www.teitimes.com

October 2020 • Volume 13 • No 6 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Special Project

Supplement

Mirror to the

future

HYFLEXPOWER aims to

demonstrate a world rst for

hydrogen.

GE Digital’s Colin Parris explains the

benets of digital twins and offers a

glimpse of what’s to come. Page 14

News In Brief

Urgent scale-up of clean

energy technologies needed

A major effort to develop and

deploy clean energy technologies

worldwide is urgently needed,

according to a new report by the

International Energy Agency.

Page 2

FERC to exploit value of

distributed energy resources

New rules approved by the Federal

Energy Regulatory Commission

look set to bring the value of

distributed energy resources to the

wholesale electricity system and to

end-consumers in the US.

Page 4

US tensions impact China

power sector

Tension between the US and China

is having an indirect impact on

China’s power sector.

Page 5

HVDC boosts cross-border

offshore wind expansion

A recent development in high

voltage direct current technology

will help Europe better utilise

offshore wind, thereby helping

the bloc to achieve its climate

ambitions.

Page 7

Siemens Energy focuses on

protability as it starts “new

era”

Siemens Energy’s listing on the

Frankfurt Stock Exchange marks the

start of a “new, important era” for

the company and a clear focus on

protability.

Page 9

Fuel Watch: Hydrogen

Germany is to study the

development of a hydrogen supply

chain with Australia, and plans to

cooperate with France on hydrogen

research and production.

Page 12

A random walk through the

energy transition

Aspen Technology discusses the

technologies that will help oil & gas

majors in what will be a difcult

transition for them to make.

Page 13

Technology Focus: Smart

meters pave the way

Octopus Energy has developed a

new cloud-based energy platform

based on smart tariffs that is

designed to deliver a smarter energy

system.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

Changes are needed to Europe’s emissions trading scheme if it is to full its new target for

carbon emissions. Junior Isles

Trump administration continues pushback

on Democrat clean energy stance

THE ENERGY INDUSTRY

TIMES

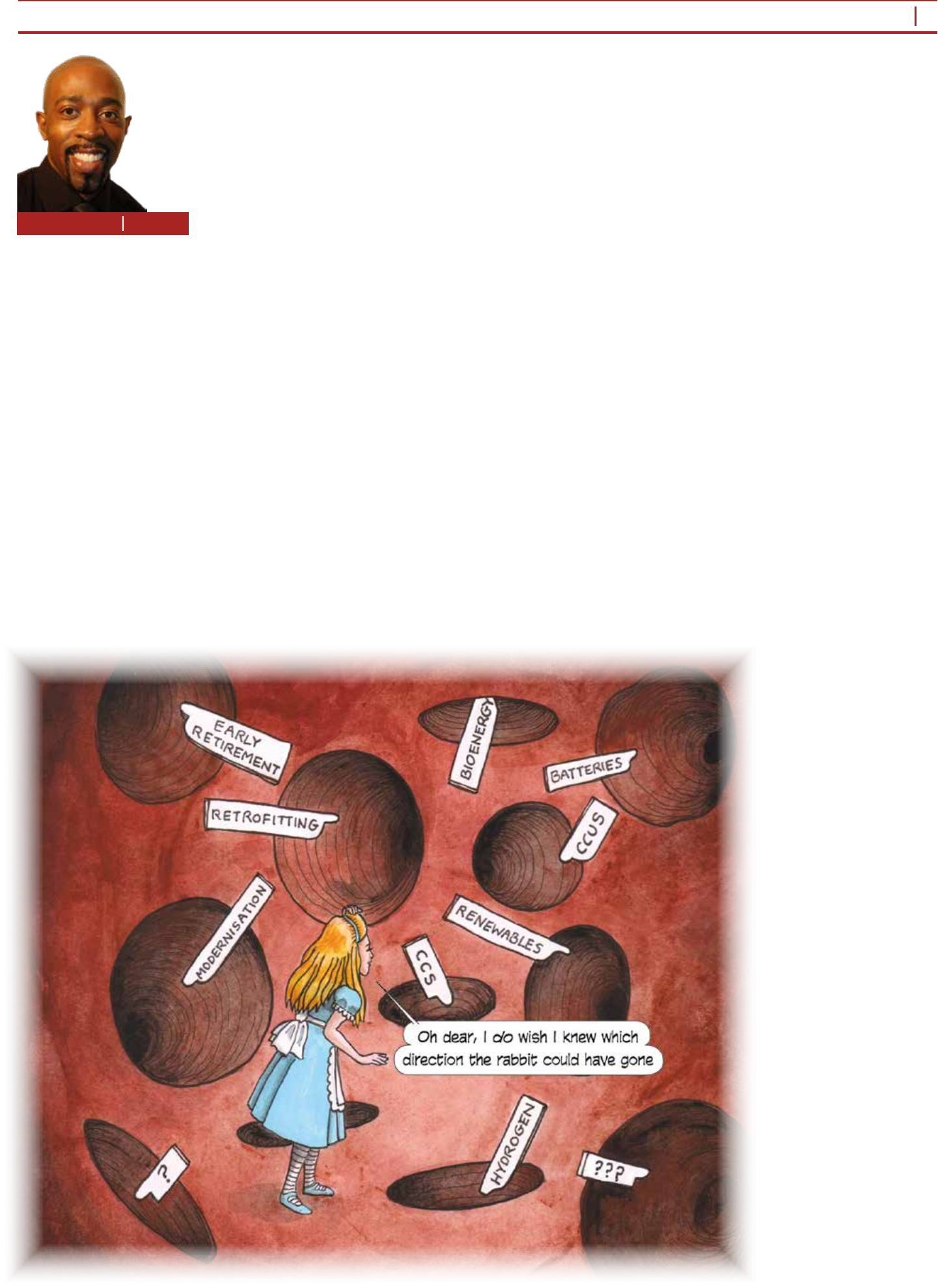

Final Word

Don’t get lost down a

rabbit hole in pursuit of

net zero, warns Junior Isles.

Page 16

There has been a growing number of

calls for the European Commission to

upgrade it Emissions Trading Scheme

(ETS) following the announcement of

the bloc’s proposal to increase its cli-

mate commitment and reduce carbon

dioxide emissions by at least 55 per

cent by 2030 relative to 1990 levels.

This is the level necessary to put the

EU on a path to climate neutrality by

2050.

A new report by the European Court

of Auditors (ECA) called for the Com-

mission to update its procedure for

targeting free allowances to reect the

Paris Agreement and recent develop-

ments. It noted that free allowances

still make up over 40 per cent of all

available allowances under the EU’s

‘cap and trade’ ETS, and that these

free allowances, distributed to indus-

try, aviation and, in some Member

States, the electricity sector, were not

well targeted.

The EU’s ETS uses free allowances

to discourage EU businesses from

transferring activity to non-EU coun-

tries with lower environmental stan-

dards, as this would reduce invest-

ment in the EU and increase global

emissions. This is known as carbon

leakage.

The industrial and aviation sectors

benet from free allowances, unlike

most operators in the power sector, as

it is considered that they can pass on

carbon costs directly to the consumer.

However, in the eight Member States

with a GDP per capita below 60 per

cent of the EU average, the power sec-

tor received free allowances to enable

modernisation to take place. Accord-

ing to the ECA, this has signicantly

reduced the speed of decarbonisation

in the power sector.

“Free allowances should be targeted

at those industrial sectors least able to

pass on carbon costs to consumers,”

said Samo Jereb, the ECA Member

leading the audit. “However, this is

not the case. Sectors representing over

90 per cent of industrial emissions are

equally considered at risk of carbon

leakage and benet from continuous

high rates of free allowances. Unless

the allocation of free allowances is

better targeted, the EU will not reap

the full benets the ETS could have on

decarbonisation and public nances.”

The auditors acknowledge, howev-

er, that the Commission has tightened

rules affecting the power sector for

2021-2030.

There were also calls to extend the

ETS to heating. EGEC Geothermal

said it is absolutely crucial the Euro-

pean Commission recognises the im-

portance of decarbonising heating and

make this a priority area for action.

The heating and cooling sector rep-

resents 51 per cent of nal energy con-

sumption in Europe and approximate-

ly 27 per cent of EU carbon emissions.

EGEC Geothermal noted that 80 per

Continued on Page 2

Trump administration has nalised its

weakening of an Obama-era rule

aimed at reducing polluted wastewater

from coal burning power plants that

has contaminated streams, lakes and

underground aquifers.

Utilities are expected to save $140

million annually under the changes,

which Environmental Protection

Agency (EPA) Administrator An-

drew Wheeler said in a statement

would protect industry jobs in part by

using a phased-in approach to reduc-

ing pollution.

But environmentalists and a former

EPA ofcials warned the move will

harm public health and result in hun-

dreds of thousands of pounds of pol-

lutants annually contaminating water

bodies.

