www.teitimes.com

April 2021 • Volume 14 • No 2 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Upping the heat

on decarbonisation

Wind resilience

With the need to decarbonise now

critical, many are pushing the envelope

in terms of where industrial heat

pumps are being applied. Page 13

Despite a difcult year plagued by

the Covid-19 pandemic, the wind

power sector witnessed record-

breaking capacity installations,

particularly onshore. Page 14

News In Brief

Transition nancing could

deliver $1 trillion per year

Transition nance, including

issuance, could contribute up to 30

per cent of the estimated $3 trillion

per year required to meet net-zero

emissions by 2050.

Page 2

Fallout from Texas blackouts

continues

An “unwinding” of peak power

prices may be one outcome of a

February cold snap in Texas that left

millions without power, although the

measure has hit opposition.

Page 4

China’s Five-Year Plan in line

with forecast

China’s 14th Five-Year Plan

had limited mentions about

decarbonising the energy sector, but

still remains in line with existing

views and forecasts for its power

and renewables sector.

Page 6

Low-carbon hydrogen

moves towards commercial

production

Green hydrogen will be in

production at scale by the end of

2022, with eight private investments

worth about €10 billion expected to

proceed.

Page 7

IEA praises Turkey’s energy

security efforts

Efforts to boost renewable energy

production and improve energy

efciency will help Turkey achieve

its energy security goals, says a

report by the International Energy

Agency (IEA).

Page 8

Renewables focus drives

utility earnings

Enel and EDP have posted strong

earnings as both utilities accelerate

renewables investments.

Page 9

Fuel Watch: Hydrogen

Biden administration scurries to put

hydrogen energy, climate policies in

place.

Page 12

Technology Focus: Heat

pumps add another level to

storage

A project is underway in China that

will demonstrate how heat pumps

can sit alongside batteries to recover

and re-use waste heat.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

Data from several studies show that carbon emissions are not falling fast enough, with

the picture now being complicated by modelling that overestimates the potential impact of

improved energy efciency. Junior isles

Kerry encourages more aggressive emissions-cutting commitments

THE ENERGY INDUSTRY

TIMES

Final Word

Our leaders must stick

to the Paris plan,

says Junior Isles.

Page 16

Recent data on carbon dioxide emis-

sions and forecasts for reductions go-

ing forward paint a bleak picture for

meeting climate targets, several reports

have found.

According to a recent International

Energy Agency (IEA) release, global

energy-related CO

2

emissions were 2

per cent higher in December 2020

than in the same month a year earlier,

driven by economic recovery and a

lack of clean energy policies.

Dr Fatih Birol, the IEA Executive

Director, said: “In March 2020, the

IEA urged governments to put clean

energy at the heart of their economic

stimulus plans to ensure a sustainable

recovery. But our numbers show we

are returning to carbon-intensive busi-

ness-as-usual. This year is pivotal for

international climate action – and it

began with high hopes – but these lat-

est numbers are a sharp reminder of

the immense challenge we face in rap-

idly transforming the global energy

system.”

The IEA said the 2020 trends under-

score the challenge of curbing emis-

sions while ensuring economic growth

and energy security. Amid a growing

number of pledges by countries and

companies to reach net zero emissions

by mid-century, the rebound in emis-

sions shows what is likely to happen if

those ambitions are not met with rapid

and tangible action.

The ndings follow a warning from

the UN that the latest emissions-re-

duction plans set out by 75 signatories

to the Paris climate agreement fell far

short of what was needed to avoid the

worst effects of a warming planet.

In its ‘Initial NDC Synthesis Report’

requested by Parties to the Paris

Agreement to measure the progress of

Nationally Determined Contributions

(NDCs), the UNFCCC urged govern-

ments to set more ambitious goals and

channel pandemic recovery funds into

policies aimed at greening economies.

The report nds that total global en-

ergy-related CO

2

emissions in 2020

were about 6 per cent lower than the

amount released the previous year, or

almost 2 billion tonnes, at a total of

about 32 billion tonnes. Total green-

house gas emissions are estimated at

about 50 billion tonnes.

UNFCCC Executive Secretary, Pa-

tricia Espinosa, said that the Synthe-

sis Report is a “snapshot, not a full

picture” of the NDCs as Covid-19

posed signicant challenges for many

nations with respect to completing

their submissions in 2020. She indi-

cated that a second report will be re-

leased prior to COP26 and called on

all countries – specically major emit-

ters that have not yet done so – to

make their submissions as soon as

possible, so that their information can

be included in the updated report.

Espinosa encouraged all nations,

even those who have submitted new

or updated NDCs, to investigate fur-

ther areas in order to create more ro-

bust NDCs. She added that an increase

in ambition must be accompanied by

a signicant increase in support for

climate action in developing nations,

fullling a key element of the Paris

Agreement.

Continued on Page 2

US presidential climate envoy John

Kerry has said the US will encourage

China and others to make more aggres-

sive emissions-cutting commitments

under the Paris Agreement.

Speaking during the CERAWeek

conference by IHS Markit, Kerry said

the Biden administration will push

China on the issue, even as it con-

fronts the world’s top greenhouse-gas

emitter over trade and intellectual

property concerns.

“There are tensions today that did

not exist back then,” but “we can deal

with this as a compartmentalised is-

sue,” Kerry said. “The climate crisis is

not something that can fall victim to

those other concerns and contests, be-

cause China is 30 per cent of all the

world’s emissions.”

The US formally re-joined some

195 other countries in the Paris

Agreement in February, and the

Biden administration is developing a

new emissions-cutting pledge that

ofcials have said will be as “aggres-

sive” as possible. The US is gather-

ing some of the world’s leading emit-

ters in an April 22 virtual summit

with the goal of raising ambition and

pushing countries to keep average

global temperatures from rising

more than 1.5°C over pre-industrial

levels.

Kerry also stressed that there are

big opportunities in hydrogen.

“That’s jump ball right now,” Kerry

said. “The test is going to be how do

we produce the hydrogen in a way

that isn’t so damaging and carbon-

intensive.”

President Biden has extolled the

climate potential of hydrogen, which

is widely seen as a lower-carbon al-

ternative to natural gas in fuelling

power plants and vehicles. While

most of it is currently extracted from

natural gas, there is a drive to gener-

ate it from renewable energy, so-

called green hydrogen.

When running for ofce, President

Biden put forth a $2 trillion plan to

eliminate all greenhouse gas emis-

sions from the US electricity grid

within 15 years, a goal that was ap-

plauded by climate campaigners but

was criticised for the enormous over-

haul it will require.

As part of its clean energy agenda,

the Biden administration last month

said it is reviving an energy depart-

ment programme that disbursed bil-

lions of dollars in loan guarantees to

companies to incentivise clean energy

innovation.

Energy Secretary, Jennifer Gran-

holm said up to $40 billion in guaran-

tees will be made available for a vari-

ety of clean energy projects, including

wind, solar, hydrogen, advanced ve-

hicles, geothermal and nuclear.

“It’s got to be clean. That’s it,” she

said. “And when I say clean, you

know, it’s technologies that are being

researched in the lab, like projects to

capture and store carbon dioxide

emissions, so-called green hydrogen

fuel and other energy sources.”

The loan programme helped launch

the country’s rst utility-scale wind

and solar farms as part of the Obama

administration’s efforts to create

green jobs but largely went dormant

under Donald Trump.

While the programme boosted Tes-

la’s efforts to become a behemoth in

electric cars, critics note that it stum-

bled with a major loan guarantee to

Solyndra, the California solar com-

pany that failed soon after receiving

federal money a decade ago, costing

taxpayers more than $500 million.

