www.teitimes.com

July 2019 • Volume 12 • No 5 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Rethinking cyber Endless options

The energy sector needs to

understand how hacker attacks can

be so successful.

Page 12

There seems to be endless

options for integrating

renewables. Each has its pros

and cons. Page 14

News In Brief

Clean technology progress

not meeting long-term goals

The majority of technologies are

failing to keep pace with long-term

goals, says the IEA’s assessment of

clean energy transitions.

Page 2

USA rolls back Obama-era

climate rules

President Donald Trump is making

good on campaign pledges to

support the coal sector with plans

to replace legislation curtailing

emissions from power plants.

Page 4

Japan continues energy

sector transformation

Japan has taken several important

steps in advancing its transition to a

low carbon emissions energy sector.

Page 5

Challenging times for

Germany offshore wind

Germany’s offshore wind sector

offers signicant opportunities

but realising its full potential has

challenges, say industry experts.

Page 6

CDC targets African grid

investments

UK-based development nance

organisation CDC has pledged $300

million to support investment in

Africa’s grid infrastructure.

Page 7

Aggreko offers new Wärtsilä

modular block

Wärtsilä and Aggreko are joining

forces to bring medium speed

reciprocating engines to the

temporary power market.

Page 8

Cyber Perspective:

Best practices

As the energy sector matures,

operators of essential services must

demonstrate they have embraced

particular cyber security principles.

Page 12

Technology: Higher

efciency improves solar

economics

As solar modules move to higher

power outputs, 158 mm wafer sizes

could become the new standard.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

The EU has stopped short of agreeing on more ambitious targets for carbon emissions despite the

UK taking the lead on signing a national net zero 2050 target into law. Junior Isles

Political inaction to blame for lack of progress on climate

THE ENERGY INDUSTRY

TIMES

Final Word

Some see zeros, some see

loopholes in the war on

climate change, says

Junior Isles. Page 16

Hopes that the EU would agree to a

net-zero carbon emissions target for

2050 were dashed at a recent climate

debate.

During talks in late June, Poland

and the Czech Republic refused to

sign up to a text that referred to a

climate-neutral EU by 2050. Hungar-

ian Prime Minister, Viktor Orbán,

also opposed the EU text, despite ear-

lier indicating that the country was

ready to compromise.

Hopes that the EU would be seen to

be moving towards more ambitious

carbon mission targets, ahead of a ma-

jor UN climate summit in September,

were buoyed by the UK’s announce-

ment that it has legally adopted a net

zero 2050 target.

Two weeks before the EU debate,

the UK became the rst major econ-

omy to pledge to cut CO

2

emissions

to close to zero. The target will re-

quire the UK to bring all greenhouse

gas emissions – excluding aviation

and international shipping – to virtu-

ally zero by 2050, compared with

the existing target of an 80 per cent

reduction.

UK Prime Minister Theresa May’s

parliament took the decision follow-

ing a report from the Committee on

Climate Change (CCC) published in

May. The report calls for extensive

electrication of the economy and a

quadrupling of low-carbon power

generation by 2050.

The move was broadly welcomed by

industry. Dr Nina Skorupska CBE

FEI, Chief Executive of the Renew-

able Energy Association (REA) com-

mented: “Being the rst G7 nation to

adopt a net zero greenhouse gases

emissions target by 2050 is a historic

step not only for our industry but for

the UK as a whole.

“This decision demonstrates that

government is listening to both the

scientic evidence regarding climate

change and to the tens of thousands of

school children and members of the

public who have taken to the streets in

recent months.

“In their net-zero recommendations,

the Committee on Climate Change

rightly identied that the variety and

sophistication of renewable technolo-

gies needed to reach net-zero already

exist. What is needed now is clear and

consistent policy that will allow for a

route to market for renewable and

clean technologies that will attract in-

vestors,” she added.

James Robottom, IET Energy and

Climate Change Lead, said: “Progress

has been made in transport and elec-

tricity but this needs to continue at a

great pace and signicant challenges

remain in decarbonising heat and in-

dustry. Eight per cent of the homes we

Continued on Page 2

Erratic policymaking is holding the

renewable energy sector back from its

potential contribution to cutting car-

bon pollution and meeting climate and

development targets, according to

REN21’s Renewables 2019 Global

Status Report (GSR).

Renewables now supply more than

a quarter (26 per cent) of global elec-

tricity production but current trends in

the sector show that bolder policy de-

cisions are needed across all end-use

sectors to make energy systems sus-

tainable, said the report.

“A key breakthrough could occur if

countries cut their fossil fuel subsidies

which are propping up dirty energy,”

said Rana Adib, Executive Secretary,

REN21. “Ambitious policy and regu-

latory frameworks are critical to cre-

ating favourable and competitive con-

ditions, allowing renewable energy to

grow and displace more expensive

and carbon-emitting fuels.

Forty countries have undertaken

some level of fossil fuel subsidy re-

form since 2015, but these subsidies

continued to exist in 112 countries in

2017, with at least 73 countries pro-

viding subsidies of over $100 million

each. Estimated total global subsi-

dies for fossil fuel consumption were

$300 billion in 2017, an 11 per cent

increase from 2016, REN21 said.

BP’s recent Statistical Review of

World Energy 2019 noted that al-

though renewables grew by 14.5 per

cent, nearing their record-breaking

increase in 2017, they still accounted

for only around a third of the increase

in total power generation.

A key nding from the Review is

that global energy demand grew by

2.9 per cent while carbon emissions

grew by 2.0 per cent in 2018, faster

than at any time since 2010/11.

Introducing the ndings, Spencer

Dale, BP Chief Economist, said:

“There is a growing mismatch be-

tween societal demands for action on

climate change and the actual pace of

progress, with energy demand and

carbon emissions growing at their

fastest rate for years. The world is on

an unsustainable path.”

Bob Dudley, BP Group Chief Ex-

ecutive, added: “The longer carbon

emissions continue to rise, the harder

and more costly will be the necessary

eventual adjustment to net zero car-

bon emissions.”

CDP, formerly known as the Carbon

Disclosure Project, recently noted

that many of the world’s biggest com-

panies, from Silicon Valley tech rms

to large European banks, are bracing

for the prospect that climate change

could substantially affect their bottom

lines within the next ve years.

Under pressure from shareholders

and regulators, companies are in-

creasingly disclosing the specic -

nancial impacts they could face as the

planet warms, such as extreme weath-

er that could disrupt their supply

chains or stricter climate regulations

that could hurt the value of coal, oil

and gas investments.

In 2018, more than 7000 compa-

nies submitted such reports to CDP

and, for the rst time, CDP explicitly

asked rms to try to calculate how

global warming might affect them

nancially.

After analysing submissions from

215 of the world’s 500 biggest corpo-

rations, CDP found that these com-

panies potentially faced approxim-

tely $1 trillion in costs related to

climate change in the decades ahead

unless they took proactive steps to

prepare.