The new rule introduced at the end

of August largely exempts coal plants

that will retire or switch to burning

natural gas by 2028.

It is the latest in a string of regula-

tory rollbacks for coal power under

US President Donald Trump – actions

that have failed to turn around the in-

dustry’s decline amid competition

from cheap natural gas and renewable

energy.

The Democrats’ clean energy vision

has come under re since Trump took

ofce in 2016 and has become a point

of political debate with the Califor-

nian forest res that have caused

blackouts in the Democrat-run state.

The American Energy Alliance said

California was a preview of what

Democratic presidential candidate

Joe Biden’s plan would do to the rest

of country, stating that the blackout

stemmed from a “severe heatwave

and without the wind blowing and the

sun shining”.

“Residents are asked to conserve

electricity to keep the power on –

something most other states do not

have to endure,” the Alliance noted.

“This should be a warning to America

about the risks of Biden’s Clean En-

ergy Standard that would require 62

per cent of our electricity which is

now produced from natural gas and

coal to come from non-carbon sourc-

es, which would primarily be wind

and solar power.”

Renewables currently generate

about 15 per cent of America’s power.

Biden has specically pledged to

eliminate carbon emissions from the

power grid by 2035.

“The whole thing is a kind of fairy-

tale that assumes you can run the elec-

tric grid on fairy dust,” said Myron

Ebell, Director of Competitive Enter-

prise Institute’s Center for Energy and

Environment. “What the Green New

Deal and the Biden Energy Plan have

not gured out is where the electricity

is going to come from when the wind

isn’t blowing and the sun has been

down for a day.”

Meanwhile, Wyoming’s governor is

promoting a Trump administration

study that says capturing carbon diox-

ide emitted by coal red power plants

would be an economical way to cur-

tail pollution. PaciCorp, the utility

that owns the plants and wants to shift

away from the fossil fuel in favour of

wind and solar energy, has questioned

the ndings.

The study released in late August

says adding carbon capture at the four

plants would reduce carbon dioxide

emissions 37 per cent, cost electricity

customers 10 per cent less and pro-

duce up to ve times more jobs com-

pared with PaciCorp’s plans to shift

to clean energy.

PaciCorp took issue with the

study, saying it ignored “everything

associated with how a utility’s costs

ow into rates” and made a range of

assumptions.

“As PaciCorp continues to exam-

ine the study’s assumptions and cal-

culations to properly evaluate its

conclusions, we’re nding many of

those conclusions are simply wrong,”

David Eskelsen, a spokesman for

PaciCorp subsidiary Rocky Moun-

tain Power, said in a statement.

Calls for changes

Calls for changes

to ETS as Europe

to ETS as Europe

raises Paris ambition

raises Paris ambition

European Commissioner Ursula von der Leyen pushing for stronger emissions target

THE ENERGY INDUSTRY TIMES - OCTOBER 2020

3

www.teitimes.com

THE ENERGY INDUSTRY

TIMES

subscribe today

The Energy Industry Times is the only publication that

covers global news related to the power and energy

sector in a newspaper style and format whose

uniqueness is recognised by our readers.

As a paid subsciber you will gain full access to our online

news desk.

You will also no longer have to wait for the printed edi-

tion; receive it by PDF “hot off the press” or download it

online.

To subscribe, email subscriptions@teitimes.com or visit

www.teitimes.com

To guarantee receiving your monthly copy of the award

winning newspaper, you need to subscribe today

28 - 30 OCTOBER | #RUKGOW20

Events.RenewableUK.com/GOW20

Network

with 4000+

global offshore

wind experts

(without even getting off the sofa)

JOIN EUROPE’S

LARGEST VIRTUAL

OFFSHORE WIND

EVENT FROM

ONLY £150

Partners |

GLOBAL

OFFSHORE

WIND

THE ENERGY INDUSTRY TIMES - OCTOBER 2020

5

Asia News

Syed Ali

Tension between the US and China is

having an indirect impact on China’s

power sector.

Last month Wood Mackenzie re-

ported that gas power plants are strug-

gling to stay aoat as they face mount-

ing pressure from lower tariffs and the

ongoing trade war.

The Chinese government has been

reducing regulated gas red power

tariffs by 16 per cent to 28 per cent in

key provincial markets since June

2020. This is driven by political goals

of reducing end-user power prices and

improving manufacturing competi-

tiveness in the wake of trade tensions

with the US. Power tariffs for indus-

tries in China have fallen 25 per cent

in the last three years.

Gas red power tariffs at some

higher-utilised gas plants (>3500

hours per year) have even been low-

ered to a level similar to the much

cheaper coal red power. This ‘coal

parity’ initiative has a huge impact on

the economics of the current gas eet

and investment decisions for new

units.

Wood Mackenzie principal consul-

tant Frank Yu said: “The new regula-

tions will cause at least a 5 to 6 per-

centage point decline in the already

poor margins of gas power plants.

Delivered fuel costs at most gas pow-

er plants have only declined by 10 per

cent to 13 per cent, while revenues

have been cut by 16 per cent to 28 per

cent due to the new regulations. Most

projects are now loss-making or bare-

ly breaking even.”

Despite strong demand growth for

clean power, government policies

have been moving to limit gas power

development and support energy

security goals.

By 2025, around 8 billion m

3

or 17

per cent of gas demand for power gen-

eration in four coastal markets could

be at risk due to fewer new builds and

lower utilisation hours as a result of

poor economics. Wood Mackenzie

estimates around 7 GW out of 17 GW

of gas red power projects scheduled

for commissioning between 2022 and

2025, to be at risk of delays or cancel-

lations. These projects are located in

the coastal provinces of Zhejiang,

Jiangsu, Shanghai, and Guangdong.

Worries over energy security and

increasing geopolitical uncertainties,

has also seen the country switch from

US nuclear power technology to a

domestically developed alternative,

according to a recent report in the

South China Morning Post.

The AP1000 technology, designed

by America’s Westinghouse Electric

Company, was once the basis of Chi-

na’s third-generation nuclear power,

but now the country has more third-

generation reactors based on its own

Hualong One technology under con-

struction or approved, than it does

AP1000 reactors.

Meanwhile, four units approved last

year and another four nuclear reactors

approved on September 2 – in Hainan

and Zhejiang province – will also use

Hualong One technology.

Wang Yingsu, Secretary General of

the nuclear power branch of the China

Electric Power Promotion Council

said that technology localisation, de-

velopment of indigenous nuclear

power technology, and the capability

of constructing and operating nuclear

power plants independently had al-

ways been China’s goal since it began

its nuclear power journey more than

50 years ago.

“More power plants will choose

Hualong One in the future because it’s

China’s independently developed

technology and it’s as good as

AP1000,” Wang commented. How-

ever, he added: “AP1000 is Westing-

house’s technology and we might be

controlled by them if we want to build

the reactors, sell and export to other

countries.”

When the US sanctioned China Gen-

eral Nuclear Power Group (CGN) and

three of its subsidiaries in 2019 over

accusations of stealing US technology

for military use, CGN said the impact

on the company was “controllable”.

Xu Kan, assistant general manager

of Qinshan Nuclear Power Plant, a

subsidiary of China National Nuclear

Corporation (CNNC), said last year

that CNNC began investigating the

possible impact of geopolitical factors

on its 21 reactors in 2018.

Japan is set to draft new rules and cre-

tae a support framework in a drive to

construct offshore wind projects at 30

locations by the end of the next decade.

Under the plans, three or four projects

would be built per year with a total

generation capacity of 1 GW, from the

scal year beginning in April 2021

until 2030-2031. By the end of the de-

cade, a total of 10 GW of potential

generation sites are expected to be

identied for further development, ac-

cording to data and analytics company

GlobalData.

Japan’s offshore wind sector is al-

ready proving attractive to investors.

In September Equinor, Jera and J-

Power announced a partnership to

enter a joint bid agreement prior to

Japan’s upcoming Round 1 offshore

wind auction.

The three companies will jointly

evaluate and work towards submitting

a joint bid in the Round 1 auction once

the Japanese government ofcially

opens what will be country’s rst off-

shore wind auction.

The Japanese government has dedi-

cated Yurihonjo and Noshiro, two ar-

eas offshore the northern Japanese

prefecture of Akita, as promotional

zones for offshore wind, each repre-

senting an area for bottom-xed off-

shore wind farms of approximately

400 MW and 700 MW, respectively.

The upcoming auction is anticipated

to start within the next months, with

bid submission taking place six months

after the auction opens. Once the auc-

tion is closed, the results are expected

to be announced towards the end of

2021. Potential wind farms would then

tentatively be operative post 2025.