Progress on

Progress on

carbon

carbon

emissions paints

emissions paints

bleak picture

bleak picture

Dr Fatih Birol: “We

are returning to

carbon-intensive

business-as-usual”

THE ENERGY INDUSTRY TIMES - APRIL 2021

2

As renewable energy sources continue

to grow rapidly, TenneT says it is build-

ing new connections, strengthening

and expanding its grid and upgrading

its system operations to meet the EU’s

new target to cut emissions by at least

55 per cent by 2030. At the same time,

the Dutch/German high-voltage elec-

tricity transmission system operator

(TSO) is making important contribu-

tions to pioneering work around future

energy system planning in Northwest

Europe, including market design, sec-

tor coupling and increased exibility

of electricity supply and demand.

Announcing its ‘2020 Integrated An-

nual Report’, Manon van Beek, Ten-

neT’s CEO, said: “In 2020, TenneT set

new records in terms of security of

supply, investments and related nanc-

ing and resourcing. Now, we are ready

for a decade full of challenges.”

TenneT is Europe’s only cross-bor-

der TSO, rmly embedded in North-

west Europe with unique access to a

vast amount of North Sea wind pow-

er. As such, it has a key role in the

growing European cooperation need-

ed to facilitate the transition to a net

zero carbon world. This, it says, re-

quires “new concepts, new partner-

ships and swift action” to create a

more integrated and affordable Euro-

pean energy system.

The North Sea has an estimated wind

capacity of 300 GW by 2050 and the

potential to drive new cooperation be-

tween neighbouring countries. TenneT

aims to exploit this potential by helping

to turn it into an international hub for

green energy.

TenneT and National Grid Ventures

will explore the development of a

multi-purpose interconnector to simul-

taneously connect up to 4 GW of Brit-

ish and Dutch offshore wind farms

between the two nations’ electricity

systems. And in close cooperation with

the German, Dutch and Danish govern-

ments, TenneT is also exploring a joint

energy hub in the North Sea connected

to these three countries.

The company said it expects annual

investments to increase from €3.4 bil-

lion in 2020 to €5-6 billion annually

through to 2025 as it works towards

providing 27 GW of offshore wind con-

nections by 2030.

TenneT also said it is developing new

standards in large projects in Germany

and the Netherlands. A new high volt-

age direct current (HVDC) interna-

tional technical standard will be used

to realise the 2 GW offshore pro-

gramme planned by the Dutch and

German governments.

Tim Meyerjürgens, TenneT’s Chief

Operations Ofcer, said: “With the

new 525 kV HVDC system, with a

capacity of almost 2 GW per connec-

tion and our smart platform concept,

we are dening the new global bench-

mark for the future.” With this concept,

TenneT said it is accommodating the

offshore wind industry’s desire for

larger wind farms.

TenneT reported solid nancial re-

sults again in 2020, with underlying

revenue of €4450 million, an increase

of 9 per cent compared to €4084 mil-

lion in 2019. Underlying EBIT (ex-

cluding special items) increased to

€796 million in 2020 from €753 mil-

lion in 2019.

The climate change battle is fur-

ther complicated by another recent

piece of research, which claims that

the predicted emissions savings re-

sulting from greater energy ef-

ciency might be overestimated.

Research led by academics at the

University of Sussex Business

School and the University of Leeds

in the United Kingdom warns that

efciency gains, which are included

in many inuential computer mod-

els, can also encourage behavioural

change towards more energy use,

meaning some of the anticipated

energy savings may be “taken

back”. This is known as the ‘re-

bound effect’.

In a review of 33 studies, the re-

searchers found that economy wide

rebound effects may erode around

as much as half of the energy and

emission savings from improved

energy efciency.

The new study argues that econo-

my-wide rebound effects are larger

than commonly assumed, which

may partly explain the close links

between energy consumption and

GDP over the past 100 years.

Improved energy efciency is ex-

pected to play a central role in meet-

ing the goals of the Paris Agreement,

contributing up to 40 per cent of the

envisaged reductions in global

greenhouse gas (GHG) emissions

over the next two decades.

However, the new research sug-

gests that models used by the Inter-

governmental Panel on Climate

Change (IPCC), the IEA and others

fail to adequately capture these re-

bound effects. As a result, their sce-

narios may underestimate future

energy demand. In the absence of

policies to mitigate rebound effects,

this could make the Paris Agree-

ment targets harder to achieve.

The authors argue that global en-

ergy modellers need to take rebound

effects more seriously, and to nd

ways of capturing the full range of

effects within their scenarios. They

also recommend the use of carbon

pricing to limit rebound effects and

the targeting of energy efciency

policies to maximise their econom-

ic and environmental benets.

Steve Sorrell, Professor of Energy

Policy in the Science Policy Re-

search Unit (SPRU) at the Univer-

sity of Sussex Business School,

said: “Rebound effects are notori-

ously difcult to estimate, but our

understanding has improved enor-

mously over the last decade.

“What we show here is that 33

studies from different countries us-

ing very different methodologies all

reach broadly the same conclusion

– namely that economy-wide re-

bound effects are large. Unfortu-

nately, the models we rely upon to

produce global energy and climate

scenarios do not adequately capture

these effects. This needs to change.”

The researchers said nearly all the

scenarios for keeping global tem-

perature increase to a manageable

level rely on heavily improved en-

ergy efciency “so understanding

the potential for rebound – and what

mitigates it – is critical”.

Continued from Page 1

Chinese suppliers now represent seven

of the ten top spots in the global rank-

ings of wind turbine manufacturers,

according to data from GWEC Market

Intelligence and BloombergNEF

(BNEF). The ndings come as the na-

tion installed more new wind generat-

ing capacity than any other country in

the world.

According to GWEC Market Intel-

ligence, Danish manufacturer Vestas

still held the title as the world’s largest

supplier of wind turbines in 2020

across onshore and offshore, with new

installations in 32 markets totalling 16

186 MW. That gure supersedes the

gure published just weeks earlier by

BNEF, which put Vestas’ total at 12.4

GW across 34 markets and in third

place.

GE Renewable Energy ranked sec-

ond with 14 135 MW, according to

GWEC and Goldwind third with 13

606 MW.

Chinese Envision ranked fourth in

2020, moving up from fth position in

2019, by taking advantage of strong

market growth in its home market,

where more than 10 GW was installed

by the company in a single year – a

record for the company.

These rankings will be published in

the ‘Global Wind Market Develop-

ment – Supply Side Data 2020’, which

will be released in late April 2021.

Preliminary results are subject to

change between now and the release

date of the actual report.

“Our preliminary ndings from the

supply side conrm that 2020 was an

incredible year for the wind industry.

Chinese and American turbine manu-

facturers had a record number of new

installations that saw most of them

moving up in global turbine OEM mar-

ket rankings,” said Feng Zhao, Head

of Strategy and Market Intelligence at

GWEC. “This makes sense as it reects

the situation that the world’s two larg-

est markets China and United States

had the lion’s share in global wind

installation in 2020.”

Last year, China broke the world

record for most wind power capacity

installed in a single year with 52 GW

of new capacity – double the country’s

annual installations compared to

2019.

The surge in installations saw seven

of the top 10 spots on the global man-

ufacturers list go to Chinese manufac-

turers, according to BNEF’s ranking

released March 10th. In addition to

Goldwind, the other Chinese manu-

facturers are: Envision (4th), Ming-

yang (6th) Shanghai Electric (7th),

Windey (8th), CRCC (9th), and Sany

(10th).

Although Siemens Gamesa had in-

stallations in 31 markets last year, the

manufacturer fell three positions to

fth place. Nevertheless, it retained

its title as the world’s largest offshore

wind turbine supplier in 2020.

Last year total investment in the off-

shore wind sector rose to $50 billion,

up from $32 billion in 2019, according

to data from BloombergNEF. How-

ever, the rush of investment into the

sector, including from oil and gas com-

panies, is expected to push margins

down for turbine makers.

Last month Andreas Nauen, Chief

Executive of Siemens Gamesa, said

the high amounts recently bid for off-

shore wind development rights would

“increase the pressure to deliver more

competitive turbines”.

In a new report, S&P Global Ratings

says it believes transition nance, in-

cluding issuance, could contribute up

to 30 per cent of the estimated $3 tril-

lion per year required to meet net zero

emissions by 2050.

