www.teitimes.com

August 2019 • Volume 12 • No 6 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Smoothing the

energy landscape

High time for

hydrogen

Flexible generation is smoothing

Europe’s transition to a renewable

energy future. Page 13

Hydrogen has had its share of false

starts in the past. The IEA believes this

time could be different. Page 14

News In Brief

Energy transition

accelerates, as clean energy

investment falls

Renewable energy technology

advances, innovation in storage

and digitalisation and increased

distributed energy generation are

accelerating the pace of the global

energy transition, according to the

latest EY research.

Page 2

ITC extension “critical” for

offshore sector

Proposals to extend nancial support

for the US offshore wind energy

sector have come at a “critical time”

for the industry, according to the

American Wind Energy Association.

Page 4

India assesses optimal 2030

energy mix

In an optimal generation system,

non-fossil fuel sources could

generate almost 50 per cent of

India’s electricity in 2030.

Page 5

Elia warns of capacity

shortage

Belgian grid operator Elia says

it envisages increasing capacity

shortages in the country as a result

of the planned nuclear exit.

Page 7

Saipem targets Saudi for

oating wind

Saudi Arabia could emerge as a key

market for oating offshore wind

energy after Sapiem and Plambeck

Emirates signed a deal to build 500

MW of capacity in the Kingdom.

Page 8

Tractebel leads innovative

offshore PV drive

Floating offshore solar photovoltaic

farms could be the next step

in offshore renewable energy

technology, according to a new

international consortium.

Page 9

Technology: CCS gets some

new chemistry

A new process for capturing carbon

dioxide is being demonstrated at

a pilot project at the Drax power

station in the UK.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

As the UK looks set to miss its CO

2

emissions reduction targets, the government’s climate

change advisory group says the next 12-18 months are crucial. Junior Isles

New EU presidency will maintain pressure on climate change

THE ENERGY INDUSTRY

TIMES

Final Word

Back to the future is here

already, says Junior Isles.

Page 16

The UK’s credibility on climate

change hinges on government action

over the next 12-18 months, according

to the Committee on Climate Change

(CCC). The warning came as there

were calls for the UK to maintain its

commitment to achieving net zero

emissions by 2050 following a recent

change in political leadership.

In its annual progress report, the

statutory climate advisor said the

UK’s net zero target would require

strengthening of the current 100

grammes of carbon dioxide per kilo-

watt-hour (CO

2

/kWh) power industry

carbon intensity ambitions. It also

urged the UK government to target

power sector emissions of below

50gCO

2

/kWh by 2030.

The CCC’s scenarios for 100gCO

2

/

kWh require around 270 TWh of low-

carbon generation to be online by

2030. The CCC said 180 TWh has

already been built or contracted and a

further 75 TWh could be achieved by

delivering the 30 GW ambition in the

offshore wind sector deal, leaving a

gap of 15 TWh.

However, a 50gCO

2

/kWh carbon in-

tensity target would add 45-50 TWh to

the gap in 2030, leaving a total of

around 60 TWh additional uncon-

tracted low-carbon generation re-

quired during the 2020s.

The CCC said the forthcoming en-

ergy White Paper should aim to sup-

port a quadrupling of low-carbon

electricity by 2050. The CCC also

called on the government to draw up

contingency plans for delayed or can-

celled low-carbon power projects.

The government has been urged to

make plans for networks to be capable

of meeting higher demand for electri-

cal energy. The body found the UK

has delivered just one of 25 critical

policies needed to get emissions re-

ductions back on track.

CCC chairman Lord Deben said it is

time for the government to show it

takes its responsibilities seriously,

stressing that reducing emissions to

net zero by 2050 requires real action

by government now.

The UK became the rst leading

economy to adopt a net zero emissions

target in June. However, it is set to

overshoot its carbon emissions targets

and could face lawsuits for missing

the country’s legally binding quotas

starting in 2023, warned the CCC.

In its annual Progress Report to par-

liament, published last month, it said

the government has failed to enact

policies to reach the new goal, and that

action during the next 12-18 months

would be critical. The report came as

Boris Johnson replaced Theresa May

as Prime Minister and leader of the

Conservative party.

Commenting on the news, Dr Nina

Skorupska CBE FEI Chief Executive

at the Renewable Energy Association

said: “Coming into this role, Boris

Johnson has a lot of work ahead of

Continued on Page 2

Hopes of the EU reaching an agree-

ment on achieving net zero carbon

emissions by 2050 look more promis-

ing with Finland assuming the EU’s

rotating presidency at the start of July.

Finland has a national climate target

of full carbon neutrality by 2035. It is

also a country in which green politi-

cians hold some of the highest ofces

of state, including the posts of foreign

minister and interior minister. Taking

on the presidency gives it consider-

able power to steer the bloc’s work

over the coming six months.

Some are hoping that Finland’s

strong climate change stance can

help push through a EU 2050 net

zero agreement.

Krista Mikkonen, the country’s en-

vironment minister, said her govern-

ment is committed to reforming

Finnish and EU climate policies. She

will, however, have to win over

Czech Republic, Hungary and Po-

land, who refused to endorse the tar-

get at an EU summit in June, citing

economic and social concerns. Esto-

nia also withheld its support from a

joint text.

Poland has since softened its posi-

tion. Minister Tomasz Dąbrowski

later said: “We will probably sub-

scribe to this target, it’s just we need

to know what the cost will be, and in

what way we can mitigate the social

impact of the whole transformation.”

Dąbrowski reiterated Poland’s po-

sition at the FT Energy Transition

Strategies conference in London,

UK. “For Poland to accept an EU-

wide net zero target would require

some kind of compensation mecha-

nism that would be equivalent to the

costs we have to bear or at least very

close,” he said. The issue will be re-

visited by EU leaders at the end of

the year, he added.

Carbon prices reached an all-time

high in July as polluters and specula-

tive investors scrambled for credits

amid an environmental crackdown

from the EU. The price of one carbon

credit allocated under the EU’s

Emissions Trading Scheme hit a re-

cord €29.27 in July, double the level

of January last year and almost 20

per cent higher than the start of this

year.

The rise has come as the total issu-

ance of 950 million credits last year is

expected to drop to about 550 million

this year. At the same time there is a

continuing bullish political backdrop

on environmental policy. Ms von der

Leyen, the newly elected President of

the European Commission, promised

environmentally friendly policies in-

cluding carbon neutrality by 2050, a

new EU carbon border tax and a green

deal on investment within her rst

100 days in ofce. She will assume

ofce on November 1st.

Next 12-18 months

will determine UK

climate change

credentials

Under scrutiny: UK Prime Minister Boris Johnson

must not let climate change commitment slip

THE ENERGY INDUSTRY TIMES - AUGUST 2019

3

3-5 SEPTEMBER 2019 | MITEC | KUALA LUMPUR | MALAYSIA

REGISTER FOR ASIA’S PREMIER

POWER INDUSTRY EVENT

Organised by:

11,000+

Attendees

350+

International

Speakers

350+

Leading Exhibitors

Cutting

Edge Content

VISIT WWW.POWERGENASIA.COM OR WWW.ASIAN-UTILITY-WEEK.COM

The co-location of POWERGEN

Asia, Asian Utility Week,

DISTRIBUTECH Asia, SolarVision

and Energy Capital Leaders Asia

provides you with one show

covering the whole value chain

of power - from generation to

transmission and distribution to

its digital transformation.

Here you will discover the

future of Asia’s Power &

Energy industry.

REGISTER

ONLINE

TODAY FOR

FREE ACCESS

DIGITAL

TRANSFORMATION

TRANSMISSION &

DISTRIBUTION

POWER

GENERATION

SOLAR

POWER

ENERGY

CAPITAL

Endorsed by:

Host Utility

Partner:

1044_PGA19_160mmx120mm port.indd 1 7/16/19 7:33 PM

17 – 18 SEPTEMBER 2019

KICC, Nairobi, Kenya

JOIN US AT THE LEADING ENERGY

CONFERENCE AND TRADE EXPO

POWERING EAST AFRICA FORWARD

1800 +

visitors

80+

exhibitors

15 +

countries

represented

Secure valuable business opportunities and be seen as a leader in the East

African power and energy sector. Contact Ade Yesufu for more information.

