www.teitimes.com

January 2021 • Volume 13 • No 9 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Transatlantic moves

A lifeline for coal?

The Edison Electric Institute’s

Dr Lawrence Jones explains what the

incoming US administration means

for climate change and transatlantic

cooperation. Page 13

Coal may no longer be leading

carbon capture and storage (CCS)

progress but the technology could

still be an economic lifeline for coal

power. Page 14

News In Brief

Offshore wind gears up to

drive hydrogen production

The drive to use offshore wind to

ramp up the production of green

hydrogen is gathering momentum,

with the recent announcement of

several signicant developments.

Page 2

US renewable investors

looking forward to good

times

Despite a slow start, the US Energy

Information Administration expects

2020 to be a record-breaking year

for renewable energy installations.

Page 4

Renewables in Asia Pacic

to undercut coal

Most markets in Asia Pacic can

expect to see cheaper levelised

cost of electricity for renewables

compared to coal by 2030, according

to a recent report.

Page 6

North Sea the focus for low

carbon energies

The Norwegian North Sea is set to

be the focus for a carbon dioxide

transport and sequestration industry

open to third parties.

Page 7

Egypt leads Africa’s green

energy charge

Egypt’s New and Renewable Energy

Authority (NREA) has allocated

EGP9 billion ($573 million) to

renewable energy projects in its

2021 budget..

Page 8

European utility businesses

target hydrogen

The lure of hydrogen as an energy

vector in a low carbon economy has

seen several European utilities adjust

business strategies in preparation for

the nascent market.

Page 9

Technology Focus:

Capturing carbon straight

from the air

Climeworks plans to demonstrate

the possibilities for capturing carbon

dioxide directly from the air at a

geothermal plant in Iceland.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

As host of the next COP26 conference, the UK’s plans to transform its energy system to

tackle climate change and drive a green economic recovery are under the spotlight. Its

recently published Energy White Paper has offered some detail on how the government aims

to meet its goals but many questions still remain. Junior Isles

World leaders urged to accelerate emissions cuts

THE ENERGY INDUSTRY

TIMES

Final Word

With a changing EU

landscape, it’s time to

work on shaping new

EU ties. Junior Isles explains.

Page 16

Following on from the Ten Point Plan

and the National Infrastructure Strat-

egy, the UK has provided further clar-

ity on how it plans to achieve its target

of net zero emissions by 2050 and

drive a green industrial revolution. In

December the government published

its policy paper, ‘Energy White Paper:

Powering our net zero future’, detail-

ing those plans.

The long-awaited paper, which was

delayed several times, has been wide-

ly welcomed and comes as the UK

prepares to host the postponed UN

COP26 conference on climate change

in Glasgow. It follows publication of

the Climate Change Committee’s

Sixth Carbon Budget – its rst route

map for a fully decarbonised nation –

as well as a pledge to cut emissions by

around two thirds within a decade.

Publishing the paper, the govern-

ment stated: “We estimate the mea-

sures in this paper could reduce emis-

sions across power, industry and

buildings by up to 230 MtCO

2

e in the

period to 2032 and enable further sav-

ings in other sectors such as trans-

port.” It also stated, however, that

“more will need to be done to meet

key milestones on the journey to net

zero”.

In its end-of-year report, think-tank,

Green Alliance said the promises to

protect the climate are not yet backed

by policies and cash. It noted there is

a “signicant gap” to the tune of £22.7

billion ($30.6 billion) between Boris

Johnson’s “world-leading plans” and

what is needed to meet the UK’s car-

bon-cutting targets.

The proposals for the power sector

will allow big infrastructure projects

such as new nuclear, carbon capture

and storage (CCS), hydrogen produc-

tion facilities, and renewable genera-

tion to be developed. The white paper

also conrmed that a UK Emissions

Trading Scheme (UK ETS) will re-

place the UK’s participation in the EU

ETS from 1 January 2021.

The Aldersgate Group welcomed

the Energy White Paper’s recognition

of the central role of rapid energy de-

carbonisation in creating a net zero

economy.

Nick Molho, Executive Director at

the Aldersgate Group, said: “The En-

ergy White Paper should be com-

mended for looking beyond just ener-

gy and recognising the central role of

the power sector in supporting the

decarbonisation of a wide range of

sectors, including heating, transport

and heavy industry. In many ways, the

Energy White Paper sets out a low car-

bon industrial strategy vision for the

UK and is based on the right premise

that achieving net zero emissions can

deliver signicant supply chain

growth and job creation across many

regions of the UK.

“The commitment to a UK Emis-

sions Trading Scheme and the

ambition to fully decarbonise the

power sector are both welcome, but it

is clear from the sixth carbon budget

that we need a zero carbon power sec-

tor by 2035, together with signicant

investments in grid reinforcements,

storage and exibility services. All of

these areas need to become policy

Continued on Page 2

World leaders have been urged to bring

forward their plans to cut emissions

and set net zero targets.

At last month’s virtual international

Climate Ambition Summit 2020,

hosted by the United Nations, United

Kingdom, France, Chile and Italy,

UN chief Antonio Guterres pressed

world leaders to declare a “state of

climate emergency” in their respec-

tive countries.

“If we don’t change course, we may

be headed for a catastrophic tempera-

ture rise of more than 3°C this centu-

ry,” he warned.

The summit, which marked ve

years since the landmark Paris

Agreement on climate change that

seeks to limit global warming to

1.5°C compared with pre-industrial

levels, witnessed some signicant

announcements.

At least 24 countries declared new

commitments, strategies or plans to

reach carbon neutrality, and a number

of states set out how they are going

even further, with ambitious dates to

reach net zero: Finland by 2035, Aus-

tria by 2040 and Sweden by 2045.

Pakistan Prime Minister Imran

Khan announced that his country

would have no new coal red power

generation as part of its contribution

in global efforts against climate

change. By 2030, Khan said 60 per

cent of all energy produced in Paki-

stan will be from renewables, while

30 per cent of all vehicles would be

electric.

China’s President Xi Jinping, mean-

while, committed to increasing the

share of non-fossil fuel in primary

energy consumption to around 25 per

cent by 2030.

The Summit was labelled as the

starting gun for “the sprint to

Glasgow”, referring to the delayed

UN Climate Conference (COP26)

which is scheduled to be held in the

Scottish city in November 2021.

As host of COP26 and keen to lead

by example, UK Prime Minister Bo-

ris Johnson announced that the coun-

try will end direct government sup-

port for the fossil fuel energy sector

overseas.

The world-leading policy will see

the UK put an end to export nance,

aid funding and trade promotion

for new crude oil, natural gas or ther-

mal coal projects, with very limited

exceptions.

Just ahead of the summit, the UK set

its Nationally Determined Contribu-

tion (NDC) to at least 68 per cent re-

duction in greenhouse gas emissions

by 2030, relative to 1990 levels.

The goal is a notable increase on a

previous target for a 57 per cent emis-

sions cut by 2030, but still falls short

of the reduction that some environ-

mental campaigners have called for.

In its sixth carbon budget, the Com-

mittee on Climate Change recom-

mends an emission reduction target of

78 per cent by 2035.

UK details pathway to

UK details pathway to

net zero but work still

net zero but work still

needed

needed

Boris Johnson’s government recognises that more needs to be done

THE ENERGY INDUSTRY TIMES - JANUARY 2021

3

2 - 3 February 2021

Vision

Accelerating fleet electrification

Adina Vălean

Confirmed speakers include

Serge Colle

Miriam Dalli

Roger Atkins

EU Commissioner

for Transport

Global Power

& Utilities Leader

Minister for Energy,

Enterprise & Sust.

Development, Malta

Founder - Electric

Vehicles Outlook Ltd

#ItsElectric

#eVision

evision.eurelectric.org

CONFERENCE

and EXHIBITION

Maputo, Mozambique

8-9 March

BUILDING A

PROSPEROUS

AND DIVERSIFIED

MOZAMBIQUE

LNG

WELCOME TO SOUTHERN AFRICA’S NEW ENERGY CAPITAL

CPGM

Câmara de Petróleo e Gás

moçambique

sales@africaoilandpower.com www.mzgasandpower.com

For further information please contact Karl Weber

Tel: 07734 942 385

8

THE ENERGY INDUSTRY TIMES - JANUARY 2021

International News

Ocean energy

ambition requires

global collaboration

Egypt leads Africa’s green

energy charge

by Nadia Weekes

Russia’s government and state-owned

energy companies are exploring op-

portunities in the burgeoning hydro-

gen market, Deputy Energy Minister

Pavel Sorokin told a Russian-German

forum at Moscow’s Skolkovo Energy

Center.

