www.teitimes.com

May 2019 • Volume 12 • No 3 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Sleepless nights? Getting closer

Energy storage and digitalisation are

two areas that are keeping energy

executives awake at night.

Page 13

Europe’s Clean Energy Package

should bring markets closer together

but some of its provisions need further

clarication. Page 14

News In Brief

Wind to become “truly

global market” in ve years

The Global Wind Energy Council

forecasts that 300 GW of new wind

capacity will be added globally by

2024.

Page 2

Opportunity Zones offer tax

breaks

A tax break offered to investors in

so-called ‘Opportunity Zones’ may

provide extra capital for renewable

energy developers in the USA

as other support mechanisms are

phased out.

Page 4

Coal still part of balanced

energy mix

The Philippines still sees coal as an

important part of its future energy

mix, as developers continue to

outline plans for future coal red

power plants.

Page 6

Ofgem addresses supplier

rules

A series of company collapses in the

UK’s energy retail sector has forced

the regulator to revise the rules for

new entrants.

Page 7

Congo wins support for

green mini-grid

The Democratic Republic of

the Congo is to boost off-grid

renewables with the implementation

of a green mini-grid programme.

Page 8

EC nes GE over

‘misleading’ LM information

GE will pay a €52 million ne

following an investigation by

the European Commission into

information provided by the

American rm during its 2017

takeover of LM Wind.

Page 9

Technology: GT26 gets a

HE upgrade

GE has launched a signicant

upgrade for the GT26 gas turbine.

The high efciency (HE) upgrade

will deliver improved efciency,

power output and exibility while

reducing maintenance costs for its

customers – the rst of which will be

Uniper, at its plant in Eneld, UK.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

The EU has concluded negotiations on its Clean Energy Package but recent research shows that

National Plans might not deliver the previously agreed 32 per cent renewables target. Junior Isles

Financial sector warned on climate risks

THE ENERGY INDUSTRY

TIMES

Final Word

We live in a rebellious

climate, says Junior Isles.

Page 16

Europe’s draft National Energy and

Climate Plans are insufcient to de-

liver the EU’s 32 per cent renewables

target for 2030, according to analysis

released by WindEurope.

The analysis shows that some EU

countries are pledging to deploy

good volumes of wind in their Plans.

But the Plans are badly lacking in the

detailed policy measures that will de-

liver these pledges – which means the

pledges are not meaningful, says the

organisation.

WindEurope CEO Giles Dickson

said: “Europe has a clear target: 32 per

cent renewable energy by 2030. Each

country has now drafted a National

Plan saying how they’ll contribute to

this. But none of the Plans properly

spell out the policy measures by which

countries will deliver on the objec-

tives they outline.”

European countries agreed last year

to draw up National Energy and Cli-

mate Plans to ensure Europe delivers

on its climate and energy targets.

WindEurope’s analysis rates every

country either insufcient or poor for

the policy measures outlined in the

draft Plans.

Most of the draft Plans give no

long-term visibility on renewable en-

ergy auctions, doing little to support

investment certainty. Only Germany

provides an auction schedule to 2030.

Nor does any country commit to

simplifying rules on planning and per-

mitting, such as common sense re-

strictions on distance or wind turbine

tip height. This is key, as obtaining

permits for new wind farms is becom-

ing increasingly difcult and more

expensive in many parts of Europe.

The National Plans are supposed to

detail not only new renewables capac-

ity but also what countries will do

with renewables that come to the end

of their operational life between now

and 2030. For wind the latter is up to

60 GW. But no country provides poli-

cies to deal with this. And only six

countries even recognise the issue

(Belgium, Denmark, France, Germa-

ny, Italy and Spain), said WindEurope.

Another issue the Plans need to ad-

dress is how to get more renewables

into heating and transport. This is es-

sential for the decarbonisation of en-

ergy, because heating and transport

accounts for three quarters of energy

consumption. But the draft Plans pro-

vide few detailed proposals or mea-

sures for electrifying heating and

transport. No European country has

planned to simplify corporate renew-

able Power Purchase Agreements

(PPAs), which is explicitly mandated

in the Renewable Energy Directive.

The report came as the EU ratied

its Clean Energy for All Europeans

Continued on Page 2

A recent report has warned that climate

change could wipe out $20 trillion

worth of assets globally.

According to the report by the Net-

work for Greening the Financial Sys-

tem (NGFS), there is still a signicant

amount of analytical work to be done

in order to equip central banks and

supervisors with appropriate tools to

identify, quantify and mitigate cli-

mate risks in the nancial system. To

address the issue, the NGFS says it

will prepare a number of technical

documents.

The report provides a number of rec-

ommendations for central banks and

supervisors, including integrating cli-

mate related-risks into nancial sta-

bility monitoring and micro-supervi-

sion. It also recommends bridging the

gap by making climate-related data

publicly available.

Following this report, an open letter,

published on behalf of the Bank of

England, Banque de France and the

Network for Greening the Financial

System, called for the nancial com-

munity to act on recommendations

provided by the NGFS to ensure the

transition to a low carbon economy.

The letter, in support of the report,

states that the catastrophic effects of

climate change are “clearly visible”

around the world and that nancial

policy makers and prudential supervi-

sors cannot ignore the “obvious” risks.

Banks have already been taking ac-

tion to reduce carbon-related assets.

In recent months, there has been a

growing wave of nancial institutions

announcing they would either tighten

rules on nancing new coal red

plants or not nance them at all.

In April, Standard Bank became the

latest nance corporation to stop -

nancing coal red power plants in the

future, unless they met strict parame-

ters set by the bank. It was the second

to do so in the space of a week.

Energy expert Chris Yelland said it

appeared as if all the major banks

were pulling out of funding coal red

plants. “Nedbank, First Rand, and

now Standard Bank – which has been

on the cards for some time – have all

pulled out.” Standard explicitly stated

it would not be funding the Thabam-

etsi or Khanyisa plants in South Afri-

ca. “It is a signicant move by all the

banks as they are under pressure not

to nance independent coal power

producers,” said Yelland.

In late March, UBS Group AG said it

would no longer provide project-level

nance to new coal red power plants

around the world, as it outlined tighter

rules on funding such transactions.

Switzerland-based UBS noted it

will only nance existing coal red

operators – dened as being more

than 30 per cent reliant on coal – that

have a transition strategy that sup-

ports the Paris climate agreement, or

transactions that are related to renew-

able energy. UBS said its carbon-re-

lated assets amounted to $2.7 billion

in 2018, down from $6.6 billion a year

before. Climate-related sustainable

investments totalled $87.5 billion, up

from $74 billion in 2017.

