www.teitimes.com

November 2020 • Volume 13 • No 7 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Getting charged up

Net zero pathways

Vehicle-to-grid technology is

preparing to become a key

weapon in the battle against

climate change. Page 13

The IEA’s recently published ‘Energy

Technology Perspectives 2020’

analyses the technologies that will

get us to net zero. Page 14

News In Brief

Global cooperation drives

energy transition

A growing number of countries

are coming together to collaborate

on ways to accelerate the energy

transition.

Page 2

US interest shifts towards

‘post fossil’ technologies

As the future of fossil-fuelled power

generation in the USA remains a key

topic of debate, some plant operators

have pre-empted federal policy with

commitments to conversion that

could give fossil power plants a low-

carbon future.

Page 4

Vietnam backs wind and

solar in new Master Plan

Vietnam is making wind and solar

its main focus as it prepares its latest

Master Plan for the power sector.

Page 6

Investment heads offshore

as renewables power

forward

Demand for renewable energy has

continued the rising trend it has

maintained since 2012 despite the

effect of Covid-19, according to

bodies that issue green certicates.

Page 7

Fossil fuel majors struggle

with low carbon targets

Despite a number of high prole

clean energy plays, companies

with their roots in fossil fuels are

struggling to align their low-carbon

ambitions with the Paris Climate

Agreement.

Page 9

Fuel Watch: Gas

The Southern Gas Corridor is

“substantially complete”, further

reducing Europe’s dependence on

Russian gas.

Page 12

Technology Focus: Getting

intelligent about cyber

security

Siemens Energy is bringing its

operations expertise and articial

intelligence to cyber security.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

In its latest World Energy Outlook, the International Energy Agency says the next decade is

“critical” if the world is to achieve its climate change ambitions and will need to deliver a

40 per cent cut in global carbon emissions during the period. Junior Isles reports.

China’s carbon neutrality goal could cost $5 trillion

THE ENERGY INDUSTRY

TIMES

Final Word

Let’s keep the skin off

that rice pudding,

says Junior Isles.

Page 16

The next 10 years will be pivotal to put

the world on track for a resilient en-

ergy system that can meet climate

goals, according to the International

Energy Agency’s recently published

‘World Energy Outlook (WEO) 2020’.

The Paris-based agency’s agship

publication states that the Covid-19

crisis has caused more disruption than

any other event in recent history, but

whether this upheaval ultimately

helps or hinders efforts to accelerate

clean energy transitions and reach in-

ternational energy and climate goals

will depend on how governments re-

spond to today’s challenges. It stresses

that “a surge in well-designed energy

policies is needed”.

Launching the report, IEA Chief Ex-

ecutive Dr Fatih Birol, said: “In the

middle of uncertainty it is important to

look at the long term trends – 2040/

2050 – but let us focus on the next 10

years, which is critical for reaching

our energy and climate goals.”

He said the WEO focuses on two

key uncertainties: rstly, the duration

and severity of the pandemic and how

it will affect the energy world; and

governments’ response to the pan-

demic in terms of addressing the other

challenges the world is facing today,

including climate change.

The key ndings of the report are

that global energy demand is set to

drop by 5 per cent in 2020, energy-

related CO

2

emissions by 7 per cent,

and energy investment by 18 per cent.

In the Stated Policies Scenario,

which reects today’s announced

policy intentions and targets, global

energy demand rebounds to its pre-

crisis level in early 2023. However,

this does not happen until 2025 in the

event of a prolonged pandemic and

deeper slump, as shown in the De-

layed Recovery Scenario. Slower

demand growth lowers the outlook

for oil and gas prices compared with

pre-crisis trends. But large falls in

investment increase the risk of future

market volatility.

Assessing the roles that the various

energy sources will play in the elec-

tricity sector going forward, the IEA

sees renewables taking a “starring

role” in all scenarios, with solar cen-

tre stage. Supportive policies and

maturing technologies are enabling

very cheap access to capital in lead-

ing markets, it said, noting that solar

PV is now consistently cheaper than

new coal or gas red power plants in

most countries.

“Solar projects now offer some of

the lowest cost electricity ever seen,”

says the IEA. In the Stated Policies

Scenario, renewables meet 80 per cent

of global electricity demand growth

over the next decade. Hydropower

Continued on Page 2

China will need more than $5 trillion

of investments to grow power gen-

eration capacity if it is to reach its

carbon neutrality target by 2060, ac-

cording to global market researcher

Wood Mackenzie.

The ambitious target announced in

September would have to translate

into boosting solar, wind and storage

capacities 11 times over to 5040 GW

by mid-century compared to 2020

levels, halving coal red capacity

and keeping gas where it was in

2019, WoodMac estimates.

“It is denitely a colossal task for a

country using 90 per cent hydrocar-

bons in its energy mix and annually

producing more than 10 billion

tonnes of CO

2

-e, and in addition, ac-

counting for 28 per cent of global

total emissions”, said Prakash Shar-

ma, WoodMac Asia Pacic head of

markets and transition.

WoodMac agrees with China’s own

estimates that emissions will rst

peak before dropping to net zero after

2050 as transport, heating and indus-

try become more electried.

China’s announcement has been

hailed as a major step forward in in-

ternational negotiations over how to

slow global warming but there are

questions over how the world’s larg-

est emitter can achieve the ambitious

target.

The International Energy Agency’s

Chief Executive Dr Fatih Birol com-

mented: “China’s actions are critical

in addressing the world’s climate

challenge. We will be eagerly await-

ing its next Five Year Plan. We hope

this will convince us that China will

reach this target.”

There are concerns that the 40-year

timeframe to reach near zero emis-

sions leaves open the possibility of

delayed action in the short-term, in

the hope that technological break-

throughs will deliver rapid gains later,

“The devil will be in the details and

China should set more specic near-

term targets and an earlier peaking

date,” said Helen Mountford, Vice-

President for climate and economics

at the World Resources Institute, a

non-governmental organisation, in a

statement.

According to WoodMac, China

will keep coal in the mix to avoid

large job losses in mining provinces.

But “to have its carbon-neutral cake

and eat it too”, it says the govern-

ment is expected to retrot coal red

power plants with carbon capture use

and storage (CCUS) technologies.

Along with CCUS, hydrogen will

also have to become the mainstay of

China’s industrial green revolution.

WoodMac estimates the country’s

hydrogen production to grow ve-

fold by 2050, equally distributed be-

tween the green and the fossil fuel-

based, paired with CCUS,

alternatives.

“Given China’s large heavy industry

and machinery sector, it is crucial that

China masters the use of CCS and

forest sinks to offset the remaining

emissions. Without it, China’s pledge

to become carbon-neutral is nearly

impossible,” Sharma said.

Despite President Xi’s calls for a

“revolution” to speed up “green de-

velopment”, Beijing has this year ap-

proved coal red power plants at the

fastest rate since 2015.

At the same time, the government

has pledged to end subsidies for new

onshore wind installations by 2021

and has halved support for solar

power plans this year, a trend that

throws into doubt the future pace of

adoption.

Much will ride on China’s 14th

Five Year Plan, due to be released

next spring.

Jorrit Gosens, a researcher on Chi-

na’s energy transition at Australian

National University, recently told the

Financial Times: “The big question

is whether the 14th ve-year plan

keeps a cap on coal power capacity at

1100 GW by 2030 or sets something

lower or higher.”

Next 10 years will

be pivotal,

says latest WEO

Dr Birol says how governments respond to the pandemic is a key uncertainty

THE ENERGY INDUSTRY TIMES - NOVEMBER 2020

3

WWW.E-WORLD-ESSEN.COM

SOLUTIONS FOR

A SUSTAINABLE

FUTURE

TRADE FAIR & CONGRESS

FEBRUARY , | ESSEN | GERMANY

WHAT MOVES THE INDUSTRY

#EnergyFuture

#EnergyTransition

#Hydrogen

#Renewables

#SmartInfrastructure

#Networking

#eMobility

#Eworld2021

WHO ARE WE

Our studio can provide a bespoke service for all your media

requirements. We offer a vast range of products including

advertising, single projects, web design, corporate identity, large scale

event printing, print and digital magazines, print and distribution

management, video and digital through to day-to-day material needed

for your business.

As a group we have produced an array of event conceptual branding

that have helped events become a huge success over the years

globally, working closely with marketing managers and event directors

to make sure what we produce is exactly what is needed.

Our team has extensive creative and management experience in a

highly pressured environment and we are able to navigate requests

across many different areas of the media industry.

Complete commitment to clients and meeting deadlines are key to our

success, alongside the vast experience of the team who have worked

in B2B for 20 years.

