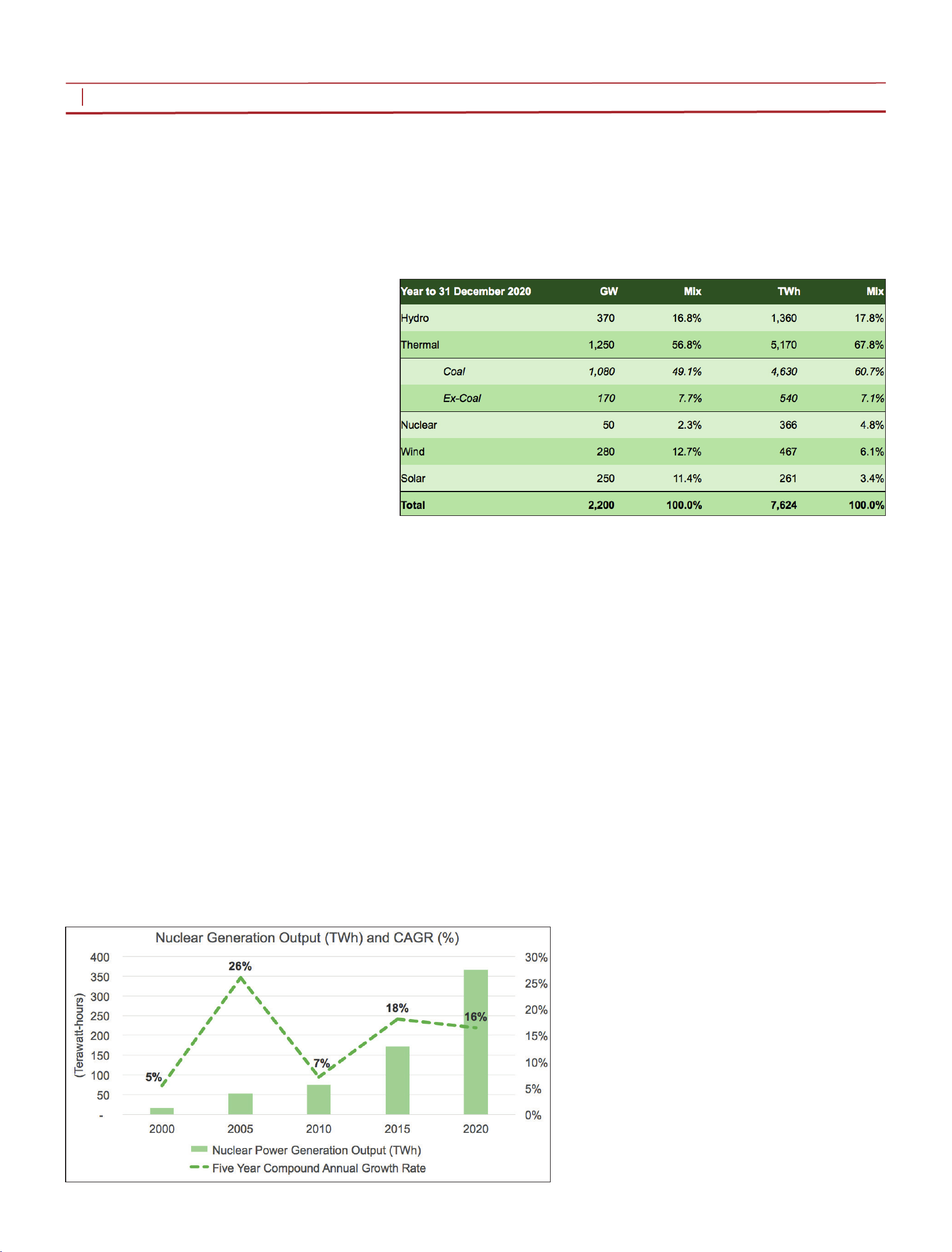

uch has been broadcasted

about China’s clean energy

exploits. In just a few years

it added massive amounts of solar and

wind generation capacity. The nation’s

clean energy equipment manufactur-

ing sector also proved its prowess.

The growth of its nuclear power in-

dustry, however, is less publicised.

Yet China regards nuclear as an im-

portant clean energy source, which

plays a highly pivotal role in the

country’s emissions reduction plan –

also known as the “30-60 goal” – over

the next several decades.

Since the rst unit came online in

1994, nuclear has generated 4630

TWh and resulted in a cut in carbon

dioxide (CO

2

) emissions of about 2.1

billion tons, according to China Nu-

clear Energy Industry Association

(CNEIA). Installed nuclear electric

capacity amounts to a little over 51

GW at 49 generating units, with a

further 21 GW under construction as

of March 2021 based on data from

CNEIA.

