www.teitimes.com

January 2020 • Volume 12 • No 11 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Beyond cables

Preparing for a

greener future

Electrical asset management in a

changing world.

Page 13

Utilities are repositioning themselves

to take a bigger focus on renewables,

storage and networks. Page 14

News In Brief

Europe aims to lead climate

battle with Green Deal

The European Commission has set

out its plan to make Europe the rst

climate-neutral continent by 2050.

Page 2

US loses out in solar tariff

war

US policy on solar energy

equipment imports has cost the

country around 10.5 GW of new

capacity, according to the Solar

Energy Industries Association

(SEIA).

Page 4

Stranded coal red asset

risk deepens as renewables

gain

A new report nds India’s

Parliamentary Standing Committee

could have underestimated the true

number of stranded assets in the

country.

Page 5

EIB deal highlights H

2

goal

The potential role that hydrogen

could play in the ght against

climate change has been highlighted

by a landmark agreement between

the European Investment Bank and

the Hydrogen Council.

Page 7

State Grid targets Oman

China’s State Grid has continued

its overseas utility sector expansion

with the purchase of a 49 per

cent stake in Oman’s Electricity

Transmission Company.

Page 8

Mitsubishi wins in Eneco

sell-off

Japan’s Mitsubishi has expanded its

European footprint with a successful

bid for Eneco, one of the largest

suppliers of electricity and gas in the

Netherlands.

Page 9

Technology: Unlocking value

through digitalisation

A new IoT platform uses intelligence

at the grid edge and across

distribution systems to help utilities

master the challenge of providing

grid exibility, resilience and

security.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

Climate negotiators agreed what is seen as a weak deal at COP25 in Madrid but delayed

agreement on carbon markets to COP26 in Glasgow. Junior Isles

WB announces global partnership for implementing

carbon markets

THE ENERGY INDUSTRY

TIMES

Final Word

COP25 haunted by the

Ghost of Christmas Past,

says Junior Isles.

Page 16

Delegates at the UN’s 25th Confer-

ence of Parties 2019 (COP25) on

tackling climate change reached a

compromise deal in December, ap-

proving the need to curb carbon emis-

sions globally. However, key issues

under Article 6 of the Paris Agreement

remain unresolved.

By the end of the talks, held in Ma-

drid, negotiators agreed that all coun-

tries will need to put new improved

climate pledges on the table by the

time of the next major conference in

Glasgow in November. All parties will

need to address the gap between what

the science says is necessary to avoid

dangerous climate change.

The UN Environment Programme’s

(UNEP) own emissions gap report,

released just prior to the COP, showed

the 1.5°C extended goal of the Paris

Agreement is “slipping out of reach”.

Even if existing climate pledges –

countries’ Nationally Determined

Contributions (NDCs) – are met,

emissions in 2030 will be 38 per cent

higher than required to meet that tar-

get, said the report.

A push led by the European Union

and small island states at the meet-

ing for greater climate ambition was

opposed by a several countries,

including the US, Brazil, India and

China. However a compromise was

agreed with the richer nations having

to show that they have kept their

promises on climate change in the

years before 2020.

Despite the deal, however, the lack

of progress in Article 6 was widely

seen as a failure for COP25. Article 6

under the Paris Agreement is de-

signed to allow developing countries

to sell their unused pollution allow-

ance, in the form of carbon credits,

to heavy polluting developed coun-

tries that exceed targets. Those that

exceed pollution levels would be

nancially penalised.

The emissions credits issued under

the 1997 Kyoto protocol, however, are

now almost worthless. The countries

that still hold the old credits, including

China, India and Brazil are arguing to

have the right to carry them over into

the new system that should have been

agreed in Madrid. Australia, mean-

while has lobbied to carry over a sec-

ond type of credit, which would allow

it to apply the credits it received for

over-achieving on prior climate goals

towards its future targets in 2030.

Continued on Page 2

The World Bank (WB) has moved to

help the rollout of carbon markets. On

the sidelines of the UN’s COP25

meeting in Madrid in December, the

bank, together with country partners

including Canada, Chile, Germany,

Japan, Norway, Spain, and the United

Kingdom, announced the ‘Global

Partnership for Implementing Carbon

Markets (PMI)’ to help countries em-

barking on carbon pricing move from

readiness to rollout.

The Partnership, which will get un-

derway in July 2020, will provide

technical assistance to countries to

design, pilot and implement carbon

pricing and market instruments. It

will support the direct implementa-

tion of carbon pricing in at least 10

developing countries and help a fur-

ther 20 countries get ready to do so.

“Well-designed carbon pricing in-

struments can be a transformative

part of the climate action toolkit.

Over half of countries worldwide are

thinking about how carbon pricing

can help them meet their climate tar-

gets,” said Laura Tuck, Vice Presi-

dent of Sustainable Development,

World Bank. “This Partnership can

help countries wanting to encourage

climate action through strong carbon

markets to get this right, building on

what we know works, sharing expe-

riences and best practices, and help-

ing them ensure their citizens are on

board with new policies.”

The PMI is a response to increased

demand for carbon pricing imple-

mentation support and knowledge

exchange. WB says it builds on the

success of its long-standing pro-

gramme, the ‘Partnership for Market

Readiness (PMR)’, that has provided

targeted technical assistance on car-

bon pricing to over 20 emerging

economies and developing countries,

collectively accounting for over 40

per cent of global greenhouse gas

emissions.

The PMI is expected to begin op-

erations in July 2020 when it antici-

pates having reached $100 million in

capitalisation and, over its 10-year

programme, will have a total capi-

talisation target of $250 million.

Germany’s Minister for the Envi-

ronment, Svenja Schulze said: “The

PMI is well-positioned to step-up the

climate action agenda to the next

level of ambition for reaching the

goals of the Paris Agreement. Thus, I

am pleased to announce for Germany

a pledge of €10 million ($11 million}

to the programme.”

The Partnership aims to:

n Support countries and jurisdictions

in the development and implementa-

tion of carbon pricing instruments;

n Assist countries to cooperate with

each other, via the operation of Article

6 of the Paris Agreement;

n Help countries identify and imple-

ment best practices and, where rele-

vant, achieve compatibility with

other countries’ carbon pricing and

markets;

n Inform national and international

policy discussions on carbon pricing,

including by providing a platform for

collective innovation on instruments

and;

n Develop a comprehensive knowl-

edge base and facilitate information

exchange on carbon pricing instru-

ments and proven market

mechanisms.

Juan Carlos Jobet, Minister of En-

ergy, Chile, commented: “The PMR

has been key in building capacities

on carbon pricing in our country, in-

cluding the mechanisms to track

greenhouse gas emissions and miti-

gation outcomes… New programmes

such as the PMI come at a very good

moment for Chile and other imple-

menting countries, since sustained

efforts are essential for our climate

policy where carbon pricing is a core

element.”

