www.teitimes.com

September 2019 • Volume 12 • No 7 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

A digital approach

to climate change

Who will beat the

clock?

Digital innovation is key to ensuring

climate neutrality by 2050.

Page 13

As the energy transition progresses

faster than expected, the industry is

on a countdown to an accelerated

reinvention. Page 14

News In Brief

Ofgem investigates UK

power outage

A major blackout in the UK has

called into question the network’s

resilience as more renewables

come onto the system, triggering an

inquiry by the energy regulator.

Page 2

Ecuador seeks renewables

developers

Ecuador is hoping to attract

international private sector investors

to a planned tender for renewable

energy plants.

Page 4

Australia’s coal proponents

still hold sway

Australia’s bid to preserve its coal

industry is threatening the region’s

climate ambitions.

Page 6

Study trebles European wind

potential

Europe could install over 50 TW

of onshore wind capacity – enough

to meet global demand to 2050,

according to a new study.

Page 7

Egypt sets grid up for the

future

Egypt is seeking advice and analysis

of its electricity grid as the country

expands its generating capacity.

Page 8

Wood ofoads nuclear unit

Wood Group has reached an

agreement to sell its nuclear energy

business to Jacobs as part of plans to

cut debt levels.

Page 9

Technology: Demanding a

response with blockchain

Blockchain technology has been

used to develop a system for

trading related to energy shortages

and surpluses among electricity

consumers.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

A plan to replace the Obama-era Clean Power Plan with the Affordable Clean Energy rule is

facing a legal challenge as climate concerns mount. Junior Isles

US leads on corporate clean energy PPAs

THE ENERGY INDUSTRY

TIMES

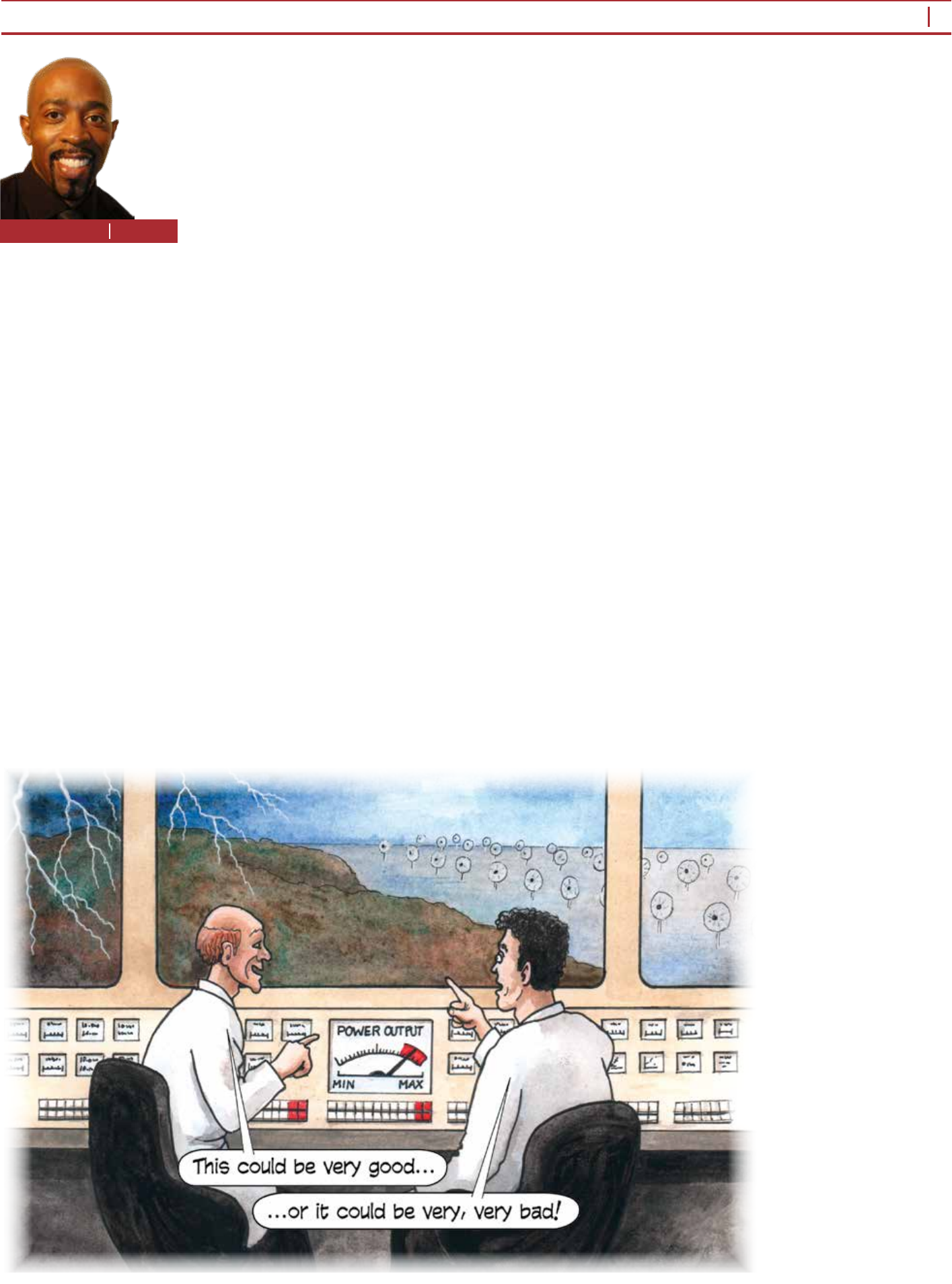

Final Word

Lightning could strike

twice, says Junior Isles.

Page 16

The US Environmental Protection

Agency’s (EPA) proposal to replace the

Obama-era Clean Power Plan (CPP)

with the Affordable Clean Energy

(ACE) looks set for a long battle in the

US court room.

In August, a coalition of 29 states

and cities led a lawsuit in the US Cir-

cuit Court of Appeals for the District

of Columbia, challenging the new rule

on grounds that it violates the federal

Clean Air Act.

Essentially, the new rule abandons

the CPP’s incentives for utilities to

shift from coal to cleaner-burning

natural gas or renewables, or join a

regional carbon trading scheme that

caps emissions and lets generators

buy and sell pollution permits. In-

stead, the ACE rule dictates that

power plants can only reduce emis-

sions with technologies that work “in-

side the fence-line”, meaning retrots

that capture or reduce gases from indi-

vidual plants.

A legal memo by law rm

O’Melveny & Myers explained the

legal background of the new rule and

the CPP it replaces.

“Both the ACE Rule and the CPP are

predicated on Section 111(d) of the

Clean Air Act, 42 U.S.C. Section

7411(d), which allows the EPA to re-

quire states to submit state implemen-

tation plan (SIP) amendments that

adopt standards of performance for

stationary sources as to air pollutants

for which air quality criteria have not

been issued.

“Under Section 111(d), SIP amend-

ments must establish standards of per-

formance that reect the degree of

emissions limitation achievable

through the application of the ‘best

system of emission reduction

(BSER)... adequately demonstrated’,

taking into account the cost of achiev-

ing such reduction while also consid-

ering any non-air-quality health and

environmental impacts and energy

requirements.

“The new ACE Rule, which replaces

the CPP, species as BSER heat rate

improvement (i.e., improved efciency),

eliminating the use of outside-the-

fence-line control measures. The ACE

Rule also omits specifying numerical

emission rates.”

The EPA says its rule focuses on

clean air standards aimed at reducing

carbon dioxide emissions from exist-

ing coal red power plants. The agen-

cy says improving the efciency of

coal red plants, as measured by the

amount of fuel required to produce a

unit of electricity, is the best way of

reducing emissions.

It is promoting six “candidate tech-

nologies” for power plants: neural

network (computer model) control

Continued on Page 2

Although many question the US

Trump Administration’s clean energy

credentials, a recent report by Bloom-

bergNEF (BNEF) has revealed that

the country is the global leader in

corporate Power Purchase Agree-

ments (PPAs).

Corporations signed contracts to

purchase 8.6 GW of clean energy in

2019 through July. This is up from

7.2 GW at the same time last year.

Overall, 2019 is on track to be bigger

than 2018 for corporate PPAs glob-

ally. The US made up 69 per cent of

this activity – by far the biggest mar-

ket globally.