Nuclear power was responsible for

over 2 per cent of the nation’s capac-

ity and a little under 5 per cent of total

electricity output, as at the end of

2020. This is a relatively small contri-

bution to the overall national electric

power generation mix given that hy-

droelectric output was responsible for

almost 18 per cent, wind power for

about 6 per cent, and solar power for

over 3 per cent.

Nevertheless, the historical growth

of nuclear has been massive albeit

this is not yet reected in its contribu-

tion to the electricity mix – merely

about 5 per cent in 2020. Nuclear

output growth substantially outper-

formed that of total electricity in four

of the past Five Year Plans (FYPs).

The compound annual growth rate

of nuclear generation was 18.1 per

cent and 16.4 per cent versus 6.7 per

cent and 5.6 per cent for electricity as

a whole in the 12th FYP, through

2015, and 13th FYP, through 2015,

respectively. The only exception was

during the 11th FYP, through 2010,

when the nation was more focused on

adding coal red generation at a fast

pace to power the extraordinary GDP

increase. Coal was a generation type

it had learned to build efciently,

quickly, and cheaply.

The principal motivation to promote

nuclear energy in China is similar to

that of other jurisdictions. Domesti-

cally generated nuclear energy re-

duces reliance on imported fuels,

namely oil and natural gas, and is an

ideal substitute for polluting base load

coal red generation. The nation

could have built even more capacity

in the past decade, but authorities

have taken safety extremely seriously.

This is particularly evident from

actions taken in the early 2010s.

China temporarily stopped its nucle-

ar generators as well as the construc-

tion of new ones for enhanced in-

spection as well as placing a

moratorium on approval of new ones

following the disaster caused by the

accident at the Fukushima Daiichi

nuclear power plant in Japan on

March 11, 2011 in the wake of an

earthquake and tsunami.

Also, the State Council, China’s

most powerful decision-making

body, decided to fully incorporate the

International Atomic Energy Agen-

cy’s (IAEA) safety standards into its

national nuclear safety rules. This

very strict approach has resulted in

the industry never experiencing an

operational event of International

than INES Level 3, there will be no

environmental damage, then probably

the upper end of the forecasts can be

realised.

Nuclear energy is at the absolute

centre of China’s energy complex and

a pivotal tool for the nation to meet

the declared “30-60 Goal”, which is

likely to become more aggressive

over the next few years.

The support of the central govern-

ment toward this energy source has

repeatedly been publicised in the

Chinese media. Premier Li Keqiang

also specically mentioned nuclear

energy’s importance in a key docu-

ment, the ‘2021 Work Report’ pre-

sented on 5 March 2021, stating:

“We will take solid steps toward the

goals of achieving peak carbon diox-

ide emissions and carbon neutrality.

We will draw up an action plan for

carbon emissions to peak by 2030.

China’s industrial structure and ener-

gy mix will be improved. While pro-

moting the clean and efcient use of

coal, we will make a major push to

develop new energy sources, and take

active and well-ordered steps to de-

velop nuclear energy on the basis of

ensuring its safe use.”

Specically on thermal coal, it is

worth noting that the Chinese Presi-

dent Xi Jinping himself declared to a

global leaders’ forum in April that

China will slow coal consumption

during the 14th FYP period and

phase it down during the 15th FYP

period, through 2030.

Given the intermittent nature of

some renewable energy sources, es-

pecially solar and wind, and also

given the high cost of energy storage

and gas generation, two tools to op-

timise power from renewables, one

can be condent that China is most

likely to raise future install capacity

targets for nuclear power generation

over the next several decades.

Giuseppe (Joseph) Jacobelli is a busi-

ness executive, analyst, and author

with over 30 years’ experience in en-

ergy and sustainability in Asia. He is

author of ‘Asia’s Energy Revolution:

China’s Role and New Opportunities

as Markets Transform and Digitalise’,

De Gruyter, 2021, available June 7.

THE ENERGY INDUSTRY TIMES - JUNE 2021

Energy Outlook

14

China Electric Power Industry

Statistics for 2020

Source: “Report of China Power

Council: Rapid Growth of

Wind Power and Solar Power

Generation in 2020” (guangfu.

bjx.com.cn February 2, 2021)

accessed May 15, 2021. Author

calculations.

China has added

huge amounts of wind

and solar. Nuclear has

been less publicised

but will be key to the

country achieving

its carbon emission

targets.

