www.teitimes.com

September 2020 • Volume 13 • No 5 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Green ammonia

Digital transitions

Is green ammonia the answer to

a carbon free future?

Page 13

GE’s Linda Rae discusses how

digitalisation can help address

the challenges facing energy

companies. Page 14

News In Brief

Utilities’ H1 operating

performance reveals impact

of Covid-19

Several European utilities have

reported robust rst-half (H1)

operating prots but performance

has been dragged down by the

impact of Covid-19 on the second

quarter.

Page 2

USA to exploit up to 28 GW

of offshore wind by 2030

Up to 28 GW of offshore wind

power in US waters off of four states

could be auctioned for development

over the next two years.

Page 4

Pakistan moves to bring

down electricity costs

Pakistan is looking to reform its

power sector while calling on the

private sector in an effort to lower

the cost of generation.

Page 5

UK nuclear plans unclear

Indecision is hanging over the

UK’s plans for nuclear power

development, as uncertainty shrouds

the future of the Wylfa Newydd and

Bradwell power stations.

Page 6

Egypt cancelling solar power

projects as demand falls

In a surprising move that is likely

to have consequences in a post-

pandemic recovery, Egypt is

cancelling plans for the installation

of several solar power projects.

Page 7

Rolls-Royce remains

cautiously optimistic

With signs of a recovery in some

markets, Rolls-Royce is cautiously

optimistic about its outlook, despite

being severely impacted by the

Covid-19 pandemic.

Page 8

Meeting the challenge of

integrating renewables

Assessing the technologies to

make renewables integration as

environmentally-friendly and

efcient as possible.

Page 12

Technology Focus: Really

cool storage

Liquid air energy storage, a large-

scale form of long duration storage

that some call “pumped hydro in

a box”, is preparing for the rst

commercial project.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

With falling oil prices and the pressure to meet emissions targets, oil and gas majors are

accelerating the move to renewable energy and lowering their carbon footprints. Junior Isles

UK offshore wind prices soon to undercut

fossil generation

THE ENERGY INDUSTRY

TIMES

Final Word

Making a star can be

problematic, says

Junior Isles.

Page 16

The shock to the global economy and

energy markets from Covid-19, which

saw a massive fall in oil prices, has

caused several international oil and gas

majors to rethink their future energy

strategy.

In August, BP announced that it will

need to invest tens of billions of dol-

lars over the next decade and may

have to accept lower returns than it

can get from oil if it is to meet its target

of becoming one of the world’s largest

renewable power generators. The oil

and gas company wants 50 GW of re-

newables such as wind, solar and hy-

dropower in its portfolio by 2030, up

from just 2.5 GW now

In a strategy update on its 2050 net

zero ambition, BP said it would cut

its oil and gas output by 40 per cent

by 2030 and spend $5 billion a year

on low carbon projects. It is also

planning to sell oil and gas assets that

would not be economically viable

with lower oil prices to raise $25 bil-

lion by 2025 to help fund its transi-

tion to cleaner energy.

It said in statement: “Within 10

years, BP aims to have increased its

annual low carbon investment 10-

fold to around $5 billion a year, build-

ing out an integrated portfolio of low

carbon technologies, including renew-

ables, bioenergy and early positions in

hydrogen and CCUS. By 2030, BP

aims to have developed around 50 GW

of net renewable generating capacity

– a 20-fold increase from 2019 – and

to have doubled its consumer interac-

tions to 20 million a day.

“Over the same period, BP’s oil and

gas production is expected to reduce

by at least one million barrels of oil

equivalent a day, or 40 per cent, from

2019 levels. Its remaining hydrocar-

bon portfolio is expected to be more

cost and carbon resilient.”

European oil majors are under

pressure from activists, banks, inves-

tors and some governments to shift

away from fossil fuels and are trying to

nd business models that offer higher

margins than the sole production of

renewable energy would generate.

Analysts say large offshore wind

farms probably offer the quickest

route for BP to scale up but as they can

take years to develop, and have high

start-up costs, it may have to turn to

acquisitions. With renewable power

companies trading at high price-to-

earnings ratios, analysts say BP could

Continued on Page 2

A dramatic drop in the cost of offshore

wind power could soon see electric-

ity from offshore wind projects in the

UK being cheaper than fossil fuelled

generation. Coupled with a slight rise

in wholesale power prices, rapidly

falling costs could mean the newest

wind farms coming online in the UK

will soon operate with negative sub-

sidies, nds new analysis.

According to recent research by Im-

perial College London, published in

the journal Nature Energy, record low

prices of around £40/MWh agreed in

contracts last year combined with ex-

pected electricity price rises mean that

UK offshore wind providers will

likely start passing on those gains to

consumers in reduced energy bills by

2023.

Lead researcher Dr Malte Jansen,

from the Centre for Environmental

Policy at Imperial, said: “Offshore

wind power will soon be so cheap to

produce that it will undercut fossil-

fuelled power stations and may be the

cheapest form of energy for the UK.

Energy subsidies used to push up en-

ergy bills, but within a few years,

cheap renewable energy will see them

brought down for the rst time. This

is an astonishing development.”

The analysis examined the future

electricity price trends and found that

from the mid-2020s onwards, the con-

tracted prices were likely to be below

the UK wholesale price over the life-

time the latest wind farms would pro-

duce electricity.

Dr Iain Staffell, from the Centre for

Environmental Policy at Imperial,

said: “The price of offshore wind

power has plummeted in only a mat-

ter of a decade, surprising many in

the eld. The UK auctions in Sep-

tember 2019 gave prices that were

around a third lower than those of the

last round in 2017, and two-thirds

lower than we saw in 2015. This

amazing progress has been made

possible by new technology, econo-

mies of scale and efcient supply

chains around the North Sea, but also

by a decade of concerted policymak-

ing designed to reduce the risk for

investing in offshore wind, which

has made nancing these huge bil-

lion-pound projects much cheaper.”

Researchers found decreasing costs

when looking at a series of govern-

ment auctions for offshore wind farms

between February 2015 and Septem-

ber in the UK, Germany, the Nether-

lands, Belgium and Denmark.

The rapid fall in the cost of offshore

wind has seen a dramatic rise in the

demand for projects worldwide. New

research published in late July by Re-

newableUK shows the global pipeline

of offshore wind power projects

which are either operational, under

construction, consented or being

planned, has soared by 30 per cent in

the last twelve months from 122 GW

to 159 GW.

Its latest ‘Offshore Wind Project

Intelligence’ report shows that the UK

has retained its top spot, dominating

the market with a pipeline of 38.9 – a

quarter of the global total. China has

moved up from 4th to 2nd place with

19.3 GW – an increase of 7.3 GW, up

60 per cent.

The USA stays in 3rd place, up from

15.7 GW to 17.8 GW, an increase of

13 per cent, while Germany has

dropped from 2nd to 4th place as its

total of 16.5 GW has remained almost

the same over the last 12 months, add-

ing just 68 MW. Taiwan stays 5th with

its project pipeline growing by 28 per

cent from 8.9 GW to 11.4 GW.