US corporations bought 5.95 GW of

clean energy in 2019, closing in on the

2018 total. Companies are once again

ocking to Texas – historically the

largest corporate procurement market

in the country – where 40 per cent of

the activity in 2019 has occurred.

Companies are signing solar PPAs in

ERCOT to take advantage of peak

pricing during the hot summer

months, which greatly improves the

economics on a deal.

BNEF said in a release: “Just 1 GW

of deals in the US have come from

green tariffs with regulated utilities.

It is likely we won’t reach the 2.6

GW seen in all of 2018. This may be

a result of buyer apprehension, as

several companies have been in-

volved in highly publicized legal

battles with regulated utilities over

clean energy buying.” It also noted

that companies are instead “favour-

ing the virtual PPA model, which has

made up 82 per cent of all US deals

in 2019”.

RE100 members will need to buy

an extra 189 TWh of clean power in

2030 to hit targets. Despite 33 new

companies joining the RE100 in

2019 through July, for a total of 191

signatories, BNEF forecasts that the

group is collectively facing a short-

fall of 189 TWh in 2030 – 1 TWh less

than its previous forecast.

Existing RE100 members signed

deals for an estimated 7.8 TWh of

clean electricity, outpacing the de-

mand from new signatories overall.

Should these companies meet their

189 TWh shortfall through solar and

wind PPAs, BNEF estimates it would

stimulate an additional 94 GW of re-

newables build, leading to $97 bil-

lion of new investment.

Corporations have purchased just

950 MW of clean energy through

PPAs in Europe, Middle East and Af-

rica in 2019. The Nordics, which

typically sets the pace for the region,

has seen just 300 MW of deals,

though several solar PPAs in Sweden

are the rst of their kind.

“There is excitement in new Euro-

pean markets like Poland and France,

and a groundbreaking deal was signed

by an oil and gas company in Oman,

but otherwise the region continues to

be underwhelming as a whole,” said

BNEF.

China is on the verge of rolling out

game-changing policies for corpo-

rate procurement. Policymakers are

set to implement two key policies.

The rst is a renewable portfolio

standard, mandating that corpora-

tions meet a percentage of their load

with renewables. The second is a

prosumer model, allowing compa-

nies to sell excess generation from

their own clean energy projects to

neighbouring sources of demand.

Both mechanisms will create more

corporate demand and give compa-

nies exibility in how they procure

renewables in China.

US states line

up to ght

ACE rule

The Trump administration’s proposal to replace the

Clean Power Plan is heading for the court room

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2019

3

The 12th Energy Storage World Forum: 8-10 October 2019, Rome will feature speakers from 16 Utilities, 2

IPPs, 2 C&Is, 7 Regulators from 19 countries. Join them for a fun-filled evening at the Pool Deck of

Sheraton Roma Hotel on 8 Oct 2019 for a Gala Dinner to mingle with more attendees from companies such

as TENNET, TRANSNET, TERNA, EKZ, KEPCO and UKRENERGO.

We have partnered with the Energy Storage World Forum who have kindly given our readers a 10%

discount to attend their event

! Buy a ticket NOW and insert the promotion code PARTNER_ROME

✔ Download a Full Programme Here and be familiar with the 3 most wanted speeches according to their

research. Here they are:

12 – 13 NOVEMBER 2019

Eko Hotel & Suites, Lagos, Nigeria

ADVANCING PARTNERSHIPS AND

SOLUTIONS FOR A SUSTAINABLE

ENERGY ECONOMY

1700 +

visitors

90+

exhibitors

15 +

countries

represented

Secure valuable business opportunities and be seen as a leader in the

Nigerian power and energy sector. Contact Ade Yesufu for more information.

Ade Yesufu T: +27 21 700 3574 | E: ade.yesufu@spintelligent.com

Hosted by Part of

Follow us @worldfuturenergysummit

Bringing future

innovation, knowledge

and business together.

The World Future Energy Summit brings together thousands of business and political

leaders, industry specialists, academics and technology pioneers to help you forge new

relationships and source practical solutions for everything your business needs across

future energy, water and waste.

EXPO & FORUM HIGHLIGHTS:

• 800 exhibiting companies from 170 countries

• 100 never-before-seen innovations

• Dedicated Energy, Water, Solar, Waste and

Smart Cities Industry Forums

REGISTER FOR FREE

www.worldfutureenergysummit.com

JOIN US IN PARIS!

12 - 14 November 2019

Paris Expo Porte de Versailles, Paris,

France

The end-to-end industry event for the energy sector.

European Utility Week and POWERGEN Europe, a three-day event that spotlights every part of

the energy ecosystem.

Join the influencers, disruptors, and innovators in Europe’s energy sector and hear about the

strategies and technologies that will deliver a shared vision of a fully integrated and interconnected

European energy system.

Deep dive into the trends

and future direction

of each aspect of the

sector – from generation

to grid to end-users!

Part of

#EUW19 | #PGE19

European Utility Week | POWERGEN Europe

#EUW19 | #PGE19

Register for your free pass: www.european-utility-week.com

Walk a bustling exhibition

floor to see the latest

technologies first hand,

exchange ideas and share

knowledge.

A packed conference programme!

SUMMIT

PASS

FREE VISITOR

PASS

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2019

5

Upcoming Event Organized by

Vietnam

Energy Association

Ministry of

Industry and Trade

Vietnam Chamber of

Commerce and Industry

Supported and Endorsed by

Please scan above QR code for visitor registration.

www.teitimes.com

THE ENERGY INDUSTRY

TIMES

subscribe today

The Energy Industry Times is the only publication that

covers global news related to the power and energy

sector in a newspaper style and format whose

uniqueness is recognised by our readers.

As a paid subsciber you will gain full access to our online

news desk.

You will also no longer have to wait for the printed edi-

tion; receive it by PDF “hot off the press” or download it

online.

To subscribe, email subscriptions@teitimes.com or visit

www.teitimes.com

To guarantee receiving your monthly copy of the award

winning newspaper, you need to subscribe today

India is looking to increase the deploy-

ment of solar and wind as part of an

effort to meet peak demand.

The state enterprise Solar Energy

Corporation of India (SECI) recently

issued a tender for 1200 MW of renew-

able power that can be used to alleviate

peak demand issued on the grid, in ef-

fect mandating the use of energy stor-

age systems (ESS).

An invitation has been issued for bids

to build, own and operate renewable

generating facilities and enter into 25-

year power purchase agreements

(PPAs) with SECI. Solar and wind (or

combined or hybrid systems) must be

capable of dispatching power to the

grid for at least six hours each day. Off-

peak energy will be provided a at

tariff payment of Rs2.70/kWh

($0.038), while a separate peak tariff

will be determined through e-Reverse

Auction, the SECI invitation document

said.

As long as the six-hour peak stipula-

tion can be met, bidders have been

given exibility to determine the tech-

nologies used, type and power rating

of the ESS portion of each project and

maybe include but not be limited to

batteries, pumped storage, mechani-

cal, chemical or combinations thereof.

According to SECI, while India has

already installed 80 GW of renewable

energy, and ambitious policies includ-

ing the National Solar Mission will

push it further ahead, the inability of

renewable generators to dispatch en-

ergy to the grid at times when it is most

needed is a key factor in preventing

wind and solar from displacing and

replacing fossil fuels.

In late July the Federal Ministry of

Power of India said India’s coal red

power capacity is expected to increase

by more than 22 per cent by 2022, as

domestic electricity demand keeps on

rising (though at a slower pace in the

last four years).

Although India is making progress in

shifting from coal to renewables, the

ongoing drive to further ramp up solar

and wind deployment is not without its

challenges.

A recent tender by NTPC for 1.2 GW

of solar PV projects received no bids,

according to the Economic Times.

The tender sought projects at loca-

tions in the states of Maharashtra, Mad-

hya Pradesh, Chhattisgarh and Gujarat,

with connectivity through substations

at existing NTPC thermal power

plants. Proposals were capped at

Rs2.78/kWh ($0.039/kWh).

