www.teitimes.com

November 2018 • Volume 11 • No 9 • Published monthly • ISSN 1757-7365

THE ENERGY INDUSTRY TIMES is published by Man in Black Media • www.mibmedia.com • Editor-in-Chief: Junior Isles • For all enquiries email: enquiries@teitimes.com

Special Project

Supplement

Intelligent

transformation

The UK’s Keadby 2 combined cycle

plant will feature rst 50 Hz HL

technology advanced gas turbine.

Assessing the practical applications

of articial intelligence.

Page 14

News In Brief

‘Age of renewables’ could be

as soon as 2035

The convergence of renewables and

electric vehicles could see the switch

from the age of oil and gas to the

‘age of renewables’ arrive sooner

than expected.

Page 2

US plans offshore wind

boost

The US offshore wind energy

pipeline looks set to grow after

the Bureau of Ocean Energy

Management issued three notices

relating to capacity development on

the east and west coasts.

Page 4

China leads the charge

in e-mobility and battery

storage

In a signicant move to shift away

from the use of fossil fuels for both

power generation and transport,

China is to open its domestic battery

market to foreign investment.

Page 6

Permit problems hold back

onshore wind in Germany

Permitting issues in Germany’s wind

sector have skewed the results of the

latest renewable energy auctions in

favour of solar.

Page 7

Iraq prepares to develop

power infrastructure

Iraq is laying the ground for further

development of its electricity sector

infrastructure with preliminary

agreements with GE and Siemens.

Page 8

Energy Outlook: Energy

transition and the future of

storage

DNV GL’s ‘Energy Transition

Outlook 2018’ forecasts that

renewables will drive rapid

electrication across several sectors

and predicts a key role for energy

storage.

Page 14

Technology: Platform for

change

Utilities are embracing change

with the help of IoT platforms and

a whole new approach to their

business.

Page 15

Advertise

advertising@teitimes.com

Subscribe

subscriptions@teitimes.com

or call +44 208 523 2573

The Intergovernmental Panel on Climate Change claims that the world is on course to miss

the climate change targets set under the Paris Agreement but not all will act on the report’s

recommendations. Junior Isles

Bioenergy to lead renewable resources, says IEA

THE ENERGY INDUSTRY

TIMES

Final Word

Are gas turbines living

on borrowed time?

Junior Isles.

Page 16

A report from 91 scientists convened

by the UN’s Intergovernmental Panel

on Climate Change (IPCC) has con-

cluded that the global temperature has

risen by 1°C since pre-industrial times

and is likely to rise by a further 2°C

by the turn of the century, based on

current policies.

This means the world is on course to

exceed the targets of the Paris climate

agreement and warm by 3°C by the

end of the century, a level that would

disrupt life on Earth. The report was

commissioned by the Paris signatories

to help them understand the vastly dif-

ferent implications of 1.5°C of warm-

ing – the target they agreed to move

towards – and the 2°C they committed

to stay below.

In producing the report, IPCC scien-

tists used over 6000 scientic studies

to produce a comprehensive report on

how to limit climate change to man-

ageable levels. The report stressed that

climate change must be limited to

1.5°C of warming to avoid the worst

impacts of climate change and that the

world needs to decarbonise as much

as possible and as fast as possible, in-

cluding halving global emissions by

2030 and reaching net zero by 2050.

To help achieve this, the report in-

sists that the use of coal for power

generation would have to fall to be-

tween zero and two per cent of current

usage.

Not all however, are prepared to act

on the IPCC’s recommendations.

While Republicans in the US doubted

the organisation’s ndings, Australia

rejected the call by scientists to phase-

out coal use by 2050.

Australia, which is among the high-

est greenhouse gas emitters per capita

and is the world’s biggest coal export-

er, said it would be “irresponsible” to

comply with the recommendation by

the IPCC to stop using coal to gener-

ate electricity.

Australia’s Environment Minister

Melissa Price believes the IPCC re-

port exaggerates the threat posed by

fossil fuel.

“Coal forms a very important part of

the Australian energy mix and we

Continued on Page 2

Renewables will continue their expan-

sion in the next ve years, covering 40

per cent of global energy consumption

growth, according to the International

Energy Agency’s (IEA’s) recent ‘Re-

newables 2018’ market analysis and

forecast report.

Notably, the report says that while

the growth in solar PV and wind is set

to continue in the electricity sector,

bioenergy remains the largest source

of renewable energy. This is due to its

widespread use in heat and transport,

sectors in which other renewables

currently play a much smaller role.

“Modern bioenergy is the over-

looked giant of the renewable energy

eld,” said Dr Fatih Birol, the IEA’s

Executive Director. “Its share in the

world’s total renewables consump-

tion is about 50 per cent today, in

other words as much as hydro, wind,

solar and all other renewables com-

bined. We expect modern bioenergy

will continue to lead the eld, and has

huge prospects for further growth.

But the right policies and rigorous

sustainability regulations will be es-

sential to meet its full potential.”

The focus on bioenergy is part of the

IEA’s analysis of “blind spots” of the

energy system – issues that are critical

to the evolution of the energy sector

but receive less attention than they de-

serve – such as the impact of air con-

ditioners on electricity demand, or the

growing impact of petrochemicals on

global oil demand. Assuming strong

sustainability measures are in force,

the report identies additional un-

tapped potential for bioenergy to

“green” and diversify energy usage in

the industry and transport sectors.

According to the IEA, the use of re-

newables continues to increase most

rapidly in the electricity sector, and

will account for almost a third of total

world electricity generation in 2023.

Because of weaker policy support and

additional barriers to deployment, use

of renewables expands far more slow-

ly in the transport and heat sectors.

China leads global growth in renew-

able energy as a result of policies to

decarbonise all sectors and reduce

harmful local air pollution, and be-

comes the largest consumer of renew-

able energy, surpassing the European

Union by 2023. Of the world’s largest

energy consumers, Brazil has the

highest share of renewables by far –

almost 45 per cent of total nal energy

consumption in 2023, driven by sig-

nicant contribution of bioenergy and

hydropower.

Meanwhile, solar PV dominates re-

newable electricity capacity expan-

sion. Renewable capacity additions

of 178 GW in 2017 broke another

record, accounting for more than

two-thirds of global net electricity

capacity growth for the rst time. So-

lar PV capacity is forecast to expand

by almost 600 GW – more than all

other renewable power technologies

combined, reaching 1 TW by the end

of the forecast period.

Wind remains the second largest

contributor to renewable capacity

growth, while hydropower remains

the largest renewable electricity

source by 2023. Similar to last year’s

forecast, wind capacity is expected to

expand by 60 per cent.

Despite the rapid expansion how-

ever, Paolo Frankl, Head of the IEA’s

Renewable Energy Division said re-

newables penetration must accelerate

in all sectors to meet long-term sus-

tainability goals.

According to the IEA’s 2017 Sus-

tainable Development Scenario

(SDS), which is in line with Paris cli-

mate goals, the organisation says that

if progress continues at the forecast

pace, the share of renewables in nal

energy consumption would be around

18 per cent by 2040. This is signi-

cantly lower than the SDS target of 28

per cent.

World on track

to miss climate

change targets,

says IPCC report

Australia’s Environment Minister Melissa Price believes

IPCC report exaggerates threat of fossil fuels

THE ENERGY INDUSTRY TIMES - NOVEMBER 2018

3

9 – 10 December 2018 | Katowice, Poland

Where policy-makers and climate technology innovators

meet on the sidelines of COP

Key streams for 2018:

Hear from

80+

High-level

speakers

Network with

600+

senior decision &

policy makers

Headline Partner

With COP24 being hailed by the UNFCCC as ‘Paris 2.0’, the Sustainable

Innovation Forum presents a crucial opportunity to drive forward the Paris

Agreement framework by bringing together government, private sector

sustainability solution providers, responsible investors and development banks.

