www.teitimes.com

February 2019 • Volume 11 • No 12 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Atomic Brexit A smarter world

With Brexit fast approaching, there

appears to be only one viable option

to keep nuclear commerce open

with the EU. Page 13

Distribution Network Operators prepare

for an energy market that is much

more distributed.

Page 14

News In Brief

USA continues clean energy

shift but carbon emissions

rise in 2018

The USA has seen carbon emissions

rise after three years of decline

despite coal plants being shut down.

Page 2

Huawei panels pose cyber

threat, warns Congress

Members of the US Congress

have warned that the use of solar

equipment manufactured by Chinese

group Huawei poses a threat to the

country’s cybersecurity.

Page 4

China goes big on storage

China is planning to build massive

amounts of pumped hydro storage

and battery capacity as its clean

energy transition continues.

Page 6

Germany sets coal phase-out

Germany’s government has reached

an agreement on when the country

will end its reliance on lignite and

hard coal red power generation.

Page 7

Uzbek nuclear plans take

shape

Construction of Uzbekistan’s rst

nuclear power plant could start by

2022.

Page 8

Shell partnership eyes

Eneco bid

Energy major Shell is considering

an investment in Dutch sustainable

energy group Eneco as part of its

wider plans to boost its role in new

and renewable energy.

Page 9

Fuel Watch: East

Mediterranean to create

Region Gas Forum

East Mediterranean energy ministers

met last month to kick-start plans for

a gas and energy hub in the region.

Page 12

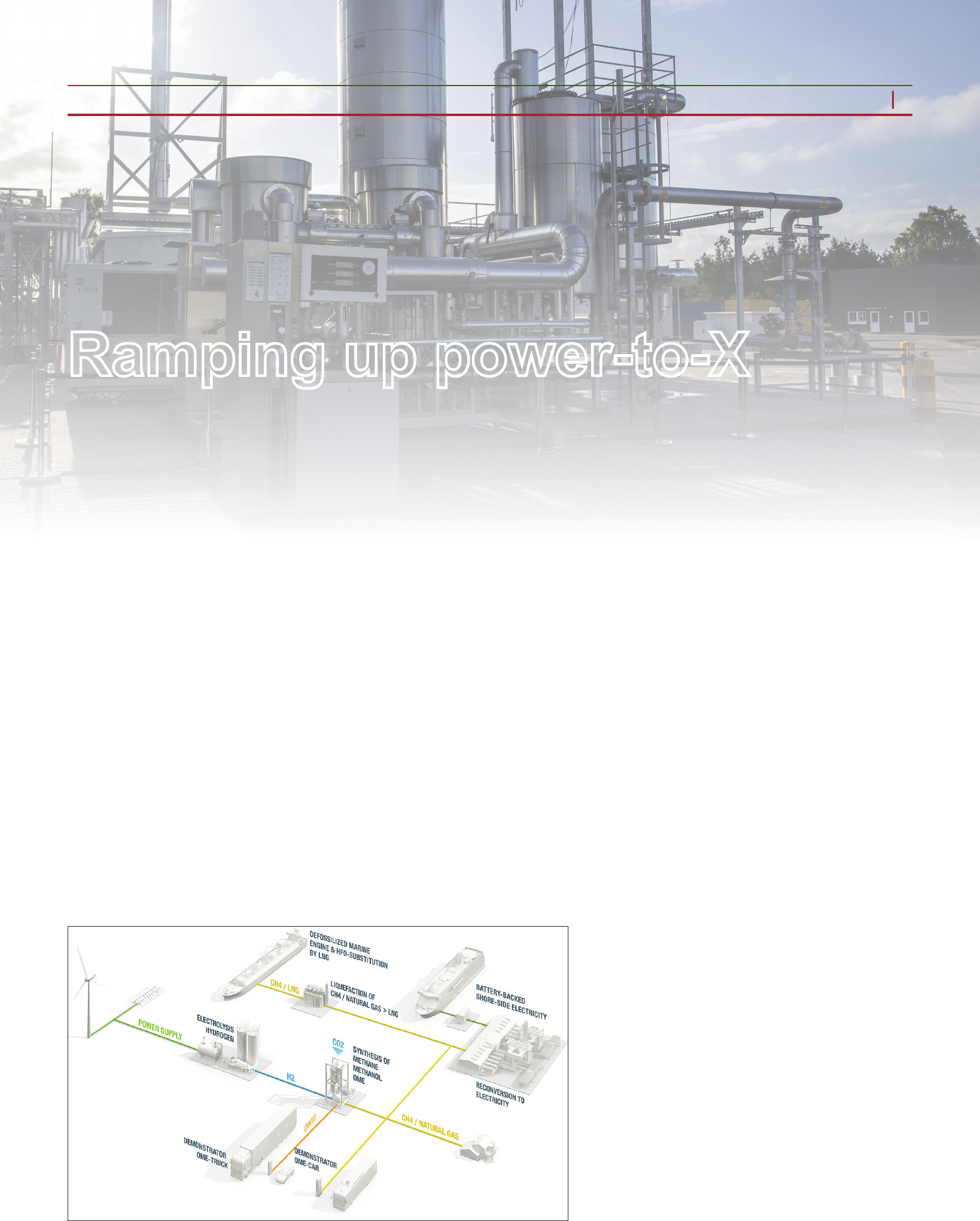

Technology: Ramping up

power-to-X

A 50 MW system is being developed

that will allow electricity from wind

and solar to be used to produce

synthetic gas that could serve as a

form of energy storage and also be

used to decarbonise the industry and

transport sectors.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

The UK’s plan to build a new eet of nuclear power plants is under severe threat following the

suspension of another of its proposed projects. Junior Isles

Tighter rules needed as energy supplier collapses continue

THE ENERGY INDUSTRY

TIMES

Final Word

Does Wylfa demonstrate

a lack of will for nuclear?

Junior Isles.

Page 16

The UK’s plan to build a new eet of

nuclear power plants is in danger of

collapsing following Hitachi’ deci-

sion to pull the plug on its 2.9 GW

Wylfa project in Anglesey, Wales. The

news comes just two months after

Toshiba’s decision to scrap its plan to

build the 3.4 GW Moorside plant near

Sellaeld, Cumbria.

