www.teitimes.com

March 2020 • Volume 13 • No 1 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Driving cars of the

future

Headwinds onshore

Utilities are key to the future of

electric vehicles.

Page 13

Unlike offshore wind power, the

conditions onshore have been blustery.

Page 14

News In Brief

Wind continues to pick up

across globe

Wind energy continues to grow

worldwide and could become the

dominant energy source for power

generation by 2050, according to

new gures.

Page 2

PPA record drives US wind

energy

Record numbers of corporate and

utility power purchase agreements

(PPAs) helped to drive the US wind

energy sector to its third strongest

year on record.

Page 4

UOB activates Asia’s rst

solar industry ecosystem

U-Solar, Asia’s rst solar industry

ecosystem, has been launched by

United Overseas Bank (Thai) in

Thailand to power the development

and adoption of renewable energy

across the country.

Page 6

Germany oats hydrogen

strategy

Germany could build up to 5 GW

of hydrogen electrolysis capacity by

2030 under draft plans to develop a

green hydrogen industry.

Page 7

Renewables spike in

sub-Saharan Africa

Sub-Saharan African countries are

seeing increasing capital ows into

renewable energy, according to

analysis from research company

BloombergNEF (BNEF).

Page 8

Vestas leads rankings after

record 2019

Vestas has held its position as the

world’s largest wind turbine supplier

following a record order intake for

2019.

Page 9

Technology Focus:

Trading places

With the help of a new energy

management and trading platform,

energy managers can now trade

based on evidence and statistical

analysis via AI-driven technology,

with no need to rely on just the

opinion of a broker.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

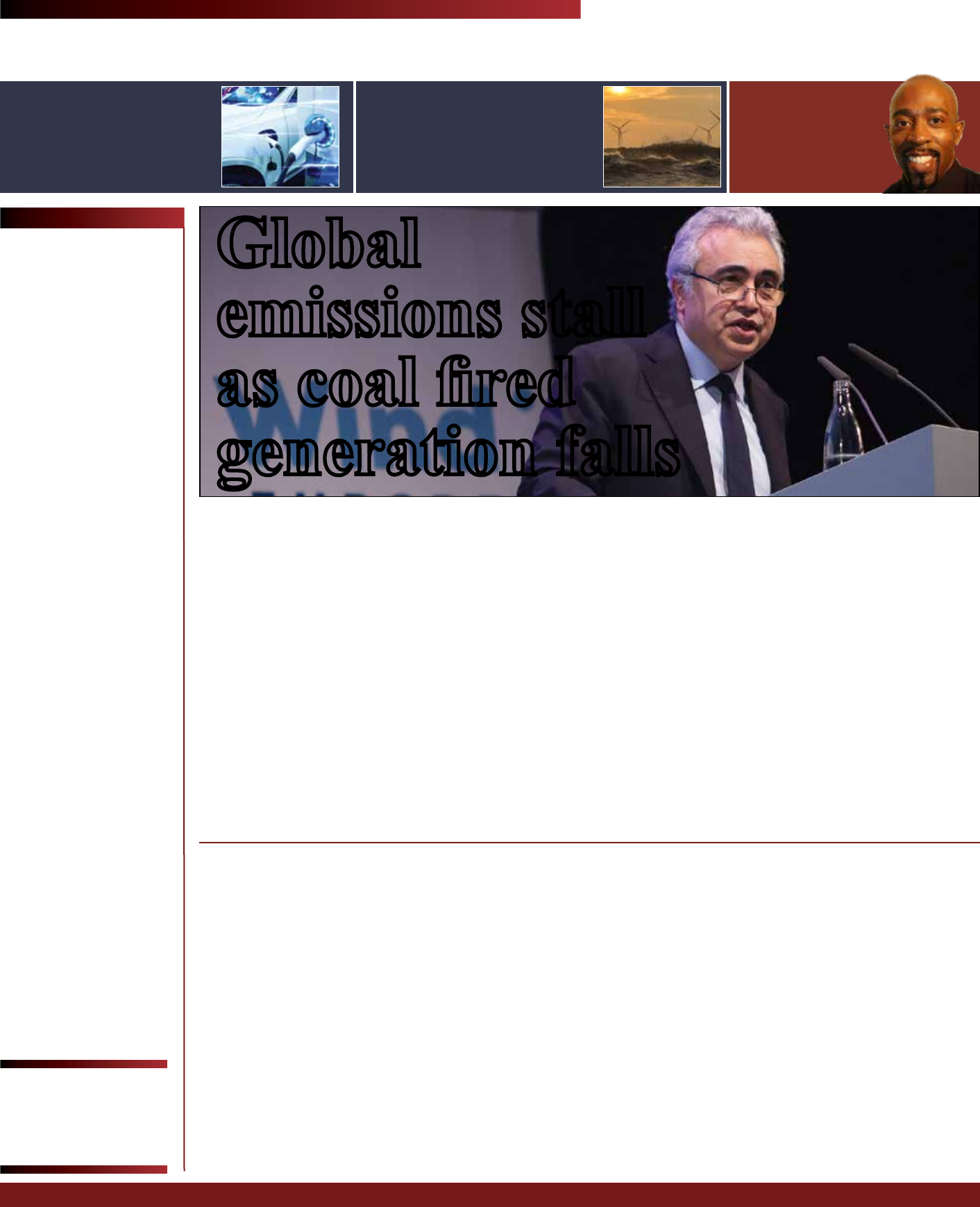

The ght against global warming may have reached a signicant moment as growth in global

carbon dioxide emissions stalled for the rst time in two years. Junior Isles reports.

EU countries accelerate coal phase-out

THE ENERGY INDUSTRY

TIMES

Final Word

Junior Isles asks: is the

world really atlining?

Page 16

Global carbon dioxide output may

have peaked following two years of

growth, after CO

2

emissions were un-

changed at 33 gigatonnes in 2019, ac-

cording to the International Energy

Agency.

IEA gures showed that energy-re-

lated CO

2

output rose in both 2017

and 2018 and earlier studies had sug-

gested this trend was set to continue,

casting doubt on efforts to drastically

cut emissions to mitigate climate

change.

The IEA says the fall was primarily

due to declining emissions from

electricity generation in advanced

economies, thanks to the expanding

role of renewable sources (mainly

wind and solar), fuel switching from

coal to natural gas, higher nuclear

power generation and weaker elec-

tricity demand.

This resulted in power generation

from coal plants falling by almost 15

per cent last year. Other factors in-

cluded milder weather in several

countries and slower economic

growth in some emerging markets,

according to the IEA report.

Commenting on the ndings, Dr

Fatih Birol, the IEA’s Executive Di-

rector, said: “The clean energy transi-

tion is starting to accelerate very

strongly. This makes me hopeful we

are seeing a peak in emissions and

they will now start to decline.”

Across advanced economies, emis-

sions from the power sector declined

to levels last seen in the late 1980s,

when electricity demand was one-

third lower than today, said the IEA.

“A signicant decrease in emissions

in advanced economies in 2019 offset

continued growth elsewhere. The

United States recorded the largest

emissions decline on a country basis,

with a fall of 140 million tonnes, or

2.9 per cent. US emissions are now

down by almost 1 gigatonne from

their peak in 2000.

“Emissions in the European Union

fell by 160 million tonnes, or 5 per

cent, in 2019 driven by reductions in

the power sector. Natural gas pro-

duced more electricity than coal for

the rst time ever, meanwhile wind-

powered electricity nearly caught up

with coal red electricity. Japan’s

emissions fell by 45 million tonnes,

or around 4 per cent, the fastest pace

of decline since 2009, as output from

recently restarted nuclear reactors

increased.

“Emissions in the rest of the world

grew by close to 400 million tonnes in

2019, with almost 80 per cent of the

increase coming from countries in

Asia where coal red power genera-

tion continued to rise,” states the

report.

