www.teitimes.com

November 2019 • Volume 12 • No 9 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

A work in

progress

What’s in store?

The energy transition still requires

massive investment from the

electricity sector, says Eurelectric.

Page 13

Analysing the trends in battery energy

storage and the key technologies

affecting utilities in their transformation.

Page 14

News In Brief

Tremendous growth in

renewables but still not

enough to halt climate

change

Two recent International Energy

Agency (IEA) reports forecast

strong growth for renewables but the

Paris-based organisation warns that

deployment at the current pace is

insufcient to meet climate goals.

Page 2

Connecticut attracts key

players for 2 GW tender

Connecticut’s offshore wind energy

sector is set for growth after a

2 GW tender attracted bids from

three major developers.

Page 4

Australia poised for clean

energy exports

Australia could soon become

a world-leader in exporting

renewable energy with the recent

announcement of plans to export

solar power and hydrogen.

Page 6

German plan fosters

onshore wind growth

Germany’s government has

presented proposals to boost growth

in the country’s onshore wind energy

sector.

Page 7

South Africa unveils power

plan as blackouts persist

South Africa has been hit by a new

wave of rolling blackouts, as the

government put forward plans for

developing its power sector for the

next decade.

Page 8

Senvion seals SGRE deal

Senvion is starting to wind down

parts of its business after securing

a deal with Siemens for the sale of

its European onshore wind services

unit.

Page 9

Technology: Cloud-based

systems take stock of

energy use

A live-streaming business energy

monitoring and costing platform

that allows real-time, deep analytics,

takes energy management to a new

level.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

Earlier this year, the International Energy Agency earmarked 2019 as the year of

unprecedented momentum for hydrogen. Several major announcements last month seem to

be proving that claim. Junior Isles, reports.

Study nds utility industry vulnerabilities to

cyber attacks

THE ENERGY INDUSTRY

TIMES

Final Word

It’s time for joined up

thinking, says Junior Isles.

Page 16

Several signicant announcements in

both Europe and Asia in recent weeks

have highlighted the growing belief

that hydrogen will play a critical role

in achieving global climate change

ambitions.

At the Hydrogen for Climate Con-

ference in Brussels last month, the EU

unveiled a multi-billion initiative to

support the development of hydrogen

projects throughout Europe to decar-

bonise industry, transport and build-

ings. The projects will seek invest-

ment exceeding €60 billion ($66.5

billion) over the next 5-10 years and

once complete are estimated to save

35 million t/y of carbon dioxide.

One notable proposal among the 11

projects is the Silver Frog project pro-

posed for the European Union’s Im-

portant Projects of Common Europe-

an Interest (IPCEI). Four companies

– Belgium-based rm Hydrogenics

Europe, Swiss solar industry supplier

Meyer Burger Technology AG, Hun-

garian solar technology rm Ecoso-

lifer, and renewables developer Euro-

pean Energy of Denmark – are hoping

to build a solar production factory to

produce high-efciency modules. The

factory, with an annual capacity of 2

GW, would provide over 10 GW of

installed PV capacity that will go to-

wards hydrogen production.

The project is estimated to support

the production of 800 000 t of green

hydrogen over an eight-year period,

offsetting 8 million t of CO

2

emissions

per year.

The news came as Germany’s Min-

istry of Education and Research said it

intends to inject at least a further €300

million in funding for green hydrogen

research by 2023, having already al-

located €180 million for the coming

years. This latest pledge brings Ger-

many’s total investment commitment

for hydrogen research to €780 million,

including the Federal Ministry for

Economic Affairs and Energy’s own

€300 million pledge that was an-

nounced in July.

In a sign that companies are prepar-

ing for a potential boom in hydrogen,

industrial gas and engineering group

Linde said last month that it has taken

a stake in a small British business that

manufactures machines to produce

hydrogen. Linde has agreed to invest

£38 million in return for 20 per cent of

Shefeld-based ITM Power, which

has a market capitalisation of about

£140 million and makes electrolysers

that use electricity to produce hydro-

gen from water.

The announcements followed news

at the beginning of the month that a

team of energy experts from Tractebel

Engineering GmbH and offshore en-

gineers from Tractebel Overdick

Continued on Page 2

A report released last month has re-

vealed that the risk of cyber attacks on

the utility industry may be worsening.

The study by Siemens and the

Ponemon Institute says that as utilities

increasingly adopt business models

that connect operational technology

(OT) power generation, transmission,

and distribution assets to information

technology (IT) systems, critical in-

frastructure is more vulnerable to cy-

ber attacks.

The survey of 1726 utility profes-

sionals, responsible for securing or

overseeing cyber risk in OT environ-

ments at electric utilities with gas,

solar, wind assets, and water utilities

throughout North America, Europe,

Middle East, the Asia-Pacic region,

and Latin America, show the risk of

cyber attacks on the utility industry

may be worsening, with 56 per cent

of respondents reporting at least one

shutdown or operational data loss per

year. Further, 25 per cent had been

impacted by mega attacks, which are

frequently aided with expertise de-

veloped by nation-state actors.

The vulnerability of critical infra-

structure to cyber attacks has potential

to cause severe nancial, environ-

mental and infrastructure damage,

and according to all respondents, 64

per cent say sophisticated attacks are

a top challenge and 54 per cent expect

an attack on critical infrastructure in

the next 12 months.

Most of the surveyed global utili-

ties say that cyber threats present a

greater risk to critical infrastructure

– compared to IT systems – and are

concerned with the unique industry

challenges, including ensuring avail-

ability, reliability and safety of elec-

tricity delivery.

Industry-wide, readiness to address

cyber attacks is uneven and has com-

mon blind spots, especially with re-

gards to the unique cyber security

requirements for OT, and the impor-

tance of distinguishing between se-

curity for OT and security for IT.

This remains a major challenge for

many organisations across the indus-

try. Only 42 per cent rated their cyber

readiness as high, and only 31 per

cent rated readiness to respond to or

contain a breach as high.

“The utility industry has woken up

to the industrial cyber threat and is

taking important steps to shore up de-

fenses,” said Leo Simonovich, Sie-

mens VP & Global Head, Industrial

Cyber & Digital Security. “We hope

this report helps utilities benchmark

their readiness and leverage best prac-

tices to stay ahead of attackers.”

The report – ‘Caught in the Cross-

hairs: Are Utilities Keeping Up with

the Industrial Cyber Threat?’ – details

the utility industry’s vulnerability to

cyber risk, readiness to address future

attacks, and provides solutions to help

industry executives and managers

better secure critical infrastructure.

It identies key vulnerabilities in

energy infrastructure that malicious

actors seek to exploit, including

common security gaps that are cre-

ated as utilities rely on digitalisation

to leverage data analytics, articial

intelligence, and balance the grid

with intermittent renewable energy

and distributed power generation.

