www.teitimes.com

March 2019 • Volume 12 • No 1 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Special Technology

supplement

Capturing carbon

CFB scrubbers can be an attractive

alternative to wet FGD systems in

cleaning up India’s coal red plants.

A ministerial initiative is hoping to get

carbon capture utilisation and storage

back on track.

Page 14

News In Brief

Wind and solar overtake coal

Coal red generation was overtaken

by wind and solar for the rst time

in ve key European markets last

year.

Page 2

Puerto Rico divided on

privatisation

Puerto Rico’s plans to attract

investment to its hurricane-

hit electricity sector through

privatisation have been opposed

by lawmakers concerned about

proposed price caps.

Page 4

Japan looks offshore

Japan is looking to offshore wind

in a move to ll the gap left left

by nuclear plant closures and meet

climate change objectives.

Page 6

German permit scheme

slows onshore sector

Fundamental issues with the

permitting scheme for new wind

farms in Germany are slowing down

growth in the sector.

Page 7

UK funding for Iraq but deals

under threat

Over $1 billion of UK export nance

is to be used to support critical

electricity infrastructure projects in

Iraq,

although some large deals

could be under threat.

Page 8

GE restructures renewables

GE says it will intensify its

focus on renewable energy with

a new division dedicated to all

of its renewable energy and grid

businesses.

Page 9

Industry Perspective: The

future has been written

The EU’s electricity future will be

decarbonised, decentralised and

electric, and distribution system

operators will need to be ready

within ve years.

Page 13

Technology: Ready for the

hybrid wind-solar market

EDP Renewables has tested a

demonstrator system in Spain that

combines wind and solar plants into

a single hybrid system.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

Germany has welcomed a proposal to close its coal red power plants by 2038, as it struggles

to keep a lid on greenhouse gas emissions. Junior Isles

Eskom breakup looms as government moves to stave off crisis

THE ENERGY INDUSTRY

TIMES

Final Word

BP’s Energy Outlook is

still a bit brown,

says Junior Isles.

Page 16

Germany has taken a signicant step

in its effort to close the gap on its green-

house gas emission (GHG) targets, as

the government welcomed a proposal

to phase out the country’s coal red

power plants by 2038. Berlin said it

would act quickly to implement the

recommendation.

According to management consul-

tancy enervis energy advisors GmbH,

the proposal would lead to noticeably

lower CO

2

emissions from coal red

power generation. It said that in 2022,

about 34 million tonnes less CO

2

will

be emitted than in a scenario without

forced coal phase-out. By 2030, the

reduction is 67 million tonnes.

Germany has been at the forefront

of the development of renewable en-

ergy in Europe with the government

committed to the energy transition

(Energiewende), a strategy to shift to

a low-carbon, environmentally sound,

reliable, and affordable energy sup-

ply. This has been reected in the

country’s 2020 climate protection

targets, which are more ambitious

than EU targets.

However, Germany has not been

able to reduce its emissions fast

enough to meet its 2020 national tar-

gets because of its signicant reliance

on coal. Further, the country has com-

mitted to reducing carbon dioxide

emissions from the energy sector by

more than 60 per cent by 2030, using

1990 as the baseline.

In recognition of the challenges it

has faced in meeting its own climate

protection targets, in June 2018 the

government established the Commis-

sion for Growth, Structural Change

and Employment (Coal Commission).

The Coal Commission was asked to

produce a plan to close the gap in

reaching the 2020 40 per cent GHG

emissions reduction target “as much

as possible” and then meet the 2030

target.

Germany currently has more than 80

power plants that run on coal and lig-

nite, accounting for about 42 GW of

capacity and producing 40 per cent of

its electricity.

The Coal Commission’s recommen-

dations would mean that about 24

plants would be closed within the rst

three years of the plan. Just eight coal

red plants would remain by 2030 if

the plan is executed as intended. This

would see coal red capacity reduced

to 30 GW by the end of 2022 and to 17

GW by the end of 2030.

According to enervis the Commis-

sion’s recommendation stays close to

the exit path that it analysed three

years ago for Agora Energiewende, a

think-tank supporting the Ener-

giewende in Germany.

Julius Ecke of enervis, notes, how-

ever that the dened exit path will not

Continued on Page 2

South Africa’s state utility Eskom is

facing the breakup of its business as

the government moves to head-off the

collapse of the company.

Last month the government un-

veiled the largest bailout in the coun-

try’s history, promising to inject R69

billion ($4.8 billion) over three years

to stabilise Eskom’s R420 billion

debt.

The bailout, however, is conditional

on Eskom achieving cost cuts of more

than R20 billion per year, and on the

imposition of a Treasury-appointed

“chief reorganisation ofcer”. It also

depends on a plan announced by Pres-

ident Cyril Ramaphosa earlier in Feb-

ruary to split up Eskom’s power sta-

tions, distribution networks and grids

into three separate businesses. The

businesses would be under Eskom

Holdings, while at the same time re-

maining the property of the state.

Delivering the national budget last

month, South Africa’s Finance Minis-

ter, Tito Mboweni, explained: “Pour-

ing money directly into Eskom in its

current form is like pouring water into

a sieve.”

The crisis is the result of years of

mismanagement that has left Eskom

unable to nance maintenance of age-

ing, mostly coal red, stations. Over-

runs at unnished new plants have

also put tremendous pressure on its

balance sheet. Acting Director Gen-

eral of the Department of Public En-

terprises (DPE), Thuto Shomang,

added that corruption and bad deci-

sion-making were also among a host

of other failures.

Phakamani Hadebe, Eskom’s chief

executive, said a bailout would sup-

port two-thirds to three-quarters of its

debt servicing costs in the three-year

period. “It releases resources to do

maintenance and we will be in a better

state than we are now,” he said.

The Treasury hopes that higher eco-

nomic growth and increased tariffs

paid by Eskom’s customers will be

able to plug the gap remaining after

the state bailout.

In February, government ofcials

told Parliament’s DPE committee that

Eskom was technically insolvent and

would cease to exist in April this year

without a bailout from government.

Shamong said the cash generated at

the utility was not covering operating

and debt servicing costs, the head-

count had increased from 32 000 to

48 000 between 2007 and 2018, with

the associated costs growing from

R9.5 billion to R25.9 billion, while

municipal debt was growing at

around R1 billion a month.

The risk of a collapse at Eskom,

which has led to power plant outages

and rolling national blackouts, is a

serious threat to South Africa’s strug-

gling economy.

In February a senior generation of-

cial at the cash-strapped company

said about a third of Eskom’s 45 000

MW capacity is ofine.

Andrew Etzinger told Reuters that

around 11 000 MW was ofine be-

cause of plant-related problems, while

approximately 5000 MW was out of

service because of planned mainte-

nance. A further 2000 MW was un-

available because of a shortage of

diesel.

In order to urgently address the op-

erational problems at Eskom, chief

amongst which is generation, the

DPE, led by Minister Pravin Gordhan

and Eskom Chairman Jabu Mabuza,

have called on Italian energy supplier

Enel to provide the power utility with

external technical assistance.

Coal phase-out will

“noticeably lower”

carbon emissions

THE ENERGY INDUSTRY TIMES - MARCH 2019

3

POWER SUMMIT 2019

NEW LEADERSHIP

20-21 May, Florence

New concepts, new business models,

new perspectives. Join to discuss new

leadership in the electricity industry with

top of the class speakers.

Hosted by

EUBCE 2019

27

th

European Biomass

Conference & Exhibition

27 - 30 MAY 2019 | LISBON - PORTUGAL

The largest gathering

of biomass experts

REGISTER NOW!

Early bird deadline 22nd March 2019

www.eubce.com

#EUBCE

THE ENERGY INDUSTRY TIMES - MARCH 2019

5

subscribe today

The Energy Industry Times is the only publication that

covers global news related to the power and energy

sector in a newspaper style and format whose

uniqueness is recognised by our readers.

As a paid subsciber you will gain full access to our

online news desk.

You will also no longer have to wait for the

printed edition; receive it by PDF “hot off the press” or

download it online.

To subscribe, email subscriptions@teitimes.com or visit

www.teitimes.com

To guarantee receiving your monthly copy of the award

winning newspaper, you need to subscribe today

www.teitimes.com

THE ENERGY INDUSTRY

TIMES

SOUTH KOREA

RENEWABLE ENERGY

SUMMIT 2019

Grand Ambassador Seoul Associated With Pullman

Seoul | South Korea

17 - 18 April, 2019

Japan is looking to offshore wind as

it moves to ll the gap left by the clo-

sure of its nuclear plants, while meet-

ing its climate change objectives. Ac-

cording to new research by Wood

Mackenzie, Japan’s offshore wind

capacity is expected to reach 4 GW in

2028, a 62-fold increase from 2018.

Wood Mackenzie estimates that Ja-

pan will see a power generation short-

fall of more than 10 GW by 2030, as it

struggles to restart 30 nuclear reactors

to meet the national nuclear target, and

renewables will play an important role.

