www.teitimes.com

June 2019 • Volume 12 • No 4 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Going global Leading the charge

The falling cost of energy from

offshore wind farms is driving its

global development.

Page 13

Solar-plus-storage prices are predicted

to decline considerably over the next

ve years, according to a new report.

Page 14

News In Brief

Vision 2020+ could see

Siemens exit power sector

Siemens is looking to exit the

power sector and increasingly focus

on digital industries and smart

infrastructure in the face of falling

demand for power plant equipment.

Page 2

Brayton Point set for key

role in offshore wind

A former coal red power plant site

in Massachusetts is set to become a

central focus of the USA’s growing

offshore wind energy sector.

Page 4

India may fall short of wind

target

Although solar installations continue

apace, plans for new wind capacity

may fall short of 2022 government

targets.

Page 6

German onshore wind in

“deep trouble”

The collapse in growth in

Germany’s onshore wind energy

sector will have serious implications

for German and EU clean energy

targets.

Page 7

Subsidy-free environment

challenges renewables

Renewable energy developers

are facing new challenges as the

industry enters a new phase of

subsidy-free growth around the

world, according to consultants EY.

Page 8

Engie and EDPR team up on

offshore wind

Competition in the global offshore

wind energy sector is set to rise

following plans by Engie and EDP

Renewables to create a new joint

venture.

Page 9

Technology: Gearing up for

hydrogen

Work is under way at the Groningen

power plant to convert one of

its units to run on 100 per cent

hydrogen.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

The ndings of the World Energy Investment 2019 report signal a growing mismatch between current

trends and the paths to meeting the Paris Agreement and other sustainable development goals.

Junior Isles

Iran nuclear programme again in focus as US tensions escalate

THE ENERGY INDUSTRY

TIMES

Final Word

The stars are aligning for

acceleration,

says Junior Isles.

Page 16

The ‘World Energy Investment 2019’,

recently published by the International

Energy Agency, claims that the level-

ling off of investment in renewables

and energy efciency represents a seri-

ous threat to efforts to meet the targets

set out in the Paris climate change

agreement and United Nations Sus-

tainable Development Goals (SDG).

Following three years of decline,

global energy investment totalled

more than $1.8 trillion in 2018, a level

similar to 2017. Still, even as invest-

ments stabilised, approvals for new

conventional oil and gas projects fell

short of what would be needed to meet

continued robust growth in global

energy demand, said the report. At the

same time, there are few signs of the

substantial reallocation of capital to-

wards energy efciency and cleaner

supply sources that is needed to bring

investments in line with the Paris

Agreement and other sustainable de-

velopment goals.

Launching the report, Mike Wal-

dron, Head of the IEA’s investment

team, explained: “A lot of this de-

crease in renewables investment was

due to a stable picture for net addi-

tions, as well as falling costs. A lot of

it is attributed to China but renewables

investment in the rest of the world ac-

tually increased in 2018.”

Last year, however, was the rst

time since 2001 that growth in renew-

able power capacity failed to increase

year on year. New net capacity from

solar PV, wind, hydro, bioenergy, and

other renewable power sources in-

creased by 177 GW in 2018, the same

as the previous year. This, says the

IEA, is only around 60 per cent of the

net additions needed each year to meet

long-term climate goals.

According to the IEA’s Sustainable

Development Scenario (SDS), spend-

ing on renewable power needs to

double by 2030 as the world should be

installing over 300 GW annually on

average in the 2018-2030 period, if it

intends to reach the goals of the Paris

Agreement. The IEA warned that the

carbon dioxide (CO

2

) emissions pro-

duced by the energy sector increased

by 1.7 per cent to 33 Gt, despite a 7 per

ent growth in the electricity produc-

tion from renewables.

“Energy investments now face un-

precedented uncertainties, with shifts

in markets, policies and technolo-

gies,” said Dr Fatih Birol, the IEA’s

Executive Director. “But the bottom

line is that the world is not investing

enough in traditional elements of sup-

ply to maintain today’s consumption

Continued on Page 2

The administration of US President

Donald Trump is renewing three key

waivers that allow European allies,

China and Russia to cooperate with

Iran on civil nuclear programmes.

The projects include reactor rede-

signs to prevent the creation of pluto-

nium and infrastructure projects that

will help ensure that some facilities

are not used for uranium enrichment.

“Iran must stop all proliferation-

sensitive activities, including uranium

enrichment, and we will not accept

actions that support the continuation

of such enrichment,” the US State

Department said in a statement.

The administration will renew the

waivers for Iran’s Fordow, Bushehr

and Arak nuclear facilities for 90

days, with the potential for them to

be renewed. This is instead of the

180 days the original waivers were

for. The waivers, which were due for

renewal May 5, allow countries to

help Iran convert its nuclear facilities

to non-military purposes in line with

a 2015 nuclear accord.

Fordow, which was originally an

underground uranium enrichment fa-

cility, is being converted into a nucle-

ar physics and technology centre un-

der the terms of the accord.

Arak is the site of an unnished

heavy water reactor Iran was building

before the deal. Iran destroyed the

heart of the reactor as part of the deal,

and now China and the United King-

dom are overseeing work on a re-

placement reactor for non-weapons

grade plutonium.

Bushehr is a civil nuclear reactor

that is fuelled by Russia, which has

been ensuring the spent fuel does not

pose a proliferation risk.

The waivers for civil nuclear coop-

eration were rst granted in Novem-

ber when the administration re-im-

posed all the sanctions that had been

lifted under the Obama-era Iran nu-

clear deal.

The US introduced the measures as

a continuation of previous policies

aimed at curbing Iran’s ability to re-

vive its nuclear weapons programme.

Two other waivers, one that allowed

Iran to ship surplus heavy water to

Oman and another that allowed Rus-

sia to process Iranian uranium, will be

revoked.

Among the policies are an oversight

of the country’s civil nuclear pro-

gramme, which the department said

would constrain Iran’s ability to short-

en its “breakout time” in terms of get-

ting a nuclear weapon.

The department introduced further

restrictions on Iran including sanc-

tions on the transfer of enriched ura-

nium out of Iran in exchange for

natural uranium and warned that any

assistance to expand Iran’s Bushehr

nuclear power plant beyond the ex-

isting reactor unit could be subject to

sanctions.

US nuclear sanctions will remain in

place to help maintain the nuclear

status quo in Iran until a comprehen-

sive deal resolving Iran’s prolifera-

tion threats is in place to replace the

2015 agreement that has been reject-

ed by President Trump.

Trump pulled the US out of the ear-

lier agreement amid criticism that the

accord was hampered by limited in-

ternational inspection requirements

while allowing the nation to resume

past nuclear weapons work in 10 to 15

years.