Hydrogen

economy

gathers pace

Siemens Australia’s Jeff Connolly, says Australia “is a

potential giant” in hydrogen production

THE ENERGY INDUSTRY TIMES - NOVEMBER 2019

3

Energy & Storage

solutions expertise

Securing energy supplies

Ensuring a reliable power supply is one

of the key factors for progress and

prosperity around the world. Building

on decades of MAN innovation, we can

help secure clean and effi cient energy

supplies for your customers. Our expertise

covers solutions for hybrid power, LNG

to power, energy storage, power-to-X,

thermal power plants, and CHP.

www.man-es.com

Your reliability

shines

1912_14870_MAN_ES_Anzeige_SC_KV_Power_YourReliabilityShines_reSe_ENG_249x160mm_ISO_V2.indd 1 01.10.19 13:36

REGISTER AT: www.africaenergyindaba.com

AFRICA’S ENERGY SECTOR:

FROM TRANSFORMATION

TO TRANSITION

3 - 4 MARCH 2020

CTICC | CAPE TOWN | SOUTH AFRICA

Thinking Energy

South African National Ene rgy Association NP C

Strategic Partners

EXPERIENCE

EXCELLENCE

E-WORLD

FOR 20 YEARS THE MEETING PLACE OF

THE ENERGY INDUSTRY.

EUROPE´S LEADING ENERGY TRADE FAIR

E-WORLD ENERGY & WATER

FEBRUARY 11 – 13, 2020

|

ESSEN

|

GERMANY

www.e-world-essen.com#Eworld2020

THE ENERGY INDUSTRY TIMES - NOVEMBER 2019

5

Asia News

Syed Ali

Emissions from thermal power plants

have declined signicantly between

2014 and 2017, according to research

carried out by a team of experts from

the UK and China.

The group analysed emissions from

coal, oil, natural gas and biomass

power plants, with a focus on coal red

power plants as the major contributors

to ambient air pollution.

The study, published in Nature En-

ergy, analysed data from 2014, when

China introduced the ambitious Ultra-

Low Emissions (ULE) Standards

Policy for renovating coal red pow-

er stations to limit air pollutant emis-

sions, to 2017.

The team found that between 2014

and 2017, China’s annual power plant

emissions of sulphur dioxide, nitro-

gen oxide and particulate matter

dropped by 65 per cent, 60 per cent

and 72 per cent each year, respec-

tively from 2.21, 3.11 and 0.52 million

tonnes in 2014 to 0.77, 1.26 and 0.14

million tonnes in 2017, which is in

compliance with ULE standards.

This means that China looks to be

on track to further reduce its emissions

if all thermal power plants meet the

ULE standards by 2020. These stan-

dards aim to limit the sulphur dioxide,

nitrogen oxide and particulate matter

emissions to 35, 50 and 10 mg/m

3

,

respectively.

Co-author, Dr Zhifu Mi at Univer-

sity College London (UCL Bartlett

School of Construction and Project

Management), said: “This is encour-

aging news for China, as well as

other countries wishing to reduce their

power emissions. Thermal power

plants combusting coal, oil, natural

gas and biomass are one of the major

contributors to global air pollution.

“These signicant emission reduc-

tions demonstrate the technical and

economic feasibility of controlling

emissions from power plants to reach

ultra-low levels, which is an important

step towards reducing the number of

deaths attributable to air pollution.”

The team constructed a nationwide

emissions data-set – the China Emis-

sions Accounts for Power Plants

(CEAP) – based on data collected

from the CEMS network between

2014 and 2017.

The research is the rst to use data

on emission concentrations collected

by China’s Continuous Emission

Monitoring Systems network

(CEMS), which covers 96-98 per cent

of the country’s thermal power capac-

ity.

China has been making a concerted

effort to reduce pollution and cut

carbon emissions from its power sec-

tor. In late September the State Power

Investment Corp. Ltd. (SPIC) an-

nounced the start of construction on a

wind power project with a power gen-

erating capacity of 6 GW in north

China's Inner Mongolia Autonomous

Region.

Qian Zhimin, SPIC's chairman, said

the project involves an investment of

Yuan40 billion ($5.6 billion) from the

company. After being put into opera-

tion, it is expected to supply nearly 20

TWh of electricity to Beijing, Tianjin

and Hebei every year and provide

green energy for the Beijing Winter

Olympics in 2022.

The project could replace 6 million

tonnes of standard coal and reduce the

emissions of carbon dioxide by 16

million tonnes a year, said Qian.

The news came as the State Council

of China said it will replace the existing

benchmark coal red power tariffs with

a new base price-plus-oating mecha-

nism as of 1 January 2020. This new

market-based price system is expected

to lead to more exible power prices

but also to lower prots for coal red

power generators.

The benchmark price is determined

according to the on-grid electricity

price of the current coal red power

generation.

Under the new system, prices will

be determined by the power genera-

tion company, the electricity sales

company and the power user through

negotiations or bidding. Prices may

be raised by up to 10 per cent and re-

duced by up to 15 per cent.

The upward price revision will be

allowed only as of 2021 to ensure that

the average electricity price of gen-

eral industry and commerce will not

rise in 2020.

The National Council on Climate and

Air Quality has suggested implement-

ing a seasonal dust management sys-

tem that will operate from December

to March next year.

The plan would see a crackdown on

illegal emissions, the shut down of 27

coal power plants and the restriction

of over 1 million diesel vehicles from

cities during the four-month period.

The council, which expects the re-

lated bill to pass before December,

says the policy initiative is aimed at

reducing domestic emissions of PM

2.5 (ultrane particles smaller than

2.5 micrometres in diameter) by 20

per cent.

Among other proposals covering in-

dustry and transport, the council has

suggested that nine to 14 coal power

plants be shut down from December

to February, and 22 to 27 plants be

suspended in March. Coal power

plants generate 12 per cent of the coun-

try’s ultra-ne dust.

The closures could lead to an average

Won1200 ($1) hike in the monthly

electricity bill for a four-member

household over the period, the council

said.

A long-term comprehensive plan to

combat particulate pollution will be

announced in the rst half of next year,

according to the council.

A signicant project was recently an-

nounced that will help curb emissions

from electricity consumed in the in-

dustrial sector.

South Korea’s SK Hynix Inc. said it

will spend Won800 billion ($668 mil-

lion) to build a 585 MW liqueed

natural gas (LNG)-based thermal

power plant in Cheongju, North Chun-

gcheong Province, by 2022 for elec-

tricity self-sufciency to run its chip

lines in the region.

SK Hynix recently presented a blue-

print of its plan to construct the LNG-

based thermal power plant, dubbed

Smart Energy Center, in Cheongju, at

its third semiconductor plant in the city

in North Chungcheong Province.

The power plant located on a 54 860

m

2

development area, will supply half

of the power consumed by the semi-

conductor facility.

China on track to meet 2020

ultra-low emissions targets

South Korea

moves to curb

pollution

n Air pollution from power plants falls dramatically n Construction starts on 6 GW wind farm

Syed Ali

Australia could soon become a world-

leader in exporting renewable energy,

with the recent announcement of

plans to export solar power and hy-

drogen to neighbouring countries.

Last month Sun Cable said it aims to

build a solar farm at a 15 000 ha site at

Tennant Creek in the Northern Terri-

tory and transmit the power produced

to Singapore via an underwater cable

from Darwin.

David Grifn, Chief Executive of

Sun Cable, said the market was there

in Singapore and he was condent the

project would be able to deliver clean

energy to the City-State in the near

future, while providing huge benets

to Australia. At present, 95 per cent

of Singapore’s electricity is generated

from liquid natural gas, which is im-

ported mainly from Malaysia and

Indonesia.

The solar export project has already

been granted major project status by

the Northern Territory Government

and environment approvals are pend-

ing. It is hoped construction can begin

in 2023.

Australia has traditionally been a

global exporter of coal and gas but the

project looks to be the start of a trend

to export green energy to countries in

the region.

