www.teitimes.com

January 2019 • Volume 11 • No 11 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Understanding the

invisibles

Creating a

winning hand

The ‘3 D’s are great but it is the

unseen things that are shaping the

energy world. Page 13

Engine manufacturers see micro- and

mini-grids based on renewables as the

route to electrifying Africa. Page 14

News In Brief

Spain’s energy strategy

aligns with EU carbon

neutral plan

Spain is proposing a renewable

energy plan aimed at producing 100

per cent of the country’s electricity

from renewables by 2050.

Page 2

Argentine recession hits

infrastructure projects

Argentina’s economic recession is

putting energy investments at risk,

its government has warned.

Page 4

Indonesia remains on

coal path

Despite several initiatives

encouraging renewable energy,

Indonesia’s push for electrication

is poised to accelerate the growth of

domestic coal consumption.

Page 6

France urged to be more

ambitious on offshore wind

The French government’s renewable

energy goals have disappointed the

offshore wind industry.

Page 7

Japan reconsiders Turkish

nuclear project

Japan is considering the withdrawal

of support for a new nuclear power

plant on Turkey’s Black Sea coast

due to rising costs.

Page 8

Renewables dominate in

utilities’ futures

European utilities are continuing

to make investment in renewable

energy the central pillar of their

strategic plans in spite of uncertainty

about the trading environment.

Page 8

Fuel Watch: Asian LNG

demand set to boom

A considerable amount of the next

generation LNG capacity, largely

created by Asia’s burgeoning

demand, will come from the US.

Page 12

Technology: Changing the

game with ammonia-based

fuel cells

A fuel cell that uses ammonia to

generate the hydrogen needed for

fuel will go commercial this year.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

Despite agreeing most of the rules needed to implement the Paris accord, many argue that

the real task of actually reducing carbon emissions still lies ahead. Junior Isles

Coal demand to remain stable through 2023, despite headwinds

THE ENERGY INDUSTRY

TIMES

Final Word

The jump in Poland was

athletic but it still falls

short, says Junior Isles

Page 16

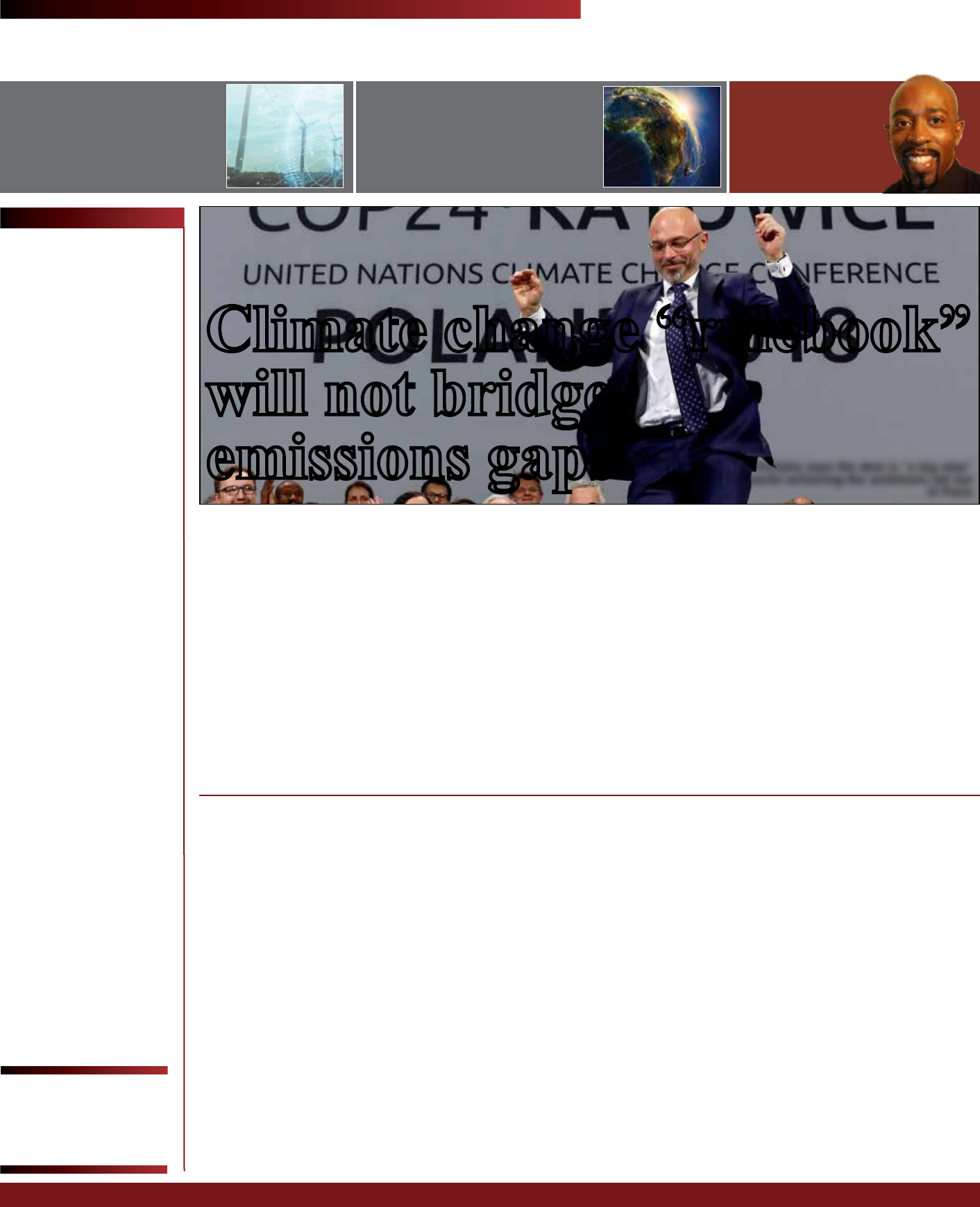

The “rulebook” agreed at the UN’s

Conference of Parties (COP) 24 cli-

mate change summit, held in Kato-

wice, Poland, has been hailed as “a big

step” towards achieving the climate

goals set under the 2015 Paris Agree-

ment. Some argue, however, that the

deal will do little to help slow global

warming.

Last month negotiators from 196

countries and the European Union

worked for two weeks on the Kato-

wice Climate Package – a set of rules

for implementing the Paris goal of

limiting global temperature rise to be-

low 2°C from pre-industrial levels.

On signing the Katowice agreement

Michał Kurtyka, Poland’s Secretary

of State in the Ministry of Environ-

ment and COP24 President said: “We

have been working on this package for

three years… we have taken a big step

towards achieving the ambitions set in

the Paris Agreement.”

The deal passed in mid-December

includes a universal system for how

governments will measure, report and

verify their CO

2

emissions-cutting ef-

forts, whereby all countries will ad-

here to the same rules that will take

effect in 2024.

The rules also include a global

“stocktake”, wherein countries agree

to submit data on emissions to the UN

every two years starting in 2024,

along with new climate targets every

ve years. This will measure whether

emissions are on track to keep global

warming within the limit.

The rules also eliminate an earlier

distinction between developed and

developing countries over their com-

mitments. However, the biggest stum-

bling block as the meeting drew to a

close was over carbon markets – a

provision for a global scheme that

would allow countries to trade emis-

sions reductions. The article related to

this issue was largely deleted from the

nal agreement due to opposition

from Brazil, with the carbon market

discussion delayed to next year.

