www.teitimes.com

October 2019 • Volume 12 • No 8 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Special Technology

Supplement

Wind farm

decommissioning:

planning ahead

Deploying renewables across

all sectors through ‘Power-to-X’

is crucial to achieving carbon

neutrality.

The industry must not lose sight of the

challenges decommissioning can and

will pose to the wind sector. Page 14

News In Brief

Electricity leads

decarbonisation but other

sectors need to act

Decarbonisation of the power sector

is gaining pace in the EU but further

political action is needed to ensure

timely decarbonisation of other end-

use sectors.

Page 2

Davis-Besse tests hydrogen

technology

The USA is investigating ways of

improving the commercial outlook

for its nuclear energy sector through

the development of nuclear-to-

hydrogen technology.

Page 4

New minister calls for end to

nuclear in Japan

Japan’s new Environment Minister

has called for the country’s nuclear

reactors to be scrapped to prevent

a repeat of the Fukushima nuclear

disaster.

Page 5

Offshore wind reaps rewards

in UK auction

The UK’s latest renewable energy

auction has generated record low

strike prices thanks to plummeting

costs in the offshore wind energy

sector.

Page 6

Adding value through

digitalisation

Adding value through digitalisation

and IoT are key to the success

of utilities. TEI Times speaks to

Omnetric’s CEO, Daniel Felicio.

Page 12

Hydrogen and a zero-carbon

world

Hydrogen production is a possible

key mechanism to a zero-carbon

energy system. The challenge is

how to accelerate the uptake of a

hydrogen economy.

Page 13

Technology:

Superconducting HVDC

passes the test

A superconducting HVDC cable

has passed qualication testing for

the rst time, heralding the rst real

step in demonstrating the technology

could be a viable option for

transmitting large amounts of power

over long distances.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

With carbon emissions at their highest and sea levels rising, world leaders committed to more

urgent action on climate change at this year’s UN Climate Change Summit in New York.

Junior Isles

Corporations embrace sustainability as climate

change battle heats up

THE ENERGY INDUSTRY

TIMES

Final Word

There seems to be some

role reversal when it

comes to climate change,

says Junior Isles. Page 16

World leaders and businesses gathered

at last month’s UN Climate Change

Summit to call for urgent action to

avoid catastrophic climate change.

At the end of September at the New

York summit, more than 60 heads of

state, spurred by António Guterres,

UN secretary-general, announced a

series of new climate targets, with

about 66 countries pledging to reach

“net zero” carbon emissions by the

middle of the century.

Guterres set the tone for the gather-

ing, saying: “If we don’t urgently

change our way of life, we jeopardise

life itself. My generation has failed in

its responsibility to protect our planet.

That must change.”

In the run up to the meeting Guterres

lobbied world leaders to come to the

summit with concrete commitments

to stop subsidising fossil fuels, stop

building new coal power stations and

move toward net zero emissions.

He also barred leaders from the US,

Brazil and Saudi Arabia from taking

the stage because of their failure to

support the Paris climate agreement,

as well as from other leading econo-

mies such as Japan and Australia be-

cause of their continued support for

coal.

In one of a number of three-minute

speeches from heads of state, French

President Emmanuel Macron urged

world leaders to respond more ur-

gently to climate change and said

France would not pursue new trade

negotiations with countries that were

not following the Paris climate

change agreement.

Signatories of the agreement

pledged to limit global warming to

well below 2°C and ideally to 1.5°C,

but their current climate commit-

ments do not add up to the emissions

cuts required.

Carbon dioxide emissions have hit

record highs and a report just pub-

lished by the International Panel on

Climate Change (IPPC) claims that

by 2100 a sea level rise of as much as

1.1 m was likely under a business-as-

usual scenario, where global carbon

dioxide emissions keep increasing.

With coal widely acknowledged as

a major driver of rising emissions,

the IPCC said in a report last year that

limiting warming to 1.5°C would re-

quire cutting coal use to virtually

zero and cutting emissions to net zero

by the middle of the century. Another

report issued by Climate Analytics

during the summit said global carbon

emissions from coal red power sta-

tions need to peak next year, and coal

Continued on Page 2

A large group of multinational compa-

nies signed up to the UN Global Com-

pact (UNGC) at last month’s UN Cli-

mate Action Summit in New York.

With the announcement of 59 new

participants, the group, with its cam-

paign to keep global warming below

1.5°C, now has 87 companies with a

combined market capitalisation of

$2.3 trillion. The initiative was

launched earlier this year with 28

companies signing up in July.

Although over 600 companies had

already committed to limiting global

warming to 2°C in line with the Paris

Agreement, their progress on actu-

ally hitting their goals has been

mixed.

Companies signing the UNGC

pledge have agreed to set indepen-

dently veried “science-based” tar-

gets and create decarbonisation plans

within 24 months to start bringing

their emissions down to keep warm-

ing below 1.5°C. They also have the

option to publicly commit to reach-

ing net-zero emissions by no later

than 2050.

Andrew Steer, a board member at

the Science Based Targets Initiative

– a coalition between the UNGC and

various environmental research and

activist groups in charge of vetting

the companies signing the pledge –

said companies now realise that

smart policies on climate change en-

courage more resource efciency

and the development of new technol-

ogy, which can improve, rather than

reduce, competitiveness.

“Just ve or 10 years ago, the vast

majority of CEOs, boards and gov-

ernments believed it would be nice to

do something about climate change

but it would require a trade off,” he

said.

Engie Impact was created this year

by French multinational electric util-

ity company to offer consulting and

services for sustainability strategy

development, execution and tracking

to accelerate sustainability transfor-

mation for corporations, cities and

governments.

Speaking on the sidelines of New

York Climate Week, the company’s

CEO, Mathias Lelievre, said: “Sus-

tainability is really a business com-

patible approach. We are hearing

good stories everywhere of people

reducing energy consumption, water

consumption, putting some circular

thinking into how they design their

products. This is happening locally

because they can reconcile the busi-

ness with the carbon dollars.

“What we are uncovering is that

when you reduce your energy con-

sumption, for example, and change

how you consume key resources, it

gives a direct bottom line opportu-

nity to plug all of that into renewable

schemes, etc.”

He said, however, the question is

how to scale this at speed. “It’s all

about how to accelerate this energy

transformation. It’s difcult and very

complex.”

One of the key challenges for com-

panies is formulating a good road-

map based on reliable data to take

action.

“Today, only a few [organisations]

are really equipped to measure in

real-time what’s going on when con-

sidering the impact on the environ-

ment, and really getting what they

need to make sure they are address-

ing the right priorities, investing in

the right projects and tracking those

projects. This is a key element that is

not there today,” said Lelievre.

UN climate

conference calls

for action

French President Emmanuel Macron urged world leaders

to respond more urgently to climate change

THE ENERGY INDUSTRY TIMES - OCTOBER 2019

3

Hosted by Part of

Follow us @worldfuturenergysummit

Bringing future

innovation, knowledge

and business together.

The World Future Energy Summit brings together thousands of business and political

leaders, industry specialists, academics and technology pioneers to help you forge new

relationships and source practical solutions for everything your business needs across

future energy, water and waste.

EXPO & FORUM HIGHLIGHTS:

• 800 exhibiting companies from 170 countries

• 100 never-before-seen innovations

• Dedicated Energy, Water, Solar, Waste and

Smart Cities Industry Forums

REGISTER FOR FREE

www.worldfutureenergysummit.com

REGISTER AT: www.africaenergyindaba.com

AFRICA’S ENERGY SECTOR:

FROM TRANSFORMATION

TO TRANSITION

3 - 4 MARCH 2020

CTICC | CAPE TOWN | SOUTH AFRICA

Thinking Energy

South African National Ene rgy Association NP C

Strategic Partners

Part of Hosted by ADSW Principal Partner

Co-located with Organised by

Middle East & North Africa

ﺎـــــــــــــــــــﻴﻘﻳﺮﻓﺍ ﻝﺎـــــــــــــــــــﻤﺷﻭ ﻂــــــــــــــــــــﺳﻭﻷﺍ ﻕﺮــــــــــــــــــــﺸﻟﺍ

REGISTER FOR FREE

www.worldfutureenergysummit.com

Discover

the future

of smart cities.

Explore disruptive innovations and meet the experts that are transforming

the urban environment at the Smart Cities Expo & Forum.

Share knowledge and do business with global technology providers,

entrepreneurs, project developers and governments.

SMART CITIES EXPO & FORUM HIGHLIGHTS:

• See the latest innovation in smart city technology

• Meet industry leaders that drive the development of smart cities

• Experience never-before seen disruptive technology

• Share best practice at the Smart Cities Forum

Knowledge Partner

The Energy Industry Times_Smart Cities.pdf 1 9/15/19 2:05 PM

JOIN US IN PARIS!

12 - 14 November 2019

Paris Expo Porte de Versailles, Paris,

France

The end-to-end industry event for the energy sector.

European Utility Week and POWERGEN Europe, a three-day event that spotlights every part of

the energy ecosystem.

Join the influencers, disruptors, and innovators in Europe’s energy sector and hear about the

strategies and technologies that will deliver a shared vision of a fully integrated and interconnected

European energy system.

Deep dive into the trends

and future direction

of each aspect of the

sector – from generation

to grid to end-users!