“In light of the power shortfall, Ja-

pan will need to increase its coal im-

ports, supported by renewable energy

capacity,” said Senior Analyst Robert

Liew. “In terms of renewable energy,

scale matters and offshore wind is at

an advantage.”

According to the consultancy, the

participation of Japan’s largest utility

Tokyo Electric Power Company Hold-

ings (Tepco) in offshore wind shows

that the sector is commercially viable,

which makes it easier for the govern-

ment and local companies to accept it.

“The medium- to long-term outlook

for offshore wind in Japan looks espe-

cially promising with Tepco’s involve-

ment in offshore wind, the growing

offshore pipeline and new policy mea-

sures to support wind development. We

expect Japan to emerge as a key off-

shore wind market in Asia,” Liew said.

Japanese companies have also been

looking to gain experience in interna-

tional waters. Last month, Sumitomo

Corporation, Sumitomo Mitsui Bank-

ing Corporation (SMBC) and Devel-

opment Bank of Japan established their

rst fund dedicated to overseas off-

shore wind projects.

The fund will acquire the assets

Sumitomo Corporation holds in the

Race Bank and Galloper offshore wind

farms in the UK as seed assets.

According to the parties, the fund

managed by Spring Infrastructure

Capital, will seek to raise up to Yen30

billion ($270 million) from Japanese

investors for nancing and investing

in the projects.

The three companies established

Spring Infrastructure Capital in July

last year to provide institutional inves-

tors with opportunities to invest in re-

newable energy assets both inside and

outside Japan.

Japan’s interest in renewables is be-

ing driven by a need to keep a lid on

CO

2

emissions. At the same time, it is

also trying to pull back from coal.

Amid growing pressure, Japan’s trad-

ing house Marubeni Corp said last year

that it would no longer start new coal

red power plant projects and would

halve its net coal power generating

capacity of about 3 GW by 2030 to help

cut greenhouse gas emissions and

tackle global climate change.

At the end of January Idemitsu Ko-

san, Kyushu Electric Power and Tokyo

Gas said they had abandoned plans to

build a 2 GW coal red power station

in Chiba, near Tokyo, as it would not

be economically feasible.

The move follows a similar decision

at the end of December by Chugoku

Electric Power and JFE Steel, a unit of

JFE Holdings, and comes amid grow-

ing pressure in parts of the world for

companies to divest coal assets due to

environmental concerns.

Australia will fall short of its 2030

emissions target without a major effort

to move to a low-carbon model, ac-

cording to a new OECD report.

The country has made some progress

replacing coal with natural gas and

renewables in electricity generation

yet remains one of the most carbon-

intensive OECD countries and one of

the few where greenhouse gas emis-

sions (excluding land use and forestry)

have risen in the past decade.

The OECD’s third ‘Environmental

Performance Review of Australia’

says Australia needs to develop a long-

term strategy that integrates energy

and climate policies to support prog-

ress towards its commitment to reduce

greenhouse emissions (including land

use and forestry) to 26-28 per cent be-

low 2005 levels by 2030. Australia

should consider pricing carbon emis-

sion more effectively and doing more

to integrate renewables into the elec-

tricity sector.

Reliant on coal for two-thirds of its

electricity, Australia has one of the

highest levels of non-renewable en-

ergy use of advanced economies, with

fossil fuel consumption still benet-

ting from government support.

Coal, oil and gas make up 93 per

cent of the overall energy mix com-

pared to an OECD average of 80 per

cent. The share of renewables in elec-

tricity generation has risen to 16 per

cent but remains below the OECD

average of 25 per cent. Australia’s

power sector – the country’s top emit-

ting sector – is not subject to emission

reduction constraints.

The OECD report, however, comes

as another research report claims Aus-

tralians are leading the world in the per

capita adoption of renewable energy

at a rate which could see 100 per cent

green power by 2032.

Australia is installing solar and wind

renewable power per capita four to ve

times faster than the EU, Japan, China

and the US, Australian National Uni-

versity Professor Andrew Blakers said.

“The electricity sector is on track to

deliver Australia’s entire Paris emis-

sions reduction targets ve years early,

in 2025, without the need for any cre-

ative accounting,” said Prof Blakers,

of the ANU Research School of Elec-

trical, Energy and Materials Engineer-

ing. Prof Blakers estimates Australia

will generate 50 per cent renewable

electricity in 2024 and 100 per cent by

2032.

Last month it was reported that pow-

er plants with a combined capacity of

283 MW have secured accreditation

under Australia’s Renewable Energy

Target (RET) in January 2019, bring-

ing the total accredited capacity over

the last three years to 4757 MW.

In 2016, CER estimated that reaching

the RET of 33 000 GWh renewable

power generation by 2020 would re-

quire 6000 MW of new capacity. Due

to a higher proportion of solar projects

in the pipeline, the estimates were

later updated to 6400 MW. With the

already accredited capacity plus 5499

MW of committed projects, Australia

will surpass the targeted capacity.

State utility PLN’s Strategic Procure-

ment Director Supangkat Iwan San-

toso says progress of power plant con-

struction is in line with its programme

to add 35 000 MW of new capacity.

The news came as he announced that

Indonesia was aiming to complete

3963 MW this year.

This would bring new installed ca-

pacity to 7000 MW or 20 per cent of

the programme introduced by Presi-

dent Joko “Jokowi” Widodo four years

ago. Supangkat said the programme

could be completed in 2022 or 2023.

Supangkat said this year’s capacity

would come from at least three coal-

red power plants with the total ca-

pacity of 2350 MW – PLTU Java 7

and Java 8 with the capacity of 1000

MW each and PLTU Lontar with the

capacity of 350 MW.

“There are also a number of small

power plants [that would begin op-

eration] this year. But coal red pow-

er plants would provide the largest

contribution,” Supangkat said.

6

THE ENERGY INDUSTRY TIMES - MARCH 2019

Asia News

Indonesia’s 35 GW plan on track

Japan looks offshore

n Offshore wind capacity expected to reach 4 GW n Fund buys into UK assets

Manilla cityscape

OECD says Australia

carbon intensity rising

Thailand’s new National Energy Poli-

cy Council (NEPC) is expected to take

effect from the second quarter.

After three years of revising and

drawing up a new version of the pow-

er development plan (PDP), in late

January the NEPC approved the plan

for 2018-37, emphasising more par-

ticipation from private companies in

the country’s power generation.

The plan can be revised every ve

years as changes and technological

trends occur in the power sector.

The plan reduces the proportion of

power generated by the state-run Elec-

tricity Generating Authority of Thai-

land (Egat) from 35 per cent in the

previous version to 24 per cent.

The new PDP sees policymakers plan

for new power capacity of 56 431 MW,

up from 46 090 MW in 2017. Of the

planned new capacity, 20 766 MW will

be from renewable power projects.

Power plants with a total capacity of

25 310 MW will be retired during 2018-

37, so total power capacity by 2037

will stand at 77 211 MW.

Energy Minister Siri Jirapongphan

said non-fossil power will represent 35

per cent of total power capacity by

2037, while coal red power plants will

be reduced to 12 per cent.

“We are very keen on renewable en-

ergy projects and energy conservation

plans, while power imported from

neighbouring countries is generated

from hydropower,” Siri said, adding

that Thailand will import 5857 MW by

2037, up from 3528 MW.

“The NEPC has ordered the Energy

Ministry to hold talks with Laos and

Cambodia regarding capacity and

power prices if the two countries want

to establish power plants and sell pow-

er to Thailand,” said Siri.

Siri also noted that the NEPC

authorised the ministry and Egat to

study grid development in a bid to

purchase more renewable power in

the future and increase the country’s

efciency to become a centre of pur-

chasing power in the region or a grid

connection.

Egat and the Provincial Electricity

Authority are required to develop a

smart grid in the Eastern Economic

Corridor in an effort to lower power

prices and attract new investment.

The PDP also allows solar panels to

be installed on private property and

surplus power to be sold to Egat.

“Egat will purchase at least 100 MW

of solar power a year in the next 10

years, while the ministry will soon put

the purchase plan into action,” Siri said.

The NEPC also approved the revi-

sion of purchasing power contracts

with 25 small power producers (SPP)

that are cogeneration plants.

