www.teitimes.com

December 2018 • Volume 11 • No 10 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Approaching a

singularity

A winning

combination

The sustainability tipping point is closer

than you might think.

Page 13

Combined heat and power is

becoming more attractive in the new

energy world. Page 14

News In Brief

UK may have to rethink

“awed” Capacity Market

The UK may be forced to rethink

its approach to securing electricity

supply following a European court

decision to suspend its Capacity

Market.

Page 2

Coal switch helps drop in

GHG emissions

Greenhouse gas emissions in the US

power sector are falling thanks to a

combination of fuel switching and

reduced electricity demand.

Page 4

Australia ramps up

transition to new energy

economy

Australia is now looking to exploit

hydrogen, along with its growing

activities in wind, solar and storage,

as it moves to a cleaner energy

economy.

Page 5

ASEAN steps up energy

cooperation

ASEAN countries recently said they

will step up cooperation and share

resources to ensure energy security.

Page 6

Brexit puts brakes on

investment

The UK’s planned departure from

the European Union in 2019 is

making investors apprehensive about

clean energy investment, according

to EY’s latest Renewable Energy

Country Attractiveness Index.

Page 7

Auctions boost East

European wind markets

New auction schemes for wind

energy in Eastern Europe, Russia

and the Caspian will help to drive

growth in the region’s wind markets.

Page 8

Business sector seeks green

growth backing

The business and industrial sectors

are putting increased pressure on

governments to make climate-

friendly investments more palatable.

Page 9

Technology: Bridging

Egypt’s energy gap

H-class gas turbines make history at

Egypt’s megaproject.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

The expansion of renewables brings major environmental benets but also a new set of

challenges that policy makers need to address quickly, nds the recently launched World