Ade Yesufu T: +27 21 700 3574 | E: ade.yesufu@spintelligent.com

The 12th Energy Storage World Forum: 8-10 October 2019, Rome will feature speakers from 16 Utilities, 2

IPPs, 2 C&Is, 7 Regulators from 19 countries. Join them for a fun-filled evening at the Pool Deck of

Sheraton Roma Hotel on 8 Oct 2019 for a Gala Dinner to mingle with more attendees from companies such

as TENNET, TRANSNET, TERNA, EKZ, KEPCO and UKRENERGO.

We have partnered with the Energy Storage World Forum who have kindly given our readers a 10%

discount to attend their event

! Buy a ticket NOW and insert the promotion code PARTNER_ROME

✔ Download a Full Programme Here and be familiar with the 3 most wanted speeches according to their

research. Here they are:

THE ENERGY INDUSTRY TIMES - AUGUST 2019

5

Asia News

The Central Electricity Authority

(CEA) has released a draft report on

India’s optimal generation capacity

mix for the year 2029-30.

The report, which was open for com-

ments until July 31st, is a study pri-

marily aimed at nding out the least

cost-optimal generation capacity mix,

which may be required to meet the

peak electricity demand and electrical

energy requirement of the year 2029-

30 in line with the 19th Electric Pow-

er Survey.

Notably, the report points out that

the capacity expansion for coal-based

projects is not signicant as compared

to solar and wind capacity additions.

It is projected that solar and wind ca-

pacity will be 300 GW and 140 GW,

respectively by the end of the year

2029-30, which is more than 50 per

cent of total installed generating ca-

pacity of 831 GW.

It also said the cost trajectory for

battery energy storage system is as-

sumed to be falling uniformly from

Rupees70 million ($1.2 million) in

2021-22 to R43 million in 2029-30 for

a 4-hour battery system, which also

includes an additional cost of 25 per

cent due to the depth of discharge. The

operation and maintenance (O&M)

cost for the battery energy storage

system has been considered as 2 per

cent.

The report projects that non-fossil

fuel (solar, wind, biomass, hydro and

nuclear)-based installed capacity is

likely to be about 65 per cent of the

total installed capacity and non-fossil

fuels will contribute around 48 per cent

of the gross electricity generation in

the year 2029-30.

The report comes as India begins

preparing a road map for the power

sector, known as the ‘Vision Document

for Power Sector for the next Five

Years.

In order to help India meets its tar-

gets and ensure states provide reliable

and affordable electricity to consum-

ers, the power ministry recently pro-

posed a “power sector council”. The

proposal is part of the ministry’s 100-

day action plan for the second term of

the Narendra Modi government. The

council will comprise the political

executive as well as the energy bu-

reaucracy’s power sector to tackle

issues between the Union and state

governments.

The proposal also comes against the

backdrop of the ongoing crisis in dis-

tribution companies caused by their

poor nancial health, which has led to

delayed payments to power genera-

tion utilities.

n In the latest budget announcement,

the Gujarat government announced it

plans to increase its target for power

generation capacity from renewable

sources to touch or surpass 30 GW by

2022. The state government has set its

sights on tripling its renewable gen-

eration capacity over the next three

years, and also envisions selling close

to 10 000 MW of the generated pow-

er to other states. Gujarat also plans

to launch a rooftop solar power gen-

eration scheme for slum areas.

India assesses 2030

energy mix

In an optimal generation system, non-fossil fuel sources could generate almost 50 per cent of India’s electricity in 2030,

according to a recent CEA draft report. Syed Ali

South Korea will build the world’s

largest oating solar farm in a fresh-

water lake next to Saemangeum, a

reclaimed area on the west coast, the

government said in July.

The Ministry of Trade, Industry and

Energy said the project to build a 2.1

GW solar farm on the lake that spans

30 km

2

was approved in an electricity

committee meeting, with the project

estimated to cost Won4.6 trillion ($3.9

billion).

Work on the solar farm is expected

to start in the latter half of 2020 fol-

lowing regulatory review processes,

the Ministry said. The plant will be

built in two stages – a 1.2 GW rst

stage, expected to be completed in the

fourth quarter of 2022, and a 900 MW

second stage to be completed in 2025.

If the facility is built as planned, it

would be 14 times the size of the

world’s largest oating solar farm in

China’s Huainan and 1.6 times the

combined capacity of the global oat-

ing solar facilities for all of last year,

the ministry said.

The project is expected to bring the

government closer to the goal of its

renewable energy initiative, which

aims to nearly triple the portion of re-

newable energy to 20 per cent by 2030.

The roadmap calls for adding 30.8

GW of solar and 16.5 GW of wind

power to have a total renewable ca-

pacity of 63.8 GW by 2030, which

would require vast spaces across the

nation.

A strategic agreement struck between

Three Gorges Power Energy Manage-

ment Co., Ltd., Tianda Energy (Shen-

zhen) Co., Ltd., Shenshang Technol-

ogy (Shenzhen) Co., Ltd. and

Ideanomics Inc. last month illustrates

the role China’s power companies

could play in broadening decarbonisa-

tion beyond their own sector.

Under the agreement, the partners

will work to promote and distribute

methanol, and hydrogen-based EV

fast-charging solutions, into existing

fuel station networks, as well as resi-

dential and industrial areas.

These new energy management so-

lutions will be part of an integrated

network access that includes large

industrial and commercial com-

pounds, as well as other areas of ve-

hicle concentration throughout China

and the ASEAN region.

The partnership’s directive is to de-

velop technology to facilitate the shift

away from petrol and diesel fuelled

vehicles, while developing more con-

venient fuel charging areas in addition

to utilising the extensive network in-

frastructure of fuel stations so that

these assets are redeveloped over time

and not simply abandoned.

Three Gorges Power Energy, the

world’s largest hydroelectric power

company with signicant cash re-

serves, will provide the nancing

capital, additional operation teams,

and the technical resources for energy

IoT solutions, intelligent operation and

maintenance solutions, smart power

solutions, comprehensive energy solu-

tions, and nancing resources that will

include, but not limited to, Three

Gorges Capital Group.

Tianda Energy (Shenzhen) will pro-

vide operational teams and technical

resources for cold storage technology,

and the resources for the external con-

nections such as attachment and con-

duit technologies, as well as other

channel resources.

Ideanomics, through its NECV divi-

sion, will provide client acquisition,

strategic sales and marketing services,

as well as other advisory services.

Alf Poor, CEO of Ideanomics, said:

“This latest partnership enables us to

participate in the lucrative after market,

including spare and replacement fuel

cells, and the recurring revenue streams

from the fast charging station networks

we will help to develop and imple-

ment… Three Gorges is one of the

world’s largest energy companies,

bringing tremendous expertise and re-

sources at scale. Their Hubei division,

along with the other partners in this

deal will see us begin to move into EV

infrastructure and the long-term reve-

nues offered by charging networks and

energy management systems.” He

added: “The fast charging technology

that NECV is working with aims at

cutting charging time from the current

charge of 30 minutes to between 5-10

minutes.”

Vietnam could face an electricity short-

age of 6.6 TWh in 2021 and 11.8 TWh

in 2022. The shortage could increase

to 15 billion kWh in 2023, according

to the Ministry of Industry and Trade

(MoIT).

The potential shortage is due to de-

layed progress in 47 out of 62 power

projects with capacities of more than

200 MW in the Vietnam Power Mas-

ter Plan VII, according to Phuong

Hoang Kim, Director of the Ministry’s

Electricity and Renewable Energy

Authority.

Deputy Minister of Industry and

Trade Hoang Quoc Vuong said the

main reason for the delayed progress

was due to capital and contractor is-

sues. Power projects are often on a big

scale with total investment of more

than $2 billion each and long construc-

tion times. Therefore, it was not easy

to nd capable contractors. In addition,

the removal of the government guar-

antee mechanism for power projects

has made it difcult to raise capital.

In addition, it took a long time for

BOT projects to negotiate power pric-

es with EVN to ensure their prots,

thus causing delays. Vuong also said

that prolonged land clearance and low

power tariffs were not attractive

enough for investors.

Although it is expected that the coun-

try will still meet its power demand in

2020, he said there would be risks of a

shortage if demand is higher than fore-

cast, water ow to hydropower reser-

voirs is poor, or there is a lack of coal

and gas for electricity production.

To partially mitigate the problem, the

Ministry said it would increase elec-

tricity imports from Laos and China.

Increasing electricity imports is only a

temporary solution, however, and the

Ministry stressed the need to speed up

work on major power projects.