Negotiators

compromise at

COP25 but key

issues delayed

UN Secretary-General António Guterres expressed

disappointment at outcome of conference

THE ENERGY INDUSTRY TIMES - JANUARY 2020

3

REGISTER AT: www.africaenergyindaba.com

AFRICA’S ENERGY SECTOR:

FROM TRANSFORMATION

TO TRANSITION

3 - 4 MARCH 2020

CTICC | CAPE TOWN | SOUTH AFRICA

Thinking Energy

South African National Ene rgy Association NP C

Strategic Partners

Energy & Storage

solutions expertise

Securing energy supplies

Ensuring a reliable power supply is one

of the key factors for progress and

prosperity around the world. Building

on decades of MAN innovation, we can

help secure clean and effi cient energy

supplies for your customers. Our expertise

covers solutions for hybrid power, LNG

to power, energy storage, power-to-X,

thermal power plants, and CHP.

www.man-es.com

Your reliability

shines

1912_14870_MAN_ES_Anzeige_SC_KV_Power_YourReliabilityShines_reSe_ENG_249x160mm_ISO_V2.indd 1 01.10.19 13:36

THE ENERGY INDUSTRY TIMES - JANUARY 2020

4

Americas News

Siân Crampsie

Chile has used the COP25 climate

talks in Madrid to outline its plans to

retire coal red power generation

capacity early.

The country’s government said it

would retire four large coal red

power plants ahead of schedule and

replace the capacity with renewables.

According to a government state-

ment, Engie’s Mejillones CTM1 and

CTM2 coal red plants, accounting

for 334 MW in capacity, will close by

the end of 2024, earlier than the

originally planned date of 2040.

Meanwhile AES Gener’s 334 MW

of capacity at its two Ventanas units

will be phased out in 2022, two years

ahead of schedule.

Chile is aiming to become carbon

neutral by 2050 and closing coal red

capacity is key to its plan. The country

is also encouraging renewable energy

investments and investing in the grid

network to assist the transition.

Coal accounts for around 40 per cent

of electricity generation in Chile,

which also says it has already hit a

target set for 2025 of 25 per cent re-

newable energy share.

According to the energy ministry,

Chile currently has a pipeline of 602

km of transmission lines and 3562

MW of power plants, 97 per cent of

which are renewable energy projects.

Engie is planning construction of

1 GW of renewables capacity in Chile

to replace its shuttered coal capacity.

Its projects include the under-con-

struction Capricorn solar park and

Calama wind farm. a third project,

Tamaya solar park, will begin con-

struction in the rst quarter of 2020.

Engie has also signed a letter of in-

tent with the Inter-American Devel-

opment Bank (IDB) to structure a

long-term loan for up to $125m to

nance investments in renewables.

IDB has developed an instrument to

lower the nancial cost of renewable

energy projects for companies that

own coal red power plants, monetis-

ing the reduction in emissions.

In 2019 Engie closed two coal units

in Tocopilla totalling 170 MW. It plans

to close 270 MW at two more sites in

2021, and will also close 135 MW in

Peru in the same year.

n Vestas has secured a turbine order

for the 185MW Cerro Tigre wind proj-

ect in Chile from Mainstream Renew-

able Power. It will supply and install

44 of its V117-4.2 MW machines and

service the wind farm for 20 years.

General Fusion will formally launch a

project to demonstrate its nuclear

fusion technology after closing a $65

million funding round.

The Canada-based company says

that the equity nance was led by Sin-

gapore’s Temasek and includes invest-

ments from Development Bank of

Canada, the DLF Group, Gimv, I2BF

Global Ventures, and Disruptive Tech-

nology Advisers.

General Fusion has also raised C$50

million ($38.26 million) in additional

investment from Canada’s Strategic

Innovation Fund, enabling it to launch

its programme to design, construct,

and subsequently operate its Fusion

demonstration plant.

The demonstration plant is designed

to conrm the performance of Gen-

eral Fusion’s magnetized target fusion

technology in a power plant relevant

environment. “Pursuit of this next im-

portant step toward commercially vi-

able fusion energy reects the growing

global collaboration between public

and private stakeholders in this trans-

formative technology,” the company

said.

“The world is pivoting toward fusion

as the necessary complement to other

technologies which, collectively, will

enable the carbon-free energy future

we all need,” said Chief Executive Of-

cer Christofer Mowry. “The success

of our nancing is further evidence that

the global stakeholders in this endeav-

our are leaning into this challenge with

action.

General Fusion has attracted more

than $200 million in funding to de-

velop its fusion technology. Existing

backers include Amazon founder Jeff

Bezos, Khazanah Nasional Berhad,

Braemar Energy Ventures, Entrepre-

neurs Fund, and SET Ventures.

US policy on solar energy equipment

imports has cost the country around

10.5 GW of new capacity, according

to the Solar Energy Industries Asso-

ciation (SEIA).

A market impact analysis carried out

by the SEIA says that tariffs imposed

on imported solar cells and modules

have “devastated” the sector with the

loss of more than 62 000 jobs and $19

billion of investment since 2017.

In addition to its economic impact,

tariffs on solar have caused 10.5 GW

of solar installations to be cancelled,

SEIA said in a statement.

The analysis comes as the mid-term

review process for the tariffs begins at

the US International Trade Commis-

sion on December 5th, and covers

tariff impacts from the beginning of

the 2017 trade complaint by Suniva

through the end of the tariff lifecycle

in 2021.

“Solar was the rst industry to be hit

with this administration’s tariff policy,

and now we’re feeling the impacts that

we warned against two years ago,” said

Abigail Ross Hopper, President and

CEO of the Solar Energy Industries

Association. “This stark data should

be the predicate for removing harmful

tariffs and allowing solar to fairly com-

pete and continue creating jobs for

Americans.”

The US administration imposed Sec-

tion 201 tariffs on solar goods in early

2018, with a 30 per cent tariff on solar

cells and modules.

The policy has helped solar compa-

nies with manufacturing facilities in

the USA such as Suniva, which

brought the original complaint to the

International Trade Commission.

According to SEIA’s analysis, each

new job created by the tariff results in

31 additional jobs lost, 5.3 MW of

solar deployment lost and nearly $9.5

million of lost investment.

According to the report, uncertainty

caused the market to lose out on 3 GW

of installations as rumours and actual

tariffs disrupted contracts in 2017 and

2018. The actual tariffs then reduced

the market for new projects by 7.5 GW

from 2019 - 2021.

The reduced solar deployment g-

ures will also impact the USA’s emis-

sions, it added, because higher prices

for solar energy push economics in

favour of substitutes, including gas-

red power plants.

Tariffs on solar are most harshly af-

fecting nascent solar markets including

Alabama, Nebraska, Kansas, and the

Dakotas. These markets “won’t be able

to get off the ground” because tariffs

make solar uncompetitive, SEIA said

in a statement.

The Section 201 solar tariffs began

at 30 per cent in 2018, and ramped

down to 25 per cent in 2019, 20 per

cent in 2020 and 15 per cent in 2021.

The US state of New Jersey has dou-

bled its offshore wind energy goal as

part of plans to produce 100 per cent

of its electricity needs from renew-

ables by 2050.

NJ Governor Phil Murphy has

signed an executive order setting the

state’s goal for offshore wind at 7.5

GW of 2035, up from the previous

goal of 3.5 GW.

The state this year issued a solicita-

tion and selected Danish energy giant

Ørsted as a preferred bidder for Ocean

Wind, the rst offshore wind project

in the state with 1.1 GW of capacity.

It is also planning to issue further

solicitations for 1200 MW of offshore

wind generation in 2020 and 2022.

Governor Murphy said: “There is no

other renewable energy resource that

provides us with either the electric-

generation or economic growth

potential of offshore wind.