Part of

#EUW19 | #PGE19

European Utility Week | POWERGEN Europe

#EUW19 | #PGE19

Register for your free pass: www.european-utility-week.com

Walk a bustling exhibition

floor to see the latest

technologies first hand,

exchange ideas and share

knowledge.

A packed conference programme!

SUMMIT

PASS

FREE VISITOR

PASS

Siân Crampsie

E.On says it is looking to take the next

“decisive step” in its realignment after

winning approval from the European

Commission for its merger deal with

RWE.

The German energy giant said last

month that the 76.8 per cent stake in

Innogy previously held by RWE has

already been transferred to E.On, and

that it also planned to also close the

voluntary public takeover offer to In-

nogy’s minority shareholders.

The transaction is part of a wider,

complex merger deal between E.On

and RWE that will see E.On focus on

energy networks and services to retail

customers, and RWE become largely

a renewable energy rm.

In February the Commission ap-

proved the acquisition by RWE of

certain generation assets owned by

E.On, but wanted to take a closer look

at the retail side of the proposals over

concerns about the impact on competi-

tion. Following its investigation, the

Commission concluded the deal would

not result in signicant loss

of competition in Germany or other

European markets.

In exchange for E.On’s takeover of

Innogy, RWE will receive an equity

interest of 16.7 per cent in E.On and a

seat on its supervisory board. E.On will

also transfer its renewables activities

and minority interests in two nuclear

power plants to RWE. Innogy’s entire

renewable energy business, gas storage

business and stake in Austrian utility

Kelag will come to RWE as “quickly

as possible next year”, RWE said.

E.On will also receive nancial com-

pensation worth €1.5 billion from

RWE.

8

THE ENERGY INDUSTRY TIMES - OCTOBER 2019

Companies News

E.On ready for “swift”

RWE integration

Masdar and EDF are targeting the en-

ergy services sector in the United Arab

Emirates (UAE) through a new joint

venture.

The two rms have announced that

the joint venture will explore and col-

laborate on opportunities in non-utility

scale renewable energy and energy ef-

ciency investments.

The agreement will reinforce EDF’s

and Masdar’s “already strong” ties in

the region, where they are currently

collaborating on large-scale renew-

able energy projects, Masdar said in

a statement.

The agreement is “a reection of

Masdar’s global clean energy ambi-

tions and further supports the UAE’s

Energy Strategy 2050 objectives to

increase renewable energy usage and

energy efciency across the UAE, the

region and internationally,” said Mo-

hamed Jameel Al Ramahi, Chief Ex-

ecutive Ofcer of UAE-based Masdar.

Both rms will leverage their inter-

national experience and expertise to

expand in small-scale solar and energy

efciency.

“Having accomplished several com-

mon successes in renewables, EDF and

Masdar are now extending their coop-

eration to energy-efciency services,”

said Marianne Laigneau, Group Senior

Executive Vice President of EDF in

charge of the International Division.

“Along with Masdar, our ambition is

to develop innovative solutions to op-

timise energy consumption and reduce

the carbon footprint of our customers

in the Middle East and in other coun-

tries where both companies already

cooperate.”

In August, the consortium of EDF

Renewables and Masdar announced

that they had reached nancial close

on the 400 MW Dumat Al Jandal wind

project in Saudi Arabia, the country’s

rst utility-scale wind farm.

In May, the Moroccan Agency for

Solar Energy (MASEN) announced

that the consortium of EDF Renew-

ables, Masdar, and Green of Africa,

was the successful bidder for the de-

sign, construction, operation and main-

tenance of the 800 MW Noor Midelt I

multi-technologies solar power plant.

Both companies are also partners in

developing the third phase of the 800

MW Mohammed bin Rashid Al Mak-

toum (MBR) solar park in Dubai, 200

MW of which was commissioned in

2018 and 300 MW is expected to enter

into service in 2019.

Senvion has said that it was aiming to

close a deal for the sale of parts of its

business to Siemens Gamesa Renew-

able Energy (SGRE) by the end of

September.

The troubled German turbine manu-

facturer announced last month that it

had entered exclusive, non-binding

talks with SGRE for the sale of “se-

lected services and onshore assets in

Europe”.

“The parties are now entering nal

negotiations and, if nal agreements

are reached, expect that the necessary

decisions will be taken by the end of

September,” Senvion outlined in a

statement. It added that it is continuing

to explore options and negotiations

with investors for the remaining parts

of its business.

Senvion also said that the nancial

arrangements to secure ongoing busi-

ness activities continue to be in place.

“Wind turbine continuation projects

are underway and will secure a major-

ity of production jobs for the next

months, with some going into 2020,”

it added.

Yves Rannou, CEO of Senvion, said:

“Today’s announcement means that

we are close to nding a safe harbour

for a signicant part of the business

and substantial parts of its employee

base. In these difcult circumstances,

these are positive news.

“Looking ahead to the weeks to

come, the management team will con-

tinue to put all efforts behind nding

the best solutions possible for the rest

of the business.”

In early 2019 Senvion announced

that it had led an application in Ger-

many for self-administration pro-

ceedings, a pre-emptive insolvency

process.

The company secured €100 million

of funding to help shore up its nanc-

es in May.

Norway’s Kvaerner is looking to new

growth areas in its renewables and oil

and gas divisions to boost its business.

The company has announced plans

to expand operations in the offshore

wind energy sector and oating pro-

duction units, targeting 40 per cent

growth “within a few years”.

In the offshore wind sector, Kvaern-

er sees increasing opportunities in

Europe and North America. It has

already delivered 50 units for off-

shore wind projects and is currently

involved in early phase work for

several customers.

Earlier this year, the company

signed a contract with Equinor to

study how oating concrete substruc-

tures for offshore wind turbines for

the planned Hywind Tampen project

in the North Sea can be designed and

constructed.

“The market for the development of

offshore wind power is growing expo-

nentially. If such developments are to

be protable for both energy compa-

nies and society, it is important that

suppliers can contribute with safe and

efcient execution. We bring valuable

knowledge from the oil industry where

the cost over time has been signi-

cantly reduced,” said Karl-Petter

Løken, Kvaerner ASA CEO.

“From now on, Kvaerner will, to-

gether with customers, subcontractors,

and public knowledge institutions etc.

aim to build a whole new industry with

jobs, expertise and value creation.”

Overall Kvaerner is aiming to in-

crease its annual revenues from around

NOK 7.3 billion ($803.9 million) in

2018 to NOK 10 billion by 2023.

UK energy utility Ovo has launched

a zero-carbon business strategy ahead

of its planned takeover of SSE’s en-

ergy retail unit.

Ovo and SSE last month conrmed

a takeover deal in which Ovo will pay

£500 million to acquire SSE’s GB

household energy and services busi-

ness. The deal will make Ovo the

second-largest energy supplier in the

UK and enable SSE to focus on its

renewable energy and regulated net-

work assets units.

Ovo’s ‘Plan Zero’ strategy aims to

drive progress towards zero carbon

living and is a direct response to the

climate crisis. “Plan Zero demon-

strates the clear role that businesses

and individuals have to play in reduc-

ing carbon emissions and acting to-

gether to ght the climate crisis,” Ovo

said in a statement.

Under the plan, Ovo hopes to mo-

bilise its customers to create a zero

carbon community, helping them

halve their total lifestyle carbon emis-

sions, and eliminate their household

emissions by 2030. Ovo will also

commit to optimise 5 million homes

with exible, low carbon technolo-

gies such as smart EV chargers and

smart heaters, it added.

The company also plans to reach net

zero emissions across its operations

and supply chain by 2030.

Ovo currently serves around 1.5 mil-

lion customers in the GB market. It

will pay £400 million in cash plus

£100 million in loan notes for SSE’s

retail unit, which provides energy,

telecoms and home services.

The deal for SSE’s retail unit will

accelerate its ambitions, the company

said. This transaction marks a sig-

nicant moment for the energy indus-

try,” said Stephen Fitzpatrick, CEO

and founder of Ovo. “Advances in

technology, the falling cost of renew-

able energy and battery storage, the

explosion of data and the urgent need

to decarbonise are completely trans-

forming the global energy system.

For the past three years Ovo has

been investing heavily in scalable

operating platforms, smart data capa-

bilities and connected home services,

ensuring we’re well positioned to

grow and take advantage of new op-

portunities in a changing market,” he

added:

Ovo was launched in 2009 and has

a market share of ve per cent. The

purchase of the SSE retail unit will

increase its market share to 18 per

cent, just behind Centrica-owned

British Gas, with 19 per cent.

Last year Ovo announced an invest-

ment in German start-up energy sup-

plier, 4hundred, marking a move into

Europe’s energy markets.

Earlier this year Ovo secured invest-

ment from Japan’s Mitsubishi Corpo-

ration in exchange for a 20 per cent

stake to help it fund future growth.