EU bloc not yet

swayed by UK net

zero emissions

ambition

Hungarian Prime Minister, Viktor Orbán also

opposed the EU text

Junior Isles

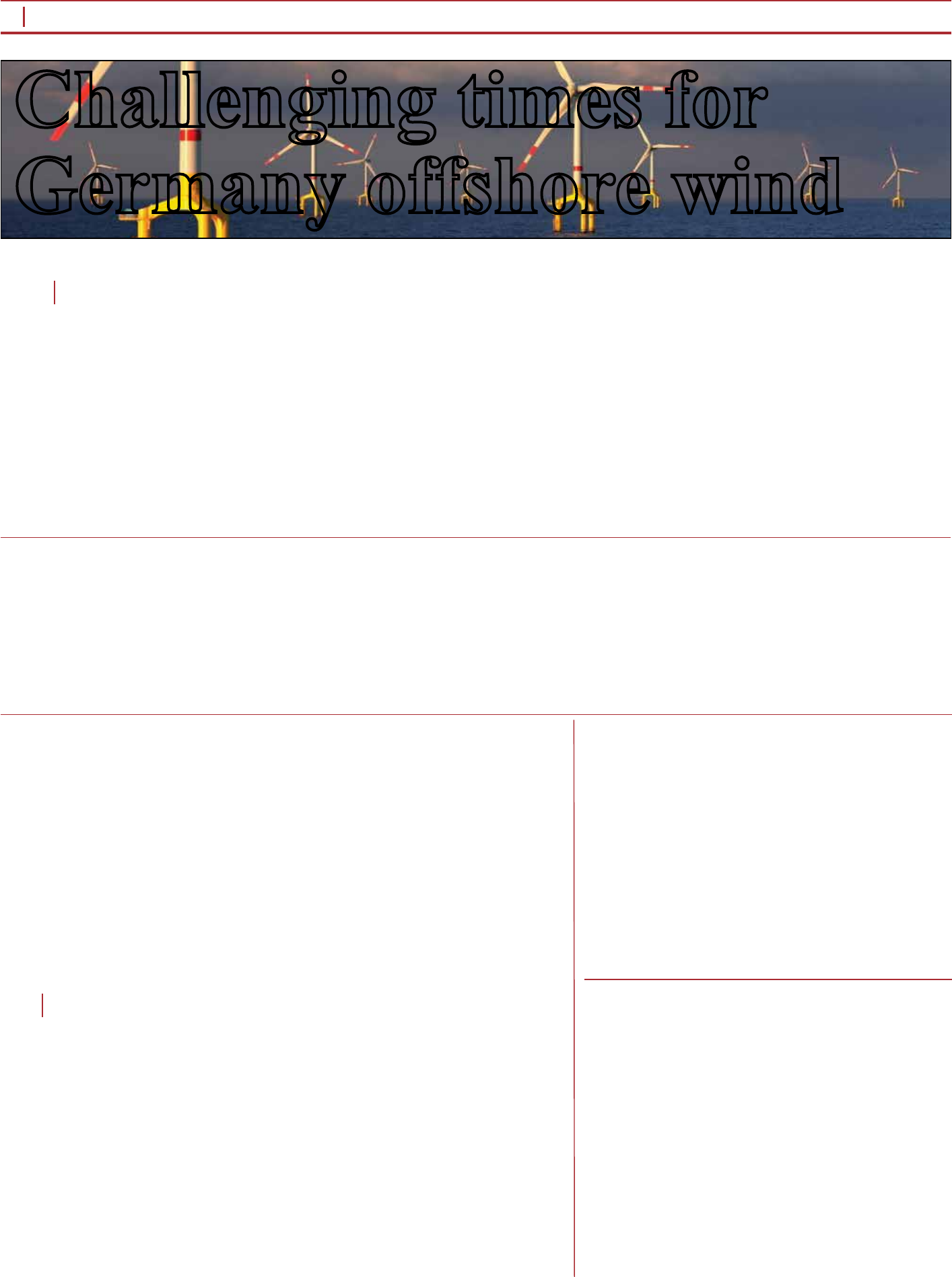

Although Germany’s offshore wind

sector offers signicant opportunities,

realising its full potential is not with-

out challenges, according to industry

experts.

WindEurope CEO, Giles Dickson

recently noted that although Germany

could “comfortably deliver 20 GW and

a higher volume by 2035”, its Nation-

al Energy & Climate Plan for 2030

currently envisages only 15 GW total

installations by 2030.

“As things stand they are being less

ambitious in relative terms on their

offshore wind build-out than the UK,

Netherlands, Belgium, Denmark and

Poland,” said WindEurope.

The organisation says that a lack of

auctions – the last one being in April

2018 and no more scheduled until

2021 – and a disappointing outlook

for future auction volumes to 2030,

means order books are drying up.

This, it says, is putting the supply

chain under real pressure.

WindEurope also said there were

concerns over whether Germany

would have sufcient power genera-

tion capacity if it did not accelerate

build-out of offshore wind at a time

when nuclear and coal red plants are

closing.

While other experts note that wind

is not the sole answer to Germany’s

looming generation problems, they

point out that offshore wind poses

challenges for the grid.

Commenting on whether wind will

be able to compensate for the loss of

nuclear and coal from the grid, Mirko

Düsel, CEO of Siemens Distribution,

said: “If you take a global view of gen-

eration today, in general there’s always

a mix. There is no one country that

relies on a single generating source due

to [grid] stability reasons as well as

availability.”

Ludger Meier, Vice President Engi-

neering & Operations, EHV grid at

Amprion GmbH, operator of the west-

ern part of the transmission grid in

Germany, said: “The increase in wind

generation and its volatility calls for

extension of the grid to keep the sys-

tem running.”

Meier noted that a signicant amount

of generating capacity in the North Sea

and Baltic Sea will lead to large trans-

mission distances in order to feed

power to the industrial middle and

south of the country. “This can cause

challenges with voltage uctuations in

the grid, so we have to invest in reactive

power compensation in the grid.”

The growth in offshore wind requires

the creation of north to south HVDC

corridors in Germany but being a

point-to-point solution, there is also a

requirement for static VAR compensa-

tion (STATCOM) technology. The

increasing volatile load in the AC-grid

also calls for STATCOM technology,

Meier and Düsel explained.

Meier and Düsel were speaking just

ahead of an event celebrating the de-

livery of Siemens’ 100th STATCOM

(static VAR compensator) from the

SVC PLUS series. The turnkey instal-

lation for Amprion will be deployed in

the important Kusenhorst node in

North Rhine Westphalia, Germany.

“HVDC usually has a starting point

and an end point, with overhead lines

or cables in between. But as a densely

populated country, with electricity de-

mand in more than one location, we

needed a multi-terminal solution for

Amprion,” noted Düsel.

AC electricity transmission requires

reactive power, which has traditionally

been provided primarily by large pow-

er plants. Due to the energy transition,

many of these plants in Germany will

be shut down – which is why grid op-

erators like Amprion are responding by

installing reactive power compensa-

tion systems.