Oil majors ramp

Oil majors ramp

up shift to low

up shift to low

carbon energy

carbon energy

BP Chief Executive Bernard Looney: aiming for 50 GW of renewables by 2030

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2020

3

Energy & Storage

solutions expertise

Securing energy supplies

Ensuring a reliable power supply is one

of the key factors for progress and

prosperity around the world. Building

on decades of MAN innovation, we can

help secure clean and effi cient energy

supplies for your customers. Our expertise

covers solutions for hybrid power, LNG

to power, energy storage, power-to-X,

thermal power plants, and CHP.

www.man-es.com

Your reliability

shines

1912_14870_MAN_ES_Anzeige_SC_KV_Power_YourReliabilityShines_reSe_ENG_249x160mm_ISO_V2.indd 1 01.10.19 13:36

8

,

000

ATTENDEES

250+

EXHIBITORS

600+

SPEAKERS

150+

HOURS OF FREE

CONFERENCES

KEEP IN TOUCH

@AllEnergy

'

all-energy

!

allenergyevent

See you at the UK’s leading

and only full supply chain

renewable and low carbon

energy event

4-5 Nov 2020 - SEC GLASGOW

REGISTER NOW: all-energy.co.uk/register

Organised by:

Learned

Society Patron

In association

with:

Host

Sponsor

Host City

Headline

Sponsor

3784 All-Energy NOV 2020 120 x 160 Reg Advert.indd 13784 All-Energy NOV 2020 120 x 160 Reg Advert.indd 1 02/07/2020 12:0802/07/2020 12:08

C

M

Y

CM

MY

CY

CMY

K

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2020

7

International News

Between now and 2030, over 205 GW

of new offshore wind capacity will be

added globally, as a result of policy

ambition, declining technology costs,

and international commitments to de-

carbonisation.

In August, GWEC Market Intelli-

gence predicted that, despite the im-

pacts of the Covid-19 crisis, around 6.6

GW of offshore wind will be installed

in 2020. Currently, around 29 GW is

installed worldwide, with 6.1 GW of

new capacity installed during 2019.

It is also highly likely that offshore

wind will be a major contributor to post-

Covid economic recovery, said GWEC

as several governments are planning

major efforts in the offshore market.

Europe is currently the leading region

for installations, but the Asia-Pacic

region looks set to show a tremendous

increase in demand for offshore wind.

China will become the global leader in

new capacity, with Taiwan, Vietnam,

Japan, and South Korea also set to be-

come major markets, accelerating in

installed capacity to 2030.

China is expected to have 52 GW of

new offshore wind capacity installed

by 2030. Taiwan will be the second

largest offshore wind market, with a

goal of 5.5 GW by 2025, and an ad-

ditional 10 GW by 2035. Vietnam,

Japan, and South Korea are expected

to install 5.2 GW, 7.2 GW, and 12 GW

of offshore wind capacity, respec-

tively. North America currently has

just 30 MW of offshore wind capacity

in operation, but installation and de-

ployment will accelerate, with 23 GW

forecast to be installed by 2023.

Notably, oating offshore wind will

reach full commercialisation by 2030,

with at least 6 GW installed globally.

Turbine technology will improve in

both efciency and resilience.

Feng Zhao, Strategy Director for

GWEC, said: “The industry’s outlook

has grown more promising as more

countries are waking up to the im-

mense potential of offshore wind. In-

novations in the sector such as oating

offshore wind, larger and more ef-

cient turbines, as well as power-to-X

solutions, will continue to open new

doors and markets for the sector and

place the offshore industry in an in-

creasingly better position to drive the

global energy transition. Offshore

wind has already proven itself as an

affordable, scalable, zero-carbon

technology. We are only beginning to

unlock the full clean energy potential

of offshore wind.”

GWEC predicted that the top ve

markets for offshore wind installa-

tions in 2030 would be: China (58.8

GW); UK (40.3 GW); USA (22.6

GW); Germany (20 GW); and the

Netherlands (11.4 GW).

Policy ambition and falling cost

drive offshore wind

South Africa will continue to face load

shedding problems for the foreseeable

future as it struggles to replace and

upgrade its aged generation infra-

structure. The country has been strug-

gling with rotating blackouts for some

years, as debt-laden Eskom deals with

years of maintenance neglect at old

plant.

At the time of writing, despite a drop

in demand due to Covid-19, Eskom

had implemented three rounds of load

shedding since the Covid-19 outbreak

in early March. The latest round was

the result of breakdowns at four gen-

erating units, combined with a delay

to the expected return to service of

another unit under maintenance.

Eskom says it implements load shed-

ding as a last resort to prevent the

national grid from a total collapse and

urged South Africans to help reduce

electricity usage. Andre de Ruyter,

CEO of Eskom, said that load shed-

ding was likely to continue until Sep-

tember 2021.

To help with the post Covid-19 re-

covery, Eskom has oated a tender for

a battery energy storage system

(BESS) with a minimum 80 MW/320

MWh usable capacity at the Skaapvlei

substation, near the 100 MW Sere

Wind farm. Eligible bidders have

seven months (extendible to a maxi-

mum of nine months) to submit bids.

Eskom said in a statement: “We have

received nancing for the project from

the World Bank, as well as the African

Development Bank and New Devel-

opment Bank. The Skaapvlei project

represents Eskom’s rst large-scale

BESS project.”

The plan is seen as part of plans to

diversify the country’s energy mix in

a move away from coal, which is used

for about 85 per cent of the country’s

power generation. Eskom is speci-

cally considering green funding to

offset debt and to re-purpose coal

plants.

No end in sight for load shedding, says Eskom

Offshore wind capacity will increase to over 234 GW by 2030 despite the slowdown caused by the global Covid-19

pandemic. David Flin

In a surprising move that is likely to

have consequences in a post-pandem-

ic recovery, Egypt is cancelling plans

for the installation of several solar

power projects. It says the cancella-

tions are due to falling power demand

resulting from actions taken to reduce

the impacts of Covid-19.

In July plans for a 200 MW solar

park due to be installed in Egypt’s west

Nile area were cancelled by the Egyp-

tian Electricity Transmission Com-

pany (EETC). It cited falling power

demand as the reason for the cancel-

lation. EETC has also cancelled a

tender for a 100 MW concentrated

solar power (CSP) project in the same

region.

EETC said that Egypt has achieved

a surplus of capacity in the grid follow-

ing the completion of a number of

thermal and renewable energy projects

over the last three years.

Egypt had been planning to develop

a mix of solar, CSP and wind power in

the west of Nile area, with bids rst

requested in September 2015. This

drive came as a result of political unrest

resulting from, among other things,

power shortages and outages in 2014.

At present, with demand depressed

by Covid-19, the west of Nile region

has a generating surplus. However,

prior to the pandemic, power demand

was rising, with GDP growth consis-

tently above 5 per cent.

Egypt set targets for renewable en-

ergy to contribute 20 per cent and 42

per cent of total energy produced by

2022 and 2035, respectively. Achiev-

ing these targets will require contin-

ual efforts to develop renewable

schemes. Signicant progress had

been made, but this looks to be in

danger of stalling.

However, wind projects are still be-

ing developed in Egypt. Egypt’s New

and Renewable Energy Authority

(NREA) and a consortium led by Ves-

tas have signed an agreement to de-

velop a 250 MW wind project in the

Gulf of Suez, costing $270 million. The

wind farm should be operational by

August 2023.

As demand for solar power rises, Tur-

key will move from being a net im-

porter of solar panels to a net exporter.

The country plans to boost its wind and

solar capacity by 10 000 MW each year

over the coming decade, as well as

becoming a net exporter of solar pan-

els.

The rst step in this process was car-

ried out when it opened its rst inte-

grated solar panel facility in Ankara’s

Baskent Organised Industrial Zone on

19 August 2020. The $400 million So-

lar Technologies Factory was built by

Kalyon Holding. The plant will manu-

facture ingot, wafer, module, and cell

units with a capacity of 500 MW per

year.

Fatih Dönmez, Turkey’s Energy and

Natural Resources Minister, said: “Our

factory, which came to life with an

investment of $400 million, will be the

world’s only fully-integrated solar

panel plant operating under one roof.”