Also in September, Spanish energy

company Iberdrola reached an agree-

ment with Macquarie’s Green Invest-

ment Group (GIG) for the acquisition

of 100 per cent of Japanese developer

Acacia Renewables. Acacia Renew-

ables currently has two offshore wind

farms in development, with a com-

bined power of 1.2 GW, which could

be operational by 2028.

It also has four other projects in its

pipeline, with a total generating capac-

ity of 2.1 GW. Three of the six projects

will use oating foundations. Iber-

drola will hold an equal share in the

six projects alongside GIG, and the

partners will develop the portfolio.

The acquisition of this local renew-

able developer gives Iberdrola the op-

portunity to position itself in the Japa-

nese offshore wind sector, which is at

an early stage of development.

Installed offshore wind capacity in

Japan is currently around 70 MW, but

the forecasts indicate that the market

will reach 10 GW of installed capacity

in 2030, and up to 37 GW in 2050.

US tensions impact

US tensions impact

China power sector

China power sector

Japan prepares

offshore wind

blueprint

n Government reduces gas red power tariffs n US reactors no longer in favour

THE ENERGY INDUSTRY TIMES - OCTOBER 2020

Special Project Supplement

Flexing the power of

hydrogen

In May this year, Siemens Energy together with its consortium partners announced a project that will see a

dry low emissions gas turbine burn up to 100 per cent hydrogen produced from renewable energy. Known as

HYFLEXPOWER, the project will be the rst to achieve this at an actual industrial site. Junior Isles

see a consortium made up of Engie

Solutions, Siemens Energy, Centrax,

Arttic, German Aerospace Center

(DLR) and four European universi-

ties implement a project funded by

the European Commission under the

Horizon 2020 Framework Program

for Research and Innovation (Grant

Agreement 884229).

The project, which is being hailed as

the world’s very rst industrial-scale

power-to-X-to-power demonstrator

with an advanced hydrogen turbine,

will be launched at Smurt Kappa

PRF’s site in Saillat-sur-Vienne,

France. Here Engie Solutions oper-

ates a combined heat and power

(CHP) facility, which produces 12

MWe of electricity and 20 MWth of

heat as steam for Smurt Kappa’s re-

cycled paper manufacturing process.

The aim of the HYFLEXPOWER

project is to prove that hydrogen can

be produced and stored from renew-

able electricity and then mixed, up to

100 per cent by volume, with the

natural gas currently used at the CHP

plant. This means it will be a com-

pletely dispatchable CHP unit, even if

insufcient hydrogen is available.

Blending natural gas and hydrogen

can substantially lower carbon emis-

sions. The EU is closing coal red

plants and has made renewables a

central pillar of achieving carbon

neutrality by 2050 but in the long

term it will also have to remove car-

bon from its gas red plant. Dis-

placement of natural gas fuel with

hydrogen is a viable means of en-

abling carbon neutral power plant

operation as hydrogen combustion

produces no CO

2

.

Notably, when operating on 100 per

cent green hydrogen the SGT-400 in

baseload operation at the Smurt

Kappa site would save up to 65 000

tons of CO

2

per year.

Hydrogen fuel blending not only

lowers CO

2

emissions, it also ensures

that the gas turbines can participate in

electricity storage and re-electrica-

tion. Hydrogen can serve as a chemi-

cal storage vehicle by being produced

through electrolysis of water during

times of excess renewable energy

generation, and then used to fuel gas

turbines or sold to other industries

Ertan Yilmaz, Strategy Manager for

Gas Turbine Technology at Siemens

Energy, and coordinator for the HY-

FLEXPOWER project commented:

“The project is not only a world rst

T

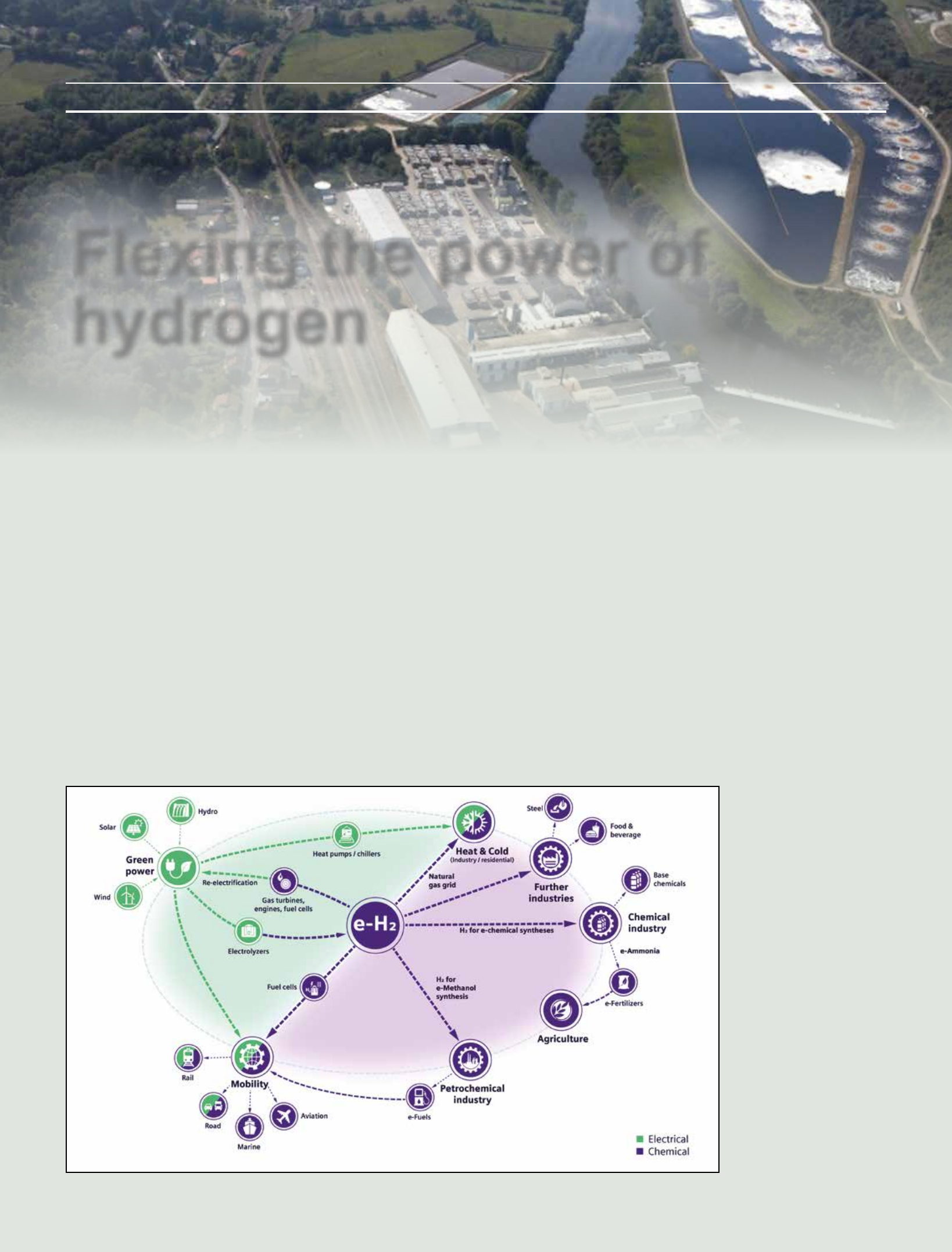

he potential of hydrogen as an

energy vector – capable of

decarbonising heat, industry,

power and transport – has long been

recognised. But it is only during the

last couple of years, with the

plummeting cost of electricity from

wind and solar, that developments

have really escalated.

Using renewable electricity to de-

carbonise energy across all sectors

has huge environmental and business

benets. And with the rst signicant

projects now taking shape, this so-

called ‘sector coupling’ – bringing

renewable energy from the power

sector into the other sectors to thereby

decarbonise the entire energy system

– is nally set to play a crucial part in

the energy transition.

It is an area that Siemens Energy

believes has enormous potential and

over the last few years has therefore

been ramping up investment in power-

to-X (P2X) technologies that enable

sector coupling.

In May this year, the company un-

veiled a signicant venture known as

HYFLEXPOWER, a project that will

play a key role in decarbonising its

eet of gas turbines. Siemens Energy

notes that although the power sector

has decarbonised signicantly by

switching from coal to gas and using

renewables, there has not been the

same level of focus on using hydro-

gen to cut carbon dioxide (CO

2

) in the

power industry compared to other

sectors.

Eva Verena Klapdor, Head of Gas

Turbine Technology at Siemens En-

ergy, commented: “There has been a

lot of discussion on how hydrogen

could reduce emissions in the indus-

trial and transport sectors, but not

so much on how to it could reduce

carbon emissions in the power sector

itself, i.e. power-to-X-to-power.”