As discussions were predominantly

technical in focus, the key question

of how countries will step up their

targets on cutting emissions remained

largely unaddressed. On current tar-

gets, the world is set for 3°C of

warming from pre-industrial levels,

which scientists say would be disas-

trous. Further, in October the Inter-

governmental Panel on Climate

Change (IPCC) issued a report advis-

ing to limit warming to no more than

1.5°C to avoid dire consequences.

Ola Elvestuen, Norway’s Environ-

ment Minister noted that the hardest

Continued on Page 2

Global coal demand looks set to rise

for the second year in a row in 2018

but is forecast to remain stable over

the next ve years, as declines in Eu-

rope and North America are offset by

strong growth in India and Southeast

Asia, according to the International

Energy Agency’s latest coal market

report, ‘Coal 2018’.

Air quality and climate policies,

coal divestment campaigns, phase-

out announcements, declining costs

of renewables and abundant supplies

of natural gas are all putting pressure

on coal. As a result, coal’s contribu-

tion to the global energy mix is fore-

cast to decline slightly from 27 per

cent in 2017 to 25 per cent by 2023.

But coal demand grows across much

of Asia due to its affordability and

availability.

“The story of coal is a tale of two

worlds with climate action policies

and economic forces leading to clos-

ing coal power plants in some coun-

tries, while coal continues to play a

part in securing access to affordable

energy in others,” said Keisuke Sad-

amori, Director of Energy Markets

and Security at the IEA. “For many

countries, particularly in South and

Southeast Asia, it is looked upon to

provide energy security and underpin

economic development.”

This is why the IEA sees technolo-

gies like Carbon Capture, Utilisation

and Storage (CCUS) as essential tools

to bridge current and future energy

needs with global and national cli-

mate ambitions.

But even without the added price tag

of CCUS, the economic case for coal

continues to look increasingly less

convincing. A report published by -

nancial think-tank Carbon Tracker at

the end of November said that two-

fths of the world’s coal power sta-

tions, including in India, were already

running at a loss.

Out of the 6685 coal power plants

studied worldwide, Carbon Tracker

nds that 42 per cent of global coal

capacity is already unprotable be-

cause of high fuel costs and by 2040

that could reach 72 per cent as exist-

ing carbon pricing and air pollution

regulations drive up costs. According

to the rm, it costs more to run 62 per

cent of India’s coal capacity than to

build new renewable generation and

by 2030 that will rise to 100 per cent.

Such trends are driving investment

away from coal. In late December in-

vestors overseeing more than $11 tril-

lion in assets, including Schroders,

Legal & General Investment Manage-

ment and two of the biggest US pen-

sion funds, called on power compa-

nies to commit to ending coal use by

2030 and spell out preparations for a

global shift towards low-carbon fuels.

In a letter to the Financial Times,

investors led by the Institutional In-

vestors Group on Climate Change and

members of the Climate Action 100+

organisation have urged European

utilities to set timelines for eliminat-

ing coal red power generation in the

EU and industrialised nations.

The call came as European Union

member states and the European Par-

liament agreed to reform the bloc’s

electricity market, including a call to

end coal subsidies by 2025.

The political agreement, which still

requires formal approval, was an-

nounced by Austria, which holds the

EU’s six-month rotating presidency.

“Member states can, after strict ex-

amination by the European Commis-

sion, distribute state aid but only until

2025,” it said in a statement, referring

to existing coal red power plants.

The subsidies, designed to compen-

sate electricity producers who main-

tained higher capacity to meet peaks

in demand, had stirred debate over the

role of coal in the bloc.

Miguel Arias Cañete, the European

Commissioner for Climate Action

and Energy, said the deal puts the “EU

in the lead in terms of rules to acceler-

ate and facilitate the clean energy

transition”.

Climate change “rulebook”

will not bridge

emissions gaps

Kurtyka says the deal is “a big step”

towards achieving the ambitions set out

in Paris

THE ENERGY INDUSTRY TIMES - JANUARY 2019

3

Event Focus

Aligning the Industry: Growth in Consumer Markets

• BehavioralEnergyEciency

• AligningBehaviorthroughTaris

• AggregationofEnergyStorage

• DERMS:Solar,Storage,SmartHome,andtheGrid

• TransitiontoDistributionSystemOperator

Leadership: Execution and Consumer Impact

• IncentivizingtheSmartHome:UtilityMarketplace

• EvolutionofEnergyManagementintheSmartHome

• EnergyOrchestration:ConsumerValueandControl

• TheEnergyDataGoldmine

• OptimizingControlwithEnergyData

• HomeServicesRevenueOpportunities

Smart Energy Summitidentiesopportunitiesacrossconverging

ecosystemstocreatenewvalueinenergysolutionsthrough

partnershipsthatleverageconnecteddevices,energymanagement,

utilityservices,andhomecontrolplatformsandservices.

www.ses2019.com | 972-490-1113

SPONSOR

EliLund

eli.lund@parksassociates.com

Register Today!

www.ses2019.com

E-WORLD

INNOVATION AREA

E-WORLD ENERGY & WATER, 5

TH

– 7

TH

FEBRUARY 2019, ESSEN

DISCOVER THE ENERGY

WORLD OF TOMORROW

START-UPS

|

SPEEDDATING

|

SCIENCE

|

CAREER

www.e-world-essen.com

www.terrapinn.com/solarmena/book

Investment, technology

and development for the solar

and wind energy sector

THE ENERGY INDUSTRY TIMES - JANUARY 2019

5

www.teitimes.com

THE ENERGY INDUSTRY

TIMES

subscribe today

The Energy Industry Times is the only publication that

covers global news related to the power and energy

sector in a newspaper style and format whose

uniqueness is recognised by our readers.

As a paid subsciber you will gain full access to our online

news desk.

You will also no longer have to wait for the printed edi-

tion; receive it by PDF “hot off the press” or download it

online.

To subscribe, email subscriptions@teitimes.com or visit

www.teitimes.com

To guarantee receiving your monthly copy of the award

winning newspaper, you need to subscribe today

weber media solutions

www.webermediasolutions.com

YOUR CREATIVE MEDIA AGENCY FOR

DESIGN AND MARKETING SOLUTIONS

We are a creative media agency providing a bespoke

service to meet your media and marketing requirements

DESIGN / VIDEO / WEB / EXHIBITION STAND DESIGN

MAGAZINES / PRINT MANAGEMENT / MAILING

weber media solutions

samples of our

exhibition stand design

Our Clients:

Our Partners:

For more information please contact:

Karl Weber / Director

T: +44 7734 942 385 / E: karlw@webermediasolutions.com

THE ENERGY INDUSTRY TIMES - JANUARY 2019

9

Companies News

Siân Crampsie

European utilities are continuing to

make investment in renewable energy

the central pillar of their strategic

plans in spite of uncertainty about the

trading environment.

Ørsted says it will invest DKK200

billion ($30.25 billion) in green energy

by 2025 as part of its strategy to con-

tribute to the transformation of the

global energy system and maintain its

position as a global leader in offshore

wind energy.

Its announcement followed news

from Enel, which said that it would

boost its renewable energy generating

portfolio by 23 per cent by 2021, to

over 48 GW. It will spend €10.6 billion

on renewable energy asset develop-

ment over the next three years, while

its installed capacity of thermal power

plants will drop to 39.5 GW in 2021,

from 46.5 GW in 2018.

Spanish group Endesa is also plan-

ning to cut thermal generation by shut-

ting down two coal red power plants

that account for 40 per cent of its coal-

red generating capacity in Spain by

2020. It announced recently in its

2019-2021 strategic business plan that

it would also invest €2 billion in re-

newable energy.