Thailand power

plan to take effect

in 2Q

THE ENERGY INDUSTRY TIMES - MARCH 2019

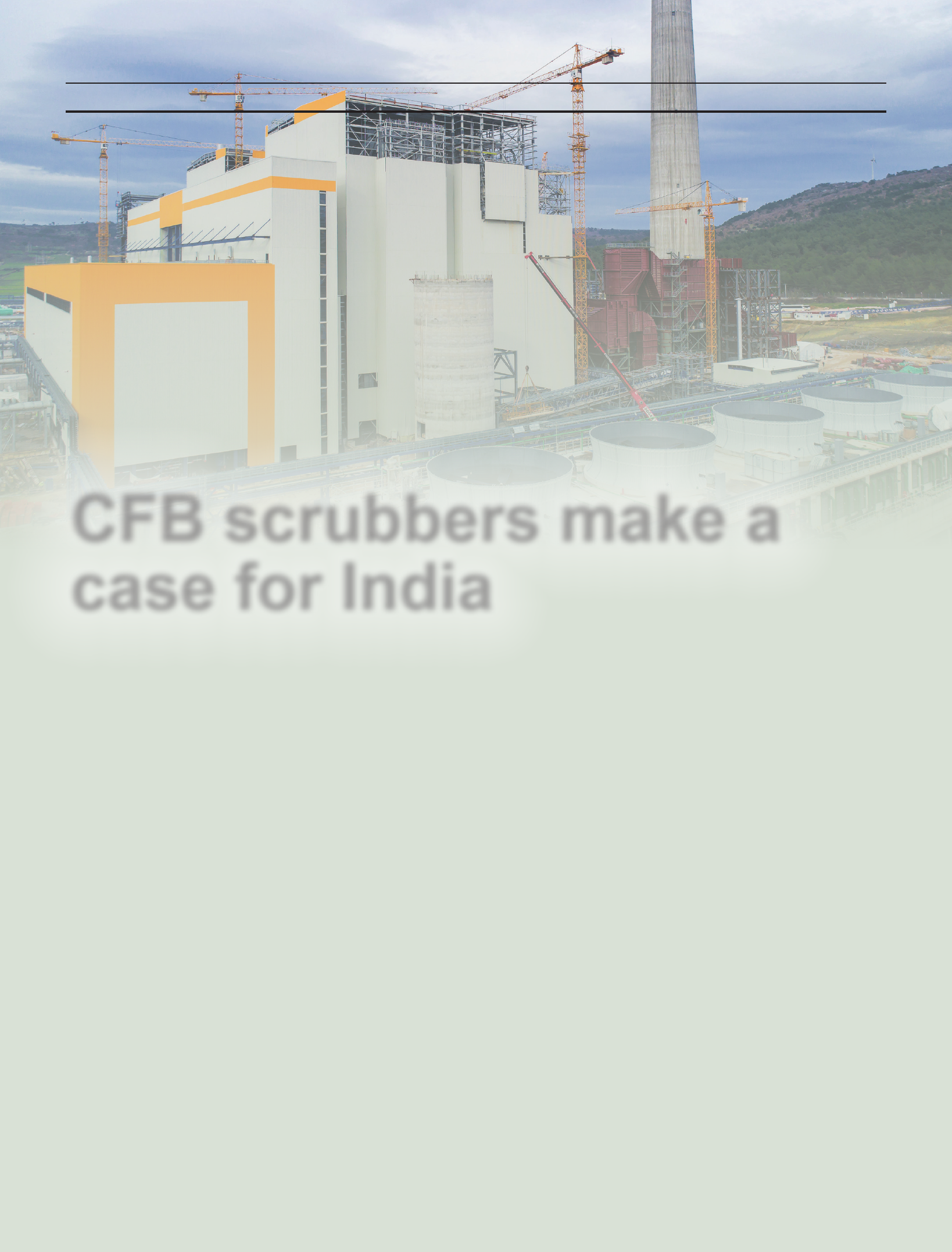

Special Technology Supplement

CFB scrubbers make a

case for India

While wet ue gas

desulphurisation

(FGD) is the

incumbent

technology for

cleaning up coal red

plants, circulating

uidised bed (CFB)

scrubbers are poised

to challenge the

status quo, especially

in markets such as

India. Junior Isles

ue gases,” said Giglio. “But they

have some downsides: they use a lot

of water, they’re expensive and they

take up a lot of room. They don’t do

a good job on non-water-soluble

acid compounds like SO

3

or some of

the halogen compounds. And they

don’t do well with heavy metals.

They are really geared to removing

SO

2

and there’s a lot of maintenance

that goes along with the extra equip-

ment involved.”

One other potential drawback with

wet FGD systems is that they also

produce gypsum. Although this can

be a valuable byproduct, in some

countries such as India where it is

projected that there will be an over-

supply of gypsum, disposal costs can

be a burden.

“The attractiveness of gypsum sale

to wallboard manufacturers was ini-

tially a big selling point but it turned

out there was not really a demand for

it. So what was seen as a potential

source of revenue offset has not been

realised. Furthermore gypsum purity

in many cases has not been high

enough for commercial sale,” said

Krishnan. “And with the Indian mar-

ket being very cost-sensitive, the

lower installed cost of the CFB scrub-

ber and its other benets mean the

technology is beginning to emerge as

a major alternative.”

Dry/semi-dry systems overcome

several of the issues facing wet FGD

technology. Notably, they have much

lower capital cost and use less water

than wet FGD technology.

According to Krishnan, in India, the

price of wet FGD systems average at

about $70-80/kW. According to SFW,

this is typically about 40-50 per cent

more than a CFB scrubber. This is due

to the greater amount of equipment

needed by the wet FGD process. A

wet FGD system also consumes about

40 per cent more water. And although

the limestone used in a wet FGD can

be 40 per cent cheaper than the lime

used in a CFB scrubber or SDA sys-

tem, operating costs tend to be higher.

P

ressure on power plant operators

to cut emissions has never been

greater. It is a global trend that

has seen even the likes of China

introduce tougher emission standards

for sulphur and nitrogen oxides (SO

x

and NO

x

), particulate matter (PM) and

CO

2

. Even developing countries such

as Indonesia, the Philippines, Thailand

and Vietnam are looking at ways to cut

emissions from their coal red eet.

And in India, which has revised its

emissions legislation, the pressure is

more acute.

Certainly emission-free renewables

such as wind and solar are growing at

a tremendous rate in many of these

countries. India for example has set a

goal of adding 175 GW of renewables

by 2022. But although renewables are

making rapid progress globally, coal

plants still have a role to play in pro-

viding base load generation and

technology therefore needs to be ad-

opted to drastically cut emissions

from the coal red eet.

Nowhere is this truer than in India,

where the country is now assessing

technology options to cut SO

x

and

NO

x

from its installed base and any

new plants on the horizon.

Robert Giglio is Senior VP Strategic

Business Development, Sumitomo

SHI FW (SFW), which is currently

targeting India as a key market for its

circulating uidised bed (CFB) dry

scrubber technology. He commented:

“Low emissions has become the new

guiding principle for power plants –

both old and new, coal and otherwise.

Of course renewables are right there

touting its benets of zero emissions

and low operating costs, and that’s

great. But renewables are not able to

ll the role of these base load fossil

plants. That means we have to deal

with the fossil fuel plants already in

the ground today and those being put

in the ground tomorrow.”

“India is the key example in the

world right now of a country that has

moved from being one of the less

conforming countries when it comes

to regulatory environmental laws, to

one that has actually become very

progressive. India is setting the lead

for what a big developing country has

to do with its coal-based generation

eet.”

According to the Ministry of Power,

in 2018 coal red power plants repre-

sented just over 56 per cent of the

country’s installed generating capac-

ity. Many of these plants have no

emissions controls, and determining

the right technology to control coal

plant emissions is a choice that India’s

plant owners are now facing.

India issued new environmental

legislation just over three years ago,

setting new standards for NO

x

and

SO

2

but more recently made some

modications.

Market expert Ravi Krishnan, at

Krishnan Associates, explained: “The

standards introduced around Decem-

ber 2015 came about all of a sudden

because of pressure from the interna-

tional community at the time to get

the country to move to greener energy

and also clean up its coal red power

plants.

“But because the regulation came

about so quickly, the government un-

derestimated how long it would take

to implement the air pollution control

projects, and did not really factor in

any delays due to custom design

considerations for high ash Indian

coals and how the costs would be

passed on to the customer.”

This, he says, led power plant own-

ers to push back on the legislation,

forcing the government to extend the

guideline for compliance from 2017

to 2022. The new legislation sets dif-

ferent limits for plants installed before

2004, those after 2004 but before

December 31, 2016 and those after

January 1, 2017.

In short, the legislation means that

plants pre-2017 of less than 500 MW

have to meet SO

2

standards of less

than 600 mg/Nm

3

, and less than 200

mg/Nm

3

for plants larger than 500

MW. For NO

x

, the level is 600 mg/

Nm

3

for all sizes built before 2004.

For plants built between 2004 and

2017, the SO

2

limits are the same as

pre-2004 plants but the NO

x

limit is

300 mg/Nm

3

. Notably, in some loca-

tions units that are smaller than 500

MW but are close to populated areas,

also have to comply with the 200

mg/Nm

3

SO

2

standard. For plants of

any size built from January 2017,

both SO

2

and NO

x

must not exceed

100 mg/Nm

3

.

The choice of ue gas desulphurisa-

tion (FGD) system, which can either

be a dry/semi-dry or wet system, de-

pends on the level of SO

x

removal

needed and the plant specics.

Dry/semi-dry FGD technologies

include: simple injection of a sorbent

into the boiler ue gas (direct sorbent

injection or DSI); the more estab-

lished spray dryer absorber (SDA)

system, which sprays a mist of lime

slurry into the ue gas; and the rela-

tively new concept of employing

(CFB) scrubber technology, with

boiler ash and lime circulated through

an absorber reactor and typically a

fabric lter.