She added: “Batteries are ne for

short-term storage of excess renew-

able energy but if you want to move

to a future where you decarbonise the

energy system completely, then you

have to look at systems where you can

store energy for more than a couple of

days. Hydrogen is really an optimal

solution, whereby you could use it to

store renewable energy and then

convert it back to electricity at a later

date through a gas turbine in a com-

bined cycle plant or combined heat

and power plant.

“We have a vision that needs to be

demonstrated. You can do lots of cal-

culations and modelling of the eco-

nomic viability of such a solution

but… ultimately you have to go and

demonstrate it.”

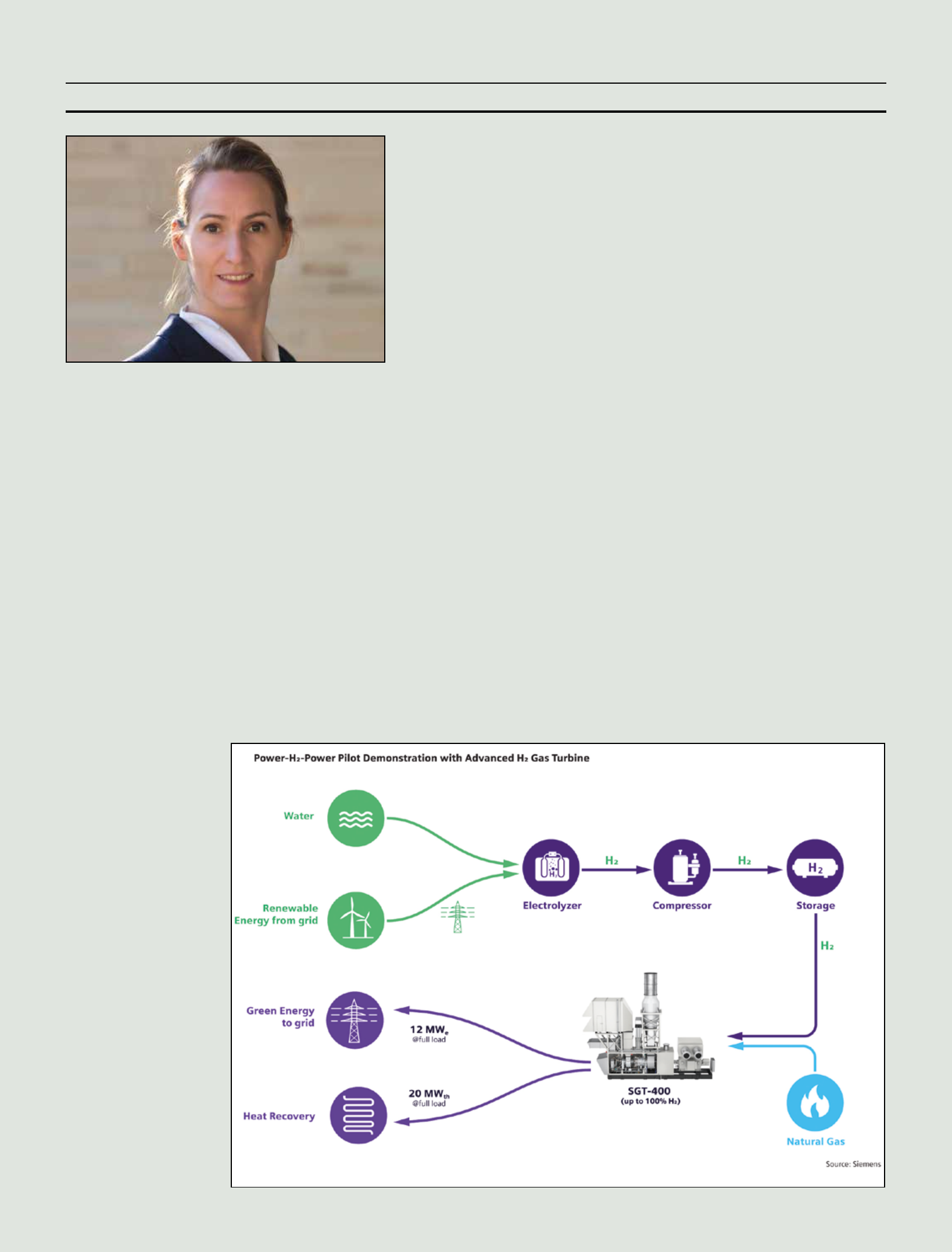

The HYFLEXPOWER project will

Sector coupling: using renewable electricity to decarbonise energy across all sectors has huge environmental

and business benets

Smurt Kappa PRF’s site in Saillat-sur-Vienne, France

where the HYFLEXPOWER project will be built

mixing station prior to the turbine;

Siemens Energy will supply the elec-

trolyser for hydrogen production and

develop the hydrogen gas turbine;

and Centrax will upgrade the package

for hydrogen operation and install the

new turbine.

The universities will support the

project’s implementation with their

research know-how. “Our university

partners will play a vital role in un-

derstanding the detailed physics as

well as the social impact of the pro-

gramme,” said Klapdor. “The Athens

university is currently doing an eco-

nomic analysis and assessing the

social impacts. The Stuttgart univer-

sity is studying the ame behaviour

to support the combustion system

development.”

Following the kick-off meeting in

May, the consortium is progressing

with the designs. The rst important

milestone will be at the end of 2021

when the hydrogen production and

storage facility, including the elec-

trolyser, will be installed. The follow-

ing year will see the upgrade and in-

stallation of the gas turbine, and

during that summer the demonstration

of what Siemens Energy calls the

“advanced plant concept”.

Yilmaz said: “This will be the initial

demonstration of the entire plant – the

electrolyser for generating the hydro-

gen and the equipment for storing the

hydrogen and supplying it back to the

gas turbine. It will be done in phases.

Each time we will learn more about

operating with higher percentages of

hydrogen.”

Initially, Siemens Energy says that

the hydrogen content will be higher

than the 10 per cent the unit is already

capable of handling. The end goal is

to demonstrate the advanced energy

plant concept sometime in the sum-

mer-autumn of 2023 for 100 per cent

hydrogen.

In the meantime, Siemens Energy

will continue to adapt its turbine

combustor, while Centrax will make

the necessary upgrades to the turbine

package.

Siemens Energy also aims to dem-

onstrate the gas turbine can operate

on pure hydrogen in DLE mode. In

DLE combustion systems, fuel and

air are mixed prior to admission to

the combustion zone in order to

precisely control ame temperature.

This in turn allows the control of the

rates of chemical processes that

produce emissions such as nitrogen

oxides (NOx). The relative propor-

tions of fuel and air is one of the

driving factors for NOx but also for

ame stability. Hydrogen’s higher

reactivity poses specic challenges

for the mixing technology in DLE

systems. According to Siemens En-

ergy, this has never been demon-

strated when burning 100 per cent

hydrogen at an industrial site.

Hydrogen differs from hydrocar-

bon fuels by its combustion charac-

teristics, which pose unique chal-

lenges for gas turbine combustion

systems designed primarily for natu-

ral gas fuels. A key challenge is the

fast burning nature of hydrogen

compared to natural gas.

Klapdor explained: “The real chal-

lenge is having a combustion system

that can run on various mixtures hy-

drogen and natural gas – from 0-100

per cent hydrogen. The tricky part is

to stabilise the ame in the right part

of the burner. With the burner design

and the guidance of the airow, you

have to counteract the burning veloc-

ity of the hydrogen fuel/natural gas

mixture. So it has to be designed in

such a way as to create a stable, con-

trolled stream inside the combustion

chamber.”

Yilmaz added: “When you premix

the fuel, as the amount of hydrogen

increases you increase the chance of

combustion upstream – in an area that

is not designed to withstand high

temperatures.”

With regards to the turbine package,

the piping and materials used will

have to be altered according to the

site. If the materials at the site cannot

accommodate 100 per cent hydrogen,

they will have to be upgraded. The

pipe diameters may also need to be

adjusted.

Another key area is the explosion

safety systems. For an existing in-

stallation, the re protection system

and enclosure ventilation have to be

but will demonstrate the importance

of hydrogen as a long-term energy

storage technology for a grid that has

a high renewables penetration.”

HYFLEXPOWER is an important

advance on another project that

Siemens Energy is working on for

chemical company Braskem in Bra-

zil, where two SGT-600 DLE (dry

low emissions) gas turbines are

scheduled to begin commercial op-

eration on hydrogen in early 2021.

Here, hydrogen will be produced

from an industrial process as op-

posed to coming from renewables.

Delivery tests conducted in 2019

proved the turbines for that plant can

run on a mixture of up to 60 per cent

hydrogen by volume, while main-

taining NOx emissions of 25 ppm.

According to Siemens Energy, the

burners are designed for reliable op-

eration on 80 per cent hydrogen.