Energy

Transition

Sustainable

Mobility

Circular

Economy

Climate

Finance

Use code

EnergyIndustryTimes

to get

10% o

Find out more: cop-24.org

Our Clients:

Our Partners:

weber media solutions

YOUR CREATIVE MEDIA AGENCY FOR

DESIGN AND MARKETING SOLUTIONS

We are a creative media agency which provide a bespoke

service to meet your media and marketing requirements

and much more

DESIGN / VIDEO / WEB / EXHIBITION STAND DESIGN

MAGAZINES / PRINT MANAGEMENT / MAILING

For more information please contact:

Karl Weber / Director

T: +44 7734 942 385 / E: karlw@webermediasolutions.com

www.webermediasolutions.com

some of our exhibition signage projects, for more information please visit our website:

N

e EnergyUpdatevv

Editable

do not delete

Outlined

BUSINESS INTELLIGENCE

US BIOGAS 2018

November 5-6, San Diego

Monetize your production-

and-use biogas cycle

FIND OUT MORE

events.newenergyupdate.com/biogas

DEVELOP SUCCESSFUL

BIOGAS PROJECTS

UTILIZE POLICY DRIVERS

SECURE FINANCE

T: +27 21 001 3808 I E: gary.meyer@spintelligent.com

Register for your delegate

pass today!

www.future-energy-nigeria.com

13 – 14 NOVEMBER 2018

Eko Hotel & Suites, Lagos, Nigeria

Supporting Utility

Share your knowledge with others and discover solutions to

the problems that are hampering the financial viability of the

Nigerian power and energy sector.

Upgrade your skills at the knowledge hub with free to attend

workshops on health & safety, operations & maintenance,

renewable energy and energy efficiency.

Meet with likeminded people and benchmark your people and

projects against your industry peers.

Iraq’s electricity ministry conrmed

last month that the country’s incoming

government has signed Memoranda of

Understanding (MOUs) with both GE

and Siemens covering work to repair,

rebuild and expand the country’s elec-

tricity generation and transmission

networks.

The agreements follow separate ef-

forts by the rival OEMs to identify ur-

gent and long-term investment needs in

Iraq’s electricity sector. Media outlets

have reported that Siemens was set to

win the majority of the contracts until

the Iraqi government came under pres-

sure from US President Donald Trump.

Siemens presented a reconstruction

plan for Iraq in September 2017, pro-

posing a series of short, medium and

long-term plans to meet reconstruction

goals and support economic develop-

ment. Its plan would add 11 GW to

Iraq’s generating capacity.

Speaking on the sidelines of a press

visit to the Beni Suef power plant in

Egypt just after the announcement,

Karim Amin, Head of Global Power

and Gas Sales at Siemens told journal-

ists: “We have a comprehensive MoU,

part of which covers new installations,

and part that is related to our own eet.

The country needs a lot of rehabilita-

tion, as a lot of facilities were destroyed

during the war. They have lost 50 per

cent of their capacity. There is also a

lot of work to be done on transmission

and distribution.

“Every company is looking at its

plan [to address the situation]; the

Iraqi government needs to see which

way to go, how fast and how much it

can afford because at the end of the

day, there is a budget.”

GE has proposed a 14 GW power

capacity plan, including the addition

of 1.5 GW by 2019 by upgrading exist-

ing plant sites.

Securing major contracts in Iraq

would be a major boost for both

OEMs’ businesses, which have strug-

gled amid a declining market for gas

and steam turbines.

Siemens CEO Joe Kaeser wrote on

Twitter that the Iraqi MoU represents

a “landmark” agreement for the com-

pany, which undertook a 12-month

study to gauge a viable redevelopment

plan that highlighted the provinces

most in need of rehabilitation.

The World Bank says that rebuilding

Iraq’s infrastructure will require $150

billion. The government has prioritised

the utility sector because it believes that

poor power supplies played a key role

in civil unrest over the summer.

8

THE ENERGY INDUSTRY TIMES - NOVEMBER 2018

International News

Iraq prepares to develop power

infrastructure

Iraq is laying the ground for further development of its electricity sector infrastructure with preliminary agreements with

GE and Siemens that could lead to major equipment and services contracts worth billions.

Sian Crampsie and Junior Isles

n GE, Trina supply new renewables projects

n 3 GW of renewables on-line by 2019

Manilla cityscape

Siân Crampsie

Energy rm DTEK is ramping up de-

velopment of renewable energy capac-

ity in Ukraine.

The company has signed deals with

major international suppliers in pursuit

of the development of wind energy and

solar photovoltaic (PV) capacity.

Last month Trina Solar announced

that it had delivered 123 MW of PV

modules to DTEK for installation at

Ukraine’s largest solar power plant.

Located near Nikopol, Dnepropetro-

vsk Oblast in central Ukraine, the proj-

ect has a planned capacity of 246 MW.

In addition, DTEK has signed a deal

with GE Renewable Energy for the

procurement, installation and mainte-

nance of 26 wind turbines for stage 1

of the 200 MW Primorskaya wind

power plant in the Zaporizhia Region

of Ukraine.

GE will provide its 3 MW hardware

for the Primorskaya wind farm, con-

struction of which is scheduled to be

completed at the end of 2018. The Pri-

morskaya wind farm will be developed

in two phases, with a second 100 MW

phase due to be operating by 2020.

DTEK has a 1 GW renewable energy

project portfolio and said in a statement

that it was engaging foreign investors

and equipment manufacturers capable

of bringing the most innovative and

advanced technologies to Ukraine.

“The new wind park will strengthen

Ukraine’s position on its way towards

modernisation of its energy sector, en-

ergy independence, and diversication

of energy sources,” said DTEK CEO

Maksym Timchenko.

China Machinery Engineering Cor-

poration (CMEC) is the main con-

tractor at the Nikopol solar energy

plant, which is expected to be com-

pleted in early 2019 and connected to

the grid in March.

Last year Ukraine approved a na-

tional emissions reduction plan, and

also set a target of increasing the share

of renewable energy generation in the

generating mix to 11 per cent by 2020.

Currently the country’s energy sup-

plies are heavily reliant on fossil fuels

and nuclear energy.

The number of licenses for producing

renewable energy delivered in Ukraine

grew from 131 in 2015 to 163 and 230

in the following years, according to

the Ukrainian Association of Renew-

able Energy (UARE). State-run power

company Ukrenergo expects the

country’s renewable energy capacity

to go from the current 1.5 GW to 3 GW

in 2019.

The future of a new coal red power

plant in Kosovo is in doubt after the

Wold Bank refused to provide nan-

cial backing for the project.

The 500 MW lignite red Kosovo C

power plant is the country’s rst major

energy project for 20 years and a key

part of the government’s plans to en-

hance energy security.

World Bank President Jim Yong

Kim said last month, however, that

the bank would not provide funding

for the plant because renewable en-

ergy would be a cheaper alternative.

“We have made a very rm decision

not to go forward with the coal power

plant because we are required by our

by-laws to go with the lowest cost op-

tion, and renewables have now come

below the cost of coal,” said Dr. Kim

at a meeting in Bali, Indonesia.

Kosovo signed a deal in 2017 with

London-listed power generator Con-

tourGlobal to build the lignite red

plant at a cost of around €1 billion

euros ($1.15 billion). It had asked the

World Bank to provide partial risk

guarantees to help unlock cheaper

loans for the project.

According to local media Kosovo’s

Minister of Economic Development,

Valdrin Lluka, said the government

will continue working with Contour-

Global on the project. Climate Home

News reported that Kosovo’s govern-

ment has turned to the Trump admin-

istration to secure nancing.

Environment pressure group Sierra

Club praised the World Bank’s deci-

sion. “We applaud the Bank’s deci-

sion,” said John Coequyt, Sierra Club’s

Global Climate Policy director. “This

decision by the World Bank recog-

nises several key truths. First, the pub-

lic doesn’t want dirty coal. Second,

coal is a bad investment, because clean

energy is cheaper than coal in places

all over the world. Third, if we want to

curb the most catastrophic effects of

the climate crisis, we have to move off

coal immediately.”

South African utility Eskom says that

its Medupi coal red power plant is

coming closer to full commercial op-

eration following the grid synchronisa-

tion of its fth unit.

Eskom and its partner, GE, said that

Medupi Unit 2 was synchronised to the

grid in early October, eight months

ahead of schedule. With ve of the

plant’s six units now synchronised, the

plant’s capacity has reached 4000 MW.

Abram Masango, Eskom’s Group

Executive for Group Capital, said:

“The achievement of Unit 2 rst syn-

chronisation, eight months ahead of

the June 2019 schedule, marks a key

milestone towards full commercial

operation of the unit. Lessons learnt on

previous units were implemented on

Unit 2, leading to the swiftness in de-

livering rst power. This is an amazing

achievement, taking us closer to com-

pleting the entire Medupi project, as

we will be left with one unit.”

Eskom said that Unit 2 would be de-

livering power to the grid intermit-

tently over the next few weeks during

a testing and optimisation phase.

Once completed, Medupi will be the

fourth largest coal red power plant

and the largest dry-cooled power sta-

tion in the world.

It will consist of six units with an

installed capacity of 4764 MW, adding

signicantly to Eskom’s generating

capacity.

Eskom, however, is currently at-

tempting to negotiate a raft of new coal

supply contracts following nancial

difculties at a major supplier.