Several projects have come on line

in recent weeks. The 49.5 MW Cat

Hiep solar power plant was ofcially

inaugurated in Binh Dinh’s Phu Cat

district on July 12, 2019, becoming the

rst of its kind in the south central

coastal province to join the national

grid. In June, Xuan Tho 1 and Xuan

Tho 2 solar power plants were also

inaugurated, each adding 49.6 MW to

the grid. The 40.6 MW BCG - CME

Long An 1 solar power plant was also

started up in June.

n Gelex Energy Ltd has started con-

struction of two wind power plants

with a total capacity of 50 MW in Hu-

ong Phung commune, Huong Hoa

district of the central province of

Quang Tri.

S. Korea to

build world’s

largest oating

solar farm

China gears up for fast EV

charging and hydrogen

Power shortages on the horizon

THE ENERGY INDUSTRY TIMES - AUGUST 2019

6

UK’s Leading Event for Energy & Water Eciency

ENERGY

FROM

WASTE

ENERGY

EFFICIENCY

TECH

SMART

WATER

INNOVATION

ZERO

EMISSIONS

ZONE

THE

RENEWABLES

ZONE

11 & 12

SEPT 2019

NEC

BIRMINGHAM

CONTAMINAT

ION

EXPO SERIES 2019

Register for your FREE TICKETS at www.futureresourceexpo.com

#FutureResource19 @FutureResource_

FUTURE

I.O.T

6 DEDICATED ZONES • 3000 INFLUENTIAL VISITORS • 200 LEADING EXHIBITORS • 80 CPD SEMINARS

D U FN

2019

NUCLEAR DECOMMISSIONING

& USED FUEL STRATEGY SUMMIT

6TH ANNUAL FOCUSED

CONFERENCE & EXHIBITION

30 SEPT - 1 OCT 2019

THE RITZ-CARLTON HOTEL, CHARLOTTE, NC

SPEAKERS AND SPONSORS INCLUDE:

7–8 November 2019

Belgrade, Serbia

Organised by:

3

rd

Аnnual International Summit and Exhibition

+44 207 394 30 90 (London)

events@vostockcapital.com

www.hydropowerbalkans.com

STRATEGIC

PLENARY SESSION:

What are mid- and

long-term hydropower

development strategies

in the Balkan countries?

What are challenges

and opportunities for

hydropower industry

development?

SPECIAL FOCUS!

Updates and the latest

information on major

projects for HPPs

construction and

renovation in the Balkan

region within 2020-2025

implementation

period

CASE STUDIES

from companies

successfully carrying

out the construction,

modernisation and

operation of HPPs across

the region

EXCLUSIVE

EXHIBITION:

innovative solutions

and equipment in the

context of greenfield and

brownfield development

ROAD SHOW:

Innovative technologies

and equipment for

hydropower development

UNPARALLELED

NETWORKING

OPPORTUNITIES:

gala dinner, exhibition,

champagne roundtables,

and face-to-face

meetings

SUMMIT HIGHLIGHTS 2019

Silver Sponsor 2018: Bronze Sponsor 2018:

Among participants 2018:

THE ENERGY INDUSTRY TIMES - AUGUST 2019

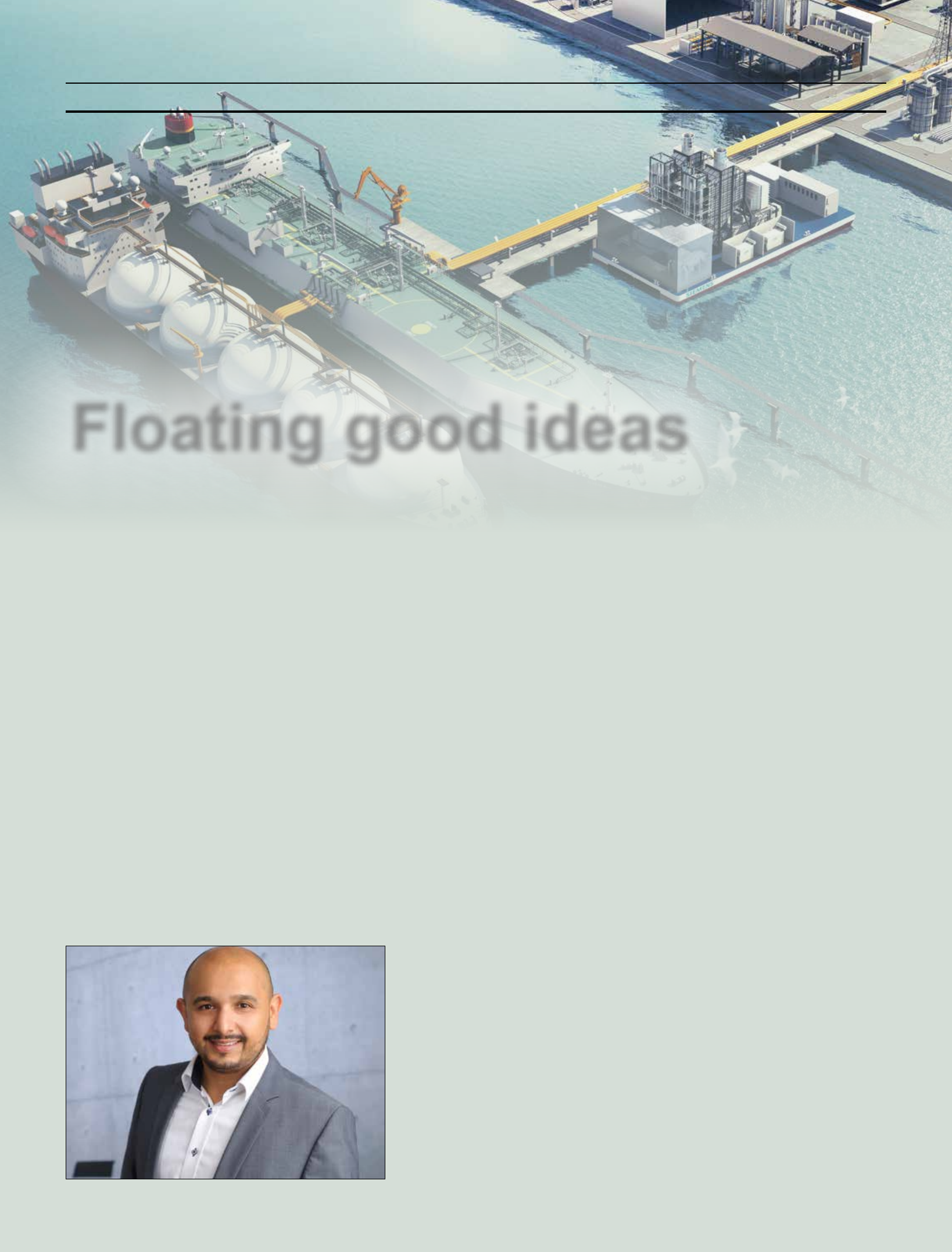

Special Technology Supplement

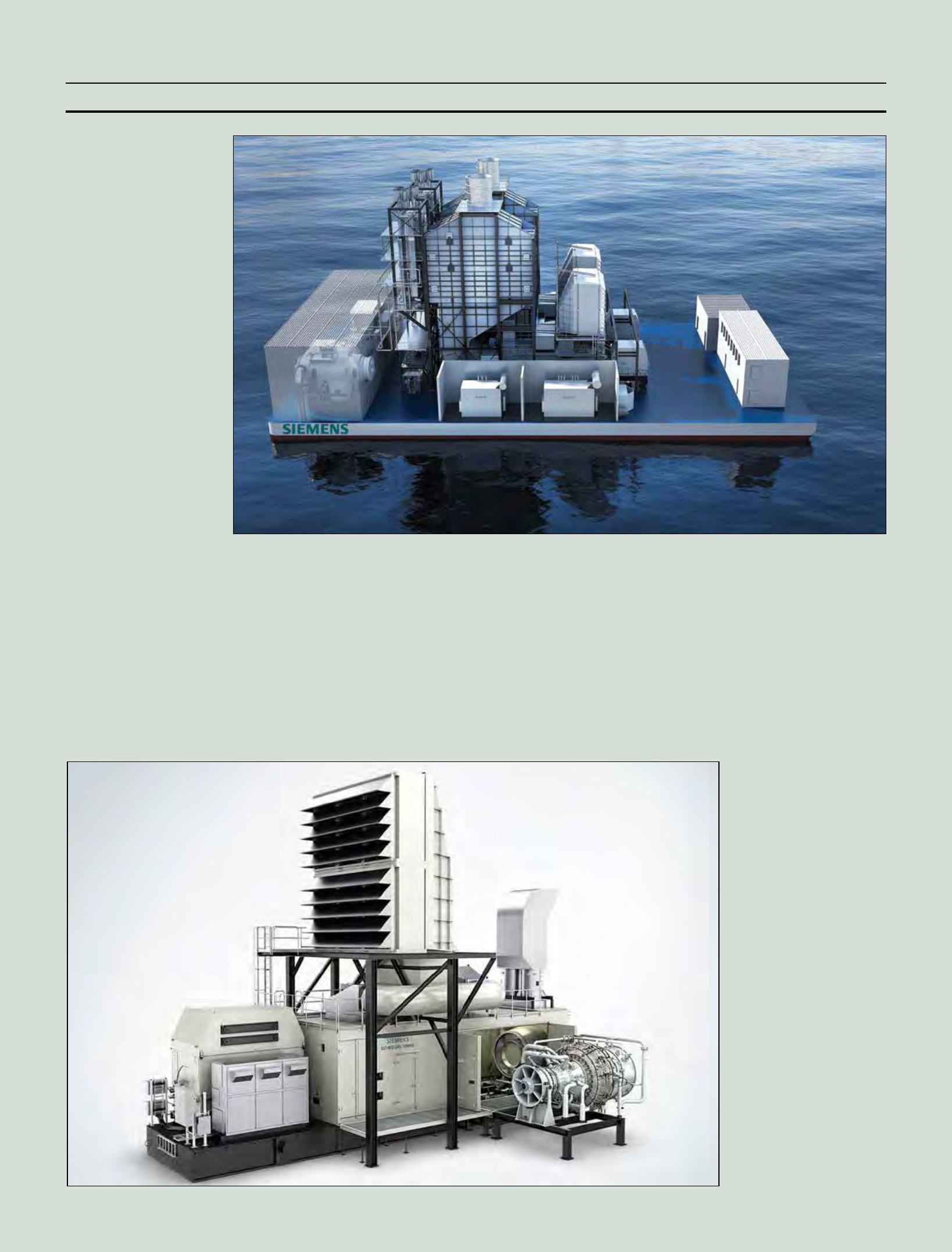

Floating good ideas

Having a power plant that can be moored near-shore or on a river has many advantages. With its new SeaFloat

concept, Siemens has resurrected the idea of oating power plants but this time with the possibility of putting almost

any of its high efciency land-based gas turbine plants on a barge. Already, the rst order has been secured for the

Dominican Republic – a project that will also feature battery storage. Junior Isles

market is desperately screaming for

the SGT-800, not only because it is a

technology frontrunner but because

of the various congurations that are

possible. You can use it for new

power generation installations based

on LNG, and expansion of industrial

applications in remote coastal areas.

“For a peaker, or fast-start plant; i.e.

start-up in less than ve minutes in

cold conditions or less than two min-

utes under hot conditions, the SGT-

A65 is the right solution.”

Because of its size, the SGT-8000H

would be best deployed in situations

where a large amount of bulk power

is needed, and space is limited but the

grid is stable. Hossain said: “It’s not

possible to take an H-class unit capa-

ble of 620 MW or 1.3 GW in a 2-on-1

conguration and feed it into a weak

grid in a developing country but in

these cases we could offer our trans-

mission grid stability solutions. And

the H-class would have advantages. If

for example, you want to replace a

large coal red power plant in a region

that has a more stable grid, with a

more efcient, lower emissions plant,

here the H-class is the right t.”

He noted that customers in countries

with labour challenges or those want-

ing to avoid the time and effort in-

volved in obtaining permits to install

land-based plants, are interested in

installing SeaFloat plants.

Project risk resulting from brown-

eld activities such as demolition

works, site levelling activities, re-

location of existing structure, etc.,

can be avoided when replacing old

plants. As the barges are built at

modern shipyards, the project sched-

ule does not depend on availability

of qualied labour and infrastructure

at the nal location. According to

Siemens, this can cut construction

time by 20 per cent.

Siemens believes it is the simple

plug and play, connect and go, possi-

bility that makes SeaFloat plants so

attractive.

The concept allows fast and easy

installation at shipyards. A SeaFloat

plant, with the SGT-800 in particular,

has a high degree of modularisation,

where delivery of pre-assembled and

pre-tested plant modules minimises

T

he idea of oating gas red

power plants is not a new one.

But rising global population,

many of which are moving to live in

megacities, where land is limited and

expensive, could see the resurgence of

these mobile power plants. Certainly

Siemens sees this as one of the key

drivers behind the development of a

new oating combined cycle power

plant concept it calls SeaFloat.

According to Siemens, SeaFloat

technology combines state-of-the-art

combined cycle power plant technol-

ogy with the mobility and exibility

required by the current and future

energy market.

Explaining why he thinks the mar-

ket is now right for SeaFloat, Hamed

Hossain, Business Owner SeaFloat

Power Plants, Siemens Gas and

Power, said: “In the mid 90s, oating

power plants were becoming popular.

At the time, Westinghouse (later

bought by Siemens) was building

oating power plants with gas tur-

bines operating in open cycle. How-

ever, we saw an increase in oil and gas

prices, which meant it was not worth

building these plants anymore be-

cause of their low efciency.”

“Now it’s different. We are building

state-of-the-art combined cycle power

plants with really high efciency,

which means if oil and gas prices in-

crease even more then it’s still

worthwhile, economically. And if

prices fall, we can use open cycle

plants. So we have all the technology

that’s available for land-based power

plants on a oating structure. This

allows exibility on plant congura-

tion, since installations are less af-

fected by fuel price.”

The real impetus to re-boot the idea

of oating power plants, however,

came about three or four years ago in

response to market demand. Hossain

said: “Customers were asking: ‘can

you supply your technology on a

oating device?’ So we decided to do

it again. Two and a half years ago,

when we saw that the market was re-

ally pushing for it, we set up an entity

within Siemens to specically focus

on it.”

Hossain sees SeaFloat as a technol-

ogy that essentially gives customers

more options when it comes to locat-

ing power plants, i.e. they can be built

on water when land is too expensive

or unavailable, and in locations where

there is a high country risk.

The technology has numerous ap-

plications, such as: powering up re-

mote areas like islands; development

of industrial areas on shorelines or

major rivers (for example, chemical

and desalination plants); the replace-

ment of out-dated plants, allowing the

existing plant to continue operating

until the new one is in place and ready

to be connected to the grid.

SeaFloat power plants, which can

provide from 145 MW up to 1.3 GW,

can also be used as emergency backup

for existing power plants during peak

loads or outages and to provide power

supply in the event of a humanitarian

disaster.

Another area where Siemens an-

ticipates great demand is in the oil

and gas sector. “We are in contact

with all the oil and gas majors. Our

portfolio is to put our power plants

on FSRUs (oating storage regasi-

cation units),” said Hossain. “Look-

ing at FPSOs (Floating Production

Storage and Ofoading vessels),

traditionally they all use open cycle

plants, which have higher emissions

relative to power output compared to

combined cycle plants.

Installing a power plant for this ap-

plication has its challenges, however.

Although the SeaFloat power plant is

compact and has a high power density,

for an oil and gas platform, the weight

and footprint has to be reduced even

further. For a platform it should also

be easy to install and have a high de-

gree of modularisation.

“This is how we came up with the

ultra-light oating combined cycle

power plant, which is part of the

SeaFloat portfolio,” said Hossain.

“It’s a major game changer; we have

reduced the weight and footprint of

the power plant by more than 50 per

cent compared to combined cycle

power plants already installed on

existing platforms.”

Installing a SeaFloat plant would

certainly help oil and gas majors im-

prove their green credentials and

lower the cost of emitting carbon. In

a country or industry where CO

2

prices are high, of the order of €50/t,

the savings can be signicant.

“Putting a combined cycle plant on

an oil and gas platform or FPSO could

reduce CO

2

footprint by 80 000-110

000 t/annum. This translates to high

single digit millions of euros in sav-

ings from CO

2

taxes and certicates

each year,” said Hossain.

