www.teitimes.com

March 2021 • Volume 14 • No 1 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Developing the edge

Driving decarbonisation

The move from centralised systems to

a more decentralised set-up calls for

innovation at the grid edge.

Page 13

Focusing on electrifying eet

vehicles holds the key to rapid

decarbonisation of transport.

Page 14

News In Brief

Hydrogen may be competitive

sooner than expected

Green hydrogen is set to play a

signicant role in the energy mix

sooner faster than expected as costs

of production fall.

Page 2

Mexico raises fears over

renewables legislation

The Global Wind Energy Council

and Global Solar Council have

now added their voices to calls

for the government of Mexico to

halt reversals to key parts of the

country’s Electricity Act.

Page 4

India can avoid high carbon

future, says IEA

India has a huge opportunity to

bring electricity to millions of its

citizens without following the high

carbon path that other countries

have followed, says the International

Energy Agency.

Page 5

EU offshore wind target

needs huge grid investment

According to the European

Commission the investment needed

for its latest offshore wind target

of 300 GW by 2050 amounts to

almost €800 billion, two-thirds of

which would be spent on network

infrastructure.

Page 7

South Africa to speed up

renewables

Large amounts of renewable energy

will be procured through auctions

in the coming weeks and months,

South African President Cyril

Ramaphosa said in his state of the

nation address.

Page 8

Offshore wind turbine

market hots up

Competition in the offshore wind

turbine market escalated last month

with Vestas’ introduction of what

will be the world’s largest wind

turbine.

Page 9

Fuel Watch: Gas

Qatar Petroleum has taken the

decision to proceed with the North

Field East (NFE) Project, the largest

LNG project ever undertaken.

Page 12

Technology Focus: Synthetic

fuels in the fast lane

The Hari Onu project in Chile

is gearing up to demonstrate the

potential of synthetic fuel production

from wind.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

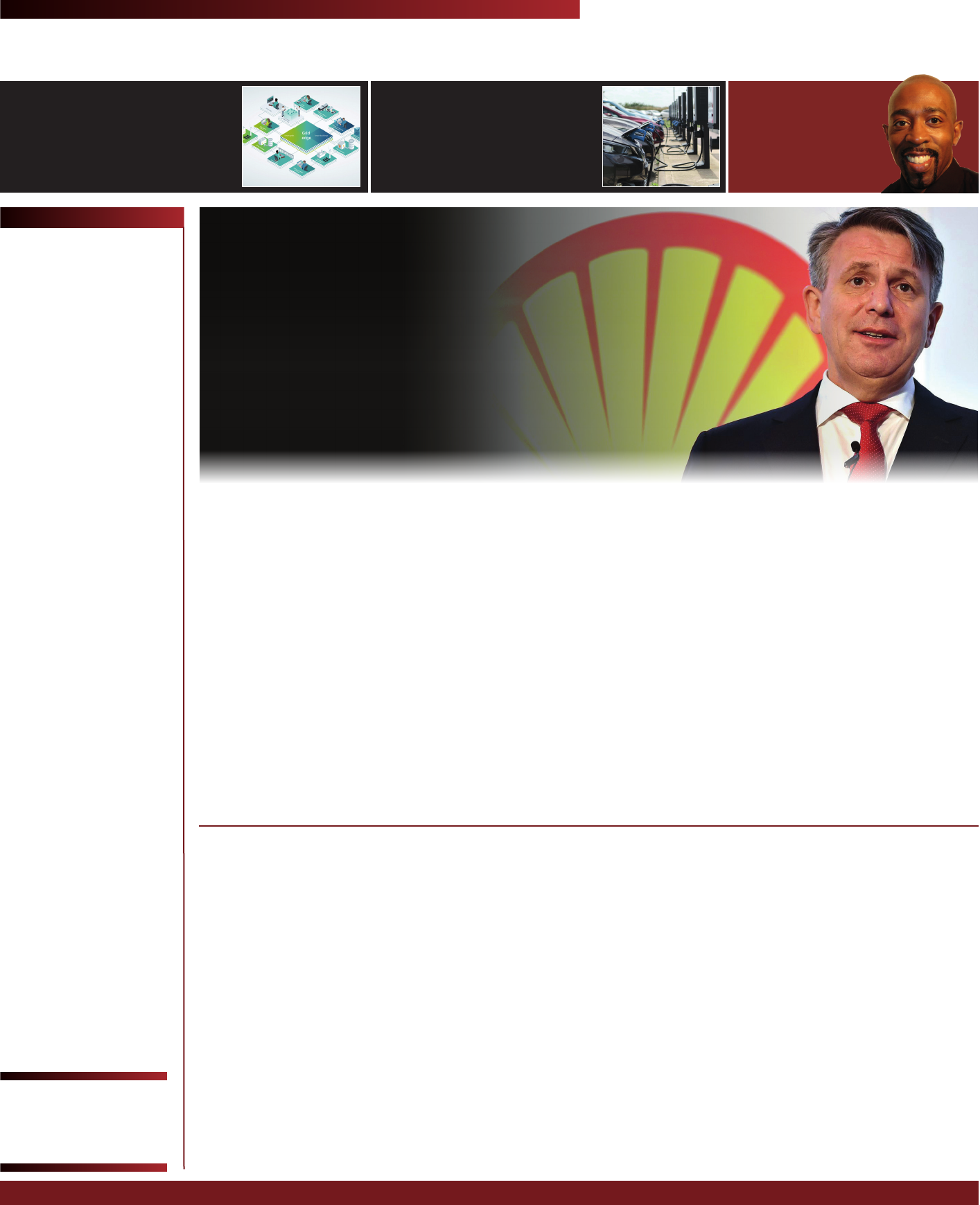

Shell has laid out its plan to reach zero carbon. The plan will see signicant investment in

renewables, with some arguing that some oil and gas companies are paying too much for