For hydrogen mixtures the relation-

ship between CO

2

reduction and hy-

drogen content is non-linear because

the hydrogen molecule has 2.5 times

the energy content of methane by

mass, but one-third on a volumetric

basis. Carbon dioxide emissions scale

by hydrogen mass content in the fuel,

while typically hydrogen and natural

gas mixtures are dened on a volu-

metric basis.

Explaining the signicance, Klap-

dor said: “If you look at the CO

2

re-

duction with 100 per cent hydrogen

versus 60 per cent hydrogen, you can

achieve more than double the

amount.”

It is clear that even with smaller

amounts of hydrogen in the fuel it is

still possible to make signicant

emission reductions. For example,

adding only 10 per cent volume hy-

drogen in the fuel will reduce CO

2

emissions by 2.7 per cent, which

would result in a reduction of 1.26

million metric tons of CO

2

for a refer-

ence 600 MW combined cycle power

plant that runs for 6000 hours a year

at an average 60 per cent efciency

This is why the concept to be

demonstrated at HYFLEXPOWER

is so important. As Yilmaz noted:

“HYFLEXPOWER will be the rst

time that we will be creating hydro-

gen using renewables and storing it

long-term; then supplying it back to

the gas turbine at the right time so it

can generate power for the grid and

heat for the process. It will be the

rst time that this will be done with

no CO

2

emissions.”

The HYFLEXPOWER project es-

sentially kicked off just over two

years ago when Siemens began to lay

out its technology roadmaps for its

gas turbines and other technologies

related to decarbonisation and the role

of hydrogen. Siemens’ vision to cut

carbon emission from gas red power

generation was one shared by Engie.

Yilmaz commented: “We wanted to

work with an industrial partner and at

the same time partner with govern-

ment. We found out that Engie, which

also had signicant interest in decar-

bonisation and CO

2

reduction, could

offer potential sites. We were also

aware that there was a government

opportunity under the European

Commission’s Horizon 2020 pro-

gramme. Following discussions, we

engaged Centrax and began really

intensifying our efforts and develop-

ing the proposal about a year ago.”

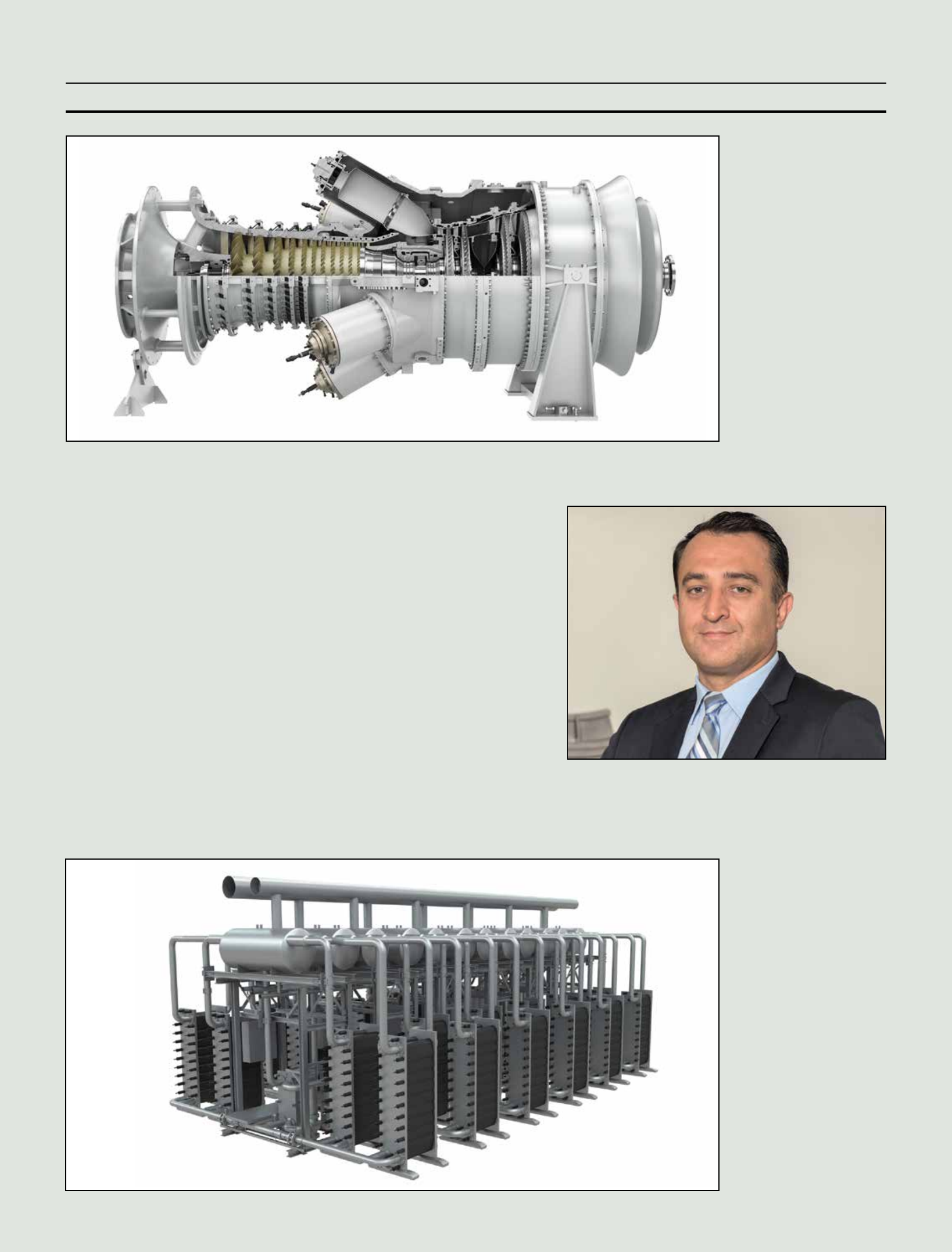

Under the project, an existing

Siemens SGT-400 industrial gas

turbine will be upgraded to convert

stored hydrogen into electricity and

thermal energy. According to Sie-

mens Energy it will be the rst time

an industrial scale power-to-hydro-

gen-to power project will be demon-

strated in a real world application.

The total budget for the project is

€15.2 million, of which €10.5 mil-

lion will be covered by the Horizon

2020 grant. The remainder will be

provided by the industry partners,

who will be responsible for the

overall project implementation.

Engie Solutions will build the hy-

drogen production and storage facility,

including the natural gas/hydrogen

Special Project Supplement

THE ENERGY INDUSTRY TIMES - OCTOBER 2020

Klapdor: Hydrogen is an optimal solution to store renewable

energy and then convert it back to electricity at a later date

Schematic of the EU-funded

HYFLEXPOWER project

THE ENERGY INDUSTRY TIMES - OCTOBER 2020

electrolysers is already under devel-

opment. These will be in the 100 MW

range and could be available by 2023.

Looking further ahead, it believes that

1000 MW units could be a reality

around the end of the decade.

This scaling is important if green

hydrogen is to compete with so-

called grey hydrogen. The hydrogen

market currently stands at around

80 million t/year, the vast majority of

which is grey hydrogen produced by

steam methane reforming of fossil

fuels. Green hydrogen currently only

represents 5 per cent of the market –

about 3.5 million t and less than 300

MW. But according to the Interna-

tional Energy Agency, this is pre-

dicted to reach nearly 3 GW in three

years, driven by ambitions for net-

zero carbon emissions by 2050.

To achieve this will require a big

push by policies and market design, as

well as an acceleration of renewables

deployment and continued scale-up of

electrolyser capacity.

Siemens Energy’s latest product, the

Silyzer 300, represents the current

state-of-the-art in terms of size for

PEM technology. The electrolyser

system that is currently being mar-

keted uses a standardised, modular

and pre-fabricated system concept

based on so called half- and full-array

(24 modules) congurations. Silyzer

300 is equipped with a fully auto-

mated water management system

(water treatment and renement

congured for hydrogen. “There are

stricter rules around safety standards

for high hydrogen content, since the

explosion risk is higher than for natu-

ral gas,” said Klapdor.

Hydrogen for the gas turbine pack-

age will be generated by an electroly-

ser based on the Siemens Energy Si-

lyzer portfolio. It is a PEM (proton

exchange membrane) type electrolys-

er, with high operational exibility.

This makes it ideally suited to produce

energy generated from volatile wind

and solar power. Notable features of

PEM electrolysers are: high efciency

at high power density; high product

gas quality, even at partial load; low

maintenance and reliable operation;

and no chemicals or impurities.