Transition nance can be dened as

any form of nancial support that en-

ables the largest carbon-emitting in-

dustries and companies – among them

the oil, gas and transportation sectors

– to contribute to a net zero emissions

economy.

According to the report, transition

nance, including issuance, could con-

tribute up to $1 trillion per year to the

economy as companies in hard-to-

abate sectors, such as energy, raise

capital and use the proceeds for ac-

tivities that help them reduce their

carbon footprint.

Over the past few years, it has become

clear that issuer and investor appetite

for nancing climate response and

other environmental objectives is

strong and accelerating. The growth of

the green bond market reects this

trend, with total annual issuance of

over $290 billion in 2020, a more than

5x increase from 2015, according to

the Climate Bond initiative (CBI).

In its report, titled: ‘Transition Fi-

nance: Finding a path to carbon neu-

trality via the capital markets’, S&P

Global Ratings says that if standardi-

sation and comparability challenges

are met, transition nance could see

impressive growth to help companies

and countries scale up capital alloca-

tion to meet their net zero emissions

commitments.

“The transition issuance market is

still relatively small, but is growing

quickly,” commented Lori Shapiro,

sustainable nance associate at S&P

Global Ratings. “Beyond the use-of-

proceeds bond model, transition -

nance could also grow to encompass

sustainability-linked instruments and

other nancial products. Many inves-

tors view these as strong drivers of

change, because the environmental

and social objectives apply to the

whole entity, rather than to a specic

transaction. For this to take off, how-

ever, current standardisation and com-

parability challenges with the asset

class would have to be addressed.”

In a preview of the launch of its

‘World Energy Transitions Outlook’,

the International Renewable Energy

Agency (IRENA) recently stressed

the need to act “fast and bold on glob-

al climate pledges” and highlighted

the shift in capital markets away from

fossil fuels and into sustainable assets

like renewables.

Francesco La Camera, Director-

General of IRENA said: “The window

of opportunity to achieve the 1.5°C

Paris Agreement goal is closing fast…

Global capital is moving too. We see

nancial markets and investors shift-

ing capital into sustainable assets.”

According to the Transitions Out-

look, energy transition investment will

have to increase by 30 per cent over

planned investment to a total of $131

trillion between now and 2050, cor-

responding to $4.4 trillion on average

every year.

It said that renewable power, modern

bioenergy and green hydrogen will

dominate the world of energy of the

future.

n The H2 Green Steel industrial initia-

tive, backed by EIT InnoEnergy, will

build the world’s rst large-scale fos-

sil-free steel plant in Boden-Luleå,

north Sweden, using green hydrogen.

The initiative mobilises some €2.5 bil-

lion worth of investments and will start

large-scale production as early as 2024.

The annual throughput of 5 million

tons of high-quality steel is planned to

be reached by 2030.

Headline News

China dominates wind turbine manufacturer rankings

China dominates wind turbine manufacturer rankings

Transition nancing could deliver $1 trillion/year

Transition nancing could deliver $1 trillion/year

TenneT makes record

TenneT makes record

investments

investments

Sorrell: Rebound effects are

notoriously difcult to estimate

European grid operator TenneT is planning to signicantly increase annual investment

to accommodate offshore wind expansion in the North Sea. Junior Isles

THE ENERGY INDUSTRY TIMES - APRIL 2021

3

How do you envision the energy systems of 2050?

The world is facing several parallel transitions that will shape our energy

future for decades to come, including decarbonization, electrification, and

digitalization. Today, many people are looking to the year 2050 as the

promise of the future. As the Global Electrification Forum celebrates its

5th anniversary, we hope to explore visions for what the energy system

will look like in 2050.

Featuring 50+ speakers and 20+ sessions, including….

¡ Thriving in a Post-Pandemic World

¡ Enabling the Clean Energy

Future

¡ Electrifying Transportation,

Industry, and Economies

¡ Intergenerational Roundtable

on Energy and Climate Change

¡ Harnessing Digital Technologies

¡ Realizing Net Zero Ambitions:

Policy and Finance

¡ Evolving Business and

Regulatory Models

¡ Serving the Customer

of Tomorrow, Today

¡ Leadership in Uncertain Times

¡ Responding to Extreme Events

REGISTER TODAY at www.tinyurl.com/EEIGEF21

PATHWAYS • INFLECTIONS • CROSSROADS • CONVERGENCE

Destination

2050

5

TH

ANNUAL

Global Electrification Forum

April 12–23, 2021

For further information please contact Karl Weber

Tel: 07734 942 385

THE ENERGY INDUSTRY TIMES - APRIL 2021

9

Companies News

Junior Isles

German utility Uniper says the decar-

bonisation of its portfolio is “in full

swing”, as it reported that it “signi-

cantly surpassed” its prior-year earn-

ings despite difcult market condi-

tions. The company posted adjusted

earnings before interest and taxes

(EBIT) of €998 million, up 16 per cent

on last year (2019: €863 million).

The company said the 2020 nancial

year benetted in particular from a

successful gas business in the Global

Commodities division but noted that

earnings declined in this segment’s

power business.

In a virtual press conference CEO

Andreas Schierenbeck also said that

Uniper’s plan announced one year ago

to make its power generation business

in Europe carbon-neutral by 2035, re-

mains on track.

“In a difcult market environment,

we managed to achieve our 2020 tar-

gets and to initiate a profound transfor-

mation of Uniper into a sustainable

energy company of the future. With our

majority shareholder Fortum, we also

launched projects that will be crucial

for the future and benecial for both

companies,” he said.

Uniper said it has been systemati-

cally implementing its coal exit plan

and other measures will enable it to

achieve more than 50 per cent of this

target by 2030. In December 2020,

Uniper and Fortum agreed on joint

sustainability targets for both compa-

nies. A key objective is to make both

companies carbon-neutral by 2050,

fully in line with the Paris climate

agreement.

In addition to reducing its own car-

bon emissions, Uniper said it will ex-

pand renewables. It plans to develop

1 GW of solar and wind capacity by

2025 and to add another 3 GW in sub-

sequent years. This will lay the founda-

tion for Uniper to grow in the emerging

global markets for green hydrogen.

“By 2050, the hydrogen market could

be worth €820 billion. We are making

a major contribution to the develop-

ment of this market of the future,” said

Schierenbeck.

Uniper is present at all stages of the

hydrogen value chain and has more

than ten projects in its development

pipeline.

In the Netherlands, for example, Uni-

per and the Port of Rotterdam Author-

ity are studying the large-scale produc-

tion of green hydrogen at Maasvlakte.

The aim is to build a hydrogen plant

with a capacity of 100 MW at the site

of Uniper’s power station by 2025, and

later to expand the plant’s capacity to

500 MW. The feasibility study should

be completed this summer.

Last month Uniper invested in Swe-

den’s Liquid Wind, an emerging devel-

oper of hydrogen-based electro-fuels.

The transaction, details of which

were not disclosed, will make Uniper

the second largest investor in Liquid

Wind, according to a press release.

The Swedish company is currently

working on developing its rst eMeth-

anol production plant in Ornskoldsvik,

on the northeast coast of Sweden. This

facility will be capable of producing

50 000 tonnes of eMethanol per year

using captured biogenic CO

2

and wind

energy to run the electrolysers, the

company said.

Liquid Wind has already assembled

an expert consortium consisting of

Siemens Energy AG, Haldor Topsøe

A/S, carbon capture specialist Carbon

Clean, and Nordic energy player Axpo,

which will integrate their technologies

into commercial-scale facilities.

The rst plant would start operation

from late 2023 or early 2024.

UK-based electricity and gas trans-

mission company National Grid is

pivoting its business away from gas

to place greater focus on electricity,

with the purchase of UK local electric-

ity network company Western Power

Distribution.

Last month the company said it

would buy WPD from American util-

ity PPL Corporation for $10.7 billion

and sell its Rhode Island gas and elec-

tricity business The Narragansett

Electric Co (NECO) to PPL for $5.2

billion, including debt. Later, Nation-

al Grid also plans to dispose of a stake

in its UK gas transmission business.