Energy Outlook 2018. Junior Isles

Finance to close energy access gap severely off-track

THE ENERGY INDUSTRY

TIMES

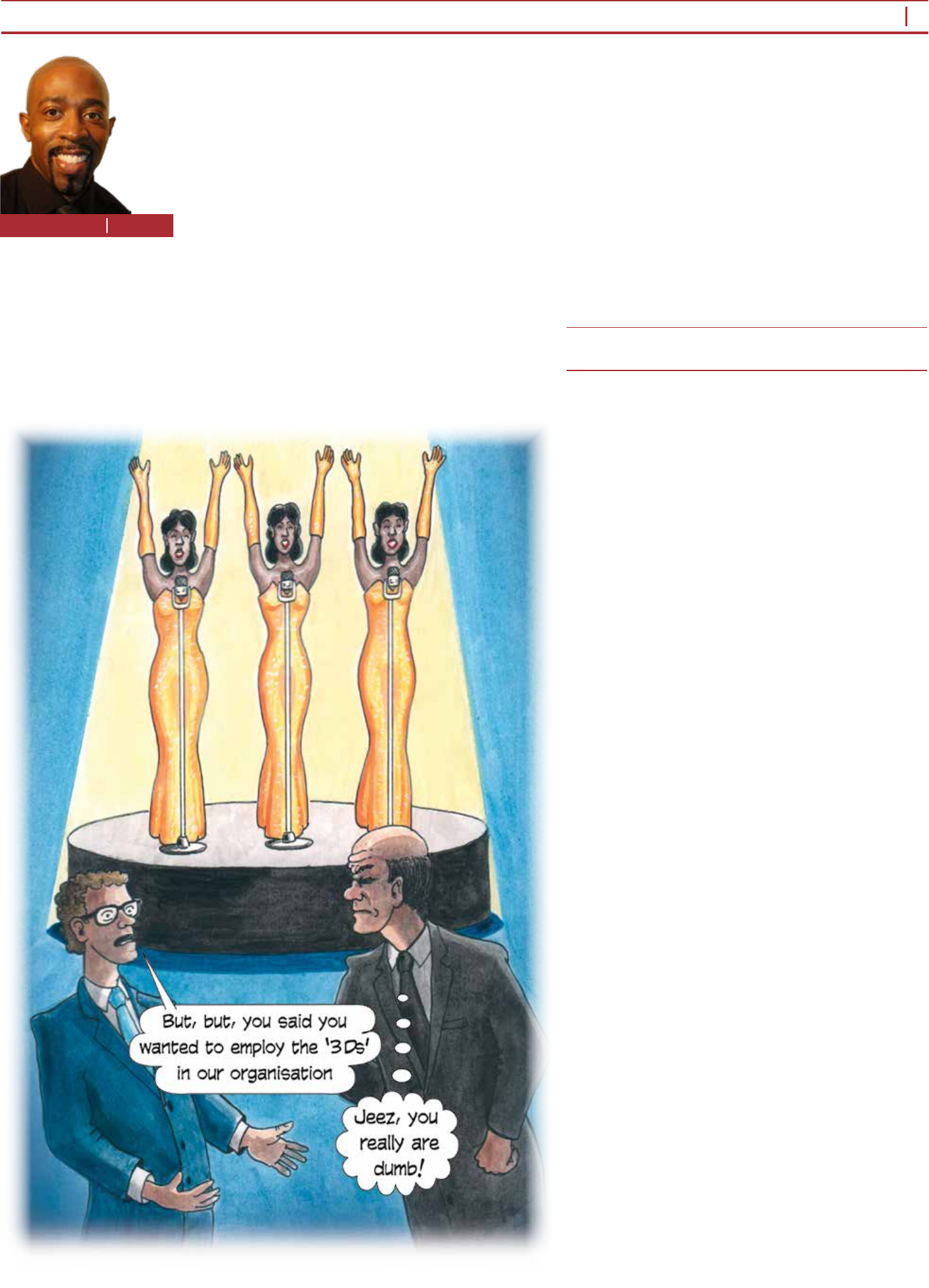

Final Word

Dumb is not part of the

‘3 Ds’, says Junior Isles

Page 16

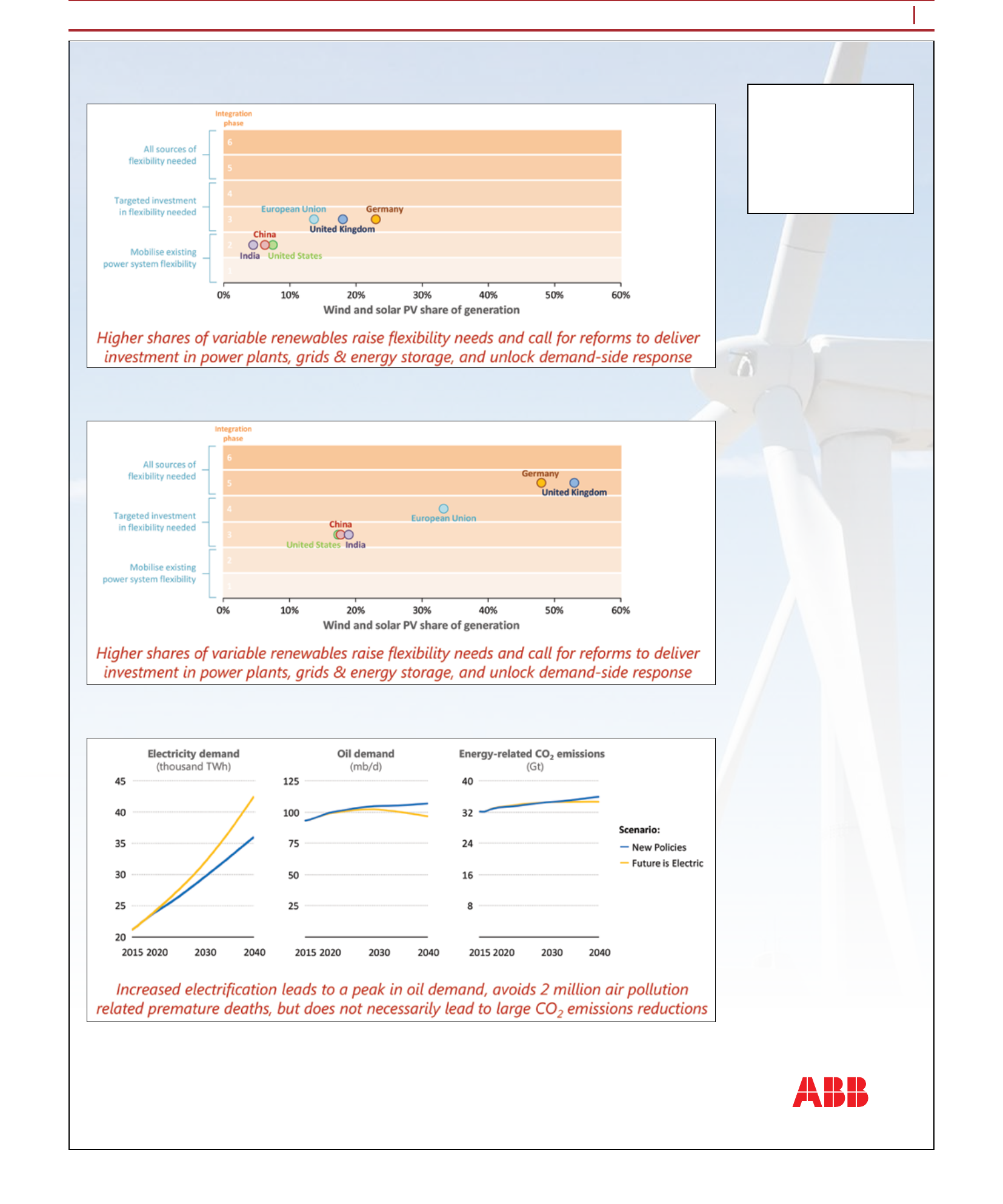

Power systems will need to make ex-

ibility the cornerstone of future elec-

tricity markets in order to keep the

lights on in a system that has higher

variability in supplies. This was one of

the key ndings in this year’s ‘World

Energy Outlook (WEO) 2018’, the

International Energy Agency’s ag-

ship publication.

According to the IEA, the issue is of

growing urgency as countries around

the world are quickly ramping up

their share of solar PV and wind, and

will require market reforms, grid in-

vestments, as well as improving de-

mand-response technologies, such as

smart meters and battery storage

technologies.

With regards to electricity, the report

addresses three key questions: what

will the future power sector look like

as a result of the increasing share of

renewables? What does the future of

the other low carbon sources of elec-

tricity, mainly nuclear, look like? And

thirdly, how much can the economy

be electried?

Laura Cozzi, IEA Chief Energy

Modeller and Head of Division for

Energy Demand Outlook said there

“is no doubt variable renewables in-

crease, and increase a lot. We are ex-

pecting electricity to grow twice as

much as energy demand, with vari-

able renewables such as wind and

solar growing four times faster than

electricity.”

The IEA says that renewables have

“become the technology of choice” in

power markets, making up almost

two-thirds of global capacity addi-

tions to 2040, thanks to falling costs

and supportive government policies.

This is transforming the global power

mix, with the share of renewables in

generation rising to over 40 per cent

by 2040, from 25 per cent today.

Cozzi commented: “This means that

more than ever, we will be asking the

electricity system to operate in a very

different way. The system will have to

move up and down to match supply

and demand at all times; four times

more than we are asking today.

“There are several [exibility] op-

tions that we need to unlock. At low

levels of wind and solar penetration,

like in the US, China and India, where

wind and solar is less than 10 per cent

of the generation mix, using current

system exibility is enough. This

means adapting the operation of coal

and gas plants. Other countries with a

higher share of variable renewables,

such as Germany and the UK, have

already had to make some targeted

investment to unlock more exibility.

For example, extending grids and

making the grid smarter. Going for-

ward, all countries will need to unlock

more exibility. This means markets

will on the one hand need to provide

electricity, and on the other hand value

exibility more, to ensure investments

Continued on Page 2

Finance required to close the electric-

ity gap remains seriously short of what

is needed to meet global energy goals

by 2030, according to a new global

report released by the UN’s Sustain-

able Energy for All.

The ‘Energizing Finance: Under-

standing the Landscape 2018’ report

analyses nance ows for electricity

and clean cooking access in countries

across Africa and Asia with the most

signicant access gaps. The report re-

veals alarming developments in sev-

eral key areas of energy access nance

that require urgent action to keep Sus-

tainable Development Goal (SDG) 7

– affordable, reliable, sustainable and

modern energy for all – within reach.

Research shows annual investment

of $52 billion is needed to meet uni-

versal electrication, yet nance

commitments for electricity in the 20

‘high-impact’ countries – which

represent 76 per cent of those without

electricity access – have barely in-

creased, averaging just $30.2 billion

annually.

Of serious concern, nance for coal

red generation is increasing, at a

time when the International Panel on

Climate Change is issuing stark warn-

ings about stalling progress on the

Paris Agreement targets. In the coun-

tries tracked, annual commitments for

coal plants almost tripled, growing

from $2.8 billion to $6.8 billion.

“The good news is that renewables

offer us a powerful opportunity to

provide reliable and affordable clean

electricity both through the grid and

off-grid”, said, Rachel Kyte, CEO and

Special Representative of the UN

Secretary-General for Sustainable

Energy for All.