National Plans

will not deliver

renewables

target

WindEurope’s Giles Dickson says none of the

plans properly spell out policy measures

THE ENERGY INDUSTRY TIMES - MAY 2019

5

11,000+

Attendees

350+

International Speakers

350+

Leading Exhibitors

Cutting

Edge Content

DIGITAL

TRANSFORMATION

TRANSMISSION &

DISTRIBUTION

POWER

GENERATION

3-5 SEPTEMBER 2019 | MITEC | KUALA LUMPUR | MALAYSIA

JOIN US FOR ASIA’S ONLY

END-TO-END POWER & ENERGY EVENT

REGISTER BY 31 MAY TO SAVE UP TO 30% WITH THE EARLY BIRD

Organised by:

VISIT WWW.POWERGENASIA.COM OR WWW.ASIAN-UTILITY-WEEK.COM

▪ SEE CONFERENCE HIGHLIGHTS ▪ VIEW THE LATEST EXHIBITOR LIST ▪ REGISTER WITH THE EARLY BIRD

INTERESTED IN

EXHIBITING OR

SPONSORING?

OPPORTUNITIES

ARE STILL

AVAILABLE

PARTICIPATE IN THE REGION’S FOREMOST

BUSINESS PLATFORM FOR POWER

PROFESSIONALS

The co-location of POWERGEN Asia, Asian

Utility Week, DISTRIBUTECH Asia, SolarVision

and Energy Capital Leaders provides

you with one show covering the whole

value chain of power - from generation to

transmission and distribution to its digital

transformation.

The combination of these leading energy

shows will bring an unprecedented authority,

with insights shared by the world’s most

forward-thinking experts and innovators.

Here you will discover the future of Asia’s

Power & Energy industry.

Our Clients:

Our Partners:

weber media solutions

YOUR CREATIVE MEDIA AGENCY FOR

DESIGN AND MARKETING SOLUTIONS

We are a creative media agency which provide a bespoke

service to meet your media and marketing requirements

and much more

DESIGN / VIDEO / WEB / EXHIBITION STAND DESIGN

MAGAZINES / PRINT MANAGEMENT / MAILING

For more information please contact:

Karl Weber / Director

T: +44 7734 942 385 / E: karlw@webermediasolutions.com

www.webermediasolutions.com

some of our exhibition signage projects, for more information please visit our website:

www.teitimes.com

THE ENERGY INDUSTRY

TIMES

subscribe today

The Energy Industry Times is the only publication that

covers global news related to the power and energy

sector in a newspaper style and format whose

uniqueness is recognised by our readers.

As a paid subsciber you will gain full access to our online

news desk.

You will also no longer have to wait for the printed edi-

tion; receive it by PDF “hot off the press” or download it

online.

To subscribe, email subscriptions@teitimes.com or visit

www.teitimes.com

To guarantee receiving your monthly copy of the award

winning newspaper, you need to subscribe today

The Philippines still sees coal as an

important part of its future energy mix,

as developers continue to outline plans

for future coal red power plants.

In April, San Miguel Corp. (SMC)

announced that it intends to continue

developing clean coal power plants.

SMC Global Power said it plans to

expand its portfolio through strategic

development of greeneld power proj-

ects and acquisition of existing power

plants.

In setting up new projects, SMC said

it would not close the door on coal red

power plants, particularly clean coal

technology, which it says “remains the

most reliable and cost-efcient fuel

source for greeneld power projects”.

The company said it would therefore

continue to consider putting up the

4x150 MW circulating uidised bed

(CFB) coal red power plant in Mariv-

eles, Bataan, and the 600 MW coal

power plant in Pagbilao, Quezon.

Separately, Aboitiz Power Corp.

also indicated it would continue to

invest in thermal power generation.

Last month it inked a $300 million

facility agreement with four interna-

tional banks to partially nance its

acquisition of a share in AC Energy

Inc.’s thermal portfolio.

“The proceeds of the loan will be used

to partially nance the acquisition by

Aboitiz Power of a 49 per cent voting

stake and 60 per cent economic stake

in AA Thermal Inc.,” the power rm

said.

Under the deal, Aboitiz Power will

take stakes in GNPower Mariveles

Coal Plant Ltd. Co., the owner and op-

erator of an operating 2x316 MW coal

plant in Mariveles, Bataan, and in GN-

Power Dinginin Ltd. Co., the devel-

oper and owner of a 2x668 MW super-

critical coal plant project in Dinginin,

Bataan currently under construction.

Aboitiz Power COO, Emmanuel Ru-

bio, said: “Aboitiz Power is committed

to addressing the country’s energy tri-

lemma of adequate supply, cost of

power, and protection of the environ-

ment. This is part of our strategy to

reach our 4000 MW net attributable

capacity by 2020 through our balanced

mix strategy.”

The company also announced that it

has opened a new coal red power

plant in Toledo City, Cebu, which will

add 170 MW of supply in Visayas.

The second unit of the project will be

online in May to add another 170 MW.

The project uses CFB technology

and best available control technology

to minimise emissions.

Meanwhile, nal work is ongoing

on the 335 MW Unit 3 expansion of

the Masinloc power plant. The plant

being built by SMC is expected to

commence commercial operation

during 2Q of 2019.

While announcing its continued

commitment to coal, SMC noted,

however, that it is also focused on

investing in battery energy storage

systems (BESS) and renewable en-

ergy projects as part of its objective

to operate in an environmentally re-

sponsible manner while considering

energy security and affordability.

“SMC Global Power also actively

seeks to identify and pursue renewable

energy investments in hydro electric

and solar projects, subject to the out-

come of viability and feasibility analy-

ses,” the rm said. Last year, SMC

President and COO Ramon Ang said

the company is targeting up to 10 000

MW of new renewable energy capac-

ity in the next 10 years.

Syed Ali

Australia is making progress in trans-

forming its energy sector, with signi-

cant announcements that demonstrate

its continued shift towards a cleaner,

more advanced power sector.

In late March Queensland celebrated

the state’s rst ever delivery of green

hydrogen to Japan, marking a signi-

cant step forward for its hydrogen in-

dustry. The Queensland government

also said it plans to release its Hydrogen

Strategy later this year.

Exported by JXTG, Japan’s largest

petroleum conglomerate, the hydro-

gen was produced at QUT’s solar cell

facility, located at the Queensland gov-

ernment’s Redlands Research Facility.

“This demonstration of renewable

hydrogen being successfully exported

overseas is an exciting rst step in pro-

ducing and exporting hydrogen at a

commercial scale in the future,”

Queensland Premier Annastacia

Palaszczuk told Parliament during a

hydrogen showcase event. “My gov-

ernment’s commitment to backing

renewable resources combined with

our existing gas pipeline infrastructure

and export facilities make us the ideal

state to lead the future production and

export of hydrogen,” she added.

Palaszczuk also announced $250 000

in funding for the establishment of a

renewable hydrogen pilot plant at the

Redlands Research Facility.

The use of solar to produce hydrogen

is further evidence of the importance

of solar in the country’s energy future.

In a move that will be signicant in

advancing solar deployment, in April

Oxamii, a startup based in Adelaide,

announced that an online platform to

connect medium to small-scale solar

energy producers with independent

electricity buyers will launch in the

coming months in South Australia.

The company said it has developed

a system to make it easier for owners

of solar arrays producing a minimum

of 200 kW to sell power on the spot

market.

Founders Aaron Yew, Luke Marshall

and Ray Carclaw have secured a num-

ber of investors for the online platform

and plan to launch before July.

Their platform connects buyers and

purchasers by making Oxamii the

agent that monitors energy ows,

calculates bills and manages loads for

its customers.

