www.teitimes.com

December 2019 • Volume 12 • No 10 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Innovation

disruptors?

A year of change

DSOs and energy communities

could be the next innovation

disruptors. Page 13

Again it has been a year of change for

the waste-to-energy sector but progress

across the globe has been fragmented.

Page 14

News In Brief

Support needed for EU

countries hit by costs of

going green

EU member states hard hit by the

costs of going green should receive

support as they make the transition

away from coal, says the European

Investment Bank.

Page 2

US rolls back coal waste

rules

Efforts by the Trump administration

to reduce the regulatory burden on

fossil fuel red power plants has

heightened the debate in the country

around climate change.

Page 4

China still too heavily

dependent on coal

In a move that threatens to offset

coal plant closures elsewhere in the

world, China is once again ramping

up the construction of coal red

plants.

Page 5

GB should target exibility

to reach net zero

Renewable energy generators in

Great Britain say more incentives

are needed to boost investment in

exibility to enable the net zero

targets to be achieved.

Page 7

Africa report highlights

investment needs

Improved energy policies will

help Africa to expand its economy

and achieve electrication goals,

according to the International

Energy Agency.

Page 8

Wind OEMs grow in strength

The global market for wind turbine

equipment is consolidating after a

decade of fragmentation, according

to analysts.

Page 9

Technology: Building a net

zero future

With more and more companies

pledging ambitious emissions

reduction targets, energy

management in buildings has

become a key focus of operations.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

Putting electricity systems on a sustainable path will require more than just adding more

renewables, according to the recently launched World Energy Outlook. It will call for a grand

coalition of all parties committed to tackling climate change. Junior Isles

Asia at the heart of climate change challenge

THE ENERGY INDUSTRY

TIMES

Final Word

The edge is where the

action is, says

Junior Isles.

Page 16

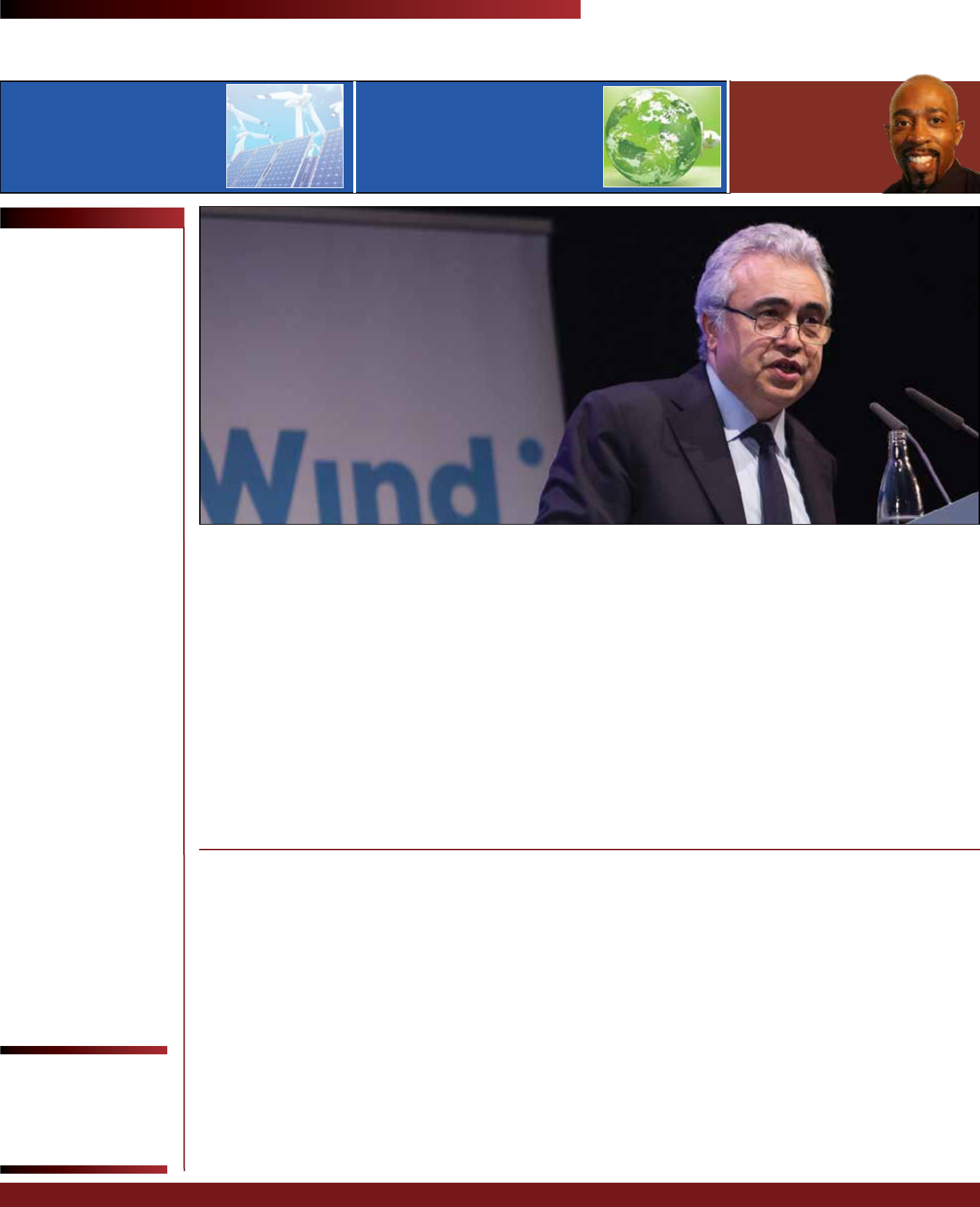

The International Energy Agency’s

recently released ‘World Energy Out-

look (WEO) 2019’ has stressed that

“rapid and widespread changes” across

all parts of the energy system are need-

ed to put the world on a path to a secure

and sustainable energy future.

Launching the organisation’s ag-

ship publication, Dr Fatih Birol, the

IEA’s Executive Director, said: “The

world urgently needs to put a laser-

like focus on bringing down global

emissions. This calls for a grand coali-

tion encompassing governments, in-

vestors, companies and everyone else

who is committed to tackling climate

change. Our Sustainable Develop-

ment Scenario is tailor-made to help

guide the members of such a coalition

in their efforts to address the massive

climate challenge that faces us all.”

The IEA says that despite rapid

transformation in some parts of the

energy sector, the momentum behind

clean energy is insufcient to offset

the effects of an expanding global

economy and growing population.

The rise in emissions slows but does

not peak before 2040.

The Stated Policies Scenario, for-

merly known as the New Policies Sce-

nario, incorporates today’s policy in-

tentions and targets in addition to

existing measures. The aim is to hold

up a mirror to today’s plans and illus-

trate their consequences. The future

outlined in this scenario is still well off

track from the aim of a secure and sus-

tainable energy future.

Putting electricity systems on a sus-

tainable path will require more than

just adding more renewables, says the

IEA, noting that the world also needs

to focus on the emissions that are

“locked in” to existing systems. Over

the past 20 years, Asia has accounted

for 90 per cent of all coal red capac-

ity built worldwide, and these plants

potentially have long operational life-

times ahead of them.

This year’s WEO considers three

options to bring down emissions from

the existing global coal eet: to retrot

plants with carbon capture, utilisation

and storage or biomass co-ring

equipment; to repurpose them to focus

on providing system adequacy and

exibility; or to retire them earlier.