“When we reach our goal of 7500

MW, New Jersey’s offshore wind in-

frastructure will generate electricity to

power more than 3.2 million homes

and meet 50 per cent of our state’s

electric power need. We have an im-

mense opportunity to maximise our

potential and make this region and,

specically New Jersey the nexus of

the global offshore wind industry.”

Chile taps renewables to ll

coal gap

Fusion rm raises

$65 million

US loses out

in solar

tariff war

Vermont hosts

Highview

NJ doubles offshore wind goal

Highview Power Storage says that a

planned long duration energy storage

facility in northern Vermont, USA, will

help to resolve transmission system

issues in the region.

The company has announced plans

to develop a 50 MW+ liquid air energy

storage system with Encore Renew-

able Energy.

The facility will be able to provide

400 MWh of storage and will be the

rst storage plant of its kind in the USA.

The project is the rst of many utili-

ty-scale, liquid air energy storage

projects that Highview Power plans to

develop in the USA to help scale up

renewable energy deployment. The

Vermont facility will contribute to re-

solving the long-standing energy

transmission challenges surrounding

the state’s Shefeld-Highgate Export

Interface (SHEI) and enable the ef-

cient transport of excess power from

renewable energy sources, such as

solar and wind power to help integrate

them on the power grid.

Salvatore Minopoli, Vice President

of Highview Power USA, said the

company has strategically sought part-

ners in the US that are renewable en-

ergy market leaders with experience in

developing large-scale projects. “With

their expertise in community-scale

solar PV systems, traditional battery

storage applications and solutions for

the redevelopment of under-utilised

properties, Encore Renewable Energy

is a perfect partner for us as we con-

tinue expanding our technology in the

United States,” Minopoli said.

With Highview Power’s liquid air

energy storage solution, excess or off-

peak electricity is used to clean and

compress air which is then stored in

liquid form in insulated tanks at tem-

peratures approaching -196°C. When

electricity is in high demand and more

valuable, the pressurised gas is allowed

to warm, turning a turbine as it expands

and thus generating energy that can be

used at peak times when the sun is not

shining and the wind is not blowing.

Chile has accelerated its coal plant closure programme and continues its investment in renewables.

SERVICE & SUPPLY

ANALYZE & INVEST

TRADING & FINANCE

FROM GLOBAL PERSPECTIVES TO

DEEP INSIGHTS INTO MARKETS.

EUROPE´S LEADING

ENERGY TRADE FAIR

E-WORLD

ENERGY & WATER

FEBRUARY 11 – 13, 2020

ESSEN

|

GERMANY

#Eworld2020

www.e-world-essen.com

THE ENERGY INDUSTRY TIMES - JANUARY 2020

6

www.teitimes.com

THE ENERGY INDUSTRY

TIMES

subscribe today

The Energy Industry Times is the only publication that

covers global news related to the power and energy

sector in a newspaper style and format whose

uniqueness is recognised by our readers.

As a paid subsciber you will gain full access to our online

news desk.

You will also no longer have to wait for the printed edi-

tion; receive it by PDF “hot off the press” or download it

online.

To subscribe, email subscriptions@teitimes.com or visit

www.teitimes.com

To guarantee receiving your monthly copy of the award

winning newspaper, you need to subscribe today

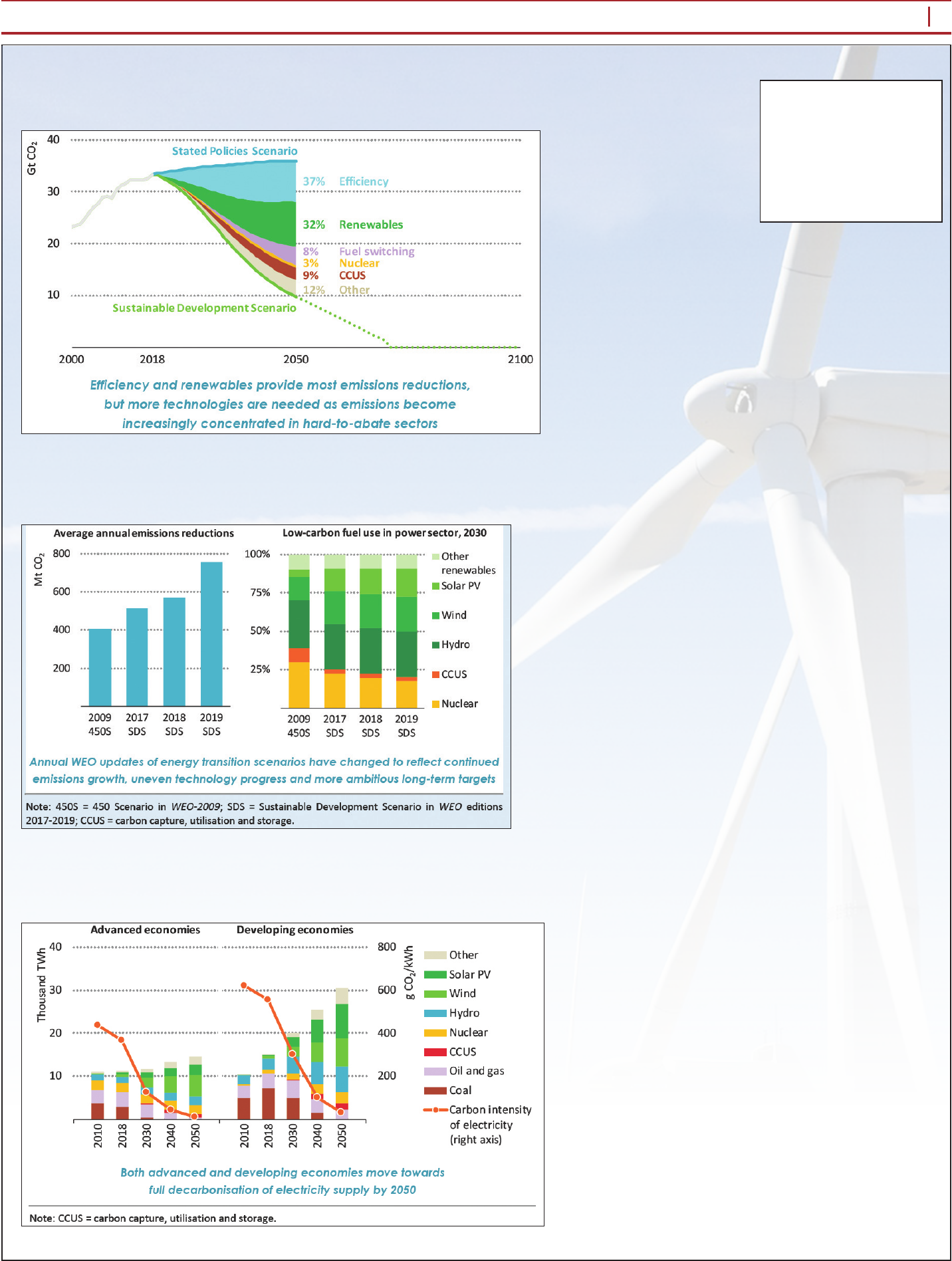

IEA 2019 World Energy Outlook. All rights reserved.