On May 9, Iran responded saying it

is pulling out of “some commitments”

made under the nuclear deal, and will

resume higher enrichment of uranium

in 60 days unless a new agreement

can be reached.

President Hassan Rouhani said:

“We are ready to negotiate, within the

boundaries of JCPOA,” referring to

the Joint Comprehensive Plan of Ac-

tion nuclear deal. “It is not us who has

left the negotiation table.”

Paris and sustainable

development goals

under threat, says

IEA

Dr Birol: energy investments now face

unprecedented uncertainties

THE ENERGY INDUSTRY TIMES - JUNE 2019

2

Siemens is looking to exit the power

sector and increasingly focus on digital

industries and smart infrastructure in

the face of falling demand for power

plant equipment.

Under its Vision 2020+ strategy the

German industrial giant plans to spin-

off its struggling gas and power unit,

then sell its majority stake in a public

listing scheduled for September 2020.

It will then concentrate on higher-

margin businesses, such as connecting

industries to the internet.

The division to be carved out com-

prises its oil and gas, conventional

power generation, power transmission

and related services businesses.

Siemens’ Gas and Power (GP) unit is

to be “given complete independence

and entrepreneurial freedom through a

carve-out and a subsequent public list-

ing”, Siemens said in a statement.

Joe Kaeser, Siemens’ Chief Execu-

tive, said he believed the conglomerate

structure should be a thing of the past.

He told investors that the answer no

longer lay in being big, otherwise “the

whole world today would be full of

dinosaurs”.

He added: “They’ve [the dinosaurs]

been the biggest. But something must

have been wrong with them because,

obviously, they don’t exist. What was

wrong with them was not their size, but

the lack of adapting to different condi-

tions that history provided for them.”

The company said the restructuring

would see it cut 10 400 jobs, but it ex-

pected to create 20 500 more through

growth through 2023, leading to a net

increase of 10 000.

With 44 000 employees, the gas and

power unit booked sales worth €12.4

billion in 2018 – the same as 2014.

Prots over that period, however,

plummeted from €2.2 billion to €377

million as the industry struggled with

gas turbine overcapacity due to the

global shift from fossil fuels to renew-

able energy.

Chief Operating Ofcer for the divi-

sion Tim Holt said the industry had

capacity to build 400 gas turbines a

year, but global orders were fewer

than 80. This led to prices being de-

pressed, impacting all the big gas

turbine manufacturers. GE Power has

dragged down GE’s bottom line re-

sults over the past two years and led

to major layoffs and changes in the

executive ranks.

Though Siemens still operates eight

divisions, the “new” Siemens will

place its focus on just two areas –

Smart Infrastructure, which connects

infrastructure to the internet, and

Digital Industries, which enhances

manufacturing with digital tools.

These two sectors have been set new

prot margin targets of 10-15 per cent

and 17-23 per cent.

Siemens will still hold large stakes in

four “strategic” companies – Siemens

Gamesa Renewable Energy (SGRE),

medical technology unit Healthineers,

the transport technology arm Mobility

and the traditional energy Gas and

Power unit. But these groups will oper-

ate independently.

The decision to divest entirely will

be left to Kaeser’s successor after his

contract expires in 2021.

Lisa Davis, Chief Executive of Sie-

mens’ gas and power division, told

investors that the new spin-off will be

able to market itself as a €30 billion

business volume company capable of

delivering any sort of electricity need,

because of its controlling stake in

SGRE.

In its latest results posting, SGRE

reported that revenue increased by 6

per cent year-on-year in the rst half

of FY 2019, to €4651 million and by 7

per cent in the second quarter, to €2389

million, supported by strong perfor-

mance in Offshore and Service. On the

back of the results, SGRE became the

rst wind turbine manufacturer to at-

tain an investment grade rating.

patterns, nor is it investing enough

in cleaner energy technologies to

change course. Whichever way you

look, we are storing up risks for the

future.”

“The world cannot afford to press

‘pause’ on the expansion of renew-

ables and governments need to act

quickly to correct this situation and

enable a faster ow of new proj-

ects,” said Dr Birol.

To meet sustainability goals, in-

vestment in energy efciency,

which has stalled over the last two

years, would need to accelerate.

The IEA also said that even though

decisions to invest in coal red

power plants declined to their low-

est level this century and retire-

ments rose, the global coal power

eet continued to expand, particu-

larly in developing Asian countries.

Waldron said: “The continuing

investments in coal plants, which

have a long lifecycle, appear to be

aimed at lling a growing gap be-

tween soaring demand for power

and a levelling off of expected gen-

eration from low-carbon invest-

ments (renewables and nuclear).

“Without carbon capture technol-

ogy or incentives for earlier retire-

ments, coal power and the high CO

2

emissions it produces could remain

part of the global energy system for

many years to come.”

He said that by 2030 under the

SDS, most if not all coal red plant

would have to be equipped with

capture. “We’re within a matter of

single digit years in which such in-

vestment decisions would need to

turn,” he noted.

Summing up the ndings from

WEI 2019, Tim Gould, who heads

the Energy Supply and Investment

Outlooks division at the IEA, noted

that investment is “well short” of

what is required to meet the UN’s

SDG.

“The share of low carbon invest-

ment – renewables, nuclear, efcien-

cy, batteries, carbon capture utilisa-

tion and storage – has been stuck at

around one third of the total [energy

investment] for the last few years. We

would need to see that share going up

to around two thirds over the next

decade in order to put us on the trajec-

tory consistent with the Sustainable

Development Goals.”

In a separate report issued shortly

after WEI 2019, the IEA stated that

despite signicant progress in re-

cent years, the world is falling short

of meeting the global energy targets

set in the SDG for 2030. The organ-

isation’s ‘Tracking SDG7: The En-

ergy Progress Report’ says that

ensuring affordable, reliable, sus-

tainable and modern energy for all

by 2030 remains possible but will

require more sustained efforts.

The report also shows that great

efforts have been made to deploy

renewable energy technology for

electricity generation and to im-

prove energy efciency across the

world. Nonetheless, access to clean

cooking solutions and the use of

renewable energy in heat generation

and transport are still lagging far

behind the goals.

See page 11 for WEI 2019 data.

Continued from Page 1

Experts believe the UK can achieve its

recently announced target for net zero

carbon emissions by 2050. The ques-

tion is at what cost?

At the end of April, the Committee

on Climate Change (CCC) issued a

report advocating that there was a

sound scientic, technological and le-

gal case for the adoption of a new,

legal net-zero emissions target by

2050 at the very latest.