Oxamii is targeting farmers who have

existing solar energy they want to sell

on the market, or farmers looking at

gaining a second source of income

through establishing a solar farm.

n Australian researchers are develop-

ing short-term weather forecasts for

solar farms to help them precisely

predict output as little as ve minutes

in advance. The $A1.2 million proj-

ect, which ofcially started in April,

will use data generated by real-time

sky cameras, satellite images and sta-

tistical modelling to design a world-

rst, short-term forecasting model to

more accurately predict weather con-

ditions from ve minutes up to two

hours. University of South Australia

Professor of Environmental Mathe-

matics John Boland said inaccurate

short-term forecasts relating to wind

and solar generation have cost Aus-

tralia’s renewable energy sector about

$5 million in the past decade. He said

precise self-forecasting would also

help solar farms with battery storage

capabilities predict when best to sell

or store their electricity.

6

THE ENERGY INDUSTRY TIMES - MAY 2019

Asia News

Australia continues to

transform energy sector

Coal still part of balanced

energy mix

Progress with plans for new coal red plants illustrate the Philippines’ desire to keep coal as part of its energy mix.

Syed Ali

Pakistan is planning to increase the

share of renewables in its total power

generation mix to 30 per cent by 2030

under a plan suggested by the country’s

new government.

In a recent announcement the World

Wind Energy Association (WWEA)

proposed to lift that share from the

current 4 per cent by enhancing gen-

eration from wind, solar, small hydro

and biomass plants. The share of large-

scale hydropower (more than 50 MW)

is also set to expand to 30 per cent

from around the current 25 per cent.

Pakistan’s Cabinet Committee on

Energy is expected to approve the

country’s 2019 renewable energy

policy that will include all future re-

newable energy projects. According to

WWEA the government’s plan to have

around 18 GW of installed renewable

energy capacity by 2030 could limit

the expansion of coal red capacity

of over 5 GW. It also noted that the

new policy should include a strategic

action plan creating a favourable en-

vironment for coordination between

various departments in the renewable

energy sector.

During the last week of February,

the Cabinet Committee on Energy

(CCoE), chaired by the Finance Min-

ister, approved proposals from the

Ministry of Energy (Power Division)

for all future renewable energy proj-

ects to be treated under the Renewable

Energy Policy 2019. The new policy,

whose guiding principles have al-

ready been approved by the CCoE, is

being reviewed by different stake-

holders and will be formally adopted

by the CCoE later.

Pakistan looks to

boost renewables

share

The Vietnamese government is aiming

to raise wind power capacity to 1000

MW by 2020 and 6200 MW by 2030

with a view to optimising the use of

this renewable energy for enhancing

the country’s socio-economic develop-

ment and energy security.

In a bid to step up green growth and

sustainable development, Vietnam has

been accelerating wind power expan-

sion with existing wind farms yielding

a combined capacity of 197 MW.

In addition, construction on many

wind farms has begun, which is ex-

pected to increase the total capacity

to 263 MW. Many more projects are

waiting for approval from authorities.

Once granted, these would add a total

capacity of 412 MW.

As much as 4236 MW to be produced

by wind farms nationwide has been

added to the country’s power develop-

ment plan while there are some 10 279

MW of wind projects registered.

Most recently, German wind, solar

and decentralised project developer

EAB New Energy GmbH announced

the inauguration of the 37.6 MW Mui

Dinh wind power plant. Ninh Thuan

has attracted many wind and solar

power projects, with a combined ca-

pacity of 2800 MW. As many as 18

solar projects and three wind power

plants are under construction in the

locality. Nine projects with a combined

capacity of 600 MW were scheduled

to go into operation this month.

Vietnam has set a goal of 10 per cent

renewables integration by 2030 and

took an important step to facilitating

that goal with the award of a battery

storage feasibility study to GE’s En-

ergy Consulting business. The study is

being funded by the US Trade and De-

velopment Agency (USTDA).

Vietnam eyes more wind power capacity

n First ever delivery of green hydrogen to Japan

n Online platform will make it easier for small solar

generators to sell power on spot market

THE ENERGY INDUSTRY TIMES - MAY 2019

9

Companies News

Siân Crampsie

German wind turbine maker Senvion

has shored up its nances with a €100

million loan facility from its main lend-

ers and bond holders.

The loan came in mid-April and just

days after Senvion said it had led an

application in Germany for self-ad-

ministration proceedings, a pre-emp-

tive insolvency process.

In a statement dated April 17, Sen-

vion said the 12-month, €100 million

debtor-in-possession (DIP) facility has

“received board approvals and allows

substantial drawings already this week,

thus enabling the company to stabilise

its business operations and provide

funds to its non-insolvent subsidiaries.”

The company added that it would

stay in the self-administration pro-

ceedings, which enable its manage-

ment to retain control of the business

with oversight from a supervisor act-

ing on behalf of creditors.

“We would like to thank both our

lenders and main bond holders for their

support in agreeing to provide us with

a DIP facility that will enable us to

continue our operations,” said Chief

Executive Yves Rannou.

Rannou said that the loan facility

was “particularly helpful” as the com-

pany had managed to signicantly

increase installations in the rst quar-

ter of 2019, installing 366 MW world-

wide in the period, more than twice as

much as a year ago.

Deployments included 120 MW in

Chile and Argentina and nearly 110

MW in Australia. Senvion also built

and installed its rst turbine in India.

Senvion embarked on a restructur-

ing programme in January 2019 and

maintains that it has a fundamentally

sound and strong business model. The

trading environment for wind turbine

makers has been challenging, how-

ever, with strong competition and fall-

ing prices globally.

Senvion has also faced delays and

penalties related to big projects. It has

over €1 billion of debt. Its transforma-

tion plan includes programmes to re-

focus operations, concentrate on the

most attractive markets, streamline the

product portfolio, improve installation

execution and realise efciency gains

in the service business.

At the end of rst quarter 2019, Sen-

vion’s total installed capacity under

service amounted to 14.1 GW. It main-

tains close to 80 per cent of this capac-

ity, with an order book of around €2.8

billion.

Battery rm Saft says that a new joint

venture will help it to expand its op-

erations and meet growing demand

for its products in China’s electric

vehicle (EV) and energy markets.

Saft, a subsidiary of French energy

giant Total, has created a joint venture

with Chinese rm Tianneng Energy

Technology (TET) to expand lithium

ion (Li-ion) battery manufacturing in

China.

The joint venture will be 60 per cent

owned by TET and 40 per cent by Saft,

with manufacturing based at the

Changxing gigafactory, with a poten-

tial capacity of 5.5 GWh. It will pri-

marily focus on the development,

manufacturing and sales of advanced

Li-ion cells, modules and packs for

China and worldwide markets.

E-bikes and EVs, as well as energy

storage solutions (ESS) will be the

target markets, Saft said.

“This is a rst strategic move driven

by Total, following the acquisition of

Saft in 2016, to grow Saft’s activity

in China, the world’s largest renew-

ables market, as well as in the ESS

segment as an essential component to

the large scale development of inter-

mittent renewable energies,” said

Patrick Pouyanné, Chairman and

CEO of Total. “The joint venture will

allow Saft to join forces with a Chi-

nese partner, a world leading lead acid

battery manufacturer, willing to de-

velop its lithium-ion activities.