renewables assets. Junior Isles

Plans for Danish energy hub take shape

THE ENERGY INDUSTRY

TIMES

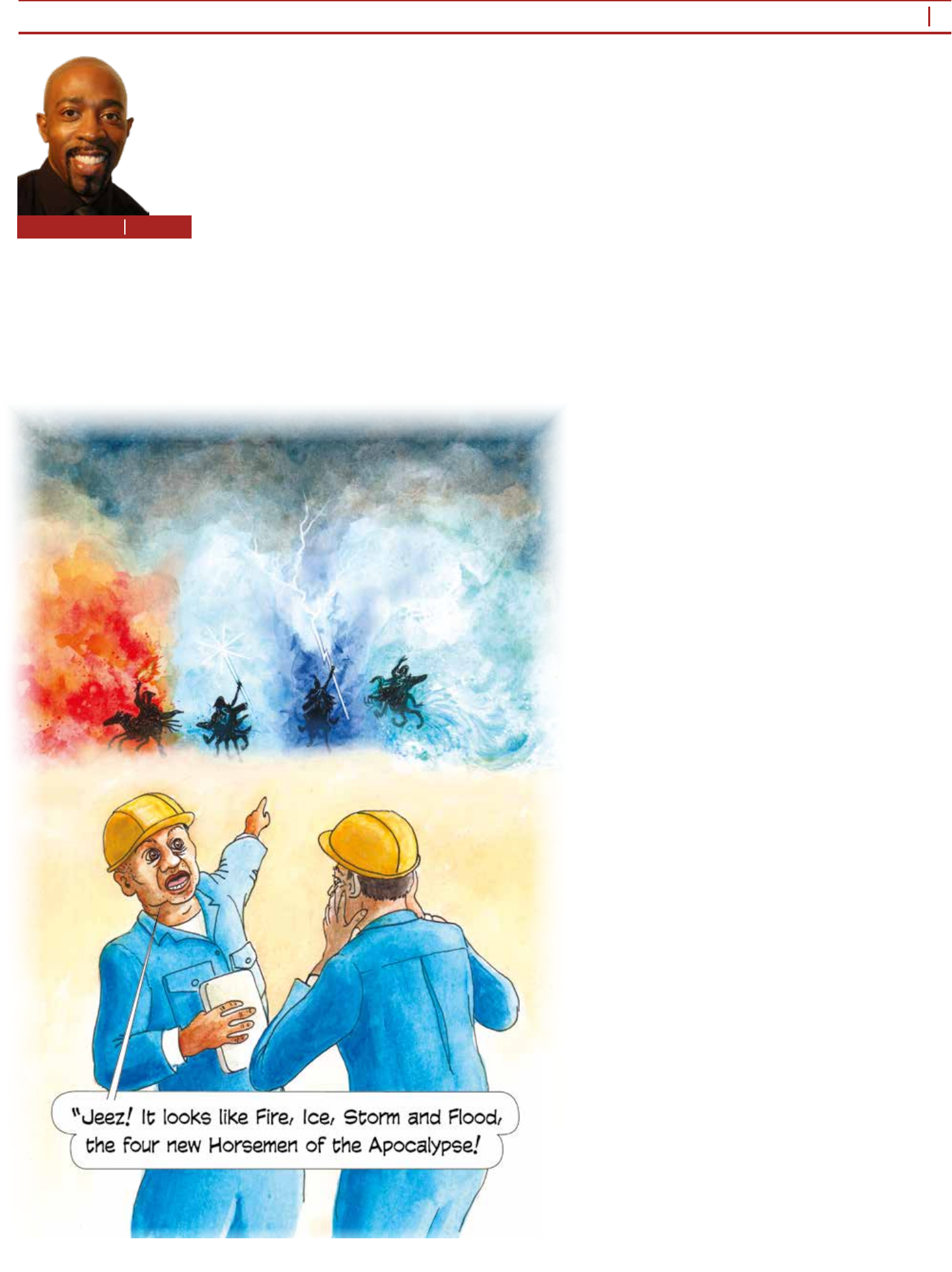

Final Word

Expecting the unexpected

must be standard practice,

says Junior Isles.

Page 16

Royal Dutch Shell has become the lat-

est oil and gas company (OGC) to an-

nounce plans to reach net zero carbon

emissions by 2050, highlighting a

growing realisation that the future lies

in shifting focus away from fossil fuels

to clean energy.

The energy major said it plans to

continue generating cash from its oil

business and “over time” invest more

into gas, chemicals, renewables and

selling power.

The plan would see net emissions

intensity, i.e. the amount of carbon per

megajoule of energy sold, fall 6-8 per

cent from 2016 levels by 2023, 20 per

cent by 2030, 45 per cent by 2035 and

100 per cent by 2050. Shell said on an

absolute basis they would also fall to

zero.

Stuart Carter a senior oil and gas

lawyer at Keystone Law, commented:

“Shell’s announcement is a modern

day ‘King Cnut’ declaration that they

cannot hold back the tide and over the

course of the next 30 years will be ac-

tively pursuing measures to cut their

carbon foot print.”

Professor David Elmes, Head of the

Global Energy Research Network at

Warwick Business School, also noted

the new strategy places the company

in the growing group of energy com-

panies committing to net zero emis-

sions and transitioning away from be-

ing an oil and gas company, but

questioned if it can fund the transition.

“There are some big technology bets

in Shell’s plans: carbon capture and

storage, more biofuels and replacing

natural gas with hydrogen. These need

a lot of investment to deliver volume

at affordable prices,” he said.

Shell hopes to increase its number of

electric vehicle charging points from

60 000 to about 500 000 by 2025. It is

also putting an emphasis on hydrogen,

biofuels, new carbon capture and stor-

age targets and offsets.

It plans to invest $19-$22 billion

each year, $8 billion in oil, $4 billion

in gas, up to $5 billion in chemicals,

up to $3 billion in renewables and “en-

ergy solutions” and around $3 billion

in marketing.

Explaining how these goals will be

funded, Shell’s Chief Executive Ben

van Beurden said: “Our upstream [oil

exploration and production] business

will continue to generate the cash

and returns needed to fund share-

holder distributions, and also to ac-

celerate our transition into the future

of energy.”

Professor Elmes, however, said that

more detail is needed. “When BP

launched their new strategy, a discus-

sion among shareholders was, can

they earn enough prots to invest in

the changes while keeping investors

happy with dividends. It’s that level of

detail that Shell needs to provide.”

There has been debate within Shell

over how far the company should go.

Some executives have called for a

faster shift towards renewables, while

others remain concerned about dilut-

ing legacy businesses, questioning

Continued on Page 2

A plan to build an energy island in the

North Sea has been given the go-

ahead by the Danish government,

marking an important step in making

the North Sea a renewable energy hub

for Europe.

The energy hub will be an articial-

ly constructed island 80 km from the

shore of the peninsula Jutland. Around

200 wind turbines with a combined

capacity of 3 GW are expected to be

installed in the rst phase of the proj-

ect. When fully developed, it will

reach a capacity of 10 GW.

Giving the green light for the proj-

ect, the Danish Ministry of Climate,

Energy and Utilities said the hub will

produce “yet unseen” amounts of

green electricity and is one of the gov-

ernment’s agship projects for the

green transition in Europe.

Danish Minister for Climate, Dan

Jørgensen said: “This is truly a great

moment for Denmark and for the

global green transition. This decision

marks the start of a new era of sustain-

able energy production in Denmark

and the world and it links very ambi-

tious climate goals with growth and

green jobs.

“The energy hub in the North Sea

will be the largest construction proj-

ect in Danish history. It will make a

big contribution to the realisation of

the enormous potential for European

offshore wind, and I am excited for

our future collaboration with other

European countries,” said Jørgensen.

The island will act as an offshore

power plant generating electricity

from the wind turbines installed

around the island and distributing it

directly to consumers in countries sur-

rounding the North Sea.

“We are at the dawn of a new era

for energy,” said Jørgensen. “The EU

has set a goal to achieve climate neu-

trality by 2050 and the Commission

has set a target of 300 GW of off-

shore wind energy in order to attain

this goal. By constructing the world’s

rst energy hub with a potential ca-

pacity of 10 GW, Denmark signi-

cantly contributes to this ambitious

target. Not only by dramatically ex-

panding renewable energy produc-

tion, but also by supplying our Euro-

pean neighbours with an abundance

of renewable energy.”

The energy island will be a public-

private partnership between the Dan-

ish state and private companies.

Denmark will own the majority of

the island, but private companies

will be crucial for the project to fulll

the potential with regards to innova-

tion, exibility, cost-effectiveness,

and business potentials, the Ministry

said.

In a related development, last month

Denmark-based green hydrogen pro-

ducer Everfuel A/S said its green

hydrogen project in the Danish penin-

sula of Jutland will lead efforts to

build a green fuel hub in the region.

The company is joining a partnership,

which also includes local consultancy

COWI, Ørsted, Vattenfall and the

Frederica renery.

Together the partners are currently

working to build industrial-scale

power-to-X facilities in the Triangle

Region for hydrogen production

from renewable energy. Everfuel’s

20 MW HySynergy project is ex-

pected to be in operation from the

middle of 2022.

A second phase of the project is be-

ing planned, which could expand ca-

pacity with a 300 MW electrolyser,

due to be operational by 2025, the

company said. The facility will pro-

duce green hydrogen but Everfuel is

also considering production of am-

monia and methanol for green marine

and aviation fuels.

Shell sets out zero

Shell sets out zero

carbon ambition,

carbon ambition,

as OGCs race for

as OGCs race for

renewables

renewables

Shell’s CEO Ben van Beurden says upstream activites will fund transition

THE ENERGY INDUSTRY TIMES - MARCH 2021

3

Our Clients:

Our Partners:

weber media solutions

YOUR CREATIVE MEDIA AGENCY FOR

DESIGN AND MARKETING SOLUTIONS

We are a creative media agency which provide a bespoke

service to meet your media and marketing requirements

and much more

DESIGN / VIDEO / WEB / EXHIBITION STAND DESIGN

MAGAZINES / PRINT MANAGEMENT / MAILING

For more information please contact:

Karl Weber / Director

T: +44 7734 942 385 / E: karlw@webermediasolutions.com

www.webermediasolutions.com

some of our exhibition signage projects, for more information please visit our website:

www.eurelectric.org

#ElectricDecade #ItsElectric #PowerSummit21

Erna Solberg

Confirmed speakers include

Dan Yergin Sandrine

Dixson-Declève

Peter Hinssen

Prime Minister,

Norway

Vice Chairman

IHS Markit &

Pulitzer Prize Winner

President & Chair of

the Commissions

R&I Think Tank

Co-founder &

Partner at nexxworks

www.teitimes.com

THE ENERGY INDUSTRY

TIMES

subscribe today

The Energy Industry Times is the only publication that

covers global news related to the power and energy

sector in a newspaper style and format whose

uniqueness is recognised by our readers.