The acquisition of WPD is subject to

approval by the buyer’s shareholders

in late April. The two transactions also

depend on regulatory clearances. Na-

tional Grid expects to complete the

purchase of WPD within the next four

months and to close the sale of NECO

before the end of the rst quarter of

2022.

“Together these transactions will

strategically pivot National Grid’s

UK portfolio towards electricity,” the

company said.

John Pettigrew, National Grid’s

Chief Executive, said the deals would

increase the company’s exposure to

electricity markets from about 60 per

cent to 70 per cent, allowing it to “en-

hance” its role in helping the UK reach

its 2050 net zero emissions target.

Gas was once seen as a vital transition

fuel on the road to net zero but many

are increasingly seeing electricity as

the main energy carrier by 2050.

Hargreaves Lansdown analyst Laura

Hoy said: “National Grid’s Western

Power acquisition draws a line in the

sand for the utility’s strategy moving

forward – electric or bust.

“From a strategic standpoint, it

makes sense as the world shifts away

from fossil fuels usage. Not only are

homes consuming more, but the boom

in electric cars represents an opportu-

nity for NG, and the WPD acquisition

puts it one step closer to seizing it.”

WPD owns and manages local elec-

tricity networks in the Midlands,

southwest of England and Wales and

serves about 8 million customers. It

made a pre-tax prot of £750 million

for the year to March 31 2020.

PPL put WPD on the block in August

2020, following a detailed strategic

review and before the start of the next

price control period for power distri-

bution companies in the UK.

Pettigrew said he was condent the

transactions would deliver “strong”

and “longer” growth, despite UK

regulator Ofgem saying in March it

would crack down on the returns it

allows local electricity grid compa-

nies – which are effectively monopo-

lies – such as WPD to make from

2023 onwards.

Enel and EDP have posted strong earn-

ings as both utilities accelerate renew-

ables investments.

Italian energy giant Enel posted a 9

per cent year-on-year rise in group net

ordinary income to €5.2 billion ($4.37

billion) despite a 19.1 per cent drop in

revenues.

There was a slight improvement in

ordinary earnings before interest, tax,

depreciation and amortisation (EBIT-

DA) off the back of a €103 million

higher contribution from Enel Green

Power. This was the result of better

performance in Italy and the entry into

service of new plants in the US, Can-

ada, Spain, Brazil and Greece.

“During 2021, in line with the Stra-

tegic Plan and its decarbonisation as

well as digitalisation objectives, we

plan to accelerate investments in re-

newables, in the improvement of the

quality and resiliency of networks, and

in the electrication of consumption,”

said Francesco Starace, CEO of the

Enel Group.

Meanwhile Spain’s Endesa increased

its EBITDA in 2020 on a like-for-like

basis to €4027 million, up 5 per cent

on the previous year. The company

showed resilience despite the chal-

lenges posed by the impact of the pan-

demic and announced that it can now

meet its CO

2

emission-free electricity

generation targets two years ahead of

schedule. Specically, the year closed

with 85 per cent of mainland genera-

tion free of GHG emissions, a goal

initially planned for 2022.

n Portuguese utility Energias de Por-

tugal SA (EDP) said it aims to add over

50 GW of renewables by 2030 to be-

come a 100 per cent green energy pro-

ducer. This is a new goal included in

the company’s Strategic Update for the

period 2021-2025, which sees EDP

being coal-free by 2025 while doubling

installed wind and solar capacity to 25

GW from the current 12 GW. The util-

ity plans to invest a total of €24 billion

($29.3 billion) to fund the initiative.

A seven company-strong consortium,

which includes RWE, BP, Evonik In-

dustries, Nowega GmbH, OGE En-

ergy Corp, Salzgitter Flachstahl

GmbH and Thyssengas is planning to

build a cross-border infrastructure for

hydrogen – from the production of

green hydrogen to transport and in-

dustrial use.

The series of projects under the GET

H2 Initiative includes the transport,

storage and industrial use of green hy-

drogen across several stages between

2024 and 2030 and could save 16 mil-

lion tonnes of CO

2

emissions, said

RWE.

The move is one of several recently

announced by utilities with strategies

aimed at leveraging the nascent hydro-

gen economy.

Last month Danish energy company

Ørsted said it believes that investments

in the transformation of wind power

into green hydrogen are an important

part of its overall strategy. Thomas

Thune Andersen, Board Chairman of

Ørsted, said the segment could poten-

tially see explosive growth, even

though it might take a few years before

this takes place. Ørsted has announced

plans to investigate and develop hy-

drogen projects in Denmark, the UK,

Germany, and the Netherlands.

Meanwhile, in late February Yara,

Statkraft and Aker Horizons signed a

letter of intent for a partnership to pro-

duce and develop a value chain for green

hydrogen and green ammonia in Nor-

way, with Herøya as the rst project.

The agreement between Yara, Stat-

kraft and Aker Horizons involves a

collaboration to electrify and decarbo-

nise Yara’s ammonia production at

Herøya while producing emission-free

fuel for shipping, carbon-free fertiliser

for agriculture and help remove CO

2

in other energy-intensive industries.

The project could be realised over a

5-7 year period, provided power is

available on Herøya and authorities

support the project.

Also in late February, Aker Horizons

launched a new platform company,

Aker Clean Hydrogen. The new rm

has a portfolio of nine clean hydrogen

projects with 1.3 GW of net capacity

under development. It has an addi-

tional pipeline of projects with 4.7 GW

capacity. The rm is targeting a net

installed capacity of 5 GW by 2030.

Consortium plans

Consortium plans

hydrogen

hydrogen

infrastructure

infrastructure

National

National

Grid bets on

Grid bets on

electricity

electricity

Renewables focus drives utility earnings

Uniper decarbonisation in full

swing, earnings up 16 per cent

n EBIT hits nearly €1 billion n Invests in Liquid Wind to support eMethanol production

Total to return to Mozambique LNG

project despite continuing violence

Biden administration scurries to put

hydrogen energy, climate policies in place

Gary Lakes

A project to develop huge natural gas

resources offshore Mozambique con-

tinues to be threatened by a radical

Islamic insurgency that has plagued the

country’s northern Afungi Peninsula

since 2017. In late March, shortly after

French energy major Total announced

that it planned to resume work on its

$20 billion LNG project in Cabo Del-

gado, the militants attacked Palma, a

town 10 km from the worksite.

An attack near the project earlier this

year prompted Total to move its per-

sonnel to the French-administered is-

land of Mayotte in the Mozambique

Channel, but following arrangements

with the government in Maputo over

increased security, Total said it is pre-

paring to restart work once the situation

is in hand and a 25 km radius security

zone is established around the project

site. The government has declared the

area around the project a special secu-

rity zone.

The development of Mozambique’s

offshore natural gas resources means

a great deal to the country’s future.

Mozambique ranks as one the world’s

poorest countries and the ghting in

the northern province is only straining

the country’s resources further. Be-

sides the insurgency, the country is

struggling to combat the coronavirus

and trying to recover from a hurricane

that struck in March 2019. But once

the LNG projects are operating, it is

estimated that Mozambique could earn

as much as $96 billion over the life of

the projects.

There are gas resources estimated at

more than 100 trillion cubic feet off the

country’s coast and several major com-

panies have signed up for their devel-

opment. In total, some $120 billion

might be invested over the life of the

projects. Total leads a group on the $20

billion Mozambique LNG project,

which will process gas from Offshore

Area 1 into LNG through two trains

with a combined capacity of 12.88 mil-

lion tons per year. Total and partners

made a nal investment decision (FID)

on the project in 2019 and the project

obtained $15 billion in nancial back-

ing in June last year from eight export

credit agencies, 19 commercial banks,

and the African Development Bank.

The US Export-Import Bank is provid-

ing $5 billion and Japan Bank for In-

ternational Cooperation is supplying

$3 billion.

