www.teitimes.com

February 2020 • Volume 12 • No 12 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

It’s coming home

Scoring PV+batteries

Home Energy Management is

where the action looks set to be.

Page 13

Weighing up the likely uptake of solar

plus batteries for various applications.

Page 14

News In Brief

Businesses show leadership

in climate crisis

While US President Donald

Trump labelled climate activists

as “perennial prophets of doom”

during his address at last month’s

World Economic Forum in Davos,

Switzerland, corporations continued

to show that they view climate

change as a serious threat.

Page 2

Brazil sees offshore wind

horizon

Brazil could deploy as much as

700 GW of wind energy in offshore

regions with water depths of 50 m

or less, according to new analysis

by EPE.

Page 4

Coal tax waiver could

threaten clean energy

growth

The Indian government’s proposed

carbon tax waiver on coal could

pose signicant risk to the country’s

renewable energy sector growth.

Page 5

Terna drives grid overhaul

Italian grid rm Terna is overhauling

the country’s electricity network

with the help of innovative storage

technologies.

Page 7

Saudi Arabia launches NREP

third round

Saudi Arabia will add 1200 MW

of solar PV capacity to its grid

following the third round of its

National Renewable Energy

Programme.

Page 8

R-R ready for “pivotal”

storage role

Rolls-Royce has increased its

holding in energy storage specialist

Qinous in a bid to broaden its reach

and boost its microgrid offering.

Page 9

Technology: Making a

sterling effort in energy

storage

New technology that combines

thermal energy storage with Stirling

engines is being developed to bring

cost-efcient, 24/7, renewable power

closer to commercialisation.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

Germany has agreed to close its coal red plants three years earlier than planned but not all

are happy with the decision. Junior Isles

Renewables must double to advance energy

transformation, says Irena

THE ENERGY INDUSTRY

TIMES

Final Word

The climate change

battle is no walk in the

park, says Junior Isles.

Page 16

Germany has bowed to public pres-

sure, with its move to speed up its exit

from coal red generation. But the

decision to close down the country’s

coal red plants earlier than origi-

nally scheduled has not been well

received by environmentalists or coal

red generators.

Last month Chancellor Angela

Merkel and ministers from the coal-

mining states of Saxony-Anhalt, Sax-

ony, North Rhine-Westphalia and

Brandenburg agreed overnight a

“shutdown plan” for the country’s

coal plants. The scheme has been writ-

ten into a draft law and is expected to

be ratied by mid-2020.

With the announcement that plants

would be closed by 2035, instead of

2038 as previously planned, “the exit

from coal begins now, and it is bind-

ing”, Environment Minister Svenja

Schulze told reporters in Berlin.

The agreement also provides for an

end to operating licences in the former

Hambach forest (west), threatened by

the extension of a lignite mine, which

became the symbol of the ght against

coal in Germany. RWE said more than

half of its 2.1 billion tonnes of coal

reserves would now remain buried.

The agreement is part of the coun-

try’s efforts to tackle the climate crisis,

the government said. A plan agreed in

December under pressure from anti-

coal demonstrators calls for Germany

to reduce output of greenhouse gases

by 55 per cent compared with 1990s

levels. The country has already admit-

ted it will miss an intermediate target

for 2020 but the task of quitting coal

has been complicated by Merkel’s de-

cision to end nuclear power genera-

tion by 2022.

Eric Schweitzer, who heads the As-

sociation of German Chambers of

Commerce and Industry, said a key

question is how the electricity cur-

rently coming from coal red power

plants will be replaced. Schulze ac-

knowledged that Germany will need a

“massive expansion of wind and solar

energy”.

The government said reviews will

be carried out in 2026 and 2029 to de-

termine whether Germany can exit

coal red electricity generation in

2035, three years before the nal

deadline.

Economy Minister Peter Altmaier,

said: “What we have here is a good

agreement for climate protection be-

cause it makes clear that we mean it

seriously.”

The Finance Minister, Olaf Scholz,

said that the coal plant operators

would receive €4.35 billion in com-

pensation for switching them off early,

with payouts spread out over the 15

years following the shutdown. The

money will be on top of €40 billion

that the government has already

promised to coal-mining regions to

soften the economic blow of abandon-

ing the fossil fuel.

RWE is set to receive €2.6 billion of

the compensation package, with the

remaining €1.75 billion set aside for

Continued on Page 2

The share of renewables in global

power should more than double by

2030 to advance the global energy

transformation, achieve sustainable

development goals and a pathway to

climate safety, according to the Inter-

national Renewable Energy Agency

(Irena). Renewable electricity should

supply 57 per cent of global power by

the end of the decade, up from 26 per

cent today.

A new booklet ‘10 Years: Progress

to Action’, published for the 10th an-

nual Assembly of Irena, charts recent

global advances and outlines the mea-

sures still needed to scale up renew-

ables. The agency’s data shows that

annual renewable energy investment

needs to double from around $330 bil-

lion today, to close to $750 billion to

deploy renewable energy at the speed

required.

Much of the needed investment can

be met by redirecting planned fossil

fuel investment, said the report.

Close to $10 trillion of non-renew-

ables related energy investments are

planned to 2030, risking stranded as-

sets and increasing the likelihood of

exceeding the world’s 1.5°C carbon

budget this decade.

“We have entered the decade of re-

newable energy action, a period in

which the energy system will trans-

form at unparalleled speed,” said Ire-

na Director-General Francesco La

Camera. “To ensure this happens, we

must urgently address the need for

stronger enabling policies and a sig-

nicant increase in investment over

the next 10 years.”

According to Irena, additional in-

vestments bring signicant external

cost savings, including minimising

signicant losses caused by climate

change as a result of inaction. Sav-

ings could amount to between $1.6

trillion and $3.7 trillion annually by

2030, three to seven times higher

than investment costs for the energy

transformation.

In January the Abu Dhabi Fund for

Development (ADFD) approved the

allocation of approximately $105 mil-

lion for eight renewable energy proj-

ects recommended by Irena. The proj-

ects recommended under the seventh

cycle of the Irena/ADFD Project Fa-

cility, marks a record level of funding

for any cycle since the facility was

launched.

The facility supports developing

countries in securing low-cost capital

for renewable energy projects to in-

crease energy access, improve liveli-

hoods and advance sustainable devel-

opment on the ground.

The new projects – in Antigua and

Barbuda, Burkina Faso, Chad, Cuba,

the Maldives, Nepal, Saint Lucia and

Saint Vincent and the Grenadines –

bring the total to 32 projects and

around 200 MW of new renewable

energy capacity under the partnership.

All of the eight new projects are

based on solar, with the exception of

those in Antigua and Barbuda (hy-

brid solar and wind), the Maldives

(waste-to-energy) and Nepal (biogas

digesters).

Falling technology costs continue to

strengthen the case for renewable en-

ergy. In its report, Irena points out that

solar PV costs have fallen by almost

90 per cent over the last 10 years and

onshore wind turbine prices have

fallen by up half in that period.

By the end of this decade, solar PV

and wind costs may consistently out-

compete traditional energy. The two

technologies could cover over a third

of global power needs.