“The bad news is that we are not yet

seeing a strong enough project pipe-

line or sufcient levels of public in-

vestment that will crowd in private

nance to seize this moment of falling

prices for revolutionary technology.

Even more worrying is that at the

same time we’re seeing incremental

increase in funding for renewable en-

ergy, investments in coal increased.”

The ‘Energizing Finance’ research,

conducted in partnership with Cli-

mate Policy Initiative, enables nance

institutions and policy-makers to de-

velop and implement strategies that

can be scaled and rened to reach

more people, more affordably, with

clean and sustainable energy.

Of the 20 countries surveyed, 15 are

in sub-Saharan Africa but worryingly,

the report revealed that only 17 per

cent ($5 billion annually) of the total

electricity nance tracked was allo-

cated to the region – down 32 per cent

from the last report.

Dr. Barbara Buchner, Executive Di-

rector, Climate Policy Initiative said:

“Regions with the highest needs, like

sub-Saharan Africa, are getting the

smallest share, while we’re seeing big

gaps for some of the technologies

with the most promise, like off-grid

renewable energy. This should be a

wake-up call to policy makers and in-

vestors who are working to ensure

universal and sustainable energy.”

She added: “The main thing is the

policy gap and framework to give in-

vestors certainty, and having the risks

that are specic to these countries

covered. We have been looking at

some new risk mitigation instruments

that really could help bring in more

private sector [nance] into some of

these countries… for example, instru-

ments that keep currency risks from

being a big barrier to investors in

some off-grid solutions.”

Flexibility must be

“cornerstone” of

future electricity

markets, says IEA

Cozzi is expecting electricity to grow twice

as much as energy demand

THE ENERGY INDUSTRY TIMES - DECEMBER 2018

3

9 – 10 December 2018 | Katowice, Poland

Where policy-makers and climate technology innovators

meet on the sidelines of COP

Key streams for 2018:

Hear from

80+

High-level

speakers

Network with

600+

senior decision &

policy makers

Headline Partner

With COP24 being hailed by the UNFCCC as ‘Paris 2.0’, the Sustainable

Innovation Forum presents a crucial opportunity to drive forward the Paris

Agreement framework by bringing together government, private sector

sustainability solution providers, responsible investors and development banks.

Energy

Transition

Sustainable

Mobility

Circular

Economy

Climate

Finance

Use code

EnergyIndustryTimes

to get

10% o

Find out more: cop-24.org

EUBCE 2019

27

th

European Biomass

Conference & Exhibition

27 - 30 MAY 2019 | LISBON - PORTUGAL

The largest gathering

of biomass experts

www.eubce.com

#EUBCE

E-WORLD

INNOVATION AREA

E-WORLD ENERGY & WATER, 5

TH

– 7

TH

FEBRUARY 2019, ESSEN

DISCOVER THE ENERGY

WORLD OF TOMORROW

START-UPS

|

SPEEDDATING

|

SCIENCE

|

CAREER

www.e-world-essen.com

www.terrapinn.com/solarmena/book

Investment, technology

and development for the solar

and wind energy sector

THE ENERGY INDUSTRY TIMES - DECEMBER 2018

5

Asia News

Australia, a country well known for its

dependence on coal, appears to be ac-

celerating efforts to move towards a

clean energy economy.

Last month in a signicant move,

the world’s biggest coal exporter and

second largest liqueed natural gas

(LNG) exporter, said it wants to build

its next big energy industry around

exploiting solar and wind power along

with brown coal to produce hydrogen.

Australia is seeking to supply what

could be a $7 billion market for hydro-

gen to China, Japan, South Korea and

Singapore by 2030, according to a re-

port carried out by consultants ACIL

Allen for the Australian Renewable

Energy Agency.

“Many of our traditional gas markets

– Japan, South Korea – have adopted

strategies that put hydrogen and ulti-

mately renewable hydrogen at the core

of their energy future. So we want to

make sure we’ve got the capability

of providing for that market,” said

Western Australia’s Regional Develop-

ment Minister Alannah MacTiernan.

While initially just a fraction of Aus-

tralia’s LNG exports, which are fore-

cast at A$48 billion ($35 billion) in

2019, hydrogen exports could grow

the same way that Australia’s LNG

industry has over the past 30 years,

according to ACIL Allen, the Austra-

lian government, and local gas pro-

ducer Woodside Petroleum.

“The development of a hydrogen

business is similar to the early days of

the LNG business,” said Shaun Greg-

ory, Woodside’s Executive Vice Presi-

dent for exploration and technology.

Output may start through the gasica-

tion of brown coal with the hydrogen

and carbon dioxide separated out. Cur-

rently, hydrogen derived from coal

gasication is cheaper to produce than

from electrolysis of water using elec-

tricity from wind and solar.

The goal is to drive down the costs

of a hydrogen cargo by 2030 to a level

that Japanese buyers would accept,

said Australia’s Chief Scientist Alan

Finkel. This will happen as the cost of

electrolysers fall, along with the con-

tinuing reduction of wind and solar

power, which is becoming increas-

ingly popular.

Solar plus storage, in particular has

been gaining traction, especially in

southern Australia.

Last month, it was announced that

the 25 MW/50 MWh Gannawarra En-

ergy Storage System (GESS) in the

state of Victoria has completed con-

struction and began exporting electric-

ity to the grid. The project is claimed

to be the largest integrated solar plus

battery facility in Australia and is

among the largest in the world.

Notably it is believed to be the rst

time a utility-scale battery system has

been retrotted to an existing solar

project, the Gannawarra solar farm,

providing a new commercial model

for other renewable and storage

facilities in Australia. The project was

developed by a consortium compris-

ing Australian renewable energy and

storage company, Edify Energy, Tesla

and EnergyAustralia and co-nanced

by Wirsol Energy.

Also in Victoria, in November UK

battery storage specialist redT began

operation of a hybrid facility that com-

bines a vanadium redox ow battery

with a lithium-ion battery at Monash

University’s campus in Melbourne.

The 1 MWh installation is claimed to

be the largest behind-the-meter C&I

(commercial & industrial) energy stor-

age facility in Australia.

Elsewhere, international infrastruc-

ture investor John Laing Group closed

nancing on its 174.9 MW Finley solar

farm in New South Wales, which is

being developed by Esco Pacic. The

project is expected to be complete in

late 2019.

At the same time as integrating en-

ergy storage, Australia is also looking

at transforming its grid to handle the

challenge presented by the intermit-

tency of wind and solar.

Last month NSW presented its Trans-

mission Infrastructure Strategy as it

seeks to prepare the grid for gigawatts

of new capacity. The strategy envis-

ages: increased interconnection capac-

ity with Victoria, South Australia and

Queensland; an expansion of the

Snowy Hydro Scheme; more afford-

able energy through a focus on spe-

cic energy zones; and streamlined

regulation and improved conditions for

investment.