Siemens Energy has been using its

PEM technology to produce hydro-

gen from water since 2011, with the

introduction of its Silyzer 100. This

was a lab-scale unit of 0.1 MW. Since

2015, Siemens Energy has (with its

Silyzer 200) a MW-sized electrolyser

in operation. On average the company

has been scaling its electrolyser

portfolio by a factor of 10 every four

to ve years and in 2018 launched the

double-digit megawatt-class Silyzer

300. This is already being used in the

world’s largest power-to-gas project

in a steel plant .

The trend towards higher capacity

units is well under way. In a presenta-

tion on its hydrogen strategy, Siemens

Energy said the next generation of

loop), leveraging natural water circu-

lation. Operation with a natural circu-

lation of the process water means that

there are no pumps, actuated valves,

or other moving parts required in the

electrolyser core. This leads to high

reliability and availability and re-

duced maintenance requirements.

The full array conguration has a

power rating of 17.5 MW and is scal-

able to 100 MW and more.

Siemens Energy estimates that

roughly 1 t/h of hydrogen would be

needed to operate the HYFLEX-

POWER project’s SGT-400 on 100

per cent hydrogen. This is a signicant

amount, requiring a sizeable amount

of renewable electricity – the bulk of

which will come from nearby wind

farms owned by Engie.

Klapdor notes, however, that the

energy content of this quantity of hy-

drogen is in principle the same as for

natural gas. She said: “People always

say, that’s a lot of hydrogen and talk

about how much renewable electricity

is needed, but we need to be cognizant

that the amount of natural gas used

coming out of the ground is taken for

granted. We will be just substituting

the natural gas with hydrogen con-

taining the same energy content.

However, it’s good for people to think

about it because it highlights the re-

quired investment in renewables to

meet decarbonisation goals.”

HYFLEXPOWER is a four-year

project, and the plan is to complete

all the data analysis and socio-eco-

nomic assessments by April 2024.

This will signal the nalisation of the

demonstration.

It will be a key milestone in Siemens

Energy’s goal to make its entire tur-

bine range capable of burning 100 per

cent hydrogen. All of Siemens Ener-

gy’s gas turbines can already operate

on hydrogen fuel, with the specic

capability of a unit depending on the

gas turbine model and the type of

combustion system.

While some of its small and medium

DLE gas turbines can burn up to 60

per cent hydrogen, the current limit

for its large machines is 30 per cent.

The company’s technology roadmap

is to have its dry low emissions units

capable of running on 100 per cent

hydrogen by 2030 to meet customer

demand for their gas turbine portfolio.

Demonstrating 100 per cent hydro-

gen capability at the HYFLEXPOW-

ER project will be an important step

in realising that goal. Further, the

project’s outcome will no doubt give

potential users a realistic view on the

technology’s suitability in meeting

their future decarbonisation goals.

Certainly the project has attracted

signicant global interest.

Yilmaz concluded: “We have other

customers and partners interested in

this application and we are looking

to apply what we learn from this in-

stallation to other countries and in

different scenarios. The goal is to

build on this momentum and really

penetrate the combined heat and

power market.”

Yilmaz says other customers and partners are interested in the

application

SGT-400 industrial gas

turbine: Siemens Energy

also aims to demonstrate

the gas turbine can operate

on pure hydrogen in dry low

emissions mode

Siemens Energy’s Silyzer

300 full-array (17.5 MW) can

produce hydrogen for a gas

turbine package

Special Project Supplement

THE ENERGY INDUSTRY TIMES - OCTOBER 2020

13

Industry Perspective

S

everal oil and gas majors have

made clear their plans to shift

strategic focus. Just recently

BP, for example, in the face of a

massive fall in oil prices, said it will

invest tens of billions of dollars over

the next decade to meet its target of

becoming one of the world’s largest

renewable power generators and

achieve net-zero in its operations by

2050.

But the energy transition will be

complicated for these companies to

navigate. There are many factors at

play that make this more complex

than it may appear. So how to rise

above the crowd in these next few

years? Technology is proving to be a

valuable tool in navigating and thriv-

ing during the energy transition and

will help companies be leaders.

Global energy demand will contin-

ue to rise, according to most predic-

tions. There are two factors driving

these forecasts: population and stan-

dards of living. The Energy Informa-

tion Administration (EIA) forecasts

global energy demand to grow by al-

most 50 per cent between 2020 and

2050. This will continue to drive the

need for energy – the question is

which energy sources? And therefore

the “energy transition” required as

the sustainability movement drives

the globe towards “greener” energy

sources.

The challenge, of course, is the

formidable reality of global energy

mathematics. The numbers are so

high, that no matter what the rate of

adoption of renewable energy

sources, hydrocarbons will remain a

crucial element of the world energy

picture for decades.

So how can technology help adapt

hydrocarbon use to achieve better

sustainability results? Let’s look at

a few levers the industry has and

the key role technology will play.

Natural gas is emerging as an im-

portant future energy source, often

seen as a ‘bridge fuel” to reduce

carbon. To make natural gas trans-

portable, though, requires the ener-

gy-intensive and complicated lique-

faction (LNG) process. Technology

is playing a key role in improving

the costs and reliability of natural

gas supply. Digital twin models and

advanced control have already

proven to be crucial in the reduction

of energy use during LNG process-

ing.

Much more use of technology will

be necessary here, as the producers,

driven by both economic reality and

sustainability needs, are embracing

these proven approaches beyond the

initial successful adopters of these

tools. Each implementation of this

technology further advances the

‘green-ness’ of natural gas.

Huge capital has been tied up in

these projects, and so utilisation

rates of these capital-intensive LNG

plants is crucial. There, the pre-

scriptive maintenance technology,

which embeds machine learning

and advanced AI analytics in solu-

tions which alert operators to condi-

tions that create risk of degradation

of the high-capital compressors and

cold boxes, are now beginning to

have an important impact. The con-

dence of owners and developers in

this technology will enable several

large development projects to pro-

ceed quickly.

For highly complex and demand-

ing assets, such as LNG plants, the

self-optimising plant, a future vision

for industry in which data and AI

contribute to make these investments

self-learning, self-adapting, and self-

sustaining, will be important.

To achieve the aggressive targets

of global players, who are pledging

to reach “zero carbon” operations

by dates ranging from 2030 to

2050, increasing the pace of devel-

oping renewable power assets is

viewed as crucial. These technolo-

gies, though, are still relatively new

in terms of the maturity curve. Util-

ity scale wind and solar arrays are

just now beginning to reach the op-

erational phase where maintenance

and uptime become concerns.

Again, as is being applied for

LNG capital assets, wind farms

have already begun successfully

adopting prescriptive maintenance

solutions, which provide asset

health alerts to maximise the avail-

ability and utilisation of these large

assets, which have not yet estab-

lished a long-term reliability and

maintainability record. This ad-

vanced digitalisation technology

will be crucial in monitoring the

health of equipment which is inher-

ently installed remotely, under envi-

ronmental stresses, and requires

maximum uptime to be reliable in

the energy mix.

An interesting analysis compiled

by global political thinker Peter

Zeihan, looks at the distribution of

land across the globe that is suited

for utility-scale renewable electrici-

ty production. Interestingly, Zeihan

shows that roughly half of the

world’s population is located in

Eastern and Southeastern Asia,

which has low potential for solar

and wind farms. Perhaps as a conse-

quence of that, Southeast Asia has

pursued a path of exploitation of

palm oil plantations as a potential

source of bio-energy and bio-chem-

icals. The balance of that ledger,

however, is not clear, as clearing of

rainforest in favour of palm oil

farms, is arguably a net negative on

the sustainability scale.

Bioenergy conversion approaches,

including bioethanol, biodiesel,

waste-to-energy pyrolysis, algae

conversion, and biochemicals, have

gained acceptance at least partially

through the benet of subsidies and

government policy. Process model-

ing technology continues to be cru-

cial, although not widely enough

used, in improving the performance

of these processes. These processes

are hamstrung by the high energy

consumption of currently accepted

technology.

In order to contribute effectively to

sustainability and energy transition,

advanced modeling and optimisation

is needed to achieve fundamental

improvement. Dr. Eric Dunlop, a

specialist in large-scale biochemical

engineering projects and the algae

business, has pioneered these ap-

proaches in some groundbreaking

work on algae-to-fuels.

New startups continue to innovate

with novel new technologies to im-

prove bio-energy conversion, and the

new generation of hybrid modeling,

which combine AI analytics with

rigorous process modeling (such as

AspenTech’s innovative AI model

builder), will be playing a big role

here in improving the technical pace

of innovation and commercialisation

opportunities.

Reducing energy use is another

key area. Energy is consumed inef-

ciently in the conversion of hydro-

carbons, synthesis of chemicals and

the supply chain. Technology will

play a key role in helping the indus-

try navigate a drive towards carbon

neutrality. In addition to improving

energy efciency, optimisation

technologies can contribute to in-

creasing the production efciency

of oil and chemical operations. Both

digital twin monitoring systems and

dynamic optimisation solutions can

together save 5-15 per cent energy

use, reducing carbon emissions a

proportional amount.