Vinay Rustagi, Managing Director of

renewable energy consultancy Bridge

To India, told the newspaper that the

reason for developers’ lack of interest

was the low ceiling tariff, considering

the lower irradiation levels in the spe-

cic areas and the higher land cost. He

added that the expectations for a viable

tariff stand at about Rs3/kWh.

In another auction Gujarat Urja Vi-

kas Nigam Limited (GUVNL) had

requested the winning bidders in its

recently concluded wind power auc-

tion to match the lowest bid of Rs2.8/

kWh. Only two out of the eight devel-

opers that bid for the projects adhered

to this request.

Pressuring developers after an auc-

tion to lower tariffs to match that of the

lowest bidder is increasingly becoming

a tactic to keep prices low.

Gujarat awarded 745 MW of wind

projects to nine developers after an

auction in May at tariffs ranging from

Rs2.80 per unit to Rs2.95 per unit.

The state distribution company asked

all the winners to match the lowest

tariff if they wanted power purchase

contracts.

The state is within its rights to do

this, but the auction process is getting

eroded, Rustagi said. Tenders are rou-

tinely getting undersubscribed, can-

celled or negotiated, so the process is

becoming disjointed and creating

uncertainty for the private sector.

Australia’s bid to preserve its coal in-

dustry is threatening the region’s cli-

mate ambitions. Last month, Canberra

blocked Pacic Islands leaders from

agreeing on a joint declaration to tack-

le climate change.

After protracted negotiations at the

Pacic Island Forum on the island

nation of Tuvalu on August 16th, lead-

ers from 18 countries watered down

the ofcial communiqué to accommo-

date concerns raised by the Australian

government.

Australia’s Prime Minister Scott

Morrison, is a staunch supporter of the

coal industry, which delivered A$67

billion ($45 billion) in export earnings

in 2018 and provides nearly two-thirds

of the country’s electricity.

Morrison led Australia’s negotiations

on the Tuvalu declaration, which

among other things called for more ef-

fort to tackle the world’s “climate cri-

sis” and a ban on new coal mines and

coal power stations.

Pacic Island countries are lobbying

developed nations to take more drastic

action to tackle climate change, which

scientists warn threatens the future

existence of smaller archipelagos,

such as Tuvalu and Kiribati.

Frank Bainimarama, Fiji’s Prime

Minister, expressed disappointment at

the outcome of the meeting.

Australia’s opposition Labor party

criticised Morrison’s stance on the

joint declaration, saying it made Aus-

tralia look like a “bad actor” on climate

change.

The country is, however, well on its

way to reaching its Renewable Energy

Target (RET). In 2016, the Clean En-

ergy Regulator (CER) estimated that

reaching its 2020 RET of 33 000 GWh

renewable power generation would

require 6000 MW of green power gen-

erating capacity. Due to a higher pro-

portion of solar projects in the pipeline,

the estimates were later updated to

6400 MW. The country has already

reached 6200 MW.

South Australia’s conservative Lib-

eral government has boasted that it has

10 GW of large scale wind and solar

projects now in the development pipe-

line, propelling the state towards its

anticipated milestone of net 100 per

cent renewables by 2030.

Several notable projects in the state

were announced last month. SIMEC

Energy Australia won development

approval for a 100 MW/100 MWh

battery storage project that will be

linked to its recently consented Cul-

tana solar park, and a A$500 million

wind-solar-battery facility capable of

generating 275 MW was given the

green light by the South Australian

government.

The project being developed by

French company Neoens Crystal

Brook Energy Park will include up to

150 MW of solar, 130 MW/400 MWh

of battery storage and 125 MW of

wind from 26 wind turbines.

Meanwhile, in Queensland, Austra-

lia’s largest wind farm, Coopers Gap,

has begun generating electricity. The

project remains on track for comple-

tion in the 2020 nancial year.

Although the commissioning pro-

cess is continuing, with almost 50 of

the 123 turbines installed, at full ca-

pacity the 453 MW wind farm will

generate enough renewable energy to

power 264 000 average Australian

homes.

n The Australian electricity operator

has recommended trialling new mea-

sures to manage the boom in rooftop

solar and batteries and capitalise on the

increasing ow of power from house-

holds back to the grid.

6

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2019

Asia News

Australia’s coal

proponents still

hold sway

India seeks to accelerate

solar and wind

India is looking to accelerate the use of solar to alleviate peak demand, while attempting to further drive down the cost

of wind. Syed Ali

Japan has compiled a plan to scale

down its feed-in tariff system. The plan

was endorsed last month by the Min-

istry of Economy, Trade and Industry’s

expert panel, and the government aims

to have a modied system approved

by the Diet in 2020 to end support for

electricity generated by wind and

large-scale solar plants.

Under the current system, power

companies are obliged to buy all elec-

tricity generated by renewable sources

at xed rates. But calls for the system’s

reform have grown as the higher price

of such energy, passed onto households

and companies via electricity bills,

continued to rise and is expected to

reach Yen3.6 trillion ($34.0 billion) in

this scal year to March 2020.

The scheme was implemented in

2012 to reduce reliance on nuclear

power following the crisis at the

Fukushima Daiichi power plant trig-

gered by the March 2011 earthquake

and tsunami, and resulted in new sup-

pliers ooding the power sector.

Power generated by renewable

sources more than tripled and even

raised concerns about transmission

capacity. Ministry ofcials have said

the cost passed on to the public and

corporations has exceeded an initially

anticipated level despite past attempts

to address the issue including lowering

the predetermined purchase price.

n Tokyo Electric Power Company

(Tepco) will dismantle all four reac-

tors at another nuclear plant near the

ruined Fukushima Daiichi nuclear

power plant. The Fukushima Daini

power station is located about 10 km

south of Fukushima Daiichi, which

suffered meltdowns in three of its six

reactors.

China’s plan to have 20 GW of wind

turbines producing green hydrogen

received a boost last month when

Goldwind signed up as one of the rst

partners in a wind-to-hydrogen project

in northeast China.

The project in the city of Baicheng,

Jilin province, which also aims to

eventually harness 15 GW of solar PV,

is the largest yet announced in China

to explicitly integrate renewable gen-

eration and hydrogen infrastructure

within a so-called hydrogen valley. It

will produce more than one million

tonnes of the hydrogen annually by

2035.

Like other wind-rich areas of China,

Baicheng’s grid faces problems ac-

commodating power from the 4.65

GW of existing wind and solar capac-

ity serving the city, leading to curtail-

ment of output. A hydrogen infra-

structure is seen as an ideal outlet for

putting unused generation potential to

good use.

n China plans to improve a subsidy

application mechanism, just launched

this year, to reduce subsidies in the

solar photovoltaic sector, according to

the National Energy Administration.

The subsidy application mechanism

was designed to boost market-oriented

development in the solar pv sector and

further reduce subsidies.