Germany’s move

to speed up coal

plant closures

meets backlash

Merkel and ministers from coal-

mining states agreed to 2035 closures

THE ENERGY INDUSTRY TIMES - FEBRUARY 2020

3

13-14 April 2020

Egypt International Exhibition Center,

Cairo, Egypt

4

FREE CONFERENCES

150+

EXHIBITORS

150+

SPEAKERS

REGISTER NOW FOR YOUR FREE PASS

AT WWW.TERRAPINN.COM/SOLAREXPO

GET YOUR

FREE

PASS NOW

Co-location with:

Novotel Paris Roissy CDG Convention

Paris, France

23-24 June, 2020

The Future Goes

Green & Digital

Open up to Balancing,

Secondary Reserve &

Island Storage

Capture Potential

Oered by Auction,

Energy Buyer, &

Prosumer Sectors

REGISTER NOW FOR INDIA’S

PREMIER ENERGY INDUSTRY PLATFORM

BEAT OUR EARLY BIRD DEADLINE FOR SUMMIT PASS SAVINGS

Register for the Summit before 28 February to SAVE 20% on the Full Delegate Pass.

Go online to see the Summit Agenda and Topics, plus the International Exhibitor List.

Indian

INDIA

Organised by: International Partner:

EXHIBITION ENTRY IS FREE!

PLUS YOU GET ACCESS TO OUR

KNOWLEDGE HUB THEATRES

WWW.POWERGEN-INDIA.COM | WWW.INDIAN-UTILITY-WEEK.COM

Connect with India's power and utility sector at this end-to-end international

high-level summit and exhibition as we look at India’s energy transition.

>

INTERESTED IN EXHIBITING?

Find out more on available options

online. Space is selling fast!

THE ENERGY INDUSTRY TIMES - FEBRUARY 2020

6

www.teitimes.com

THE ENERGY INDUSTRY

TIMES

subscribe today

The Energy Industry Times is the only publication that

covers global news related to the power and energy sector

in a newspaper style and format whose

uniqueness is recognised by our readers.

As a paid subsciber you will gain full access

to our online news desk.

You will also no longer have to wait for the printed edition;

receive it by PDF “hot off the press” or download it online.

To subscribe, email subscriptions@teitimes.com or visit

www.teitimes.com

To guarantee receiving your

monthly copy of the award

winning newspaper, you need to

subscribe today

GTW full page.indd 1 17/11/16 12:22:16

THE ENERGY INDUSTRY TIMES - FEBRUARY 2020

9

Companies News

The Ocean Renewable Energy Action

Coalition says it will bring together

industrial groups with civil society

and intergovernmental institutions to

prepare a pathway to 2050 for ocean

energy technologies as well as repre-

sent the sector in the global dialogue

on climate action.

The coalition’s members include

CWind, Global Marine Group, JERA,

MHI Vestas, Mainstream Renewable

Power, Shell, Siemens Gamesa, Ten-

neT and The Crown Estate.

According to a report publisehd by

the Expert Group of the High-Level

Panel for a Sustainable Ocean Econ-

omy, ocean based renewables such as

offshore wind, oating solar, tidal and

wave power, could account for almost

ten per cent of the annual greenhouse

gas emissions reductions needed by

2050 to keep global temperatures at

less than 1.5°C above pre-industrial

levels. Most of this climate change

mitigation potential is expected to

come from offshore wind.

“If we’re serious about ghting the

climate crisis, it’s vital we decarbo-

nise the world’s energy use as quick-

ly as possible through technologies

like offshore wind,” said Benj Sykes,

Vice President at Ørsted. “The Ocean

Renewable Energy Action Coalition

will work together to accelerate the

opportunity presented by ocean re-

newables to achieve the Paris Agree-

ment goals.”

Stephen Bull, Senior Vice President

for Wind and Low Carbon at Equinor,

said: “Collaboration between nations

and companies is needed to accelerate

the sustainable deployment of ocean

renewable energy. This Action Coali-

tion includes leading industry players

in offshore wind and we are working

together to unleash the full potential

of offshore wind globally.”

The Action Coalition was formed in

response to the September 2019 Call

for Ocean-Based Climate Action

made by the High-Level Panel for a

Sustainable Ocean Economy, with ad-

ditional partners including Global

Wind Energy Council and the UN

Global Compact.

It will devise a vision for 2050, high-

lighting the actions that industry, -

nanciers and governments can take to

sustainably scale-up offshore wind,

and thereby contribute to the UN Sus-

tainable Development Goals and

global decarbonisation goals.

Initial outputs will be announced at

the UN Ocean Conference in Lisbon

in June 2020.

Siân Crampsie

UAE rm Masdar is extending its

global reach with new international

joint ventures targeting renewable en-

ergy in Europe, the Middle East and

Africa.

The company has signed an agree-

ment with France’s EDF to establish a

company offering energy efciency

and distributed solar energy services

in Abu Dhabi, and has also established

a joint venture with Spain’s Cepsa to

develop renewable energy projects in

the Iberian Peninsula.

In a third deal, Masdar and Egypt’s

Innity Energy have announced plans

to develop utility-scale solar energy

and wind power projects in Egypt and

Africa.

Masdar and EDF’s new joint venture

will leverage the support of their re-

spective subsidiaries, including

Dalkia, EDF ENR, EDF Renewables

and Citelum, to provide solutions such

as Energy Performance Contracts.

The company will help tackle the

“signicant challenge” of reducing

building and industry-related emis-

sions, and support Abu Dhabi’s 2030

energy efciency strategy, Masdar

CEO Mohamed Jameel Al Ramahi

said.

In Europe, Masdar and Cepsa have

established a 50:50 joint venture called

Cepsa Masdar Renovables that will

focus on developing wind power and

solar photovoltaic projects with an ini-

tial target of 500 to 600 MW in Spain

and Portugal.

Renewables accounted for more than

half of Portugal’s electricity demand

in 2019, with the country targeting

80 per cent clean power by 2030. Spain

is looking to reach 74 per cent electric-

ity generation from clean power sourc-

es by the end of the decade.

“The Iberian Peninsula is an attrac-

tive location for renewable energy in-

vestors and we look forward to expand-

ing our renewable energy portfolio

further into the region, while strength-

ening our partnership with Cepsa,” Al

Ramahi said in a statement.

Last month Masdar announced an

agreement with renewable energy rm

Innity Energy to take advantage of

renewable energy opportunities in

Egypt and Africa.

The joint venture – Innity Power

“will bolster the progress Egypt has

made in renewable energy and catalyse

further development in the region”, Al

Ramahi said.

Innity Energy currently operates six

solar plants with a total capacity of

235 MWp, and is the leading renew-

able energy developer in Egypt. “Inn-

ity Power will also extend its commit-

ment to our home continent – Africa,”

said Mohamed Elamin Ismail Man-

sour, Managing Director and co-

founder at Innity Energy. “We believe

in Africa’s large growth potential in the

power sector and we look forward to

implementing renewable energy gen-

eration projects where they are needed,

and to seeing the positive impacts of

these projects on the local communities

where they are located.”

The European Bank for Reconstruc-

tion and Development recently com-

mitted an investment in Innity En-

ergy of up to $60 million in the form

of capital increase to nance the devel-

opment of renewable energy projects.

Siemens Gamesa Renewable Energy

(SGRE) has expanded its geographical

reach in the lucrative wind turbine ser-

vices market with the completion of a

deal to buy part of its insolvent German

rival, Senvion.

SGRE announced in January that it

had sealed the €200 million deal, ac-

quiring large parts of Senvion’s ser-

vices business across 13 European

countries and securing around 2000

jobs.

It called the move “transformation-

al” because it will strengthen its com-

petitive position in Europe with the

addition of around 9 GW of serviced

capacity.

The deal also includes Senvion’s in-

tellectual property. “This has been a

unique opportunity for consolidation,

a win for all parties and a perfect match

for Siemens Gamesa,” said SGRE

CEO Markus Tacke. “By integrating

these assets and highly skilled profes-

sionals we will improve our position

as a leading global service partner at a

crucial moment for the wind industry´s

growth.