While many welcomed the report,

there is a big question mark as to what

it will cost.

Michael Wheeler, Executive Direc-

tor, UK Energy, Ramboll, said:

“Achieving a net zero target is possible,

but the cost of doing so is still uncertain

– with many technologies still in de-

velopment, we aren’t able to provide

cost certainty for many potential solu-

tions to all our energy usage problems.

There is also some uncertainty as to

what will be the size of the energy mar-

ket as we become more energy efcient

and what may be the impact of chang-

es in other sectors.”

He also noted that achieving net zero

will be heavily inuenced by whether

new nuclear will be economically vi-

able. “If it is not included in the mix,

then the source of rm reliable energy

will need to come from energy storage

methods to counter the intermittent

energy supply associated with renew-

able technologies, such as solar or

wind power.

“The present alternatives to nuclear

and energy storage for achieving zero

emission ‘rm’ capacity include bio-

mass red projects and gas red

CCGT incorporating carbon capture

and storage (CCS), however these do

not currently receive government

subsidy (in today’s energy market all

forms of rm capacity power genera-

tion and storage need some form of

subsidy to be viable).”

Just ahead of the CCC report, a select

committee of MPs said the UK cannot

“credibly” reduce greenhouse gas

emissions to net zero without the

widespread use of carbon capture but

government support for the edgling

industry has been “turbulent”.

The UK has yet to develop a com-

mercial-scale project. Government

subsidy auctions, in 2007 and 2012, to

develop projects were later cancelled

amid concerns over costs.

The government maintains it aims to

have “the option to deploy CCUS at

scale during the 2030s, subject to costs

coming down sufciently”. However,

the business, energy and industrial

strategy select committee report said

this did not indicate a commitment

commensurate “with the importance of

this technology”.

In 2012, it was estimated that pro-

posed power plants with carbon cap-

ture schemes would require govern-

ment subsidy contracts with a “strike

price” of £170/MWh. More recent

projections have reduced to £80-90/

MWh, although this is still more ex-

pensive than offshore wind.

The CCC report says the UK will

need 75 GW of operating offshore

wind capacity to reach net-zero green-

house gas emissions target by 2050.

Matthew Wright, MD at Ørsted UK,

commented: “75 GW of offshore wind

by 2050 is denitely achievable. The

cost of offshore wind has already re-

duced to the point where it is compa-

rable with conventional generation,

and it’s continuing to fall.”

In a Legal Update on its recommenda-

tions on cyber security in the energy

sector, the EU Commission has said

that companies should not rely on a

“one-size-ts-all” approach for the

security of their products. They should

instead split the overall systems into

logical zones and apply appropriate

measures to each of them.

This Legal Update gives a refresher

on the EU cyber security framework

for the energy sector and provides a

summary of the EU Commission Rec-

ommendations, including next steps

that energy network operators should

consider.

In April the EU institutions (i.e., the

European Parliament, the Council and

the EU Commission) reached an agree-

ment on the Cyber security Act. The act

creates EU cyber security certication

schemes for information communica-

tions technology (ICT) products; ser-

vices (involved in transmitting, stor-

ing, retrieving or processing

information via network and informa-

tion systems); and processes (activities

performed to design, develop, deliver

and maintain ICT products and ser-

vices). The new framework is designed

to give companies operating in the

energy sector an opportunity to certify

their products, services or processes.

The EU Commission also proposed

sector specic legislation under the

‘Clean Energy for All Europeans’

package, which has cyber security

aspects. The new ‘Regulation on Risk

Preparedness of the Electricity Sec-

tor’ requires EU member states to

develop national risk preparedness

plans that take into account cyber

security and guarantee the stability of

their systems against potential threats.

Member states are expected to take

steps to follow the EU Commission

Recommendations when developing

national cyber security frameworks

(e.g., through strategies, laws, or

regulations). Within the next 12

months and every two years thereaf-

ter, EU member states are required

to communicate to the EU Commis-

sion details about the state of the

implementation.

The war on cyber attacks received a

recent boost with the announcement

of a new partnership between Siemens

and Chronicle, an Alphabet company,

to protect the energy industry’s critical

infrastructure.

Through a unied approach that

will leverage Chronicle’s Backstory

platform and Siemens’ strength in in-

dustrial cyber security, the combined

offering is claimed to give energy com-

panies “unparalleled visibility” across

information technology (IT) and op-

erational technology (OT) to provide

operational insights and condentially

act on threats.

The partnership will help companies

securely and cost-effectively leverage

the cloud to store and categorise data,

while applying analytics, articial in-

telligence, and machine learning to OT

systems that can identify patterns,

anomalies, and cyber threats. Chroni-

cle’s Backstory, a global security te-

lemetry platform for investigation and

threat hunting, will be the backbone of

Siemens’ managed service for indus-

trial cyber monitoring, included in

both hybrid and cloud environments.

Headline News

UK can achieve net zero ambitions but at what cost?

EU says one size does not t all on

cyber security

Vision 2020+ could see

Siemens exit power sector

The struggling market for large gas turbines, which has already caused a massive shakeup

at GE, has now prompted Siemens to take steps to spin-off its gas and power division.

Junior Isles

Gould: investment is “well

short of requirements

THE ENERGY INDUSTRY TIMES - JUNE 2019

5

11,000+

Attendees

350+

International Speakers

350+

Leading Exhibitors

Cutting

Edge Content

DIGITAL

TRANSFORMATION

TRANSMISSION &

DISTRIBUTION

POWER

GENERATION

3-5 SEPTEMBER 2019 | MITEC | KUALA LUMPUR | MALAYSIA

JOIN US FOR ASIA’S ONLY

END-TO-END POWER & ENERGY EVENT

REGISTER BY 31 MAY TO SAVE UP TO 30% WITH THE EARLY BIRD

Organised by:

VISIT WWW.POWERGENASIA.COM OR WWW.ASIAN-UTILITY-WEEK.COM

▪ SEE CONFERENCE HIGHLIGHTS ▪ VIEW THE LATEST EXHIBITOR LIST ▪ REGISTER WITH THE EARLY BIRD

INTERESTED IN

EXHIBITING OR

SPONSORING?

OPPORTUNITIES

ARE STILL

AVAILABLE

PARTICIPATE IN THE REGION’S

FOREMOST BUSINESS

PLATFORM FOR POWER

PROFESSIONALS

The co-location of POWERGEN Asia,

Asian Utility Week, DISTRIBUTECH

Asia, SolarVision and Energy Capital

Leaders provides you with one

show covering the whole value

chain of power - from generation to

transmission and distribution to its

digital transformation.