The company announced in Sep-

tember that coal supplies at ten of its

power plants were running low and

that it was attempting to secure new

contracts with other companies as

well as move coal stocks around to

ensure that power plants could be kept

on-line.

Eskom is required to keep at least 20

days’ worth of coal supplies in stock.

The situation has once again put its

generating system under pressure as

the utility approaches peak summer

demand season.

Ukraine boosts

renewables

World Bank refuses Kosovo

coal plant

Eskom ahead of

schedule with

Medupi

n Renewables a cheaper option

n USA a possible nance source

Oman has launched its electricity sec-

tor privatisation plan as part of a wid-

er drive to attract investment and boost

its economy.

The Gulf state is looking to sell off

strategic stakes in ve electricity trans-

mission and distribution companies.

The process will start with the sale

of up to 49 per cent of shares in Oman

Electricity Transmission Company,

which has assets of $2.2 billion, and

up to 70 per cent of shares in Muscat

Electricity Distribution Company,

with assets of about $1 billion.

In 2019 up to 70 per cent of shares

in three other companies will follow:

Majan Electricity Distribution Com-

pany, Mazoon Electricity Distribu-

tion Company and Dhofar Power

Company.

The privatisations are the latest step

in Oman’s electricity sector reform

process, which aims to boost the ef-

ciency of the sector and attract overseas

investment. Last year the government

removed subsidies on electricity sup-

plies to commercial customers with

annual consumption needs of more

than 150 000 kWh.

Oman is also continuing to boost its

electricity generating capacity.

Last month a report from Oman’s

Implementation Support & Follow-up

Unit (ISFU) said that the country’s

plans to build 1600 MW of solar en-

ergy capacity over the next ve years

would attract investments of around

RO 616 million ($1.6 billion).

According to ISFU, four utility-scale

solar projects totalling 1600 MW will

be built in the next ve years.

The rst – known as Ibri IPP (Inde-

pendent Power Project) – is sized at

around 500 MW and will be opera-

tional by 2022. This will be followed

by Solar 2022 and Solar 2023, each

with 500 MW of capacity, and due to

come on stream by 2022 and 2023

respectively.

In addition, Petroleum Development

Oman (PDO) is procuring a 100 MW

solar power plant at Amin in the south

of its concession. The project is sched-

uled to launch by 2020, the report said.

Oman launches privatisation drive

THE ENERGY INDUSTRY TIMES - NOVEMBER 2018

Special Project Supplement

First 50 Hz HL for Keadby

The rst power plant

to use Siemens’

SGT5-9000HL

advanced gas

turbine is to be built

at Keadby in the UK.

The project indicates

there is still room

for highly efcient

and exible large

gas red combined

cycle power plants

in a market that is

being increasingly

dominated by

renewables.

Junior Isles

turbine case and blade tips during

operation for increased efciency. As

with the H machine, all blades can be

replaced without lifting the rotor from

the engine.

The improvements in the efciency

and exibility come from ve key

technologies – the compressor, com-

bustion system, internal cooling fea-

tures, thermal barrier coating and the

turbine 4th stage blade.

The compressor is the third genera-

tion of the design – originally intro-

duced in the SGT6-5000F and then

further developed for the H-class

family. The new compressor makes

use of advanced 3D blades, for im-

proved aerodynamic efciency. This

has enabled Siemens engineers to in-

crease the compression ratio (from

21:1 in the H-class machine to 24:1),

with one less compressor stage com-

pared with the H. The HL-class has a

12-stage compressor compared with

13 in the H-machines.

For reduced complexity, the HL also

has one inlet guide vane (IGV) and

two variable guide vanes (VGVs).

The H has one IGV and three VGVs.

A similar can-annular combustion

system is also retained but is modied

to improve fuel/oxygen mixing.

The advanced combustion system

for high efciency has a pilot burner

that is surrounded by a higher num-

ber of pre-mix burners than in the

H-machines – increased from eight

to 25. This allows the ring tempera-

ture to be increased by around 100 K,

while maintaining low NOx levels at

part-load. It is designed to go down

to 35 per cent part-load, which serves

a market that has more renewable

energy.

In addition to higher efciency,

Siemens says the combustor design

is a key contributor to the turbine’s

improved ramp rate and part-load

capability.

Thermal barrier coating (TBC) is

used for the rst seven airfoils, com-

pared with the rst six in the SGT-

8000H series. In the HL-turbines,

TBC is used on row vane 1 to row

vane 4 and blade row 1 to blade row

3. The last stage blade 4 is not coated.

T

he last few years have been very

challenging for Europe’s gas

turbine market, with very few

sales of large machines anywhere in

the region. Yet a recent order for what

is currently among the largest and most

advanced gas turbines on the market

perhaps shows that there is still scope

to deploy these large units under the

right market conditions.

At the end of August, energy com-

pany SSE plc announced that it was

planning to build a new 840 MW

combined cycle project based on

Siemens’ SGT5-9000HL gas turbine

at Keadby in Lincolnshire, UK. Nota-

bly, it represents the rst order for a

50 Hz version of the new machine,

endorsing the value of the turbine’s

high efciency and exibility in the

UK market.

Andreas Senzel, Project Director at

Siemens Energy and Project Execu-

tion Lead for Keadby noted that the

machine’s unique combination of

exibility, efciency and large capac-

ity was a key reason behind its selec-

tion for Keadby 2.

“In the UK, generators rely on sev-

eral revenue streams. The Capacity

Market, established four years ago,

helps to cover one part of the busi-

ness case. With Capacity Market

payments going down, it is helpful if

a plant operator can also participate

in the traditional energy market and

offer exibility for ‘balancing ser-

vices’. The HL combines all three –

840 MW net output and approxi-

mately 63 per cent [electrical]

efciency. It will have the highest

efciency in the UK, putting it rmly

at the top of the merit order.” he said.

“In addition, the HL is a very exible

machine with a ramp rate comparable

to smaller engines.”

Yet some industry observers argue

that even this – combined with the

exibility of gas red power plants

and their resulting ability to comple-

ment intermittent wind and solar –

might not be enough to guarantee the

recovery of the market. Their thinking

is that renewables plus storage is the

way forward.

Steve Scrimshaw, UK Country

Lead for the Power and Gas and

Power Services divisions at Siemens

plc, however, is not convinced. “You

need large synchronous capacity to be

able to handle the big swings in fre-

quency, etc. Being entirely reliant on

storage or wind doesn’t give you that

exibility. There is a role in the energy

mix for renewables, storage and small

reciprocating gas engines. But there

will also be a role to play for large,

efcient, gas red plant, so that when

the wind is not blowing, you have

synchronous generating capability on

the grid.”

Commenting on its thinking behind

the project, Martin Pibworth, SSE’s

Wholesale Director, said: “Its highly

efcient technology, not previously

seen in the UK, will provide rm, reli-

able power from the early 2020s at

half the carbon emissions of the coal

generation it is replacing. New CCGT

complements SSE’s ambitions to de-

velop more offshore and onshore

wind as CCGTs remain well-placed

to provide exible, grid-scale back up

to complement the large volumes of

renewables the UK needs to meet its

low carbon targets.”

Scrimshaw added: “The prolifera-

tion of low carbon renewable tech-

nologies in the UK has had a conse-

quential impact on the more

traditional market. The Capacity

Auction, where capacity is bought for

years ahead, surprised many people

last year with a low clearing price of

£8.40/kW. We think that was mainly

due to the reduced capacity require-

ment, which could mostly be met by

interconnectors and existing generat-

ing plants. It didn’t leave much room

in the energy mix for new plant, in-

cluding CCGTs.”

But even though the Capacity Mar-

ket has been quite disappointing,

Siemens has played an important role

in the capacity auctions in recent

years, winning contracts to build

King’s Lynn and Spalding, and now

Keadby 2. It puts this down to the

suitability of its technology in meet-

ing both the market and its customers’

needs.

“We have the view that we only win

if our customers win,” said Scrim-

shaw, “and we both saw that there is

probably a place for highly efcient,

exible combined cycle power plants

in the future energy mix.”

Scrimshaw believes that having this

common objective – combined with a

long-standing relationship with SSE,

which has seen the two companies

work together on projects in both

generation and transmission and dis-

tribution, is what helped secure the

deal.

“If you look at the objectives of both

parties – for us it was to secure a deal

to enable market entry of the new 50

Hz, 9000HL gas turbine. And, we

think, for SSE, it was having a plant

that would be top of the merit order

– one that could compete in the mar-

ket in the future,” he said.