“What comes through with crystal

clarity in this year’s World Energy

Outlook is there is no single or simple

solution to transforming global energy

systems,” said Dr Birol. “Many tech-

nologies and fuels have a part to play

across all sectors of the economy.”

The IEA noted that greater energy

efciency is crucial to its Sustainable

Development Scenario. A sharp pick-

up in energy efciency improvements

does more than any other energy

Continued on Page 2

China and India will have to curb their

coal use if the world is to have any

chance of making its climate goals.

According to the International En-

ergy Agency’s recent ‘World Energy

Outlook (WEO) 2019’, coal is re-

sponsible for 30 per cent of all energy-

related carbon dioxide emissions,

making it the biggest single contribu-

tor to greenhouse gas emissions.

If the world is to limit the increase in

temperature as a result of climate

change to less than 2°C (3.6°F), it is

clear that coal consumption will have

to be reduced far more dramatically

than is currently forecast.

The International Energy Agency

(IEA) said that under its Stated Poli-

cies Scenario China’s coal use goes

from 2.83 billion tonnes of coal

equivalent to 2.84 billion in 2030 and

2.57 billion by 2040, but under the

Sustainable Development Path it

would need to drop to 2.07 billion by

2030 and 1.15 billion by 2040.

India’s demand was 586 million

tonnes of coal equivalent in 2018, and

the IEA forecasts this to rise to 938

million by 2030 and 1.16 billion by

2040 under the Stated Policies Sce-

nario, but to meet the sustainable de-

velopment scenario it would need to

be 546 million.

The two countries currently account

for 60.2 per cent of global electricity

generated by coal, according to data

from the Institute for Energy Eco-

nomics and Financial Analysis

(IEEFA).

The IEA suggests that India effec-

tively has to limit its coal demand to

current levels, while China will have

to cut its consumption by some 60 per

cent by 2040.

This would require a major change

in policy direction in both countries,

something that would be difcult to

achieve, both politically and nan-

cially. For China the challenge is

harder, given the size of its coal sector

and the subsequent cost of shifting

away from the fuel.

The IEA suggests China may be

able to deploy carbon capture and

storage systems on a large scale, but

this would be costly and there is cur-

rently little political impetus to make

this happen. Replacing coal with re-

newables, hydro or nuclear will also

be expensive, especially since the sus-

tainable development path would

mean retiring many coal red power

plants well ahead of their normal

lifespan of about 50 years.

Recent research by Wood Macken-

zie provided an indicator of the cost of

decarbonisation in the region. The

organisation indicates that Asia Pa-

cic’s decarbonisation bill could hit

$3.5 trillion by 2040. This includes

investments in solar, wind, hydrogen,

nuclear, and hydropower, collectively

referred to as zero-carbon energy be-

tween now and 2040, under Wood

Mackenzie’s accelerated transition

scenario.

The majority of Asia Pacic’s de-

carbonisation bill will come from the

power and transport sectors, as both

accounted for over 50 per cent of the

region’s carbon emissions last year.

This signicant shift requires invest-

ment and support from all stakehold-

ers especially China and India.

World needs

“laser-like focus”

to bridge emissions

gap, says WEO

Dr Birol says there is no single or simple solution

THE ENERGY INDUSTRY TIMES - DECEMBER 2019

3

Energy & Storage

solutions expertise

Securing energy supplies

Ensuring a reliable power supply is one

of the key factors for progress and

prosperity around the world. Building

on decades of MAN innovation, we can

help secure clean and effi cient energy

supplies for your customers. Our expertise

covers solutions for hybrid power, LNG

to power, energy storage, power-to-X,

thermal power plants, and CHP.

www.man-es.com

Your reliability

shines

1912_14870_MAN_ES_Anzeige_SC_KV_Power_YourReliabilityShines_reSe_ENG_249x160mm_ISO_V2.indd 1 01.10.19 13:36

SERVICE & SUPPLY

ANALYZE & INVEST

TRADING & FINANCE

FROM GLOBAL PERSPECTIVES TO

DEEP INSIGHTS INTO MARKETS.

EUROPE´S LEADING

ENERGY TRADE FAIR

E-WORLD

ENERGY & WATER

FEBRUARY 11 – 13, 2020

ESSEN

|

GERMANY

#Eworld2020

www.e-world-essen.com

THE ENERGY INDUSTRY TIMES - DECEMBER 2019

5

Asia News

Syed Ali

In a move that threatens to offset coal

plant closures and associated carbon

emissions elsewhere in the world,

China is once again ramping up the

construction of coal red plants as it

seeks to stimulate slowing economic

growth.

According to a report from Global

Energy Monitor, a non-prot group

that monitors coal stations, 148 GW of

coal red plants are either being built

or are about to begin construction. This

almost equals the current capacity of

the entire EU coal eet.

Speaking to the Financial Times, Ted

Nace, Head of Global Energy Monitor,

said the new coal plants would have a

signicant impact on China’s already-

increasing carbon emissions.

“What is being built in China is sin-

gle-handedly turning what would be

the beginning of the decline of coal,

into the continued growth of coal,” he

told the FT, adding that China was

“swamping” global progress in bring-

ing down emissions.

China halted construction of hun-

dreds of coal stations in 2016 amid

concerns over air pollution and over-

investment in coal. Many have since

been restarted, as the government

looks to boost an economy that is

growing at its slowest pace since the

early 1990s.

The Global Energy Monitor report

shows the pace of new construction

starts of Chinese coal stations rose 5

per cent in the rst half of 2019, against

the same period last year. About

121GW of coal power is actively under

construction in China, slightly lower

than the same point a year ago.

The ndings follow an announce-

ment in late October that China will

overhaul its coal red electricity pric-

ing terms. Effective 2020, the new

price of coal red electricity supplied

to the grid will comprise a benchmark

price plus a variable element with a

10 per cent ceiling and a 15 per cent

oor, with the aim of having a market-

driven approach to price coal red

electricity, and to further reduce end-

use electricity tariffs to cut manufac-

turing costs and boost the economy.

Wood Mackenzie believes this move

will have a signicant impact on both

the power and coal markets. The rm

calculates the average transaction

price will fall to around RMB330/

MWh, but this will still be about

RMB15/MWh above the breakeven

price.

The change in tariff, it argues, could

mean renewable projects will face

challenges in 2020. In a press note,

Wood Mackenzie said: “Although re-

newables pricing has shifted to com-

petitive auctions (compared to feed-in

tariff previously), the coal on-grid tar-

iff remains a key reference when eval-

uating the economics of renewables

projects.

While projects sanctioned in 2020

and earlier will largely be unaffected,

subsidy-free or low-subsidy projects

approved from 2021 onwards will face

greater uncertainty. With limited-to-no

subsidies, new projects will be highly

sensitive to coal on-grid tariffs.”

n China has developed a giant offshore

wind turbine with a 210 m rotor diam-

eter, which will be put into production

soon, according to the science and

technology bureau of southwest Chi-

na’s Chongqing Municipality. The

wind turbine, coded H210-10MW, has

a capacity of 10 MW and is China’s

rst to have a rotor diameter of more

than 200 m. It was developed by HZ

Windpower, a subsidiary of the state-

owned China Shipbuilding Industry

Corporation.

More than half of India’s coal red

power plants ordered to retrot equip-

ment to curb air pollution are set to

miss the deadline, according to indus-

try estimates and a Reuters analysis.