Joseph Jacobelli

China’s unseen

decarbonisation tool

China Nuclear Electric Power Generation Growth in Past Five Year Plans

Sources: bp plc, “Statistical Review of World Energy 2020” (https://www.bp.com/en/global/corporate/

energy-economics/statistical-review-of-world-energy.html, 2020) accessed May 15, 2021. “Report of

China Power Council: Rapid Growth of Wind Power and Solar Power Generation in 2020” (guangfu.bjx.

com.cn February 2, 2021). Author calculations.

THE ENERGY INDUSTRY TIMES - JUNE 2021

15

Technology Focus

A gas engine

now operating on

green hydrogen at

a combined heat

and power plant in

Hamburg, Germany,

is a signicant

milestone in the

development of

reciprocating engines

for burning the

carbon-free fuel.

Junior Isles reports.

Warming up to hydrogen

Warming up to hydrogen

Richers: We are ready and just

waiting for hydrogen to be

available on a broader scale

The engine in Hamburg has

been optimised for natural gas

operation with the capability

to also burn hydrogen

A

s global pressure to decarbo-

nise continues to grow, an

increasing number of utili-

ties are exploring how hydrogen can

be utilised as a zero carbon energy

source in their existing operations.

In November HanseWerk Natur

GmbH– a subsidiary of German en-

ergy service provider HanseWerk

AG – together with INNIO Jenbach-

er began eld testing on a converted

combined heat and power (CHP)

plant in the Othmarschen area of

Hamburg. The project marks a sig-

nicant milestone in the develop-

ment of gas engine technology for

burning hydrogen – being claimed as

the world’s rst large-scale gas en-

gine in the 1 MW range that can be

operated either with 100 per cent

natural gas or with variable hydro-

gen-natural gas mixtures up to 100

per cent hydrogen.

Announcing the start of eld test-

ing, Carlos Lange, President and

CEO of INNIO said: “Our joint proj-

ect with HanseWerk Natur is a key

milestone on the path toward climate

neutrality since green hydrogen is an

important part of the solution. A par-

ticularly attractive aspect of our gas

engine technology is that existing

natural gas engines can also be con-

verted to run on hydrogen. This of-

fers operators security of investment,

with the added benet that the exist-

ing infrastructure can not only be uti-

lised in the longer term, but also de-

ployed in a way that is environ-

mentally sound.”

Demonstrating the feasibility of a

hydrogen-fuelled engine in a CHP

plant has long been on the compa-

ny’s agenda so it decided to see how

it could take advantage of its long-

standing relationship with Hanswerk

Natur to realise its goal.

“We have realised a number of

projects with them over the years, a

lot of them being very innovative in

terms of heat use, etc. They are an

excellent partner,” said Carl Richers,

VP Product Management and Mar-

keting at INNIO Jenbacher. “It was

not only important to demonstrate

that we could build a hydrogen pow-

er plant but that we could realise two

rsts – a megawatt-scale, 100 per

cent hydrogen unit, and the rst con-

version of an existing natural gas

unit to hydrogen operation.”

The project is the latest in

Hanswerk Natur’s drive to “green”

its operations. Many of its units al-

ready run either on biogas or on bio-

methane and the company is keen to

show that existing CHP plants – with

their high fuel conversion efciency

and ability to stabilise the grid – not

only have a role to play today in de-

carbonisation but also in a future

where the energy landscape is domi-

nated by renewables.

Richers noted: “It was important to

show the different use cases for our

engines going forward. That means

operating on natural gas today and

then as increasing amounts of hydro-

gen is injected into the gas grid, the

ability to operate on hydrogen-natu-

ral gas mixtures, and ultimately on

100 per cent hydrogen as the gas sys-

tem is fully decarbonised.”

At the moment, certied green hy-

drogen for the engine – which is

housed in a car park area of a leisure

complex – is delivered in bottles.

The main challenge in developing or

converting a gas engine to burn this

hydrogen is the different combustion

behaviour of the two fuels and their

volumetric energy densities.

Richers explained: “This means

you need a greater volume of hydro-

gen. Hydrogen also burns much fast-

er than natural gas, and is more ‘ig-

nition friendly’, i.e. it has a lower

knocking resistance. These are things

that had to be addressed in the en-

gine development.”

The design team therefore focused

on modications to the engine con-

trol system, fuel supply system and

turbocharger.

“Pressure monitoring of each cylin-

der is needed to optimise combustion

in each cylinder, noted Richers.

“Also, gas and air are normally

mixed before it enters the turbo-

charger but with hydrogen, port in-

jection valves are needed to deliver

the fuel to each individual cylinder.