Hitachi formally suspended the £20

billion ($26.4 billion) project at a

board meeting in Tokyo in January in

a move that will see it write off ¥300

billion ($2.8 billion) in project related

activities.

The company said it had decided to

suspend the Horizon project from the

viewpoint of its economic rationality

as a private enterprise, noting that “it

is now clear that more time is needed

to develop a nancial structure”.

Toshiaki Higashihara, Hitachi’s

President and CEO, said: “A freeze

means we will not put in any addi-

tional investment.” He added that the

company would only renew its in-

volvement if the project was kept off

Hitachi’s balance sheet, required only

a limited capital investment from the

company and offered the prospect of

an adequate prot.

Duncan Hawthorne, CEO of Hori-

zon Nuclear Power, the company set

up by Hitachi to develop the project

said: “I am very sorry to say that de-

spite the best efforts of everyone

involved we’ve not been able to

reach an agreement to the satisfaction

of all concerned.

“As a result we will be suspending

the development of the Wylfa

Newydd project, as well as work re-

lated to Oldbury, until a solution can

be found. In the meantime we will

take steps to reduce our presence but

keep the option to resume develop-

ment in future.”

The collapse of the power stations

and the Moorside project that Toshi-

ba scrapped in November means the

government could have a huge hole

to ll in the late 2020s and early

2030s. Together the three power sta-

tions would have supplied 15 per

cent of electricity demand.

The British government and nan-

cial institutions agreed to provide

¥2 trillion ($18.3 billion) to support

the project, which was the initial es-

timated cost. But with escalating

forecast on the nal cost Hitachi has

failed to nd investors to nance the

balance. The government revealed it

had also been willing to offer Con-

tract for Difference terms with a

strike price of up to £75/MWh.

Greg Clark, the Secretary of State

for Business Energy and Industrial

Strategy addressed the Commons

concerning the UK’s nuclear future

following the announcement. He said:

Continued on Page 2

There have been calls for energy regu-

lator Ofgem to introduce tighter regu-

lation as the number of collapses of

UK energy suppliers reached 10 in the

last 12 months. At the end of January

Our Power became the latest to fold,

two just weeks after Economy Energy

ceased trading.

Industry experts say four major is-

sues must be addressed relating to

new entrants: a lack of checks on en-

try, unfair cost exemptions, loss-lead-

ing tariffs, and the lack of conse-

quences for failure.

Jane Lucy, Founder of Labrador, a

company that enables automated

supplier switching, said: “The fact

that eight energy providers ceased

trading in 2018 and another two have

closed only 25 days into 2019, indi-

cates that Ofgem does not have the

correct due diligence in place to en-

sure that energy providers are prop-

erly regulated… Energy suppliers

should have to validate the nancial

health of their business, given that

there are wider issues surrounding

the obtaining of licences in general.

It is only through proper regulation

that the industry can prevent further

closures.”

Professor David Elmes, leader of

the Warwick Business School Global

Energy Research Network, said,

however, that asking the regulator

Ofgem to look again on the checks it

does on companies is not the only

solution needed.

“The government needs to think

again about the policies it makes that

Ofgem has to implement,” he said.

“Last year we saw eight energy com-

panies collapse and the merger be-

tween SSE and nPower fall apart. The

collapse of Economy Energy shows

2019 is going to be no easier for the

energy sector.”

Members of the ‘Big Six’ suppliers

also called for intervention. “We’ve

got to a point where the industry, the

regulator and the politicians need to

sit down and think about this,” said

Keith Anderson, CEO of Scottish-

Power. “I think they need to look at

the mess that currently exists and how

it can be dealt with and cleaned up.”

Lucy warned, however, that the cur-

rent turmoil, which has largely been

the result of too many suppliers enter-

ing the market too quickly, should not

be seen as a reason for consumers to

favour the Big Six.

“It is also important to stress that the

closure of the aforementioned energy

suppliers does not mean that you need

to submit to poor customer service

and extortionate prices from the big

six energy suppliers,” she said.

Wylfa suspension

jeopardises UK

nuclear plans

Hitachi’s Higashihara says a “freeze”

means the company will not put in any

additional investment

THE ENERGY INDUSTRY TIMES - FEBRUARY 2019

3

TRUTH

AND

DARE

– THE CLIMATE IS WARMING AND

ACTIONS ARE NEEDED NOW.

The most signiicant reason for climate

change is the greenhouse gases produced by

the use of fossil fuels. Nuclear power is one

of the best ways to solve the problem. It is

an e icient way to produce large amounts of

energy, reliably and with no emissions.

Stopping climate change is the most

important issue in the world. Be part of the

solution: fennovoima.com/recruitment

Fenno_rekry_249x160_ENG.indd 1 21/12/2018 9.39

EUBCE 2019

27

th

European Biomass

Conference & Exhibition

27 - 30 MAY 2019 | LISBON - PORTUGAL

The largest gathering

of biomass experts

REGISTER NOW!

Early bird deadline 22nd March 2019

www.eubce.com

#EUBCE

THE ENERGY INDUSTRY TIMES - FEBRUARY 2019

5

subscribe today

The Energy Industry Times is the only publication that

covers global news related to the power and energy

sector in a newspaper style and format whose

uniqueness is recognised by our readers.

As a paid subsciber you will gain full access to our

online news desk.

You will also no longer have to wait for the

printed edition; receive it by PDF “hot off the press” or

download it online.

To subscribe, email subscriptions@teitimes.com or visit

www.teitimes.com

To guarantee receiving your monthly copy of the award

winning newspaper, you need to subscribe today

www.teitimes.com

THE ENERGY INDUSTRY

TIMES

SOUTH KOREA

RENEWABLE ENERGY

SUMMIT 2019

Grand Ambassador Seoul Associated With Pullman

Seoul | South Korea

17 - 18 April, 2019

Tuesday 19 February: 09:00 – 17:30

Wednesday 20 February: 09: - 17:00

The Nile Ritz-Carlton Cairo, Egypt

60+

FREE SEMINARS

50+

EXHIBITORS

90+

SPEAKERS

REGISTER NOW FOR YOUR FREE EXPO PASS

AT WWW.TERRAPINN.COM/SOLAREXPO

Joins us at

the Solar and wind Show

GET YOUR

FREE EXPO

PASS NOW

China’s State Grid Corporation of

China (SGCC) will build 6 GW of

pumped hydro storage as part of ongo-

ing efforts to cut rates of wind and

solar power curtailment.