Japan to scale back

feed-in tariffs

Renewables key to

China hydrogen plan

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2019

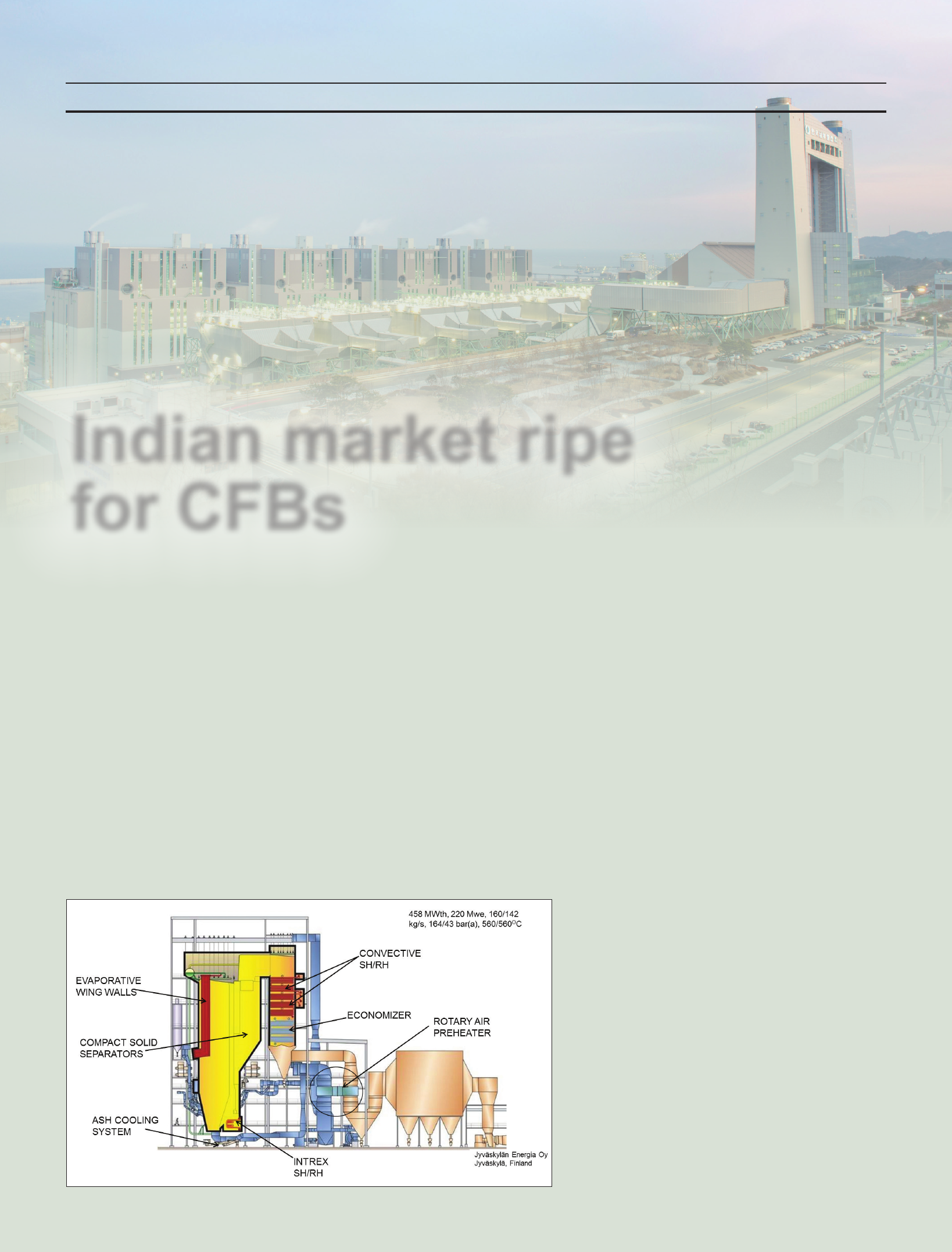

Special Technology Supplement

Indian market ripe

for CFBs

Stricter emission laws in India could see the country re-assessing its choice of technology for base load coal red

plants. With large-scale units now possible, combined with supercritical and ultra-supercritical parameters for high

efciency, circulating uidised bed technology is now being considered by the government as an alternative to

pulverised coal red boilers. Junior Isles

blending different types of fuels and

co-ring with biomass. So CFB

technology has become a much

stronger and more compelling alter-

native to PC red power plants,”

Krishnan added.

This thinking was highlighted in a

Ministry of Power expert committee

report published last year. The report

notes that CFB has “several benets”

over PC boilers. “CFB boilers are

extremely exible, allowing a wide

range of fuel qualities and sizes to be

burned. Emissions of SOx and NOx

are signicantly reduced without the

addition of expensive ue gas emis-

sions control systems,” it stated.

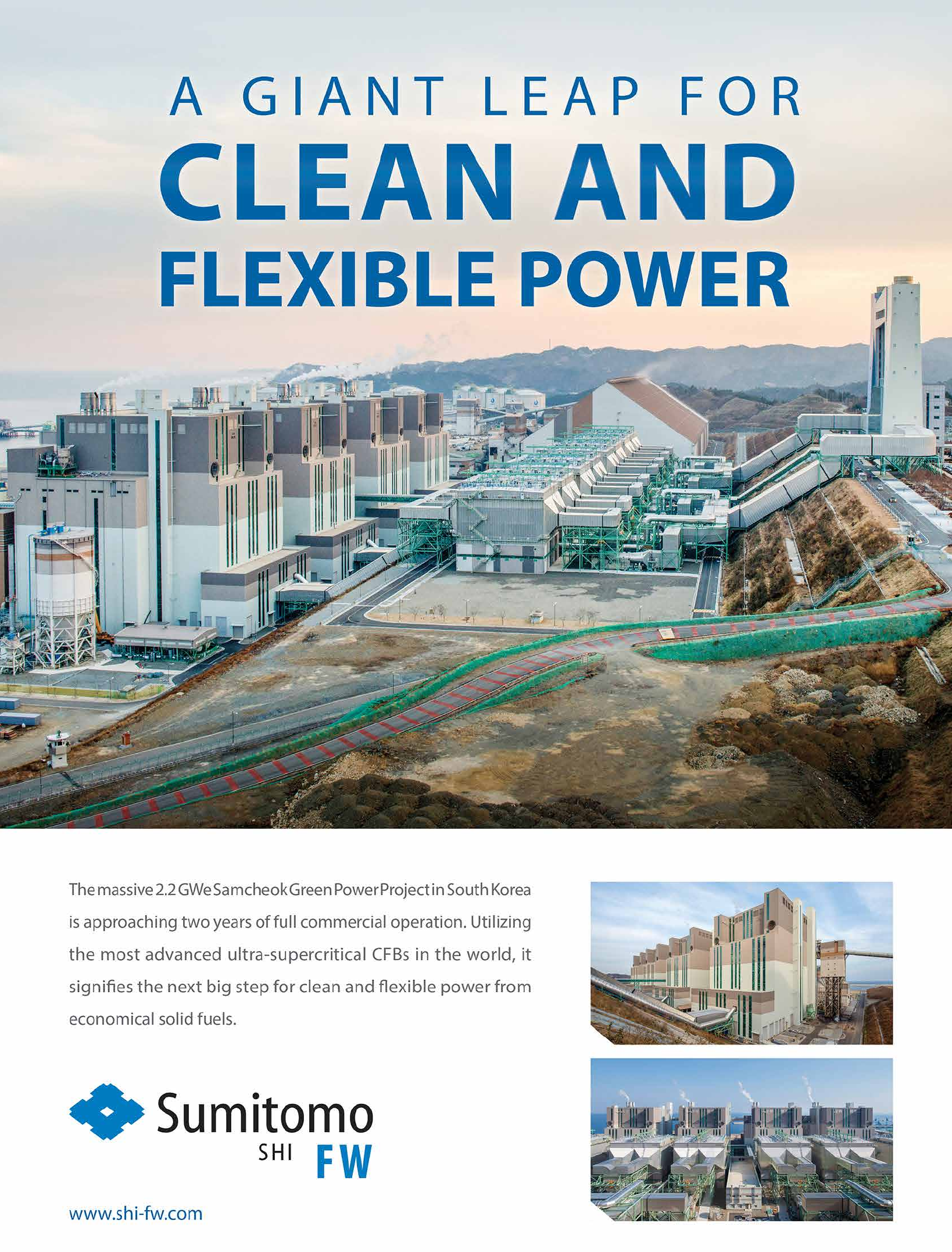

Over the last 25 years or so, Sumi-

tomo SHI FW (SFW) has broadened

both fuel exibility and unit size so

much that a growing number of

power companies have taken notice.

Many now see CFBs as a way to

produce low cost power from low

quality fuels such as brown coals,

lignite, and waste coals, as well as,

high-energy, hard-to-burn fuels like

anthracite and petroleum coke.

They can also burn an almost “limit-

less number” of other types of solid

fuels, separately or mixed with coal.

“The limitations, if any, are only in

the feeding system and other me-

chanical equipment,” stated the re-

port. Other solid fuels include bagasse

in sugar plants, bark in pulp and paper

mills, biomass products as well as,

municipal solid waste. Mixing with

coal when other fuels are not avail-

able gives uninterrupted steam and

energy supply.