He said that promising export mar-

kets include Japan, South Korea and

China in Asia, and Germany and

France in Europe. Transport, power

generation, the chemical industry, fer-

tiliser production and oil rening are

possible areas of application.

Rosatom Overseas President Yevg-

eny Pakermanov said his company was

considering the creation of a hydrogen

export cluster around its nuclear pow-

er plants in northwest Russia.

Oil major Gazprom plans to build a

hydrogen production plant in the

north of Germany, near the exit of the

Nord Stream and Nord Stream 2 gas

pipelines, according to Head of En-

ergy Conservation and Ecology, Al-

exander Ishkov.

Ishkov also formally announced the

creation of Gazprom Hydrogen, a

subsidiary engaging in the low-car-

bon production, storage, transporta-

tion and application of methane-hy-

drogen mixtures.

A German government ofcial,

Karsten Sach, conrmed that the Nord

Stream 2 pipeline may become one of

the routes for hydrogen supply to Eu-

rope. As demand shifts towards hy-

drogen, it makes sense that a major

gas supplier like Russia cooperates

with Germany and Europe “to start

building up a new hydrogen infra-

structure and hydrogen energy sup-

port schemes,” Sach said.

The Nord Stream 2 project involves

building two pipeline strings with an

annual capacity of 55 billion m

3

from

the coast of Russia through the Baltic

Sea to Germany. It is said to be 93 per

cent complete.

Meanwhile, Germany has signed a

memorandum of understanding with

Tunisia for a €30 million grant ($37

million) to establish a Tunisian-Ger-

man green hydrogen alliance named

Power-to-X. Tunisia has the potential

to become a green hydrogen producer,

given its abundant renewable energy

resources.

Elsewhere, international companies

are said to be interested in investing

in the special economic zones and free

zones of Oman to produce electricity

from solar and wind energy, and green

hydrogen for export. Oman has des-

ignated a clean-energy zone covering

100 km

2

in Sizad, and other areas are

also being considered.

The African Development Bank

(AfDB) has approved a $25 million

package to support independent power

producers investing in renewable en-

ergy generation in sub-Saharan Africa.

The funding comprises $10 million

in equity and a $5 million reimbursable

grant from the Sustainable Energy

Fund for Africa (SEFA), and $10 mil-

lion from the Clean Technology Fund

(CTF).

The African Renewable Energy

Fund (AREF) II will use the funding

to help small and medium-sized pro-

ducers to add more than 800 MW of

hydropower, solar and wind power and

battery storage in countries across sub-

Saharan Africa.

“We are very excited to support

AREF II at a time when, due to compet-

ing nancing needs on account of the

cost impacts of the pandemic and for

post Covid-19 recovery efforts, there

is real risk of under-investment in the

African power sector, including in re-

newables,” said Dr. Kevin Kariuki,

AfDB’s Vice President for Power, En-

ergy, Climate and Green Growth.

AREF II, the second generation of

the pan-African fund, is targeting a

$300 million market capitalisation. It

will be managed by Berkeley Energy.

Meanwhile, Somalia has received an

$8.5 million grant in support of clean

energy by the Africa Enterprise Chal-

lenge Fund (AECF). The programme

aims to give 300 000 people access to

clean energy while creating jobs for

young people and women.

“The Somali market presents a

unique opportunity for us and other

development partners to change the

narrative of reliance on diesel-pow-

ered mini-grids as we facilitate a

switch to renewable energy sources,”

said Victoria Sabula, Chief Executive

Ofcer of AECF. She highlighted the

importance of boosting renewable-

energy value chains and securing the

engagement of the private sector.

The World Bank estimates that 11

million Somalis lack access to electric-

ity services. “For this call, we are look-

ing to work with businesses at different

developmental stages, particularly

those at an early stage. In addition to

the funding, we will provide technical

support, business linkages and invest-

ment facilitation,” said Sabula.

The programme targets private sec-

tor companies and micronance insti-

tutions that can deliver low cost, clean

energy products and services that ben-

et the poor in rural and peri-urban

Somalia. The deadline for applications

is January 22, 2021.

A new report by the Ocean Renewable

Energy Action Coalition (OREAC)

calls for global collaboration between

industry, government and key stake-

holders to deliver 1.4 TW of offshore

wind by 2050.

According to OREAC’s ‘The Power

of Our Ocean’ report, ve building

blocks are needed to maximise the

benets of offshore wind and other

forms of ocean-based renewable en-

ergy: stable policies; pipeline visibil-

ity; resourced institutions; a supportive

and engaged public; and a competitive

environment.

OREAC says that ocean-based re-

newable energy offers an effective

decarbonisation route to 2050 targets,

and that offshore wind also reduces air

pollution and water consumption for

energy use. If the 1.4 TW vision is

achieved, the report nds, it could save

$1.88 trillion in pollution-related pub-

lic health costs.

Offshore wind can revitalise coastal

communities and support the develop-

ment of critical infrastructure. The

report estimates that a 500 MW off-

shore wind project with an average

25-year lifetime creates about 10 000

years of full-time employment.

OREAC is spearheaded by leading

offshore wind developer Ørsted and

energy utility Equinor. It includes a

number of other major players in the

global offshore wind sector and part-

ner organisations such as the Global

Wind Energy Council, World Re-

sources Institute and the Chinese

Wind Energy Association.

by Nadia Weekes

Egypt’s New and Renewable Energy

Authority (NREA) has allocated EGP9

billion ($573 million) to renewable

energy projects in its 2021 budget.

Egypt has ambitious targets for re-

newable energy to represent 20 per

cent and 42 per cent of total energy

produced by 2022 and 2035, respec-

tively. It has a pipeline of large-scale

wind and solar plants.

A 500 MW wind energy project to be

developed by France’s Engie, in part-

nership with the local Orascom Con-

struction, Japan’s Toyota Tsusho Cor-

poration and Eurus Energy Holdings,

has recently received environmental

permits and will begin construction in

2021.

The same consortium commissioned

the 262.5 MW Ras Ghareb wind proj-

ect in 2019 – the rst wind project in

Egypt to be tendered under a build-

own-operate model.

Meanwhile, Dubai-based AMEA

Power has gained permission to expand

its planned Abydos solar farm from 300

MW to 500 MW. The developer has

made power purchase agreements

(PPAs) with the Egyptian Electricity

Transmission Company (EETC) for

both this plant and the 500 MW Amunet

wind project in the Gulf of Suez.

AMEA Power has made network

connection contracts with the EETC

for both projects, and usufruct agree-

ments with NREA. Egypt’s nance

ministry has issued sovereign guaran-

tees for the projects.

AMEA Power also has PPAs for a 50

MW wind project in Kenya, a 30 MW

solar project in Morocco, a 50 MW

solar project in Mali and 120 MW of

solar capacity in Chad. The company

is building solar and wind farms in

Jordan and Togo.

According to analysis by Rystad

Energy, Africa’s installed renewable

energy capacity, which stood at 12.6

GW in 2019, is set for consecutive

years of signicant growth, driven by

Egypt, Algeria, Tunisia, Morocco and

Ethiopia.

The analysis forecasts capacity across

the continent to have reached 16.8 GW

by 2020, with 5.5 GW added in 2021

and a cumulative capacity of 51.2 GW

by 2025. As the cost of renewables con-

tinues to fall, investment in Africa is

expected to become more attractive.

At present, South Africa leads with

3.5 GW of wind, 2.4 GW of utility

solar, and a solar-dominant 1 GW pipe-

line of projects in development.

Egypt has approximately 3 GW of

installed capacity and a massive 9.2

GW development pipeline mostly con-

sisting of wind projects – putting it on

track to overtake South Africa in 2025

and become the green powerhouse of

Africa.

Morocco has 2.5 GW of installed

capacity, dominated by 1.7 GW of

wind power. Rystad Energy expects

solar to drive the growth there, with a

handful of large projects already in the

works. Ethiopia’s installed renewable

capacity will leap from the current 11

MW of solar and 450 MW of wind to

3 GW by 2025.

Nearly 40 out of 50 African countries

have installed or plan to install wind

or solar projects. First-time market

entrants will be able to leverage the

lessons learned in frontrunners Egypt,

South Africa and Morocco.