He added that following the commis-

sioning of the plant, the share of solar

energy in electricity production in Tur-

key will increase by 25 per cent. He

emphasized that solar power was going

to be an area of major growth, and that

Turkey needed to be in the forefront of

manufacturing panels.

Egypt cancelling solar

power projects as demand

falls

Turkey to export solar panels

Battery rms

Battery rms

to quadruple

to quadruple

output

output

Global lithium-ion cell manufacturing

capacity will quadruple to 1.3 TWh by

2030, with China doubling pipeline

capacity during this period.

Accordiing to a recent report from

Wood Mackenzie, there are currently

119 battery manufacturing facilities

that are operational, under constuction,

or announced, with over 50 vendors.

It says the growth is being driven by a

demand for energy storage to balance

out uctuations in supply from vari-

able renewable supply.

Mitalee Gupta, Senior Analyst with

Wood Mackenzie, said: “Manufactur-

ing capacity in Asia Pacic accounts

for 80 per cent of global capacity

pipeline. The region will remain as

the leader of lithium-ion battery pro-

duction for the next decade. Within

Asia-Pacic, China dominates the

pipeline capacity and is expected to

double its capacity from 345 GWh in

2020 to over 800 GWh by 2030. In

addition to local vendors’ rapid ex-

pansion in China, foreign manufac-

turers such as LG Chem, Samsung

SDI and SK Innovation have also been

adding new lines after they became

eligible for subsidies from the Chi-

nese government in 2019.”

Europe will increase capacity sig-

nicantly over the next decade, reach-

ing 25 per cent of global pipeline

capacity in 2030, up from 7 per cent

currently. Asian manufacturers are

investing heavily in new plants in

Europe: CATL’s Erfut Plant, LG

Chem’s Wroclaw Plant, and Samsung

SDI’s Goed Plant. In addition, local

manufacturers such as Northvolt and

ACC have put forward ambitious

plans to scale up production in

Europe.

Hydrogen gains momentum as Europe

makes serious plans for implementation

Turkey discovers gas in Black Sea but

challenges remain

Gary Lakes

There are plenty of skeptics and hy-

drocarbon industry diehards, but hy-

drogen is a hot word in energy circles

as the world plans an economic re-

bound from the consequences of

Covid-19.

Over the course of 2020, the focus of

concern has not only been about im-

proving the health of the human popu-

lation, but improving the health of

Planet Earth as well, and this has

brought much discussion on the pluses

of moving away from carbon and im-

plementing a hydrogen economy.

The energy transition as currently

planned may not happen as quickly as

many would like, but the European

Commission in July adopted a hydro-

gen strategy for a carbon neutral Eu-

rope by 2050. Hydrogen is the most

abundant element in the universe and

once harnessed and produced in large

quantities, it will be applied to trans-

port, industry, power generation and

other sectors of human activity.

In the paper outlining its hydrogen

programme, the EC noted that only

small amounts of hydrogen are cur-

rently produced, and that is made by

using coal and natural gas as feedstock

for the electricity needed for the elec-

trolysis process, which according to the

EC, results in the production of 70-100

tons of CO

2

emissions annually.

“For hydrogen to contribute to cli-

mate neutrality, it needs to achieve a

far larger scale and its production must

become fully decarbonised,” the EC

paper states, and it pointed out that the

list of planned global investment in

hydrogen production projects is

growing on a weekly basis and the

number of companies joining the In-

ternational Hydrogen Council is

steadily increasing.

The European Union is expected to

invest between €180 billion to €470

billion in hydrogen by 2050.

This summer Germany announced a

€9 billion investment in a National

Hydrogen Strategy and the UK

launched the Hydrogen TaskForce.

Meanwhile, Russia is also looking at

investment in hydrogen to meet future

European market demand.

Germany plans to have 5 GW of

hydrogen production capacity by

2030 and another 5 GW added to this

by 2040. The programme is part of a

€130 billion stimulus designed to con-

tribute to economic recovery from the

coronavirus pandemic. The invest-

ment in hydrogen production is part

of €40 billion marked for climate-

related spending and could result in

providing hydrogen to produce 10 per

cent of Germany’s total electricity

capacity.

The technical methods of producing

hydrogen are colour-coded: brown

and grey hydrogen come from hydro-

gen that is produced by coal and

natural gas. These produce about 95

per cent of the world’s hydrogen. Blue

hydrogen is produced from natural

gas, using carbon capture and storage

(CCS) to capture and store the CO

2

.

Green hydrogen is produced by re-

newable energy sources and emits no

carbon during production. The pro-

cess separates hydrogen from water

using electrolysis and ultimately is the

stage that the world wants to reach.

Germany is looking to accelerate

green hydrogen production but the

technology requires a huge ramp-up

in wind and solar energy output. Once

renewable energy production is sol-

idly established and widespread,

green hydrogen will be available for

power stations, heavy industry and to

replace fossil fuels for home heating

and transportation.

The UK’s Hydrogen Taskforce an-

ticipates the release of a government

hydrogen strategy in 2021 in which

the production target for 2035 will be

125.3 TWh, 80 per cent of which will

be blue hydrogen and 20 per cent

green. The Taskforce further argues

that moving to hydrogen will not only

reduce carbon emissions but also

boost the economy through the cre-

ation of new jobs. It projects that by

2035 the UK’s hydrogen economy

will be worth £18 billion and create

75 000 jobs. Furthermore, it states that

much of the infrastructure currently

used in the natural gas industry can be

adapted to transport hydrogen and that

many jobs within the oil and gas in-

dustry can easily t into hydrogen

operations.

Russia’s Ministry of Energy an-

nounced in July that it will produce

‘clean’ hydrogen in 2024 by using

nuclear energy in a partnership be-

tween gas company Gazprom and

nuclear energy rm Rosatom. Gaz-

prom has forecast that the EU hydrogen

market will be worth €153 billion by

2050 and wants to participate in sup-

plying the new fuel. The company has

suggested that it will be able to supply

a gas mixture containing 70 per cent

hydrogen to Germany using the yet to

be completed Nord Stream 2 pipeline.

Russian sources report that the coun-

try wants to be capable of supplying

15 per cent of global hydrogen produc-

tion by 2035 by using its huge hydro-

carbon resources as a bridging technol-

ogy for hydrogen production.

Gary Lakes

The Republic of Turkey on August 21

announced the discovery of a natural

gas resource in the Black Sea and es-

timated its size at around 320 billion

cubic metres (around 12 trillion cubic

feet). The discovery, located near the

exclusive economic zones (EEZs) of

Bulgaria and Romania, is signicant

for Turkey, which until now has had

no sizeable oil or gas discoveries in

its territory.

The discovery at the Tuna-1 well, if

developed, could have an important

impact for the Turkish economy, which

relies on energy imports. Turkey uses

45-50 bcm annually of natural gas,

virtually all of which is imported from

Russia, Iran and Azerbaijan. The coun-

try imports LNG from Algeria and

Nigeria, and with the price of LNG

currently low on the global market, it

has been importing LNG from the spot

market through four Floating Storage

Regasication Units (FSRUs) in-

stalled at various locations along its

coast. Gas imports last year cost Turkey

some $40 billion.

Turkish President Recep Tayyip Er-

dogan announced the gas discovery

on Turkish TV signifying the impor-

tance of the discovery to Turkey, and

validating his efforts to push Turkish

Petroleum (TPAO) to discover any-

thing, anywhere.

Erdogan’s policy of encroaching on

the internationally recognised terri-

tory of littoral countries in the East

Mediterranean has seriously ratcheted

up tensions with Greece, Cyprus,

Egypt and even Israel.