The CFB’s ability to burn high ash,

low caloric value coal is a big plus

for the Indian market where coal

typically has 30-40 per cent ash con-

tent. Robert Giglio, Senior Vice

President of Strategic Business De-

velopment for SFW, noted that its

technology can handle coals with up

D

espite sluggish global econo-

mic growth, India’s economy

is forecast to grow at 7.0 per

cent in 2019, picking up to 7.2 per cent

in 2020, according to the International

Monetary Fund.

As is always the case with rapidly

growing economies, this will drive

demand for new base load power

generating capacity in order to meet

new demand and maintain reserve

margins.

Market expert Ravi Krishnan, at

Krishnan Associates, commented:

“Following a few years of a down-

ward trend in the economy due to

structural reforms, the signs are for

stronger economic growth starting

from this year. The need for base load

generation has therefore become

imminent. When there is good, solid,

economic growth, like we had be-

tween 2008 and 2014, on average

India adds about 15 000-20 000 MW

of new capacity per year.”

India has very little gas or oil.

Therefore it largely depends on coal

for base load generation. According

to the Central Electricity Authority,

coal accounted for nearly 56 per cent

of system capacity in 2018/19. Most

of this was fuelled by domestic coal,

with imported coal only serving about

20 per cent of the coal red installed

base.

Traditionally, India has predomi-

nantly used pulverised coal (PC)

technology but fairly recent tighten-

ing of emission regulations could see

things change. “The market favoured

PC technology and more so because

there were no environmental regula-

tions whatsoever for NOx and SO

2

,

and there was a relaxed standard for

particulates as well… The new emis-

sion laws promulgated in 2016 means

that any new power plant commis-

sioned in India has to meet a standard

of 100 mg/Nm

3

for NOx and SOx and

designed for as low as 30 mg/Nm

3

for

particulates,” said Krishnan.

The new legislation sets different

limits for plants installed before

2004, those after 2004 but before

December 31, 2016 and those after

January 1, 2017.

In short, the legislation means that

plants pre-2017 of less than 500 MW

have to meet SO

2

standards of less

than 600 mg/Nm

3

, and less than 200

mg/Nm

3

for plants larger than 500

MW. For NOx, the level is 600 mg/

Nm

3

for all sizes built before 2004.

For plants built between 2004 and

2017, the SO

2

limits are the same as

pre-2004 plants but the NOx limit is

300 mg/Nm

3

. Notably, in some loca-

tions units that are smaller than 500

MW but are close to populated areas,

also have to comply with the 200

mg/Nm

3

SO

2

standard. For plants of

any size built from January 2017,

both SO

2

and NOx must not exceed

100 mg/Nm

3

.

The legislation means that many PC

plants have to be retrotted with se-

lective catalytic reduction (SCR)

equipment to cut NOx, and ue gas

desulphurisation (FGD) to control

sulphur. This presents an opportunity

for circulating uidised bed (CFB)

technology. As CFB technology is

inherently cleaner, it does not require

the additional equipment. Krishnan

says this now makes it a lot more

competitive with PC red technology.

“Additionally, there has also been a

focus on lowering CO

2

; that has led a

lot of power plant owners to look at

SFW’s circulating uidised

bed steam generating

technology

Further, due to the high heat transfer

rate of the solids (via conduction heat

transfer), the nal superheat and re-

heat coil sizes are many times smaller

than the pendent and convective coils

in PCs saving more capital and oper-

ating cost.

In addition to recognising the fuel

exibility and new economic case for

CFBs, the Indian government has

also acknowledged that their much

increased power output and efciency

makes them much more suitable for

utility scale application than in the

past.

The report stated: “Almost all of

the existing CFBC power generating

units are small in size (330 MWe

compared to > 1000 MWe for a PC

boiler), and use subcritical steam

conditions that make CFBC systems

less efcient than supercritical/ultra-

supercritical PCC plants. The poorer

economy of scale and lower ef-

ciency of the CFBC plants result in

higher plant costs and has limited

deployment. However, over the last

decade, signicant advances have

been made in scaling up CFBC units

and in the adoption of supercritical

(SC) steam cycles.”

Giglio noted: “It’s always a case of

the incumbent wanting to stay with

what they know. So it’s a case of

educating, and getting the message

out that there is another option. And

while it has not been demonstrated in

India on these 500+ MW coal plants,

it has been demonstrated in other

parts of the world.”

SFW’s CFB technology has been

proven at increasing sizes for a

number of years, achieving the 200

MW utility size in the 1990s. Today,

SFW has single unit CFB designs up

to 800 MWe capacities with ad-

vanced vertical tube supercritical

steam technology.

Supercritical steam conditions rep-

resent a physical point just above the

vapour/liquid equilibrium phase of

water. When the steam pressure

reaches above the critical pressure of

221.2 bar two-phase mixtures of wa-

ter and steam cease to exist, and as the

temperature of the water rises above

374°C the water behaves as a single

supercritical uid, allowing the uid

to absorb much more heat resulting in

signicantly improved overall power

plant efciency.

The technology advance to once-

through supercritical (OTSC) units

was rst demonstrated at the 460

MWe Łagisza plant in Poland, which

entered commercial operation in

2009. Since its startup, the plant has

operated on a range of Polish bitumi-

nous coals and has demonstrated a

to 60 per cent ash. He said: “India’s

domestic coal is ideal for CFBs. It’s

amazing that they have been ring

that coal in PCs for as long as they

have been, but it’s much easier for the

CFB because you don’t have to deal

with slagging ash, etc., and you can

meet the new emission control stan-

dards without the expensive back-end

equipment in what is a cost-sensitive

market.”

A CFB’s ability to burn a broad

range of fuels is due to its ameless,

low-temperature combustion process

at the heart of the technology. Unlike

conventional PC or oil/gas boilers,

instead of an open ame, circulating

solids are used to achieve high com-

bustion and heat transfer efciency to

burn a wide range of fuels. The fuel’s

ash does not melt or soften, which

allows the CFB to avoid the fouling

and corrosion problems encountered

in conventional boilers.

“In a normal boiler the ash gets so

hot it turns into a fouling material or

slag and coats everything,” noted

Giglio. “The CFB uses the ash to

support the process. It uses it to cir-

culate and distribute the heat in the

boiler evenly. It also keeps the sur-

faces clean. So instead of causing

fouling, resulting in maintenance is-

sues and frequent outages, etc., you

can choose a different technology

and solve a lot of these issues.”

From an environmental aspect, the

low temperature CFB combustion

process – typically 800-900°C, which

is signicantly lower than in a PC

boiler – minimises NOx formation

and allows limestone to be fed di-

rectly into the furnace to capture SOx

as the fuel burns. In most cases, a

SCR and FGD are not needed for

NOx and SOx control, dramatically

reducing plant construction and oper-

ating cost and water consumption,

while improving plant reliability and

efciency.

Since the fuel ash does not soften or

melt in a CFB, the size of the furnace

does not increase as much as PC boil-

ers when ring lower quality fuels. In

order to control fouling, slagging and

corrosion, a PC furnace height typi-

cally increases by 45 per cent and its

footprint by more than 60 per cent

when ring low quality fuels such as

high sodium lignite. With a CFB,

boiler height increases by only 8 per

cent and its footprint by only 20 per

cent. This results in a smaller and

lower cost CFB boiler as compared to

the PC boiler for lower quality fuels.

Further, unlike a PC boiler, a CFB

boiler does not need soot blowers to

control the build-up of deposits and

slag in the furnace since the circulat-

ing solids keep the furnace walls,

panels and steam coils clean for the

most efcient heat transfer.

Another important advantage of

CFB boilers is their ability to with-

stand the corrosion that can occur

when certain fuels are burned. In a

boiler, nal superheat and reheat

steam coils operate at the highest

metal temperatures, making them the

most vulnerable to corrosion and

fouling attack.

In a PC or oil/gas boiler, these coils

are hung from the furnace ceiling and

are directly exposed to the slagging

ash and corrosive gases (sodium and

potassium chlorides) in the hot fur-

nace ue gas. To cope with this unde-

sirable situation, boiler designers use

expensive high-grade alloys and rec-

ommend a high level of cleaning and

maintenance for these coils.

This is avoided in SFW’s CFBs by

submerging these coils in hot solids,

uidised by clean air in heat ex-

changer compartments called IN-

TREXs, protecting them from the

corrosive ue gas. The bubbling hot

solids efciently conduct their heat to

the steam contained in the coils and

since the solids never melt or soften,

fouling and corrosion of these coils

are minimal.