Dr Birol, commented: “This wel-

come halt in emissions growth is

grounds for optimism that we can

tackle the climate challenge this de-

cade. It is evidence that clean energy

transitions are underway – and it’s

also a signal that we have the oppor-

tunity to meaningfully move the

needle on emissions through more

ambitious policies and investments.”

To support these objectives, the IEA

will publish a ‘World Energy Outlook

Special Report’ in June that will map

out how to cut global energy-related

carbon emissions by one-third by

2030 and put the world on track for

longer-term climate goals.

Continued on Page 2

Several of the EU’s major economies

have announced plans to accelerate

the phase-out of coal red power

generation.

Last month British Prime Minister

Boris Johnson said Britain is set to

bring forward by a year its deadline

for phasing out coal. The govern-

ment’s goal is to bring coal’s share to

zero, by closing the last coal red

plant in the country by October 1,

2024. The previous deadline for that

was 2025, announced in 2015.

The move was announced during

the Year of Climate Action launch

event ahead of the COP26 Climate

Summit in Glasgow in light of statis-

tics showing that Britain’s reliance

on coal red power generation has

dropped from 70 per cent in 1990

to around 40 per cent in 2012 and

to less than 3 per cent in 2019. The

contribution of renewables, mean-

while, is now “at record levels”

standing at 33 per cent.

The news came as the UK Govern-

ment’s Ofce of Gas and Electricity

Markets (Ofgem) set out its plan to

bring the country’s emissions to net

zero. The Decarbonisation Action

Plan details nine steps the agency will

take to achieve the UK’s target of net

zero emissions by 2050.

The plan to bring forward the target

date for phasing out unabated coal

will be subject to a public consulta-

tion. It will be undertaken as part of

the country’s efforts to decarbonise its

power sector as it aims to achieve a

net-zero emissions level by 2050.

According to the latest government

statistics, the UK’s greenhouse gas

emissions have declined by 2.1 per

cent between 2017 and 2018 mainly

thanks to the wave of coal plant clo-

sures. Last year, Great Britain, which

now has four active coal generators,

ran for 3700 hours, or more than ve

months in total, without using coal.

“This phenomenon of global warm-

ing is taking its toll on the most vul-

nerable populations around the plan-

et,” Johnson said. “That’s why we are

pledged here in the UK to deliver net

zero by 2050. We are the rst major

economy to make that commitment,

and it’s the right thing to do.”

Spain also recently said it was

speeding up plans to phase-out coal.

At the start of February the country

said that only three out of 15 coal red

plants in the country will remain op-

erational by 2022. Coal’s share of

power production has been reduced

from 15 per cent to 5 per cent in less

than a year, and it will be completely

replaced before 2030.

In January German Chancellor An-

gela Merkel and ministers from the

coal-mining states of Saxony-Anhalt,

Saxony, North Rhine-Westphalia and

Brandenburg agreed a shutdown plan

for the country’s coal plants. Plants

would be closed by 2035, instead of

2038 as previously planned.

At the start of February Uniper pre-

sented its closure programme for its

hard coal red power plants in Ger-

many. The company intends to close

about 1.5 GW of hard coal capacity

by year-end 2022, corresponding to

three generating units at the Schol-

ven power plant in Gelsenkirchen

and the Wilhelmshaven power plant.

In addition, Uniper plans to shut

down another 1.4 GW at Staudinger

and Heyden power plants by 2025 at

the latest.

Global

emissions stall

as coal red

generation falls

Dr Birol: “grounds for optimism”

THE ENERGY INDUSTRY TIMES - MARCH 2020

3

Business Models

ENERGY RE-IMAGINED

The world’s most exciting futureenergy event

30 June - 1 July | London ExCeL

terrapinn.com/spark/EnergyIndust-Times

Distribution Disrupted

Digital Innovation Renewables &Storage

Electric Vehicles

Smart Meters

Markets Unblocked Energy Management Hydrogen

A UNIQUE EVENT AT A CRITICAL TIME

www.landisgyr.eu

In these � mes of increasing dynamics in the distribu� on system, Landis+Gyr’s

Advanced Grid Analy� cs are designed to help u� li� es op� mize their asset

management, secure grid opera� on and achieve opera� onal excellence.

DISCOVER GRID EDGE INTELLIGENCE

THE ENERGY INDUSTRY TIMES - MARCH 2020

4

Americas News

Siân Crampsie

The US government has announced

funding to develop coal red power

plants with the exibility needed to

support future grids.

The Department of Energy (DOE)

will award up to $64 million of cost-

shared funding to projects aimed at

developing next-generation coal tech-

nologies that are “transformational”

in their efciency and exibility.

The DOE expects to spread the award

across some 14 projects as part of its

Coal FIRST (Flexible, Innovative,

Resilient, Small, Transformative)

initiative.

“Coal is a critical resource for grid

stability that will be used in developing

countries around the world well into

the future as they build their econo-

mies,” said US Secretary of Energy

Dan Brouillette. “Investing in R&D

for cleaner coal technologies will al-

low us to develop the next generation

of coal plants for countries to use this

valuable natural resource in an envi-

ronmentally responsible manner.”

“The evolving US energy mix re-

quires cleaner, more reliable, and

highly efcient plants,” noted Assis-

tant Secretary for Fossil Energy Ste-

ven Winberg. “Technologies devel-

oped for the Coal FIRST initiative will

lead to just that – reliable, highly ef-

cient plants with zero or near-zero

emissions.”

The National Energy Technology

Laboratory (NETL) will manage the

projects supporting Coal FIRST,

which is a joint initiative among the

Ofce of Fossil Energy’s Transforma-

tive Power Generation, Supercritical

Carbon Dioxide Technology, Ad-

vanced Turbines, Gasication Sys-

tems, and Carbon Capture research

programmes.

Last month the DOE also announced

$64 million of funding to nance re-

search and development (R&D) proj-

ects that will further expand the coun-

try’s hydrogen (H

2

) market.

The funding will be extended by the

DOE with the goal to open new markets

for the so-called H2@Scale initiative

– a concept that explores the potential

for wide-scale hydrogen deployment

in various applications. It is also ex-

pected to lift the scale of hydrogen

production from the current 10 million

tonnes per year.

Up to $15 million of the total fund-

ing will go for projects aiming to cut

the cost of H

2

from MW- and GW-

scale electrolysers, while an addi-

tional $15 million will target cost re-

ductions of compressed gas and

hydrogen storage tanks by advancing

carbon-bre technology.

Some $10 million will be channelled

for advancing the development of do-

mestically manufactured fuel cell

components and up to $8 million are

earmarked for R&D on the use of hy-

drogen in steel manufacturing.

Chilean power utility has boosted the

output of its proposed Horizonte wind

farm from 607 MW to 980 MW.

The utility has submitted the envi-

ronmental impact study for the

planned project in the Atacama desert

commune of Taltal in the Antofagasta

region. According to the ling with

the Chilean environmental evaluation

service (SEA), the company antici-

pates investments of up to $700 mil-

lion will be required for the project.

The Horizonte project will feature

140 wind turbines with up to 7 MW

capacity, installed across an 8000 ha

site.

A recent report by Banco Security

said that Colbun has “solid margins”

that would enable it to invest more

heavily in renewable energy.

Banco Security added that overall in

Chile, the electricity sector enjoyed a

healthy nancial performance in 2019

despite the riots and protests that en-

gulfed Chile during the fourth quarter.

However some new legislation

drawn up in response to the riots – in-

cluding a price stabilisation mecha-

nism and a distribution law that re-

duces the protability of power

distributors – would affect the sector

in 2020.

Other negatives in the market in-

clude the coal retirement plan, which

will affect the largest utilities with

coal-red capacity, and a continued

drop in hydro generation due to the

drought.

n Xinjiang Goldwind Science & Tech-

nology has connected the Loma Blan-

ca II wind farm – its rst wholly-

owned project in South America – to

the Argentine grid. Loma Blanca II is

part of the 250 MW four-project Loma

Blanca wind complex in Chubut prov-

ince, Patagonia. The Chinese wind

turbine company acquired the Loma

Blanca portfolio along with the 97.65

MW Miramar wind project in Buenos

Aires province.