Turkey’s claim to a continental shelf

in the East Mediterranean and a ‘Blue

Homeland’ that includes half of the

Aegean Sea and vast expanses of the

Mediterranean as far as the coastlines

of the Greek islands of Rhodes and

Crete, and to the edge of Libyan ter-

ritorial waters has led to diplomatic

alarm within the European Union and

with France in particular.

Turkey has long claimed most of the

Cypriot EEZ and frequently interfered

with exploration efforts there by

France’s Total and Italy’s Eni. Turkish

drillships, including the Fatih, which

made the Tuna-1 discovery, drilled

several wells in the Cypriot EEZ over

the last year and currently the Yavuz

drillship and a seismic vessel are in the

area.

Turkey stated recently that it will

send its third drillship into the East

Mediterranean soon, but has not said

where. If the ship should enter Greek

territory, then tensions are expected

to reach a tipping point. The EU has

already warned Ankara to remove its

ships from Greek and Cypriot waters,

but Turkey has chosen to ignore the

warning.

Gloating over the gas discovery,

which has been renamed ‘Sakarya’,

Erdogan said that Turkey hoped to

bring the resources into development

by 2023, the centennial of the found-

ing of the Turkish Republic. Erdogan

called it an “historic day” saying:

“Turkey has made its biggest natural

gas discovery,” adding that it gives

Turkey a “new era.”

Certainly, once the gas is owing

it will contribute signicantly to

Turkey’s energy security, but it will

not solve all the country’s problems.

Some in Turkey have already fallen

into the gas dreams scenario that a new

discovery often conjured up. Turkish

Finance Minister Berat Albayrak, Er-

dogan’s son-in-law, called it a nan-

cial game changer. “It will remove the

current account decit,” he said. “We

will be soon talking about current ac-

count surpluses.”

Bringing the eld on-stream will

require many more appraisal and de-

velopment wells and billions of dol-

lars in investment. Also, the deep-

water environment will pose

challenges of its own. It is unclear if

TPAO actually has the expertise to

bring a project like this into operation,

since it has not done this before, and

will likely require a partner. Consider-

ing the fact that a huge market for the

gas is already there in Turkey, a part-

ner or two might not be hard to nd.

But with gas prices so low amid

global oversupply, it may be some

time before developing the eld

would be worth the investment. Some

analysts have said that it could take

seven to 10 years to develop the eld.

In the region, only two reservoirs have

been fast-tracked: the Tamar eld off-

shore Israel and the giant Zohr eld

offshore Egypt. In both cases it was

because the countries were in dire

need of gas supplies.

One thing is certain, Turkey will con-

tinue its neo-Ottoman approach to gas

exploration in the East Mediterranean,

where most exploration – with the ex-

ception of Turkey – has stopped due to

the coronavirus pandemic.

However, Total and Eni, which in

partnership hold seven licenses in the

Cyprus EEZ, are due to resume drill-

ing some time in 2021. So too will

ExxonMobil, which holds the license

to Cyprus Block 12, where in January

2019 it announced the Glaucos-1 dis-

covery. Chevron Corp in July pur-

chased Noble Energy, which includes

Israel’s 22 tcf Leviathan eld and

Cyprus’s 4.5 tcf Aphrodite eld.

Those companies cannot be ex-

pected to be held at bay by Turkey

forever.

Hydrogen

Gas

For hydrogen to contribute to climate neutrality, it needs to achieve a far larger scale and its production

must become fully decarbonised but the list of planned global investment in projects is growing on a

weekly basis.

The huge natural gas discovery at the Tuna-1 well could have a massive impact for the Turkish economy

but the investment that will be needed, combined with political tension in the region, means it could be some

time before it reaps the potential rewards.

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2020

11

Fuel Watch

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2020

12

Industry Perspective

A

s more renewable power

sources join to gradually re-

place carbon-based energy,

we need to ensure our grids remain

resilient and become more exible

as they adapt to fast-changing de-

mands and increasing decentralisa-

tion. While the growth of renewable

energy must be celebrated, there’s no

denying it will add to the challenges

of managing what is mostly a legacy

grid and will therefore require some

changes in how power is transmitted

and distributed in the future.

The challenges faced by grid oper-

ators vary depending on if the re-

newable power enters the grid at the

distribution or the transmission level.

The big offshore wind farms are usu-

ally integrated at the transmission

level with a single point connection,

meaning there is less redundancy in

the setup with potentially a long con-

nection line in between load centres.

Onshore wind farms are in the range

of hundreds of megawatts so they

can connect in the distribution grid

where the controllability is not en-

sured; it is a stochastic uctuation of

the loads that makes ensuring stabili-

ty a challenge.

The interconnected continental sys-

tem is well matched during regular

operations. When you have a weak-

ened operation because of line out-

ages or splits of the system, it can

potentially be a big challenge and

with increased renewables will be al-

most unmanageable in the future.

With the digital transformation

having a positive impact on the

power sector, as it is throughout the

rest of the industrial world, there

are numerous technology solutions

available. These include high volt-

age direct current (HVDC), thyris-

tor-controlled series compensation

(TCSC), phase-shifting transform-

ers (PST), distributed series com-

pensation and even unied power

ow controllers (UPFC); with the

best solution being dependent on

each particular challenge.

The PST is well established in the

continental system, particularly

around the Benelux regions where

they need to cope with the high

power ows from north to south.

They are inexpensive compared to

other options, but they are only suit-

able for steady-state control. If you

go more into dynamic response of

the grid where you require a re-

sponse in under a second, then they

are not sufcient. In those instanc-

es, you need series compensation of

lines with TCSC or UPFC; howev-

er, market acceptance of the latter

solution is not high. When it comes

to UPFC, there is no market for this

kind of innovation in the European

system, so you will not nd it in-

stalled anywhere.

At the same time, TCSC is not the

answer when it comes to managing

an increased load of renewable ener-

gy to the grid. Instead, it is a method

of optimising what is already avail-

able, with lower gains. For the com-

ing years, we need to build up capac-

ity in the grid.

The HVDC option, pioneered by

Hitachi ABB Power Grids, is more

attractive because it allows you to

introduce new lines that are more

controllable and will increase the

transfer capacity. It is also the most

environmentally-friendly technology

as it can provide more power per

square metre over greater distances

with lower losses, meaning that

more power reaches the consumer

more efciently. Another signicant

advantage is that you can modulate

the active power transmitted.

What we see as a big market for

HVDC is the integration of offshore

wind, a role that it is already lling.

The next step will be to combine in-

terconnections and offshore wind

connections with building up con-

necting networks such as the UK to

the Continental system or Scandina-

via. This will be the next growth area

for HVDC as hybrid interconnectors

or multi-purpose systems.

The biggest drawback for HVDC

lines, as is also true for AC lines,

particularly onshore, is the lengthy

planning processes with the associat-

ed environmental concerns and pub-

lic opposition involved in getting

new lines constructed. This can

sometimes be mitigated by clever

routing. For example, the connection

between Italy and France runs in

parallel with a motorway. However,

the distances involved there are short

compared to the north-south corridor

required in Germany. The systems

and procedures for planning are

there in Europe in its Ten Year Net-

work Development Plan, but it takes

a long time to build up this new in-

frastructure. When you work within

an existing substation, you do not

have all these issues, but when you

want to touch a line or build up a

new line, it can be a lengthy process.