In late September the South Austra-

lian government unveiled a plan to

become a leading global exporter of

certied green hydrogen. South Aus-

tralian Premier Steven Marshall used

his opening address at the Internation-

al Conference on Hydrogen Safety in

Adelaide to launch its Hydrogen Ac-

tion Plan.

He said while other jurisdictions

were looking at non-renewable hydro-

gen as a stepping-stone to renewable

hydrogen, South Australia was well

placed to move straight to certied

renewable hydrogen. Four key hydro-

gen projects are already underway in

South Australia, utilising $17 million

in government grants and $25 million

in loans.

The state is already a world leader in

wind, solar and battery storage, to the

point where excess renewable energy

is often shed during peak production

periods.

“In this scenario, storage technolo-

gies such as hydrogen are extremely

attractive to our state and as a large

state in an area with remote communi-

ties, prospective mineral regions and

long transport routes, hydrogen is an

exciting, exible fuel for the future,”

said Marshall.

Marshall said South Australia was on

track to reach 90 per cent renewable

energy generation in the mid-2020s

and become a net renewable energy

exporter in the 2030s.

South Australia was the rst Austra-

lian jurisdiction to develop a plan to

accelerate a hydrogen economy with

the release in 2017 of a Hydrogen

Roadmap. Last year, Australia’s na-

tional science research agency CSIRO

released its National Hydrogen Road-

map and several other states have also

since released their own plans.

6

THE ENERGY INDUSTRY TIMES - NOVEMBER 2019

Asia News

Australia poised for clean

energy exports

Global analytical company CRISIL

says it expects India to miss its goal of

having 175 GW of renewables gen-

eration capacity in 2022 by around 42

per cent amid policy uncertainty and

low interest in tender rounds.

The rm predicts the country’s in-

stalled renewables capacity at the end

of scal 2022 will be just 104 GW,

including 59 GW of solar and 45 GW

of wind.

In its ‘REturn to Uncertainty’ report,

CRISIL said there has been a signi-

cant drop in developer interest as tariff

ceilings are being lowered. This, it

says, is constraining project viability

and causing renegotiation of tenders.

The fact that some local governments

have tried reducing the tariffs in signed

contracts is not helping, it added.

CRISIL’s report shows that around

26 per cent of the 64 GW of projects

auctioned by the central government

and state agencies in the scal year

ended March 2019 attracted no, or

lukewarm, interest, while 31 per cent

faced delays in allocation. As a result,

the ratio of auctioned or awarded proj-

ects to tendered projects fell to 34 per

cent in scal 2019 from 77 per cent

over scals 2015-16 and 2016-2017.

In order to restore developers’ con-

dence, India needs to relax tariff caps

and provide a consistent and stable

policy environment, CRISIL said. Be-

sides, some policies such as renewable

purchase obligations and penalties for

delays in payments should be of-

cially included in the Electricity Act,

it added.

India’s renewable energy pro-

gramme is the world’s most ambitious

and is central to meeting its climate

commitments. The programme, how-

ever, has also faced problems related

to the use of agricultural land for re-

newable projects.

In a move to address the issue, last

month a top government ofcial said

India would set up solar and wind proj-

ects on fallow land along its interna-

tional border with Pakistan. A 30 km

long, 20 km wide plot of land has been

identied along the border in Kutch

district of Gujarat and stretches along

the border in Bikaner, Barmer and Jais-

almer districts of Rajasthan.

The government has proposed that

state-run companies build massive

clean energy parks at a cost of around

$2 billion each with built-in incentives

to ensure states and operators are in-

vested in the success of the parks.

The proposed renewable energy

power parks of 2000 MW each will

help developers achieve economies of

scale and further bring down solar and

wind power tariffs

India set to miss

renewables target

A

B

C

D

E

A

B

C

D

E

A

B

C

D

E

A

B

C

D

E

+

-

INTERNET

GATEWAY

+

-

+

-

+

-

+

-

+

-

+

-

+

-

+

-

45

1945 55..12

ABM-XZ

+

-

Create digital services easily

Connect all DER to a VPP

Create smart energy tariffs on the fly

Offer Home Energy Management

for you residential customers

Manage smart energy districts

and energy communities

Come visit us at the European

Utility Week in Paris and enjoy a live

demonstration of our solution:

12th - 14th Nov, stand P160,

next to Digitalisation Hub theater

Get your free visitor pass

https://tinyurl.com/y3yerm5t

Connect and manage

decentralized energy assets to build any energy IoT solution

n Solar power exports planned to Singapore

n Hydrogen Action Plan unveiled

THE ENERGY INDUSTRY TIMES - NOVEMBER 2019

7

Europe News

Siân Crampsie

Germany’s government has presented

proposals to boost growth in the coun-

try’s onshore wind energy sector.

The Federal Ministry of Economy

has devised an 18-point ‘Wind Plan’

aimed at speeding up licensing proce-

dures and overcoming growing levels

of opposition to onshore wind from

citizens groups.

The plan will help to unlock the 11

GW backlog of onshore wind farm

projects caught up in Germany’s plan-

ning process and will be implemented

over the next 12-18 months by various

local, state and federal government

departments.

Wind installations in the rst half of

2019 fell by 82 per cent to 287 MW,

the lowest level in two decades, ac-

cording to the German Wind Energy

Association (BWE). In Germany’s

latest onshore wind energy auction,

just 187 MW of capacity was award-

ed out of 500 MW available.

“The awed auction design and dif-

culties in obtaining licences for tur-

bine construction have discouraged

investors, resulting in a lacklustre

performance of the auction mecha-

nism,” said Mohit Prasad, Project

Manager at GlobalData.

According to GlobalData, Germany

is expected to have onshore wind in-

stallations of 54.6 GW at the end of

2019, an increase of 1.9 GW over

2018, considerably less than the 4 GW

averaged in 2014 and 2015.

The new Wind Plan includes mea-

sures to simplify appeals processes

and species protection regulations as

well as the introduction of regional

plans for wind energy growth.

It also includes a commitment to

introducing a minimum distance rule

for new wind farm developments, as

outlined in the new Climate Package

drawn up by Germany’s coalition gov-

ernment in time for September’s in-

ternational climate meeting in New

York, USA.

BWE welcomed the Wind Plan as a

“major improvement” but expressed

concerns over the minimum distance

rule, which could lead to a large per-

centage of land for wind development

being lost.

It has also expressed concern over

the possibility of Germany’s onshore

wind targets being reduced in the lat-

est draft of the Climate Package.

Early versions of the Package indi-

cated that a 2030 target of 80 GW

would be set for onshore wind, but

this has been reduced to 67-71 GW in

the latest draft.

BWE called the new targets “incom-

prehensible” and said they would af-

fect Germany’s ability to meet its 2030

climate goals.

Germany says that it intends to reach

a 65 per cent share of renewable ener-

gies in electricity consumption by

2030.

n Germany and the Netherlands have

signed a Joint Declaration of Intent on

the energy transition, which includes

cooperation on the development of

cross-border offshore wind projects.

The two countries say that they see

great potential in the development of

offshore wind projects and infrastruc-

ture in the North Seas region to ac-

celerate the deployment of renewable

energy, and have identied a number

of potential cross-border projects that

could benet from cooperation. Last

month Dutch-German offshore grid

operator TenneT TSO issued a tender

for two high voltage direct current

(HVDC) systems, and offshore and

onshore converters for the 4 GW

Ijmuiden Ver offshore wind zone.

TenneT will develop two 2 GW off-

shore HVDC grid connections for

integrating IJmuiden Ver wind farms

into the Dutch power grid from 2024-

2030.