“There are A$27 billion of new en-

ergy projects in the NSW pipeline but

only 1 in every 20 projects can connect

– it’s time to change that,” said the

state’s Energy Minister Don Harwin.

These projects, the combined capac-

ity of which is over 20 GW, include

wind, solar, bioenergy, gas, coal plant

upgrades and pumped hydroelectric

storage.

Australia ramps up

transition to new energy

economy

Australia is now looking to exploit hydrogen, along with its growing activities in wind, solar and storage, as it moves to a

cleaner energy economy. Syed Ali

India’s National Thermal Power Com-

pany (NTPC) is planning to start bio-

mass co-ring across all its coal-based

thermal power stations in an effort to

reduce greenhouse gas emissions and

cut pollution.

The aim is to co-re surplus agricul-

tural residue, creating an alternate

market for its large-scale utilisation in

power plants, while reducing carbon

emissions from coal power plants.

NTPC is aiming to burn biomass like

scrap lumber, forest debris, crop resi-

dues, manure and some types of waste

residues along with coal to generate

electricity. The company will soon

start procurement of biomass pellets

and torreed biomass pellets and bri-

quettes for co-ring across all its coal

red power plants and will soon oat

a tender.

Harminder Singh, Power Analyst at

data and analytics company Global-

Data, commented: “NTPC’s decision

to implement biomass-based co-ring

at all its power stations is a bold move

that will help in curtailing air pollution.

This follows the policy announced by

the Ministry of Power in 2017, regard-

ing biomass utilisation for power gen-

eration through co-ring in pulverised

coal red boilers. NTPC has already

successfully used a 7 per cent blend of

biomass for co-ring at its Dadri pow-

er plant.”

He added: “With India’s cities expe-

riencing signicant levels of smog in

the winter months, it makes a lot of

sense to co-re this biomass along with

coal in the coal red power plants. On

one hand, it will reduce the emissions

from these power plants, and on the

other, reduce the coal requirements of

these plants, easing the pressure on

coal sourcing.”

According to GlobalData, NTPC has

a total coal-based capacity of more than

40 GW and assuming all its power sta-

tions use 7 per cent biomass blend, the

company itself can utilise 10-12 mil-

lion tonnes of biomass, which is around

one-third of the residue burnt.

NTPC eyes biomass

co-ring at Indian

coal plants

ASEAN countries recently said they

will step up cooperation and share

resources to ensure energy security

through expanding power grid con-

nectivity and developing renewable

energies.

Ministers and deputy ministers in

charge of energy of the ten member

states of the Association of the South-

east Asian Nations (ASEAN) made

the commitment at the 36th ASEAN

Ministers on Energy Meeting

(AMEM) and associated meetings

held in Singapore in late October.

Speaking at the event, Singaporean

Minister for Trade and Industry Chan

Chun Sing said investments in power

generation capacity and infrastructure

will be needed to meet ASEAN energy

demand, which has grown by 60 per

cent over the past 15 years.

Chan stated that in addition to efforts

by each nation, cooperation within

ASEAN and between the grouping

and dialogue partners and interna-

tional organisations like the Interna-

tional Energy Agency (IEA) and the

International Renewable Energy

Agency (IRENA) in energy invest-

ment and infrastructure nance will

support the region’s increasing energy

demand and make ASEAN more at-

tractive to investors.

At the meeting, member countries

agreed to increase grid connectivity to

double integration capacity from the

current 5200 MW to 10 800 MW in

2020 and 16 000 MW after that year.

Phase 1 of the Laos-Thailand-Malay-

sia-Singapore Power Integration Proj-

ect, the rst multilateral power agree-

ment, started in January this year and

has so far hit 15.97 GWh.

ASEAN nations signed a memoran-

dum of understanding (MoU) with

IRENA on renewable energy develop-

ment and approved an action pro-

gramme to realise this MoU, with a

view to supporting ASEAN in achiev-

ing the target of increasing the renew-

able energy share to 23 per cent by

2030. Renewables have now reached

12.4 per cent in the region’s total en-

ergy mix. They also recognised “out-

standing results” in energy cooperation

such as reducing the region’s energy

intensity in 2016 by 21.9 per cent

compared to 2005 levels, ahead of the

targets of 20 per cent in 2020 and 30

per cent in 2030.

6

THE ENERGY INDUSTRY TIMES - DECEMBER 2018

Asia News

ASEAN steps up energy

cooperation

ASEAN member countries commit to greater grid connectivity and developing renewables.

Manilla cityscape

ABB announced that it is taking a key

role in the world’s rst HVDC grid in

China and also launched a new Tech-

nology Experience Center that will

help demonstrate its solutions for

transmission and distribution infra-

structure.

The Zhangbei high-voltage direct

current (HVDC) grid in the Beijing-

Tianjin-Hebei area of China will en-

able the integration of remote wind,

solar and hydro energy in a transmis-

sion ring that ensures optimisation of

power ow.

The unique HVDC grid is designed

by State Grid Corporation of China

(SGCC). ABB will supply several

critical elements including an HVDC

Light valve, wall bushings, trans-

former components, high-voltage

capacitors and power semiconductor

devices.

HVDC is a highly efcient technol-

ogy for transmitting large amounts of

electricity over long distances with

minimal losses. Traditionally, they are

point-to-point links, but the Zhangbei

pilot project is unique because several

stations are connected with each other

in a network, optimising the use of

renewables while ensuring reliability

of power supply.

ABB, along with other local suppli-

ers, is supplying key equipment for

this milestone project, which will be

the world’s largest and most ad-

vanced Voltage Sourced Converter

(VSC) HVDC system with four inter-

connected stations in a ring network,

delivering up to 4500 MW of clean

energy.

The company also announced that it

has ofcially opened the ABB Tech-

nology Experience Center in the north

building of ABB Xiamen Hub, Fujian

province.

The centre, which represents an in-

vestment of around $300 million, will

South Korea has introduced a cap on

the operation of some coal and oil red

power plants at 80 per cent for the rst

time, as most cities including its capi-

tal Seoul issued an air pollution advi-

sory, its energy ministry said.

The measure kicks in when an air

pollution advisory is issued and the

concentration of ne particulate matter

with diameters of less than 2.5 mi-

crometres (PM 2.5) is expected to ex-

ceed 50 micrograms per cubic metre

until the following day.

Seven coal red power plants with a

total capacity of 820 MW and four oil

red power plants with a combined

capacity of 280 MW lowered their op-

erations from 6 a.m. (21:00 GMT) to

9 p.m. on November 7th.