US policy on solar energy equipment

imports has cost the country around

10.5 GW of new capacity, according

to the Solar Energy Industries Asso-

ciation (SEIA).

A market impact analysis carried out

by the SEIA says that tariffs imposed

on imported solar cells and modules

have “devastated” the sector with the

loss of more than 62 000 jobs and $19

billion of investment since 2017.

In addition to its economic impact,

tariffs on solar have caused 10.5 GW

of solar installations to be cancelled,

SEIA said in a statement.

The analysis comes as the mid-term

review process for the tariffs begins at

the US International Trade Commis-

sion on December 5th, and covers

tariff impacts from the beginning of

the 2017 trade complaint by Suniva

through the end of the tariff lifecycle

in 2021.

“Solar was the rst industry to be hit

with this administration’s tariff policy,

and now we’re feeling the impacts that

we warned against two years ago,” said

Abigail Ross Hopper, President and

CEO of the Solar Energy Industries

Association. “This stark data should

be the predicate for removing harmful

tariffs and allowing solar to fairly com-

pete and continue creating jobs for

Americans.”

The US administration imposed Sec-

tion 201 tariffs on solar goods in early

2018, with a 30 per cent tariff on solar

cells and modules.

The policy has helped solar compa-

nies with manufacturing facilities in

the USA such as Suniva, which

brought the original complaint to the

International Trade Commission.

According to SEIA’s analysis, each

new job created by the tariff results in

31 additional jobs lost, 5.3 MW of

solar deployment lost and nearly $9.5

million of lost investment.

According to the report, uncertainty

caused the market to lose out on 3 GW

of installations as rumours and actual

tariffs disrupted contracts in 2017 and

2018. The actual tariffs then reduced

the market for new projects by 7.5 GW

from 2019 - 2021.

The reduced solar deployment g-

ures will also impact the USA’s emis-

sions, it added, because higher prices

for solar energy push economics in

favour of substitutes, including gas-

red power plants.

Tariffs on solar are most harshly af-

fecting nascent solar markets includ-

ing Alabama, Nebraska, Kansas, and

the Dakotas. These markets “won’t be

able to get off the ground” because

tariffs make solar uncompetitive, SEIA

said in a statement.

The Section 201 solar tariffs began

at 30 per cent in 2018, and ramped

down to 25 per cent in 2019, 20 per

cent in 2020 and 15 per cent in 2021.

US funding backs coal, H

2

Colbun wind farm

swells

US loses

out in solar

tariff war

Brazil eyes offshore prize

Renewable energy developers are

showing signs of interest in Brazil’s

offshore wind sector.

BI Energia, a Brazilian-Italian joint

venture, has plans to invest BRL5 bil-

lion ($1.2 billion) in the offshore wind

sector of Brazil’s Rio Grande do Norte

state, according to a statement by the

local government

The state has an offshore wind en-

ergy potential of 200 GW, according

to the state government, which is

developing a wind atlas to help attract

investors.

BI Energia is also developing a 600

MW offshore wind farm off the coast

of neighbouring Ceara state and has

announced plans to hold a public

hearing on the proposed project later

this month [March].

The Caucaia offshore wind farm

will have 48 offshore wind turbines

and 11 near-shore turbines located

south of Fortaleza. It will be Brazil’s

rst offshore wind farm, with turbine

installation planned to start in late

2021, the company says.

A recent study by Brazil’s state-

owned energy research rm EPE said

that the country has a total offshore

wind energy potential of 700 GW in

water depths of up to 50 m.

However it indicated that a lot of

changes will need to be made for the

country to reach its offshore wind

potential, including the adaptation of

environmental licensing procedures

and establishing supply chains.

n Next-generation focus for coal n $64m for H

2

research

THE ENERGY INDUSTRY TIMES - MARCH 2020

5

world-nuclear-exhibition.com

An event

Organised by

WORLD NUCLEAR EXHIBITION / PARIS NORD VILLEPINTE - FRANCE

THE LEADING MARKETPLACE

DEDICATED TO THE GLOBAL

CIVIL NUCLEAR COMMUNITY

4

th

edition

Find out more at: enlit-asia.com

Find out more at: enlit-asia.com

Brought to you by

ICE, BSD City,

Jakarta, Indonesia

Combining Asia’s leading energy events

ATTENDEES

12,000+

SPEAKERS

250+

EXHIBITORS

380+

MATCHMAKING

BUSINESS

The inclusive guide to the energy transition.

Enlit is the new unifying brand for Asia’s premier events POWERGEN Asia and

Asian Utility Week, part of Clarion Energy’s worldwide series. It is the world’s

only complete energy event, designed to bring clarity to the global energy

transition and define the roles of all those involved in powering the next

generation of the industry.

Energy is evolving.

So are we. The possibilities are endless.

20

20

22 – 24 SEPT

subscribe today

The Energy Industry Times is the only publication that

covers global news related to the power and energy

sector in a newspaper style and format whose

uniqueness is recognised by our readers.

As a paid subsciber you will gain full access to our

online news desk.

You will also no longer have to wait for the

printed edition; receive it by PDF “hot off the press” or

download it online.

To subscribe, email subscriptions@teitimes.com or visit

www.teitimes.com

To guarantee receiving your monthly copy of the award

winning newspaper, you need to subscribe today

www.teitimes.com

THE ENERGY INDUSTRY

TIMES

The contracts are a key step in

TVO’s work to prepare the 1600

MW Olkiluoto 3 (OL3) for com-

mercial operation. They will cover

nuclear plant outage and mainte-

nance scopes, including engineer-

ing, instrumentation and control

(I&C) and non-destructive testing

services.

“Our presence in Finland will al-

low us to effectively deliver these

service contracts for the Olkiluoto 3

EPR and positions us to further sup-

port our utility partners in Finland

and Sweden,” said Catherine Cor-

nand, Senior Executive Vice Presi-

dent of Framatome’s Installed Base

Business Unit.

Valmet will supply a ue gas condens-

ing plant to Helen Ltd’s Vuosaari C

bioenergy heating plant in Helsinki,

Finland.

The new bioenergy heating plant

will achieve very high energy ef-

ciencies, as the heat from ue gases

will be recovered to increase district

heat production by 69 MW with

Valmet’s technology.

Valmet’s delivery will consist of a

ue gas condensing plant and con-

densate treatment equipment, in-

cluding a boiler make-up water pro-

duction system. The plant will be

handed over to Helen in December

2022.

Samsung C&T Corp., the construction

unit of Samsung Group, has secured a

Won1.15 trillion ($970 million) deal

to build a power plant in the United

Arab Emirates.

Under the deal with F3 Holding

Company B.V., Samsung C&T will

build a 2 400 MW combined cycle

power plant in Qidfa in the Emirate

of Fujairah by the end of April

2023.

Siemens has won an order from Be-

larus to supply six industrial gas tur-

bines to state-run energy provider

RUE Minskenergo.

It will supply six SGT-800 gas tur-

bines for a new gas red power

plant being developed in Minsk,

which will boost grid stability and

the reliability of power supplies in

Belarus.

The 300 MW plant will be de-

signed for 700 operating hours and

350 cold starts per year, Siemens

said. Commissioning is scheduled

for December 2021.

Siemens’ complete scope of sup-

ply includes the six SGT-800 gas

turbines as well as associated gener-

ators and the control system PCS 7.

It also includes the gas receiving

station as well as high- medium-,

and -low-voltage equipment.

GE has been selected to provide gen-

eration equipment and 20-year ser-

vices for Azito’s phase IV extension

combined cycle power plant in Côte

d’Ivoire.