Ovo sets out

Plan Zero

strategy

Masdar and EDF in Esco venture

n E.On moves on Innogy takeover n Energy giants ready for new focus

Senvion in talks with SGRE

Kvaerner looks to new growth

THE ENERGY INDUSTRY TIMES - OCTOBER 2019

Special Technology Supplement

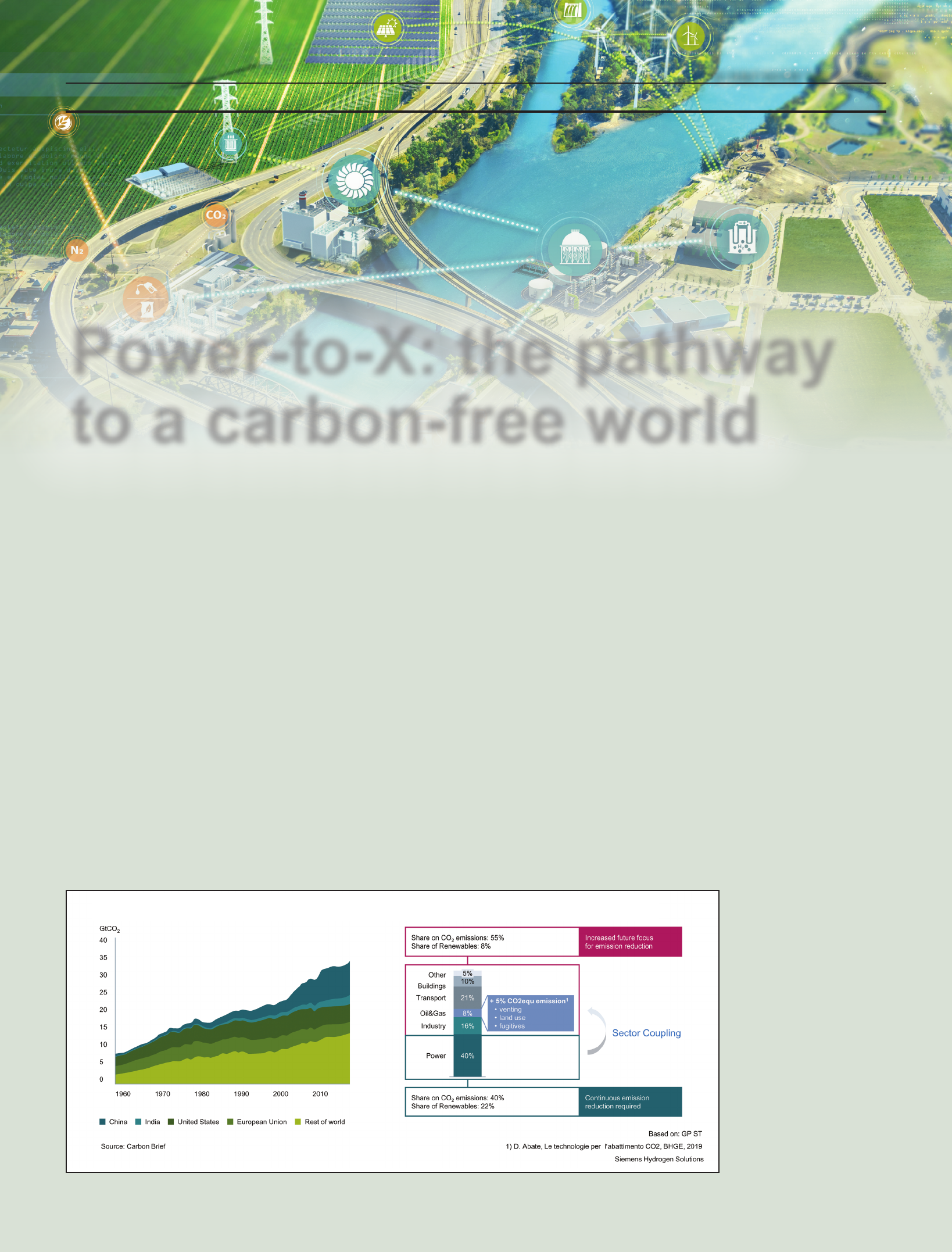

Power-to-X: the pathway

to a carbon-free world

Deploying renewables across all sectors of the global energy economy is seen as crucial in meeting zero carbon

emissions targets. Power-to-X is the key to unlocking the potential of this so-called sector coupling.

Junior Isles

About half of it is used for the syn-

thesis of ammonia, which is the basis

for ammonia phosphate or urea and

other chemicals, mainly methanol.

Hydrogen is also used in reneries

for hydrocarbon cracking and other

processes.

Unlike the SMR method, the gen-

eration of e-hydrogen via electrolysis

of water with electrical energy from

renewable sources is completely free

of CO

2

emissions. “This pathway is

pretty straightforward,” said Dr Pug.

“We are already seeing the rst proj-

ects because it can be done on a small

scale, e.g. for private passenger cars

or hydrogen buses and trucks.”

He added: “Right now we are devel-

oping a project in Chile. This is the

world’s best renewables location and

we can produce green hydrogen from

electrolysis at the same cost as from

steam reforming of natural gas.”

The second pathway, which Dr

Pug believes will be “a signicant

part of the future”, is using hydrogen

to produce synthetic fuels. Although

the direct electrication of cars

through batteries is an important lever

in the utilisation of green electricity,

he says it cannot be applied to all

types of transport.

“If you look at the energy consumed

in mobility, 50 per cent goes to heavy

trucks and long haul marine and avia-

tion. These three areas cannot use

battery-based energy storage. This is

where hydrogen and synthetic hydro-

carbon fuels kick-in.”

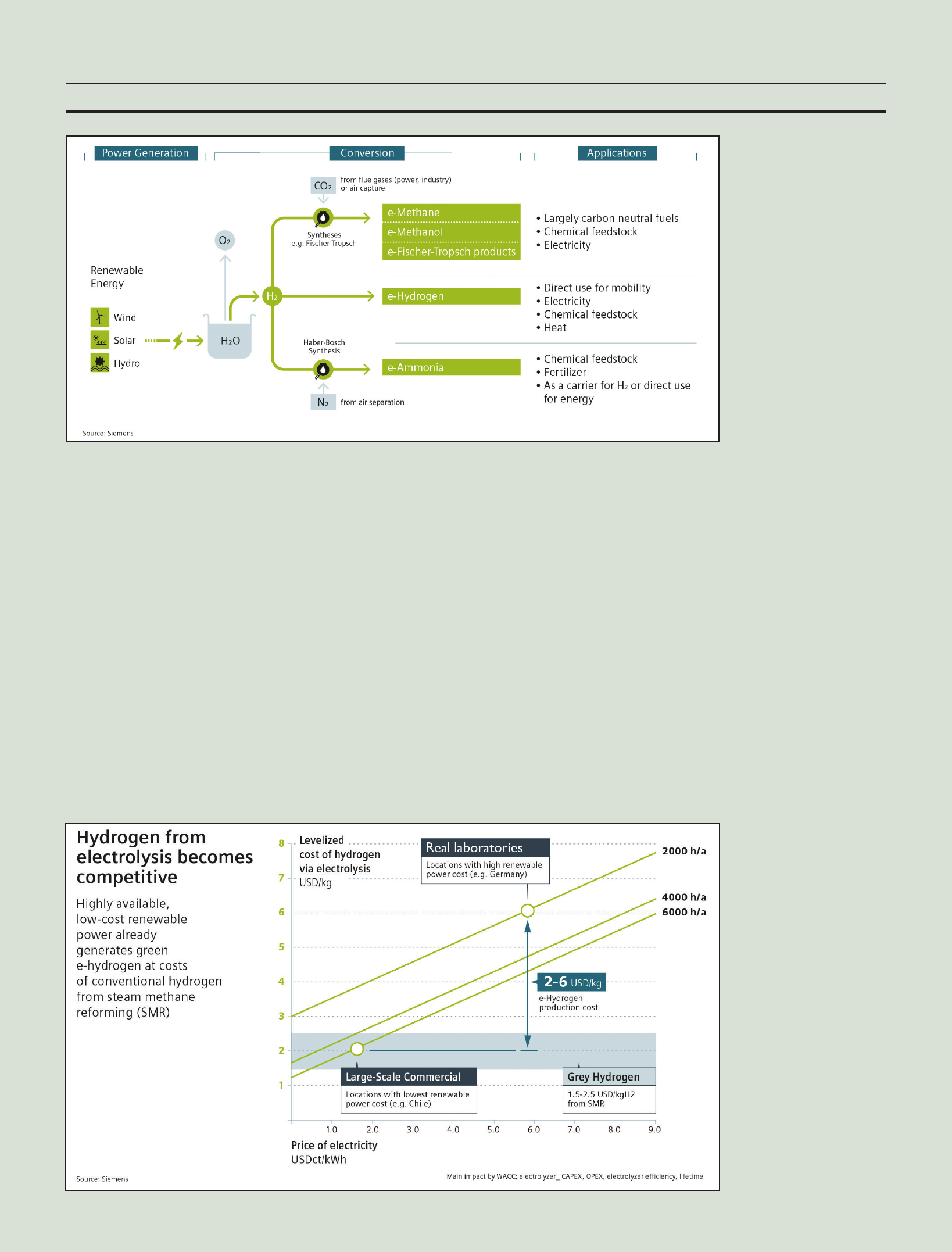

Using synthesis with carbon dioxide

(from biogenic sources, unavoidable

industrial emissions or from the air),

hydrogen can be converted into syn-

thetic, sustainable ‘e-fuels’ such as e-

methanol or e-jet fuel or other carbon-

based chemicals.

These “green fuels” can replace

fossil fuels, lowering the carbon

emissions from their expended energy

by as much as 90 per cent. They can

also replace biofuels, such as ethanol,

which now consumes considerable

farmland to grow its main feedstock,

corn. This can resolve the food-ver-

sus-fuel debates on the use of increas-

ingly valuable farmland and return

acreage to food production or non-

crop uses, such as nature reserves,

recreation areas, residential develop-

ments and reforestation.