Special Technology Supplement

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2019

The technology advance to

once-through supercritical

(OTSC) units was rst

demonstrated at the 460 MWe

Łagisza plant in Poland

Giglio says India’s domestic

coal is ideal for CFBs

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2019

257 bar [g]. The once-through ultra-

supercritical (OTUSC) CFB boilers

utilise advanced vertical tube low

mass ux Benson evaporator technol-

ogy, which is more efcient and easier

to build and maintain than conven-

tional spiral-wound supercritical

boiler technology.

The vertical tube design has several

advantages over a spiral tube design.

It has a lower pressure drop across the

boiler, resulting in higher efciency.

Samcheok has a net electrical ef-

ciency of more than 42 per cent (LHV)

compared to the 38-39 per cent typi-

cally achieved with traditional boilers.

SFW says that out of the hundreds of

boilers sold in the market, only a few

use this relatively unique technology.

Under a contract awarded in 2011,

SFW designed and supplied four 550

MWe (gross) ultra-supercritical boil-

ers producing steam at 600°C for the

rst phase of the project. The rst

phase (Units 1 and 2) are congured

as two blocks with each block having

two boilers feeding into a single 1100

MW steam turbine.

An important aspect of the project is

its ability to burn low quality interna-

tional coal that is 20-30 per cent

cheaper than premium quality coal.

For a plant as large as Samcheok’s

phase I, this fuel discount works out to

be a considerable amount in plant op-

erating cost savings, considering that

the fuel cost is around 70 per cent of a

power plant’s total running cost.

The boilers are expected to burn

about 5 per cent biomass in terms of

heat input, depending on availability.

LHV net plant electrical efciency of

43.3 per cent. Then in 2016 SFW

completed the Novocherkasskaya

GRES No. 9 supercritical CFB proj-

ect in Russia. This 330 MWe CFB

unit, which is the rst of its kind in

the country, is capable of combusting

a wide selection of fuels including

anthracite, bituminous coal and coal

slurry.

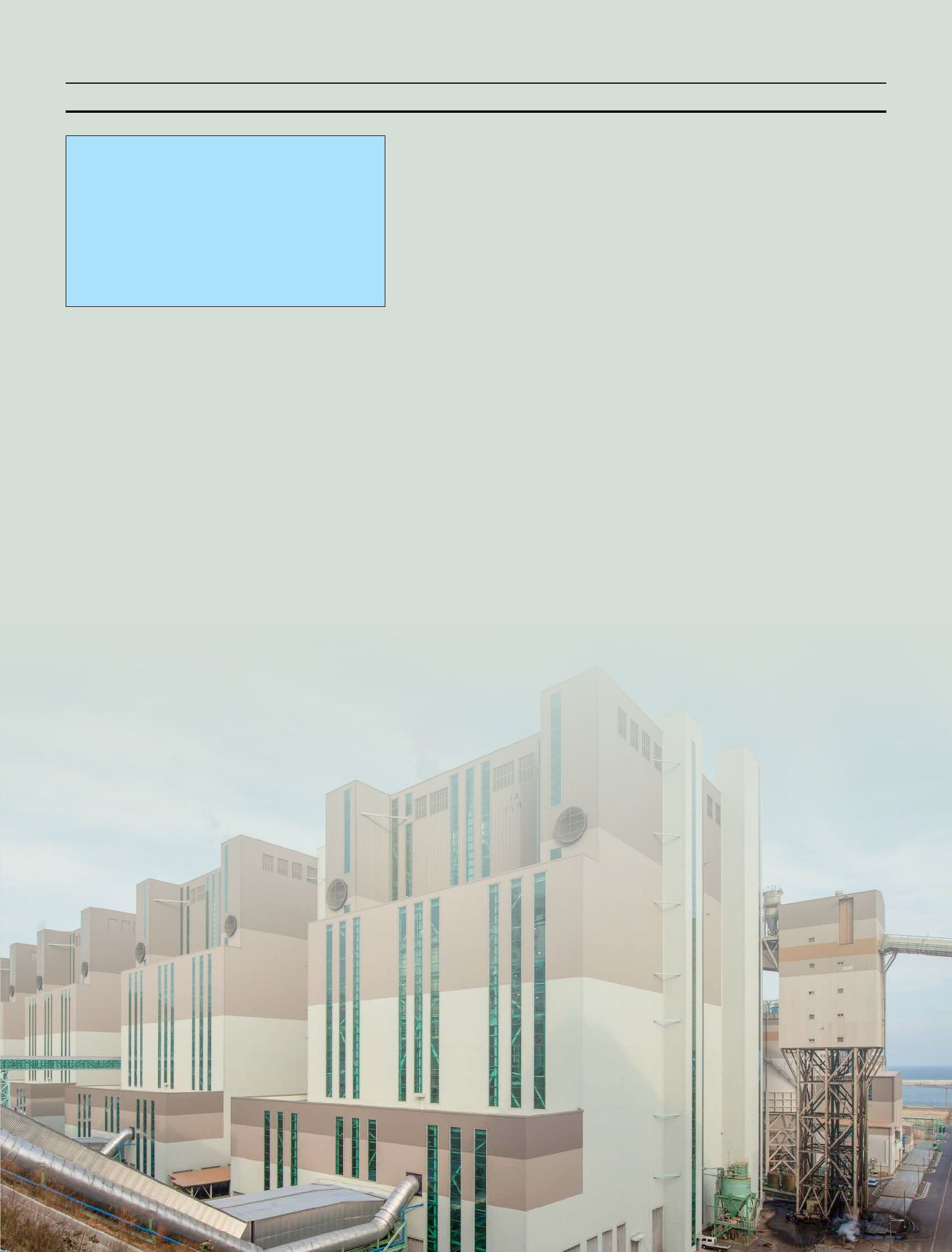

Notably, SFW took the next evolu-

tionary step in the design and scale-up

of its CFB boilers at the Samcheok

Green Power Plant in South Korea,

owned by Korea Southern Power

Company (KOSPO). These are the

most advanced supercritical circulat-

ing uidised bed boilers in the world,

capable of co-ring a wide range of

coals with biomass.

Each boiler at Samcheok is designed

to produce main steam at a tempera-

ture of 603°C and reheat steam at

603°C. Superheat steam pressure is

This is likely to be in the form of re-

cycled wood waste from the local

lumber industry and imported wood

pellets. The plant’s environmental

performance will be further improved

as more biomass is introduced to the

mix.

In the rst years of operation, the

Samcheok CFB plant has been ring

mainly Indonesian coals and domes-

tic biomass. KOSPO has begun ex-

ploring other fuel sources by test ring

US and Russian coals. SFW says the

plant’s full fuel exibility potential

will be realised over time

According to SFW, environmental

performance on these low rank coals

has also been “excellent”, meeting the

design limits. NOx and SOx emis-

sions are each guaranteed at 50 ppm

(at 6 per cent O

2

). Dust emissions are

controlled by an electrostatic precipi-

tator, so that particulates do not ex-

ceed 20 mg/Nm

3

. Carbon dioxide

emissions are around 800 g/kWh,

which is about 25 per cent below a

typical coal red plant in Korea.

Unit 1 has been operating success-

fully since late 2016 and Unit 2 since

June 2017. Samcheok is a good refer-

ence for India, as such units are in the

right size range and efciency for the

Indian market.

“Most of the plants that come online

are increasingly supercritical units,”

said Krishnan. “And if you look at the

projects that are on the drawing board

at this point, many of them are in the

500-660 MW range.”

The size of the opportunity in India,

however, is a function of how fast the

economy grows. As Krishnan notes:

“If it grows at 9-10 per cent, the need

for new capacity becomes more criti-

cal. And if it grows at 7 or 8 per cent,

it is essential but not as much. An-

other factor is the ageing of India’s

coal red eet as a number of plants

approach their end of life requiring

new capacity additions. So we are

looking at between 10 000-20 000

MW per year in additional capacity,

and a lot of that is going to be coal

red. Perhaps 20-30 per cent will be

renewables and hydro and 70-80 per

cent will be coal red.