The UK government says that capac-

ity market payments will resume fol-

lowing approval of the capacity market

(CM) scheme by European regulators.

The European Commission has been

assessing the CM scheme, which sup-

ports security of supply objectives in

Great Britain, and ruled last month that

it is compatible with State Aid rules.

The CM scheme has been in opera-

tion since 2014 but was halted in late

2018 when a company operating in the

market appealed against the European

Commission’s original approval of it.

The latest ruling not only means that

the market can resume, but that CM

payments owing to generators operat-

ing in the GB market over the last 12

months can be released.

The government said that the “vast

majority” of the £1.04 billion owed to

generators would be paid in January

2020.

According to Moody’s InterGen NV

will receive £39 million with the res-

toration of the market, while EDF is

owed over £300 million. SSE and

RWE are also owed CM revenues.

Industry trade body Energy UK said

that it was “delighted” with the Euro-

pean Commission’s ruling as the sus-

pension of the market had “threatened

serious consequences”.

“The CM can now continue to do the

job it has done successfully for a num-

ber of years, ensuring security of

supply at the lowest cost to customers

in times of high demand,” said Law-

rence Slade, chief executive at Energy

UK. “The Capacity Market has been

rightly evolving to reect a different

mix of energy generation with newer

technologies gaining a greater share in

recent auctions. With the inclusion of

renewables in future auctions – some-

thing we have long called for – a tech-

nology-neutral CM will continue along

this path and drive progress towards a

net-zero economy bringing benets for

both the environment and the economy,

while reducing costs for customers.”

The Commission’s investigation

conrmed that the CM scheme com-

plies with EU State aid rules, in

particular with the 2014 Guidelines on

State Aid for Environmental Protec-

tion and Energy. “In particular, the

investigation conrmed that the

scheme is necessary to guarantee se-

curity of electricity supply in Great

Britain, is in line with EU energy

policy objectives, and does not distort

competition in the Single Market,” the

Commission said in a statement.

The Commission said it did not nd

any evidence that the scheme would

put demand response operators or any

other capacity providers at a disadvan-

tage with respect to their participation

in the scheme.

Cornwall Insight noted that electric-

ity suppliers in GB are now required

to make payments to the Electricity

Settlements Company to repay gen-

erators, which provided capacity dur-

ing the 2018-19 delivery year. Suppli-

ers were allowed to keep collecting this

money under Ofgem’s price cap regu-

lation and payments. The payments are

likely to be expected by December

2019 and are estimated to be in the

region of £1 billion.

Tom Edwards Senior Modeller at

Cornwall Insight, said: “While this is

undoubtedly good news for generators,

this could potentially cause problems

for suppliers at a time when they are

already facing large payments for

other bills such as their Renewables

Obligation and Feed-in Tariff.”

German plan fosters

onshore wind growth

Stalled CM scheme gets European approval

n Industry concern over distance rules n Climate Package cuts onshore target

TIGER drives tidal

growth

Plans for large-scale deployment of

tidal stream technology in Europe

took a step forward last month with

the approval of a €46.8 million project

to support tidal stream energy devel-

opments in and around the Channel

region.

The EU-funded Interreg VA France

(Channel) England Programme has

approved €28 million of nancing for

the Tidal Stream Industry Energiser

Project (TIGER), which aims to in-

stall up to 8 MW of capacity at sites

in and around the Channel region. The

region has around 4GW of economi-

cally exploitable resource.

TIGER is led by the UK’s Offshore

Renewable Energy (ORE) Catapult

and includes a total of 19 partners from

across the UK and France, including

Edinburgh-based Orbital Marine Pow-

er, the European Marine Energy Centre

(EMEC), France’s EDF, Minesto AB

of Sweden, and SIMEC Atlantis En-

ergy Ltd.

Programme Manager Carolyn Reid

stated that the long-term objective is

to help the sector cut generating costs

to about €150 per MWh by 2025 from

the current €300/MWh. There is also

an EU-set target to achieve €100/

MWh by 2030.

SIMEC Atlantis says the programme

will help it develop a tidal energy proj-

ect planned for the Raz Blanchard site

off the coast of Normandy, France.

Enel completes Kareas

Enel Green Power says that the com-

pletion of the largest onshore wind

farm in Greece marks a milestone in

the company’s history.

Enel has completed construction of

the 154 MW Kareas wind farm,

which consists of 67 Enercon wind

turbines installed across seven loca-

tions on the island of Evia.

The €300 million project is signi-

cant because Greece is one of the rst

countries where Enel started its renew-

able journey more than a decade ago.

“Kareas underscores our global com-

mitment to renewable energy and de-

carbonisation, in line with our pursuit

of the United Nations Sustainable

Development Goals, as well as our

commitment to a diversied genera-

tion mix at country level,” said Antonio

Cammisecra, Enel Green Power CEO.

Kareas spent almost 14 years in

Greece’s planning system, according

to the country’s wind energy associa-

tion (Eletaen), which has welcomed

recent moves by the government to

speed up planning procedures and cut

red tape for developers.

There is an estimated 20 GW of on-

shore wind energy projects held up in

Greece’s planning system. In Septem-

ber Greece’s Ministry of Environment

and Energy set up a working group to

nd ways of simplifying complex

planning procedures, while the Energy

Regulatory Authority (RAE) held a

consultation to gather views on the

permitting system.

The government’s committee is aim-

ing to introduce new legislation by the

end of the year to update procedures

for wind farm production licences, and

has targeted the spring of 2020 for new

legislation on environmental licences.

RAE has proposed simplied applica-

tion procedures as well as a mechanism

to cancel permit applications for proj-

ects that do not reach key milestones.

Wind farm projects take an average

of eight years to obtain all their permits,

Eletaen says.

are more attractive to nancial inves-

tors in particular. Going forward that

will change and we will be going into

the arbitrage opportunity; so in mar-

kets like California where storage and

solar are co-located, it’s a different

investment proposition.

“Solar and storage are a good thing

to co-locate in California, where

there’s peak sun at midday and peak

demand in the evening; it is the per-

fect application for Li-ion batteries.

But it doesn’t work on a lot of projects

yet. The costs coming down will

change that. We see this accelerating

over the next couple of years as evi-

denced by the 2 GW of solar plus

storage PPAs signed in the recent past

in the US.”

The pace of deployment, however,

varies from country to country, ac-

cording to regulatory development

and market structure.

Ghavi said: “Australia has started

well, as has the US. And we are start-

ing to see more in Europe. It’s also

about open markets versus closed

markets. The value of storage as an

asset can vary signicantly, depend-

ing on whether it’s in an open or

closed market.”

Looking to the future, with the

battery still being the biggest cost in

an energy storage solution, ongoing

cost reduction of the battery along

with performance improvement, will

be key. With regards to the entire

system, Ghavi says that further en-

abling cost reduction through opti-

misation will also be important,

adding that “the next thing will be

how to take the system to the next

level through digitalisation”.

She concluded: “It has been an

amazing journey and there’s so much

more we can do from a digitalisation

and system level perspective, from a

practical deployment perspective

and also in terms of business models.

It’s about how we can help our cus-

tomers manage energy more ef-

ciently, enable new business models

and revenue streams, and really help

them to evolve.”

T

he need to integrate renewables

has been one of the main drivers

behind the transformation of

the energy sector and the technologies

associated with enabling that transfor-

mation – the key among them being

battery energy storage systems

(BESS). Without storage, the effective

use of intermittent renewables will be

severely limited.