E-fuels can immediately be mixed

with fossil fuels to reduce the overall

carbon footprint. P2X thus allows a

T

here is a general consensus that

far more has to be done, and far

more quickly, if the world is to

avoid irreversible climate change. In

an effort to limit global warming to

well below 2°C above pre-industrial

levels, the Paris Agreement, negotiated

at the 2015 United Nations Climate

Change Conference, requires effect-

ively zero emissions by 2050.

The global climate effort has re-

sulted in huge investment in renew-

ables in the electricity sector, increas-

ing the share of renewables to up to 22

per cent globally. But it has had little

impact on global carbon emissions.

Some 60 per cent of global carbon

emissions come from outside power

generation, i.e. in transportation,

buildings, industry and heating, and

there has been very little progress in

decarbonising these sectors.

To reach the target of zero CO

2

emissions by mid-century, there has

to be an integrated approach to decar-

bonising all sectors of the economy.

Using renewable electrical energy

from the power sector – especially

energy from wind and solar that can-

not be immediately consumed – to

decarbonise energy across all sectors

unlocks enormous environmental and

business benets. This so-called

‘sector coupling’ is one fundamental

element of the energy transition and

involves increased direct electrica-

tion of other sectors as well as provi-

sion of renewable energy to other

sectors in a suitable (e.g. chemical)

form.

It is a growth area that Siemens be-

lieves has tremendous potential and is

therefore investing in technologies

known as Power-to-X (P2X) that en-

able sector coupling.

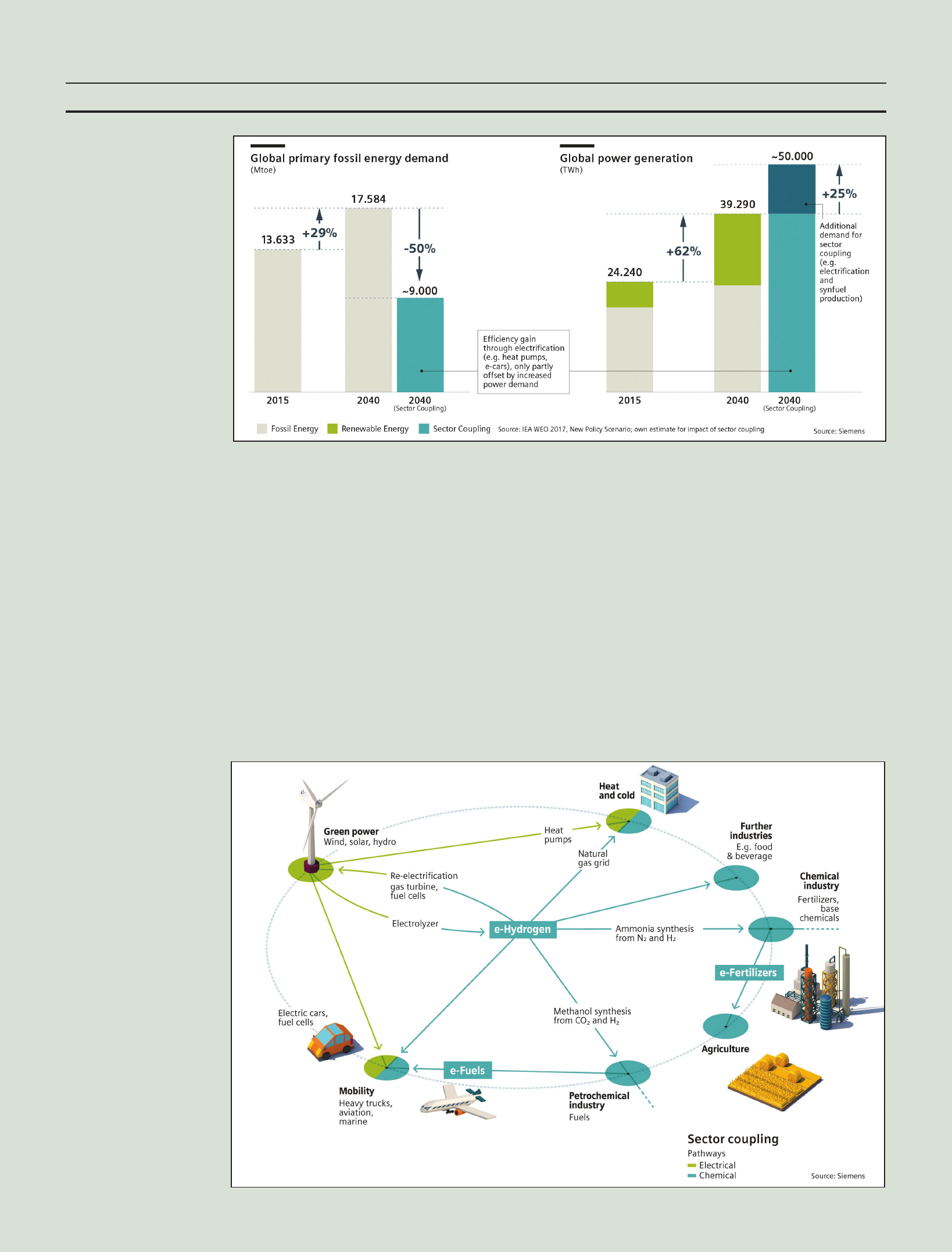

Commenting on the idea, Dr. Volk-

mar Pug, Vice President Energy

Consulting, Siemens AG, said: “Of

all the buzzwords over the last 10

years, sector coupling is a very big

one because it really can change the

world.

“The idea of sector coupling is

nothing more than bringing renew-

able energy from the power sector

into the other sectors to thereby de-

carbonise the entire energy system,

making electricity the backbone of

energy supply in the future. As an

example, an increase of power gen-

eration by 25 per cent would reduce

primary fossil energy consumption

by a half, due to the increased ef-

ciency associated with electrication

of other sectors.”

Although there has been growing

interest around this line of thinking

for the past two or three years, it has

really come to the fore in recent

months. “This,” says Dr Pug, “is

because there are now, practically, not

just theoretically, enough technolo-

gies available at reasonable cost that

can help decarbonise the world.”

As one of many activities to decar-

bonise global energy production and

use, Siemens is active in the “Power-

to-X for Applications” Working

Group at the Mechanical Engineering

Industry Association (VDMA),

which has 3200 member companies

and is Europe’s largest mechanical

engineering organisation. Siemens

says its involvement with VDMA is

part of its commitment to social and

environmental responsibility.

Siemens is driving three pathways

for P2X. The rst is what it calls e-

hydrogen – using renewables to gen-

erate electricity, which is then fed to

an electrolyser to produce hydrogen.

Hydrogen is a versatile energy carrier,

which can be stored and used in the

transport, industrial or chemical sec-

tors or as a fuel in gas turbines.

Currently, over 50 Mt of hydrogen

is produced worldwide every year

from fossil sources via the steam

methane reforming (SMR) process.

CO

2

emissions reduction has so far focused on power, but all sectors in the economy must contribute

in gas turbines. Green hydrogen pro-

duced by electrolysis can be converted

into electricity again (re-electrica-

tion) and used as an admixture with

natural gas or in pure form to fuel gas

turbines.

“Over time, oil and gas will be dis-

placed by green fuels or green gases.

Hydrogen would be a very good op-

tion here,” said Dr Pug.

Several gas turbine manufacturers

are already making progress in this

area.

In 2019, as part of its commitment

toward environmental sustainability,

Siemens signed a European industry

agreement that promises that its new

gas turbines will be capable of operat-

ing on 20 per cent hydrogen (mixed

with natural gas) by 2020 and 100 per

cent hydrogen from 2030 onwards.

Parts of these commitments have

already been fullled, as much of the

Siemens gas turbine portfolio can use

fuel mixtures with hydrogen levels of

up to 30 per in large gas turbines, 60

per cent in medium sized machines

and even up to 100 per cent in

aeroderivative models with a wet low

emissions system.

“It’s an area where we are continu-

ally working,” said Dr Pug. He

stressed: “Gas turbines can operate on

natural gas from fossil sources or

green gas such as hydrogen. This

makes gas turbine plants a sustainable

investment and avoids the risk of

ending up as stranded investments

when decarbonisation is enforced by

regulators. All scenarios for a deeply

decarbonised world in the year 2050,

consider gas turbines as the most

economic option to provide security

of supply.”

Erik Zindel, Director Energy Con-

sulting at Siemens added: “Fifty or 60

per cent of the time, there is sufcient

sun, wind or hydro available. The rest

of the time, you can use the stored

hydrogen by combusting it in conven-

tional combined cycle plants. Gas

turbines are the technology of choice

for providing dispatchable power

when there is not enough solar or

wind power in the grid. It is an area of

great interest to plant owners, many

smooth transition from the fossil

world to one that is largely carbon-

neutral.

Dr Pug noted that synthesising to

methanol is hugely important. “We

strongly believe that methanol is the

substance of choice; it could be a

substitute in the replacement of bio-

ethanol, for example. The big advan-

tage is that, basically, you can create

any kind of hydrocarbon fuel using

methanol as the basic substance.