According to Scope Ratings, tighter

binding renewable energy targets ad-

opted by the EU will help to drive in-

vestment in renewables and will also

expose utilities with carbon-emitting

power plants in their portfolios to

greater risk.

Some countries have pledged to

phase out coal red power generation,

while others are considering limiting

which power plants can take part in

capacity schemes according to stricter

CO

2

emission criteria.

“The big change is that political risk

is back centre stage, in the form of

stricter environmental regulations and

a more nationalist tone to energy pol-

icy which risk squeezing credit metrics

in the years ahead,” said Sebastian

Zank, analyst at Scope.

Ørsted is planning to reach a global

installed offshore wind capacity of

more than 30 GW by 2030. It has also

increased its 2025 ambition from 11-

12 GW to 15 GW.

“We expect the global market for

renewable energy to more than triple

towards 2030,” said Henrik Poulsen,

Ørsted’s CEO. “Our second growth

platform is our onshore business, con-

sisting of onshore wind, solar energy

and energy storage. It’s our ambition

to create a leading North American

company within renewable energy.”

Enel’s plans include increasing its

wind energy portfolio from 8 GW in

2018 to 14 GW in 2021. Solar energy

will increase from 2 GW to 5 GW.

Endesa said that it would increase its

renewable installed capacity by 30 per

cent over the 2019-2021 period, most

of which will come from wind and so-

lar projects. By 2021, the company

intends to raise its total renewable in-

stalled capacity from 6.5 GW in 2018

to 8.4 GW, by adding 1.9 GW of new

wind and solar capacity (of which 0.9

GW through 2017 auctions).

Endesa will close the 1051 MW

Compostilla lignite red power plant

in Leon, whose units were commis-

sioned between 1961 and 1984, and

the 1101 MW Andorra coal red

power plant in Teruel, which started

operations in 1970.

The move is a key part of Endesa’s

plans to reduce its CO

2

emissions by

47 per cent by 2020 compared with

2005 gures and by a further 44 per

cent between 2020 and 2030, in order

to entirely decarbonise its asset base

by 2050.

Hitachi’s purchase of ABB’s power

grid division will help the Japanese

technology rm to shift its focus away

from nuclear plants, it says.

The two companies have agreed a

deal in which Hitachi will acquire

80.1 per cent of ABB’s power grid

business in a deal worth $11 billion.

ABB said that the deal would expand

an existing partnership between the

two companies and enable ABB to

focus on its digital industries business.

Under the deal, ABB will retain own-

ership of 19.9 per cent of the business

for up to three years after the deal

closes, expected in 2020. It intends to

return all of the estimated net cash pro-

ceeds of $7.6-7.8 billion from the 80.1

per cent sale to shareholders.

Hitachi said that the acquisition will

help it to overhaul its business and

diversify into the fast-growing grids

business. The acquisition is the largest

in the rm’s history, and Chief Execu-

tive Ofcer Toshiaki Higashihara

hinted that more deals could follow.

“Power Grids will strengthen Hita-

chi as global leader in energy infra-

structure and Hitachi will strengthen

Power Grids’ position as a global

leader in power grids,” said ABB

CEO, Ulrich Spiesshofer. “To com-

pete in today’s fast-changing world,

we fully empower our businesses,

through the discontinuation of the

legacy matrix structure ensuring zero-

distance to customers and increasing

our agility in decision-making.

“The continued simplication of our

business model and structure will be a

catalyst for growth and efciency in

our businesses.”

Oil and gas major Shell says it will help

to drive the development of Asia’s so-

lar energy sector through the acquisi-

tion of a 49 per cent stake in Cleantech

Solar.

The Singapore-based rm is one of

the largest solar energy developers

operating in southeast Asia, with more

than 120 solar power plants across the

region. It said in a statement that the

deal will give Shell “an immediate

path to an established commercial and

industrial platform in Southeast Asia

and India”.

The deal is Shell’s second foray into

solar in 2018 following an investment

in Silicon Ranch Corporation, one of

the USA’s largest independent solar

project developers. It has an option to

expand its ownership stake in Clean-

tech Solar after 2021.

“We are very impressed by Cleantech

Solar’s record of developing lasting

relationships with multinational and

regional corporations who are eager to

implement subsidy-free renewable en-

ergy into their corporate strategies,”

said Marc van Gerven, Shell Vice

President of solar and storage. “Asia is

a signicant commercial and indus-

trial solar generation market for Shell

and we are proud to work with Clean-

tech Solar as a leading solar company

in the region.”

SSE is reassessing the future of its re-

tail business unit after the rm can-

celled plans for a merger with Innogy.

The two companies announced plans

in late 2017 to merge their retail busi-

nesses to create a new, independent

energy supply company in the UK

market.

However negotiations over the com-

mercial terms of the deal stalled over

the provision of nancial support to the

new company. SSE said it decided to

exit the deal as it did not believe the

new company would be able to meet

trading collateral requirements and

would not be able to gain a premium

listing.

“We closely monitored the impact of

all developments and continually re-

viewed whether this remained the right

deal to do for our customers, our em-

ployees and our shareholders. Ulti-

mately, we have now concluded that it

is not,” said Alistair Phillips-Davies,

Chief Executive of SSE.

“We believed at the time it was the

right thing in terms of what we saw.

There was a signicant prize to go

for,” Davies added. “But market con-

ditions changed over the past 13

months.”

Davies cited the highly competitive

retail environment as one of the chal-

lenges for the new company, alongside

the introduction of a price cap mecha-

nism on some types of tariffs in 2019.

He said that the company would con-

tinue to investigate options for the

future of its retail arm.

Innogy, which is owned by RWE but

due to be sold to E.On in 2019, said it

was also assessing options for the fu-

ture of its British retail arm.

The failure of the merger is further

evidence of a very competitive trading

environment in the utility sector, ac-

cording to analysts.

Professor David Elmes, leader of the

Warwick Business School Global En-

ergy Research Network said: “When

SSE and npower proposed their merg-

er, there were concerns that this was

bringing together two of the ‘big six’

energy companies and the debate fo-

cused on how this might affect the

choices on offer to customers.

“This missed the point that both

companies had found running a prof-

itable retail business challenging and

this was a move to combine their

customer businesses and hopefully

make a new rm that would be more

successful.

“Since the deal was announced, we

have seen the government impose a

price cap on the sector and we’re start-

ing to see the impact that’s having on

company prots.

“The fact that eight energy compa-

nies have collapsed this year reects

just how hard it is to run a viable retail

energy business in the UK.

“These eight failures among the

smaller energy retailers, plus the col-

lapse of the SSE-npower deal, show

the government is struggling to sup-

port a sector that’s essential to the UK

economy.”

SSE and Innogy

reassess future following

merger cancellation

Hitachi buys ABB grid

unit in shift away from

nuclear

Shell stake in Cleantech

Solar paves path into Asia

n Enel, Endesa, Ørsted set out strategic plans n Political risk higher for utilities

n Hitachi diversies with grid business

n ABB sets focus on digital sector

Renewables dominate

in utilities’ futures

ABB will be responsible for key

equipment supplies including trans-

formers, surge arrestors and gas in-

sulated switchgear.

Siemens has been awarded an order to

connect the Moray East offshore wind

farm to the grid.