Siemens currently offers SeaFloat

power plants based on three main gas

turbine technologies – the SGT-800,

SGT-A65 and the SGT-8000H series

– but says it is not limited to these

machines. “In addition to these, we

also have the SGT-750, SGT-A35

(formerly the RB211), which will be

for the oil and gas market,” noted

Hossain.

With the three initial technologies

on offer, Siemens says it can address

the majority of the market require-

ments it has seen so far. The turbines

were selected following careful mar-

ket analysis, an examination of the

advantages of each turbine and ac-

cording to feedback from customers

and developers that have contacted

Siemens.

Each of the three gas turbine solu-

tions has its own benets. Hossain

explained: “The SGT-800 solution is

our frontrunner. Two thirds of the

Hossain: Customers were

asking, ‘can you supply your

technology on a oating

device?’

(HGI) and major overhaul (MO) at

every 30/60 000 equivalent operating

hours (EOH).

The SST-600 steam turbine (ST) is

also provided as a pre-assembled and

system tested single-lift package on a

3-point mount base frame. It has a

weight of about 475 t. The steam tur-

bine single-lift package consists of

steam turbine, condenser with evacu-

ation systems, generator and genera-

tor switchgear. It has a size of 25 m x

7.0 m x 5.5 m (length, width, height).

The Once Through Steam Genera-

tor (OTSG) will be provided as a

package with maximum modulari-

sation. This modular approach has

been applied in dozens of units

worldwide and, says Siemens, results

in safer and better quality fabrication

under optimised shop conditions. The

arrangement enhances faster and

smoother installation at the shipyard.

The steel structure for the OTSGs is

designed as one combined block, so a

rigid structure is formed to withstand

marine environment conditions.

The OTSG package has a weight of

approximately 665 t. The SCC-800

2-on-1 plant conguration has a size

for the OTSG combined structure of

14 m x 23.6 m x 28 m (length x width

x height).

The entire power plant can be in-

stalled under various commercial

models, including straightforward

sale and various lease options. “We

are open to all options,” said Hossain.

“At the moment the market is asking

more for sale options, where the

the manpower required at the con-

struction yard and the hook-up time

at place of operation.

The SGT-800 combined cycle

SeaFloat can be provided in SCC-

800 2+1, 3+1 or 4+1 congurations

to produce 150-450 MW. The SCC-

800 2x1 has a length of 55 m and

width of 30 m. According to Siemens,

these plants are an excellent choice

for providing baseload power to

public or industrial grids, as well as

for oil and gas applications. They

offer broad exibility in fuels, oper-

ating conditions, maintenance con-

cepts, package solutions, and ratings.

The plant is designed to withstand

near-shore conditions, with equip-

ment intended for on-board installa-

tions based on international codes and

standards valid for power plants.

Certain modications are imple-

mented to suit the marine environ-

ment with respect to, but not limited

to air intake lters, materials, surface

treatments and protection against

water ingress and corrosion. Move-

ments and deection are addressed by

particular technical modications.

Hossain noted: “SeaFloat is not

re-inventing the wheel; it’s not

rocket science for the Gas and Power

business. It is the same technology

we use on a land-based plant that has

been optimised for a oating device.

You could look at it as a power plant

with a moving foundation. This

means it has roll, pitch and accelera-

tion; and the hull of the oating de-

vice has deections. When you want

to build a power plant on top of a

foundation that is bending and mov-

ing up and down, you have to ensure

your equipment can withstand the

roll and pitch, acceleration, as well

as the deection.”

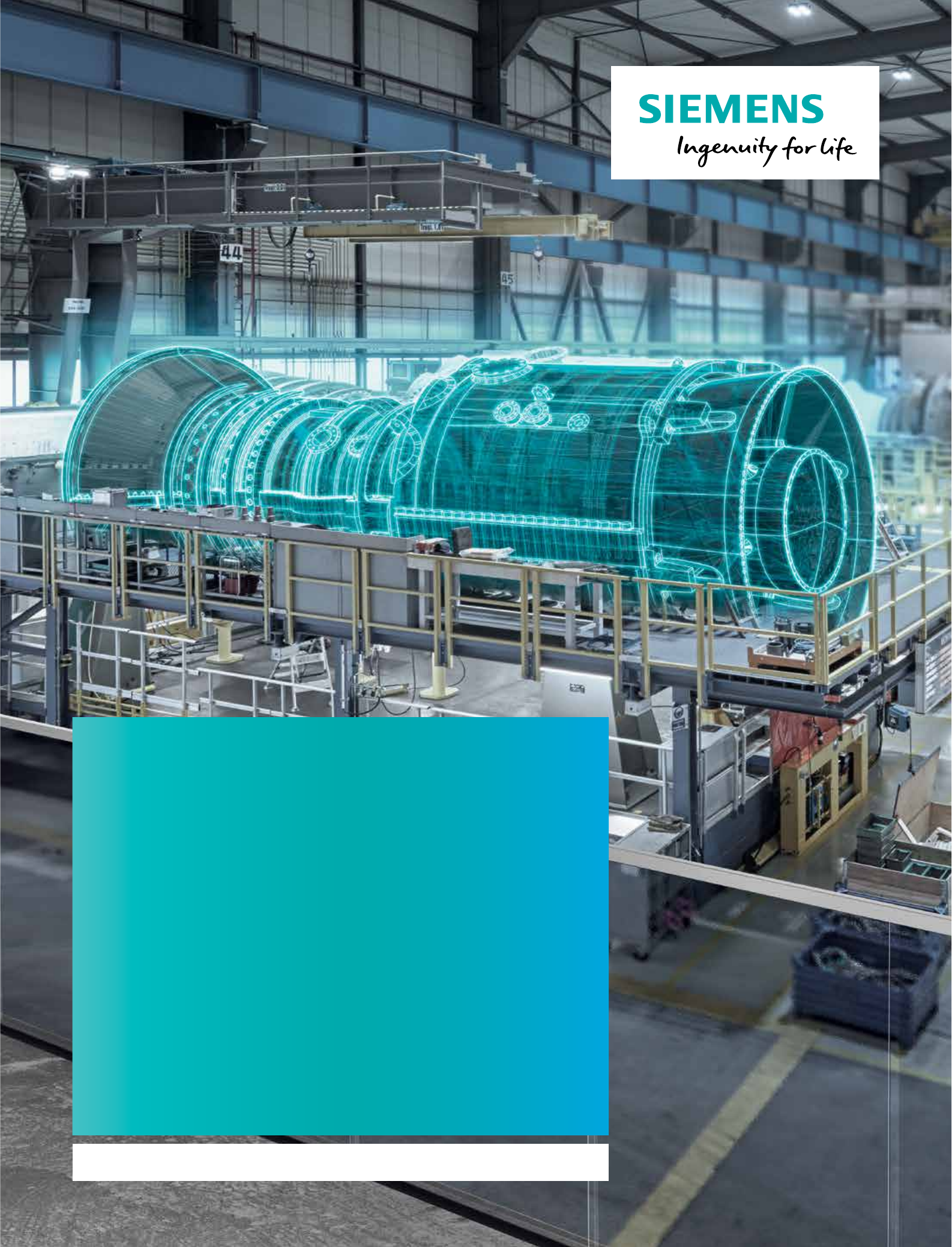

As an example, he noted that the

SGT-800 comes as a single-lift pack-

age on a 3-point mount frame, con-

sisting of turbine, mechanical auxil-

iary systems, gearbox, generator and

generator switchgear. It has a weight

of about 265 t and comes pre-assem-

bled and system tested with a dedi-

cated electrical and control module.

“This means the solution stands on

three legs, designed as a foundation to

withstand the deection of the hull.

The gas turbine is almost the same [as

the land-based machine]; it’s just the

connection point to the foundation

needs some smart solutions to really

make it happen,” noted Hossain.

“Deection must not be transferred to

the gas turbine, so it has to be decou-

pled. For roll and pitch and accelera-

tion, you have to address the lube oil

systems. If the barge moves in one

direction as a result of roll and pitch,

you have to ensure the gas turbine

bearings remain lubed.”

The single-lift package concept en-

ables 48 h core engine exchange for

plants with highest requirements on

availability. The easy ‘roll-out’ capa-

bility of the gas turbine core engine

enables on-board maintenance and

overhaul, with turbine inspections/

overhauls, hot gas path inspection

Special Technology Supplement

THE ENERGY INDUSTRY TIMES - AUGUST 2019

The SGT-800 gas turbine will

be provided as a single-lift

package and 3-point mount

installation, consisting of

turbine, mechanical auxiliary

systems, gearbox, generator

and generator switchgear

SeaFloat gives owners more

options when it comes to

locating power plants

Reliable technology –

dependable partner.