“The transaction also offers Senvi-

on’s customers a long-term solution for

their servicing needs, following Sen-

vion’s insolvency.”

“This acquisition is an important

part of our strategy to grow our multi-

brand service business. Now that

we’ve successfully closed the transac-

tion, we will focus on the integration

and ensuring that operations continue

smoothly,” said Mark Albenze, CEO

of Siemens Gamesa’s Service busi-

ness. “By acquiring all relevant know-

how and IP to access the SCADA and

controller software, technical knowl-

edge on spare parts supply and Sen-

vion’s remote control centre, we are

well positioned to offer competitive

service solutions to all of Senvion’s

customers worldwide,” he added.

Senvion went into administration in

2019 and says that the deal with SGRE

will save around 60 per cent of its

workforce.

The company had struggled nan-

cially in the competitive wind energy

market faced with falling levels of

government support and lower energy

prices.

Rolls-Royce has increased its holding

in energy storage specialist Qinous in

a bid to broaden its reach and boost its

microgrid offering.

The engineering rm says it is acquir-

ing the shareholdings of other current

nancial investors in Qinous to take its

holding to 73.1 per cent.

The details of the transaction have

not been disclosed but will give Rolls-

Royce a broad range of battery storage

options and enable it to pool all of its

microgrid activities operating under its

Power Systems Division.

Rolls-Royce had already acquired a

19.9 per cent stake in Berlin-based

Qinous as a start-up back in October

2018. The company is involved in

battery storage systems and associ-

ated control systems, and has already

implemented storage solutions

around the world.

Qinous will become the competence

centre for microgrid solutions within

Rolls’ Power Systems division, with

its founding shareholders continuing

to hold shares in the company and re-

taining their current roles, Rolls-Royce

said.

“Our new subsidiary is to play a piv-

otal role going forward,” said Andreas

Schell, CEO of Rolls-Royce Power

Systems Division. “This is where we

are going to pool all the division’s mi-

crogrid activities – from simple stor-

age solutions to complete, complex

microgrid solutions of various sizes

and congurations.

“As a young, start-up-style company,

Qinous brings expertise that is an

ideal complement to Rolls-Royce’s

industrial credentials.”

According to Schell, the two compa-

nies have been working jointly on stor-

age technology development and be-

lieve they can “achieve new market

potential by integrating more closely.

We see great market potential for sus-

tainable power supplies, especially for

distributed, environmentally-friendly

MTU microgrid solutions.”

Qinous specialises in modular, scal-

able, prefabricated plug-and-play bat-

tery products that combine renewable

energy sources, power generators and

battery storage technology.

“This even closer partnership be-

tween Rolls-Royce and Qinous is a

logical and consistent step towards

opening up the rapidly growing mi-

crogrid market,” said Steffen Hein-

rich, co-founder and co-managing

director of Qinous.

“The functionality and reliability of

the solutions have been proven in a

large number of projects. Now, with

MTU’s experience and global pres-

ence, we can meet demand more

quickly and more comprehensively.”

R-R ready for

“pivotal” storage

role

Masdar

builds

with new JVs

SGRE expands with Senvion deal

Ocean coalition aims to

accelerate offshore wind

A new global partnership has been created by energy giants Ørsted and Equinor in a bid to help accelerate the growth

of offshore wind and other ocean renewable energy technologies.

n Masdar targets Iberia with Cepsa

n EDF, Masdar boost Abu Dhabi

buildings efciency

Equinor has assumed stable frame-

work conditions and necessary in-

vestments in the electricity grid.”

Japan’s Marubeni and French energy

major Total are to build an 800 MW

solar photovoltaic (PV) plant in Qatar.

Marubeni announced it has signed

a 25-year power purchase agree-

ment (PPA) with Qatar General

Electricity and Water Corporation

(Kahramaa) for the output of the Al

Kharsaah Solar PV independent

power project. It will own a 20.4

per cent stake in the project, while

Total will own 19.6 per cent.

Qatar Petroleum and Qatar Elec-

tricity & Water Company (QEWC)

will own the remaining 60 per cent

of the project.

The Tunisian Ministry of Mines and

Energy and STEG has selected a con-

sortium led by Engie and Nareva as

the preferred bidder for constructing

the Gafsa photovoltaic power plant in

Tunisia.

The consortium will develop, de-

sign, nance, build, operate and

maintain the 120 MWp plant, which

will be one of the rst solar IPPs in

Tunisia and part of the country’s re-

newable energy sector development

programme.

The project is the rst collabora-

tion between Engie and Nareva in

Tunisia. The two companies have

previously jointly developed the

300 MW Tarfaya wind farm located

in Morocco.

SNC-Lavalin’s Candu Energy has

been awarded a $10.8 million contract

by Societatea Nationala Nuclearelec-

trica (SNN) for engineering analyses

and assessments on the Cernavoda

Unit 1 nuclear reactor in Romania.

Under the contract, Candu Energy

will focus on the fuel channel and

feeder assemblies of the plant, with

the objective of extending its oper-

ating life by around four years, or

up to 245 000 effective full power

hours (EFPH).

The work will enable the plant to

continue operating safely until it is

ready for refurbishment in 2026.

Cernavoda 1 produces over 700

MW of electricity, about 10 per cent

of Romania’s electricity demand. It

was commissioned and began com-

mercial full power operation in De-

cember 1996.

GE has received a second order from

the Israel Electric Corporation (IEC)

for a 9HA.01 heavy-duty gas turbine

for the Orot Rabin plant, located in

Hadera, Israel.

The unit will be installed at the

Orot Rabin power plant, which is

being converted from coal to gas

ring. For the conversion, GE will

also provide a steam turbine, gener-

ator, heat recovery steam generator

and balance of plant equipment – as

well as a 15-year multi-year servic-

es agreement.

Once operational, the Orot Rabin

combined cycle gas turbines are ex-

pected to be the largest and most

efcient gas red power units in

the country, delivering up to 1260

MW, i.e. more than eight per cent

of Israel’s current total power gen-

eration capacity.

BWSC has entered into a Technology

Supply contract and a 15-year O&M

contract for Gentse Warmte Centrale

(GWC), a 20 MWe biomass power

plant located in Ghent, Belgium.

BWSC will design and supply

GWC’s biomass feeding system,

the biomass red boiler and the ue

gas treatment system. Belgian Eco

Energy (BEE) is the developer of

the project.

Elecnor, based in Bilboa, Spain, is

the turnkey contractor for the plant.

The construction period is sched-

uled for 25 months with the plant

expected to be operational early

2022.

Iberdrola has selected DNV GL’s

GreenPowerMonitor (GPM) solution

to monitor the 500 MW Núñez De

Balboa solar power plant in Spain.

The solar farm is the largest under

construction in Europe and is due to

start operating in the rst quarter of

2020. The plant will be monitored

with GPM SCADA management,

which allows control of each indi-

vidual device in the solar plant.

The Núñez de Balboa solar proj-

ect is the biggest photovoltaic plant

monitored by DNV GL’s GPM. It

joins a portfolio of over 4000 solar

and wind facilities that produce

more than 29 GW of clean energy

around the globe.

DNV GL acquired GreenPower-

Monitor in June 2016.

Nordex has won a contract in the

Netherlands to equip the De Drentse

Monden en Oostermoer wind farm.