Siân Crampsie

Plans by Italy to introduce new renew-

able energy support measures have

won the backing of the European

Commission.

The Commission has approved the

proposed scheme under state aid rules,

noting that it will contribute to Euro-

pean Union environmental goals with-

out distorting the energy market.

“More renewable energy in power

generation is essential for the future

of our planet and environment,” said

Commissioner Margrethe Vestager, in

charge of competition policy.

“The €5.4 billion scheme will in-

crease the level of Italy’s electricity

production from renewable sources.

This is in line with the EU environ-

mental objectives and our common

state aid rules,” he added.

Approval of the Italian scheme came

as the Commission published an as-

sessment of EU nations’ National

Energy and Climate Plans (NECPs),

which aim to drive investments in

clean energy technologies and ensure

that the 28-nation bloc reaches its

2030 climate goals.

According to the Commission, the

NECPs will not enable Europe to meet

its 32 per cent renewable energy target

because they lack ambition and be-

cause they do not contain sufcient

detail on the mechanisms that will de-

liver renewable investment.

WindEurope CEO Giles Dickson

said: “The message from the Euro-

pean Commission is clear: failing to

plan is planning to fail. The draft Plans

don’t get Europe to 32 per cent renew-

ables by 2030. And they’re badly lack-

ing when it comes to specic policy

measures.”

Dickson added: “The Commission’s

recommendations highlight the areas

where countries need to step up their

game, e.g. permitting, electrication,

corporate PPAs, and the repowering

of existing wind farms. Member

States now know what they’ve to do

– ramp up the ambition and ll in all

the policy gaps.”

The Italian scheme will run until

2021 and will support renewable en-

ergy generation schemes with a pre-

mium on top of the market price.

Competitive auctions will determine

which projects qualify for support.

The premium will not be higher than

the difference between the average

production cost for each renewable

technology and the market price, and

will also include a clawback mecha-

nism in case the market price moves

above the average electricity produc-

tion cost for each renewable energy

technology.

6

THE ENERGY INDUSTRY TIMES - JULY 2019

Europe News

EC approves Italian

renewables support

Challenging times for

Germany offshore wind

n Offshore wind goal lacks ambition n Siemens and Amprion cooperate on grid stabilisation

France will add over 500 MW of on-

shore wind energy to its grid follow-

ing its latest tender round for the

technology.

Some 516 MW of capacity spread

across 21 wind farm sites won con-

tracts in the onshore wind tender. The

average bid price in the tender round

stood at €63 ($71.2) per MWh, which

represents a decrease from the €65.4/

MWh and €68.7/MWh in the rst and

second rounds, respectively.

Winners will be awarded 20-year

feed-in premium contracts. The tender

is one of six rounds that aims to procure

3000 MW of onshore wind capacity

over the next three years.

Proposals for the fourth round are due

by August 1st.

n The French Ministry of Ecology and

Energy Transition has selected a con-

sortium of EDF, Enbridge and Innogy

to design, build, operate and maintain

the nearly 600 MW Dunkerque off-

shore wind project in northern France.

The consortium offered a price below

50/MWh. The project will consist of

around 45 wind turbines and is ex-

pected to be commissioned in 2026.

Bill Gates’ Breakthrough Energy Ven-

tures has teamed up with the European

Investment Bank to launch a new €100

million fund to support investments in

clean energy.

EIB and Breakthrough Energy Ven-

tures are both contributing €50 million

to kick start the fund, known as Break-

through Energy Ventures Europe.

The fund will invest in rms innovat-

ing to cut emissions in ve energy sec-

tors: electricity; transportation; agri-

culture; manufacturing; and buildings.

Breakthrough Energy Investors have

called these the ‘Grand Challenges’ –

the largest contributors to greenhouse

gas emissions and the areas in which

ventures in innovation investment will

have the most impact towards a future

of zero emissions.

The initiative will boost public-pri-

vate investments in clean energy in-

novation, the partners said. Maroš

Šefčovič, Vice-President of the Com-

mission for the Energy Union, said:

“Business as usual is not an option. We

need to boost our investments with

more than €500 billion each year to

achieve a carbon neutral economy by

2050. I am pleased that our pilot coop-

eration with Breakthrough Energy has

taken off so fast.

“This is pioneering work: aligning

private and public investment in cut-

ting-edge innovation, to the benet of

the Energy Union and our climate.”

France boosts onshore

wind

Gates launches clean

energy fund

EDF Energy could put forward pro-

posals for a new nancing model for

the Sizewell C nuclear power plant

project in the UK.

The French energy giant has indi-

cated that a new funding model, based

on regulated asset base (RAB) fund-

ing, would mean that households

would pay a £6 annual levy on energy

bills to nance the project.

The RAB model – where consumers

pay upfront to fund large infrastruc-

ture projects – is expected to be more

palatable than the contracts for differ-

ence (CFD) system used for the under-

construction Hinkley Point C nuclear

power plant.

EDF Energy sealed a £92.50/MWh

CFD strike price for Hinkley Point C

– approximately double the current

wholesale electricity price – leading

to sharp criticism of the government

over the costs of the project.

The RAB model has been success-

fully used for the Thames Tideway

‘super sewer’ through London. EDF

believes that putting in place a guar-

anteed return via the RAB mechanism

would make the project more attrac-

tive to investors.

It also believes it can cut the cost of

the Sizewell C project by 20 per cent

compared with the £19.5 billion Hin-

kley project due to the replication of

the build.

n EDF is now reviewing the start-up

schedule and costs of its agship Fla-

manville nuclear project in France

after the regulator said it would have

to x faulty weldings that have already

delayed the project. Nuclear watch-

dog ASN says that EDF needs to repair

eight of the joins at Flamanville,

where nuclear fuel loading was sched-

uled for the end of 2019.