THE ENERGY INDUSTRY TIMES - JANUARY 2020

11

Energy Industry Data

Energy-related CO

2

emissions and reductions by source in the

Sustainable Development Scenario

Average annual post-peak CO

2

emissions reductions and power

sector mix in various WEO scenarios

Electricity generation by source and carbon intensity of electricity

in the Sustainable Development Scenario

World Energy Outlook 2019, © IEA/OECD, Figure 2.1 , page 79

World Energy Outlook 2019, © IEA/OECD, Figure 2.2, page 84

World Energy Outlook 2019, © IEA/OECD,, Figure 2.2, page 84

For more information, please contact:

International Energy Agency

9, rue de la Fédération

75739 Paris Cedex 15

France

.

Email: bookshop@iea.org

website: www.iea.org

there is “a massive opportunity”

which might come in the shape of

shifting demand patterns or sector

coupling.

Mark Lewis, Head Climate Change

Investment at BNP Paribas, said “the

debate is moving quite quickly” and

the method of providing exibility

will be location dependent. “Gas will

certainly be needed for the next de-

cade but storage is the next obvious

thing. Ultimately, that will be the key

technology over the next decade or

two. If we are really going to decarbo-

nise global power systems, that is es-

sentially the rst step to achieving the

Paris Agreement targets.”

Anna Borg, Chief Financial Ofcer,

Vattenfall, described the impacts of

the changing energy landscape, and

what it takes to become a fossil-free

utility. One of the utility’s core beliefs

about how utilities will adapt, is that

digitalisation is necessary throughout

the entire value chain.

“It has already hit in the customer

interface many years ago. We can

now see that it is being deployed in

the actual businesses of the compa-

nies and their whole operation to

bring efciencies and utilise the data

that we have in the right way, etc.”

She says the next step will be B2B

business models around opportunities

at the core capabilities of digitalisa-

tion. “The difference between that

and just using digitalisation in new

business models is like using it to

widen a road that goes across a moun-

tain or using it to dig a tunnel through

the mountain. These are two very

different business models – it doesn’t

matter how good you are at widening

a road over a mountain if someone

builds a tunnel. That step still remains

[to come] within the energy industry.”

Borg believes it is possible to

achieve “fossil-free living within one

generation” and outlined Vattenfall’s

path to getting there. She stressed:

“It’s not our sustainability strategy;

it’s our core business strategy.”

She said the company’s operations

in the Netherlands would be coal-

free from 2020, following the closure

of the last of its coal plant in 2019.

By 2023 it will have 10 GW of third

party renewables capacity under

management and 600 MW of exible

hydro capacity to enable more re-

newable generation.

This means that by 2025, it will

generate enough fossil-free energy

to power 30 million homes. Also, by

2025 its entire Nordic production

eet will be free from fossil fuels. It

plans to phase-out fossil fuels in heat

production, which is mainly in Ger-

many, by 2030.

Like many of Europe’s big utilities,

Vattenfall is restructuring and dra-

matically changing its investments to

focus mainly on renewables. At the

same time, it is forming partnerships

in areas such as battery storage and

electric vehicles.

As Borg pointed out, there are many

pieces of the puzzle that need to t

together as utilities adapt to the new

market. And there will be pieces that

utilities are not yet aware of in areas

that may also present opportunities.

They will need to make investments

in interconnectors and transmission

grids, as well as distribution grids, she

added. But, as Borg summarised:

“Vattenfall, will be protable, not

despite doing this but because we’re

doing this.”

It is a key message for energy com-

panies around the world as the transi-

tion continues to take shape.

A

lthough subsidies are playing

less of a role in driving invest-

ment in renewables, 2020-

2021 will see Europe’s utilities con-

tinue to gear investments toward

renewable energy, according to

Moody’s. And one consequence of

this will be a continuation in the repo-

sitioning of business models, with a

greater focus on networks and storage.

At its ‘European Utilities’ confer-

ence held in November in London,

the ratings agency said the outlook

for unregulated utilities over the next

12-18 months remains positive and

that power prices would remain

around the same level, as demand

remains at.

In a separate research note pub-

lished around the time of the confer-

ence, S&P Global Ratings had said it

sees “stable and credit-supportive

power prices over 2020-2022”,

which eases downside risk. It noted:

“European utilities we rate, have

signicantly reduced their merchant

power exposure by selling part of

their generation eet and investing

heavily in long-term contracted or

subsidised renewable energy proj-

ects, thereby protecting themselves

from power price volatility.”

In its own research note issued

alongside its conference, which ad-

dressed the theme ‘Going Green:

Delivering the energy transition’,

Moody’s said environmental policies

will continue to be one of the main

drivers of growth of renewables’

share in the energy mix. It said that

development of renewables slowed in

certain countries, such as Spain and

Italy, during the middle of the decade,

when subsidies were reduced. How-

ever, it expects that renewables’ share

of output will continue to rise rapidly

in Germany and Great Britain, add-

ing, “… and we expect growth in

southern European countries to pick

up as the cost of solar photovoltaic

falls”. The agency said that utilities

would commission about 15 GW of

solar and wind capacity in 2020.

According to Moody’s, the ongoing

build-out of utility-scale renewables

will therefore continue to displace

conventional generation. In parallel,

the rise in the carbon price under the

EU Emissions Trading Scheme

(which has more than tripled since

early 2018 following the reform of

the market stability reserve mecha-

nism) and declining gas prices are

increasingly pushing coal red gen-

eration out of the merit order.

As a result of these market condi-

tions, it noted that Endesa SA an-

nounced in September 2019 the sus-

pension of its mainland coal red

power generation in Spain, while SSE

plc conrmed in November 2019 the

closure of its last remaining coal units

at Fiddler’s Ferry by 31 March 2020.

The agency added: “Conversely, we

expect gas red plants to benet from

the shift in the merit order, at least in

the next two to three years.”

Speaking at the conference Paul

Marty, Senior Vice President/Man-

ager, EMEA Infrastructure Finance,

at Moody’s, said: “We expect that

coal will continue to come down and

that will be offset by an increase in

renewables. As coal comes off the

system in the coming years, it will be

partially replaced by exible technol-

ogy such as gas, and we see gas

coming back to the levels that we saw

at the start of the decade.”

In a scenario where power prices

remain largely stable, while the fuel

mix changes, Marty says utilities

have repositioned their business

models.

“It is fair to say the sector has con-

tinued to successfully transition its

business model, moving away from

too many exposed activities, such as

merchant generation, to more low risk

contracted generation and networks.”