Wasted electricity from solar projects

in the country’s northwest has often

been in double-gure percentages,

with national rates of PV curtailment

peaking at 11 per cent in 2015, accord-

ing to ofcial gures. These have been

falling with the 2017 gure at just 6

per cent. The equivalent gure for wind

power is 12 per cent.

The ve pumped storage projects an-

nounced by the SGCC will be in op-

eration by 2026 and require an invest-

ment of RMB38.7 billion ($5.67

billion). China is targeting 40 GW of

pumped hydro storage by 2020.

The country has also embarked on a

national Mission for Energy Storage,

which includes plans to build ow bat-

tery projects, some of which will be

several hundred megawatts in size.

China is also pushing along its elec-

tric vehicle (EV) programme, which

could also help renewables integration.

In a move that gives a signicant boost

to EVs, in late December SGCC and

China Southern Power Grid entered a

partnership with two private rms to

create a RMB 500 million ($74 mil-

lion) joint venture (JV) specialising in

providing charging facilities for EVs.

The new company, Xiongan Lianx-

ing Network Technology Co. will be

the country’s largest electric vehicle

charging operator and control about 80

per cent of the country’s 730 000 charg-

ing piles. The company aims to de-

velop more charging stations across the

country to cater for the fast growing

number of EVs.

According to a recent report by

BloombergNEF, in 2018 China was

again the clear leader in clean energy

investment “playing a major role in the

dynamics of the energy transition,

helping to drive down solar costs, grow

the offshore wind and EV markets”.

Offshore wind attracted $25.7 billion

of clean energy investment last year, a

14 per cent increase compared to 2017.

This trend looks set to continue in 2019.

In mid-January, the Jiangsu Province

in China approved 24 offshore wind

projects with a total capacity of 6.7 GW.

The announcement is part of the prov-

ince’s 10 GW offshore wind plan

known as Three Gorges on Sea. The

approved offshore wind farms are ex-

pected to be completed by the end of

2020.

n China has approved construction of

a dam on the upstream section of its

longest river, the Yangtze. The dam is

part of a hydropower project envisaged

to eventually consist of four turbines

with a total capacity of 2000 MW.

The operator of Australia’s electricity

grid has raised the prospect of house-

hold rooftop solar panels being retro-

tted to ensure they meet compliance

standards after some units failed to

adequately respond to a major inter-

connector outage last year, which

isolated two states from the power

system.

A range of supply sources including

solar, wind and coal generators either

tripped or were unable to assist in

boosting supply to Queensland and

South Australia when a lightning

strike caused the Queensland and

South Australia interconnectors to

trip simultaneously last summer.

An ofcial investigation subsequent-

ly found thousands of rooftop solar

units did not comply with Australian

standards.

The Australian Energy Market Op-

erator detailed how 15 per cent of

sampled solar systems installed before

October 2016 dropped out during the

emergency event. Of those installed

after that date, nearly a third in South

Australia and 15 per cent in Queens-

land failed to meet the Australian stan-

dard for reducing excess frequency.

Changes to compliance and accredi-

tation processes may be needed, ac-

cording to AEMO, as it investigates

why the solar inverters, which convert

electricity from rooftop panels into

power that can be fed to the grid, failed

to respond as expected.

The market operator aims to com-

plete an assessment of the technical

requirements of solar inverters by

June and improve their performance

standards by the end of 2019. It also

hopes to obtain better data and de-

velop simulation models and analysis

by the end of 2020 to predict the re-

sponse of solar rooftop to “system

disturbances” like last year’s major

outage.

The reliability of rooftop solar is

becoming increasingly important as

Australia moves away from fossil

red generation. At the beginning of

January, some states reported a sharp

drop in brown coal generation as solar

and wind output surged.

According to data compiled by Dylan

McConnell, a researcher at the Univer-

sity of Melbourne’s College of Climate

and Energy, brown coal generation in

Victoria was 8227 GWh in the Decem-

ber quarter, down from 8500 GWh in

the December 2017 quarter and well

below the 11 000 GWh in the Decem-

ber 2016 quarter, the last full quarter

before Hazelwood’s closure in late

March 2017.

Gas generation also plummeted to

just 3183 GWh in the December quar-

ter from 5692 GWh in the December

2017 quarter.

The big winners were rooftop solar,

which surged by more than a quarter

to 2690 GWh from a year earlier,

utility-scale solar, which increased

vefold to 917 GWh as more large

solar farms came online, and wind, up

a fth to 3426 GWh. Hydro generation

also grew 17 per cent to 3400 GWh.

6

THE ENERGY INDUSTRY TIMES - FEBRUARY 2019

Asia News

Australia reviews rooftop

solar compliance

China goes big on storage to

accommodate burgeoning

renewables

China is planning to build massive amounts of pumped hydro storage and battery capacity as its clean energy

transition continues. Syed Ali

The Department of Atomic Energy

(DAE) has informed Parliament that

21 new nuclear power reactors with a

total installed capacity of 15 700 MW

are expected to be set up in the coun-

try by 2031. It also said that ve des-

ignated sites, which would have a

total of 28 nuclear reactors, have been

given ‘in principle’ approval by the

central government.

In a written statement Jitendra Singh,

Minister of State for Personnel, Public

Grievances and Pensions and Prime

Minister’s ofce (PMO), said that “at

present, there are nine nuclear power

reactors at various stages of construc-

tion” that are targeted for completion

by 2024-25.

“In addition, 12 more nuclear pow-

er reactors have been accorded admin-

istrative approval and nancial sanc-

tion by the government in June 2017,”

he added.

The update followed news that In-

dian and French experts will soon

begin discussions to determine the

cost of the proposed nuclear power

plant in Jaitapur in the western state

of Maharashtra.

The discussions to build the 9900

MW Jaitapur Nuclear Power Plant

(JNPP) have now been made possible

by a techno-commercial proposal that

French nuclear power company EDF

recently submitted to India. A techno-

commercial offer is signicant in that

it sets off the negotiations process as it

helps the parties determine the project

cost and the energy tariff.