In Partnership with

weber media solutions

weber media solutions

CONTACT

Karl Weber / Director / t: +44 7734 942 385 / email / karlw@webermediasolutions.com

www.webermediasolutions.com

DESIGN

PRINT MANAGEMENT

EXHIBITION STAND DESIGN

VIDEO

DIGITAL

C

M

Y

CM

MY

CY

CMY

K

THE ENERGY INDUSTRY TIMES - NOVEMBER 2020

7

Europe News

Janet Wood

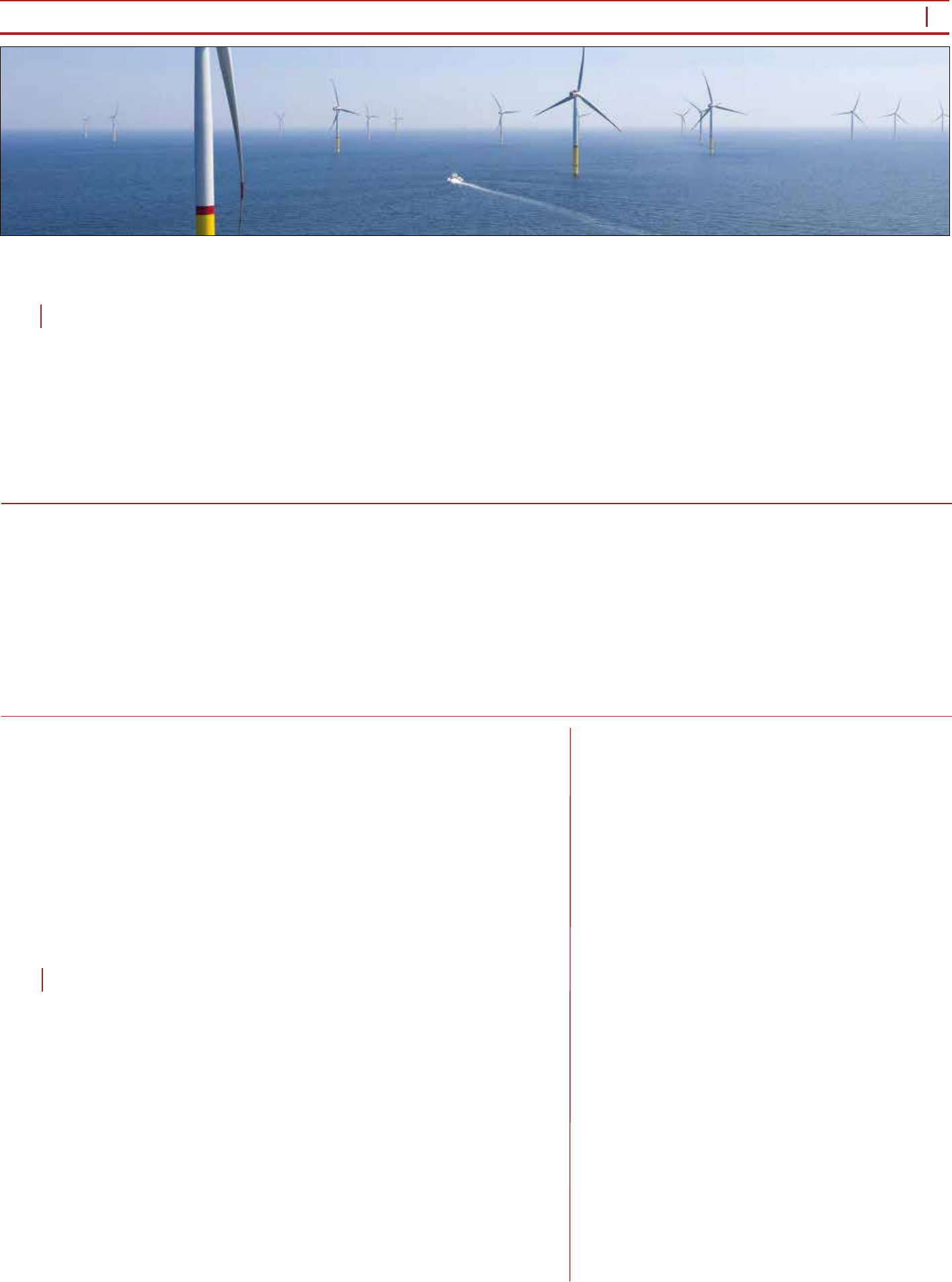

Europe’s demand for renewable ener-

gy has continued the rising trend it has

maintained since 2012 despite the ef-

fect of Covid, according to bodies that

issue green certicates. Demand for

renewables documented with Guaran-

tees of Origin has steadily increased,

up 16 per cent every year during the

period from 2012 to 2020. Growth re-

mained close to that gure at 15 per

cent in 2020, despite the pandemic,

according to new gures from the As-

sociation of Issuing Bodies (AIB).

“The fact that especially corporate

demand for renewables seems unaf-

fected is truly inspiring during these

unusual and trying times,” said Tom

Lindberg, Managing Director at ECO-

HZ. EU demand for renewables

reached 530 TWh at the close of Q2

2020.

Hydropower retained its position as

the biggest renewable source, but it

has fallen from 90 per cent of supply

a decade ago to just 61 per cent in

2019. Wind is the second largest re-

newables source at 23 per cent in 2019

and looks set to take another leap, with

new offshore wind leases up for grabs.

The UK’s Crown Estate is nearing

the completion of the second of its

three tender stages for Offshore Wind

Leasing Round 4, which should add 7

GW of projects in UK waters. Long

awaited government plans are also

expected to support 1 GW of oating

offshore wind. Eight countries – Po-

land, Germany, Denmark, Sweden,

Finland, Lithuania, Estonia and Latvia

recently committed to expand offshore

wind energy in the Baltic Sea, where

Poland’s PGE alone plans to develop

6.5 GW of capacity as part of a strat-

egy to become climate neutral by 2050.

And recently European Energy of-

cially led for permission to build two

wind farms – Omø South and Jammer-

land Bay – offshore of Denmark.

Knud Erik Andersen, CEO of Euro-

pean Energy, said: “Our offshore wind

farms will supply more than 500 000

Danish households with green energy

and be key to achieving the ambitious

emissions reduction targets in Den-

mark and the EU.”

Tidal stream and wave energy could

also replicate the success of offshore

wind. A ‘2030 Vision’ report from in-

dustry body Ocean Energy released in

October unveiled ambitious targets,

saying 3 GW of ocean energy could be

deployed worldwide by 2030, with

costs falling to around €90/MWh for

tidal stream and €110/MWh for wave

energy. Charlina Vitcheva, Director-

General for Maritime Affairs and Fish-

eries at the European Commission,

said: “Ocean energy can be a real

‘jewel in the crown’ of the Blue Econ-

omy. The economic and environmental

opportunities it offers EU coastal citi-

zens are exactly what the European

Green Deal is all about.”

ENCS, the European Network for Cy-

ber Security, and E.DSO, the Euro-

pean Distribution System Operators’

Association, have launched the third

in a series of security guidelines for a

smarter and more secure energy net-

work, following on from security re-

quirements for electric vehicle charg-

ing points and smart meters.

Roberto Zangrandi, Secretary Gen-

eral of E.DSO, said that these founda-

tions for an industry-wide set of

recommendations “would be a huge

step forward to ensuring security of

critical European energy grids and

infrastructure, which can only really

be achieved through a collaborative

effort between DSOs and cybersecu-

rity experts”.

The need for common ground on

security was illustrated by four UK

distribution network operators

(DNOs) who announced in October

that they would join forces for the rst

time to provide exibility providers

with a direct path to participate in ex-

ibility on multiple networks. Western

Power Distribution, SP Energy Net-

works, Scottish and Southern Elec-

tricity Networks and Northern Pow-

ergrid all said that the ‘Flexible

Power’ collaboration would be used

to signpost and operate their exibil-

ity requirements. The DNOs intend to

work in partnership to develop the

brand.

Jim Cardwell, Northern Powergrid’s

Head of Policy Development, said: “It

will offer customers with assets con-

nected across multiple networks a

much simpler and single interface and

this will help accelerate the roll out of

exibility across the entire UK energy

system.”

The system will allow for interface

with other exibility platforms, mak-

ing the need for collaboration on se-

curity still more important.

Kiwi Power will be supporting the

project by providing its Kiwi Core

Virtual Power Plant software to the

four DNOs. Stephan Marty, Chief

Commercial Ofcer, said that the soft-

ware will allow exibility providers

to declare their assets’ availability,

receive dispatch signals and view per-

formance and settlement reports.

“Flexibility providers will be able to

overlook multiple networks using one

single platform.”

Janet Wood

The pace of investment in hydrogen is

making a marked step up, as countries

vie to become major players and en-

ergy companies link up with their

counterparts in other sectors to develop

what is expected to become an impor-

tant energy vector.

Recent national announcements sug-

gested the EU’s Member States are

competing to become hydrogen hubs.

Spain has announced plans to attract

€8.9 billion ($10.5 billion) of invest-

ment into hydrogen – largely from the

private sector – over the next 10 years.

It plans to install 4 GW of electrolysers

to take advantage of growing renew-

able energy capacity by 2030. Ger-

many has pledged to invest €9 billion

in hydrogen by 2030 and France plans

investment of €2 billion over the next

two years.