India, which has some of the worst

air pollution levels in the world has a

phased plan for plants to comply with

new emission norms, with some plants

having until end-December 2019,

while others have up to the end of 2022

to comply. A total of 440 coal red units

that produce 166.5 GW have to comply

with the regulations by December

2022. These deadlines already repre-

sent an extension to a December 2017

deadline.

A Reuters analysis of Central Elec-

tricity Authority (CEA) data indicates

267 units, which produce 103.4 GW

of power, have to be compliant be-

tween December 2019 and February

2022, which is 27 months from now.

Installations of ue gas desulphurisa-

tion (FGD) units, which cut sulphur

emissions, take about 27-30 months.

The data shows that of these, 224 units,

which produce 84.8 GW of power,

have not yet awarded contracts for in-

stalling FGD units.

That means at least 51 per cent of all

coal red units, which have the emis-

sion targets could fail to comply with

the deadlines.

The Asian Development Bank (ADB)

and Gulf PD Co Ltd have signed a

Bhat5.4 billion ($180 million) agree-

ment to build and operate a 2500 MW

combined cycle gas turbine power

plant in Rojana Rayong 2 Industrial

Park.

The project will build the fourth-

largest power plant and one of the

largest combined cycle gas turbine

power plants in Thailand. ADB Dep-

uty director-general for Private Sector

Operations Christopher Thieme said

the project will be key to the Eastern

Economic Corridor [EEC] develop-

ment plan, which is “considered as

the prime economic growth driver for

the country until 2028”.

The plant will be integral to Thai-

land’s energy security, given that more

than 8500 MW of ageing power plants

– equivalent to about 20 per cent of

current national energy capacity – will

be retired between 2020 and 2025.

China still too heavily

dependent on coal

Indian coal

plants to miss

retrot deadline

ADB supports gas

red generation

China is ramping up construction of coal red plants and cutting coal red electricity tariffs in an effort to boost

economic growth. The action not only threatens global efforts to combat climate change but could also jeopardize

renewable projects.

6

THE ENERGY INDUSTRY TIMES - DECEMBER 2019

Asia News

In late November Neoen Australia said

it would expand the Hornsdale Power

Reserve in South Australia, already the

world’s biggest battery, by 50 per cent.

Neoen said the 100 MW/129 MWh

Tesla-built battery will see a 50

MW/64.5 MWh increase which will

help back-up the record inux of re-

newable generation in South Australia.

Minister for Energy and Emissions

Reduction, Angus Taylor, said the ex-

pansion will improve response times

on the worst days when demand is at

its highest and the wind is not blowing

and the sun is not shining.

“Projects like this, combined with the

gas and pumped hydro projects that are

coming online, are extremely impor-

tant to the future integration of renew-

able energy to the South Australian

grid,” said Taylor.

The battery expansion will provide

additional fast response capacity to

prevent tripping of the South Austra-

lian and Victorian interconnector, and

react to sudden changes in load. This

is expected to lead to a reduction in the

cost of procuring services to manage

the grid, ultimately resulting in savings

for consumers.

The expansion will showcase the

potential for grid scale batteries to

provide ‘virtual’ inertia, which in-

volves a contribution to the capability

of the power system to resist changes

in frequency and unlock new revenue

streams and commercial pathways for

other batteries.

Neoen will work with the Australian

Energy Market Operator to test the

potential for the battery to improve grid

security sufciently to allow an easing

of the current curtailment arrange-

ments for solar PV and wind generation

in South Australia.

As Australia’s electricity system is

changing, the large inux of intermit-

tent energy sources along with thermal

generator closures means new mea-

sures are needed to support reliability

in the National Electricity Market.

The changing market continues to

attract renewables companies. Last

month French energy company Engie

said it is developing an investment

fund in Australia designed to support

2000 MW of solar and wind energy

projects over the next 10 years, Reuters

reported.

Meanwhile Risen Energy Australia

said it has completed the construction

of its 100 MW Yarranlea solar park in

Queensland and expects commercial

operations to be launched at the start

of 2020 after “continuous testing”

needed to make it grid-compliant.

Also in in Queensland, Luminous

Energy, the UK-based international

solar and energy storage developer, an-

nounced the start of connection works

for its 162 MWac (202 MWdc) solar

farm.

Still, not all projects in the state have

gone smoothly. The Kennedy Energy

Park (KEP) in North Queensland,

which combines wind, solar and en-

ergy storage technologies, is unlikely

to reach full commercial operations in

the next four to ve months even

though it has been fully installed and

energised.

Windlab Ltd, one of the two compa-

nies behind the Kennedy Energy Park

project, said in an update that the EPC

contractor has failed to deliver in time

a fully functioning, compliant genera-

tor performance standard (GPS) mod-

el and electrical plant meeting the

network standards. This has so far

prevented the registration of the proj-

ect as a generator, which is key for

launching full commercial operation.

The Kennedy Energy complex com-

bines 43.2 MW of wind, 15 MW of

solar and 2 MW/4 MWh of Tesla bat-

tery storage capacity. It started gener-

ating limited volumes of power in

August 2019.

n AGL Energy Ltd.’s Barker Inlet

power plant began operations last

month, Australia’s rst major new fos-

sil fuel power station since 2012. The

A$295 million ($204 million), 210

MW facility in South Australia will

help supplement renewables, which

regularly meet more than 50 per cent

of the state’s power demand, the com-

pany said in a statement. The plant is

capable of reaching full capacity

within 5 minutes, AGL said.

Taiwan’s Ministry of Economic Af-

fairs plans to set a goal of developing

further 10 GW of offshore wind ca-

pacity between 2026 and 2035. This

is in addition to the existing goal of

developing 5.7 GW of offshore wind

capacity by 2025.

Wind farms to be built from 2026

onward will have a bidding price

lower than the average price of elec-

tricity sold to users in 2025, said the

Ministry. The new plan will also con-

tain local content requirements.

The announcement was made dur-

ing the inauguration of the Formosa

1, Taiwan’s rst commercial offshore

wind farm, and follows the launch of

Formosa 2.

In late October, Siemens Gamesa

Renewable Energy (SGRE) was

awarded the contract to install 47 SG

8.0-167 DD offshore wind turbines at

the 376 MW project. Construction of

the project, located in Miaoli county,

is expected to begin in 2020. The park

is situated close to the site of For-

mosa 1, which consists of a total of

22 SGRE offshore wind turbines.

The project reached nancial close

at the end of October. Total funding

for the project of TWD 62.4 billion

($2.1 billion) will be nanced by a

consortium of 20 international and

local Taiwanese nancial institutions.

The project is being led by Macqua-

rie’s Green Investment Group, the

lead project sponsor, and Swancor

Renewable Energy. UK Export Fi-

nance (UKEF) has provided a

TWD9.2 billion project nance guar-

antee to support British ompanies

involved in the construction.

Pakistan took a signicant step to-

wards its goal of generating 20 per cent

of its electricity from non-hydro re-

newable sources by 2025 after secur-

ing nancing for six wind projects.

Last month the International Finance

Corporation (IFC), a member of the

World Bank Group, issued a press re-

lease saying that it has led the nancing

of a rst-of-its-kind programme to

build six wind power projects in the

country, named the Super Six.

The IFC’s total investment in the

project is $450 million, which will help

deliver cleaner, cheaper power to meet

the country’s critical demand for en-

ergy and reduce reliance on expensive

imported fossil fuels. With this pro-

gramme, the IFC will have made in-

vestments in 11 wind power projects

in Pakistan.