But securing the deal is just one ele-

ment. Siemens now has to work hard

on the manufacturing and testing of

the new gas turbine, and then con-

struction and commissioning of the

plant.

“Gas turbine technology has been

around for a century, but several de-

velopments come together in this new

machine to give a step-change in

performance. Computer modelling

allows us to understand more, new

materials give us new properties to

work with, and additive manufactur-

ing allows us to make new shapes and

test prototypes faster than before,”

said Scrimshaw.

The SGT5-9000HL is the heart of

Keadby 2. Essentially, it has been

designed to be a very good comple-

ment for uctuating renewables, as

well as a highly efcient base load

system. It is designed to have a simple

cycle power output of 567 MW and a

simple cycle efciency of 42.6 per

cent, and more than 63 per cent elec-

trical efciency in combined cycle.

Its design draws heavily from the

proven H-class design. Like the H-

class machine, the HL is air-cooled

and has the same single tie-bolt rotor

concept with interlocked discs using

Hirth serration couplings. It also uses

Hydraulic Clearance Optimisation to

minimise the clearance between the

HL in a commercial setting will begin

in 2020 at Duke Energy’s Lincoln

power plant in North Carolina, USA.

After four years, ownership of the

new unit will be handed over to Duke

Energy for full commercial operation.

Schwarz explained: “We have a

four-year time window at Duke for

testing and validation to enable us to

implement our latest developments.

This is why we call the HL-class a

technology carrier, because we see

this as just a starting point.”

Both the projects in the UK and in

the USA will allow Siemens to collect

a huge amount of data, thanks to the

several thousands of sensors con-

nected to the two units. A dedicated

testing team will be in charge of the

data collection and analysis in order

to stream live data to all of its engi-

neering hubs globally.

The Keadby plant will have a testing

and validation phase of several

months. Since the unit is expected to

go into commercial operation in

2022, its early test results will be used

to gather experience to be transferred

to all following projects.

How Keadby operates, and more

specically its exibility, will be cru-

cial to its commercial success in the

UK and indeed other competitive

markets.

The HL has two start-up modes

from cold – normal and fast. In the

normal start-up up mode, the machine

can be ramped up at 15 MW/min and

35 MW in fast start mode. When the

turbine reaches hot conditions, it is

designed to ramp up and down at 85

MW/min. This means that full com-

bined cycle output can be achieved in

30 minutes.

Andreas Senzel, Project Director at

Siemens Energy and Project Execu-

tion Lead for Keadby said: “The 30

minutes is normal, as with the other F

and H frames, but the difference is the

amount of power. The time remains

the same but now we can bring the

840 MW on line in the same time-

frame as the smaller output engines.”

The turbine at Keadby will be ar-

ranged in a 1-on-1 conguration, i.e.

the gas turbine and generator will be

housed in a gas turbine building and

the steam turbine and its associated

generator in a separate steam turbine

building.

Hot gas from the turbine is ex-

hausted to a vertical, triple-pressure,

heat recovery steam generator

(HRSG). The boiler is a reheat HRSG

where the high-pressure (HP) section

has a Benson-type design. HP steam

is generated at 170 bar and 600°C;

steam ow is 156 kg/s. In the interme-

diate-pressure (IP) section, steam

ow is 166 kg/s at 40.7 bar and

610°C. Low-pressure (LP) steam is

generated at 4.9 bar and 296°C with a

steam ow of 182 kg/s.

The plant will be a purely condens-

ing plant as there is no heat extraction.

Senzel, noted: “Heat extraction is

possible; this is what the consent re-

quested but the primary design is not

for steam, so it will be a condensing

plant.”

The condenser is cooled, with the

main cooling water passing through a

hybrid cooling tower. The hybrid

cooling tower receives makeup water

from a channel connected to the River

Trent.

According to Senzel, this arrange-

ment is the rst-of-a-kind. “This is an

optimal arrangement that we devel-

oped with the gas turbine. We will use

it as a reference for HL-class plants.”

In order to meet contracted emission

levels, Keadby 2 will use selective

catalytic reduction (SCR). This will

cut NOx to 22 ppmv, CO to 80 ppmv

and 5 ppmv for NH

3

, which is slip-

page from the SCR. “These are the

guaranteed values at all levels of

power,” noted Senzel. “Keadby 2 will

have up to a nominal load of 840 MW

(net) and can be turned down to a

minimum load of 360 MW (net).

Notably, special attention is given to

the rst row vane 1.

In terms of blade coating, an easy

way to improve blade protection is to

simply increase the thickness of the

TBC. However, the ceramic TBC has

a different thermal behaviour to the

base metal material of the actual

blade and therefore experiences ther-

mal stresses during start-up and shut-

down. Siemens says it has therefore

developed a technology that increases

the thickness of the TBC while mini-

mising these stresses.

It uses a technique called laser en-

graving to cut very thin squares on the

TBC of vane 1. This helps to reduce

thermal stresses in the TBC by avoid-

ing spallation, which is the biggest

cause of damage to TBC.

A second root cause of spallation – a

process in which fragments of mate-

rial (spall) are ejected from a body

due to impact or stress – occurs during

commissioning. This is due to abrad-

able metallic seals on the compressor

side. During commissioning, opera-

tors perform a controlled run of the

compressor which causes small me-

tallic fragments or dust created during

manufacturing to melt and stick to the

TBC of vane 1. This changes the

thermal behaviour of the TBC and

causes spallation.

Siemens engineers noticed that

there is spallation during the rst

couple hundred operating hours be-

fore disappearing. It therefore intro-

duced a sacricial layer on vane 1.

The metal dust deposited on the sac-

ricial layer disappears after the rst

couple hundred operating hours to

leave the original TBC layer below so

the vane remains protected.

In addition to better TBC, higher

ring temperature can be achieved by

improved blade cooling. However,

blade cooling should be achieved

without using more cooling air, which

reduces turbine efciency since less

air would be available for combus-

tion. Siemens says it has been able to

do this through better blade design.

In a major departure from the SGT-

8000H design, the last-stage turbine

blade is also internally cooled. This is

needed for the higher exhaust gas

temperature, which is increased from

nearly 640°C in the H-class to about

680°C for the HL. This in turn has a

positive impact on the bottoming

steam cycle, delivering higher com-

bined cycle efciency.

This last-stage blade is a free-

standing blade, which reduces exit

losses and thus improves overall

combined cycle efciency.

Testing of the ve core technologies

began in 2014, with much of the test-

ing having already been carried out in

Berlin. The company is taking a step-

wise approach to testing and valida-

tion, as it did with the SGT-8000H

series.

The programme started with com-

ponent testing on the rig at Siemens’

Clean Energy Centre (CEC). Here, all

combustion parts can be tested.

Kolja Schwarz, Head of HL-class

Portfolio Management, Siemens AG

commented: “We have the capability

there to install all of the combustion

system into a rig and test all parame-

ters. We can also set up rigs next to

this so we can install blades and vanes

to perform simulations. Here, we can

make use of 3D printing and rapid

prototyping so that we can test differ-

ent designs very fast.”

This technique allowed engineers

to, for example, design and test differ-

ent blade types in Berlin. Siemens has

different test rigs around the world for

developing and testing different

components.

“We have our own compressor rigs,

turbine rigs, combustion rigs, etc., for

testing all the main components – as

well as shared facilities at Universi-

ties,” said Schwarz. “Once rig testing

is successful, we bring them to our

engine test facility, also in Berlin,

where we install them on an 8000H

base engine for full-load, off-grid

testing.”

The third and nal stage in the de-

velopment test programme is to install

the new technologies into operating

8000H eets. “This means that in total

we have several thousand hours of

operating experience on the technolo-

gies because we are running and op-

erating them in 8000H and 4000F

engines around the globe already,”

noted Schwarz.

Results have so far been promising.

Since initial launch data was an-

nounced, design performance has

been increased as a direct result of the

testing.

Schwarz said: “The results are all

going in the direction that we want

them.” He added: “But tests don’t al-

ways go in the way they’re predicted

so we are always designing several

components in parallel, For example,

we had three designs for turbine blade

4 and tested them all before deciding

that two of them were not suitable.”

Siemens says the HL engine is a

“continuous development”, where the

different test phases are ongoing and

will start again with the next genera-

tion of components.

With combined cycle efciency al-

ready in the 63 per cent range, Sie-

mens says the mid-term goal is to

push this to 65 per cent. This will be

achieved through the use of additive

manufacturing, which will, for ex-

ample, allow better component de-

signs for improved cooling and thus

higher ring temperature. There will

also be improvements in the water

steam cycle.