The proposal is now before the Nu-

clear Power Corporation of India

(NPCIL), the Department of Atomic

Energy’s arm that operates public sec-

tor atomic power plants.

India’s nuclear

programme

makes progress

The private sector will play a bigger

role in the addition of new generating

capacity in Thailand’s revised Power

Development Plan (PDP).

The new version drawn up by the

National Energy Policy Council

(NEPC) for 2018-37, is expected to

take effect from the second quarter. The

plan can be revised every ve years as

changes and technological trends oc-

cur in the power sector.

The new PDP seeks to add 56 431

MW of new power capacity during the

plan period, 20 766 MW of which will

come from renewable power projects.

Power plants with a total capacity of

25 310 MW will be retired during the

period, so total power capacity by 2037

will stand at 77 211 MW, up from 46

090 MW in 2017.

In 2037, 53 per cent of the country’s

power production will be generated by

natural gas, 35 per cent from non-

fossil fuels and 12 per cent from coal.

“We are very keen on renewable en-

ergy projects and energy conservation

plans, while power imported from

neighbouring countries is generated

from hydropower,” said Energy Min-

ister Siri Jirapongphan.

Notably, in the new PDP power pro-

duction from state utility Electricity

Generating Authority of Thailand

(Egat) will be lower. Egat will now take

more responsibility for system secu-

rity from the grid connection. Energy

Minister Siri Jirapongphan said: “It

will not only receive fees from trans-

mission lines but play a role in joining

in with investments. Egat is expected

to nish its planning late this year.”

After the new PDP is enacted, four

other plans will soon be drawn up and

implemented: oil management, natural

gas supply, alternative energy develop-

ment, and energy savings and efciency.

Just prior to unveiling the new PDP

the Energy Ministry announced plans

to open bidding for independent pow-

er producers (IPPs) for a combined

capacity of 8300 MW this year.

Permanent Energy Secretary Kulit

Sombatsiri said new IPPs would be

developed at large sites that will be

fuelled by gas, coal and diesel. “All

details for interested companies will be

disclosed sometime this year,” he said.

n The Energy Ministry will allow solar

panel owners to sell surplus electricity

in communities from 2021, in line with

the new national energy reform plan.

Under the law, solar panel owners can-

not sell power directly to others, but

can sell it to the state grid under power

purchase agreements.

Bigger role for private sector in revised

power plan

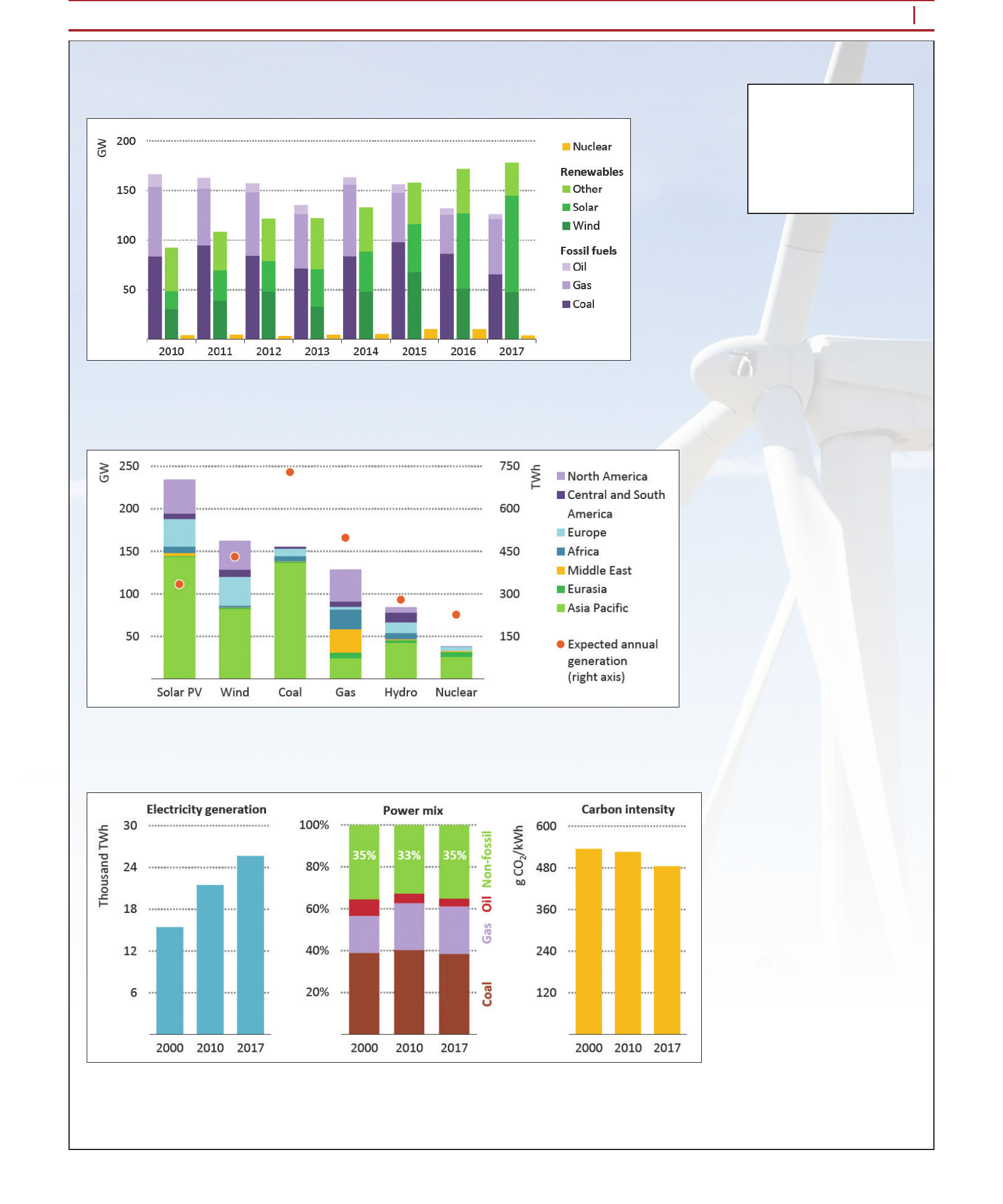

Source: World Energy Outlook 2018

THE ENERGY INDUSTRY TIMES - FEBRUARY 2019

11

Energy Industry Data

For more information, please contact:

International Energy Agency

9, rue de la Fédération

75739 Paris Cedex 15

France.