Funding spree

boosts Africa’s

clean energy drive

Russia joins

Russia joins

pan-European

pan-European

hydrogen drive

hydrogen drive

n Nord Stream 2 could carry hydrogen to Europe

n Gazprom creates low-carbon hydrogen subsidiary

The AfDB is supporting renewable energy development

Ambitious Egypt sets the scene for Africa to attract green energy

investment, as renewables become low-cost option of choice.

THE ENERGY INDUSTRY TIMES - JANUARY 2021

9

Companies News

Junior Isles

The lure of hydrogen as an energy vec-

tor in a low carbon economy has seen

several European utilities adjust busi-

ness strategies in preparation for the

nascent market.

In December German utility RWE

AG said it will set up a new hydrogen

business unit within its electricity pro-

duction subsidiary RWE Generation.

The new business will focus on de-

veloping and implementing RWE’s

hydrogen strategy and promote project

deployment in its core markets. The

company highlighted its ability to pro-

duce green hydrogen through elec-

trolysers powered by electricity from

its offshore wind parks. The hydrogen

can then be temporarily stored in its

gas storage facilities and sold through

its RWE Supply & Trading business,

it explained.

“We are in a perfect position to play

a leading role in hydrogen. With our

new business unit, we ensure to fully

leverage this advantage,” said Roger

Miesen, CEO at RWE Generation.

At present, RWE is taking part in

more than 30 hydrogen projects in Ger-

many, the Netherlands and the UK.

Last month also saw another Ger-

man utility, Uniper and Finland’s For-

tum announce they are intensifying

their cooperation to jointly tackle

growth, performance and sustainabil-

ity goals more effectively. This will

include greater focus on hydrogen.

For Uniper, the strategy means mov-

ing away from coal and moving to-

wards the expansion of gas as the fast-

est way to signicantly reduce CO

2

,

and to develop hydrogen and renew-

able energies for the future.

Uniper aims to be overall CO

2

neutral

by 2050, which is a common goal for

both Fortum and Uniper.

In order to enable net zero, Uniper is

developing new technologies for the

further decarbonisation of gas red

power plants and is entering into tar-

geted partnerships with manufacturers

such as Siemens Energy and General

Electric.

Fortum has been supporting the new

Uniper strategy since it was announced

in March 2020.

Joint working groups will drive both

companies’ growth opportunities in the

hydrogen and renewable energies sec-

tors . The goal is to pursue a “one team

approach” in which one of the two

companies takes over the lead.

According to Uniper, joint activities

in the eld of hydrogen will build on

Uniper's extensive know-how.

It said in a press statement: “Uniper

is one of the pioneers in this eld. In

our view, hydrogen is both a source

of energy and a platform of opportuni-

ties to effectively advance the goal of

climate neutrality for most industries,

including the chemical, steel, heating,

freight and shipping industries, as

well as the manufacture of aviation

fuels.”

Uniper is present in all stages of the

hydrogen value chain and has more

than 10 projects in its development

pipeline. Combined with Fortum’s

strong market access in the Nordic

countries, this presents both compa-

nies with the opportunity to actively

shape the international hydrogen

market.

A concrete example of this type of

collaboration is the project for the

production of sustainable methanol

with renewable hydrogen, with which

the chemical company Perstorp is to

be supported in signicantly reducing

its carbon emissions in Sweden.

“This is a real partnership project

between Uniper and Fortum,” said the

statement.

Danish wind turbine manufacturer

Vestas is continuing its drive to be-

come a leader in offshore wind with

the completion of the acquisition of

MHI Vestas Offshore Wind. Closure

of the deal formally ends the 50/50

MHI Vestas Offshore Wind A/S joint

venture.

After securing regulatory approval,

Vestas bought MHI’s entire stake in the

offshore wind turbine outt to merge

it back into the group. In exchange,

MHI acquired 2.5 per cent in Vestas

and earned a nomination to the Danish

group’s board of directors.

Capital increase, which saw Vestas

issue roughly 5.05 million of its shares

to MHI, has been completed, the tur-

bine company said. Organisational

integration of Vestas and MHI Vestas

Offshore Wind is expected to nalise

by February 1, 2021.

“Welcoming offshore back is the be-

ginning of a new chapter in Vestas’

history, offering strong growth oppor-

tunities towards 2030 and further ac-

celeration of the deployment of renew-

able energy,” said Bert Nordberg,

chairman of the Vestas board.

Since divesting its offshore business

back in 2013, the company has been

in partnership with Mitsubishi Heavy

Industries.

Vestas CEO Henrik Andersen said he

expects the integration to give the com-

pany a stronger position in the industry.

“The immediate priority for us will be

to integrate offshore into our operat-

ing model, which together with a lead-

ing offshore product platform and

continued focus on execution will

enable us to lead the industry overall

and accelerate the energy transition,”

Andersen said.

The company also recently an-

nounced that it will be expanding into

project development through a new

tie-up with fund manager Copenha-

gen Infrastructure Partners.

In December, the Danish wind tur-

bine manufacturer said it is investing

€500 million in the venture, thereby

expanding its push into developing

projects.

Andersen said the new deal would

help Vestas work across the value chain

of clean energy by growing its project

development business, which encom-

passes the permitting, design, con-

struction and operation of wind farms.

Speaking to the Financial Times, he

said: “We would like to see how we

can take a more active role, developing

new markets and new projects across

the world in the next 10 to 20 years.”

The tie-up with CIP – which will

launch a new Energy Transition Fund

next year, with Vestas as anchor inves-

tor – is the turbine maker’s biggest step

yet into project development.

CIP’s managing partner Jakob Ba-

ruël Poulsen said the new Energy Tran-

sition Fund would focus on expanding

in markets outside Europe, as well as

‘power-to-X’ projects, which convert

wind power into other forms of energy

such as green hydrogen.

The two partners will not have any

exclusivity agreements as part of the

deal; CIP is still free to buy turbines

from any manufacturers, while Vestas

is free to work with other developers

and investors.

n The latest research by Wood Mack-

enzie nds that Vestas, Siemens Game-

sa Renewable Energy and GE Renew-

able Energy will hold 60 per cent

market share by 2029, up from 43 per

cent in 2019. It predicts Siemens

Gamesa will dethrone Vestas as the top

installer by 2025, a position it will keep

through the end of the decade.

GreenCom Networks AG, the Germa-

ny-based energy IoT company has

concluded its latest nancing round of

€12 million, led by Shell Ventures and

supported by Energy & Environment

Investment (EEI) and existing inves-

tors. The investment enables Green-

Com to expand its strategy of interna-

tional growth and to further enhance

its position in Europe’s residential

energy IoT (Internet of Things) market.

Shell Ventures, Shell’s corporate

venture capital arm, and Japanese

venture capital rm EEI have joined

existing investors such as Centrica,

E.On’s Future Energy Ventures, Mu-

nich Venture Partners and SET Ven-

tures to further advance GreenCom’s

technology solutions to digitally con-

nect distributed assets and provide

an IoT platform for home energy

management

The new funding from Shell, EEI and

existing investors will be used to en-

hance GreenCom’s energy IoT posi-

tion in Europe, while also leveraging

its new investors to penetrate markets

outside Europe and connect Green-

Com with new heat pump, inverter, and

battery storage manufacturers in Asia.

“We have been very impressed by

the quality of the technology platform

and the management team at Green-

Com,” said Jurgen Hornman, Invest-

ment Director at Shell Ventures. “Gre-

enCom’s ability to connect, provide

insights into, and control distributed

energy assets such as solar PV, battery

storage, EV chargers and heating de-

vices of various manufacturers great-

ly enhances a service provider’s abil-

ity to offer integrated home energy

solutions to end consumers, energy

communities and a fast-growing

group of prosumers.”

British engineering company Rolls-

Royce Holdings plc (R-R) has agreed

to divest its civil nuclear instrumenta-

tion and control (I&C) operations to

French nuclear reactor company

Framatome, as part of a stated plan to

raise over £2 billion ($2.67 billion)

from asset disposals. The divestiture

does not include R-R’s UK civil nu-

clear business or small modular reac-

tor activities.

The deal requires regulatory approv-

als and is scheduled to complete at the

start of the second half of 2021.

Through this acquisition, Framatome

will add to its engineering expertise,

and expand its global capabilities in

I&C systems. Under the deal, Frama-

tome – which is majority-owned by

French electric utility EDF – will ac-

quire the I&C division’s activities and

teams in France, the Czech Republic

and China.