The rush to hydrogen comes as an

industry group in the UK launched a

new bid for government funding for

an energy ‘innovation hub’ to meet

the needs of energy intensive indus-

tries based around Ellesmere Port in

Cheshire. The bid, launched in Octo-

ber, looks towards replacing natural

gas with hydrogen or heat networks,

along with other energy innovations.

Hydrogen is not the only ‘green’ fuel

of interest. Oil and gas group Repsol

is planning to join with Saudi Arabia’s

Saudi Aramco to produce synthetic

fuels from green hydrogen at its ren-

ery in northern Spain.

Offshore wind developer Ørsted has

just announced a new joint venture

with Yara, a leading global fertiliser

company. They will develop a 100

MW wind powered electrolyser plant

for renewable hydrogen production

and aim to use it to replace fossil-

based hydrogen for ammonia produc-

tion in Yara’s Sluiskil plant in the

Netherlands. In addition to its current

use, ammonia is seen as a potential

form to use hydrogen in power ap-

plications. “Green ammonia can be

essential to enable sustainable food

production, in addition it is emerging

as the most promising carbon neutral

energy carrier for several energy ap-

plications,” said Martin Neubert, Ex-

ecutive Vice President and CEO of

Ørsted Offshore.

Increased interest in alternative

gases has coincided with recent deci-

sions to withdraw support from bio-

mass, prompted by continuing ques-

tions over its sustainability at large

scale. Dutch ministers recently de-

cided to phase out subsidies for pow-

er and heat projects using biomass,

as Economic Affairs Minister Eric

Wiebes told his fellow MPs that there

are greener alternatives. Vattenfall

decided that it would postpone plans

to build a biomass plant on the out-

skirts of Amsterdam, following sus-

tainability concerns raised by local

authorities.

Investment heads offshore as

Investment heads offshore as

renewables power forward

renewables power forward

‘Green gases’ rise as

biomass fades

Groundwork laid for responsive distribution networks

n Plans for huge investment in Baltic and North Seas

n Wave and tidal could replicate offshore wind success

n R&D looking towards and beyond hydrogen

n Ørsted and Yara to generate green hydrogen for ammonia

production

Poland and Romania

take nuclear route to

lower carbon

Poland will decide next year on which

nuclear technology to use for its

planned investment in its rst nuclear

power plant. Recently the programme

to build 6-9 GW of nuclear generation

took a step forward when it signed a

new co-operation agreement with the

USA.

“Over the next 18 months, the US

and Poland will work together on a

report delivering a design for imple-

menting Poland’s nuclear power pro-

gramme as well as potential nancing

arrangements,” the text of the Poland-

US agreement stated. “This will be the

basis for US long-term involvement

and for the Polish government to take

nal decisions on accelerating the con-

struction of nuclear power plants in the

country.”

The programme will partially replace

Poland’s lignite plants, which cur-

rently meet 80 per cent of demand, with

power from, “large, proven pres-

surised water reactors”, with the rst

reactor ready to go into operation in

2033.

The Polish programme will take sec-

ond place in eastern Europe’s nuclear

expansion to Romania, which recently

announced plans to upgrade two oper-

ating reactors at its huge Cernavoda

nuclear site and complete units 3 and

4. The two plants are due to begin op-

eration by 2030, in a new agreement

between Romania and the USA.

Announcing the agreement, Roma-

nian Economy, Energy and Business

Minister Virgil Popescu said: “Roma-

nia is today taking a huge step in de-

veloping its strategic partnership with

the United States in terms of the en-

ergy component, namely cooperation

in the civil nuclear eld.” A statement

released to mark the agreement said:

“This partnership will ensure energy

security, lead to economic growth and

implement the highest safety stan-

dards. Nuclear energy will continue to

play a prominent role in the country’s

national energy mix, providing Roma-

nia with reliable, emission-free energy

to meet the increasing demand.”

Meanwhile the UK government,

looking for ways to support its own

nuclear build programme, has consid-

ered taking an ownership stake in fu-

ture plants.

The UK is considering using a ‘reg-

ulated asset base’ (RAB) approach for

Sizewell C, the follow-up to EDF’s

Hinkley Point C reactor which is now

under construction. The RAB model

would place the risk of delays or can-

cellation on consumers, but Energy

and Industry Minister Kwasi Kwart-

eng suggested in October that if the

government took part ownership, con-

sumers would also have a share in any

upside.

8

THE ENERGY INDUSTRY TIMES - NOVEMBER 2020

International News

Africa urged to do more to exploit green energy potential

Embattled Eskom reviews 10-year grid upgrade plans

Nadia Weekes

After setting out plans to become the

energy hub for its region, Iran is now

planning to upgrade its grid infrastruc-

ture so that it can export energy to

Europe, energy minister Reza Arda-

kanian said during a virtual summit on

Caspian economic cooperation last

month.

The Iranian Energy Ministry has

been negotiating with neighbouring

countries including Iraq, Russia, Af-

ghanistan, Azerbaijan and Qatar to

connect their power networks with Iran

to enable electricity transmission to

new destination markets through Iran.

So far, Iran’s electricity network has

been synchronised with Iraq, and in

September, Ardakanian announced

that the electricity networks of Russia

and Azerbaijan would be next in line

for linking with the Iranian grid.

“Within the next few months, the

study project of synchronisation of the

electricity networks of Iran, Azerbai-

jan and Russia will be completed and

then the executive operations will

begin,” the minister said.

A subsea connection with Qatar is

also being discussed, and high-level

meetings have conrmed that a pro-

posal to do so “should be worked on”.

Iran is now taking the next step as

the region’s power hub with a sugges-

tion that it becomes a bridge between

the East and Europe for transmitting

electricity.

“We are ready to connect Iran’s elec-

tricity network, as the largest power

generation power in West Asia, with

the European countries, and to provide

the ground for the exchange of electric-

ity with Europe,” Ardakanian said ad-

dressing the Caspian online event.

Ardakian said that Iran’s energy in-

frastructure in the oil, gas, and electric-

ity sectors can be used as a good plat-

form for the transfer of energy from

the region to Europe. He also said that

Iran’s skilled manpower and advanced

facilities in the eld of energy are well

suited to the development of interna-

tional transport and energy corridors.

“In order to help promote commu-

nication between our landlocked

neighbours and international markets,

we have created a huge transit infra-

structure in our country and have

demonstrated in practice our commit-

ment to regional development and

peace and stability,” Ardakanian said.

The Energy Minister said that by in-

vesting in energy production in Iran,

Europe could meet part of its future

energy needs on a sustainable basis.

The country enjoys abundant gas

resources, which fuel the majority of

its power plants. Iran’s installed elec-

tricity capacity is 85.5 GW.

Iran recently announced plans to triple

its nuclear power generation capacity

to 3 GW. Two additional 1 GW units at

Bushehr Nuclear Power Plant, on the

Persian Gulf coast, are currently under

construction. They were originally due

online by 2027 but nancial difculties

have hindered progress.

Russia’s Rosatom energy rm has

been contributing to the construction

of the plants, but Iran has said it intends

to cut its future reliance on Russian

engineers for the maintenance of the

Bushehr plant.

Germany’s energy ministry is looking

to strike deals with its Ukrainian and

Russian counterparts in a move aimed

at opening up channels for hydrogen

imports.

Russian Energy Minister, Alexander

Novak, said last month that his country

was ready to participate in joint proj-

ects with other countries and had

agreed to sign a memorandum with

Germany on conducting joint research

in this area.

Meanwhile, Ukraine is also looking

for German support to integrate hy-

drogen technologies into Ukraine’s

energy system as part of the Green

Hydrogen for a European Green Deal.

Following the signing by Ukrainian

acting minister Olha Buslavets with

the German government of a memo-

randum of understanding on an en-

ergy partnership in late September,

Ukraine is now seeking to take further

steps toward supplying German com-

panies with hydrogen.

Germany and Ukraine are consulting

on a number of priority pilot projects

to be developed in the rst instance,

according to Buslavets. Under the EU

programme, the two countries should

also discuss implementation mecha-

nisms and possible funding sources,

she added.

It is envisaged that Ukraine’s gas

transmission facilities could be used

– subject to the necessary adaptations

– to transport renewable hydrogen to-

wards the EU.

Buslavets called on German compa-

nies that have prior experience of

working with hydrogen to combine

efforts with reliable Ukrainian partners

and jointly implement pilot projects in

Ukraine.

Two recent reports have concluded that

Africa is not doing enough to exploit

its potential to generate clean energy

from the wind and the sun.

The African continent could generate

up to 180 000 TWh a year from onshore

wind only – enough to satisfy its elec-

tricity demand 250 times over – ac-

cording to analysis by Everoze for IFC,

a member of the World Bank Group.

Algeria has the highest resource with

a total potential of 7700 GW, and 15

other countries could each potentially

install more than 1000 GW. Over one-

third of Africa’s wind potential is in

areas with very strong winds, with

capacity factors of up to 46 per cent.