As a paid subsciber you will gain full access to our online

news desk.

You will also no longer have to wait for the printed edi-

tion; receive it by PDF “hot off the press” or download it

online.

To subscribe, email subscriptions@teitimes.com or visit

www.teitimes.com

To guarantee receiving your monthly copy of the award

winning newspaper, you need to subscribe today

THE ENERGY INDUSTRY TIMES - MARCH 2021

5

Asia News

Syed Ali

India has a huge opportunity to bring

electricity to millions of its citizens

without following the high carbon path

that other countries have followed,

says the International Energy Agency

(IEA).

In its ‘India Energy Outlook 2021’,

the Paris-based said India’s ability to

ensure affordable, clean and reliable

energy for its growing population will

be vital for the future development of

its economy, but doing this in a low

carbon way will require strong poli-

cies, technological leaps and a surge in

clean energy investment.

The India Energy Outlook 2021 – a

special report in the IEA’s World En-

ergy Outlook series – examines the

opportunities and challenges faced by

the planet’s third-largest energy con-

suming country as it seeks to recover

from the Covid-19 crisis. India is set

to experience the largest increase in

energy demand of any country world-

wide over the next 20 years as its

economy continues to develop.

The nation’s energy needs are ex-

pected to grow at three times the

global average under today’s policies.

Energy use has doubled since 2000,

with most of that demand met by coal

and oil. Energy demand is set to grow

about 35 per cent by 2030, down from

the 50 per cent forecasted before the

coronavirus pandemic.

“India has made remarkable prog-

ress in recent years, bringing electric-

ity connections to hundreds of mil-

lions of people and impressively

scaling up the use of renewable en-

ergy, particularly solar,” said Dr Fatih

Birol, the IEA Executive Director.

“What our new report makes clear is

the tremendous opportunity for India

to successfully meet the aspirations of

its citizens without following the

high-carbon pathway that other econ-

omies have pursued in the past.”

More than that of any other major

economy, India’s energy future de-

pends on buildings and factories that

are yet to be built, and vehicles and

appliances that are yet to be bought.

Based on India’s current policy set-

tings, nearly 60 per cent of its CO

2

emissions in the late 2030s will be com-

ing from infrastructure and machines

that do not exist today. This represents

a huge opening for policies to steer

India onto a more secure and sustain-

able course, says the report.

The IEA says this pathway will call

for widespread electrication of pro-

cesses, greater energy efciency, the

use of technologies like carbon cap-

ture, and a switch to progressively

lower-carbon fuels.

It notes, however, that these transfor-

mations, “on a scale no country has

achieved in history”, will require huge

advances in innovation, strong partner-

ships and vast amounts of capital. The

additional funding for clean energy

technologies required to put India on a

sustainable path over the next 20 years

is $1.4 trillion, or 70 per cent higher

than in a scenario based on its current

policy settings, says the report. But the

benets are huge, including savings of

the same magnitude on oil import bills.

Birol said policymakers needed to

ensure the next wave of growth is met

with renewable energy sources such as

solar. “India has a huge potential to be

the kingmaker in solar electricity, be-

cause it is very cheap,” Birol said.

According to a recent data from Mer-

com, the share of solar power in India’s

installed power capacity mix reached

10.3 per cent, exceeding that of wind-

based power sources for the rst time.

Solar, however, still only represents

4 per cent of generation, with coal still

providing 70 per cent of the country’s

electricity. And despite impressive

gains in renewables, the country still

continues to make large coal capacity

additions. In February, Bharat Heavy

Electricals Limited (BHEL) success-

fully commissioned the second unit

(800 MW) of the 2x800 MW Gadar-

wara supercritical coal red power

plant in Madhya Pradesh.

n A Statement of Intent has been signed

between IndianOil Corp. Ltd. and M/s

Greenstat Hydrogen India Pvt. Ltd., a

subsidiary of Greenstat Norway for

setting up of a Centre of Excellence on

Hydrogen (CoE-H). The Government

of India is giving more attention to

exploration of new and emerging forms

of energy such as carbon capture usage

and storage (CCUS) and fuel cells.

South Korea says it will build the

world’s largest wind farm by 2030, as

part of a green economic recovery fol-

lowing the Covid-19 pandemic.

The 8.2 GW offshore wind power

complex in Sinan, South Jeolla Prov-

ince, is one of the main components of

South Korean President Moon Jae-in’s

New Green Pact, which began last year

to curb dependence on fossil fuels in

Asia’s fourth economy and make it

carbon neutral by 2050.

Moon said the project will require an

investment of about Won48.5 trillion

($43.2 billion) and will create 5600

jobs. The project will also be central

to helping the government achieve its

target to increase the country’s wind

capacity to 16.5 GW by 2030, up from

the current 1.67 GW.

South Korea has set a goal of becom-

ing by 2030 one of the top ve nations

when it comes to offshore wind power

generation.

Indonesia has outlined its smart grid

development programmes, in a move

it hopes will improve grid reliability

and efciency.

Under a new government plan, ve

new systems will be installed in Java-

Bali between 2020 and 2024, reaching

a total of 25 systems by the end of the

period.

The Ministry of Energy and Mineral

Resources Republic of Indonesia said

in a statement issued in February: “In

increasing the reliability of the electric

power system, smart grid is believed

to be one of the solutions to increase

efciency in services to the commu-

nity. In addition, smart grids can in-

crease transmission exibility [in or-

der] to receive more Variable

Renewable Energy (VRE).”

Speaking at a webinar, Secretary of

the Directorate General of Electricity

Munir Ahmad, said: “The use of smart

grid technology is not limited to urban

and large-scale electricity consumers.

Smart grid technology can also be

utilised on small-scale smart mi-

crogrids in rural and remote areas with

difcult access to the transmission

network.”

State power utility PLN has already

conducted several smart grid pilot proj-

ects. Smart grid implementation will

initially focus on reliability, efciency,

customer experience and grid produc-

tivity. In the next stage PLN will focus

on resilience, customer engagement,

sustainability and self-healing.

India can avoid high

India can avoid high

carbon future, says IEA

carbon future, says IEA

South Korea plans world’s

largest offshore wind farm

Indonesia sets

Indonesia sets

out smart grid

out smart grid

programme

programme

n Energy demand is set to grow about 35 per cent by 2030

n Clean technology path will require $1.4 trillion

billion East Anglian Hub offshore

wind farm in the UK.

Over 200 14+MW wind turbines

are planned for the East Anglian

Hub, according to Iberdrola, parent

company of ScottishPower Renew-

ables. The two companies have

agreed to work together ahead of

the next Contracts for Difference

auction – scheduled for later this

year – to optimise the projects, with

the ambition of then signing turbine

supply and installation agreements.

Subject to the outcome of the plan-

ning considerations, construction of

the East Anglia Hub is expected to

commence in 2023, with completion

in 2026.

The East Anglia Hub projects have

the potential to deliver more than 7.5

per cent of the UK’s 40 GW target

for offshore wind generation by

2030 as set out in the government’s

Ten Point Plan. To deliver on the

plan’s ambitions, this year’s Con-

tracts for Difference auction will

need to ensure sufcient deployment

to put the UK on track to achieve

this target.

Hitachi ABB Power Grids announced

in February that it has received a $20

million order from TEİAŞ, the trans-

mission system operator for electric-

ity in Turkey. The order is to supply

power transformers for a grid expan-

sion project to bring power to remote

regions across the country.

Under the contract, Hitachi ABB

Power Grids’ transformer business

will supply 62.5 MVA and 100

MVA, 154 kV power transformers.

GE has announced the start of com-

mercial operation of Junliancheng

Power Plant in Tianjin City, China. GE

provided the power generation equip-

ment for the new 661 MW CHP gas-

red power plant that replaced the

coal-red power plant. Following the

transition, the Junliangcheng plant is

expected to reduce SO

2

and NOx emis-

sions by 1200 and 7775 tons per year,

respectively.

The new plant, owned by China

Huadian Tianjin Junliangcheng Pow-

er Generation, part of China Huadian

Corporation (CHD), features the rst

commercially operating GE 9HA.01

technology in China. In addition to

the 9HA.01 gas turbine, GE supplied

the Mark* VIe Distributed Control

Solution, for full combined cycle

plant control and operation, while

GE’s local partner on this project -

Harbin Electric - provided the steam

turbine, generator and balance-of-

plant equipment for Junliangcheng.