Under the order, placed by Azito

Energie, GE will supply its GT13E2

gas turbine in combined cycle con-

guration, one heat recovery steam

generator, one steam turbine gener-

ator, condenser and associated sys-

tems and maintenance services for

20 years.

The extension will add 253 MW

to the gas red power plant, located

in Yopougon district of Abidjan in

Côte d’Ivoire.

installation of piping systems for the

construction of the new nuclear pow-

er plant in the South West of England.

The £58 million ($74.13 million)

contract will be completed by 2025

and demonstrates Blinger’s “out-

standing capabilities” on large-scale

new-build projects, the company

said. It will provide execution de-

sign, pre-fabrication and supply of

pipework for the balance of plant

package, which comprises piping

systems that support the operation

of the power station. The piping

systems consist partly of steel and

partly of glass-reinforced epoxy

(GRE) pipework.

Bilnger was already recognised

as a strategic supplier to EDF’s

Hinkley Point C project in 2018 and

has since received contracts worth

€20 million for design preparation

and planning work. In November

2019, EDF reafrmed its intention

to award the NSSS (Nuclear Steam

Supply System) contract to Biln-

ger. The award is expected later in

2020.

Danish wind turbine manufacturer

Vestas has secured a wind turbine sup-

ply contract from its Swedish cus-

tomer Stena Renewables.

According to the contract, Vestas

will supply its EnVentus V162-

5.6MW turbines for installation at

the Riskebo wind energy project in

Hedemora municipality, Sweden.

The 39 MW project will be the rst

in the country to use that turbine

type.

The contract includes supply, in-

stallation and commissioning of the

wind turbines and a 30-year service

agreement. Vestas is planning to de-

liver the turbines by the third quar-

ter of 2021, with commissioning

planned for the fourth quarter of

2021.

MHI Vestas Offshore Wind to supply

its WindStar transformers to the Triton

Knoll offshore wind farm, 33 km off

the east coast of England.

MHI Vestas will deliver 90 wind

turbines for the wind farm and

ABB’s WindSTAR transformers

will be installed in each turbine.

The transformers are designed to t

inside the wind turbine and can

withstand strong vibrations, sudden

movements and variable electrical

loading, typical of wind power.

The transformers also increase

voltage to 66 kV, the highest volt-

age category for wind transformers.

Marine energy rm Minesto has

signed a power purchase agreement

(PPA) with Faroese utility SEV for a

proposed tidal energy project in the

Faroe Islands.

The PPA comprises both the

planned installations of two 100 kW

systems of Minesto’s subsea kite

technology and an additional 2 MW

allocated for installations of utility-

scale tidal energy systems.

Minesto eventually hopes to in-

stall up to 70 MW of tidal energy

capacity in the Faroe Islands, which

has set a goal of sourcing 100 per

cent of its electricity needs from re-

newable energy by 2030.

Framatome has signed a series of ser-

vice contracts with Finnish utility

TVO to support the long-term opera-

tion of the Olkiluoto 3 nuclear power

plant.

Spanish civil engineering group

Obrascon Huarte Lain (OHL) has se-

cured two contracts worth €80 million

($86.4 million) to build 136 MW of

renewable energy projects in Chile.

The company was awarded the en-

gineering, procurement and con-

struction (EPC) contract by Austria-

based renewables investor Clean

Capital Energy Group (CCE) for an

86 MW solar photovoltaic (PV)

project in the region of Atacama.

Alongside the full EPC, the scope

of the €70 million Atacama deal in-

cludes operation and maintenance

(O&M) services, OHL said.

The second contract, worth €10

million, was awarded by Spanish

renewables developer OPD Energy

SA. The agreement covers the bal-

ance of plant (BOP) for the 50 MW

La Estrella wind project in Chile’s

O’Higgins region.

The Nordex Group has received an

order to supply the turbines for the

fourth construction phase of a wind

farm complex in Brazil.

The wind farm is located in the

state of Rio Grande do Norte near

to the city of São Miguel do Gosto-

so and is being developed in four

phases. Nordex will supply 24 of its

AW132/3465 wind turbines for the

fourth phase, bringing its overall

capacity to over 256 MW.

Nordex will install the 24 turbines

on 120 m concrete towers. The con-

tract also includes a long term ser-

vice agreement for maintenance and

repair of the turbines for a period of

15 years.

Candu Energy has been awarded two

ve-year vendor of record (VOR)

contracts by Canada’s Ontario Power

Generation (OPG).

The rst VOR contract is for ma-

chine shop services to support

OPG’s facilities while the second

contract covers nuclear safety anal-

ysis at Darlington, Pickering and

the Western Waste Management Fa-

cility adjacent to Bruce Power.

Under the contract for nuclear

safety analysis, SNC-Lavalin’s team

of nuclear safety experts, project

managers and reactor engineers will

deliver projects important to safety

for the workers, environment and

public.

The scope of work under the ma-

chine shop services contract will in-

clude machining, fabrication, heat

treatment, welding and assembly of

equipment for all OPG-owned sites.

Siemens Gamesa Renewable Energy

(SGRE) has won a 205 MW turbine

order for part of a 400 MW wind en-

ergy complex in Alberta, Canada.

Suncor Energy has placed an or-

der for 45 SG 4.5-145 turbines with

exible power rating for the Forty

Mile wind power project. SGRE

will also maintain the machines for

20 years following their commis-

sioning in 2021.

The entire capacity of the Forty

Mile wind farm will be switched on

in December 2022. It will comprise

a total of 89 turbines.

MHI Vestas Offshore Wind has been

selected as the preferred turbine sup-

plier for the 300 MW Zhong Neng

offshore wind farm in Taiwan.

The company says it is in the nal

stages of developing a local supply

chain for the project, which is being

developed by China Steel Corpora-

tion and Copenhagen Infrastructure

Partners (CIP). Local industrial

partners will be unveiled in the next

few weeks, it added.

The wind farm is due to go into

operation in 2024.

Vestas has won an order from an un-

named customer to deliver 52 MW of

wind turbines for a project in China.

Under the contract, the manufac-

turer will supply 12 units of its

V150-4.2 MW turbines in 4.3 MW

power optimised mode. It expects

to start delivering the turbines in the

last quarter of this year and com-

mission them in the same quarter.

Bangladeshi developer Jamuna Power

has awarded Wärtsilä a contract to sup-

ply a 78 MW power plant to support

the growth of an industrial complex in

northeast Bangladesh.

Wärtsilä will supply eight of its

34SG engines on a fast track basis

for installation at the Jamuna indus-

trial Park, which is in need of an in-

dependent power supply to ensure

reliability and support growth.

Delivery of the Wärtsilä equip-

ment will be completed during the

rst half of 2020, and the plant is

expected to become fully operation-

al in early 2021.

Bharat Heavy Electricals Limited

(BHEL) is inviting tenders for contrac-

tors to set up a 100 MW AC oating

solar project for the National Thermal

Power Corporation (NTPC) in Telan-

gana, India.

BHEL won a contract to develop

the $3.66 million plant in December

2018. It has already launched a ten-

der process for the design and sup-

ply of the project’s oatation plat-

form.

The scope of work includes the

assembly of oatation devices and

is expected to be completed within

six months of the contract award.

Raghuganga Hydropower Limited

(RGHPL), a unit of the Nepal Electric-

ity Authority (NEA), has placed an

order with BHEL for the electrome-

chanical works for the Rahughat hy-

dropower project in Nepal.

Under the order, BHEL will carry

out the design, engineering, manu-

facturing, supply, erection and com-

missioning of the complete electro-

mechanical package involving

supply of two Vertical Pelton Tur-

bines (20 MW each) along with as-

sociated equipment, matching gener-

ators, governors, controls and

instrumentation, protection system,

transformers, 220 KV switchyard

and balance of plant (BoP) packages.