Email: bookshop@iea.org

website: www.iea.org

Annual power generation capacity additions, 2010-2017

Power plants under construction or expected to 2020 and expected annual

generation in 2020 by source

Electricity generation, power mix and carbon intensity, 2000, 2010 and 2017

World Energy Outlook 2018, © IEA/OECD, Figure 7.11, page 293

World Energy Outlook 2018, © IEA/OECD, Figure 7.13, page 295

World Energy Outlook 2018, © IEA/OECD, Figure 7.12, page 294

THE ENERGY INDUSTRY TIMES - FEBRUARY 2019

13

Industry Perspective

B

rexit – and all the ongoing

parliamentary wrangling – is

seldom out of the headlines.

But amidst all the speculation that

businesses may be: considering relo-

cating to the mainland; the UK may

soon be able to strike new trade

deals with the growth economies;

and potential agreements on regula-

tory standards, the potential impact

of the UK’s withdrawal from the Eu-

ropean Atomic Energy Community,

commonly known as ‘Euratom’, is

often overlooked.

However, this is a dangerous lapse

to ignore. It is, quite literally, a nu-

clear issue, with an effect likely to be

far reaching and profound.

After all, the UK’s membership in

Euratom provides the framework for

bilateral cooperation in nuclear trade

between and among the United

Kingdom and the other 27 EU states

that are party to the treaty, including

major equipment and material sup-

pliers such as France, for example.

Additionally, through bilateral nu-

clear cooperation agreements be-

tween the European Atomic Energy

Community and other states, the

UK’s participation in the Communi-

ty provides the basis for nuclear

power cooperation with Australia,

Argentina, Canada, Japan, Kazakh-

stan, South Africa, Ukraine, the

United States, and Uzbekistan. Once

the UK exits Euratom on March 29,

2019, the nuclear cooperation agree-

ments that the UK has through Eura-

tom shall no longer be in effect and

shall cease to function.

The UK’s post-Brexit nuclear

strategy has been to put in place by

the end of March 2019 all the inter-

national agreements it requires to

ensure uninterrupted cooperation

and trade in the civil nuclear sector,

and to negotiate an orderly with-

drawal from Euratom. This entails

negotiating a new nuclear coopera-

tion agreement with Euratom, as

well as simultaneously negotiating

individual agreements with the

UK’s major nuclear trade partners.

Exit from Euratom also requires

setting up a domestic nuclear safe-

guards programme to take over

once the Euratom safeguards ar-

rangements are no longer in effect.

Once the UK leaves Euratom, the

UK will have the responsibility of

ensuring that all ores, source materi-

als and special ssile materials cov-

ered by the Euratom Treaty and pres-

ent in the UK post-Brexit are

handled in accordance with applica-

ble international treaties and conven-

tions on nuclear safety, safeguards,

non-proliferation and physical pro-

tection of nuclear materials, and in-

ternational treaties and conventions

on the safety of spent fuel manage-

ment and the safety of radioactive

waste management.

The good news is that the UK gov-

ernment has reported remarkable

progress in setting up a domestic

safeguards regime to replace the

Euratom safeguards regime and has

also made remarkable progress in

putting new nuclear trade agree-

ments in place.

The UK is well along the way to-

wards implementing a domestic

safeguards system with the equiva-

lent effectiveness and coverage as

that previously provided under

Euratom.

The new State System of Account-

ing for and Control of Nuclear Mate-

rial (SSAC) will be administered by

the Ofce of Nuclear Regulation

(ONR) and will ensure that the UK

continues to meet its international

non-proliferation commitments in

the post-Brexit world. The ONR is

developing a regulatory framework

to implement the SSAC, including a

new information system capable of

processing nuclear material accoun-

tancy reports. The ONR will also

need to hire and train safeguards in-

spectors, nuclear material accoun-

tants, and safeguards ofcers to ad-

minister these new systems and to

ensure compliance with the SSAC.

In addition to developing the new

domestic safeguards regime, the UK

has also made astounding progress

in putting new nuclear cooperation

agreements in place with major sup-

plier countries.

In hindsight, there was little to be

optimistic about regarding a “soft

landing” for the UK nuclear industry

after Brexit. Getting all the neces-

sary third-party cooperation agree-

ments in place, especially consider-

ing the resources necessary to

negotiate the terms and conditions of

the larger Brexit from the European

Union, was an extraordinarily ambi-

tious undertaking, and one that was

received with a dose of healthy scep-

ticism from many observers.

Past implementation of treaties

with Euratom and third parties have

proceeded at a glacial pace and, giv-

en the hostility that the EU has

shown to the UK at times during the

Brexit process, there were few signs

of hope. Not helping matters, Barack

Obama, the former President of the

United States, starkly warned that

the UK would be at the “back of the

queue” in any trade deal with the

United States if the country chose to

leave the EU.

Despite generally low expecta-

tions for success, the UK govern-

ment has made good progress on

reaching new nuclear cooperation

agreements with many of its non-

EU trading partners. A new agree-

ment between the UK and the Unit-

ed States was signed on May 4,

2018, and received US Congressio-

nal approval in August 2018, and

that agreement is now before Parlia-

ment for nal approval.

Likewise, new nuclear cooperation

agreements have been agreed with

Australia and Canada, which are

both major suppliers of nuclear ma-

terials to the UK. Negotiations to up-

date the existing nuclear cooperation

agreement with Japan also appear to

be on-track. Meanwhile, nuclear co-

operation agreements with China

and Russia continue to remain in ef-

fect, and the UK continues to discuss

arrangements for ongoing coopera-

tion with countries where nuclear

agreements are not a requirement but

are nonetheless currently in place

through Euratom, such as Kazakh-

stan and Uzbekistan, which are both

major global suppliers of uranium.