“You could also use existing infra-

structure [for methanol], e.g. transport

logistics and refuelling stations,

which you could not do if you go the

(molecular) hydrogen pathway. And

you avoid step increases in technology

that are initial cost and performance

hurdles to their widespread imple-

mentation in established markets”

Notably, Dr Pug says that the need

for CO

2

in producing e-fuels could

trigger a renaissance of carbon cap-

ture, i.e. carbon capture and utilisa-

tion. CO

2

could be captured from ex-

isting, unavoidable point sources, e.g.

from cement production, biomass

power plants or fossil fuelled power

plants. In future, recovering CO

2

from

the atmosphere (direct air capture,

DAC) could also become an option,

especially for regions that are rich in

renewable energy but far away from

industrial sites.

The third pathway that Siemens is

pursuing, is power-to-ammonia.

Here, e-ammonia (NH

3

) is synthe-

sized from e-hydrogen and nitrogen

derived from an air separation using

the Haber-Bosch process. E-ammo-

nia can be used as feedstock for fer-

tilizers (urea, ammonia phosphates)

and other chemicals. With about 175

kg hydrogen per tonne of ammonia,

it is an excellent carrier of hydrogen

to transport it over long distances.

Ammonia cracking processes are

under development for recovering

the hydrogen.

“The problem here,” says Dr Pug,

however, “is that there are no green

drivers for ammonia, and no one

wants to make food more expensive.

So, reducing the cost of green am-

monia production is an imperative.”

Siemens is currently developing

technology solutions in line with the

three pathways that it foresees for

hydrogen.

One clear component is the elec-

trolyser. There are three types of

electrolysis: alkaline, which has the

longest experience; solid oxide (SO),

which is currently used at smaller-

scale; and proton-exchange mem-

brane (PEM) electrolysis. With PEM

technology the electrolyser can be

switched on and off without preheat-

ing, leading to high exibility, ramp

rates and overall system efciencies

even with partial loads.

With an extended operating range,

PEM technology can ramp up in-

stantly in its operating capacity. It can

then operate at from 5-100 per cent of

capacity at very high ramp rates.

This, says, Siemens makes it per-

fectly suited for the load proles of

renewable power sources like wind

and solar which are volatile by nature.

Siemens has what it calls its H

2

package, which comprises all units to

produce e-hydrogen. “We have one of

the most advanced PEM electrolyser

portfolios,” noted Dr Pug.

In 2015, Siemens deployed the Si-

lyzer 200, a large-scale, commercial

version of PEM electrolysis at one of

the world’s largest power-to-gas

plants in Germany. Today, the com-

pany has taken that technology into

its third generation, with the deploy-

ment of the Silyzer 300 at the H2FU-

TURE project, in partnership with

Verbund Solutions GmbH, voestal-

pine Stahl GmbH, K1 MET GmbH,

and the Austrian Power Grid AG.

The Silyzer 300 consists of up to 24

PEM electrolytic modules per array

that together draw 17.5 MW of power

to produce up to 340 kg/h of virtually

pure hydrogen with no CO

2

emis-

sions. The system operates at over 75

per cent efciency,

The Siemens Silyzer development

roadmap targets fourth-generation

hydrogen plants that, by 2023, can

draw more than 100 MW of power for

hydrogen production at ever greater

efciencies. By 2030 and beyond,

Siemens envisions building 1000

MW, fth-generation plants.

The second area of technology de-

velopment for Siemens is what Dr

Pug calls “Power-to-X solutions”,

where the current focus is power-to-

methanol and power-to-ammonia.

Here Siemens can provide all equip-

ment related to these applications,

including the electrolyser, compres-

sion and storage equipment, instru-

mentation and controls, electrical

equipment (transformer, switchgear,

rectier etc.); water treatment and

de-ionisation equipment, hydrogen

cleaning systems, etc.

The third big area is in develop-

ments that allow hydrogen to be red

Special Technology Supplement

THE ENERGY INDUSTRY TIMES - OCTOBER 2019

With sector coupling, the

increased electrication

reduces primary energy

consumption signicantly

Sector coupling is nothing

more than bringing renewable

energy from the power sector

into other sectors to thereby

decarbonise the entire energy

system

THE ENERGY INDUSTRY TIMES - OCTOBER 2019

produced,” said Dr. Pug. “In terms of

technology, we are at the beginning of

driving down costs by automating the

manufacturing side of electrolysers

for example. And if you look at carbon

capture, you could say we are still at

the beginning there too, considering

that CO

2

capture never really took off.

If you can make this very cheap, it will

eventually be a disruptive technology.

“This is another area where we are

doing some technology develop-

ment,” he added.

Siemens has developed a process for

the post-combustion removal of CO

2

from power plant ue gases. Employ-

ing an environmentally friendly aque-

ous solution of an amino acid salt

(PostCap

TM

), approximately 90 per

cent of the CO

2

from ue gases are

captured. Siemens is looking for an

opportunity to re-demonstrate its

PostCap technology together with

customers/partners in the context of

P2X.

With regards to policy, Siemens be-

lieves a few things have to happen.

First and foremost there has to be

legislation in support of carbon reduc-

tion. “As these technologies are still

more expensive than the conventional

black fuels, all of this won’t happen if

there is not a clear regulatory push for

decarbonisation,” said Zindel. “It’s a

of which are already investigating

whether their machines can be up-

graded in the future to burn hydrogen.”

“This would enable the transition to

100 per cent renewables. But we ex-

pect this to happen at a later stage, as

we believe that at the moment the

value of green hydrogen is higher in

other sectors than in the pure power

generation industry.”

Hydrogen is expected to rst pene-

trate the areas, outside of the power

sector that are proving difcult to de-

carbonise such as parts of the chemical

sector, the steel and cement industries

and mobility.

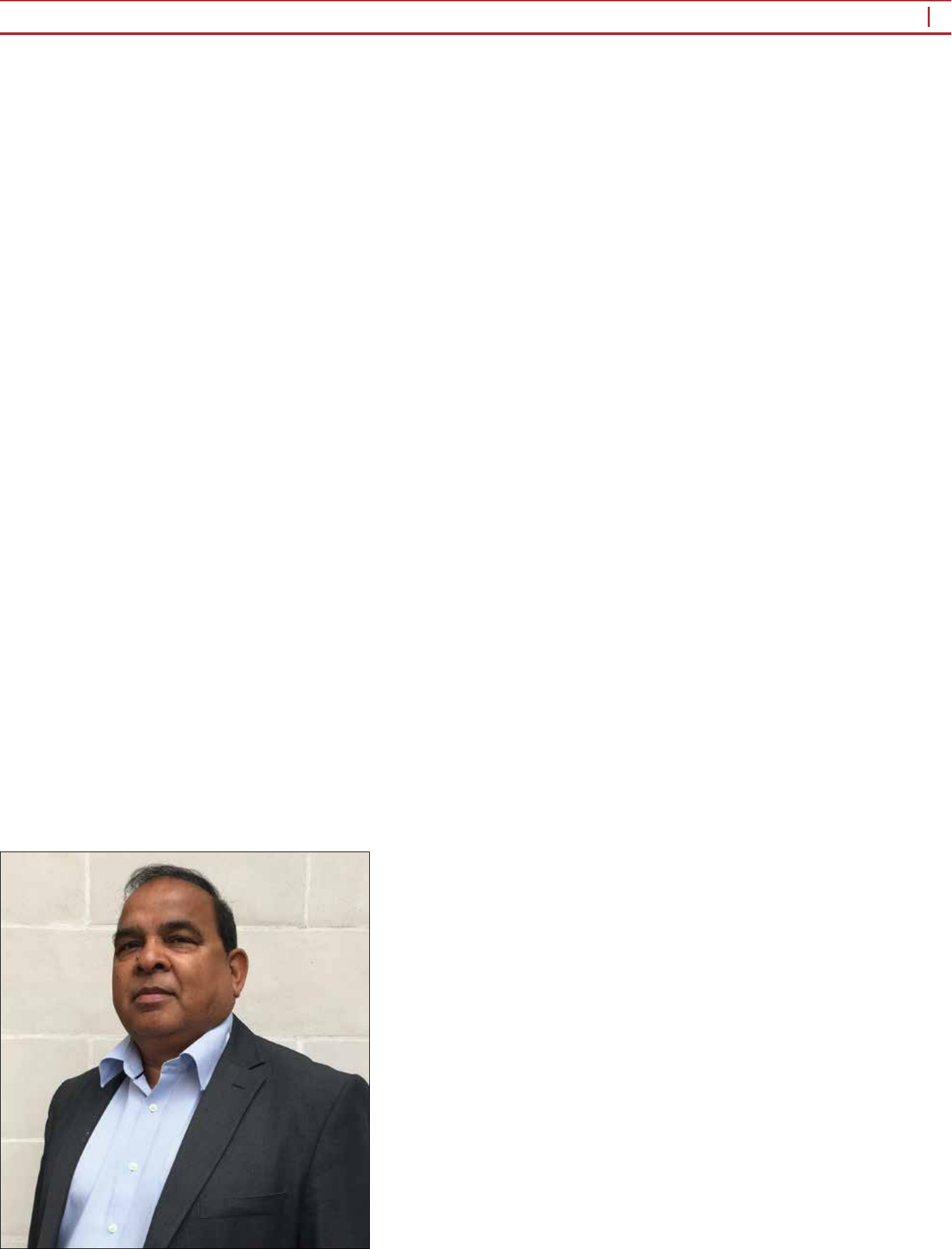

For P2X to really materialise, how-

ever, both technology, which will en-

able cost reductions, and policy will

have to develop simultaneously.