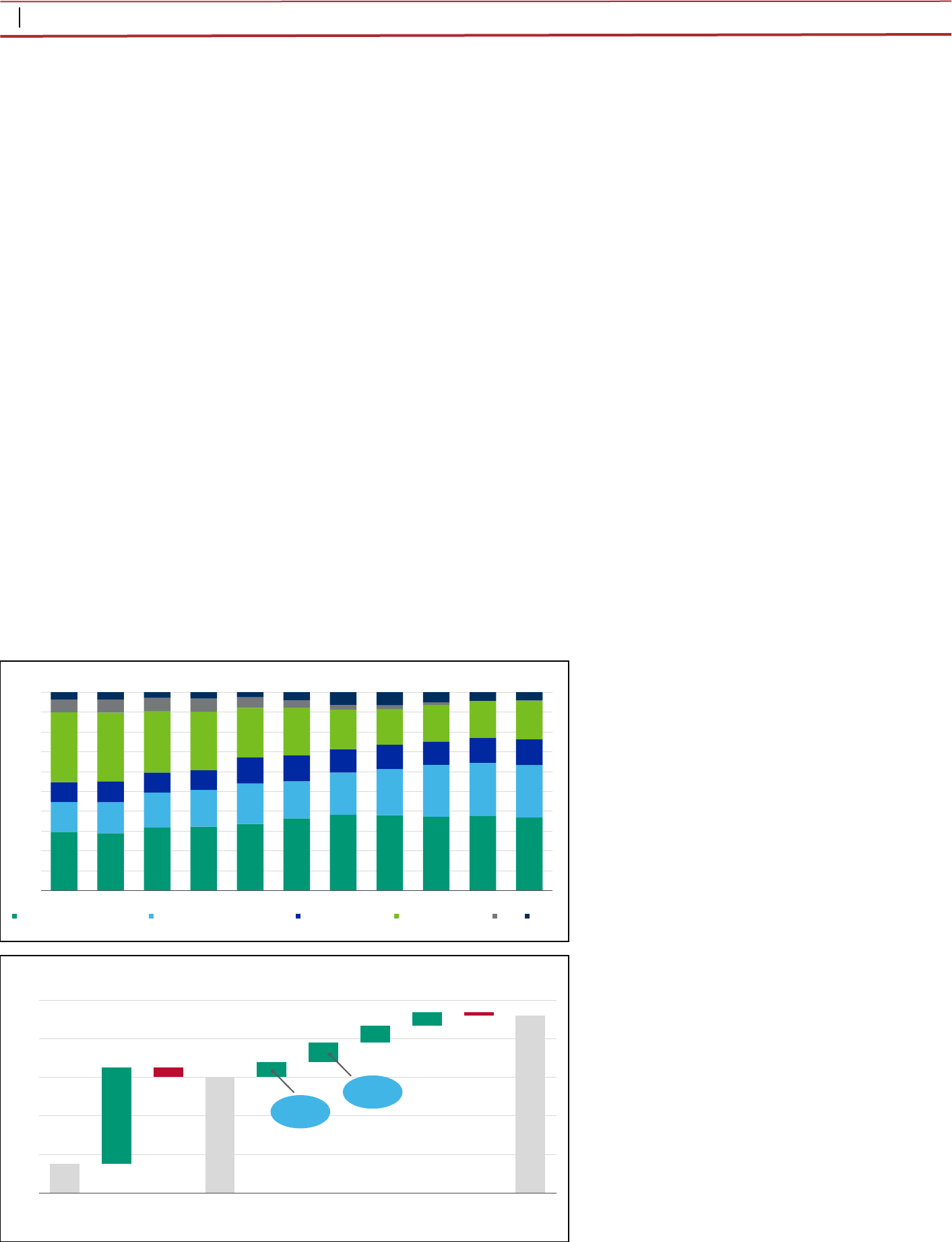

He showed how the EBITDA splits

for the 20 largest utilities had changed

over the last decade. The share of

regulated networks and storage, along

with regulated/contracted generation,

had risen from about 45 per cent in

2011 to around 65 per cent.

Moody’s expects investment in

regulated networks, renewable gen-

eration and energy supply and ser-

vices to represent more than 70 per

cent of total capital expenditure in the

2019-21 period.

Following the outlook from Marty,

John Feddersen, Co-Founder and

CEO of Aurora Energy Research, of-

fered his view on the implications of

very deep decarbonisation for utilities

and investors.

Looking at the UK, as the rst major

economy to commit to net zero decar-

bonisation by 2050, Feddersen noted

that it would require an average of

£4-9 billion of capital investment in

renewables per year through to 2050.

He said: “… regardless of what route

you take, we are going to need a lot of

renewables; they are the cheapest

form of decarbonisation.”

He stressed, however that the UK

will not get to net zero with market

arrangements as they currently are.

“There won’t be enough value in the

energy market to deploy the renew-

ables or anything else that we need.

The government could continue to

support the build-out of assets through

CfDs (Contracts for Differences) and

ROC (Renewable Obligation Certi-

cates). Another way is to put up car-

bon price substantially, which would

increase the price of electricity and

we could deploy more renewables at

a given cost…”

Feddersen described renewables as

“the dog” and exibility as therefore

“the tail of the dog”. He noted that a

high-renewables system increases

the need for exibility and reliability,

which creates opportunities for ex-

ible generation and particularly

storage.

“The problem with the dog is that

renewables are unpredictable, we

don’t know how much output we are

going to get in the next hour or two or

next day; it’s variable, in that its out-

put goes up and down; and it’s undis-

patchable, we can’t turn it up or down.

This brings a lot of opportunities in

the exibility space.”

According to Aurora, this opportu-

nity is quite large. The amount of

daily storage in Great Britain on a

winter’s day in 2040 was estimated at

only about 240 GWh, which is about

24 GW of daily storage capacity. At

the moment, he says Britain has about

5 GW. Feddersen commented: “A

material increase is needed in the

daily system but it’s not huge.” How-

ever, beyond daily storage he says

THE ENERGY INDUSTRY TIMES - JANUARY 2020

Energy Outlook

14

As pressure

increases to achieve

net zero carbon

emissions, utilities

are repositioning

themselves to take

a bigger focus on

renewables, storage

and networks.

Junior Isles reports.

Preparing for a greener future

Utilities have

repositioned

their business

models

Source: Eurostat, Moody’s Investors Service

30%

29%

32%

32%

34%

36%

38%

38%

37%

37%

37%

15%

16%

18%

19%

20%

19%

21%

23%

26%

27%

26%

10%

11%

10%

10%

13%

13%

12%

12%

12%

12%

13%

35%

35%

31%

29%

25%

24%

20%

18%

18%

19%

20%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2011 2012 2013 2014 2015 2016 2017 2018 2019E 2020E 2021E

EBITDA split for the 20 largest rated utilities in EMEA

Regulated networks & storage Regulated/contracted generation Supply and services Merchant generation E&P Other

Source: Companies, Moody’s Investors Service

Networks and contracted

generation to settle at 60-

65% of EBITDA

90

92

94

96

98

100

EBITDA

2018

YoY change One-offs Underlying

EBITDA

2019

Regulated

networks &

storage

Regulated /

contracted

generation

Supply &

services

Merchant

generation

Other Underlying

EBITDA

2020

€ billion

We forecast sector aggregated EBITDA growth of 3-4% in 2020

Earnings growth

to be driven by

all segments

Source: Moody’s Investors Service

EBITDA of 13 out of the 20

largest European utilities

will grow by at least 5%

RES

+15 GW

RAB

+2-3%

Utilities have repositioned

their business models.

Networks and contracted

generation to settle at 60-65

per cent of EBITDA.

Source: Companies, Moody’s

Investors Service

Earnings growth to be driven by all segments. EBITDA of 13 out of the 20 largest European

utilities will grow by at least 5 per cent. Source: Moody’s Investors Service

THE ENERGY INDUSTRY TIMES - JANUARY 2020

15

Technology

Landis+Gyr has introduced its Gridstream Connect solution for European utilities. The IoT platform uses intelligence at

the grid edge and across distribution systems to help utilities master the challenge of providing grid exibility, resilience

and security. Junior Isles.