EDF considers new model for Sizewell C

n €5.4 billion scheme will increase production from

renewable sources

n Approval comes as Commission publishes National

Energy and Climate Plans

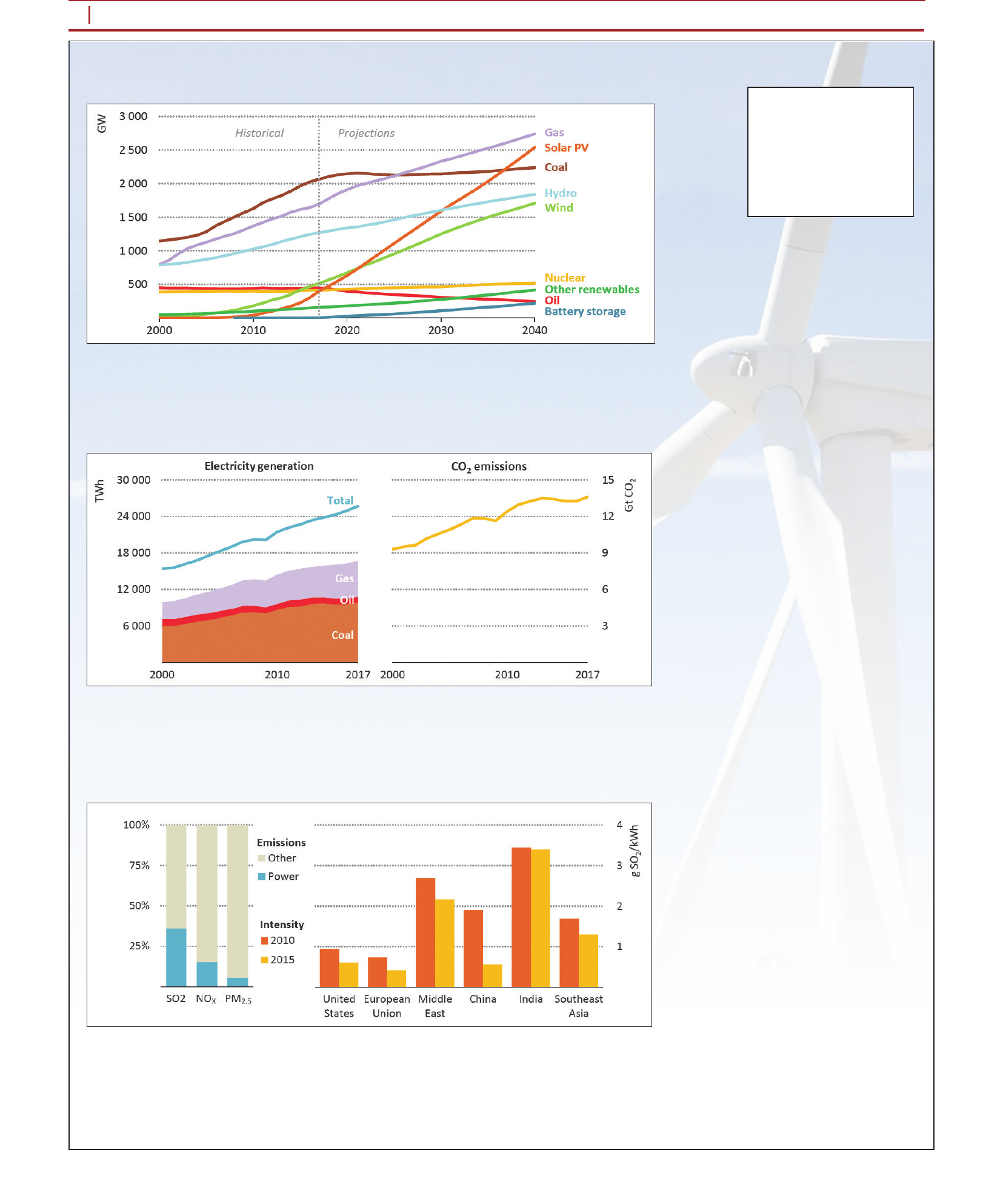

Source: World Energy Outlook 2018

Installed power generation capacity worldwide by source in the

New Policies Scenario

Fossil fuels in electricity generation (left) and CO

2

emissions from power

generation (right), 2000-2017

Share of 2015 power sector pollutant emissions (left) and SO

2

intensity by

region (right), 2010-2015

World Energy Outlook 2018, © IEA/OECD, Figure 8.15, page 346

World Energy Outlook 2018, © IEA/OECD, Figure 7.35, page 322

World Energy Outlook 2018, © IEA/OECD, Figure 7.34, page 321

For more information, please contact:

International Energy Agency

9, rue de la Fédération

75739 Paris Cedex 15

France.

Email: bookshop@iea.org

website: www.iea.org

THE ENERGY INDUSTRY TIMES - JULY 2019

10

Energy Industry Data

consumption of companies and

households. This valuable data is an

important, attractive asset, which

can be used by attackers to threaten

both security and privacy.

Being decentralised means the en-

ergy sector does not have one large

pool of resources to invest in cyber

security as larger organisation would.

However, even signicant investment

in cyber security is no longer effective

against new threats. The truth is that

there is currently a patchwork of dif-

ferent cyber security solutions de-

signed to target specic parts of the

organisation’s system.

For example, one programme for

email screening, another to block pop

up ads that may contain viruses, etc.

Further, these are all designed for a

different time in cyber criminality and

often do not address the more new,

devastating attacks sophisticated

hackers are undertaking.

The lack of an up-to-date, integrated

system means that if one aspect fails

to update with patches and bug xes

it becomes an entry point that leaves

the whole system unprotected on the

hardware and software levels

The mission is therefore to create a

paradigm shift. It is essential to create

a holistic security solution that covers

all modern IT components. By rede-

signing the hardware and the software,

starting at the most fundamental level,

it is possible to implement security by

design – a fortress that keeps all the

sensitive data safe from internal as

well as external threats.

As well as technical threats, it is

important to create a solution that

addresses the human factor. It needs

to be a security system that provides a

superior user experience. If the tech-

nology is too complex to use, em-

ployees will try to make their lives

easier by sidestepping it.

Therefore, the cyber security indus-

try needs to encourage legislators,

regulators, customers and organisa-

tions to be part of this paradigm shift

and to create a unique approach to

cyber security that will keep compa-

nies, their systems, data and ulti-

mately also people safe and secure.

This is clearly no small challenge, but

with the right approach and expertise,

we can prevent a hacker-initiated

blackout.

Unlike many action movies, we

don’t have to wait until it’s too late.

Companies can be one step ahead of

cyber criminals as long as they face

the new threats and take the respec-

tive measures by building not only

walls around the property but also

cyber walls around the data treasures.

Yuval Porat previously worked in in-

ternational cyber intelligence before

co-founding his own cyber security

company, Kazuar.

W

ith everything from trans-

portation and communica-

tion, through to manufactur-

ing and healthcare relying on energy

– and particularly electricity – it’s not

surprising that the whole industry is

one of the biggest targets for criminals

who want to harm organisations or

individuals.

You may recall the incident in 2015

when the Ukraine power grid suf-

fered a cyber attack. It all happened

very quickly. Workers at the Prykar-

pattyaoblenergo control centre were

about to nish their shift when one

employee realised that the curser on

his computer started to move on its

own. The hackers had managed to

take over control of the power grid.

Around 30 substations were switched

off and hundreds of thousands of citi-

zens were suddenly without electric-

ity for hours. This type of activity

marks a new era of threats to the en-

ergy sector through a new channel:

cyber crime.

Since this incident, there have been

several attacks on critical industry,

such as the recent inltration of an

electrical grid in the US. In this case,

the hackers gained access by using

seemingly simple methods such as

phishing emails and malware that was

planted on frequently used websites.

Often the victims don’t even realise

that they have been hacked until they

get the ransom demand or notice that

information has been leaked.