While Siemens says that e-hydrogen

can already present a positive business

case in some instances, costs will need

to be driven down by lowering capex

and the levelised cost of electricity of

the renewable energy that is used to

feed the electrolyser. It also said much

depends on the amount of hours that

the electricity produced is available.

The capacity factor is as important as

the LCOE because it denes the capi-

tal efciency of the electrolysis plant.

“These are the main three parameters

that dene the cost of the hydrogen

bit like solar and wind power; 20

years ago they were completely out of

the market in terms of cost… now

their LCOEs are a third of most

modern gas red stations. You need

incipient markets to warrant R&D

investment and economies of scale to

bring the costs down.”

Secondly, the value of e-fuels pro-

duced from green hydrogen has to be

recognised by governments. “The use

of synthetic fuels from green sources

has to be accepted,” said Dr Pug.

And to some extent, this is already

happening. Under the new Renew-

able Energy Directive (RED II) the

EU stipulates that green fuels should

represent 14 per cent of the market

share of transport fuels by 2030.

Despite the target, Dr Pug believes,

however, that the emphasis that gov-

ernments have put on EVs has created

an uneven playing eld for technolo-

gies. “There has to be a level playing

eld between e-cars and [cars running

on] synthetic fuels,” he stressed.

“The emissions they associate with

e-cars are measured from the battery

to the wheel, so there are no emis-

sions. But if you look at the lifecycle

– taking into consideration battery

production and the energy mix used

to provide electricity to charge the

battery – for the rst one or two years,

e-cars emit a similar amount of CO

2

as a regular car,” Dr Pug explained.

“And if the lifetime of a battery is

only around four years before it has

to be disposed of, you have a signi-

cant carbon footprint for a battery-

powered car.”

He argues that if carbon emissions

are assessed over the entire lifecycle,

there would be much greater focus on

e-fuels or hydrogen fuelled cars.

Thirdly, Dr Pug says there needs to

be government support for the instal-

lation of large scale demonstration

projects, as we have seen in Germany.

Germany is investigating how hydro-

gen can be used on a large scale as an

energy carrier in the heat market, the

transport sector and industry. The

project will cost the ministry more

than €100 million per year, and results

should be seen by 2020.

In July this year, Federal Economics

Minister Peter Altmaier said Germany

wants to be a global leader in the de-

velopment of hydrogen technologies.

The government also said it will de-

velop a hydrogen strategy by the end

of the year.

In terms of frontrunners, geographi-

cally, Siemens says much depends on

production and consumption.

Zindel said: “If we are talking about

methanol, we don’t have to produce

the methanol in the same country that

it will be consumed. We can produce

it in areas where there is good wind or

solar and export it those where there

is a good price premium for it, such as

Europe, California or Japan.”

Dr Pug added: “Much depends on

the regulatory regime and energy

policies. If the green fuel is attractive

and fetches a premium, then it makes

a business case feasible. Projects are

developing in Austria, Denmark,

Germany, Switzerland and the UK,

and we see a number of things coming

up in Latin America, Central America,

Canada, China and parts of the US.”

Essentially, developed countries

with a goal to decarbonise are the

main areas for consumption, while

production will be in places where

conditions are good for renewable

energy, such as the Middle East,

which is increasingly looking to take

advantage of its favourable solar

conditions.

According to Siemens, it is seeing

varying degrees of interest from po-

tential customers.

Zindel said: “They are not so aware

of it in places like Africa and Latin

America but in Central Europe and

Japan, it’s already a topic. Some in-

dustries like oil and gas know they

are in a business that is not sustain-

able, politically and in terms of regu-

lation, over the long term. Oil majors

like Shell and Total are already

thinking about these technologies.

Utilities looking to reduce their CO

2

emissions are also asking us about

our hydrogen capabilities on gas

turbines. We have also had a lot

meetings with utilities in the US

about hydrogen in recent months.”

This interest, adds Zindel, extends

across various sectors, noting that car

manufacturers and airlines are also

enquiring about Siemens’ capability

in the eld of synthetic fuels.

Siemens believes the world is only

at the beginning of the switch to a

sustainable future. In the power sector

there has already been a shift from

fossil fuels to renewables but Siemens

says it is about more than just the

power sector.

Zindel concluded: “It’s about energy

consumption in all the sectors in the

economy worldwide. There has been

a huge movement from conventional

energy to renewables in the last 10-20

years but looking worldwide at all the

sectors, we are just at the beginning of

the transition. It’s probably one of the

largest transformations in energy

technology that the world will have

seen in the last 100-200 years.”

Three pathways of

power-to-x: electricity-based

molecular hydrogen, ethanol

and hydrocarbons, as well as

ammonia

E-hydrogen can already

present a positive business

case in some instances

Special Technology Supplement

Capturing renewable

energy’s full potential

Step onto the path to a carbon-free world

with Power-to-X.

A smoother transition to a fully sustainable world starts today. Siemens Power-to-X

technologies can produce fuels that have an immediate decreasing effect on greenhouse

gas emissions, bringing reduced carbon emissions to multiple industries and paving the way

for decarbonization in any future energy landscape. Worldwide decarbonization of the

overall energy systems is urgently needed to mitigate global warming. Power-to-Hydrogen.

Power-to-Fuels. Power-to-Ammonia. With Siemens as your partner you can start your

journey today. Visit our website to learn more.

siemens.com/power-to-x

so they will be using IoT to create a

digital twin of the substations to un-

derstand, exactly, things like whether

there is a danger or if the substation

needs maintenance. This is very clear

but it’s not so obvious for other organ-

isations and utilities.”

He says that, generally, US utilities

are aware that they need to collect and

make better use of their data and that

IoT and digitalisation are important.

And while maybe 20 or 30 per cent

are talking about bold digitalisation

strategies, the operation at scale is

“really not there yet”.

Felicio noted: “They need to under-

stand how to go forward and start pi-

loting with clear criteria; implement

at scale and if it doesn’t work, move

to the next pilot.”

Looking to Omnetric’s future in

addressing the industry’s near to mid-

term challenges, Felicio re-iterated

the company’s mission: to capitalise

on the industry change in order to

generate value for its customers. “All

of our growth and protability will

only come from creating value for our

customers,” he said.

With utilities looking to become

smarter, greener and more diverse,

Omnetric notes that it has a lot of

competence in the areas that utilities

are looking to expand in the short to

mid-term. “We will be going from the

meter rollout that we had in the past

to all these areas around the rollout.

Utilities will be concentrating more

and more on business optimisation,

which I believe will run at a larger

scale.

“With our IoT and IT integration

capabilities, we are in a good position.

And together with our buildings

technologies unit of Siemens, we

have a very good offering.

“The expansion of renewables and

EVs will also be playing a role, and

here we can count on the support of

our colleagues in ‘future-grid’ in our

smart industries operating unit. These

areas will bring us the growth required

in the next one to three years.”

Going forward, Omnetric says it is

building on the expansion of IoT in

other industries, with the goal of

building a €3 billion business by

2023. This will come from expansion

into other verticals in the Siemens

domain. Felicio cited smart infra-

structure and logistics mobility as

examples, where it can build on its

competencies in the pure energy/util-

ity arena.

“Building a €3 billion by 2023 is an

awesome challenge and part of what

attracted me to Siemens. But we’ve

had lots of growth and I’m very con-

dent. If you think of why Siemens

acquired the share from Accenture,

our strength is that we have the IT

capabilities. We have the IT DNA but

we can also use the operational tech-

nology (OT) competencies of Sie-

mens and very quickly dene the rel-

evant use cases and assess the impact

on our customers’ businesses, based

on the assets they already have. With

the deep knowledge of IT and OT

assets, we really understand where we

can deliver value.”

T

here is a broad consensus that

the electricity and energy sector

is just at the start of an enormous

scaling of the digitisation of busi-

nesses, where the Internet of things

(IoT) and related services will play an

increasingly important role. The ac-

celerating shift means that players

need to better understand how to move

away from a pure proof-of-concept

approach to a situation where they

understand the value of digitalisation

and implementing IoT at scale, and

how it can generate real value.

It is an issue that Daniel Felicio sees

as one of the most immediate chal-

lenges facing the industry, and one of

the rst tasks he will address as the

new CEO of Omnetric.

Initially formed in 2014 as a joint

venture company owned by Siemens

(51 per cent) and Accenture (49 per

cent), Omnetric brought together

Siemens’ range of products and so-

lutions with Accenture’s manage-

ment and technology consulting,

systems integration and managed-

services capabilities.

Felicio joined Omnetric in Sep-

tember 2018, shortly after Siemens

acquired Accenture’s share in the

company to become sole owner.

Since the start of this year he has

been CEO of Omnetric as well as

CEO of Siemens’ IoT solutions and

implementation unit.

He commented: “My biggest chal-

lenge is how we convey the right

messages and produce the right

lighthouse projects that show the

industry we can generate value for

our customers through IoT and digi-

talisation and create a new economy,

not only in energy but also in other

industries.”

When it was rst formed ve years

ago, Omnetric was heavily involved

in the smart meter rollout that is still

ongoing across Europe. It has also

been participating in projects aimed at

integrating distributed generation

sources into the IT space. Now things

are changing. Today it is much more

about creating systems that allow

sharing of utility data, even with po-

tential competitors, to allow new

business models to be created.