Framatome will incorporate R-R’s

products and technologies, which are

installed in 150 operating reactors

worldwide, as part of its I&C portfolio.

This transaction will allow Framatome

to integrate all safety critical functions,

to serve its clients and particularly the

French nuclear plants.

“The purchase of the Rolls-Royce

Civil Nuclear I&C business aligns

with our strategy to ensure the conti-

nuity of a strong skill base and to ex-

pand our footprint for long-term op-

erations,” said Bernard Fontana, CEO

of Framatome.”

The I&C operation to be sold em-

ploys 550 staff and generated revenue

of £85 million in 2019.

In November R-R completed a

planned £2 billion rights issue, rais-

ing funds from the bulk of its existing

shareholders to fend off the most

damaging effects of the Covid-19

pandemic.

The UK engineering rm has lost 48

per cent of its stock value in the past

12 months and has a current market

capitalisation of £10.95 billion.

Rolls-Royce to shed

Rolls-Royce to shed

civil nuclear I&C

civil nuclear I&C

unit

unit

Vestas continues

Vestas continues

offshore wind

offshore wind

drive

drive

Equity funding boosts Greencom

international expansion plan

European utility businesses

target hydrogen

n RWE to set up hydrogen business n Hydrogen part of Uniper and Fortum cooperation

A

s the dust slowly settles fol-

lowing the US election, there

is renewed hope that under

the incoming Biden-led administra-

tion the world will now be able to

act in greater unison in tackling the

climate emergency. And although

President-elect Joe Biden has vowed

to re-join the Paris global climate

agreement and laid out plans to put

low-carbon energy at the heart of the

country’s economic recovery, there

is still much debate around what that

low carbon economy will look like

and how transatlantic collaborations

will pan-out.

Dr Lawrence Jones, Vice President

International Programs at the Edison

Electric Institute, which represents

all US investor-owned electric com-

panies and has more than 65 non-US

electric company members with op-

erations in 90 countries, is one of

those who believes that the new gov-

ernment could provide a shot in the

arm for the battle against climate

change.

“The declarations of the new ad-

ministration thus far are very impor-

tant from a global perspective. Un-

der the previous administrations, the

US was a global player on the cli-

mate stage and really drove the Paris

agreement home. Its disengagement

over the last four years has created

some concerns. So, re-engagement

by the US is extremely important,

not just in terms of sending the right

signals but also in terms of taking

the right actions.”

Certainly, there is already much

activity in the US at the state level,

with a number of states bullish on

their own climate objectives, but the

signals at the federal level are im-

portant in galvanising the private

sector. And actions like the creation

of a new climate envoy in the form

of former Secretary of State, John

Kerry, who played a major role in

negotiating the Paris agreement,

will strengthen the belief that the

US is back in the game and keen to

re-establish its climate credentials

as a nation.

“Based on conversations with in-

dustry leaders around the world,

there is expectation that the US will

come to the table with concrete ac-

tions and not just words,” said Dr

Jones, “And I think that the creation

of the climate envoy is at least one

action that indicates that the incom-

ing administration is going to priori-

tize this topic.”

The world will be taking note of

how fast the US sets about putting

any rekindled climate ambitions into

practice. How much the incoming

Democrat administration can

achieve in reaching any new clean

energy targets – especially if the Re-

publicans secure a majority in the

Senate – is, however, certainly a top-

ic for debate.

Biden’s climate plan released in

July promised $2 trillion over four

years to fund clean energy and infra-

structure as a way of reviving the US

economy. It is a huge number, which

some argue will most likely have to

be scaled back. The President-elect

has said he will target net zero emis-

sions by 2050, and for all electricity

to be emissions-free by 2035. He has

also pledged to electrify large parts

of the country’s transit network and

crack down on pollution.

But while politics and changing

governments can set goals and tar-

gets, it is the general direction of

travel that is most important.

“Targets are targets, actions mat-

ter,” said Dr Jones. “I remember

many years ago when the UN came

up with their Millennium Develop-

ment Goals. The aim was to have

these goals met by 2015 but as we

neared the date, another target, 17

Sustainable Development Goals

(SDG), was set in 2016 to be met in

2030 – soon here by the way.

“One thing a target does, is it sets a

timeline and creates an ambition,

which is one way to catalyse bold

actions… today several countries

have set net zero targets – many with

different timelines. Targets galvanise

a level of engagement from the pri-

vate sector; the momentum that

comes with setting these targets ar-

guably is more important than the

actual targets themselves.”

“In the US, for example, the

Obama Administration’s Clean Pow-

er Plan called for the electric power

industry to reduce its carbon dioxide

emissions by 32 per cent by 2030.

As of the end of 2019, we had re-

duced emissions by 33 per cent, hit-

ting the target a decade early.”

We have seen the impacts of tar-

gets in many OECD and emerging

economies in terms of the energy

system transition.

As Dr Jones pointed out: “While

the direction of trajectory of the en-

ergy transition may be set by poli-

cies, there are many external factors

that ultimately determine the pace

and permanence of systemic change.

Politics alone cannot ensure change.

Instead, as we are seeing across the

globe, the collective actions of the

private sector and citizens around

the world are critical to realising a

clean energy future. But how we get

there – the pathways – consist of di-

verse policies and investment strate-

gies, etc.”

In addition to continuing the drive

to install wind and solar, all indica-

tions are that low carbon technolo-

gies more broadly will be a focus of

the incoming administration.

Dr Jones rmly believes nuclear

will be “part of any strategy” aimed

at achieving net zero globally.

“Looking at other trends around the

world, we cannot safely and reliably

decarbonise by excluding nuclear,”

he said. “And not just large nuclear

but also small modular reactors.”

Noting that “wind and solar alone

is not going to get us there”, he sees

two other areas of focus – hydrogen

and carbon capture utilisation and

storage (CCUS).

Dr Jones says that although hydro-

gen has several benets, the question

is how to generate it. “The genera-

tion of hydrogen has to be clean.

There are some parts of the world,

such as Australia, Japan and Nor-

way, for example, where companies

are doing some impressive things.

The UK government is also looking

at hydrogen.” He added: “Although

it’s been talked about for years, I

also think a breakthrough could be

coming very soon for CCUS. The

cost issue is real but over time we

will see it come down.”

He also noted that large long dura-

tion energy storage would be “part

of the equation” in terms of commer-

cial technologies that will have a big

impact. “In short, the technological

innovation that is necessary to drive

decarbonisation is in sight and pri-

vate investors are looking at it as a

growth opportunity enabled by the

right public policies.”

While President-elect Biden’s

stance on the role of fossil fuels in

the energy mix and the future of

fracking is not completely clear, it is

likely that gas will still be a key part

of the generation mix of any realistic

energy transition. “And it should

be,” said Dr Jones. “As we talk

about transitioning the energy sys-

tem, we have to understand that ev-

ery nation has a different energy

mix… I don’t know whether the

Biden administration will put a stop

to the use of natural gas because the

reality is, to bridge into the 21st cen-

tury you need some exibility in the

system. This will partly come from

exible gas red power plants for re-

silience and reliability.”

Like many countries around the

world, the incoming administration

sees clean energy as a route to eco-

nomic recovery in the aftermath of

the Covid-19 pandemic. Dr Jones

sees a clear link between the pan-

demic and climate change efforts,

not just in the US but globally.

“I call it the three C’s – climate,

Covid and cost – because in a sense,

if done in a holistic way, the impact

of Covid [on tackling climate

change] could be minimal. One has

to ask: where are the future jobs

coming from? Covid presents an op-

portunity to seriously rethink how to

create a new set of jobs in a low car-

bon economy. The bottom line is, we

have to rethink life.”

Like most of the world, Dr Jones

hopes the Biden administration will

make international collaboration a

priority. He sees the appointment of

a climate envoy and talk of creating

a “czar” to focus on relationships

with Asia, as good signs that the US

will start rebuilding “relationships

that have struggled or ones put on

ice for the last four years”.

He said: “Global collaboration is

essential for addressing global chal-

lenges and the incoming administra-

tion has declared it a priority; let’s

hope they can put the actions in

place so we can all benet from

greater collaboration.”

There is plenty to be done from a

global perspective and the EU is al-

ready sending the right signals to

the incoming Biden administration.

On December 2, Brussels proposed

a ‘new EU-US transatlantic agenda

for global change’.