ExxonMobil plans to build another

LNG facility adjacent to Total’s but it

has delayed making an FID on the $30

billion Rovuma LNG until 2022 be-

cause of low oil and gas prices. Ro-

vuma LNG will process and export gas

from Offshore Area 4 while partner Eni

will concentrate on developing a oat-

ing LNG (FLNG) project – the Coral

South project, which will have a capac-

ity to produce 3.4 million tons per year.

The onshore facility will be capable of

producing 15.2 million tons per year.

The Coral South project got under-

way in 2018 and is due to start opera-

tions next year. The FLNG vessel is

located 80 km offshore and will load

LNG directly onto tankers, thus en-

abling it to avoid any violent disrup-

tions that might arise onshore.

Total has scheduled exports to begin

in 2024, but if the insurgency continues

and spreads, it could push the start of

operations past 2025 and by that time

there is no telling where the LNG mar-

ket will be. While gas is seen as remain-

ing a big part of the energy mix in the

coming years, a number of countries

are planning to move as quickly as pos-

sible into expanding their use of renew-

able fuels with a likely result of lower-

ing gas demand. Europe is especially

heading in that direction and other

major energy consumers are also mov-

ing that way.

Already there are questions in the

market about current gas demand and

prices, as well as in the middle of the

decade. Further delays with Mozam-

bique bringing its gas resources on-

stream may leave it struggling to com-

pete in a market that is already troubled.

Gary Lakes

The administration of US President Joe

Biden is moving quickly to ensure the

growing number of innovations in the

blooming hydrogen industry will have

an impact on the future US economy.

And at the same time, his administra-

tion is forming a climate and environ-

mental policy to present to the world

before Earth Day on April 22 when the

president will host a virtual global cli-

mate summit.

Since coming to ofce less than three

months ago, Biden has been pressed

by his supporters to take big steps to-

wards hydrogen and move the econo-

my to a green energy future. Some

impact on the energy sector will be

made with the $1.9 trillion stimulus

bill that has recently passed Congress,

and he is reported to be planning to

soon introduce an infrastructure bill

that will carry through on the ‘Build

Back Better’ slogan he used during the

election campaign. The infrastructure

package is likely to amount to more

than $3 trillion with the intention to

create jobs, build modern sustainable

infrastructure, boost US manufactur-

ing and aim for a clean energy future.

Biden announced in February that

his administration would accelerate

research and development for low-

cost hydrogen production. One step

he has taken is that of forming the

Climate Innovation Working Group,

which is to coordinate and strengthen

efforts within the federal government

to set a course for net zero carbon

emissions by 2050, in keeping with

the Paris Climate Accord.

Since Biden took ofce on January

20, energy industry leaders and other

stakeholders in clean energy have met

with government ofcials and ex-

pressed their support for policy propos-

als. In mid-March CEOs from a num-

ber of major oil companies – including

ExxonMobil, BP, Shell, Chevron, and

ConocoPhillips – attended a meeting

with White House National Climate

Adviser Gina McCarthy and agreed to

collaborate with the administration to

work towards halting climate change.

The CEOs agreed to support federal

regulations limiting methane emis-

sions from wells and oileld equip-

ment, and the expressed support for the

US return to the Paris Climate Accord.

They urged the government to provide

support for carbon capture and hydro-

gen technology that would reduce

emissions of carbon dioxide.

Following the meeting, the White

House said that McCarthy “made it

clear that the administration is not

ghting the oil and gas sector, but ght-

ing to create union jobs, deploy emis-

sion reduction technologies, strength-

en American manufacturing and fuel

the American economy”.

The Clean Hydrogen Future Coali-

tion (CHFC) also expressed in mid-

March a shared vision by a number of

groups, including energy companies,

labour unions, utilities, NGOs, equip-

ment suppliers, and project developers.

The group said in a statement that it

will support federal clean hydrogen

policies that promote clean hydrogen

as a key pathway to achieve global

decarbonisation objectives that also

increase US global competitiveness.

“Clean hydrogen sits squarely with

President Biden’s plan to ‘Build Back

Better’ as it has the potential to decar-

bonise all sectors of the US economy,

create and transition good-paying jobs,

and grow our economy. The [CHFC]

is calling upon policymakers to ensure

that clean hydrogen plays a signicant

role to advance a national energy and

climate strategy,” Erik Mason, the in-

coming chair of the group and Nikola

Global Head of Energy Supply & Trad-

ing said in the statement.

Several small steps have already been

taken in an effort that will ultimately

require an investment of trillions of

dollars. The Department of Energy in

mid-March provided a grant worth $2

million to four research and develop-

ment projects designed to create clean

hydrogen production technologies.

The recipients are involved in explor-

ing different ways to produce hydro-

gen. The money will go to research

groups at Auburn University, Electric

Power Research Institute, University

of Utah and University of Kentucky

Research Foundation.

The DoE also announced last month

that it is in the early stages of design-

ing and building a grid energy storage

facility worth $75 million in Richland,

Washington. The Grid Storage Launch-

pad will be hosted by the Pacic North-

west National Laboratory and will

serve as a hub for the accelerated de-

velopment of long-duration and low-

cost grid energy storage. The facility

is due to be complete in 2025.

The US media is reporting that the

economic plan that Biden’s team is

drawing up calls for spending and tax

credits that will amount to between $3

billion and $4 billion, and that a sig-

nicant part of it will go towards infra-

structure that will incorporate clean

energy with the intention of sparking

jobs growth.

Building a clean energy system

across the US is reported to be central

to all aspects of Biden’s economic

plan. However, the administration has

yet to introduce a carbon tax, which

would likely make a real difference in

efforts to transform the country’s en-

ergy usage.

Hydrogen

Gas

Ongoing violence is jeopardising Mozambique’s efforts to develop its gas resources, and delays in bringing gas

resources on-stream may leave the fuel struggling to compete in a market with an already uncertain long-term future.

n Clean Hydrogen Future Coalition will support federal clean hydrogen policies

n Department of Energy provides grants for R&D projects and is designing long-duration

energy storage facility

THE ENERGY INDUSTRY TIMES - APRIL 2021

Fuel Watch

12

T

here is no doubting the impor-

tance of managing energy con-

sumption in heating and in-

dustry in order to meet global carbon

reduction and sustainability goals.

According to the International En-

ergy Agency (IEA), almost one-fth

of the growth in global energy use in

2018 was due to hotter summers

pushing up demand for cooling, and

cold snaps leading to higher heating

needs. And looking at energy con-

sumption by sector, data from the

IEA’s ‘World Energy Outlook 2019’

shows that industry will replace the

buildings sector as the biggest ener-

gy consumer before 2030.

Fossil fuel red boilers have long

been the go-to technology for meet-

ing heat demand in buildings and

industry, despite having a signi-

cant environmental impact. Accord-

ing to the IEA’s ‘World Energy Out-

look 2020’, the direct use of fossil

fuels in the buildings sector resulted

in just over 3 Gt of CO

2

emissions

in 2019, with a further 6.4 Gt in in-

direct emissions coming from the

use of electricity and district heat.

Meanwhile, the industrial sector

was responsible for more than 8.5

Gt of CO

2

emissions in 2019, of

which around 70 per cent were from

the direct combustion of fossil fuels

and the remainder from industrial

processes.

There has therefore been a growing

interest in the electrication of heat-

ing, not only as a way of decarbonis-

ing heat by using electricity generat-

ed from renewables to drive heat

pumps, but also to improve energy

efciency in heating.

Typically heat pumps are more ef-

cient than a conventional boiler

from a heating perspective – whether

in a district heat application or mu-

nicipal application. A heat pump

(HP) might typically have a Coef-

cient of Performance (COP) of 3.5 to

5 (or higher depending on the appli-

cation), i.e. it can transfer 500 per

cent more energy than it consumes.