“It will also give Saft access to Chi-

na’s booming battery market as well

as highly-competitive mass produc-

tion capacity to accelerate its growth.”

“We are delighted to start building

a long-term partnership with Tian-

neng with a shared industrial vision,”

said Ghislain Lescuyer, Saft CEO.

“This joint venture will allow us to

make a step-change and signicantly

increase our footprint in the Chinese

Li-ion market that will represent over

40 per cent of the global demand by

2025 and to develop our worldwide

activities.”

Statkraft is to join up with energy stor-

age rm redT energy plc in a new part-

nership that will offer solar-plus-stor-

age solutions for UK commercial and

industrial clients (C&I).

The two companies have signed

heads of terms to partner on the project

that will see them install solar panels

with redT battery storage at no upfront

cost. The move will mark the rst time

such a product, nanced under a pow-

er purchase agreement (PPA), is of-

fered on the UK market, according to

a statement from redT last month.

The companies will initially install

10 MWp of solar photovoltaic (PV)

capacity and 6 MWh of battery storage

capacity, and are aiming to increase the

size of the portfolio to 100 MWp and

60 MWh over the next three years.

They will sell the generated electric-

ity from the facilities under 25-year

power purchase agreements (PPAs)

with Statkraft. The latter will also pro-

vide exibility optimisation services

using its in-house virtual power plant.

“With this roll out of low cost solar

coupled with heavy cycling, ow ma-

chine technology, we hope to acceler-

ate the deployment of energy storage

providing low-risk energy savings to

commercial energy users, and creating

an effective, hedge against rising en-

ergy prices,” said Neil O’Brien, ex-

ecutive chairman of redT.

Statkraft and redT estimate the C&I

users opting for the new product will

be able to reduce energy costs by up to

20 per cent over the 25-year term of

the PPA.

n Statkraft says it will stop investing

in wind power in Norway after it com-

missions three new wind farms in the

country. It plans to complete the Fosen,

Kvinesdal and Remmafjellet projects

before shifting focus to building main-

land-based wind farms in other coun-

tries in Europe, South America and

Asia. The move is due to falling pow-

er prices in its home market.

GE will pay a €52 million ne follow-

ing an investigation by the European

Commission into information pro-

vided by the American rm during its

2017 takeover of LM Wind.

The European Commission says that

GE provided misleading information

to regulators who were reviewing the

$1.65 billion takeover of the Danish

rotor blade manufacturer. “Our merger

assessment and decision-making can

only be as good as the information that

we obtain to support it,” said Commis-

sioner Margrethe Vestager, in charge

of competition policy. “Accurate infor-

mation is essential for the Commission

to take competition decisions in full

knowledge of the facts.

“The ne imposed… on General

Electric is proof that the Commission

takes breaches of the obligation for

companies to provide us with correct

information very seriously.”

EU merger regulations require com-

panies to provide correct and non-

misleading information for merger

investigations. According to the Euro-

pean Commission, GE notied it of its

plans to buy LM Wind in January 2017,

but said that it did not have any higher

power output wind turbine for offshore

applications in development beyond

its existing 6 MW turbine.

However, through information col-

lected from a third party, the Commis-

sion found that GE was simultane-

ously offering a 12 MW offshore wind

turbine to potential customers.

GE then withdrew its notication of

the acquisition of LM Wind, and later

GE re-notied the same transaction,

this time including complete informa-

tion on its future project.

The European Commission ap-

proved the deal in March 2017.

The Commission can impose nes of

up to one per cent of the aggregated

turnover of companies, and takes into

account the nature, gravity and dura-

tion of infringements.

“GE committed an infringement by

negligently providing incorrect infor-

mation in the merger notication

form,” the Commission said in a state-

ment. “The Commission considers that

this infringement is serious because it

prevented it from having all relevant

information for the assessment of the

transaction.

“Moreover, the Commission con-

siders that GE, with whom it had

continuous contacts during the merg-

er review process, especially on the

subject of GE’s pipeline products in

this market, should have been aware

of the relevance of the information

for the Commission’s assessment,

and of its obligations under the merg-

er regulation. Therefore, GE’s breach

of procedural obligations was a seri-

ous infringement.

“On the basis of these factors, the

Commission has concluded that an

overall ne of €52 million is both de-

terrent and proportionate.”

EC nes GE over

‘misleading’ LM

information

Saft targets

China for battery

scale-up

Statkraft tie-up with redT for solar-plus-storage

The signing of a 12-month, €100 million loan facility has given Senvion the lifeline it needs to continue operations and

complete its planned business transformation.

n LM merger approval stands

n Fine in line with “serious infringement”

Senvion stabilises with

loan deal

contributing to the discussion on

how to implement Citizens Energy

Communities.

As part of the governance regula-

tion, the national energy and climate

plans should become valuable tools in

assessing collective progress towards

2030 targets and electrication. Eur-

electric is currently analysing the

draft plans and will advise the Com-

mission based on the ndings. For

instance, it is of critical importance

that these plans are clear about how to

increase the level of electrication but

also that they assess the potential im-

pact of other policy tools on the EU

Emissions Trading System, the Euro-

pean CO

2

market.

Beyond the improvements brought

by the CEP, major investment chal-

lenges lie ahead. In a world with

ramping shares of renewables, a low

level of wholesale price, including an

increase of close to zero or negative

prices, there is a need to ensure energy,

exibility and reliability are properly

valued. In several countries, there are

inadequate price signals both for the

closure of plants and for new invest-

ments, including those that are needed

to ensure security of supply and ex-

ibility. It is unlikely that the CEP will

provide the necessary long-term in-

vestment signals for a cost-efcient

energy transition.

Eurelectric will soon publish its

analysis of the investment environ-

ment in the EU power sector and its

diagnosis of the improvements

brought by the CEP. Under the man-

date of the incoming European Com-

mission, Eurelectric will also focus

on the review of the energy and envi-

ronment state aid guidelines, taking

stock of the great achievements of the

power sector, and the challenges and

opportunities lying ahead.

Infrastructure will also be a key is-

sue: which type of infrastructure

should be deployed and where should

structural funds go? An electric, inter-

connected and digital network will be

the backbone of a society where

transport is increasingly electric,

buildings become smarter and ef-

cient, and where industrial sectors

adopt electrication, clean hydrogen

or power-to-X. This topic will be

critical under the next mandate of the

European institutions.

This is the year of revitalisation.

With new policymakers making their

debut in Brussels, we all take stock of

what was achieved and establish for-

ward looking goals. Who will lead the

electrication agenda?

On 20 and 21 May, in Florence,

utility CEOs and industry captains

will come together with thought lead-

ers, disruptors, customers, policy-

makers, consultants and think-tanks

at this year’s Eurelectric Power

Summit to discuss the multi-level as-

pects of “New Leadership”. Climate

change, customers’ proactivity, in-

dustry adaptations, technological in-

novations – all have a say about to-

morrow’s New Leadership.