The Super Six plants, with a com-

bined capacity of up to 310 MW will

be built in the Jhimpir wind corridor

in Sindh province and will generate

more than 1000 GWh hours of electric-

ity annually.

“The government is aiming to in-

crease the non-hydro renewable en-

ergy share in the overall generation mix

from 4 per cent to 20 per cent by 2025

and it is welcoming to see Pakistan’s

local private sector behind these Super

Six wind projects, supporting the gov-

ernment’s long-term objective to see

more wind and solar in the country’s

energy mix,” said Federal Minister for

Energy, Omar Ayub.

The cost of power from the Super Six

projects is expected to be more than 40

per cent lower than the current average

cost of generation.

The nancing was secured after the

Alternative Energy Development

Board (AEDB) signed Implementa-

tion Agreements with the representa-

tives of 11 wind power projects with a

capacity of around 560 MW.

S. Australia puts faith in

renewables plus batteries

Taiwan aims to add another

10 GW of offshore wind

Pakistan secures wind project nance

South Australia is continuing to demonstrate its faith in a renewables-based electricity system with announcements of

new investments in solar and battery projects. Syed Ali

THE ENERGY INDUSTRY TIMES - DECEMBER 2019

13

Industry Perspective

R

eecting upon what could be

seen as a simple change, from

high-carbon centralised gen-

eration assets to low-carbon distrib-

uted assets, the energy transition

brings many technical and deep eco-

nomical and socio-cultural challeng-

es. From a eld mostly dominated

by incumbents, the energy sector

now nds other industries knocking

at its door. In Europe it is becoming

the scene of many innovative busi-

ness models and, at last, we see indi-

viduals, small organisations and

players from other sectors forming

energy communities to accelerate the

pace of change, wanting to own part

of the transition and to locally retain

benets from this revolution.

The increase of distributed energy

resources (DERs) – such as in the

Nordics where installed capacity in-

creased by approximately 46 per

cent between 2005 and 2017 – is

changing the nature of interactions

between buildings, districts, cities,

and the overarching energy system.

The impact and control level of dis-

tributed assets on the grid varies de-

pending on their nature and connec-

tion type. On the medium-voltage,

assets such as CHP and wind tur-

bines can be seen, whereas at low-

voltage levels, there is the emer-

gence of residential assets such as

heat pumps, solar PV and electric

vehicles (EVs).

While the higher penetration of

DERs may have positive impacts on

the grid with energy loss reduction

and possible reduction of voltage

uctuations, it can also create new

congestion problems. We have seen

such an issue in the Netherlands,

when after a successful campaign to

incentivise the uptake of solar PV,

the grid did not have enough capac-

ity to cope with the extra electricity

generation. Now, while Dutch oper-

ators struggle to connect new gener-

ation assets, grid reinforcement

deferral (copper in the ground) is

seen as a temporary solution. By us-

ing the platform GOPACS, exibili-

ty providers can place orders on an

energy trading platform.

The platform GOPACS was found-

ed by the Dutch network operators

including the Transmission System

Operator (TSO) Tennet, all the

Dutch Distribution System Opera-

tors (DSOs), and the spot market ex-

change ETPA in order to provide

exibility for DSOs. This gives

DSOs a way of managing congestion

whilst maintaining TSO system re-

quirements, and gives providers an

additional revenue stream option. By

including their location data,

GOPACS checks if an order can

solve DSO congestion requirements.

The platform uses existing intraday

energy markets, and coordinates

with the TSO to reduce congestion

problems.

The pace of change to solve the de-

carbonisation of Europe creates new

problems of network management

for system operators. As we saw

with the example of the GOPACS

platform, amongst proactive solu-

tions is the development of new

ways of using demand-response with

a trend toward a bottom-up approach

of procuring exibility. We see the

emergence of three levels of de-

mand-side exibility (DSF) – turn-

ing down demand loads, using bat-

teries for example to provide

short-term power boosts, dispatching

local generators, etc. – to manage the

grid; at the transmission level with

voltage and frequency management,

at the distribution level with conges-

tion management, and at the local

level with local grid management

and support to the distribution net-

work. Indeed, we see a trend towards

DERs becoming increasingly man-

aged within local energy systems

(LES). The use of DSF at these three

levels will necessitate better TSO-

DSO coordination and better DSO-

LES coordination. This clearly puts

DSOs at a central pivotal point, us-

ing DSF as a strategy to decrease

network management costs, invest-

ment costs, and working in coordina-

tion with LES to minimise the cre-

ation of new congestions, ideally

using them as one exible asset.

At Delta-EE, whilst exploring the

uptake of DSOs procuring commer-

cial solutions for DSF across differ-

ent countries in Europe, it became

clear that the competitive dynamics

of exibility markets are being re-

drawn. The new EU ‘Clean Energy

for All Europeans’ legislative pack-

age sets new rules for DSOs, encour-

aging them to procure exibility as

one of the cost-effective solutions to

solving grid issues. The Member

States must translate this into a regu-

latory framework.

The nal national regulation and

the pace of implementation are key

drivers, which can provide commer-

cial advantages and opportunities.

DSOs and other exibility stake-

holders such as aggregators and

suppliers, by being ahead of the

learning curve in their home mar-

ket, could seize interesting market

shares from this new value stream

and be ready to penetrate other mar-

ket with the strong advantage of be-

ing established. Meanwhile, smaller

and less innovative DSOs may not

rest on their laurels operating busi-

ness-as-usual.

On the one hand, there are already

many lessons to be learnt from early

movers. On the other hand, DSOs

may be accountable to new stake-

holder types who could threaten con-

cession renewals for those like in

Germany who are typically granted

concession contracts to operate the

grids, while local authorities keep

the grid’s ownership. We have seen

such a case when back in 2013 in

Berlin, the cooperative BuergerEner-

gie Berlin (Citizen Energy Berlin),

unsatised with the Vattenfall sub-

sidiary Stromnetz Berlin and criti-

cised for not embracing the transi-

tion fast enough, decided to compete

against the DSO for control of the

grid. Finally, in 2019, Stromnetz lost

the grid concession rights to the Ger-

man city of Berlin for a period of 20

years.

From our study on DSO exibility,

it seems clear that DSOs are on

board to embark on the innovative

journey of delivering DSF solutions

commercially, and have unique op-

portunities to develop new exibility

markets, ensure better margins, and

secure concession renewals.

Coming back to LES, it is a term

that encompasses many types of lo-

cal systems, including, for example,

systems with energy generation

owned and managed by energy com-

munities, systems functioning under

specic models such as the Collec-

tive Self-Consumption model in

France, Belgium or Spain, the Miet-

erstrom model in Germany, but as

well including some smart-grids sys-

tems, local energy market systems,

and microgrids with islanding capac-

ity, to name some of the varied local

systems developing in Europe.

The soaring number of DERs con-

nected on networks is accompanied

by a growth in LES creation with

several drivers: lower capex with im-

proved performance and falling costs

of assets; innovative platforms for

balancing and optimising LES; inno-

vating trading platforms; multiplica-

tion of investment sources such as

crowdfunding platforms; the ‘Clean

Energy Package’ providing a posi-

tive legal framework for energy

communities, which is being trans-

lated into national regulation.