An order to supply gas power genera-

tion equipment for West African En-

ergy’s 300 MW combined cycle gas

turbine (CCGT) power project in Cap

des Biches, Dakar, Senegal has been

awarded to GE. In a statement, GE

said: “Upon completion, the Cap des

Biches plant will be the biggest power

plant in Senegal and is expected to

generate nearly 25 per cent of the elec-

tricity consumed in the country.

The plant is expected to begin op-

erations in phases starting in 2022.

GE will supply two 9E.03 gas tur-

bines, one STF-A200 steam turbine,

three A39 generators, two heat re-

covery steam generators, and addi-

tional balance-of-plant equipment as

part of the project scope.

biggest onshore wind farm in Europe.

The agreement includes a full turbine

service and maintenance deal for 25

years.

The Önusberget onshore wind farm

in Sweden will have a generating ca-

pacity of 753 MW. Luxcara has

started infrastructure work, while GE

Renewable Energy aims to start de-

ploying the rst of the 137 Cypress

onshore wind turbines from July

2021. Each turbine has a capacity of

5.5 MW and a rotor of 158 m.

The turbine blades will include an

ice mitigation system to ensure re-

duced downtime and a stable level

of availability.

Hitachi ABB Power Grids has won an

order from the 3.6 GW Dogger Bank

Wind Farm in the UK to connect the

third transmission link from the

world’s largest offshore wind farm to

the UK mainland, a distance of more

than 130 km.

This contract extends the ongoing

delivery of Dogger Bank A and B to

include C1. The contract is subject to

nancial close of the third phase of

Dogger Bank Wind Farm, currently

scheduled for late 2021.

Dogger Bank Wind Farm is a 50-

50 joint venture between SSE Re-

newables and Equinor. Hitachi ABB

Power Grids will supply it HVDC

Light technology, enabling electrici-

ty transmission and dynamic integra-

tion of the offshore wind farm to the

onshore grid.

Niklas Persson, Managing Direc-

tor of Hitachi ABB Power Grids’

Grid Integration Business, said: “We

are playing a key role in accelerat-

ing the energy transition. HVDC

technology signicantly contributes

towards a carbon-neutral energy fu-

ture by enabling the integration of

large-scale and remote renewable

energy generation.”

EDF Renewables and its Belgian part-

ner Windvision secured a 226 MW

project in France’s latest tender for

onshore wind turbine capacity in early

February.

The Mont des Quatre Faux project

will be located near Rethel, in the

Ardennes department of France’s

Grand Est region. The power com-

plex will cost around €250 million

($300 million). EDF said that the

project was authorised last year by

the Administrative Court of

Chalons-en-Champagne, but it is

currently being challenged in the

administrative court of appeal. A -

nal investment decision is expected

in 2022.

Enel Green Power, a subsidiary of

Enel, has awarded the Nordex Group

an order for seven N133 turbines for

a wind farm in Italy. The turbines will

be installed at a 30 MW wind farm in

the Basilicata region in southern Italy.

The contract also includes a service

contract for the turbines for an initial

two-year contract.

Construction of the wind farm is

scheduled to start at the beginning of

2022, with completion shortly after.

ScottishPower Renewables has se-

lected Siemens Gamesa as the pre-

ferred bidder to supply and install

14+MW wind turbines for its £6.5

Siemens Energy has signed an agree-

ment with TC Energy of Canada to

commission a novel waste heat-to-

power pilot installation in Alberta.

The facility will capture waste heat

from a gas red turbine operating at

a pipeline compression station and

convert it into electricity, which will

be put into the grid.

As part of the agreement, Siemens

Energy will build, own, and operate

the facility, with the option for own-

ership to be transferred back to TC

Energy. The patented technology is

based on an advanced Rankine Cy-

cle and uses supercritical CO

2

(sCO

2

) as the working uid. Be-

cause of its properties, sCO

2

can in-

teract more directly with the heat

source than water/steam, eliminat-

ing the need for a secondary ther-

mal loop.

Benets include a 25-40 per cent

smaller footprint than steam-based

systems, a 10 per cent increase in

compressor station efciency, and

because the working uid is con-

tained within a closed-loop system,

no boiler operator is required, mak-

ing the system suitable for remote

operation.

The pilot project is supported by

$8 million in funding from Emis-

sions Reduction Alberta’s Industrial

Efciency Challenge. The new fa-

cility is scheduled to be commis-

sioned by the end of 2022.

Colorado Springs Utilities has award-

ed GE with an order for six LM2500X-

PRESS gas turbine packages to help

it power the downtown area of Colo-

rado Springs until a new transmission

line is completed in 2025.

Colorado Springs Utilities has

committed to retiring the coal red

Martin Drake Power Plant by the

end of 2022. The LM2500XPRESS

units will allow the uility to steadily

reduce emissions by at least 80 per

cent by 2030, from 2005 levels.

The 34 MW LM2500XPRESS

units are the rst of their kind to be

installed in North America and are

expected to start commercial opera-

tion by summer 2022.

Aram Benyamin, CEO of Colorado

Springs Utilities, said: “The units

were purchased to provide safe, af-

fordable, and reliable generation to

support the increased use of renew-

able solar and wind power. These

natural gas units will help us better

integrate renewable energy sources,

further reduce CO

2

emissions, and

accelerate the retirement of the Mar-

tin Drake Power Plant.”

A contract to provide an energy stor-

age system for the 50 MW Eolica

Coromuel (ECO) wind farm in La Paz,

Mexico has been awarded to Wärtsilä.

The energy storage system is designed

to deliver 10 MW. Wärtsilä is also

providing a long-term service agree-

ment, including maintenance, spare

parts, repairs, remote monitoring and

performance guarantees.

ECO is owned by San Diego-based

Eurus Energy America Corporation,

the majority owner of which is the

Tokyo-based Toyota Tsusho Corpo-

ration. Eurus Energy America Cor-

poration is part of the Eurus Energy

Group.

The energy storage system will be

connected to the local grid operated

by the National Centre for Energy

Control (CENACE), Mexico’s inde-

pendent system operator.

Nick Henriksen, Vice President of

Eurus Energy America, said: “This

project will help Mexico meet its re-

newable energy goals, and efcient

energy storage is a key element for

its success. Mexico is to have 30 per

cent of energy generated by 2021,

and 35 per cent by 2024.”

Framatome has signed a contract to

upgrade a component of the instru-

mentation and control I(&C) system

for the two units at Exelon’s Calvert

Cliffs Nuclear Power Plant in Mary-

land, USA. The new component,

Framatome’s digital control element

drive control system (DCEDCS), pro-

vides simplied maintenance, stream-

lined system conguration, and over-

all operational reliability.

Framatome will provide design,

fabrication, assembly, documenta-

tion, installation, and testing for the

new DCEDCS at Calvert Cliffs

Units 1 and 2. The upgrade also in-

cludes cybersecurity solutions from

Framatome subsidiary FoxGuard So-

lutions and training simulator up-

grades from Framatome subsidiary

CORYS.

The 1800 MW Calvert Cliffs Nu-

clear Power Plant is located in Mary-

land, USA, and consists of two PWR

units.

California Energy & Power (CE&P)

has secured a contract to supply its

vertical-axis wind turbines to engi-

neering, procurement and construc-

tion (EPC) rm Hansei Corporation

for projects in the Philippines.

Initially, turbines will be installed

in strategic locations, with Hansei

planning to deploy the turbines

along a newly constructed express-

way to power lighting systems, sig-

nalling/protection and electric vehi-

cle charging stations.

The turbines will be combined with

solar arrays for maximum power

output in a small footprint. Califor-

nia Energy & Power is to begin ship-

ping the turbines this year.

Eurus Energy has selected ONYX In-

Sight to provide predictive mainte-

nance services on 33 wind turbines at

two wind farms in Japan – a total of

59 MW. The contract is for two years.

Under the terms of the contract,

ONYX InSight will use its ecoCMS

condition monitoring system to mon

-

itor drive train performance across

the wind farms. This will be coupled

with eetMONITOR to analyse the

performance and health data across

the turbines.