D

istribution system operators

(DSOs), i.e., operators of the

low and medium voltage grid

are facing the challenge of having to

handle an inux of variable produc-

tion from renewables injected into

the grid. But unlike in the high volt-

age transmission network, a lack of

transparency in the distribution grid

means operators do not have a clear

picture of how voltage levels are

varying in the grid. It is the major

reason for the need for greater digi-

talisation at the distribution level.

“This is the rst step in having

greater insight into every connection

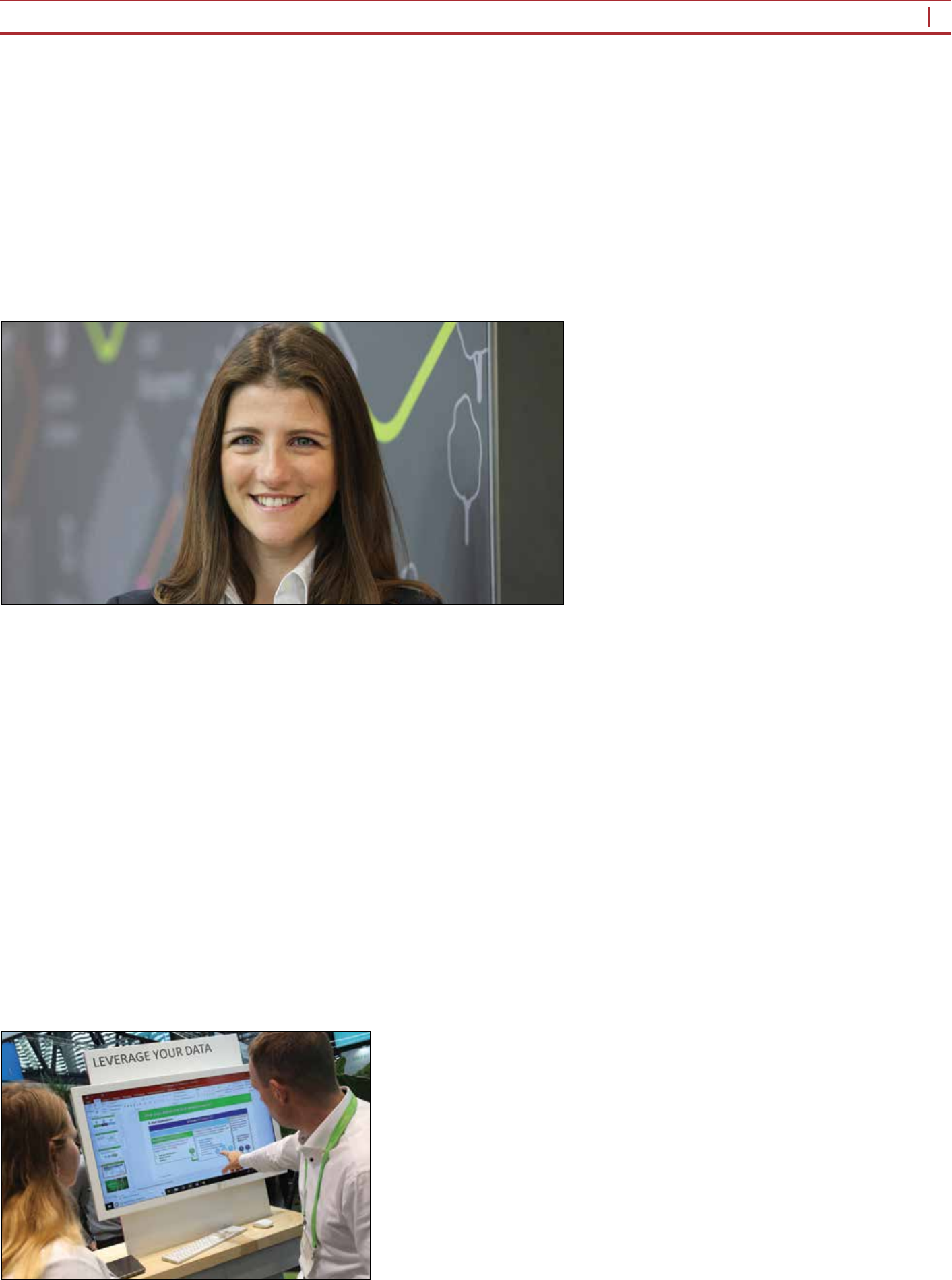

to the grid,” said Igeneia Stefani-

dou, Head of Product Management

Grid Edge at Landis+Gyr. “The next

step is how to use the data from

smart meter devices and systems to

benet the whole utility – not just

the metering and billing departments

but also the grid department. It’s

about how utilities can use this data

to better understand if their capacity

in the system is enough; if they are

cost-efcient; if all the changes on

the low voltage side, such as batter-

ies, EVs, etc., are having a negative

impact on the grid.”

At the recent European Utility

Week in Paris, Landis+Gyr gave a

demonstration of this “next step”

with the introduction of its Grid-

stream Connect solution for Europe-

an utilities.

Gridstream Connect is an open, se-

cure and scalable Internet of Things

(IoT) platform designed to unlock

added value and maximise efcien-

cies from advanced metering infra-

structures (AMI) by bringing togeth-

er intelligent endpoints, communi-

cations, software and applications.

As a connectivity platform for utili-

ties of all sizes, Landis+Gyr says “it

extends beyond AMI into new, data-

driven use cases”, providing utilities

with a basis for “a multitude of new

services and business models”.

It leverages intelligence at the grid

edge and across distribution systems

for more efcient management of

energy capacity, the integration of

renewables, and enhanced consumer

engagement.

Gridstream Connect bundles

Landis+Gyr’s entire IoT portfolio.

The capabilities of the platform were

strengthened in November by the

launch of new Landis+Gyr intelli-

gent endpoints, an extension of the

company’s communications portfo-

lio, as well as evolving software and

applications.

“The intelligent end points, are in-

telligent devices in the eld that can

also make decisions,” said Stefani-

dou. “It supports different communi-

cations technologies, depending on

the application. We decide on the

technology, together with the utility,

according to their needs. At the ap-

plication level, it also enables third-

party applications to make use of the

measurements and data collected

centrally. The question is what is

needed: do we need local intelli-

gence on the device or from the big

application? Or is the optimal some-

where between? We can do both

grid-edge intelligence and central in-

telligence; we just work with the

customer to nd out what is the opti-

mal solution.”

She noted that there are local is-

sues such as voltage regulation,

while “global” issues that can be

addressed centrally might include

energy balancing.

Stefanidou believes the ability to

gather and analyse data calls for a

much-needed review of existing tar-

iff models. “Today’s grid tariff

models are based on the old scenar-

io of energy owing from the top

down. This has changed, as have

the grid users. So this data should

be used to allow utilities to better

understand how they can adjust

their tariff models.”

She says there are already exam-

ples of this happening, mainly with

utilities that have decentralised gen-

eration, perhaps with batteries.

“There are a lot of pilot projects in

Europe, where utilities are trying to

better understand what the future

will look like, and which tariff

models will give the right incen-

tives for end consumers to become

energy efcient. These pilot proj-

ects will also help grid departments

to plan the system more efciently

for the future – to build capacity

where it’s necessary.”