Bilnger has won a contract from Hin-

kley Point C for the execution design,

supplier management, fabrication and

Americas

Asia-Pacic

OHL bags 136 MW Chile

contract

Nordex turbines for

83 MW Rio Grande do

Norte wind farm

MHI picked for Zhong

Neng

Bilnger wins Hinkley

contract

Stena orders Vestas units

ABB to deliver Triton

transformers

Minesto signs Faroe PPA

Samsung wins UAE plant

contract

Success for Siemens in

Belarus

GE equipment to power

Azito extension

Helen opts for Valmet

Wärtsilä boosts

Bangladesh growth

Success in China for Vestas

BHEL launches oating

solar tender

Raghuganga places BHEL

order

OPG awards VOR

contracts

Siemens bags 205 MW

Canadian order

International

International

Europe

10

THE ENERGY INDUSTRY TIMES - MARCH 2020

Tenders, Bids & Contracts

Framatome signs OL3

service contracts

THE ENERGY INDUSTRY TIMES - MARCH 2020

13

Industry Perspective

A

shift to electric vehicles (EVs)

has never been more viable

than it is right now. For start-

ers, consumers are opening up their

minds to more environmentally

friendly forms of transportation. This

could be largely due to advance-

ments in EV technology increasing

vehicle range and new models and

options making the price tag more

tenable to a wider range of buyers.

Currently, Tesla is selling around

40 000 Model 3s a month, and every

major manufacturer from Porsche to

Volkswagen has new models in the

making.

But electric vehicles aren’t just a

viable option. Soon, for motorists,

they’ll become one of the only op-

tions. Just last month, the UK gov-

ernment announced it will ban the

sale of all polluting cars by 2035,

and all eyes are on EVs as an alter-

native. The International Energy

Agency predicts the installed base of

EVs could reach as much as 125

million in 2030, compared to 3.1

million in 2017. But is our utility in-

frastructure ready for so many more

cars plugging in?

While the rise of EVs will help in

our global goal of being more envi-

ronmentally friendly, it cannot hap-

pen without an impact on our exist-

ing electricity grid. The grids were

built a long time before even cars

were a commercially viable consum-

er product – let alone EVs. So, as

transportation evolves from gas to

the grid, utility retailers need to start

factoring in the substantial increase

in energy demand across the country,

but with peaks in certain areas.

Estimates suggest the shift to EVs

will mean peak energy loads will

grow from 1 to 4 per cent. That

doesn’t seem like a lot, but it could

bring with it volatile, unpredictable

energy spikes at both a local substa-

tion and feeder level. In certain ur-

ban areas, where the population is

denser, EV charging could be re-

sponsible for as much as 30 per cent

peak growth. For individual house-

holds, the impact will be just as sig-

nicant, with energy usage increas-

ing by 15 per cent or more. And

during peak times, energy use could

even double.

The year 2035 isn’t that far away,

so the pressure is mounting now for

utility providers to start planning for

the shift if we’re to minimise its ef-

fects. The UK energy regulator, Of-

gem, has proposed system reforms to

support the electric vehicle revolu-

tion, planning for extra grid capacity

to be built. The government’s ‘Auto-

mated and Electric Vehicles Act’ has

made it easier to install charging

points at motorway services, mean-

while. But how do utility providers

work out where to expand or in

which locations to add additional

charging points?

The rst step will be understanding

the impact EVs are currently having

on the grid, including full visibility

of the current footprint of EVs with-

in concentrated areas, as well as the

energy consumption habits of their

owners.

Luckily, technology is available to

help utilities better understand these

factors. With machine learning and

advanced analytics added to data in-

telligence from household energy

patterns and Advanced Metering In-

frastructure data (where available),

utilities can now detect and disaggre-

gate the presence of EVs within a

household. Using this technology,

utility companies can glean the time

and frequency of charging, and as

such, better predict energy consump-

tion and forecast future demand as

more EVs come online.

This is critical for several reasons.

First, it helps time and resource-

strapped utilities make needed as-

sessments on grid investments. They

can then assess whether enhance-

ments are needed to meet supply and

demand today or whether customer

engagement programmes can help

curb and even-out the ow of charg-

ing at peak times.

This insight also allows utilities to

become trusted advisors to custom-

ers who may be in the dark as to

how owning an EV is impacting

their energy footprint and bill. By

giving customers insight into both

these factors, utilities can incentivise

EV owners to change their charging

behaviour to plug-in at off-peak

times – saving them money and sup-

porting the health of the energy grid.

In the future, similar engagement

programmes could be used to buy

back unused energy from their cus-

tomer’s EV batteries, further benet-

ting the customer while balancing

supply and demand in times of need.

EVs are set to change the way we

get from A to B, and are also going

to change the way we consume ener-

gy. But it’ll be a disaster if the grid

just isn’t ready to support an inux

of EVs on the road. Utilities need to

start planning now, to manage the

changes that the EV explosion is go-

ing to bring. Advanced analytics and

machine learning are helping utilities

manage the shift, and ensuring the

impact of EVs is a positive one, for

consumers and energy grids alike.

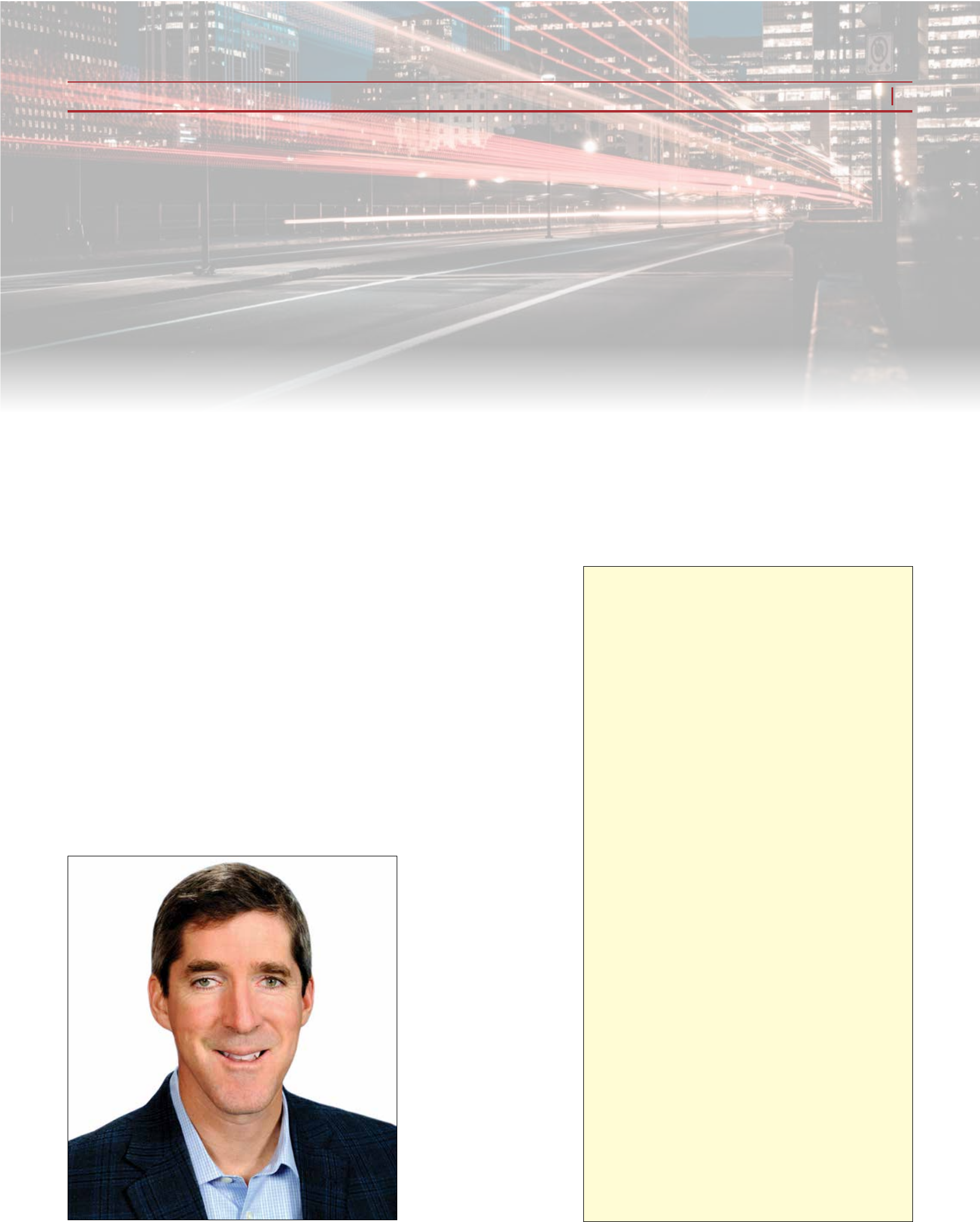

Dan Byrnes is Senior Vice President

of Product Development at Oracle

Utilities.