The manufacturer will supply 44

of its N131/3900 turbines including

the foundations with a total capaci-

ty of 171.6 MW to Duurzame Ener-

gieproductie Exloermond BV,

Raedthuys DDM B.V. and Wind-

park Oostermoer Exploitatie B.V.,

who are jointly developing the proj-

ect, located in Groningen.

Nordex will also be providing ser-

vice for all these turbines after in-

stallation on the basis of a Premium

Service contract for a period of 25

years. The turbine delivery and in-

stallation will start from the second

half of 2020.

Norwegian energy giant Equinor has

announced plans to cut absolute

greenhouse gas emissions from its

offshore and onshore operations to

near zero by 2050.

Under the plan Equinor is aiming

to reduce emissions from its Nor-

wegian operations by 40 per cent

by 2030 and 70 per cent by 2040,

requiring annual cuts of more than

5 million tonnes.

It will achieve the targets through

large scale industrial measures, in-

cluding energy efciency, digitali-

sation and the launch of several

electrication projects at key elds

and plants, including the Troll and

Oseberg offshore elds and the

Hammerfest LNG plant.

“We plan investments in the order

of 50 billion Norwegian kroner

($5.46 billion) together with our

partners by 2030 to cut emissions in

order to strengthen the long-term

competitiveness for our elds and

plants,” said Eldar Sætre, CEO of

Equinor. “In setting these ambitions

Burns & McDonnell will serve as the

engineering, procurement and con-

struction (EPC) contractor for a $134

million electrical control system up-

grade and modernisation project at

the New York Power Authority’s

2525 MW Robert Moses Niagara hy-

dropower plant.

Burns & McDonnell will work

with Emerson to implement the up-

grade, which is part of a $1.1 billion

programme to extend the life of the

hydropower plant. Emerson will

provide its Ovation automation sys-

tem as well as associated congura-

tion and commissioning services.

The project will be implemented

in a phased approach and started in

late 2019.

Wärtsilä has signed a two-year opera-

tion and maintenance (O&M) agree-

ment with the Bahamas Power and

Light Company Ltd (BPL) for a 132

MW power plant that it recently com-

pleted in the Bahamas.

Wärtsilä will train and develop the

owner’s Bahamian work force for

managing the new technology,

while also providing key perfor-

mance guarantees.

The Clifton Pier Station A power

plant project was awarded to Wärt-

silä in December 2018 on an engi-

neering, procurement, and construc-

tion (EPC) contract. The plant was

urgently needed to replace an age-

ing facility, and to improve the reli-

ability of the local grid. Wärtsilä

delivered the new plant on a fast-

track basis in just 12 months.

The New Providence-based

plant’s output is generated by seven

Wärtsilä 50 engines, running on

heavy fuel. Its engines can play an

effective balancing role, ensuring

system stability to offset the inevi-

table uctuations in supply from

wind and solar sources.

The US Department of Energy (DOE)

has awarded funding to Expert Micro-

systems to develop technology to im-

prove operations at coal red power

plants.

Expert Microsystems will lead a

project to develop, demonstrate, and

commercialise a novel approach to

improve coal red power plants’

ability to follow loads and handle

transient behaviour by integrating

two proven real-time monitoring

techniques.

“The future role of coal plants will

depend on the ability to cycle power

output and follow loads to meet

marginal power demands, accom-

modate renewables and support the

grid,” commented Randy Bickford

President & CTO of Expert Micro-

systems.

The hybrid analytics approach pro-

vides a single solution that inte-

grates an established, advanced data-

driven analytics solution that in-

cludes articial intelligence, ad-

vanced pattern recognition, and ma-

chine-learning techniques provided

by Expert Microsystems with a well-

proven, rst-principle thermal heat

balance model solution provided by

MapEx Software Inc.

XMPLR Energy is also supporting

the project.

Siemens Gamesa Renewable Energy

(SGRE) has been named as the

preferred turbine supplier for the 2640

MW Dominion Energy Virginia off-

shore wind project in the USA.

The wind farm is the largest US

offshore wind farm in development

to date. Dominion is expecting to

complete turbine installation off the

coast of Virginia by 2026 but has

yet to determine the nal number of

units and exact turbine model.

The agreement is subject to cer-

tain conditions including Dominion

Energy’s nal investment decision,

governmental permitting, and other

required approvals, SGRE said. It

will also include a long term service

and maintenance agreement.

Dominion Energy Virginia Off-

shore Wind will expand on knowl-

edge gained though the current two-

turbine, 12 MW Coastal Virginia

Offshore Wind (CVOW) project. It

is the rst offshore wind project to

be built in US Federal waters and

will utilise SGRE’s 6 MW SWT-

6.0-154 wind turbines.

CVOW is set to be online in 2020

within a research lease area adja-

cent to the site where the 2640 MW

project will be located.

Wärtsilä has signed an engineering,

procurement and construction (EPC)

contract for a new 100 MW/100 MWh

energy storage project in an unnamed

location in South East Asia.

The new facility will use Wärt-

silä’s GEMS energy management

software and will provide grid sup-

port services. It will enable the tran-

sition towards the greater use of re-

newables in the region by boosting

grid reliability, Wärtsilä said.

A Chinese consortium has signed a

deal to build the world’s largest oat-

ing solar hybrid power project.

BGRIM Power Energy China, a

consortium of B Grimm Power Plc

(BGRIM) and China Energy Engi-

neering Group Shanxi Electric

Power Engineering Co Ltd. (Energy

China) has signed an engineering,

procurement and construction

(EPC) contract with the Electricity

Generating Authority of Thailand

(Egat) to build the project at the Sir-

indhorn Dam.

BGRIM will install a 45 MW so-

lar power plant on the water surface

of the Sirindhorn reservoir and

combine it with the output of exist-

ing hydropower capacity at the site.

The project will help to create a

synergy between solar and hydro-

power and is an important step in

the development of renewable ener-

gy in Thailand, according to Egat

Director Gen Somsak Rungsita.

The solar project is set to start op-

erating at the end of 2020.

JinkoSolar Holding has signed deals

to deliver 150 MW of photovoltaic

(PV) panels for three projects in

Cambodia.

JinkoSolar will supply panels for

one 60 MW and one 30 MW PV

park in Krakor district, in Cambo-

dia’s Pursat province. The third

plant, with a capacity of 60 MW,

will be located in the central prov-

ince of Kampong Chhnang.

The solar farms are part of gov-

ernment efforts to increase renew-

able energy generation in Cambo-

dia, where electricity demand is set

to grow from 1.5 GW currently to

2.3 GW by 2020 and 2.8 GW by

2021.

Americas

Asia-Pacic

NYPA orders hydro

upgrade

Wärtsilä brings Bahamian

plant on line

Wärtsilä supports ASEAN

grid

BWSC wins Belgium

contract

DNV to monitor Núñez de

Balboa

Total and Marubeni to

build Qatar PV plant

Engie and Nareva win bid

for Gafsa

SNC-Lavalin to assess

Cernavoda 1

Israel opts for GE

HA technology

Nordex adds 172 MW to

the Netherlands

Equinor commits to

zero CO

2

Egat to build oating solar

JinkoSolar powers

150 MW in Cambodia

Expert Microsystems gets

DOE support

SGRE selected for

Dominion offshore wind

International

International

Europe

10

THE ENERGY INDUSTRY TIMES - FEBRUARY 2020

Tenders, Bids & Contracts

typically high cost kerosene or batter-

ies (used in lamps) or diesel generated

electricity, the economics of solar

with batteries is very attractive.