Depending on the nature of the

projects, other factors may inuence

the creation of a LES. For instance,

some industrial players may struggle

with high electricity grid connection

costs and mitigate it by requesting a

lower capacity grid connection and

integrate DERs onsite, and some de-

velopers may mitigate the time it

takes to get grid connection approval

by creating a microgrid.

The term ‘local energy systems’

covers a wide diversity of local sys-

tems in terms of architectures, own-

ership and business models, at both

local and national levels. This holis-

tic approach allows us to draw com-

parisons and provide analysis on

market dynamics. From our research

across different types of LES, we see

three general trends in Europe:

n a rise in energy communities and

their inuence as European

stakeholders;

n a race amongst industry

stakeholders to nd protable and

replicable LES business models.

This comes after the withdrawal of

support mechanisms in Europe such

as the Feed-in-Tariffs;

n and a rise of industry stakeholders

seeking to shift their business

models to new paradigms involving

energy communities.

Navigating and succeeding in the

complex world of LES requires an

understanding of the many challeng-

es and opportunities paving the way.

These include the relationship with

network operators, the legal aspects,

such as in France with the overly

complex creation of an entity (Per-

sonne Morale Organisatrice – PMO)

to create a Collective Self-Consump-

tion project, but also the different

stakeholders’ motivations.

Regarding the latter, industry

stakeholders should not underesti-

mate the importance of grasping and

adapting new driver types, not nec-

essarily based on what might seem

like ‘logical thinking’. Energy com-

munities can be composed of indi-

viduals, SMEs and local authorities

including municipalities. Within one

community, conicting motivations

may be found. While the point of

one participant could be to inter-

nalise environmental and climate

change costs, for another the motive

would be to source their energy lo-

cally and hence retain the benets

locally.

The fragmented nature of LES and

their stakeholders explains why nd-

ing replicable and protable business

models proves to be such a difcult

task. However, this represents a fan-

tastic eld of opportunities, for ex-

ample energy communities procur-

ing exibility at the DSO level, but

moreover for all stakeholders includ-

ing DSOs, utilities, aggregators and

communities to create un-siloed ap-

proaches for effective and fair busi-

ness models.

Rita Desmyter is Research Analyst,

Local Energy Systems at Delta-EE.

There is a trend towards distributed energy resources becoming increasingly managed within local energy systems.

This clearly puts Distribution System Operators at a central pivotal point, using demand side exibility as a strategy

to decrease network management costs, investment costs, and working in coordination with local energy systems to

minimise the creation of new congestion, ideally using them as one exible asset, says Delta-EE’s

Rita Desmyter.

Desmyter: the competitive dynamics of exibility markets are

being re-drawn

Energy communities and DSOs:

the next innovation disruptors?

production waste into an SRF.

Co-processing facilities are not the

only innovators of course, nor are all

innovators large in size. But they do

often attract a signicant share of the

spotlight. And awareness plays an

important part in inspiring others to

think differently when it comes to

WtE.

External factors will continue to

encourage further WtE change across

the globe too. China’s ban on plastic

waste imports has rocked the waste

industry – not just in the USA but

worldwide – so many operators are

going back to the drawing board

when it comes to their preferred treat-

ment methods and routes to market.

This will see progress accelerate in

2020.

Public perception is another extra-

neous variable that requires careful

management. While consumers are

generally becoming more vocal

about their passion for the planet,

many still don’t want to live in close

proximity to a WtE plant. In the

USA, this is perhaps because some

mass burn facilities built in the 1980s

don’t really represent what modern

WtE technologies are truly capable

of. They haven’t always taken ad-

vantage of the latest pre-treatment

methodologies, which ensure that

WtE operations are scientic, so-

phisticated and incredibly clean.

This has left communities worrying

about the atmospheric implications

of RDF/SRF sites, so there’s a huge

educational task to tackle, in banish-

ing present-day misconceptions.

Armed with incentives such as a

carbon credit – as is being offered in

Canada – more businesses in the USA

may sit up and pay attention to the

potential that exists surrounding fuels

such as RDF, SRF and biomass. There

is denitely untapped potential and

2020 could be the year this starts to be

unlocked. We’re bolstering our team

with the addition of more RDF/SRF

specialists to reect our condence in

the market.

Bernhard Martinz is President of

waste shredding specialist, UNTHA

America; Gary Moore is Director of

Global Business Development.

T

he utilisation of waste as an

energy source is not a new con-

cept. Think about wood for

example – as one of the world’s oldest

materials, it has been used to generate

heat for thousands of years. But, as

environmental thinking has evolved,

so too have efforts to prioritise the re-

use and recycling of wood, before it

is burned. And when it does come to

incineration, rened processing meth-

ods mean that a specied biomass fuel

can now be created for maximum heat

efciency and therefore optimum en-

vironmental gain.

However, even the use of wood – a

widely acknowledged energy source

– varies from country to country. In

places like Kenya and Nigeria, it re-

mains a primary source of raw do-

mestic energy, and the simplest of

scraps can help generate much needed

heat. In European nations such as

Germany, Sweden and Latvia, market

demand centres upon the consump-

tion of a comparatively sophisticated

biomass fuel, with these countries

reported to be consuming around 74

per cent of the world’s pellets.

There’s a mixed picture back in

North America. Pre-consumer wood

waste has been virtually eliminated,

but the level of wood debris in MSW

(Municipal Solid Waste) and C&D

(construction and demolition)

streams, shows there’s still room for

improvement, with millions of tons

of such recoverable material still

available, per year.

Some people – perhaps those out-

side of the industry – will be surprised

to read this of such a developed

country. But here lies a key point. The

global waste landscape is extremely

fragmented, particularly when it

comes to waste-to-energy. This

doesn’t just apply to the USA and

Canada. And it can’t just be said for

wood.

European countries like Germany,

Denmark and Austria have been har-

nessing the potential of alternative

fuels such as Refuse Derived Fuel

(RDF) and Solid Recovered Fuel

(SRF), for decades. Their waste infra-

structures are therefore unsurprisingly

advanced. Investment has been sig-

nicant and WtE plants are often even

considered something for the com-

munity to be proud of. Elsewhere in

Europe there is a very different picture

entirely, with countries such as Ro-

mania, Bulgaria and areas within the

Baltic states having a long way to go.

In Asia, Singapore has arguably led

the way in waste being recognised as

a national resource. Conversely in

other developing economies such as

Vietnam – where a waste collection

system barely exists – there is much

more work to be done.

This goes to show that it isn’t pos-

sible to paint a generic WtE picture

for one continent – or even a nation.

In the USA, attitudes towards WtE

are equally divided.

To a certain degree, legislation – or

the lack of it – has a part to play in

this. The EU Waste Directive – and

more specically the waste hierarchy

– guides environmental conscience in

much of Europe and encourages ev-

eryone to think about the prioritised

actions for ‘waste’ handling.

In parts of the same continent, the

ban of certain high-caloric ‘wastes’

from landll, has also driven signi-

cant environmental progress. The fear

of regulatory non-compliance – and

the scal penalties associated with

this – has almost forced those in the

waste industry to think differently

about what to do with materials that

still contain a vast amount of resource

value.

In North America, on the other

hand, standpoints vary from state to

state due to the absence of a federal

law. Some momentum is gathering in

Canada and certain US states, but

waste contractors – and businesses in

general – are not obligated to do

anything, which remains a fundamen-

tal reason why much depends on the

initiative and commitment of indi-

vidual organisations.