Blandine Malvault is Advisor Whole-

sale Markets & Network Codes, Eur-

electric; Marion Labatut is Eurelec-

tric’s Director of Policy Issues.

T

he Paris agreement has set clear

objectives to limit the rise of

global temperatures and to pur-

sue efforts to stay below 1.5°C. The

European Union (EU) has so far com-

mitted for 2030 to a reduction of emis-

sions of at least 40 per cent below 1990

levels, while establishing targets for

energy efciency and renewable en-

ergy sources (RES).

In view of dening its trajectory

towards 2050, the European Com-

mission published its ‘Strategic

long-term vision for a prosperous,

modern, competitive and climate-

neutral economy’, last November.

The document outlines six scenarios

for 80 and 90 per cent greenhouse gas

(GHG) emissions reductions and two

scenarios where Europe moves to-

wards carbon-neutrality by 2050.

Change and commitment are also

visible at the level of Member States.

While Sweden has pledged for car-

bon-neutrality, Austria has an-

nounced to have a 100 per cent re-

newable production of electricity by

2030. France has also introduced

legislation to achieve carbon-neutral-

ity by 2050.

The electricity sector is leading

Europe’s energy transition. Today, 60

per cent of the electricity produced in

Europe comes from carbon-neutral

sources and the EU electricity sector

forcefully spearheads the energy

transition. Speeding up its own decar-

bonisation process, the industry has

pledged to become carbon-neutral

well before 2050 and to help other

sectors decarbonise through electri-

cation. This will require massive in-

vestments throughout Europe and

rely on the involvement of govern-

ments and regulators to ensure speedy

implementation of the Clean Energy

Package (CEP). The different starting

points of Member States in terms of

energy mix will also have to be taken

into account to ensure a fair and in-

clusive transition. The commercial

availability of transition-enabling

technologies will also be critical.

Eurelectric’s recent ‘Decarbonisa-

tion Pathways’ study nds that the

electrication of transport, buildings

and industry is the most sensible way

to curb emissions. In practice, this

means that to achieve deep decar-

bonisation of the EU economy, 60 per

cent of all nal energy consumption

has to be electric. To get there, elec-

tricity will massively turn to renew-

ables. By 2045, the electricity gener-

ated from RES is indeed expected to

be over 80 per cent.

Eurelectric’s study shows the mag-

nitude of the investments needed to

deliver on this journey. On average, a

total capital investment of €89-111

billion per year in generation and

storage will be necessary. According

to the European Commission Long

Term Strategy, if Europe moves to-

wards reaching net zero emissions by

2050 additional annual investments

in power grids will amount to around

€90-100 billion.

Over the past few years, there have

been efforts to establish a single Eu-

ropean electricity market that allows

for price signals to trigger invest-

ments. Some headway has certainly

been made. For instance, the 2009

Third Energy Package introduced

network codes to harmonise whole-

sale market rules, improve cross-

border capacity management and

streamline system operation.

Yet, there is still a patchwork of

nationally regulated energy systems,

which hinders the prospect of a real

level playing eld at European level.

National solutions are mostly a real-

ity for what concerns support

schemes for RES, capacity mecha-

nisms, generation taxes and retail

price regulation.

The recently adopted Clean Energy

Package continues to improve the

level of integration in the European

electricity market. Miguel Arias Ca-

ñete, EU Commissioner for Climate

Action and Energy, celebrated the

agreement, saying: “The agreement

on the future electricity market design

is a vital part of the package. The new

market will be more exible and fa-

cilitate the integration of a greater

share of renewable energy. An inte-

grated EU energy market is the most

cost-effective way to ensure secure

and affordable supplies to all EU citi-

zens. The new rules will create more

competition and will allow consum-

ers to participate more actively in the

market and play their part in the clean

energy transition.”

The functioning of short-term mar-

kets is also signicantly improved by

the CEP. It notably: ensures the non-

discriminatory access to balancing

markets; requires participants to

manage all imbalances; and offers the

possibility to act in the market either

individually or through aggregation.

These changes are key in a system

where variable RES play an increas-

ing role. Market players and consum-

ers must get the right signals to pro-

vide exibility and be remunerated

for this service. Moreover, the CEP

establishes a clear framework for the

implementation of capacity mecha-

nisms, which requires adequacy as-

sessments (analysis of the security of

supply situation) being made at both

national and European level.

Nevertheless, a number of provi-

sions in the CEP need further clari-

cation. This is particularly the case

with those related to capacity alloca-

tion and congestion management. It

has been emphasized in the two last

editions of ‘ACER Market Monitor-

ing Report’ that interconnectors have

not been utilised to their full potential.

Therefore, the electricity regulation

of the CEP introduced an obligation

on Transmission System Operators to

allocate a minimum of 70 per cent of

interconnector capacity to the market

to maximise the benets of market

integration. Yet, Eurelectric and other

stakeholders cautioned against such

an approach throughout the legisla-

tive process, arguing that cross-border

capacities should be maximised in a

cost-effective manner. It is unsure

if this ‘one-size-ts-all’ approach will

ensure the most efcient use of inter-

connection capacity.

The CEP recognises the central role

of distribution system operators

(DSOs) in the energy transition. With

90 per cent of new renewables being

connected to distribution networks

and the planned development of

electric vehicles, DSOs will be the

ones enabling decarbonisation and

electrication of the economy. The

recent EY report developed in coop-

eration with Eurelectric outlines dif-

ferent stages of the DSO evolution

towards new business models sup-

porting the transition. The integration

of decentralised and new sources, the

access to exibility through new

platforms and the full digitalisation of

the grid are the new frontiers of distri-

bution system operation.

A clear sign of this is the creation of

the EU DSO entity. This novel Euro-

pean organisation for distribution

system operators will contribute to

the drafting of new network codes,

especially in the area of exibility and

cyber security.

With the CEP, consumers are also

put at the centre of the clean energy

transition. The right to self-produce

and self-consume is enshrined in the

new legislation, together with the

customer’s access to a range of tools

to value their exibility. For instance,

the Electricity Directive allows the

development of innovative demand

response services, giving consumers

control over their electricity con-

sumption. Moreover, it provides a

clear framework for demand response

aggregators to operate in the electric-

ity market, making them responsible

for the imbalances they might cause.

This last provision allows for an ef-

cient overall framework.

The CEP also introduces the concept

of “Citizen Energy Communities”

and “Renewable Energy Communi-

ties”. These Communities will,

among other things, give consumers

the opportunity to organise them-

selves and invest in their own means

of generation. Eurelectric welcomes

the new framework set up by the CEP

in this regard, as it elaborates key

provisions for an efcient develop-

ment of Energy Communities.

While acknowledging the participa-

tion of a new category of actors in the

market, the text also requires that they

are put on a full level playing eld

with other actors. Energy Communi-

ties are therefore subject to fair, pro-

portionate and transparent procedures

and to balancing responsibility.

Moreover, they shall be subject to an

appropriate network tariff reective

of any use of the distribution grid.