With baseline SO

2

emissions aver-

aging around 1200 mg/Nm

3

, India’s

600 mg/Nm

3

limit could be met us-

ing a DSI system for many plants but

to meet the 200 mg/Nm

3

standard

would require the use of a wet FGD

system, or one of the other dry/semi-

dry processes.

For decades, the established tech-

nology for cleaning up coal plants

has been wet FGD scrubbers, which

use limestone as the reagent for

capturing SO

x

. In India, over the last

year or so, around 15 wet FGD sys-

tems (representing 10-12 GW) have

been ordered for power large plants

but going forward, the choice of wet

FGD for pollution control might not

be so automatic.

“They have gained this dominant

position because they were built at

scale many decades ago, and proven

themselves over a wide range of

conditions and fuels and quality of

CFB scrubbers have been

installed behind the Soma Kolin

CFB boilers in Turkey

can capture.

“This restriction is not there with a

CFB scrubber, you can add as much

lime as you want to the system be-

cause the chemistry is much less de-

pendent on the amount of water in-

jected into the ue gas; water is only

used in the CFB scrubber to set the

temperature and humidity of the gas.

This gives the exibility and freedom

to go to very high levels of capture of

all the acid gas and metals.”

SFW sees this ability to capture a

wide range of pollutants, including

SO

x

, PM, acid gases and organic

compounds, as a big plus in today’s

market.

Commenting on this exibility, Gi-

glio said: “You can install one today

to get you to where you need to be on

SO

2

but it also reduces SO

3

, HCl, HF,

mercury, beryllium, cadmium – all of

these metals that may not be regulated

in many countries for a long time but

it’s coming. So in the future, you

don’t have to go out and buy another

scrubber or add on activated carbon

systems as regulations tighten.”

In a CFB scrubber, boiler ue gas

enters at the bottom of an up-ow

absorber vessel. The gas mixes with

hydrated lime and water injected into

the absorber, as well as recirculated

solids from the downstream fabric

lter. The turbulator wall surface of

the absorber causes high turbulent

mixing of the ue gas, solids and water

to achieve a high-capture efciency

of the vapour-phase acid gases and

metals contained within the ue gas.

The scrubber design incorporates a

number of built-in features to maxi-

mise reliability. The absorber vessel

is a self-cleaning upow reactor with

a cloud of water droplets spreading

over a large surface area of solids

churning in a 23 m (75 ft) high sec-

tion within the connes of the vessel

walls.

Water injection nozzles, located on

the perimeter of the absorber above

the introduction points for the re-cir-

culated and sorbent solids, provide an

atomised spray cloud of water drop-

lets. These nozzles must be removed

periodically for replacement of com-

ponents subject to wear. However, the

entire perimeter of the CFB absorber

vessel is used to locate the water

nozzles thus additional nozzle loca-

tions are typically available to allow

installation of a spare nozzle prior to

removing an operating nozzle for in-

spection or maintenance.

One or more multi-compartment

fabric lter baghouses are located

downstream of the absorber vessel to

allow recirculation of particulate

solids. The multi-compartment bag-

house lends itself to on-line replace-

ment of lter bags with one compart-

ment off-line.

Separate compartments are each

lockable on the ue gas side for

maintenance purposes thus it is pos-

sible to shut down one compartment

“In a CFB scrubber, you don’t have

to maintain lime crushers, mills,

slurry pumps, spray nozzles, or dry-

ing systems for the byproduct, etc.,”

noted Giglio.

Despite these advantages, however,

in the past they have generally only

been selected for projects where the

boiler size was not too large and the

fuel sulphur level was not too high.

Traditionally, this has been true of

both SDA and CFB scrubbers. Since

their introduction 10-15 years ago,

however, a steady increase in scale is

seeing CFB scrubbers become an in-

creasingly attractive alternative to

wet FGD systems. During this time,

they have also been proven over a

much wider range of sulphur levels

and coals.

Today, there are single unit designs

up to 700 MWe backed by operating

references on coal power plants of

over 500 MWe and on fuels with sul-

phur levels above 4 per cent. In June

2011 for example, a CFB scrubber

began operating at the 520 MW coal

red plant at Basin Electric’s Dry

Fork station in Gillette, Wyoming,

USA .

According to SFW, CFB scrubbers

can operate on a wide range of coals.

Low ash, high moisture fuels such as

Indonesian sub-bituminous coals

might require more reagent but as the

fuel’s ash level increases less reagent

is needed since the ash plays a role in

capturing the pollutants in the ue

gas.

Giglio noted: “It can take the widest

range of fuels – from hardly any ash

to an overwhelming amount of ash –

and still function well. They can do

what a wet FGD system can do in

many cases, and they can do it for a

lot less cost and a lot less water.”

For optimum operation, he says

there is “a sweet spot” where ash

levels are between 7 per cent up to

around 30-40 per cent. This gives the

maximum capture with the least

amount of reagent injection. This re-

agent could be anything from hy-

drated lime, sodium bicarbonate or

even activated carbon, depending on

the pollutant being targeted.

“The scrubber provides the exibil-

ity to tailor the reagent recipe to most

effectively capture the target pollut-

ants,” said Giglio. “Whereas a wet

system has to be precisely con-

trolled… it’s a tight chemical balance

– there can’t be too much chlorides,

metals or ash in the system before

adversely impacting the capture ef-

ciency. All these things move it off its

optimum operating point. CFB scrub-

bers use dry absorption chemistry

instead of water solubility chemistry

to make the reactions work in the

scrubber.”

He points out, however, that the

choice of technology largely depends

on the specics of the project. “Wet

FGD uses limestone, which is cheap;

whereas the semi-dry processes use a

more rened lime that is more expen-

sive. It’s all part of a discussion

around capital cost, operating cost,

what to do with the byproduct, water

usage, space requirement. It’s never a

one size ts all solution.”

There are also differences between

the dry/semi-dry processes to con-

sider. Compared with SDAs, CFB

scrubbers offer lower maintenance

cost, compact footprint, and the ex-

ibility to use low quality lime and

water.

Another drawback of SDA technol-

ogy, says Giglio, is that it cannot ac-

cept as many solids. SDAs use atom-

ising nozzles, some with motorised

rotary heads to enable a very ne mist

to be sprayed. Because the nozzles

have very ne passages, passing

boiler y ash through them causes

blockages and erosion. CFB scrub-

bers avoid this problem by using large

diameter venturis to mix the ash with

turbulent ue gas.

Giglio explained: “The CFB scrub-

ber uses the boiler’s y ash to help

capture the target pollutants. This

benet can reduce reagent consump-

tion and operating cost, which be-

comes most signicant for fuels con-

taining high levels of calcium in their

ash. The technology uses the ash as

receptor sites to absorb the vapour

phase pollutants (SO

2

, SO

3

, HCl, etc.)

on to the surface of the solid particles.

But the main process advantage of a

CFB scrubber is that, unlike SDA or

wet FGD technology, the amount of

lime injection is not limited by the

ue gas temperature, allowing sig-

nicantly improved acid gas scrub-

bing performance.

“This a key advantage; none of the

other scrubbers do this. SDA and wet

FGD technology use a slurry of lime

and water to spray into the gas to

clean it. But the problem with this is

you’re now connecting gas tempera-

ture and moisture level to sulphur re-

moval. The more slurry that’s sprayed

into the ue gas, the lower the gas

temperature becomes and the more

humid it becomes. This means that

whatever device is put behind the

absorber vessel, you need to ensure

that the gas is safely above its water

dew point so that it doesn’t cause op-

erating problems or corrosion in the

downstream device like a baghouse,

ESP or stack,” said Giglio.

“Both the baghouse and ESP need a

gas that’s relatively dry – gas that at

least has a 20°C approach tempera-

ture to the dew point of the ue gas.