Rating: *****

n Application 2: Displacement of oil

generation. Developing countries use

large quantities of heavy fuel oil and

diesel to produce power. Costs vary by

country and region, but it is expensive

and polluting. Fuel savings can be

achieved by reducing demand for

heavy fuel oil and diesel-powered gen-

eration using PV and storage.

Solutions rely on tying the technolo-

gies together into a grid and providing

energy management to balance the

contributions of each energy source

and load requirements.

Currently, PV can typically account

for 10-15 per cent of energy intensive

users baseload demand, and 20-25

per cent of energy demand for domes-

tic dominated demand.

Hybrid PV-storage-diesel solutions

are suitable for isolated heavy indus-

tries or villages that use diesel genera-

tors. With typical requirements from

hundreds of kilowatts to tens of

megawatts, shifting from diesel-only

generation to hybrid solutions brings

economic and environmental benets,

extending the diesel generator’s ser-

vice life. Competing against diesel,

the economics are strong. Even versus

heavy fuel oil, such applications are

attractive.

Rating: ***** versus diesel; and ****

versus heavy fuel oil.

n Application 3: Managing PV ramp

rates where grid connected. In some

countries, PV makes up such a large

proportion of the energy mix that

weather-related uctuations in output

can cause network instability and

centrally controlled PV generation is

often curtailed. Grid operators in

Costa Rica and other countries have

addressed this by requiring PV plants

to ramp-up and ramp-down produc-

tion on demand.

Grid-tied PV and batteries can

comply with this ramp requirement.

The PV inverter is set up to provide

the ramp-up slope. Batteries can be

deployed to prevent steep falls, thus

providing the ramp-down slope. This

does not require large storage – only

equivalent to about 15 minutes of PV

capacity is needed.

Adding storage to a PV system will

increase the cost of the solution but

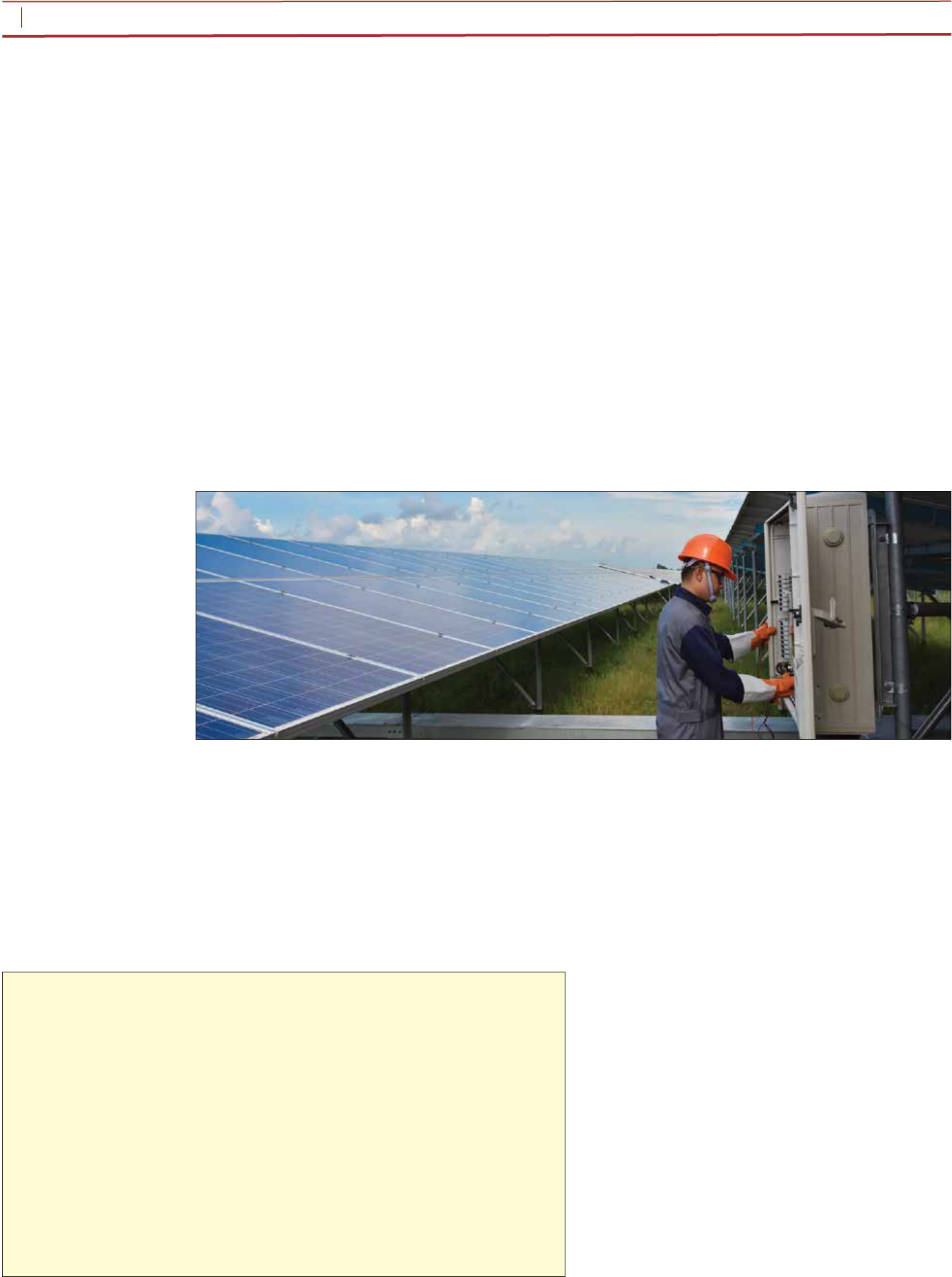

T

he percentage of renewable en-

ergy (RE) in the global energy

mix has increased signicantly

in recent years. Solar photovoltaic

(PV) technology is leading this emer-

gence, with large-scale grid-tied proj-

ects dominating in both developing

and developed countries.

Success is due to the modularity of

PV systems, which can be designed in

capacities ranging from kilowatts to

megawatts, and are simple to install,

operate and maintain.

The steep reduction in project costs

from component manufacturing, in-

stallation, operations and mainte-

nance and other costs, are the main

drivers for the rapid spread of PV

technology globally.

Grid-tied PV systems are connected

to the utility grid and have to supply

energy at a specied voltage and fre-

quency. Grid operators have addi-

tional requirements such as reactive

power control.

The main limitation of grid-tied PV

is its dispatchability – the ability to

supply power on demand. Steeply

falling energy storage costs are help-

ing PV operators respond to the

challenge, countering weather-related

intermittency to achieve a smoother

energy output curve.

Batteries are competing in the elec-

tric vehicle (EV) market as well as

bulk energy management, and inte-

grating solar PV and batteries is

opening up novel possibilities. The

following four examples cover the

main opportunities this combination

of technologies can address.

In each case, we give an indicative

scoring of the likely uptake based on

a ve-star rating, with a two-star

score indicating a marginal case for

deployment, while ve-stars indicates

a very attractive economic return.

n Application 1: Rural electrication

in developing countries. Much of Af-

rica remains off-grid. Many national

governments are not planning to ex-

pand their electrical networks into

rural areas in the foreseeable future as

low population density makes it hard

to recoup the cost of investment.

Off-grid PV offers a solution. It can

meet the needs of isolated homes,

health centres and industries. PV with

batteries can meet needs ranging from

1-10 W ‘pico’ systems for street light-

ing, for example, to domestic and

community scale. When meeting the

needs of several consumers, solutions

will involve a distribution network

and metering – so-called ‘micro-‘ or

‘mini-grid’.