Noah Myrent, Global Head of

Monitoring, ONYX InSight, said:

“By adopting predictive mainte-

nance technologies, Eurus has posi-

tioned itself as a market leader in

Japanese wind. Eurus will benet

from being one step ahead in an in-

creasingly digital market, allowing

the company to better manage opera-

tional budgets and improve turbine

performance.”

German-based asset manager, Lux-

cara, has signed an agreement with

GE Renewable Energy to develop the

Americas

Asia-Pacic

Siemens Energy to demo

supercritical CO

2

turbine

Colorado Springs orders

six LM2500XPRESS GTs

Wärtsilä energy storage

for La Paz wind farm

Calvert Cliffs NPP to get

digital I&C upgrade

CE&P vertical-axis wind

turbine for Philippines

Turkey orders $20 million

transformer

GE supports China

coal-to-gas transition

Senegal to build 300 MW

CCGT plant

ONYX InSight to provide

predictive maintenance

GE to build Europe’s

biggest onshore wind farm

Hitachi ABB seals Dogger

Bank transmission deal

EDF and Windvision land

226 MW French project

Seven Nordex wind

turbines for Italy

East Anglia Hub to feature

14+MW turbines

International

International

Europe

10

THE ENERGY INDUSTRY TIMES - MARCH 2021

Tenders, Bids & Contracts

G

rid edge is an evolving term

but today, generally refers to

the numerous technologies

between the grid and the demand

side. Driven by renewables and dis-

tributed energy resources (DERs), it

is an area where, arguably, the great-

est activity in the electricity sector is

taking place.

Certainly all grid edge technolo-

gies are essential in realising the en-

ergy transition but there are three el-

ements that are seen as key.

Maxine Ghavi, Head of Grid edge

Solutions at Hitachi ABB Power

Grids, commented: “In terms of spe-

cic technologies there are three

key areas that we focus on and be-

lieve are key enablers of the grid

edge. First, is power – battery stor-

age, for example. Next is automation

– for exibility applications: how

you optimise the asset; how you max-

imise its value; how you manage the

different types and increasing num-

ber of DERs. And third, is digital:

things such as data analytics and ar-

ticial intelligence, and applications,

especially the cloud applications –

these have an impact from a technol-

ogy perspective and also have an im-

pact on the economics of an asset

and maximising its performance.”

These three components not only

help the grid operators and utilities

to address the challenges they are

seeing on the network as a result of

more renewables and DERs, but also

help them to maximise customer val-

ue, improve customer retention and

create new business opportunities.

“As you bring on more renewables

you need a much more exible sys-

tem, so exibility is key. And as you

bring on more assets, the next level

is optimisation,” she noted. “To have

exibility and optimisation, you can-

not look at any single challenge in

silo because you are now part of a

much bigger network.

This means that as renewables and

DERs grow, a much more complete

view of the electricity system is

needed. Ghavi explained: “Grid edge

technologies can be what happens at

the edge of the grid, what can hap-

pen behind the utility meter, or in

front of the meter. But because of the

way the transition is happening,

what happens behind the meter can

no longer stay behind the meter;

what happens at the edge can no lon-

ger stay there, so there has to be a

much more holistic view of looking

at the grid infrastructure and the ca-

pabilities we need to enable.”

While this does not call for a fun-

damental change in grid edge tech-

nologies in the near to medium term,

Ghavi believes existing technologies

will likely need to evolve and ex-

pand. “The physical assets layer is

going to become more complicated.

Today when we talk about electric

vehicles, the penetration is still very

small. And when you talk about en-

ergy storage and the global deploy-

ment of renewables, it’s still small.

But as those physical assets continue

to build up, the challenges will in-

crease. Plus you also have a growing

number of prosumers at the residen-

tial and commercial/industrial levels

making the system more dynamic,”

she said.

“So as this complexity increases, a

more comprehensive approach to

solving those problems becomes

more necessary. The power, automa-

tion and digital capabilities not only

help to address the challenges in the

network but also help utilities and

grid operators realise new business

opportunities.”

Looking at power specically,

Ghavi says the true value of grid

edge technologies such as smart bat-

teries, automation and energy man-

agement, however, is not necessarily

recognised if each of the enablers are

taken in isolation. It is when they are

integrated that the new possibilities

are realised.

Ghavi noted: “When solar was

[rst] deployed, it was about install-

ing it for self-consumption, and sell-

ing excess back to the grid. That has

evolved, especially when you bring

storage into play.”

She pointed to a project, which Hi-

tachi ABB Power Grids executed in

collaboration with Skagerak Energi

at Skagerak Arena in Skien, Norway,

as a good example of how grid edge

technologies such as solar and smart

batteries are being stacked to offer

new possibilities. The arena is home

to Odds football club, which initially

had the idea to use the roof of its sta-

dium “for something useful”. The

idea grew into a project that has seen

the soccer club become the greenest

soccer club in Europe.

As part of the ‘Skagerak Energi-

lab’, the entire rooftop of the stadi-

um was covered with 5700 m

2

of so-

lar modules, with a nominal power

of 800 kWp. An 800 kW/1MWh

PowerStore battery and energy man-

agement system ensures maximum

use of renewable power even when

there is low light to power the stadi-

um’s oodlights. But the soccer club

has gone further. It is combining its

solar and storage technology with a

microgrid to participate in the elec-

tricity market. And in addition to

providing the neighbourhood with

electricity, the project also allows

Skagerak Energi to collect insights

into how a prosumer system – where

consumers both produce and con-

sume electricity – operates under dif-

ferent conditions.

Ghavi added that the project is

also set up to use EVs in vehicle-to-

grid (V2G) applications. “It’s about

taking that value stacking to the next

level,” she said. With EV charging

becoming more of a requirement,

she also noted that this also has an

impact on the electricity system’s

complexity and reliability.

“Utilities are evolving and looking

at ways to retain customers by en-

abling services. But as the grid infra-

structure becomes more complex,

the expectation is that they still pro-

vide the same reliability and resilien-

cy. This is where exibility comes

in,” said Ghavi.

She cited the Energy Storage for

Commercial Renewables Integra-

tion, South Australia (ESCRI-SA)

Project, which the company execut-

ed for ElectraNet. Here the deploy-

ment of a PowerStore battery and e-

mesh control system reduced

outages from eight hours down to

30 minutes in the rst six months of

operation. It also improved network

reliability, reduced renewables cur-

tailment and lowered operating

costs.

If utilities are to accelerate the de-

ployment of these grid edge solu-

tions, continued policy support will

be crucial. Ghavi believes energy

storage is a game-changer – even

though it is no longer seen as a new

component – and says that the recog-

nition it is now beginning to receive

from policymakers will be “really

important”.

She said: “Deregulation of electric-

ity markets and increased penetra-

tion of variable renewables creates

an environment that is prime for the

accelerated deployment of storage.

So there has to be enabling policies

for both deregulation and renew-

ables. There also has to be enabling

policies that recognise storage as a

network asset that utilities can de-

ploy and leverage.”

Although the approach to policy

and the uptake of grid edge technol-

ogies varies from country to coun-

try, all are generally travelling in

the same direction. “Some are mov-

ing faster than others,” said Ghavi.

“Part of that is due to their local dy-

namics and needs, and the challeng-

es they are facing.”

Using the UK as an example, she

explained: “The UK is leading the

way in the energy transition be-

cause if you look at the increased

penetration of renewables, the UK

is doing fantastic. And there is a de-

regulated electricity market. This

has created a perfect environment

where a lot of companies – whether

technology companies, utilities or

service providers – see the UK as a

huge opportunity.”

North America and Australia were

cited as other examples where, al-

though the dynamics and grid infra-

structures are different, market de-

regulation and renewables are

driving storage.

Looking forward, Ghavi said that

while the energy sector will contin-

ue to build on existing solutions to

address the challenges and opportu-

nities of the energy transition, there

will be further innovation in the

grid edge space, especially in other

sectors.

“If you look at the electrication of

transport because of EVs, the electri-

cation of industry driven by heating

and process conversion, and the

electrication of buildings, they will

require additional innovation,” said

Ghavi. “There will also be additional

innovation around energy optimisa-

tion and digital. It’s about the future

being electric and this is nally be-

ing recognised. And as these three

sectors are electried and converge,

they will drive innovation in the

overall power systems.”