The combination of these leading

energy shows will bring an

unprecedented authority, with insights

shared by the world’s most forward-

thinking experts and innovators.

Here you will discover the future of

Asia’s Power & Energy industry.

1024_PGA19_120x160_Ad_TEIT.indd 1 4/17/19 8:48 PM

Our Clients:

Our Partners:

weber media solutions

YOUR CREATIVE MEDIA AGENCY FOR

DESIGN AND MARKETING SOLUTIONS

We are a creative media agency which provide a bespoke

service to meet your media and marketing requirements

and much more

DESIGN / VIDEO / WEB / EXHIBITION STAND DESIGN

MAGAZINES / PRINT MANAGEMENT / MAILING

For more information please contact:

Karl Weber / Director

T: +44 7734 942 385 / E: karlw@webermediasolutions.com

www.webermediasolutions.com

some of our exhibition signage projects, for more information please visit our website:

THE ENERGY INDUSTRY TIMES - JUNE 2019

9

Companies News

Siân Crampsie

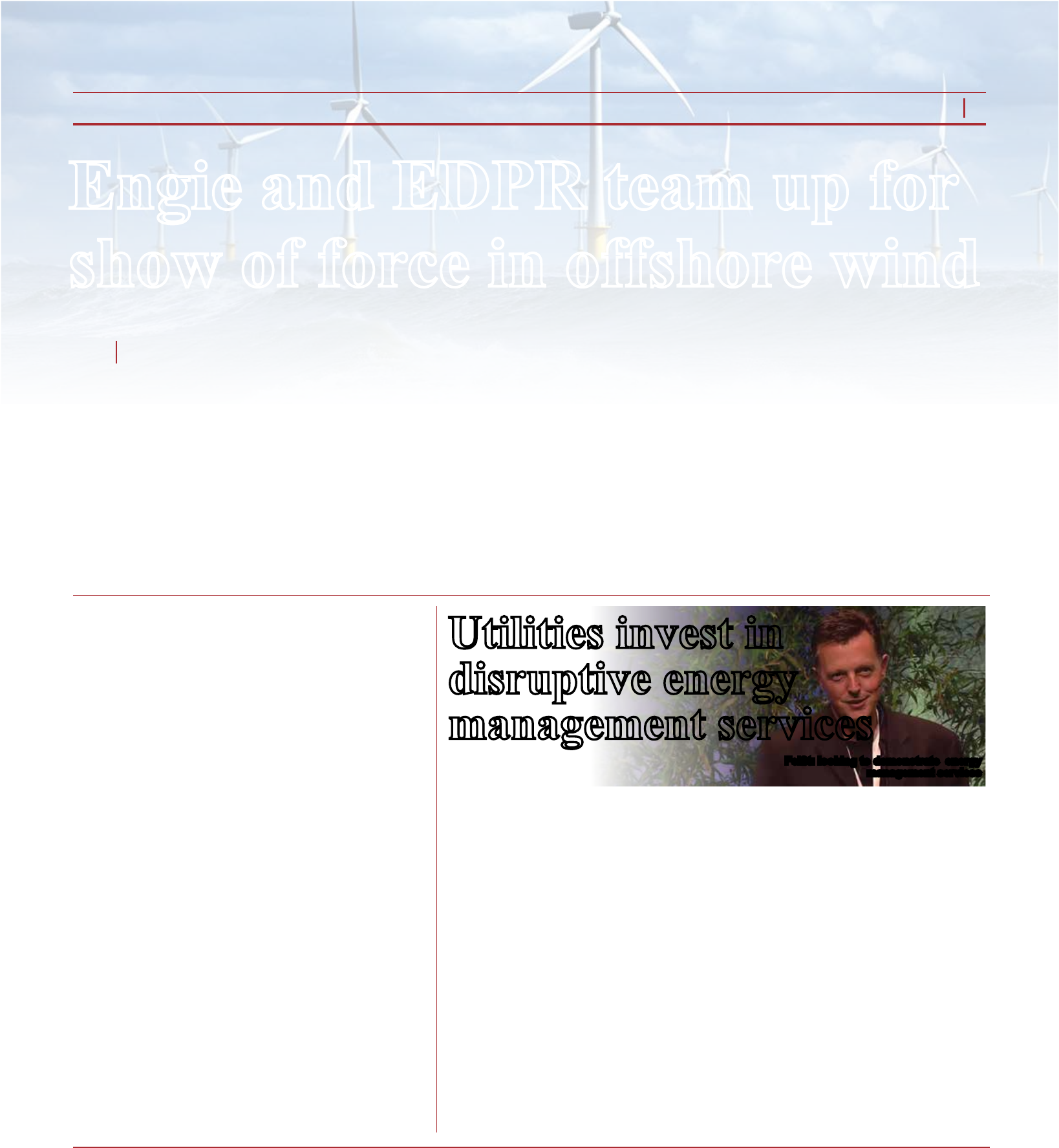

Competition in the global offshore

wind energy sector is set to rise follow-

ing plans by Engie and EDP Renew-

ables (EDPR) to create a new joint

venture.

The two companies have signed an

agreement to create a 50-50 partnership

targeting the xed and oating founda-

tion offshore wind markets globally.

The new entity will be the exclusive

investment vehicle for both Engie and

EDPR in the offshore wind sector and

will bring together the two companies’

expertise in project development, they

said in a statement.

The move is a sign of the need for

large renewable energy developers to

join forces in order to compete with

existing large players such as Orsted

and ensure they have the nancial

might and technical expertise to tackle

large and complex projects in emerging

markets in the USA and Asia.

“The offshore wind sector is set to

grow very signicantly by 2030,” said

Isabelle Kocher, Engie CEO. “The

creation of this JV will enable us to

seize market opportunities while in-

creasing our competitiveness on one

of our key growth drivers, renewables.

This agreement is also fully aligned

with Engie’s zero-carbon transition

strategy.”

Under the terms of the agreement,

EDP and Engie will combine their off-

shore wind assets and project pipeline

in the newly-created venture, starting

with a total of 1.5 GW under construc-

tion and 4.0 GW under development,

with the target of reaching 5 to 7 GW

of projects in operation or construction

and 5 to 10 GW under advanced devel-

opment by 2025.

The company will become a global

top-5 player in the eld, and will be up

and running by the end of 2019, Engie

and EDPR said.

In a statement, the two companies

said that the joint venture will primar-

ily target markets in Europe, the Unit-

ed States and selected geographies in

Asia. Projects will be self-nanced,

they added.

EDPR and Engie said that a joint

venture would allow them to create “an

entity with greater scale and a fully

dedicated team, with global business

development reach and strong power

purchase agreement… capabilities”.