Felicio explained: “[In the past]

projects were not so much driven by a

vision to generate a partner eco-sys-

tem to create a digital system. But

today, in one project that we are doing

with a large central European utility,

we are connecting the leader data

management platform to the billing,

to the SAP and to the portal. The util-

ity said either they play a role in creat-

ing an eco-system of partners where

the partners can connect to the plat-

form and use customer data… to cre-

ate new business models, or risk

competitors passing them by and be-

coming irrelevant.

“This is a good example of a project

where we have delivered a platform

with interfaces to the billing, to the

SAP, and to the portal, etc., and are

now creating the use cases. For ex-

ample, a developer might have solar

panels or EV charging and want to

connect to a billing platform and

customer access platform. They could

now simply connect to this [leader

data management] platform via the

portal as a business-to-business [user]

and draw from all the consumer and

billing data that the customer already

has, and provide an added value ser-

vice to their consumers and share the

revenue with the utility.

“This is a very concrete example of

how utilities are not only thinking

about IT driven by regulatory issues

or smart metering, but are really

thinking about creating new business

models and building an eco-system of

partners.”

Although utilities are now actively

building new business models, ex-

perts often question whether they are

moving at a fast enough pace in the

rapidly changing energy landscape.

“What I’m very worried about – and

I also see it as our role and task to help

drive this process with [our] custom-

ers – is the HR transformation that is

also required. This is often neglected

in projects; utility organisations still

too often act in silos. But I am hope-

ful,” he said. “More and more, I see

the CIO, or chief digitalisation ofcer,

and the COO at the same table. So

although I am very worried at the

speed at which the industry is trans-

forming itself, there are some positive

signs.”

Felicio notes, however that the

speed of transformation and chal-

lenges vary from market to market,

which presents differing levels of

opportunity. The US is seen as being

in the “second generation after smart

meter production”, where projects are

“very much driven” by IT. “We see

there is a good follow up and expan-

sion of the IT platforms to allow the

companies to transform,” he said.

Like the US, Europe has been

stimulated by the expansion of re-

newables but, says Felicio, digitali-

sation has been slowed by data pro-

tection and regulatory issues.

“Sometimes, I would like to see

more boldness in the transformation

of utilities. There are very good ex-

amples like Enel, who very early on

recognised the need to transform

themselves, but a lot more needs to

happen.”

In the Middle East, where the energy

sector is largely still state-owned,

progress is much slower. “Although

the smart cities initiative is driven by

a lot of money, energy utilities are

typically very conservative,” noted

Felicio.

In Asia, the biggest transformation

is ongoing in China, where the gov-

ernment says it will fully digitalise its

energy network by 2022. “We are

tracking it very closely and feel there

is denitely an opportunity there. But

we don’t yet have a clear view of how

they can achieve such a timeline,” he

said.

Digitalisation and IoT bring many

benets but there are also dangers.

The technologies allow adopters to

deliver myriad outputs without hav-

ing a large amount of resources and

the associated xed costs. “It allows a

company to be much lighter, more

dynamic and able to give much more

added value to the customer, and have

more direct contact to the customer,

etc.,” said Felico.

Yet, introducing IoT into a company

is not straightforward. “It’s not a case

of creating all of your stats and out-

comes at the beginning and imple-

menting steps one, two and three to

get there,” Felicio noted. “The world

is now much more dynamic and vola-

tile. You need to start with specic

assumptions, start implementing pi-

lots and quickly go to scale. But you

will only go to scale if you clearly

know the original intent and have

clear criteria on why you want to ex-

pand quickly. If you don’t have this

clear criteria, you will be in a proof-

of-concept hell where you don’t know

whether you will create value or not

by scaling, so you will be trying re-

peatedly and this will drag you down.

So there are positives and negatives.

“Sometimes it’s easy; like the large

utilities in North America. In Califor-

nia, for example, where there have

been res, they know they need wider

visibility and control of the substa-

tions. The risk has been recognised,

THE ENERGY INDUSTRY TIMES - OCTOBER 2019

Interview

12

Omnetric believes the

ability to add value

through digitalisation

and IoT are key to

the success of utilities

– and to achieving

its own near-term

growth targets.

Junior Isles caught

up with Daniel Felicio,

the company’s new

CEO.

Adding value through

digitalisation

Felicio: Utilities will be concentrating more and more on

business optimisation

“… we can generate value through IoT and

digitalisation and create a new economy, not only in

energy but also in other industries”

THE ENERGY INDUSTRY TIMES - OCTOBER 2019

13

Industry Perspective

H

ydrogen production is a pos-

sible key mechanism to a

zero-carbon energy system.

Currently available mature technolo-

gies for hydrogen production are

electrolysis from water and reform-

ing of natural gas. As power genera-

tion from renewable sources increas-

es, it is possible to anticipate a time

in the near future when peak output

will regularly exceed demand. Sur-

plus power can be converted to hy-

drogen. Hydrogen from renewables

is described as ‘green’. Production

of hydrogen from fossil fuels, using

techniques such as steam methane

reforming (SMR), is termed ‘brown’

if by-produced CO and CO

2

are sim-

ply discharged into the environment.

Marrying H production with carbon

capture, usage and storage (CCUS)

makes it ‘blue’ hydrogen, with car-

bon monoxide and dioxide. This too

can be compatible with a net-zero

carbon energy system by.

But so far, hydrogen for energy is

conceptually and technically in its

infancy. In the UK, some work on

adaptation of domestic appliances

and conversion of some industrial

thermal energy applications is under

way. There are limited plans for hy-

drogen fuel-cell vehicles and small-

scale power-to-gas. Two proposals

for bigger steam methane reforming

(SMR) with CCUS plants are in

train. However, there are no utility

scale hydrogen production projects

up and running anywhere, globally.

Rapid acceleration is required to

develop the systems we need to meet

2050 zero-carbon commitments.

More radical action by government

and industry is required to drive de-

velopment of a hydrogen-based en-

ergy system forward. Only by dem-

onstrating and scaling up the

systems, and guaranteeing a market,

can a robust and investable hydrogen

economy be created.

Clearer and more consistent poli-

cies would reduce risk for private in-

vestors. There is already a ban on in-

ternal combustion engine vehicles

from 2040 in the UK. This should be

accompanied by similar deadlines in

other consuming sectors, including a

commitment to run all combined cy-

cle gas turbines (CCGT) – the work-

horses of the current power system –

on hydrogen say by 2035. Direct

state involvement may even be need-

ed in the construction of major key

elements of hydrogen infrastructure,

such as new gas transmission and

distribution grids.

There are signs that the system can

work. Carbon taxes, market incen-

tives, the availability of cheap re-

newables, and half hourly pricing

that reects variation in the power

supply and demand balance, are al-

ready encouraging some hydrogen

output in northwest Europe. Hydro-

gen is becoming more valuable at

peak times due to its potential for

conversion to power in CCGTs and

fuel cell power plants.

Perhaps the most promising imme-

diate opportunity for hydrogen is for

energy storage. Renewables are

dogged by intermittency. When sup-

ply is high, prices fall. Indeed, sup-

pliers can be penalised for exceeding

demand. Meanwhile, there are peri-

ods when renewable power output

falls short of demand.

Converting surplus electricity to

hydrogen and using it in a gas tur-

bine or fuel cell to generate electrici-

ty would produce a hybrid solution

capable of evening out power supply

and maximising revenue. Cheap ex-

cess renewable electricity and vari-

able power prices in Europe have led

electrolysis unit manufacturers and

hydrogen production advisers, in-

cluding Air Liquide, Hydrogenics,

ITM Power, Nel Power and Siemens

to invest in such technologies.

But existing hydrogen production

units based on electrolysis are small.

Air Liquide’s largest, used in the

EU’s agship electrolysis project in

Austria, is only 6 MW.

Co-ordinated planning as well as

capital investment are needed in

electrolysis at scale, brown hydro-

gen with CCUS, hydrogen utilisa-

tion, and transmission, distribution

and storage.

Japan offers an interesting example

of the benet of government support.

It has yet to introduce carbon penal-

ties or price power in real-time and

has less cheap renewable power

available than the UK. But there

have been more extensive state

sponsored efforts to push hydrogen

development in tandem with private

companies.

In the UK and Europe, the state

could also play a key role by getting

directly involved. To date, govern-

ment has had to remove risk from

major private energy investment

projects, to attract private investors.

For example, the $20+ billion Hin-

kley C nuclear power project has a

government-guaranteed price for

power of £92.50/MWh.

One option now being considered

for large energy projects is the Regu-

lated Asset Base (RAB) model. The

state, acting through the energy regu-

lator, would ensure security of cash-

ows to private sector asset owner-

operators, so reducing the cost of

capital. This approach is favoured

for proposed SMR projects in the

UK. Their backers have different

motives for involvement, but all are

waiting for central government to

adapt the regulatory environment in

line with the national policy commit-

ment to net-zero carbon emissions

by 2050.

For the biggest hydrogen projects,

there may be just too much risk for a

private company or consortium, and

direct state funding and ownership

(as least initially) may be required.

This was the case when the existing

natural gas systems were established

in the 1970s. Such projects might in-

clude, in the UK, a 3000 km, multi-

billion-pound dedicated hydrogen

national transmission grid.