“Storage is really a key enabler for

maximising renewables, having a

stronger, greener, grid and maximis-

ing the value of physical assets,” said

Maxine Ghavi, Head of Grid Edge

Solutions within ABB. And com-

menting on what she sees as the key

trends in this critical technology,

Ghavi said: “Probably the biggest

single trend in battery storage has

been the cost reduction.”

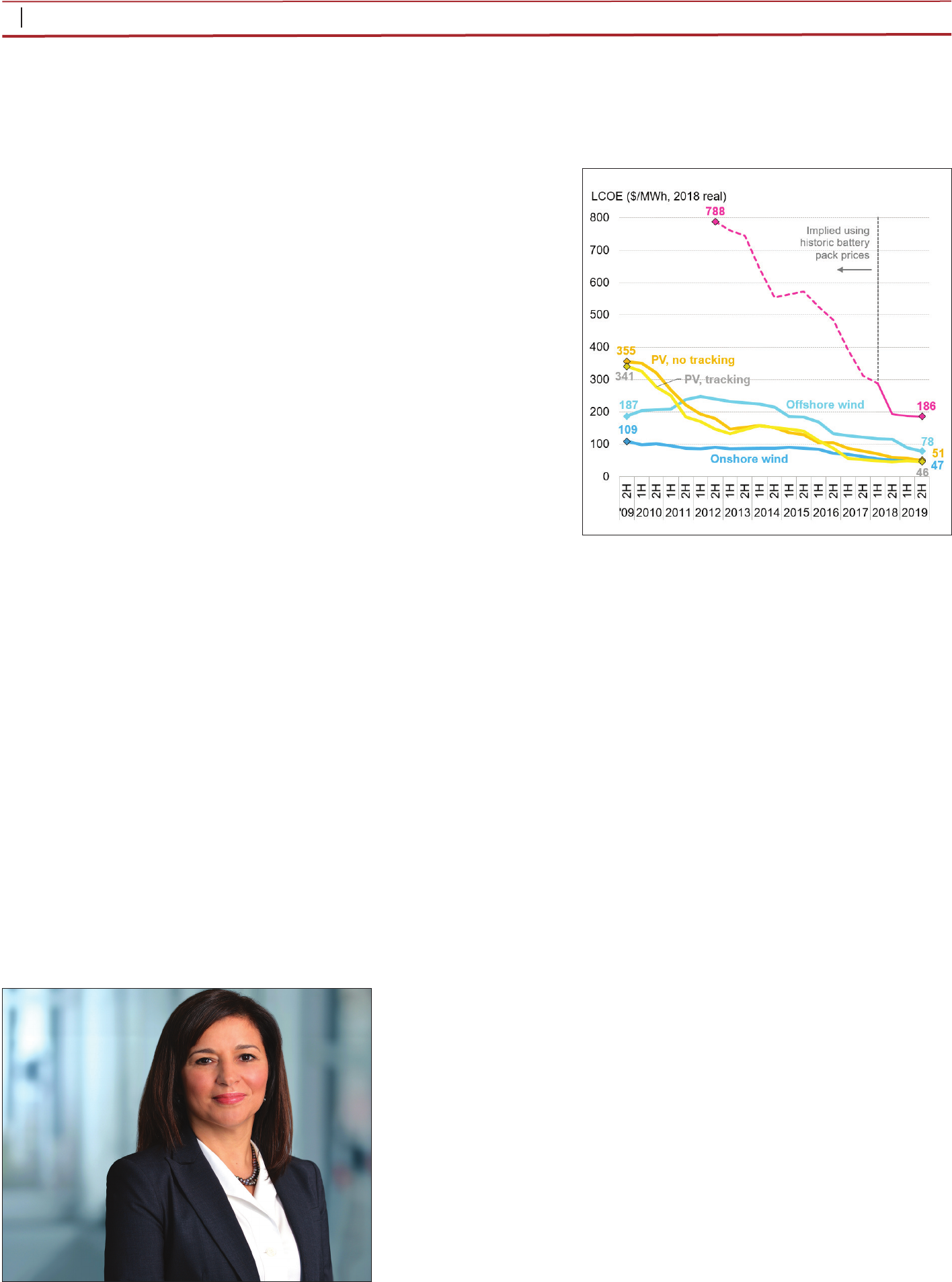

According to BloombergNEF

(BNEF) the volume weighted aver-

age of an automotive battery pack fell

85 per cent from 2010-18, reaching

an average of $176/kWh. It notes that

currently, lithium ion batteries are

getting 18 per cent cheaper with ev-

ery doubling of cumulative volume.

BNEF’s ‘Energy Storage Outlook

2019’ predicts a further halving of

lithium-ion battery costs per kilowatt-

hour by 2030, as demand takes off in

both the stationary storage and elec-

tric vehicles markets. Based on this

observation, and its battery demand

forecast, it expects the price of an

average EV battery pack to be around

$94/kWh by 2024 and $62/kWh by

2030.

This dramatic reduction fall is also

being reected in the power sector. In

its ‘2H 2019 LCOE Update’, released

at the BNEF Summit in London in

October, the global levelised cost of

capacity benchmark for short dura-

tion battery sits at $112/kW/yr, down

4 per cent from 1H 2019. It said that

for up to 1 hr storage duration, batter-

ies are already cheaper than new

build gas red open cycle plants ev-

erywhere except in the US.

This is increasing the business cases

where storage can be applied. Ghavi

commented: “The cost reduction is

not as much technology related but

really comes from scale and [manu-

facturing] efciencies. This means

we are starting to see them deployed

in distributed networks as well as for

utility scale.”

Beyond the battery itself, she notes

that there are also some interesting

trends with regards to other compo-

nents such as the power conversion

and overall system integration. “The

next main trend we are seeing,” she

says, “is in system integration – from

the integration of cells into modules

and then into large stationary systems

– together with thermal management

and protection equipment etc.”

System integration is a trend that

has seen ABB bring its expertise from

power grids together into its grid edge

business.

“We are looking at how you can

build the most efcient system,” said

Ghavi. “And how we have evolved,

reects how the industry has evolved.

As a grid edge solution provider, we

see that it is increasingly important to

look at storage from a holistic per-

spective – focusing on system inte-

gration and the entire solution includ-

ing automation and control. We will

see more of this, as customers become

more demanding.”

According to ABB, data driven

concepts and services, aggregation

of distributed energy resources, opti-

misation and energy management,

are all becoming part of the bigger

picture.

Ghavi noted: “These all impact your

overall economics because they allow

you to provide more value-stacking

from your assets and also reduce costs

through energy management and im-

proving operational performance – by

leveraging things like forecasting,

articial intelligence and machine

learning – over the life of the asset.”

Certainly the life and performance

of a battery is a concern in the indus-

try. One of the major challenges fac-

ing batteries is “absolute safety” at an

acceptable cost. “This is really key,

along with how the risks are mitigated.

It’s a key challenge that all the battery

suppliers are looking at today,” said

Ghavi. “From a systems integrator’s

perspective, you want the batteries to

be safe.”

This, adds Ghavi, is where data ana-

lytics, etc., can help in terms of the

safety, operational performance and

lifetime. Here, automation is a huge

enabler. “The more we are able to in-

corporate data analytics, machine

learning and AI into the automation,

the more we are actually able to look

at things related to reliability, lifetime

and safety.”