But instead of becoming a sitting

duck, waiting for an attack, what

companies need to do is to learn more

about their “new” enemies and pre-

pare themselves, because it is not a

question of “if” but rather “when” a

similar attack will be deployed with

more devastating effects.

In order to understand how hacker

attacks can be so successful, it is im-

portant to take a step back and look at

the current developments in the energy

eld and how they are exploited by

criminals, because it’s those new

trends that affect the evolving ap-

proach of cyber criminals.

In the context of the transformation

from nuclear and coal-based genera-

tion to renewables, digitisation plays

an important role. Smart grids that are

tipped as the future of the industry,

with many remote stations being in-

terconnected but not necessarily run-

ning the same operational protocols

due to them being managed by dispa-

rate organisations.

This move from typically one or a

few large, well-funded, nationalised

institutions to the new trend for poten-

tially numerous smaller, decentralised

organisations opens the door for a

new wave of threats. Only one weak

spot in the system can give cyber

criminals access to highly sensitive

data or worse, enable them to disrupt

or shut down a whole system. As an

increasing number of power plants

and grids are part of the digital net-

work, it is crucial for these institutions

to be aware of these new risks.

There are a few notable cyber crime

trends. Criminals have always been

early adopters of new technology and

the ongoing digitalisation in every

sector has provided them with many

new targets. It only takes one look in

the newspapers to see it’s not only an

ever-increasing number of these at-

tacks but also that the nature of cyber

attacks has changed drastically.

Today cyber crime is crippling the

operations of global organisations

and some of the trends we are seeing

are more than alarming. For example,

48 per cent of the businesses that were

a victim of a hacker attack in the past

12 months identify at least one attack

per month – an alarmingly large

number. Moreover, many studies

have shown that more than half of the

companies are not prepared to defend

a cyber attack.

While technology continues to

evolve, so do the strategies and skills

of the cyber criminals. When we talk

about hackers today it’s important to

keep in mind that these criminals are

far from being the hoody-wearing

stereotype of a hacker who works

from a dark basement as often shown

in movies. It is, in fact, a well-funded,

highly protable and innovative in-

dustry that is being inspired and fed

by governmental capabilities.

As a result, cyber attacks have

reached a new level of sophistica-

tion: not only do hackers bring a

wider and deeper research base than

ever before, they also plan attacks

precisely and over a long term period.

Thanks to the use of greater techno-

logical innovation, they are able to

exploit unprotected layers, including

the employees.

Additionally, they can orchestrate

multi-dimensional attacks, which

means the attack targets hardware,

software, end-points, servers and

human operators.

Moreover, the cyber crimes are no

longer just tactical approaches but

have, in fact, switched to strategic at-

tacks that are not purely focusing on

stealing money anymore. They are

often state-level attacks that aim to

disrupt processes and cause chaos.

These attacks range from malware

on websites or in email attachments

(phishing emails) to side channel at-

tacks (SCAs), which aim at extracting

secrets and information from a chip or

a system. For this attack, the hackers

use the analysis of physical parameters

such as electromagnetic emission or

execution time. This type of cyber

attack allows criminals to even break

robust encryption.

It’s fair to say that in our digital

world no organisation is immune

from becoming a victim of a cyber

attack but companies in the critical

infrastructure, such as the energy

sector, need to be especially aware

that their data and assets are an attrac-

tive prospect to cyber criminals.

If you bring the ongoing changes

and trends of these two sectors to-

gether and converge them, it becomes

clear that the threat level has never

been higher. Overall, here is a sector

with extremely sensitive data that is

unprotected – being decentralised

now, it has more weak spots than ever.

Further, the increasing skills of cyber

criminals who can exploit the digi-

tised and decentralised service provi-

sions, means the energy sector has to

look at both issues.

Connecting the energy industry to

a digital network provides cyber

criminals with a huge amount of

targets. Innovations like smart grids

turn a whole power grid into a data

network that just needs to be ac-

cessed through one of the various

entries. Hackers could not only come

into possession of data about the

electricity, the machines or the energy

company itself but also of detailed

information regarding the energy

THE ENERGY INDUSTRY TIMES - JULY 2019

Cyber Perspective Part 1

12

The energy sector

is one of the biggest

targets for cyber

criminals who want to

harm organisations or

individuals. In order

to understand how

hacker attacks can

be so successful, it

is important to take

a step back and

look at the current

developments in

the energy eld and

how they are being

exploited.

Yuval Porat

Time to rethink

cyber security

Porat: Innovations like smart grids turn a whole power grid into

a data network that just needs to be accessed through one of

the various entries

years ago.

Though natural gas is likely to be a

critical piece to the energy matrix in

many countries for years to come, it’s

far from the only option that can

handle the intermittency of renew-

ables. Technologies continue to

emerge, and some utilities have

latched on to static VAR compensa-

tors (SVCs), static synchronous

compensators (STATCOMs), capaci-

tor/reactor banks, ywheels, and bat-

tery or pumped storage. But as newer

technologies, all offer pros and cons.

Synchronous condensers are another

possible avenue. Though not a new

technology, they represent a hybrid

solution for balancing the intermit-

tency of renewable sources by offer-

ing reactive power support, a role

previously played by large central-

station generators.

A synchronous condenser is a DC-

excited synchronous machine that

makes use of increasingly plentiful

renewable power to overcome me-

chanical losses, converting that en-

ergy into much needed reactive

power, inertia and system short-cir-

cuit current. These services are es-

sential for everything from charging

transmission lines to starting large

motors, riding through faults, and

enabling the proper operation of

critical protection devices on distri-

bution lines to consumers.

Both old and new technologies will

be needed as the world moves toward

higher and higher percentages of re-

newables as it is unlikely we can ever

build enough wind, solar and other

renewable energy sources to offset

the current fossil generation eet.

Right now, globally, we have 6.6 TW

of generating capacity. If the entire

globe were to transition to 100 per

cent renewable power, it’s projected

that we would need to quadruple our

capacity to 28.7 TW. And it’s not just

changing and building out renew-

ables, it is completely changing our

generation mix. For us to move to-

ward a renewable future, we will need

more exible generation.

Whether it’s a large wind farm or

solar panels on a residential roof, re-

newables are making a profound

mark on the energy landscape – al-

though no one knows yet what to do

with recycled batteries or scrap solar.

But what is known is that the range of

potential options associated with re-

newable energy is shaking up the en-

ergy market as it exists today.

If it is in the direction of signi-

cantly more renewables, it will be

best practice – and nancially worth-

while – to have a robust integrated

resource plan in place, one that pro-

vides utilities with a holistic view that

includes energy’s endless options.

Megan Parsons is Renewable Energy

Development Manager at Burns &

McDonnell

L

imited options make for easy

decisions. Back in the day, en-

ergy markets were one-size-

ts-all, with grids simply functioning

to deliver one-way power ows. Gen-

erating capacity was designed to

cover peak demand on that single hot-

test (or coldest) day. The entire indus-

try was slow to adapt and slow to

change because it didn’t need to.