Put another way, it produces 5 kW of

heat for every 1 kW input of electric-

ity. In contrast, if a high-efciency

gas boiler is, say, 95 per cent ef-

cient, this means 95 per cent of the

energy in the gas comes out as useful

heat, with the other 5 per cent being

lost as heat through the ue.

In the energy provider or utility

space we have been witnessing a

growing interest in HPs being used

as a primary source of generation,

replacing fossil fuelled boilers in the

generation of steam or steam and

power.

Notably, of late there has been a

demand for HP solutions that are in-

creasing in scale and complexity,

pushing the envelope in terms of

where industrial heat pumps are be-

ing applied. They are moving into a

range of applications with outputs of

between 40-70 MW, which would

have traditionally been served by a

series of boilers or a combined heat

and power (CHP) plant.

Importantly, there is also great po-

tential where there are signicant

cooling requirements, for example in

data centres. And where there is

cooling, the natural by-product is

waste heat. This means that while

cooling a space, there is the opportu-

nity to build a simultaneous applica-

tion, whereby heat could be provided

to, for example, a district or location.

With a heat pump, cooling and heat-

ing can effectively be done at the

same time – something that is not

possible with a boiler.

Yet despite their benets and matu-

rity, more education is needed.

While energy companies and utilities

are quite familiar with the technolo-

gy, energy managers within many

core industrial market segments have

a more risk-averse approach even

though heat pump technology has

been available for many years as an

alternative to conventional boilers.

Whether it is for a cooling applica-

tion at a pharmaceutical facility or in

a brewery, there is an opportunity

here for them to address both their

explicit cooling needs and their com-

mitment to energy sustainability.

It is a case of the energy manager

at the pharmaceutical facility or

brewery having the condence to

convince all stakeholders that, in this

scenario, the heat pump is a proven

technology that can address their

cooling needs and at the same time

serve to replace the boiler to meet

the ongoing requirements for hot

water.

Energy managers can be condent

in not only the capability of heat

pumps, but also in the fact that they

can be readily adapted to specic

installations.

There are various types of heat

pump and choosing the right one de-

pends on a number of factors. It de-

pends on the kW load requirement –

different loads will move you into

different technologies – and grade or

temperature of heat. It is also about

matching the heat pump running

conditions to the needs of the appli-

cation. Number of running hours is

therefore a factor. Similarly, operat-

ing conditions will affect mainte-

nance and therefore operating expen-

diture (opex). Factors such as uptime

and the need for redundancy must

also be taken into consideration,

along with choice of refrigerant and

its associated potential health and

safety impacts.

Ultimately, the choice of technolo-

gy – whether selecting between heat

pump technologies, or between a

heat pump and an alternative tech-

nology such as a gas boiler – is de-

termined by the Net Present Value

(NPV) of the installation. For cool-

ing, which is a necessity at a dairy or

an abattoir, there is no option to us-

ing a cooling plant. But for a heating

application, where there is always an

alternative to heat pumps, it comes

down to total cost of ownership and

return on investment. Industrial heat

pumps are more expensive than oil,

biofuel or gas boilers but payback

times can be as little as two years.

While climate and sustainability

commitments are the main drivers

for market growth, the actual techni-

cal and operating benets compared

to conventional boilers are slowly

being acknowledged and subse-

quently embraced by energy compa-

nies and energy managers.

According to market research com-

pany Technavio, the global industrial

heat pumps market is expected to

achieve a CAGR of close to 5 per

cent during the period 2019-2023.

This growth, however, will vary

from country to country. The market

for heat pumps is most mature in

Nordic countries, which have been at

the forefront of sustainability. Here

they are being used for: cooling in

data centres; in hospitals for space

cooling in areas such as operating

theatres, for example, while provid-

ing hot water; and by municipalities

for district heating.

In mainland Europe, we are now

seeing Germany, Switzerland and

the Netherlands pushing forward.

And in the UK, the government’s

Renewable Heat Incentive (RHI)

provides funding to encourage the

generation of heat from renewable

sources. Similar grants have also

been available in France for a num-

ber of years for almost completely

funding such capital investment.

Elsewhere, warmer countries like

Spain and regions like the Middle

East, where the need is more for

cooling, are further behind the matu-

rity curve but still project emergence

in this market.

Legislation such as the UK’s RHI

and the announcement from the Eu-

ropean Commission on the “Green

Deal” is certainly having an impact

in shifting the needle in the utility

and energy providers’ space, as we

see energy utilities step up their ac-

tivity. For this to continue, govern-

ments have to continue providing the

framework to drive the change.

Advances in technology will also

drive uptake. With many industrial

applications needing heat at higher

temperatures, there is ongoing work

to develop refrigerants to allow heat

pumps to accept heat at a tempera-

ture of 60-100°C and upgrade it to

200°C and beyond. In the future we

may see units based on water vapour

that could even go to nearly 300°C.

As energy prices increase, along

with downward pressure on carbon

emissions, the incentive for trans-

forming high temperature heat from

sources other than fossil fuels will

drive the development of very high

temperature heat pumps. And this

could really change the game.

Certainly as the world continues its

low carbon transition, the use of heat

pumps will be an integral part of de-

carbonising heat in the creation of

smart, sustainable cities and cutting

emissions in the industrial sector

while improving process efciency

in both heating and cooling.

Dave Dorney is Vice President &

General Manager Industrial Refrig-

eration at Johnson Controls.

Morten Deding is Heat Pump Prod-

uct Director BE Europe, Johnson

Controls.

There has been a

demand for heat

pump solutions that

are increasing in

scale and complexity,

pushing the envelope

in terms of where

industrial heat pumps

are being applied.

But more education

around the benets

is needed in many

core industrial market

segments.