“There will also be innovation in

storage media, where technologies

that have been around for a long

time could become economically

viable in the mid- to long-term. But

no matter what is deployed in terms

of physical assets, things that we

are working on – for example in our

e-mesh portfolio and e-mesh appli-

cations – will still be relevant to

technologies that are coming down

the pipe.”

The move from centralised systems to a more decentralised set-up calls for innovation at the grid edge – where the

energy supply side, the grid, meets the demand side. Junior Isles speaks to Hitachi ABB Power Grid’s

Maxine Ghavi about what the key developments will be in the near to mid-term and the challenges that remain.

Developing the edge

THE ENERGY INDUSTRY TIMES - MARCH 2021

13

Industry Perspective

Ghavi: It’s about the future

being electric and this is

nally being recognised

to offer better economics to the

driver and a better experience for the

passenger.”

The second challenge is nancing.

Although signicant green stimulus

is available, penetration varies from

country to country. The scope and

how nancing is deployed as stimu-

lus, says Colle, is also not aligned

with eet. “Regulators are not really

considering eet separately. For ex-

ample, onsite, on premise charging

infrastructure is obviously one of the

things that could be taken into ac-

count as well.”

Infrastructure and the challenge of

growing the number of charge points

is seen as the third big challenge.

Colle believes this is still “at the

heart” of accelerating eet and notes

that there is no “eet-centric deploy-

ment policy”, if there is any policy at

all. He said: “If you look at public

charging points, it’s haphazard. Either

it’s a private initiative or perhaps has

happened because licensing is avail-

able at a certain point where there is

high trafc density. It’s not necessar-

ily related to eet requirements or big

eets around the country.”

The digital interface is another key

issue to be addressed. This is about

putting the driver at the centre and

providing a seamless experience as

they visit various charging points.

Portugal’s EDP provides a good ex-

ample. The utility has a specic lease

platform, whereby it can optimise

many of the challenges that a lease

driver would encounter.

The fth and nal issue that needs to

be addressed is regulation. There has

to be cohesive regulation. The report

notes that “a strong mandate for

electrication will set a clear direc-

tion so that every participant in the

value chain can engage in joined-up

planning and investment”.

There is a sound business case for

eet electrication. According to the

report, about €350 billion per year is

being spent on new eet vehicles,

with their annual fuel costs being

€230 billion. Further, the market for

eet e-mobility services, including

new services such as exibility ser-

vices, is worth some €120 billion by

2030.

As drivers’ charging behaviour be-

comes better understood, and as the

ability to forecast load becomes more

sophisticated, network operators will

make more informed investment de-

cisions on future grid capacity. In

turn, the EVs themselves will become

part of a virtuous energy circle, pro-

viding short-term grid exibility via

smart charging vehicle-to-grid (V2G)

energy exchange.

Smart charging will shift power de-

mand to times of the day when renew-

able supply is high and power prices

low. V2G goes one step further and

enables the charged power to be

pushed back to the grid to balance

variations in energy production and

consumption.

The e4Future project is one recent

T

ransportation accounts for 25

per cent of the EU-27’s carbon

emissions, second only to the

electricity sector. It is therefore no

wonder the European Commission

sees the transport sector as central to

achieving its aim to be carbon neutral

by 2050.

To achieve its green deal target of

cutting carbon emissions by 90 per

cent by 2050, the European Commis-

sion says it will need almost all cars,

vans, buses and heavy duty vehicles

to be zero emissions by then.

The near-term aim is therefore to get

30 million zero emissions vehicles on

EU roads by 2030, along with the in-

stallation of 1 million charging points

by 2025 and 500 hydrogen fuelling

points by 2030.

One of the fastest ways to accelerate

the transition to an electric mobility

(e-mobility) future and decarbonised

transport sector is to scale electrica-

tion of eet vehicles. Some 63 million

vehicles are currently owned by eets

in the EU27 plus UK. And although

this is only 20 per cent of the total

number of vehicles – car, vans, buses

and trucks – they represent 40 per

cent of the kilometres driven and over

50 per cent of carbon emissions from

all vehicles.

The question, however, is how to

unlock this opportunity? This was

the main topic of discussion at the

recent online eVision conference or-

ganised by Eurelectric, the organisa-

tion that represents Europe’s electric

utilities. Eurelectric chose the event

to introduce a major report produced

in collaboration with EY that exam-

ines how to accelerate eet electri-

cation in Europe.

The report, which includes feedback

from European industry leaders

across automotive, utilities, oil and

gas, battery manufacturer, eet man-

agement, leasing and charging infra-

structure businesses, seeks not only to

understand how to exploit this op-

portunity but also to assess the busi-

ness case and how it can be aligned

with climate interests.

Presenting the report’s conclusions,

Serge Colle, EY’s Global Power and

Utilities Leader, said: “If we are to

reduce transportation emissions, it’s

very clear that we have to go after

eet rst. If we can make [the decar-

bonisation of] eets work it will be an

incredible accelerator for the transi-

tion that we seek in transportation.”

He also cited additional reasons for

tackling eet vehicles rst. Fleet ve-

hicles turnaround in typically 5-6

years compared to 10-12 years for the

average consumer car. “This means

that between now and 2030, in theory,

we have the opportunity to turnaround

the entire eet two times, so there are

two cycles still ahead of us.”

Fleet vehicles also offer a better

business case. As they do more kilo-

metres, Colle argues that they will

benet more from the lower cost of

ownership of EVs. “Low emission

zones, for example will drive the dif-

ferent eet owners to potentially

switch faster. Fleet vehicles also have

more predictable journeys. This

means you can better plan for the

needs of the new EV eets.

The report identies 11 different

eet types that each has its own

characteristics in terms of vehicle

type, driving patterns and economics

that need to be accounted for.

“These go from the very easy to

understand and easily addressable

company cars to the other extreme –

local transportation, which faces its

own challenges in terms of range and

vehicle types,” noted Colle. “But the

good news is, as we have been engag-

ing with the different eet owners to

try to understand the various eet

types, there’s a roadmap that we can

build for every one of those segments

which leads to acceleration of electri-

cation of the eet.”

The report claims that about 60 per

cent of the 63 million eet vehicles

are ready for acceleration to electri-

cation. Still, challenges remain even

with these eets. It identies ve

common problems that need to be

addressed.

The rst is the supply chain. Colle

explained that the right type of vehicle

has to be put in place. “There’s work

to be done to offer an even better ex-

perience. China offers a good exam-

ple, where DiDi, their equivalent of

Uber, is working with the car industry

to build a 7-seater taxi vehicle that has

no trunk and just one door at the kerb-

side. They are optimising the vehicle

THE ENERGY INDUSTRY TIMES - MARCH 2021

Energy Outlook

14

Focusing on

electrifying eet

vehicles holds

the key to rapid

decarbonisation of

transport.

Junior Isles explains.

More than a eeting

More than a eeting

interest

interest

example of an initiative that aims to

show what is possible. Launched in

August last year it hopes to demon-

strate how electric vans and cars can

support the UK grid and provide a

protable and sustainable solution for

business eets.

As part of that work, in January

Nissan, E.On Drive and Imperial

College published a white paper that

explores how the bi-directional

charging capability of eet EVs not

only helps achieve the UK’s long

term climate goals but also could help

deliver overall power systems cost

savings of up to £885 million per year.

It also reveals that annual eet V2G

charging benets could range be-

tween £700-£1250 per vehicle.

Exploiting the synergies between

the European power and transport

sectors will help to unlock the com-

mercial, environmental and societal

value that e-mobility offers. The role

of system operators, however, is criti-

cal in the rollout of charging infra-

structure. They must ensure adequate

grid capacity to accommodate the

surge in drivers putting their EVs on

charge at the end of the working day,

without disrupting existing assets.

Speaking at the eVision conference,

Adina Valean European Commissioner

for Transport noted that the Commis-

sion also has to ensure that the electric-

ity grid is “up to the task” of accom-

modating the number of EVs and

charge points. She also said: “Obvi-

ously upgrading our infrastructure so

that it is t for a new era of mass market,

zero emissions, mobility comes with a

price tag. We are considering a budget

of at least €1.2 billion for the rst three

years of the Connecting Europe Facil-

ity programme.”

The EY/Eurelectric report calcu-

lates that installing the 3 million

charging points that will be needed by

2030 will require €20 billion. It is a

huge investment and an undertaking

that calls for broad collaboration.