“There is a clear need for govern-

ments to enact policies to take advan-

tage of the vast resource that the report

identies and enable large scale invest-

ment in wind as a key building block

for green economic recovery post Co-

vid-19,” said Ben Backwell, CEO of

the Global Wind Energy Council

(GWEC).

Another report released in October

by the Pan African University, however,

accused African governments of being

too dependent on donor aid to drive

solar and wind power deployment.

Egypt’s Minister of Electricity and

Renewable Energy, Mohamed Shaker

also said in October that he is looking

to increase the percentage of electric-

ity generated from renewable sources

to 60 per cent by 2035, up from the

current target of 42 per cent.

Before the end of the year, Egypt is

looking to begin developing a 500 MW

wind power plant in cooperation with

Siemens, and launch 2000 MW of

renewable energy capacity following

negotiations with foreign investors.

Meanwhile, the US Trade and Devel-

opment Agency has awarded a grant for

a feasibility study to help Lekela Ener-

gie Stockage deploy utility-scale bat-

tery storage technology in support of its

Taiba N’Diaye wind farm, the largest

of its kind in Senegal and West Africa.

The project, expected to deploy at

least 60 MWh of battery storage capac-

ity, will serve as a model for replication

across the region.

Under the Sustainable Energy for All

initiative, work has started on improv-

ing energy infrastructures across the

African continent to help it meet grow-

ing demand.

Stantec has been selected to work

with the leading African Union con-

tinental and regional institutions to

develop a generation and transmis-

sion master plan that can guide deci-

sion-making on the location, size and

timing of investments in generation

and transmission assets to support

intra- and inter-pool interconnections

and trading.

South African electricity utility Eskom

has revised down plans for a transmis-

sion infrastructure boost, days after it

suffered a judicial setback in its bid to

recoup R69 billion ($4.25 billion) of

government equity through higher

electricity tariffs.

Eskom spokesperson Sikonathi

Mantshantsha said that Eskom had not

got the benet of the equity injection

by the National Energy Regulator of

South Africa (Nersa), and that the ap-

peal court should clarify how that

money will be recovered by Eskom.

Sharing its 10-year Transmission De-

velopment Plan (TDP) for the period

2021-30 with stakeholders during an

online public forum, Eskom said it

would add about 5650 km of high-

voltage lines and 41 595 MVA of trans-

former capacity at a cost of up to R118

billion.

Eskom’s plans for new transmission

lines fall slightly short of the 6700 km

Chief Executive Andre de Ruyter had

anticipated the country would need, in

a speech earlier in October.

Under transmission licensing re-

quirements issued by South Africa’s

National Energy Regulator, Eskom

must review its TDP annually and sub-

ject it to public consultation.

Eskom’s Group Executive for Trans-

mission, Segomoco Scheppers, said

some adjustments had been made to

the TDP since its last publication in

2019, which included the re-phasing

of capital investment in transmission

projects to align them with the project

execution timelines that were associ-

ated with servitude acquisitions, and

current available funding.

The utility has warned South Africans

that the country’s electricity system is

under severe pressure, urging them last

month to “switch off all unnecessary

lights, pool pump and non-essential

appliances”.

SA Reserve Bank (SARB) has

blamed Eskom for the country’s stag-

nant economy, claiming that electric-

ity shortages were a major obstacle to

economic growth.

SARB Head of Economic Research,

Chris Loewald, said electricity prices

could rise signicantly in the medium

term. He said the Monetary Policy

Committee forecasts indicated in-

creases, averaging 8.2 per cent for

2021 and 10 per cent for 2022. Price

rises could be higher if Eskom’s court

challenges succeed, Loewald added.

Eskom has defended its demand for

higher tariffs, citing a 2016 World

Bank study showing that South Afri-

ca’s electricity prices were the third

lowest out of 39 countries in sub-Sa-

haran Africa, leading to an annual

revenue shortfall for the utility of

about R60 billion.

The utility is faced with a mounting

debt of R488 billion and has embarked

on an aggressive campaign to recoup

monies owed to it by debtors as its age-

ing infrastructure fails to handle rising

demand.

Eskom has warned that load shed-

ding will persist throughout 2021,

when it expects its maintenance ef-

forts to start bearing fruit. But the util-

ity says it also needs additional capac-

ity to deal with growing demand. It

plans to add 30 GW of capacity,

mainly solar and wind, over the next

10 years.

Research by the Council for Scien-

tic and Industrial Research has alert-

ed South Africans to the risk of expo-

nential increases to load shedding until

at least 2022.

Germany eyes

hydrogen deal with

Ukraine and Russia

Iran sets out

Iran sets out

ambition to export

ambition to export

energy to Europe

energy to Europe

n Synchronisation study to begin “within months”

n Subsea connection with Qatar also being discussed

Eskom has been forced to dial-down plans for a transmission system upgrade after the government rejected higher

tariffs. Nadia Weekes reports

THE ENERGY INDUSTRY TIMES - NOVEMBER 2020

9

Companies News

Despite a number of high prole clean

energy plays, companies with their

roots in fossil fuels are struggling to

align their low-carbon ambitions with

the Paris climate agreement.

In October, a partnership between

London School of Economics academ-

ics and investors that manage $21 tril-

lion in funds, called the Transition

Pathway Initiative (TPI), assessed 125

oil and gas producers, coal miners and

electricity groups on their prepared-

ness for a lower-carbon economy.

According to the study, only seven of

the 59 major oil, gas and coal players

assessed are on track to align with the

emissions pledges governments made

as part of the 2015 Paris Agreement.

TPI said only three oil and gas com-

panies – Shell, Total and Eni – are get-

ting closer to the 2°C scenario although

their emissions reduction targets and

low-carbon investment plans are still

insufcient to bring them into line with

that benchmark.

The ndings will make uncomfort-

able reading for the companies, which

were assessed on “carbon perfor-

mance”. This factors in the carbon

intensity of the products they produce

and sell, emissions reduction targets,

and how they would fare under three

models: should governments meet ex-

isting national emissions pledges, a

scenario in which temperatures rise by

2°C; and one where they rise by less

than 2°C.

In the new report, BP was not named

as a leader in action on climate change,

despite announcing ambitious plans

in August to cut oil and gas production

by 40 per cent over the next decade.

BP, like a number of European com-

panies, has also been diversifying into

clean energy. It has set a target of own-

ing 50 GW of renewable capacity by

2030, up from its current 2.3 GW.

The ongoing change in the energy

landscape, which is being accelerated

by the pandemic, is forcing fossil fuel

companies to make tough decisions. In

June BP announced 10 000 job cuts as

part of its overhaul.

At the end of September Royal Dutch

Shell followed suit saying it will cut up

to 9000 jobs. As the pandemic depress-

es crude prices, Shell’s review of its

operations is designed to make the

group more nancially resilient and set

it up for a shift towards lower-carbon

energy businesses. In April, the com-

pany announced a plan to become net

zero by 2050.

Shell said it is restructuring its busi-

ness in Germany, listing offshore wind

and hydrogen as some of the key

elements of its operations in the coun-

try. The company said it plans to par-

ticipate in the production of electric-

ity from renewable energy sources in

Germany through offshore wind, or

combined offshore wind-hydrogen

projects.

The company is targeting a ten-fold

increase in the electrolysis capacity of

its Rhineland renery, and plans to

investigate further hydrogen projects.

In the next decade, it will also set up

around 1000 fast charging stations at

its lling stations.

French energy giant Total has been

making similar moves. Announcing

its strategy at the end of September, it

said that in the next decade oil prod-

ucts sales will diminish by almost 30

per cent and Total’s sales mix will

become 30 per cent oil products, 5 per

cent biofuels, 50 per cent gases, and

15 per cent electrons.

Days before the announcement, it

signed an agreement with the Spanish

developer Ignis to develop 3.3 GW of

solar projects located close to Madrid

and Andalusia. This operation brings

to more than 5 GW its portfolio of so-

lar projects under development in

Spain by 2025.

Clean energy investment is proving

to be a sound strategy, especially dur-

ing the pandemic. Total said renew-

ables and electricity are expected to

deliver a predictable cash ow of more

than $1.5 billion per year by 2025.

In early October NextEra, the

world’s largest solar and wind power

generator, surpassed ExxonMobil in

stock market value, reecting inves-

tors’ bets on a changing energy system

and an uncertain outlook for oil

demand.

Siemens is strengthening its hand in

the ‘energy-as-a-service’ (EaaS), mar-

ket, having made several recent strate-

gic investments.

In mid-October Siemens Financial

Services (SFS), the private equity arm

of energy and manufacturing power-

house Siemens AG, announced that it

has acquired a 49 per cent stake in

Brazil-based solar developer Brasol

Participações e Empreendimentos

S.A. (“Brasol”). The investment

marks one of the largest foreign cap-

ital injections into the Brazilian solar

power sector to date.