Since 1990, Siemens has completed over 500 turnkey power

plants with total output exceeding 155,000 megawatts. With

more than 7,000 installed gas turbines in over 100 countries, we

are the leading original equipment manufacturer – not only for

this technology but for all plant needs throughout the lifetime

of the asset. With the right ideas, innovations and know-how we

are the dependable partner of our customers.

Reliable energy for today –

and for generations to come.

siemens.com/power-generation

THE ENERGY INDUSTRY TIMES - AUGUST 2019

connected to the grid, providing fre-

quency control when needed. This is

made possible with a battery storage

system. Here, Siemens can also de-

liver its hybrid SIESTART solution,

combining a exible (gas turbine)

combined cycle power plant with a

battery energy storage system.

The SeaFloat concept is already be-

ginning to bear fruit. At the end of

November 2018, Siemens and the

marine arm of ST Engineering in

Singapore jointly secured the rst or-

der for a project for a SCC-800 2x1C

SeaFloat power plant from Seaboard

Corporation subsidiary Transconti-

nental Capital Corporation (Bermuda)

Ltd., an independent power producer

(IPP) with operations in the Domini-

can Republic.

Under a turnkey plug and play con-

cept, Siemens as consortium leader

will provide a 145 MW SeaFloat

combined cycle power plant known as

Estrella del Mar III, along with its

power plant is sold to the customer.

Some are also asking for Siemens to

operate the plant; so we can add an

O&M contract to the sale. Others ask

for a special purpose vehicle to be set

up to own and operate the project and

ask if Siemens is willing to take a

share in the project as a stakeholder if

a project is viable. We have done it for

land-based plants – where we bring in

equity or nancing – and can also do

it for sea-based applications.”

The economics of SeaFloat projects

appear to be sound. According to Sie-

mens, the SeaFloat concept completed

in a shipyard will provide the cus-

tomer with “a quality proven power

plant” at a potentially 20 per cent

lower CAPEX than a similar land-

based plant.

A SeaFloat power plant could oper-

ate as a baseload power plant with

the aim of selling electricity but with

the owners also being paid a premium

for having the ability to always stay

SIESTART solution. ST Engineering

will be responsible for the engineer-

ing design, procurement and con-

struction of the oating power barge,

the balance-of-plant and the installa-

tion of the oating power plant.

ST Engineering will receive the gas

turbine as a pre-installed package, the

steam turbine as a separate package

and the boiler in three modules, where

it will be erected and pre-installed at

a controlled, highly skilled shipyard.

It will then be towed to the nal des-

tination and connected to the grid.

For the SIESTART solution, Fluence

Energy, a company jointly owned by

Siemens and AES, is providing a

5 MW/10 MWh battery energy stor-

age system to be integrated as part of

the power plant for frequency regu-

lation control. This will allow the

plant to operate at full capacity with

highest fuel efciency.

The Estrella del Mar III plant will

replace existing power barges based

on reciprocating engines at the cus-

tomer’s location in the capital city

Santo Domingo. Using combined

cycle gas turbine technology will in-

crease efciency and lower emis-

sions, which is especially important

in built-up areas.

Due to site constraints with limited

free land and Seaboard’s experience

with previous power barges, the plant

owner selected a SCC-800 2x1 Sea-

Float concept with two Siemens

SGT-800 gas turbines and one SST-

600 steam turbine.

This rst SeaFloat project is ad-

vancing smoothly. Power plant equip-

ment is expected to leave Siemens’

manufacturing facilities shortly so

that erection at the shipyard can begin

soon after. The plant will be connected

to the grid of the Dominican Republic

in the spring of 2021.

And with the rst order secured,

Siemens expects others will follow

soon. “We are involved in many ac-

tivities all around the world. There

could be orders from any country –

from the US to Asia, where we are

currently supporting customers. We

are not limited to any specic country;

there are a lot of opportunities.”

Siemens will also continue to de-

velop the technology. As Hossain

concluded: “Siemens always takes an

evolutionary approach as opposed to

a revolutionary approach. So we are

continuously checking our design,

receiving feedback from execution

teams – both land-based and those

that will be in the Dominican Repub-

lic – and feeding it back into our team.

This will allow us to continue im-

proving our solution, so that each

customer can expect the highest

quality SeaFloat application based on

the experience of our eet.

Special Technology Supplement

The SCC-8000H SeaFloat can replace a

large coal red power plant in a region with

available grid capability

Types of SeaFloat plants

Length (m) Width (m) Area (m²) Net power Efciency (%)

output (MW)

2x SSC-A65 (50/60 Hz) ~50 ~22 ~1.100 147/151 55/55.3

SCC-800 2x1 ~55 ~30 ~1.650 149.4 56.6

SCC-800 3x1 ~65 ~40 ~2.600 224.4 56.6

SCC-800 4x1 ~75 ~40 ~3.000 299.3 56.7

SCC5-8000H 1x1 (50/60 Hz) ~170 ~60 ~10.200 665/460 61

SCC5-8000H 2x1 (50/60 Hz) ~170 ~90 ~15.300 1330/930 61

Note: SSC = Siemens simple cycle; SCC = Siemens combined cycle

THE ENERGY INDUSTRY TIMES - AUGUST 2019

15

Technology

A new process for

capturing carbon

dioxide is being

demonstrated at a

pilot project at the

Drax power station in

the UK.

Junior Isles reports.

A

ccording to many industry

observers, the world will not

be able to achieve its climate

ambitions without carbon capture

and storage (CCS). Although the

electricity sector is making a rapid

transition away from fossil fuels,

globally, coal and gas will continue

to play a signicant a role for de-

cades to come. Finding a way of de-

carbonising existing and future fossil

red eet is therefore crucial. Cut-

ting carbon emissions in industry is

also important and currently there

are very limited options when it

comes to cutting carbon dioxide

emissions.

The International Energy Agency

(IEA) states that CCS could reduce

global CO

2

emissions by 19 per cent,

and that ghting climate change

could cost 70 per cent more without

CCS.

But in spite of the pressing need

for the technology, its commercial

uptake has been very slow. A report

published in May by the Internation-

al Association of Oil and Gas Pro-

ducers (IOGP) noted there are only

18 commercial projects in operation

globally today with a total capture

capacity of some 40 Mtpa CO

2

.

CCS deployment has been predom-

inantly limited by economics – sev-

eral projects have seen budgeted

capital costs spiral, and the technolo-

gy also imposes an energy penalty

on power plants, which makes the

business case in power generation

challenging.

But this could be set to change as a

team of chemists and engineers look

to implement a new carbon capture

technology at the massive Drax

power station in North Yorkshire,

UK.

In June, C-Capture, the designer of

innovative chemical processes for

carbon dioxide removal, working

alongside the Drax Group, secured a

£5 million grant from the UK gov-

ernment for a two year programme

of work to progress their £11 million

bioenergy and carbon capture and

storage (BECCS) pilot project at

Drax.

The funding will be used by

Leeds-based C-Capture, a company

established in 2009 out of Leeds

University’s School of Chemistry

following investment from IP

Group, and Drax’s Innovation team

to further develop its understanding

of how C-Capture’s technology

could be scaled up.

Explaining the origins of C–Cap-

ture and the technology, Professor

Chris Rayner, an organic chemist

and Founder of the group, said:

“About 10 years ago, maybe longer,

we started looking at ways where we

could selectively get CO

2

to react in

the presence of other gases – particu-

larly things like nitrogen and oxy-

gen, which is typically what is in

ue gases – and try to develop new

chemistry to do that. People have

been doing CO

2

separation for many

years. The original technology pat-

ented in the 1930s used amines.

They capture CO

2

very well but

they’ve been around for so long,

when we set up C-Capture we

thought there must be a better way to

do it.”

After four or ve years of research

and development, the company has

come up with a process that allows

CO

2

to be captured under much

milder conditions than has been pre-

viously possible.

“The chemistry is much better in

terms of performance and environ-

mental prole but still uses very sim-

ple chemicals... and for the scale that

CCS is done on, it has to be simple

and really scalable,” said Professor

Rayner.

The technology is what Professor

Rayner calls a post-combustion, sol-

vent-based capture process.