The venture will also enable them to

grow their asset base rapidly and to

operate “more efciently” as a stable

partnership.

The alliance follows the two rms’

cooperation as consortium partners in

the Dieppe Le Treport and Yeu Noir-

moutier xed offshore wind projects

in France and Moray East and Moray

West in the UK. EDPR and Engie are

also partners in two oating offshore

wind projects in France and Portugal,

as well as in the Dunkerque offshore

wind tender currently ongoing in

France.

Antonio Mexia, EDP CEO said:

“This agreement for wind offshore

represents an important step in EDP's

renewables strategy. We are condent

that this partnership will reinforce our

distinctive position in renewables al-

lowing us to accelerate our path in

offshore wind, one of the key growth

markets in the next decade.”

n Vattenfall and GE have created an

alliance to develop GE’s new 12 MW

Haliade-X offshore wind turbine. De-

velopment and production of the new

turbine will take place largely in

France. Vattenfall says it has already

conducted an in-depth technical due

diligence of the platform, which will

feature a 220 m rotor and a 107 m

blade.

RWE is preparing for its integration

with the renewable energy arm of

E.On later this year.

The German energy giant has secured

a €5 billion credit agreement with a

group of international banks and says

that the plan to merge with E.On’s re-

newable energy activities is on track.

The company earlier announced that

it had abandoned plans to build a new

lignite power station at its existing

Niederaussem site in North-Rhine

Westphalia, Germany. “New coal-

red power stations no longer have a

place in our future-oriented strategy,”

said Rolf Martin Schmitz, CEO of

RWE.

Under the agreement reached in

March 2018, E.On is to take over

RWE’s 76.79 per cent stake in innogy,

while RWE is to obtain all of E.On’s

major renewable energy activities and

innogy’s renewable energy business,

as well as a 16.67 per cent minority

stake in E.On.

Following the completion of the

transaction, which is expected in the

second half of 2019, RWE will operate

approximately 8 GW of renewable

energy assets, including offshore and

onshore wind as well as hydro and

photovoltaics.

RWE said that the new credit line

would be provided by 27 internation-

al banks, and was signicantly over-

subscribed.

Once the merger deal closes, RWE

will be the world’s second-largest off-

shore wind operator with a top ve

position among all renewable energy

producers.

“We’re on schedule in implementing

our transaction with E.On. The prepa-

ration of the integration of the renew-

ables business is also making good

progress: The ‘new RWE’ is in sight,”

Dr. Markus Krebber, CFO of RWE,

said.

RWE had planned to build 1.1 GW

of lignite red capacity at Nieder-

aussem to replace the existing coal

red units at the site, which have a

combined capacity of 1.2 GW.

A German government-appointed

expert panel recently agreed that coal

burning should end by 2038.

UK utility SSE is continuing with plans

to ofoad its retail arm after a deal to

merge it with Npower’s retail arm

failed in 2018.

The company has announced plans

to spin-off the business unit by mid-

2020, either by listing it as a stand-

alone company, or through “alterna-

tive ownership”.

Last year SSE announced plans to

merge its retail business with that of

Npower, another of the UK’s ‘Big Six’

energy retailers, but the deal fell apart

when the companies failed to reach a

deal to provide nancial support to the

new company.

SSE has now created a separate board

for the retail unit, which lost 550 000

customers in the year to March 31 and

which, like other retailers in the UK, is

facing the competitive pressures of a

crowded market.

It has also announced a round of job

cuts to help it meet efciency targets.

“Like a number of suppliers, we are

facing challenges due to competition

increasing, the introduction of the en-

ergy price cap and higher operating

costs,” said Tony Keeling, SSE Chief

Operating Ofcer and co-head of retail.

“To run a sustainable business, we

need to become more efcient and en-

sure we have the right number of em-

ployees in the right locations to best

serve our customers.”

Last month SSE booked a large fall

in annual adjusted prot after earnings

fell at both its retail and wholesale op-

erations. Pre-tax prot for the year

through March rose to £1.37 billion,

up from £864.4 million on-year, as the

company beneted from the proceeds

of asset sales.

Adjusted pre-tax prot, however, fell

38 per cent to £725.7 million.

Energy companies continued to dem-

onstrate their desire to work with dis-

ruptive start-up companies last month

with the announcement that innogy

Innovation Hub has become an inves-

tor in Munich-based energy IoT com-

pany GreenCom Networks AG.

The investment follows a successful

capitalisation round at the end of last

year, when GreenCom attracted fund-

ing from UK utility Centrica. The in-

vestment from innogy Innovation Hub

is for an undisclosed amount. innogy

SE is a German energy company that

supplies energy to around 22 million

customers across Europe.

The two companies rst connected

through the Free Electrons energy ac-

celerator programme, founded in

2017, which provides opportunities for

later stage energy start-ups to gain ac-

cess to utility customers.

Using its Energy Information Bro-

kerage Platform (EIBP), GreenCom

integrates distributed assets like solar

PV, battery storage, electric vehicles

and heat pumps from various manu-

facturers. Based on EIBP, GreenCom

enables white-label end customers

services like energy communities and

energy at rates.

EIBP also offers optimisation and

visualisation of energy ows in homes

to utilities and manufacturers of ener-

gy-relevant devices.

The investment follows a deal be-

tween the two companies in April that

saw GreenCom acquire shine, an en-

ergy management services start-up

founded by the innogy Innovation

Hub. GreenCom will integrate shine’s

end-customer base and services into its

energy IoT platform.

Jan Roschek, SVP Business Devel-

opment & Strategic Partners at Green-

Com, said: “In terms of their customer

engagement models and sales and

marketing initiatives, utilities don’t

have the well established processes to

scale up technology solutions projects

and get them to market. shine has es-

tablished these processes. This will

help the utilities we are working with

to get these [solutions] to market.”

shine already utilises GreenCom’s

EIBP and the deal will allow Green-

Com to expand the services it offers

on top of its EIBP platform. Green-

Com says it plans to demonstrate dis-

ruptive services for residential cus-

tomers that go beyond today’s at-rate

or energy community offerings in the

market.

Christian Feißt, CEO of GreenCom

Networks, said: “The acquisition of

shine is perfect for us to demonstrate

how disruptive energy management

services will be offered to retail cus-

tomers through digital technology…

the deal with shine allows us to truly

demonstrate what the retail energy

business will look like.”

Utilities invest in

disruptive energy

management services

RWE prepares

for E.On

integration

SSE continues spin-off plans despite Npower setback

Engie and EDPR hope to challenge offshore giants such as Ørsted with a new joint venture.