So far SMR with CCUS project

proposals have been far bigger than

electrolysis proposals. On the draw-

ing board are the Hynet Northwest

Partnership on the Mersey estuary,

backed by a consortium of gas dis-

tributor Cadent, oil and gas giant

Shell, and developer/port operator

Peel. In the northeast, a consortium

is backing a Teesside plant that will

supply Leeds. On Humberside, a

third SMR/CCUS hub is proposed

by oil and gas company BP with en-

ergy rms Centrica, Ørsted, Equi-

nor, Engie and Northern Gas Net-

works. In North Yorkshire,

generator Drax, Equinor and Na-

tional Grid Ventures (the transmis-

sion rm’s new energy technologies

arm), are aiming to develop a large-

scale hydrogen demonstrator on the

Drax site by the mid-2020s, com-

bining carbon capture from SMR

hydrogen production as well as

from thermal power production.

Some hydrogen-only pipelines

have already been built in Europe,

including Air Liquide’s pipeline

from France to Belgium, and a 210

km network in Germany. Up to 20

per cent hydrogen can be safely

blended with natural gas in existing

gas transmission and distribution

pipelines. Blending pilot projects are

going ahead at Keele and Leeds in

the UK.

In addition to SMR, several small

electrolysis plants are operating at

reneries, including Shell’s 10 MW

electrolysis plant in the Rhineland

renery in Germany (partnering with

ITM Power). Shell says it aims to

test the technology on an industrial

scale in order to develop new busi-

ness models, but its investments so

far are modest. BP has a similar re-

nery-based electrolysis project in

the Netherlands.

Blue hydrogen produced using

SMR with CCUS is an attractive in-

termediate step in the development

of a hydrogen-based energy system.

It provides a near-term market for

gas, helping oil and gas companies

to transition their businesses from

predominantly hydrocarbon-based to

renewable: The storage, transmission

and distribution infrastructure need-

ed for a functioning blue hydrogen

system will be the same as for green.

There are already green hydrogen

plants running on tidal energy in Or-

kney, as well as solar and wind else-

where. Various nuclear operators are

investigating the possibility of using

nuclear power to produce hydrogen

when prices are low (converting low

cost power into hydrogen via elec-

trolysis would enable it to be con-

verted back or sold on as a fuel when

prices rise). Norway plans to pro-

duce hydrogen from hydropower for

sale to Japan at a target price that

will outcompete a rival coal-fed

SMR project based in Australia.

Because hydrogen is such a low-

density gas, transportation is an issue

at scale. So, as well as local gas

pipeline and storage networks, other

transportation mediums need to be

considered. Options under develop-

ment include cryogenic liquefaction

of hydrogen – although this has ma-

jor costs and risks. A carrier process

using ammonia is more practical.

Splicing nitrogen and hydrogen to-

gether to create ammonia (NH

3

) is a

simple and easily reversible chemi-

cal engineering process. An ammo-

nia trading network already exists

globally, serving the fertiliser indus-

try, although existing networks

would need to be expanded dramati-

cally and modied to include con-

version facilities.

Hydrogen molecules can be chemi-

cally bonded into a class of materials

known as hydrogen carriers (HC),

which come in both liquid and solid

forms. Liquid organic HCs enable

transportation in regular tankers and

pipelines; solid HCs can be trans-

ported as freight. These HCs can be

non-toxic and fully inert, and very

cheap if produced at mass scale.

HCs can be charged and depleted re-

peatedly. The cost comes in the pro-

cess of bonding and separating hy-

drogen from them – hydrogenation

and dehydrogenation – and from

transporting the depleted HC back to

source for recharging.

Development of high capacity, low

cost, transportation is feasible – tech-

nically no more challenging than the

intercontinental transportation of

natural gas is today. Overcoming

that barrier would open up the possi-

bility of producing cheap solar pow-

er in the world’s deserts for con-

sumption in remote locations.

The transition towards a renew-

ables-hydrogen system is benetting

from the increasing number of inves-

tors acting on traditionally non-com-

mercial priorities. A quarter (or $20

trillion) of the world’s professionally

managed investments take account

of environmental, social and gover-

nance criteria. Fossil fuels increas-

ingly do not meet them.

Meanwhile, investors and insurers

are looking to reduce their exposure

to climate risks. The risk premium

for holding hydrocarbon stocks is

rising with every extreme weather

event. Meanwhile, emissions-free

hydrogen power is well aligned with

urban transport policies that address

the link between poor air quality and

harm to public health.

A comprehensive hydrogen sys-

tem, encompassing domestic and in-

dustrial power and heat, plus trans-

port, would support full energy

security. Building up stores of hy-

drogen would enable cities, regions

– perhaps entire countries – to ride

out inter-seasonal uctuations in re-

newable energy output, reducing re-

liance on fossil fuels imported from

abroad.

Large scale networks need to be

developed by the governments,

backed up by regulations based on

timelines for an accelerated growth.

Such projects can then be sold to the

private sector. Relying on energy

majors and private sector via RAB

models may be a mistake in the long

run as the current snail pace will

continue into the 2030s.

Further the public should be made

aware of the benets of using hydro-

gen to the society in addition to cli-

mate change. We can continue to

drive and y and let the next genera-

tion also experience the wonders of

the world. All of these milestones

can be achieved. Doing so involves

imparting some initial energy to the

hydrogen economy, to get it ready

to roll.

Dr Paramjit Mahi is Development

and Innovation Director, Energy

Sector, Mott MacDonald.

Progress towards

net zero carbon will

eventually require

the end of the use of

natural gas for all but

a small number of

critical applications.

Although hydrogen is

not an energy source,

it is a potentially

leading energy

vector.

Dr Paramjit Mahi

explores how to

accelerate the

hydrogen economy.

Dr Mahi: the public should be made aware of the additional

benets of using hydrogen to the society

H

2

and a zero-carbon world

THE ENERGY INDUSTRY TIMES - OCTOBER 2019

16

Final Word

W

ith the number of school

children demonstrating

globally and taking to the

stage at the recent UN Climate Change

Summit in New York, many adults

must be having ashbacks to school

days. But this time with roles reversed.

The scowl of teenage climate activist

Greta Thunberg as US President

Donald Trump made a eeting visit to

the summit was that familiar look your

English teacher might have given that

perpetually disruptive kid in class.

Heads of government, commercial

organisations, cities and municipali-

ties gathered in the ‘Big Apple’ at the

end of September knowing that they

have to take a huge bite out of carbon

emissions to stand any chance of

avoiding catastrophic climate change.

Last year a report from the Intergov-

ernmental Panel on Climate Change

found that limiting warming to 1.5°C

would require cutting emissions to net

zero by the middle of the century.

A report issued by DNV GL just a

couple weeks ahead of the New York

gathering highlighted the extent of the

task. Its forecast indicates that for a

1.5°C warming limit, the remaining

carbon budget will be exhausted as

early as 2028, with an overshoot of

770 Gt of CO

2

in 2050. Limiting

global warming to well below the 2°C

target of the Paris Agreement would

call for even greater acceleration of

solar and wind, as well as other tech-

nology measures, it said.

According to the company’s ‘Energy

Transition Outlook 2019’, solar

power would have to increase by more

than ten times to 5 TW and wind by

ve times to 3 TW by 2030, meeting

50 per cent of the global electricity

use per year. There would have to be

a 50-fold increase in production of

batteries for the 50 million electric

vehicles needed per year by 2030,

alongside investments in new tech-

nology to store excess electric energy

and solutions that allow electricity

grids to cope with the growing inux

of solar and wind power. Global en-

ergy efciency improvements would

need to increase by 3.5 per cent per

year within the next decade.

To address sectors outside electricity,

the report said green hydrogen would

be needed to heat buildings and indus-

try, fuel transport and make use of

excess renewable energy in the power

grid. It also noted that rapid and wide

deployment of carbon capture, utilisa-

tion and storage installations would

also be critical.

Commenting on the outlook, Ditlev

Engel, CEO of DNV GL Energy, said:

“Our research shows that technology

has the power to close the emissions

gap and create a clean energy future.

But time is against us. Those technol-

ogy measures can only be successful

if they are supported by extraordinary

policy action. We are calling for

government policies to expand and

adapt power grids to accommodate the

rise of renewables, economic stimulus

for energy efciency measures and

regulatory reform to accelerate the

electrication of transport. Govern-

ments, businesses and society as a

whole need to change the prevailing

mindset from ‘business-as-usual’ to

‘business-as-unusual’ to fast-track the

energy transition.”

The report also demonstrates that

the energy transition is affordable, as

the world will spend an ever-smaller

share of GDP on energy. “Technology

keeps giving us more for less,” said

Ditlev, noting that the UK now gets

“much more bang for the buck” for its

offshore wind projects compared to 10

years ago.

DNV GL’s report looks at the mar-

ket’s needs from a cost perspective, so

all of its forecasts for technology re-

quirements are based on what it sees

as the most cost-effective technologies

that can be deployed during the out-

look period.

Which technologies will ultimately

come through in the race to decarbo-

nise will indeed likely come down to

cost, although some will argue that we

need to use everything that is available.

But not all agree with this thinking.

Speaking during a recent panel debate

on innovations to tackle climate

change, held at the Finnish Ambas-

sador’s Residence in London, Mi-

chael Liebreich, Chairman, CEO of