However, an orderly exit from Eur-

atom requires more than developing

a domestic nuclear safeguards re-

gime and putting a handful of nucle-

ar cooperation agreements in place,

as these don’t address the “unwind-

ing” of the UK from Euratom. Nor

do any of the nuclear cooperation

agreements that have been put in

place provide for nuclear trade be-

tween the UK and the EU. Nuclear

commerce with key European trad-

ing partners, France most notably,

will be interrupted unless and until a

new treaty between the UK and Eur-

atom is put in place. The UK negoti-

ated a comprehensive Agreement on

the withdrawal of the United King-

dom of Great Britain and Northern

Ireland from the European Union

and the European Atomic Energy

Community (“Withdrawal Agree-

ment”), but that agreement was

soundly defeated by Parliament in

the 15 January 2019 “meaningful

vote” on Brexit.

While there are many criticisms to

be made of the Withdrawal Agree-

ment, one thing it did do very well

was orchestrate a deliberate and me-

thodical exit for the UK from Eura-

tom, while maintaining security and

safeguards standards at their current

levels. To be clear, both the EU and

the UK appear to agree on virtually

every aspect of the UK’s withdrawal

from Euratom, down to the last de-

tail. So, what is the problem?

Exasperatingly, even though the

details of an orderly exit from Eura-

tom have been worked out, the cur-

rent Euratom exit deal is being held

hostage to the overall Brexit “deal”.

Unfortunately, with each passing

day, hope of securing any kind of

deal – even a bad one – seems in-

creasingly unlikely.

With the Brexit deadline fast ap-

proaching, there appears to be only

one viable option to keep nuclear

commerce open with the EU: split

exit from Euratom from the larger

Brexit agenda. This would require

the UK to forgo its current “all or

nothing” approach and introduce

legislation to carve out the Euratom

deal for separate approval by Parlia-

ment. Separating exit from the Euro-

pean Union from exit from the Euro-

pean Atomic Energy Community

would ensure that the nation’s nucle-

ar commerce continues to operate

during an orderly transition from

Euratom, and while this may not be

a headline-grabbing title akin to the

Irish backstop or customs union, it

would allow a largely unseen, but vi-

tal, UK sector to continue functioning.

Ensuring a safe and orderly exit

from Euratom is necessary to protect

nuclear energy generation both in the

UK and EU, but nalising an agree-

ment has been overshadowed by the

larger Brexit debate. With agree-

ments in place, or largely negotiated,

with the almost all UK nuclear trad-

ing partners, the lack of a Euratom

agreement is notable. Solving this is-

sue would help prevent a costly di-

lemma in the long run but, perhaps

of more interest to the government, it

would also demonstrate that the gov-

ernment is capable of solving prob-

lems, even if just one at a time.

Vince Zabielski is a former nuclear

engineer and now partner at the

international law rm Pillsbury.

The potential impact of the UK’s withdrawal from the European Atomic Energy Community

could have massive impacts. But with the March 29th deadline for Brexit fast approaching,

there appears to be only one viable option to keep nuclear commerce open with the EU.

Vince Zabielski explains.

Euratom: now what?

Zabielski: the current Euratom

exit deal is being held hostage

to the overall Brexit “deal”

THE ENERGY INDUSTRY TIMES - FEBRUARY 2019

15

Technology

MAN Energy

Solutions is

developing a 50 MW

system that will allow

electricity from wind

and solar to be used

to produce synthetic

gas that could not

only serve as a form

of energy storage but

could also be used

to decarbonise the

industry and transport

sectors. Junior Isles

T

he falling price of electricity

from wind and solar is pre-

senting all manner of possibil-

ities for decarbonising the global

economy. In addition to directly

eliminating carbon dioxide emis-

sions by avoiding the burning of fos-

sil fuels, wind and solar can also be

used in ‘power-to-X’ (P2X) systems.

This is the possibility of converting

renewable energy, for example, into

methane gas (power-to-gas) or liquid

methanol (power-to-liquid). The re-

sulting carbon-neutral synthetic gas

can easily be transported through ex-

isting gas pipelines and used in gas-

powered engines.

It is a technology that MAN Ener-

gy Solutions believes has great po-

tential, and one that complements

its traditional engine manufacturing

business. Over the last several

years, the company has been devel-

oping the technology to the point

where it says it is now ready to of-

fer a 50 MW plant solution.

Commenting on the drivers behind

a technology that has been slowly

gaining traction globally, Marc

Grünewald, Head of Business De-

velopment and new energies at the

Power Unit of MAN Energy Solu-

tions, said: “The challenge for the

future is producing energy while re-

ducing your CO

2

footprint. Tradi-

tionally, the approach has been to

improve the efciency of fossil fu-

elled plants. But today, you can pro-

duce electricity from wind and solar

at below €6 ¢/kWh and lower. Re-

newable generation and electricity

demand do not always match, which

is why storage solutions are essen-

tial. Batteries are ideal as short term

storage, but storing the energy as a

liquid or gas through power-to-X

allows unlimited storage both in

terms of amounts and time.”

According to Grünewald, such a

technology can make sense in the

right setting. Germany has been a

leader in the deployment of P2X fa-

cilities. Of the more than 30 instal-

lations in Europe, approximately 20

are in Germany, says Grünewald.

“The biggest of these is the one we

built with Audi in 2012/2013,” he

noted.

Since the summer of 2013, the

German car manufacturer has been

using climate-neutral ‘e-gas’ from a

methanation reactor developed by

MAN Energy Solutions at its plant

in Werlte. According to MAN Ener-

gy Solutions, the prototype plant is

the rst installation on an industrial

scale to convert excess electricity

generated from wind into e-gas and

is currently the largest of its kind

worldwide.

Power-to-gas basically uses re-

newable energy that cannot be fed

into the grid to produce hydrogen

and oxygen via electrolysis. At the

Audi Werlte plant, CO

2

is added to

the hydrogen in a methanation reac-

tor supplied by MAN Energy Solu-

tions. The methanation reactor is a

xed-bed type and uses a catalyst to

turn hydrogen (2H

2

) and carbon di-

oxide (CO

2

) into methane (CH

4

).

As part of the Volkswagen Group,

Audi was among the rst of the car

companies in Germany to look at

‘green’ gas-powered vehicles. Volk-

swagen has around 17 models within

its group – including Seat and Skoda

– that run on gas.