This is not to say legislation is the

only factor that drives innovation, al-

though it undeniably plays a crucial

part, certainly in motivating the

masses.

Commercial factors naturally come

into play too. Linked to the above

point, the introduction of a landll tax

was a huge catalyst for the UK better

committing to the aforementioned

waste hierarchy. The hike in the levy

– which rose to £80 per ton in 2013

and now stands in excess of £90 –

meant that disposing of waste wasn’t

nancially feasible anymore.

In the USA, landll charges are

typically low. An UNTHA client in

Texas, for example, could dispose of

trash for as little as $30-35 per ton.

The incentive to invest in waste

treatment technologies that would

enable landll to be avoided, is

therefore limited – irrespective of

environmental gain.

But this client identied rising

global demand for WtE fuels, not to

mention mounting societal pressures

to be kinder to the planet. They’ve

therefore worked hard to design an

intelligent yet economical SRF pro-

duction plant able to manufacture a

renewable energy source for a limited

cost per ton.

The commercial viability of an RDF

or SRF manufacturing plant is height-

ened when there is a guaranteed off-

taker of the fuel. This goes some way

to explaining why co-processing fa-

cilities are growing in number in parts

of the world, including the USA.

Energy-intensive operations such as

cement kilns are increasingly moving

towards the production of their own

SRF for example, to reduce their reli-

ance on the world’s depleting fossil

fuels, secure their energy feedstock,

lower the clinker factor in their n-

ished cement and contribute to a more

circular economy. This therefore sees

them source, process and transform

waste themselves – sometimes with

the help of a local partner – to produce

their own RDF/SRF either on site or

at an adjacent facility.

The global nature of many such

operations then promotes more wide-

spread deployment of this co-pro-

cessing approach, almost irrespective

of local WtE attitudes.

It is perhaps inevitable that co-pro-

cessing facilities will become increas-

ingly popular in 2020 and beyond,

regardless of environmental legisla-

tion in the countries concerned.

Larger organisations often have more

dened ‘green’ agendas and are com-

monly looked to as the pioneers for

change within industries such as WtE.

Their appreciation for the WtE po-

tential of different input materials is

also inspiring. While MSW and C&I

waste is probably still the most com-

mon RDF/SRF application – on the

whole – the potential doesn’t end

there. The transformation of ‘waste’

textiles, carpets and mattresses into

an energy source, is becoming in-

creasingly common, for instance.

And not just in the Western world. In

Vietnam, UNTHA has been involved

in a project to convert footwear

THE ENERGY INDUSTRY TIMES - DECEMBER 2019

Energy Outlook

14

It has once again

been a year of

change for the waste-

to-energy sector, but

it would be naïve to

think that – when it

comes to alternative

fuel production –

there has been

unied progress

across the globe.

Here, UNTHA’s

Bernhard Martinz

and Gary Moore

reect on the evolving

WtE landscape

in the USA and

further aeld, before

predicting what 2020

may have in store.

A year in WtE and what

lies ahead

Martinz: The global waste landscape is extremely fragmented,

particularly when it comes to waste-to-energy

Moore: There is denitely untapped potential and 2020 could be

the year this starts to be unlocked

THE ENERGY INDUSTRY TIMES - DECEMBER 2019

15

Technology

With more and more companies pledging ambitious emissions reduction targets to support climate change goals,

energy management in buildings has become a key focus of operations. Siân Crampsie

I

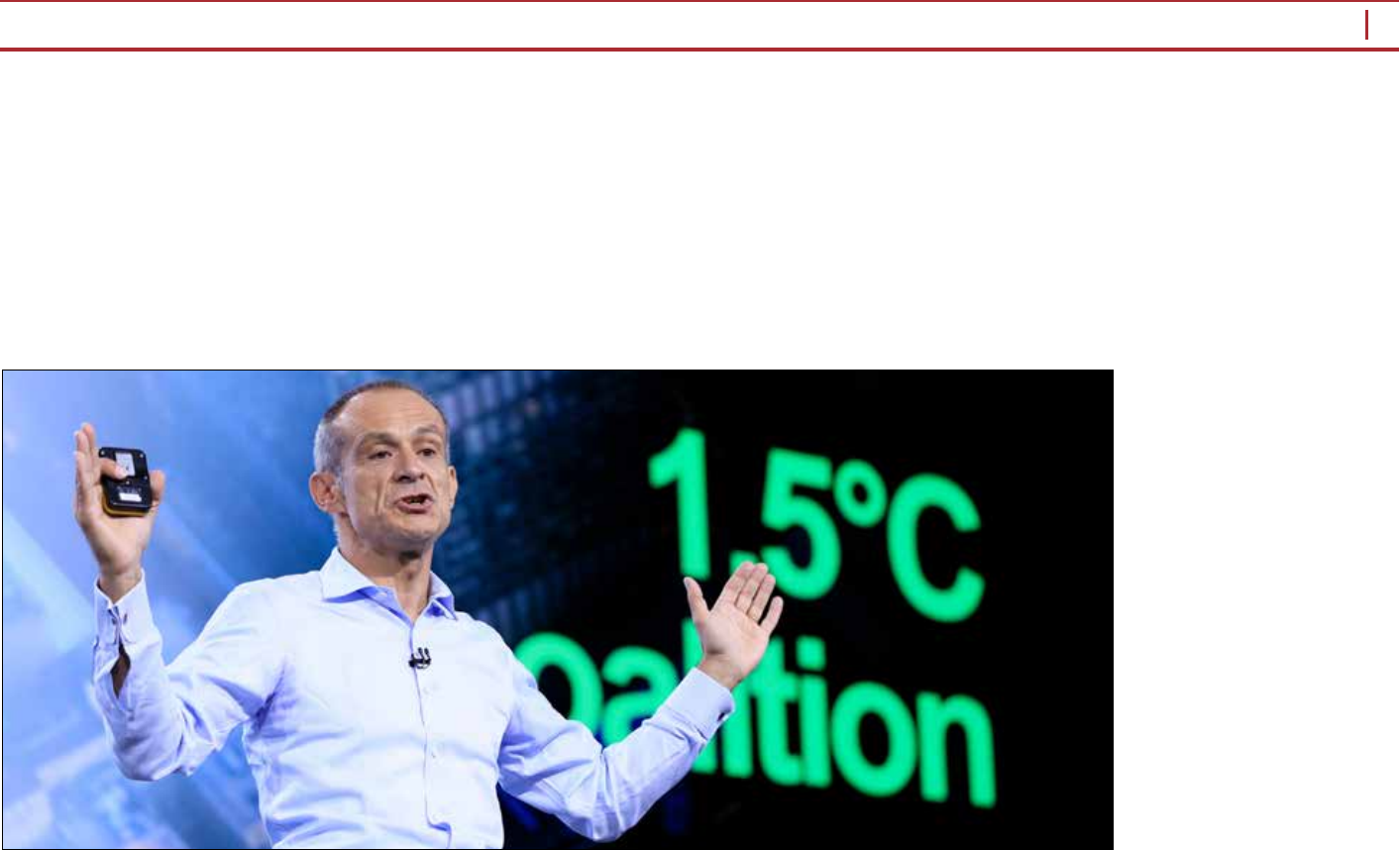

n July 2019, 28 companies from

around the world with a com-

bined market capitalisation of

$1.3 trillion stepped up to a new

level of climate ambition in re-

sponse to a call-to-action campaign

led by the UN.