It is the second Brazilian acquisition

SFS has made in the EaaS eld. In

August 2019, Siemens announced an

investment in a company that provides

energy storage batteries through per-

formance contracts.

The move underscores Siemens’

pivot to energy service and distributed

infrastructure. Together, Siemens and

Brasol plan to offer a broad suite of

EaaS solutions for commercial and

industrial energy consumers, leverag-

ing data intelligence to reduce energy

costs and risks.

Brasol currently provides turnkey

solar-as-a-service solutions to busi-

nesses across Brazil through a nan-

cial lease model. Brasol’s approach

for providing solar-as-a-service her-

alds a growing emphasis on the use

of on-site renewable energy sources

by commercial and manufacturing

enterprise.

The deal was the second such move

by Siemens in a matter of days. In

early October Siemens Smart Infra-

structure (SI), SFS and Macquarie’s

Green Investment Group (GIG) an-

nounced the formation of Calibrant

Energy.

Calibrant Energy offers a combina-

tion of technical, operating, and risk

management expertise that enables

customers to access the benets of

on-site energy systems with a new

level of simplicity. Using an EaaS

model, Calibrant will build onsite en-

ergy solutions that seek to deliver im-

mediate cost savings, cost certainty,

resilience and low-cost energy grid

augmentation.

Calibrant’s technologies will in-

clude solar, integrated solar-battery

solutions, hybrid systems, standalone

batteries, microgrids, combined heat

and power, and centralised heating

and cooling infrastructure upgrades.

Customers will include corporate and

industrial clients, as well as munici-

palities, universities, schools and

hospitals.

A growing number of companies are

exiting coal as they move towards be-

coming carbon neutral.

In mid-October Japanese trading

house Mitsui & Co Ltd announced

plans to sell its remaining stakes in coal

red power stations by the end of the

decade as it shifts to gas from coal to

help achieve its 2050 net zero emission

target.

Its Chief Executive, Tatsuo Yasun-

aga, told Reuters: “Renewable energy

can’t replace all other power sources

in one fell swoop. Gas goes well with

volatile renewable energy as gas red

power generation is easy to switch on

and off,” adding Mitsui is also keen

on cleaner energy such as offshore

wind farms and hydrogen projects.

“We still own stakes in coal red

plants in Indonesia, China, Malaysia

and Morocco, but our goal is to make

it zero by 2030.”

GE also announced that it is setting

a goal to achieve carbon neutrality for

its facilities and operational green-

house emissions by 2030. It follows

the recent news that it is exiting the

new build coal power market, as a start

toward reducing emissions associated

with its products.

A growing number of companies are

committing to decarbonising their

operations. At the end of September

Europe’s leading tech companies

joined forces under the initiative,

Leaders for Climate Action (LFCA).

Their aim is to ght the climate crisis

by pledging to make their own com-

panies carbon-neutral, build an active

community that sets more sustainable

industry standards, and inuence

policy makers.

LFCA takes a unique approach to

growth by connecting directly from

leader to leader. Since starting out a

year ago as a small group of entrepre-

neurs from the Berlin tech industry,

its members have actively worked on

the reduction of their carbon footprint

(-20 per cent goal) and initiated a col-

lective investment of over €4 million

in climate protection projects, saving

more than 250 000 tons of CO

2

.

Spanish energy company Iberdrola is

making good on its pledge to spend

€10 billion a year to increase its glob-

al inuence in renewables and energy

networks. In October it expanded its

list of acquisitions this year with a more

than $8 billion deal to buy PNM Re-

sources in the US. The deal will see its

North American business, Avangrid,

become one of the largest players in

the US utilities sector.

Under the deal, expected to close in

12 months, Iberdrola will pay $4.3 bil-

lion in cash to shareholders in a deal

worth $8.3 billion including debt.

The acquisition will create the third-

largest renewable energy company in

the US, with operations in 24 states,

according to the Spanish group. The

combined company will have 10.9 GW

of capacity and assets worth more than

$40 billion.

PNM owns signicant fossil-fuel

generation capacity in addition to its

wind and solar assets, although it has

pledged to be emissions-free by 2040.

Avangrid, has 1.9 GW of renewables

in New Mexico and Texas, with 1.4

GW more in the pipeline. Iberdrola

has committed to be carbon-neutral

by 2050.

Iberdrola’s Chairman and Chief Ex-

ecutive, Ignacio Galán, called the deal

the “next step” in the group’s strategy

of “friendly transactions, focused on

regulated businesses and renewable

energy, in countries with good credit

ratings and legal and regulatory stabil-

ity, offering opportunities for future

growth”.

He said the group was concentrating

on “ve or six main countries” includ-

ing the US. Other acquisitions this

year have included the French renew-

ables company Aalto Power for €100

million and Australian renewables

group Ingen.

Iberdrola plans to capitalise on its bet

on renewables now that countries

across the globe were moving away

from fossil fuels. The company also

hopes to benet from the EU’s €750

billion coronavirus recovery fund, in

which the transition to clean energy is

a top priority.

In September Iberdrola said it plans

to establish green hydrogen business

units in the UK and Spain to position

itself as a supplier to hard-to-decarbo-

nise industries.

Iberdrola broadens

Iberdrola broadens

green footprint

green footprint

Siemens

Siemens

pursues

pursues

energy-as-a-

energy-as-a-

service

service

Corporations continue coal exit

Fossil fuel majors struggle with

low-carbon targets

Oil and gas majors are restructuring to embrace the clean energy revolution but most are still falling short of climate

change targets. Junior Isles

THE ENERGY INDUSTRY TIMES - NOVEMBER 2020

13

Electric-Mobility

E

-mobility will play a key role

in combatting climate change

and facilitating the energy

transition – not just because electric

vehicles directly remove carbon

emissions from road travel but also

due to the role they can play in bal-

ancing variable generation from re-

newables on the grid.

Accordingly, in recent months un-

der the umbrella of various green

recovery packages the EU and na-

tional governments have committed

unprecedented nancial support to

e-mobility related industries as a re-

sponse to the economic con-

sequences of the Covid-19 crisis.

Under plans announced in late

May, the European Commission un-

veiled a two-year €20 billion EU

scheme of grants and guarantees to

boost sales of “clean” vehicles, with

2 million electric and hydrogen ve-

hicle charging stations to be in-

stalled by 2025.

Such support will inject further

momentum into the growing num-

ber of EVs, charge points and smart

charging programmes that are cru-

cial if EVs are to full the their po-

tential as a resource that energy

companies can use effectively in re-

alising the energy transition.

Speaking at a webinar in July

jointly hosted by Eurelectric and

BloombergNEF, Michael Liebreich,

Chairman and CEO of Liebreich

Associates, and former CEO of

Bloomberg New Energy Finance,

said: “The percentage of electricity

from non-hydro renewables grew to

11 per cent in 2019 from 1 or 2 per

cent just a decade or so before. It’s

important to bear that in mind be-

cause e-mobility with its batteries,

works well with renewables.”

Despite what he called “a bit of a

wobble” over the last year, Lieb-

reich said EV sales have seen “tre-

mendous” compound annual growth

rates over the last few years. This

has been partly due to a rapid drop

in battery prices, which have fallen

by more than 85 per cent over the

last decade, which has in turn re-

duced the cost of vehicles. At the

same time, there has been a dramat-

ic improvement in the performance

of batteries.

During a webinar in mid-October,

Mike Hughes, President of Schnei-

der Electric UK & Ireland, said:

“The EV story is happening in the

middle of a massive revolution

around the whole grid and the way

energy is managed.”

He cited the UK, noting that in

2008 there were 80 points of gener-

ation, with just 4.9 per cent coming

from renewables. In 2050, he says

there will be more than 1 million

points of generation. “That’s a com-

plete fragmentation of the genera-

tion side of the grid. And projec-

tions are saying that renewables

will represent up to 85 per cent of

the energy being fed into that grid.”

Such fragmentation represents a

huge technical challenge. At the

same time, there will be a signicant

increase in electricity demand. Ac-

cording to Hughes, demand in the

UK will increase from around 308

TWh per year in 2020 up to 530

TWh in 2050, with some 40 per cent

of that new demand forecasted to

come from EVs. The number of

EVs in the country is predicted to

grow from about 300 000 to 37 mil-

lion by 2050. Across Europe the 2

million currently on the roads is ex-

pected to rise to 40 million by 2030

according to gures published by

Delta-EE.

Yet while EVs are part of the

problem, they are also part of the

solution. Although electrication of

transport through e-mobility will

drive an increase in demand on net-

works and decentralised generation,

using them to provide storage and

exibility management will allow

them play a critical role in balanc-

ing those same networks and ad-

dressing energy needs.

Hughes noted: “The EV story is

existing within a story of grid frag-

mentation on generation and in-

creased demand. And if we get to

the projected number of 37 million

EVs [in the UK] by 2050, you will

end up for the rst time in the histo-

ry of the electricity grid, having

roughly 17 per cent of a demand

that is mobile. This means 17 per

cent of the national demand can the-

oretically move around and appear

in a place you may not have thought

about.”