And to control the different air/fuel

mixture, we had to modify the turbo-

charger and install a waste gate to

have more exibility in adjusting the

engine to the two fuels used.”

Initial testing of the components

began on a test bench engine in Jen-

bach, Austria, during the spring-sum-

mer of 2020 in order to optimise load

points, parameters for emission com-

pliance and load acceptance behav-

iour of the unit. Conversion of the

engine at the Hamburg plant then be-

gan in September last year.

Richers notes that this short devel-

opment time was possible because

of the company’s experience of

burning gases with hydrogen con-

tent. “We have a signicant eet

running on wood gas, coke gas, syn-

gas and various process gases –

some of these have a hydrogen con-

tent of up to 70 per cent. We were

able to leverage this experience for

the latest development.”

INNIO Jenbacher has also been

running engines on hydrogen and

hydrogen/natural gas mixes since the

early 2000s in Argentina and Germa-

ny. Now on the engine in Hamburg,

the rst period of operation has dem-

onstrated that it can operate reliably

on varying degrees of hydrogen in a

typical CHP use prole with no tech-

nical restrictions.

“It has shown that the engine can

run continuously or balance the grid

with frequent starts and stops,” said

Richers. “From a hardware perspec-

tive, the use of port injection means

they are already prepared for ex-

tremely fast starting.”

Because the Hamburg engine has

been optimised for natural gas opera-

tion with the capability to also burn

hydrogen, Richers says there had to

be a “couple of compromises” in

terms of performance.

“We have to de-rate the engine

when running on 100 per cent hydro-

gen operation, so that power output

is reduced by roughly 40 per cent.

Electrical efciency also drops very

slightly; it’s 42 per cent on natural

gas but still above 40 per cent on hy-

drogen. The overall efciency, when

including heat, is almost identical:

around 93 per cent.”

The slight reduction in electrical

efciency is driven partly by the dif-

ferent combustion and partly by the

de-rating. “Because the mechanical

friction in the engine remains identi-

cal and there is less power output,

the efciency drops; it’s mathemat-

ics,” said Richers.

Going forward, the plan is to have

shorter test periods to achieve small-

er optimisations in order to deliver,

for example, higher power output

when running on hydrogen.

The HanseWerk Natur engine is an

important piece of INNIO Jenbach-

er’s technology roadmap. “It’s im-

portant to be ready for the future,”

said Richers. “Developments are

happening quickly and we want to be

able to convert our existing installed

units to hydrogen, or install new

units based on hydrogen. So we are

ready and just waiting for hydrogen

to be available on a broader scale.”

INNIO is in discussions with sever-

al customers on potential projects,

and investigating opportunities; nota-

bly, one that could materialise in

Austria with Verbund. The Austrian

energy company operates two gas

turbine at a site in Mellach and is

planning to install electrolysers.

Here, there is the possibility to install

an engine-based CHP unit that would

run on hydrogen.

Commenting on the future, Richers

said: “The bottleneck today is avail-

ability and price of green hydrogen.

That’s what is limiting the number of

projects to a couple of demonstrator

projects.”

With regards to conversion of its

product portfolio, INNIO Jenbacher

says it has a commercially available

solution today and will continue de-

velopment to minimise the power re-

duction on hydrogen operation.

“The focus is on our Jenbacher

Type 4 (up to 1.5 MW) and Type 6

(2-4.5 MW) platforms and I would

expect that we have serial release of

engines with minimised impact on

the power output by around 2025,”

said Richers. “This would also be for

retrot kits for installed units.”

Retrots would require installation

of a new fuel injection system,

changes to the cylinder heads, new

waste gate and changes to the control

system. Depending on the congura-

tion, changes to the piston might also

be required. “These are the major

equipment changes needed in order

to adjust the compression ratio for

hydrogen operation. Sometimes the

re protection concept of the engine

room or plant also has to be revised.”

He added: “The price of the con-

version could be reduced if it is com-

bined with a scheduled overhaul

where many of the components have

to be touched anyway.”

In the long term, Richers believes

there will be a good market for in-

stalling its hydrogen fuelled CHP

plants in a number of regions but es-

pecially in Europe and the west coast

of the US for his company. In an en-

ergy landscape that is 100 per cent

renewables, he says, these will be

driven by the hydrogen produced

from excess electricity and from hy-

drogen that will be imported to com-

pensate for a seasonal under-supply

of electricity in the system.

He noted: “In a scenario where we

need green heat as well as green

electricity, we will require signicant

amounts of chemically stored energy.

Hydrogen would either come from

locally run electrolysers or imported

from other parts of the world.”