Engie and EDPR team up for

show of force in offshore wind

Feißt: looking to demonstrate energy

management services

Recent investment in GreenCom Networks further demonstrates that energy

companies are recognising the value of bringing disruptive technology and new

services to their businesses. Junior Isles

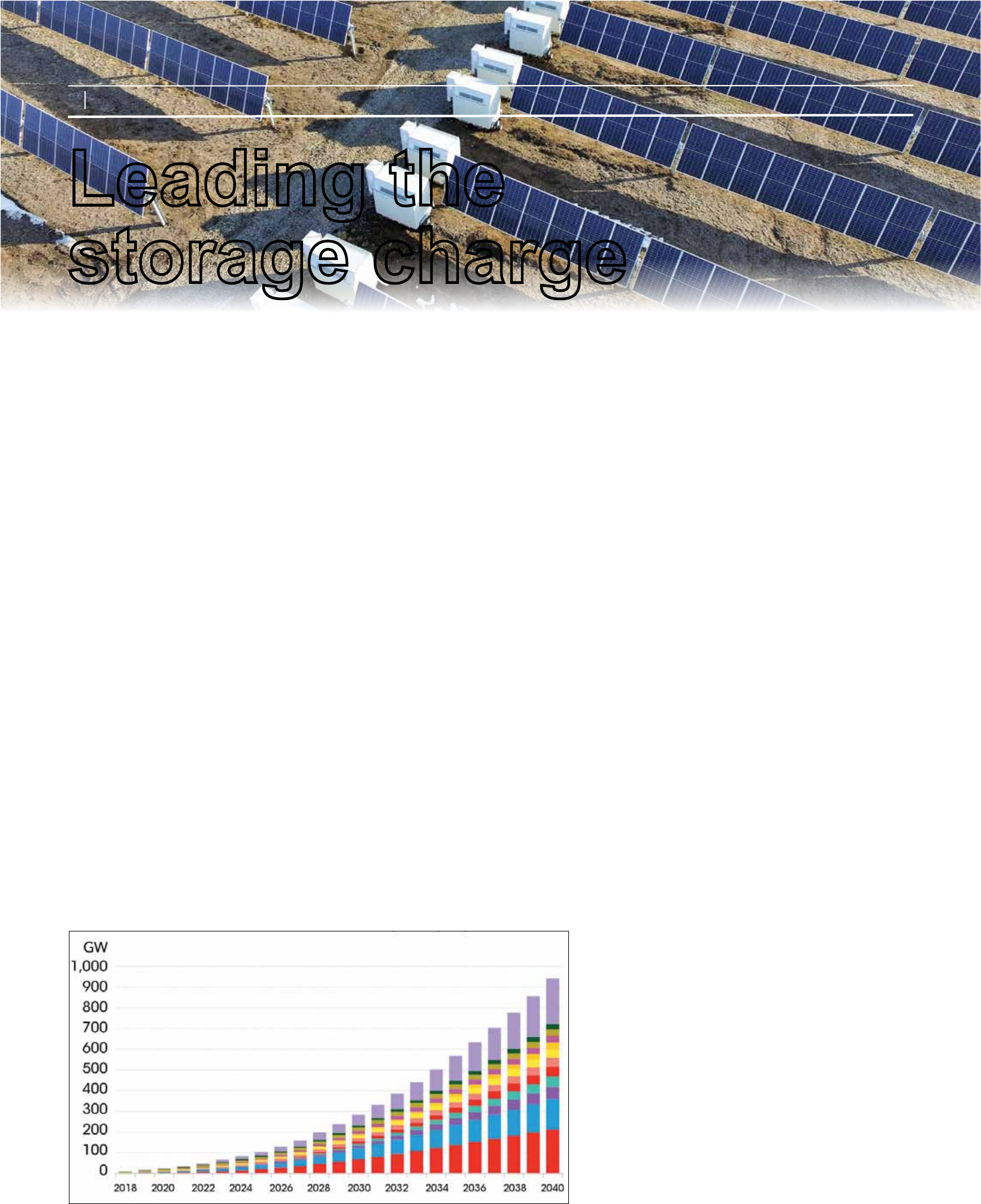

market will grow to a cumulative 942

GW/2857GWh by 2040, attracting

$620 billion in investment over the

next 22 years. Its ‘Long-Term Energy

Storage Outlook’ published in No-

vember shows the capital cost of a

utility-scale lithium-ion battery stor-

age system sliding another 52 per cent

between 2018 and 2030, on top of the

steep declines seen earlier this decade.

In a more recent report, released by

GlobalData at the beginning of May,

the global battery energy storage

market is forecast to grow by 7 per

cent to reach $13.13 billion by 2023.

Its latest report: ‘Battery Energy

Storage Market, Update 2019 –

Global Market Size, Competitive

Landscape and Key Country Analysis

to 2023’, reveals that the fall in tech-

nology prices and increasing pace of

development in the power market are

the primary driving factors for the

battery energy storage market.

It says APAC will continue to be the

largest market reaching $6.05 billion

in 2023, as countries increase invest-

ments in grid infrastructure to im-

prove the market structure and attract

foreign investment. Asia-Pacic ac-

counted for 45 per cent of the global

market installed capacity in 2018 and

is expected to maintain its top posi-

tion in the forecast period 2019-2023.

With the number of grid-connected

renewable electricity generation

plants increasing rapidly, countries

such as China, India, Japan, South

Korea, and the Philippines will focus

on frequency regulation to normalise

the variation in power generation

from renewables, the report said.

Bhavana Sri, a power analyst at

GlobalData, said: “With countries

aggressively promoting the moderni-

sation of grids, and developing their

capability to handle the demands of

the present and future, batteries are

being deployed to support smart

grids, integrate renewables, create

responsive electricity markets, pro-

vide ancillary services, and enhance

both system resilience and energy

self-sufciency.

“Market conditions are improving

and more companies are moving into

decentralised generation, leading to

an increase in the onsite deployment

of renewables and batteries; as with

micro or mini girds. Supportive poli-

cies and high electricity charges are

also nudging the market towards re-

newables and/or storage plus renew-

ables at the end-consumer level. As

the power sector evolves to accom-

modate new technologies and adapt

to varying market trends, energy

storage will play a central role in the

transition and transformation of the

power sector.”

Nevertheless, storage is still in its

infancy. The market will need to

fairly compensate the value storage

provides in order for storage paired

renewables to take-off. Business

models still need to be rened accord-

ing to market design and future policy

options. The Wood Mackenzie report

also noted that safety and re hazards

need to be looked at carefully and

concludes that once these challenges

are addressed, solar-plus-storage will

be “a great asset” for the power grid.