The UK recently announced plans to ban all polluting cars by 2035. Any country going down this path, however, will

need to make changes to its existing grid infrastructure to manage the added demand from electric vehicles, says

Oracle Utilities’ Dan Byrnes

Utilities are key to the cars

of the future

Byrnes: Electric vehicles

aren’t just a viable option.

Soon, for motorists, they’ll

become one of the only

options

Global EV count climbs to 7.9 million

The number of electric vehicles (EVs) on the road worldwide has

risen to around 7.9 million in 2019, according to a recent report

by the Centre for Solar Energy and Hydrogen Research Baden-

Württemberg (ZSW).

In terms of totals, China remains the global leader with 3.8

million EVs, followed by the USA with nearly 1.5 million. Nor-

way takes third place with 370 800. Japan is in fourth place with

around 300 000 e-cars, followed by France with 274 100 and the

United Kingdom with 235 700. Germany is in seventh place with

230 700 electric vehicles, which is one higher than the previous

year’s placing.

New registrations reached a record high in 2019 at 2.3 million

vehicles worldwide. However, the global growth rate was just

four per cent, compared to 74 per cent in the previous year. This

development is largely attributable to the reduced subsidies for

battery-powered vehicles in China and the USA. Even so, the

number of new registrations in these countries approached the

previous year’s marks with 1.204 million in China, down 52 000

from the previous year, and 329 500 in the USA, down 31 800

from 2018.

In Europe, Germany bucked the international trend as the

number of new registrations continued to rise, topping last year’s

24 per cent growth rate with 61 per cent this year. The country is

now third worldwide with 108 600 newly registered electric cars,

moving up one place from last year’s showing. Norway follows in

fourth place with 81 540 newly registered vehicles.

A different picture emerges when it comes to EV’s share of total

new passenger car registrations. More than one of every two new

passenger cars in Norway is electric. This 57 per cent share is the

largest worldwide. By comparison, electric cars account for three

per cent of new registrations in Germany, ve per cent in China

and two per cent in the USA.

The report encompasses only those passenger cars and light

commercial vehicles with battery-powered electric drives, range

extenders and plug-in hybrids – that is, all vehicles that are

charged externally with electrical power. It does not factor in full

hybrid vehicles that can cover shorter distances with a relatively

small battery, but cannot be charged externally; nor does it

include mild hybrids and vehicles equipped with fuel cells. This

assessment is based on data from the German Federal Motor

Transport Authority, government agencies and NGOs abroad, and

other sources.

The authors of the report were able to ascertain the number

of previously and newly registered electric vehicles in countries

worldwide. However, data on specic makes and models is not

available on a global scale. The authors therefore based their

analysis of newly registered makes and models on data sourced

from the 18 largest markets for e-vehicles. ZSW says its gures

represent a conservative assessment of actual developments.

THE ENERGY INDUSTRY TIMES - MARCH 2020

15

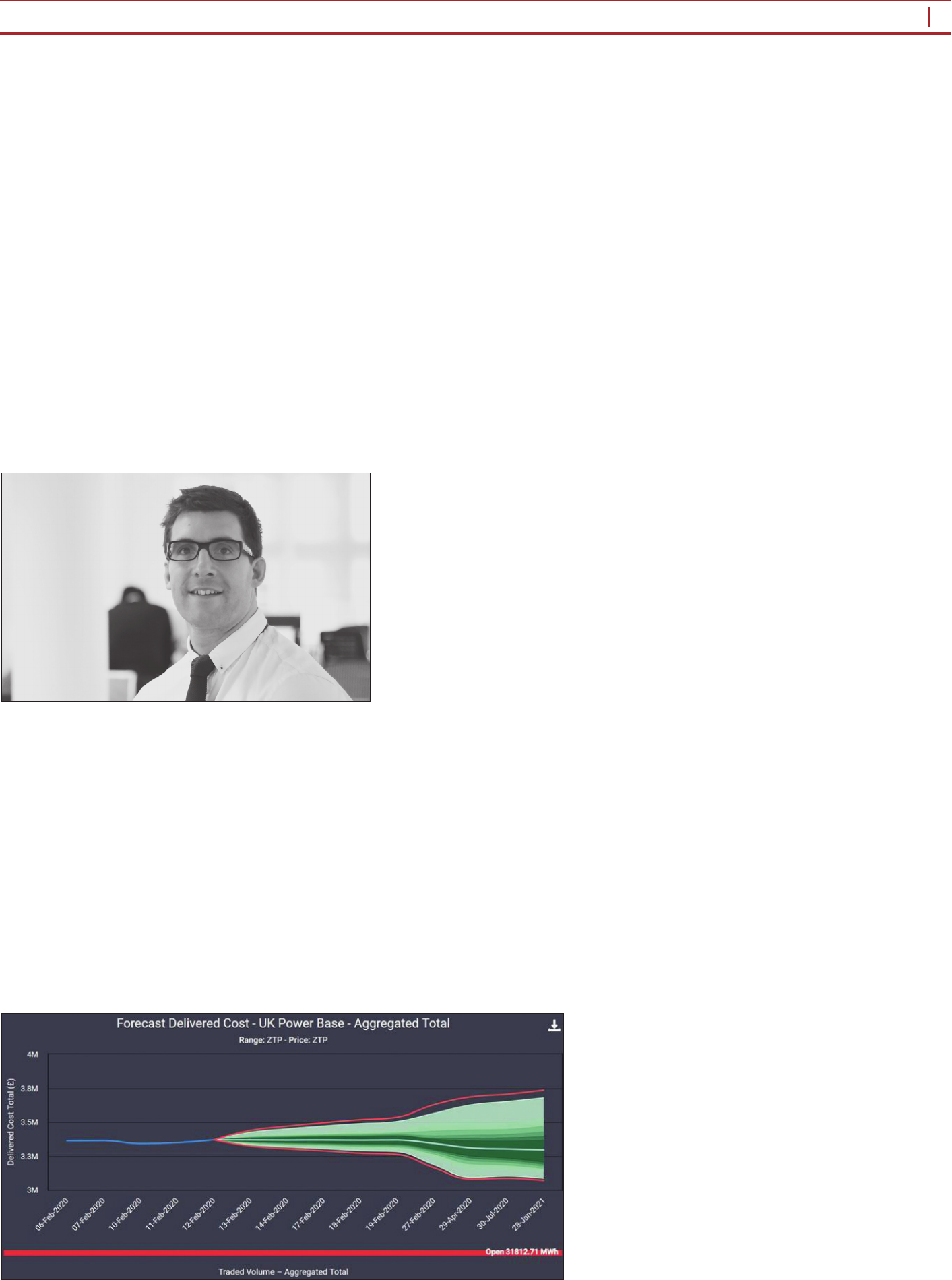

Technology

With the help of a new energy management and trading platform, energy managers can now trade based on evidence

and statistical analysis via AI-driven technology, with no need to rely on just the opinion of a broker.

Junior Isles explains.