He added, however, that 37 mil-

lion EVs on the road have sufcient

battery capability to deliver 2.2

TWh. This is a signicant resource,

whereby vehicle-to-grid (V2G)

technology can enable bi-directional

ow of energy to provide a major

backup source of energy for stabilis-

ing the grid.

V2G essentially allows EVs to

feed electricity into the grid to sell

demand response services. Drivers

can store renewable energy in their

cars, use that energy to power their

homes and sell excess energy back

to the grid at peak times, earning re-

wards from smart charging their

electric vehicle.

It is a huge opportunity and ener-

gy companies are already taking

their rst steps into this area. Ac-

cording to V2G Hub, there are

around 80 projects in 22 countries

around the world. More than half of

these projects are in Europe, with

the UK currently at the forefront of

developments.

At the end of 2018 UK supplier,

OVO Energy claimed a world rst

with the installation of a domestic

V2G charger in a customer’s home.

Over the last two years other com-

panies have launched their own tri-

als. In September Octopus Energy,

through its sister company, Octopus

Electric Vehicles, announced that is

was offering customers the chance

to lease an EV for a “reduced price”

in return for particpating in a V2G

trial.

At the end of October Kaluza, the

intelligent energy platform, together

with Bosch, a supplier of charging

services and embedded vehicle tech-

nology, successfully proved how

EVs can be smart charged to meet

the needs of the local grid via direct

connection with a digital platform.

Also last month the Electric Na-

tion Vehicle to Grid trial, a project

of Western Power Distribution

(WPD) and CrowdCharge, an-

nounced electricity aggregator Flex-

itricity as its rst energy partner in

what is seen as a key project.

Electric Nation is different to oth-

er V2G projects because it is using

up to ve different energy partners

instead of just one. WPD says this

means that the trial “is a more real-

istic simulation” of a future world in

which many streets will have a num-

ber of EVs using V2G chargers with

different energy suppliers (see box).

Meanwhile, bi-directional charg-

ing technology continues to ad-

vance. In October ABB announced

a new 11 kW station, which it will

supply as part of a contract with

France’s DREEV, a joint venture

between Électricité de France

(EDF) and Nuvve, which specialis-

es in intelligent charging for EVs.

ABB’s solution integrated with

DREEV software technology will

enable EV drivers to export surplus

power back to the grid, with the po-

tential to generate up to €20/EV/

month for drivers. Under the part-

nership, ABB will supply V2G bi-di-

rectional kiosks in France, followed

by installations in the UK, Italy, Bel-

gium and Germany.

As technology continues to ad-

vance and such collaborations gain

momentum, the future of V2G looks

bright. With the need to rapidly

bend the greenhouse gas emissions

curve, hopefully it will not be long

before EVs, through V2G, are an ef-

fective tool in the arsenal of technol-

ogies needed in the battle against

climate change.

The growth in

electric vehicles is

driving ambitions to

see vehicle-to-grid

technology become

a key weapon in the

battle against climate

change. Junior Isles

Charging up to tackle

Charging up to tackle

climate change

climate change

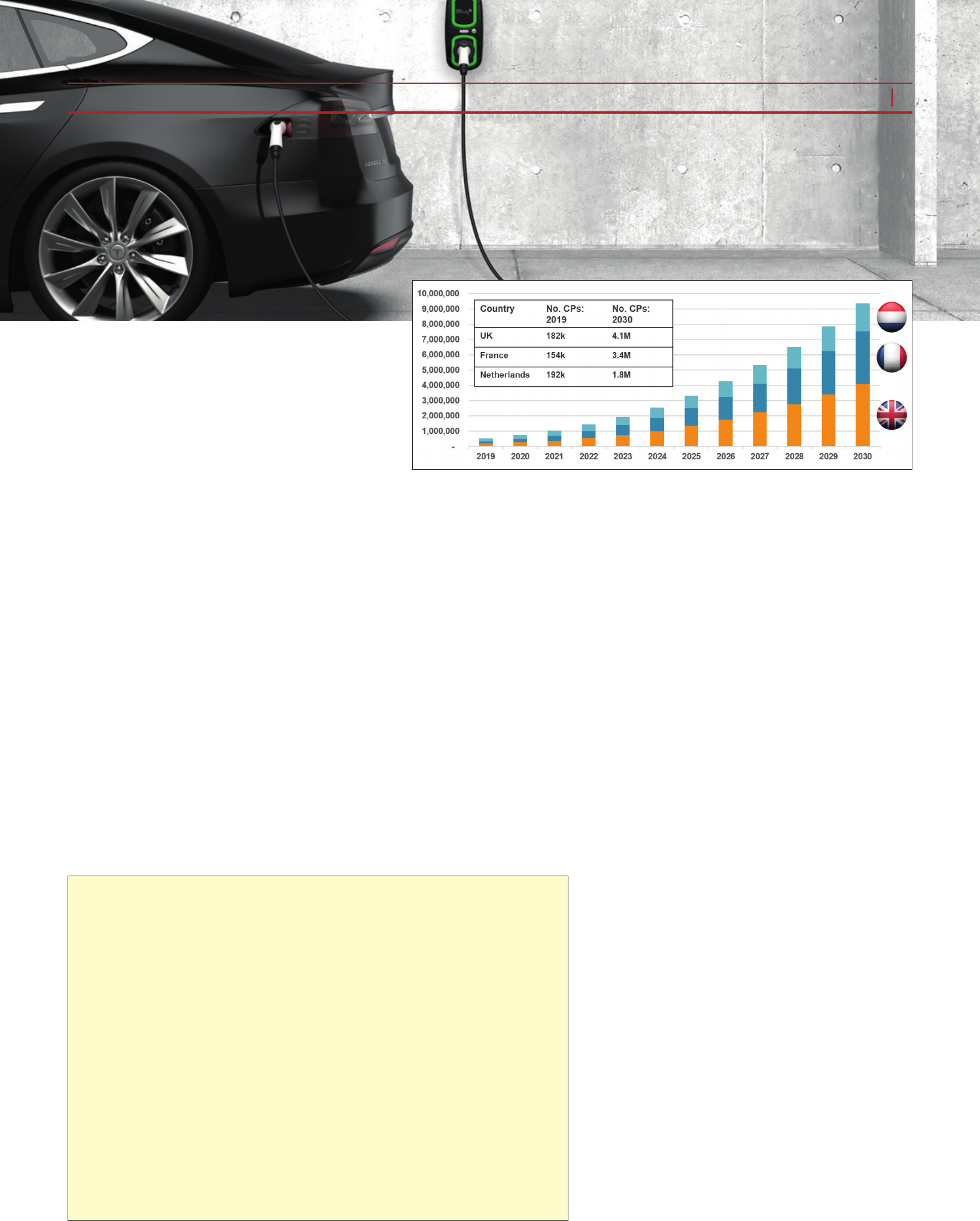

Cumulative charge point forecasts to 2030 in the leading European countries – UK, France and

the Netherlands. The chart represents charge points in all locations: home, work and public.

Source: Delta-EE

Flexitricity joins Electric Nation Vehicle to Grid project

In October Flexitricity was announced as the rst energy partner in the Nation Vehicle to Grid (V2G) trial, a proj-

ect of Western Power Distribution (WPD) and CrowdCharge that will demonstrate how electric vehicles (EVs)

can provide V2G services.

Flexitricity aggregates distributed power generators as well as sites, which consume power, in order to balance

the load on the electricity grid. The EVs that are part of the Electric Nation trial will be used to put power back

into the grid when required and will be charged during periods of excess supply in the system.

Demand side response or demand side exibility involves participants being nancially incentivised to reduce

or increase their energy use to provide exibility to National Grid ESO or Distribution Network Operators

(DNOs) when it is needed. As well as lling in for shortfalls or rapid spikes in national demand, providers taking

part in demand side response can also be incentivised to use excess green energy from the grid, for example on a

windy day.

Unlike other V2G projects, Electric Nation is using up to ve different energy partners instead of just one. A se-

lection of 25 applicants on the Electric Nation V2G trial will be offered the opportunity to join the project with

the Flexitricity and CrowdCharge ‘energy optimisation with grid services’ proposition. Potential participants can

join with any electricity supplier and on any electricity tariff. However, the best results will be gained from partic-

ipants with a time of use and export tariff.

EV drivers will inform the CrowdCharge platform to state when they next need the car and how much energy

they will need. The rst priority for CrowdCharge is to ensure these requirements are met. People are often

plugged in for over 12 hours overnight, yet they may only need 1-2 hours of charge on average each night. This

allows considerable time and exibility to t in the EV charging.

If the EV driver has a time of use tariff, the CrowdCharge platform will schedule charging to reduce electricity

bills for the EV driver by using electricity to charge the car at cheaper times, and in doing so CrowdCharge will

also be able to reduce the carbon footprint of the household.