“Renewables, especially solar, are

making inroads into the Indian market

but the country needs base load power,

and renewables in India are still unre-

liable and expensive in many parts of

the country. With the abundance of

local coal that is available in India, it

is very much at the forefront of all the

fuels. And SFW is the only one with

supercritical CFB units in the size

range that India is demanding.”

There is no doubt that CFB technol-

ogy is now at the point where it

matches the demands of the Indian

market much better than in the past.

As Giglio summarised: “In the past it

was not about the fact that the CFBs

could meet the emission limits with-

out the backend equipment, because

the emission limits didn’t exist before.

So the default choice was PC. Now

that’s been disrupted because they

now have to control the emissions

from these plants. The Indian market

is now at the point where it sees the

value of the CFB.”

Special Technology Supplement

SFW took the next evolutionary step in the

design and scale-up of its CFB boilers at

the Samcheok Green Power Plant in South

Korea

Samcheok design steam

parameters at 100 % load

SH steam ow (kg/s) 437.7

SH steam pressure (bar[g]) 257

SH steam temperature (°C) 603

RH steam ow (kg/s) 356.4

RH steam pressure (bar[g]) 53

RH steam temperature (°C) 603

Feed water temperature (°C) 297

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2019

13

Industry Perspective

I

n recent times, it has become

abundantly clear that something

must be done about climate

change. According to a recent Inter-

governmental Panel on Climate

Change (IPCC) report, global emis-

sions of carbon dioxide must peak

by 2020 to keep global warming be-

low 1.5°C. And with the energy sec-

tor responsible for 61.4 per cent of

global carbon emissions, people are

demanding large-scale action from

within the energy sector itself.

The detrimental effects of climate

change have put in motion an un-

precedented mass movement calling

upon governments, organisations

and businesses to take the lead. In

response to this demand for action,

the EU has proposed to cut its emis-

sions by 80-95 per cent by 2050

compared to 1990 levels. It’s a gar-

gantuan task in which digitalisation

plays a fundamental role.

While many solutions, both big

and small exist, only digitalisation

and technological innovations can

drive the renewables sector quickly

enough and on a large enough scale

to effect the changes required to

combat climate change. Digital inno-

vation and technologies must work

hand in hand to transform the world

we live in and bridge the gap be-

tween companies and this new digi-

tal world.

When it comes to combating cli-

mate change, there’s good news and

bad news. The good news is that car-

bon emissions are declining. Some

think they’ll be 20 per cent lower by

2050 than they are today, in relation

to the reference case. However, the

bad news is that they still remain far

away from the less than 2°C path-

way laid out in the 2016 Paris

Agreement.

Even in an accelerated scenario, it

is unlikely this 2°C goal will be

achieved unless extraordinary mea-

sures are taken, measures that in-

clude greater private investment and

data analytics support for more ef-

cient performance of clean power

production. Even as renewable ener-

gies like solar and wind are becom-

ing big global and protable busi-

nesses, carbon emissions continue to

be released into the atmosphere.

This is in spite of the fact that be-

tween 2014 and 2018 the average

yearly investment in clean energy

has been close to £245 billion ($300

billion). This jump in energy invest-

ment has been encouraged by lower

renewable energy costs that have

beat hydro, coal and gas options. In

fact, the most recent data available

suggests the lowest auction value for

wind and solar tariffs of under $25/

MWh in Mexico, Morocco and

Dubai show that exceptionally low

values can be translated into large

projects in countries with average

wind and solar conditions.

With a multiplicity of right loca-

tions with high wind or solar load

factors and low grid connection

costs, it is hard to believe that the

battle to decarbonise the planet is be-

ing lost.

The Internet of Things (IoT) and

Articial Intelligence (AI) are key to

changing the course of this battle

through their ability to maximise

both efciency and returns, while

providing greatly increased transpar-

ency. And that can only happen

when the management of the genera-

tion assets of the renewable sector

integrate both technical and nancial

aspects.

Although IoT is an unparalleled

source of data, it is AI that makes

this data actionable and operational-

ly functional. As AI processes data in

real-time, algorithmic decisions are

made and acted upon without any

time lag. It can also identify patterns

and undetected situations within the

data over time, which means predic-

tive and augmented analytics can be

applied to guarantee that any opera-

tion or function is running at maxi-

mum efciency.

The emerging Data as a Service

(DaaS) industry is becoming a criti-

cal link between investor and opera-

tor as well as producer and consum-

er. In the near future, other vital parts

of the system, like grid integration

and balance, blockchain, load man-

agement and storage, will be inter-

ceded by DaaS operators. Data plat-

form services are particularly

essential for maximising perfor-

mance of power generation by mini-

mising risks and costs while maxi-

mising returns. It is growing to the

extent that Statista suggests that the

market for DaaS and machine learn-

ing data preparation, something that

relies heavily on IoT, is expected to

reach $2.5 billion by 2023.

It is fundamental that this begins to

be applied more in the renewables

sector. In most industrialised coun-

tries, renewable energies already

represent around 15-25 per cent of

total power generation globally, most

of which is hydro. Looking into the

future, say by 2050, around 50 per

cent of all electricity produced will

be based on renewable sources.

Hydro will represent roughly 20 per

cent while more than half of that 50

per cent will be solar and wind.

Over the past 20 years, renewables

have grown from practically nothing

to close to 20 per cent average

worldwide. Some places may have

reached 80 per cent or more while in

others they are reaching 10 per cent.

But we will see a situation where

half of all power generated in the

world, say by 2050, will be entirely

driven by economics. By 2025, even

with the added costs of ‘system-inte-

gration’, where batteries or other

exible sources of power generation

are needed to complement them, re-

newables will be cost effective.

Data is the key to attracting the re-

quired capital to unlock the full po-

tential of renewable energy assets

that are driving the green energy

transition. A key obstacle facing the

renewables sector is a lack of invest-

ment due to the nancial and perfor-

mance risks associated with this type

of investment.

Despite the fact that digital tech-

nologies can provide unparalleled

security and transparency, in a recent

report published by DNV GL, 40 per

cent of nance industry respondents

said they were not using digital tech-

nology at all. The potential of the

technology must therefore be har-

nessed and showcased to investors to

demonstrate how they can provide

investment security, risk manage-

ment and portfolio management for

assets from anywhere and at any

time. Only this can change the nan-

cial sector’s reluctance to take ad-

vantage of new digital technologies.

This is especially pertinent now giv-

en that the viability of investment in

fossil fuels is plummeting, which is

helping to narrow the signicant

protability gap that had put off in-

vestors before.

Indeed, a recent study conducted

by McKinsey demonstrated that by

2050, almost 26 per cent of energy

will come from renewable resources,

and notably, 7 per cent will come

from wind and solar sources. More-

over, a BNP Asset Management

Study conducted this year found that

for the same capital outlay, wind and

solar projects will produce three to

four times more useful energy at the

wheels of electric vehicles than oil

will at $60/barrel for diesel-powered

vehicles. Renewables have become

much more than an ethical or moral

imperative; investment in clean ener-

gy sources is now grounded in cold,

hard economic logic and long term

protability.

The opportunities afforded to in-

vestors by the digitalisation of ener-

gy investment are two-fold. Firstly,

computing power is constantly in-

creasing and enabling greater levels

of AI and machine learning to build

the digital platforms and operators

that understand the investment situa-

tion on a local level. Further, thanks

to the IoT, the data available to these

computers for analysis is increasing

exponentially, which means that in-

vestments can be optimised more

readily and risks drastically reduced.

Digital platforms that mobilise AI

tools are able to process nancial in-

formation and create an all-inclusive

data package by aggregating techni-

cal, meteorological and nancial

data to create a database. This is then

used to provide digestible informa-

tion to investors in the form of KPIs,

thereby helping to maximise the per-

formance of assets and portfolios.

Such advances in the digitalisation

of energy allows for better decisions

to be made and automated, which

provides investors with greater lev-

els of transparency.

This condence in the guarantee of

returns on investment through great-

er investment security can only be

attained through the aggregation of

technical and nancial data stored in

digital platforms, and transmitted in

real-time to investors. The capabili-

ties of the IoT, machine learning and

AI to position renewables as a ratio-

nal, viable, and protable economic

investment are limitless.