The contract represents Siemens’

largest UK offshore grid connection

deal to date. The company will de-

liver an onshore substation and three

offshore transformer modules for the

950 MW project.

Moray East is being developed by

a joint venture company owned by

EDP Renewables, Engie, and Dia-

mond Generation Europe Ltd., a

subsidiary of Mitsubishi Corpora-

tion. Siemens will be responsible for

the onshore substation including

three SVC Plus as well as the three

offshore substation platform top-

sides. It will also install a 30 km un-

derground cable to the onshore su

station at New Deer in Aberdeen-

shire for the power generated.

The 100 MW Kipeto wind farm in

Kenya has reached nancial close, GE

has announced.

The US energy giant says that the

agship project will be funded by

equity from Actis and a Kenyan

company, Craftskills Wind Energy

International, alongside senior debt

from the Overseas Private Invest-

ment Corporation (OPIC), the US

government’s development nance

institution (DFI).

Kipeto is expected to reach com-

mercial operation in 2020 and will

provide clean energy to Kenya’s na-

tional grid through a 20-year power

purchase agreement with Kenya

Power and Lighting.

GE Renewable Energy will pro-

vide 60 of its 1.7-103 turbines for

the project, as well as operations and

maintenance services.

Siemens has signed a contract to build

a new combined cycle gas turbine

plant in the United Arab Emirates us-

ing its H-class gas turbine technology.

The contract marks the rst time

the company’s H-class gas turbine

will be used in the Gulf region, Sie-

mens said, adding that the plant will

be the most efcient of its kind in

the UAE.

Under the contract, Siemens will

build the new, 600 MW plant at

Emirates Global Aluminum’s smelt-

er in Jebel Ali, Dubai. The H-class

power plant is expected to cut green-

house gas emissions from EGA’s

power generation at Jebel Ali by 10

per cent. NOx emissions are expect-

ed to be reduced by 58 per cent.

Siemens Gamesa Renewable Energy

(SGRE) has secured a second order in

Russia from Enel Russia for the supply

of 201 MW of wind turbines.

The scope of the agreement in-

cludes supply, installation and com-

missioning of 57 Siemens Gamesa

3.X platform turbines at the Kola

wind farm, located in Murmansk re-

gion, Russia. The Kola wind farm is

due to be commissioned in 2021.

The contract includes full scope op-

eration and maintenance services

during the rst two years with an op-

tion to extend.

Senvion has signed conditional orders

with global wind and solar develop-

ment company Mainstream Renew-

able Power for 81 Senvion 4.2 MW

wind turbines in Chile.

Senvion’s project scope includes

the delivery, installation and com-

missioning of 37 of its 4.2M148 tur-

bines for the Tchamma project and a

further 44 Senvion 4.2M118 units

for the Cerro Tigre project. The deal

also includes a 20-year full service

contract.

The contracts are the largest order

intake for the newly launched Senvi-

on 4.2M148 and will likely become

rm in 2019. These projects com-

prise the rst of three phases for

Mainstream’s fully-contracted 1.3

GW wind and solar platform award-

ed in the Chilean energy auction in

August 2016. The installation of the

projects of the rst phase is planned

for 2020.

The Nordex Group has received a

follow-up order in Argentina from

AES Generación, it has announced.

Nordex will provide 24 of its

AW132/3465 turbines for the Vien-

tos Neuquinos wind farm in Neu-

quén, southwest Argentina, which is

being developed by AES. The order

follows a September 2018 order

from AES for 30 Nordex

AW132/3300 wind turbines for the

Energética wind farm in Argentina.

Nordex recently announced plans

to collaborate with Fábrica Argenti-

na de Aviones to establish a local

manufacturing facility in Argentina.

The company said that the move

would help to improve its competi-

tiveness in the country.

Wärtsilä has been contracted to de-

liver a dual fuel power plant to the

Caribbean island of Aruba.

The 102 MW plant has been or-

dered by the local utility, Water-En

Energiebedrijf Aruba N.V. (WEB),

and will enable WEB to reduce its

use of heavy fuel oil (HFO) and inte-

grate renewable energy capacity into

its grid.

The power plant will consist of six

Wärtsilä 50DF dual fuel engines.

They will initially operate on HFO,

reverting to liqueed natural gas

(LNG) when that fuel becomes

available on the island.

Wärtsilä will supply the plant on

an engineering, procurement and

construction (EPC) basis. Delivery is

scheduled for the fourth quarter of

2019 and it is expected to be fully

operational by February 2020.

Danish wind turbine supplier Vestas

Wind Systems has received a 151 MW

rm and unconditional order for the

Folha Larga wind project in the Brazil-

ian state of Bahia.

Vestas will supply 36 of its V150-

4.2 MW wind turbines for the proj-

ect. Casa dos Ventos has also con-

tracted Vestas to operate and

maintain the machines over the next

20 years.

Deliveries are expected in the rst

quarter of 2020, while commission-

ing is scheduled to occur by the end

of the second quarter of the same

year.

Suzlon has secured a maiden order

from Atria Power for a 50.4 MW wind

power plant in Tamil Nadu, India.

The project will comprise 12 of

Suzlon’s S111-140M and 12 of its

S120-140M machines installed on

hybrid lattice tubular towers at a site

in Tuticorin. The wind farm will be

commissioned in two phases by the

end of the rst half of 2020.

ReNew Power has placed an order

with GE Renewable Energy to provide

120 wind turbines for the Gadhsisa

wind farm in Gujurat, India.

GE will provide ReNews Power

with its 2.5-132 turbine hardware for

the 300 MW project. The project

represents the largest full turnkey en-

gineering, procurement and con-

struction (EPC) project by GE Re-

newable Energy in India.

ReNew Power successfully bid for

the wind farm project in the third

round of auctions conducted by the

Solar Energy Corporation of India

(SECI) in February 2018. The proj-

ect is due to be commissioned pro-

gressively, starting at the end of

2019.

Nexans has been awarded a full turn-

key contract to reinforce the national

grid of the Philippines.

Nexans’ scope includes manufac-

turing, delivery and installation of

350 kV high voltage direct current

(HVDC) mass-impregnated (MI)

submarine cable in water depths of

up to 650 m for the submarine link

of the Mindanao-Visayas Intercon-

nection Project.

The National Grid Corporation of

the Philippines (NGCP) launched the

Mindanao-Visayas Interconnection

Project (MVIP) to connect the three

power grids of Luzon, Visayas, and

Mindanao into one unied national

grid. With the completion of the

MVIP, expected by 2020, NGCP

aims to ensure a more stable and se-

cure supply of power in the country

and maximise the use of available

local energy resources.

Phu Yen TTP Joint Stock Company

has awarded Pöyry an owner’s engi-

neer services contract for the Hoa Hoi

solar photovoltaic (PV) power plant

project in Phu Yen province, Vietnam.

The project consists of a total of

257 MWdc solar photovoltaics and a

220 kV electrical interconnection,

constructed on 260 hectares of land

in the south central coast area of

Vietnam.

Pöyry’s assignment includes assis-

tance in project management, de-

sign review, and site supervision

services during construction and

commissioning.

The expected duration of the proj-

ect is nine months.

“We are proud to have been cho-

sen by B. Grimm and Truong Thanh

Vietnam Group as their owner’s en-

gineer for this important project,

which is one of the largest solar PV

projects in southeast Asia.

This project further strengthens

Pöyry’s role in supporting the re-

newables boom in the southeast

Asian region, where we have so far

been involved in more than 4000

MW of solar and 3000 MW of wind

power projects,” said Petteri Härk-

ki, Regional Director of Pöyry.