The government has introduced the

cap on a trial basis and plans to fully

introduce it from 2019, according to a

ministry statement.

South Korea, Asia’s fourth largest

economy, has been grappling with

worsening air quality. The government

halted operations of ve old coal red

power plants from March to June to

reduce air pollution.

Coal power generates about 40 per

cent of the country’s total electricity,

followed by nuclear and gas. Last year,

South Korea unveiled its power supply

plan, with an aim to boost the share of

renewable energy for power genera-

tion to 20 per cent by 2030, while scal-

ing back dependence on coal.

More recently, the government

signed an agreement with Denmark to

deepen their ties on renewable energy

and new energy industries. At the end

of October the two countries said they

would be expanding joint projects,

overseas marketing and technology

development in the renewable energy,

smart grid and energy storage system

areas.

Also at the end of October, President

Moon Jae-in announced a massive

clean energy complex that will be built

on reclaimed land in Saemangeum

near the southwestern port city of Gun-

san. The clean energy complex will

have a total capacity of 3 GW. This

includes a 1 GW offshore wind farm

that will be built in waters outside a 33

km seawall at the site. “The world’s

largest solar power complex and a

large-scale offshore wind farm will be

built at Saemangeum,” Moon said.

The import of coal for electricity gen-

eration looks set to increase in the near

future, said Deputy General Director

of Electricity Vietnam (EVN) Ngô Sơn

Hải.

Hải told the Coaltrans conference on

emerging Asian coal markets in Hanoi

in November that the total power ca-

pacity by the end of 2017 was more

than 45 000 MW, 38 per cent of which

was coal red power generation.

He also said total coal red power

capacity would reach 26 000MW by

2020, accounting for 42.7 per cent of

the total and 55 300MW by 2030, or

42.6 per cent.

According to the National Power

Master Plan VII for 2011 to 2020 with

a vision to 2030, coal red power

would comprise a big portion in the

country’s power supply.

ABB pioneers electricity infrastructure

technology in China

South Korea caps operations

of coal, oil power plants

Vietnam still hooked on coal

give customers the opportunity to ex-

perience rst-hand ABB’s pioneering

technologies, from substation to sock-

et through the ABB Ability platform

of digital solutions.

Among the exhibits at the centre are

demonstrations of ABB’s cloud ser-

vices and remote factory testing capa-

bilities. There is also a smart lab and

a segment sand table, which simulates

electricity ows.

The smart lab, which is at the heart

of the centre, enables customers to

observe the performance of ABB prod-

ucts and solutions for industry, utilities

and infrastructure under a range of

operational conditions. The technolo-

gies available for customer demon-

strations include ABB’s solutions in

micro-grids, digital substations and

distribution automation, industrial

power supplies, transport, buildings

and industrial automation.

n China has terminated the levy of

anti-dumping and countervailing du-

ties on solar grade polysilicon origi-

nating from the European Union. The

duties were in place since May 2014.

The move comes in response to the

EU lifting anti-dumping and anti-

subsidy measures against Chinese

solar panels in September.

THE ENERGY INDUSTRY TIMES - DECEMBER 2018

9

Companies News

Siân Crampsie

The business and industrial sectors

are putting increased pressure on gov-

ernments to make investments in

climate-friendly tehnolologies more

palatable.

Last month, over 100 organisations

called on European governments to

make renewable energy investments

easier, while RE100 said that some

155 multinational companies are now

signed up to its pledge to source 100

per cent of energy needs from renew-

able sources.

According to the RE-Source Plat-

form, a European alliance represent-

ing clean energy buying, corporate

renewable power purchase agree-

ments (PPAs) worth 6 GW have al-

ready been signed in Europe, includ-

ing 2 GW in 2018 alone. RE-Source

wants policymakers to remove all

regulatory and administrative barri-

ers to corporate sourcing of renew-

able energy to enable more corporates

to invest directly in renewable energy

and establish PPAs.

“We call on governments to set the

right policies to full our ambition to

live within the limits of the planet,”

said Pia Heidenmark Cook, CSO of

IKEA Group, which has set an ambi-

tion to be climate positive by 2030.

RE-Source said that its declaration

would send “a strong signal” to poli-

cymakers in Europe. Its members

include Microsoft, Google and IKEA.

“As the world's largest corporate

buyer of renewable energy, we are

dedicated to doing our part to scale

renewables in Europe,” said Marc

Oman, Senior Energy Lead from

Google. “Expansion of corporate

PPAs can be a major driver in Eu-

rope’s renewable energy transition.”

According to a new report published

by RE100, its member companies

sourced 72 TWh of renewable power

in 2017, an increase of 41 per cent

compared with the preceding year. “If

RE100 were a country, it would be

the 23rd largest in terms of electricity

use, ahead of Egypt and just behind

Thailand,” stated the report.

The report states that 37 out of

RE100’s member companies sourced

over 95 per cent of their electricity

from renewables in 2017, and almost

half of the members achieved more

than 50 per cent. This is not only ahead

of the global average of 26.5 per cent,

but also ahead of leading countries

such as Spain (33.7 per cent) or the

United Kingdom (26 per cent).

The average target year for RE100

members to become 100 per cent re-

newable is 2026, and more than three

in four companies aim to get there by

2030.

The private sector power usage ac-

counted for two-thirds of the world’s

electricity demand last year, the report

notes. RE100 members have a total

combined revenue of more than $4.5

trillion which is over 5 per cent of

global GDP.

In November the Energy Transitions

Commission (ETC), a group of busi-

ness leaders tasked with seeking solu-

tions to sustainable economic growth,

said that although cutting emissions

will impact GDP, they would be out-

weighed by the benets of avoiding

climate change.

The ETC believes that curbing emis-

sions will help some companies to

become more competitive. They will

require the support of government

policies, however.

A deal to combine two leading US bat-

tery manufacturing rms will create

one of the world’s largest energy stor-

age providers, the companies say.

Charlesbank Capital Partners says

that it has reached a deal with KPS

Capital Partners to sell its Trojan Bat-

tery Company, a leading manufacturer

of deep-cycle energy storage solutions.

The deal will see Trojan combined

with C&D Technologies, a subsidiary

of KPS and a manufacturer and sup-

plier of battery systems for a wide

variety of applications. Combined, the

two companies will have over $1 bil-

lion in revenues, eight manufacturing

facilities and a presence in every major

region around the world.

Trojan CEO Neil Thomas said that

the deal would “secure the company’s

future and position it for even greater

success”.

Thomas added: “The synergies be-

tween Trojan and C&D will create a

global leader in energy storage solu-

tions with two iconic brands, quality

products and the ability to supply ad-

vanced battery technologies to cus-

tomers around the world”.