Another great technology weapon

is utility supply optimisation. As

power plants looks to minimise car-

bon emissions, the choices between

oil, gas, biofuels, and renewables

can be made on a sophisticated ba-

sis. The choices can be made min-

ute-by-minute, or at any longer inter-

val. The technology can model the

interplay between multiple plants,

and multiple utility sources, for ex-

ample choosing between a wind en-

ergy source, natural gas-based elec-

tricity, or diesel combustion at the

plant, taking into account dollar cost,

carbon costs, and reliability.

So what is the future path for oil

and gas majors? Firstly, predicting

peak oil demand is the forecaster’s

elusive gold star. Will it be 2025,

2030, 2040 or later?

This will depend on factors in-

cluding global economic growth

(only really forecasted to grow sig-

nicantly in Asia), energy conserva-

tion (or “intensity”) in different re-

gions, a shift to electric power over

combustion and others. The IEA in

its most recent report has forecast

peak oil demand will take place in

the 2030s.

Corporations globally have ac-

knowledged the onset of the energy

transition. Some have chosen to re-

ect this through their investments

and their actions. An IHS Markit

analysis shows that Total, Shell, BP

and Equinor have made at least 66

acquisitions in the past several

years to diversify their energy port-

folios. Others have chosen to focus

on innovation in use of capital and

on operational excellence to build a

resilient market position.

As the industry navigates the ener-

gy transition, technology will be a

key partner as organisations and

their executives make strategic

moves to improve their agility and

competitive positions into the fu-

ture. Those companies who adopt

some or all of the technology op-

portunities mentioned will be bound

to have an advantage.

Ron Beck is Marketing Strategy Di-

rector at Aspen Technology.

A number of oil and

gas majors are now

grappling with making

a signicant shift into

renewables.

Aspen Technology’s

Ron Beck discusses

the technologies that

will help in what will

be a difcult transition

for them to make.

A random walk through the

A random walk through the

energy transition

energy transition

Beck: As is being applied

for LNG capital assets, wind

farms have already begun

successfully adopting

prescriptive maintenance

solutions

provide a connected view of the end-

to-end network of assets, based on

real operational data.

Operators and owners can imple-

ment these digital twins in several

ways: either they can purchase the

relevant tools from GE Digital and

build it themselves; or buy a twin

from GE Digital’s catalogue of twins

and input their own data. “We have

over 300 pre-built digital twins of

components in our APM systems, so

they can feed their data into the twin,

which then learns about their sys-

tem,” said Parris. The third way, he

notes, is for GE Digital to take the

customer’s data and build the twin.

One of the biggest challenges that

companies often face, however, is to

rst collect the necessary data, and

this to some degree is determining the

prevalence of the technology in the

various parts of the power sector.

Looking forward, Parris highlights

a few key areas of advancement in

digital twins and ways in which GE

Digital is working to accelerate their

use.

Although digital twins can bring

value and deliver savings through

early warning, prediction and optimi-

sation, he noted that operators are of-

ten not comfortable with basing their

strategies on twins to, for example,

predict the lifetime of a $20 million

sensor in a turbine.

“Getting people to adopt it is the

hardest thing. So about three years

ago we created something called

Humble AI, which takes into account

the zone of competency for a particu-

lar [digital] model; so you use the

model inside the zone of competency,

and when outside that zone you use a

different model or human and feed

that data back in so the AI system gets

smarter. That’s why it’s humble; it

knows what it doesn’t know and it

wants to learn.”

The technology has already been

developed for gas turbines and wind

turbines and Parris notes that it is

giving operators greater comfort in

terms of reducing risk.

Another area that Parris says GE

Digital is currently focusing on is

how to put this “all into a process

that people like”. The company is

therefore combining digital with

Lean methodology.

He explained: “Lean takes any

process you have and says: ‘tell me

what you are trying to solve.’ In

power, you might be trying to reduce

the cost of maintenance or increase

how much power you deliver at a

certain fuel level. So there’s a process

behind it. Lean will call for a value

map of the process, whereby all the

data will be pooled from the experts.

Lean is about pulling the data, and

that same data is what a data scientist

D

igitalisation has opened up all

kinds of possibilities in the

power sector. Yet there is one

area of digitalisation that can make a

profound difference – the concept of

the digital twin, a mirror of the physi-

cal world.

The digital twin is most commonly

dened as a software representation

of a physical asset, system or process

designed to detect, prevent, predict

and optimise through real-time ana-

lytics to deliver business value. The

technology has been around for

some time but with the Internet and

progress in technologies such as arti-

cial intelligence (AI) and machine

learning, digital twins are entering a

new phase, bringing new possibili-

ties to owners and operators of

power assets.

Colin Parris, Senior Vice President

and Chief Technology Ofcer, GE

Digital, has seen the technology

grow from its infancy to become an

important tool in GE Digital’s arse-

nal to better serve its customers’ ef-

forts to improve the operation and

value of their assets – whether in

power generation or transmission

and distribution.

He said: “The digital twin actually

came out of aviation and in particular

the military, perhaps a decade or

more ago. The Navy was looking at

how to understand the readiness of

an aircraft sitting on one of its carri-

ers. It’s not like a plane at an airport;

if you don’t plan for parts or service,

the aircraft doesn’t y and the mis-

sion is compromised.

“So the notion was: can I have a

digital model that can tell me the state

of readiness of an aircraft…? GE then

began thinking about how it could do

something like that, initially for its

Aviation business. And because we

also have turbines running every-

where for the electricity and energy

sectors – where typically we had to

give suppliers six or seven months

lead-time before the parts were needed

– it made sense to have digital twins.”

GE Digital then began to investigate

what else a twin might be able to do.

“Because we have engines that are in

the air, engines that are producing

electricity or engines that are pump-

ing oil out of the ground, we began to

see a pattern of what customers

wanted to do.

“First, they want an early warning

of a problem; with a jet engine you

need an early warning about failure.

In the energy sector, you want to be

warned about any anomalies – it’s

much better to x a bearing or blade

early rather than to get to a point

where there is damage that can cause

an engine to be out for six months.

The second is continuous predictions

on the remaining life of a part, to

understand what parts I need in my

inventory for when it has to be re-

placed. And the third thing is optimi-

sation: optimising a turbine for

highest energy delivery and lowest

fuel cost.”

GE Digital then moved to see how

this could be expanded across an

electricity network, looking at all the

components on the grid to optimise

the maximum amount of generation

for the lowest cost. This was then

extended to processes, such as smelt-

ing in order to consume the least

amount of electricity and least amount

and materials.

The digital twins that are increas-

ingly being adopted today are not like

the static models of the past that were

used to perhaps predict the behaviour

of a network at a given moment in

time. Today’s digital twins are what

Parris calls “living, learning models”

that take in a steady stream of data to

continuously update their models.

He said: “While there is widespread

use of things we call twins, which just

give insights from data coming in, we

are now moving into combining the

physics and AI to give us deeper and

deeper insights into what’s happen-

ing. There are twins in generation,

transmission and distribution and

there are especially new twins for

what is going with distributed energy

resources. People are wondering how

to model all of the electric vehicles

and battery sources that are coming

on line – with all the volatility it cre-

ates, you need twins and analytics to

help you.”

GE Digital is focused on how digital

twins can help its customers across

three core areas: assets, networks and

processes.

Addressing the power generation

sector, the company’s Asset Perfor-

mance Management (APM) software

solution creates digital twins based

on operational/eet data of: compo-

nents such as pumps or compressors;

critical assets, like turbines; or sys-

tems of assets such as an entire

power station. This type of digital

twin is an increasingly common tool

for operators of large equipment to

optimise their maintenance sched-

ules and to predict and avoid un-

planned downtime.

For transmission and distribution,

its Advanced Distribution Manage-

ment Solution (ADMS) and Geo-

graphic Information System (GIS)

use operational data from across the

network to create network digital

twins that can create virtual models.

These allow grid operators to better

manage and optimise networks, for

example, in the face of increasingly

extreme weather, aging infrastructure,

and the growing use of renewables

on the grid. Such twins essentially

THE ENERGY INDUSTRY TIMES - OCTOBER 2020

Executive Interview

14

Digital twins are an

exciting technology

with incredible

potential.

Junior Isles catches

up with GE Digital’s

Colin Parris for his

take on some of the

benets they bring

and a glimpse of

what’s to come.

A mirror to the future

A mirror to the future

needs... to create a model for embed-

ding in the process.

“Engineers like this combination of

digital and Lean because they all

know Lean, and now they can see

Lean inside of digital. Lean helps fo-

cus on the amount of money you will

save, or whatever it is you want to

change, while digital does the digital

transformation inside the process.