The agenda spans four areas, one

of which is climate change and bio-

diversity. The EU is proposing to

establish a comprehensive transat-

lantic green agenda, to coordinate

positions and jointly lead efforts for

ambitious global agreements, start-

ing with a joint commitment to net

zero emissions by 2050.

Dr Jones stressed, however, that

the economics of climate change

must be at the forefront of the energy

transition. “We have to spend more

time on it because that’s where

things can fall apart. It has to be just

and equitable,” he said. “If it’s not

done right, we are in danger of creat-

ing signicant energy policy chal-

lenges – even in a place like Europe.

It’s an area the incoming administra-

tion should also prioritise. This tran-

sition will create challenges for some

aspects of our economy and some of

our citizens in terms of jobs. So, it’s

an economic debate as well as a cli-

mate debate.”

Dr Jones’ nal piece of advice is

for global leaders to advocate what

he calls an “inter-generational dia-

logue” on climate. He concluded:

“We can’t have a world where most

of the people ghting for change are

the youth, while the ones making de-

cisions are the older people; there’s a

disconnect between the urgency of

addressing existential global chal-

lenges. We need a movement where

we start to bring everyone – all de-

mographics – together to create solu-

tions that are t for a sustainable fu-

ture and planet for all.”

There is renewed hope that the incoming Biden administration will push the energy transition back up the US

government agenda and galvanise global efforts to combat climate change. Junior Isles speaks to the Edison

Electric Institute’s Vice President for International Programs, Dr Lawrence Jones, about what the election of Joe Biden

could mean for the world of energy.

A new era for transatlantic

climate cooperation

THE ENERGY INDUSTRY TIMES - JANUARY 2021

13

Industry Perspective

Dr Jones says global

collaboration “is essential”

for addressing global

challenges and the incoming

administration has declared it

a priority

rst movers. The US Department of

Energy (DOE) has therefore helped

fund detailed engineering studies for

CCS on nine existing power plants –

ve coal red and four gas red. Lo-

cated across the country, the projects

tend to feature cheap coal and com-

munities with an interest in retaining

a vital local industry. Several are also

backed by capture technology provid-

ers keen to prove their worth on a

full-scale plant. Most claim they will

achieve a capture cost of around $45

per ton of CO

2

– coming in conve-

niently below the 45Q level.

Aside from oil recovery projects, a

major initial barrier to CCS expan-

sion has been the costly, time-con-

suming process for characterising and

permitting geological storage sites.

The DOE’s ‘CarbonSAFE’ initiative,

which is performing this work for

several suitable formations around

the country, is therefore a huge benet

for coal power plans including Prairie

State in Illinois, Project Tundra in

North Dakota, and Dry Fork in Wyo-

ming. An initiative at San Juan Gen-

erating Station in New Mexico,

meanwhile, plans to simply link up to

the existing nearby network of CO

2

pipelines for the oil industry.

With coal power in the US already

struggling to compete with cheap gas,

CCS seems unlikely to forge a future

for new coal capacity, but it may well

extend the lifetime of some well-locat-

ed generators with healthy demand

and limited gas. The justication for

the current wave of projects often rests

on a comparison between the cost of

tting CO

2

capture to the unit with the

cost of its replacement by a new gas-

red plant, while recognising that no

matter how cheap wind or solar gets,

some backup will be needed.

Following the mothballing of the

Petra Nova capture project in May

2020, the new initiatives have also

been quick to point out the unusual

business model of the Texas facility,

which encompassed ownership of an

oil eld and was therefore intimately

linked to falling oil prices. Some of

the projects will directly claim the tax

credit, and others will look to secure

stable offtake agreements for CO

2

.

Proposed legislation aims to further

strengthen 45Q by converting it to a

direct cash payment and extending

the deadline to begin construction –

currently set at the end of 2023.

Completing at least some of these

45Q-driven coal projects in the US

will be vital in further establishing the

technology and reducing costs, but

the real market for CCS with coal

power will always be in Asia. The

massive global scale of coal emis-

sions was a key reason for the initial

focus of CCS on coal, and it is not a

problem which has gone away. Well

over half the world’s coal capacity

has been built in the last 20 years,

with 90 per cent of that growth taking

place in Asia and two thirds in China

alone. Existing coal plants will pro-

D

espite everything, 2020 turned

out to be a good year for carbon

capture and storage (CCS),

with both the UK and Norway com-

mitting to spend big on new infrastruc-

ture to store CO

2

emissions deep be-

neath the North Sea. In the US, the

climate change mitigation technology

received early backing from the Pres-

ident-elect. CCS has previously strug-

gled under half-hearted support, cast

by critics as a desperate bid by fossil

fuel companies to maintain the status

quo. Following an initial wave of po-

litical interest in the 2000s, relatively

few large projects were realised, and

many high-prole initiatives fell

through due to rising costs or insuf-

cient backing.

The recent rise of corporate and na-

tional net zero carbon targets has been

instrumental in putting CCS back in

the frame – now a fundamental means

of making the numbers add up. Sev-

eral governments have concluded that

carbon capture must nally be

cracked, while oil and gas companies

– who crucially have the engineering

expertise to store the greenhouse gas

– have scented a business opportunity,

which could also secure their long-

term future. CCS advocates now hope

that the technology will feature heav-

ily in post-Covid stimulus packages.

But CCS today looks quite different

to CCS ten years ago. Where once the

technology was practically synony-

mous with ‘clean coal’, coal power

now appears low on the agenda. This

is perhaps unsurprising, given that in

Europe and North America, where

interest in CO

2

capture is greatest,

coal is in sharp decline. The political

focus is increasingly on emissions

from process industries such as steel

and cement, as well as the idea of

decarbonising the production of hy-

drogen from natural gas. While some

countries still envisage a role for

CCS-equipped power plants in bal-

ancing renewable generation, the

vision – and sometimes the econom-

ics – has shifted in favour of gas or

biomass-fuelled plant. The associa-

tion with coal is seen by some as an

embarrassing relic of the technology’s

less successful past.

Where does this leave coal power?

CCS was once regarded as the salva-

tion of the sector, capable of ushering

in a more sustainable future and

averting plant closures. The technical

feasibility of tting CO

2

capture to a

coal plant has been demonstrated

over the last decade by pioneering

projects at Boundary Dam 3 in Cana-

da, and Petra Nova in Texas, which

both achieved their performance tar-

gets after some initial teething prob-

lems. Based on this experience and

other advances, capture technology

manufacturers claim cost reductions

of around a third are possible for a

next wave of coal plants. But any kind

of CCS is still a costly business,

which makes little commercial sense

unless it can be used to generate some

kind of revenue.

In 2018, the US took a major step

towards creating just such a business

case with the expansion of the exist-

ing 45Q tax credit to directly reward

CCS – raising it to $35 per ton of

captured CO

2

used in enhanced oil

recovery projects, and up to $50 per

ton for storage in saline aquifer for-

mations. A thriving market for CO

2

to

boost agging oil well production has

long put the US at the forefront of

CCS developments, but these reve-

nues are too low to fund capture of the

greenhouse gas from relatively dilute,

large-scale emitters like power plants.

The new credit therefore represents

an effective income stream, which

could put many more projects in the

black.

Even with 45Q, and the slightly

perverse ‘advantage’ of producing

large amounts of CO

2

, tting CO

2

capture to coal plants is still on the

brink of protability, particularly for

THE ENERGY INDUSTRY TIMES - JANUARY 2021

Energy Outlook

14

Coal may no longer

be leading carbon

capture and storage

progress but there is a

chance the technology

could still provide a

lifeline for some coal

red power plants,

especially in Asia.

Toby Lockwood

explains.

Can CCS be an economic

Can CCS be an economic

lifeline for coal power?

lifeline for coal power?

duce over 100 Gt of CO

2

if allowed to

see out their normal economic life.

Although China has been active in

CCS research since the 2000s, even

setting up some fairly large-scale fa-

cilities, real political support seems to

have balked at the idea of burning

more coal for less power. However,

following President Xi Jinping’s

September announcement of a target

to reach ‘net zero’ in 2060, many ex-

pect this stance to change. With its

huge eet of mostly ‘cookie-cutter’,

efcient plants built in the last 15

years, good domestic capture tech-

nologies, and favourable geology for

CO

2

storage, the stage seems set for

mass CCS roll-out.