Fast forward to today. A surge of

distributed, mostly renewable energy

resources, is disrupting the norm.

Before intermittent renewable re-

sources gained traction in the early

2000s, traditional energy resource

planning primarily focused on the

lowest cost of electricity. The for-

mula was fairly straightforward: de-

termine the cost to install a power

plant with a life expectancy of 30-40

years; the cost of fuel to operate it;

and how often it would be dispatched.

The biggest variable was guring out

how much fuel would cost over the

next 20-30 years. This was before

renewable energy resources emerged

on the scene.

Beginning in the early 2000s, the

cost for wind power started to drop

signicantly, thanks mostly to gov-

ernment backing in many countries.

With tax credits and other incentives

available, developers and utilities

began to jump onboard. Then, in

2010, solar photovoltaic costs began

a rapid descent – what was $4 per watt

in 2014 is now projected to be

$0.70/W by 2020. These cost declines

have been roughly parallel in both the

US and in Europe.

But wind and solar generation do

not always align with customer de-

mand, meaning renewable penetra-

tion will produce diminishing returns

if a viable storage market or other

source of backup power supply fails

to emerge.

Enter lithium-ion batteries (LIB).

Coincidental to the rise of renewables,

Tesla has helped propel the electric

vehicle (EV) market, driving innova-

tion and cost reductions in LIB tech-

nologies. Since 2012, the global LIB

manufacturing boom has reduced

prices by 70 per cent, according to

IHS Markit. As prices are projected to

continue to decline, the global de-

ployment of these batteries, as stated

in a recent report by GTM Research,

is anticipated to grow by 55 per cent

each year for the next ve years.

In California and Hawaii, utilities

have started to feel the heat from so-

lar’s rapid popularity increase and

strong renewable policy mandates.

Generation planners now have to ac-

count for abrupt power supply transi-

tions. This requires closer integration

with transmission planners, more

outreach with ratepayers, and more

focus on exibility rather than simply

determining the lowest-cost peaking

capacity.

In the US, integrated resource plan-

ning is being redened, with some

states requiring more engagement

with their customers during the inte-

grated resource plan development,

including a rigorous evaluation of

distributed generation resources.

There’s a real need to look holistically

at transmission and distribution plan-

ning when preparing for generation as

well, but there are few established

best practices in how to do that. With

unclear rules, the entire US utility in-

dustry is starting to look at the early

adopters. But even they don’t have all

the answers yet.

In July 2017, American Electric

Power (AEP), an Ohio-based electric

utility that plans to add more than 3

GW of solar and more than 5 GW of

wind power capacity to its portfolio

by 2030, announced a plan to build

the largest US wind farm in the west-

ern panhandle of Oklahoma. Dubbed

the Wind Catcher, this 2 GW project

was slated to provide 9 TWh of wind

energy annually to customers in Ar-

kansas, Louisiana, Oklahoma and

Texas.

But its $4.5 billion price tag proved

to be too much and last year Texas

utility regulators rejected the project,

citing a lack of benets for ratepayers.

Obstacles included a lengthy 350

miles of transmission line needed for

delivery of electricity to end users.

One takeaway from the AEP experi-

ence is we can’t just be focused on

busbar cost anymore. We have to look

at delivery cost as well as the value of

location in this new power supply

equation. Economies of scale cap-

tured with large central stations have

made the most sense in the past, but in

the new utility model, there’s a lot of

locational value to be unlocked in

bringing more renewables and power

supply to a system.

No single technology, at this point

in time, does everything we need.

With all alternative generation sourc-

es, the economics are completely

different, and none provide the same

level of support to the grid.

Policymakers in both the UK and

US are encouraging utilities to evalu-

ate storage in their integrated resource

planning. But it is difcult to go all-in

without specic regulation around

how energy storage facilities will be

compensated. Planners can’t wait for

regulation to be nalised, energy stor-

age costs to further decline, or tech-

nology risks to be realised through

research and development or pilot

programmes. In the meantime, as ag-

ing fossil fuel plants are retired, elec-

tric utilities are turning to a more ef-

cient fossil fuel: natural gas.

Much like wind and solar, natural

gas is abundant and cost-effective

while also checking the boxes for grid

stability and reliability. In the US,

natural gas is expected to continue as

the primary electricity generation re-

source for at least the next decade.

Moreover, gas is expected to become

even more predominant as more and

more coal red capacity is retired.

One thing we’re doing during the

integrated resource planning process

is helping utilities realise the eco-

nomic benet of faster-response, gas

red generation technologies. In

some markets, smaller aeroderiva-

tive and reciprocating engine tech-

nologies are attractive because they

have a small footprint, can quickly

respond to load demand, and can be

placed near load pockets to offer

highly reliable capacity.

In Denton, Texas, a medium-sized

city located near Dallas-Fort Worth,

city leaders opted to build a 225 MW

gas red reciprocating engine plant as

a bridge to allow them to meet a goal

of grid stability while working toward

an eventual goal of 100 per cent re-

newable energy.

Low-cost, high-efciency gas is an

important component as the grid

transitions to renewable energy, keep-

ing reliable power owing to custom-

ers. There have been great strides

within the gas turbine market, in-

creasing efciency, reducing emis-

sions and lowering cost for reliable

gas generation. The already highly

efcient gas turbines can follow load

demand much more effectively and

efciently than they could just ten

THE ENERGY INDUSTRY TIMES - JULY 2019

Energy Outlook

14

As the grid transitions

to renewable energy,

technologies continue

to emerge to handle

its intermittency.

Although gas red

generation is likely

to be a critical part

of the energy matrix

in this respect, some

utilities have latched

on to other newer

technologies. But all

offer pros and cons.

Megan Parsons

Planning for renewables:

the endless options

Parsons: Both old and new technologies will be

needed as the world moves toward higher and

higher percentages of renewables

THE ENERGY INDUSTRY TIMES - JULY 2019

15

Technology

As solar modules

move to higher power

outputs, 158 mm

wafer sizes could

become the new

standard.

Junior Isles speaks

to JinkoSolar’s

Dr Alex Li about what

the company’s move

to a larger standard

wafer size means for

the industry.

M

uch has changed in the so-

lar industry in recent years

– advances that have seen

solar farm sizes increase and lev-

elised cost of energy (LCOE) from

those farms reach grid parity in

many countries.

With China being a global leader in

the sector, Chinese companies are

playing a key role in the progress of

solar panel technology.

Dr Alex Li, Ph.D in Photovoltaics

Engineering and Head of Technical

Service, Asia Pacic (APAC) at

JinkoSolar, commented: “About two

years ago in Australia, people were

typically only building 5 MW solar

farms; these days, 200 MW farms

are being discussed. There’s been re-

ally rapid change and rapid growth

in the industry.

“What we are trying to achieve is

how to ensure solar, as a relatively

new technology, reaches grid parity

and becomes competitive with tradi-

tional forms of generation such as

coal red plant or hydro.”