A

s might be expected for a part

of the world that receives good

levels of sunshine all year

round, it is not surprising that solar

photovoltaics (PV) represents one of

the fastest growing renewable energy

sources in the Asia-Pacic region.

According to Wood Mackenzie

Power and Renewables’ global solar

PV market outlook update, the Asia-

Pacic region is set to install 55 per

cent of all the world’s new solar PV

in the next ve years. Cumulative

capacity in Asia-Pacic, including

Australia, will increase by 60 per

cent, from 222 GW in 2017 to 578

GW in 2023. China, India and Japan

together will account for 78 per cent

of this capacity increase.

Yet such rapid growth of a variable

energy source sometimes results in

curtailment, due to over production

of electricity that cannot be fed into

the grid. This has in turn led to a

growing demand for battery storage.

The cost of storage, however, is often

cited as one of the obstacles that

needs to be overcome to enable solar

to really take centre stage in the future

energy mix. But it is a scenario that is

set to change before too long.

In May, Wood Mackenzie published

a report, that projects solar-plus-

storage prices, or levelised cost of

electricity (LCOE), for both utility-

scale and distributed commercial and

industrial (C&I) segments are to de-

cline considerably over the next ve

years.

The report reveals some interesting

ndings based on LCOE for a 4-hour

lithium-ion solar-plus-storage. Re-

search Analyst for Asia Pacic,

Rishab Shrestha, commented: “If you

look at the production prole of solar

energy, you have a production peak at

around 12 noon or 1 pm. And if the

system demand typically has a morn-

ing peak and even larger evening peak

demand, then four hours is usually

enough to store excess solar energy. If

you increase the [storage] period to

more than four hours, the cost can

increase quite a bit so that’s why we

usually see four hours or less.”

The study predicts that such a utility-

scale solar-plus-storage system will

command a cost premium between 48

per cent and 123 per cent over solar-

only LCOE in 2019. On the distrib-

uted C&I solar-plus-storage front, the

storage premium over solar LCOE is

between 56 per cent and 204 per cent

this year.

The reason for such a wide LCOE

range, says Wood Mackenzie, is be-

cause “there are some mature markets

where solar cost is extremely com-

petitive while others are not and some

in-between”. This is due to a mix of

labour, land, environment, civil costs,

weighted average cost of capital, and

procurement methods, tenders vs

feed-in tariffs (FIT), etc. Also, some

markets have very well established

supply chains with the availability of

storage manufacturing.

Shrestha commented: “We covered

several APAC markets that are at

various stages of solar maturity.

Some have storage manufacturing,

while some do not. India for example,

has a very competitive solar price

compared to Japan, which has a very

high solar price.” The cost premium

over solar-only in a market such as

India would therefore be higher than

in Japan.

LCOE depends on a range of factors

such as capex, including balance-of-

system cost, module cost, inverter

cost, battery cost etc. In addition,

there is the cost of nancing, which

can be impacted by the type of busi-

ness model.

Whether solar-plus-storage can be

competitive largely depends on sev-

eral market factors. For example, it

could make economic sense in replac-

ing expensive peaking units.

Subsidy mechanisms such as green

certicates and feed-in tariffs can also

make the difference. Shrestha said:

“If you look at India, where there

might be procurement from a central

government specically for solar-

storage projects, there are projects

that can make economic sense.”

If Wood Mackenzie’s forecasts are

proved correct, many more projects

will become increasingly nancially

viable.

The report predicts that the cost

premium for unsubsidised utility-

scale LCOE for a 4-hour lithium-ion

solar-plus-storage will reduce to be-

tween 39 per cent and 121 per cent in

2023. On the distributed C&I solar-

plus-storage front, the premium over

solar LCOE over solar-only will nar-

row to between 47 per cent and 167

per cent in 2023.

“In general, we expect the average

solar-plus-storage LCOE in Asia Pa-

cic to decrease 23 per cent from

$133/MWh this year to $101/MWh in

2023,” said Shrestha. “By then, solar-

plus-storage costs would already be

competitive against gas peakers in all

the National Electricity Market

(NEM) states of Australia. The coun-

try’s utility-scale solar-plus-storage

LCOE will hover at about 23 per cent

above average wholesale electricity

price.”

He added: “Based on gas prices, in

Victoria the LCOE [of solar-storage]

is just about where the peaking plants

are at the moment. By 2023, LCOE

will be able to undercut all of the

states.”

According to Wood Mackenzie,

only Thailand is expected to have a

utility-scale solar-plus-storage LCOE

below the average wholesale electric-

ity price by 2023. “While the country

does not have a wholesale electricity

market, industrial power price taken

as a proxy is higher compared to

other wholesale markets and hence

shows competitive solar-plus-storage

economics,” it stated.

Unsubsidised C&I solar-plus-stor-

age is expected to be competitive in

Australia, India and the Philippines

by 2023.

“The residential market also poses a

great opportunity for solar-plus-stor-

age,” said senior analyst Dr. Le Xu.

“In 2018 with the help of government

subsidies, Australia’s New South

Wales saw a 76 per cent savings on

annual electric bills through solar-

plus-storage installations.”

Another attractive residential solar-

plus-storage market is Japan. FITs for

600 MW of solar projects are poised

to expire this year. As power prices

are set to increase, storage retrots

provide an opportunity for home

consumers to avoid high residential

prices.

Indeed, Wood Mackenzie notes that

in general, capex subsidies and addi-

tional remuneration through different

forms of renewables certicates will

be crucial for projects to go-ahead.

Certainly there is evidence that nan-

cial support can stimulate markets.

“If you look at South Korea, that is

a good example, where they have

Renewable Energy Certicates to try

to drive solar-plus-storage,” said

Shrestha. “With these certicates you

will be compensated at ve times

their value during the peak hours.

This is driving demand.”

As installations increase, along with

technology improvements, this will

drive down the cost of battery storage

and drive further investment.

According to BloombergNEF

(BNEF), the global energy storage

THE ENERGY INDUSTRY TIMES - JUNE 2019

Energy Outlook

14

A recently published

report by Wood

Mackenzie predicts

solar-plus-storage

prices for both utility-

scale and distributed

commercial &

industrial segments

will decline

considerably over the

next ve years.

TEI Times reports.

Leading the

storage charge

Global cumulative storage deployments to 2040. Source BNEF

THE ENERGY INDUSTRY TIMES - JUNE 2019

16

Final Word

I

f nothing else, the mix of speakers,

delegates and tone of presenta-

tions at this year’s Eurelectric

Power Summit in Florence, Italy,

again illustrated how fast the electric-

ity sector is changing, and how far it

has already come.