Just two months later, at the UN

Climate Summit in New York, that

number had grown to 87 companies

with a combined market capitalisa-

tion of over $2.3 trillion and annual

direct emissions equivalent to 73

coal red power plants.

The initiative – known as Business

Ambition for 1.5°C – is backed by

the United Nations Global Compact,

the Science Based Targets initiative

(SBTi) and the We Mean Business

coalition, and commits signatories to

setting climate targets across their

operations aligned with limiting

global temperature rise to 1.5°C

above pre-industrial levels and

reaching net-zero emissions by no

later than 2050.

The initiative is a sign of the grow-

ing movement towards socially re-

sponsible corporate culture and the

realisation that sustainable practises

make good business sense – provid-

ing opportunities to both save money

and grow revenues.

“There is a new attitude towards

climate and sustainability,” said

Jean-Pascal Tricoire, Chairman and

CEO of Schneider Electric, one of

the initiative’s signatories, speaking

at the company’s own Innovation

Summit in Spain in October. “We

will look for efciencies throughout

our value chain… It will make us

more competitive by reducing

waste.”

Like other signatories to the pact,

which include Deutsche Telekom,

EDP, Ørsted, Suez, Enel and Accio-

na, Schneider will work to ensure

that all parts of its business value

chain – and those of its suppliers –

are aligned with the 1.5°C target.

The company has already achieved

net zero status in 13 of its own build-

ings, and says that digital technolo-

gies will make the transformation

needed possible. “Our sites deliver

energy efciency year on year; a

number of them enjoy on-site pro-

duction of renewable electricity, and

in some cases microgrids and energy

storage. Net-zero carbon innovation

is technologically possible today and

makes economic sense,” said Xavier

Houot, Schneider Electric’s Senior

Vice President Global Safety, Envi-

ronment, Real Estate.

According to the World Green

Building Council (WorldGBC), the

building and construction sector is

responsible for around 30 per cent of

global energy consumption and

GHG emissions. Meanwhile Archi-

tecture 2030, a non-prot group,

states that approximately two-thirds

of the building area that exists today

will still exist in 2050, but building

renovations affect only 0.5-1 per

cent of the building stock annually.

This means that to meet Paris cli-

mate targets, existing buildings must

be renovated at an accelerated rate

and to net zero carbon standards, so

that all buildings operate at net zero

carbon by 2050.

Schneider itself has calculated that

50 per cent of global CO

2

emissions

could be eliminated by 2040 if digi-

tally enabled energy saving mea-

sures were implemented in just half

of existing buildings. Achieving net

zero in 13 of its own sites – includ-

ing a factory in Wuhan, China, and a

logistics centre in Spain – helped the

company to a 22 per cent reduction

in CO

2

emissions in 2018 over 2017.

Overall, Schneider has achieved

over 30 per cent energy savings

globally in its operations over the

last ten years. Some 45 per cent of

its operations are powered by renew-

able energy.

Digital energy management sys-

tems are well-placed to enable the

energy transformation in the build-

ings sector, Schneider says. Plat-

forms with open, interoperable archi-

tectures and internet-of-things (IoT)

ability can deliver safe, reliable and

sustainable solutions for companies

seeking energy savings measures.

Schneider’s EcoStruxure platform

uses advancements in IoT, sensing,

cloud, analytics and cybersecurity to

connect devices including meters,

drives and PV systems with soft-

ware, apps and analytics to make

buildings ‘smarter’ and greener.

Schneider Electric has deployed its

EcoStruxure digital energy manage-

ment solutions to help it achieve

emission reductions in its buildings,

and can point to other examples of

success stories in the buildings sec-

tor. At Swansea University in Wales,

digital energy management solutions

have reduced energy consumption as

well as given operators improved in-

sight into carbon footprints, cyberse-

curity and costs.

Swansea University began its

transformation in 2013 with plans

for a £500 million campus transfor-

mation programme. The programme

involved the renovation of the exist-

ing Singleton Park Campus, along-

side development of the new Bay

Campus, with work scheduled to be

completed in 2020.

With a mix of old and new assets,

Swansea University faced the chal-

lenge of tying together the opera-

tions of the two campuses, while

modernising its existing systems. It

identied Schneider’s EcoStruxure

Building architecture as an ideal

solution.

EcoStruxure Building combines

Schneider Electric’s building man-

agement software and connected

hardware to connect everything in a

facility, from sensors to services,

through a single smart building IoT

platform. By facilitating data ex-

change between energy, HVAC and

re safety systems, the system

serves as a comprehensive solution

for building automation, control and

optimisation.

Other capabilities identied by the

team at Swansea University include

EcoStruxure’s open integration

across buildings, systems and tech-

nologies. The data, outputs, and in-

sights provided fed directly into

plans for the next phase of develop-

ment. This gradual upgrade saved

the University the cost of having to

perform a complete upgrade, avoid-

ing the disruption caused by switch-

ing from one integrated solution to

another. This ensured the new

system’s compatibility with the ex-

isting Singleton Campus and al-

lowed for the development of the

Bay Campus.

The project gave the University

greater visibility over its carbon

footprint, building and third-party

system performance. By ensuring

that the new EcoStruxure Building

Operation system continued to com-

municate with the legacy infrastruc-

ture, building managers can see and

control all their systems and infor-

mation through a single interface.

With the integration of EcoStruxure

Energy Expert and EcoStruxure

Building Operation, the University

has also been able to use its existing

network architecture to collect pow-

er monitoring information without

causing disruption or major replace-

ment works.

EcoStruxure Energy Expert also

provided the team with a better over-

all view of the University’s energy

usage and electrical network health,

whilst providing basic power quality

information. “The wealth of informa-

tion obtained from EcoStruxure En-

ergy Expert helped us recognise the

need for more granularity in our criti-

cal power applications,” said Christo-

pher Lewis, BMS Manager at Swan-

sea University. “Therefore, we are

now investing in Schneider Electric’s

EcoStruxure Power Monitoring Ex-

pert solution for our datacentres.”

Schneider Electric’s EcoStruxure

Building solution is currently being

used to oversee the University’s

BMS and to control district heating

systems, ensuring energy efciency.

It is enabling the monitoring of sys-

tem alerts ranging from critical re

and safety alarms through to pump

failures. It is also playing a pivotal

role in reducing energy consumption,

and will enable departments to better

understand their energy costs and

carbon footprint through onsite dash-

boards.

The EcoStruxure Building solution

has facilitated the combined opera-

tions of the two campuses. The lega-

cy Schneider Vista system, which

continues to be a crucial part of the

older Singleton Campus, is fully inte-

grated with the upgraded EcoStruxu-

re Building Operation platform on

the Singleton and Bay Campuses.

Given the high levels of compatibili-

ty and the bespoke, modular nature

of EcoStruxure, the upgrade or com-

plete replacement of the Vista infra-

structure can be done incrementally,

whilst aligned with budget and plan-

ning cycles, as opposed to a one-off,

costly investment.

Lewis continued: “The EcoStruxu-

re architecture has been very success-

ful in bringing the campuses together

into one front end. It has dramatically

improved on-site engineering ef-

ciency, ensured point-to-point cyber-

security and opened the door to the

Internet of Things.”

Swansea University is now expand-

ing the EcoStruxure Building system

to monitor additional room condi-

tions, including HVAC and lighting.