The price of solar power has fallen

by around 90 per cent over the last

10 years. This, says Dr Li is largely

down to two factors: “Number one is

the power output, driven by efcien-

cy. Higher power means you can re-

duce the balance-of-system (BOS),

such as trackers and other compo-

nents, not including the panels.

“But I would say the most impor-

tant thing is economy of scale. Ten

years ago manufacturers were only

producing 100 MW each year. To-

day, all the tier 1 manufacturers are

producing 10 GW/year but the prot

is the same. So the unit price has

been driven down.

“China has been the major contrib-

utor to the PV industry when it

comes to mass production, able to do

very high density mass production in

a single manufacturing facility. The

silicon maker, wafer maker and cell

maker are all next to each other so

that you an access those technolo-

gies and technology developments in

a relatively efcient way.”

JinkoSolar recently announced that

it was switching high volume pro-

duction capacity for its PV panels

from polycrystalline to premium

monocrystalline. It also said its new

Cheetah module is now combining a

bigger size wafer with half-cut cell

technology. In what it claimed to be

an industry’s rst, the new Cheetah

module will now use a 158 mm wa-

fer as its new standard size.

Dr Li says moving to the larger

wafer size is important for end users

– both residential and utilities – as it

allows higher power output in a

cost effective way. Having a higher

output panel, he stressed, is a way

of achieving a better return on in-

vestment for solar projects, thus

making them more attractive for -

nancial investors.

“When I rst joined Jinko two

years ago, people were talking about

a 320 W panel. This means you

would need ve panels to build a 1.6

kW system. Today, with a 400 W

panel, you only need four panels,”

he said. “This means you can reduce

the cost of the mounting system sig-

nicantly. You can also reduce in-

stallation cost, etc. When you are

talking about a 100 MW solar farm,

using a 400 W panel will reduce the

balance of system (BOS) cost signif-

icantly.”

Launched about one year ago, the

Cheetah 410 W module set a new

standard for a commercially mass-

produced panel output. “It was the

rst time in history that a single PV

panel could reach 400 W. Now other

major suppliers are following the

trend of moving towards highly ef-

cient mono technology,” said Dr Li.

According to Jinko, it was able to

move to a 158 mm wafer, from the

traditional 156 mm size, without any

major upgrade of its existing manu-

facturing facilities. “This means we

were able to increase the power of

the modules without increasing man-

ufacturing cost signicantly. So this

was a cost-effective technology de-

velopment.”

The decision to base its modules

on what it calls “premium” mono-

crystalline instead of poly-crystalline

was also ultimately based on eco-

nomics. Dr Li says, these premium

mono-crystalline panels have a dif-

ferent cell structure to standard mo-

no-crystalline modules and have 2-3

per cent higher efciency.

Mono-crystalline solar panels have

the highest efciency rates, currently

in the 20 per cent region, since they

are made out of the highest-grade

silicon. They also have a long lifes-

pan, typically 25-30 years. Tradition-

ally, however, they are more expen-

sive. By contrast, poly-crystalline

panels are less efcient, around 13-

16 per cent and typically have a

slightly shorter lifespan of 23-27

years. However they are traditionally

cheaper.

But the economics of the two

technologies has been changing.

“About 30 years ago, in the early

days of the PV industry, the price

difference between poly and mono

was very big, almost 200 per cent,”

said Dr Li. “So back then, and even

just 10 years back, people favoured

poly because of cost. But both are

reliable technologies.”

As the industry has evolved, how-

ever, the price gap has become very

small and according to Dr Li, the

trend is towards mono crystalline

panels. “If you calculate the capex of

the entire system – including not just

the module but the inverter, tracker

DC cable and all the civil works – a

400 W mono now has a lower capex

than a 320 W poly. This is a mile-

stone and indicates that poly will

probably start to phase out for the

rst time in the history of PV.”

He believes that when looking at

the technology development road-

map, there will be “no way back” for

polycrystalline panels. “Poly does

not have too much room to improve.

If you spend $1 million in a poly de-

velopment, you would probably get

a 0.1 per cent increase in efciency

but if you spend that in a mono tech-

nology development, you would get

a 0.2 to 0.3 per cent increase in ef-

ciency, said Dr Li. “This is why

many investors now choose to invest

in mono technology development

rather than poly.”

For manufacturers, the change

from poly crystalline cell production

to mono will be painful but may be

inevitable. “It will be challenging

because manufacturers will want to

make use of existing facilities for as

long as possible. But at some point,

when they can no longer make a

prot, they will be forced to upgrade

their manufacturing facility to pro-

duce premium mono solar cells.”

Indeed, it will be an increasingly

likely shift judging by the falling

LCOE delivered by advancing tech-

nology. A nancial analysis by

JinkoSolar of a Cheetah 158 mm,

high performance mono cell versus

a standard poly-crystalline cell re-

veals an LCOE of 3.49 /kWh versus

3.55 c/kWh.

Meanwhile, Dr Li says JinkoSolar

will continue to upgrade its technol-

ogy in a cost-effective way. “Next

year or in the very near future, we

will be offering a major technology

development for the solar PV com-

munity. Already this year, we

launched a bifacial technology with

a transparent backsheet. Because it

allows electricity to be generated

from both sides, you can generate

more energy from the same area of

land.”

He forecasts that next year it will

have modules with power outputs in

the region of 450-460 W from a sin-

gle panel. These, he says, will have

an efciency above 20 per cent.

Looking forward, Dr Li adds that

new technology will have to be af-

fordable, reliable in the eld and du-

rable. He concluded: “From a nan-

cial point of view, if we want to

make sure that your nancial invest-

ment is secure. Together with power,

reliability and durability, we also

have to ensure that the solar panel

performs as predicted from day-one

– that is JinkoSolar’s mission for the

entire PV community.”

Higher efciency improves

solar economics

Dr Li says polycrystalline

technology will probably start

to phase out “for the rst time

in the history of PV”

How the economics stack up

Cell technology Industrial standard Jinko Cheetah

156 mm cell 158 mm cell

Module Type Industrial standard Cheetah high

performance poly series mono series

Module power(W) 330 400

Analysis results

LCOE (¢/kWh) 3.55 3.49

IRR (%) 9.35 9.56

Project overall cost ($/Wp) 0.7500 0.7438

BOS cost ($/Wp) 0.5000 0.4588

Inverter cost ($/Wp) 0.0793 0.0771

Mounting structure cost ($/Wp) 0.1024 0.0845

Other material and construction cost ($/Wp) 0.3183 0.2972

Increasing conversion efciency

In early June, JinkoSolar Holding Co Ltd said it achieved maximum conversion efciencies of 24.38

per cent and 24.58 per cent, respectively, for its Cheetah size cells and N-type photovoltaic (PV) cells.

The Chinese Academy of Sciences undertook the testing of the cells in March, JinkoSolar said in a

statement, claiming the efciencies are the highest in the world.