Cost, performance, density, safety,

etc., will all drive which battery

technology gains greater acceptance.

Deployment will also be impacted by

collaborations with manufacturers of

car batteries, and the potential for us-

ing second-life batteries.

Although separate industries, the

EV and stationary battery storage

markets are closely intertwined.

“You can’t decouple the stationary

battery storage and EV battery mar-

kets. From the battery suppliers’ per-

spective, they try to leverage from the

same technology. In the stationary

storage business, we’re benetting

from growth in the EV sector. We can

benet from the economies of scale as

the EV production capacity continues

to increase.”

In terms of technology, Ghavi notes

that battery suppliers from both sec-

tors also try to leverage from the same

technology. “They would have a por-

tion of their business that goes to EVs

and a portion that goes to the station-

ary market because it also balances

their portfolio.

“From our perspective, clearly

we’re looking at second-life [EV]

batteries – what it takes to integrate

them, what performance we expect,

etc. There is a lot of discussion around

second-life batteries and of course it

all depends on the cost of integration

and how to maximise their remaining

life, as well as how to mitigate the risk

of integrating these second-life

packs.”

Using second life batteries has the

obvious benet of providing a way

of recycling old EV batteries but

there are also risks. “When we get

the batteries for large stationary

systems, the racks are all tested. But

when you get one based on second

life batteries, you might have 50

batteries from an EV and there’s the

question of how do you put them

together and test them. They will all

be at different levels in terms of ca-

pacity, for example. There are a lot

more variables to deal with.”

She added: “It doesn’t mean the

challenges can’t be overcome; it just

means there has to be a lot more col-

laboration between battery suppliers

and system integrators.”

Another challenge is regulation.

This has a big part to play in recognis-

ing and rewarding the value of storage

in the network. For example a battery

can act as a synchronous generator

but respond much faster. It is therefore

useful for applications such as exible

peaking, frequency control, reserve

capacity, etc, or relieving transmis-

sion congestion. Meanwhile, behind

the meter it enables time-of-use bill

management or demand charge re-

duction; increased self-consumption

or act as an uninterruptible power

supply.

Speaking at the recent BNEF Sum-

mit, Donald Joyce, Chief Financial

Ofcer at RES (Renewable Energy

Systems), the world’s largest inde-

pendent renewable energy company,

said: “From an investor’s point of

view, if storage is structured in the

right way, with the right partners that

understand the contractors, etc., it can

be a star performer.

“A lot of the projects we have done

are more around ancillary services,

such as frequency response. Some of

those have longer-term contracts, so

THE ENERGY INDUSTRY TIMES - NOVEMBER 2019

Energy Outlook

14

The energy industry

is transforming. More

renewables are

coming on to the grid,

electricity consumers

are also generators,

and electric vehicles

will not only consume

energy but will also

feed it back into the

grid. This means

changes in the grid

are needed to allow

electricity to ow both

ways. Junior Isles

speaks to ABB’s

Maxine Ghavi about

battery energy

storage and the key

technologies affecting

utilities in their

transformation.

What’s in store?

Ghavi: the next main trend

we are seeing is in system

integration

Global benchmarks – PV, wind and batteries

Note: The global benchmark is a country-weighted average using the latest

capacity additions. The storage LCOE is reective of a utility-scale Li-ion

battery storage system with four-hour duration running at a daily cycle and

includes charging costs, assumed to be 60 per cent of wholesale average

power price.Source: BNEF Summit in London.

THE ENERGY INDUSTRY TIMES - NOVEMBER 2019

15

Technology

A live-streaming business energy monitoring and costing platform that allows real-time, deep analytics, takes energy

management to a new level. David Appleyard reports.

N

ew internet-enabled energy

management technology has

been developed by energy

and technology consultancy Global

Procurement Group (GPG), to help

businesses monitor and control their

energy usage more effectively. Ac-

cording to GPG, the ground-break-

ing new technology has emerged on

the back of similar internet-enabled

transformations that have taken

place in other industry verticals such

as retail, gaming and nance. Now,

advances in technologies such as ar-

ticial intelligence (AI) and machine

learning are providing new opportu-

nities for improved future energy

management, reducing waste and

cutting CO

2

emissions.

Indeed, GPG notes that a lack of

innovation in the energy sector has

been costly in both nancial and en-

vironmental terms and aims to ad-

dress this decit with its novel ap-

proach to energy management. As

Fokhrul Islam, Chief Executive Of-

cer and founder of GPG’s Northern

Gas and Power, explains: “We stand

on the edge of a period of signicant

change, heralding ideas and innova-

tions that will transform the way en-

ergy is used for future generations.

We recognise there is a real demand

for change. The energy industry

needs not only a change of attitude;

it needs a change of technology.”

The current generation of energy

management technology and moni-

toring and targeting systems were

largely built on technologies that are

now out-dated. As a result, over time

these technologies have become lim-

iting, inexible, costly and difcult

to use. Recognising that the energy

sector needed new technology that is

agile, powerful, accessible, scalable

and cost-effective, GPG looked to

develop an innovative solution

through its ClearVUE Systems and

Energy Lab technology units, which

are based in Malta and India, respec-

tively. This technology arm compris-

es up to 100 senior developers and

engineers who are rigorously testing

and developing new innovative tech-

nology in a bid to ensure that GPG

remains ahead of the curve. The

cloud-based, low-cost monitoring

and targeting platform which

emerged from this programme is, ac-

cording to GPG, the rst of its kind.

ClearVUE’s Alpha.Lite energy

software as a service (e-SaaS) and

Alpha. PRO platforms provide real-

time data to help companies deter-

mine how much energy their assets

use at any given point in time. Instal-

lation requires no hardware or even

site visits but nonetheless provides

detailed insights into energy con-

sumption. As a result, it enables en-

terprises to identify any inefcien-

cies and thus reduce energy costs,

minimise waste and cut carbon emis-

sions. The IoT hardware devices and

software solutions are cloud-based,

giving users the ability to instantly

run deeper analysis to reduce energy

waste, for example.

Islam explains: “This development

emerged from a combination of our

customers’ desires and our own per-

ception of what the future drivers

were and the way the IoT revolution

could impact on the energy sector.

From talking to our customers, we

understand there’s a real demand for

change. Businesses tell us they want

to become more eco-friendly, but

technology and a lack of useable

data has limited their ability.”

Claimed as the world’s rst live-

streaming business energy monitor-

ing and costing platform, Clear-

VUE’s next generation Internet of

Things (IoT) metering and monitor-

ing devices provide real-time and

deep analytics by measuring up to 35

vital energy fundamentals simultane-

ously and in real-time and by the

second. The data is granular down to

circuit level and can therefore pro-

vide the basis for equipment perfor-

mance improvements potentially

right down to individual machines.

In addition, it is possible to combine

the cloud-based and secure system

with modular loT sensors to get a

full view of other factors such as

how changes in the ambient environ-

ment can affect energy performance.

Scalable from one to up to 50 indi-

vidual business sites, the platforms

all break down bill data including

distribution, transmission and any

government charges, which may

have been levied.

The energy management IoT prod-

ucts allow deep energy analytics

with full consumption data available

from the previous day. Automatic

warnings and alerts can also be ap-

plied at key set points to enable users

to take action within seconds if ener-

gy usage issues are agged. Further-

more, all data may be exported for

further analysis. The systems offer

immediate access to historical data,

so businesses can understand areas

where energy is being wasted within

minutes of sign up. Although there is

no specic requirement for any hard-

ware such as disruptive wiring or

costly server installation, consump-

tion metrics such as kWh, kW, kVA,

reactive power and more are avail-

able from the platforms.