Advantages of off-grid applications

include: ability to meet different load

proles; wide range of capacity from

watts to megawatts; low cost of distri-

bution due to the short distance be-

tween points of production and use;

and ability to interconnect with diesel

or hydro generation to achieve 24/7

power.

Given that the benchmark option is

THE ENERGY INDUSTRY TIMES - FEBRUARY 2020

Energy Outlook

14

Integrating solar

PV and batteries is

opening up novel

possibilities. Mott

MacDonald examines

four examples that

cover the main

opportunities this

combination of

technologies can

address, in each

case providing an

indicative scoring of

the likely uptake.

Oscar Velasco

Strengthening the PV offer

with batteries

Falling cost is the main driver for the rapid spread of PV technology

Main characteristics of solar and batteries in the four different applications

Application Main Storage Share of Output Economic Indicative

grid duration output Prole attractiveness cost

connected ¢/kWh

Rural electrication No 3-4 hours 70% Load tracking **** 25-30

Displacement of No 15-30 20-25% Natural bell ***** 8-12

oil generation mins shape

on mini grid

Managing PV Yes 15 mins Not Natural bell *** 8-12

ramp rates meaningful shape

Capacity Yes 3-4 hours Not Truncated *** 25-30

rming Meaningful bell shape

will make it technically feasible for

countries to continue to increase PV

penetration into their electrical net-

works.

The economics of adding batteries

to manage ramping are signicantly

less strong for the owner of the gen-

erator, although on an overall system

basis, this often provides a signicant

net benet. The star rating depends on

whether the generator can access the

overall system benets.

Rating: *** where benets can be ac-

cessed; otherwise **

n Application 4: Capacity rming

where grid connected. Capacity rm-

ing enables PV plus storage to dispatch

a committed power output over an

extended time period, but much less

than 24/7. Capacity rming is achieved

by storing a proportion of the energy

generated from the PV array during

peak sunlight hours, then exporting it

to the grid after sundown or even re-

taining it for early morning, when ir-

radiance is low.

Typically, this solution requires

around three generating hours of stor-

age. Committed power output will

vary depending on the power pur-

chase agreement (PPA); the PPA

needs to provide an uplifted purchase

price for delivering power outside of

the peak daylight hour which is suf-

cient to make investment in addi-

tional PV capacity and storage

worthwhile.

Rating: *** where the PPA provides

the incentive.

The table summarises the main

characteristics of solar and batteries

in the four different applications. The

indicative costs are in ¢/kWh and all

relate to a megawatt scale application

in an average African country.

Overall, we see investments in solar

continuing. It is exible, increasingly

robust and in time can be linked with

emerging technologies such as ‘green’

hydrogen – that is, hydrogen pro-

duced from water by electrolysis us-

ing renewable energy. By strengthen-

ing PV systems with batteries, the

scale of installations will increase. In

large power systems, we anticipate

single projects touching 2-3 GW in

capacity by 2030, calling for HVDC

grid connections due to increasing

distances from the power source.

Oscar Velasco is Solar Engineer at

Mott MacDonald Limited.

THE ENERGY INDUSTRY TIMES - FEBRUARY 2020

15

Technology

New technology that

combines thermal

energy storage with

Stirling engines is

being developed to

bring cost-efcient,

24/7, renewable

power closer to

commercialisation.

Junior Isles

explains.

R

enewables plus storage, and

in particular solar plus stor-

age, is fast becoming a major

disruptor technology in the electrici-

ty sector – whether as an off-grid so-

lution for remote communities in de-

veloping countries or for owners in

more developed markets looking to

produce their own power and poten-

tially sell excess electricity back to

the grid.

Typically, these systems take the

form of solar photovoltaic (PV)

panels connected to batteries, usual-

ly lithium-ion. But while battery

storage systems are cost-effective

for providing a few hours of storage

per day, they are not the ideal solu-

tion in scenarios where longer term

storage is needed.

In September last year, Swedish

solar energy company Azelio

launched a partnership with Abu

Dhabi Future Energy Company

(‘Masdar’) and Khalifa University

of Science and Technology to run a

pilot project in Abu Dhabi that will

evaluate a new technology in power

storage. It is the second such pilot

that is being built to ofcially verify

this promising technology.

This latest pilot will be installed

within the site of the Sustainable

Bioenergy Research Consortium

(SBRC) – a research centre located

at the Masdar City campus of Khali-

fa University. Electricity generated

from the installation will be used to

power the air conditioning for the

project’s ofce and storage units.

The pilot aims to test and demon-

strate Azelio’s Stirling engine sys-

tems and integrated thermal energy

storage (TES) solution for renewable

energy projects that use solar PV,

concentrated solar power (CSP) and

wind energy, or projects that provide

off-grid solutions, with the purpose

of determining if the technology can

be included in current and future re-

newable energy projects.

Commenting on the drivers behind

the technology’s development, Jonas

Eklind, Azelio’s CEO, said: “The

key driver for all our projects is that

if you want storage that can provide

you with renewable energy 24 hours

a day, our technology is the most

cost-efcient alternative.

“And the most unique thing is that

we can build these 24 hr/day solu-

tions in a distributed way, so you can

have small-medium sized projects

close to the end-user. Of course you

can build 24 hr storage with stored

hydropower but you need quite a big

end-user. Ours is a solution for what

you call distributed baseload, where

projects are based on 100 kW mod-

ules that can provide electricity for

13 hours. Plants will be typically be-

tween 500 kW and 20 MW.”

Typically, the system would com-

prise wind turbines or solar panels,

an energy storage media and a Stir-

ling engine for converting the heat

from the storage media to electricity.

Eklind explained: “The heat stor-

age is done at a very high tempera-

ture of 600°C. Firstly, this gives a

very high energy density, for more

cost-efciency; and secondly it gives

a high efciency when you convert

that heat back into electricity, since

that efciency very much depends

on the temperature potential between

the ambient temperature and the

storage temperature.”

Research and tests showed that an

aluminium alloy, with a melting

temperature of 577°C was the opti-

mum material to use as the storage

media. Eklind also explained that

having a storage media that goes

through a phase change, e.g. from

solid to liquid, allows an even high-

er energy density. He added: “We

have a maximum temperature in the

system of 670°C. As we need to do

this phase change at least one time

every day for 30 years, we need a

material that is not destroyed by the

high temperature. Salt [as the ener-

gy storage media] could not survive

such a high temperature. And even

at a lower temperature, salt could

not survive one phase change per

day for 30 years.”

Notably, the aluminium alloy is

stored in a specially shaped contain-

er that not only accommodates the

changing shape of the melting alloy

but also maximises heat transfer

from the electrical heating element

into the block of alloy. Eklind also

notes that one of the biggest innova-

tions is in the energy transport within

the system. “At the other end of the

system we have to transport the heat

energy stored in the aluminium into

our conversion unit, which is a Stir-

ling engine.”

The Stirling engine basically oper-

ates in a closed system, extracting

the heat from the storage media to

drive a piston that is connected to a

generator to produce electricity.

Azelio has been working on the

system for several years. It has been

using its Stirling engine since 2008

and developed the thermal energy

storage system in 2016. Eklind says

the company has put all the compo-

nents of the system together and is

currently running a demonstration

project in Sweden.

In addition to this, the rst pilot

plant is under way at the Noor solar

complex in Morocco. In collabora-

tion with Morocco’s Agency for

Sustainable Energy (Masen), the pi-

lot aims to produce verication data

under the more challenging ambient

conditions in which it will typically

operate.