Services company Wood Group has

won a $66 million contract to supply

digital control technologies to the

Sellaeld nuclear site in Cumbria, UK.

The 10-year contract covers all

stages of system design, manufac-

ture and assembly of equipment, ob-

solescence management and mainte-

nance support for project work and

decommissioning carried out by

Sellaeld.

“Securing this important frame-

work is proof of the rationale for ac-

quiring Amec Foster Wheeler 12

months ago and a good revenue syn-

ergy,” head of specialist technical so-

lutions Bob MacDonald said.

Valmet will supply automation tech-

nology to Pori Energia Oy’s Aitta-

luoto biomass power plant in Pori,

Finland.

Pori Energia has established a proj-

ect to replace its outdated power

plant process systems, decrease the

use of fossil fuels and meet the oper-

ational requirements of local indus-

tries. The modernisation will de-

crease the CO

2

emissions of the

Aittaluoto power plant by 88 000

tons annually. Valmet’s automation

will improve plant availability and

emissions control.

Valmet’s delivery will include a

Valmet DNA automation system, a

safety system and an information

management system with applica-

tions for emissions control and boiler

performance monitoring. Additional-

ly, the delivery includes system engi-

neering, installation, commissioning

and training.

The modernised biomass power

plant will start its operation in the

summer of 2020.

Vestas has received a 33 MW order

from German municipal utility ener-

city Erneuerbare GmbH, a subsidiary

of Hannover-based utility enercity

AG, for the Klettwitz III B.A. 2.2 proj-

ect located in Klettwitz in the Bran-

denburg region in eastern Germany.

The Klettwitz III B.A. 2.2 is an ex-

tension of the existing Klettwitz park

and will make a signicant contribu-

tion to the German energy transition,

said Ivo Grnhagen, CEO of enercity

Erneuerbare. The project will com-

prise ten V117-3.3 MW turbines,

which will be installed on a former

coal surface mining area.

The contract includes supply, in-

stallation and commissioning of the

wind turbines, as well as a 15-year

Active Output Management 4000

service agreement. The project will

feature the VestasOnline Business

SCADA solution to lower turbine

downtime and optimise the energy

output.

Deliveries are scheduled for late

2019 and early 2020.

LG Chem has selected ABB to provide

a substation for Europe’s largest elec-

tric car battery factory in Poland.

The new car battery plant in Kobi-

erzyce, near Wroclaw will be capa-

ble of supplying up to 250 000 elec-

tric cars with batteries per annum. It

is also the rst large-scale lithium-

ion battery plant for automotive ap-

plications producing all battery com-

ponents, from electrodes to cells,

modules and packs.

THE ENERGY INDUSTRY TIMES - JANUARY 2019

10

Tenders, Bids & Contracts

Americas

Asia-Pacic

Mainstream signs up

Senvion

Sellaeld selects Wood

Pori opts for Valmet

automation

Vestas secures rst order

from enercity Erneuerbare

ABB solution for EV

battery plant

Suzlon wins Atria order

GE bags 300 MW in India

Nexans cables reinforce

Philippines grid

Pöyry wins Vietnam

assignment

AES gives second nod to

Nordex

Wärtsilä supports Aruban

goals

Casa dos Ventos opts for

Vestas

International

Europe

Siemens wins UK grid

order

Kipeto reaches nancial

close

H turbine set for UAE

smelter

SGRE signs second order

with Enel in Russia

This section is supported by ABB

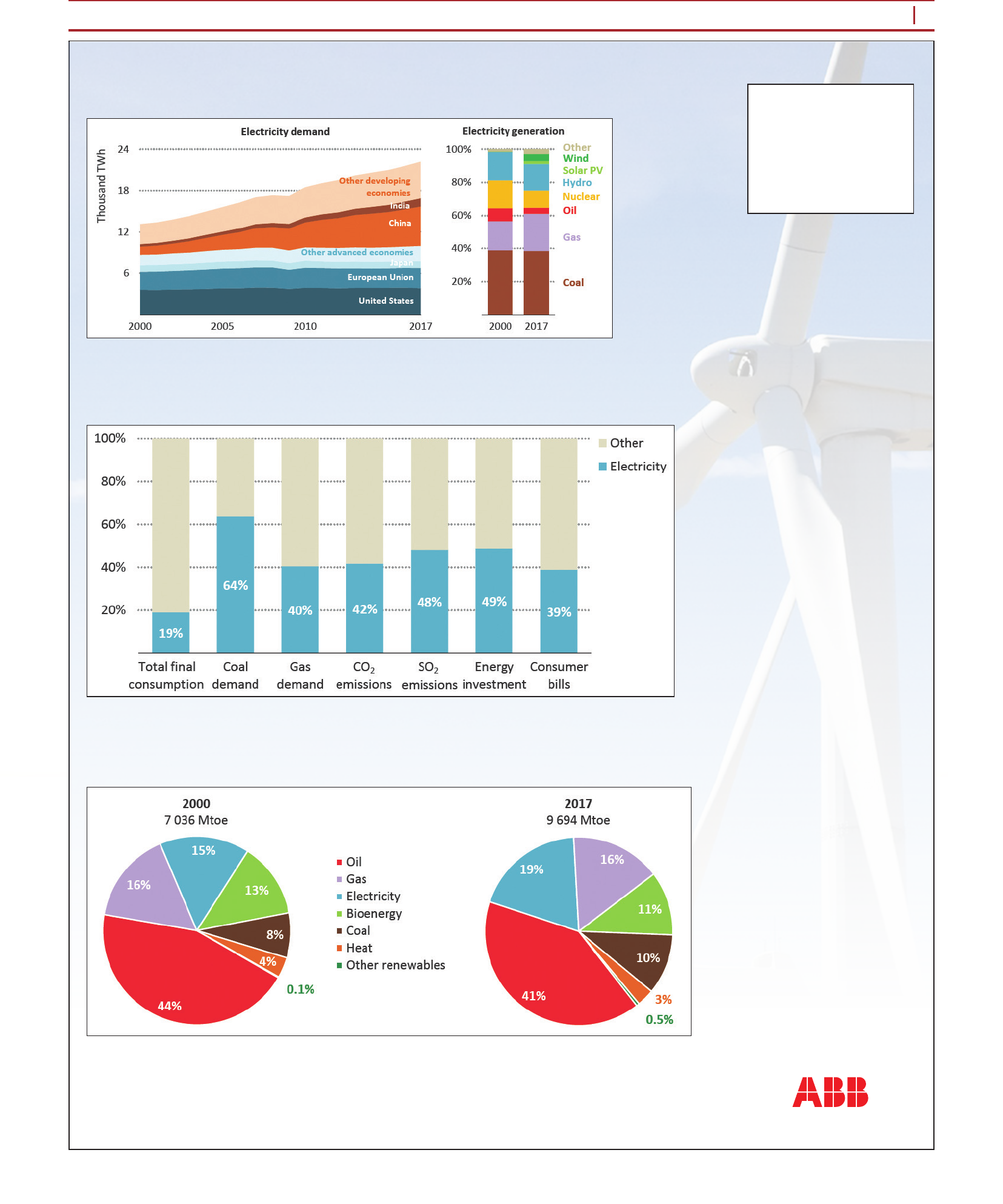

Source: World Energy Outlook 2018

THE ENERGY INDUSTRY TIMES - JANUARY 2019

11

Energy Industry Data

For more information, please contact:

International Energy Agency

9, rue de la Fédération

75739 Paris Cedex 15

France.