Islam says: “Our platforms and

technology has been developed and

designed from the ground up. They

provide incredible power to custom-

ers and the technology is constantly

evolving and improving with their

needs. Both operational and behav-

ioural attributes impact on cost sav-

ings. We provide dedicated energy

management support and a virtual

energy manager; either one-to-one or

group based. We ensure full staff in-

clusion to aid our customers on their

way to a positive energy future in

terms of reduced cost and environ-

mental impact.”

With simple pricing, which the

company describes as “low-cost”,

signing up for energy software as a

service (eSaaS) takes only a few

minutes on-line and, being cloud-

based, can be accessed from any-

where in the world with an internet

connection.

In addition to new technology, the

company has also launched two en-

ergy price comparison sites – Busi-

ness Energy Quotes and Energie Su-

perMarché, which are targeted at the

UK and French markets, respective-

ly. Requiring just a business name

and a post code, the sites are able to

generate a comprehensive range of

competitive tariffs from a variety of

suppliers. Northern Gas and Power

contracts around 6 TWh of energy

annually and cites growth of some

20 per cent per annum.

According to Islam, the benets of

the platforms in terms of energy

costs and control are expected to at-

tract a strong customer base with

some 5000 customers on its Alpha.

Lite eSaaS platform expected in the

rst year. “The power of the technol-

ogy speaks for itself. We can’t nd

anything matching what ClearVUE’s

technology does for this price point

for the energy-customer,” he says.

Looking further ahead, new break-

throughs based on AI and machine

learning are anticipated to yield ad-

ditional benets for industrial and

commercial energy consumers,

which will translate into environ-

mental and nancial gains.

As Islam says: “ClearVUE Sys-

tems in Malta is developing an AI

and deep learning framework for our

non-intrusive monitoring meter.

These developments will allow us to

deliver analysis of energy data that

could not even be comprehended be-

fore now, and will transform not

only energy monitoring but the ener-

gy market. We knew that if we could

make a meter that could gather that

much data, we could apply the new

technology of machine learning,

deep learning and AI onto that data,

analyse it… and get information

that’s never been available for cus-

tomers before, improving not only

costs, but also the global impact of

carbon emissions.”

He adds: “People want change –

businesses want to become more

eco-friendly and nd better ways to

manage their energy but technology

has been very limiting. There is a

real demand. People want to im-

prove their behaviour with energy.

We must meet this opportunity and

drive it with innovation and technol-

ogy. There is huge potential for new

industries to emerge from the oppor-

tunity technology offers us and we

feel this will drive the future econo-

my to great new heights.”

Since the birth of the internet, the

technology has revolutionised and

vastly improved many industries,

even creating many e-commerce sec-

tors. Companies such as GPG are

now looking to harness those same

breakthroughs to benet the energy

sector. As Islam concludes: “If you

look at other industry verticals such

as medicine and nance, technology

has had a huge impact over the last

decade. Yet there has not been the

same technological impact seen

within the energy sector, and we

have seen very little innovation in

this space. New Technology needs to

be applied in the energy sector that is

agile, powerful, scalable and cost ef-

fective, changing the way we view,

control and use our energy bringing

about positive change.”

Cloud-based systems take

stock of energy use

Islam: People want change –

businesses want to become

more eco-friendly and nd

better ways to manage their

energy

THE ENERGY INDUSTRY TIMES - NOVEMBER 2019

16

Final Word

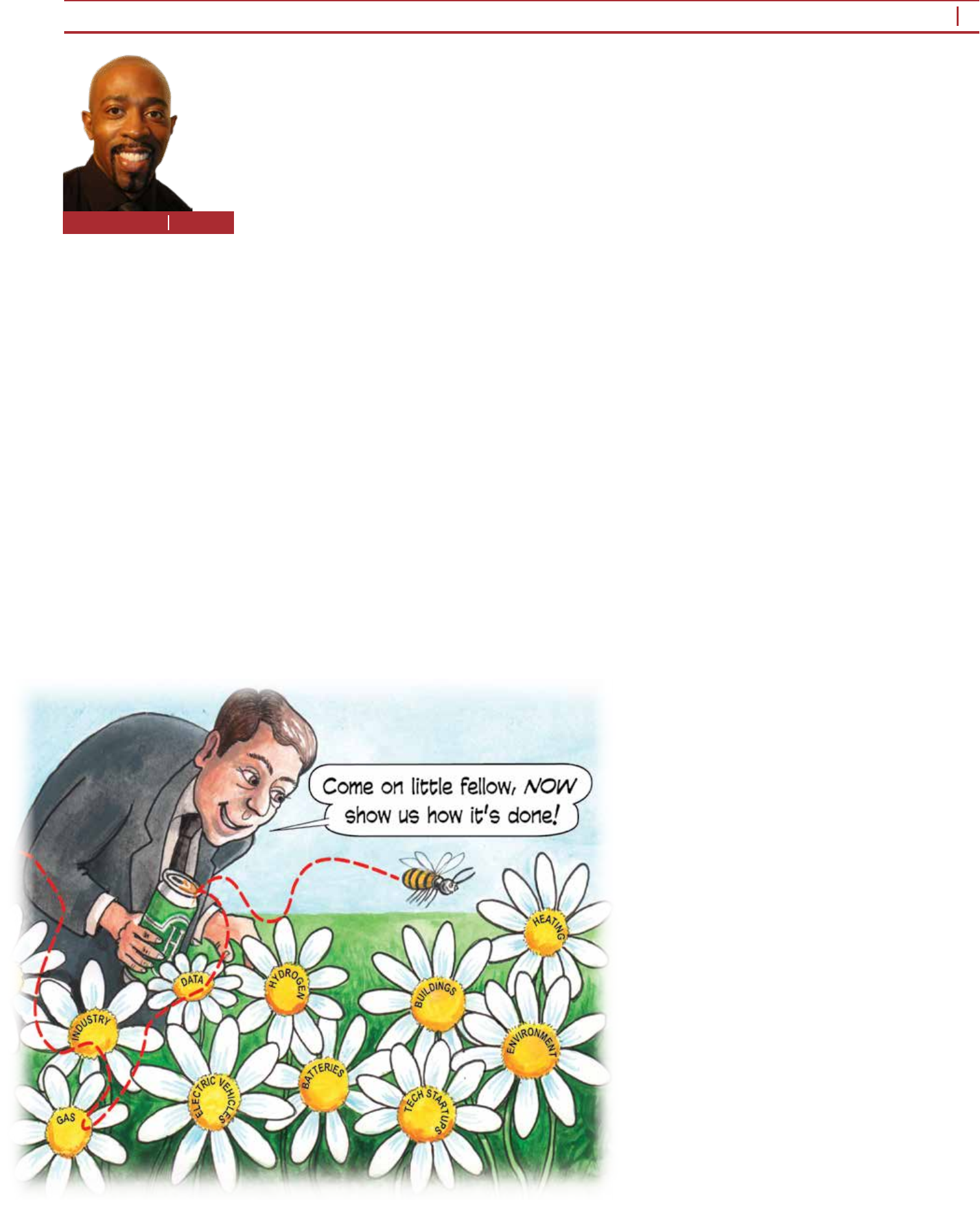

A

lthough electricity is my beat,

so to speak, I nd it increas-

ingly difcult to write solely

about the industry, as the lines between

different sectors continue to blur. And

while most of us like to remain in our

comfort zone, plying our trade in a eld

where we know the boundaries, a little

cross-pollination is no bad thing. After

all, the electricity sector alone cannot

meet the challenge of cutting global

carbon emissions at the required pace

– and we can always learn from other

industries.