But for now, engine production for

both 50 Hz and 60 Hz machines is in

full swing. Parts are now coming in to

the manufacturing area in Berlin and

Charlotte, USA, and engine assembly

has started.

Testing and validation of the rst

Special Project Supplement

THE ENERGY INDUSTRY TIMES - NOVEMBER 2018

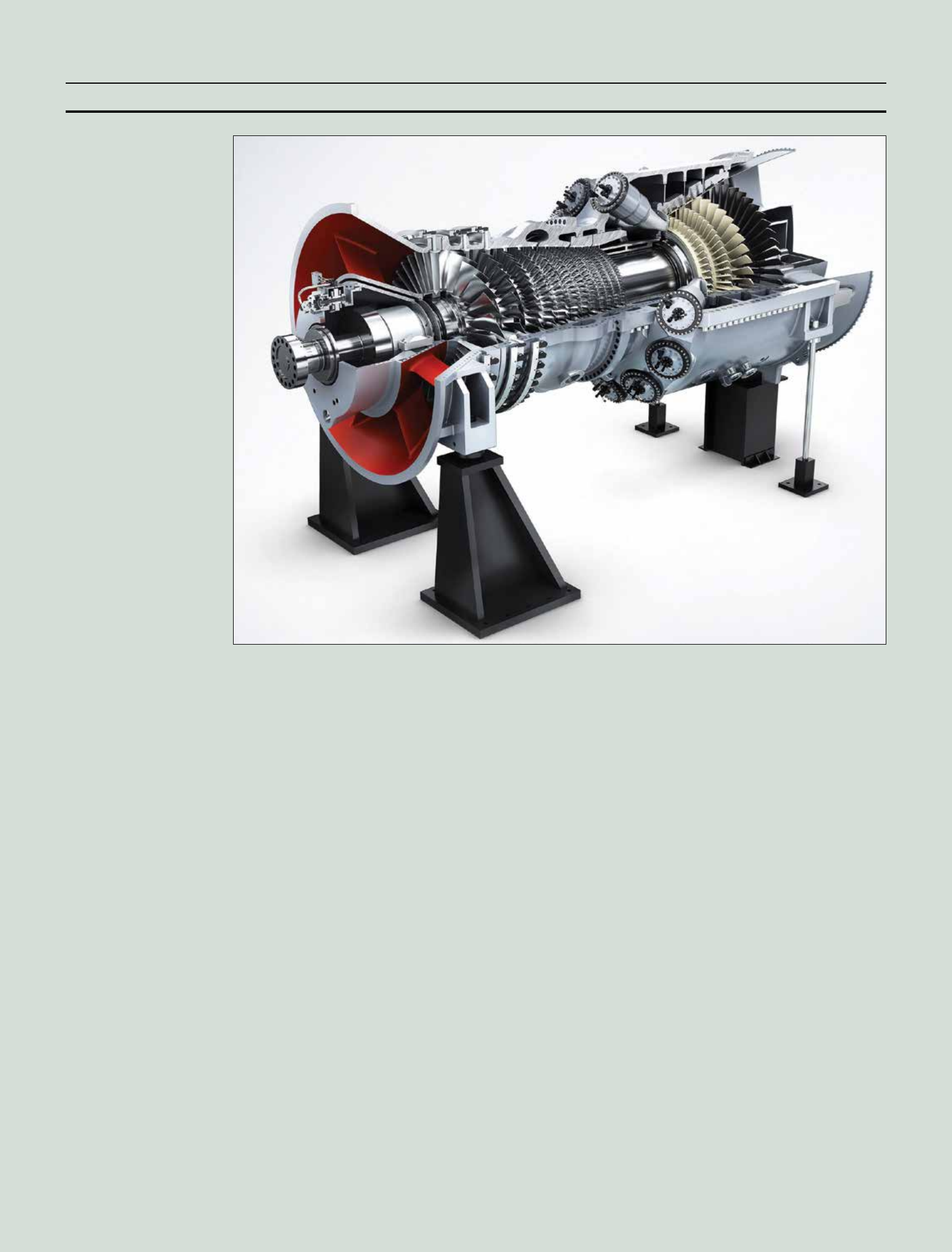

Cutaway model of the HL

turbine: improvements in

efciency and exibility come

from ve key technologies

the compressor,

combustion system, internal

cooling features, thermal

barrier coating and the

turbine 4th stage blade

THE ENERGY INDUSTRY TIMES - NOVEMBER 2018

Keadby 2 represents a £350 million

investment. It will be constructed as a

full turnkey solution by Siemens,

which will also provide plant servic-

ing under a 15-year contract.

Siemens received the Notice-to-

Proceed on May 31, 2018, and im-

mediately began work at the site. De-

molition works of the existing

underground structures from a former

coal red plant site is currently under

way and the underground is being

prepared in the site installation and

plant areas in preparation for installa-

tion of the new plant.

“It is the site of a former coal red

plant and there are still existing

foundations,” said Senzel. “In order

to prepare the piling for the new

plant, we have to remove the existing

foundations.”

This work will continue to around

the start of December, at which time

the rst test piling activities for the

new plant will be carried out before

full piling begins in January. Piling

work will continue to around May

2019. Construction of the main foun-

dations of the steam turbine building

is expected to begin one month after

this and on the gas turbine building

foundations a month after that. Steel

structure works for these buildings

should then proceed in the autumn and

the main steel structure for the boiler

will begin in December 2019.

Most of the big components are

scheduled to arrive at site during the

rst three months of 2020. “The main

transformer will arrive at the end of

January 2020. The gas turbine genera-

tor will arrive February/March and

the gas turbine will be placed on

March/April,” said Senzel.

Mechanical erection will begin once

all the main components are on site

and the team will work towards rst

ring of the gas turbine in December

2020. This marks the start of hot com-

missioning and what Siemens calls

“primary validation”.

As it will be the rst-of-a-kind, the

plant will undergo an extensive com-

missioning programme.

Senzel explained: “We will go load

level-by-load level rst to validate the

machine and then to execute the nor-

mal commissioning activities at load

level. Then we will carry out all

commissioning activities for the

combined cycle plant and present all

the characteristics to the client and to

the grid.

“After that, we will have a period

starting around April-May 2021

where the plant can be operated by the

client but under our control. This is so

we can observe the machine for what

will be approximately 2500 hours.”

During this time the machine will

still be tted with thousands of sen-

sors so that engineers and operators

can see more closely how the turbine

is behaving far beyond the normal

validation period. This means that

from rst re to the end of commis-

sioning, the turbine will be closely

monitored and data collected by Sie-

mens for several thousand hours.

At the end of commissioning a hot

gas path inspection will be performed

where the machine will be opened

and the instrumented parts removed

and evaluated along with the rest of

the machine. The turbine will then be

re-assembled, re-commissioned and

put through a 30-day trial run before

handover to SSE for commercial op-

eration in January , 2022.

Schwarz noted: “It’s an extensive

[commissioning] period but I think it

is a wise decision to look at the ma-

chine longer. We’re following the

path that we did at Irsching for the

8000H, where we had perfect results

in terms of validation and bringing an

engine to market.”

Siemens is condent Keadby 2,

along with Duke, is just the start of

things to come for its HL technology.

The company says it is in contact with

customers around the globe and has

established itself as preferred bidder

or been technically selected for sev-

eral projects.

“We have more in the US, South

America, further engines in Europe as

well as in the Asian region, where the

market is quite active,” Schwarz said.

“We’ve seen all kinds of interest;

we‘ve had customers looking at base

load and customers like Duke, which

is installing the engine for simple cycle

and plans to operate it for peak load.”

It is this exibility to operate under

different conditions according to

market needs that Siemens believes

will bring many opportunities for the

HL machine.

Although gas turbines sales are not

what OEMs have been used to in the

past, the company believes the inter-

est is still high and it is a matter of

decision-making in the energy mar-

ket, as demonstrated at Keadby.

“We have been developing this for

quite some time, working together

with the customer. It takes more time

to really understand the business case

and dene the best solution for the

need. This is the best way to imple-

ment such an engine into the future

energy mix,” said Schwarz.

In conclusion, Scrimshaw added: “I

think that people who would normally

bid in the capacity auction will prob-

ably think a little bit more about what

the future might hold and their strate-

gies because of the Keadby project.”