Email: bookshop@iea.org

website: www.iea.org

Global electricity demand by region and generation by source, 2000-2017

Share of electricity in the global energy system, 2017

Total nal consumption, 2000 and 2017

World Energy Outlook 2018, © IEA/OECD, Figure 7.1, page 281

World Energy Outlook 2018, © IEA/OECD, Figure 7.3, page 285

World Energy Outlook 2018, © IEA/OECD, Figure 7.2, page 284

THE ENERGY INDUSTRY TIMES - JANUARY 2019

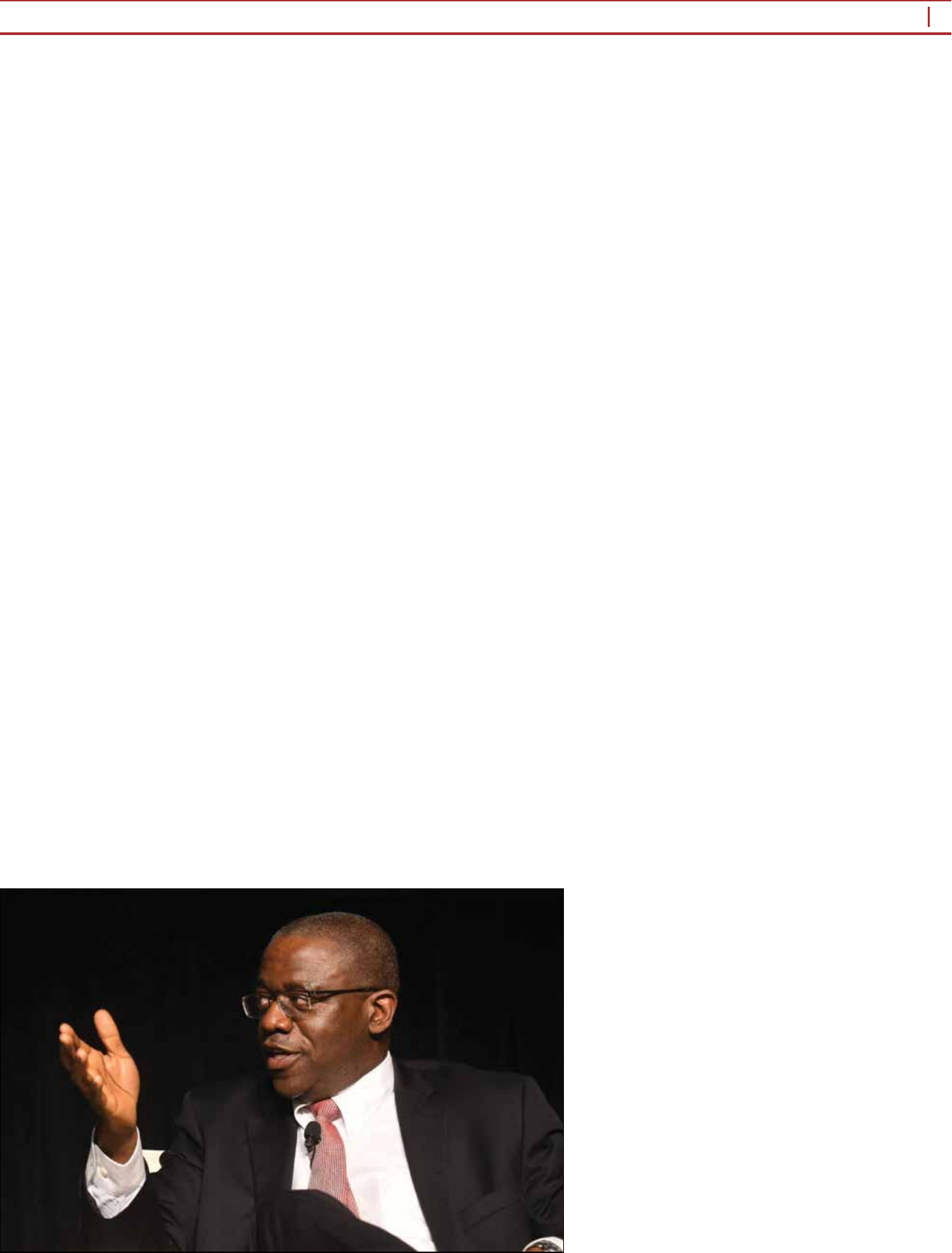

13

Industry Perspective

T

he three ‘D’s – decarbonisa-

tion, decentralisation and digi-

talisation – are very interesting

but what are we missing? Do they

have unintended consequences hid-

den in what we cannot see?” It is a

thought-provoking question posed

by Dr Lawrence E. Jones, Vice Pres-

ident International Programs, Edison

Electric Institute (EEI), as he speaks

about “understanding the invisibles”

and why “what we can’t see denes

what we see”.

Dr Jones, who was in London to

participate in the Transatlantic Dia-

logue on Cyber Security Strategy

and Preparedness co-organised by

EEI and UK Power Networks, starts

by explaining that for the ‘D’s to

work, we have to focus on the ‘I’s –

integration, interdependence, inde-

pendence, interconnectivity, intelli-

gence, interoperability and

innovation.

“These ‘I’s are very important. The

‘D’s are at the big picture, macro

level but at the end of the day, you

have to think about integration…

and in particular innovation; the in-

visible innovations that keep this en-

ergy industry going and in fact keeps

society functioning.”

While many might not see the en-

ergy industry as innovative, Dr Jones

points out that there is an incredible

amount of innovation that goes into

the technology and physical infra-

structure behind lighting a room

through the simple ip of a switch.

Yet because that technology is not

seen, it is not viewed as innovative

and not valued by society in perhaps

the same way as an iPhone.

“The ‘D’s sound great but it’s all

the things behind that you don’t see

that are the things that are really

shaping what’s happening in our

world. The challenge we have is:

what do we have to do to make the

invisible more visible and therefore

valued in a way that it’s OK to pay

for the invisibility that actually keeps

the lights on?”

Indeed, not recognising the value

of things that are commonly taken

for granted in developed countries

can present difculties. For example,

a utility can sometimes face chal-

lenges when securing support for

investing in physical infrastructure.

“A lot of what we do is predicated

on having a physical infrastructure

that works… but investments in the

physical infrastructure have to be

paid for,” explains Dr Jones. “Your

stakeholders – regulators, consum-

ers, investors – have to understand

that investments, backed by good re-

turns, need to be made in the invisi-

bles because of the value they create.

But people want services to be pro-

vided at an ever-cheaper cost. It

sometimes becomes difcult to

make the business case for, say,

modernising electricity infrastruc-

tures when the stakeholders just

don’t see it. Yet having an electricity

system that is consistently at least

99.9 per cent reliable is only possible

by investing in those invisibles…?”

So what are some of those invisi-

bles that are becoming increasingly

important? Dr Jones points to tech-

nologies such as articial intelli-

gence (AI), machine learning, auton-

omous systems, data analytics,

smarter grid equipment, and hyper-

personalisation.

He explains: “Today almost every-

thing you do is controlled by an al-

gorithm. In our business, I call these

the algorithms that light up the

world. The sad thing is, you may not

even know these algorithms exist.

But those are the innovations that are

driving our industry, driving the

transition.”

But as society moves to a scenario

where everything can be measured

to furnish increasing amounts of

data and create digital twins to im-

prove system modelling, simulation

and control, Dr Jones fears there is

a danger of moving to a world

where we “over-value the digital”

and under-value the physical”. The

problem, he says, is the “value lens”

used by stakeholders.