This is allowing the technology to

gain more traction in the industry.”

So what is the future of the technol-

ogy itself? Parris offered a glimpse of

a few research projects he has been

working on with investment from or-

ganisations such as the US Defense

Advanced Research Projects Agency

(DARPA) and the Intelligence Ad-

vanced Research Projects Activity

(IARPA).

Over the last three years they have

been investing money with GE Digi-

tal in an area called ‘Emerging Lan-

guages’. About ve years ago, GE

Digital began exploring the idea of

assets that could talk to each other and

solve problems.

Parris explained: “What if one wind

turbine could show another turbine

its sensor readings, ask if it has seen

these readings before and then ask:

‘what was the problem?’ And that

turbine could respond, saying for

example, I have seen these readings

before and it was a bearing problem.

And what if then, that asset could

communicate with us and tell us what

it thinks the problem is? This would

be tremendously helpful. It would

allow us to identify problems very

early on.”

GE began developing a language

between the turbines and has been

experimenting for the last year, with

“some interesting results”.

Parris said: “It can communicate

simple things like: there was a storm,

damage to a blade, this sensor reading

looks wrong and I think it’s this. It’s

at an early stage but what begins to

get me excited is the speed at which

they communicate, and the things that

they say is interesting.

“If you think about the next 4-5

years of this and get to a point where

machines are diagnosing themselves,

although humans will still be in-

volved, it will all be a lot faster.”

It’s an exciting future. On a wider

scale machines talking to each other

in such a way offers an incredible

opportunity in the ght against cli-

mate change.

Parris concluded: “It’s especially

relevant to me because of the decar-

bonisation problem. If you ever get

to a point where these assets are go-

ing to have to work together to reduce

carbon in the atmosphere, you want

them working together in the most

optimal way.”

Parris: we are now moving into

combining the physics and AI

to give us deeper and deeper

insights into what’s happening

THE ENERGY INDUSTRY TIMES - OCTOBER 2020

16

Final Word

I

t’s easy to get lost down the rabbit

hole of focusing on renewables

and new clean energy systems as

we strive to reduce carbon emissions

and halt climate change. Almost every

online conference or webinar (and

there have been way too many since

the lockdowns have prevented physi-

cal gatherings) has in some way fo-

cused on renewables. Whether it’s

increasing the use of wind and solar,

or energy storage to optimise the use

of intermittent generation, or smart

grids to accommodate uctuating gen-

eration, or the decarbonisation of in-

dustry and transport through greater

electrication using renewable sourc-

es – it almost always comes back to

renewables.

Clearly the reasoning is born of ne-

cessity. In its recently published ‘En-

ergy Transition Outlook’ (ETO), DNV

GL stated that despite a fall in carbon

dioxide emissions this year due to the

pandemic, “we will still blow past the

carbon budget for a 1.5°C future in

2028”. It said the 2°C carbon budget

would be exhausted by 2051.

It notes that the transition is happen-

ing at a fast pace, predicting that

“within a generation”, renewables and

fossil fuels will have roughly an equal

share of the energy mix compared to

an approximately 20-80 split today.

According to the company’s projec-

tions, solar capacity will expand by 20

times and wind 10-fold by 2050 as

costs plunge. Yet it will not be enough.

Policy levers are needed to stimulate

other technologies that are vital to

reduce energy use and emissions.

DNV GL says that carbon capture and

storage (CCS), for example, is a vital

component in decarbonising natural

gas, including the production of blue

hydrogen, but notes that a lack of

policy coordination means that by

2050 CCS will only capture 11 per cent

of carbon emissions, despite the

technology rst appearing in the

1970s.

Launching the ETO 2020, Remi

Eriksen, Group President and CEO of

DNV GL, said: “We can’t empty the

airliners twice, so we need all hands

on deck to nd practical solutions to

the climate crisis – now. The rapid rise

of solar PV, wind and battery tech-

nologies in recent years gives me hope

that humanity has solutions at hand.

However the so-called hard to abate

sectors need strong policy incentive to

move the needle on decarbonisation.

Decarbonised natural gas, including

hydrogen, will play a key role in the

transition to the energy future human-

ity wants and needs.”

Similar observations were made by

the International Energy Agency in its

recent Energy Technologies Perspec-

tive (ETP) 2020 – the rst core ETP

report for three years following a re-

vamp of the series.

The report analyses more than 800

different technology options to assess

what would need to happen to reach

net zero emissions by 2070. The

blistering pace of technological

transformation that would be neces-

sary for the world to reach net zero

emissions by 2050 is explored in the

report’s ‘Faster Innovation Case’. It

nds that to meet the huge increase in

demand for electricity, additions of

renewable power capacity every year

through 2050 would need to average

around four times the current annual

record, which was achieved in 2019.

The report stresses that energy in-

novation will be crucial but sees

“reason for optimism”, despite the

disruption and uncertainty caused by

the pandemic. Dr Fatih Birol, the

IEA’s Executive Director stated:

“Investment in clean energy start-ups

by venture capital funds and compa-

nies rose to a new record in 2019. And

governments and businesses are -

nally putting serious resources into

the clean energy potential of hydro-

gen, which this report makes clear

will be critical for reaching net zero

emissions.”

But his most important takeaway

from the report is the major challenge

of how to tackle emissions from the

vast amount of existing energy-related

infrastructure around the world.

“Personally, the most important

blind spot in the climate change debate

today is the overwhelming focus on

what we are going to build – the new

power plants, new factories, new cars

– and that they should be clean and

sustainable,” said Dr Birol. “Yes they

should be, and we should focus on

them but there’s a big issue: we have

built power plants, steel and cement

factories for years and years and they

will be with us for several decades to

come. Without addressing emissions

from the world’s existing infrastruc-

ture, we will have no chance whatso-

ever of meeting our energy and climate

goals.”

According to the IEA, if no action

is taken, today’s existing infrastruc-

ture will emit about 750 Gt of CO

2

over the next ve decades. The bulk

of cumulative emissions from exist-

ing infrastructure is expected to come

from the power (55 per cent) and

heavy industry (26 per cent) sectors,

reecting their large shares of emis-

sions today and the long lifetimes of

the assets, e.g. power stations and

manufacturing facilities.

Timur Gül, the IEA’s Head of Tech-

nology Policy and director of the re-

port, said there would be no chance of

fully decarbonising the energy sector

by 2050 unless “we nd a way to ad-

dress emissions from these existing

assets”.

How each country tackles the prob-

lem will depend on its individual cir-

cumstances and the age of the different

facilities. Some may opt for retrotting

or modernisation, and some may go

for early retirement. In Asia for ex-

ample, 80 per cent of existing coal red

generating capacity was built in the

last 20 years – retiring these early will

be hard to justify economically.

The existing coal plant eet, along

with emissions from industry are

particularly tough nuts to crack. Green

hydrogen is attracting increasing inter-

est as a way of decarbonising industry

and transport (alongside electric ve-

hicles). CCS and CCUS (carbon

capture utilisation and storage) has

been promoted for some time as a way

to address the existing coal, and to a

lesser extent gas, power generation

eet but the economics still do not

stack up. There could be a case for

industrial settings and there has been

some progress here, but the uptake of

CCS/CCUS in the power sector has

been woeful.

Gül commented: “Progress with

CCS technology has been somewhat

behind expectation over the last de-

cade but it is a technology that we will

ultimately need in certain applica-

tions such as cement [production]; to

produce synthetic fuels; and to remove

CO

2

emissions from the atmosphere.”

According to Dr Birol, of the 800

technology options covered by the

report, CCUS, hydrogen, batteries and

bioenergy, “appear to be the frontrun-

ners today” and are “the game-

changing technologies that are ready

for the big time”. But with regards to

CCUS, he also concedes that although

“the technology has been with us for

a long time, we have still not seen a

major breakthrough yet”.

Still, he maintains it is a necessity.

“In my view, we don’t have many

options to have a bridge between our

huge fossil fuel assets and our climate

goals.”

That may be so but the economics

will have to change and this can only

come with a big policy push to drive

the price of carbon.

In the meantime, the world will

likely continue to focus on how it can

increasingly utilise renewable energy

sources, which are becoming cheaper

and cheaper. Renewables in power

generation and greater electrication

of industry and transport can do much

in navigating the road to net zero but

it is difcult to see how they can get

us there alone, and by 2050.

Like Alice in Wonderland, we will

have to go further down the rabbit hole

– pursuing maximum use of renew-

ables going forward without losing

sight of the technologies that are

needed for the fossil fuel and indus-

trial installations of today. It is a

complex journey but let us hope that

chasing zero emissions is not as cha-

otic as chasing Alice’s white rabbit.

Chasing the white rabbit

Junior Isles

Cartoon: jemsoar.com