The text also requires that consum-

ers who are part of such structures

should be entitled to maintaining their

rights and obligations as nal con-

sumers. Some clarications will still

be required when it comes to the im-

plementation of these new provisions,

especially when many Member States

already have some communities in

place. Eurelectric is actively engag-

ing in this assessment and will soon

publish its analysis.

The actual implementation of the

CEP is now critical. The European

Commission is working on the re-

quired implementing/ delegated acts,

and Member States and national regu-

lators must also follow suit. Eurelec-

tric will monitor the implementation,

for example we are currently actively

THE ENERGY INDUSTRY TIMES - MAY 2019

Energy Outlook

14

Europe’s electricity

sector has identied

its priorities

and key policy

recommendations

with regard to the

different elements

of the Clean

Energy Package

(CEP). Eurelectric

elaborates on the

key CEP objectives

and outlines what

it sees as the main

drivers and enablers

to achieve these

objectives.

Blandine Malvault

and Marion Labatut

Bringing electricity

markets closer together

THE ENERGY INDUSTRY TIMES - MAY 2019

15

Technology

GE has launched

a signicant

upgrade for the

GT26 gas turbine.

By incorporating

advanced technology

from its F- and

H-class machines as

well as 3D printing,

the high efciency

(HE) upgrade will

deliver improved

efciency, power

output and exibility

while reducing

maintenance costs

for its customers –

the rst of which will

be Uniper, at its plant

in Eneld, UK.

Junior Isles

I

n spite of arguments by environ-

mentalists that fossil fuels should

stay in the ground, gas is predict-

ed to continue to play a signicant

role in the power generation land-

scape for the foreseeable future.

In its 2019 ‘Energy Outlook’, BP

says that by 2040, the power sector

will account for around 75 per cent

of the increase in primary energy. It

also forecasts that 85 per cent of the

growth in energy supply will be gen-

erated through renewable energy and

natural gas, with renewables becom-

ing the largest source of global pow-

er generation by 2040. According to

the Outlook natural gas is the only

fossil fuel that will continue to grow

its share of global energy demand

before plateauing and then showing

a decline after 2035.

International Energy Agency fore-

casts are slightly less bullish but pre-

dict that the share of natural gas in

electricity generation remains steady

at about 20 per cent. Nevertheless, it

is clear that renewables and natural

gas will dominate the generation

landscape, with renewables under-

pinning growth in the sector.

The situation is even more acute

in Europe, where, according to a re-

cent report by Wood Mackenzie

Power & Renewables, coal genera-

tion was overtaken by wind and so-

lar for the rst time in ve key Eu-

ropean markets last year.

It said that the uplift in renewables

squeezed out supply from coal and

gas in every market except the UK.

Although the UK’s renewable share

reached an all-time high, nuclear

outages highlighted the market’s re-

liance on gas.

It is no wonder then, that genera-

tors are still looking at ways to in-

crease the value of their gas red

assets, and gas turbine manufactur-

ers are working to improve the

competitiveness of their installed

gas turbine eet.

In a move that GE is seeing as a

major step forward, in March it an-

nounced the launch order for its

new GT26 HE (high efciency) gas

turbine upgrade with Uniper for the

utility’s Eneld Power Station in

greater London, United Kingdom.

The upgrade marks the rst time

that GE has taken technology and

capabilities from its F and H class

eets to create a solution for opera-

tors of the GT26, developed by Al-

stom. Since GE’s acquisition of Al-

stom, it also represents the rst

upgrade that blends GE and Alstom

technologies and expertise across all

major components of a gas turbine.

Commenting on the rationale be-

hind the introduction of the GT26

HE, Michael Rechsteiner, CEO of

GE’s Power Services business in

Europe, said the new market dy-

namics mean there will be more op-

portunity for gas going forward. He

noted this was especially the case in

Europe, which is preparing for nu-

clear phase-outs in some countries

and is seeing higher CO

2

prices.

“We believe the installed capacity

of gas [red generation] in Europe

will grow slightly in the next 10

years,” he predicted. “Actual gener-

ation from gas assets in the future,

however, will be at. Gas turbines

will have a totally different operat-

ing regime... in the past they were

optimised for base load. Today, with

very low electricity prices and re-

newables coming up, they have to

be able to compensate for uctuat-

ing renewables. So our units today

need the capability to be parked at

low load, start-up quickly and

ramped up and down. This is why

we came up with the high efciency

solution to help our customers.”

The GT26 has an installed base of

about 90 units across 21 countries in

four regions, but mostly in Europe.

Although designed for base load op-

eration, a signicant portion (28 per

cent) of these are now in low utilisa-

tion. At the same time, GE has about

1400 F- and H-class gas turbines in

operation.

Amit Kulkarni, general manager of

F-Class turbines for Power Services,

commented: “We had to look at how

to make them [the GT26] competi-

tive in the market. This is the rst

upgrade where we are bringing H

technology into an F-class machine.

“When we talk about upgrades,

we typically do modules – we do

components. For example, the hot

gas path of the turbine or the com-

bustor or compressor. The HE

upgrade is the entire gas turbine –

the turbine, compressor and the

combustor. It is the biggest upgrade

the GT26 has seen in 20 years –

since it was developed.’’

While there has been investment

over the years to drive efciency

and output, Kulkarni says the HE

upgrade is “a huge step-change”.

Although the GT26 architecture

has been maintained, with the same

rotor and structural parts, the rotat-

ing parts and combustion compo-

nents have been changed.

GE has re-designed the rst three

stages of the low-pressure (LP) tur-

bine. The blade and vanes have im-

proved aero proles and the ow

path around the rst stage has been

enlarged. The intricate cooling de-

sign featured in the H-class has also

been utilised.

GE has adopted thermal barrier

coatings from the H-class that will

allow higher turbine inlet ring

temperature and subsequently better

efciency.

To improve durability, vane 2 has

been coated with new, more oxida-

tion resistant, material and stage 1

blades feature heat shields that have

an abradable coating that permits

improved clearance control and sub-

sequently improved performance.

GE has also incorporated 3D print-

ing, or additive manufacturing, into

some of the components. This al-

lows very intricate cooling designs

that cannot be achieved with tradi-

tional manufacturing processes.

Kulkarni noted: “The lance at the top

of the SEV (sequential EV) combus-

tor has 3D printed parts. The frame

at the bottom is also 3D printed.”

GE has also put a great deal of ef-

fort into improving the machine’s

operating range through the use of

devices such as high and low fre-

quency dampers. However it manag-

es to maintain low NOx levels across

the wider operating range, in spite of

the higher ring temperature in the

turbine.

“We have done some interesting

things with the burner that allows

better air-fuel mixing so we can stay

within emissions compliance, while

giving a wider operability window,”

said Kulkarni.

The HE upgrade also has a brand

new compressor, with 3D aerofoils.

All of these changes have served

to improve combined cycle base

load efciency by 2 per cent. Based

on a gas price of $7/million Btu, ac-

cording to GE’s calculations this

translates to as much as $4 million

in fuel savings annually per unit.

Meanwhile, efciency in part-load

is improved by 1 per cent, yielding

up to $1 million in fuel savings a

year per unit.