Theoretically, you can transform an

existing overhead line for use with

HVDC; there is one reference case

within Europe which is now in exe-

cution. The problem, however, is the

reason to do this is to increase capac-

ity on a line that is fully loaded but

to carry out this work you have to

cease operation for some time. The

challenge is how to schedule that

within the operational constraints

that you may have.

There was a push in 2016 with a

so-called network code for HVDC

from the European Commission. The

Network Code on HVDC species

requirements for long-distance direct

current (DC) connections. The idea

behind that network code was to har-

monise their requirements for

HVDC systems, no matter what

country they are connecting, promot-

ing interconnections. Unfortunately,

what we could see afterwards was

that during national implementation

these codes diverged again. This is

increasing the risk for the technology

moving ahead with multi-terminal

systems or even HVDC for offshore

wind connection. Grid codes must be

developed soon to close this gap.

A good example of the benets of

HVDC is in the Baltic Sea. The 600

MW Danish Kriegers Flak offshore

wind farm, which comes online in

2022, will consist of two parts: the

western Kriegers Flak A (KFA) with

a total capacity of 200 MW and the

eastern Kriegers Flak B (KFB) with

a total capacity of 400 MW.

The Kriegers Flak combined grid

solution project will connect the

Danish region of Zealand with the

German state of Mecklenburg-West-

ern Pomerania via two offshore

windfarms – German Baltic 2 and

Danish Kriegers Flak. It is an inno-

vation in the context of the energy

transition, as it is the world’s rst

project combining grid connections

to offshore wind farms with an inter-

connector between two countries.

The interconnector will allow

electricity to be traded in both direc-

tions – from Denmark to Germany

and from Germany to Denmark. En-

erginet is currently building the grid

connection of the future Kriegers

Flak offshore wind farm (600 MW).

The Kriegers Flak (Denmark) and

Baltic 2 (Germany) wind farms are

less than 30 km apart, and both wind

farms are linked through two sea ca-

bles with a transmission capacity of

400 MW, forming the interconnector.

The frequencies of the Danish and

German transmission systems use a

slightly different phase, which

means they need to be matched at

the interface. This will be enabled by

two serially connected voltage

source converters (VSC). One con-

verter transforms the alternating cur-

rent (AC) from the Nordic intercon-

nected system to direct current (DC).

The other converter transforms this

direct current back to alternating cur-

rent – only now adapted to the Con-

tinental Europe Synchronous Area.

This so-called back-to-back convert-

er will be installed in Bentwisch,

near Rostock in Germany.

With the provision of reactive pow-

er, you can also make sure that you

have voltage support at the point of

connections. However, this is a bit

limited because the further away you

get from the node the HVDC con-

verter is connected, the less effective

such reactive support is. Overall, we

believe that the setup in the future

for maximum renewables integration

is going to be a combination of

HVDC, TCSC for optimised line

loading, Static Synchronous Com-

pensators (Statcoms) for voltage

control, and PSTs for steady state

optimisation of power ows.

In terms of the next challenges, it is

about managing the longer power

ows. The market will become more

volatile with more renewables,

which is where HVDC came into its

own from the beginning. HVDC

plays a crucial role in the transition

to a stronger, smarter and greener

grid powered by renewable energy

sources, which typically require long

distance transmission. It is particu-

larly effective, for example, for

bringing wind power from remote

offshore wind farms to mainland

grids. With WindEurope estimating

that Europe’s offshore wind capacity

will reach 450 GW by 2050, HVDC

technology will be instrumental in

efforts to keep the extent of global

warming below 1.5°C.

Andreas Berthou is Global Head of

HVDC of Grid Integration business,

Hitachi ABB Power Grids.

Meeting the challenge of

Meeting the challenge of

integrating renewables

integrating renewables

Berthou: The challenges

faced by grid operators

vary depending on if the

renewable power enters the

grid at the distribution or the

transmission level

With the increasingly urgent drive to decarbonise the power system, renewable energy will play an ever expanding

role. However, we need to ensure that the renewables integration is as environmentally-friendly and efcient as

possible in order to full our vision of ensuring affordable and clean energy, sustainable living and a world t for all our

next generations. Andreas Berthou

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2020

13

Energy Outlook

T

he coronavirus pandemic has

been a hard time for everyone

across the globe, and as things

begin to return to a new state of

‘normal’, there are some lessons we

should take from our time in lock-

down. Because of the restricted

movement, shutting down of build-

ings and remote working policies

forcing most of us to stay within the

connements of our own homes, our

carbon emissions have rapidly de-

pleted. In fact, the UK reached the

milestone of not having used coal-

powered electricity for two whole

months for the rst time in 140 years

during the lockdown.

Statistics already suggest that as re-

strictions are easing, and the popula-

tion is beginning to get back to nor-

mality, carbon emissions are rising

once again. Although it’s been re-

ported that they’re 5 per cent lower

than they were during the same time

in 2019, the rapid return of such high

levels of carbon emissions is ex-

tremely worrying. If the government

is to reach its target of zero carbon

emissions in the next 30 years, there

is still some way to go.

While the move away from coal

represents good progress in reducing

carbon emissions from the power

sector, renewable sources still only

account for around 20 per cent of our

electricity generation. And similar

progress in other energy-intensive

sectors such as industry, transport

and heat remain, as yet, elusive. This

brings about the questions of what

exactly our future energy systems

look like? How will we continue to

provide easy access to affordable en-

ergy, and avoid the causes of climate

change? This is where green ammo-

nia comes in, offering a low cost,

carbon free solution to help battle

the global ght against climate

change.

Some of the most popular and

well-known renewable power sourc-

es offer carbon-free energy, but the

problem is their intermittency. We

can’t control when the sun shines, or

when the wind blows – yet we want

(and are used to) the freedom to

choose when we use this energy.

Recent analysis from the Depart-

ment for Business, Energy and In-

dustrial Strategy shows that in 2019,

37 per cent of the UK’s electricity

generation came from renewable

sources such as wind turbines and

solar, four percentage points higher

than 2018. However, this is still not

enough to reach net zero using re-

newables alone, so a reliable storage

technique is needed.

Energy storage is often presented

as the solution to this intermittency

problem, but the challenge is to store

energy in sufcient quantities – and

at low enough costs – to meet our

needs which are growing all the

time. Energy is, of course, already

stored in vast quantities today – it is

just that the energy stores we are

used to come in the form of fossil fu-

els such as oil (and its derivatives)

and natural gas. These chemical en-

ergy vectors are ubiquitous for a rea-

son – carbon-based fuels are stable,

energy dense, and are easy to store

and transport.

The issue lies with the CO

2

emitted

when we burn them. So, what if

there was an alternative? What if we

could synthesise a carbon-free fuel

using renewable energy, which could

be used to store and transport that

energy in bulk, without the carbon

emissions associated with its fossil-

based counterparts?

Ammonia (NH

3

) is a promising

candidate for just such a carbon-

free, synthetic fuel. An ammonia

molecule is made up of one nitro-

gen atom and three hydrogen atoms

– in some ways similar to natural

gas (methane, CH

4

) which has one

carbon atom plus four hydrogen at-

oms – and can be synthesised from

abundant raw materials, namely air

and water.

Nitrogen comprises 78 per cent of

the atmosphere, and may be readily

separated out from air; water may be

split back into its constituent ele-

ments via an electrochemical process

called electrolysis.

Once the hydrogen and nitrogen

are produced, they can be combined

in a reaction called the Haber-Bosch

process to produce ammonia. If re-

newable energy is used to power

these processes, then that energy be-

comes locked up in the ammonia

molecule, without any direct carbon

emissions.