The upgrade of the Singleton Cam-

pus will continue for the next two

years to bring its smaller metering-

only installations onto the central

system.

Net zero: building a future

Tricoire says “there is a new

attitude” towards climate and

sustainability

THE ENERGY INDUSTRY TIMES - DECEMBER 2019

16

Final Word

A

s the move towards renewables

and decentralisation gathers

momentum in an increasingly

decarbonised world, there is a real fo-

cus around exibility and how it can

be facilitated. That much was clear at

this year’s European Utility Week.

Speaking on the sidelines of the

conference, Andy Bradley, Director of

the global energy research and consul-

tancy services organisation, Delta-EE,

said: “The hot topics we are seeing

around exibility include demand re-

sponse – both for energy companies

and network system operators. We are

also seeing a lot of activity around

energy communities and e-mobility.”

The need for exibility, he says,

provides threats and opportunities.

“The network operators see the threat

of a less stable energy system in future

because of the increasing amount of

renewables on the system and rapid

change in demand proles through

electrication of heat or transport. But

the energy suppliers and commercial

companies see the opportunity of

commercialising new technologies for

their customers, and maybe therefore

creating the problem, but also solving

the problem by creating platforms

such as aggregation platforms, and

peer-to-peer trading models that actu-

ally provide service to the energy

system to keep it in balance.”

And the opportunities are there not

just for energy companies but also for

those outside of the sector. Car

companies are a good example. EVs

are likely to play a big role in provid-

ing exibility in the future. Being the

company that has control over those

assets, and having access to cars that

are parked for most of the day, is

potentially a big prize. This could see

car companies become a different

type of company in the future if they

choose to.

“If you’re going to sell an EV, then

why not be the company that controls

that EV and provides exibility ser-

vices to the energy system?” said

Bradley. “It’s what makes this such a

fascinating space right now. There’s

this convergence of industries, in a

way. There are organisations that have

never been in energy, and never

wanted to be in energy, that now have

the option of engaging in the energy

sector because of connectivity and

digitalisation.”

There was one such move earlier this

year when Japanese car manufacturer

Honda announced that it would build

a portfolio of energy management

products and services to offer a com-

prehensive solution for EV customers

and service operators throughout Eu-

rope, starting with agreements with

two companies in particular; battery

storage rm Moixa and EV charging

solutions provider Ubitricity.

Moixa’s GridShare software enables

aggregation and smart charging of

batteries in response to grid signals.

This provides additional value from

aggregating battery eets to provide

GWh scale virtual power plants to help

balance the grid.

Simon Daniel, CEO of Moixa said:

“Japan is growing at 10 MWh per

month and will probably get to about

0.25 GWh in the next 18 months, and

that’s before we start working with

additional EVs and other types of

technology in the market. Honda has

asked us to be its smart charging

partner for Europe and we will be

doing a lot more projects with EV

charging. “

The need for exibility and grid

balancing also brings opportunities for

everyday household consumers who

are now able to take part in commu-

nity energy schemes. Energy com-

munities could help to enable the

exibility potential of customers and

therefore more effectively integrate

renewables and technologies such as

EVs into the grid. With its “Clean

Energy for all Europeans” package

(CEP) initially published on 30 No-

vember 2016, the European Commis-

sion proposed for the rst time to

formally recognise community energy

projects in European legislation.

Denmark and Germany probably

provide the two best practice examples

for community energy generation.

Denmark focuses on wind power

plants, while Germany also invests in

solar projects.

The most recent of these projects is

the Brunnthal scheme near Munich

currently being executed by Green-

Com Networks. GreenCom says it

expects to signup its rst customers

before the end of this year. “The long

term goal of the project is to have the

whole community CO

2

neutral,” said

Klaus Müller, GreenCom’s Marketing

Manager. “In order to push that, we

want to motivate people to use electric-

ity that is generated in the community,

so we will incentivise local production

and consumption.”

Residents of Brunnthal will get a

bonus of 1 eurocent/kWh on top of

the feed-in tariff if they consume less

than they produce, and a discount of

3 eurocents/kWh for what they con-

sume during periods of oversupply.

“The goal of this project is not to

make money but to show that a

community [energy scheme] can

actually work,” explained Müller.

“Going forward we will license the

connectivity, optimisation, visuali-

sation and billing of our product. We

hope to help other utilities, communi-

ties and municipalities to establish

such communities.”

Community energy schemes, where

consumers can take advantage of

rooftop solar PV and smart meter

technology, could be a real contributor

to a decarbonised future, especially in

developing countries.

Linda Jackman, Vice President of

Strategy EMEA, Oracle Utilities,

noted: “They are doing a lot of this,

especially in Africa and India, where

they are looking at this idea of doing

distributed grids and the whole con-

cept of microgrids. It means you’re not

building massive transmission towers.

Transmission losses in India are as

much as 50 per cent; so you are build-

ing twice as much generation as you

actually need.

“So if there’s one single investment

the rest of the world needs to make,

it’s to help developing nations build

networks where you are not reliant on

massive transmission and centralised

generation. You then have greater

control over that localised generation,

where the fuel mix could solar PV,

run-of-river hydro, batteries or a

number of technologies that ensure a

lower carbon future.”

Siemens sees the decentralisation

space as an interesting one. Speaking

at the EUW keynote and later at a

media roundtable, Cedrik Neike

Member of the Management Board of

Siemens AG and responsible for the

Smart Infrastructure business, noted

that the company was restructuring to

focus on the energy transition.

“We think that most of the innovation

will be in the decentralised energy

space… there will be much more

electricity, that will be much more

intermittent, and needs to be balanced.

This means the grids will need to be

much more intelligent,” he said. “The

prosumer also has to be much more

intelligent, and these two meet at what

we call the grid edge.”

Neike was speaking as the company

unveiled a new Grid Diagnostic Suite,

which includes cloud-based applica-

tions that collect data from new or

existing eld devices for protection,

distribution automation and power

quality. This data is then stored and

analysed in the cloud.

Dr Michael Weinhold, Chief Tech-

nology Ofcer (CTO) of Siemens

Smart Infrastructure commented:

“The load side, or grid edge is becom-

ing more and more active. It’s not like

in former days where, like in Ger-

many for example, there were a

couple hundred centralised power

stations and the load was passive.

Today in Germany there are more

than 1 million solar PV rooftops that

interact with the grid.”

This increasing activity at the grid

edge is seeing a proliferation of solu-

tions aimed at unlocking new value for

utilities. EUW 2019 saw Landis+Gyr

introduce its Gridstream Connect IoT

platform to help utilities “master their

present and future challenges in pro-

viding grid exibility resiliency and

security”.

Landis+Gyr says the platform lever-

ages intelligence at the grid edge and

across distribution systems for more

efcient management of energy ca-

pacity, the integration of renewables

and enhanced consumer engagement.

Igeneia Stefanidou Head of Prod-

uct Management Grid Edge at

Landis+Gyr, said: “With decarbonisa-

tion we see the production shift from

higher voltage levels to lower voltage

levels as solar panels are connected to

low voltage grids. This creates the

need for more digitalisation – utilities

need to digitalise their low voltage

systems in the same way they have for

their high voltage systems.”

Digitalisation will not only be a fa-

cilitator of the energy transition but

will be an accelerator. And as the en-

ergy sector is on the edge of massive

change, all eyes will be focused on

what is happening at the grid edge.

Living on the edge

Junior Isles

Cartoon: jemsoar.com