This limits how much sulphur you

Special Technology Supplement

THE ENERGY INDUSTRY TIMES - MARCH 2019

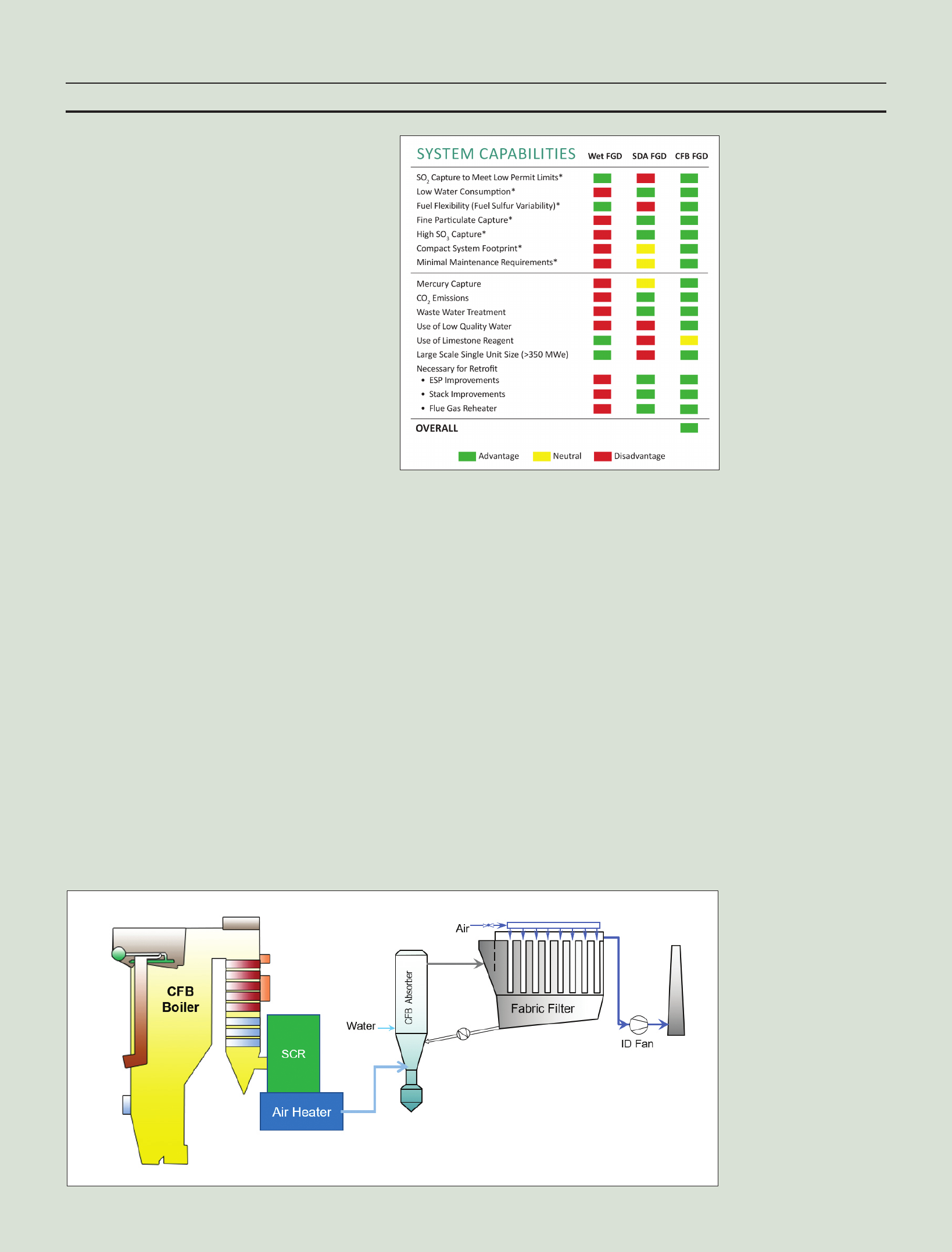

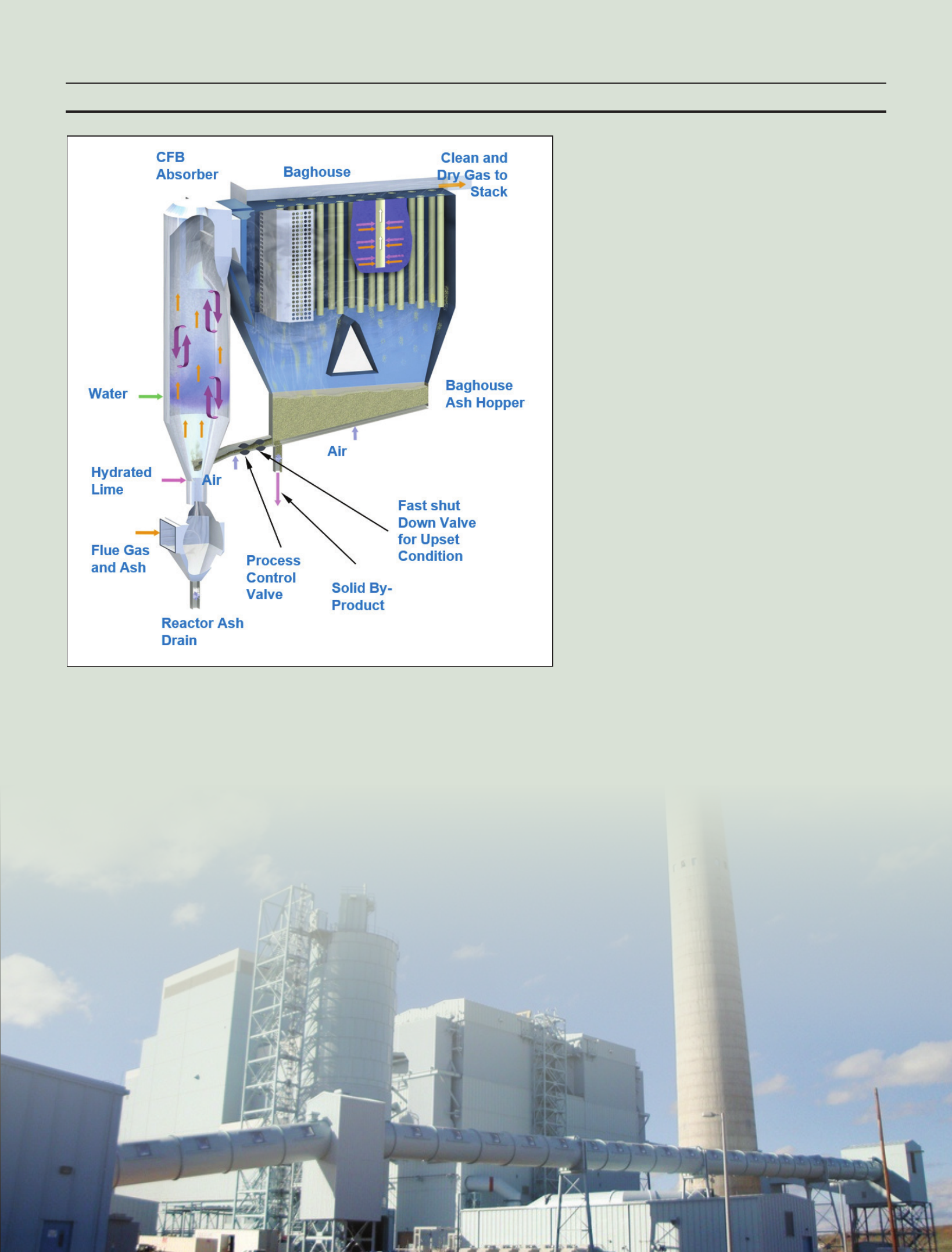

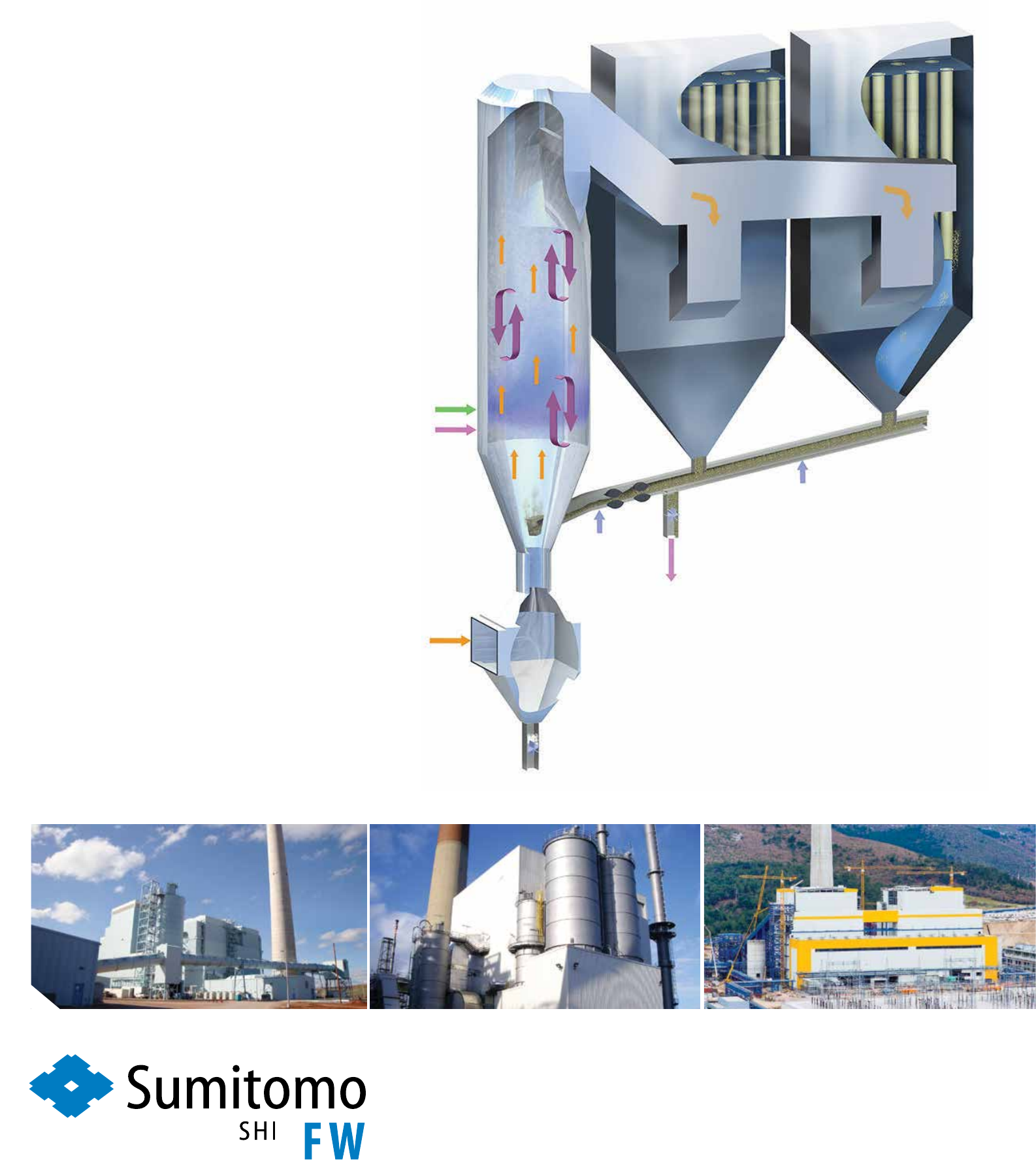

Overall ow diagram showing

a CFB boiler and cleaning

systems

Wet FGD, SDA, and CFB:

comparison of capabilities

THE ENERGY INDUSTRY TIMES - MARCH 2019

storage bins for the large portion of

the material that is fed into the solids

recycling system. This is accom-

plished by means of a control valve

for maintenance while running the

remaining compartments with 100

per cent boiler ue gas ow. The

baghouse hoppers serve as temporary

via maintenance-free air-slides back

into the absorber.

But although the technology is

proven and can in many cases be the

best choice for pollution control,

Giglio says that global deployment is

short of where it could be.

There are around 80 SFW CFB

scrubbers installed around the world,

with half of these being behind waste-

to-energy plants, mainly in Europe.

Notable recent references include

the Soma Kolin project in Turkey,

which has two 255 MW CFB boilers

ring low quality lignite. CFB scrub-

bers have been installed behind the

boilers to give future exibility on

what pollutants might need to be cap-

tured in the future. The Zabrze plant in

Poland is another example, where the

CFB scrubbers future-proof the plant

against new potential emission legis-

lation for years to come.

Giglio commented: “We have done

well in our ‘home’ markets, i.e. where

we supply CFB boilers proving that

the scrubber brings additional value

to the projects we do. These are

mainly in Europe but now we are

looking to expand into other key

markets such as India, central Asia

and southeast Asia.”

The opportunity in India is huge.

According to Krishnan, the FGD

market is roughly 120 GW in terms

of size. Almost 100 GW – nearly 50

per cent of the coal red installed

base – is made up of units greater

than 500 MW that will need an FGD

solution. “The remainder will either

have to go for a DSI type system, or

retire their plant if it is old. Those

[smaller units] that are close to popu-

lated areas will also have to put in an

FGD system,” he said. “This means

around 55-60 GW could potentially

use CFB scrubbers.”

Giglio added: “I would argue it’s

more about economics than size [of

unit]. It also very much depends on

geography, supply chains, byproduct

options, etc.”

With the 2022 deadline fast ap-

proaching, power plant operators in

India are in the midst of conducting

evaluations to avoid stiff penalties for

non-compliance. Giglio warned

however: “Although the train is mov-

ing much faster now, there are still

some lingering issues that are allow-

ing the power producers to push back.

They need clarication on things such

as: will tariff reform allow plant own-

ers to pass the compliance cost on to

ratepayers? Will the limestone supply

chain develop in time? What are my

options for gypsum and byproduct

sales or disposal? There are things

that might delay the compliance

deadline further.”

While upcoming elections could

heighten uncertainty, the clean up of

coal plant is something that is sup-

ported by all parties.

In addition to India, SFW sees

China and other high coal use coun-

tries as the main targets for CFB

scrubbers. “China is the biggest

market; they’ve already gone well

down the road in adding a lot of

systems – both wet and semi-dry

CFB scrubber types. They’ve also

done DSI-type systems for plants

needing only limited reduction of

select pollutants,” said Giglio.

“Australia is another key market,

which is largely dependent on coal for

its power generation with most plants

having no control of SO

x

or NO

x

emissions. While they have been

more focused on CO

2

, they have ig-

nored the SO

x

, NO

x

, PM issues. Once

they get through the CO

2

debate,

which seems to be coming out to a

more balanced approach where they

will allow upgrade of coal plants in

combination with renewables, I think

they will start looking at the coal they

have and seeing what they can do to

make it cleaner.

“Indonesia, Philippines and Viet-

nam are right now all in the midst of

ratcheting down emissions when they

look at new coal plants.”

He concludes: “The lower costs,

lower water consumption, multi-pol-

lutant capability, compact footprint

and exibility to handle a wide range

of coals, now combined with the big-

ger unit sizes, make a compelling case

for CFB scrubbers as a coal clean up

technology.”

Special Technology Supplement

A CFB scrubber has been operating at the

520 MW coal red Basin Electric Dry Fork

power station since 2011.

Photograph courtesy: Basin Electric Co-Op and

Wyoming Municipal Power Agency

Flow schematic of the

CFB scrubber process

u

Uses 30-40% less water than wet FGDs

u

50% lower capital cost than wet FGDs

u

Best capture of acid gases and metals

u

Excellent capture of oxides of sulfur

u

Very low operating cost and need for lime reagent

with calcium rich boiler ash (ideal for CFB boilers)

u

Low maintenance since it doesn’t

utilize lime slurry

and rotary atomizers

A flexible

multipollutant

technology

Our Circulating Fluid Bed (CFB) Scrubber

eciently captures all acid gases,

metals

and particulate matter down to the

lowest levels. It is a versatile and exible

technology that can clean up ue gases

from boilers and industrial processes

using the least amount of water and

project capital.

www.shi-fw.com

The Initiative will also ensure the

sharing of best practice policy and

regulatory developments. Carbon

Sequestration Leadership Forum

“Policy Group” activities will also be

transferred to the new Initiative,

streamlining the organisational space

for CCUS. The Initiative also intends

to assist with identifying future in-

vestment opportunities, both short-

and longer-term.

Perhaps the most pressing activity

is, however, to bring the nance sec-

tor on board to discuss how to make

CCUS projects more investable. Es-

sentially this comes down to dening

why CCUS projects are or, as in most

cases are not, bankable.

The Initiative will be well-placed

to ensure dialogue and information

exchange between governments, in-

dustry and the nance sector – all

key stakeholders to make CCUS

projects happen in the future. The

initiative intends to ensure that the

views of the nancial institutions can

be taken into account by govern-

ments as they plan policy approaches

to help CCUS deployment.

“As investment in carbon capture

has lagged far behind other clean en-

ergy technologies, a particular focus

our member governments have is on

engaging with the nancial sector.

Their views on how to make CCUS a

bankable proposition are vital for the

governments who want to create

conducive investment conditions,”

said Lipponen.

The Clean Energy Ministerial pro-

cess functions on a voluntary action

basis. Rather than signing on to

binding objectives, the participating

governments come together to show-

case clean energy activity and to or-

ganise collaboration under various

technologies.

While commercial scale CCUS

projects in power have been few in

number and expensive to date, there

are some bright spots. There have

been positive developments support-

ing plans for CCUS and new projects

from Norway, Netherlands and the

United Kingdom.

The United States passed legisla-

tion (the Future Act) that expands tax

credits for the capture of CO

2

from

power plants or industrial facilities

(up to $50/t CO

2

). This means that

for a medium-size coal-red power

plant (1-50 MWth), capturing 80 per

cent of CO

2

produced could provide

upwards of $70 million per year in

additional revenue. The tax credit

could also spur investment in CO

2

capture for natural gas processing

and rening.

With few projects visible on the

horizon, enhanced government sup-

port would be necessary to provide

opportunities to drive down costs

through learning-by-doing. The

CEM’s CCUS Initiative aims to be a

central cog in delivering that much

needed global government push.

“We don’t have the luxury to wait

anymore,” Lipponen stressed, “ac-

tion is needed now and we hope to

make a difference with the new Ini-

tiative under the Clean Energy Min-

isterial umbrella.”

C

arbon capture, utilisation and

storage (CCUS) has long been

recognised by many as one of

the suite of technologies needed to

combat climate change. Carbon diox-

ide (CO

2

) injection for enhanced oil

recovery (EOR) started in the US in

the early 1970s, and the world’s rst

dedicated CO

2

storage project, the

Sleipner project in Norway, has over

20 years of operational experience.

But despite decades of experience,

the technology has struggled to de-

ploy on a large scale. According to

the Global CCS Institute, there are a

total of only 18 large-scale CCUS

projects in operation today. In rela-

tively recent times, progress can at

best be described as mixed.

The decision in June 2017 to sus-

pend start-up activities for the

Kemper gasication system in the

United States, due to the project’s

economics, is a reminder of the chal-

lenges that rst-of-a-kind technology

faces. It is somewhat ironic that

Kemper’s problem was not carbon

capture technology per se, but lig-

nite gasication scale-up.