The nal step, energy release from

this “green ammonia”, can be

achieved by cracking the ammonia

back into nitrogen and hydrogen,

and then using the hydrogen in a fuel

cell – such as in a fuel cell electric

vehicle. Another way is to use it in

combustion – in exactly the same

way as we burn carbon-based fuels

today – such as in a gas turbine, for

example.

In this way, green ammonia offers

the enticing prospect of reducing

carbon emissions not just in electri-

cal power generation, which has so

often been the limit of our current

best efforts to decarbonise, but also

other sectors such as transport and

industry.

By switching to renewable electric-

ity to make ammonia, it’s possible

that we could save more than 40 mil-

lion tonnes of CO

2

each year in Eu-

rope alone, or over 360 million

tonnes worldwide. With the govern-

ment’s continued commitments to

meet net zero emissions targets by

2050 and the recent announcement

that they are set to invest a further

£350 million to fuel green recovery,

new carbon free fuels such as green

ammonia and green hydrogen will

be needed to decarbonise energy

generation, heat and transport and

industry.

The latest government announce-

ment, and the clarication that £139

million of that budget will be spent

on cutting emissions in heavy indus-

try by supporting the transition from

natural gas to clean hydrogen power

is denitely a step in the right direc-

tion. But the pace of change is still

slow for a solution that is readily

available.

Siemens has shown this process is

possible at the Rutherford Appleton

Laboratory in Oxfordshire, where,

with the Science and Technologies

Facilities Council, the University of

Oxford and Cardiff University, it de-

veloped the world’s rst Green Am-

monia Demonstrator.

The beauty of this is that the tech-

nology required to begin to imple-

ment and use green ammonia al-

ready exists. Industrial air separation

processes to produce nitrogen are

routine; water electrolysis was per-

formed on an industrial basis before

steam methane reforming became a

cheaper source of hydrogen.

Fritz Haber won his Nobel Prize

“for the synthesis of ammonia from

its elements” in 1918, and today the

Haber-Bosch process accounts for

180 million tons of ammonia pro-

duction each year. The infrastructure

required to store and transport it

safely is already widespread and

would make the transition to using

renewable energy sources simpler,

quicker and cheaper than previously

predicted. Green ammonia has the

opportunity to play a vital part in a

future, low-carbon energy system.

Understandably, the pandemic has

meant we are not dealing with “busi-

ness as usual” and it’s right that the

government’s time is dedicated to

this unprecedented issue, especially

as it doesn’t look like it’ll be going

away anytime soon. However, the

need for a climate strategy that is

able to avert the risks of irrevocable

climate change aren’t changing and

cannot be pushed to the side. The so-

lution has already been found; it just

needs to be invested in.

Steve Scrimshaw is Vice President,

Siemens Energy UK&I.

Green ammonia

offers the prospect

of reducing carbon

emissions, not just

in electrical power

generation but also

other sectors such

as transport and

industry.

Steve Scrimshaw

Green ammonia: the answer to

a carbon free future?

Scrimshaw: the technology

required to begin to

implement and use green

ammonia already exists

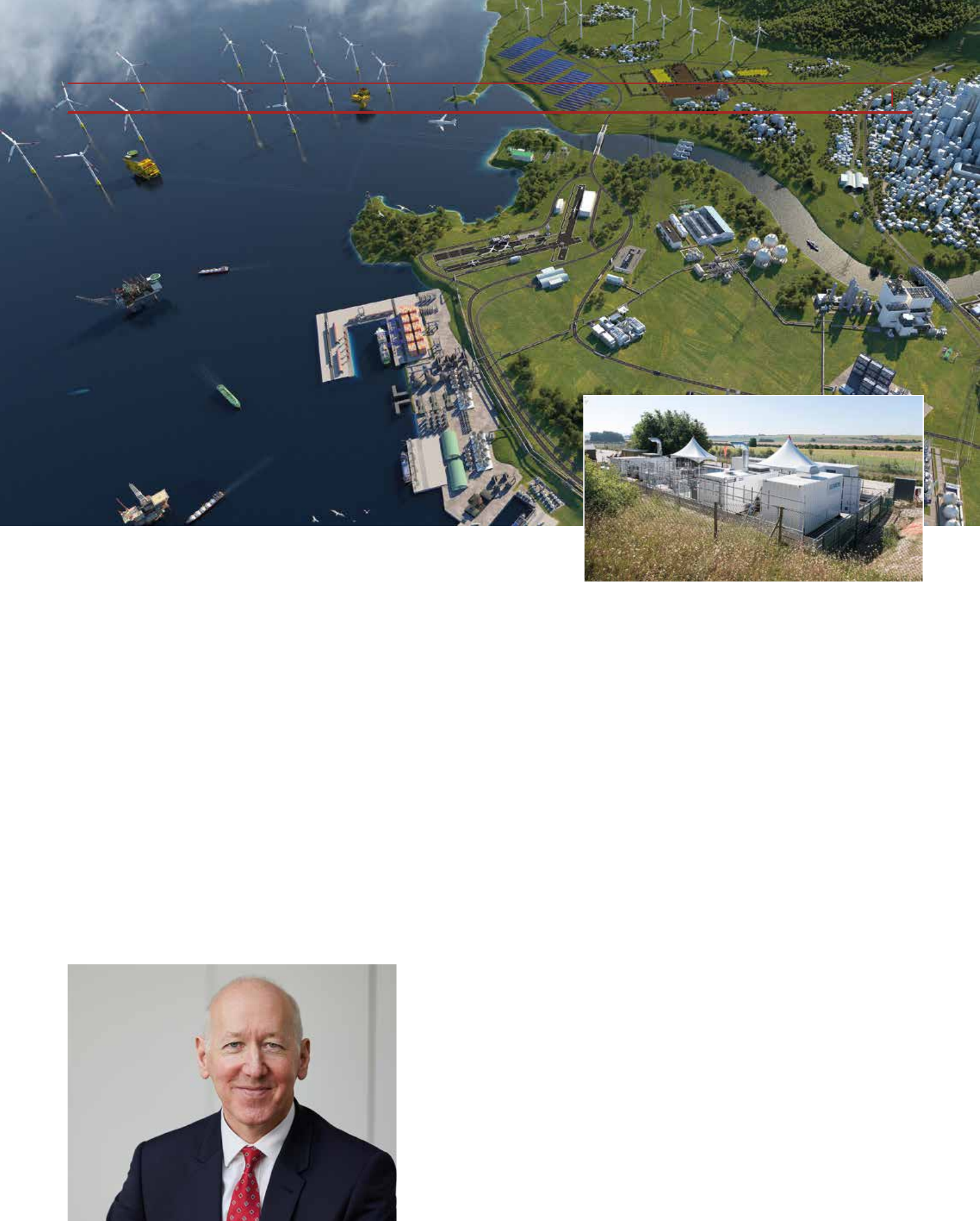

Power-to-X city: synthesising

a carbon-free fuel using

renewable energy. © Siemens

Energy

Siemens Energy Green Ammonia demonstrator plant at the

Rutherford Appleton Laboratory, Oxfordshire, UK. Image courtesy

of the Science Technology Facilities Council

She added: “We account for factors

such as capacity retirements. We also

look at generation and consumption

patterns and broader factors, such as

GDP growth, that impact consump-

tion of energy over time, and of

course digital penetration. We look at

customer trends, behaviours and pain

points that can be addressed through

digital solutions.”

Rolling out digital solutions requires

an understanding of the utility’s needs

and emerging trends. For GE Digital,

this starts with the deep relationship it

has with the customer, as well as hav-

ing the expertise that comes with be-

ing a sister company to GE Power.