“If you look at a lot of stock mar-

ket valuations of companies today,

you will see that a lot of those com-

panies valued at billions of dollars

have a digitally-based business mod-

el; they don’t own any physical as-

sets. The Facebook and Ubers of the

world have huge market capitalisa-

tion and all they are offering for the

most part – the deliverable – is an

experience or, in some cases, infor-

mation. I’m not saying it’s not im-

portant; it’s what people value. But

why is it that the physical infrastruc-

ture, something that is so fundamen-

tal to modern society, is less valued

by the market and society at-large?”

Indeed it is perhaps a strange val-

ue lens that society uses, since the

digital world cannot exist without

the physical world. In some coun-

tries, it is perhaps more easy to ap-

preciate the digital world because

the physical world has already

been built. However, this built en-

vironment must be ma

intained and upgraded.

He says it is an issue that needs se-

rious consideration when thinking

about decentralisation. Digitalisation

is a major driver and facilitator of

decentralisation. The creation of vir-

tual power plants through the aggre-

gation of devices and the technology

needed to create smart grids to en-

able prosumers, and micro-grids

where users can conduct peer-to-

peer transactions, are all part of the

digitalisation movement.

But Dr Jones is not convinced that

the future is purely decentralised. As

the world’s population grows and

mega-cities become even larger, he

asks: “When you think of urbanisa-

tion and a world with 10 billion peo-

ple, the question is: can you run a

world with 10 billion people on de-

centralised power?

“As those populations grow, how

can we provide electricity in those

large urban areas where there are not

enough rooftops or land [for solar

panels] for providing electricity?

And there will be times when the

sun doesn’t shine or the wind doesn’t

blow. So we should be careful not to

create an either or scenario.”

Dr Jones believes the future is “hy-

brid”, a mix of centralised and de-

centralised solutions. He warns,

however, that in this “age of hybridi-

ty” – where there is a mix of central-

ised and decentralised systems and

the digital world is integrated with

the physical world – there are issues

that need to be seriously considered.

“There will be a need for greater

coordination in terms of planning

because there is an interdependency.

No one builds a micro-grid with the

goal of it continuing to run as a mi-

cro-grid. People ultimately want a

micro-grid to expand – who builds a

micro-grid to serve just one custom-

er? So we have to consider how the

micro-grid will interact with the

macro-grid and vice versa. So there

has to be more integrated planning

of hybrid systems.”

He says new approaches to plan-

ning are being looked at around the

world. “Research institutes are look-

ing at it, and utilities and network

operators themselves are beginning

to look at it and incorporate it into

their thinking and planning. If you

don’t take a holistic approach, it

sometimes becomes difcult to see

the true value of everything along

the value chain, or more increasingly

the value networks.”

He added: “We haven’t found a

way to come up with the analytical,

legal frameworks, etc., to assess the

merits of these hybrid systems to-

gether, as one… The digital and

physical worlds are coming together

but, in general, we still address them

as silos.

“If you look at the investment

model for investing in the physical

world, they are long-lived assets. A

transmission line, for example, is de-

signed to last many years. But the

time horizon for investment in the

digital world is different, so you

have to have a more integrated ap-

proach when assessing the merits of

the ‘digital-physical’ world.”

One major concern in the area of

digitalisation, and the proliferation

of digital twins in particular, is the

issue of data – its accuracy and pri-

vacy. “Inaccurate data means inaccu-

rate behaviour of the twin,” he said.

“The other important thing is cyber

security, making sure you can secure

the protection of that data. This has

to be key.”

The move to digitalisation has po-

tential ramications that reach far

and wide, leading Dr Jones to pose

several interesting questions.

“Why should we care about the

black boxes? Those invisible algo-

rithms are doing stuff you don’t

know about. What happens when

the algorithms autonomously gener-

ate new algorithms that function in

a way that dees legal and regulato-

ry frameworks? Regulators are in

trouble because they have no under-

standing of these algorithms. What

if AI gives biased results based on

biased information? What does that

mean for how systems will evolve?

And what happens if the predictive

analytics give a wrong prediction?”

In the power sector, this could be a

huge issue in forecasting. In a tradi-

tional power system, network opera-

tors are able to balance supply and

demand because they have a good

understanding of the demand, its lo-

cation and the rate at which it goes

up and down. But in a more digi-

tised, decentralised, world it is not so

straightforward.

Dr Jones observes: “When we

don’t have that level of sophistica-

tion, we start to rely on predictive

analytics to help forecast the behav-

iour of all those interconnected de-

vices. So if our prediction of a cer-

tain pattern, for example a

consumption pattern or charging/

discharging pattern, is wrong,

what’s the recourse? It becomes an

interesting scenario, even in terms

of regulatory framework. If a regu-

lator designs a bad framework be-

cause they are unable to do holistic

scenario planning for what the

world will look like, there could be

implications.”

Moving forward, Dr Jones says the

global industry should adopt indus-

try-specic solutions and business

models. While he believes that

blockchain, for example, has its

merits, talk of it being the game-

changing technology for the energy

industry is perhaps “a little over-

blown”. Neither does he believe that

platform approaches such as those

used by Uber are really suitable.

He concluded: “Uberisation and

other digital business models do not

necessary lend themselves to some

of the physical things we’d like to do

in energy… digitalisation in terms of

improving operations is important

but I don’t see how some of these

models that don’t require a physical

system can be applied to the energy

sector.

“I’d like to consider myself a real-

istic energy futurist. We have to

adopt solutions that reect the needs

and expectations of the customer in a

given industry environment. While

the ‘D’s of the energy transition are

global in scale, the ‘I’s which are

key to realising the transition are lo-

cal in character. Welcome to the age

of hybridity!”

As the face of

the energy sector

continues to change,

TEI Times caught

up with Edison

Electric Institute’s Dr

Lawrence E. Jones to

discuss his views on

some of the industry’s

challenges and key

issues that will shape

it as it moves forward.

Junior Isles

Dr Jones: “It’s all the things behind that you don’t see that are the things that are really shaping

what’s happening in our world.”

Understanding the invisibles

“hugely more expensive” than a hy-

brid renewables-genset system,

which also delivers exibility. He

noted that solar plus storage would

start to become competitive from

around 2027, when the cost of stor-

age falls to around $125-150/kWh.

Countries like Senegal, however,

where there are blackouts due to the

gap between supply and demand, do

not have the luxury of waiting for

costs to come down. This is why

Rautkivi believes they should invest

in exible genset-based generation as

it provides the path to 100 per cent

renewables in the most economic and

optimal way.

Wärtsilä hopes its purchase of

Greensmith will position it to serve

markets like Africa now and in the

future.

In addition to capturing opportuni-

ties globally, based on short duration

battery storage projects, Rautkivi

says right now there are opportunities

for hybrid solutions where the com-

pany already has an installed base.

These, he said, are in, for example,

the mining sector, on islands, or in

countries like Senegal. Earlier this

year Wärtsilä installed a 130 MW

Flexicyle power plant as part of Sen-

egal’s strategy to increase its energy

production, while in the medium

term, reducing the cost of electricity

for consumers. Importantly, it says

the plant will provide the exibility

needed to facilitate the integration of

intermittent renewable energy into

the country’s network.

Rautkivi said: “In the next phase

we will start to see the solar-energy

storage packages, where we provide

that block of renewable energy that

can be shifted to the evening or

morning periods.”