The advent of digital platforms

and technological advances also

have the potential to impact every-

day consumers in vast and tangible

ways. It also means that energy con-

sumption is more controlled, ef-

cient and kept to reasonable levels.

This can also be applied in the mo-

tor industry. Rolling out smart charg-

ing technologies for electric vehicles

could help shift charging to periods

when electricity demand is low and

supply is abundant. This would pro-

vide further exibility to the grid

while saving $100-$280 billion in

avoided investment in new electrici-

ty infrastructure between 2016 and

2040.

The possibilities that the digitalisa-

tion of the energy sector presents are

endless. If we capitalise on digital

innovations we can gain insight into

optimised forecasting of asset per-

formance, lifetime and generation

level, which is something we have

never had before. Now more than

ever, the EU and other national and

supranational organisations and gov-

ernments have the digital solutions

and the incentive required to further

propel the renewable energy transi-

tion and increase the global market

for clean energy sources.

Hanno Schoklitsch is a Civil

Engineer and founder & CEO of

Kaiserwetter, an energy IntelliTech

company.

Digital innovation combined with technologies such as the Internet of Things and articial intelligence are key to

ensuring climate neutrality by 2050, says Hanno Schoklitsch

Schoklitsch: condence in the guarantee of returns on investment

can only be attained through the aggregation of technical and

nancial data stored in digital platforms, and transmitted in real-

time to investors

A digital approach to tackling

climate change

THE ENERGY INDUSTRY TIMES - SEPTEMBER 2019

16

Final Word

L

ightning doesn’t strike twice in

the same place, or so they say,

but it happens often enough for

grid operators to prepare for the even-

tuality. Yet the UK system seemed

unprepared for a set of circumstances

that caused widespread power cuts

that not only disrupted trains but also

left almost 1 million consumers, in-

cluding a hospital, without power.

According to UK grid operator Na-

tional Grid, a lightning strike was

partly to blame for what was the

country’s largest blackout in a decade.

Some, however, took the opportunity

to blame the event on the growing

amount of renewables on the network.

In the immediate aftermath of the

blackout, Justin Bowden, National

Secretary of GMB, the UK energy

union, said: “Whatever the nal out-

come of the blackout inquiry some

lessons should already have been

learned to make sure lightning doesn’t

strike twice.

“National Grid must make sure it

has enough spare capacity to cope

with unexpected outages – which will

only become more frequent as we

switch over to renewables. Reason-

ably priced, reliable energy is not an

optional extra in our low carbon fu-

ture, it is an essential right.

“The reliable, ultra-low carbon

electricity from new nuclear power

stations will be vital – not only during

the transition to a zero carbon world,

but to ensure continuity in our elec-

tricity supply once we get there.

Some green groups have yet to face

up to this reality.”

There is some basic logic to the argu-

ment. High volumes of renewable

energy make it more difcult for Na-

tional Grid to maintain the frequency

of the grid, which was originally built

to accommodate base load, predomi-

nantly fossil fuel, power plants.

Yet any call to return to conven-

tional generation sources and main-

taining the old ways is somewhat of a

knee-jerk reaction.

Lightning strikes are common in

National Grid’s infrastructure, which

is hit on average three times per day,

and rarely cause serious problems.

But National Grid said in an interim

report that a lightning strike on a

transmission circuit, followed by

“two almost simultaneous unexpected

power losses” at two power plants,

caused the disruption on August 9.

Problems on the grid started when

lightning hit part of the network near

Cambridge. This caused 300-400 MW

of capacity in the local electricity net-

work to go ofine. The outages at

Hornsea off-shore wind farm and Little

Barford gas power station, causing a

combined loss of about 1400 MW,

occurred independently but each was

associated with the lightning strike.

Analysts have speculated that Horn-

sea may have disconnected from the

grid if its safety systems were cong-

ured too sensitively to drops in fre-

quency. Ørsted, the wind farm owner,

acknowledged that a “technical fault”

had meant that the wind farm “rapidly

de-loaded”, but made no further com-

ment while it investigates the issue

alongside the energy regulator.

The scale of generation loss caused

the network’s frequency to drop, and

the level of backup power required

under the regulatory standards was

insufcient to cover the loss, the re-

port from National Grid Electricity

System Operator said.

As a result, the system automati-

cally disconnected customers on the

distribution network – resulting in

about ve per cent of electricity de-

mand being turned off to protect the

other 95 per cent.

“As generation would not be ex-

pected to trip off or de-load in response

to a lightning strike, this appears to

represent an extremely rare and un-

expected event,” said the report.

But how rare and “unexpected” was

it, really? According to the Mail on

Sunday, in April, National Grid pub-

lished research warning that using

more renewable power sources “posed

a threat to the network’s stability”. In

a report based on a £6.8 million re-

search project, National Grid admitted

that renewables increased the “unpre-

dictability and volatility” of the power

supply which “could lead to faults on

the electricity network”.

There is also precedent. In Australia

last year, a lightning strike caused the

Queensland and South Australian in-

terconnectors to trip simultaneously

on August 25, forcing electricity to be

cut to big industrial users and retail

customers in New South Wales and

Victoria. An ofcial investigation

found thousands of rooftop solar units

did not comply with Australian stan-

dards and has raised the prospect of

household rooftop solar panels being

retrotted to ensure they meet compli-

ance standards after some units failed

to adequately respond to the intercon-

nector outage.

And just a few weeks ago, the

Australian Energy Regulator said it

will take four South Australian (SA)

wind farm operators to court, accusing

them of failing to perform properly

during SA’s state-wide blackout in

2016. The allegations relate to the

performance of wind farms during the

severe weather event that swept across

SA in September 2016, which ulti-

mately triggered the outage.

The storms damaged more than 20

towers in the state’s mid-north, bring-

ing down major transmission lines and

causing a knock-on effect across the

state’s energy grid.

A report from the Autralian Energy

Market Operator (AEMO) released

about a month later found nine of 13

wind farms online at the time of the

blackout switched off when the trans-

mission lines came down.It found the

inability of the wind farms to ride

through those disturbances was the

result of safety settings that forced

them to disconnect or reduce output.

The blackout sparked a war of words

between supporters of renewable

power and those who blamed SA’s

high reliance on wind and solar gen-

eration as a contributing factor.

But there will always be those un-

willing to embrace change. Wind and

solar will indeed increase grid instabil-

ity – but let’s not forget that there have

also been signicant power cuts in the

past, long before wind and solar were

prevalent. No system is perfect. What

power providers and grid operator are

learning now, is that losing large, base

load generation can be a problem, if

not planned carefully.

Lessons are being learned and it will

take time to make the adjustments.

National Grid has developed a fre-

quency ‘monitoring and control sys-

tem’ to deal with issues arising from

the drive to renewables. It should be

operational by 2025 when it expects

to have moved to a ‘zero carbon’

electricity system.

A spokesman for National Grid said:

“As we move to a more renewable

system we are creating new markets

and products to manage this effec-

tively. We are condent we will be able

to operate Britain’s electricity at zero

carbon by 2025 with a safe and resil-

ient network, given the right regula-

tory framework and incentives.”

Jeremy Nicholson, an expert at en-

ergy consultancy Alfa, said: “This is

not about wind being unreliable. It’s

about having the right system in place

to accommodate it. It’s a question of

doing it safely.”

John Pettigrew, National Grid’s

Chief Executive, described the out-

age as a “once-in-30-years” event and

said there was “nothing to indicate

that it was anything to do with the fact

that we are moving to more wind or

more solar”.

Indeed, renewable energy in itself

should not be blamed for blackouts, or

used as an excuse by some to stick with

conventional, polluting generating

sources. And in any event, it is a moot

point; the renewables ship has already

set sail. But what governments must

do now, is accelerate the transition of

networks through the use of storage

and demand response schemes etc., to

create a more dynamic system that is

both resilient and meets climate

change ambitions. Hoping for light-

ning strikes to not coincide with other

infrequent events is no plan at all.

Lightning could strike

twice…

Junior Isles

Cartoon: jemsoar.com