Distribution system operators

(DSOs) will work alongside charge

point operators to connect charging

points to the grid. They will also work

with e-mobility service providers,

transmission system operators

(TSOs), EV users, businesses and

municipalities to make the grid

smarter and able to utilise all the ex-

ibility and storage options across the

distribution network.

“Looking at the complexity and the

enormity of the challenge – the need

for a 10 per cent year-on-year reduc-

tion in CO

2

for the next 10 years – it

can only be done if we build partner-

ships,” said Colle.

If this can be achieved, says the EY/

Eurelectric report, Europe stands “a

very good chance” of meeting its

2030 greenhouse gas emissions tar-

get. The bloc is certainly on the right

path – last year the EU passed China

for the rst time in terms of EVs sold.

As Colle put it: “This might be the

beginning of the real acceleration we

are looking for.”

Bi-directional charging

capability of eet EVs not only

supports long term climate

goals but could also help

deliver overall power system

cost savings

THE ENERGY INDUSTRY TIMES - MARCH 2021

15

Technology Focus

The Haru Oni project

in Chile is gearing up

to demonstrate the

potential of synthetic

fuel production from

wind. Professor

Armin Schnettler

Synthetic fuels in the fast lane

Overview of Haru Oni process.

The project’s initial aim is to

demonstrate the production

process to show that this is a

viable technology solution

Prof. Schnettler: facilities

would tap into the vast under

utilised potential for renewable

energy

T

o achieve climate neutrality in

Europe, a 90 per cent reduc-

tion in transport emissions is

needed by 2050. To date, much of

the focus has been on electrication,

but the adoption of electric vehicles

(EVs) still needs time as well as a

fast expansion of the EV charging

infrastructure.

The EU’s ambitious carbon reduc-

tion targets will therefore require

technologies to bridge the gap until

electrication is mainstream. One of

the most promising technologies to

ll this gap is e-fuels. These are syn-

thetic fuels produced with electric

power from renewable energy sourc-

es, hydrogen, and carbon dioxide.

The hydrogen is made from water

via electrolysis, while the CO

2

can

be taken directly from the air or un-

avoidable industrial sources. In the

rst step, hydrogen and CO

2

are con-

verted into so-called e-methanol,

which is then processed into e-fuel in

another synthesis step.

One advantage that synthetic fuels

have over electrication is that they

can be used in existing petrol en-

gines and be distributed through the

existing lling station network.

However, synthetic fuels are primari-

ly produced from fossil sources such

as oil and natural gas. If these fuels

are synthesised from green hydrogen

and carbon dioxide from the air or

from unavoidable sources, sustain-

able fuel can be produced.

A vital step in this development is

taking place with a demonstration

project in Chile beginning the road

to a methanol future. Siemens Ener-

gy’s partners in this project are

AME and ENAP from Chile, Enel

from Italy, and Porsche.

Porsche has an obvious interest in

the technology. It is not just meeting

EU emission targets that make e-fu-

els attractive; synthetic fuels allow

classic cars to be driven with little or

no net CO

2

emissions. This is partic-

ularly important for prestige brands

such as Porsche. About 70 per cent

of all Porsche cars ever sold are still

on the road, and with synthetic fuels

these classic cars can be part of the

solution to lower emissions.

The core of the project, known as

Haru Oni, is located in the Ma-

gallanes Region south of mainland

Chile. When operational in 2022 it

will become the world’s rst com-

pletely integrated plant, producing

almost climate-neutral e-fuel from

wind energy. By 2026, it should be

producing more than one million

tons of e-methanol equivalent to over

half a billion litres of e-gasoline per

year. Because the production of e-fu-

els uses only renewable electricity

and as the combustion of the e-fuel

in the engine generates only as much

CO

2

as was taken from the air during

production, the entire production

chain is almost CO

2

neutral.

This four-stage process of turning

renewable energy into a synthetic

fuel suitable for existing engines is

complicated. Many have questioned

the economic viability of such a

strategy. Project lead at Siemens En-

ergy Markus Speith explained: “The

project’s initial aim in Chile is to

demonstrate the production process

to show that this is a viable technolo-

gy solution, we are planning to pro-

duce about 130 000 litres of e-fuel

per year. It will also conrm that

synthetic fuels produced here have

an exceptionally low environmental

impact. In the long term, we are

planning larger projects with much

higher production rates, and from

our initial calculations, the costs look

remarkably close to current fuel pric-

es if there is a reduced tax on CO

2

neutral fuels.”

Already the next phase of the proj-

ect will be at an industrial scale, and

this process is designed to be repli-

cated to increase e-fuel output by at

least a factor of ten for the next two

phases planning for the mentioned

550 million litres of e-fuel in 2026.

The hydrogen electrolyser is a mod-

ule, where, like a battery, modules

can be simply stacked to increase

output. Conventional industrial scale

methanol synthesis plants allow for

such sizes already.

For the demonstration project, a 3.4

MW Siemens Gamesa wind turbine

will be erected on the site. For phase

two, the wind farm will be expanded

to around 280 MW, and by the time

it reaches an industrial scale, it will

be 2.5 GW.

The Haru Oni project will initially

use a Silyzer electrolyser to convert

wind energy to hydrogen. Siemens

Energy has developed the Silyzer

portfolio family based on PEM tech-

nology. PEM takes its name from the

proton exchange membrane, which

is permeable to protons (H

+

) but tight

for gases and electrons. In other

words, this kind of membrane acts as

an electrical isolator between the an-

ode and cathode side as well as a

physical separator, preventing hydro-

gen and oxygen from remixing.

This method enables optimum ef-

ciency at high power densities and

good product gas quality even at

partial loads. The operation is low-

maintenance and reliable without

the use of chemicals or other for-

eign substances.

Multiple basic systems can be com-

bined into a PEM electrolysis net-

work in a higher performance class.

The scope includes an optional re-

cooling system, water treatment sys-

tem, power grid connection, and oth-

er associated equipment.

For the CO

2

that is combined with

the green hydrogen to produce e-

methanol, the project will use Global

Thermostats (GT) direct air capture

equipment. GT uses custom equip-

ment and proprietary dry amine-

based chemical sorbents that are

bonded to porous, honeycomb ce-

ramic monoliths that act together as

carbon sponges. These carbon

sponges efciently adsorb CO

2

di-

rectly from the atmosphere. The cap-

tured CO

2

is then stripped off and

collected using low-temperature

steam (85-100°C), ideally sourced

from residual or process heat at little

or no cost – the output results in 98

per cent pure CO

2

at standard tem-

perature and pressure. Only steam

and electricity are consumed during

the process, without the creation of

emissions or other efuents.

This technology represents a break-

through in the cost of Direct Air

Capture (DAC), so that at industrial

scale the Haru Oni project is expect-

ed to be economically viable. As

with other technologies, costs are

expected to continue to decrease

through learning by doing, enabling

DAC to play a prominent role in ad-

dressing the threat of climate change.

Although the pilot plant is making

use of carbon captured directly from

the air, there are other CO

2

sources

termed as “unavoidable CO

2

emis-

sions”. Not all emissions resulting

from industrial operations can be

avoided but all unavoidable emis-

sions can be compensated for and by

using these in the production of e-fu-

els they are carbon free according to

carbon calculations. This opens the

opportunity of co-locating future e-

fuel production facilities at industrial

sites that currently emit CO

2

.

Siemens Energy’s technology in-

volvement ends with the production

of the green methanol, which is then

passed to a methanol to gasoline

(MTG) plant. This uidised bed

MTG technology licensed and sup-

ported by ExxonMobil is a cost-ef-

fective solution to convert methanol

into fuels, which can be sold as-is or

blended with ethanol, methanol, or

petroleum renery stocks. This min-

imises offsite and logistic complexi-

ty and investment for synthetic fuel

distribution.

For Porsche, this demonstration

project paves the way to full the

German automaker’s low carbon

strategy. Marcos Marques, Project

Lead, at Porsche, explained: “Porsche

is collaborating with worldwide part-

ners to industrialise almost CO

2

-neu-

tral fuels. In the future, these are to

be made available competitively in

all markets. Our intention is not to

replace e-mobility, but to ank it ef-

fectively. This applies to all those ar-

eas and markets where the transfor-

mation of the trafc sector is

proceeding at a speed below the one

required to reach the Paris climate

targets.”