Prior to the net zero announcement,

interest in CCS for the power sector

was already growing, partly as a result

of an average CO

2

emissions intensity

target placed on the country’s major

power companies. Given China’s

highly regulated power market and

current excess of coal capacity,

awarding CCS-equipped plants with

guaranteed operating hours is often

proposed as an initial driver. Although

next steps in China also seem centred

in the oil and gas sector, such as an

initiative in the far west of the country

led by the Oil and Gas Climate Initia-

tive and China National Petroleum

Corporation, a few coal power proj-

ects are on the drawing table.

Coal may no longer be leading CCS

progress, but there is a chance it can

follow. Much of the current shift in

direction is linked to a widespread

realisation that the major hurdle to

overcome is the development of

shared infrastructure for CO

2

storage

and transport – an activity naturally

dominated by the oil and gas sector. If

a viable CO

2

storage service industry

can be created, then emitters of all

types will be free to concentrate on

capturing CO

2

and selling it at the

plant fence. Why shouldn’t a coal

plant tap into such infrastructure if the

price is right? Might even Germany

consider equipping its many new, ef-

cient coal plants with CCS, perhaps

for the CO

2

to be shipped to vast

North Sea stores? On the other hand,

the ‘pay to take away’ model proposed

in Europe will not favour the high

CO

2

intensity of coal in the same way

as 45Q currently does.

While not even CCS is likely to alter

the anti-coal mood in Europe, the

technology must surely play a role in

decarbonising China and the many

other Asian countries where coal re-

mains king. In these regions, a pro-

tracted shift from coal to gas would

merely delay the eventual need for

CO

2

capture on all fossil plants. So

far, lower-income economies have

understandably hesitated to properly

back CCS while the West still dithered

– now, the world will be watching

their next move.

Toby Lockwood is Senior Analyst at

the IEA Clean Coal Centre.

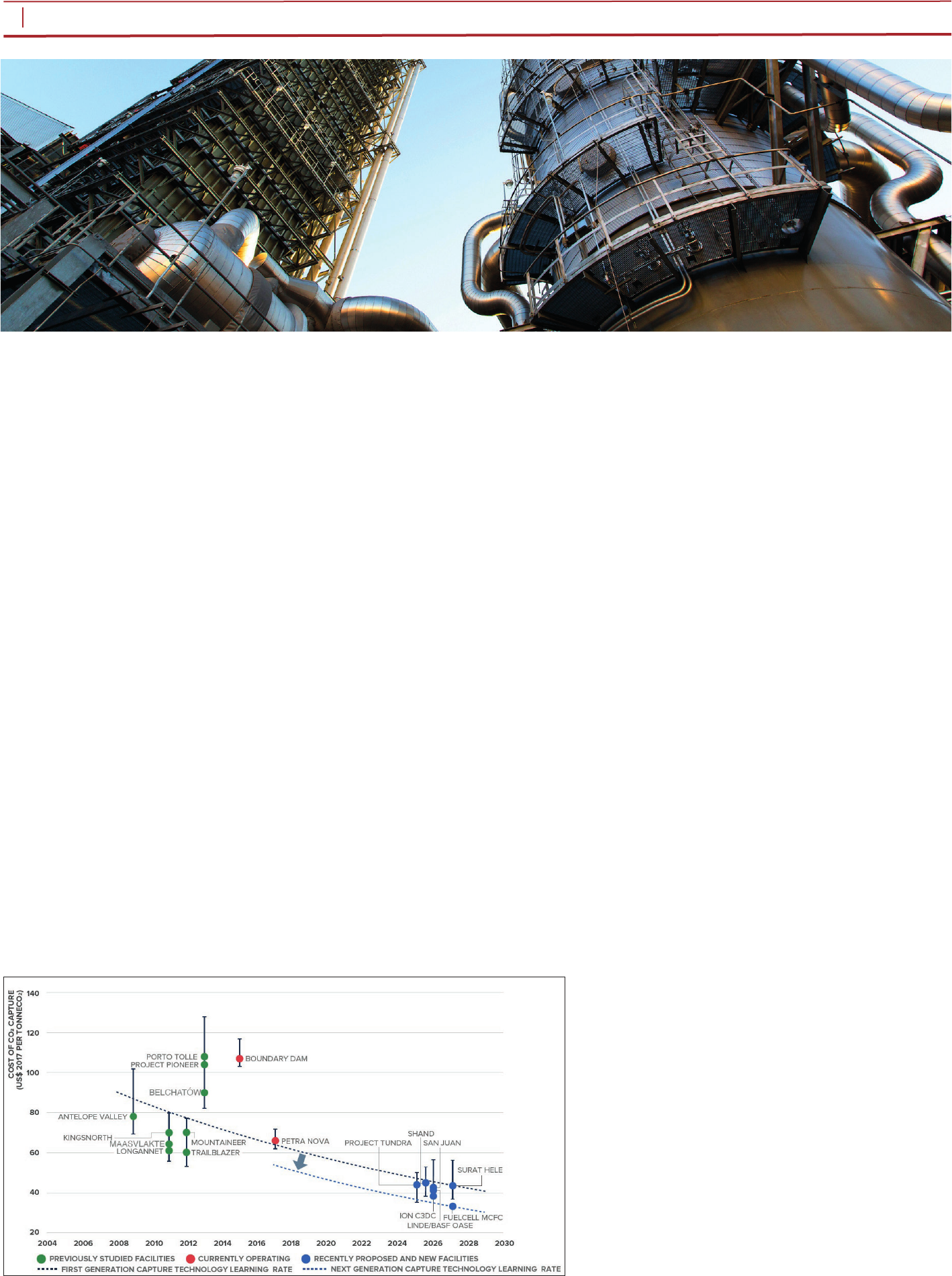

Levelised cost of CO

2

capture for large scale post-

combustion facilities at coal

red power plants, including

previously studied facilities

THE ENERGY INDUSTRY TIMES - JANUARY 2021

15

Technology Focus

Capturing carbon

dioxide directly from

the air could be an

important part of the

toolkit in getting to

net zero emissions

by 2050. Climeworks

plans to demonstrate

the possibilities at a

geothermal plant in

Iceland.

Dr. Nathalie Casas

O

ver the last century, the

Earth’s temperature has risen

by 1.14 °C, largely due to at-

mospheric carbon dioxide produced

by human activity. Solving the cli-

mate crisis is possible but it will not

be easy. As UN Secretary-General

António Guterres remarked: “The

climate emergency is a race we are

losing, but it is a race we can win”.

The way we win is by tackling the

challenge from multiple angles at the

same time and creating a whole solu-

tion. Energy will always be an im-

portant part of this ─ whether for re-

cycling plants, the production of

energy efcient technology, or sim-

ply to keep the lights on. Clean re-

newable energy supplies are, there-

fore, going to play a major part in

achieving net zero emissions by

2050.

Yet, even if we managed to com-

pletely revolutionise the economy,

and made every product more ener-

gy efcient, we would still have his-

toric high levels of CO

2

in the atmo-

sphere and would still be adding to it

because some sectors, such as avia-

tion, are hard to fully decarbonise.

So, along with nding ways to re-

duce the amount of carbon dioxide

being added to the atmosphere, we

also need to nd ways to remove un-

avoidable emissions as well as the

CO

2

already in the atmosphere. The

obvious way to remove CO

2

is by

planting trees. Yet, the number of

trees required is huge and conicts

with the need for space, so it’s hard

to see how tree planting can be the

only answer.

Climeworks is a company that is

supplementing the CO

2

removal

work of trees with a rather more

high-tech solution: direct air cap-

ture. Carbon dioxide is captured di-

rectly from the air by sucking it

through one of the company’s CO

2

collectors that contain a patented

lter material, which binds the CO

2

.

When the lter material is saturated,

the collector automatically closes,

and is gently heated. At elevated

temperatures the CO

2

is then re-

leased from the lter material, and

can be collected. Subsequently, it

can be up-cycled into climate-friend-

ly products such as carbon-neutral

fuels and materials, fertiliser for

greenhouses or for carbonating zzy

drinks; or it can be safely and perma-

nently stored. Afterwards the collec-

tor re-opens and starts the whole

process again. This cycle happens

thousands of times a year to capture

tonnes of CO

2

from the atmosphere.

The real magic to the process is the

lter material. Climeworks has de-

veloped several actively used classes

of lters based on well-known and

understood materials, as well as ex-

perimenting with new materials to

develop new and improved efcien-

cy lters.

Since the whole process takes en-

ergy to complete, Climeworks is

working closely with renewable en-

ergy providers, situating its direct

air capture plants near renewable

energy generation facilities to make

the process as efcient as possible.