Dave Dorney and

Morten Deding

Turning up the heat

Turning up the heat

on decarbonisation

on decarbonisation

THE ENERGY INDUSTRY TIMES - APRIL 2021

13

Industry Perspective

Dorney: Heat pumps are

moving into a range of

applications with outputs of

between 40-70 MW

THE ENERGY INDUSTRY TIMES - APRIL 2021

15

Technology Focus

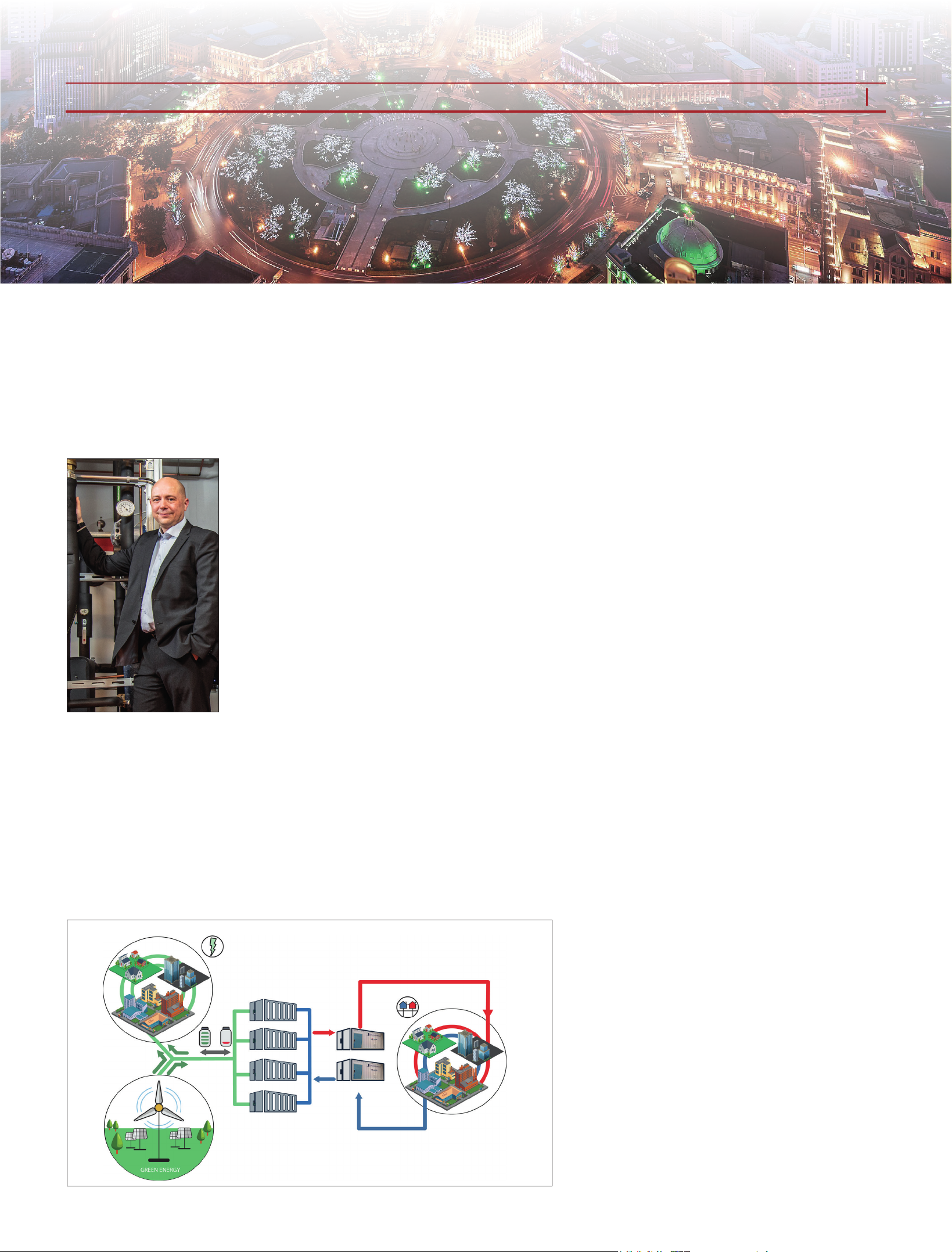

The growing amount of battery storage deployed to support variable renewable energy sources presents a big

opportunity for heat pumps. A project is underway at a massive facility in Dalian, China, which will demonstrate how

heat pumps can sit alongside batteries to recover and re-use waste heat. Junior Isles explains.

Heat pumps add another

Heat pumps add another

level to storage

level to storage

Tulokas: There needs to be

greater awareness about what

heat pumps can do

Waste heat from the batteries

is cooled by the HPs and

fed back to the batteries for

cooling. HPs then boost it to

the temperature needed for

district heating

Renewable green

electricity production

Power line

Battery containers

Capacity 200MW/800MWh

Oilon ChillHeat

pump containers

cooling

waste heat

COPtot=8,6

District heating return

District heating supply

The State

Grid

District heating

C

hina has been increasing its

use of wind and solar in an ef-

fort to green its economy and

last year announced a target to reach

carbon neutrality by 2060. As the

country installs more variable wind

and solar power, it is also deploying

battery technology to help stabilise

the grid.

One important battery project that

is now being built in Dalian, north-

eastern China, will be the largest in

the country and one of the largest in

the world. With a peak capacity of

200 MW and electricity storage ca-

pability of 800 MWh, the battery

will serve as a fast-reacting reserve

capacity for wind power. But nota-

bly, it will also full another role.

Through the use of heat pumps

(HPs), supplied by Finnish company

Oilon, it will also use heat from the

batteries to provide heat to the city’s

district heating network.

Explaining the rationale behind the

decision to include HPs in the proj-

ect, Tero Tulokas, CEO, Oilon, said:

“There are both environmental and

economic drivers for such projects

but in the long-run waste heat

streams will increasingly be utilised

to reduce emissions.”

The project is the culmination of

several years’ work, which roughly

two years ago also saw Oilon and

Dalian Henliu Energy Storage Power

Station Company Ltd (Dalian Hen-

liu) build a pilot plant to prove the

concept of applying this type of in-

dustrial HP for simultaneous cooling

and district heating. The pilot al-

lowed the partners to conrm key

parameters such as HP efciency and

capacity, etc., with actual devices.

Satised with this pilot, Dalian

Henliu decided to order eight HPs

for the commercial project. These

rst eight units are scheduled to be

up and running this spring, with a

second batch of eight planned for a

second stage in the future.

The Dalian installation is a gov-

ernment-approved demonstration

project primarily to test the func-

tionality of vanadium batteries con-

nected to the grid. It will serve as a

fast-reacting reserve capacity for

wind power when there is no wind

and will also curtail the peaking

power requirements in the area by

about eight per cent.

The Dalian battery project consists

of large vanadium redox ow bat-

teries, wherein the energy storage

capability is based on ion reactions

of the electrolyte solution owing

inside the batteries. Unlike lithium-

ion batteries, vanadium batteries are

free of re safety issues and are also

long-lived. They can be charged

more than 20 000 times without re-

ducing the storage capacity, and

they allow charging and discharging

at the same time.

Like most batteries, however, they

still require cooling and for this pur-

pose Oilon will supply eight of its

containerised ChillHeat P-series

high-temperature heat pumps, each

with a capacity of over 1 MW, de-

pending on the temperature levels.

When used for both district heating

and cooling, they can reach an over-

all efciency (COPtot) of 8.6.

Commenting on the choice of HP

technology, Tulokas said: “In this

type of application, there are options.

You could use air-to-water, waste

heat-to-atmosphere or even air-to-air

heat pumps. Because Dalian is a big

installation and the owners wanted to

be even greener, they wanted to uti-

lise the waste heat.

The HPs at Dalian are ‘liquid-to-

liquid’ units, meaning that both the

heating and cooling sides have liquid

connections. The water is heated on

the district heating side and cooled

on the battery cooling side.

Waste heat from the batteries will

have a temperature of about 25-

35°C. This is cooled by the HPs and

fed back to the batteries for cooling.

HPs then boost it to the temperature

needed for district heating, i.e.

around 80°C.

“What’s great in this application is

that both the heating and cooling

sides are valuable. Usually in cool-

ing applications, the waste heat is

discarded,” said Tulokas. “Here,

there is a cooling circuit, where wa-

ter is circulating. Heat is taken from

that water and fed back to the batter-

ies to cool them and the remaining

heat is utilised for district heating.”

While capex, opex, environmental

impact of the refrigerant, etc., were

all important in selecting the most

suitable HP technology, Tulokas said

the district heating temperature was

key. “It puts limitations on the refrig-

erants and compressor type. Not all

types of compressor can go up to

these temperatures. Normally these

type of cooling systems go up to 40-

60°C. So here we are using high

temperature HPs.”

He added: “The exibility of the

system is also very important; there

has to be a wide enough turndown

ratio to ensure the conditions are sta-

ble enough for the main process.” He

says operating between 1 and 100

per cent 1 “is not a problem” due to

the use of frequency converter–driv-

en compressors and the fact there are

several compressors in each heat

pump.

The project, which will be built in

two stages, will feature a total of 16

pumps on nal completion with a ca-

pacity of approximately 16 MW for

each application.

“The heating output will be about

16 MW and the cooling output just

under 16 MW since some of the

electricity is consumed by the heat

pumps in the cooling application.

The heating COP is equal to the

cooling COP plus the electricity

used by the heat pumps. So the

heating COP is always slightly more

than the cooling COP,” explained

Tulokas. “So the total useable heat-

ing and cooling is about 30 MW.”

The HP installation has a combined

COP, i.e. heating plus cooling, of

8.6. This means that each 1 kW of

electricity can provide 8.6 kW of

heating and cooling. Commenting on

this level of efciency versus, say, a

gas boiler, which could only be used

for heat, Tulokas said: “We still pro-

vide burners for boilers but we are

seeing this desire to reduce emis-

sions and many energy companies

are nding it is very cost efcient to

use heat pumps in situations where

low grade heat is needed.”

He added: “There are also many

cases where combustion is already in

place but there is an opportunity for

heat pumps to reduce the amount of

combustion needed. Here heat

pumps are used rst, with the re-

maining capacity or reserve served

by boilers.” According to Tulokas,

there are a large number of projects

where companies are opting for this

hybrid, boiler plus HP, approach.