Perhaps the best summary of the

progress that has been made was

presented by Michael Liebreich,

Chairman and CEO of Liebreich As-

sociates, and Founder and Senior

Contributor to Bloomberg New En-

ergy Finance.

The rst slide he showed was one he

presented in 2015, which showed that

global investment in renewable capa-

city and energy efciency had reached

an all-time high of $413 billion,

growing from just $95 billion in 2004.

Although investment fell to $384

billion in 2018, new capacity has

continued to increase, hitting 179 GW

last year.

“What we see is that the investment

value has stalled at around $354 bil-

lion a year but the volume of instal-

lations has continued to increase…

we’re seeing one dollar in every six

invested in energy going into clean

resources. The reason why volume

goes up while investment stalls, is

because of the experience curve.”

A snapshot of world records for

clean energy prices globally showed

that solar PV and onshore wind deals

were signed in 2017 Mexico at $1.97

¢/kWh and 1.77 ¢/kWh, respectively.

In Germany, meanwhile, in 2016

Dong/EnBW submitted a bid of 4.9

¢/kWh for an offshore wind project

to be built in 2024.

“The cheapest source of electrical

power that you can add to the grid,

country after country now, is renew-

able, is clean, is zero carbon,” said

Liebreich.

His gures showed that there have

been almost ve doublings of variable

wind power in the generation mix

since 2004 and almost nine doublings

in the share of solar over the same

period. This means there is an increas-

ing amount of variable power coming

on to grids around the world.

At the same time coal, which has

been the stalwart of baseload power

for decades, continues to fall off the

grid. And while, gas red generation

is growing incrementally, it is not

enough to replace coal. Like most

industry observers, Liebreich believes

that gas has an important role to play

going forward but increasingly for

exibility only, i.e. to compensate for

uctuating generation from wind and

solar. “The future is one of variable,

very cheap renewable energy,” he said.

In markets around the world, this has

often resulted in more electricity

production than is needed at points in

time and oftentimes curtailment of

wind power, in particular. But while

some see this as a problem, Liebreich

merely notes that over-generation is

“a feature of these systems”. The

question, he says, is what do you do

with excess renewable electricity that

carries zero carbon cost?

Although the cheapest way to store

power is through heat, e.g. with a hot

water tank, most of the current focus

is on batteries – whether via stationary

storage, passenger electric vehicles

(EVs), commercial EVs or electric

buses. Global growth for batteries in

all sectors, including consumer elec-

tronics, has indeed skyrocketed over

the last four years. Liebreich showed

that global demand has grown from

less than 100 GWh in 2015 to around

250 GWh in 2019 and will hit 2000

GWh in 2030.

“The good news is there will be lots

of batteries and that will help you a

lot,” he told delegates during his pre-

sentation, “the bad news, or not so

good news, is that overwhelmingly

they are going to be in vehicles. Sta-

tionary storage will be the minority.”

The growth in batteries for vehicles

is being driven by an EV market that

is growing so rapidly, that BNEF ex-

pects that more than half of all new car

sales in 2040 will be electric, compared

with a couple of per cent today.

The move towards the electrica-

tion of transport, and indeed other

sectors such as industry and build-

ings, is where things get interesting

for the power sector. In its ‘Decar-

bonisation Pathways 2018’,

Eurelectric concludes that a major

shift to electricity in transport, build-

ings and industry is needed to meet

the goals set by the Paris Agreement.

It notes that for the EU to reach full

decarbonisation by 2050, electricity

needs to cover at least 60 per cent of

nal energy consumption.

Commenting on developments over

the last six or seven months and look-

ing forward, speaking on the sidelines

of the conference, Serge Colle,

Global Power & Utilities Advisory

Leader at EY, said: “In a world of full

electrication, electricity production

has to double. So the rst thing we see

is that it is becoming more and more

of a reality that we will see more

electrication and deeper electrica-

tion. But it’s also about accelerating

the speed of electrication… the

danger is we need to go faster.”

He added: “The second big topic for

me is the DSOs (Distribution System

Operators). They can be proud of

what they’ve achieved so far but…

they will have to accelerate their ef-

forts to digitalise, not only the net-

works but also their businesses. Many

are still counting on the resilience of

their systems. There are a lot of good

plans but they still lack an integrated

plan to digitise the networks and the

business.”

Ahead of a planned information

session at the conference, Paul de Wit,

Senior Advisor of Regulatory Affairs

at Alliander and Chair of the Working

Group ‘Institutional Framework’,

talked about the evolution of the

DSOs since the Third Energy Pack-

age ten years ago, and the central role

of DSOs. In order to reect this

central role at EU level, the recently

adopted Clean Energy Package cre-

ated a new European Association for

DSOs, currently called the ‘EU DSO

Entity’, which will be set up by DSOs

in early 2021.

He said: “The DSO Entity is a new

body for the DSOs to work together

on network codes, cyber security,

digitalisation, exibility and collabo-

ration [with Transmission System

Operators] on things like data manage-

ment and network planning. For ex-

ample, in the Third Energy Package it

was mainly the TSOs that wrote the

network codes… but it put us in the

situation that we were only one of

many stakeholders in the whole pro-

cess. This was not a comfortable situ-

ation for us because we had the same

responsibility with regards to keeping

the lights on and system security, etc.

We therefore lobbied for the concept

of the DSO as mutual market facilita-

tor and emphasise that we have a big

role to play in market facilitation.”

The role of the DSOs will become

much more important in light of the

energy transition, and having a single

association speaking with one voice

for 2400 DSOs is an important step.

Dr Erik Landeck, Managing Direc-

tor Stromnetz Berlin GmbH and Vice

Chair of Eurelectric Distribution and

Market Facilitation Committee, said:

“Now we have the possibility to form

a voice for all DSOs. Some steps have

already been set – statutes have to be

developed within one year; after that

there will be consultations with the

Commission and we will then be

tasked with bringing the entity into

existence. So right now we are in the

rst phase of drafting the statutes and

nancing rules.”

Along with the progress being made

by DSOs and the digitalisation of

networks, investment in renewables

and the electrication of transport and

industries will be the hot topics to

watch in the coming 12 months leading

up to the next Eureletric Power Sum-

mit in Dublin, Ireland, next year.

Colle summed up his views on

what’s to come, saying: “It’s going to

be exciting to see how different indus-

tries continue to converge on our

business. Reading the tea leaves, I see

that the stars are lining up for accel-

eration. I am seeing a lot of things

happening whereby there is a strong

force of alignment that could poten-

tially push for a more aggressive

scenario than we have in the Paris

agreement.”

Reading the tea leaves

Junior Isles

Cartoon: jemsoar.com