He explained: “When you gener-

ate power, you’re usually burning

something... The ue gas produced

will usually have anything between

5-15 per cent of CO

2

, as well as

quite a lot of nitrogen and some ox-

ygen. The key thing is to selectively

react the CO

2

and leave anything

else unreacted.”

This is achieved in a two-step pro-

cess. The rst stage has an absorber

column, where a shower of the new

amine-free solvent comes down the

column while the ue gas is blown

upwards. When the solvent comes

into contact with the ue gas, it se-

lectively reacts with the CO

2

, leaving

the remaining gases to continue up-

wards to exit the top of the column

free of CO

2

.

Solvent with CO

2

attached to it re-

mains at the bottom of the column.

This is then pumped into a stripper

column that operates at a much high-

er temperature, around 100-120°C,

compared to 20-30°C in the rst. At

this temperature, the bond between

the solvent and the CO

2

breaks and

the CO

2

comes out of the stripper

column as a pure stream that can be

used or sequestered. This stripper

column also serves to regenerate the

solvent, so that “lean” solvent is

ready to capture more CO

2

.

“It’s a continuous process, where

the solvent is pumped around the ab-

sorber and stripper, so ue gas goes

into one end and a stream of CO

2

comes out of the other,” said Profes-

sor Rayner.

The key thing in the process is the

new class of solvent, which has quite

a different reactivity compared to

amines. An important aspect of the

solvents is their energy requirement

– a big drawback with current sol-

vent-based post combustion capture

is they require a signicant amount

of energy to heat up the solvent in

order to release the CO

2

. This para-

sitic load reduces the efciency of

the power station.

According to Professor Rayner, the

new solvents are less reactive with

air than existing amine solvents and

therefore oxidise less, resulting in

less degradation over time. “We

think we have major benets in

terms of solvent lifetime compared

with the current best technologies,”

he noted.

He added that the new solvents are

much less corrosive than many of

the amines that are currently used.

This means cheaper construction

materials can be used, which could

in turn signicantly lower the cost of

building plants.

With the economics of CCS being

a major stumbling block, the devel-

opment of the technology comes at a

crucial time.

Professor Rayner said: “Pretty

much everyone says we need to de-

carbonise as rapidly as we can. In

three of the four scenarios presented

by the IPCC, we need CCS to limit

warming to 2°C... if the [UK] gov-

ernment is to reach its net zero target

by 2050, then CCS is essential. So

we need to start doing things now

and we need to start doing them on

scale.

“Costs are an issue but there have

been numerous high-level studies

that show that the cost of doing noth-

ing far outweighs the cost of deploy-

ing CCS... The costs of these things

are always coming down.”

“To calculate the cost of capturing

a tonne of CO

2

from a very large

power station is a very difcult cal-

culation but what I can say, is that

the energy penalty of our process is

signicantly lower when comparing

our technology with others that are

out there. World-leading amine pro-

cesses use about 2.5 GJ per tonne of

CO

2

captured. Ours is in the region

of 1.5-2 GJ/t. The Drax project is

trying to understand that number and

rm up whether it’s nearer to 1.5 or

2. Even if it’s 2 GJ, that’s still a ma-

jor improvement compared to all the

current technologies.”

Since it began capturing carbon

dioxide in February, proving the

technology works, the team at the

Drax pilot has done different up-

grades on the solvent and this work

will continue.

The recent government grant will

help take the pilot project up from

about 1 t/day of CO

2

capture to 100

t/day over the next two years. This

size will provide much of the

chemistry and engineering informa-

tion needed to design a much larger

process.

“We hope that we will have every-

thing we need to design a very large

process within a couple of years,”

said Professor Rayner. To give an

idea of the nal scale needed, he

says Drax would need roughly a 10

000 t/day capture installation on its

site.

The Drax pilot will be running for

at least another six months before

trials are shifted to Norway. Here a

chemistry validation and testing pro-

gramme will be conducted with re-

search partners SINTEF and the CO

2

Technology Centre Mongstad. The

pilot scale rigs at Mongstad will en-

able more accurate measurement of

parameters such as energy consump-

tion and emissions. In addition to be-

ing larger in scale, the Norway facil-

ity will also provide a degree of

independent validation.

“As the programme begins to get

nalised at Drax we will move

things over to Norway, which will

probably be some time towards the

end of next year,” said Professor

Rayner. “It will happen when we

think we have enough good data to

operate the plant in Norway.”

The goal is to have a large scale

process on the Drax site in the mid

2020s. This would coincide with the

government’s timeframe of having

CO

2

capture clusters and CO

2

trans-

port infrastructure in place.

“There’s no point building a big

capture plant if you have no way of

disposing of the CO

2

,” noted Profes-

sor Rayner. “Over the next 5-10

years, there will be lots of develop-

ments where clusters of CO

2

produc-

ers will have to come together in dif-

ferent locations to provide hubs,

which can then take the CO

2

via

pipelines to the North Sea for stor-

age in geological features, mainly

depleted oil wells.”

With Drax being the UK’s largest

power plant, and one that has

switched from coal to biomass, the

world will be watching this next step

closely. Notably, as it runs on bio-

mass it will become the world’s rst

negative emissions power station –

effectively removing carbon dioxide

from the atmosphere while electrici-

ty is being produced. This is impor-

tant in offsetting emissions from oth-

er sectors that are very difcult to

decarbonise such as aviation.

Professor Rayner summed up:

“The Drax project has given us a

high prole, which has helped with

enquiries from outside. Now, a num-

ber of projects are under discussion

around world. We also will be de-

ploying the technology in other areas

which require large scale CO

2

sepa-

ration such as industrial emitters like

cement, iron and steel, and hydrogen

manufacture, and gas upgrading ap-

plications, such as purication of

natural gas and biogas.

“Working with Caspar Schoolder-

man, our COO and Director of En-

gineering and Doug Barnes, Head

of Chemistry, we’ve developed

something that is incredibly new

and important for the future... see-

ing something go from a very small

scale in a lab up to, say, 10 000 t of

CO

2

capture a day, would be awe-

some. And that really is just getting

things started.”

CCS gets some new

chemistry

Professor Rayner: “we’ve

developed something that is

incredibly new and important

for the future”