“It can be that the heat capacity of

the heat pump is only 20-30 per cent

of the maximum load but it can still

provide 80-90 per cent of the needed

energy. In this situation it is not cost

effective to have a heat pump capaci-

ty that fully covers the required max-

imum heat capacity – it is better to

have a boiler where you have these

peak hours,” he said.

Oilon has been making burners for

conventional boilers for decades but

notes that the HP business is grow-

ing. “We have been doing heat

pumps for years but now it seems

this sector is growing rapidly all over

the world. There are huge possibili-

ties for green heating using waste

heat from cooling.”

The economics of each installation

varies from project. Much comes

down to the cost of electricity, which

is the main operating cost. Tulokas

says payback time can be as little as

one year but is often 3-5 years, and

sometimes more. “At the moment,

the industry is prepared to accept the

longer payback times because of the

need to reduce CO

2

.”

As pressure grows on countries to

cut emissions, Tulokas believes there

will be more of these projects where

waste streams are utilised. “With the

climate targets, they have to do ev-

erything they possibly can.”

Looking at the market, he noted

there have been a number of an-

nouncements in places such as Baltic

countries, the US and France, and

countries where battery energy stor-

age is being used to complement

uctuating renewable electricity gen-

eration. “Our main market for indus-

trial heat pumps is denitely Europe.

But we have also done projects in

China, North America and South

America,” said Tulokas. He also not-

ed that the proliferation of data cen-

tres also presents opportunities to use

waste heat for district heating.

“Companies and industries with a

need for cooling can use heat pumps

to provide district heating. Recently

we sold a project in Europe to a

company that is manufacturing prod-

ucts from moulded plastics. The heat

pumps provide cooling for the pro-

cess machines and then use the heat

to allow the plant to also sell district

heating.” He added: “There is also

interest from district heating compa-

nies to have this kind of heat in their

networks to reduce CO

2

emissions in

their production.”

Assessing the future of HPs, Tulo-

kas concluded: “There needs to be

greater awareness about what heat

pumps can do but it is gaining mo-

mentum. I don’t see any big techno-

logical barriers or breakthroughs

that are needed; it’s mature technol-

ogy. It’s just about understanding

the possibilities.”

THE ENERGY INDUSTRY TIMES - APRIL 2021

16

Final Word

T

he countdown to COP (the

Conference of Parties) is well

underway. But as the clock

ticks towards the 26th United Nations

Climate Change Conference (COP

26), scheduled for November, there is

mounting evidence that drastic action

will be needed if we are to stick to

agreed targets on climate change.

With just seven months to the gather-

ing in Glasgow, UK, the pressure is

on. The upcoming conference, which

was postponed from November last

year due to the Covid-19 pandemic,

will be the rst time that Parties are

expected to commit to increased ambi-

tion since the landmark climate

agreement was signed in 2015 at COP

21 in Paris.

Under the Paris Agreement nations

agreed to keeping a global tempera-

ture rise this century well below 2°C

above pre-industrial levels and to

pursue efforts to limit the temperature

increase even further to 1.5°C.

The Paris Agreement requires all

Parties to put forward their best efforts

through their emissions targets –

known as Nationally Determined

Contributions (NDCs) and to

strengthen these efforts in the years

ahead. Informally known as the

“ratchet mechanism”: Article 4 of the

Paris Agreement says that countries

will revise their NDCs and communi-

cate them every ve years. This is

essentially a periodic global stocktake

to assess the collective progress to-

wards achieving the purpose of the

agreement and to inform further indi-

vidual actions by Parties.

Unfortunately, it looks increasingly

likely that COP26 will show ‘global

stocks’ to be in a parlous state.

Last month a UNFCCC report

claimed climate commitments were

“not on track” to meet the Paris Agree-

ment goals. Its Initial NDC Synthesis

Report, showed nations must “re-

double efforts and submit stronger,

more ambitious” national climate ac-

tion plans in 2021 if they are to achieve

the Paris Agreement goal of limiting

global temperature rise by 1.5°C by

the end of the century.

UN Secretary-General, António

Guterres, called 2021 “a make or break

year” to confront the global climate

emergency. “The science is clear, to

limit global temperature rise to 1.5°C,

we must cut global emissions by 45

per cent by 2030 from 2010 levels,”

he said.

According to Guterres, the interim

report is “a red alert for our planet”. It

shows governments are “nowhere

close” to the level of ambition needed.

He said: “The major emitters must step

up with much more ambitious emis-

sions reductions targets for 2030 in

their Nationally Determined Contri-

butions well before the November UN

Climate Conference in Glasgow.”

The report was requested by Parties

to the Paris Agreement to measure the

progress of NDCs ahead of COP26.

Covering submissions up to 31 De-

cember 2020, it shows 75 Parties have

communicated a new or updated

NDC, representing approximately 30

per cent of global greenhouse gas

emissions.

The report shows that while the

majority of nations represented in-

creased their individual levels of

ambition to reduce emissions, their

combined impact puts them on a path

to achieve a less than 1 per cent reduc-

tion by 2030 compared to 2010 levels.

The Intergovernmental Panel on Cli-

mate Change, by contrast, has indi-

cated that emission reduction ranges

to meet the 1.5°C temperature goal

should be around 45 per cent lower.

Responding to the publication of the

UNFCCC Synthesis Report, Christian

Aid climate policy lead, Dr Kat

Kramer, said: “It is unutterably appall-

ing that the combined impact of the

pledges that have been made put the

world on course to achieve only a 1

per cent reduction in emissions by

2030 from 2010 levels. The science

suggests that even for a 50 per cent

chance of limiting warming to 1.5°C,

emissions will need to roughly halve

over that same period. Those are the

same odds as playing Russian roulette

with three bullets in the chamber. This

is a call to action.”

Certainly the time for action is now.

The UNFCCC sees 2021 as an “un-

precedented opportunity” to make

signicant progress on climate change

and urged all nations to build forward

from Covid-19 with more sustainable

and climate-resilient economies.

“This is a rare moment that cannot be

lost,” said UNFCCC Executive Sec-

retary, Patricia Espinosa. “As we re-

build, we cannot revert to the old

normal.”

Yet it seems her words come too late.

There is worrying evidence that the

old normal has already returned, and

with a vengeance.

Last month, the International Energy

Agency (IEA) revealed that, following

a steep drop in early 2020, global

carbon dioxide emissions have re-

bounded strongly. The Paris-based

agency said global energy-related CO

2

emissions were 2 per cent, or 60 mil-

lion tonnes, higher in December 2020

than in the same month a year earlier.

The resurgence was attributed to a

pickup in economic activity, which

pushed energy demand higher, and a

lack of clean energy policies.

Dr Fatih Birol, the IEA Executive

Director, said: “The rebound in global

carbon emissions toward the end of

last year is a stark warning that not

enough is being done to accelerate

clean energy transitions worldwide. If

governments don’t move quickly with

the right energy policies, this could put

at risk the world’s historic opportunity

to make 2019 the denitive peak in

global emissions.”

Emissions in China for the whole of

2020 increased by 0.8 per cent, or 75

million tonnes from 2019 levels,

driven by China’s economic recovery

over the course of the year. China was

the rst major economy to emerge

from the pandemic and lift restrictions,

prompting its economic activity and

emissions to rebound from April on-

ward. China was the only major

economy that grew in 2020.

In India, emissions rose above 2019

levels from September as economic

activity improved and restrictions

were relaxed. In Brazil, the rebound

of road transport activity after the April

low drove a recovery in oil demand,

while increases in gas demand in the

later months of 2020 pushed emis-

sions above 2019 levels throughout

the nal quarter.

Emissions in the United States fell

by 10 per cent in 2020. But on a

monthly basis, after hitting their low-

est levels in the spring, they started to

bounce back. In December, US emis-

sions were approaching the level seen

in the same month in 2019. This was

the result of accelerating economic