He concluded: “We are positive

about the future. CHP natural gas en-

gines are important today in support-

ing the transition to a low carbon fu-

ture, as they have the exibility to

support the growth of renewables by

compensating for the uctuations

caused by renewables, and because

of their high overall energy efcien-

cy since they provide both electricity

and heat. And in the future, they can

be converted to green hydrogen op-

eration to be an integral part of a ful-

ly renewable energy landscape.”

THE ENERGY INDUSTRY TIMES - JUNE 2021

16

Final Word

T

he International Energy Agen-

cy’s recent net zero roadmap

is certainly a comprehensive

piece of work. It prompted a long-

time friend and fellow journalist to

quip: “That IEA roadmap was really

something. I wonder if anyone will

pay attention to it?” Plenty paid at-

tention (the website reportedly

crashed for hours on its publication)

but perhaps the real question is: how

much difference will it make?

Titled: ‘Net Zero by 2050: a Road-

map for the Global Energy Sector’, the

report is hailed by the IEA as “the

world’s rst comprehensive study of

how to transition to a net zero energy

system by 2050 while ensuring stable

and affordable energy supplies, pro-

viding universal energy access, and

enabling robust economic growth”.

It sets out clear milestones – more

than 400 in total, spanning all sectors

and technologies – for what needs to

happen, and when, to transform the

global economy from one dominated

by fossil fuels into one powered pre-

dominantly by renewable energy like

solar and wind.

Launching the report, the IEA said

that the world “has a viable pathway”

to building a global energy sector with

net zero emissions in 2050, “but it is

narrow” and requires an unprecedent-

ed transformation of how energy is

produced, transported and used

globally.

“Our Roadmap shows the priority

actions that are needed today to en-

sure the opportunity of net zero

emissions by 2050 – narrow but still

achievable – is not lost. The scale and

speed of the efforts demanded by this

critical and formidable goal – our best

chance of tackling climate change and

limiting global warming to 1.5°C –

make this perhaps the greatest chal-

lenge humankind has ever faced,”

said Dr Fatih Birol, the IEA Executive

Director.

Certainly anything is achievable but

what is the likelihood? To say the

pathway remains narrow and ex-

tremely challenging is perhaps an

understatement of what needs to be

done.

Based on the study, Dr Birol said he

sees three big pieces of “homework”

for everyone – governments, indus-

tries, citizens, academics, etc. Firstly,

make the most of existing clean en-

ergy options including energy ef-

ciency and electric cars. Number two,

“push the magic button of innovation”;

i.e. incentivise technologies such as

advanced batteries, hydrogen applica-

tions and direct air capture so they are

ready for the market to help reduce

emissions after 2030. And thirdly,

substantially reduce the use of fossil

fuels.

Looking at the IEA’s stipulations for

the third task, however, it would ap-

pear that we have failed even before

we start. The press release for the

Roadmap states that, “from today”,

there must be no investment in new

fossil fuel supply projects, and no

further nal investment decisions for

new unabated coal plants.

Clearly, that will not happen. In April

China said it would not start phasing

down coal use until 2026. Speaking

via video link at the Leaders Summit

on Climate hosted by US President Joe

Biden, Chinese President Xi Jinping

said: “We will strictly limit the in-

crease in coal consumption over the

14th ve-year plan period (2021-

2025) and phase it down in the 15th

ve-year plan period (2026-2030).”

Although Su Wei, Deputy Secretary-

General of the National Energy Ad-

ministration (NEA), China’s state

planning agency, said the country

would aim to reduce the share of coal

in its total energy mix to less than 56

per cent this year, China remains one

of the only major economies to ap-

prove new coal projects. “For the

moment we don’t have another

choice,” said Su. The NEA also said it

will continue to “moderately and ra-

tionally” push the launch of coal red

power plants alongside China’s major

power transmission lines.

Meanwhile, a draft electricity docu-

ment seen by Reuters in April, also

shows that India may build new coal

red plants, as they generate the cheap-

est power. The fuel still accounts for

nearly three quarters of the country’s

annual power output.

This does not align with some of the

key milestones set out in the IEA

roadmap: the phase-out of all sub-

critical coal red plants by 2030 (870

GW existing plants and 14 GW under

construction) and the phase out of all

unabated coal red plants by 2040.

Then there is the question of what

happens to coal red plants already

under construction in China, India and

other places like Vietnam and Indone-

sia, which are not due for completion

for several years? It is highly unlikely

they will be decommissioned so early

on in their 30+ year lifespan, or retro-

tted with carbon capture technology

any time soon.

The IEA also noted that annual solar

and wind capacity additions would

have to quadruple this decade, com-