“Operating in Morocco is different

to Sweden,” said Eklind. “There is

different ambient temperature, there

is a lot more sun and more heating

up of enclosures and there is a lot

more dust. The quality of the elec-

trical output also has to be tested. In

Sweden, there is no sun in the win-

ter, so we are charging it with grid

electricity, this quality will be dif-

ferent from the electricity produced

from PV panels.”

This pilot started operating at the

end of December last year and Aze-

lio is now optimising and tuning the

system before starting a formal ver-

ication run that will be supervised

by an external company. Data pro-

duced from this verication will be

important in securing nancing for

future commercial projects. “For

normal projects, you typically need

6-12 months of data,” said Eklind.

Formal verication will start dur-

ing the rst quarter of this year to

provide data which demonstrates

that the system can, for example, be

charged in the predicted time, con-

tain the specied amount of energy,

and discharge it in the predicted 13

hours at the specied power output.

It also needs to demonstrate the

predicted operational availability.

“We need to demonstrate that it has

run as it should with only the need to

stop it for normal service every 6000

hours,” said Eklind. “It should also

not need any special tuning or ad-

justments that requires specialists.

Essentially it must run as a commer-

cial or industrial project, that can be

serviced by local people.”

The pilot in Abu in Dhabi is a sec-

ond verication unit that will be

started in the second quarter of this

year. Here Khalifa University will

provide the research support and

expertise needed for the two testing

periods at the pilot and the data col-

lected by the researchers during the

testing phases will be compared

with data from existing dispatchable

technologies.

Following this, Azelio expects to

start volume production of its units

during the summer of 2021 and then

start “more industrial deliveries” in

the second half of that year.

There has already been signicant

interest from potential customers. In

January Azelio signed a Memoran-

dum of Understanding (MoU) with

the Jordanian company Hussein

Atieh & Sons Co. (HAE), to work

together on setting up a small-scale

project in Jordan.

The project paves the way for a

commercial collaboration of about

25 MW of Azelio’s energy storage

technology in the Jordanian market

until 2023. This capacity is forecast-

ed to provide 50 kW in 2020, 3 MW

in 2021, 7 MW in 2022 and 15 MW

in 2023. The rst project of 50 kW

with 13 hours of storage will be in-

stalled in Q4 2020.

Eklind added: “We actually have

MOUs for ve projects that have

specied timelines. These are MOUs

for projects that have a request for

deliveries of around 160 MW in total

for the period of 2020-2024. These

are in sub-Saharan Africa, Oman,

Jordan and California. We also have

MOUs with three companies for

projects without specied timelines.”

With agreements for expected de-

livery of small commercial installa-

tions this year, Azelio’s system is

essentially already a commercial of-

fering. Verication data will allow

these projects to secure nancing

and for the end customer to achieve

nancial closure.

Certainly the future looks promis-

ing, with potential customers already

lining up. According to Eklind the

company is currently evaluating a

project pipeline with a value of €16

billion.

“When we presented the solution

for the rst time in June 2018, dur-

ing that summer we received re-

quests for more than 100 projects in

20-25 different countries,” he said.

Eklind concluded: “The huge pipe-

line shows that the market is vast

and that the technology can be used

in so many different places… but at

the same time we are directly replac-

ing fossil fuels with dispatchable re-

newables. Being able to bring elec-

tricity 24 hours/day to regions that

have no access to electricity at all

has a big social impact. This makes

working on such a development very

rewarding.”

Making a

sterling effort in

energy storage

Eklind: “… the most unique

thing is that we can build

these 24 hr/day solutions in a

distributed way”

Dispatchable wind and solar, 24/7: an

artist’s rendering of Azelio’s solution

THE ENERGY INDUSTRY TIMES - FEBRUARY 2020

16

Final Word

U

S President Donald Trump

may have been the most men-

tioned participant at the recent

World Economic Forum (WEF) An-

nual Meeting in Davos, Switzerland,

but he offered little in terms of his

country’s contribution to the battle

against climate change.

While topics like geopolitics and

cyber threats were among the top

subjects of the week-long debates, the

main discussions centred on climate

change and the associated risks. Much

of Trump’s speech, however, was de-

voted to lauding his administration’s

domestic economic policies.

Clearly Trump – a long time climate

change sceptic, who in the early days

of his presidency dismissed it as a

hoax created by the Chinese – either

remains unchanged in his beliefs or

puts his own domestic economy

ahead of tackling what is by common

consensus a global crisis.

Indeed in his Davos address the US

president poured scorn on what he

sees as pessimism and alarmist rheto-

ric from climate change activists and

environmentalists.

“To embrace the possibilities of

tomorrow we must reject the peren-

nial prophets of doom and their pre-

dictions of the apocalypse. They are

the heirs of yesterday’s foolish fortune

tellers,” he said, adding that those

people “want to see us do badly”. He

compared such “alarmists” to the

Cassandras of earlier decades who

warned of over-population, “mass

starvation,” and the “end of oil”.

“We will never let radical socialists

destroy our economy, wreck our

country…,” he said. This begs the

question: does Trump see “radical

socialists” as a greater threat than

climate change? Perhaps he knows

something we do not, although I

doubt it.

Trump said that with “US research-

ers and companies leading the way, we

are on the threshold of virtually unlim-

ited reserves of energy including from

traditional fuels: LNG, clean coal, next

generation nuclear power and gas

hydrate technologies”. Trump should

note that such energy reserves are from

unlimited and with the exception of

nuclear, all emit carbon when burned.

In fact, although a potentially valuable

energy resource, gas hydrates release

large amounts of methane – an even

more potent greenhouse gas than CO

2

– when they decompose.

So apart from investing in “virtually

unlimited reserves of energy”, what’s

his plan? The only statement related

to climate change that received ap-

plause from the audience was his

commitment to the ‘1 Trillion Trees

Initiative”, a programme to protect and

restore one trillion trees by 2050.

Planting more trees is admirable; trees

are nature’s carbon-sink and efforts are

needed from all directions. Yet it is

hardly a strategy that Trump needs to

announce with such fanfare. Putting it

into perspective, 1 trillion trees is al-

most three times the amount of all the

trees in the amazon rain forest. Just

nding space and physically planting

that many trees is a tall order; and how

much of an effect will they have?

Equally critical, is how fast would they

have an impact?

Trump would do better to clean up

industries and their energy supplies,

and redouble efforts in energy ef-

ciency in both electricity supply and

heat. Further, there is increasing evi-

dence that investing in clean tech will

not “wreck our economies”. To the

contrary, businesses see investing in

clean and sustainable technology as

crucial to addressing their future busi-

ness challenges, of which risks linked

to climate change rank as the greatest

concern.

During the Davos meeting the WEF,

in collaboration with Marsh &

McLennan and Zurich Insurance

Group, launched its ‘Global Risk

2020 Report’. The report is part of the

Global Risks Initiative, which brings

stakeholders together to develop

sustainable, integrated solutions to

the world’s most pressing challenges.

In compiling the report, over 750

global experts and decision-makers

were asked to rank their biggest

concerns in terms of likelihood and

impact. For the rst time in the sur-

vey’s 10-year outlook, the top ve

global risks in terms of likelihood are

all environmental.

The report sounds the alarm on:

extreme weather events with major

damage to property, infrastructure

and loss of human life; failure of

climate change mitigation and adap-

tation by governments and busi-

nesses; man-made environmental

damage and disasters, including en-

vironmental crime, such as oil spills,

and radioactive contamination; major

biodiversity loss and ecosystem col-

lapse (terrestrial or marine) with ir-

reversible consequences for the envi-

ronment, resulting in severely

depleted resources for humankind as

well as industries; and major natural

disasters such as earthquakes, tsuna-

mis, volcanic eruptions, and geomag-

netic storms.