While there are technical difcul-

ties in operating CCUS plants exi-

bly, these are deemed to be small in

comparison with the economic con-

sequences. High-efciency CCUS

plants are costly to build and it is

questionable whether newly built

plants would be able to recover costs

if required to operate exibly.

On the positive side, however, the

Petra Nova project in the US state of

Texas – commissioned in 2017 and

delivered on time and to budget –

retrotted post-combustion capture

technology on an existing coal red

power station. The project is a vi-

tally important model for the future

if operation of today’s relatively

young global coal red eet is to be

compatible with a low-emissions

future.

Further, lessons from the two large

scale commercial retrot plants in

operation – Petra Nova and Boundary

Dam in Saskatchewan, Canada – in-

dicate that signicant cost reductions

are possible. This suggests that CCUS

could provide an important strategic

hedge for the existing coal eet in a

carbon-constrained world.

Another important step was the

world’s rst large-scale CCS project

in the iron and steel industry, which

commenced operation in Abu Dhabi

at the end of 2016.

Capitalising on the recent surge of

attention to CCUS, in May last year

the Clean Energy Ministerial (CEM)

launched the “CCUS Initiative”

aimed at accelerating the deployment

of CCUS technologies via the volun-

tary CEM process. The CCUS Initia-

tive brings together 10 countries

spearheaded by Norway, Saudi Ara-

bia, the UK and the US governments

(plus Canada, China, Mexico, Japan,

South Africa United Arab Emirates)

that are key players in CCUS, and for

whom CCUS is relevant.

“The CEM CCUS Initiative has at-

tracted critical mass to be a relevant

actor, with several of the key countries

already involved, but we remain open

to further interested governments

joining,” said Juho Lipponen, ex-IEA

CCS team-lead, now working as the

initiative coordinator. “We are also

keen to partner with industry.”

This initiative intends to strengthen

the framework for public-private

collaboration on CCUS, while com-

plementing the efforts of – and add-

ing co-ordinated value beyond – the

activities of existing organisations

and initiatives, such as the Carbon

Sequestration Leadership Forum

(CSLF), the International Energy

Agency (IEA), the IEA Greenhouse

Gas R&D Programme (IEAGHG),

Mission Innovation (MI), and the

Global CCS Institute (GCCSI).

At the launch in Denmark, Fatih

Birol, Executive Director of the IEA

said the initiative represented a “sec-

ond birth” for CCUS.

The IEA has long held the view that

CCUS is essential in meeting climate

change targets, pointing out that even

with much greater electrication,

there will be sectors that will require

other energy sources with most of

the world’s shipping, aviation and

certain industrial processes not yet

“electric-ready”.

In its ‘World Energy Outlook 2018’

published in November, the IEA

noted that nding solutions for these

sectors that remain dependent on oil

and gas requires a different approach,

including further clean technology

research and development spending

and much more attention to areas

such as CCUS.

The oil and gas industry itself is al-

ready one of the global leaders in de-

veloping and deploying CO

2

capture.

According to the IEA, of the 30 Mt

CO

2

captured today from industrial

activities in large-scale CCUS facili-

ties, nearly 70 per cent is captured

from oil and gas operations. Around 4

Mt of the CO

2

captured today is in-

jected into geological storage simply

to reduce the emissions intensity of

operations.

The oil and gas industry is active in

this area because it can often make

use of the CO

2

that is captured: either

by selling it to industrial facilities or

by injecting it into the sub-surface to

boost oil recovery. A number of oil

and gas processes produce highly

concentrated streams of CO

2

that are

relatively easy and cost-efcient to

capture.

Combining CO

2

capture facilities

with enhanced oil recovery projects is

not only a way to reduce the emis-

sions intensity of oil; it could also

help reduce the costs of future CCUS

projects.

Globally, the IEA estimates that

just over 700 Mt CO

2

indirect emis-

sions from oil and gas operations

could be avoided using CCUS. Fur-

ther, injecting CO

2

in EOR projects

could actually produce “negative

emissions” oil if the CO

2

is captured

from the atmosphere.

The technology could also have an

important role to play in the produc-

tion of hydrogen in industrial plants,

thus serving to facilitate the hydro-

gen economy.

In WEO 2018 the IEA stated: “Car-

bon capture, utilisation and storage

needs to play an important role in

meeting climate goals”. Its ndings

maintain that to reach Paris climate

targets of 2˚C by 2060, 14 per cent of

cumulative emission reductions must

derive from CCS. But at the same

time it observes that “there are very

few projects operating or planned”.

This can only be addressed through

a concerted, coordinated, global ef-

fort at the highest level. By bringing

a dedicated CCUS work stream un-

der a wider clean energy portfolio,

the participating governments of the

CCUS Initiative aim to ensure that

CCUS has a place in the holistic

clean energy debate.

A key objective of the Initiative is to

provide a sustained forum for govern-

ments to work with both industry and

the nancial community. By ensuring

a channel through which views from

industry and particularly the nan-

ciers can be directly channelled to

decision-makers, the Initiative can

accelerate the necessary decisions on

policy approaches.

THE ENERGY INDUSTRY TIMES - MARCH 2019

Energy Outlook

14

Although challenged

by economics, many

industry observers

maintain that carbon

capture utilisation

and storage (CCUS)

is essential in

meeting climate

change targets.

The Clean Energy

Ministerial’s CCUS

Initiative is hoping to

get the technology

back on track.

TEI Times reports.

A new boost for carbon

capture

Chapter 11 | Innovation and the environmental performance of oil & gas supply

499

11

The value of eliminang the emissions associated with liquefacon operaons can be

illustrated by looking at the spectrum of emissions for natural gas consumed in China

in 2040 in the New Policies Scenario (Figure 11.12). Some sources of LNG (from North

America and Australia) are already less GHG emissions-intensive than gas imports by

pipeline because of the lower levels of energy required during their extracon and the ght

controls placed on their methane emissions. However, they remain above that of domesc

producon within China. For LNG imports to be the cleanest source of gas consumed in

China, emissions from the LNG process would need to be reduced by around 70-80%.

Energy eciency improvements could provide some of this reducon, but electrifying LNG

operaons (assuming the electricity itself has a low-emissions intensity) or producing the

LNG in facilies equipped with CCUS would likely be necessary. Ensuring that methane

emissions are kept as low as possible would also be essenal.

11.4.3 Carbon capture, ulisaon and storage

The oil and gas industry is already one of the global leaders in developing and deploying

CO

2

capture. Of the 30 Mt CO

2

captured today from industrial acvies in large-scale CCUS

facilies, nearly 70% is captured from oil and gas operaons (Figure 11.13). Around 4 Mt of

the CO

2

captured today is injected into geological storage simply to reduce the emissions

intensity of operaons. However, the oil and gas industry is also acve in this area because

it can oen make use of the CO

2

that is captured: either by selling it to industrial facilies

or by injecng it into the subsurface to boost oil recovery (see secon 11.4.4). A number of

oil and gas processes produce highly concentrated streams of CO

2

that are relavely easy

and cost-ecient to capture.