Special Project Supplement

Model of an installed HL gas turbine

Like the H-class machine,

the HL is air-cooled and

has the same single tie-

bolt rotor concept. It also

uses Hydraulic Clearance

Optimisation to minimise the

clearance between the turbine

case and blade tips during

operation for increased

efciency

Shares DNA with its

predecessors, while

looking toward the future

Siemens HL-class: The next generation

of advanced air-cooled gas turbines

With the development of the HL-class, we continue to set the leadership

trend in high-efficient gas turbines. Based on shared DNA of Siemens

proven H-class design, our next generation incorporates cutting-edge

technologies, such as an advanced combustion system. Furthermore,

you will benefit from digital services that help you optimize your

engine’s operation – today and in the future. The result:

A technology carrier to the next level with a combined cycle efficiency

beyond 63 percent and a clear roadmap to 65 percent. Meet the future

of gas turbines with new Siemens HL-class.

siemens.com/hl-gasturbines

combined cycle power plant in Syria’s

western coastal province of Latakia.

The plant is expected to begin sim-

ple cycle operation at the end of next

year and full combined cycle opera-

tion in 2021.

Enel Green Power has placed orders

with Vestas for the supply of wind tur-

bines to two projects in South Africa.

Vestas has won orders to supply,

install and commission 70 of its

V136-4.2 MW turbines, delivered in

4.2 MW Power Optimised Mode, for

the 147 MW Karusa and Soetwater

projects. It said it will procure local-

ly produced towers to fulll local

content requirements, and that it ex-

pects to deliver and install the tur-

bines in the second half of 2020.

The orders also include a ve-year

Active Output Management 5000

(AOM 5000) service agreement.

DTEK Renewables and GE Renew-

able Energy have signed an agree-

ment for the construction of the sec-

ond stage of the Prymorsk wind farm

in the Ukraine.

The total planned investment cost

of the second stage of Prymorsk

wind power plant is about €150 mil-

lion. It will be situated on the shore

of the Sea of Azov in the Zapor-

izhzhia region of Ukraine. The con-

struction works are expected to start

in the fourth quarter of 2018 and end

in late 2019.

GE will supply 26 wind turbines

with a capacity of 3.8 MW each.

Tunisia has extended a deadline for

tenders for the construction of 130

MW of wind energy capacity until

December 18, 2018.

Tunisia’s Ministry of Industry and

Small and Medium Enterprises ex-

tended the deadline for ling applica-

tions by two months. It has invited

applications for 120 MW of wind

power capacity with individual pro-

posals of up to 30 MW, and, in a

separate category, for an additional

10 MW with single projects of up to

5 MW.

Tunisia aims to generate 30 per

cent of its electricity from renew-

ables by 2030. That goal will be

achieved through the addition of 1

GW of capacity in 2017-2020 and

1.25 GW in 2021-2030.

GE Power has won a contract to de-

liver the turbine island for the El Dabaa

nuclear power plant project in Egypt.

The contract was secured through

AAEM, GE Power’s joint venture

with Russian rm Atomenergomash.

GE Power will supply the basic de-

sign of four conventional islands,

supply four nuclear turbine generator

sets, including the Arabelle half-

speed steam turbines, and provide

technical expertise for the on-site in-

stallation and commissioning.

Electricity demand in Egypt has in-

creased rapidly as a result of a grow-

ing population and increasing indus-

trial activity. It is estimated that an

additional 1.5 GW of new capacity

will be needed each year until 2022.

To support this increasing demand,

Egypt has an ambitious energy plan

which includes diversifying its in-

stalled base. The El Dabaa nuclear

power plant will help deliver on that

plan by stabilising the Egyptian grid

with dependable, CO

2

-free energy.

Once in operation, El Dabaa will

produce 4.8 GW.

PaciCorp has placed an order with

Vestas for turbine components to re-

power the Marengo and Marengo II

wind power projects in Washington,

USA.

Vestas will provide its V100-2.0

MW hardware for the two wind

farms, which were commissioned in

2007 and 2008, respectively, and

which are currently equipped with

V80-1.8 MW machines.

The order includes supply and

commissioning of the turbines as

well as a multi-year service agree-

ment, designed to ensure optimised

performance of the project. Turbine

delivery will begin in 2Q 2019.

GE and Clarke Energy are to provide

a turnkey combined heat and power

(CHP) plant to municipal electricity

utility Sebewaing Light & Water

(SL&W) in Michigan, USA.

The project includes one each of

GE’s Jenbacher J624 and J620 gas

engines, providing 4.4 MWe and 3.3

MWe, respectively, with a total out-

put of 7.7 MWe. Clarke Energy will

also install GE’s Distributed Power’s

myPlant Asset Performance Man-

agement (APM) offering.

Shipment of the equipment to the

site will take place in the fourth

quarter of 2018. Commissioning will

then follow to ensure the site is oper-

ational in the rst quarter of 2019.

MHI Vestas will supply three V164-

8.3 MW wind turbines for the Nauti-

lus offshore wind farm in New Jersey,

USA, after being selected by EDF

Renewables North America as the

preferred supplier.

The Nautilus wind farm will be

the rst offshore project in New Jer-

sey and also marks the rst project

in the USA for MHI Vestas’ V164

platform.

Nautilus offshore wind will be lo-

cated in state waters and is already

fully permitted. The project is cur-

rently under review by the New Jer-

sey Board of Public Utilities for ap-

proval of an offshore renewable

energy credit (OREC) agreement.

Australia-based Downer EDI Ltd has

secured an order to build Innogy SE’s

349 MWp Limondale solar park in

New South Wales, Australia.

Innogy subsidiary Belectric Solar

and Battery GmbH awarded the con-

tract to Downer. Construction of the

facility was set to begin in October,

Innogy said when it took a nal in-

vestment decision on the project in

September.

Downer says it has already re-

ceived Notice-to-Proceed on the

contract. Construction is due to be

completed in 2020.

The solar farm will be located near

Balranald. Innogy bought the Li-

mondale project from Overland Sun

Farming earlier in 2018.

LM Wind Power has signed a 1.1 GW,

three-year deal to supply wind turbine

blades to Chinese wind turbine mak-

er Xinjiang Goldwind Science &

Technology.

The blades will be used in Gold-

wind’s 3 MW-4 MW onshore plat-

form for both international and

domestic markets. LM Wind will

produce them at its factory in Qin

Huang Dao, northeastern China, be-

tween 2018 and 2021.

The deal covers three blade types –

the LM 66.9 P, LM 66.9 P2 and LM

69.0 P. It follows a 140 MW pre-

agreement signed last year and is the

largest between the companies since

2010.

The rst variant of this blade se-

ries, the LM 66.9 P, was installed on

Goldwind’s 3 MW prototype in Jan-

uary last year.

Gulf Energy Development Co and

Mitsui & Co have appointed Pöyry as

Lenders Technical Advisor for a pro-

posed 2500 MW combined cycle gas

turbine power plant in Thailand.

The power plant will be located in

Sriracha District, Chonburi Prov-

ince. Pöyry will carry out technical

due diligence, construction monitor-

ing and operation monitoring. The

anticipated lenders are leading inter-

national and local investment banks.

The power plant will consist of

four 625 MW units, the rst of

which is expected to start operating

in March 2021.

MAN Energy Solutions has won a

contract to deliver the electricity gen-

eration technology for two power

plants in Bangladesh.

The rst project will expand an ex-

isting 58 MW power plant in the

Manikganj district, part of the Dhaka

administrative division, by 167 MW.

The second project involves con-

struction of a new power plant in

Bhairab, 80 km northeast of Dhaka,

with a capacity of 55 MW.

Both power plants will be operated

by Doreen Power, a long-standing

customer of MAN.

Valmet will supply a biomass boiler

to Greenalia’s new Curtis-Teixeiro

biomass power plant in Teixeiro,

Spain.

The order is included in Valmet’s

third quarter of 2018 orders re-

ceived. It was placed by Acciona In-

dustrial and Imasa, a Spanish EPC

contractor joint venture for the plant.

The biomass power plant’s takeover

is scheduled for January 2020.

The plant, which will burn forest

biomass, mainly eucalyptus and

pine wood, will encourage the col-

lection of small-sized wood waste

that is normally discarded for indus-

trial use. It will increase the genera-

tion of energy from renewable

sources to help reduce carbon diox-

ide emissions.

UK-based renewables developer Re-

newable Energy Systems Ltd (RES)

is to repower the rst wind farm it

built in France.

The 20.8 MW Souleilla-Corbieres

wind farm in Aude county, southern

France, currently uses 16 Bonus 1.3

MW turbines. The machines have

been operational since 2001.

RES will partner with French tur-

bine manufacturer PomaLeitwind to

carry out the repowering, which

will increase the output of the wind

farm to 24 MW.

CGN Europe Energy has chosen re-

newable energy management system

Greenbyte Energy Cloud to manage

its wind and solar PV farms.