With the price of renewables driv-

ing the change, making the case for a

renewables-based system in Africa is

becoming increasingly easier. Raut-

kivi concluded: “If people have to pay

extra for sustainability in developing

countries, it will be a challenge but if

it comes with affordability there is

less resistance against the change;

then we have a winning hand.”

A

s the cost of electricity from

wind and solar in particular

continues to fall, renewables

are being touted as a solution to elec-

trifying the African continent’s many

countries that still have no access to

electricity.

Certainly the use of renewables is

gaining momentum in Africa as those

countries see the possibility of bring-

ing electricity to rural communities

through microgrids based on renew-

able energy, thus avoiding the need to

extend the national grid. It is a trend

that is also one of the drivers behind

the move by several genset compa-

nies to tie-up with energy storage

companies to offer hybrid solutions

for the renewable energy space.

In 2017, Wärtsilä closed its acquisi-

tion of energy storage company,

Greensmith Energy Management

Systems, while engine rental compa-

ny, Aggreko, bought Younicos. More

recently, in a move to expand its posi-

tion in the micro-grid market, Rolls-

Royce acquired a stake in Berlin-

based energy storage start-up Qinous.

Commenting on Africa and the

move towards an electricity system

based on renewables, Qinous co-

founder and Head of Business De-

velopment Busso von Bismarck said:

“I strongly believe Africa will leap-

frog the traditional approach to

electrifying countries through grid

extension, simply because it is much

cheaper do it in a decentralised way...

energy storage alongside solar or

wind – will play a major part in such

a development.”

Established in 2013, Qinous has

developed a standardised package

that is well suited to the needs of

many of the off-grid communities

found in African countries and other

emerging markets, and could also be

used in commercial and industrial

applications. In Africa, the company

is already active in Madagascar,

Tanzania, Kenya and is in talks in

Mali.

“The idea is to offer a turnkey solu-

tion where everything is integrated in

a container, including the micro-grid

management, that can be installed

quickly. This is how we think the is-

sue of micro-grids in remote areas

should be addressed,” said von Bis-

marck. “Our focus is in the 30 kW to

the single digit megawatt power

range, and addressing this market is

only economically viable with stan-

dardised products.”

Rolls-Royce’s investment in Qin-

ous makes sense on several levels but

mostly because it enables a tradi-

tional technology such as reciprocat-

ing engines, which are commonly

found in African countries, to be inte-

grated with renewable-based micro-

grids. Not only does such an approach

bring cleaner electricity, it also lowers

the cost of energy and introduces reli-

ability into the system.

“The genset producers and suppli-

ers have understood that there is no

way to carry on with business as

usual, mainly because solar has be-

come cheaper than anyone could

have ever imagined. We can now

produce solar electricity at around

4-8¢/kWh; diesel [generation] is

around 30+ ¢/kWh,” noted von Bis-

marck. “But you can only integrate

solar into a diesel micro-grid to

around 15 to 20 per cent on an annual

average without energy storage. If

you want to go further, you need to be

able to switch off the genset during

the sunshine hours and allow a 100

per cent solar penetration… but you

need the genset to form a stable grid.

You therefore need another device to

takeover the role of the genset – this

is the energy storage system.”

Matti Rautkivi, Director of Sales &

Marketing at Wärtsilä Energy Solu-

tions, has a similar outlook on the

rationale for renewables and storage

but expanded on how diesel engines

t into the picture. He used Senegal

as a good example of how African

countries can make the transition to

renewables-based electricity sys-

tems through the use of engine-based

technology.

Currently, Senegal’s electricity ac-

cess rate is 64 per cent and there are

1.1 million homes without power.

While 90 per cent of its urban popula-

tion has access to electricity, power

only reaches 44.5 per cent of the rural

community, according to data from

USAID (United States Agency for

International Development).

The country is largely reliant on oil

products such as imported crude for

electricity, yet it is one of only a

handful of places on Earth that has

the resources to produce substantial

amounts of wind and solar power at

the same time. According to the

Ministry for Renewable Energies,

solar irradiation is above 2000 kWh/

m

2

/year for Global Horizontal Irra-

diation and above 1800 kWh/m

2

/

year for Direct Normal Irradiation

for most of the country. There is also

substantial wind energy potential

along the coastal strip between Da-

kar and St. Louis.

Notably, the government has made

power sector development a key

component of its Plan Sénégal Emer-

gent, which aims to make Senegal an

emerging economy by 2025. Priori-

ties include lowering the cost of gen-

eration by reducing dependence on

imported liquid fuels and increasing

electricity access – particularly in ru-

ral areas.

Senegal is one of about 70 power

systems modelled by Wärtsilä to as-

sess the optimal and most economi-

cal generating mix for various

countries. Rautkivi said: “For Sene-

gal, our study looks at what would be

the optimal from 2018 to 2038 and

what should be built – whether it

should be new coal plant, new LNG,

HFO or renewables. All the models

show that Senegal should invest in

signicant amounts of renewable

energy – it should build, easily, up to

80-90 per cent.”

According to Rautkivi, renewables

are already cheaper than the coun-

try’s coal red generation. He

stressed, however, that it is not

purely an issue of cost. The genera-

tion system also has to be capable of

despatching reliable power.

“That’s why we have done this

system-level analysis for Senegal.

You need to provide reliability as

well as the lowest cost of electricity.”

He says that the company’s analysis

shows that incorporating gensets into

the system provides the optimal path

to a 100 per cent renewable system

that is reliable, sustainable and afford-

able. “Building HFO or gas plants

provides the system exibility and

reliability today but also leaves room

for renewables.”

His thinking is that this approach

basically enables a massive increase

in renewables in a way that does not

result in the problems seen in China,

which is increasing renewable ca-

pacity but at the same time is still

building base load coal plant. He

explained: “Coal red generation is

inexible by its nature, so that’s why

they can’t add more renewables into

the system or, if they do, there is the

30 per cent curtailment rate, which

we are already seeing today.

“That’s why we do this modelling

– to nd the most economical way to

get to 100 per cent renewables. And

building exible capacity is key.”

Again looking at Senegal, he says

that the HFO plants that are running

in base load today will change their

operation as more renewables come

on to the system, running less to pro-

vide system exibility in the future.

Rautkivi therefore believes that the

days of adding signicant amounts of

large inexible generation in Africa

are numbered. “Every power system

will have a signicant amount of re-

newables in the future. If only solar is

available, it will take a little bit longer

to get to 100 per cent renewables be-

cause we will have to wait until en-

ergy storage technologies become

cheaper. But even if we only had solar

PV [without storage], we can say that

30 per cent of electricity should come

from solar-only systems.”

There are those that would argue

that fossil fuel systems, engine-based

or otherwise, have no place in a

world that needs to decarbonise as

fast as possible, and countries should

immediately pursue renewables plus

storage and other forms of dispatch-

able renewable energy. Rautkivi not-

ed, however that this would be

THE ENERGY INDUSTRY TIMES - JANUARY 2019

Energy Outlook

14

Micro- and mini-grids

based on renewables

are seen as the route

to electrifying regions

like Africa, where

many people have no

access to electricity.

This thinking

has led several

reciprocating engine

manufacturers to

tie-up with energy

storage providers

aimed at delivering

hybrid solutions for

remote sites and

rural communities.

Junior Isles

Creating a winning hand

While 90 per cent of Senegal’s urban population has access to

electricity, power only reaches 44.5 per cent of the rural community