Using energy from fossil fuel power

plants would require the capture of

far more CO

2

to see a net benet

and is, therefore, not an option for

Climeworks.

In Iceland, this relationship with

renewable energy providers is taken

one step further. Iceland meets al-

most all its energy needs from re-

newables, with around 73 per cent

coming from hydropower and 27 per

cent from geothermal. Climeworks

works closely with Reykjavik Ener-

gy, a geothermal power producer,

and its subsidiary Carbx, special-

ised in CO

2

storage. Carbx mixes

Climeworks’ air-captured CO

2

with

water and pumps it underground

where the CO

2

is mineralised, and

turns into stone – it is thus perma-

nently and safely removed from the

atmosphere.

This fairly unique arrangement

means Climeworks’ new plant in

Iceland, named Orca, has all its ener-

gy needs met by renewables while

being able to easily store the air-cap-

tured CO

2

in an ideal location.

Orca is located in the Geothermal

Park of ON Power, Climeworks’

project partner, in Hellisheidi, Ice-

land. ON Power provides energy

(electricity and heat) to the Clime-

works plant directly. Typical energy

consumption gures expected for

the scaled-up machines are approxi-

mately 2000 kWh heat and about

650 kWh electricity per tonne of

carbon dioxide that is captured.

Long-term energy requirement pro-

jections based current technology

assumptions for the direct air cap-

ture (DAC) process are expected to

be around 2000 kWh per tonne of

CO

2

(400 kWh electrical and 1600

kWh thermal).

Since Orca is located on the site of

the Hellisheidi geothermal power

plant, the integration is relatively

straightforward and simple. Because

Climeworks’ direct air capture plants

can be built very close to both the

energy source and the CO

2

injection

site, it delivers a substantial reduc-

tion on costs for media and utility

connections (electricity, geothermal

heat, CO

2

transport).

Climeworks is deploying the new

optimised CO

2

collector design for

the Orca plant where, in addition to

improved capture efciency and oth-

er improvements, the amount of steel

used has been reduced by 40 per

cent compared to the previous gener-

ation of CO

2

collectors, generating

further cost improvements. In terms

of economics, the overall investment

for Orca amounts to more than $10

million.

Kicking off construction of the

plant, Christoph Gebald, the co-

founder of Climeworks, said:

“Breaking ground on the construc-

tion of Orca marks an exciting mile-

stone for Climeworks and an impor-

tant step in the ght against climate

change. Climeworks’ new Orca

plant demonstrates that scalable,

pure carbon dioxide removal via di-

rect air capture is possible. And we

are excited to be a vital part in kick-

starting the carbon dioxide removal

industry.”

When construction is completed in

spring 2021, the Orca plant will cap-

ture 4000 tons of CO

2

per year. This

might sound like a lot of carbon di-

oxide, but it is a drop in the ocean

compared to the 3210 billion tonnes

currently in the atmosphere. Most

other carbon capture companies fo-

cus on building large plants that

have a high initial capacity. Unfortu-

nately, however, this can risk the

project failing to complete as bud-

gets dry up or appetite changes. Un-

fortunately, this has often been the

case for large scale CO

2

capture

projects in Europe in the last decade.

In contrast, the technology behind

Climeworks’ Orca plant is highly

modular – the modular CO

2

collec-

tors can be stacked to build ma-

chines of any size – allowing for a

relatively small plant to be built

quickly as a proof of concept. Not

only does this mean that Climeworks

can rapidly deploy direct air capture

technology, but it also helps mitigate

risk. By starting small and then scal-

ing up projects, Climeworks can

adapt to demand and budgets to en-

sure that projects are fully completed

and operational on time.

In addition, through expanded op-

erations within its current acreage,

Reykjavik Energy has indicated it

can and would accept up to 2 million

tonnes of carbon dioxide per year.

For storage in basaltic systems, the

conditions at Hellisheidi make it one

of the very best sites in the world

and the right place to start.

In 2020, Carbx, ON Power and

Climeworks announced the scale-up

of carbon dioxide removal capaci-

ties in Iceland. For example, in Ice-

land, as much as 50 million tons of

CO

2

per year could be stored within

the Icelandic Rift System. On a

global scale, many studies have

concluded that the global capacity

of CO

2

storage in basaltic systems

is well over a trillion tonnes – be-

tween 5-30 trillion. Good sites are

distributed all over the world, in-

cluding North America, the Middle

East, and China.

For direct air capture to become a

major component of the response to

the climate emergency, it needs to be

cost-effective and sustainable in

terms of investment. There is already

nancial pressure on companies to

be more environmentally friendly, in

the form of industry regulations, car-

bon taxes, and nancial incentives

like tax breaks, green bonds and

government grants.

To bolster the economic argument

for direct air capture, it is essential

for providers to work hard to bring

costs down even further. For exam-

ple, bringing the CAPEX (capital ex-

penditure) of direct air capture plants

down will reduce the capital invest-

ment needed upfront to make a proj-

ect successful.

Climeworks’ modular approach

keeps CAPEX to a minimum, scal-

ing up once results have been prov-

en. First, a smaller plant is built and

starts generating results. Investors

then have a great case for further

funding, scaling up the plant size to

capture even more CO

2

. This, in

turn, creates an appetite for more

direct air capture plants in different

areas, expanding and scaling the ap-

proach across the world and helping

to achieve net zero emissions by

2050.

Another way costs can be reduced

is through the technology. While the

basis of the tech is fairly straightfor-

ward, more efcient and cost-effec-

tive lters can make a big difference

to the development and operating

costs. More efcient lters lead to

lower energy consumption per tonne

of CO

2

and a reduced footprint of di-

rect air capture plants.

By reducing costs and increasing

awareness, Climeworks aims to

make direct air capture technology

available to everyone, regardless of

budget, helping to create a big, excit-

ing market.

To raise awareness, the company is

also working to inspire one billion

people to remove carbon dioxide

from the air and become part of the

mission to reach net zero emissions.

As such, people can subscribe to the

company’s carbon dioxide removal

service, which allows them to have

CO

2

removed from the atmosphere

in their name, giving individuals a

practical, affordable way to take cli-

mate action.

By working together on a set of

clear goals, implementing and devel-

oping new energy generation and di-

rect air capture technology, and giv-

ing both companies and individuals

access to permanent and safe carbon

dioxide removal solutions, everyone

can contribute to achieving net zero

emissions by 2050 and thereby build

a climate-positive world.