It adds that unless stakeholders adapt

time will run out to address some of

the most pressing economic, environ-

mental and technological challenges.

This signals where action by business

and policy-makers is most needed.

John Drzik, Chairman of Marsh &

McLennan Insights, said: “There is

mounting pressure on companies –

from investors, regulators, customers,

and employees –to demonstrate their

resilience to rising climate volatility.”

Corporations appear to be embracing

the changes needed to build sustain-

able, clean businesses – not just to gain

PR points but because it makes busi-

ness sense. The growing number of

RE100 members and companies

achieving carbon neutrality is grow-

ing. RE100 is a global corporate

leadership initiative bringing together

inuential businesses committed to

100 per cent renewable electricity.

Since it was launched at Climate

Week NYC 2014, the initiative has

expanded across Europe, North

America, India, and China, and is now

seeing rapid growth in areas such as

Japan and Australia.

Led by The Climate Group in part-

nership with CDP, RE100’s purpose is

to accelerate change towards zero

carbon grids, at global scale. Both The

Climate Group and CDP are part of

the We Mean Business coalition,

working to catalyse business action

and drive policy ambition to accelerate

the zero-carbon transition.

According to the coalition, 1176

companies globally now recognise the

transition to a zero-carbon economy is

the only way to secure sustainable

economic growth and prosperity for

all. It says businesses are harnessing

climate action as a driver of innova-

tion, competitiveness, risk manage-

ment and growth, while delivering the

emissions reductions needed to avoid

dangerous climate change.

With energy systems being the

driver of economic growth, corpora-

tions are making the transition by

committing to sourcing 100 per cent

of their energy from renewables and

increasing energy productivity.

Last month Visa announced it had

reached its goal to use 100 per cent

renewable electricity by 2020, while

Japanese carmaker Toyota Motor

Corp. said it successfully powered its

European operations and facilities

with 100 per cent renewable electric-

ity in 2019. And in a blog post pub-

lished during the week of the Davos

meeting, Microsoft went one step

further, pledging to become “carbon

negative” by 2030. The $1.2 trillion

software giant said it would launch a

$1 billion innovation fund to tackle the

climate crisis with new carbon reduc-

tion, removal and storage technology

and said would offset all the carbon

emissions it has produced since it was

founded in 1975.

These announcements illustrate that

clean energy and sustainability is not

only essential to avoid irreversible

climate change but is also big business.

In January research company

BloombergNEF (BNEF) reported

that a new record was set in 2019 for

the volume of sustainable debt issued

globally in any one year, with the

total hitting $465 billion globally, up

from $261.4 billion in 2018.

Jonas Rooze, lead sustainability

analyst at BNEF, commented: “Our

data show sustainable nance con-

tinuing to power ahead on a global

basis. The steep increase is fuelled by

end-investors’ concerns about the

threat of climate change, and the

desire of many big company, bank

and government leaders to be seen as

behaving responsibly.”

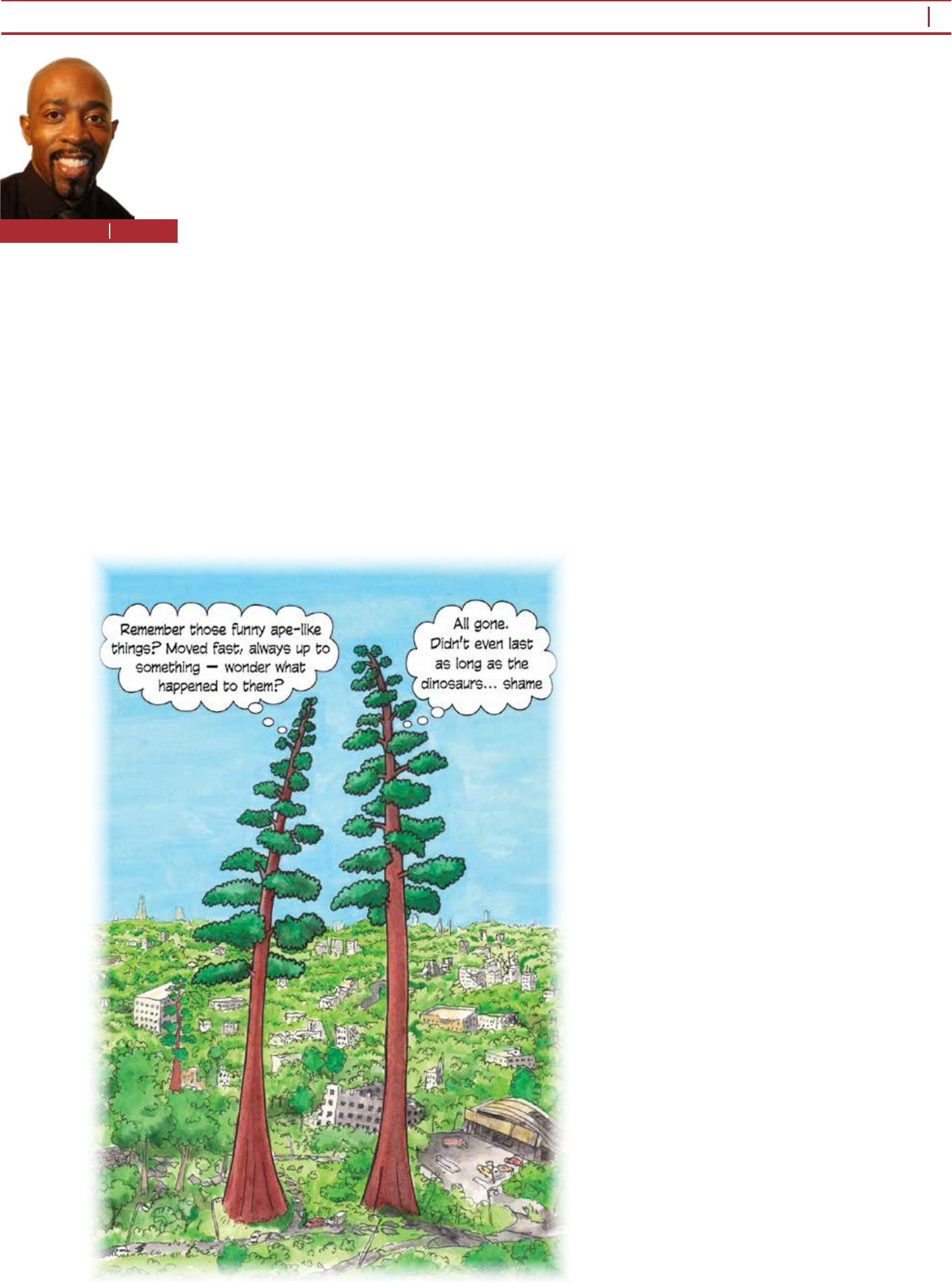

The path ahead, however, will not

be easy. As Mathias Lelievre, CEO at

Engie Impact, points out: “Compa-

nies are increasingly embracing the

notion of sustainability transforma-

tion, but the challenge of achieving

carbon reduction targets is highly

complex – that’s why according to

Engie Impact analysis, only 25 per

cent of companies are on pace to

achieve their commitments.”

Clearly the battle against climate

change is no walk in the park, no

matter how many trees are planted.

More trees just won’t cut it

Junior Isles

Cartoon: jemsoar.com