Greenbyte will integrate CGN EE’s

wind and solar assets in Europe and

Africa, amounting to 900 MW, as

well as CGN’s future renewable en-

ergy investments. The portfolio,

which comprises 130 wind and solar

farms in the UK, Ireland, France, the

Netherlands, Senegal and Belgium,

will be managed through Breeze and

Bright, the two specialised compo-

nents of Greenbtye Energy Cloud for

wind and solar farms.

UK-based extra high voltage cable

system specialist VolkerInfra has

signed a multi-million pound contract

with Ørsted to install 360 km of high

voltage onshore cables for the mas-

sive Hornsea 2 offshore wind farm off

the coast of northeast England.

Hornsea 2 is in the early stages of

construction and when complete in

2022 will be the biggest offshore

wind farm in the world.

Having worked with Ørsted on the

Burbo Bank Extension offshore

wind farm project, VolkerInfra will

install three 220 kV transmission

circuits along the 39 km onshore

cable route for Hornsea 2, which

runs from Horseshoe Point in east

of Tetney to the substation site in

North Killingholme.

Fluence Energy LLC will supply

60 MW of battery capacity for the

second phase of UK Power Reserve’s

120 MW energy storage portfolio in

the UK.

Fluence, the energy storage spe-

cialist formed by Siemens AG (and

AES Corp, was previously selected

to supply batteries for the rst 60

MW phase of the project. Both phas-

es of the project will use the energy

storage joint venture’s (JV) Advan-

cion platform.

The rst phase, including three 20

MW of battery storage systems, is

currently under construction at sites

in the Midlands and North Wesis. It

is scheduled to become operational

by the end of this winter. The full

120 MW capacity is to be switched

on by the end of the summer of

2019, ahead of the winter 2020

deadline.

The storage capacity will help

boost the exibility and stability to

the UK power grid as the volumes

of renewable energy on it continue

to grow.

Nexans has been awarded a contract

to design, manufacture and test the

submarine power export cable for the

Northwester 2 offshore wind farm.

Comprising 23 turbines, the 219

MW Northwester 2 project will be

the seventh wind farm to be con-

structed off the Belgian coast. It will

also be the rst offshore wind farm to

feature the world’s most powerful

wind turbine – the 9.5 MW V164 tur-

bine manufactured by MHI Vestas.

The Northwester 2 wind farm is

expected to be fully operational in

the rst half of 2020.

Iran’s energy and infrastructure con-

glomerate Mapna has signed a con-

tract to build a 540 MW gas red

THE ENERGY INDUSTRY TIMES - NOVEMBER 2018

10

Tenders, Bids & Contracts

Americas

Asia-Pacic

Vestas repowers Marengo

Sebewaing orders

Jenbacher units

MHI Vestas preferred

supplier for Nautilus

Downer wins Limondale

contract

Pöyry wins contract for

Thai CCGT

Mapna to build gas red

plant in Syria

Vestas to equip SA projects

DTEK signs GE for

Prymorsk phase 2

Tunisia extends wind

deadline

GE to supply turbine

islands for El Dabaa

MAN boosts Bangladesh

capacity

Valmet to supply biomass

boiler to Teixeiro plant

RES repowers wind farm

in France

Siemens, AES JV wins 60

MW battery storage deal

Ørsted signs VolkerInfra

CGN EE chooses Green-

byte Energy Cloud

Northwester cable

contracts awarded

LM Wind scores with

Goldwind

International

Europe

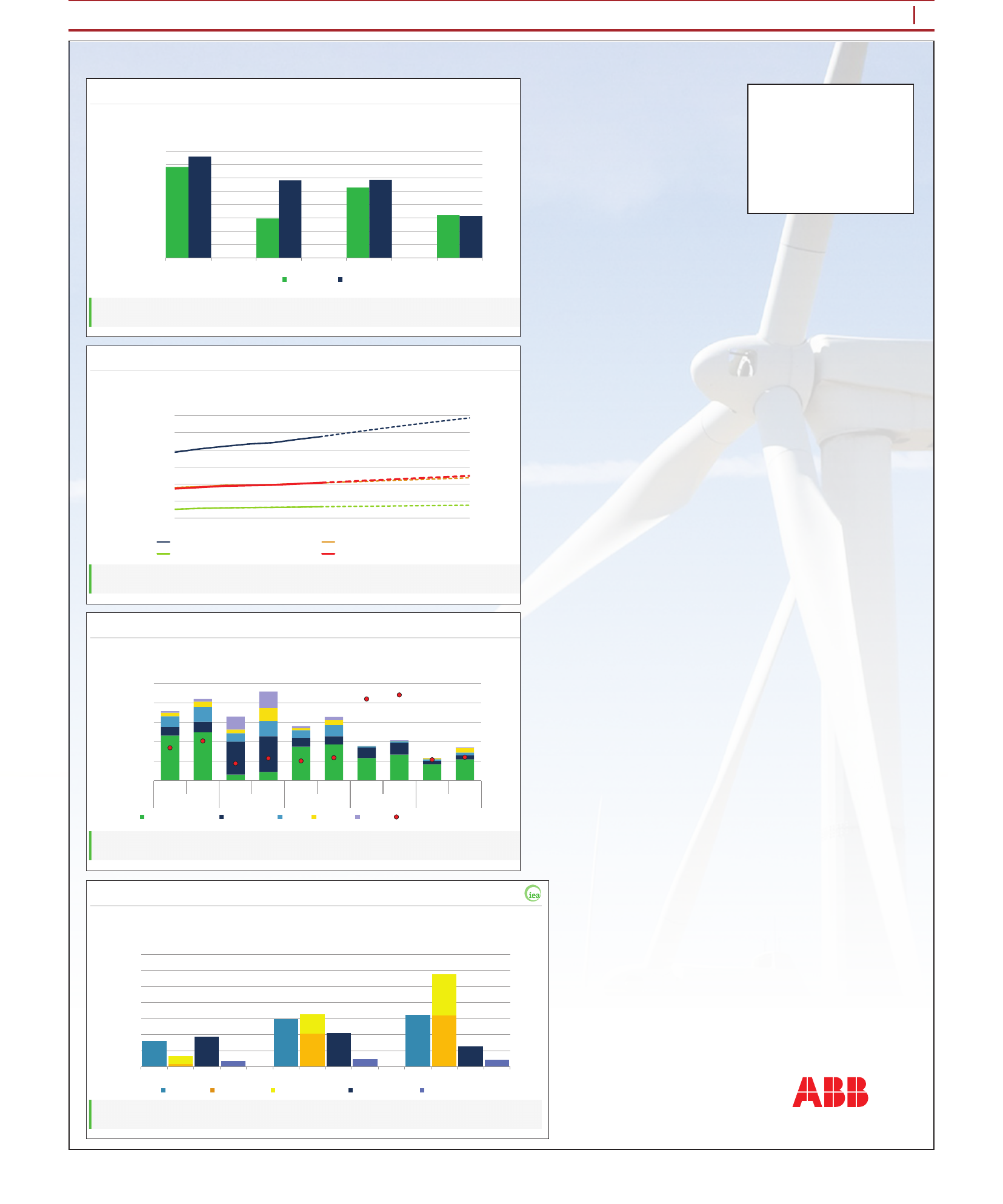

IEA Renewables 2018 highlights

4

© OECD/IEA

2018

Total renewable energy consumption is expected to increase by almost 30% over 2018-2023,

covering 40% of global energy demand growth

Total energy consumption growth of renewables over 2012-23

Modern bioenergy set to lead renewables growth

0

10

20

30

40

50

60

70

80

Modern

bioenergy

Solar PV Wind Hydropower

Mtoe

2012-17 2018-23

5

© OECD/IEA

2018

Electricity contributes two-thirds of renewables growth

But electricity accounts for less than 20% of total final energy consumption

Share of renewables in the electricity, heat and transport sectors

Renewables share of energy consumption increases by one-fifth

0%

5%

10%

15%

20%

25%

30%

2011 2014 2017 2020 2023

%

Renewable electricity Renewable heat

Renewable transport % of renewables in total energy consumption

6

© OECD/IEA

2018

China accounts for the largest absolute growth over the forecast period surpassing the EU,

while renewable energy consumption in India increases by 50%

China becomes the largest RE consumer, Brazil has the highest share

Renewables contribution to energy consumption by country in 2017 and 2023

0%

10%

20%

30%

40%

50%

0

50

100

150

200

250

2017 2023 2017 2023 2017 2023 2017 2023 2017 2023

European Union China United States Brazil India

Mtoe

Modern bioenergy Hydropower Wind Solar PV Others % of renewables (right axis)

8

© OECD/IEA

2018

China remains the absolute solar PV leader by far, holding almost 40% of global installed PV capacity in 2023.