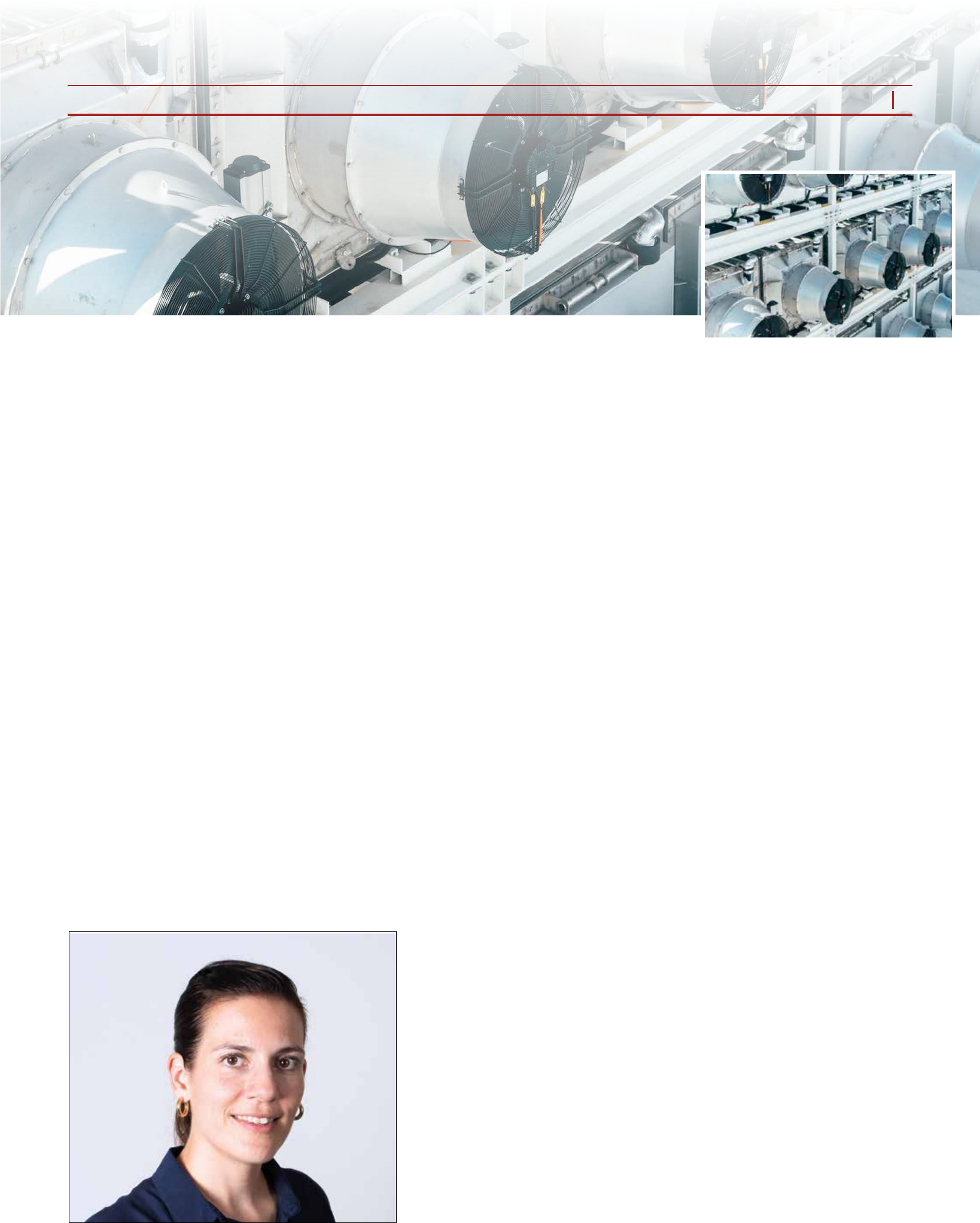

Dr. Nathalie Casas is Head of R&D

at Climeworks.

Capturing carbon

Capturing carbon

direct from the air

direct from the air

Dr. Casa: The real magic to the

process is the lter material

Climeworks direct air capture plant close-up

Copyright Climeworks - Photo by Julia Dunlop

THE ENERGY INDUSTRY TIMES - JANUARY 2021

16

Final Word

W

hile Europe and the rest of

the world attempts to limit

cross-border interaction in

an effort to slow the spread of Cov-

id-19, the European Commission is

pushing moves in the opposite direc-

tion on the energy front. Yet forging

closer ties is seldom straightforward.

December was an important month

for the bloc’s electricity grids, as the

Commission adopted a proposal to

revise the EU rules on Trans-Europe-

an Networks for Energy (the TEN-E

Regulation) in order to better support

the modernisation of Europe’s cross-

border energy infrastructure and

achieve the objectives of the Euro-

pean Green Deal.

Certainly the transition to a new in-

frastructure adapted to new technolo-

gies is a pre-requisite to climate neutral

economy powered by clean energy.

The TEN-E policy supports this

transformation through projects of

common interest (PCIs), which must

contribute to the achievement of the

EU’s emission reduction targets for

2030 and climate neutrality by 2050.

According to the Commission, the

revised regulation will continue to

ensure that new projects respond to

market integration, competitiveness

and security of supply objectives.

Among the new proposals are: a new

focus on offshore electricity grids with

provisions facilitating more integrat-

ed onshore wind; as well as upgraded

rules to promote the uptake of smart

electricity grids to facilitate rapid

electrication and scale up of renew-

able electricity generation.

Commenting on the revisions, Com-

missioner for Energy Kadri Simson

said: “The current TEN-E framework

has been fundamental in creating a true

single energy market, making it better

integrated, more competitive and se-

cure. But our ambitious climate targets

demand a stronger focus on sustain-

ability and new clean technologies.

This is why our proposal prioritises

electricity grids, offshore energy and

renewable gases, while oil and natural

gas infrastructure will no longer be

eligible for support.”

As with any new proposal or revi-

sion, it is always a point of debate as

to whether it goes far enough.

WindEurope criticised the TEN-E

revision, rst claiming it leaves a door

open for fossil fuel projects, and then

went on to highlight the lack of coop-

eration on planning.

“The TEN-E revision conrms the

essential role of these hybrid offshore

wind projects in saving money and

space as well as improving electricity

ows across borders. It also intro-

duces a dedicated ‘offshore one-stop-

shop’ per sea basin to simplify the

permitting process of offshore grids

for renewable energy. But it does not

provide for the joint planning of the

generation and transmission assets.

Member States will need to address

this,” it said.

Just ahead of the revision, Eurelec-

tric, the organisation that represents

Europe’s electricity industry, pre-

sented two new publications at an

online media roundtable assessing

the state of play in Europe’s networks.

The papers outlined what the organ-

isation would like to see from the

TEN-E regulation and, more gener-

ally, the regulation of grids going

forward – with a particular focus on

distribution grids.

Kristian Ruby, Eurelectric’s Secre-

tary General, said: “We know: big

investments are going to be needed;

there will be signicant amounts of

renewable energy coming on to the

grid; and there’s a general decentrali-

sation of the grid happening. What

does that entail for the grids? And how

should the EU and regulation make

this happen with the tools they have at

their disposal?”

With increasing decentralisation, it

is quite right that there should be a

focus on distribution grids. Europe’s

distribution setup is a complex pic-

ture. According to Eurelectric there

are 2556 distribution system opera-

tors (DSOs) in the EU-27, operating

10 million km of power lines connect-

ing more than 300 million customers.

These DSOs supply 2800 TWh of

electricity/year – a signicant gure.

Further, by 2030 over half of the

generation eet will be decentralised

and connected at the distribution grid

level, predicted Eurelectric.

Louise Rullaud, Eurelectric’s Ad-

visor for Distribution & Market Fa-

cilitation, and Infrastructure &

Flexibility Lead, commented: “This

illustrates that the energy transition

cannot effectively be achieved

without a very large scale of distribu-

tion grid digitalisation.”

A key indicator of progress is the

level of smart meter rollout – an es-

sential part of digitalisation and the

realisation of smart grids. Smart me-

ters are key to enabling DSOs to offer

new services and ways to manage

electricity distribution. Eurelectric’s

data shows there are currently around

120 million smart meters installed in

the EU-27, representing about 48 per

cent of all metering points. Rullaud

noted, however, that “while this is

very satisfying”, the rollout is very

different from one country to another.

She stressed that strong support is

needed to incentivise investments in

power distribution. Eurelectric calcu-

lates that achieving a smart meter

penetration of 92 per cent by 2030

calls for €41 billion in investment.

Pierre Braun, Advisor, Distribution

& Market Facilitation, and Investment

Lead at Eurelectric, analysed the state

of investment in distribution. He

noted that between 2015 and 2020,

EU funding from the ve nancing

instruments has been mainly allo-

cated to electricity transmission and

gas networks.

“In the different instruments, the

share of funding for electricity distri-

bution has been quite marginal,” he

said. “In terms of total allocated

amounts, funding for distribution

projects represents a small share – just

0.3 per net of available funding.”

Clearly there is a disconnect between

the growing share of decentralised

power and the investment needed to

create a system that can absorb the

increasing amount of renewables.

“We have an energy system that is

decentralising very rapidly. Today we

have a share of less than 20 per cent

distributed power in the system but

in 10 years it will be more than 50 per

cent if we are to meet the targets. [But]

the investments made by the EU are

consistently ploughed into central-

ised grid infrastructure – whether it’s

gas or electricity,” said Ruby. “That

really should give everybody a little

food for thought.”

Ruby therefore stresses that a com-

pletely different agenda has to be set

for grid investment going forward.

“TEN-E is a crucial element here but

is only one of several. It is critical that

investments reect the need of a future

more decentralised energy system.”

In line with this thinking, Eurelec-

tric set out some key asks for the

TEN-E revision. “We rst need to

acknowledge that electricity infra-

structure has a key role when it comes

to delivering on decarbonisation,”

Ruby said. “Decarbonisation means

electrication; it’s just a plain fact.

It’s not the only needed vector but it’s

the main vector.”

Taking the next steps in the energy

transition through increased electri-

cation will need a wider system ap-

proach. In addition to prioritising

projects that foster electrication and

direct use of renewables, Eurelectric

says TEN-E should leverage the de-

ployment of distribution grids to en-

able decarbonisation of mobility,

heating, renewable integration and

active customers.

“When you look at the funding and

how it’s going, there is really not suf-