“Audi had these gas powered cars

already and was looking to make the

fuel green for its customers,” said

Grünewald.

The CO

2

for the methanation is

captured by amine gas treating from

a nearby biogas plant. Per MWh in-

put into the electrolyser, about 35 kg

of synthetic natural gas (SNG) can

be produced.

The Audi e-gas plant produces

around 1000 tons of SNG per year,

enabling 1500 natural gas-powered

cars to drive 15 000 km on CO

2

-neu-

tral gas each year. In addition, the

plant absorbs around 2800 tons of

CO

2

in the methanation process. This

corresponds approximately to the

amount that a forest absorbs with

over 220 000 beech trees per year.

Having successfully installed the

6.2 MW plant for Audi, MAN Ener-

gy Solutions is now looking to

build units of up to 50 MW (elec-

trolyser input) for other industrial

clients and applications. With the e-

gas from a plant of this size, 19 800

natural gas-powered cars could each

drive 15 000 km annually.

Carbon-neutral synthetic gas is

seen as a very important future en-

ergy carrier, which is not only per-

fectly suited for cars and trucks, but

also for public transport and even

ships. And this is where the real fu-

ture of power-to-x probably truly

lies – in the decarbonisation of in-

dustry and transport.

“More than 50 per cent of the ships

around the world have engines from

MAN,” noted Grünewald. “If you

look at these large vessels, you can-

not go with batteries because they

are too heavy. And you cannot go

with hydrogen because it requires

too much space to store it. Power-to-

X allows us to green-up the fuel and

enable the maritime industry to meet

its CO

2

goals by 2050.”

With regards to the 50 MW size, he

said: “There are huge markets for

power-to-x and if we do not start de-

livering this solution to decarbonise

industry, we will not achieve CO

2

re-

duction targets. We are pretty open

to delivering whatever our customers

are looking for but you need to have

some kind of standardisation. So we

said we want to deliver in the range

of 2 MW to 50 MW. If we do not

start now, we are losing years.”

Over the last six years, MAN Ener-

gy Solutions has been working on

improving the methanation process,

moving towards what it calls

‘methanation 2.0’. The aim is to in-

crease efciency, improve operation-

al exibility, reduce costs and foot-

print, etc.

The company has a research site

in Deggendorf where it is develop-

ing and manufacturing reactor sys-

tems for the chemical and petro-

chemical industry, reneries and

research projects in physics. MAN

Energy Solutions says it has already

delivered more than 750 reactor

systems to customers worldwide,

noting that its reactors can be used

for more than 80 different chemical

and petrochemical processes. These

processes can be tested in the

Deggendorf laboratory on a small

scale and improved before running

on a larger scale.

For power-to-X specically, in the

laboratory it has built a small-scale

methanation reactor where research-

ers are continuously improving the

methanation process, i.e. improving

the efciency of the catalysation of

the two raw materials, hydrogen and

carbon dioxide, into methane. Test-

ing includes different reactor temper-

atures and pressures, as well as per-

formance tests with different

catalysts.

Grünewald commented: “At our

site in Deggendorf, MAN Energy

Solutions is heavily involved in the

development and research of syn-

thetic fuels – a future market with

great growth opportunities. There we

have our own research. In pilot reac-

tors, chemical syntheses are tested

on a small scale (gram to kilogram

volume) in order to produce the de-

sired product quantity with the low-

est amount of raw materials used.”

He added: “The new methanation

reactor is now two thirds smaller and

30 per cent cheaper (in terms of in-

vestment costs) than its predecessor

in Werlte and all this with improved

gas quality.”

Notably, the reactor in Werlte

measures 8 m long x 4 m wide x

15.5 m high. Today, that same reac-

tor would have dimensions of 6 m x

4 m x 7.5 m. Meanwhile, the pro-

cess design of methanation 2.0 en-

ables product gas compositions of

more than 95 per cent methane con-

tent (up from 92-95 per cent). This

makes it suitable to feed into natural

gas grids, which, says the company,

means all relevant applications can

be addressed that run on natural gas

today.

“Longer residence times within

the reactor can improve this num-

ber, but with the [higher] cost of

larger reactors or lower output

rates,” said Grünewald. “Higher gas

purities can be achieved with gas

treatment measures downstream the

methanation itself.”

MAN Energy Solutions says it

will continue developing the power-

to-X technology with the knowl-

edge that there are not many other

real options for decarbonising in-

dustry and transport, and says it is

ready for the market.

Grünewald concluded: “There is

huge interest and we already have a

couple of leads – my hope is that

we will sell the rst one this year.

The concept for the 50 MW P2X

complete solution is ready to offer

and we could start a project for a

customer tomorrow.”

Ramping up power-to-X

Power-to-gas uses renewable

energy to produce hydrogen

and oxygen via electrolysis.

CO

2

is added to the hydrogen

in a methanation reactor

that uses a catalyst to turn

hydrogen (2H

2

) and carbon

dioxide (CO

2

) into methane

(CH

4

)

Audi has been using climate-neutral ‘e-gas’ from

a methanation reactor developed by MAN Energy

Solutions at its plant in Werlte, Germany

THE ENERGY INDUSTRY TIMES - FEBRUARY 2019

16

Final Word

T

hey say, where there’s a will

there’s a way. Not in the case

of Wylfa. Like Moorside, the

planned UK nuclear project has lost

its way; once again demonstrating the

changing dynamic of the global en-

ergy landscape.

In January, Japanese company Hi-

tachi halted plans for its £20 billion

($26.4 billion) project on Anglesey

island, Wales. It also said it was

abandoning its other planned UK

nuclear plant, at Oldbury-on-Severn

in Gloucestershire.

As with Toshiba’s Moorside and

other large nuclear projects, the cost

of building the 2.9 GW Wylfa project

has proven too high for the private

sector to take on without sufcient

government support. The UK govern-

ment was only prepared to offer a strike

price of about £75/MWh with a price

below £60/MWh for later reactors on

the site. This is signicantly lower than

the £92.50/MWh that EDF managed

to secure for its Hinkley Point C plant.

In a statement, Hitachi said: “De-

spite the best efforts of everyone in-

volved, the parties have not been able

to reach an agreement. As a result,

Hitachi has decided to suspend the

project at this time from the viewpoint

of its economic rationality as a private

enterprise.”