Gridstream Connect gives the DSO

“eyes” at every connection point on

the grid. Measurements taken by the

smart meter, which is used for bill-

ing, can be imported as an input. At

the same time the system topology

can be imported from a Geographic

Information System (GIS). These

can then be mapped together to cal-

culate exactly how the energy ows

throughout the distribution system.

This gives DSOs a view of how ev-

ery component in a system is loaded

throughout the day, year, etc., and

enables them to assess which equip-

ment is more critical and likely to

fail and thus prioritise investments.

“By understanding how the system

is used, DSOs can prepare the sys-

tem for the future, so that it is reli-

able, and cost-efcient,” said Ste-

fanidou. “And with limited budgets,

this helps them decide which proj-

ects to prioritise. For example, you

could compare two similar trans-

formers that might be the same age

but one is loaded quite low, with no

overloading, while the other is also

healthy but is regularly overloaded.

So it helps identify the bottlenecks

and identify which might need re-

placing, thus preventing outages”

According to Landis+Gyr, utilities

are now seeing that the smart meter

rollout is offering added value for

other departments. “Today, we see

interest in smart metering systems

from people in the grid departments

of utilities because they see the value

of smart meters for their grid opera-

tions,” said Stefanidou.

In September last year utility E.On

Sweden became the rst Gridstream

Connect customer in EMEA.

Landis+Gyr’s solution for E.On’s

smart metering rollout will include

one million smart electricity meters

– including both residential and in-

dustrial meters – with NB-IoT/M1

communication technology and a

Head End System on a Gridstream

Connect platform.

The work to replace the existing

smart metering infrastructure began

in July last year. With this technolo-

gy, E.On will be able to increase

transparency and control in its distri-

bution grid and improve its custom-

ers’ experience through reliable and

precise data.

Sweden is among Europe’s front-

runners in the use of advanced ener-

gy technology, with its rst nation-

wide installation of smart meters

dating back to 2009. Now, the coun-

try is taking another key step – re-

placing all 5.4 million metering

points with the latest technology.

This modernisation will further em-

power end consumers to improve

efciency of energy usage and is

critical for enhancing smart grids to

manage large-scale integration of

renewable energy and the use of e-

vehicles.

The possibilities with smart meter-

ing and greater digitalisation at the

grid edge seem endless. Landis+Gyr

also demonstrated its latest technolo-

gy to drive how a utility engages

with the customer.

Jesper Nielsen, Head of Technical

Solution Sales EMEA, Landis+Gyr

said the company was looking to en-

able this in different ways, one of

which is by creating opportunities

for smart home use cases that can

run on say, mobile apps. It is now

doing this through the use of real-

time data.

“We measure current and voltage

as fast as we possibly can with the

meter and then generate some trends.

The rst trend or pattern we do is

called the power DNA. By analysing

the current and voltage patterns, we

can actually tell you what [electrical

appliance] is on: whether it is a dish-

washer, fridge, air-conditioner, etc.

Not only could we tell you whether

it is a dishwasher, we could also tell

you what brand it is.”

Nielsen says the new system will

not only enable users to remotely set

alarms and have a view of the state

of appliances, etc., but will also help

them compare their energy use and

environmental performance to other

houses in the area or city.

“It’s another way for utilities to

better engage with their customers…

and this is where it gets really inter-

esting because it gives them an ad-

vantage over the next utility. By cor-

relating how much energy it is

producing from green sources, a util-

ity could then recommend to cus-

tomers when they should turn on an

appliance or turn off the heating, for

example, and thereby tell them by

how much they could improve their

carbon footprint.”

While these functions/applications

are not here yet, Nielsen says they

are coming.

Presenting customers with the pos-

sibility of saving money while tack-

ling the climate crisis is a tremen-

dous opportunity for utilities, and

greater digitalisation at the grid edge

could be the key.

Unlocking value through

digitalisation

Stefanidou says Gridstream

Connect gives the DSO “eyes”

at every connection point on

the grid

Nielsen demonstrates new

possibilities to engage end

customers

THE ENERGY INDUSTRY TIMES - JANUARY 2020

16

Final Word

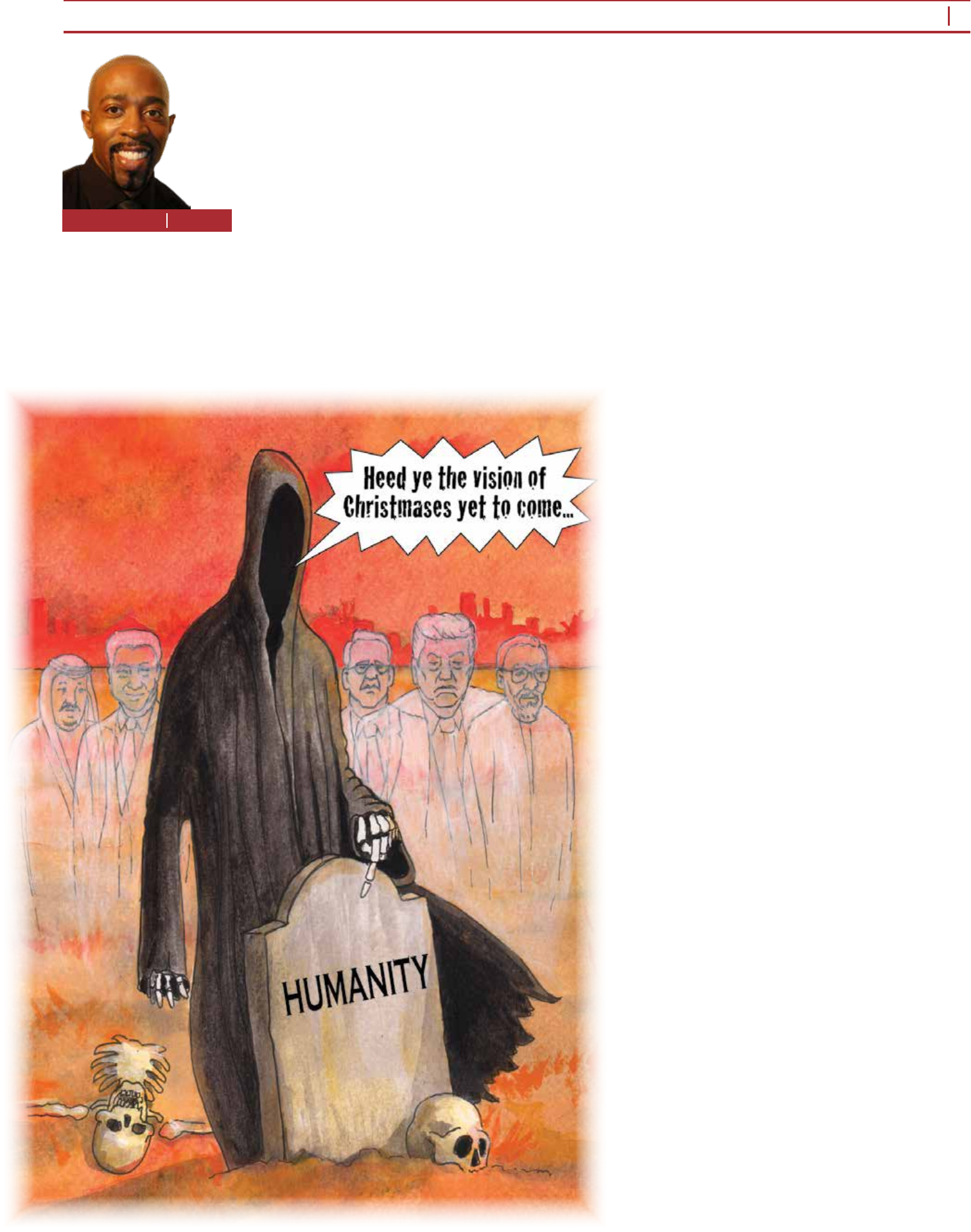

W

here was the Christmas

spirit during the recent

COP25 conference in Ma-

drid? There was little to be merry about

at the most recent instalment of UN

climate meetings aimed at tackling

impending climate change. Indeed it

was more a case of negotiations being

thwarted by the Ghost of Christmas

past.