“Given C&D and Trojan’s comple-

mentary portfolios of global manufac-

turing plants, markets and products,

this is a highly compelling combina-

tion with tremendous strategic value

and an exciting multi-segment growth

opportunity,” said Armand Lauzon,

Chief Executive Ofcer of C&D.

n Advent closes purchase of GE unit

n GE sets up further asset sales

Off-grid communities look set to ben-

et from a new partnership between

decentralised grid technology com-

pany ME SOLshare and Alpha En-

ergy, part of the Alpha innovation

facility established by Spanish multi-

national telecoms giant Telefónica.

The collaboration will see the com-

panies work to better understand how

data can be used to evolve peer-to-peer

microgrids, with the ultimate goal of

delivering clean and reliable power to

the next billion people.

ME SOLshare is looking to expand

its microgrid technology – the SOL-

box IoT meter – that enables commu-

nities to share and monetise energy.

The SOLbox IoT meter, which allows

peer-to-peer electricity trading be-

tween off-grid households, is already

connected to solar panels in Bangla-

desh. Alpha Energy, meanwhile, says

its mix of power systems engineering

and AI data analytics capabilities will

enable the companies to work to en-

hance the efciency of low voltage,

peer-to-peer microgrids.

Dr. Sebastian Groh, Managing Di-

rector of ME SOLshare, said: “Having

already established the world’s rst

peer-to-peer solar energy platform for

off-grid households in Bangladesh,

we want to take our SOLboxes to com-

munities all over the world.

“The aim is to create efcient and

dynamic local energy markets that

empower households and encourage

solar entrepreneurism. We see this

partnership with Telefónica’s Alpha

Energy team as a crucial step towards

creating a viable alternative to inef-

cient national grids that frequently

fail to serve populations.”

Alpha Energy, meanwhile, sees

great potential in analysing actual user

data from off-grid distribution sys-

tems as a means of validating technol-

ogy development and gaining insights

from user behaviour. This will allow

the development of products and tech-

nologies that are more exible to the

needs of communities not connected

to reliable grid systems.

Headed by former NaturEner COO

Candace Saffery Neufeld, Alpha En-

ergy was established to explore new

business opportunities for Telefónica

within the experimental energy sector.

She said: “At Alpha Energy we see

decentralised distribution systems as

an exciting space that can be evolved

through innovative controls and stor-

age, applied intelligence and better

understanding of user behaviour. Our

partnership with ME SOLshare is fo-

cused on enhancing our shared under-

standing of these systems that they

have started to implement across Ban-

gladesh. Ultimately, our aim is to pro-

vide clean and reliable power to bil-

lions of people around the world.”

Alpha Energy says that Bangladesh,

with more than 4 million homes with

standalone solar systems, is a unique

market in that “it has some of the key

ingredients” that it needs to work on

for peer-to-peer microgrids.

“We see some really big technology

opportunities in emerging markets and

having a place that already has a pen-

etration of standalone solar systems,

gives us a place to test quicker,” said

Saffery Neufeld.

While Alpha Energy says it does not

have a particular market focus, it is

looking for representative markets.

“We have found that about 2.7 billion

people have less than six hours of reli-

able electricity per day. So from that

perspective, the market is huge.”

Distributed power company Innio says

it is well-positioned to play a key role

in the global gas engine sector and to

become an integral part of the energy

transformation after completing its

spin-off from GE.

The company last month re-launched

after Advent International completed

the $3.25 billion purchase of GE’s dis-

tributed power business and says that

its two main brands – Waukesha and

Jenbacher – give it a proven track re-

cord in reciprocating engines in the

distributed power generation and gas

compression businesses.

According to Advent, Innio is well-

positioned in the $5 billion global gas

engine sector, with growth anticipated

to be a mid to high single-digit rate per

annum, driven by the rising demand

for affordable, reliable and sustainable

solutions for power generation and gas

compression near or at the point of use.

“This is an exciting time to emerge

as a stand-alone energy company,” said

Carlos Lange, President and CEO of

Innio. “With the continued growth of

renewables across the globe and the

increased emphasis on energy ef-

ciency, Innio is well-positioned to be

a key enabler and integral part of the

energy transformation.”

Advent inked the purchase of GE’s

distributed power business in June

2018. GE has also announced plans to

sell its lighting systems company Cur-

rent as part of its plans to raise cash

and reduce debt.

Current is being purchased by Amer-

ican Industrial Partners, a private eq-

uity group, for an undisclosed price.

GE set a target of making $20 billion

of divestments after carrying out a

comprehensive business strategy re-

view earlier this year in response to

poor performance in several of its in-

dustrial business units, including pow-

er generation.

It has also sold its industrial solutions

business to ABB and its healthcare

software unit to Veritas Capital.

Alpha Energy, ME SOLshare partnership targets off-grid communities

GE engine business

relaunched as Innio

Trojan deal combines

battery brands

The business and industrial sectors can play a major part in combatting climate change, but only with strong

government support, leaders say.

Business sector seeks

green growth backing

from governments

Lauzon: "... this is a highly

compelling combination..."

This section is supported by ABB

Source: Launch presentation of World Energy Outlook 2018 © IEA/OECD 2018

THE ENERGY INDUSTRY TIMES - DECEMBER 2018

11

Energy Industry Data

For more information, please contact:

International Energy Agency

9, rue de la Fédération

75739 Paris Cedex 15

France.

Email: bookshop@iea.org

website: www.iea.org

Phases of integration with variable renewables share, 2017

Phases of integration with variable renewables share, 2017

What if the future is electric?

THE ENERGY INDUSTRY TIMES - DECEMBER 2018

15

Technology

Since achieving what was at the time a new world record in combined cycle plant efciency at the Irsching plant in

Germany, Siemens has set numerous benchmarks with its H-class gas turbine. Junior Isles recently visited the

Beni Suef power plant in Egypt to witness what is another milestone in the technology’s deployment.

I

n 2014, Egypt was suffering from

a chronic energy decit, with a

huge gap between generation and

demand – in the region of 5 GW.

When things came to a head follow-

ing an almost total blackout, the gov-

ernment accelerated the construction

of the 650 MW Attaqa gas red

combined cycle plant. Encouraged

by the success of this accelerated

project, in 2015 the government took

an even bolder decision – to sign an

agreement to develop what became

known as the ‘Megaproject’.