CrowdCharge can further reduce bills where a time-of-use tariff is active by exporting energy from the EV bat-

tery to power the home when electricity is more expensive, for example during the early evening.

For those who have solar PV panels on their property, CrowdCharge will aim to divert as much solar electricity

to the car as possible, with any surplus energy being exported to the grid.

THE ENERGY INDUSTRY TIMES - NOVEMBER 2020

15

Technology Focus

Siemens Energy is

bringing its operations

expertise and articial

intelligence to cyber

security. Junior Isles

explains.

M

oving to an energy system

that is more decentralised

and digitalised is neces-

sary, but brings with it problems

that go beyond the challenges of

dealing with integrating distributed

energy sources. As energy compa-

nies embrace the energy transition,

they now also have to address the

growing number of cyber attacks on

their operations.

In an effort to help combat the cy-

ber threat, Siemens Energy recently

unveiled a new articial intelligence

(AI)-based industrial cyber security

service that monitors and detects po-

tential cyber attacks in real-time.

Siemens Energy sees digitalisation

and cyber security as “two sides of

the same coin”. Commenting on the

cyber threat created by the changing

energy landscape, Leo Simonovich,

Global Head, Industrial Cyber and

Digital Security, Siemens Energy

said: “Each node of a digitally con-

nected device that we bring online –

and there will be 2.5 billion digitally

devices added over the next couple

of years in the energy sector – will

expand the attack surface, or the

pathways that bad actors can take to

get into a system.”

The core challenge that Siemens

Energy has therefore been working

on is what Simonovich calls the

“visibility challenge” – with the ba-

sic premise being, “you cannot pro-

tect what you cannot see”.

According to Simonovich, the en-

ergy sector has now “reached a tip-

ping point” where the number of at-

tacks, the sophistication of those

attacks, and the gap between the de-

fenders and attackers is increasing.

He notes that a different approach is

now needed.

“You have to understand how digi-

tal attackers are manipulating the

physical world – so you have to fo-

cus on both the physical world and

the digital world. You have to look at

operational data, control data and

network data in such a way that al-

lows us to create a unied data

stream and then detect anomalies,

contextualise them and then take ac-

tion,” he said.

Siemens Energy has therefore in-

troduced what it calls ‘Managed De-

tection and Response (MDR), pow-

ered by Eos.ii.’ MDR’s technology

platform, Eos.ii, leverages AI and

machine learning methodologies to

gather and model real-time energy

asset intelligence. This allows Sie-

mens Energy’s cyber security ex-

perts to monitor, detect and uncover

attacks before they execute. Armed

with actionable insights from MDR’s

technology platform, Siemens Ener-

gy’s cyber security experts imple-

ment precise defence measures in

the company’s state-of-the-art opera-

tional technology security operations

centre (OT-SOC) to defend power

generation, oil and gas, renewable

energy, and transmission and distri-

bution customers.

MDR is able to collect raw infor-

mation technology (IT) and opera-

tional technology (OT) data from

across an industrial operating envi-

ronment, and then translate – and

contextualise – it in real-time. This

provides a unied picture of anoma-

lous behaviour for defenders with

actionable insights to stop attacks.

According to Siemens Energy, its

MDR service goes beyond conven-

tional monitoring by achieving a

deeper understanding of how digital

systems relate to the real world.

With its unied OT and IT data

stream, MDR’s Eos.ii technology

platform uses AI and digital twin

technology to compare billions of

real-time data points against a cor-

rectly functioning asset. This pro-

vides context for Siemens Energy’s

analysts to determine not only which

events are abnormal, but which are

consequential. Siemens Energy says

the technical achievement of unied

data streams and machine learning

creates an “unprecedented platform”

for targeted, in-depth analysis.

To collect and prepare vast

amounts of network data for analy-

sis, Siemens created a proprietary

method called Process Security

Analytics (PSA), which serves as the

backbone of the Eos.ii technology

platform. PSA is a systematic meth-

od for unifying OT and IT data

streams, revealing anomalous behav-

iour and discovering cyber attacks in

an OT environment.

Unifying IT and OT data streams

enables greater visibility into the in-

teractions of digital and physical as-

sets. This is crucial. Where conven-

tional network monitoring would

only reveal that network trafc is

higher than usual between two de-

vices, MDR’s PSA methodology ap-

plies advanced and continuously

adapting algorithms to its data col-

lection and synthesis process to

power AI models for deeper insights.

Simonovich compared this to ex-

isting solutions. “The systems that

are out there are heterogeneous, old

and don’t speak the same language.

We’ve been working on how to ag-

gregate the data, bring it into a sin-

gle stream and then use our digital

twin technology to model the

threats. This allows us to answer the

‘what if?’ questions – what kind of

damage an attack could cause to the

physical world. And do all of that

with billions of data points in real-

time.

“The Eos.ii platform allows all

these diverse data streams to be

brought together into one, detect

what is normal or not normal and

provide actionable recommenda-

tions to the operators on proportion-

ate response.”

Simonovich believes that Siemens

Energy has an advantage over its

competitors in building cyber securi-

ty solutions for industrial environ-

ments because of its understanding

of operational data – how turbines

run, how power plants function –

combined with its understanding of

traditional security data, i.e. net-

works and points. “The technology

has been built on data gathered from

services that Siemens provides to

thousands installations around the

world,” he said.

“The Eos.ii platform has been in

the making for the last three years.

There are a number of startups that

claim to do energy [cyber] security;

they rapidly prototype and get some-

thing out there. We took our time –

using decades of data to develop the

platform. There are real consequenc-

es to detection and turning power

plants on and off. We ensure that the

algorithms and the rules and detec-

tion engine are really tuned to the in-

dividual customer environment.

“The technology we’ve developed

gives us a complete view into the

production environment and what’s

normal and not normal.”

He added, however that it is not

just about technology. “It’s also

about expertise and understanding

what you are looking at,” he said.

“We call it human intelligence – an

understanding of how an attacker

may try to move through the system

to cause damage.”

Trained in plant operations, Sie-

mens Energy says its experts can

think and act like a hacker to stop an

attack; and they remain dedicated to

an incident case – from the time it is

detected to the time it is neutralised.

Siemens Energy says a key goal

was to make its service acceptable

and affordable. “In addition to solv-

ing the visibility challenge, the other

big thing we are striving for is to ad-

dress the resource challenge, which

is not enough qualied experts out

there that understand what is going

on,” said Simonovich.

Over the last 10 years the company

has therefore accumulated monitor-

ing experts that can help asset own-

ers understand what is going on. It is

now bringing all of this to small and

medium sized utilities.

“These are the organisations that

need this type of service most,” said

Simonovich. “They just don’t have

the expertise in-house to access this

type of technology and access to

these types of experts. The service

is not designed as a ‘plug and play’.

We look at the customer’s specic

environment – the fuel mix, how

the environment is operated, and we

tune the platform and the algorithm

to the customer.”

According to Simonovich, the sys-

tem has been thoroughly tested to

conrm how well it performs. One

of the ways Siemens did this was

through a “hackathon”, where its

best control engineers attempted to

breach the system, and monitored if

the platform could detect it.

“The platform has a rule engine –

that contains the logic of our 60 top

control engineers – which looks at

ways to hack the environment. We

then took that logic and put in the

alerts to potential attacks and auto-

mated that logic.”

According to Siemens Energy, the

new service has been well received.

“The feedback has been awesome

because for operators, security is of-

ten a black box. If someone tells

them something is odd in their net-

work, the attitude is: ‘well it doesn’t

relate to what I do day-to-day’. So

being able to contextualise and say

to them what’s happening is really

powerful,” said Simonovich.

He also notes that the system has

been useful in detecting miscongu-

rations, i.e. operational issues unre-

lated to cyber security, thus helping

them improve operations as well as

making them more secure.

“If you’re a little guy, security can

be a headache – it takes a huge

amount of effort, capital and capabil-

ities. If they can leave it to someone

that can be a one-stop shop for mon-

itoring, detection and then response

and remediation, it takes a lot of the

headache away.”

The two initial target markets for

the new service are the UK and the

US. Siemens has built a security op-

erations centre that houses the tech-

nology and analysts in Atlanta, GA,

USA. It is using this centre to moni-

tor its efforts in both countries. And

with the rst contract already in ef-

fect for a customer in the US and

the next expected for the UK short-

ly, we could be at the start of elimi-

nating much of cyber pain that

small and medium sized operators

are having to endure.