Plant output is increased by be-

tween 15-55 MW per unit, depend-

ing on the unit being upgraded and

site conditions. This in turn im-

proves revenue opportunities.

Another key benet is extended

inspection intervals, which are in-

creased from 24 000 hours to 32

000 hours. This reduces mainte-

nance and operating costs.

Such benets were sufcient to

entice Uniper to enter into an agree-

ment with GE that would see its En-

eld plant become the site for vali-

dation and demonstration of the

upgrade. The unit at Eneld has

been in operation since 1999 and

the upgrade will also add another 15

years to the unit’s life.

Eckhardt Rümmler, CEO, Uniper

SE, said in a statement: “In Great

Britain’s very competitive and chal-

lenging power generation environ-

ment, investing to keep our plants

competitive by lowering operational

and maintenance costs, at the same

time as increasing efciency and

exibility, is critical for the long-

term success of our eet.”

During the press launch, Pedro

Lopez Estebaranz, Director of Oper-

ations CCGT Asset Operations, Uni-

per Kraftwerke GmbH, said: “The

HE has the potential to be a game-

changer for us... we have been main-

taining and upgrading our gas eet

to operate better in the market. We

had been operating Eneld as a mid-

merit plant, running for 3000-4000

hour per year. Last year we had in

the region of around 150 starts,

which is normal in the UK market.

Increasing the efciency will allow

us to operate for much more hours.”

Uniper is seen as an ideal partner

to launch the product. It has an in-

stalled base of 4.2 GW of GE units

across Europe and has another three

GT26 units in the UK – one more at

Eneld and two at Grain power sta-

tion – which are potential candidates

for rollout of this technology. Nota-

bly, it has also been co-developing

products with GE since 2012, which

makes it comfortable about hosting

the rst unit.

“It is not the rst time we have

tested new technology working with

GE,” said Lopez. “We have strong

engineering capabilities that enable

us to understand the technical risks

when implementing validation units,

we have done in the past.’

While some tests have already

been performed on GE’s test rig in

Germany on components such as the

combustor, the validation of the en-

tire unit will be at Uniper’s Eneld

site. Installation is expected during a

scheduled outage in June 2020 and

the validation will run for about four

months after re-start of the unit. Re-

sults are expected in 2021.

Following what is expected to be

successful validation, GE is antici-

pating wider rollout to other exist-

ing units.

Rechsteiner said: “We’ve had a lot

of interest from customers in many

countries. After the UK, the next

one will be in Italy. Elsewhere in

Europe, there’s also Germany and

Spain. There is also interest from

Singapore, Malaysia and even Ja-

pan. We will not make any other

commitments until we have had the

results from Eneld but we are ne-

gotiating with customers already.’’

With regards to the future of the

GT26 and any further potential up-

grades, he concluded: “For the next

couple of years, this is it because

this is really a huge step forward in

the development of this machine.”

GT26 gets a HE upgrade

The GT26 HE upgrade at a

glance

THE ENERGY INDUSTRY TIMES - MAY 2019

16

Final Word

E

xtinction Rebellion (XR) pro-

testers are a nuisance – not only

do they disrupt daily commut-

ers, they are also a drain on valuable

police resources. Yet they serve a use-

ful purpose. Their demonstrations

have probably done more to put cli-

mate change back in the spotlight than

cyclone Idai, which devastated Mo-

zambique, Malawi and Zimbabwe.

Even cyclone Kenneth, which again

battered Mozambique just weeks later,

did little to intensify the climate

change debate.

There is no doubt that extreme

weather events are a growing concern

and that carbon emissions are, accord-

ing to scientists, reaching a tipping

point that could see irreversible cli-

mate change.

In its recently published Issues

Monitor, the World Energy Council

cited resilience to extreme weather

risks as one of the main challenges

keeping energy executives awake at

night.

Weather risks are obvious in coun-

tries such as Cameroon where extreme

droughts could affect hydropower

generation. The World Energy Coun-

cil’s survey did in fact reveal that en-

ergy leaders in Cameroon are worried

that in the future climate change could

worsen the intensity and frequency of

droughts in the region.

The report also noted that climate

change is causing increasingly irregu-

lar rainfall, rising temperatures, and

desertication in Niger, a country that

is already highly vulnerable to natural

hazards, particularly droughts, oods,

and landslides.

And the concern is not just in devel-

oping countries. In 2018, natural di-

sasters such as heavy rains, typhoons

and earthquakes caused enormous

damage in Japan, and uncertainty

about large-scale accidents caused by

future large-scale earthquakes and

volcanic eruptions is still high. Ac-

cording to the Monitor, there is grow-

ing awareness that extreme weather

caused by climate change may further

increase the damage caused by heavy

rains and typhoons.

The Council stated that with one

degree Celsius of warming so far, “the

Earth has seen a crescendo of extreme

weather”, including heatwaves,

droughts, oods and deadly storm

surges made worse by rising seas.

Importantly, it also states that the

chance of capping global warming at

“well below” two degrees Celsius are

becoming less likely.

“Even taking into account voluntary

national pledges to slash carbon emis-

sions caused by burning fossil fuels,

the planet is currently on track to warm

by an unliveable 3°C to 4°C by cen-

tury’s end,” it states. “This makes it all

the more important, not to regard

Paris as the end of the discussion, but

as the starting point for an ambitious

global climate protection framework

for the future.”

In late March the International En-

ergy Agency (IEA) released its second

‘Global Energy and CO

2

Status Re-

port’. It made bleak reading. Accord-

ing to the study global energy-related

CO

2

emissions rose by 1.7 per cent in

2018, hitting a historic high of 33.1 Gt.

It was the highest rate of growth since

2013, and 70 per cent higher than the

average increase since 2010.

This was in spite of rapid growth in

wind and solar generation, which grew

at double-digit pace with solar alone

increasing by 31 per cent.

In its latest assessment of global

energy consumption and energy-relat-

ed CO

2

emissions for 2018, the IEA

found that energy demand worldwide

grew by 2.3 per cent last year, nearly

twice the average rate of growth since

2010 and the fastest this decade. This

demand, however, was largely met by

fossil fuels. For the second year run-

ning fossil fuels met nearly 70 per cent

of demand growth.

Coal use in power alone surpassed

10 Gt CO

2

, mostly in Asia. China,

India, and the United States accounted

for 85 per cent of the net increase in

emissions, while emissions declined

for Germany, Japan, Mexico, France

and the United Kingdom.

Coal red power plants were the

single largest contributor to the growth

in emissions, accounting for 30 per

cent of global CO

2

emissions. For the

rst time, the IEA assessed the impact

of fossil fuel use on global temperature

increases. It found that CO

2

emitted

from coal combustion was responsible

for over 0.3°C of the 1°C increase in

global average annual surface tem-

peratures above pre-industrial levels.

This makes coal the single largest

source of global temperature increase.

The global average annual concentra-

tion of CO

2

in the atmosphere aver-

aged 407.4 ppm in 2018, up 2.4 ppm

since 2017. This is a major increase

from pre-industrial levels, which

ranged between 180 and 280 ppm.