THE ENERGY INDUSTRY TIMES - AUGUST 2019

16

Final Word

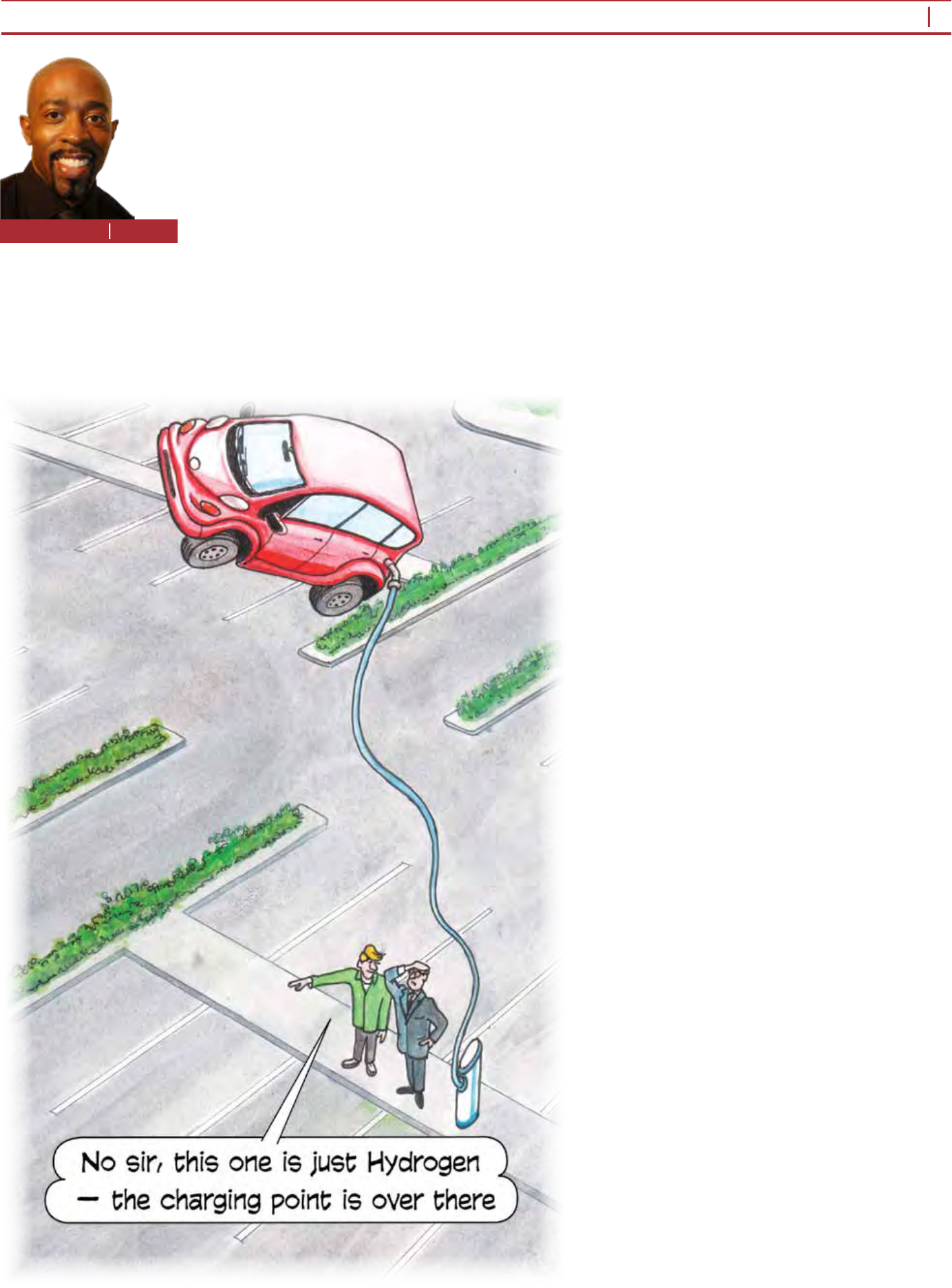

T

he energy transition is real. And

the speed at which it is happen-

ing is exhilarating; everyday,

the rhetoric around electrication and

the hydrogen economy increasingly

becomes a reality.

Recently, I had the pleasure of at-

tending the Goodwood Festival of

Speed and the opportunity to not only

see the latest fast cars – as well as the

old classics – in action, but also get a

rst hand look at how quickly times

are changing.

Siemens was the technology partner

for what is dubbed as ‘the world’s

greatest festival of motor sport’,

showcasing a host of clean, green and

digital technologies, ranging from

electric motorcycles and fast charging

systems for electric vehicles, to fuel

cells and 3-D printing.

But perhaps the most interesting,

from the viewpoint of how fast our

energy system is actually changing,

was its tie-up with GeoPura to use a

100 kW fuel cell powered by green

hydrogen to charge all of the EVs at

the festival. Not so long ago, electric-

ity for these festival-type applications

would have come from a diesel fuelled

generator.

Here was a real life demonstration

of what the future will look like. The

interest in fuel cells and hydrogen as

one way of electrifying transport

cleanly is growing and coming from

a variety of areas, not just the ones

anticipated.

According to GeoPura, it is not just

those responsible for areas where

people want to park – car park owners,

local authorities supermarkets and

even large corporations with car parks.

Andrew Cunningham, Managing Di-

rector of GeoPura, noted that these

organisations are beginning to realise

they have “a bit of a problem” even at

this early stage of EVs.

“They are beginning to hit up against

local distribution network issues and

are wondering what the future holds

for them. So we expected a lot of inter-

est from that sector but other things

have also come out the woodwork.

Caravan club members, for example,

is a group I never thought would be

interested but they have signicant

issues with people turning up and

needing to charge. And it’s not such a

small market either.”

For things to really take off, how-

ever, these positive conversations rst

need to be turned into contracts. “Get

these in place, and the rest of the in-

frastructure will follow, because there

will be contracts in place to invest

against,” said Cunningham.

According to Cunningham, the

economics of using hydrogen to

charge electric vehicles already makes

sense. He estimated that the charge

needed to run an EV the same distance

as a petrol engine would equate to

roughly about £1.10-1.15 per litre,

which is a about 10 pence less than

current UK petrol prices. And it is

expected that these prices will only fall

with reducing capex and opex costs.

Ian Wilkinson, Programme Manager

at Siemens Corporate Technology

said: “The trajectory for the big

capital cost, the electrolyser, is down-

wards. Electrolyser prices are at the

beginning of the cost curve. The world

volume is still in the 10s of MWs.

Tens of GWs are required to do this at

scale and that’s when, inevitably,

you’ll get the economies of scale...

the trajectory for the big operational

cost, i.e. the cost of electricity is also

downwards. We’ve seen renewable

electricity prices come down substan-

tially over the past few years.

“So this is why we are starting with

EVs. The commercials work at today’s

prices with today’s available equip-

ment, and it will only get better.”

Facilitating the hydrogen economy

shows that EVs have a major role to

play in the new decarbonised energy

landscape – one that goes beyond just

replacing combustion engines with a

non-CO

2

emitting mode of transport.

Although they will add signicant

demand to local electricity networks,

EVs could also be a key tool in provid-

ing utilities and network operators

with storage and grid support through

smart charging.

Just a few weeks ago UK Power

Networks launched a trial called

‘Shift’, where 1000 vehicles will take

part in the UK’s rst ever trial of a

market-led approach to smart charg-

ing. The trial aims to develop a large-

scale, smart charging solution that can

be rolled out nationwide by exibility

service providers like charge-point

operators, aggregators and energy

suppliers.

Ian Cameron, head of innovation at

UK Power Networks said: “There has

been a lot of talk about how smart

charging could save customers money

and help manage the network, but this

is the rst time we’ve actually set out

to discover how.”

It is hoped the trial will show how

smart charging could limit the need to

build new infrastructure, which could

be a major stumbling block in the UK’s

effort to only sell EVs by 2040, and its

new legal obligation to reach net zero

CO

2

emissions by 2050.

While car parks in shopping malls

and workplaces, etc. are ne if a

driver plans to be at a location for a

long period of time, much investment

is still needed for charging vehicles en

route. Obviously car manufacturers

and companies developing charging

systems are a big part of en route

charging. Here, rapid charging is key.

Wilkinson noted: “The trend is de-

nitely upwards for faster charging

rates. Having a charging post that can

supply the power you need is rela-

tively easy – charging posts that can

do 350 kW can be designed now and

made available. The particular chal-

lenge is with managing the heat the

battery generates when it’s being

charged rapidly. So the limitation will

be the battery management system on

the car; the charge rates that will be

widely adopted is largely a question

for the car manufacturers.”

Siemens and GeoPura’s vision is that

charging points are available wher-

ever they are needed and that making

the dedicated trip to a refuelling point

is no longer necessary.

That, however, will require a big shift

in the existing mindset. It is therefore

no surprise that key players in the chain

are making their move.

David Hall, Vice President of Power

Systems at Schneider Electric said:

“We’re now seeing some of the big

fuel companies talk about how they

change their fuel stations. A fuel sta-

tion is not about a trickle charge... so

we’re now starting to break this market

down into destination venues – where

somebody might stay overnight at a

hotel or somewhere for several hours

– and the high rapid chargers, where

you can pull in somewhere and get an

80 per cent charge in 15 minutes. This

rapid charging is the area where invest-

ment in infrastructure is needed.”

The big question, he asked, is who

will roll-out this rapid charge infra-

structure? “Will it be the utilities or the

contracting businesses that can do

connections to the grid? Or might the

end-user customer want to own the

asset? It’s very early but things are

starting to move. Customers are com-

ing to us saying they have large eets,

ofces, petrol stations etc., and asking:

‘what can you do for us’?”

On this basis, if things continue to

accelerate along with car battery de-

velopment, Hall believes the UK can

meet its EV and net zero targets. He

notes, however, that the biggest chal-

lenge is the general infrastructure to

connect the substations for the high-

power chargers.

It was a point echoed by Wilkinson,

who said “there is the challenge up-

stream of providing enough electricity

to charge a signicant number of cars”

from the 350 kW chargers, adding that

the Siemens, GeoPura approach ad-

dresses that issue.

Whether the future is “lling up” in

car parks, etc., where power is pro-

vided by fuel cells or whether it is at

back-to-the-future petrol stations

converted to provide fast charging,

remains to be seen. Whatever the nal

outcome, neither us nor the kids will

be saying “are we there yet?” for too

much longer.

High speed change

Junior Isles

Cartoon: jemsoar.com