Getting intelligent

Getting intelligent

about cyber security

about cyber security

Simonovich says the energy

sector has “reached a tipping

point”, where the gap between

defenders and attackers is

widening

THE ENERGY INDUSTRY TIMES - NOVEMBER 2020

16

Final Word

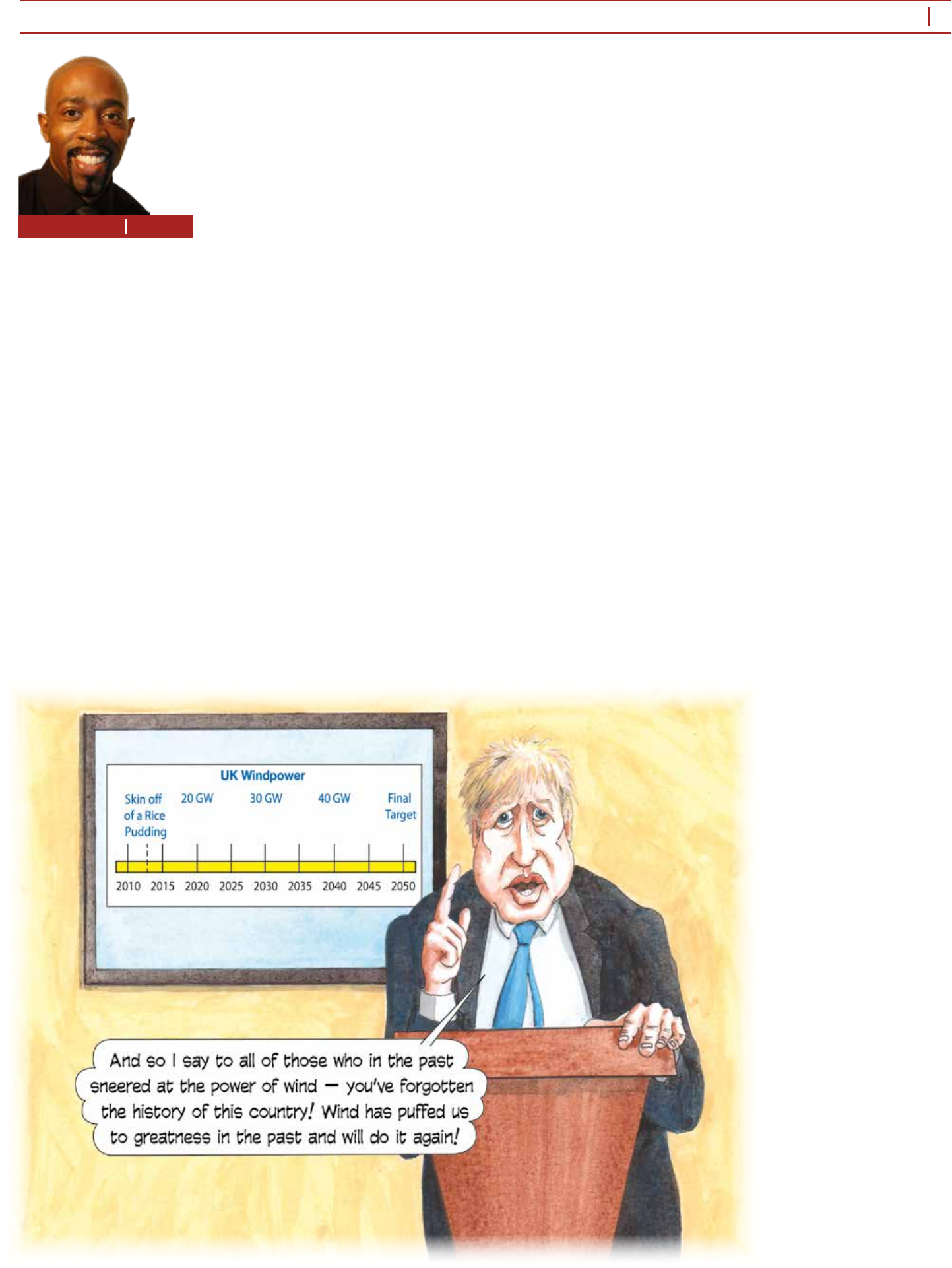

S

peaking on LBC radio in 2013,

Boris Johnson, then London’s

Mayor, said: “Labour put in a

load of wind farms that failed to pull

the skin off a rice pudding. We now

have the opportunity to get shale gas

– let’s look at it. It is part of the 2020

vision we have for this city – power

generation is vital.” How times

change. Johnson is now Prime Minis-

ter and nds wind, especially offshore

wind, a much more attractive proposi-

tion for consumption.

At his Conservative party confer-

ence in early October, the Prime

Minister pledged a 40 GW target for

offshore wind by 2030. With typical

Johnson ourish, he said: “The UK

government has decided to become the

world leader in low cost clean power

generation – cheaper than coal and gas

– and we believe that in 10 years time

offshore wind will be powering every

home in the country, with our target

rising from 30 GW to 40 GW.

“You heard me right. Your kettle,

your washing machine, your cooker,

your heating, your plug-in electric

vehicle – the whole lot of them will

get their juice cleanly and without guilt

from the breezes that blow around

these islands.”

To achieve its ambitions the UK

plans to invest £160 million in ports

and factories across the country, to

manufacture the next generation of

wind turbines.

In addition to building xed arrays

in the sea, the government says that by

2030 it will also build 1 GW of oat-

ing wind farms – “15 times as much

as the rest of the world put together”.

The targets are all part of the UK’s

goal to reach net zero carbon emis-

sions by 2050, while putting clean

energy at the heart of economic recov-

ery from the Covid-19 pandemic.

They are lofty ambitions, which are

welcome, but are not without chal-

lenges. The UK is the world leader in

offshore wind, with a third of the

global installed offshore wind capac-

ity and a strong pipeline of new

projects. But achieving its 2030 goal

from the current base of just over 10

GW is no easy task, and more will be

needed if the net zero ambition is to

be realised.

Unsurprisingly, the UK’s announce-

ment was front and centre at Renew-

ableUK’s recent virtual Global Off-

shore Wind conference.

Speaking in the opening session, the

panel noted there are issues around

consenting, the grid, and ensuring

oating offshore follows the same

commercialising and scaling, and cost

reduction that we have seen for xed

offshore.

Chris Stark, Chief Executive of the

UK Committee on Climate Change,

said he could “give a solid dose of

optimism” but would also have to

stress that “things are not as rosy as

we’d quite like them to be”.

He likened the situation to the old

Irish proverb, saying: “I wouldn’t start

from here, gov’. I think that was

written for climate change policy

workers during the pandemic. We are,

though, starting from here, and will

have to make the best of it. We are

still in the grip of this pandemic,

which is presenting a set of competing

pressures to the steps that we might

otherwise be taking to decarbonise

our economy… the real uncertainty

for me is whether we really grab this

moment and accelerate our progress

towards net zero here in the UK or

whether we get distracted and hold

things up unnecessarily. I hope we

take the former but there is denitely

a risk of the latter.”

He noted that so far, the reaction of

the government has been “really

good” but with COP26 being held in

Glasgow next year, he said the UK’s

credibility in terms of climate leader-

ship and work towards net zero hangs

on what it does over the coming 12

months. At the heart of that, is what

the UK energy system will look like.

With Johnson’s announcement,

Stark noted that offshore wind “now

looks like it will be the backbone” of

that energy system. “That is such a

pleasing thing to be able to say after

years of doom-mongering and naysay-

ing about it,” he said. “The 40 GW

commitment is fantastic but it’s just a

start… we could be looking for at

least 100 GW by 2050.”

Although Stark said there was now

great clarity around what is needed, he

noted that the investment challenge is

huge – in the region of £50 billion,

according to Aurora Energy Research.

But it is likely there will be no shortage

of money. Sean McLoughlin, an eq-

uity analyst at HSBC noted that the

“investment euphoria” surrounding

offshore wind should continue as long

as the policies are there.

Stark also said the UK will need to

build the networks and exible de-

mand for the electricity that will be

generated offshore. This means in-

creasing the number of electric ve-

hicles on the road, heat pump instal-

lations, etc. And it has to happen at the

same pace as the giant offshore wind

farms that are being planned.

Another challenge is the mismatch

between countries that support off-

shore wind and where turbines are

made. During the discussion, Michael

Liebreich, Chairman and CEO of Li-

ebreich Associates, and former CEO

of Bloomberg New Energy Finance

said: “There is huge commitment of

funds, and to the industrial future of

offshore wind, but we don’t make the

turbines. We make lots of parts in the

value chain but do we make enough?”

Others also voiced concern. On

hearing the government’s announce-

ment, Danielle Lane, UK country

manager for Vattenfall, which is

building the 1.8 GW Vanguard wind

farm off the Norfolk coast, said:

“[But] for the rhetoric to become real-

ity, it’s important that the government

doesn’t overlook some signicant

hurdles. Planning decisions still take

far too long, meaning renewable en-

ergy projects can be left in limbo for

years before they know whether they

will be approved.”

Nevertheless, the news was largely

welcomed without too much scepti-

cism or criticism – even from Green-

peace who called it a “light bulb mo-

ment” before stressing that Johnson

now needs to “follow through by

knocking down all the barriers”.

So it is time for Johnson to live up

to his verbosity. The UK should in-

deed “be to wind what Saudi Arabia

is oil”. And the pandemic, although