“Because we work with customers

as both an OEM and digital provider,

we understand the issues around reli-

ability, availability of equipment,

O&M costs, worker safety, mobility,

etc. These are all factors in which we

are deeply entrenched with our cus-

tomers,” said Rae.

“We help them understand what the

right scope and approach is for them.

In some instances, it’s a very small

pilot to get them started. In other

cases, some are able to take on a

whole plant or critical assets. We have

a team of experts that works with the

customer through the entire imple-

mentation process.

“We congure a software and ser-

vices portfolio that enables the digiti-

sation of those assets and the plant

operations to optimise the utilisation

and minimise risk.”

Through its long-term R&D invest-

ments and long history in the power

industry, GE Digital has developed a

broad library of digital twins and

equipment blueprints covering about

50 per cent of failure modes and

equipment sites today, and continues

to add to those libraries. “Our strategy

is to maximise the ROI for the cus-

tomer by leveraging the deep exper-

tise that we have,” said Rae.

Digitalisation is certainly proving

its worth in the current pandemic,

which has brought home the impor-

tance of remote operations.

Rae said: “Most of the customers

I’ve talked to during the pandemic

have been operating with skeletal

staff… the indispensability of digital

solutions to ensure business continu-

ity while working with a skeletal and

largely remote staff has been eye-

opening to our customer base and to

us.”

She says there has been a sharp up-

tick in demand for GE Digital’s Re-

mote Operations digital solution,

which allows plant operators to access

the plant and x issues in a remote

and secure manner.

But implementing digital solutions

does not come without its challenges.

According to Rae the biggest of these

is the change management that utili-

ties have to go through as they adapt

their business processes to take ad-

vantage of the digital solutions that

N

avigating the changing energy

landscape is no easy task. In a

world where access to electric-

ity is still not a given for more than a

billion of the world’s population, end-

ing ongoing energy poverty is still a

challenge. Renewables and distribut-

ed energy sources have a role to play

here. Renewables are also key to mak-

ing the all-important transition to a low

carbon economy.

The transition and the inexorable

rise of renewables, however, has seen

utilities and energy companies having

to develop new business models and

draw on new tools to ensure they

continue operating efciently while

delivering reliable, affordable and

cleaner electricity to consumers.

As a major technology partner to

energy companies around the world,

GE Digital sees digitalisation as an

integral part of making that shift.

Linda Rae is General Manager for

the Power Generation and Oil and

Gas businesses for GE Digital. Hav-

ing taken up the position in January

this year she is responsible for run-

ning a segment of the GE Digital

business that is seeing an increasing

reliance on digital solutions to meet

the demands of the industry.

She identied availability of elec-

tricity across the globe, integrating

renewables, and meeting global cli-

mate change targets as the top three

issues driving today’s power genera-

tion sector and outlined the impor-

tance of technology in addressing

those drivers.

Rae noted: “Many corporations

have committed to achieving net zero

emissions by 2050 or earlier. Trillions

of dollars have owed into low car-

bon technology since 2010. Solar and

wind are now quite competitive in

most markets but with the majority of

the world’s power still coming from

fossil fuels, getting to zero emissions

in 30 years is a tremendous challenge.

“It will require tremendous innova-

tion in renewables and in smart grids,

and we believe that digital will play

an important role in that trend.”

Digitalisation is taking place across

the entire power sector value chain –

from generation, through transmis-

sion and distribution, to consumption.

Highlighting some of the key areas,

Rae said: “On the generation side, we

have been working with customers to

help them stay protable in a com-

petitive environment. Many are em-

bracing digitalisation to drive opera-

tional excellence. Operation and

maintenance (O&M) cost reduction

continues to be a major imperative for

our generation customers, and soft-

ware-driven reliability and mainte-

nance is a principle means of driving

O&M costs down. This is not just for

critical assets but also for the balance-

of-plant; so it’s really enterprise-wide

leverage of digital tools and predic-

tive analytics to drive O&M costs

down.

“They’re also looking at opportuni-

ties for business process automation.

This all helps to avoid unforeseen

outages and enable smarter choices

about how to maintain and operate

their assets.”

The New York Power Authority

(NYPA) is America’s largest state

power organisation, with 16 generat-

ing facilities and more than 1400 cir-

cuit-miles of transmission lines. GE

Digital has partnered with NYPA to

enable an innovative energy infra-

structure to forecast and prevent

equipment failures and signicant

outages with its predictive analytics

software. Online remote monitoring

of power plants, substations and

power lines is increasing plant ef-

ciency and productivity, reducing

unplanned downtime, lowering

maintenance costs and minimising

operational risks.

Rae says capacity forecasting and

planning is another way in which

digitalisation is helping utilities.

“Today’s energy market is pretty

complicated; daily decisions have to

be made by generators about what

they will produce and during which

period of time. Digitalisation helps

them understand how they will deal

with trading surpluses and pricing

maximisation over time.”

And at the cutting-edge, GE Digital

says it is seeing greater digitalisation

in areas such as control technologies,

drones and augmented reality for re-

mote maintenance and operation.

This is something that has certainly

been seen more since the Covid-19

pandemic. “Digitalisation is a way for

them to maintain operations with re-

duced stafng in their facilities,” said

Rae.

In transmission and distribution,

most digitalisation efforts have been

in making grids smart to allow more

efcient transmission of electricity,

smart communications between utili-

ties and consumers, as well as in the

integration of renewables.

Rae said: “Digitalisation enables

smarter decisions about when renew-

ables are utilised versus more tradi-

tional sources of energy, as well as

how that energy is passed through the

grid to optimise supply and demand.

And on the consumption side, digital

capabilities help to ensure energy ef-

ciency at the end-point as well as

enabling a potential reduction in peak

load demand.”

With such benets, it’s clear why

digitalisation is big business and

continues to grow. According to 2020

research carried out by Harbor Re-

search, the total Industrial Analytics

Software & Services market (includ-

ing manufacturing & resources seg-

ments) will grow to more than $80

billion by 2025 at a 24 per cent

CAGR. “We expect Power Genera-

tion Software and services to grow to

$6.7 billion by 2025 at about 17 per

cent CAGR,” Rae said.

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2020

Executive Interview

14

Energy companies face a number of challenges as they continue to reinvent themselves in response to the changing

energy landscape. Linda Rae, General Manager for the Power Generation and Oil & Gas businesses for GE Digital,

says digitalisation is the key. Junior Isles

Digital transitions

Digital transitions

they have adopted.

“There are years of entrenched

manual practices and ultimately we

are trying to automate those practices

and ways of doing business. This re-

quires a proactive approach to change

management and helping employees

get through that transition.”

As examples she cited: the chal-

lenges around gathering and under-

standing of data; making decisions

around capital allocation; and deci-

sions around risk versus cost.

“There are cultural challenges as

well as multi-generational challenges.

Many facilities have an older work-

force that aren’t as comfortable with

leveraging digital tools to make deci-

sions, juxtaposed with an inux of

millennials who are naturally tuned to

using digital. This can add to the cul-

tural challenge that customers are

facing.

“Also, the general shift from reac-

tive methods to condition-based

monitoring and maintenance can take

time for users to adapt to.”

Apart from the technology concerns

– the main one probably being cyber

security – Rae adds that a common

concern she hears, is “time to value”.

“It’s a fairly intense investment in

terms of resources and time and

money to undergo a digital transfor-

mation. So the question is always:

‘how do I know I will get the value to

justify this big investment?’ We help

customers understand how they can

shorten their time to value.”

The nal concern, she says, relates

to data – its availability, cleanliness

and the ongoing data maintenance

requirements. She assured, however:

“We work with them to help them

address all of these things.