While the project’s location is not

ideal in terms of executing construc-

tion because it is very remote, it was

selected due to excellent wind condi-

tions in terms of wind speed and

availability. Also there is no other

way to harvest this clean energy and

move it to where it is needed.

For high wind locations in Europe,

it is arguable that this would not be

an efcient use of renewable energy

when there are many other options

available such as e-mobility. But in

Chile, as with other remote regions

of the world, there is a vast potential

for wind energy that otherwise

would not be harvested. It can easily

be converted into hydrogen but

transporting hydrogen over long dis-

tances is extremely expensive and

challenging. That sparked the idea of

transforming it into an e-fuel on-site

to make it easy to transport by tank-

ers. In the future, the tankers can run

with e-methanol on a CO

2

-neutral

basis.

Once the technology is proven at

an industrial scale and the economics

validated, the pathway is open to

building plants in various locations.

These could be in South America,

North America, the Middle East, Af-

rica, or Australia. These facilities

would tap into the vast under utilised

potential for renewable energy, both

wind and solar, to generate green e-

fuel to decarbonise the automotive

sector. But that is not all, the aviation

sector is searching for a zero-carbon

fuel, and aviation kerosene produced

from green methanol is another in-

triguing and valuable application.

Prof. Armin Schnettler is EVP New

Energy Business at Siemens Energy.

THE ENERGY INDUSTRY TIMES - MARCH 2021

16

Final Word

C

icero may not have had the

foresight or cunning to avoid

his beheading but energy com-

panies, grid operators and certainly

politicians around the world could still

learn a thing or two from the Roman

statesman. As Texans struggled to

keep warm with no electricity last

month, politicians were only too keen

to play political football with the pow-

er outages that recently crippled the

US state. But surely they must realise

there is a bigger game at stake?

In mid-February a winter storm

swept through the southern and

southwestern US and parts of Mexico

leaving millions without access to

electricity, heat, and water. Despite

rolling blackouts imposed by the

Electricity Reliability Council of

Texas (Ercot) and the Southwest

Power Pool (SPP) grid operator, some

residents of Texas went without

power and heat for over 30 hours in

sub-zero temperatures.

While observers from around the

world may believe that “couldn’t

happen here”, events in Texas demon-

strate why preparedness now has to be

taken to the next level.

The connection between Texas’

nickname and its grid has not gone

unnoticed when citing reasons for the

catastrophe. The ‘Lone Star’ state,

proud of its go-it-alone spirit, took the

decision decades ago to remain iso-

lated from the grids of other states so

that it would not be under the jurisdic-

tion of federal energy regulators. It is

a decision that has now come back to

bite. Not being able to wheel power in

from across state lines, however, was

only part of the problem.

Initially, fossil fuel lobbyists

blamed renewables for the disaster.

Dan Brouillette, an energy secretary

under the Trump administration, said:

“We’ve moved away from that to a

more intermittent and frankly some-

times less reliable form of energy in

the sense of wind and solar,” Brouil-

lette said on Bloomberg Television.

“We’ve got to address this very

squarely and have a very honest

conversation about renewable energy

in America.”

Texas has the largest amount of in-

stalled wind power capacity in the US

and, according to Ercot, some 16 GW

was forced ofine because of ice in the

west and along the Gulf of Mexico

coast. Ercot noted, however, that this

gure exaggerates the amount of wind

lost relative to expected output. In a

seasonal resource assessment pub-

lished in November, Ercot foresaw

Texas wind farms operating at between

19 per cent and 43 per cent of rated

capacity, providing 6.1 GW of power.

With Texas experiencing a shortfall

of 45 GW out of a total 83 GW at the

start of winter, singling out wind as

the problem is a red herring. Dan

Woodn, Ercot’s Senior Director of

market operations noted that thermal

power units, which run on natural gas,

coal and nuclear fuel, accounted for

slightly less than 30 GW of the capac-

ity out of service.

In an interview with Bloomberg,

Jason Bordoff, Founding Director of

the Columbia Center on Global En-

ergy Policy, pointed out that while it

was true that wind output was down,

it was also true that most of the lost

electricity generation forcing outages

came from gas and coal, because

pipelines and valves were freezing

along with coal piles.

In a separate interview with CNN

he stressed that no single energy

source was to blame. “The extreme

cold is causing the entire system to

freeze up,” he said. “All sources of

energy are underperforming in the

extreme cold because they’re not

designed to handle these unusual

conditions.”

Clearly, all generating sources were

impacted, and debating which energy

source was at fault is a distraction

from the bigger issue – are power

companies and other critical infra-

structure owners making adequate

preparations for climate change?

Writing for CNN, atmospheric sci-

entist Adam Sobel from Lamont-

Doherty Earth Observatory noted that

icy disasters such as this are often

cited as evidence against the reality of

climate change. While, he says that

“the scientic consensus on human-

induced global warming has never

meant the permanent end of winter or

of deadly cold snaps”, he goes on to

explain that scientists are still debating

how climate change affects the fre-

quency and severity of cold snaps.

Sobel describes one way that it could

make them more common. He theo-

rised that warming in the Arctic

weakens the jet stream, making it

wavier. “If the jet bends all the way to

the Gulf of Mexico, it brings Arctic air

with it in what is also called the polar

vortex,” he said.

Yutian Wu, an Associate Research

Professor at Lamont-Doherty Earth

Observatory, lends credence to such

polar vortex phenomena. In 2019, she

used climate modelling to show that

decreases in sea ice in the Barents and

Kara seas could weaken the jet

stream, allowing frigid air to break

out of the Arctic.

While scientists are still deciphering

the relationships between climate

change and cold snaps, one thing is

clear: the increasing frequency and

severity of heat waves, wildres, hur-

ricanes, and other extreme weather,

will continue to stress electricity grids.

In the wake of the US outage, an

investigation ordered by Texas Gov-

ernor, Greg Abbott, is underway that

will among other things look at how

generators bolster their plants against

extreme weather.

Woodn said that winterisation

practices put in place after a 2011

freeze would be reviewed. “We’ll

denitely go in and work with genera-

tion entities... and try to beef-up that

plan to be able to handle what we

understand to be more extreme

weather,” he said.

Cold weather kits common in more

northerly states have historically not

been necessary in Texas’s warmer

climate, and will come at a signicant

cost. Some kits can add about $150

000 to the cost of a turbine, said a

banker involved in energy projects.

Yet this pales against the economic

cost of major blackouts, not to mention

the cost of human lives.

US President Joe Biden could make

use of the crisis to push for “historic

investment” in the nation’s grid, in-

cluding better transmission systems

and battery storage that would make

the system more resilient amid ex-

treme weather spurred by climate

change.

The crisis should certainly give

other nations pause for thought as the

energy transition moves along at a

pace that needs to be ahead of irre-

versible climate change.

All countries should note that an

unreliable power system puts the en-

ergy transition at risk. Randy Bell,

Director of the Global Energy Center

and the Richard Morningstar Chair for

Global Energy Security at the Atlantic

Council, said: “Produce clean power,

the thinking goes, electrify as much as

possible, and we can cut out a large

chunk of greenhouse gas emissions.

But if the grid is not reliable and resil-

ient... one wonders how many people

will actually choose electric vehicles,

electric heat, and electric cooking.”

The World Energy Council’s 2020

Issues Monitor – a survey of over

3000 responses from energy leaders

in 104 countries as well as 550 re-

sponses from individual energy users

in 50 countries – identied the major

trends and topics impacting the en-

ergy transition. It found that although

the climate framework issue receives

priority attention in all countries,

uncertainty remains around the im-

pact of intensifying extreme weather

events and the need to adopt climate

adaptation and mitigation measures.

Countries with greater exposure to

extreme weather events show more

concern about the pace of climate but

there has to be wider concern over the

pace of collective global actions.

Texas should be a lesson to owners

and operators of critical infrastructure

all over the world. It is no longer suf-

cient to describe events in California

and Texas as “unprecedented” and

expect that to be sufcient to placate

citizens left freezing in the dark. It is

time for utilities to adjust their models

to account for new precedents.

Moreover, politicians must stop us-

ing energy policy to score goals. As

Cicero once said: “Let us not go over

old ground. Let us rather prepare for

what is to come.” Building resilience

is key. Be prepared for extremes.

As Oscar Wilde put it: “To expect

the unexpected shows a thoroughly

modern intellect.”

Expect the unexpected

Junior Isles

Cartoon: jemsoar.com