JinkoSolar also said its 72 version monocrystalline module has reached peak capacity of 469.3 W

during tests conducted by German safety standard authority TÜV Rheinland. The tests were carried

out in May.

The company has tied up with advanced R&D centres globally to create a joint research platform for

solar products. In January, it announced an efciency of 24.2 per cent for a large-area N-type TOPCon

monocrystalline silicon solar cell.

THE ENERGY INDUSTRY TIMES - JULY 2019

16

Final Word

S

ome would argue that setting

even more ambitious targets,

although you are failing to

achieve the current ones, smacks of

fantasy. Yet this is what the UK is look-

ing to do by legislating “net zero”

emissions by 2050. Likewise, the EU

is now discussing whether to follow

the UK’s example.

The story so far does not instil much

condence. Global emissions hit a

record high last year and most coun-

tries including Belgium, France,

Germany and the UK are set to miss

their 2020 carbon targets. A recent EU

assessment also found that the bloc is

not on track to meet its 2030 target to

draw 32 per cent of electricity from

renewable sources, because countries’

individual energy policies are insuf-

cient to meet the collective goal.

A report by the International Energy

Agency last month served only to add

to the pessimism. Of the 45 energy

technologies and sectors assessed in

the IEA’s latest ‘Tracking Clean En-

ergy Progress’ report, only seven are

on track for reaching climate, energy

access and air pollution targets. These

latest ndings follow an IEA assess-

ment published in March showing that

energy-related CO

2

emissions world-

wide rose by 1.7 per cent in 2018 to a

historic high of 33 billion tonnes.

Based on progress so far it is under-

standable why many would see intro-

ducing “net zero” legislation as

nothing more than ight of fancy of

an outgoing Prime Minister under

public pressure from activists and

looking to leave a positive legacy.

Yet past failures should not neces-

sarily dictate future ambition. And the

global energy transition is indeed ac-

celerating as the economics of tech-

nologies such as wind, solar and

storage become more favourable.

A report last month by Bloomberg-

NEF (BNEF) gives reasons to be

cheerful, and perhaps some con-

dence that net zero emissions by 2050

might be more than a pipedream.

In its New Energy Outlook 2019

(NEO), BNEF forecasts that deep

declines in wind, solar and battery

technology costs will result in a grid

nearly half-powered by the two fast-

growing renewable energy sources

by 2050.

The report notes that Europe transi-

tions furthest and fastest. By 2040,

renewables make up 92 per cent of the

electricity mix, with wind and solar

accounting for 80 per cent. Cheap re-

newables, exible demand and batter-

ies shift the European power system

away from fossil fuels and nuclear to

one built around variable renewables

and emissions-free energy.

Notably, by 2050 renewables pro-

vide 96 per cent of generation and

Germany’s emissions are 97 per cent

below what they are today. The UK,

meanwhile, adds 228 GW of wind and

solar by 2050, as well as 27 GW of

batteries, and renewables provide 89

per cent of generation.

According to the Outlook, the US

electricity system continues to replace

aging coal and nuclear with cheaper

renewables and gas, which becomes

the country’s premier source of power

generation. Coal and nuclear are

pushed out by age and economics, such

that by 2050 both technologies have

almost disappeared from the electric-

ity mix. Utility-scale batteries for

peaking purposes grow in signi-

cance from around 2035, supporting

renewables penetration, which

reaches 43 per cent in 2050. In that

year, emissions are 54 per cent lower

than today.

China, the world’s largest carbon

emitter along with the US, sees peak

coal generation and emissions in 2027,

as the world’s biggest electricity sys-

tem reaches 37 per cent renewables

penetration. China continues to be the

largest market for wind and solar,

which together grow from 8 per cent

to 48 per cent of total generation by

2050. By that time, China has 1.3 TW

of solar PV and 1.2 TW of wind in-

stalled – equivalent to 17 per cent of

all PV and a third of all wind power

installed globally. Nuclear, the only

base load CO

2

-free technology re-

mains important for China and sees

four-fold growth to 182 GW by 2050.

Shortly after the UK announced it

would be the rst to make its net zero

commitment legally binding, there

was some good news on the country’s

direction of travel.

For the rst time since the Industrial

Revolution, Britain is obtaining more

power from zero-carbon sources than

fossil fuels. National Grid revealed

that clean energy (nuclear, renewable

and clean electricity imports) has

moved ahead with 48 per cent of

generation, against 47 per cent for coal

and gas. The rest comes from biomass

burning. It said that over the past de-

cade, coal generation has plummeted

from 30 per cent to 3 per cent.

While this and the new legislation

are welcome – as is so often the case

in government policy – the politicians

have given themselves a get out-of-

jail card, or two.

The net zero target comes with a

noteworthy proviso: it will depend on

whether other countries are following

suit. A review within ve years will

assess whether other countries have

adopted similar goals – and if they

have not, it would give the UK the

opportunity to lessen its ambition.

Environmental groups have under-

standably criticised this as a major

“loophole”. Also, the term “net zero”

clearly indicates the government ac-

knowledges it may not be able to

achieve the goal that environmental-

ists are really pushing for – ‘actual

zero’ carbon emissions. “Net zero”

means that any remaining emissions

could be balanced by schemes to offset

an equivalent amount of carbon from

the atmosphere, such as planting trees

or through purchasing international

carbon offsets.

“It is disappointing that the govern-

ment has ignored its climate advisers’

recommendation to exclude carbon

offsets – as well as caving into Trea-

sury pressure to review the target in

ve years’ time,” said Craig Bennett,

head of Friends of the Earth.

Perhaps it is disappointing, yet

wholly understandable. The UK is

willing to lead the battle on tackling

climate change but is not willing to be

that single drop in the ocean, legally

culpable for what is a global respon-

sibility. Further, with Brexit looming

and a weakening economy, its govern-

ment has to be mindful of spending

and how much it can burden taxpayers.

Chancellor Philip Hammond warned

Theresa May that her net zero by 2050

plan will cost the UK “well in excess”

of £1 trillion. This would currently

equate to over $1100/year for every

UK taxpayer for the next 30 years.

Arguably, it’s a small price to pay for

our planet – if you are not already on

the bread line.

But it is no small task. Bloomberg-

NEF says the power sector will, at least

until 2030, contribute its share toward

keeping global temperatures from

rising more than 2°C. However, there

is heating, transport and industry to

consider – decarbonising these will be

much more challenging.

“We should be honest that it is a huge

industrial undertaking, and it will have

signicant cost,” said Dieter Helm,

Professor of Energy and Economics at

Oxford, who welcomed the new plan.

“These are enormous industrial ac-

tivities, there is nothing in history that

looks like this outside of wartime.”

Perhaps that is how governments

need to look at the issue. The battle

against climate is a war and when

going to war, countries seem to have

few reservations on how many zeros

are attached to the price tag.

Differentiating between

zeros and loopholes

Junior Isles

Cartoon: jemsoar.com