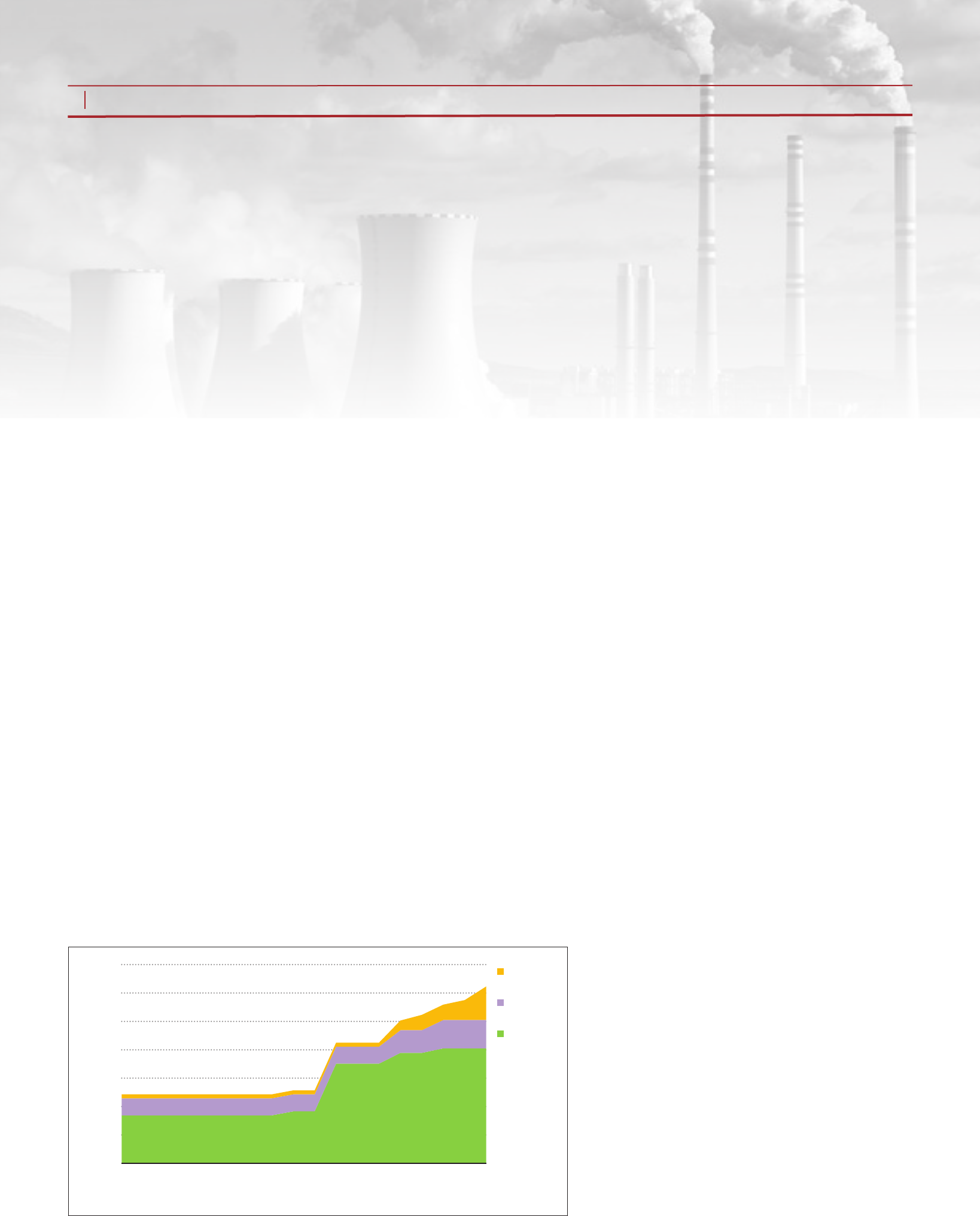

Figure 11.13

⊳ Historical volumes of CO

2

captured globally

5

10

15

20

25

30

35

2000 2005 2010 2015 2017

Mt CO

2

/year

Other

Refining

Natural gas

processing

Nearly 70% of the 30 Mt CO

2

emissions captured today is from oil and gas operations

© OECD/IEA, 2018

Historical volumes of CO

2

captured globally. Nearly 70

per cent of the 30 Mt CO

2

emissions captured today is

from oil and gas operations.

© IEA/OECD. Source: World

Energy Outlook 2018

THE ENERGY INDUSTRY TIMES - MARCH 2019

16

Final Word

W

ith the introduction last year

of its ‘Evolving Transition’

(ET) as the reference sce-

nario in its annual ‘Energy Outlook’,

to all intents and purposes BP, the oil

and gas major, ofcially acknowl-

edged that the energy transition is here

to stay. The ET scenario assumes that

government policies, technology and

social preferences continue to evolve

“in a manner and speed seen over the

recent past”.

This year BP continued in a similar

vein, highlighting the changing energy

landscape while stressing that meeting

growing energy demand and at the

same time reducing carbon emissions

presented “one of the biggest chal-

lenges of our time”.

Launching the Outlook, Bob Dudley,

BP’s Chief Executive, said: “The

Outlook again brings into sharp focus

just how fast the world’s energy sys-

tems are changing, and how the dual

challenge of more energy with fewer

emissions is framing the future. Meet-

ing this challenge will undoubtedly

require many forms of energy to play

a role.”

“The world of energy is changing,”

agreed Spencer Dale, BP Group Chief

Economist. “Renewables and natural

gas together account for the great

majority of the growth in primary

energy. In our evolving transition

scenario, 85 per cent of new energy is

lower carbon.”

According to the Energy Outlook,

renewables are set to penetrate the

global energy system more quickly

than any fuel previously in history.

“Historically, it has taken many de-

cades for new fuels to penetrate the

energy system,” it stated. “For ex-

ample, it took almost 45 years for the

share of oil to increase from 1 per cent

of world energy to 10 per cent in late

1800s/early 1900s. For natural gas, it

took over 50 years from the beginning

of the 20th century.”

In the ET scenario, the share of re-

newables in world energy increases

from 1 per cent to 10 per cent in only

25 years.

BP points out that during the outlook

period, the mix of fuels in global

power generation shifts materially,

with renewables gaining share at the

expense of coal, nuclear and hydro.

The share of natural gas is broadly at

at around 20 per cent.

As the fastest growing energy source

(7.6 per cent p.a.), renewables account

for around two-thirds of the increase

in global power generation during the

period, and become the single largest

source of global power generation by

2040.

Both wind and solar power grow

rapidly – increasing by a factor of 5

and 10 respectively – accounting for

broadly similar increments to global

power. This rapid growth is aided by

continuing pronounced falls in the

costs of wind and solar power as they

move down their learning curves.

In terms of regional deployment, the

EU continues to lead the way in terms

of the penetration of renewables, with

the share of renewables in the EU

power market increasing to over 50

per cent by 2040.

The growth in renewable energy is

dominated by the developing world,

with China, India and ‘Other Asia’

accounting for almost half of the

growth in global renewable power

generation.

The airtime given to clean energy in

the Outlook is a far cry from 2015

when the focus was largely on oil and

gas, with little mention of renewables.

Since 2016, however, with the public

spotlight on climate change, BP has

been slowly acknowledging the im-

portance of low carbon energy

sources such as wind and solar.

BP says the ‘Energy Outlook’ is

“produced to aid its analysis and deci-

sion-making, and is published as a

contribution to the wider debate”.

Some, however, appear to believe it is

perhaps designed to colour the de-

bate. Certainly it is debatable whether

BP’s apparent shifting in stance is due

to a true recognition of, and subsequent

alignment with, where the sector is

heading, or whether it is down to

pressure from external voices.

The company recently announced it

is supporting the aim of the Paris

Agreement, with its call to rapidly

reduce greenhouse gas emissions in

the context of sustainable develop-

ment and eradicating poverty, since it

was agreed in 2015.

At the start of February BP said that

it would support a call from a group

of institutional investors for the

company to broaden its corporate

reporting to describe how its strategy

is consistent with the goals of the

Paris Agreement.

Investor participants of the Climate

Action 100+ initiative have proposed

a resolution to be put to shareholders

at the company’s annual general

meeting in May 2019 – a resolution

that the BP Board says it will support.

In line with the proposed resolution

BP will describe how its strategy is

consistent with the Paris goals, as well

as set out a range of additional related

reporting.

But not all are convinced of BP’s true

commitment to a clean energy future.

In response to the group’s claim that

its business plan is aligned with the

Paris climate targets, Charlie Kronick,

Oil Campaigner for Greenpeace UK,

said: “Whether deluded or disingenu-

ous, BP’s management clearly isn’t up

to the task of navigating the transition

to a low carbon economy. BP claiming

its business plan is in line with the

Paris targets, while still planning to

drill for new oil the world can’t afford

to burn in an area of huge ecological

signicance like the Mouth of the

Amazon, is simply ridiculous. If cli-

mate change wasn’t actually a matter

of life and death, this claim would be

comical.”

In its Outlook BP maintains that

“signicant levels of investment” are

required for there to be sufcient

supplies of oil to meet demand in 2040.

Climate change is certainly no joke

but when considering the tone of the

Outlook and the company’s state-

ments, such accusations by environ-

mental campaigners seem somewhat

harsh at rst glance.

BP may or may not be wholeheart-

edly invested in the dream of a carbon-

free energy future, if indeed such a

thing is even possible. As it points out,

its challenge is to “understand, adapt

and ultimately thrive in this changing

energy landscape”.

Interestingly, however, in every

Outlook BP foresees continued

growth in energy demand and there-

fore is always able to justify ever

greater demand for fossil fuels.

Highlighting the power sector,

which accounts for the lion’s share of

energy demand, it states: “The strong

growth of power demand in develop-

ing economies means there is greater

scope for renewables to increase. But

in the ET scenario, renewables do not

grow sufciently quickly to meet all

of the additional power demand, and

as a result coal consumption also

increases.”

It also says natural gas grows

strongly, supported by broad-based

demand, plentiful low-cost supplies,

and the increasing availability of gas

globally, aided by the growing sup-

plies of liqueed natural gas (LNG).

In the ET scenario, natural gas grows

at an average rate of 1.7 per cent p.a.

– increasing nearly 50 per cent by

2040 – led by industry and the power

sector. The additional gas absorbed by

the power sector is driven by the

overall growth in power demand, with

the share of natural gas in the sector

remaining relatively stable at around

20 per cent.

But how sound is BP’s assumption

of ever-increasing demand? A recent

report by McKinsey Energy Insights

predicts energy demand will plateau

by 2035, despite strong GDP and

population growth.

It will be interesting to see if BP’s

Outlook next year, or any subsequent

year, ever shows a decoupling of

economic growth and energy demand.

If not, I suspect the Outlooks might

continue to gradually become greener

but will always retain a browner hue

than some might be happy with.

ET is green… with a bit

of brown

Junior Isles

Cartoon: jemsoar.com