Commenting on the ndings, Dr

Fatih Birol, the IEA’s Executive Direc-

tor, said: “Despite major growth in

renewables, global emissions are still

rising, demonstrating once again that

more urgent action is needed on all

fronts – developing all clean energy

solutions, curbing emissions, improv-

ing efciency, and spurring invest-

ments and innovation, including car-

bon capture, utilisation and storage.”

The impact of coal red generation

is clear and the technology is there to

address the issue. Renewables have

come a long way but it would appear

that they cannot be integrated fast

enough to bend the emissions curve at

the necessary speed. With renewables

subsidies being steadily phased out,

perhaps it is now time for governments

to look at how to incentivise or fund

the retrotting of carbon capture on

existing coal red plants.

But this is still only half the story.

National energy and climate plans

need to address how to get more re-

newables into heating and transport.

In the EU, this is essential for the de-

carbonisation of energy – three quar-

ters of total energy consumed is in

these two sectors. Certainly, decarbon-

ising heat and transport, as well as

industry, will be much more challeng-

ing than it has been for the electricity

sector.

Unfortunately, although their mo-

tives are honourable it is likely that

most XR protesters are unaware of the

difculty of achieving what they are

asking.

In London, XR insists that it will

continue its disruptive protests until

the UK government agrees to meet and

discuss its demands – a key one being

that the UK must reduce carbon emis-

sions to zero by 2025. Putting the

power industry aside, retting every

household with some form of heat

pump or electric boiler, as well as

having a charging infrastructure in

place for 100 per electric vehicles,

would be nigh on impossible. Then

there is the tremendous cost to the

already hard-pressed working-class

household.

XR protesters in London are also

perhaps unaware that the UK is a world

leader in terms of how much it has cut

CO

2

emissions. The IEA report shows

that in 2018 its emissions declined for

a sixth consecutive year, hitting some

of the lowest levels recorded since

1888 and 39 per cent below 1990

levels. This is predominantly due to

the switch from coal to renewables –

electricity generation from renew-

ables saw a record year, accounting

for 35 per cent of generation. At the

same time the share of coal fell to 5

per cent, a record low.

Indeed emissions across Europe fell

by 1.3 per cent, or 50 Mt, largely

driven by a drop of 4.5 per cent in

Germany, as both oil and coal combus-

tion fell sharply. The drop in coal

consumption was concentrated in the

power sector, where generation from

renewables reached a record high of

37 per cent of the electricity mix.

Unfortunately, the same cannot be

said of India, China and the US. While

per capita emissions in India remain

low at only 40 per cent of the global

average, in 2018 CO

2

emissions in the

country rose 4.8 per cent from the

previous year – a faster rate than any

other major energy-consuming nation.

In China, emissions grew by 2.5 per

cent, or 230 Mt, to 9.5 Gt, while in the

US the emission reductions seen in

2017 were reversed, with an increase

of 3.1 cent.

On this basis, the efforts of London’s

XR protestors are perhaps mis-direct-

ed and the authorities might consider

another approach to the disruptions

they cause. Rather than arresting

protestors, only to see them return the

next day, it would be far more effective

for everyone to y them to India,

China or the US where they are

needed most. And plant a few trees to

offset the carbon footprint of the ight.

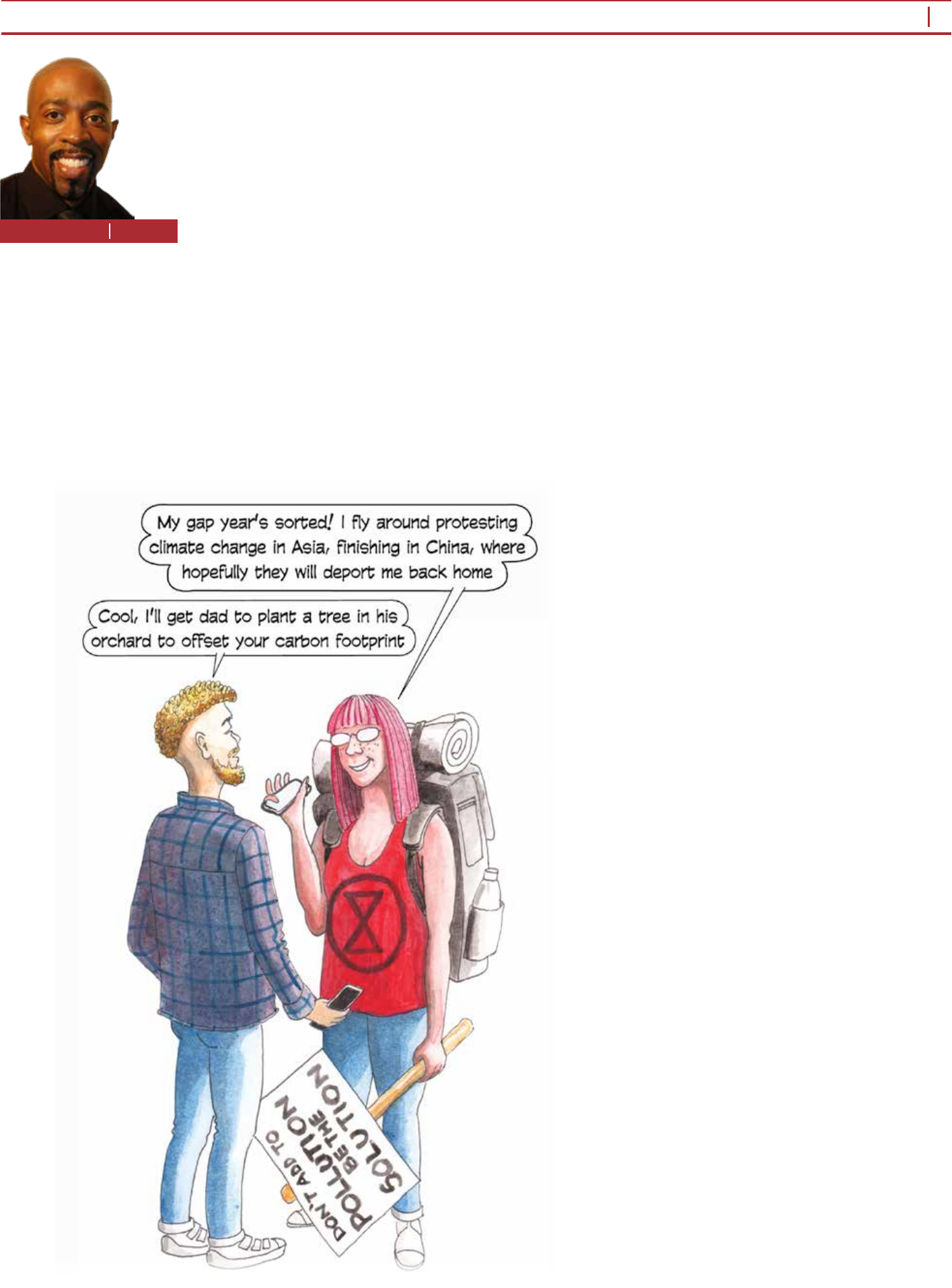

A rebellious climate

Junior Isles

Cartoon: jemsoar.com