Toshiaki Higashihara, Hitachi’s

Chief Executive, said: “A freeze

means we will not put in any addi-

tional investment.” He added that the

company would only renew its in-

volvement if the project was kept off

Hitachi’s balance sheet, required only

a limited capital investment from the

company and offered the prospect of

an adequate prot.

Although Higashihara says the

project is frozen, in reality it is as good

as dead. Hitachi has plenty on its plate

in terms of strengthening its balance

sheet, and rhetoric from the UK gov-

ernment strongly indicates it is highly

unlikely to shift position on Wylfa.

The acquisition of ABB for $6.4

billion in December has no doubt put

a strain on Hitachi’s balance sheet and

the company will now have to write-

off ¥300 billion ($2.8 billion) for ac-

tivities related to Wylfa. The company

has now cut its net income forecast for

the year to March 2019 from ¥530

billion to ¥230 billion, reecting the

scale of the loss.

Commenting on the Wylfa news

Rebecca Long-Bailey MP, the shadow

business secretary, said suspension of

Moorside and Wylfa left a “6.3 GW

hole of low carbon energy – 13 per

cent of the UK’s electricity”. But does

it really?

If it wants to continue its pursuit of

large scale nuclear, the UK could,

theoretically, turn to China or even

Russian companies, which are keen to

provide nancing for their projects.

Alternatively it could decide to build

more gas red plant or accelerate its

expansion of renewables. Despite

constant reassurances – throughout

and after the protracted negotiations

with EDF over Hinkley – that it is

committed to nuclear, it seems the

latter is becoming the government’s

preferred option.

In a letter published in the Financial

Times, Greg Clark, Secretary of State,

Department for Business, Energy and

Industrial Strategy said the global

energy market is changing fast and that

cleaner sources of power, such as

offshore wind, have fallen in cost to

the point they will soon need no

public subsidy.

“In this context, Britain’s electricity

requirement for the 2030s is not a

problem of shortages but the much

better challenge of abundance. In fact,

the last contract for difference auction

in the UK procured 3 GW of offshore

wind – equal to the capacity of a nu-

clear power station – for only £57.50

per megawatt hour,” he wrote.

Still perhaps paying lip service to

the government’s commitment to

nuclear, or at least attempting to keep

the door open to nuclear developers,

he said the UK remained “committed

to nuclear power” as part of a diverse

energy mix. Further, he noted that

“Hinkley Point C is proceeding apace

and other projects, including Sizewell

C and Bradwell, are progressing

through the regulatory process”. He

also stated that small modular reac-

tors can have a role to play.

Notably, however, he stated that

“none of these can be at any price”.

This, he wrote, has led to the decision

to “set limits on consumers’ and tax-

payers’ exposure to the costs of Wylfa,

and the work being done to reduce

nancing and construction costs for

new nuclear”.

The UK government has long been

warned that the cost of its programme

for 16 GW of new nuclear capacity

makes little economic sense, but is

only now heeding the warnings – un-

fortunately at great cost to the private

developers that have already made

substantial investment in time and

money into the projects.

In fairness, few could have pre-

dicted the rate at which the price of

electricity from wind and solar would

fall. Reducing costs and the emerging

ability of developers to pitch new

projects as purely merchant proposi-

tions presents a strong case for a re-

balancing of long term UK energy

policy.

Clark indicated that this would

likely be the direction of travel for the

government. He said that a White

Paper to be issued this summer will

build on the ‘Cost of energy’ report

produced by economist Professor

Dieter Helm for the government in

2017, and his own November 2018

speech “After the Trilemma”.

Clark said that developing technol-

ogy and changing economics meant

power could be produced from a

wider range of sources than ever and

that rather than stick to an approach

that was put together a decade ago, the

government’s policy should allow

“taxpayers and consumers to take

advantage” of developments.

It will be interesting to see what the

White Paper proposes and whether the

government decides to forego any

signicant support for big nuclear

projects going forward. Neither

Clark’s speech nor Helm’s report

picked winners. Helm’s review es-

sentially said consumers were paying

too much for energy and that the best

way to achieve carbon targets is to set

a carbon price with all technologies

ultimately competing on a level play-

ing eld in terms of government sup-

port, with feed-in-tariffs and other

low-carbon Contracts for Differences

being gradually phased out.

Helm’s report did note, however, that

in the case of nuclear, the nature of the

costs, the time horizons, and the soci-

etal decisions about risk and waste

“make these investments always a

matter for the state”.

It says: “Unless there is a market

belief that fossil fuel prices will rise

very sharply, and the markets are

prepared to offer long-term contracts

to match such projections, nuclear will

not be developed by the competitive

markets. The government therefore

needs to decide whether and how to

proceed”.

If the government does decide that

large nuclear projects are essential in

the energy mix, it will have to nd a

solution that does not burden taxpay-

ers. The Department for Business,

Energy and Industrial Strategy has

already said it is reviewing alternative

funding models for future nuclear

projects and will update on these nd-

ings in summer 2019.

Clark conrmed that the government

is now considering funding nuclear

power stations using what is called

regulatory asset base (RAB), and

would issue a report before the sum-

mer. Essentially, the RAB model

mitigates the construction risks by

enabling investors to receive returns

before projects have been completed.

In a research note, Wood Macken-

zie’s Europe Power and Renewable

team stated: “While the government

may still consider alternative funding

models and new modular reactor

technologies as means of delivering

nuclear power, it would appear in-

creasingly prudent to evaluate wind,

solar and decarbonised thermal

sources, particularly gas, as the main-

stays of future power generation.”

With the UK’s nuclear programme

hanging by a thread, the rest of the

world will be watching closely to see

how this saga plays out. Finland’s

Hanhikivi 1, although delayed due to

regulatory approval issues shows

there are ways of nancing big nucle-

ar projects (but does little to guarantee

they are built to time and budget). And

there is always Chinese money wait-

ing in the wings.

The government may have no will

for Wylfa but still has to address the

real question of whether it wants, or

needs, to be in the business of ensuring

the future of large scale nuclear at all.

No will for UK nuclear

Junior Isles

Cartoon: jemsoar.com