The US remains the second-largest growth market for solar PV, followed by India, whose capacity quadruples

Renewable electricity capacity growth by technology

Solar PV expansion in electricity larger than all renewables combined

0

100

200

300

400

500

600

700

2006-11 2012-17 2018-23

GW

Wind PV-utility PV-distributed Hydropower Other renewables

This section is supported by ABB

Source: International Energy Agency ‘Renewables 2018’ press webinar

THE ENERGY INDUSTRY TIMES - NOVEMBER 2018

11

Energy Industry Data

For more information, please contact:

International Energy Agency

9, rue de la Fédération

75739 Paris Cedex 15

France.

Email: bookshop@iea.org

website: www.iea.org

THE ENERGY INDUSTRY TIMES - NOVEMBER 2018

13

Industry Perspective

A

rticial intelligence (AI) is

one of a suite of disruptive

technologies that promises to

transform our world.

Strip away all the techie-speak and

AI becomes a very relatable concept,

particularly if we apply it to some-

thing tangible, like an autonomous

vehicle. A camera, embedded in the

vehicle, detects the lines on the road;

it uses logic to assess whether to turn

left or right; and it initiates the ac-

tion. It sounds plausible. But what

can AI do in a sector that is all about

pipes, wires, grids, call centres and

customers?

In fact, the three principles that

can be applied to autonomous vehi-

cles, work for the power and energy

sector too. As a technology, AI does

three things: identies patterns; ap-

plies logic and initiates an action.

AI is so-called because it incorpo-

rates an element of reasoning typi-

cally associated with living things. It

enables tasks – usually repetitive, la-

bour-intensive tasks – to be per-

formed much more rapidly and accu-

rately than a human being could ever

do. So, in the power and utilities sec-

tor, it could feasibly sift through

masses of data to identify patterns; it

could apply logic that determines

how to respond to anomalies and ini-

tiate the appropriate response. Far

from replacing human ingenuity, it

complements it.

Right now, there are three principle

uses for AI in the power and utilities

industry. These are:

n Efciency savings. EY recently

undertook research that predicts that

Europe and Australia have just three

years until non-utility solar and

battery systems reach cost and

performance parity with grid-

delivered energy. Between 2023 and

2025, electric vehicles (EVs) should

achieve price and performance parity

with combustion engines. And we

have a decade or more before it

becomes cheaper to generate and

store electricity locally than to

transport and distribute it. While

these projections are subject to

geographic variations, two things are

certain: (1) once these tipping points

are reached, we will change how we

produce, distribute and use energy

forever, and (2) time is running out.

AI can help make existing ways of

working more efcient, reducing

costs and resources that could be

better deployed in the energy transi-

tion. Many of the traditional ways of

working are, indeed, ripe for an ad-

vanced technology intervention.

We might, for instance, use AI to

empower chatbots in call centres, so

that the rst few steps of customer

contact are fully automated, without

compromising the experience of the

end-user.

We could employ AI’s “deep

learning” capabilities – an articial

neural network that analyses differ-

ent layers of information to make

better predictions about the mainte-

nance of network assets, so that in-

tervention is timely but targeted. An

AI solution that can identify, with

99 per cent certainty, when an over-

head line warrants manual interven-

tion, will generate signicant ef-

ciency savings.

Or we could use AI to identify pat-

terns of behaviour that indicate cus-

tomer dissatisfaction, enabling inter-

vention and remediation to reduce

churn.

n Enabling the energy transition.

We are fast approaching the point at

which energy is neither created nor

consumed centrally. Consumers that

produce their own energy –

“prosumers” – will connect their

distributed energy resources to the

grid, and “prosumption” will be

dictated by variables such as weather

conditions and household needs.

Consumers will also connect their

devices – including smart appliances

– to the internet. Acceleration in

technology take-up means AI can

hive off data, pinpoint patterns of

behaviour and make predictions on

energy usage with greater accuracy

in order to deliver an intelligent,

stable and autonomous grid.

AI algorithms will, for instance,

recognise patterns of behaviour on,

say, a weekday evening in 2023,

when millions of EV drivers arrive

home and recharge their vehicles. By

distinguishing between drivers who

habitually use their cars overnight,

and those who leave it charging until

the following morning, the intelli-

gent grid will ensure that the battery

is sufciently charged in time for the

driver’s next journey, without exert-

ing simultaneous load on the grid

where possible.

n Accessing new revenue streams.

AI also provides an opportunity for

power and utilities companies to

access new business models and

revenue streams that will help them

to remain relevant beyond the energy

transition. They could, for instance,

use AI to compress, analyse and

monetise the huge swathes of data

moving through the energy

ecosystem, or follow the lead of

technology start-ups by harnessing

apps and other innovations to enhance

the networked and connected home.

Though AI articially enhances ca-

pabilities, many of its limitations are

the result of human trepidation.

For example, deep-learning AI al-

gorithms train themselves by sifting

through large volumes of data, and

from this they learn to identify ex-

ceptions to the norm and to make re-

liable predictions. Utilities therefore

need to ensure that they take steps to

structure and evaluate the data be-

fore introducing AI. If they do not,

there is a risk that the technology

will be ready while the data is still

being prepared. Ultimately, better

data produces a better AI learning

experience and improved outcomes.

Then there are issues relating to

computer power – or rather the lack

of it. Some utilities ght shy of mi-

grating to cloud computing solu-

tions, due to fears over data privacy

and cost. It is, however, all but a pre-

requisite for AI, given the technolo-

gy’s extensive storage and process-

ing needs.

Utilities also have to get to grips

with data privacy. They need to un-

derstand who owns the data; which

data is condential; and how open

data should be used and stored, if

they are to optimise its potential and

comply with relevant regulations.

There are exceptions. Some utili-

ties recognise that training a deep-

learning network takes dedicated in-

put and collaboration from both the

IT function and the business itself.

Increasingly, at EY, there are engi-

neers, shop oor workers, asset man-

agers and programme managers

working together on their AI capa-

bilities. They jointly dene and test a

use case, and populate the system

with relevant data – rather than

draining the entire data pool – to de-

liver the right algorithm training.

AI is a big data game. At EY, we

are working with organisations to

dene their data architecture, data

management and data governance.

By better understanding ownership

of the data and how it can be shared

and combined, meaningful algo-

rithms can be developed to underpin

trusted AI programs.

To make the most of AI’s potential,

boundaries are coming down – and

not just between IT functions and

other parts of the business.

While some utilities incubate their

own AI solutions in isolation, EY is

increasingly seeing evidence of a

growing tendency for businesses to

collaborate with other players – and,

in particular, existing start-ups.

EY has also seen utilities collabo-

rate with start-ups to access special-

ist capabilities – primarily in Germa-

ny, the UK, the US and the Middle

East. Notably, many are working

with omni-channel, intelligent cus-

tomer support applications, which

are essentially AI-powered chat solu-

tions that understand customer con-

versations and automate repetitive

processes – thereby reducing re-

source needs and costs.

Some start-ups even offer a plat-

form architecture for storing, con-

suming and selling energy, while

others work with utilities to deliver

predictive maintenance solutions.

By reducing unnecessary system in-

tervention, they enable timely reme-

dial action too, ensuring costs and

resources are focused in all the right

places.

I would go as far as to say that

collaboration or partnership is a

must for any utility. Otherwise, they

could struggle with the level of

technology sophistication and spe-

cialisation that more nimble start-

ups readily achieve.

So how far can AI go? Frankly, it’s

slow off the mark for some utilities;

others show varying degrees of AI

maturity.

Time is pressing. While there is no

need to invest huge sums right now,

start-ups will begin to erode utilities’

business models by developing AI-

enabled solutions that are smart –

and which customers like.

In conjunction with the Internet of

Things (which offers a virtual envi-

ronment through which distributed

energy resources can be connected)

and blockchain (which facilitates

trusted transactions between buyers

and sellers of home-grown electrons,

without the intervention of a central

authority) – AI has the potential to

reinvent energy delivery. Mean-

while, quantum computing – which

is still some way off but attracting

lots of investment – could be the big

game changer for AI. It will make

deep-learning networks faster, more

powerful and able to solve the tricki-

est challenges, all while storing even

larger bodies of data.

But even before all of these tech-

nologies reach maturity, utilities that

are not riding the wave of technolo-

gy innovation now risk losing some

or all of their business to competi-

tors. So, if they are to push ahead

with AI, they need to:

n Dene their AI strategy – an

absolute must