Diego Pavia, CEO, EIT InnoEnergy

recently noted the European Commis-

sion’s decision to use “what has been

done around electric-mobility and the

battery value chain, as the blueprint”

for European industrial strategies.

Speaking at The Business Booster in

Paris, an annual gathering aimed at

supporting start-ups and promoting

innovation, Pavia said: “It has been

decided by the Commission to be

taken as the blueprint for any future

industrial strategy in Europe. And then

we will nd PV, we will nd hydrogen,

and many other industrial strategies;

but that will be the blueprint to be

followed.”

Innovation will certainly be key to

the industrial strategies that will sit at

the heart of the individual National

Energy and Climate Plans (NECPs),

which will dene how each country

will contribute to Europe’s 2030 goals.

EU countries are required to develop

integrated NECPs that cover the ve

dimensions of the energy union for the

period 2021 to 2030 (and every sub-

sequent ten-year period) based on a

common template. These will be ap-

proved in December. Pavia noted:

“They provide a perfect roadmap of

where innovation will t.”

In 2017 the EU’s primary energy

demand was 1621 Mtoe, according to

the International Energy Agency

(IEA). This will fall to 1274 Mtoe by

2040 under its New Policies Scenario.

Notably, however, the share of elec-

tricity in meeting overall energy de-

mand is predicted to increase signi-

cantly due to the electrication of

transport, heat, industry, and increas-

ing digitalisation.

As electricity spreads its tentacles,

so too do energy companies, car and

battery manufacturers and those in-

volved in building the charging infra-

structure, players in the building

sector, fuel suppliers such as oil and

gas majors, heating specialists, not to

mention us as journalists.

Keeping an eye on what is happening

in those other sectors traditionally

outside of electricity is becoming

increasingly important as we move

forward. Avoiding irreversible cli-

mate change not only requires joined

up thinking but calls for keeping your

nger on the pulse of what is happen-

ing outside of your patch.

Clearly the energy sector is leading

the way in combatting climate

change. In the IEA’s Sustainable

Development Scenario, energy-relat-

ed CO

2

emissions are reduced by

more than 45 per cent to 17.6 Gt by

2040. The power sector witnesses the

most dramatic change, with the share

of low-carbon technologies reaching

85 per cent in 2040 (up from 35 per

cent today). Emissions from the

power sector comprise nearly 20 per

cent of total CO

2

emissions in 2040

(down from 42 per cent today). Al-

though emissions from passenger

cars halve, despite the number of cars

nearly doubling, transport is the larg-

est emitting sector in 2040 in this

scenario, followed by industry, where

emissions rise to nearly 30 per cent

(up from 19 per cent today).

Clearly transport, industry, buildings

and others need to do more. An idea

of what is needed at the country level

to meet net zero emission ambitions

was highlighted in a recent report.

The London-based consultancy Capi-

tal Economics said the UK will have

to spend £240 billion installing an

average of 4000 electric vehicle charg-

ing points and heat pumps a day if the

government is to meet its target of

cutting greenhouse gas emissions to

net zero by 2050.

This may sound like mission impos-

sible but technology companies often

have a way of making the impossible

possible.

Last month US-based EV Connect

announced that it had closed a $12

million Series B round of funding to

support the global expansion of its

exible, open, cloud-based solutions.

The EV Connect Network, and the

EV Cloud platform on which it runs,

delivers an innovative cloud-based

software platform for managing net-

works of EV charging stations, their

interaction with utilities, and the

overall driver experience. As part of a

collaboration with General Motors,

EV Connect will help GM improve

Chevrolet Bolt EV drivers’ charging

experience with dynamic charge sta-

tion data, including insights on station

status.

Real-time charge station data re-

ceived from EV Connect will enhance

future versions of the myChevrolet

app. As the charging network pro-

vides new information, real-time data

on charge station health will indicate

if a charging station is working, avail-

able, and compatible with the Chev-

rolet Bolt EV, offering a one-stop

shop for all range and charging data

before or during a trip.

Doug Parks, General Motors Vice

President of Autonomous and Electric

Vehicle Programs, said: “By collabo-

rating with EV Connect, we are con-

tinuing our efforts to remove obstacles

for drivers looking to charge their EV

on the go.”

Jordan Ramer, founder and CEO of

EV Connect, added: “The only thing

more powerful than having many EV

charging stations available is having

them networked together. For society

to fully realise all the benets of EVs,

we have to reduce range and charg-

ing anxiety by giving drivers access

to charging and information about

chargers, no matter where they travel.”

With range anxiety and charging

speed probably being the main drag

on the uptake of EVs, another impor-

tant recent announcement was news

that StoreDot and its strategic partner

BP had demonstrated a live full-

charge of a two-wheel electric vehicle

(EV) in just ve minutes. The dem-

onstration with its “rst generation”

fast charging battery is the precursor

to tests with a second generation

battery that will be used in electric

cars.

Erez Lorber, StoreDot’s Chief Oper-

ating Ofcer said: “The second gen-

eration battery, which we have been

developing for the last two years, will

be more suitable for EVs, since it will

be lower cost.” With more than 18 000

fuelling stations worldwide that could

site fast charging stations, the tie-up

with BP is signicant.

“It eliminates the range anxiety over

whether you can reach the next charg-

ing station, and wait for 40 minutes,

or not, and [the need for] all sorts of

apps. If you know you can charge fast,

you won’t worry about it like you do

today,” said Lorber.

The technology is based on the use

of nano-particles in materials, such as

the coating on electrodes, and unique

processes that enable faster movement

of lithium ions in the battery. This fast

movement of ions, he says, is achieved

while maintaining very low internal

resistance – something that is critical

in reducing heat in EV battery pack

congurations.

“This means you don’t need a vast

amount of energy to remove the heat

that’s generated. Cooling is the major

headache that the automotive industry

is facing,” said Lorber. He adds that

such batteries could be on the road by

around 2024. To this end, StoreDot has

already started working with Daimler

on how to incorporate the battery into

one of its future full-electric models.

It is also in close contact with 10-15

other leading car manufacturers such

as VW to understand their specica-

tions and needs, says Lorber.

Certainly there is plenty going on in

the EV battery space. Two start-ups,

NanoOne and Innolith, both pitched

battery developments at the recent

BloombergNEF Summit in London

outlining technologies that improve

cycling and reduce the risk of re. Such

developments will not only eventually

see applications in the stationary bat-

tery storage space but will also increase

the uptake of EVs thus cutting carbon

emissions in transport.

Progress in decarbonising industries

such as steel and cement, however, is

painfully slow. Options are limited and

carbon capture and storage, although

seen as essential, continues to be a

white elephant.

Here, hydrogen and power-to-X

could be the answer. And having been

forced to broaden my journalistic beat,

I feel tempted to extend myself still

further to a bit of marketing copywrit-

ing. Here’s a slogan for hydrogen

proponents, inspired by Heineken:

“Hydrogen refreshes the parts that

electricity cannot reach”.

Time for joined up

thinking

Junior Isles

Cartoon: jemsoar.com