The plan would see Siemens and

its local partners, Orascom Con-

struction and Elsewedy Electric,

build three huge 4.8 GW combined

cycle gas turbine (CCGT) plants at

Beni Suef, Burullus and New Capital

for Egypt Electricity Holding Com-

pany. As part of the megaproject,

Siemens will also deliver 12 wind

parks with up to 600 wind turbines

and a capacity of 2 GW. At a com-

bined cost of €8 billion – with the

three CCGT plants accounting for

€6 billion of that total – the 16.4 GW

megaproject represents the biggest

ever order in Siemens’ history.

But it is the three CCGT plants that

are the most impressive aspect of the

megaproject: the plants are the big-

gest of their kind in the world; utilise

advanced H-class gas turbine tech-

nology and were built in record time.

Gas for the projects will come

from the Zohr gas eld discovered in

2015. Some 1 billion ft

3

(bcf) of gas

from the eld is expected to come on

stream by the end of this year and

produce 2.7 bcf/day by the end of

2019. The Zohr eld will certainly

provide a cheap source of gas for the

three massive combined cycle

plants, which will be the most ef-

cient in the country.

Beni Suef, Burullus and New Capi-

tal all have an almost identical de-

sign, with the exception of plant

cooling. While Beni Suef and Burul-

lus both use wet cooling, New Capi-

tal, due to its desert location, uses

air-cooled condensers. These con-

densers are the rst of their kind in

Egypt and are claimed to be the larg-

est in the world.

Each of the three plants comprises

four 1200 MW combined cycle

blocks in a 2-on-1 conguration, i.e.

two SGT5-8000H gas turbines, each

with its own generator and heat re-

covery steam generator (HRSG),

with steam from the HRSGs feeding

a single steam turbine with its own

generator. This means there is a total

of 24 gas turbines, 24 HRSGs, 12

steam turbines and 36 generators.

Each plant will have an electrical

efciency of over 61 per cent, which

will ensure best possible plant eco-

nomics. The more than 61 per cent

efciency of the CCGT blocks is

signicantly higher than the electric-

ity system average and is expected to

save around $1.3 billion per year in

natural gas. High efciency also en-

sures low emissions. At base load,

guaranteed values for NOx and CO

emissions are 25 ppm and 80 ppm,

respectively.

The high efciency of the com-

bined cycle blocks can be largely at-

tributed to the H-class advanced gas

turbines, which form the heart of the

power blocks.

The SGT5-8000H is a single-shaft

machine of single-casing design. It

is one of the world’s most powerful

gas turbines in commercial opera-

tion, designed to deliver about 400

MW in simple cycle operation and

over 600 MW in combined cycle

operation.

In combined cycle mode, exhaust

gas from the gas turbine, at a tem-

perature of about 630°C, is fed to a

three-pressure HRSG. The HRSG is

a Benson-type boiler also supplied

by Siemens.

The HRSG supplies 107 kg/s of

high pressure (HP) steam at 589 °C

and pressure of 178 bar[g]; 122 kg/s

of reheat steam (RH) at 585°C/34.5

bar[g] and 11 kg/s of low pressure

(LP) steam at 247 °C/4 bar[g].

Steam from the HRSG is combined

with expanded RH steam so total

ow to the steam turbine is 133 kg/s.

Steam from the HRSG is fed to a

400 MW steam turbine that features

a HP section and a combined inter-

mediate pressure/low pressure (IP/

LP) section.

Construction of the plants was a

huge task. A single combined cycle

power plant block with a capacity of

1200 MW typically takes approxi-

mately 30 months. For the Egypt

megaproject, Siemens built 12 of

these blocks in parallel in record

time and connected them to the grid

– 14.4 GW in just 27.5 months.

This called for close collaboration

between Siemens and its partners

from the beginning. Although Sie-

mens had the largest share (62 per

cent) of the contract and was consor-

tium leader, it was paramount that

the companies worked seamlessly.

While Siemens had total responsi-

bility for the manufacture, delivery,

installation of equipment and com-

missioning of the plants, the tremen-

dous work and effort of managing

civil works and construction was

down to the local partners.

Orascom Construction and

Elsewedy Electric were therefore re-

sponsible for all site preparation

work – Orascom for Burullus and

New Capital, and Elsewedy for Beni

Suef. This meant the companies

were in charge of tasks such as fenc-

ing, site levelling and piling where

necessary; and subsequent civil

works, which included concreting,

steel erection and construction.

Coordinating the construction,

manufacture, delivery and installa-

tion of all the equipment for the

three projects was no small task. Ac-

cording to Siemens, managing the

whole process was a huge logistical

challenge from start to nish. Some

400 000 freight tons were imported

to the sites from all over the world,

with 7000 containers being delivered

to each site.

To achieve the record-breaking

schedule – which saw connection of

the rst 4.8 GW to the Egyptian grid

in 18 months – work had to start be-

fore the ofcial contract signing, i.e.

during the last phase of negotiations,

which was a very short phase.

Once the contract for the 24 gas

turbines was conrmed, notice was

given to the Berlin factory that it

would have to work around the clock

to meet the delivery schedules.

With each gas turbine and steam

turbine having its own generator, the

delivery of 36 generators meant Sie-

mens had to call on both its genera-

tor factories in Muelheim, Germany,

and Charlotte in the US. Twenty of

the generators were manufactured in

Muelheim and 16 were manufac-

tured at the Charlotte factory. At the

same time, Siemens had to manufac-

ture the 24 HRSGs.

All of this work and planning cul-

minated in achieving the milestone

of rst power to the grid in January

2017. The total 14.4 GW was con-

nected to the grid in June the follow-

ing year, fullling the promise that

Siemens made to the Egyptian gov-

ernment back in 2015.

With Beni Suef fully handed over

to the customer in September, Burul-

lus was scheduled to complete ac-

ceptance tests and handover in No-

vember. New Capital is scheduled

for full hand over in December.

Forecasts show the megaproject

will provide enough power to meet

demand up until 2022/23. Emad

Ghaly, CEO, Siemens Egypt noted:

“With the commissioning of the

14.4 GW, Egypt’s electricity chal-

lenges will be solved for the fore-

seeable future.”

Summing up his feelings on the

project during the press visit to

Beni Suef, Karim Amin, CEO

Global Sales, Power and Gas, Sie-

mens, said: “The project really is a

dream come true, not only for the

[power] industry but also for the

people around this area – the shops

that are growing and the economy

that is developing.”

H-class technology bridges

Egypt’s energy gap

H-class advanced gas

turbines form the heart of the

power blocks

The 4800 MW Beni Suef power plant is

part of Egypt’s massive megaproject

completed in just 27.5 months

THE ENERGY INDUSTRY TIMES - DECEMBER 2018

16

Final Word

T

he three Ds – Decarbonisation,

Digitalisation and Decentrali-

sation – is one of those popular

catch phrases in today’s power and

energy sector. Certainly the decar-

bonisation trend is irreversible, con-

tinued digitalisation is highly likely

and the pace of decentralisation is

accelerating.