COP meetings almost always run to

the eleventh hour before anything is

agreed. The Madrid meeting, how-

ever, was the longest on record,

running over by some 44 hours. And

despite the overrun, negotiators failed

to reach the hoped-for outcome.

More than 25 000 delegates arrived

in the Spanish capital in early Decem-

ber with the expectation of nalising

the ‘Rulebook’ drawn up at COP24 in

Katowice, Poland in December 2018.

The Rulebook contains the rules and

guidelines detailing how the Paris

Agreement will operate in practice

but there were two key issues that

countries were unable to agree on in

Katowice.

The rst was rules detailing how

countries can voluntarily work to-

gether across borders to reduce emis-

sions through approaches like inter-

national market mechanisms. One of

the main tasks of COP25 was

therefore to agree rules for a new

global carbon market under ‘Article 6’

– the sixth article of the Paris climate

accord. Article 6 creates a system that

would allow countries to pay each

other for projects that reduce emis-

sions. It must also ensure these reduc-

tions are not counted twice.

The second unresolved issue in the

Rulebook following COP24 was that

the Paris Agreement asked countries

to consider whether they should

standardise the time periods covered

by countries’ Nationally Determined

Contributions (NDCs). At the mo-

ment, some NDCs extend to 2025

while others extend to 2030. In Kato-

wice, countries agreed they should use

a common time period for future

NDCs but could not agree on specic

years.

At the conclusion of the Poland

meeting, the plan was that rules not

nalised in Katowice would be re-

viewed and rened in Bonn, Germany,

the following June and then adopted

at COP25. With negotiators leaving

Bonn with an unagreed text, it was

hardly surprising that, despite increas-

ing public pressure, countries left Ma-

drid without a consensus on Article 6.

At the heart of the discord was the

argument by some countries that they

should be allowed to carry over Certi-

ed Emission Reduction units (CERs)

created under the 1997 Kyoto proto-

col. Most of those credits, which were

conceived as a way for rich countries

to pay poorer nations for emissions

reduction projects, are almost worth-

less on the open market, valued at

around $0.2 per tonne of CO

2

.

The EU and vulnerable countries,

as well as environmental groups,

were rmly against the carrying over

of CERs. Japan, not a signatory to the

principles, told the nal plenary meet-

ing that it also opposed the use of

Kyoto-era credits. They all argued the

CERs would undermine already in-

sufcient ambition by allowing tar-

gets to be met with “emissions reduc-

tions” that have already happened, in

place of additional cuts being made

in the future.

However the countries that still hold

the old credits – mainly China, India

and Brazil – argued for the right to

transition them over into any new

system. Around 4.3 billon credits are

available under the Kyoto protocol’s

Clean Development Mechanism,

according to Berlin-based think-tank

NewClimate Institute. This is more

than the annual emissions of the EU.

China holds about 60 per cent of

these, India 10 per cent, and Brazil 5

per cent.

A supply in the billions of tonnes of

CERs far exceeds demand, meaning

prices under Article 6 would also be

low. Carbon Brief noted that this

would reduce the incentive for addi-

tional private-sector investment in

the scheme, cutting off potential -

nancial ows to the very countries

that wanted to benet from participa-

tion in the rst place.

Assigned Amount Units (AAUs) are

an additional source of Kyoto units

given to developed countries with

targets under the protocol that effec-

tively permits them to emit a certain

amount of CO

2

. For some countries,

weak targets or economic collapse has

led to a large surplus of AAUs, often

despite a lack of deliberate action to

cut emissions.

Australia lobbied to carry over its

AAUs. Using the credits would reduce

what Australia needs to do to meet its

2030 target of a minimum 26 per cent

cut in emissions below 2005 levels by

more than half. Analysts said there

was no legal basis for Australia using

the credits as the Kyoto and Paris

agreements were separate treaties,

and noted ofcials had acknowledged

Australia was the only country plan-

ning to still count them.

An analysis published by think-tank

Climate Analytics during COP25, said

if China and Brazil use their CERs

domestically to meet their domestic

NDCs, and if Australia uses its surplus

AAUs towards its NDC, this would

“reduce global ambition” by 25 per

cent.

In a scathing attack, Laurence Tu-

biana, an architect of the Paris accord,

said: “If you want this carry-over it is

just cheating.” Speaking to the Finan-

cial Times, he added: “Australia was

willing in a way to destroy the whole

system, because that is the way to

destroy the whole Paris agreement.”

“It is a ghost from the past in some

way,” said David Waskow, Director of

the World Resource Institute’s (WRI)

climate initiative, and an observer at

the talks. “When you look at the nal

text, you can see that the Kyoto carry-

over question was where the nub of

the nal issue lay – that was where

things really did not get resolved,” he

told the FT.

Still, there was some reason for

seasonal good cheer. At the confer-

ence, the EU was praised for devising

the strongest new plan, where nations

agreed a bloc-wide goal of reaching

net-zero carbon by 2050. The African

Development Bank, which attended

the conference to lend strategic sup-

port to its regional member countries

in the negotiations, pointed out that

Africa is committed to climate action:

51 of the 54 African countries have

already ratied their NDCs.

Most notably, COP25 delivered a

deal that will see new, improved car-

bon reduction plans on the table by

the time of COP26 in Glasgow at the

end of this year. During the Madrid

negotiations the EU and small island

states had pushed for increased ambi-

tion but met opposition from a range

of countries including the US, Brazil,

India and China. However, a compro-

mise was agreed with the richer na-

tions having to show that they have

kept their promises on climate change

in the years before 2020.

As we move into 2020, most would

agree that this is a pivotal year for

climate action, and the scale of the task

ahead cannot be understated. Vice

President for climate and economics

at WRI, Helen Mountford, said:

“There is no sugar-coating it, the ne-

gotiations fell far short of what was

expected. Instead of leading the

charge for more ambition, most of the

large emitters were missing in action

or obstructive. This reects how dis-

connected many national leaders are

from the urgency of the science and

the demands of their citizens. They

need to wake up in 2020.”

As talks came to a close at COP25

in Madrid, Christian Aid’s Global

Climate Lead, Dr Katherine Kramer,

said: “The UK now has a gargantuan

task of overseeing a successful climate

summit in Glasgow. That meeting is

supposed to be the moment the world

responds to the climate crisis by

strengthening the pledges made in the

Paris Agreement.”

If 2019 was haunted by the ghost of

the Christmas past, let’s hope that 2020

and COP26 does not doom us to

Scrooge’s Ghost of Christmas Yet to

Come.

Scrooged?

Junior Isles

Cartoon: jemsoar.com