“And of course we have a customer

success organisation that works with

customers throughout their subscrip-

tion to make sure they have ongoing

support and access to further expertise

and training if they need it. Our com-

mitment is to ensure customers get

the value they signed up for.”

Looking ahead, digitalisation will

no doubt grow as current trends con-

tinue to play-out, although a great

deal of policy and government inter-

vention work has to happen for sus-

tained progress.

Rae concluded: “The inux of re-

newables will continue to grow over

the next 10 years to the point that we

will see a fundamentally different

business model around producer and

consumer – the ‘prosumer’ – that will

dramatically change the whole energy

marketplace. The impact of decar-

bonisation will radically change the

sources of energy as well as the opti-

misation of capacity and efciency.

There will also be faster growth in

microgrids, more utilisation of data

over time, integration of data through-

out the entire value stream and ulti-

mately we will see a much more digi-

tally mature energy sector.”

Rae: Many corporations

have committed to achieving

net zero emissions by 2050

or earlier… It will require

tremendous innovation in

renewables and in smart grids,

and we believe that digital will

play an important role

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2020

16

Final Word

W

e always tell our children:

“Never give up on your

dreams.” After all, human-

kind would not progress without the

stuff of dreams and the pioneers with

the unwavering determination to

chase them. But the art of balancing

pragmatism versus aspiration is a

tricky one.

Five years ago in an interview with

The Guardian newspaper Steven

Cowley, who was then leading the

UK’s participation in ITER (the Inter-

national Thermonuclear Experimental

Reactor) said the experimental fusion

reactor being built in Cadarache,

France, is “going to show that man can

make a star”.

As ambitions go, they don’t come

much bigger. Yet this incredible dream

took a big step towards reality with the

ofcial start of assembly of what has

been called “the world’s largest sci-

ence project”.

ITER (pronounced “eater”) – Latin

for “the way” – is an international

project with components coming from

35 partner countries. It will be the

world’s largest nuclear fusion device,

designed to show that fusion can

generate power sustainably, and

safely, on a commercial scale. Cru-

cially, it is intended to be the rst fusion

reactor to produce more power than it

consumes. ITER is meant to produce

about 500 MW of thermal power but

as an experimental project, it is not

designed to produce electricity.

John Smith, Director of magnetic

technology at General Atomics says it

will try “to run a fusion experiment for

several hundred seconds, which has

never been done at the power levels

talked about”. He added: “And then

most importantly, they’re going to

show what they call the ‘fusion gain’.

That’s where the power that it takes to

create the fusion reaction, they’ll actu-

ally get 10 times more power out of

the reaction than what they put in.”

Nuclear fusion has long been the holy

grail of energy production – almost

limitless power without any carbon

emissions and very little radioactive

waste. Yet, as with all holy grails, it

always seems to be just out of reach

– fusion has long been dubbed as a

technology that is “always 30 years

away”.

Fusion happens in our sun and every

star, where, under immense tempera-

ture and pressure the nuclei of hydro-

gen atoms, which are protons, fuse to

form a nucleus of helium, releasing

energy. But, due to the repulsive

forces between the protons, it is a

process that takes millions of years

before a star can be born.

To replicate the process on Earth,

scientists therefore usually use two

hydrogen isotopes instead – deuterium

and tritium – that contain one and two

extra neutrons in their nuclei, respec-

tively. Deuterium is abundant in sea-

water and tritium can be made by the

fusion reactor itself. By heating the

deuterium-tritium mixture to well

over 100°C million inside a ring-

shaped vessel, the two elements fuse

to form helium, energy and fast-

moving neutrons. The neutrons will be

absorbed by shielding around the reac-

tor vessel that contains lithium, and

the interaction will create more tritium.

There is a virtually limitless source

of fuel in the world’s oceans to feed

future nuclear fusion reactors. Accord-

ing to the project’s partners, “a pine-

apple-sized amount of fuel is the

equivalent of 10 000 tons of coal”. And

though the process produces some

radioactive waste products, they all

have short half-lives and will become

inert within a few hundred years, as

opposed to the thousands of years for

the radioactive waste from today’s

ssion reactors.

In a statement, the partners said:

“Fusion is safe, with minute amounts

of fuel and no physical possibility of

a run-away accident with meltdown”

as with traditional nuclear power

stations.

At ITER a doughnut-shaped cham-

ber called a Tokamak will heat the

hydrogen mixture until it becomes a

cloud-like ionized plasma, which is

then shaped and controlled by super-

conducting magnets. These magnets

create an overlapping set of elds that

keep the electrically charged gas in-

side from touching the sides of the

Tokamak and thereby losing energy.

Fusion occurs when the plasma

reaches in the region of 150°C million

– 10 times hotter than the sun’s core.

The size and complexity of the facil-

ity is staggering. The main fusion reac-

tor will be built on a attened area of

concrete that would cover 60 football

pitches. The Tokamak vessel will

comprise about a million components,

with some, like the superconducting

magnets, standing as high as a four-

storey building and weighing 360 tons

each. When the main building contain-

ing the reactor is complete, it will be

60 m tall and extend 10 m below the

ground.

As the components arrive from the

project’s partners all over the world,

the task of putting together what is

described as the world’s largest puzzle

begins. Some 2300 people are at work

on site to put the machine together.

ITER’s Director-General Bernard

Bigot, said: “Constructing the machine

piece by piece will be like assembling

a three-dimensional puzzle on an in-

tricate timeline. Every aspect of

project management, systems engi-

neering, risk management and logistics

of the machine assembly must perform

together with the precision of a Swiss

watch. We have a complicated script

to follow over the next few years.”

ITER’s initial demonstration of its

functionality, called “rst plasma” is

scheduled for December 2025 and

could reach full power by 2035.

Whether that timeline will be met is

anyone’s guess. The project is already

running ve years behind schedule and

has seen its initial budget triple to some

€20 billion ($23.4 billion).

Yet I have every condence that

scientists will get there eventually; the

desire is too great. As Smith noted:

“Maybe 15 years ago, I might have

had my doubts about coordinating

such a complex effort. Now that I’ve

seen it being brought together and then

working intimately with the world-

wide group, I have no doubt that it will

come together.”

Nonetheless, ability and determina-

tion is not the problem here. Com-

menting on the potential impact, Smith

added: “It changes, I think, the whole

world’s energy economics entirely if

fusion goes forward.”

‘If’ is a big word. And fusion will not

get the chance to change the world’s

energy economics. Long before we get

there, it’s more likely energy econom-

ics will change the prospects for fu-

sion.

ITER will continue and most likely

eventually succeed; and no doubt the

various national plans to build com-

mercial reactors will build on its suc-

cess. At the same time dozens of private

companies will carry on pushing for-

ward and raising funds to develop

fusion reactors based on different ap-

proaches to ITER. This work is

mostly due to a genuine belief that

fusion will play a part in the future

energy mix but I suspect that some

national projects may be more about

earning bragging rights.

The challenge will be economics and

urgency. Some argue that with the

climate crisis, fusion has to happen.

The technology, however, will not be

commercial before the crisis is upon

us. And further, where is the incentive

when there are available technologies

and strategies that can do the job at a

fraction of the cost?

Five years ago, Cowley said: “There

are probably, over history, a handful

of historic moments where in a ash

the future changed. In a ash the future

will change with this machine…”

This is certainly true. I fear, how-

ever, that Cowley may not be around

long enough to see it happen. Man may

indeed be capable of making a star but

if the cost of wind and solar keep

falling, this “sun in a box” may never

see the light of day.

Still star gazing

Junior Isles

Cartoon: jemsoar.com