It is generally believed that the three

Ds are creating a fourth D: disruption

– at least to utilities in Europe. Yet it

is a belief that was questioned at this

year’s European Utility Week (EUW).

Speaking at the opening keynote

session, Albert Cheung, Head of

Analysis at Bloomberg NEF, ac-

knowledged that the growth of wind

and solar has been phenomenal, that

electric vehicles will also witness a

rapid uptake in the coming years and

that carbon markets have died and

risen again. And while these are all

drivers of the three Ds, he did not

believe they would necessarily disrupt

Europe’s utilities.

“Lots of things have changed over

the last few years but through all of

this, have utilities actually faced dis-

ruption? Basically, six out of the top

ten utilities from ten years ago are still

in the top ten. That’s not what disrup-

tion looks like.”

He stressed that although the energy

mix and the electricity sector will look

very different in 2050, it does not mean

utilities are being disrupted.

“We can see that the future will look

very, very different from the past but

does that mean utilities are being

disrupted or not? The most useful way

to think about this is to go back to the

idea of disruptive innovation versus

sustaining innovation.”

He explained that disruptive innova-

tions change the basis of competition,

so that: rst, the things you are good

at do not really matter any more; and

second, there is a new thing that mat-

ters, and someone else is structurally

better than you at it.

Cheung used Kodak as an example,

where the advent of digital photogra-

phy made the company’s dominance

of photographic lm irrelevant. Again

using Kodak as the example, he

pointed out that Kodak was also not

structurally the best at delivering

digital devices and software.

To explain sustaining innovation,

Cheung referred to Bob Kerns, the

inventor of intermittent windscreen

wipers. He said: “Today it seems easy

now but back then, Ford and GM and

Chrysler couldn’t do it. This guy in-

vents it in the back of his garage and

what happens? All of the engineers at

the auto companies copy his idea, put

it in their cars and Bob Kerns spends

the rest of his career trying to sue them

for patent infringement.

“The point is, sustaining innovations

happen all the time and it doesn’t

matter if the innovation is super-hard

to do. What matters is, does it really

change the basis of competition? For

car manufacturers, it turns out that

being really good at windscreen wip-

ers didn’t matter. What mattered is still

being good at producing engines and

doors, etc. So when it comes to utili-

ties, we have to think about what are

the things that might bring disruptive

innovation and what are the things that

might sustain the industry and the

structure that we have today.”

Decentralisation of energy is an

obvious example. The question is: in

2050 – assuming there is much more

decentralised energy from the growth

of wind, solar and virtual power plants

(VPPs) etc., – will it be disruptive or

sustaining to utilities? And according

to Cheung, this will depend on what

will really matter when it comes to

winning at decentralised energy.

“If you believe that it is having great

VPP software and analytics, great IoT

and connectivity solutions, the best AI

for forecasting and optimisation, then

maybe it is disruptive, because there

is no reason why utilities have a

structural advantage in those areas.

“But if you think the decentralised

energy world will give advantage to

companies that really understand

power markets, are good at trading

and have a good asset portfolio and

really understand the networks, then

maybe decentralised energy is sus-

taining. Maybe it’s not disruptive at

all.”

Whichever, you case you believe,

it’s all the same for the equipment

manufacturers and solution providers

who will therefore continue to facili-

tate the new energy world, regardless

of whether utilities are disrupted or

not. Beyond doubt, grids have to be-

come more intelligent.

At a press conference on the side-

lines of EUW, Cedrik Neike, Member

of the Managing Board, Siemens AG,

noted that digitalisation and smart

networks will be needed to cope with

decentralisation.

He said: “The complexity that is

coming through this is pretty amazing.

In Germany 100 per cent of the big

transmission lines are being digitised.

In the distribution systems in medium

and low voltage, we are talking 10-15

per cent. Our energy networks have

been dumb and that is not going to

help us address decentralisation.”

Digitalisation is certainly a prereq-

uisite for decentralisation and the

all-electric world, which many think

we are moving toward. Thomas Zim-

mermann, CEO Siemens Digital Grid,

followed on by outlining the com-

pany’s ongoing efforts in the Internet

of Energy (IoE) for the connection and

managing of data from generation,

transmission and distribution assets,

distributed energy sources and de-

vices like smart meters, inverters for

photovoltaics, e-mobility assets,

storage systems and microgrids.

IoE, connectivity and digitalisation,

however, bring challenges. In the

same way that networks can no longer

be dumb, organisations and utilities

need to be smart about how they

handle the proliferation of a growing

number of internet connected devices

on the network. And cyber security

has to perhaps be at the top of their

agendas.

On a scale of one to ten, in terms of

importance in an increasingly decen-

tralised and digital world, Anjos Nijk,

Managing Director of the European

Network for Cyber security (ENCS)

rates cyber security as “almost a ten”.

He said: “For me, security is really

an enabler for making smart grid in-

novations happen… the innovations

needed for the transition cannot be

done without implementing security

in the right way. For example, during

the election in the Netherlands, the

voting computers appeared insecure,

which forced us to go back to pencil

and paper. So innovation was held

back due to security. If there is a major

incident in the roll-out of smart grid

technology, this might urge the regula-

tor to say: ‘we cannot afford this to

happen’. And this is why security is

very important in this whole thing.”

He pointed out that while securing

connectivity at the edge of the grid is

important, for example in the roll-out

of electric vehicle charging infrastruc-

ture, where he said a lot of work is

being done, Nijk also stressed that

compromise of larger critical equip-

ment deeper in the grid could cause

blackouts.

Globally there are big differences in

the appreciation of the seriousness

and handling of cyber threats. “I think

Europe is more sophisticated than the

US, and is pretty advanced in terms of

smart grid innovations,” said Nijk.

“But inside Europe, there is also quite

a difference between member states,

both in terms of the status of the grid

and how security is approached.”

The ENCS says it has made signi-

cant progress in standardising how

countries address cyber security on a

systems basis and from an organisa-

tional perspective. “A lot of harmoni-

sation still needs to take place but we

have made pretty good progress in the

last couple of years,” said Nijk.

As such efforts continue and the three

Ds continue to cut deeper, what is

certain is that companies, organisa-

tions and governments have to be

smart about how they approach the

new energy world. We may not know

how or if the three Ds will lead to

disruption of utilities but what we do

know, is that another three Ds will

always ring true: Dumb Doesn’t Do it.

Dumb doesn’t do it

Junior Isles

Cartoon: jemsoar.com

“Our energy networks have been dumb and that is

not going to help us address decentralisation.”