E

nergy management today is

not just about reducing the

cost of consumption. With

exible markets and the ability to

trade, there are tremendous com-

mercial opportunities for energy

consumers, if their energy managers

can make more accurate trades

more reliably.

Last year, UK energy management

consultants ZTP introduced what it

sees as a revolutionary software plat-

form that could be a game-changer

in terms of managing energy costs

and mitigating risks on energy

trades.

ZTP was established in 2012, orig-

inally procuring energy for real es-

tate clients. Joe Warren, co-founder

and Director explained the challeng-

es facing energy managers in the

sector at the time.

“The immediate challenge back

then was getting hold of data. Every-

thing was run wholeheartedly manu-

ally. There were individual sites do-

ing individual contract negotiations,

getting individual bills by PDF and

paying them, which would then go

onto an accounting system some-

where else. We had to give people

the ability to report on their costs,

consumption and carbon emissions.”

To address the issue ZTP devel-

oped its Trace software, which es-

sentially digitalised the energy pro-

curement, bringing visibility to

consumption patterns across multi-

ple buildings. This in turn then

opened up the exibility market to

ZTP. “Suddenly we had a big

enough consumption to allow us to

start trading the energy for our cli-

ents,” said Warren. Taking this next

step, however, was not straightfor-

ward.

Warren explained: “There was a

massive challenge on the data side –

the visibility of what’s going on:

what’s my open position, what’s my

close position? For example, if the

market moves two per cent today,

does that mean my budget of £10

million has jumped two per cent? Or,

if you consider that non-commodi-

ties represent more than half the bill,

and I’ve already locked-out more

than 80 per cent of my position, a

two per cent rise may look scary on

a graph but on my budget it’s only a

matter of pounds. We had none of

this visibility whatsoever.”

ZTP therefore set about building

Kiveev, which is essentially a plat-

form to improve business perfor-

mance and mitigate risk. “It started

off as this admin piece but we soon

realised there was a massive oppor-

tunity on the risk management ele-

ment,” said Warren.

Kiveev has been designed to digi-

talise the procurement and manage-

ment of ex power and gas con-

tracts, providing users with enhanced

clarity of position, risk mitigation,

time saving and budget control.

ZTP says it spotted a gap in the

market whereby many domestic and

international multi-site businesses

buying high volumes of energy on

exible/monthly contracts, had no

system in place to monitor and fore-

cast their energy usage, analyse cur-

rent market prices, forecast future

prices or build-in accurate risk

calculations.

“Basically, what we are saying is if

today’s [energy] price is, say £40/

MWh, what’s the chance of that go-

ing up to, say £50/MWh tomorrow

or in 5 days, 6 months or 12 months,

for example? Or coming down to

£30/MWh?” said Warren. “So we

started looking at how we could

build this risk management piece.

There was no commercially avail-

able tool that we thought was any-

where near good enough.”

Development of the platform was

undertaken through a two-year proj-

ect in collaboration with the Univer-

sity of Kent’s Kent Business School

(KBS) and School of Mathematics,

Statistics and Actuarial Science

(SMSAS). Funding for the project

was secured in May 2018 from

Innovate UK and the Economic Re-

search and Social Council (ESRC).

“With funding from Innovate UK,

it had to be innovative. So we had to

build new and very advanced risk

modelling software, concentrating

on UK power and gas. And once

we’d gone as far as we could at that

stage with the model, we would then

start looking at Europe.”

The two-year project would see

the partnership design and build

risk management algorithms that

will enable UK and multi-national

businesses to mitigate risk associat-

ed with open energy market posi-

tions. Ultimately, the platform will

engage stakeholders from multiple

countries and aggregate risk report-

ing to a single reporting facility.

A major milestone in the project

was reached in March last year with

the ofcial launch of the platform.

Using articial intelligence (AI), the

platform will enable users to: track

and forecast consumption; build and

analyse budgets; design trade strate-

gies; assess market conditions and

price forecasts; calculate risk; record

trades and positions; evaluate strate-

gies and report on performance.

As Kiveev constantly monitors the

market, businesses can quickly re-

act to market conditions and imme-

diately see the impact against pur-

chasing strategies. Investigation of

price trends can also be performed

through the Kiveev market dash-

board. This dashboard provides: live

data – live commodities exchange

and OTC price data; market com-

mentary – daily and weekly market

insight commentary; delivered cost –

total transparency with built-in non-

commodity rate algorithms; strategy

library – strategy builder and library

provides users with more control;

alerts – live alerts provide a constant

over-watch; and legislative change –

updates on legislation to ensure users

are aware of changes.

With the UK modelling complete

for now, although modelling is an

ever-progressing process, the next

stage is to carry out modelling for

the European markets.

According to ZTP, there are two el-

ements to doing this. The rst is the

“range”, which Warren describes as

“a fan chart of where prices may

go”. He explained: “We are using AI

to apply different models to different

forecasts. Tomorrow’s range forecast

might be a very different mathemati-

cal model to a six-monthly forecast.

And we are using AI to determine

which model, or combination of

models, has been the most accurate.”

The second element, which Warren

says is perhaps the more exciting

part, is price forecasting.

“Here, as well as predicting the

chance of it being between this

range, we are also predicting what

the price will be. Again, it is using

AI or machine learning to say, for

example, determine what effect

does oil have on UK power or what

inuence does wind production

have? And doing the same for Ger-

many, wind production, for exam-

ple, will denitely have a very dif-

ferent inuence on German markets

to that of the UK. So we put differ-

ent weightings on these predictors,

which could be anything from

weather to interest rates and any

number of commodities. For exam-

ple, the models are constantly moni-

toring the price of carbon, as that is

going to have a major impact on

UK and European power prices. We

use AI to say what level of impact

that predictor is having and to en-

able the model to keep correcting it-

self. It basically uses all the data

available to it to predict where pric-

es will go.”

So far, modelling has been done for

nine EU power markets (in addition

to the UK) and seven gas markets.

State-by-state modelling is also on-

going for the US. “Modelling is now

being client-led. If a client wants,

say, Japan, the rst check is: is it an

open market and the second is can

we get the data? If there is enough

data, we can model it and get back to

the client,” said Warren.

ZTP also says it has branched out

from real estate and is already speak-

ing with a number of the biggest en-

ergy users in the UK. These include

retailers, car manufacturers, chemi-

cal production companies and other

industrial players.

Warren noted: “Previously these

companies just wouldn’t give any

sort of time to a traditional energy

broker – although we don’t see our-

selves as ‘energy brokers’ – because

they probably know the energy mar-

ket better than the person that’s call-

ing them. But now suddenly, they

can have some technology and digi-

talised information that helps them

trade much better.

“Kiveev is a really big turning

point for them... no one has this level

of risk modelling; certainly there is

nothing nearly as advanced.”

The payback for big energy con-

sumers can be huge and in some cas-

es immediate. “It could save a lot of

money: we’re talking double-digit

percentages,” said Warren. “Not nec-

essarily by consumption reduction

but by trading better. Although there

is a cost to having the software,

which isn’t in anyone’s budget… the

payback could be from a single

trade. So it could be one day. We re-

cently saved a client over £100 000

on one trade – the cost of the soft-

ware was nowhere near that for that

particular client.” He added: “It’s

trade, so it’s not risk-free but it cer-

tainly mitigates the risk tremendous-

ly compared to what we see at the

moment, which is basic gut decision

and over-reliance on a consultant’s

opinion.”

With the ability to predict with 98

per cent condence that a future

spend will fall within a given range,

and all within a dynamic system,

Kiveev demonstrates the power of AI

as a new tool for energy managers.

Warren concluded: “It is impossi-

ble to keep up as a human: If you

wanted to look at this level of detail

on your Excel spreadsheets, you lit-

erally can’t. So this is really exciting.

And it digitalises the whole aspect of

trading – of using your own data to

see the implications on your budget

or delivered costs. Users can then

make much more informed trading

decisions and open themselves to

opportunities to reduce their costs

massively, while protecting them-

selves against increases in costs. It’s

a fundamental improvement in how

people can now trade energy.”

Trading places

Warren: “We are using AI

to apply different models to

different forecasts”

“Range” forecasting is

an important part of the

modelling

THE ENERGY INDUSTRY TIMES - MARCH 2020

16

Final Word

F

or want of a better word, Febru-

ary was “wavy” (not in the ur-

ban sense). On a personal level,

the undulations of the Caribbean sea

was a high; followed by a brief low of

news that our cruise ship was sus-

pected of having passengers that con-

tracted the novel coronavirus just days

after the end of our journey. Fortu-

nately the results were negative; it

seems we are in the clear – for now.

Meanwhile, news of global carbon

emissions atlining last month came

as a pleasant surprise – and a welcome

relief from the hugely worrying

headlines surrounding the coronavi-

rus, Covid-19, which is threatening to

become a global pandemic.

In spite of widespread expectations

of another increase, global energy-

related carbon dioxide emissions

stopped growing in 2019, according

to data released last month by the In-

ternational Energy Agency (IEA).

The Paris-based agency reported

that after two years of growth, global

CO

2

emissions remained unchanged

in spite of the economy growing by

almost 3 per cent. The halt in carbon

growth has largely been put down to

progress in decarbonising the electric-

ity sector – greater use of renewables,

switching from coal to gas, and more

nuclear. Subsequently, power genera-

tion from coal red plants in advanced

economies declined by nearly 15 per

cent as a result.

The IEA said global power sector

emissions declined by some 170 Mt,

or 1.2 per cent, with the biggest falls

taking place in advanced economies

where CO

2

emissions are now at

levels not seen since the late 1980s

(when electricity demand was one-

third lower). “Emissions trends for

2019 suggest clean energy transitions

are underway, led by the power sec-

tor,” it said.

The power sector now accounts for

36 per cent of energy-related emis-

sions across advanced economies,

down from a high of 42 per cent in

2012. The average CO

2

emissions

intensity of electricity generation fell

by nearly 6.5 per cent in 2019, a rate

three times faster than the average over

the past decade. In absolute terms, an

average emissions intensity of 340

grams of CO

2

per kWh in 2019 is

lower than all but the most efcient

gas red power plants.

According to the IEA, the growth of

renewables in electricity generation in

advanced economies delivered 130 Mt

of CO

2

emissions savings in 2019.

Wind accounted for the biggest share

of the increase, with output expanding

12 per cent from 2018 levels. Solar PV

saw the fastest growth amongst renew-

able sources, helping to push renew-

ables’ share of total electricity genera-

tion close to 28 per cent. Coal-to-gas

fuel switching for power generation

avoided 100 Mt of CO

2

in advanced

economies and was particularly strong

in the United States due to record low

natural gas prices. Higher nuclear

power generation in advanced econo-

mies, particularly in Japan and Korea,

avoided over 50 Mt of CO

2

.

Global CO

2

emissions from coal use

declined by almost 200 million tonnes

(Mt), or 1.3 per cent, from 2018 levels,

offsetting increases in emissions from

oil and natural gas. Economic growth

in advanced economies averaged 1.7

per cent in 2019, but total energy-re-

lated CO

2

emissions fell by over 370

Mt (or 3.2 per cent), with the power

sector responsible for 85 per cent of

the drop.

Looking at where the most cuts in

CO

2

were made, the US saw the larg-

est decline in 2019 on a country basis

– a fall of 140 Mt, or 2.9 per cent, to

4.8 Gt. US emissions are now down

almost 1 Gt from their peak in the year

2000, the largest absolute decline by

any country over that period. A 15 per

cent reduction in the use of coal for

power generation underpinned the

decline in overall US emissions in

2019. Coal red power plants faced

even stronger competition from natu-

ral gas red generation, with bench-

mark gas prices an average of 45 per

cent lower than 2018 levels. As a

result, gas increased its share in elec-

tricity generation to a record high of

37 per cent.

In the European Union, including the

United Kingdom, energy-related CO

2

emissions dropped by 160 Mt, or 5 per

cent, to 2.9 Gt. The power sector drove

the trend, with a decline of 120 Mt, or

12 per cent, resulting from increasing

renewables and switching from coal

to gas. Output from EU coal red

plants fell by more than 25 per cent in

2019, while gas red generation in-

creased by nearly 15 per cent to

overtake coal for the rst time.

Germany spearheaded the fall in the

EU. Its emissions fell by 8 per cent to

620 Mt of CO

2

, a level not seen since

the 1950s, when the German economy

was around 10 times smaller. The

country’s coal red power eet re-

corded a drop in output of more than

25 per cent year-on-year as electricity

demand declined and generation from

renewables, especially wind increased

(+11 per cent). With a share of over 40

per cent, renewables for the very rst

time generated more electricity in

2019 than Germany’s coal red

power stations.

The UK continued its progress with

decarbonisation as output from coal

red plants fell to only 2 per cent of

total electricity generation. Rapid ex-

pansion of output from offshore wind,

as additional projects came online in

the North Sea, was a key driver. Re-

newables provided about 40 per cent

of electricity supply in the UK, with

gas supplying a similar amount.

Japan saw energy-related CO

2

emis-

sions fall 4.3 per cent to 1030 Mt in

2019, the fastest rate of decline since

2009. The power sector experienced

the largest drop in emissions as reac-

tors that had recently returned to

operation contributed to a 40 per cent

increase in nuclear power output.

This allowed Japan to reduce electric-

ity generation from coal, gas and oil

red power plants.

Emissions outside advanced econo-

mies grew by nearly 400 Mt in 2019,

with almost 80 per cent of the increase

coming from Asia. Coal demand

continued to expand in the region,

accounting for over 50 per cent of

energy use, and is responsible for

around 10 Gt of emissions. Fortu-

nately, this was offset by cuts in ad-

vanced economies.

In addition to declining emissions in

advanced economies, the IEA also

attributed the halt in CO

2

output to

milder weather in several countries

and, notably, slower economic growth

in some emerging markets.

However, it is far too soon to rest on

our laurels, with the IEA warning that

emissions would need to fall more

sharply still to meet the goals of the

Paris climate agreement. “We now

need to work hard to make sure that

2019 is remembered as a denitive

peak in global emissions, not just an-

other pause in growth,” said Dr Fatih

Birol, the IEA’s Executive Director.

But although 2019 might the year

CO

2

emissions stopped rising, 2020

could be the year it gets moving again.

And not because of lack of effort.

Last year emissions in China rose,

even though tempered by slower

economic growth and higher output

from low-carbon sources of electricity.

As is often the case, the words ‘China’

and ‘emissions’ are never far apart.

Unfortunately, this time it is human

‘emissions’ infected with Covid-19

that are the immediate concern.

As of February 28th, the virus had

infected around 85 000 people glob-

ally – nearly 79 000 of which were in

mainland China, where it originated.

The outbreak has had a severe impact

on China’s industries and subse-

quently the world economy. For ex-

ample, last month Hyundai was forced

to halt output across all its car factories

in South Korea after running out of

engine components from China. At the

same time, many of the world’s stock

markets plummeted to their lowest

levels since the 2008 nancial crisis.

The impacts of the virus have been

profound and it will be some time

before supply chains in the energy

sector and other industries return to

normal. And as energy consumption

slumps due to falls in industrial output,

so will emissions rebound.

While we are all hoping for the virus

to be brought under control quickly, it

will be interesting to see how the IEA’s

gures for global carbon emissions

play out in 2020. No doubt there will

be a huge spike as China gets the virus

under control and returns to normal

economic production.

A harbinger of doom might surmise:

it seems one way or another, we’re all

doomed; if the virus doesn’t get us, the

impact of carbon emissions will.

Ups and downs of a

atlining world

Junior Isles

Cartoon: jemsoar.com